Forex analysis review |

- October 24, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- October 24, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- Brexit stalled, pound awaits EU verdict on postponing Britain's exit from the alliance

- BTC 10.24.2019 - Watch for selling opporutnities on the rally, nerw momneutm down on the MACD oscillator in the background

- Gold 10.16.2019 - Broken symmetrical triangle to the upside, watch for buying opportuniteis on the pullbacks

- Technical analysis of ETH/USD for 24/10/2019

- Technical analysis of BTC/USD for 24/10/2019

- Technical analysis of GBP/USD for 24/10/2019

- EURUSD: Last speech by Mario Draghi as head of the ECB. What course will Christine Lagarde take?

- GBP/USD 10.24.2019 - Broken bearish flag,sell zone on the GBP

- Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 24)

- GBP/USD: plan for the American session on October 24th. Volatility declines amid lack of Brexit news

- EUR/USD: plan for the American session on October 24th. Weak manufacturing activity in the eurozone did not allow to break

- The FED cannot afford to cut rates – the impact on GBPUSD

- Technical analysis of EUR/USD for October 24, 2019

- The fall of the pound. Trading idea for GBPUSD pair

- Trading strategy for EUR/USD on October 24th. Business activity in Germany and the European Union: a disappointment

- Trading strategy for GBP/USD for October 24th. Brexit is postponed. It remains only to settle the formalities

- USD/CAD – take profits!

- USDCHF to reach 1st support at 0.9917, potential to drop!

- Trading plan for EUR/USD and GBP/USD on 10/24/2019

- EURUSD and GBPUSD: The EU is thinking about delaying Britain's exit from the EU, which will seriously affect the pound. Mario

- Simplified wave analysis of EUR/USD and GBP / JPY on October 24th

- Trading recommendations for the EURUSD currency pair - placement of trade orders (October 24)

- The corporate reporting season helped the dollar recover, the euro in anticipation of the ECB meeting, and the pound went

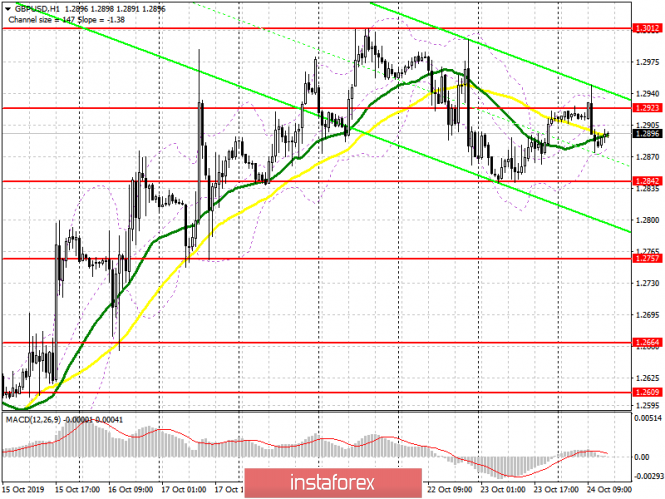

| October 24, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 24 Oct 2019 07:52 AM PDT

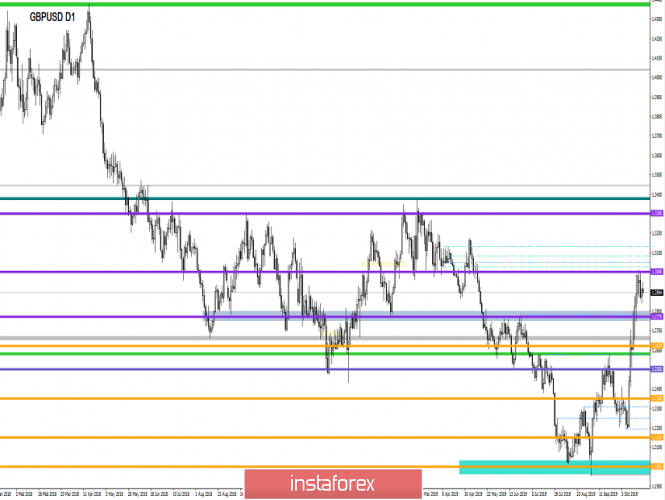

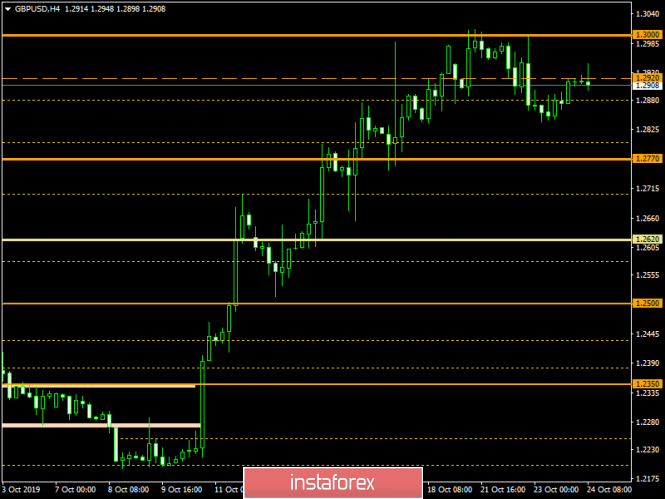

Two weeks ago, the price zone of 1.2400-1.2415 (Double-Bottom pattern neckline) was breached to the upside allowing further bullish advancement to occur towards 1.2800 then 1.3000 where the GBP/USD looks overbought outside the depicted bullish channel. This week, the GBP/USD pair has failed to achieve a successful bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent TOP that goes back to May 2019. Moreover, the depicted ascending wedge has been broken-down indicating a high probability of bearish reversal around the price levels of 1.2950-1.2970. That's why, a quick bearish movement was expected to originate around these price levels down to 1.2780 (Key-Level) where price action should be assessed again. The current Bearish breakout below 1.2870 should be maintained to enhance further bearish decline towards 1.2780 where an Intraday Key-Level comes to meet the pair. Trade Recommendations: Intraday traders were advised to have a valid SELL entry around the price levels of (1.2950-1.2970). It's already running in profits. Remaining T/P level to be placed around 1.2780 while S/L should be placed lowered to 1.2980 to offset the associated risk. Conservative traders are advised to look for a valid BUY entry around 1.2780 if significant bullish rejection is expressed. The material has been provided by InstaForex Company - www.instaforex.com |

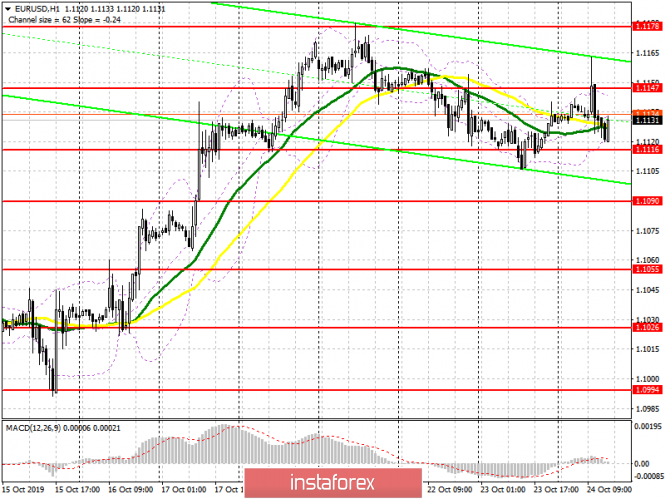

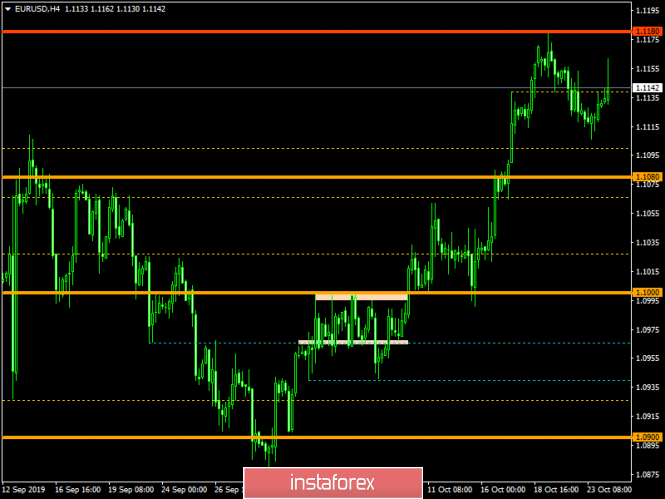

| October 24, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 24 Oct 2019 07:50 AM PDT

Since September 13, the EUR/USD has been trending-down within the depicted short-term bearish channel until signs of trend reversal were demonstrated around 1.0880 (Inverted Head & Shoulders Pattern). Shortly After, a bullish breakout above 1.0940 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) maintaining bullish movement above the recent bullish trend. Temporary bearish rejection and a sideway consolidation range were demonstrated after hitting the price zone of (1.1000 -1.1020) on October 7. That's why, initial Intraday bearish pullback was demonstrated towards 1.0940-10915 where another bullish swing was initiated. The intermediate-term outlook remains bullish as long as the EUR/USD pair pursues its current movement above 1.1060 (Nearest demand-zone). That's why, the recent bullish breakout above 1.1120 (100% Fibonacci Expansion) enhanced further bullish advancement towards the price zone of (1.1175-1.1195) where the current bearish pullback was recently originated. Today, more bearish pullback will probably be expressed towards the depicted Keyzone (1.1090-1.1100) where the depicted uptrend line comes to meet the EUR/USD pair. Trade recommendations : Conservative traders should wait for further bearish pullback towards the depicted uptrend line (1.1090-1.1100) for a valid BUY entry. Initial T/P levels to be projected towards 1.1195 while S/L should be placed below 1.1060. The material has been provided by InstaForex Company - www.instaforex.com |

| Brexit stalled, pound awaits EU verdict on postponing Britain's exit from the alliance Posted: 24 Oct 2019 07:21 AM PDT

The situation with Brexit took a temporary respite until Friday, when EU leaders could pass a verdict on allowing Britain to postpone the date of withdrawal from the alliance. On Wednesday evening, the ambassadors of the 27 EU countries held the first informal discussion of postponing Brexit, but no official decision was made. At the same time, all participants of the meeting agreed on the need to postpone the exit of Misty Albion from the block in order to avoid the implementation of a "hard" scenario. Previously, information appeared that the delay could be floating, that is, Brexit could take place earlier than the agreed date, if London and Brussels will be able to quickly ratify the agreement on its terms. "Due to the fact that British Prime Minister Boris Johnson failed with his Brexit plan in the House of Commons, we can expect that part of the risk premium that has been eliminated over the past three weeks will be returned to the value of the country's assets. How much it hurts the pound depends on how long the EU will extend Brexit. In theory, the alliance can offer a two-stage extension," Bloomberg expert Ven Ram said. According to him, the first extension can be granted for two weeks and will be conditional on the fact that B. Johnson's plan will become law, provided that all parliamentary barriers are removed. In such a scenario, the pound could fall against the US dollar to $1.24–$1.25 and then jump sharply if there are signs that the United Kingdom will leave the EU with a deal. "If B. Johnson fails to secure the approval of the deal by Parliament during the first extension period, the EU is likely to extend the validity of Article 50 of the Lisbon Agreement until January 31 to prevent the risk of the UK leaving the bloc without a deal," V. Ram believes. He predicts that in this case, the pound risks falling to $1.22–$1.23 because such a scenario opens up a combination of probabilities with many different variations. In particular, a longer extension of Brexit implies the possibility of early parliamentary elections in the United Kingdom before Christmas. "Recent opinion polls have shown that the conservatives could win a majority in Parliament, which would ultimately ensure the exit of Albion from the EU and open the door for the growth of the pound. However, voters' intentions may change ahead of the election. Labor victory would mean great uncertainty, as they tend to push for a second referendum on whether Britain should really leave the EU. Until the cloud of uncertainty around Brexit disperses, expect the pound to weaken," Ram said. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Oct 2019 07:08 AM PDT Bitcoin has been trading sideways at the price of 7.475 in the recent, 24 hours. I still expect more downside and potential of 6.610 in the next period but would wait for upward correction first.

Green rectangle – Resistance and good sell zone Blue horizontal line – Support line and downward objective MACD is showing us strong new downside momentum in the background and I expect more downside after the bullish correction. Resistance level is found 7.780 and support level at 6.610. Bollinger band middle line(resistance line) is set at 7.853The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Oct 2019 06:45 AM PDT Gold finally did upside breakout of the symmetrical triangle that I was mentioning in recent few days. My advice is to watch for buying opportunities on the pullback with the target at 1.517.

Orange rectangles – Broken resistance became support Purple lines – Broken symmetrical triangle Rising purple line – Expected path MACD is showing new momentum up, which is good sign for the further upside continuation. Support level is now set at the price of 1.496 and the major resistance at 1.517. Watch for first pullback after the breakout and try long opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of ETH/USD for 24/10/2019 Posted: 24 Oct 2019 06:40 AM PDT Crypto Industry News: Changpeng Zhao, president of Binance's leading cryptocurrency exchange, called Russian President Vladimir Putin the most influential person in the Blockchain industry. On October 22, Zhao, also known in the cryptographic community as CZ, pointed to Russian President Vladimir Putin as the most influential person in Blockchain space. Zhao also said he believes that the bill on regulating digital money can be adopted in the Russian Federation in the near future. Zhao also revealed that Binance may in some cases pass on user information to Russian financial regulators and warned those involved in crime to stay away from the trading platform, noting: "As a rule, we do not share information with any supervisory authorities en masse. But in individual cases - yes, [...] therefore, if you are involved in a crime, you do not register with Binance." - we read. Zhao concluded his statements by telling how he sold his home in 2014 to buy Bitcoins before falling from $ 600 to $ 200, despite which he kept them to this day when the BTC price is currently $ 8,100. History was a way to explain his belief that the world's most popular cryptocurrency will see impressive growth by the end of this year. Technical Market Overview: As anticipated before, the level of $151.30 has been hit during the dynamic and sudden down move towards the lows. The bulls have managed to bounce a little, but the move up is very shallow and the market might resume the downtrend anytime. Moreover, the price is still trading below the long-term trendline resistance, so the odds for the down move are even stronger. In the case of a breakout lower, the next target is seen at the level of $127.04. The nearest technical resistance is seen at the level of $168.15. Weekly Pivot Points: WR3 - $203.55 WR2 - $195.01 WR1 - $184.09 Weekly Pivot - $175.68 WS1 - $163.10 WS2 - $154.16 WS3 - $142.73 Trading Recommendations: The best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the uptrend. When the wave 2 corrective cycles are completed, the market might will ready for another impulsive wave up of a higher degree and uptrend continuation.

|

| Technical analysis of BTC/USD for 24/10/2019 Posted: 24 Oct 2019 06:39 AM PDT Crypto Industry News: The Opera web browser now allows you to make payments usingac Bitcoin directly in your browser. The company announced this information in a press release saying that 350 million Opera users can now send and receive Bitcoins directly from the browser, and also use cryptocurrency to buy goods and services on e-commerce sites. In addition, the browser now allows you to add a Bitcoin and TRON card to the built-in cryptocurrency wallet to track your cryptocurrency. Charles Hamel, head of Opera cryptography, commented on the introduction of a new feature: 'We believe that opening our browser to a larger number of Blockchain chains, including Bitcoin, is the logical next step to make our solution more suitable for anyone who has a Bitcoin cryptocurrency wallet and would like to operate their cryptocurrencies except just keeping them in their account" -he said. Technical Market Overview: The BTC/USD pair has broken below all key technical supports located at the levels of $7,892 and $7,707. The bears have total control over the market and more downside is very likely to come soon. The next target for bears is seen at the level of $7,231, which is the 61% of the Fibonacci retracement of the whole swing up. This might be a key level for bulls as well, because they will definitely defend this retracement. The nearest technical resistance is seen at the level of $7,538. Weekly Pivot Points: WR3 - $9,074 WR2 - $8,707 WR1 - $8,444 Weekly Pivot - $8,103 WS1 - $7,849 WS2 - $7,474 WS3 - $7,245 Trading Recommendations: Due to the short-term impulsive scenario invalidation, the best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the uptrend. When the wave 2 corrective cycles are completed, the market might will ready for another impulsive wave up of a higher degree and uptrend continuation.

|

| Technical analysis of GBP/USD for 24/10/2019 Posted: 24 Oct 2019 06:37 AM PDT Technical Market Overview: The 900 pips rally on GBP/USD pair looks completed, so after the short-term trendline support has been violated around the level of 1.2962, the bears have managed to push the prices lower towards the local technical support located at the level of 1.2865. Any violation of the level of 1.2865 will likely lead to another leg down to the level of 1.2783 again and even a slide towards the level of 1.2705. The key technical support is still located at the level of 1.2561. The larger timeframe trend remains bearish. Weekly Pivot Points: WR3 - 1.3651 WR2 - 1.3325 WR1 - 1.3193 Weekly Pivot - 1.2842 WS1 - 1.2723 WS2 - 1.2355 WS3 - 1.2252 Trading Recommendations: The best strategy for current market conditions is to trade with the larger timeframe trend, which is down. All upward moves will be treated as local corrections in the downtrend. In order to reverse the trend from down to up, the key level for bulls is seen at 1.2999 and it must be clearly violated. The key long-term technical support is seen at the level of 1.2231 - 1.2224 and the key long-term technical resistance is located at the level of 1.3509. As long as the price is trading below this level, the downtrend continues towards the level of 1.1957 and below.

|

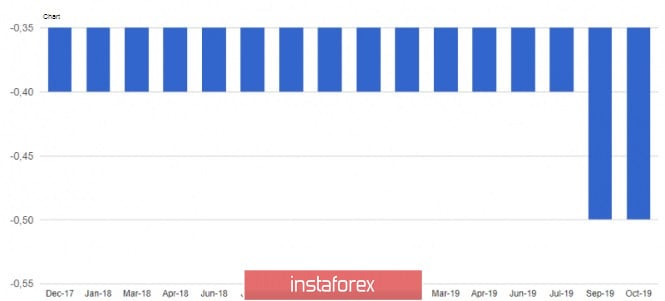

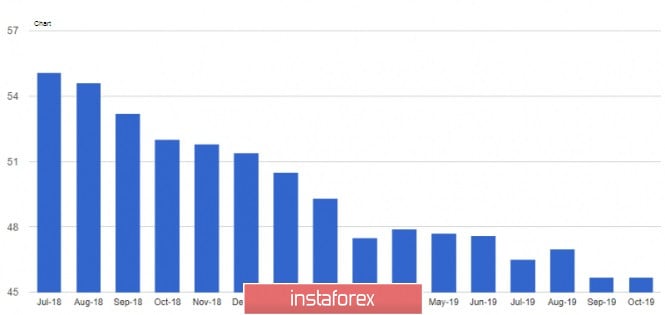

| EURUSD: Last speech by Mario Draghi as head of the ECB. What course will Christine Lagarde take? Posted: 24 Oct 2019 06:34 AM PDT Data on manufacturing activity in the eurozone once again proved the fact that the start of the 4th quarter in the eurozone is on a minor note. Therefore, all the attention of traders today was focused on the publication of the decision of the European Central Bank on interest rates, as well as on the last speech of the head of Mario Draghi. According to the data, the European Central Bank left the refinancing rate unchanged at 0.0%, as well as the deposit rate at its negative level of -0.5%. This decision provided some support to the euro. The ECB said that the key rate will remain at the current or lower level until inflation moves confidently to the target level of about 2.0%. The purchase of bonds, as previously stated, will begin on November 1 for 20 billion euros per month, and will continue for as long as necessary. This suggests that the regulator is laid for a sufficiently long period of low-interest rates and soft credit policy, and at least 2-3 years, you cannot expect changes in it. During a press conference, ECB President Mario Draghi said he was ready to adjust all instruments to achieve the inflation target, as the latest data indicate the continued weakness of the eurozone economy, thereby hinting that by the end of the year, the regulator may further reduce the already negative interest rates. According to Draghi, downside risks for economic growth and inflationary pressure appear restrained, but the slowdown is due to the weakness of trade, as well as the threat of protectionism (it is about trade duties from the United States) and the current geopolitical processes (it is about the situation with Brexit). Draghi also appealed to EU countries, saying that governments with space for fiscal maneuvering should take timely action, rather than waiting for support from the ECB. Given that the further growth of the euro will remain quite weak, and mainly the upward movement will be due to the weakness of the US dollar, support for risky assets in the medium term can be provided by the new head of the ECB Christine Lagarde. First of all, her actions will be aimed at finding balance among several leaders of the ECB Governing Council, however, Christine Lagarde will likely try to convince the governments of the eurozone countries to reform fiscal policy. As noted above, the publication of the eurozone purchasing managers' indices (PMI) for October led to a decline in the EURUSD pair in the short term. The only country where there was an acceleration in industrial activity was France. According to preliminary data, the purchasing managers' index (PMI) for the French manufacturing sector in October this year rose to 50.5 points against 50.1 points in September. Economists had expected the index to be at 50.3 points. The service sector remained at a fairly good level. There, the PMI for the services sector rose to 52.9 points in October from 51.1 points in September. The index was forecast at 51.6 points. In Germany, things are not as fun as we would like. As the preliminary report showed, the purchasing managers' index for the manufacturing sector in October remained at a record low of 41.9 points against 41.7 points in September. Economists had forecast a figure of 42.0 points. As for the services sector, there was a slight slowdown, although the index remained above 50 points. According to the data, the preliminary purchasing managers' index (PMI) for the German services sector in October fell to 51.2 points against 51.4 points in September. As for the overall indicator for the eurozone, the purchasing managers' index for the manufacturing sector in October remained unchanged at 45.7 points, although economists had expected an increase to 46.0 points. The sphere was slightly better, showing a level of 51.8 points in October, against 51.6 points in September. The eurozone composite purchasing managers' index rose to 50.2 points in October from 50.1 points in September. It has been repeatedly noted that the problem in the eurozone manufacturing sector is directly related to the trade war that the United States is waging with other countries. The decline in exports and the slowdown in the world economy add to the overall negative picture in production. As for the EURUSD pair, further growth is still limited by the resistance of 1.1150. Its breakdown will renew demand for the euro, which will lead to an update of the local maximum around 1.1180, and then to an update of the larger resistance levels of 1.1225 and 1.1270. In the scenario of a decrease in risk assets after the ECB meeting, you can count on support only at the minimum of 1.1090, as well as from the local zone of 1.1050. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 10.24.2019 - Broken bearish flag,sell zone on the GBP Posted: 24 Oct 2019 06:34 AM PDT GBP/USD has been trading sideways at the price of 1.2894. Anyway, I still expect more downside due to the breakout of the rising wedge pattern in the background.

Orange rectangles - Support levels Upward purple lines – Broken rising wedge Smaller rising purple lines – Broken bear flag MACD is showing us that upside momentum totally lost the power on the recent push higher, which is sign, that warning for buyers that sellers took control. Most recently, I found the breakout of the bearish flag on the 4H time-frame, which is good signal for sell. Downward targets are set at the price of 1.2780, 1.2696 and 1.2540. Watch for selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

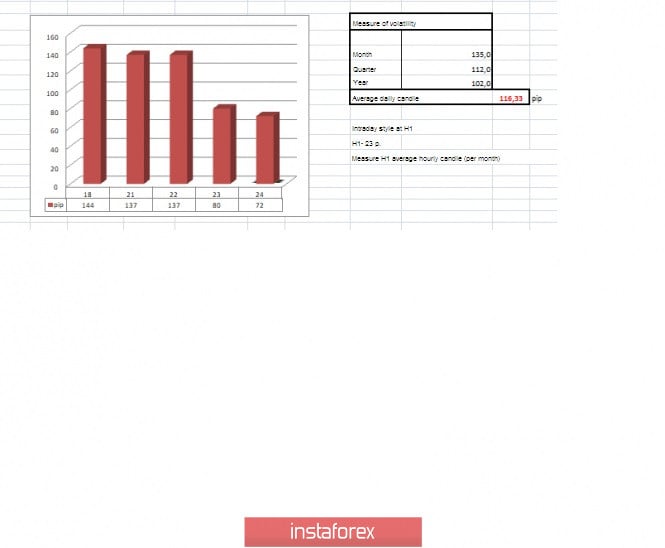

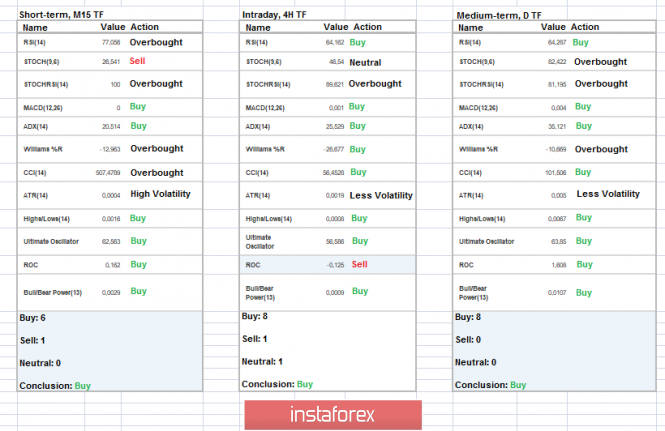

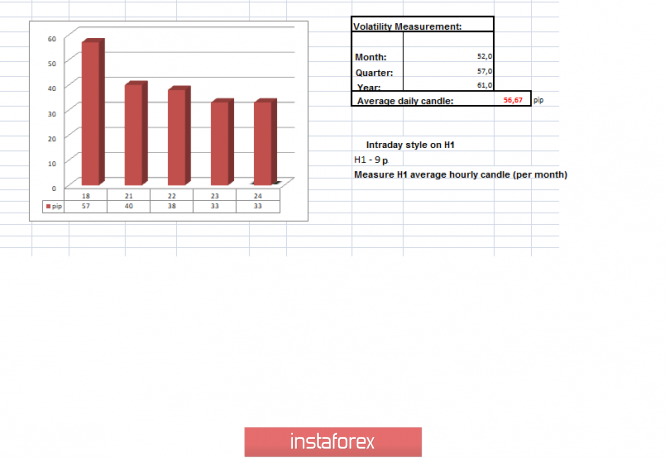

| Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 24) Posted: 24 Oct 2019 05:58 AM PDT For the first time in a long time, the pound/dollar currency pair has shown low volatility of 80 points, which will lead to everything, we will analyze in the current article. From technical analysis (TA), we see a desperate attempt to restore short positions, where working out a strong psychological level of 1.3000, we ended up barely working out at 20% relative to the inertial stroke. The reluctance of sellers to return to the market is felt, and they can be understood. The emotional component that was present on the market on October 10-17, was striking in its scale. Even the most restrained traders were exposed to the symptom of FOMO (lost profits syndrome), and when the fountain of joy reached the side channel, everyone froze in ambiguity, where it is indecent to go up, the overbought level went to the limit, and it was somehow scary to sell. We got what we have. In terms of volatility, we have a rather interesting picture: for 9 trading days in a row, the extremely high amplitude of fluctuations was kept, stably exceeding the average daily indicator, and now, since Monday of the current week, the recession began. October 21 and 22 were synchronous, giving an amplitude of 137 points, which already reflected a decrease in volatility with last week's data. Volatility on October 23 for the first time fell below the daily average of 116.33 – 80 points, which can be characterized as a relief of the FOMO symptom of market participants. Thus, in the case of confirmation of the above theory, the downward recovery process may resume over time, unless, of course, the quote is fixed above the level of 1.3000. Analyzing the hourly past day, we see a smooth upward movement, where there was not a single impulse, the course was more like a step. Theoretically, the sluggish upward move could be a temporary overflow of trading operations and the emerging ambiguity, which is just reflected in the volatility. As discussed in the previous review, speculators working at the stage of pseudo recovery from the level of 1.3000 went into active fixation within 1.2850-1.2870 due to several factors. So, the indecision of sellers to join the recovery phase alerted many and forced the closure of trading operations. At the same time, the emotional backdrop has declined, dropping many outside the market. The first thing that traders see when considering the trading chart in general terms (the daily period) is an inertial upward move. Then comes the fear of a trend reversal and only then the realization that the existing vertical movement is extremely unstable and is formed on the emotions of the market participants themselves. Whether the psychological level of 1.3000 will be able to restrain the emotions of buyers, time will tell. Now, we do not see a correction or even a full-fledged rollback, it is more like a stop. The prerequisites for restoring the initial movement will appear to traders only after fixing the price below 1.2770 The news background of the last day was empty, the statistics on the UK and the United States were not published. Whether it is good or bad, everyone decides for himself, I can only state the fact that the pound at the current time very indirectly reacts to statistical data and largely ignores them. The reason for the suspension lies in the strong background of information, which attracts all the attention and forms the highest fluctuations in the market. The information background, in particular, the Brexit process, continues its daily development, saturating the news feed with interesting headlines and comments. This time we discussed postponing Brexit. The ambassadors of the 27 EU member states met in Brussels, where each spoke about the possible delay requested by England. The Commonwealth of EU countries is generally not against granting a delay of three months with the possibility to leave before the deadline, but no official decision has been put forward. Subsequently, comments were received that a deferral decision would be made at a subsequent meeting on Friday. Market reaction to the news was not strong, but still in favor of reducing the fear of exit without a deal. From the remaining background, there was a local noise of the split of the government due to the elections and Brexit, which was later denied by the Prime Minister's office, as well as a misunderstanding about border checks in Northern Ireland and the UK, which was also dispelled by the Brexit Minister Stephen Barclay. Today, in terms of the economic calendar, we have a package of statistics for the United States, where data are waiting for durable goods, which are projected to decline by 0.6%. PMI data will also be released: Services sector 50.9 – 51.0; Manufacturing sector 51.1 – 51.0. Further development Analyzing the current trading chart, we see an interesting amplitude and local surges in the period 09:00-11:00 hours (time on the trading terminal) first threw the quote at the time of night accumulation, and then returned it to the area of fluctuations of the past day. The total amplitude was 72 points. In turn, speculators probably fell for the accumulation of (1.2905/1.2920) Pacific and Asian trading sessions, where they worked on the breakdown. The result was probably twofold since an up/down surge could hit two orders at once. It is possible to assume that while maintaining the same ambiguity, the process of horizontal running with wide boundaries of 1.2830/1.3000 can shut up for a few days. Thus, the work inside the corridor will be more interesting to speculators who will try to work on local fluctuations. In turn, conservative traders are in no hurry to act, and those with borders have extended even more 1.2770/1.3000, waiting for price-fixing beyond the established framework. Buy and sell positions are arranged depending on your approach to trading (speculative and conservative], follow the material described above. Indicator analysis Analyzing different sector timeframes (TF), we see that the indicators in the short term will recover relative to the morning jump – an upward signal. The intraday perspective works on the morning jump. The medium-term outlook invariably holds upward interest due to the past inertia. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 24 was built taking into account the time of publication of the article) The volatility of the current time is 72 points, which is the average for this period. It is likely to assume that the effect of the slowdown is still possible in the market, as we wrote at the beginning of the article. Key levels Resistance zones: 1.3000; 1.3170**; 1.3300**. Support zones: 1.2770**; 1.2700*; 1.2620; 1.2580*; 1.2500**; 1.2350**; 1.2205(+/-10p.)*; 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic level ** Range level *** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on October 24th. Volatility declines amid lack of Brexit news Posted: 24 Oct 2019 05:51 AM PDT To open long positions on GBP/USD, you need: The lack of news on Brexit and specifics from the EU did not allow the bulls today to get to the resistance of 1.2925, which remains a problem for them. From a technical point of view, nothing has changed. Buyers of the pound still have a high chance of a rise in the pound, but much will depend on the EU's decision to grant a reprieve. As noted in the morning forecast, if the delay is 1-2 weeks – this is a bullish signal, and a break in the resistance of 1.2925 will lead to a larger upward movement to the weekly highs of 1.3012 and to their renewal in the area of 1.3074, where I recommend taking the profits. If the EU refuses to grant a delay for such a short period – this is a bearish signal. Therefore, in the case of a decline in GBP/USD, it is best to count on buying after the formation of a false breakdown in the support area of 1.2842, or after the decline and the test of large lows of 1.2757 and 1.2664. To open short positions on GBP/USD, you need: The sellers are still satisfied with the current Brexit news, but the EU is required to meet Boris Johnson and approve a short delay of 1-2 weeks. Sellers coped with the task and did not let the pound above the resistance of 1.2923, which is, to some extent, a bearish signal. However, the main task for the second half of the day is to break the support of 1.2842, which will lead to the demolition of several stop orders and further decline of GBP/USD to the area of the lows of 1.2757 and 1.2664, where I recommend taking the profits. In the case of a successful breakdown of the resistance of 1.2925, above which there is a large number of stop orders of sellers, the next large levels for opening short positions will be viewed in the area of 1.3074 and 1.3167. However, I do not recommend considering the pound for sales, as the situation is still on the side of buyers. Indicator signals: Moving Averages Trading is around 30 and 50 daily averages, indicating market uncertainty. Bollinger Bands In the case of pound growth and breakthrough of the upper limit of the indicator in the area of 1.2923, it can expect further upward movement along with the trend.

Description of indicators

|

| Posted: 24 Oct 2019 05:43 AM PDT To open long positions on EURUSD, you need: Data on low manufacturing activity in Germany and the eurozone put pressure on the European currency in the first half of the day, which did not allow the bulls to get above the resistance of 1.1147. However, from a technical point of view, nothing has changed. A surge in volatility is possible during Mario Draghi's press conference, at which the ECB head will announce his departure and possibly signal further monetary easing. The focus remains on the level of 1.1116, the formation of a false breakdown will be a signal to open long positions in the euro. However, the main task of the bulls is to break and consolidate above the resistance of 1.1147, which will return the demand for EUR/USD and lead to a test of the weekly maximum of 1.1178. However, a more distant target of buyers will be the level of 1.1226, where I recommend fixing the profits. However, without good news on Brexit, building a major upward momentum will be almost impossible. If the pair returns to the support of 1.1116, it is best to return to long positions from the lows of 1.1090 and 1.1055. To open short positions on EURUSD, you need: The formation of a false breakdown in the resistance area of 1.1147 in the first half allowed the bears to pull the initiative to their side. I paid attention to this in my morning forecast. However, the main task is to break through and consolidate under the support of 1.1116. If the bears manage to break below this range, most likely the demolition of a number of stop orders of bulls will collapse EUR/USD to the new support of 1.1090 and 1.1055, where I recommend taking the profits. In the scenario of growth above the resistance of 1.1147, which can be implemented only in the case of good news on the Brexit agreement, I recommend returning to short positions only after updating the weekly maximum around 1.1178, or immediately on the rebound from the resistance of 1.1226. Indicator signals: Moving Averages Trading is conducted around 30 and 50 moving averages, which indicates market uncertainty. Bollinger Bands The breakthrough of the upper limit of the indicator in the area of 1.1147 will provide the market with new buyers of the euro.

Description of indicators

|

| The FED cannot afford to cut rates – the impact on GBPUSD Posted: 24 Oct 2019 05:36 AM PDT Fundamental analysis: The Federal Reserve will meet on the 30th October with the US GDP anounced earlier that day. Who in their right mind would reduce rates with markets at near all-time highs and the US earnings season doing well; jobs market getting tighter by the week. UK Parliament will probably sign off on the deal Mr Johnson has agreed with the European Union and this should get through next week, so any rally on that news could be an opportunity to go short ahead of the 30th October Fed decision. Trade idea I am suggesting the GBPUSD pair is done for now, we have seen a sell signal 2 days ago, and both the wave count and Fibonacci resistance look compelling to me. Note I do not show indicators, Fibonacci is the "CODE of TRADING" to me it is far superior to indicators. However, there was clear MACD divergence at September lows but the retracement is now complete and it is time to get short again. Levels to watch: Today: I am looking to sell 1.2950, stop above today's high, target 1.2785. This week, sell any rally into 1.2970 Next week: if we see any move into 1.3050 I will short

|

| Technical analysis of EUR/USD for October 24, 2019 Posted: 24 Oct 2019 03:17 AM PDT Overview: The EUR/USD pair broke resistance which turned to strong support at the level of 1.1089 yesterday. The level of 1.1089 coincides with 50% of Fibonacci, which is expected to act as major support today. Since the trend is above the 50% Fibonacci level, the market is still in an uptrend. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Consequently, the first support is set at the level of 1.1089 (horizontal green line). This would suggest a bearish market because the moving average (100) is still in a positive area and does not show any trend-reversal signs at the moment. So, the market is likely to show signs of a bullish trend around the spot of 1.1089. In other words, buy orders are recommended above the spot of 1.1089 with the first target at the level of 1.1180; and continue towards 1.1218 (the weekly resistance 2). Bearish outlook On the other hand, if the EUR/USD pair fails to break through the resistance level of 1..1180, the market will decline further to 1.1089. The pair is expected to drop lower towards at least 1.1032 with a view to test the weekly support 2. The material has been provided by InstaForex Company - www.instaforex.com |

| The fall of the pound. Trading idea for GBPUSD pair Posted: 24 Oct 2019 02:29 AM PDT Good day, dear traders! Today, I present to your attention the trading idea for the GBPUSD pair. The trading idea is very simple and consists in rejecting the news impulse for its continuation. This is the so-called ABC structure – very effective in the world of trading. At the heart of wave A is news related to the failed Brexit vote on Saturday, October 24th. To date, the pound has rolled back up to 50% of this news, and those who are familiar with Fibonacci levels are well aware of what this says. Moreover, today, Europe has already passed the first confirming impulse towards the news itself, which tells us that the bears are still in the market: I recommend shorting the GBPUSD pair to update the level of the lows of the last four days with profit-taking at the quote of 1.28351. That's where the buyers' stop is now, including those waiting for a positive vote on Saturday. They just have nowhere else to hide. Their stops are very likely to work and possibly go to your profit. I remind you that today at 12:45 and 15:30, there will be important news on the euro. Be careful when trading this instrument at the specified time. Good luck with trading and see you on new reviews! The material has been provided by InstaForex Company - www.instaforex.com |

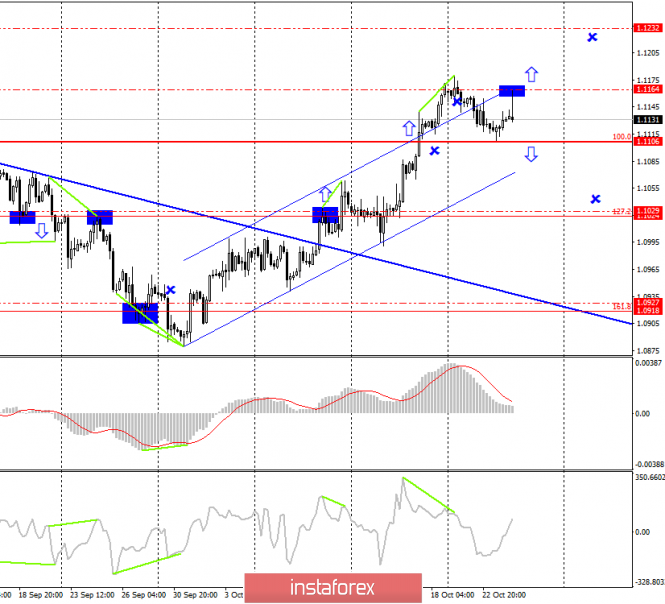

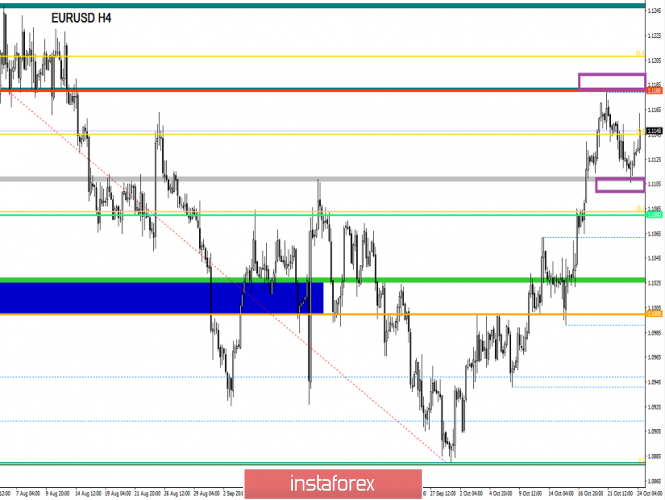

| Posted: 24 Oct 2019 02:29 AM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a not too confident rebound from the correction level of 100.0% (1.1106), a reversal in favor of the EU currency and a return to the level of 1.1164, from which it also performed a rebound. Thus, a new reversal in favor of the US currency and the resumption of the fall in the direction of the same level of 100.0% may follow. Closing the euro/dollar exchange rate under the Fibo level of 100.0% will increase the chances of continuing the fall towards the next correction level of 127.2% (1.1024). Emerging divergences today are not observed in any indicator, and the fall of quotations allows even an upward trend channel. On Monday, Tuesday and Wednesday, the EUR/USD pair were deprived of information feed. Not a single economic report for these three days was published either in America or in the European Union. Traders quite reasonably decided to use this time for correction, and this morning, they rushed to buy the European currency, as forecasts for all six indices of business activity in the services and manufacturing sectors of Germany and the European Union were higher than the values of September. However, optimistic forecasts were not destined to come true. Some indices were indeed higher than the previous value, but how can we call, for example, a positive factor business activity in the manufacturing sector in Germany, which increased from 41.7 to 41.9? In the German services sector, business activity showed a decline to 51.2, the composite PMI slightly improved from the previous month, but still worse than traders' expectations. In the European Union, the situation with business activity is approximately the same. In the manufacturing sector, no changes were recorded compared to September – 45.7, in the services sector – an increase to 51.8, which is still worse than the forecast of 51.9, and the composite index is 50.2. Even though these are not the final values for October, traders are still very sensitive to any deterioration in these indicators, as even Mario Draghi said that weak business activity in manufacturing will pull down other industries. Thus, suddenly in recent months, business activity indicators have turned from mediocre in importance indicators into significant ones. Well, then the euro also does not expect anything good. In a few hours, Mario Draghi, the ECB Chairman, will give his last speech, which will sum up not only the two-day meeting but also his 8-year work. It is unlikely, given the weak economic reports from the eurozone, Draghi will find words of optimism when he talks about the economy and monetary policy of the European Union. Thus, the hope for bull traders lies in economic reports from America, where business activity indices in the services and manufacturing sectors will also be released, as well as reports on orders for long-term goods. Values worse than forecasts for these reports will return demand for the euro on October 24th. What to expect from the euro/dollar currency pair today? On October 24, traders may well expect to fall to the level of 1.1106 and even lower – to 1.1024. There will be plenty of news today, but traders will attach the greatest importance to the American reports. Mario Draghi's press conference may become a formality, the probability of surprises is small. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend selling the pair with a target of 1.1024 if the close is made below the level of 1.1106(100.0% Fibonacci). A stop-loss order above the level of 1.1106. I recommend opening the pair's purchases with the target of 1.1232 and the stop-loss order below the level of 1.1164 if the closure is performed above 1.1164. The material has been provided by InstaForex Company - www.instaforex.com |

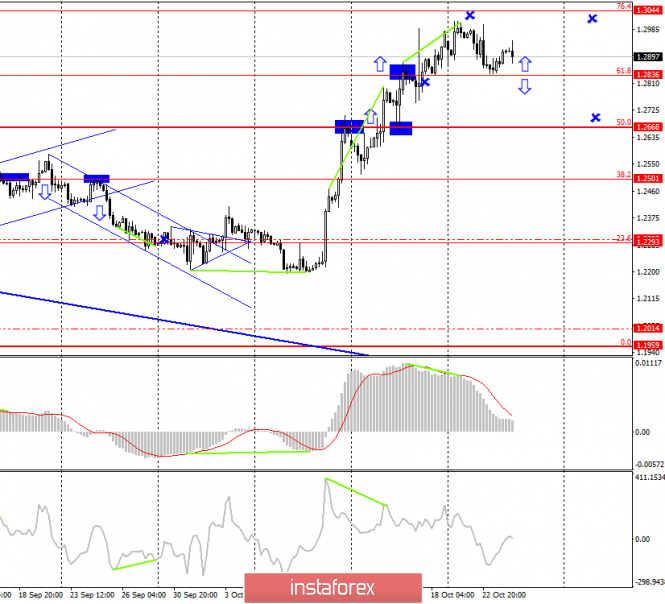

| Posted: 24 Oct 2019 02:29 AM PDT GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a fall to the Fibo level of 61.8% (1.2836), however, the correction from this level of correction was not performed. Nevertheless, the growth process has begun, within which the pound/dollar pair is now located. Thus, traders have received neither the signal to buy nor the signal to sell for the past day. None of the indicators has emerging divergences today. There is a persistent feeling that the pound is preparing for a new fall. Today, on October 24, it is almost officially possible to say that Brexit has been postponed to January 31, 2020. This date was repeatedly called a few months ago, because even then there were great doubts that the UK with Boris Johnson will leave the European Union on October 31. Now, the European Union has already declared its readiness to grant a new delay. As this is what the British Parliament sought, despite the formal approval of Johnson's deal, all parties except Johnson are fully satisfied. To postpone Brexit for 3 months, they will not even convene a summit of European countries, everything will be issued in writing shortly. Thus, Donald Tusk and Jean-Claude Juncker ignored the "additional" letters from Boris Johnson, in which he asked not to postpone Brexit. As a result, we have witnessed a stunning situation "one against all", where Boris Johnson is hiding under the word "one," who stubbornly do not want to understand that 650 deputies of the Parliament and the EU government alone cannot be beaten. Well, the British pound will have to decide in the coming days where to move next. Since the next busy period can be considered left behind, bull traders need to decide on how to buy the pound further. I believe that there are not so many reasons for this. Today, we will closely monitor the economic reports from America, but for a long time, the pound will not be able to grow on only weak data from the USA. Moreover, the situation itself with Brexit has not been solved and remained. Nothing has changed, and the pound may begin to fall again, as it has done for the last three years. I believe that traders will sooner or later return to this scenario. It is Brexit that remains the most significant topic for the British currency, and even, for example, a reduction in the key rate of the Fed will not mean more to traders. According to economic reports from the UK, traders have already managed to get bored. There are no reports from the Kingdom on the news calendar this week. It was already felt that it was weak reports from the United States that could affect the pound/dollar pair, but do not forget that in the UK economic figures leave much to be desired, and the Bank of England is considering lowering the key rate. What to expect from the pound/dollar currency pair today? The pound/dollar pair fell to the correction level of 61.8%. I am waiting for quotes to close below this level today, as I believe that the upward momentum has exhausted itself. The information background today will be in the American reports. On the topic of Brexit, I do not expect important news. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I recommend buying the pair with a target of 1.3044 if the rebound from the Fibo level of 61.8% with the stop-loss order below the level of 1.2836 is performed. I recommend considering sales of the pair with a target of 1.2668 if consolidation below the Fibo level of 61.8% is performed. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Oct 2019 02:29 AM PDT Good day, dear traders! Once again, I congratulate those who took advantage of my recommendation, which was published last night. In it, I offered to sell USD/CAD in this scenario:

And yesterday, at the end of the American session, this plan was fully implemented. USD/CAD fell in price exactly to the target level of 1.3070, thereby fully implementing our plan:

Congratulations to those who took advantage of my trading idea. I remind you that today at 12:45 and 13:30, there will be important news on the euro. Be careful when trading at this time! The material has been provided by InstaForex Company - www.instaforex.com |

| USDCHF to reach 1st support at 0.9917, potential to drop! Posted: 24 Oct 2019 01:50 AM PDT |

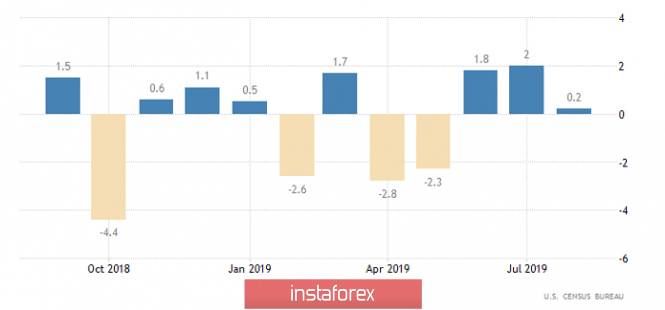

| Trading plan for EUR/USD and GBP/USD on 10/24/2019 Posted: 24 Oct 2019 01:36 AM PDT The silence that had lasted for several days, which was only occasionally interrupted by the cries of a quarrel coming from London, threatening to develop into a fight, will now be a thing of the past. Indeed, today, a meeting of the Board of the European Central Bank will take place, which will be a farewell for Mario Draghi since the next meeting will be chaired by Christine Lagarde. Although no one doubts that the monetary policy parameters of the European Central Bank will remain unchanged, today's meeting is extremely important. After all, it is quite obvious that after the deposit rate has been reduced, and the next step should inevitably be a reduction in the refinancing rate. However, it is not clear when exactly. It is hoped that Mario Draghi himself will give an answer to this question during his farewell press conference. If during his speech he expresses concern about the current state of the European economy, as well as concerns about its prospects, there will be little doubt that the very first decision by Christine Lagarde as head of the European Central Bank will be just to lower the refinancing rate to a negative value . Moreover, the state of the European economy does cause a lot of concern. To do this, just look at the dynamics of industrial production. Nevertheless, it is highly likely that Mario Draghi will essentially not say anything, although his speech will be lengthy and verbose. In addition, one should not assume that everything that will happen today is limited only to a meeting of the Board of the European Central Bank. It turns out a lot of interesting macroeconomic data will be published. Which, incidentally, indirectly suggests that the speech of Mario Draghi will be neutral. Thus, preliminary data on business activity indices in several European countries have already been published. and, as usual, they came out somewhat different than expected. In France, everything is fine, as the index of business activity in the services sector grew from 51.1 to 52.9, and production from 50.1 to 50.5. The forecasted growth was to 51.6 and 50.3, respectively. As a result, the composite business activity index, which was supposed to grow from 50.8 to 51.0, showed growth to 52.6. In Germany, the picture is somewhat different, although there is an increase in indicators. The most important thing is that the business activity index in the production index grew from 41.7 to 41.9, which allowed the composite index to grow from 48.5 to 48.6, despite a decline in the business activity index in the service sector from 51.4 to 51.2. However, they forecasted an increase in the index of business activity in the manufacturing sector from 41.7 to 42.0, and in the service sector from 51.4 to 52.0. Thus, they were waiting for the growth of the composite index from 48.5 to 48.8. So, although there is growth, it is still not the same as we would like. But more importantly, the manufacturing index continues to remain below 50.0 points. However, data across Europe are of much greater importance, and, frankly, they resemble data for Germany. That is, they showed growth, but not as expected. Moreover, the index of business activity in the manufacturing sector remained unchanged, at a value of 45, 7 points waiting for growth to 46.0 points. The growth was demonstrated by the index of business activity in the services sector, but not to 51.9, but from 51.6 to 51.8. As a result, the composite index of business activity grew from 50.1 to 50.2, although it is forecasted to rise to 50.3. Composite Business Activity Index (Europe): The United States also publishes preliminary business activity index data. In particular, the index of business activity in the manufacturing sector may decline from 51.1 to 50.9. At the same time, they expect an increase in the index of business activity in the services sector from 50.9 to 51.1. As a result, the composite index of business activity can grow from 51.0 to 51.5. Data on orders for durable goods will also be published, which should be reduced by 0.6%. A similar fate awaits the sale of new homes, but they should only be reduced by 2.2%. Thus, in general, forecasts on American statistics do not cause such optimism. However, data on applications for unemployment benefits will add joy. So, the number of initial applications for unemployment benefits should decline by 11 thousand, and the number of repeated applications by another 14 thousand. In other words, American macroeconomic statistics are unlikely to allow investors to determine their sentiments due to their apparent divergence. Durable Goods Orders (United States): The euro / dollar currency pair found a resistance point in the face of the mirror level of 1.1180, forming as a fact a local correction in the direction of the previously passed level of 1.1100. The next step was in terms of an attempt to return buyers to the market, but the characteristic surge did not lead to anything radical, and we remained at the congestion point. It is likely to assume temporary restraint in the area of 1.1145, where in the absence of proper price fixing above a certain point, we will be temporarily drawn into horizontal fluctuations even before the release of information from the ECB. The pound/dollar currency pair, drawing a vertical movement, reached the subsequent psychological level of 1.3000, where it sensed a resistance point in front of us and locally corrected us. It is likely to assume that the fervor of buyers has not yet subsided enough, and this puts pressure on sellers. Thus, a temporary ambiguous chatter within 1.2835 / 1.2945 can form in the market. |

| Posted: 24 Oct 2019 01:01 AM PDT Today, a meeting of the European Central Bank will take place, at which Mario Draghi is unlikely to make new statements on monetary policy. Some experts expect that Draghi's latest appearance as head of the ECB will be formal and that the bank's future work will be done on autopilot until Christine Lagarde assumes the new head. She will take the reins of government from Mario Draghi on November 1.

However, we should not forget that the eurozone economy is gradually slipping into recession, and now you can see the lack of measures that the European Central Bank resorted to during the September meeting. Let me remind you that the regulator lowered interest rates on deposits, and also announced a return to the bond redemption program. The task of the future ECB President will be to smooth out all disagreements among the members of the Governing Council, since some of them, especially from Germany, are tough opponents of soft measures. It is also expected that the new head of the ECB will focus on the balance between monetary and fiscal policies. The lack of important fundamental data yesterday kept the EURUSD pair in a narrow side channel, and a small increase in risk, which was observed at the beginning of the North American session, was offset by a weak report on consumer confidence in the eurozone. Although the report is only preliminary, the lack of optimism among consumers is a bad signal for the economy, as the decline in spending will affect retail sales, which are the main driver of GDP growth.

According to the statistics agency, the preliminary index of consumer confidence in the eurozone in October this year fell to -7.6 points against -6.5 points in September. The main problem for consumers is the trade war waged by the US against several developed countries, including the eurozone, as well as the general slowdown in global economic growth. Yesterday, news also appeared that Republican leaders in the US House of Representatives had called for open testimony from an informant in the impeachment case before the US Congress. Michael McCall, Jim Jordan, and Devin Nunez, in their address to the head of the House Committee, said an open hearing was needed on the topic of impeachment against US President Donald Trump. Let me remind you that back in September of this year, the Democrats began an impeachment process against Donald Trump because of his interference in the elections through an attempt to discredit the political opponent. Trump denies the allegations. As for the current technical picture of the EURUSD pair, much will depend on the level of 1.1150. Its breakthrough will renew demand for the euro, which will lead to an update of the local maximum around 1.1180, and then to an update of the larger resistance levels of 1.1225 and 1.1270. In the scenario of a decrease in risk assets after the ECB meeting, you can count on support only at the minimum of 1.1090, as well as from the local zone of 1.1050. GBPUSD

The British pound is waiting for the decision of European leaders on Brexit. It's about granting a reprieve. The EU leaders are in a difficult position, since, on the one hand, everyone wants to complete the epic with Brexit, and this requires concessions to Boris Johnson and a short delay of 1-2 weeks, which also does not guarantee an exit from the EU. On the other hand, the provision of a longer postponement may cause Britain to leave the bloc without an agreement on October 31, which the Prime Minister of Great Britain constantly talks about. European Council President Donald Tusk advocates a three-month postponement, while France does not see this as a need, offering to postpone a few days after the deadline of October 31 to allow the British Parliament to ratify the deal. As for the technical picture of the GBPUSD pair, there were also no significant changes. A break of 1.2925 resistance will lead to a new wave of pound growth with reaching maximums in the areas of 1.3020 and 1.3165. If the pressure on the pound returns, with an extension of the release period by three months, then a break of support of 1.2840 will bring the trading instrument down to the lows of 1.2750 and 1.2610. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis of EUR/USD and GBP / JPY on October 24th Posted: 24 Oct 2019 01:01 AM PDT EUR/USD Analysis: On September 3, the quotes of the euro form an upward wave on the chart. In the larger wave model of June 25, this section became a correction. The final section (C) is formed in the wave. Since the end of last week, the price is rolling back down. Forecast: The preliminary calculation allows you to wait for the rise in the area of 2 price figures until its completion. Today, it is expected to continue the flat movement of the pair in the lateral plane. At the end of the day or tomorrow, the probability of a turn and the beginning of the rise increases. Potential reversal zones Resistance: - 1.1170/1.1200 Support: - 1.1100/1.1070 Recommendations: Selling the euro today is only possible as part of an intraday reduced lot. At the end of the current pullback, it is recommended to monitor the reversal signals to find the points of purchase of the pair.

GBP/JPY Analysis: A bullish wave has been forming on the cross chart since the beginning of August. Its high potential makes it possible to classify the whole movement as a medium-term trend. The price reached intermediate resistance. Since the beginning of the current week, the price rolls back down. Forecast: Today, the price is expected to move in the side corridor between the nearest counter zones. The decrease is likely in the second half of the day. The nearest support zone shows the lower limit of the expected daily course of the pair. In the future, it can be pushed down. Potential reversal zones Resistance: - 140.60/140.90 Support: - 138.80/138.50 - 137.50/137.20 Recommendations: Trading within the correction is quite risky and makes sense only in the intraday style. It is better to reduce the lot. The best tactic would be to refrain from entering the cross-market at the time of the decline and to buy a pair at its end.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement. Attention: The wave algorithm does not take into account the length of time the tool moves! The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the EURUSD currency pair - placement of trade orders (October 24) Posted: 24 Oct 2019 12:52 AM PDT Over the past trading day, the currency pair euro / dollar showed a low volatility of 33 points again, as a result of which confirms the previously built theory of speculators. From the point of view of technical analysis, we see that the recovery process from the mirror level of 1.1180 led the quote to the next value in the face of the range coordinate 1.1100, where the quote slowed down and, as a fact, formed ascending candles. In terms of volatility, we were faced with a sequential decline that began on Monday [October 21], where volatility fell below the daily average. The following days were reflected in a further decline: 40 ---> 38 ---> 33 points. The emotional component and the so-called FOMO**** of the market participants began to decline, and as a result, this affected the volatility. Analyzing the past hourly hour, we see a quite boring low-amplitude oscillation in the form of a closing upward movement, where the hourly average candlestick had a volatility of about 5 points. The only remarkable thing was that the support was found precisely in the features of the range level 1.1100. As discussed in the previous review, speculators, working to lower from the value of 1.1145 (1.1140), switched to the complete fixation of previously opened transactions as soon as the quotation reached the first forecasted point of 1.1120. The reason for so much cardinal progress was due to the fact that the market will remain extremely high ambiguity, which does not allow to fully return sellers to the market, even though the market has an extremely high overbought. As a result, an exit with a small but still profitable profit. Considering the trading chart in general terms [the daily period], we see that the pullback from the level of 1.1180 is extremely insignificant, and if the quotation returns back to the level of 1.1180, there will be a clear confirmation that there is a characteristic indecision of market participants in terms of short positions. From the point of view of the clock component, we see the elongated correction that continues to this day, built at the moment of an emotional flurry of market participants, just the echoes of this same FOMO **** are not letting us now properly recover in terms of the main course. The news background of the past day did not have statistical data for Europe and the United States. Thereby, the main focus of market participants was built on monitoring the information tape. Thus, in terms of informational background, there was a further analysis of the UK & EU divorce process, where, as we already know, it was not agreed, in the shortest possible time, as the British Prime Minister Boris Johnson planned for this. Now, we are talking about the postponement of Brexit, and on the part of the European Union, a meeting of EU ambassadors was organized in the Belgian capital, where representatives of the Commonwealth countries agreed that they could provide the United Kingdom with another postponement. From the discussion, it can be distinguished that not all EU members supported the three-month delay of Brexit, so, for example, the French insist on a tight deadline until November 15. It was also raised in the discussion that even in the case of a three-month delay, Britain will have the opportunity to withdraw from the EU earlier if the agreement is ratified. Let me remind you that the meeting of the EU ambassadors was unofficial, thus no official decisions were made. The final decision will be made on Friday during the next meeting of EU ambassadors. In turn, the official representative of the Cabinet of Ministers of Germany, Steffen Seibert, said that Germany would not mind delaying Britain's exit from the European Union if it was agreed. The reaction of the single currency to the information background was somewhat positive, although not sharp. In fact, we had another reaction to the fact that the fears of hard Brexit are reduced. Today, in terms of the economic calendar, we have a meeting of the European Central Bank, which will be the last for its head, Mario Draghi. Should I expect something from the decision of the ECB and the subsequent press conference? In fact, a decrease in the interest rate with its transfer to the negative zone is possible. There were signals even at the time of reducing the deposit rate, but I seriously doubt that Draghi's last decision would be to lower the refinancing rate. The new head of the ECB, Christine Lagarde, will already have this step, but now, what you can hear is just the comments of Mario Draghi at the press conference, and if he says anything about the future decline, the euro will obviously reduce. I would like to repeat once again that, probably, we won't hear anything regarding further actions of the regulator; there will be just a farewell speech by Draghi. In terms of statistics, we have a data package for Europe, where there are not so bad data. So, where the index of business activity in the manufacturing sector grows from 45.7 to 46.1, the composite index in business activity from Markit also shows growth of 50.1 -> 50.03, as the service sector 51.6 -> 51.9. In the afternoon, we are waiting for data on durable goods in the United States, where they forecast a decrease of 0.2% Further development Analyzing the current trading chart, we see a smooth upward swing with a small stop, where the accumulation of 1.1128 / 1.1145 has formed. In fact, buyers are trying to enter the phase of inertial motion again, but the first thing to see is only a return to the resistance point of 1.1180, before discussing the return to inertia widely. Detailing the hourly available time interval, we see that the Pacific and Asian trading sessions were in terms of horizontal movement, showing low volatility. With the onset of the European trading session, there was a surge in breaking through the boundaries of the existing accumulation of 1.1128 / 1.1145 . Probably, the price for positive statistics for Europe is already being laid. In terms of the emotional component, characteristic ambiguity remains. In turn, speculators will take profits from short positions, went into the waiting stage, analyzing the behavior of the quote relative to the coordinates 1,1100 / 1,1145. As we can already see from the result, a local entrance to long positions was made with a primary perspective in the direction of 1.1170-1.1180. It is likely to assume that in the case of the birth of the next FOMO there is a chance to return to the mirror level of 1.1180. Deeper steps are already considered with the support of the information background and price fixing higher than 1.1180. In turn, the tactics of monitoring the news feed remains unchanged, revealing information about Brexit as early as possible. Based on the above information, we derive trading recommendations: - Some traders already have buying positions in the direction of 1,1170-1,1180. If you do not consider yourself a speculator, then it is better not to rush and wait for the price fixing higher than 1.1180. - We consider selling positions in the event of a change of background or another development of the level of 1.1180. Indicator analysis Analyzing a different sector of timeframes (TF), we see that the indicators unanimously signal an upward trend, where short-term and intraday periods worked on the existing price impulse. The medium-term outlook, on the other hand, invariably retains upward interest against the background of an earlier inertia. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 24 was built taking into account the time of publication of the article) The current time volatility is 33 points, which is already good for the start of trading. It is likely to assume that due to dense statistics and a meeting of the ECB, volatility will exceed the daily average. The slowdown in the volatility of the last three days confirms the waiting position of traders, which can result in an acceleration in terms of volatility. Key levels Resistance Zones: 1.1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support areas: 1,1100 **; 1,1000 ***; 1.0900 / 1.0950 **; 1.0850 **; 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level **** FOMO - Lost Profit Syndrome ***** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

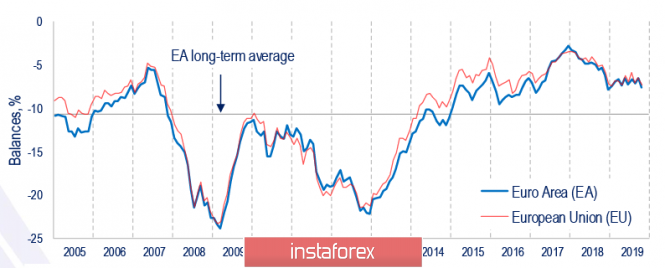

| Posted: 24 Oct 2019 12:28 AM PDT The corporate reporting season led to the growth of US stock indices and supported the dollar. Thus, companies show an average higher results than forecasted by the market. Today, volatility may increase by the end of the day. In the USA, updated data on orders for durable goods and PMI will be published according to Markit and from the UK, you can expect a new revelation about the progress of the negotiations on Brexit. At the same time, the growth of quotes of the oil, against the background of an unexpected reduction in reserves and the threat of copper shortages, are supported by commodity currencies, which may stay in the lateral range amid growing demand for the dollar. However, euro and franc look weaker and may decline by the end of the day. EUR/USD Today, Markit will publish preliminary data on business activity in the eurozone in October. The data last September turned out to be disastrous, and there are fears that the weakness of the manufacturing sector will begin to flow into the services sector. The European Commission reported on the dynamics of consumer confidence. The decline to -7.6p from -6.5p a month earlier is stronger than forecasts, thus, the likelihood of a decline in PMI in the services sector is high. Despite the stability of the fall, the safety margin has not been exhausted, since the current value is still above the long-term average. At today's meeting of the ECB and the last press conference for Mario Draghi, no significant changes are expected. The dynamics of bond yields in Germany and France are weak, that is, expectations of the market do not imply a strong reaction. Thus, the probability of a euro decline by the end of the day increases. Draghi, in turn, can allow himself to call for more aggressive steps during his closing speech to support the European economy, given the weak inflation and reduced business activity, which can lead to limited sales of the euro. Nevertheless, a rate reduction is not expected, since such a step will distort the already planned changes - the introduction of a new approach to deposit rates from October 30 and asset purchases from November 1. These previously announced measures are significant, and it will take time to assess their impact on the economy of the eurozone, and therefore, Christine Lagarde will decide on the rate at subsequent ECB meetings. Accordingly, we expect a slight decline in the euro at the end of the day as part of the implementation of the most likely scenario. Immediate support for 1.1108 during the first test has survived, but the probability of a repetition remains high. Thus, it is possible to reduce the euro in the support zone of 1.1061 / 81, which will allow you to stay in the upward channel, but will mean loss of momentum and a transition to the lateral range. GBP/USD The Brexit saga continues to control the pound and the general mood in the markets. Prime Minister Boris Johnson suspended the implementation of the Brexit agreement in the British Parliament, as he lost the ability to maintain the necessary pace. Now, the solution to the issue depends on the success of the negotiations between Johnson and Labor leader Corbyn. On the other hand, CBI reports that production in the UK continues to decline and over the past quarter, the decline was 10% while the total number of new orders fell by 15% in the 3rd quarter. As a result, employment in the sector declined by 9%, the maximum reduction since April 2010. Thus, forecasts are negative - Most respondents expect orders to decline at a faster pace in the 4th quarter. Against the backdrop of gloomy prospects for manufacturers, investment plans reached a minimum after the financial crisis of 2008/09. The main problem that CBI points out is a lack of understanding on export prospects. Exit from the EU also means exit from trade agreements, which means that the UK has to fight for duty-free access to markets. As a result, the pound fell back to the support zone of 1.2810 / 30, which remained stable, but the chances of continued growth still decreased significantly. The lack of news keeps the pound in the range with the upper limit of 1.3012, although there is no driver. Therefore, the pound may go either way, depending on what news comes in about the Brexit negotiations. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment