Forex analysis review |

- Fractal analysis of the main currency pairs on October 10

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY (H4). Comprehensive analysis of movement options from October 10, 2019 APLs

- Forecast for the price of gold - GOLD for October and November

- Markets are frozen in anticipation of important events, Washington and Beijing could upset the fragile balance

- Gold breaks into battle

- Faces of the dollar: from the king to the victim of circumstances and the euro's executioner

- Gold relies on trade failure and Fed easing

- "The nature of proof, the Nordic": the Norwegian krone is not afraid of the bottom

- EURUSD and GBPUSD: What to look for in the Fed minutes. Rumors didn't help resume the pound's growth

- GBP/USD: Brexit deal on the verge of failure, and the pound on the verge of collapse

- EUR/USD. October 9. Results of the day. The pair is in a flat and awaits data on inflation in the US and Powell's latest

- GBP/USD. October 9. Results of the day. The UK and the EU continue to blame the impending "hard" Brexit on each other

- AUD/USD. Either 0.6880 or 0.6670: the aussie awaits the outcome of trade negotiations

- USDJPY bounces but remains below key resistance

- Gold bulls recapture $1,500 but price remains below key resistance

- October 9, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- October 9, 2019 : GBP/USD Intraday technical outlook and trade recommendations.

- Gold 10.09.2019 - 2 potential scenarios for the FOMC

- GBP/USD 10.09.2019 - Is the GBP ready for new downward move?

- BTC 10.09.2019 - Sell zone for Bitcoin, important resistance on the test

- EURUSD – towards 1.1

- Technical analysis of AUD/USD for October 09, 2019

- Trading plan for EUR/USD for October 09, 2019

- Trading recommendations for the EURUSD currency pair – placement of trade orders (October 9)

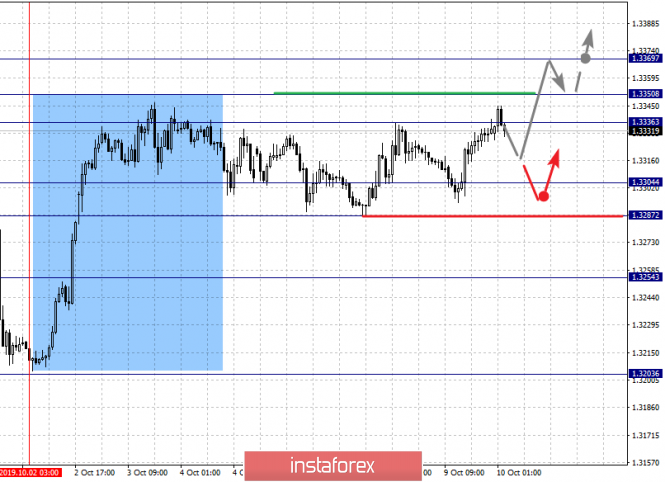

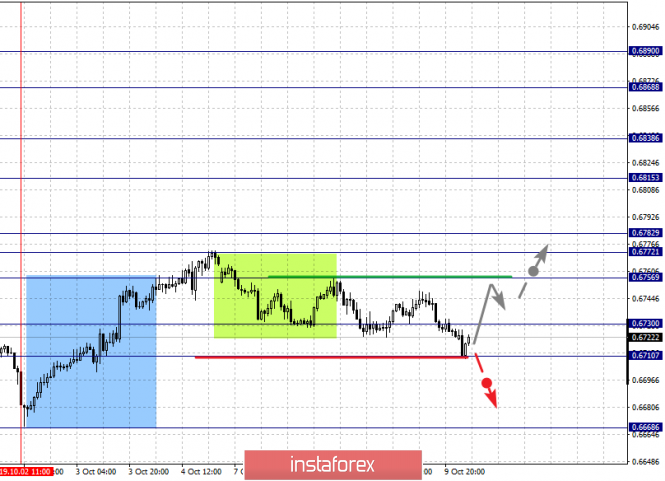

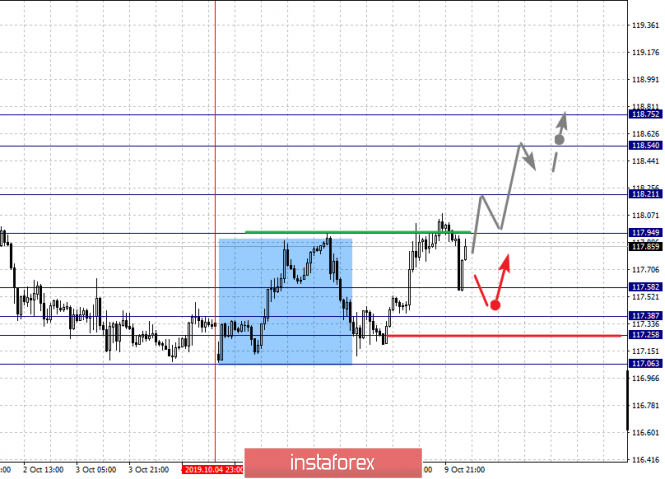

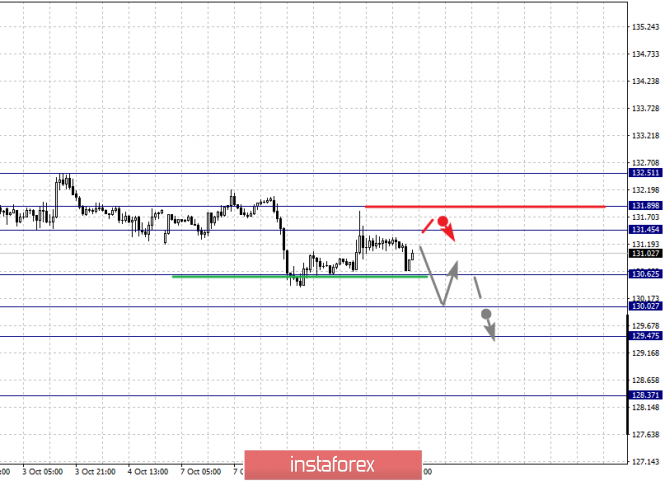

- Fractal analysis for cryptocurrencies as of October 9

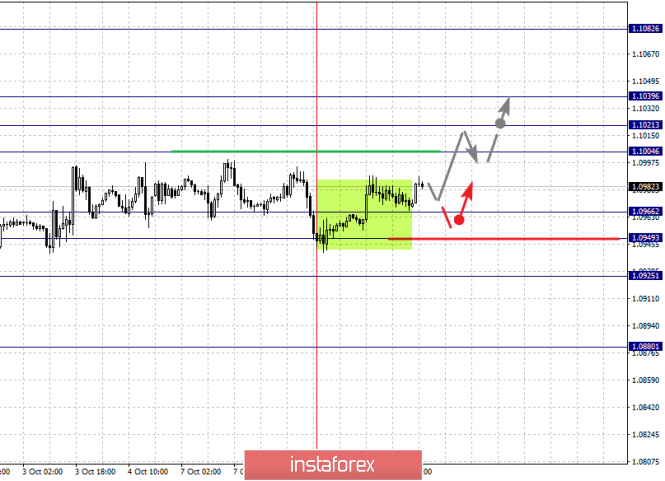

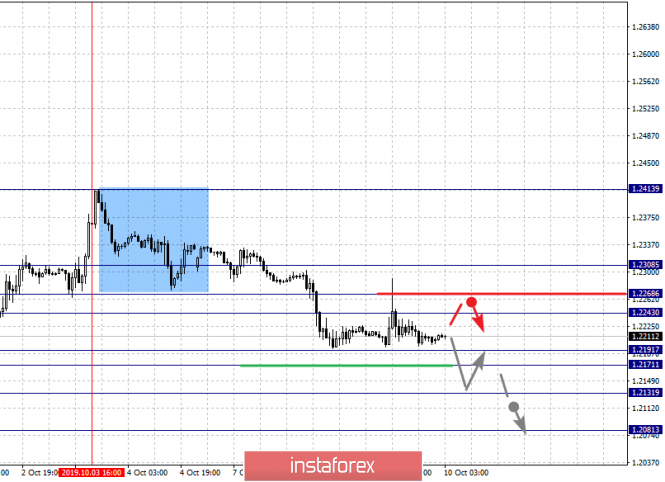

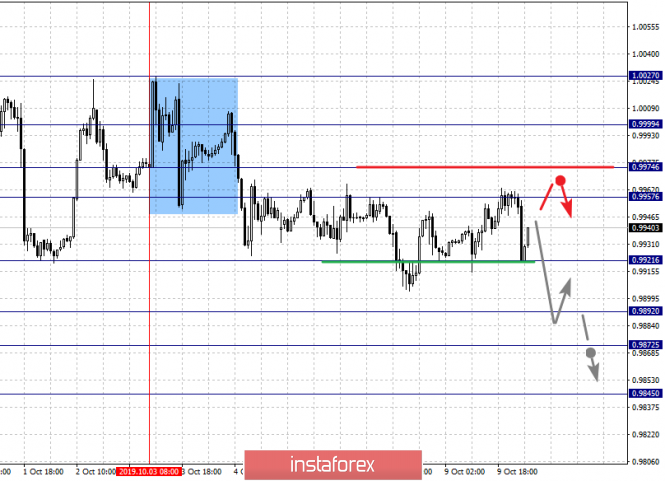

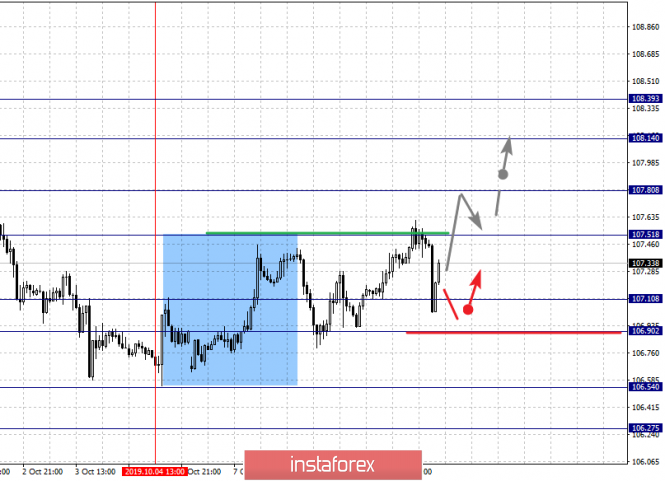

| Fractal analysis of the main currency pairs on October 10 Posted: 09 Oct 2019 06:03 PM PDT Forecast for October 10: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1082, 1.1039, 1.1021, 1.1004, 1.0966, 1.0949 and 1.0925. Here, the price formed a small local structure for the top of October 8. The continuation of the movement to the bottom is expected after the breakdown of 1.1004. In this case, the target is 1.1021. The breakdown of which will allow us to count on the movement of 1.1039. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.1082. The expressed movement to which is expected after the breakdown of the level of 1.1040. Short-term downward movement is possibly in the range 1.0966 - 1.0949. The breakdown of the last value will lead to a long correction. Here, the target is 1.0925. This level is a key support for the top. The main trend is the medium-term upward structure from October 1, the local structure from October 8. Trading recommendations: Buy: 1.1005 Take profit: 1.1020 Buy 1.1022 Take profit: 1.1037 Sell: 1.0965 Take profit: 1.0950 Sell: 1.0947 Take profit: 1.0925 For the pound / dollar pair, the key levels on the H1 scale are: 1.2308, 1.2268, 1.2243, 1.2191, 1.2171, 1.2131 and 1.2081. Here, we follow the development of the downward cycle of October 3. The continuation of the movement to the bottom is expected after the price passes the noise range 1.2191 - 1.2171. In this case, the target is 1.2131. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.2081. Upon reaching which, we expect a pullback to the top. Short-term upward movement is expected in the range 1.2243 - 1.2268. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2308. This level is the key downward structure. The main trend is the downward cycle of October 3. Trading recommendations: Buy: 1.2243 Take profit: 1.2267 Buy: 1.2270 Take profit: 1.2308 Sell: 1.2170 Take profit: 1.2135 Sell: 1.2128 Take profit: 1.2081 For the dollar / franc pair, the key levels on the H1 scale are: 1.0027, 0.9999, 0.9974, 0.9957, 0.9921, 0.9892, 0.9872 and 0.9845. Here, we follow the development of the descending structure of October 3. The continuation of the development of the downward trend is expected after the breakdown of the level of 0.9921. In this case, the target is 0.9892. Price consolidation is in the range of 0.9892 - 0.9872. For the potential value for the bottom, we consider the level of 0.9845, upon reaching which, we expect a pullback to the top. Short-term upward movement is possibly in the range of 0.9957 - 0.9974. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9999. This level is a key support for the downward structure. Its breakdown will lead to the development of the upward movement. Here, the potential target is 1.0027. The main trend is the descending structure of October 3. Trading recommendations: Buy : 0.9976 Take profit: 0.9999 Buy : 1.0003 Take profit: 1.0027 Sell: 0.9920 Take profit: 0.9892 Sell: 0.9870 Take profit: 0.9845 For the dollar / yen pair, the key levels on the scale are : 108.39, 108.14, 107.80, 107.51, 107.10, 106.90, 106.54 and 106.27. Here, the price forms the potential for the top of October 4. The continuation of the movement to the top is expected after the breakdown of the level of 107.51. In this case, the target is 107.80. Price consolidation is near this level. The breakdown of the level of 107.80 will lead to a pronounced movement. Here, the goal is 108.14. For the potential value for the top, we consider the level of 108.39. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 107.10 - 106.90. The breakdown of the last value will have the downward structure. In this case, the first target is 106.54. We consider the level 106.27 as a potential value for the bottom. The main trend: the formation of the upward potential of October 4. Trading recommendations: Buy: 107.51 Take profit: 107.80 Buy : 107.82 Take profit: 108.12 Sell: 107.10 Take profit: 106.92 Sell: 106.88 Take profit: 106.60 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3369, 1.3350, 1.3336, 1.3304, 1.3287 and 1.3254. Here, the price forms the medium-term initial conditions for the top of October 2. Short-term upward movement is possibly in the range 1.3336 - 1.3350. From here, we expect a key reversal in the correction. For the potential value for the top, we consider the level of 1.3369. Short-term downward movement is possibly in the range of 1.3304 - 1.3287. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3254. This level is a key support for the top. The main trend is the formation of medium-term initial conditions of October 2. Trading recommendations: Buy: 1.3336 Take profit: 1.3350 Buy : 1.3352 Take profit: 1.3369 Sell: 1.3304 Take profit: 1.3390 Sell: 1.3285 Take profit: 1.3260 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6868, 0.6838, 0.6815, 0.6782, 0.6772, 0.6756, 0.6730 and 0.6710. Here, the price is close to the cancellation of the upward structure from October 2, which requires a breakdown of the level of 0.6710. In this case, the potential target is 0.6668. The continuation of movement to the top is expected after the breakdown of the level of 0.6756. Here, the first target is 0.6772. The price passes the noise range 0.6772 - 0.6782 will lead to the development of a pronounced movement to the top. In this case, the target is 0.6815. Short-term upward movement, and also consolidation is in the range of 0.6815 - 0.6838. For the potential value for the top, we consider the level of 0.6868. The movement to which is expected after the breakdown of the level of 0.6840. Consolidated movement is possibly in the range of 0.6746 - 0.6730. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6710. This level is a key support for the ascending structure. The main trend is the ascending structure of October 2, the stage of deep correction. Trading recommendations: Buy: 0.6756 Take profit: 0.6772 Buy: 0.6782 Take profit: 0.6815 Sell: 0.6705 Take profit: 0.6670 For the euro / yen pair, the key levels on the H1 scale are: 118.75, 118.54, 118.21, 117.94, 117.58, 117.38, 117.25 and 117.06. Here, we are following the formation of the ascending structure of October 4. The continuation of the development of the ascending structure is expected after the breakdown of the level of 117.95. In this case, the goal is 118.21. Price consolidation is near this level. The breakdown at the price level of 118.21 will lead to the development of pronounced movement. Here, the goal is 118.54. For the potential value for the top, we consider the level of 118.75. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. A correction is expected after the breakdown of the level of 117.58. Here, the target is 117.38. The range of 117.38 - 117.25 is a key support for the top. Its passage at the price will lead to the development of a downward structure. Here, the goal is 117.06. The main trend is the upward structure of October 4. Trading recommendations: Buy: 117.95 Take profit: 118.20 Buy: 118.23 Take profit: 118.54 Sell: 117.56 Take profit: 117.40 Sell: 117.25 Take profit: 117.07 For the pound / yen pair, the key levels on the H1 scale are : 132.51, 131.89, 131.45, 130.62, 130.02, 129.47 and 128.37. Here, the main structure is the downward cycle of September 20. The continuation of the movement to the bottom is expected after the breakdown of the level of 130.62. In this case, the target is 130.02. Short-term downward movement as well as consolidation is in the range of 130.02 - 129.47. For the potential value for the bottom, we consider the level of 128.37. The movement to which is expected after the breakdown of the level of 129.40. Short-term upward movement is possibly in the range of 131.45 - 131.89. The breakdown of the last value will lead to a long correction. Here, the target is 132.51. We also expect the formation of expressed initial conditions for the upward cycle to this level. The main trend is the descending structure of September 20. Trading recommendations: Buy: 131.45 Take profit: 131.85 Buy: 131.92 Take profit: 132.50 Sell: 130.60 Take profit: 130.04 Sell: 130.00 Take profit: 129.50 The material has been provided by InstaForex Company - www.instaforex.com |

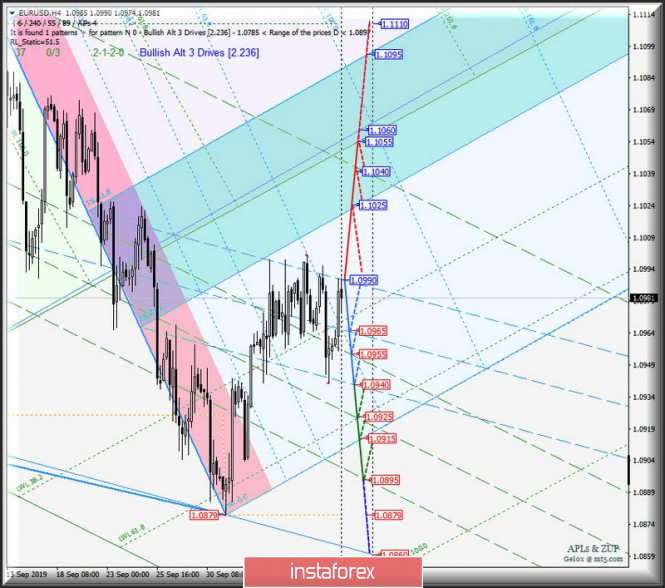

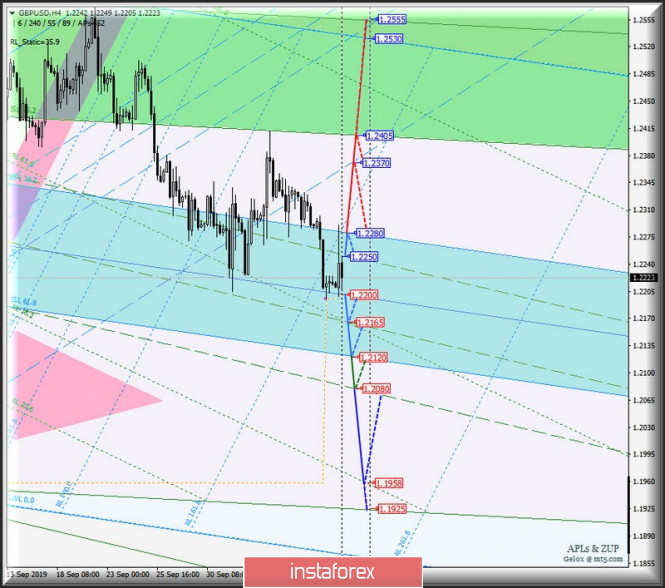

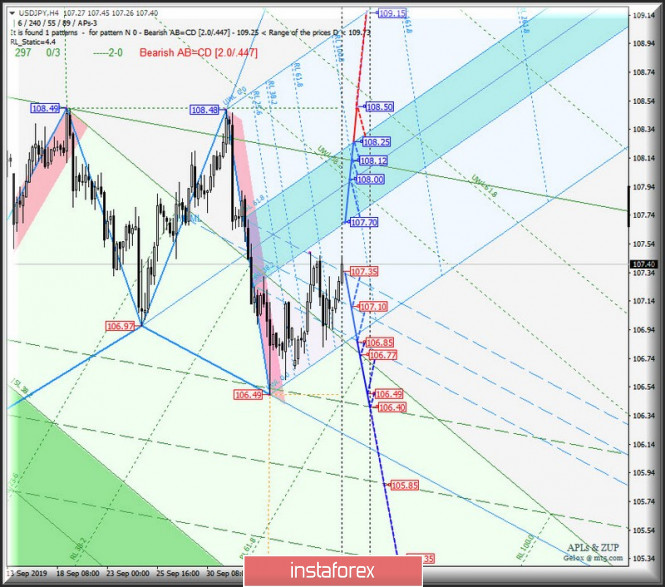

| Posted: 09 Oct 2019 05:30 PM PDT Here are the options for the development of movement in an integrated form of currency instruments in H4 - #USDX, EUR / USD, GBP / USD and USD / JPY from October 10, 2019. Minuette (H4 time frame) ____________________ US dollar Index The movement of the dollar index #USDX from October 10, 2019 will continue to be determined by the development and the direction of the breakdown of the boundaries of 1/2 Median Line channel (98.77 - 98.95 - 99.15) Minuette operational scale fork. The details are shown in the animated chart. The breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 99.15) of the Minuette operational scale fork will direct the movement of the dollar index to the boundaries of the 1/2 Median Line Minuette channel (99.30 - 99.45 - 99.57) with the prospect of reaching the lower boundary of the ISL38.2 (99.70) equilibrium zone of the Minuette operating scale fork. In contrast, in case that the lower boundary of the 1/2 Median Line Minuette channel (support level of 98.77) is broken, the option of developing the downward movement #USDX to the targets is the local minimum 98.63 - the upper boundary of the ISL38.2 (98.40) equilibrium zone of the Minuette operational scale fork. The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar The single European currency continues to remain inside the 1/2 Median Line channel (1.0940 - 1.0965 - 1.0990) of the Minuette operational scale fork, the direction of breakdown of which will determine the further development of the EUR / USD movement from October 10, 2019. The marking the movement inside the 1/2 Median Line channel can be seen at the animated chart. The breakdown of the lower boundary of the 1/2 Median Line channel (support level of 1.0940) of the Minuette operational scale fork - the development of the downward movement of the single European currency can be continued to the goals - 1/2 Median Line Minuette (1.0925) - the initial line of SSL Minuette (1.0915) - the lower boundary of the 1/2 Median Line channel (1.0895) of the Minuette operational scale fork. In contrast, the breakdown of the upper boundary of the 1/2 Median Line Minuette channel (resistance level of 1.0990) will make it relevant to continue the development of the upward movement of EUR / USD to the equilibrium zone (1.1025 - 1.1060 - 1.1095) of the Minuette operational scale fork. The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar The movement of Her Majesty's GBP / USD currency from October 10, 2019 will be determined by the direction of the breakdown of the range :

The breakdown of the 1/2 Median Line Minuette (support level of 1.2200) - the development of Her Majesty's currency movement towards goals - 1/2 Median Line Minuette (1.2165) - lower boundary of the ISL61.8 (1.2120 equilibrium zone of Minuette operational scale fork - lower boundary of 1/2 Median Line channel (1.2080) of the Minuette operational scale fork with the prospect of reaching a minimum of 1.1958. Meanwhile, the breakdown of the upper boundary of the 1/2 Median Line Minuette channel (1.2250) will make the development of the upward movement of GBP / USD relevant whose goals will be - the upper boundary of ISL38.2 (1.2280) equilibrium zone Minuette operational scale fork - final Shiff Line Minuette (1.2370) - ISL38.2 (1.2405) lower boundary of the Minuette operational scale fork. The details of the GBP / USD movement can be seen in the animated chart. ____________________ US dollar vs Japanese yen As in the previous case, the movement of the USD / JPY currency of the "country of the rising sun" from October 10, 2019 will also be determined by the direction of the breakdown of the range:

The breakdown of ISL38.2 Minuette (resistance level of 107.70) - the development of the USD / JPY movement in the equilibrium zone (107.70 - 108.00 - 108.25) of the Minuette operational scale fork with the prospect of reaching a maximum of 108.50. On the other hand, the breakdown of the support level of 107.35 - the movement of the currency of the "land of the rising sun" will continue in the 1/2 Median Line channel (107.35 - 107.10 - 106.85) of the Minuette operational scale fork with the prospect of reaching support levels - 106.77 (the initial SSL line for the Minuette operational scale fork) - local minimum 106.49 - the upper boundary of the 1/2 Median Line Minuette channel (106.40). We look at the details of the USD / JPY movement in the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

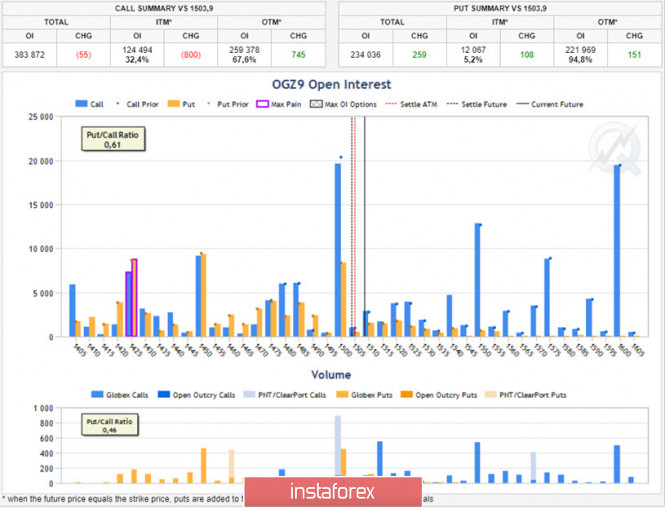

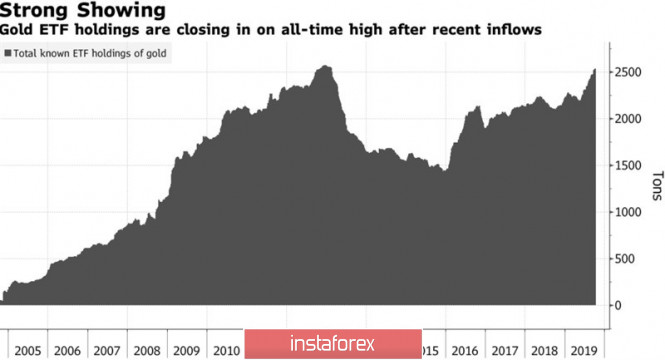

| Forecast for the price of gold - GOLD for October and November Posted: 09 Oct 2019 05:10 PM PDT In September, after a period of rapid growth, the price of gold stopped near the level of $ 1,500. How long will the consolidation continue, should traders and investors expect a decline in the price of gold and when growth is possible? We will analyze in this article. The summer of 2019 was very favorable for gold. Within three months, the price rose from the level of 1300 to 1550 dollars per troy ounce, and it seemed that gold was about to reach the level of $ 1600, but it was not there. Thus, September turned out to be not very successful for gold, which pretty much disappointed many investors, and speculators focusing on rising prices began to suffer losses. So what really happened and what should we expect next? In order to answer this question, we need to understand how the gold market functions and what drives the price. I must say right away that I do not pretend to the truth in the last resort and may be mistaken in my assumptions. Nevertheless, I dare to bring them to the judgment of the readers. First of all, we need to understand that the price of gold, which is formally determined in London, is in fact determined not there, but in the USA, because the largest trading volumes are held on the New York COMEX Exchange and the Chicago CME Exchange (COMEX-CME Group), where they trade gold futures. Despite the fact that futures require physical delivery and are traded every month, financial contracts are carried out on most contracts, which means that these commodity futures are largely subject to financial seasonality. Financial seasonality, in turn, is formed by quarterly cycles, according to which futures trading in March, June, September and December have the greatest liquidity. To prove this, let's look at the volume and Open Interest of CME Gold Futures. On Tuesday, October 8, Open Interest in the November contract was equal to 1037 contacts, and in the December contract was equal to 482703 contracts. However, gold has its own specifics, and the most liquid contracts are those that close in February, April and August, although the most liquid are June and December. In addition to futures contracts, the exchange trades monthly options tied to a specific futures: February (G), April (J), June (M), August (Q), October (V) and December (Z). There are still weekly options, but we will not consider them. Options trading takes place through an open auction, when the buyer and the seller independently look for each other, placing orders in the exchange terminal. It is believed that in the general case, large players sell options and small traders buy, although this is not always the case, and most traders build various option designs, but ruthless statistics say that most options close out of money (out the money), which provides sellers with a positive mathematical expectation from the transaction. Cases where sellers suffer losses, and most of the options are closed in money (in the money), are extremely rare, but possible. This is what happened this summer, when demand for gold exceeded all possible forecasts, and the trend turned out to be strong enough to force option sellers to supply futures at unprofitable prices. The main impulse of Gold purchases was European and American exchange-traded funds, which actively bought gold in response to various factors, whether it be a reduction in the Fed and the ECB rates, a fall in overall profitability in the eurozone, trade wars or speculative positioning in futures and options (Fig.one). As we can see from the chart below, American and European funds actively bought gold in June and September. Fig.1: Monthly cash flows of ETFs. Source: World gold council As a result of the price increase, in May - September, option sellers suffered losses, but does this mean that they are ready to accept them in December? By no means, in fact, losses on the December contract will mean an extremely unfortunate year for option sellers, and in this regard, we can assume that they will try to correct the situation that is not in their favor by December. If we consider the situation in the December option contract OGZ9 (closing November 25), then it now looks like this. The Put / Call Ratio = 0.61 option ratio means that for 100 call options there are only 61 put options, and the maximum pain point for Max Pain buyers is at $ 1,425 (Fig.2). In other words, the higher the price, the greater the losses sellers will bear and the greater profit buyers will receive. In the November option contract OGX9 (closing October 28), the ratio Put / Call Ratio = 0.71, and the MP point is located at around $ 1475. As you can see, in both contracts the interest of option sellers is significantly lower than the current futures - $ 1,510, which suggests the option of lowering the price of gold in the future in October and November. Fig.2: The ratio of option positions in gold to the OGZ9 contract as of October 8th. CME Source The fact that the mood in the futures market is gradually changing, says the latest report on the obligations of traders - COT, published by the US Commodity Futures Commission CFTC last Friday, October 4. According to the report, in just one week since the end of September, Open Interest in gold futures lost a fifth of open positions, falling from a record 1 million 248 thousand contacts up to 1 million 250 thousand contacts. The decline in the OI of futures in the cash gold market was reflected in the fall in prices from the level of 1,530 to 1,470 dollars per troy ounce. Moreover, the main category of players who closed long positions in the futures market were Money Manager speculators. They belong to ETF exchange trading funds, which actively bought gold in the previous four months (Fig.one). Long positions Money Manager decreased from 309 thousand up to 254 thousand contracts in just one week. It is the category of speculators that the US Commodity Futures Commission classifies as major buyers in the commodity market. Thus, it turns out that buyers closed their long positions, but if the main buyers leave the market, then who will buy gold and move the price up? It is assumed that closing long positions of speculators was by no means an accidental positioning. Perhaps, the drivers that are moving the price so far have stopped working, and some traders prefer to take profits in anticipation of new events. However, the technical picture that each of us can observe in the forex terminals fully confirms my assumptions. So, what conclusion can I draw from my thoughts? According to the futures and options market, as well as reports on the positions of COT traders, I assume that the price of gold will undergo a correction to its rising trend in the daily time in October and November this year. This will enable investors to buy gold at lower prices, in turn, traders will be able to earn on lowering prices. In my opinion, the rise in the price of gold will begin no earlier than the second half of November, on the night of New Year holidays, and most likely, after the December option contracts are closed, as well as after new growth impulses appear on the market. Such impulse may include risks of falling stock markets, a policy of lowering Fed rates, positioning in the futures market, and the celebration of the lunar new year, which will be held in China and Asia from January 25 and the next few weeks. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Oct 2019 04:57 PM PDT The markets are in expectant sentiment. Investors are waiting for a new round of high-level US-China trade negotiations to be held October 10-11, as well as the publication of the minutes of the September meetings of the Fed and the ECB. Speaking at the meeting of the National Association of Business Economics (NABE) the day before, Fed Chairman Jerome Powell said the regulator is returning to buying assets. At the same time, the head of the American Central Bank noted that this should not be regarded as a new round of quantitative easing (QE): the Federal Reserve is only increasing its balance. "As we pointed out in the March statement on the normalization of the Fed's balance sheet, there will come a time when we will begin to increase our portfolio of securities to maintain an appropriate level of reserves. This time has come." said J. Powell. He emphasized that there was no question of large-scale asset purchase programs, similar to those that the Central Bank conducted three times between 2008 and 2014. According to the chairman of the Federal Reserve, this is not stimulating the American economy: it is already in good shape. During QE, the Fed acquired long-term US government bonds in the secondary market. Now, the regulator intends to buy short-term bills which is necessary to restore balance in the monetary system. Since the end of QE, the amount of bank reserves has decreased from $ 2.8 trillion to $ 1.4 trillion. The balance of the Federal Reserve began to decline rapidly since 2018 as part of the process of tightening monetary policy. On the other hand, the shortage of dollar liquidity led to an increase in money market rates above 10%, and thanks only to the active use of US Central Bank repo transactions did they drop to less than 2%. It is assumed that regular purchase of bills will be a less costly way to stabilize the situation than repurchase operations. In this case, the balance of the Fed will grow. This is a "bearish" factor for greenbacks. Thus, investors are still counting on a federal rate cut at the October FOMC meeting. Recently, the head of the Federal Reserve, Jerome Powell, often recalls international risks and says that the regulator will act accordingly to support the growth of the US economy. It draws parallels with the 1990s, when the Central Bank carried out monetary expansion three times for preventive purposes. The derivatives market estimates the chances of reducing the federal funds rate by 25 basis points at the next FOMC meeting at 84%. They increased after it became known that the base producer price index (PPI) in the US in September unexpectedly declined by 0.3% after increasing by 0.1% in August. Due to this, Jerome Powell's announcement of the Fed's return to buy assets has diverted investor attention from the publication of the minutes of the September FOMC meeting. However, the Federal Reserve did not yet know about the negativity from business activity and producer prices; thus, the tone of the protocol will be rather hawkish, which will allow the EUR / USD bears to carry out another attack. The main currency pair came up against strong resistance while trying to grow above 1.10. It should be noted that this pair is quite strongly correlated with the general demand for risky assets. In 2017, it grew spectacularly, adding 16% in nine months, when the world enjoyed a simultaneous acceleration of global growth, and vice versa, pressure on EUR / USD strengthened amid an escalation of trade disputes. Last week, the pair slipped below 1.10 and remains at the lower boundary of the downward trading range. Further postponement of the final trade agreement between the United States and China seems the most likely option as of now. However, in this case, the risk appetite may increase, and the euro may well be under increased pressure, as well as the currencies of developing countries. Following that, the whole question will arise whether politicians will be able to withstand the global cooling of business activity. In this regard, the EUR / USD pair has the prospect of returning to the area of 1.03-1.05, where it has found support since 2015, before the end of December. If the markets are so impressed by the progress of the US-Chinese trade negotiations and there is hope for a decrease in tariffs and a reversal of world trade to growth, then EUR / USD can not only return to the upper boundary of the downward channel above 1.12 in the coming weeks, but also test the level of 1.14. Such a reversal also seems possible in the case of strengthening faith in the restoration of the European economy and accelerating inflation in the region, which will allow the ECB not to put so much pressure on the pedal of monetary impulse. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Oct 2019 03:49 PM PDT Gold quickly returned above the psychologically important level of $1,500 per ounce due to weak statistics on US business activity. The United States feel the pain of trade wars and may well pull the rest of the world into the abyss, as has happened in the past more than once. At the same time, neither the US labor market report nor Jerome Powell's statement about the launch of the asset-purchase program made an impression on the precious metal. Obviously, investors are waiting for something. It is easy to guess that this is news from the negotiating table of Washington and Beijing. Despite the fact that the Federal Reserve chairman made it clear that the upcoming program for the purchase of short-term securities is not QE, its start can be considered a positive factor for the bulls on XAU/USD. Increasing the activity of a large buyer is a good argument in favor of rising prices and falling profitability. Non-interest-bearing gold is not able to compete with bonds if rates on them rise. If they, on the contrary, decline, the precious metal begins to enjoy increased popularity. This is confirmed by the high demand for products of ETF funds. Their stocks have been increasing for 17 consecutive days, which is the longest winning streak since 2009. The total size of the indicator is only 35 tons below the record high that took place in 2012. Gold ETF Stock Dynamics The strong growth in stocks of specialized exchange-traded funds and the stability of gold against a strong dollar allow Citigroup to adhere to its bullish forecast for XAU/USD. The company believes that the precious metal will grow to $1,700 per ounce within 6-12 months. But on the side of its fans plays and increased activity of central banks! Thus, the People's Bank of China has been building up gold reserves for the 10th consecutive month. During this period, it acquired 99.8 tons. As a result, stocks rose to 62.64 million ounces. According to the World Gold Council, 14 regulators from various countries continue to diversify their reserves in favor of precious metals in order to reduce their dependence on the US dollar. In 2018, central banks from around the world bought $27 billion worth of gold, a record high. The dynamics of gold reserves in China While central banks and ETF fans are buying gold, speculators prefer to exit. In the week of October 1, their net longs fell to their lowest level since late July. It's not necessary to be frightened by it. Financial managers quite logically take profits on the eve of an important event - trade negotiations between the US and China. Most likely, their impact on financial markets will be much greater than the publication of the minutes of the September meetings of the Fed and the ECB. Technically, the "Splash and Shelf" pattern takes place on the daily gold chart. Breakthrough of the lower boundary of the consolidation range of $1490-1520 will launch another correctional wave in the direction of $1440-1445 per ounce. In contrast, a successful assault on the resistance at $1520 will strengthen the risks of restoring the "bullish" trend and continuing the rally in the direction of the target at 161.8% on the AB=CD pattern. The material has been provided by InstaForex Company - www.instaforex.com |

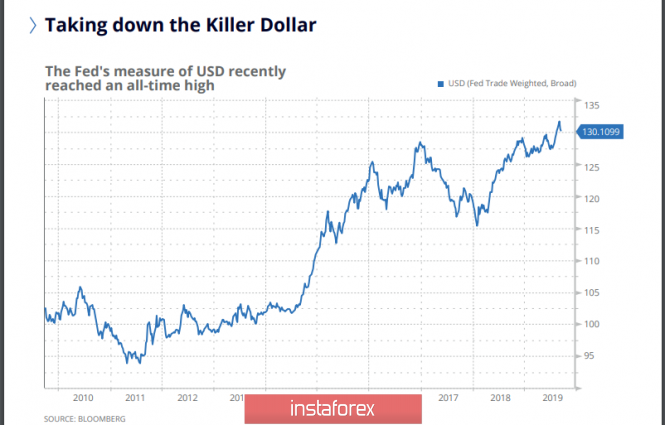

| Faces of the dollar: from the king to the victim of circumstances and the euro's executioner Posted: 09 Oct 2019 03:49 PM PDT The US currency does not cease to amaze market participants. Sometimes it slightly decreases, as if allowing itself to marginally fall, and then traditionally strengthens its position. The US dollar resembles a powerful lion, imposing and confident in its strength, which nothing can shake. However, not all experts share this view. In anticipation of trade negotiations between the US and China, the US currency, previously shaken, has strengthened again. However, the strengthening of the dollar could be very volatile, experts warn. They consider it unlikely that a mutual agreement will be reached between the two powers, since China will never agree to American oversight of its companies. Fuel was added to the fire by the fact that on the day the Chinese delegation arrived in the United States, the White House administration blacklisted 28 companies in China. As a result, the political background remains quite tense, and experts do not count on a favorable outcome of the negotiations. The current situation may negatively affect the US dollar exchange rate by cutting off its wings. Problems with the balance of the Federal Reserve are also not in the best way reflected in the dynamics of the US currency. Economists believe that the redemption of treasury bills is one of the options for solving this issue. According to Fed Chairman Jerome Powell, the regulator is considering the possibility of such a move in order to build a balance for managing the department's reserves. The Fed chief did not directly call this measure a quantitative easing, but his statement was interpreted in this vein. The main goal of these measures is to maintain the US economy. The White House is ready to use all appropriate means to resolve this issue. Here, the role of the dollar, which has long been considered a key figure in the economy of the United States and other countries, is very important. Its "royal" position still remains stable and demonstrates superiority over other currencies. Saxo Bank analysts conducted an interesting study, offering a non-standard look at the greenback. They published a report titled "The Killer Dollar." In it, analysts gave a negative assessment of the impact of dollar hegemony on the world financial system and the global economy. Saxo Bank believes that a powerful global crisis can only slightly delay the devaluation of the US currency. Ultra-low interest rates have already proven ineffective in a number of countries, so the US will have to sacrifice a strong dollar to normalize the situation. Analysts believe that the current year will be remembered as the beginning of the end of a large-scale monetary experiment that launched a global recession, despite the extremely low interest rates in history. According to currency strategists at Saxo Bank, global dependence on dollar financing is stifling global economic growth. Stabilization of the situation is impossible due to a shortage of dollar liquidity, analysts said. Saxo Bank economists recommend using the only financial instrument that has not yet been used in the global economy - the cheapening of the dollar. Analysts are sure that this will give respite to other currencies and help them strengthen. A weakening dollar along with the euro will strengthen the position of the single currency, experts said. This is necessary to maintain balance, otherwise the power of the dollar threatens to drown the euro, experts said. At the moment, the EUR/USD pair is trading in the range of 1.0979–1.0982. In the moment, it fell to a critical rate of 1.0959. However, experts are confident that buyers will be able to return the euro to 1.0990-1.0992. Apparently, this forecast is coming true. The recent breakdown of the support level near 1.0965 and the weakening activity of sellers increase the risk of a further decline in the pair's quotes. According to analysts, the bearish scenario remains a priority. The increased activity of buyers will help the resumption of growth of the EUR/USD pair, analysts said. However, the rise is possible only after overcoming resistance at 1.1000. The euro will hold on to the last, not giving the dollar a chance to weaken itself, although the forces are not equal, analysts summarize. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold relies on trade failure and Fed easing Posted: 09 Oct 2019 03:49 PM PDT Despite the correctional decline that followed last month, gold is still trading near multi-year highs. The focus of market participants is the resumption of trade negotiations between Washington and Beijing. Although the parties took a step towards each other (US President Donald Trump shifted the deadline for raising duties on Chinese goods from October 1 to October 15, China began to buy more agricultural products from the United States), but it's premature to say that they will conclude an agreement. Both China and the United States have strong leaders who do not intend to retreat. Obviously, the protectionist policies of the White House did not bring America any preferences. The US trade deficit in August increased by 7% in annual terms. The US president failed to achieve either an improvement in the state of foreign trade, or a 3% increase in national GDP. Therefore, he is likely to bet on an agreement with China. Apparently, the latter understands this and is trying to capitalize on the lower political rating of Donald Trump, who is under the impeachment sword of Damocles. No one knows how the case will end. October 10-11, the first dialogue between trade representatives of China and the United States will take place in recent months. Traders fear that if the parties are unable to make progress in the upcoming negotiations, then trade tension will intensify, which will put additional pressure on the entire world economy, the growth rate of which is already slowing down. For gold, negative news from the trade front is always positive. The dynamics of the US dollar and, accordingly, precious metals are also influenced by the monetary policy of the Federal Reserve. With a reduction in the Fed interest rate, the exchange rate of the US currency tends to decrease, and the price of gold rises. Last Monday, the president of the Federal Reserve Bank of Minneapolis Neil Kashkari said that he was pleased that the US central bank is lowering the rate on federal funds. "My position is clear: we must support the economy with the help of monetary policy, and not slow it down," he said and added that he did not know how much the Fed should lower the rate. It is assumed that if the Fed continues to soften monetary policy, gold will continue to rise in price up to $1,900 per ounce. The material has been provided by InstaForex Company - www.instaforex.com |

| "The nature of proof, the Nordic": the Norwegian krone is not afraid of the bottom Posted: 09 Oct 2019 03:49 PM PDT Individualism and determination to keep up with world central banks actively reducing interest rates puts the Norwegian krone in a special position. This Scandinavian means of payment, despite the subsidence in relation to the leading currencies of the world, is trying to maintain its position. On Tuesday, October 8, the Norwegian krone was trading at lows along with other Scandinavian currencies. Pressure on quotes was exerted by low oil prices, as well as concerns about the prospects for the global economy and the preservation of the previous volumes of raw material production in Norway. It was previously expected that fossil fuel reserves in the country would last for 30-50 years, but due to the deterioration of the external background, these forecasts are being revised. A rather favorable effect on the Scandinavian means of payment was exerted by another increase in interest rates of the central bank of Norway. Recall that during this year, Norges Bank raised rates four times, arguing that this contributes to economic growth and a decrease in the debt burden. The Norwegian central bank believes that such measures help normalize inflation and do not have a negative impact on the country's stable economy. According to analysts, such a rise in rates helps the Norwegian krone to strengthen. For example, on September 19 of this year, when the regulator once again raised the key rate from 1.25% to 1.5%, the Norwegian currency grew against the euro. EUR/NOK was trading at 9.858, and after the decision of the central bank of Norway, its rate reached 9.895. The regulator began raising the rate from a low of 0.5%, and then gradually increased it to 1.5%. According to experts, such trends demonstrate favorable changes in the Norwegian economy. Experts do not exclude further growth of the EUR/NOK pair in the event of a significant deterioration in risk sentiment. The catalyst for this development of events could be a failure in trade negotiations between the US and China, analysts suggest. Currently, the EUR/NOK pair has exceeded the psychologically important level of 10.00 amid increased risk appetite. Now the pair is trading in the range of 10.069-10.071, although in the first half of the day it was close to 10.053-10.054. The Norwegian krone is highly dependent on oil prices. Recall that the country is one of the largest exporters of black gold. The recent attack on refineries in Saudi Arabia and a further increase in commodity prices have triggered a stronger Norwegian krone against the euro. The Norwegian authorities are worried about the unstable geopolitical situation, in particular, doubts about the success of the trade negotiations between China and the United States, as well as the prospects for a worsening global economy. Such factors limit the rise in oil prices and drive the krone into a bearish scenario. Norway receives the lion's share of revenue from oil production and sales. Such dependence contributes to some volatility of the Norwegian currency, however, the country's internal economic stability does not allow the krone to sink to the bottom. The Norwegian economy is showing positive results, seeking to continue to move in this direction. This allows the national currency to stand steady on its feet, demonstrating an unbending character and readiness to withstand any economic threats. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD and GBPUSD: What to look for in the Fed minutes. Rumors didn't help resume the pound's growth Posted: 09 Oct 2019 03:48 PM PDT Given the absence of important fundamental statistics today in the morning, all the attention of traders is focused on the situation around Brexit, as well as on today's minutes of the US Federal Reserve. GBPUSD The British pound, which collapsed yesterday against the US dollar after news that the EU will not make concessions to Britain on the Northern Ireland border, has sharply increased today. However, the growth was short-lived, as it was based only on rumors that the EU could still make such concessions. In the morning, a note was made in the Times of London that the EU could agree to allow a double majority in the Northern Ireland assembly. However, Downing Street immediately denied these rumors, saying that London would not accept an additional agreement concerning only Northern Ireland, which quickly returned the pound to its place, making it possible for new players to enter short positions from fairly large levels of resistance. Yesterday in Brussels, they expressed the opinion that, most likely, the British government would turn to the EU for extending the Brexit term until the summer of next year, making a direct hint that the EU would not object to this. However, Prime Minister Boris Johnson has so far adhered to his previous strategy, saying that England will withdraw from the EU on October 31 this year, with or without an agreement. From a technical point of view, in addition to updating the level 1.2285, nothing has changed. An unsuccessful return to the resistance of 1.2240 may lead to further sales and the resumption of the bearish trend with the test of the next monthly lows in the areas of 1.2170 and 1.2110. EURUSD In the afternoon, attention will be focused on the publication of the minutes of the September meeting of the US Federal Reserve. It is no secret to anyone that the Fed can lower interest rates by another 25 points in December this year, as well as announce the launch of a new program of quantitative easing, as committee chairman Jerome Powell indirectly hinted yesterday. Therefore, attention today must be focused on the distribution of votes within the committee, as the text of the minutes should provide more detailed information on the discussion of the decision to lower the key interest rate to 1.75%. Also, attention will be drawn to the forecast for inflation in 2019, 2020 and 2021 from Fed economists. If they are revised downward, this will be another signal in the direction of easing monetary policy. A significant moment is a "split in the ranks of the Fed." If there are more people who oppose further interest rate cuts in the future, the less pressure will be created on the US dollar. As for the technical picture of the EURUSD pair, buyers of risky assets showed activity in the first half of the day, but failure to update Tuesday's high may create serious problems for further growth. Returning 1.0970 under intermediate support will return the market to a bearish mood, which will push the trading instrument to the lows of 1.0940 and 1.0905. It will be possible to talk about the resumption of the bull market only after a breakthrough of resistance in the 1.1000 area, which will lead to larger local highs in the areas of 1.1040 and 1.1070. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: Brexit deal on the verge of failure, and the pound on the verge of collapse Posted: 09 Oct 2019 03:48 PM PDT The British currency could fall to $1.15 or even to $1.10 against the US dollar, if the United Kingdom leaves the European Union on October 31 without an agreement. "If Great Britain manages to extend the delay in quitting the European Union before the deadline is set, then a slight positive reaction can be observed in the dynamics of the pound. In this case, the GBP/USD pair will consolidate in the range of 1.20–1.25," the analyst said. "If the UK achieves a deferment and forms a non-socialist government, sterling could go up to $1.30," he added. It should be noted that the last time for 1 pound was given less than 1 dollar and 15 cents in the distant 1985. Nearly no one believes that an agreement on the Brexit conditions between the EU and UK can be concluded until October 31. Recall, the day before, German Chancellor Angela Merkel said that Northern Ireland should remain part of the EU customs union. The Prime Minister of the United Kingdom, Boris Johnson, said in response that this condition, along with the EU's reluctance to meet its latest deal proposals, is paving the way for a no-deal Brexit. At the same time, EU representatives made it clear that they were ready to discuss the postponement of Great Britain's withdrawal from the EU. "We think that the UK will nevertheless ask for another Brexit postponement and hold early elections in late November – early December," analysts at ING said. "This delay can be granted for a period of more than three months, and this time should be enough for the new British government to find a common language with the EU," they believe. "If parliamentary elections in the United Kingdom take place earlier, then the British currency will be under pressure. In this case, Conservatives can get a majority in Parliament, which will increase the likelihood of a hard Brexit and increase the risk premium for owning the pound. In this scenario, GBP/USD should fall below 1.20, as well as a retest of EUR/GBP at 0.93. Strengthening the risks of a disordered UK exit from the EU will limit the growth potential of EUR/USD and adversely affect the segment of European currencies as a whole," said ING. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Oct 2019 03:48 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 60p - 58p - 43p - 39p - 55p. Average volatility over the past 5 days: 51p (average). On Wednesday, October 9, the EUR/USD pair was unable to continue the downward movement that had begun the day before. Thus, the pair moved to the side channel, which is signaled by Bollinger Bands, now directed sideways. In the past few days, traders clearly cannot determine which way to trade the pair, and this is not surprising, since there were no important macroeconomic publications from the very beginning of the week. There are only daily speeches by Jerome Powell, who, however, does not say anything that traders could respond by rough opening of positions. Yesterday there was potentially important information that the Federal Reserve plans to start buying assets from the open market. Many traders even considered that the regulator resumes the quantitative easing program that it had already conducted but stopped its implementation long ago, but Powell explained that this is a temporary and small-scale redemption of short-term bills, and not about buying long-term government bonds. Thus, we can say that the news from the United States and the European Union, in principle, is coming, but there is no data that can move the pair from its spot. Based on this, we can only wait for these very data or the moment when the market will move for other reasons. These may be technical reasons, this may be the entry into the international currency market of a bank with a large application for the purchase of euros or dollars, which will cause a sharp change in supply and demand for this currency and, accordingly, a change in the exchange rate. By the way, Jerome Powell has another speech set for tonight and we do not recommend missing it, although the last three of his speeches were not very interesting for the forex market. In addition, the minutes of the Fed meeting is set to be released today, however, these minutes very rarely contain any unexpected information. The FOMC minutes is rather a written summary of the results of the Fed meeting, that is, traders will not learn anything new from it. The last two trading days of the week will be a little more interesting than the first three, but it is very difficult to call them fascinating from a fundamental point of view. The value of inflation in the United States for September will be published on Thursday, and, according to analysts, a slight acceleration is expected to reach 1.8% y/y. We can check whether Jerome Powell was right when he recklessly declared that inflation was at "acceptable levels". Last month, we recall, many also expected an acceleration in the consumer price index, but instead there was a slowdown. A speech by Mario Draghi will take place on Friday, which is unlikely to please buyers of the European currency, and is also unlikely to surprise investors at all. Mario Draghi will leave his position at the end of the month,so it makes little sense to conduct active work to change the monetary policy of the ECB now. Moreover, at the last meeting, he already announced a reduction in the deposit rate and revival of the QE asset-purchase program in November. Thus, it is unlikely that the ECB will go twice in a row to reduce the rate, therefore, nothing special can be expected from Mario Draghi. Trading recommendations: The EUR/USD pair went sideways. Thus, traders are now not recommended to conduct any trade. It is recommended to wait until the flat is completed, the Bollinger Bands widen to one side and only then should you open new positions for the euro/dollar pair. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Oct 2019 03:48 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 97p - 147p - 81p - 49p - 107p. Average volatility over the past 5 days: 96p (high). Great Britain and the European Union are like two tennis players - they throw the ball of charges through the net. Boris Johnson has repeatedly stated that he has made a "generous and fair" proposal to Brussels and is trying in every possible way to find a common language with its European colleagues and conclude a "deal" as the Parliament wishes. Unfortunately, the EU does not consider this proposal "generous and fair". There is one very important question for Boris Johnson: why did he not spend the first month and a half of his reign on negotiations with the European Union, but on preparing for the hard Brexit? Recall that about 100 million pounds were allocated only for advertising hard exit, to inform the entire population of the United Kingdom about the upcoming exit and all its aspects. Since, according to many media and the public as a whole, someone alone should be to blame for the disordered Brexit, the EU also does not want to take the blame. Not later than today, the head of the European Commission, Jean-Claude Juncker, once again stated that a "divorce" without an agreement would have disastrous consequences for the UK. "I do not accept the accusation that the possible failure of the Brexit negotiations is due to the EU's position," Juncker said. "If this fails in the end, the responsibility lies solely with the British side," said Jean-Claude. Meanwhile, it was reported that immediately after the EU summit, which is now defined as the last chance to conclude a deal, the British Parliament will meet for a meeting, within which the fate of Brexit will be decided. It is expected that if the deal is somehow miraculously agreed between Johnson and the European deputies, then it will be necessary for the British Parliament to approve it as soon as possible. If not, then at a cruising pace it will be necessary to develop a new plan of action, as well as try to understand what Boris Johnson will do and stop him on time if he does try to pull the country out of the EU on October 31. The pound remained on dry rations today, as there were no really important news for the day. But, despite the news drought, traders were still able to make a jump up, almost work out the critical Kijun-sen line and return to their original positions below the support level of 1.2222. Thus, the downward movement is again more priority and likely. Unfortunately, the pound will continue to remain under pressure from investors at least until October 19, when it becomes clear what the UK expects in the coming months. In theory, 10 days is even enough for traders to pull down the pound/dollar pair to multi-year lows near the price level of 1.1958. We will not evaluate the chances of executing a particular Brexit option now. A huge number of experts and analysts were already engaged in this, and Britain, as it could not leave the EU, is still not able to do this. The technical picture of the pair now also implies a continued downward movement. The Ichimoku indicator has formed a "dead cross", which is strong, all indicators are pointing down, so short positions are still advisable now. Trading recommendations: The pound/dollar currency pair resumed its downward movement. Thus, we recommend that you now support already open short positions with targets at 1.2134 and 1.2109. The fundamental background remains on the side of the US currency, so purchasing the pound is impractical at the moment. In addition to the technical picture, fundamental data and the time of their release should also be considered. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| AUD/USD. Either 0.6880 or 0.6670: the aussie awaits the outcome of trade negotiations Posted: 09 Oct 2019 03:48 PM PDT The Australian dollar, like its American namesake, completely focused on waiting for the outcome of negotiations between the US and China, which should start tomorrow, October 10. The aussie's reaction is expected to be as volatile as possible, since China is Australia's main trading partner. In this context, the prospects for the US dollar are not so clear: in the event of a negotiation failure, the greenback, on the one hand, will be under pressure from the dovish intentions of the Federal Reserve, but, on the other hand, can take advantage of the status of a defensive instrument, as it was during the last escalation trade war this summer. But the fate of the Australian currency in the event of a negative scenario is quite predictable. I recall that at the last meeting, the Reserve Bank of Australia lowered the interest rate by 25 basis points. This is the third rate cut this year: the regulator first resorted to easing monetary policy this summer, right after the next round of the trade war. However, this factor played an important, but not decisive role. Since February, rumors have been circulating in the market that the Australian central bank will have to resort to incentive measures amid ongoing global conflict and a slowdown in the global economy. The hypothetical intentions of the regulator took on a distinct form after the publication of key macroeconomic data. First of all, the growth dynamics of the Australian economy was disappointing: the GDP indicator has been consistently and steadily declining over the course of four quarters since the beginning of last year. This year the situation only worsened: in the second quarter, the key indicator fell to multi-year lows, that is, around 1.4%. Other indicators, in particular labor market data, are also controversial. For example, the unemployment rate, on the one hand, is at low values, and the overall growth rate of the number of employed people is consistently coming out of the "green zone". However, the structure of this release suggests that the increase in the number of employees is due only to part-time employment. But full employment shows a negative trend, collapsing into a negative area. All this suggests that AUD/USD traders should not expect a breakthrough in inflationary growth in the near future, in particular due to the fact that part-time work implies a lower level of wages. There is another cause for concern: we are talking about the indicator of confidence in the business environment from NAB (National Australia Bank). According to analysts from the largest Australian bank, consumer confidence fell to zero in September. This is despite the fact that over the past four months the figure has been consistently and quite rapidly declining. This result is due to the difficult relations between the United States and China, as well as a decrease in the commodity market (primarily iron ore). In other words, traders should prepare for the next round of interest rate cuts. Firstly, the head of the Reserve Bank of Australia, Philip Lowe, hinted at this. He made it clear that the regulator is ready to continue to respond to the decline of key indicators, "playing ahead of the curve". Lowe did not push himself and his colleagues into any time frame, but the market is confident that by the end of the year the RBA will still lower the rate to 0.5%. In the framework of 2019, two more meetings will be held - November 5 and December 3. According to the general expectations of traders, the actions of the regulator will depend on the results of the US-Chinese negotiations. If they fail, then with a high degree of probability the rate will be reduced in November. Otherwise, the corresponding decision will be made at the December meeting, taking into account the dynamics of key macroeconomic indicators. It is worth noting that Philip Lowe is skeptical of incentive programs (which are adopted by, in particular, the Bank of Japan and the ECB), therefore, the Australian central bank will respond to external challenges only by reducing rates. Thus, the focus of the AUD/USD traders is still on the US-Chinese trade negotiations, on the outcome of which, in fact, depend on the prospects of the monetary policy of the RBA. If the outcome is positive, the pair can impulsively jump to the resistance level of 0.6880 (the upper boundary of the Kumo cloud, which coincides with the upper line of the Bollinger Bands indicator on the daily chart). But the main goal of the upward movement will be the mark of 0.7000 - only when it is overcome can we talk about a trend reversal. But if the parties again disperse "in the corners of the ring" without any agreement, the aussie can again test the lows of this year, dropping to the area of 0.6670, that is, to the lower line of the Bollinger Bands indicator on D1. The material has been provided by InstaForex Company - www.instaforex.com |

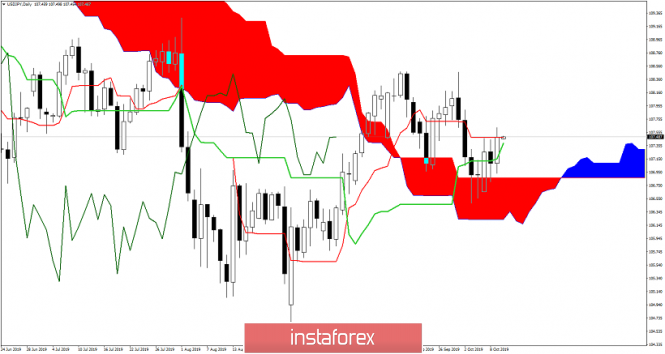

| USDJPY bounces but remains below key resistance Posted: 09 Oct 2019 02:48 PM PDT USDJPY is trading at 107.45 and in order to be able to see a move towards 110, we need bulls to break the resistance area of 108.30-108.50. Price has formed a bullish pattern and a beak above it will signal a move towards 110.60.

USDJPY needs to break the black resistance area. Support is at 106.50 and a break below it will be a bearish. The 100% extension of the first leg targets 110.55.

|

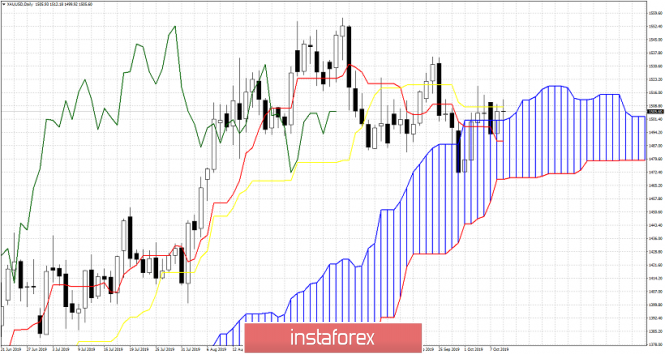

| Gold bulls recapture $1,500 but price remains below key resistance Posted: 09 Oct 2019 02:39 PM PDT Gold price bounces back above $1,500 but price remains inside the downward sloping bearish channel. Gold bears need to break below $1,500 and bulls want to see $1,525-$1,520 resistance broken.

|

| October 9, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 09 Oct 2019 10:07 AM PDT

Recent Descending-Tops were established around the price levels of 1.1060-1.1075 where the backside of both broken trends was retested. This rendered the recent bullish spike above 1.1100 as a bullish trap. Since then, the EURUSD has been trending-down within the depicted short-term bearish channel until recent signs of bullish recovery were demonstrated around 1.0880 (Inverted Head & Shoulders Pattern). Shortly After, a bullish breakout above 1.0960 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) where another episode of bearish rejection should be expected. The intermediate-term outlook turned into bullish as long as the EURUSD pair pursues its current movement below 1.1030. However, initial Intraday bearish pullback should be expected towards 1.0940-10915 where another bullish swing will probably be initiated. On the other hand, If bullish persistence above 1.1030 (0% Fibonacci Expansion) is established earlier, the long-term projection target would be projected towards 1.1115 (Low Probability Scenario). Trade recommendations : Intraday traders were advised to consider the recent bullish breakout above 1.0960 as a valid BUY signal. Initial bullish target level was already reached around 1.1000. Another Intraday BUY entry can be considered upon a bearish pullback towards 1.0915-1.0940 (Backside of the broken bearish channel). T/P levels to be located at 1.0960, 1.1000 and 1.1029. S/L should be placed below 1.0870. The material has been provided by InstaForex Company - www.instaforex.com |

| October 9, 2019 : GBP/USD Intraday technical outlook and trade recommendations. Posted: 09 Oct 2019 10:05 AM PDT

On August 9, the depicted bullish channel has been established. Since then, the GBP/USD pair has been trending-up except on September 3 when a temporary bearish breakout was demonstrated towards 1.1960. Around the price level of 1.1960, aggressive signs of bullish recovery (Bullish Engulfing candlesticks) brought the GBPUSD back inside the depicted movement channel. Moreover, Temporary bullish advancement was demonstrated towards 1.2550 where a short-term reversal channel was demonstrated. As anticipated, the reversal channel was broken-down on September 23 supported by obvious bearish price action demonstrating a successful bearish closure below 1.2450. On September 25, the depicted bullish channel was finally terminated with significant full-body bearish candlesticks which managed to achieve bearish closure below 1.2395. The Short-term outlook remains bearish as long as the most recent top established around 1.2400 remains defended by the GBP/USD bears. Bearish persistence below 1.2400-1.2440 (Reversal-Pattern Neckline) allowed more bearish decline to occur towards the price levels of 1.2210 where recent bullish pullback towards 1.2400 was previously originated on October 2. This week, the price zone of 1.2300-1.2330 (Fibonacci Cluster Zone) remains a significant SUPPLY zone to be watched for SELL entries if any bullish pullback occurs. On the other hand, bearish persistence below 1.2220 is mandatory to allow further bearish decline towards 1.2160 and 1.2120. Trade Recommendations: Conservative traders are advised to consider any bullish pullback towards the Fibonacci Cluster Zone (Anywhere around 1.2300-1.2330) as a valid SELL entry. T/P levels to be placed around 1.2330, 1.2280, 1.2240 and 1.2160 while S/L should be placed above 1.2450. The material has been provided by InstaForex Company - www.instaforex.com |

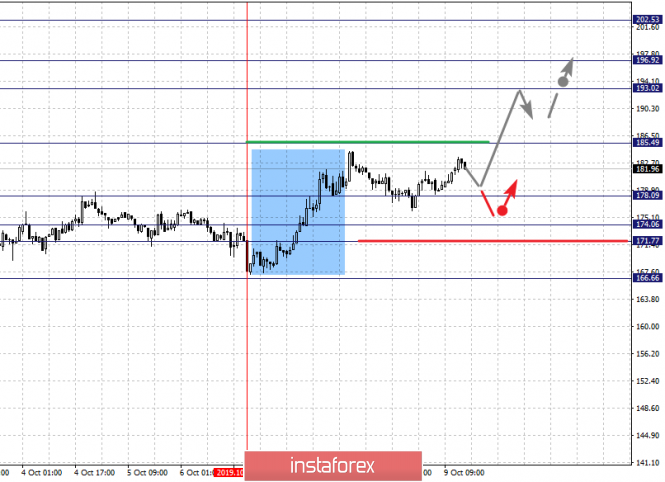

| Gold 10.09.2019 - 2 potential scenarios for the FOMC Posted: 09 Oct 2019 08:16 AM PDT Gold has been trading sideways at the price of $1,507. Currently the Gold is at the resistance (yellow rectangle) and it is not good for buying at this stage. There is potential for downside move towards the $1,497-$1,486.

Yellow rectangle – Resistance levels Red rectangles – Support levels Purple lines – Potential scenarios Today is FOMC day and I see two potential scenarios. Scenario 1: The breakout above the $1,511 will confirm potential test of $1,534 (swing high). Scenario 2: In case that you don't see breakout of resistance, watch for selling opportunities to the downside with targets at $1,497 and $1,486. The material has been provided by InstaForex Company - www.instaforex.com |

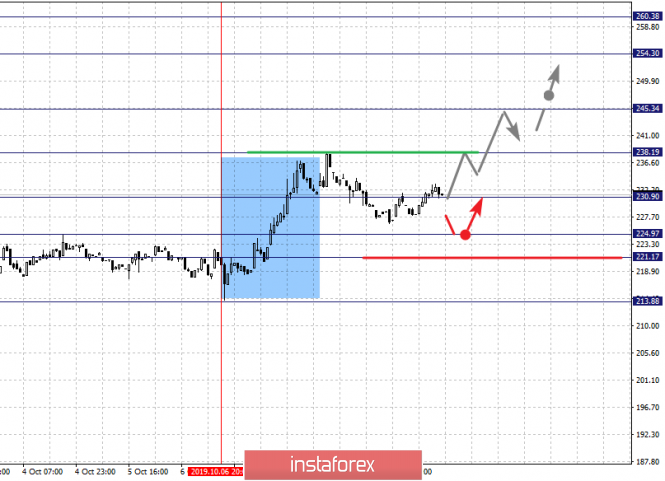

| GBP/USD 10.09.2019 - Is the GBP ready for new downward move? Posted: 09 Oct 2019 08:06 AM PDT GBP has been trading sideways at the price of 1.2218. I found strong rejection of the 20SMA on the 4H time-frame, which is sign that sellers are still present. Bearish flag is in creation and I expect –potential more downside. Today we have FOMC meeting minutes, which is the reason why the currencies are in equilibrium. Market is awaiting for new informations.

Green rectangle – Broken support became resistance Orange rectangle – Support level Purple falling line – Expected path Bearish flag is in creation based on the 4H time-frame. Watch for potential breakout to the downside to confirm further downward continuation. I found broken Head and Shoulders pattern in the background, which is another good sign that sellers are present. Resistance level is found at the price of 1.2230 and support level at 1.2110. Selling opportunities are preferable. The material has been provided by InstaForex Company - www.instaforex.com |

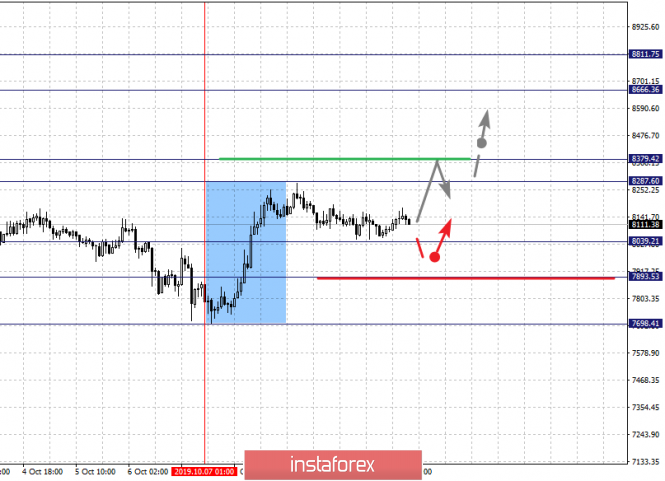

| BTC 10.09.2019 - Sell zone for Bitcoin, important resistance on the test Posted: 09 Oct 2019 07:55 AM PDT BTC is did reach our yesterdays' target at the price of $8,050 but then rejected strongly. BTC is the momentum UP but resistance at the price of $8,500 is on the test and I would not watch for any upward opportunities as long as the resistance is on the test. BTC might rotate lower and test $8,320.

Red rectangle – Important resistance levels Yellow rectangle – Resistance become support Purple falling line – Expected path Strong resistance at the price of $8,500 is on the test and I would prefer potential selling opportunities. Watch for potential sell divergence on the MACD oscillator on 15/30 time-frame to confirm further downside rotation. Resistance levels are seen at $8,500 and $8,800. The support level is set at the price of $8,300. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Oct 2019 07:13 AM PDT Good afternoon, dear traders! Today, I present to your attention an overview of the situation on EUR/USD, which repeats the fate of gold after Jerome Powell's speech yesterday. During the last trading week, the European currency against the US dollar was trading in the range between two levels: 1.1000 and 1.0940. Yesterday, there was a barely noticeable, but still a breakdown of the lower level during Powell's speech, whose speech, by the way, was neutral. However, today at the opening of European markets, EUR/USD showed a rather strong bullish rally that is unusual for this instrument, which can now only speak about one thing – the seller's weakness. The upper mark of 1.1000 is just an extremely important level for the seller, so further growth of this instrument is very likely.

Today, the market expects a series of news, such as the number of job openings in the JOLTS labor market, followed by another speech by Jerome Powell. Moreover, at 19:00 (London time) a press conference of the Open Markets Committee (FOMC) will begin, which will also be, albeit small, but a driver for the markets. Strong movements at 21:00 should not be expected, since these are ordinary protocols, without a decision on the interest rate. I recommend working from long positions to update the round level of 1.1. And take profits. I wish you great profits and good luck in trading! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for October 09, 2019 Posted: 09 Oct 2019 05:55 AM PDT Overview: The AUD/USD pair was trading around the area of 0.6724 a week ago. Today, the level of 0.6724 represents a weekly pivot point in the H1 time frame. The pair has already formed minor resistance at 0.6776 and the strong resistance is seen at the level of 0.6804 because it represents the weekly resistance 2. So, major resistance is seen at 0.6804, while immediate support is found at 0.6776. Further close above the high end may cause a rally towards 0.6776. Nonetheless, the weekly resistance level and zone should be considered. Therefore, there is a possibility that the AUD/USD pair will move upside and the structure of a fall does not look corrective. The trend is still above the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the upside. Thus, amid the previous events, the price is still moving between the levels of 0.6724 and 0.6776. If the AUD/USD pair succeed to break through the resistance level of 0.6776, the market will rise further to 0.6804 as as the second target. This would suggest a bearish market because the RSI indicator is still in a positive spot and does not show any trend-reversal signs. The pair is expected to rise lower towards at least 0.6804 so as to test the daily resistance 2. On the contrary, in case a reversal takes place and the AUD/USD pair breaks through the support level of 0.6697, then a stop loss should be placed at 0.6650. The material has been provided by InstaForex Company - www.instaforex.com |

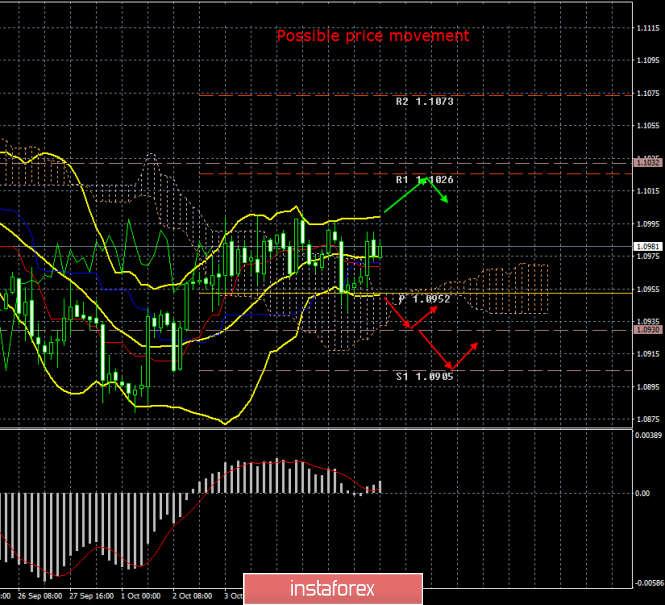

| Trading plan for EUR/USD for October 09, 2019 Posted: 09 Oct 2019 05:34 AM PDT

Technical outlook: The EUR/USD pair had been flirting with the resistance line inside a range-bound trade for a while, before dropping off yesterday to a fibonacci support close to 1.0940 levels. The subsequent rally came in as no surprise and we can see the euro trading back into the buying zone of the dropping trend line connecting previous highs at 1.1075. The immediate outlook looks to be on the north side towards 1.1075, provided yesterday's lows hold. Going forward, resistance shall be faced at 1.1025 and 1.1075 while support stays at 1.0905, followed by 1.0879 respectively. Trading point of view, one could look to remain on the long side until prices stay above 1.0905 and subsequently above 1.0879. A break below could be of concern to the bullish setup, but should be short-lived. Trading plan: Remain long, stop at 1.0879, target 1.1075 and 1.1110 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the EURUSD currency pair – placement of trade orders (October 9) Posted: 09 Oct 2019 05:32 AM PDT Over the last trading day, the euro/dollar currency pair showed volatility just below the daily average of 54 points, but this was enough to meet the expectations of traders. From technical analysis, everything is fine. The three-day sideways movement of 1.0960/1.0990 (1.1000) was still broken, locally descending to the first predicted point of 1.0940, which reflects the minimum pullback on October 3. Analyzing the trading day in detail, we see that the local surge occurred at the time interval of 15:00-18:00 (time on the trading terminal), after which the rollback process came. As discussed in the previous review, traders did not do anything for several days, except for a thorough analysis of quotes relative to the borders of 1.0960/1.0990 (1.1000). The goal was only one – to identify the stretch of a particular border, which traders received as a result, along with a piece of the profit. Looking at the trading chart in general terms (the daily period), we see that the correction phase has not gone away and we are still within it. In turn, the psychological level of 1.1000 continues to play the role of resistance, giving hope to traders that it will play a major role in restoring the global course. The news background of the past day contained data on producer prices in the United States, where they did not expect confirmation of the data, but as a result, they got a slowdown from 1.8% to 1.4% (y/y). This news turned out to be a kind of deterrent from a further decline (EURUSD), and we saw the same initial pullback. We move further and we see that the information background did not stand still, it was the main impetus for the last decline in the market. German Chancellor Angela Merkel during a telephone conversation with the British Prime Minister said that a Brexit deal is possible only if Northern Ireland remains in the EU customs union. The British proposals for the deal ended unsuccessfully, and you should not expect any miracle. In turn, the head of the European Council, Donald Tusk, reminded Johnson that negotiating an exit – not a stupid game of accusation. "@BorisJohnson, what's at stake is not winning some stupid blame game. At stake is the future of Europe and the UK as well as the security and interests of our people. You don't want a deal, you don't want an extension, you don't want to revoke, quo vadis?", Donald Tusk wrote on his twitter @eucopresident Tuesday was a very busy day in terms of incoming information. Yesterday, there was a meeting between the President of the European Parliament (EP) David Sassoli and British Prime Minister Boris Johnson, during which the EP President did not hear any proposals that could advance the Brexit process. As for the postponement, Sassoli said the European Parliament is open to the possibility if there is a good reason or purpose for it. But the request for a delay must be from the UK. As a result of the information received, the EURUSD pair locally stepped down, implementing our previously set forecast. Today, in terms of the economic calendar, we have data on open vacancies in the United States labor market (JOLTS), which are expected to be reduced from 7.217M to 7.191M. The main event is the publication of the text of the minutes of the meeting of the Federal Committee on Open Market Operations, as the contents of the protocol carry valuable information regarding further actions of the regulator. It's only worth considering that even earlier at a press conference, Jerome Powell already stated that the regulator does not observe any signs of a recession, thereby the protocol will to a greater extent reflect what we already have. Further development Analyzing the current trading chart, we see a characteristic surge in prices, returning the quotation to the limits previously reached (1.0960/1.0990/1.1000), having as a fact a perfectly accurate touch of the border of 1.0990 (1.1000). The reason for the surge is not yet clear, media sources and insider are silent. If we analyze the fluctuation minute by minute, we will see that the surge came in the morning period 9:25-11:25 (time on the trading terminal), after which it stopped. In turn, traders were probably in the phase of fixing previously received profits, waiting for the breakdown of the mark of 1.0940. I do not exclude that speculators locally managed to enter the position just at the stage of the primary pullback, but already left long positions at the moment of approaching 1.0990 (1.1000). It is likely to assume that now we are waiting for a temporary stop in the range of 1.0976/1.0990, where already near the time of publication of the Fed minutes, a reverse surge in the price is possible. The alternative development scenario looks like a continuation of the course within the flat 1.0960/1.0990 (1.1000). Based on the above information, we derive trading recommendations:

Indicator analysis Analyzing different sector timeframes (TF), we see that the indicators signal a multidirectional interest relative to all major periods. So, the short-term interval signals sales, the intraday interval took an upward position due to the recent surge. The medium-term Outlook has moved into a neutral phase. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 9 was built taking into account the time of publication of the article) The volatility of the current time is 37 points, which is the average for this period. It is likely to assume that in the case of another hang in the amplitude of 1.0960/1.0990 (1.1000), volatility will be squeezed into the daily average. Key levels Resistance zones: 1.1000***; 1.1100**; 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100 Support zones: 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |