Forex analysis review |

- Forecast for AUD/USD on October 23, 2019

- USDCHF reaching resistance, watch out!

- Fractal analysis of the main currency pairs for October 23

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY. Comprehensive analysis of movement options from October 23, 2019 APLs &

- Pound awaits reboot

- GBPUSD and Brexit: Brexit deal may be approved, but its opponents have one more trump card

- EUR/USD. October 22. Results of the day. Fundamental isolation of the euro led to an expected technical correction

- October 22, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- October 22, 2019 : GBP/USD confirms Ascending-Wedge reversal pattern. Anticipated Bearish decline towards 1.2780 is about

- GBP/USD. Get ready for the storm of volatility: Brexit's fate is in parliament again

- Trading idea for USDJPY

- GBP/USD: plan for the American session on October 22nd. The pound is gradually declining and waiting for the outcome of the

- BTC 10.22.2019 - Gap area is still holding

- Gold 10.22.2019 - Watch for potential breakout of the symmetrical triangle to confirm further direction

- EUR/USD: plan for the American session on October 22nd. Buyers have missed out on an important level of support, but the

- GBP/USD 10.22.2019 - Broken rising wedge, bigger downside potential

- Trading plan for EUR/USD for October 22, 2019

- Oil "bulls" do not favor

- Trading recommendations for the EURUSD currency pair – placement of trade orders (October 22)

- The dollar is on a slippery road, the euro and the pound are waiting for a key vote on Brexit

- Trading strategy for EUR/USD on October 22nd. Trade talks between China and the United States paused again

- Trading strategy for GBP/USD on October 22nd. Boris Johnson does not give up trying to ratify the Brexit agreement

- Technical analysis of GBP/USD for October 22, 2019

- USDCHF reaching resistance, watch out!

- Australian rally. Trading idea for AUDUSD

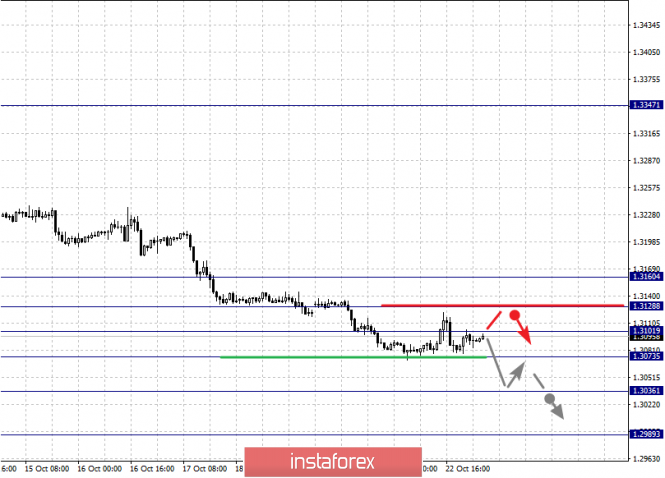

| Forecast for AUD/USD on October 23, 2019 Posted: 22 Oct 2019 08:53 PM PDT AUD/USD The Australian dollar turned down without reaching the upper limit of the blue price channel, which began in January 2018. The immediate goal is the coincidence point of the line of the crane price channel with the indicator line of MACD at the price of 0.6788. On a four-hour chart, reaching the specified level will correspond to consolidating the price below the MACD line, here the price may slightly adjust upwards or form a horizontal consolidation before further decline. The prospects for decline are deep: 0.6675 - the low of October and August, then 0.6620 - support for the red price channel on a daily scale. |

| USDCHF reaching resistance, watch out! Posted: 22 Oct 2019 06:08 PM PDT |

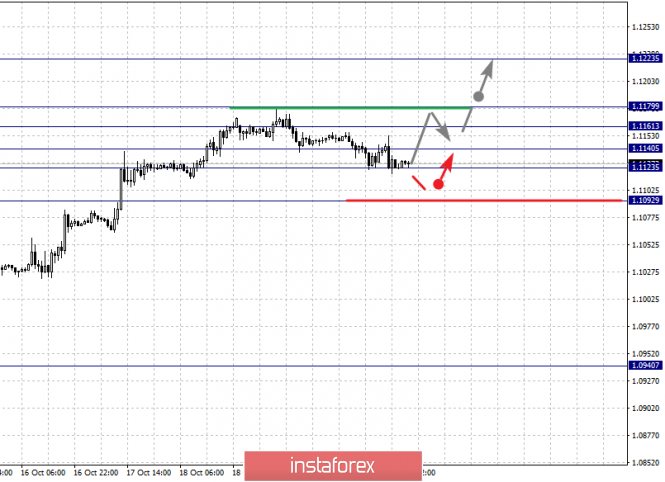

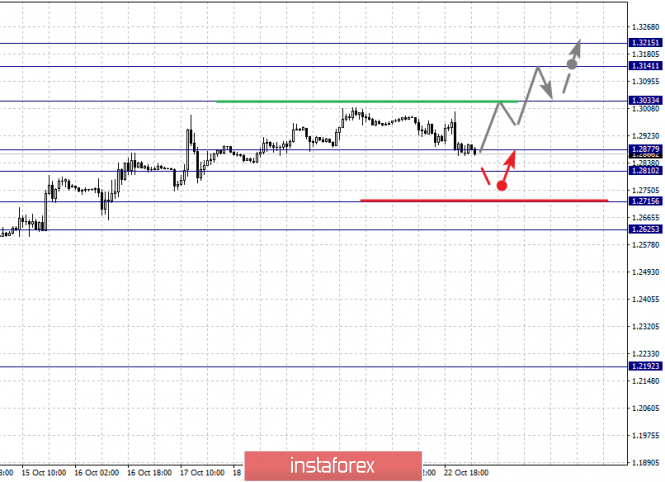

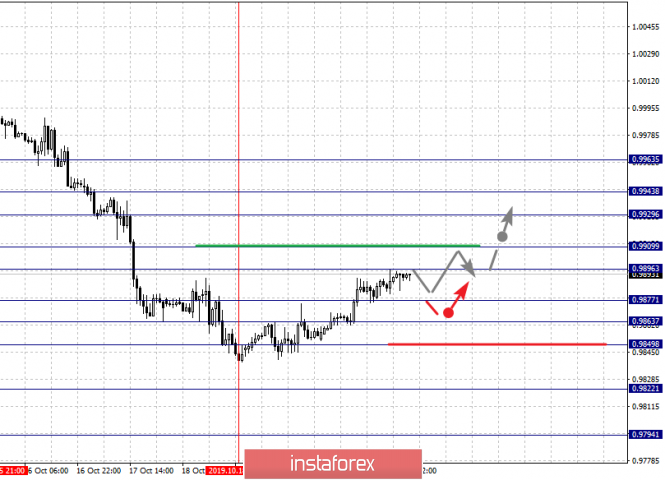

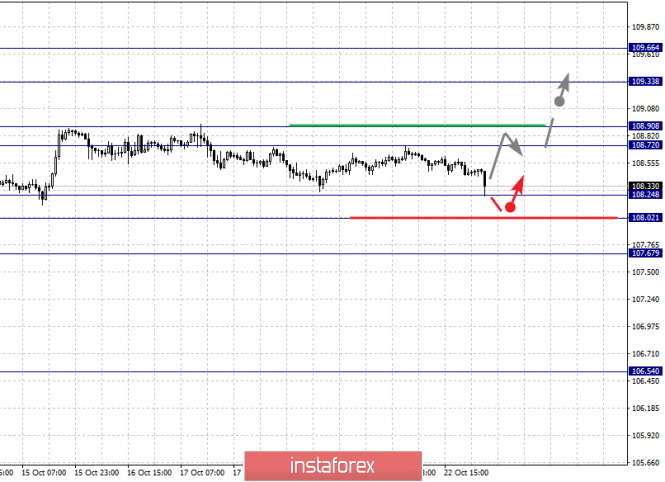

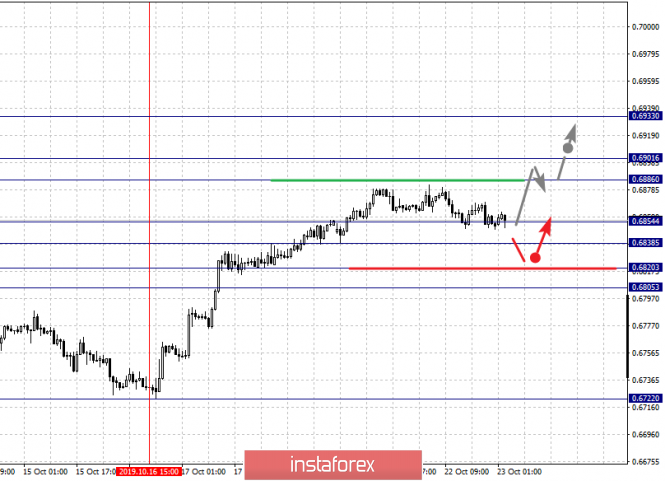

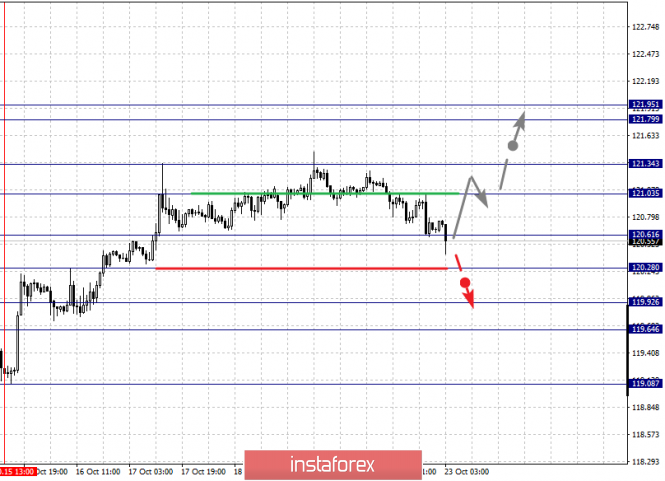

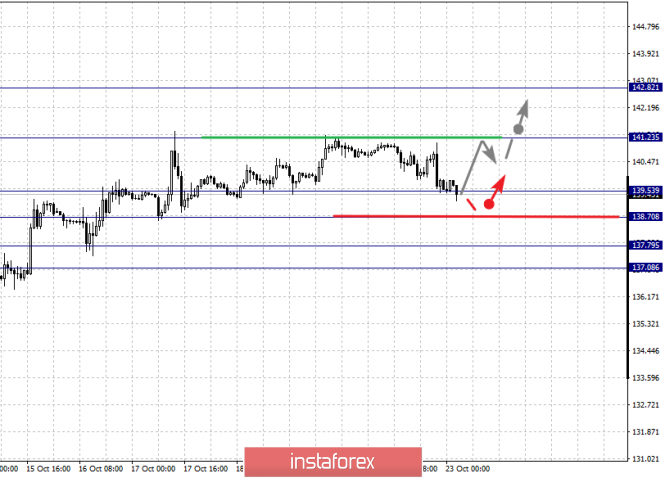

| Fractal analysis of the main currency pairs for October 23 Posted: 22 Oct 2019 05:56 PM PDT Forecast for October 23: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1223, 1.1179, 1.1161, 1.1140, 1.1123 and 1.1092. Here, we continue to monitor the development of the upward cycle of October 9. Short-term upward movement is expected in the range 1.1161 - 1.1179. The breakdown of the last value will lead to a movement to a potential target - 1.1223, when this level is reached, we expect a pullback to the bottom. Consolidated movement is expected in the range 1.1140 - 1.1123. The breakdown of the last value will lead to a long correction. Here, the goal is 1.1092. This level is a key support for the top. The main trend is the local ascending structure of October 8. Trading recommendations: Buy: 1.1162 Take profit: 1.1175 Buy 1.1181 Take profit: 1.1220 Sell: Take profit: Sell: 1.1121 Take profit: 1.1093 For the pound / dollar pair, the key levels on the H1 scale are: 1.3215, 1.3141, 1.3033, 1.2939, 1.2810, 1.2734 and 1.2625. Here, we are following the development of the upward cycle of October 9. The continuation of the movement to the top is expected after the breakdown of the level of 1.3035. Here, the potential target is 1.3141. Price consolidation is in the range of 1.3141 - 1.3215. Short-term downward movement is expected in the range of 1.2877 - 1.2810. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2715. This level is a key support for the top. Its breakdown will lead to the formation of potential for the downward cycle. Here, the target is 1.2625. The main trend is the upward structure of October 9. Trading recommendations: Buy: 1.3035 Take profit: 1.3140 Buy: 1.3143 Take profit: 1.3215 Sell: 1.2877 Take profit: 1.2813 Sell: 1.2808 Take profit: 1.2717 For the dollar / franc pair, the key levels on the H1 scale are: 0.9963, 0.9943, 0.9929, 0.9909, 0.9896, 0.9877, 0.9863, 0.9849 and 0.9822. Here, the price forms a pronounced potential for the upward movement of October 18. Short-term upward movement is expected in the range 0.9896 - 0.9909. The breakdown of the latter value will lead to a movement to the level of 0.9929. Price consolidation is in the range of 0.9929 - 0.9943. For the potential value for the top, we consider the level 0.9963. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9877 - 0.9863. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9850. This level is a key support for the upward structure. Its breakdown will allow you to count on movement to the level of 0.9822. The main trend is a local descending structure of October 15, the formation of potential for the top of October 18. Trading recommendations: Buy : 0.9896 Take profit: 0.9907 Buy : 0.9912 Take profit: 0.9929 Sell: 0.9877 Take profit: 0.9864 Sell: 0.9861 Take profit: 0.9850 For the dollar / yen pair, the key levels on the scale are : 109.66, 109.33, 108.90, 108.72, 108.24, 108.02 and 107.67. Here, we are following the development of the upward cycle of October 4. Short-term upward movement is expected in the range 108.72 - 108.90. The breakdown of the latter value will lead to a movement to the level of 109.33. Price consolidation is near this level. For the potential value for the top, we consider the level of 109.66. Upon reaching this level, we expect a consolidated movement, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 108.24 - 108.02. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.67. This level is a key support for the top. The main trend: the upward cycle of October 4. Trading recommendations: Buy: 108.90 Take profit: 109.30 Buy : 109.34 Take profit: 109.65 Sell: 108.24 Take profit: 108.03 Sell: 108.00 Take profit: 107.70 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3160, 1.3128, 1.3101, 1.3073, 1.3036 and 1.2989. Here, we consider the descending structure of October 10 as a medium-term initial condition. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3073. In this case, the target is 1.3036. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.2989. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.3101 - 1.3128. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3160. This level is a key support for the downward structure. The main trend is the downward cycle of October 10. Trading recommendations: Buy: 1.3101 Take profit: 1.3126 Buy : 1.3130 Take profit: 1.3160 Sell: 1.3073 Take profit: 1.3038 Sell: 1.3034 Take profit: 1.3000 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6933, 0.6901, 0.6886, 0.6854, 0.6838, 0.6820 and 0.6805. Here, we are following the development of the ascending structure of October 16. Short-term upward movement is expected in the range of 0.6886 - 0.6901. The breakdown of the latter value will lead to the development of pronounced movement to a potential target - 0.6933. From this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6854 - 0.6838. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6820. The range of 0.6820 - 0.6805 is the key support for the upward structure. The main trend is the upward structure of October 16. Trading recommendations: Buy: 0.6887 Take profit: 0.6900 Buy: 0.6904 Take profit: 0.6930 Sell : 0.6854 Take profit : 0.6840 Sell: 0.6836 Take profit: 0.6820 For the euro / yen pair, the key levels on the H1 scale are: 121.95, 121.79, 121.34, 121.03, 120.61, 120.28, 119.92 and 119.64. Here, we are following the development of the local ascendant structure of October 15. Short-term upward movement is expected in the range 121.03 - 121.34. The breakdown of the level of 121.35 should be accompanied by a pronounced upward movement. Here, the target is 121.79. Price consolidation is in the range of 121.79 - 121.95. From here, we expect a correction. Short-term downward movement is possibly in the range of 120.61 - 120.28. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.92. This level is a key support for the top. Its passage at the price will lead to the formation of initial conditions for the downward cycle. In this case, the first goal - 119.64. The main trend is the upward structure of October 15. Trading recommendations: Buy: 121.05 Take profit: 121.34 Buy: 121.36 Take profit: 121.76 Sell: 120.60 Take profit: 120.33 Sell: 120.25 Take profit: 119.94 For the pound / yen pair, the key levels on the H1 scale are : 142.82, 140.89, 139.53, 138.70, 137.79 and 137.08. Here, we are following the development of the upward cycle of October 8. The continuation of movement to the top is expected after the breakdown of the level of 140.90. In this case, the potential target is 142.82. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 139.53 - 138.70. The breakdown of the last value will lead to a long correction. Here, the target is 137.79. The range of 137.79 - 137.08 is the key support for the top. The main trend is the medium-term upward structure of October 8. Trading recommendations: Buy: Take profit: Buy: 141.25 Take profit: 142.80 Sell: 139.50 Take profit: 138.75 Sell: 138.65 Take profit: 137.80 The material has been provided by InstaForex Company - www.instaforex.com |

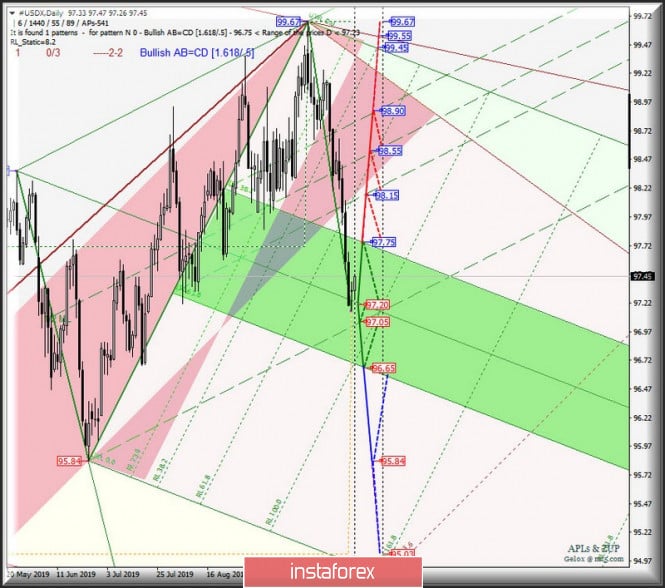

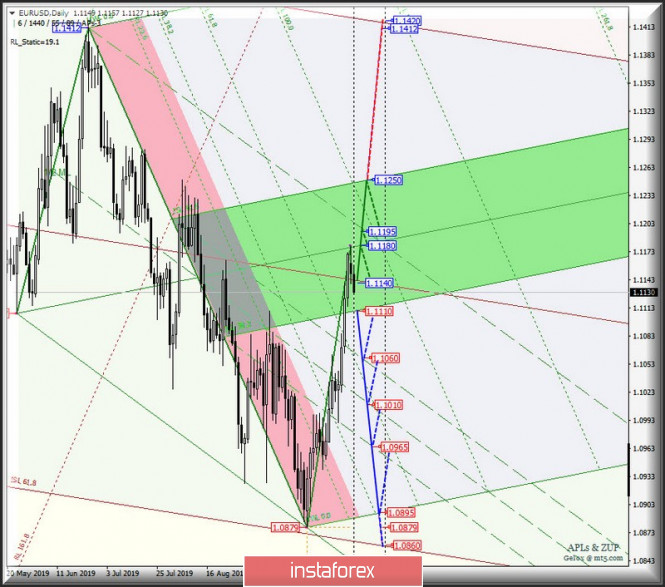

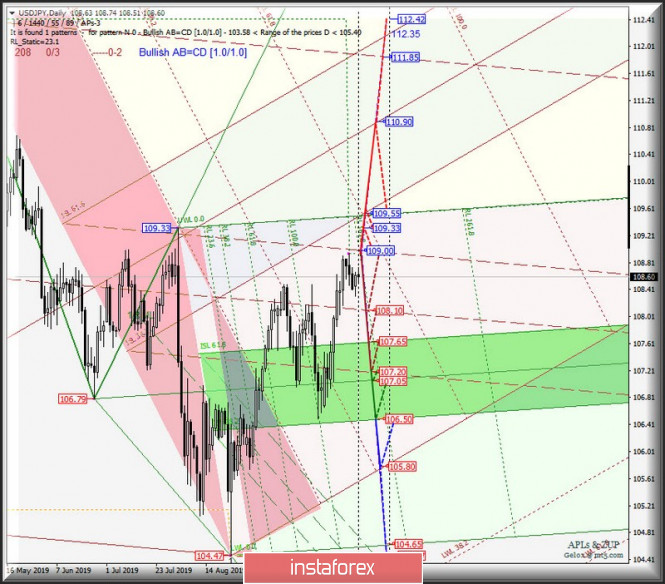

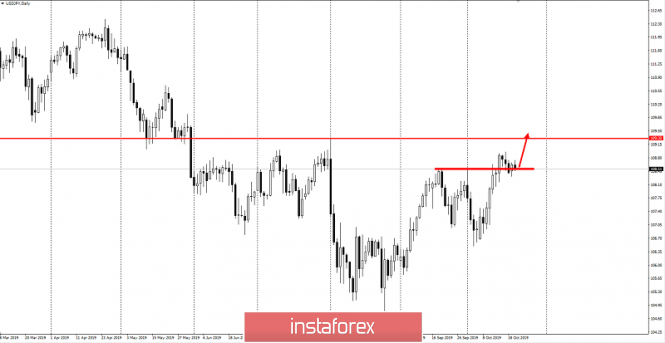

| Posted: 22 Oct 2019 05:33 PM PDT Two Brexit votes - not much in one day? - Here's a comprehensive analysis of movement options - #USDX, EUR / USD, GBP / USD and USD / JPY (DAILY) from October 23, 2019. Minor (Daily time frame) ____________________ US dollar Index From October 23, 2019, the development of the movement of the USD index #USDX will depend on the development and direction of the breakdown of the boundaries of the equilibrium zone (96.65 - 97.20 - 97.75) of the Minuette operational scale fork. Look at the details of the movement inside this zone in the animated chart. In case of breakdown of the upper boundary of ISL38.2 (resistance level of 97.75) of the equilibrium zone of the Minuette operational scale fork, the development of the movement of the dollar index will continue to the boundaries of the 1/2 Median Line channel of Minuette (98.15 - 98.55 - 98.90). On the contrary, if the breakdown of the lower boundary ISL61.8 (support level of 96.65) of the equilibrium zone of the Minuette operational scale fork takes place, then the downward movement #USDX will be directed to the minimum (95.84 - 95.03). The markup of #USDX movement options from October 23, 2019 is shown in the animated chart. ____________________ Euro vs US dollar Further development of the movement of the single European currency EUR / USD from October 23 will be determined by the development and the direction of the breakdown of the range :

In case that the EUR / USD breaks the lower boundary of ISL38.2 (support level of 1.1110) of the equilibrium zone of the Minuette operational scale fork, then the downward movement can be directed to the boundaries of the 1/2 Median Line Minuette channel (1.1060 - 1.1010 - 1.0965) with the prospect of reaching the SSL start line Minuette (1.0895). On the contrary, the breakdown of the resistance level of 1.1140 (Median Line of the Minor operational scale fork) - the development of the movement of the single European currency can be continued towards the goals - the Median Line channel of Minuette (1.1180) - the final Schiff Line Minuette (1.1195) - the upper boundary of ISL61.8 (1.1250) of the equilibrium zone of the Minuette operational scale fork with a probability of reaching a maximum of 1.1412. The details of the EUR / USD movement options from October 23, 2019 are shown in the animated chart. ____________________ Great Britain pound vs US dollar The development of Her Majesty's GBP / USD currency movement from October 23, 2019 will also be due to the development and direction of the breakdown of the range :

The breakdown of the Median Line Minuette operational scale fork (support level of 1.2875) - development of Her Majesty's currency movement can be continued towards the goals - lower boundary of ISL38.2 (1.2685) of the equilibrium zone of the Minuette operational scale fork - 1/2 Median Line channel of the Minuette operational scale fork (1.2520 - 1.2390 - 1.2260). On the contrary, if a breakdown occurs in the final Schiff Line Minuette (resistance level of 1.2945), then the upward movement of GBP / USD will be directed to the targets - the upper boundary of the ISL61.8 (1.3085) equilibrium zone of the Minuette operational scale fork - the lower boundary of ISL38.2 (1.3295) equilibrium zone of the Minor operational scale fork - maximum 1.3379. The details of the GBP / USD movement from October 23, 2019 can be seen in the animated chart. ____________________ US Dollar vs Japanese yen The movements of the USD / JPY currency from October 23, 2019 will continue in the a Median Line (109.00 - 108.10 - 107.20) of the Minor operational scale fork. The details of the movement inside the specified channel 1/2 Median Line are presented in the animated chart. In case of breakdown of the upper boundary of the 1/2 Median Line channel Minor (resistance level of 109.00) and updating the local maximum 109.33, it will become possible for the currency of the "land of the rising sun" to reach the boundaries of the equilibrium zone (109.55 - 110.90 - 112.35) Minor operational scale fork. On the other hand, a combined breakdown of the lower boundary of the 1/2 Median Line channel (support level of 107.20) of the Minor operational scale fork and the 1/2 Median Line channel of Minuette (107.05) will determine the option to continue the development of the downward movement of USD / JPY to the lower boundary of the equilibrium zone of the ISL38.2 (106.50) Minuette operational scale fork and SSL Minor start line (105.80) with the prospect of reaching the SSL Minuette start line (104.65). We look at the details of the USD / JPY movement in the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power factors correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Oct 2019 03:45 PM PDT The British currency has been storming over the past few days. The pound is experiencing significant congestion during meetings related to the UK exit from the EU. A number of analysts believe that the sterling expects strong volatility. The dynamics of the currency of Britain is not too stable. It is undermined by uncertainty around Brexit, although there have been positive developments in this process recently. Recall, the British Parliament held another debate last Saturday, but they did not clarify the issue of Brexit. British Prime Minister Boris Johnson managed to get the approval of a new deal on the country's exit from the EU. He urged lawmakers to vote for the new document, arguing that his deal with the EU would provide a "real Brexit" capable of restoring national sovereignty. However, in the future B. Johnson was disappointed, because the deal that was adopted in Brussels, did not receive the approval of the British Parliament. It was agreed that the final decision is possible only after a thorough study of the related legislation, which takes time. According to experts, in this way lawmakers are trying to promote the law, according to which B. Johnson will have to extend Britain's membership in the EU until January 31, 2019. This time, the prime minister obeyed the decision of Parliament, but sent a letter to Donald Tusk, President of the European Council. In it, the politician asked EU leaders to reject his own petition, arguing that further delay harms the interests of the UK and the European Union. Experts noted the failure of the next Brexit deal, which could not but affect the pound. The sterling reacted by falling during the Asian session on Monday, October 21. The British currency strengthened again during the European session, pulling the GBP/USD pair behind it. Yesterday, the pair updated a five-month high, rising to 1.2982. After a while, the GBP/USD pair reached the level of 1.3011. On Tuesday morning, October 22, the pair traded within 1.2964–1.2965. The long epic with Brexit drains the strength of politicians and negatively affects the dynamics of the pound. Analysts do not rule out that EU leaders will meet the request to postpone Brexit to a later date. A new review of the deal is planned for today in the UK. If B. Johnson manages to convince the Parliament, the country will have a potential chance to leave the euro bloc on November 1, 2019. According to experts, a small advantage is still observed on the side of the prime minister, and the market perceives the current version of the deal more positively. The result of Monday was the rise of the GBP/USD pair to 1.3000. Recall that the last time the British currency reached this level was in May of this year. Due to the uncertainty around Brexit, the market was again at a crossroads. At the moment, all options are relevant: from a second referendum to the rejection of Brexit as such. In such conditions, another surge in volatility of the British currency is possible, experts remind. They point out two main ways in which the locomotive of British-European history can move by pulling a pound: 1. If Parliament approves the current agreement presented by B. Johnson, sterling will receive some support. Recall that the British currency has already done an impressive rally. This reduces the potential for its further strengthening from the current point to a high of 1.3200. 2. If Parliament continues to reject the prime minister's initiatives, the pound may show a downward trend. Experts do not rule out a full return to the starting point, that is, the whole cycle of negotiations and approvals can begin anew. This can permanently unsettle the British currency and throw it to positions near 1.2200, from where the pound rally started 11 days ago. According to experts, the immediate growth potential of the pounds is now at around 1.3600. On hand to the pound is the fact that the likelihood of a "hard" Brexit has significantly decreased, and this supports the British currency. Now the GBP/USD pair is trading in the range of 1.2952–1.2954, showing a downward trend after the morning rise. At the moment, the pair fell to a critical value of 1.2935, but it restored lost positions in a short period of time. Many experts expect serious changes in the dynamics of the pound, a kind of reboot. They believe that cardinal changes cannot be avoided for sterling, the only question is how intense they will be. Goldman Sachs currency strategists, focusing on reducing the risks of the hard Brexit by 5%, are considering two scenarios: 1) If the UK leaves the EU before October 31, 2019, if a deal is concluded, the GBP/USD pair will reach 1.3500; 2) The UK exit from the euro bloc is postponed, and London receives a deferment from Brussels. In this case, the GBP/USD pair will go down to the level of 1.2600. In any case, it will not be easy for the pound. Analysts hope that the next reboot of the price will not unsettle the British currency too much. Previously, the pound showed amazing stability, sometimes rising like a phoenix from the ashes. This time, experts also rely on its ability to resist negative factors. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPUSD and Brexit: Brexit deal may be approved, but its opponents have one more trump card Posted: 22 Oct 2019 03:45 PM PDT The pound slightly fell in the morning after reports that the UK government may withdraw its Brexit bill. If the British Parliament votes against the deal today, official London may withdraw the bill he proposed. This will jeopardize the work of Parliament, which will lead to the next election, which may take place before Christmas. Such a situation, of course, does not suit Brexit supporters in the Tory party, nor the Labour Party, nor other parties. In the meantime, discussion of the bill itself has begun, and the debate may last until late at night, which will periodically exert pressure or support to the British pound. However, many lawmakers would prefer to have more time to study the conditions proposed by Johnson, which has been repeatedly stated. But here we are already talking about moving the Brexit date from October 31 to 2020, which clearly does not suit Boris Johnson. Even if the prime minister succeeds this week in approving the deal in Parliament, and this happens only if the date of the deal on UK withdrawal from the EU is extended, in the future this scenario will allow amendments to the bill that could completely bury the deal. Johnson now has a much better chance of making a deal than ever, since on the weekend he secured some support from the Laborites and opponents of Brexit in his Tory party. Just a few votes can allow Johnson to win. However, as I noted above, under the scenario, if Johnson's deal is not ratified, Britain will have general elections and even a referendum on the exit and the EU. As for the technical picture of the GBPUSD pair, the pound only slightly fell against the US dollar, and this did not lead to significant changes. If the deal is approved, it is unlikely that the pound will break above resistance at 1.3040, which will lead to further growth of the trading instrument in the area of highs 1.3170 and 1.3260. If lawmakers are able to resist the government, then the pressure on the pound will increase, and the decline in GBPUSD under the support of 1.2840 will increase the pressure on the pair even more, which will lead to the demolition of a number of stop orders and a fall to larger lows of 1.2840 and 1.2670. EURUSD In the meantime, traders are closely following the news from the British Parliament, the euro is gradually falling against the US dollar. This is due to expectations that the European Central Bank may resort to an even greater easing of monetary policy. The European Central Bank will hold its last meeting with Mario Draghi as the head this Thursday. It is expected that Draghi will "slam the door" and go for another reduction in deposit rates, or at least make direct allusions to such measures that can be implemented in December. In the case of this approach, it is not entirely correct to expect purchases of risky assets after a decision on Brexit. From a technical point of view, further upward movement will occur only after the successful Brexit, otherwise the bears have already coped with the priority task and returned the pair to the support level of 1.1130, which gradually increases the pressure on buyers. Negative news will force them to close their long positions, pulling down the euro to the lows of 1.1090 and 1.1050. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Oct 2019 03:45 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 55p - 64p - 75p - 56p - 41p. Average volatility over the past 5 days: 58p (average). The second trading day of the week for the EUR/USD pair is held in absolutely calm trading with low volatility. As we said in yesterday's evening review, the pair will be prone to a downward correction at least before the ECB meeting and the Mario Draghi press conference on Thursday. Thus, tomorrow is another day of news lull. No interesting information was received from the European Union and the United States either yesterday or today. Amid such a lull, traders have no choice but to pay attention to the ongoing ups and downs associated with Brexit. But even they do not influence the preferences of traders and their activity too much. Thus, at least one more trading day, market participants will be in a state of fundamental hunger. We will try to figure out today what can await us at the ECB meeting, as well as the prospects for the euro for the next six months or a year. From our point of view, everything will depend not on the actions of the ECB, but on the actions of the Federal Reserve. As we have repeatedly said, the ECB has almost exhausted all its strongest trump cards in the confrontation with the recession into which the EU's economy is slipping. That is, the rates are already negative, and it was during these negative rates that the EU economy began to slow down again. As a result, the deposit rate was again lowered, and what next, if the drop in macroeconomic indicators is not stopped? The quantitative easing program will not be effective until November 1. It is unlikely that the regulator will immediately expand it. Most likely, it will only take several months to assess its impact on the economy of the European Union. And only then, if there are no positive effects or if the external economic situation worsens, it will be possible to count on a new easing of monetary policy or on additional stimulation. Thus, in the next six months or a year, it is hardly worth expecting more than one rate cut. At the moment, the probability of such an outcome is no more than 45%, according to the estimates of world analytical agencies. But the Fed has much to reduce the rate. At the moment, it is equal to 2.0%, which makes it possible for at least another 8 declines. After all, Donald Trump spoke of a rate of 0.0% as necessary for the economy. In addition, the Fed may also revive the QE program. Thus, the Fed has a lot of room for maneuver in stimulating the economy, if necessary, and also in meeting the demands of the US president. And if the Fed uses these tools, involuntarily or voluntarily, these will be factors that will already work in favor of the euro. This is precisely the chance of the euro to complete the long-term downward trend. The ECB meeting on Thursday, according to many experts, will be a farewell ceremony for Mario Draghi, who will be replaced by Christine Lagarde as head of the Regulator on November 1. Traders also do not believe that the ECB will make any changes in monetary policy, therefore, the key event will be the press conference of Draghi, in which he is likely to answer questions related to QE and assessing the current state of the EU economy. The technical picture of the pair is almost unambiguous - a downward correction to the Kijun-sen critical line, then we will expect a rebound from this line in accordance with the continuing upward trend. Trading recommendations: The EUR/USD pair continues to adjust. Thus, it is recommended that traders wait for the completion of the current correction and only after that resume trading on the increase with targets of 1.1191 and 1.1230. It is recommended to return to selling the euro currency not earlier than when the bears overcome the critical Kijun-sen line, which will be the first signal of a change in trend. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

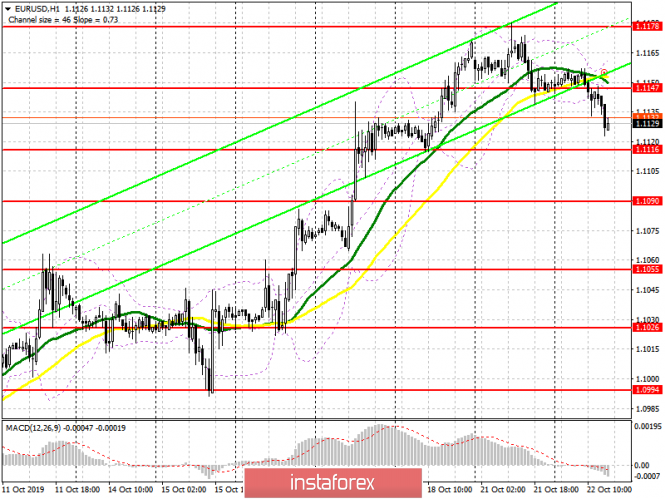

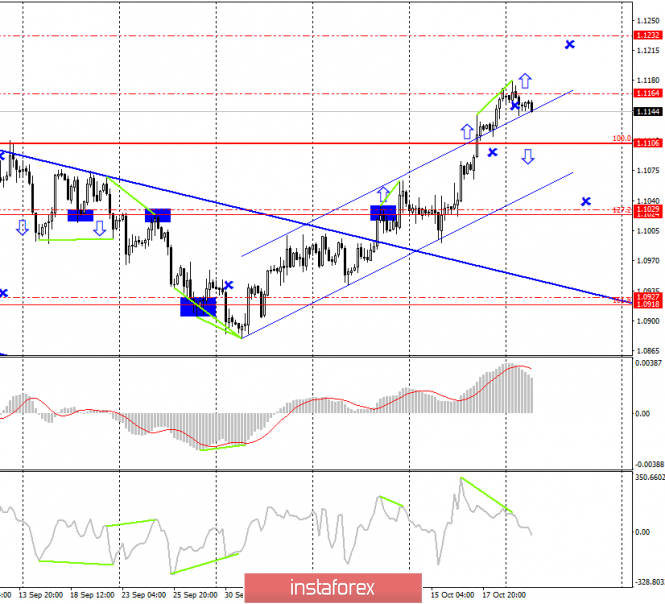

| October 22, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 22 Oct 2019 09:32 AM PDT

Since September 13, the EUR/USD has been trending-down within the depicted short-term bearish channel until signs of trend reversal were demonstrated around 1.0880 (Inverted Head & Shoulders Pattern). Shortly After, a bullish breakout above 1.0940 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) maintaining bullish movement above the recent bullish trend. Temporary bearish rejection and a sideway consolidation range were demonstrated after hitting the price zone of (1.1000 -1.1020) on October 7. That's why, initial Intraday bearish pullback was demonstrated towards 1.0940-10915 where another bullish swing was initiated. The intermediate-term outlook remains bullish as long as the EUR/USD pair pursues its current movement above 1.0990 (Last Prominent Bottom). Moreover, the recent bullish breakout above 1.1120 (100% Fibonacci Expansion) enhanced further bullish advancement towards the price zone of (1.1175-1.1195) where the current bearish pullback was recently originated. Today, more bearish pullback will probably be expressed towards the depicted Keyzone (1.1090-1.1100) where the depicted uptrend line comes to meet the EUR/USD pair. Trade recommendations : Yesterday, Intraday SELL entry was suggested around the price levels of (1.1175-1.1195). It's already running in profits. T/P levels to be located at 1.1135 and 1.1120. S/L should be lowered to 1.1165 to offset the associated risks. Conservative traders should wait for further bearish pullback towards the depicted uptrend line (1.1090-1.1100) for a valid BUY entry. Initial T/P levels to be projected towards 1.1195 while S/L should be placed below 1.1060. The material has been provided by InstaForex Company - www.instaforex.com |

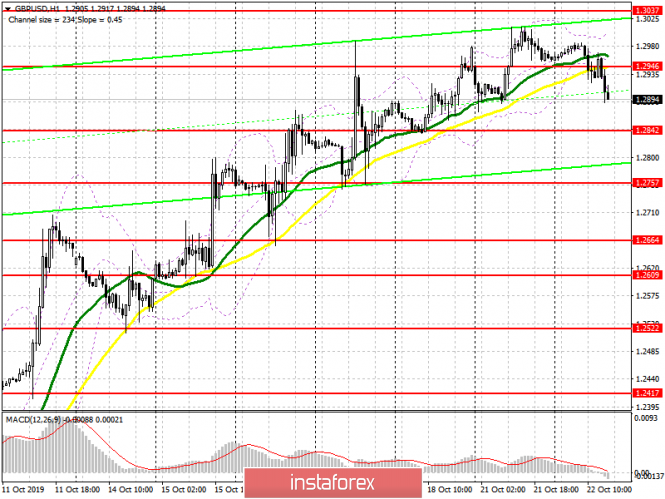

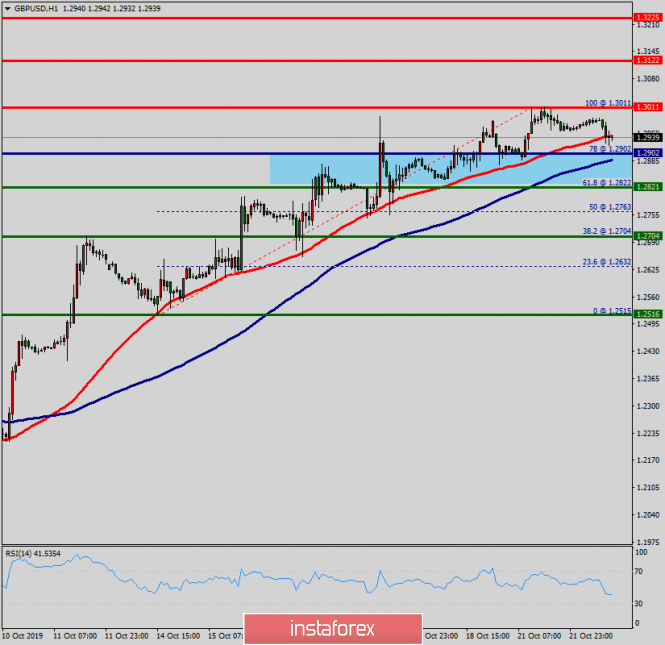

| Posted: 22 Oct 2019 09:04 AM PDT

Two weeks ago, the price zone of 1.2400-1.2415 (reversal pattern neckline) was breached to the upside allowing further bullish advancement to occur towards 1.2800 then 1.3000 where the GBP/USD looks overbought outside the depicted bullish channel. This week, the GBP/USD pair is failing to achieve a successful bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent TOP that goes back to May 2019. Moreover, the depicted ascending wedge has been broken-down indicating a high probability of bearish reversal around the current price levels 1.2950-1.2970. That's why, a quick bearish movement is expected to originate around the current price levels down to 1.2780 (Key-Level) where price action should be assessed again. Quick Bearish breakout below 1.2870 is needed to bring further bearish decline towards 1.2780 where an Intraday Key-Level comes to meet the pair. Trade Recommendations: Intraday traders are advised to have a valid SELL entry around the current price levels (1.2950-1.2970). T/P level to be placed around 1.2870 then 1.2780 while S/L should be placed above 1.3010. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Get ready for the storm of volatility: Brexit's fate is in parliament again Posted: 22 Oct 2019 08:28 AM PDT Today, late in the evening (approximately at 19:00-20:00 London time), there will be another "decisive" vote on Brexit in the British Parliament. It is difficult to calculate how many such votes have already been in the last few years: in each case, the deputies and members of the government tried to unravel the tangle of contradictions, which became more complicated from year to year. And now, the parties approached the "barrier" again: today, the British parliament will either give the "green light" to the future deal or launch an alternative scenario that involves a postponement of Brexit, re-election and (possibly) a referendum on the terms of the new agreement. Given such an eventful crossroads, we can say without any exaggeration that the echoes of today's vote will be felt by traders of the GBP/USD pair for several months.

In anticipation of key events, the pound paired with the dollar behaves accordingly: retreating from the achieved highs, it froze in anticipation of the parliamentary verdict. On the eve of such votes, the British currency, as a rule, loses its positions, as many traders are reinsured by closing long positions. But in recent days, events alternate with kaleidoscopic speed, so the pound does not have time to follow the news flow. The fact is that quite contradictory information has surfaced in the British press regarding the prospects for voting: according to an insider of some journalists, Johnson will find support among some Labor who are willing to negotiate a deal with Brussels – even at the cost of "political dissent." The number of such labor members who are willing to go against the party's general line varies from 19 to 50. The position of the Democratic Unionist Party is also unclear – according to official information, representatives of the Northern Irish refused to vote for the deal, but according to unofficial information, negotiations on this matter are still ongoing. Therefore, it is not at all excluded that the unionists will eventually agree with the general principle of the proposed bill. In other words, the intrigue regarding the evening meeting persists. It should be noted that Johnson wanted to hold a "signal" vote yesterday, but Speaker Bercow blocked this attempt. According to him, the law does not allow repeated voting on the same issue (if the circumstances on this issue have not changed significantly). Therefore, the prime minister changed tactics – he again proposed the same deal, but in the complex 110-page bill. Today's parliamentary debate began this afternoon, while by 21:00 the deputies should answer the main question: whether they approve the basic principles of the proposed deal or not. If the answer is yes, parliamentarians will go further in the procedure by voting for the schedule for considering the bill. In the case of a negative answer, such procedural maneuvers will already be inappropriate. It is too early to talk about further scenarios. If the deputies nevertheless say a preliminary "yes," they will continue to discuss the 110-page document. Johnson's government insists that in this case, it is permissible to consider the bill within three days, although, as a rule, much more time is allocated for the consideration of international agreements of this level – at least three weeks. Many deputies (primarily Labor) insist on a full review procedure, so if their demands are supported by a majority, then Johnson will be forced to request technical delay from Brussels. However, if the deputies fundamentally agree with the deal, this delay will no longer be of fundamental importance.

It is much more difficult to predict the development of events if parliamentarians fail the deal today. On the one hand, Boris Johnson has already sent to Brussels a request for a delay. On the other hand, he did not sign this letter, having sent "after" the second appeal of a personal nature – with the opposite request. The EU leadership is ready to "turn a blind eye" to the personal opinion of the British Prime Minister – Europe is set to continue the negotiation process, especially since the formal grounds for this already exist. But these are the events of the following days. The reaction of the pound in the short term (today – tomorrow) will depend on the results of today's vote. In the case of a positive answer, the pound will again go to storm the 30th figure (and very likely consolidate in the range of 1.3020 – 1.3090). Otherwise, a fairly significant price pullback will follow, at least to the base of the 25th figure. It is too early to talk about lower values: in any case, the probability of a "hard" Brexit on October 31 is now minimal (given the position of the British Parliament and Brussels), so the worst-case scenario for the pound is unlikely to be realized in the near future, at least until the end of the year. This fact will provide background support to the British currency, as they say, "in any weather." The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Oct 2019 08:23 AM PDT Good afternoon, dear traders! The USD/JPY currency pair is now interested in the long term – in my opinion, there is a high probability of continuing the daily rally to update the extreme of 109.30. One of the reasons – the strong initiative of the buyers on the weekly timeframe, which pushed the "Japanese" over the local level of 108.50, in the area of which this instrument is now traded. The strong growth is due primarily to the US dollar, and the following news from the US (which will be released only on Thursday at 15:30) will be very useful.

Therefore, the plan for today is simple: you can carefully type in purchases on USD/JPY with a take profit at 109.30 while limiting losses to the minimum of yesterday – the level of 108.31. I wish you success in trading and big profits! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Oct 2019 08:16 AM PDT To open long positions on GBP/USD, you need: The debate over the Brexit agreement began in London, and buyers of the British pound are gradually leaving the market. The morning support level of 1.2946 could not be held, but the pound also did not reach a major sale. As has been said many times, everything will depend on the results of today's parliamentary vote. In a positive scenario, a return to the resistance of 1.2950 will be an additional signal to buy the pound, and the new target will be the highs of 1.3037, 1.3125 and 1.3167. With the approval of the Brexit agreement, the option of updating the 32nd and 33rd figures is not excluded. If the pressure on the pound persists in the second half of the day, it is best to return to long positions on a false breakdown from the support of 1.2842 or on a rebound from the larger minimum of 1.2757. In the most negative scenario, GBP/USD may be supported by the area of 1.2664. To open short positions on GBP/USD, you need: Sellers coped with the morning task and returned the pair under the support of 1.2946, but the rest Sellers coped with the morning task and returned the pair under the support of 1.2946, but the rest of the movement, as we see on the chart, will depend on the debate that has now begun in the UK Parliament on the Brexit agreement, as well as on the outcome of the vote. A break of 1.2842 support will lead to the demolition of several stop orders and a further decrease in GBP/USD to the area of the lows of 1.2757 and 1.2664, where I recommend taking the profits. When the bulls return to the level of 1.2946, I do not recommend returning to short positions today. The next major levels will be viewed in the area of 1.3074 and 1.3167. However, as noted above, the option of updating the 33rd figure is not excluded. Indicator signals: Moving Averages Trading is below the 30 and 50 daily averages, which indicates a possible correction of the British pound. Bollinger Bands If the pound rises and the upper limit of the indicator breaks in the area of 1.2995, it can expect further upward movement along with the trend.

Description of indicators

|

| BTC 10.22.2019 - Gap area is still holding Posted: 22 Oct 2019 07:05 AM PDT To open long positions on Bitcoin you need: At the moment, the task of the bulls is to keep trading above the gap area 7.960 and try to go towards the resistance levels at 8.447 and 8.900. So far, the gap is still holding... To open short positions on Gold you need: Main task for bears will be to fill the gap at 7.950 and then eventually break the support 7.777. The first goal will be the potential test of 7.441 where I recommend profit taking. Signals of indicators: MACD – Momentum is still not that big the still overall on positive side above the zero. Bollinger bands: The upper boundary of the indicator in the area of 8.330 will act as resistance and lower boundary at the price of 7.865 like support.

|

| Posted: 22 Oct 2019 06:37 AM PDT To open long positions on Gold you need: At the moment, the task of the bulls is to break the resistance at 1.495, above which we can expect continued growth towards 1.519, where I recommend taking profits. There are no high impact events today and the market would need fresh new money in order to get out of the defined symmetrical triangle. You can also try to buy first pullback if you see the breakout of the resistance. To open short positions on Gold you need: You will need the breakout of the support at the price of 1.480. The first goal will be test of 1.462, where I recommend profit taking. There is big chance that investors on Gold are waiting for FOMC meeting minutes before any new direction. Signals of indicators: MACD – Momentum is very low and it is confirming sideways market activity, which usually proceeds before the breakout Bollinger bands In case the Gold declines, support will be provided by the lower boundary of the indicator around 1.482. The upper boundary of the indicator in the area of 1.495 will act as resistance.

|

| Posted: 22 Oct 2019 06:33 AM PDT To open long positions on EURUSD, you need: The bulls did not cope with the morning task, and against the background of the absence of important fundamental statistics on the eurozone, which yesterday helped buyers to hold the market, the pair began to gradually slide down. However, the main movement will take place following a vote in the British Parliament on Brexit. The task of buyers of the euro is now to return to the level of 1.1147, as fixing it again will give the pair an upward momentum that can lead to an update of the highs of the month in the area of 1.1178 and 1.1226, where I recommend taking the profits. If the pressure is further maintained, support will be provided by the level of 1.1116, but it is best to open long positions from there when a false breakdown is formed, but you can buy immediately for a rebound from a minimum of 1.1090. To open short positions on EURUSD, you need: The bears are still entrenched below the support of 1.1147 and are trying to push the pair lower to the minimum of 1.1116, where I recommend taking the profits, as the main movement will be based on the results of the Brexit vote. In the second half of the day, the release of important fundamental statistics is also not expected, therefore, with a positive vote, the bulls can quickly win back the level of 1.1147. In this scenario, it is best to consider new short positions after forming a false breakdown near this month's high of 1.1178 or sell EUR/USD immediately on a rebound from the resistance of 1.1226. Indicator signals: Moving Averages Trading is conducted below 30 and 50 moving averages, which indicates the possible formation of a downward trend in the pair. Bollinger Bands The breakthrough of the upper limit of the indicator in the area of 1.1161 will provide the market with new buyers of the euro.

Description of indicators

|

| GBP/USD 10.22.2019 - Broken rising wedge, bigger downside potential Posted: 22 Oct 2019 06:14 AM PDT GBP/USD has been trading downwards. I found the breakout of the well defined rising wedge pattern in the background, which is indication that sellers are in control. Watch for potential selling opportunities on the rallies.

Orange rectangles – Support levels and objectives Rising purple lines – Broken rising wedge pattern Falling purple line – Expected path Broken falling wedge is very important technical point that you should be aware if you plan to buy GBP. My advice is to watch for selling opportunities on the rallies with the targets at 1.2790, 1.270 and 1.2541. Key resistance is set at 1.3000. Signals of indicators: MACD – Upside momentum was lost and not MACD turned into negative territory Bollinger bands In case the Gold declines, support will be provided by the lower boundary of the indicator around 1.2810 The upper boundary of the indicator in the area of 1.3018 will act as resistance.The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR/USD for October 22, 2019 Posted: 22 Oct 2019 05:25 AM PDT EURUSD trade setup video for a potential bottom which was formed at 1.0879 earlier. The material has been provided by InstaForex Company - www.instaforex.com |

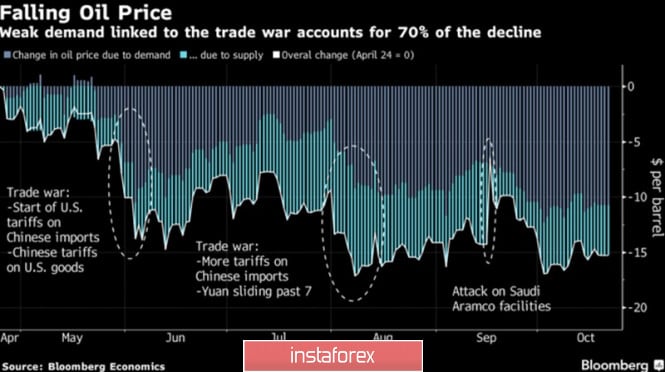

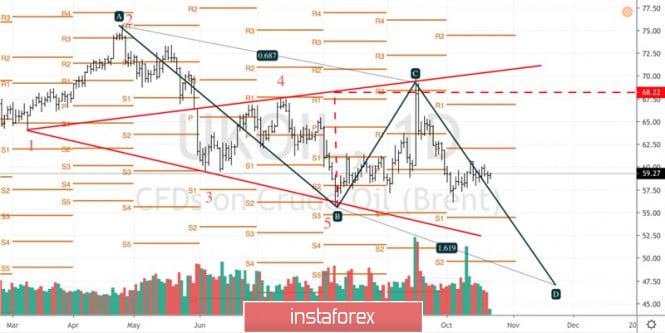

| Posted: 22 Oct 2019 04:44 AM PDT Strange things are happening in the oil market! With many "bullish" drivers, Brent and WTI quotes do not grow, but consolidate, while speculators are not tired of increasing short positions in black gold. According to the results of the week, by October 15, net longs for the Texas variety fell to 86,530 contracts, which is the lowest level since the beginning of January. Rates on price cuts have almost tripled since mid-September, which triggered a WTI drop of about 20%. But from fundamental analysis, you cannot say that "bears" dominate the market. OPEC, Russia and other manufacturing countries adhere to their plans to reduce production by 1.2 million b/d and are ready to extend the terms of the agreement in early December. American sanctions against Iran have significantly reduced exports from this country: up to 2 million b/d as to the moon in April 2018. The political crisis in Venezuela led to a drop in production to 644 thousand b/d, which is 1.3 million b/d less than two years ago. If we add to this the tense geopolitical situation in the Middle East, including attacks on tankers in the Strait of Hormuz and on production facilities in Saudi Arabia, then the natural question arises, why is Brent not growing towards at least $80 per barrel? Perhaps the Americans are not tired of increasing production? No, its dynamics are gradually deteriorating. This forced Goldman Sachs to reduce its growth forecasts from 1 million b/d to 0.7 million b/d in 2020. According to Bloomberg Economics, the reasons for the "bearish" oil market conditions should be sought in demand, not in supply. 70% of the blame for the fall in prices is due to trade wars and slowing global demand, and only 30% – with supplies. Dynamics and structure of changes in oil prices

Indeed, the IMF in October lowered its forecast for global economic growth to 3%, which is the worst dynamics in a decade, and the IEA – estimates of growth in demand for black gold. American oil reserves are increasing for the second week in a row and, according to Bloomberg experts, will continue to do so at the end of the five days by October 18. What about the fact that after the talks in Washington, investors believe in a de-escalation of the trade conflict between the US and China – the main culprit of slowing global demand for black gold? According to estimates of the International Monetary Fund, if current tariffs remain in force, this will reduce the growth of global GDP by 0.6% points in 2020. Since the trade conflict has hit business activity and investment, the abolition of tariffs will not be enough for the world economy to quickly regain its lost ground. Technically, the current consolidation of Brent is quite capable of expanding to the range of $55–62 per barrel. A breakthrough in its upper boundary will create the prerequisites for the implementation of the reversal pattern "Wolfe Waves" with an initial target of $68.2. On the contrary, updating the August low and activating the AB = CD model will increase the risks of falling prices to its target by 161.8%. It corresponds to the mark of $47.1. Brent, the daily chart

|

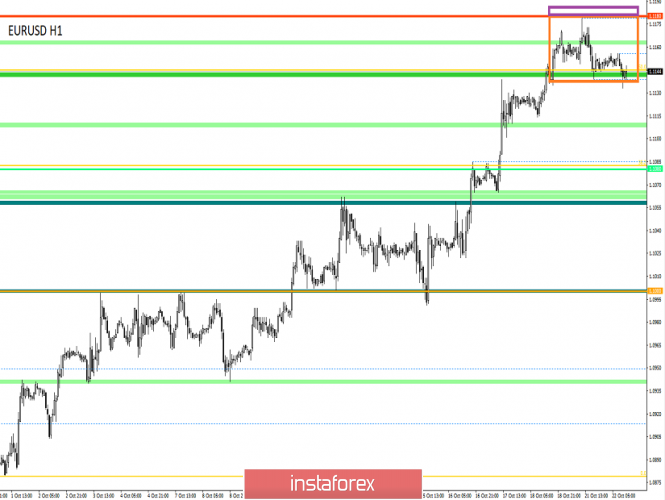

| Trading recommendations for the EURUSD currency pair – placement of trade orders (October 22) Posted: 22 Oct 2019 04:44 AM PDT For the first time in a long time, the euro/dollar currency pair showed reduced volatility of 40 points, as a result of having a touch of the periodic level. From technical analysis, we see that the quote has reached the framework of the periodic coordinate of 1.1180, which has long played the role of a mirror level. As a result, we saw a characteristic slowdown followed by a pullback. Whether the current level will be able to keep persistent buyers, only time will tell, but the market overbought has almost reached the limit due to a stable inertial course. The reason for such a confident upward move lies in several factors, but an integral contribution was made in the form of the emotional mood of market participants. Looking at the hourly last day, we see that the movement was mostly horizontal and only in the period of 10:00 – 11:00 hours (time on the trading terminal), there was a local upward momentum, just touching the periodic level of 1.1179. As discussed in the previous review, speculators recorded profits in the area of 1.1160/1.1180 from previously opened long positions. After that, there was a waiting period with the analysis of the framework of 1.1145/1.1180, where they expected not just a puncture, but a price fixation, preferably with the support of an inertial move. This development never happened, no deals were opened. Looking at the trading chart in general terms (daily period), you are faced with an ambiguous judgment. The main downward trend has existed for as long as 1.5 years, and the current movement exists a little less than a month, so why many people already managed to reverse the trend from downward to upward? In percentage terms, we have a change of only 18%, and this is still within the oblong correction. Thus, the fuss divorced on this issue once again confirms that the existing forms in the form of an inertial move are built more on the emotions of market participants. The news background of the day did not include statistics on Europe and the United States. The information background, on the contrary, was full of headlines about the Brexit process. So, another attempt by the Prime Minister of Great Britain, Boris Johnson, to stretch the agreement previously agreed with the European Union through the parliament (UK) failed. UK deputies simply refused to vote on Monday, citing a law prohibiting the government from asking again to vote on the same initiative. In turn, the Ministers of Scotland and Wales, Nicola Sturgeon and Mark Drakeford, addressed the head of the European Council Donald Tusk with a letter asking him to provide an extension of Brexit. "We would like to support this request for an extension so that there would be no risk of Britain leaving the EU without an agreement ratified by both the EU and the UK. Our common view is that the result of the Westminster process should be a referendum on EU membership. But in any case, there must be enough time for proper study of the bill on withdrawal from the EU," the text of the open letter of the two leaders says. The information background does not end there, and so, from Europe, in particular, Germany, a comment has been received regarding a possible rim. The head of the German Federal Republic of Germany, Heiko Maas, said: "Naturally, the position of the German and EU governments has always been that we do not want a disordered Brexit without a deal. We want this to be an orderly process. I hope that the lower house of parliament will decide with necessary responsibility on this issue and that based on this decision we will have the opportunity to implement the scenario of an orderly Brexit." The Brexit relay race is completed by European Commission President Jean-Claude Juncker, who is no longer so optimistic about what is happening on the new agreement. "Today I am speaking to you for the 105th time and in many of these debates, I had to discuss Britain's exit from the European Union. I am very disappointed that I had to spend so much time on my Brexit mandate, while I fought to do the best for EU citizens. A waste of time and a waste of energy," said Jean-Claude Juncker, speaking at an EP meeting in Strasbourg. Today, in terms of the economic calendar, we have only data on sales in the secondary housing market in the United States, where a decrease of -0.7% is expected in September. At the same time, the process of (trying) the approval of Brexit in Britain is actively ongoing, and the parliament has only three days to approve, where there will be repeated voting and reading. Further development Analyzing the current trading chart, we see how the quote hovered within the lower boundary of the previously designated framework of 1.1145/1.1180, showing, to put it mildly, low volatility. We see an attempt by sellers to form a consistent correction, but so far there are not many who want to join short positions. Detailing the hourly available day, we see that during the Pacific and Asian trading sessions, there was a narrow consolidation, but with the arrival of the European trading session, a local downward movement was formed (09:00 – 11:00 time on the trading terminal). In turn, speculators are hoping for a short-term downward move in terms of recovery, where short positions were considered around the mark of 1.1145. Due to safety net, speculators have an alternative position that liquidates the first one, in case the inertial upward move resumes and the price fixes above the level of 1.1180. It is likely to assume that the swing within the current coordinates is still possible, wherein the case of holding the local downward interest, a descent towards 1.1120 – 1.1080 can occur. At the same time, while maintaining the hype mood of market participants, the primary oscillation (1.1145/1.1180 (+/-10 points)) may persist until the moment of standing information background. Based on the above information, we derive trading recommendations:

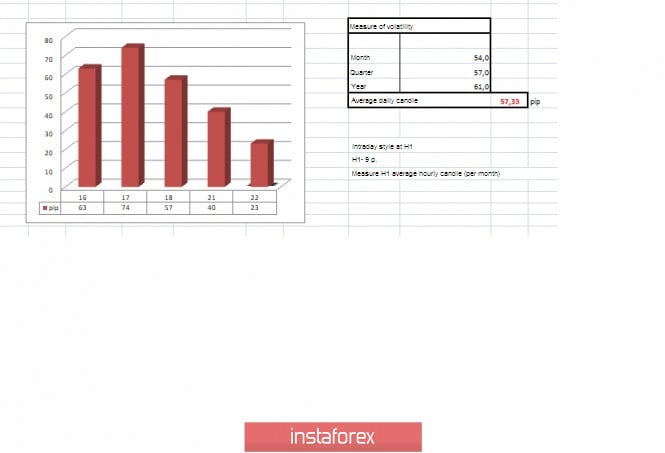

Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators maintain an upward mood on the general background of market emotions. At the same time, short-term intervals signal variable interest due to the existing accumulation process. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 22 was built taking into account the time of publication of the article) The volatility of the current time is 23 points, which is more low than average. It is likely to assume that as long as the price moves within the established framework of accumulation, it is not worth waiting for something drastic from volatility. Key levels Resistance zones: 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1100**; 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar is on a slippery road, the euro and the pound are waiting for a key vote on Brexit Posted: 22 Oct 2019 03:30 AM PDT

According to some analysts, the dominance of greenback in the foreign exchange market now looks the most precarious since the beginning of 2018. The US dollar fell by 2.1% this month against a basket of six competing currencies. If the situation does not change, then October may be the worst month for the USD since January last year. NatWest Markets experts believe that the US currency is threatened by the prospect of a positive Brexit outcome, which will damage the safe-haven assets, as well as the likelihood of a more significant reduction in interest rates in the United States. "The long-term bullish outlook for the dollar is questionable since some of the key themes of the market has reached its peak of influence. Also, the Fed's plan to buy three-month US Treasury bills to reduce the repo market deficit could be a significant deterrent to the greenback over the next few quarters. During this period, the Fed may again reduce interest rates in December and March," they noted. Meanwhile, the market is discussing the duration of European QE. From November, the ECB intends to buy €20 billion worth of assets until inflation is defeated. However, if we proceed from the rule of 33% of the volume of bonds issued by one country, the program can be completed by the end of next year or even earlier if the situation in the eurozone economy continues to deteriorate. At the moment, the European Central Bank has already bought 31% of the total debt of the Netherlands and 30% of the debt of Germany. Thus, the potential for easing the ECB's monetary policy is limited, while the Fed is quite wide, which is a serious "bullish" factor for EUR/USD. Along with the ECB's inability to give the market more than it gave in September, another trump card for the euro is the progress in negotiations between London and Brussels regarding Albion's exit from the EU. Last week, the parties announced a Brexit deal, but it must be approved by the British Parliament. The vote on the draft "divorce" agreement in the House of Commons, which may take place today, will be a key driver of changes in the quotes of EUR/USD. The adoption of the document will allow the main currency pair to gain a foothold above the 12th figure, while another defeat of Boris Johnson in Parliament will lead to a correction in the direction of 1.112 and 1.108. The main problem for B. Johnson may be the amendments that the opposition will make. Most of them are unacceptable to the government. Their adoption may lead to the fact that the Cabinet itself will remove the document from the vote. The final word on the issue of which amendments will be approved before the vote rests with the Speaker of the House of Commons, John Bercow, who did not allow voting on the deal with the EU yesterday. Rejecting the document or making significant amendments to its text is likely to mean postponing Brexit for several months, as there are only nine days left before the deadline for its implementation. The British government says it has stepped up preparations for a no-deal Brexit, but experts say the likelihood of such an outcome is low. The GBP/USD pair rose above 1.30 for the first time since May but then retreated from five-month highs in anticipation of a key vote on the deal of the Prime Minister of the United Kingdom regarding Brexit. "The reaction of the market should be simple: the pound will rise if the bill passes, it will fall if this does not happen. Outside of today, it seems unlikely that a majority will be gathered in the House of Commons to call for a new referendum, which the Laborites are likely to request," RBC currency strategists believe. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Oct 2019 03:07 AM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a reversal in favor of the US dollar after the formation of a bearish divergence at the CCI indicator and rebounded from the level of 1.1164. Thus, a drop of the quotes may continue towards the correctional level of 100.0% (1.1106). The upward trend channel, despite the closing quotes of the euro/dollar pair above it, remains in force, indicating the "bullish" mood of traders. Fixing the pair's rate on October 22 above the level of 1.1164 will increase the probability of continuing growth towards the next extremum level of 1.1232. Traders continue to expect Thursday, when not only a meeting of the ECB will take place, as a result of which changes can again be made in the monetary policy of the European Union, but also released a lot of economic reports in the US and the European Union. Until this day, traders can only adjust the pair by closing purchases, as, firstly, the European currency has grown quite decently in recent weeks, and secondly, it is difficult to expect anything optimistic from Mario Draghi's decisions and his speech at the press conference. Meanwhile, nothing interesting is happening in the US either. Trade talks between China and the US have concluded, both sides said "progress has been made" and, in general, "good atmosphere", and that's all. No agreement was signed, no new data on this topic. It seems that Beijing is playing cat and mouse with Washington, verbally declaring one thing, in practice, implementing a completely different strategy. And this strategy can be only one. The delay time. China is well aware that Donald Trump is unlikely to be re-elected for a second term. Moreover, the US President would at least finalize the current term until the end, since the topic of possible impeachment has not subsided, unlike trade negotiations. Thus, why should China make concessions, try to come to terms with Trump, with whom no one has managed to reach an agreement if a more loyal president comes to power in a year, with whom it will be possible to restore trade relations between the countries that were before Trump? It seems to me that Beijing understands this and deliberately pulls time. But Trump can only threaten with the introduction of new duties, the tightening of existing duties, to push China to sign a deal that is primarily beneficial to the United States. Theoretically, a solution to the trade conflict could have a beneficial effect on the dollar, as it would mean the end of the cycle of deterioration of economic indicators in America. But no. Thus, traders are now waiting for the meetings of the ECB and the Fed, realizing that these events can either support the existing trend or return the euro/dollar pair to a downward trend. What to expect from the euro/dollar currency pair today? On October 22, traders will be able to count on the continuation of the pair's growth if the consolidation above the level of 1.1164 is performed. Otherwise, we are waiting for a slow slide to 1.1106, below which we can already look towards new purchases of the US currency. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend selling the pair with a target of 1.1024 if the close is made below the level of 1.1106 (100.0% Fibonacci). A stop-loss order above the level of 1.1106. I recommend opening new purchases of the pair with the target of 1.1232 and the stop-loss order below the level of 1.1164 if the closure is performed above 1.1164. The material has been provided by InstaForex Company - www.instaforex.com |

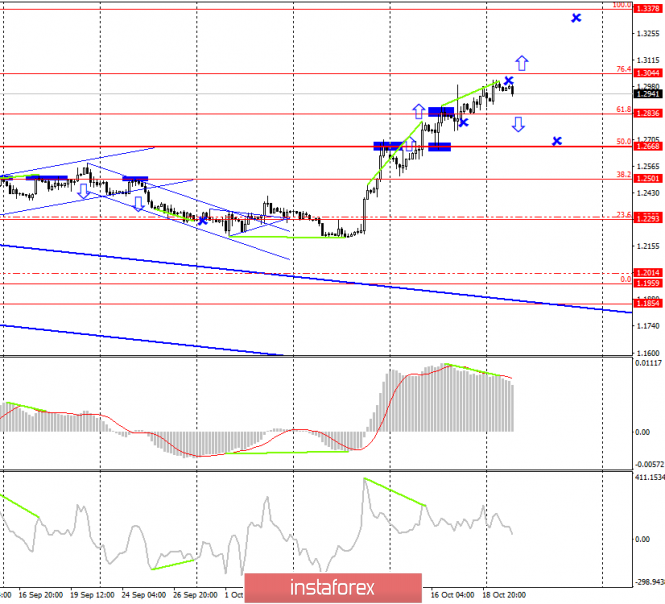

| Posted: 22 Oct 2019 03:04 AM PDT GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair continues the growth process in the direction of the correction level of 76.4% (1.3044). The resulting bearish divergence of the MACD indicator allows us to count on a reversal of the pair in favor of the US currency and some fall in the direction of the correction level of 61.8% (1.2836). The closing of the pair's quotes above the Fibo level of 76.4% will allow us to expect continued growth in the direction of the correction level of 100.0% (1.3378). The policy of Boris Johnson is increasingly causing a flurry of criticism. For example, the Prime Minister did not appear at Monday's meeting, sending a "replacement" for Brexit Minister Stephen Barclay. As a result, a large number of deputies criticized Johnson and accused him of complete disrespect in the Parliament. Johnson's strange behavior. In a situation where he just needs the support of Parliament, he openly shows his disrespect for the deputies, while urging them to approve his agreement. Now, it even seems that Theresa May should have resigned. Given the fact that May herself was opposed to leaving the European Union, she did everything to implement the will of the people and please the majority of deputies. She also urged deputies to support the draft of her Checkers deal but did not succeed. Now, we have Boris Johnson in the role of Prime Minister, who provokes a strong hostility among half of the Parliament, which, according to Johnson himself, should accept his version of the agreement, which does not differ much from the deal of Theresa May. Moreover, Johnson allows himself not to attend meetings, which makes the deputies even angrier. According to the latest information, over the next three days, deputies will again consider a multi-page document of the agreement with the European Union, and a vote will be held on Thursday evening, which, for example, was canceled on Monday, since Speaker of the House of Commons John Bercow said that it was no different from voting on Saturday. What will change before Thursday is not clear? However, in any case, nothing can prevent the deputies and the speaker from blocking the draft agreement once again on Thursday. In general, the question is in the air, and how many more votes is Johnson going to hold and what does he expect? At the moment, everything is going to the fact that Brexit will again be postponed, and the Prime Minister will continue to anger Parliament. Economic reports on Monday, Tuesday and Wednesday in the UK will not be published, so traders will continue to remain immersed in the topic of Brexit. What to expect from the pound/dollar currency pair today? The pound/dollar pair almost reached the correction level of 76.4%. Thus, I expect further growth of quotations in the case of consolidation above this level in the direction of the next Fibo level of 100.0% (1.3378). The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I recommend buying the pair with a target of 1.3378 if the close above the Fibo level of 76.4% is executed with the stop-loss order below the level of 1.3044. I recommend considering selling the pair with the target of 1.2668 if the consolidation under the Fibo level of 61.8% is performed. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for October 22, 2019 Posted: 22 Oct 2019 02:38 AM PDT Overview: On the H1 chart, the GBP/USD pair is trading in a bear trend above the 50 and 100-day simple moving averages since last week. Moreover, the GBP/USD is trading above the main SMAs, suggesting bullish momentum in the near term. Support is seen at the 1.2902 zone and the 1.2821 price level. Alos, it should be noted that the news limited further gains in the New York session. According to the previous events, the pair is still in an uptrend. From this point, the GBP/USD pair is continuing in a bullish trend from the new support level of 1.2902. Thereupon, the price spot of 1.2902/1.2821 remains a significant support area. Therefore, the possibility that the Cable will have an upnside momentum is rather convincing and the structure of the uprise does not look corrective. In order to indicate a bullish opportunity above 1.2902, it will be a good signal to buy above 1.2902 with the first target of 1.3011. It is equally important that it will call for uptrend so as to continue bullish trend towards 1.3122. However, the stop loss should be located below the level of 1.2821. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCHF reaching resistance, watch out! Posted: 22 Oct 2019 02:26 AM PDT |

| Australian rally. Trading idea for AUDUSD Posted: 22 Oct 2019 02:21 AM PDT Australian rally. Trading idea for AUDUSD Good day, dear traders! Today, I present to your attention a trading idea for the AUDUSD pair. Last week, we made good money on this tool on the strategy of "Price action" and "Hunt for stops". Now, I have a new trading idea. Fundamental components at once:

Technical picture: After a false breakdown of the year, AUDUSD showed good bullish dynamics and came close to the top of September in the area of the round level of 0.69. Its breakdown will happen with a high probability, but it is unprofitable to buy from current prices. But there is a technical level in the area of 0.68200 with a pullback, which can be bought cheaply and hold the position until the breakdown of the September extreme of 0.69 Success in trading and control risks! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment