Forex analysis review |

- BTC 11.22.2019 - Daily Ichimoku price action analysis

- Gold 11.22.2019 - Another rejection of the major Fibonacci confluence support at $1.461, upside still in play

- November 22, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- EUR/USD for November 22,2019 - First downwrad target on EUR at 1.1050 reached, potential for more downside and test of second

- November 22, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Trading recommendations for the EUR USD currency pair - prospects for further movement

- GBPUSD and EURUSD: the pound is losing ground on weak services activity. The euro continues to beat the resistance of 1.1090

- The US election may be the main risk for the markets, which will add to the appeal of gold and treasuries

- Fractal analysis of the main currency pairs on November 22

- GBP/USD: plan for the American session on November 22. The pound is expected to react to the fall on a weak report on activity

- Trading idea for USDCAD pair

- Evening review for EUR/USD on 11/22/19

- EUR/USD: plan for the American session on November 22. Activity in the manufacturing sector and the service sector of the

- Two directions for the euro

- Euro Marks the Kings

- Technical analysis of NZD/USD for November 22, 2019

- What is preventing the pound from continuing its rally?

- Trading recommendations for the GBP/USD currency pair - prospects for further movement

- Trader's Diary 22.11: EURUSD Consolidation on the Elections in Britain and the USA

- Technical analysis recommendations for EUR/USD and GBP/USD on November 22

- Simplified wave analysis of GBP/USD and USD/JPY on November 22

- The Disappointment of the Pound: Victory was near

- EURUSD - working out the first goal

- EURUSD: the ECB decided to wait for further changes in monetary policy. Data on the US economy may support the dollar today

- Indicator Analysis: Daily review on November 22, 2019, on the GBP / USD Currency Pair

| BTC 11.22.2019 - Daily Ichimoku price action analysis Posted: 22 Nov 2019 08:25 AM PST BTC has been trading downwards, exactly what I expected yesterday. The price broke main swing low at $7.285 with the strong momentum. Our first major target has been reached at $7.285. New downward targets are set at the price of $6.550 and $5.912.

Ichimoku analysis: The price is trading below the Ichimoku cloud and Kijun-Tenkak sen lines, which is sign of the strong downward trend. Next important support levels I have found at the price of $6.550 and $5.913. Resistance level now became previous support at $7.285. Additionally, the major breakout of the symmetrical triangle in the background is still active and projection from that pattern is that BTC can reach the level of $4.000. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Nov 2019 08:14 AM PST Gold did another rejection of our main multi-pivot support and Fibonacci confluence at $1.461, which is sign that there is still space for more upside movement and eventual test of $1.485.

Stochastic oscillator showed fresh new bull cross, which is good sign that buyers are still present and that buying opportunities are preferable. Support levels are seen at the price of $1.465 $ and $1.485. Resistance level is set at $1.473, $1.478 and $1.485. My advice is to watch for buying opportunities as long as the Gold is trading above the $1.454. The material has been provided by InstaForex Company - www.instaforex.com |

| November 22, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 22 Nov 2019 07:53 AM PST

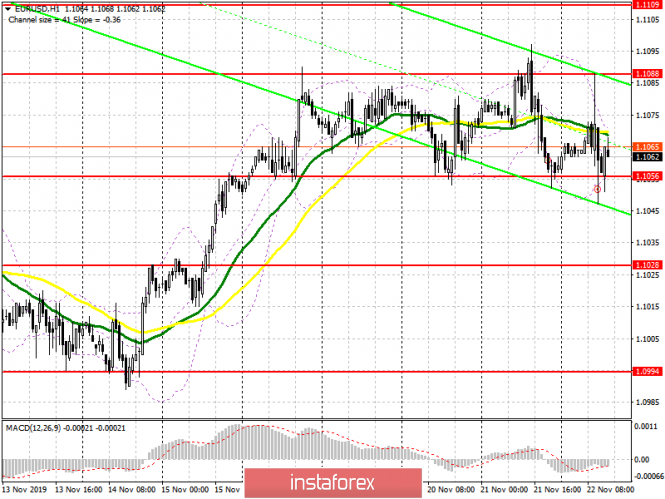

On October 2, an Inverted Head & Shoulders reversal Pattern was demonstrated around 1.0880. Few days later, bullish breakout above 1.0940 (neckline) confirmed the depicted pattern enabling further bullish advancement towards (1.1000 -1.1020). Since then, the EURUSD pair has been trending-up until October 21 when the pair hit the price level of 1.1175. The price zone around (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 which offered valid bearish positions two weeks ago. That's why, further bearish decline was executed towards 1.1025 and 1.0995 where the current bullish pullback was initiated. Recently, the mentioned episode of bullish pullback was demonstrated towards 1.1065-1.1085 where a cluster of supply levels are located (61.8% Fibo - 50% Fibo levels). The current price levels 1.1065-1.1085 demonstrated early bearish rejection and another valid SELL entry can be taken here. Estimated initial bearish targets are located at 1.1020 and 1.1000 provided that bearish persistence below 1.1055 (neckline of the triple-top pattern) is achieved. Please note that any bullish breakout above 1.1110 invalidates the mentioned bearish scenario allowing further bullish advancement towards 1.1150. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Nov 2019 07:49 AM PST Gold did break our important multi-pivot support at 1.105 and reached first downward target at $1.1055 and it is approaching our second and third target at 1.1032 and 1.1015..

Stochastic oscillator is fresh new down cross, which is good sign that sellers are in control and that selling on the rally is preferable strategy for today. The cause of the downside move on the EUR may be th weak data from Morning news. Support levels are seen at the price of 1.1032 and 1.1015. Resistance level is set at 1.1050.The material has been provided by InstaForex Company - www.instaforex.com |

| November 22, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 22 Nov 2019 07:42 AM PST

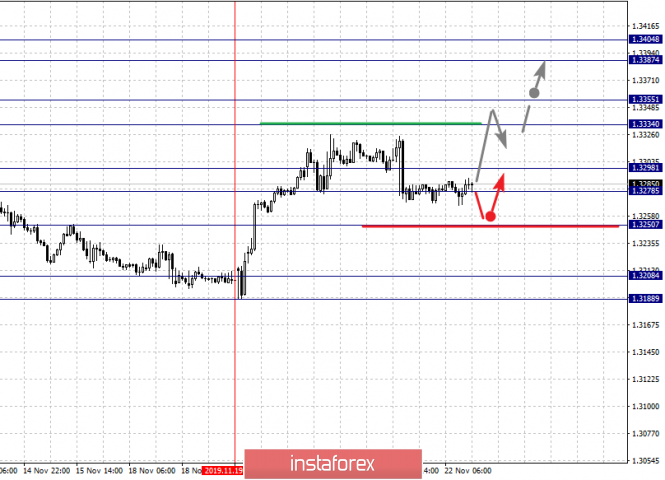

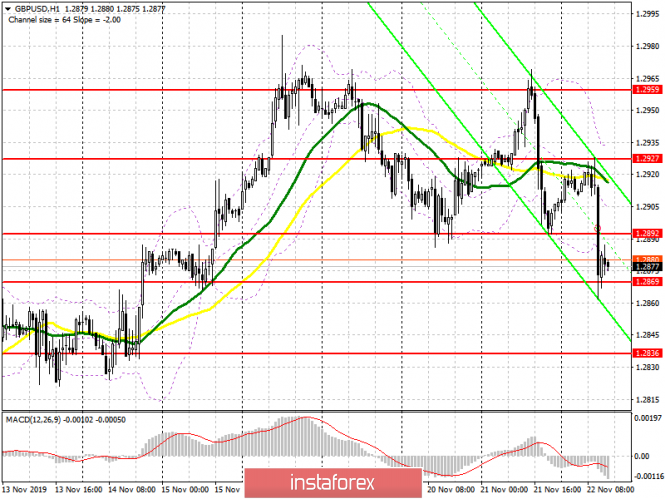

Few weeks ago, Further Bullish advancement was demonstrated towards 1.2650 then 1.3000 after the neckline of the depicted Double-Bottom pattern (1.2400-1.2415) was breached to the upside. Since October 21, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Moreover, an ascending wedge reversal pattern was confirmed on October 22. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was anticipated towards 1.2780 (Key-Level) where bullish recovery was recently demonstrated on two consecutive visits. Since then, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.2980) until now. Technical outlook remains bearish as long as consolidations are maintained below 1.3000 on the H4 chart. Moreover, negative divergence was being demonstrated on the H4 chart. That's why, high probability of bearish rejection existed around the price levels of (1.2980-1.3000). A quick bearish breakout below 1.2875 (short-term uptrend) was needed to enable further bearish decline towards 1.2780 where a better decision can be taken upon recent price action. On the other hand, any bullish pullback towards 1.2915 should be watched for early bearish rejection and another valid SELL entry. The material has been provided by InstaForex Company - www.instaforex.com |

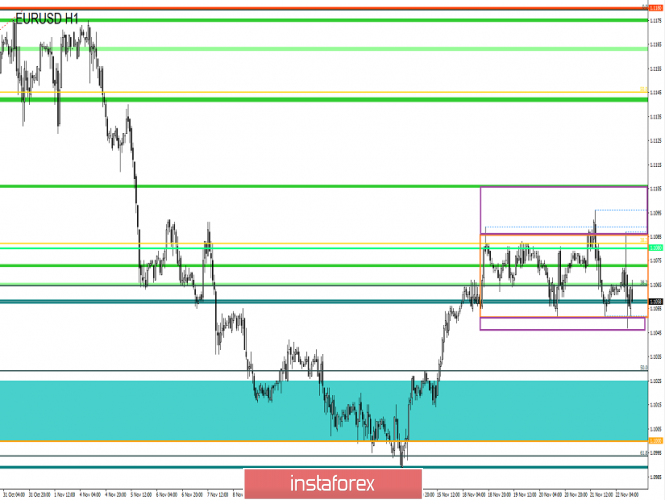

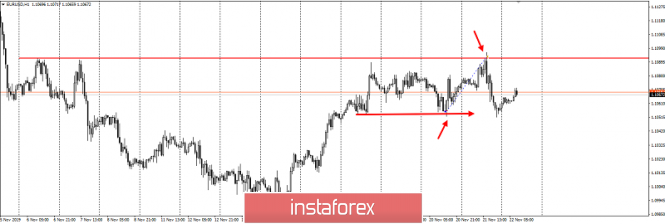

| Trading recommendations for the EUR USD currency pair - prospects for further movement Posted: 22 Nov 2019 06:27 AM PST From technical analysis, we see an extremely tedious and intriguing accumulation along with the range level of 1.1080, which stretches for the fourth day in a row. The breakdown points of the control values of 1.1055/1.1100 have not been recorded, local shooting shadows - that's what we had all the time. In this situation, traders began to arise a variety of theories that explain the essence of what is happening. So, one of the most interesting theories is that the stagnation in the composition of the course 1.1000-1.1080 carries a change in the recovery process, a temporary correction in the composition of the recovery 1.1180-1.1000-1.1080-1.1000-(...). Common sense is here since the move 1.1180-1.1000 could locally overheat short positions, and the fact of convergence with the platform of the second stage produced a flurry of fixation of trading positions. The subsequent upward move and the slowdown within the first stage (1.1080) confirm the fact that the market still has a proper number of sellers, which do not allow to confidently continue the upward move higher than 1.1100. Analyzing the hourly past day, we see the cycle of the course inside the accumulation, where within the coordinate 1.1100, the resistance point was found again, which returned us to the lower frame with the control point 1.1055, and the cycle repeated. As discussed in the previous review, traders are closely watching the coordinates 1.1055 (sell) / 1.1100 (buy) for clear breakdowns, but over the past period, such cases have not yet been recorded. Looking at the trading chart in general terms (daily period), we see a downward trend, in the structure of which there is an oblong correction, which at this time is trying to close, being at 33% recovery. News background of the past day had data on applications for unemployment benefits in the United States, originally predicted a decrease of 4 thousand, but after reviewing the previous data, the actual ones were worse than expected, as a result, we received an increase in applications by 3 thousand. At the same time, the publication of the text of the minutes of the ECB October meeting, which was the last under the leadership of Mario Draghi, can be distinguished from the remarkable events of the past day. And so, in the protocol, there was a discussion concerning the slowdown of rates of inflation and delay of the process of achievement of earlier established target levels on it. Something extraordinary from the ECB report was not noticed, we already heard it all before the protocol. In terms of the information background, there was a kind of refutation of the previously raised noise in the media sources, regarding the fact that the US Senate passed a bill on the protection of democracy in Hong Kong, the trade deal between the two countries could be undermined. Chinese Commerce Ministry spokesman Gao Feng responded to the uproar: "External rumors about the first phase of the deal and trade negotiations, in general, are not accurate. Beijing is ready to cooperate with Washington to eventually conclude an agreement and end the trade war." Today, in terms of the economic calendar, we had data on Europe, where we first published German GDP figures for the third quarter, confirming the level of 0.5%. After that, weak composite PMI data for November (EU) was published, which affected the dynamics of the single currency in terms of depreciation. The most interesting event was the speech of the new ECB head Christine Lagarde, who has remained silent on monetary policy since the day of her election. So, the head of the ECB began her speech with the fact that she urged the EU government to pay attention to the new order of the world economy, to which it is necessary to react. "We are starting to see a global shift mainly due to emerging markets, from external demand to domestic demand, from investment to consumption and from production to services," Lagarde said. Christine Lagarde also noted that monetary policy will continue to support the economy, but that higher government spending, especially on investment, is key. Lagarde continues where her predecessor, Mario Draghi, left off, in his closing speech, he called for financial support for the eurozone. The upcoming trading week in terms of the economic calendar has several statistics for the United States, which will publish the next estimate of GDP. At the same time, the end of the week is expected to be with reduced trading volumes due to the celebration of Thanksgiving in the United States. The most interesting events displayed below: On Tuesday, November 25th USA 15:00 London time - Composite housing price index S&P/CS Composite - 20 seasonally adjusted (y/y), for September: Prev. 2.0% - Forecast 2.1% USA 16:00 London time - New home sales, October: Prev 701K - Forecast 707K On Wednesday, November 26th USA 14:30 London time - Basic orders for durable goods, October: Prev -0.4% - Forecast 0.2% USA 14:30 London time - GDP (preliminary): Prev 1.9% On Thursday, November 27th USA - Thanksgiving On Friday, November 28th USA - Thanksgiving - Early closing at 11:00 EU 11:00 London time - Unemployment rate: Prev 7.5% EU 11:00 London time - Consumer price index (preliminary): Prev 0.7% Further development Analyzing the current trading chart, we see that during the publication of statistical data on the EU and at the time of the speech of the head of the ECB, there was an attempt to break the lower frame in the face of the mark of 1.1055, but once again we had only punctured with shadows, no more. We have a shaky position, where the lower frame has almost fallen and many market participants still hope that the quote will still be able to move forward. In terms of volatility, we cannot say that there are cardinal shifts, but due to the background and long accumulation, price spikes are present, but still within the daily average. Detailing the available time interval minute by minute, we see that the surge in activity occurred in the period 10:30-11:00 hours (time on the trading terminal), which coincides with the economic calendar and Lagarde's speech. In turn, speculators closely monitor the control points, hoping that soon they will enter into trading operations in the flyover phase. It is likely to assume that the existing accumulation is at the limit of its formation and it needs to either break through the boundaries, sending the quote into motion, or expand the existing framework. If we refer to the previously voiced theory, the probability of a breakdown of the lower coordinate 1.1055 is still high. Based on the above information, we derive trading recommendations:

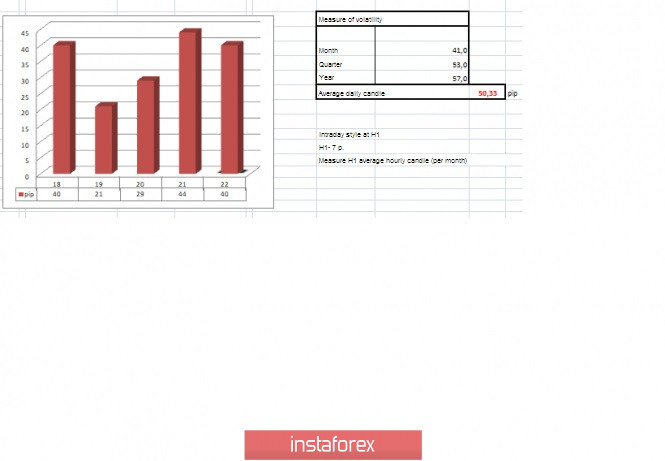

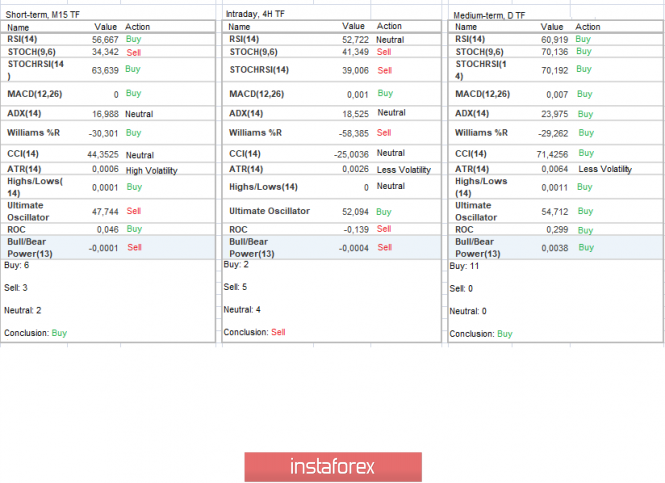

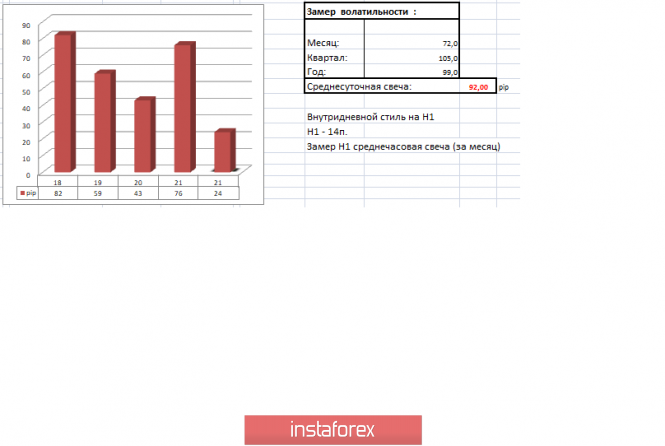

Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators are not in the best shape, as the accumulation of rare confused them. So, the short-term period is not taken into account, as it tries to show allegedly working off from the lower border, wagging within the accumulation. Intraday indicators are trying to start a downward trend. Medium-term indicators have the variable interest of neutral/upward. The volatility for the week / Measurement of volatility: Month; Quarter; Year. Volatility measurement reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year. (November 22 was built taking into account the time of publication of the article) The volatility of the current time is 40 points, which is already very good for this section of time but still below the daily average. If we still see the breakdown of the lower frame, then for the first time in a long period, we will be able to contemplate an indicator above the daily average. Key levels Resistance zones: 1.1080**; 1.1180* ; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

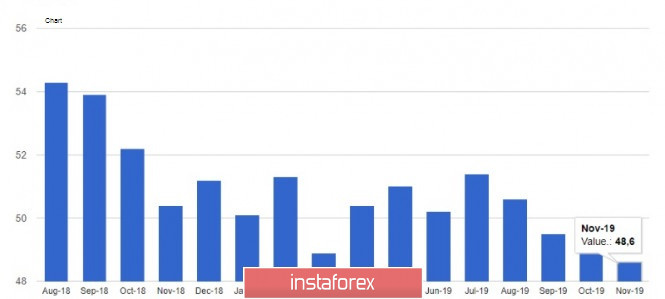

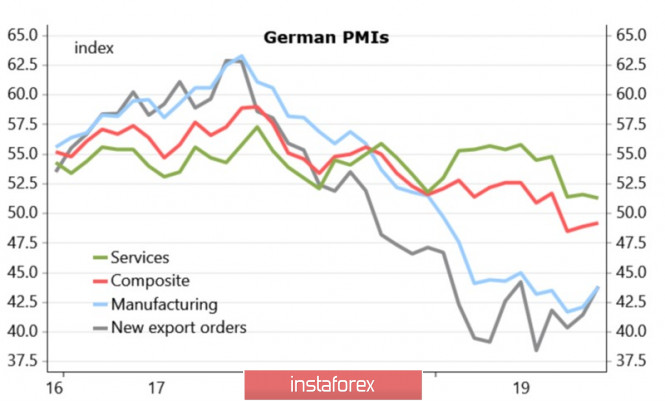

| Posted: 22 Nov 2019 06:27 AM PST Data on eurozone manufacturing activity and services provided only temporary support to risky assets, while all attention remains on the US-China trade relationship. Today, Chinese leader Xi Jinping said that he is ready to work with the United States on a first-phase trade agreement, but this work should be carried out based on mutual respect and equality. Xi also stressed that China did not start this trade war and it is not his responsibility. The Chinese President also noted that China and the United States should strengthen communication on strategic issues and avoid misunderstandings and incorrect conclusions. The preliminary purchasing managers' index (PMI) for the French manufacturing sector in November this year rose to the level of 51.6 points, while it was predicted at the level of 50.9 points. In October, the index was 50.7 points. The preliminary purchasing managers' index (PMI) for France's services sector in November remained unchanged at 52.9 points, with growth forecast to 53.0 points. The data on Germany attracted the most attention. According to the report, business activity in Germany remains weak in November this year. According to IHS Markit, the preliminary composite purchasing managers' index for Germany in November was 49.2 points against 48.9 points in October. Thus, the preliminary purchasing managers' index (PMI) for the German manufacturing sector in November rose to 43.8 points against 42.1 points in October, while it was forecast at 42.8 points. The services sector showed less active growth, but the reduction was avoided. According to the report, the preliminary purchasing managers' index for Germany's services sector in November was 51.3 points against 51.6 points in October, with growth forecast at 52.0 points. In the first half of the day, data on German economic growth in the 3rd quarter of this year were also published, which signaled a slight recovery thanks to the support of consumption. According to the Federal Bureau of Statistics Destatis, in the 3rd quarter of this year, GDP grew by 0.1% compared to the previous quarter and by 0.5% compared to the 3rd quarter of the previous year. Household spending rose by 0.4% from the previous quarter, while government spending increased by 0.8%. The data was better than economists' forecasts. As for activity in the eurozone, the preliminary purchasing managers' index (PMI) for the eurozone manufacturing sector in November rose to the level of 46.6 points, being slightly above the forecast of economists and above the data for October, when the index was 45.9 points. Separately in the directions. The purchasing managers' index (PMI) for the eurozone services sector in November was 51.5 points with a forecast of 52.5 points. But the preliminary purchasing managers' index for the eurozone manufacturing sector in November was at 46.6 points against 45.9 points in October. As for the technical picture of the EURUSD pair, despite all these data, it remained unchanged. All attempts of buyers of risky assets to get beyond the resistance of 1.1090 failed again. The bullish scenario can still be implemented only after the level of 1.1090 is breached. This will continue the upward correction to the highs of 1.1110 and 1.1140. However, we should not exclude the possibility of a downward correction, as the breakthrough of large support of 1.1050, which the bulls managed to hold yesterday, can push the pair even lower and return it to the lows of 1.1020 and 1.0990. GBPUSD The British pound continued to decline after the release of a disappointing report, which indicated a reduction in activity in the private sector in the UK. According to IHS Markit, the index for the services sector fell to a 40-month low of 48.6 points, showing reduction after falling to 50.0 points in October this year. The PMI for the manufacturing sector fell to 48.3 points from 49.6 points in October. The composite index fell to 48.5 points in November. The main pressure was created by the lack of clarity of the situation with Brexit, as well as the general election in the UK, which is scheduled for December 12. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Nov 2019 04:56 AM PST Morgan Stanley expects the continuation of growth in gold prices in 2020. "The complete cessation of trade negotiations between the US and China could lead to a recession in the global economy. In this case, the price of gold will exceed $ 1,500 per 1 ounce, "said representatives of the financial institute. "Even if an interim agreement is concluded, the precious metal will still show greater returns for the current year compared to last year. One of the obstacles to signing an agreement between the two largest economies in the world can be street protests in Hong Kong, which have been going on for quite some time and which have no end in sight." they added. Therefore, traders should prepare for increased volatility next year, as the US presidential election will be another reason to hedge risks, TD Securities strategists warn. "Donald Trump could be the first American leader to be impeached by the House of Representatives during re-election." they said. At the same time, the bank prefers gold and 10-year US Treasury bonds, expecting the Fed to cut interest rates by 50 basis points in 2020, rather than 25 basis points, as the market predicts. "American treasury bonds look like an attractive hedge, including given the prospect of further easing of monetary policy by the Fed. Such a scenario also implies an increase in the cost of the yellow precious metal." TD Securities experts believe. They expect to conclude the first phase of the trade agreement between the United States and China, but a comprehensive deal is expected no earlier than a year. "Unfortunately, 2020 does not promise a respite from turbulence associated with structural uncertainty. Even the easing of tension in the form of a transition from a trade war to a truce only paves the way for a new escalation associated with the next US presidential election. Although in the short term, the upside potential for gold does not look too impressive, the precious metal may rise in price to $ 1,650 an ounce next year." TD Securities said. The material has been provided by InstaForex Company - www.instaforex.com |

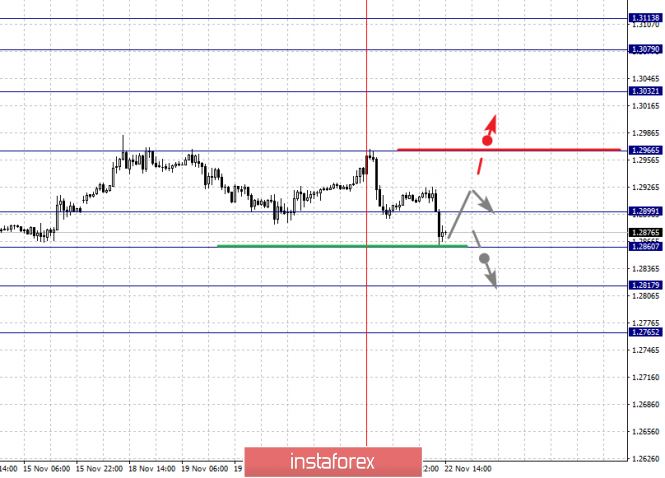

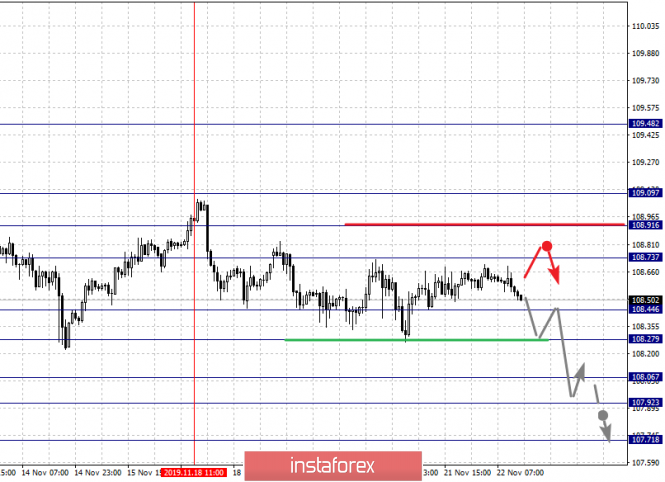

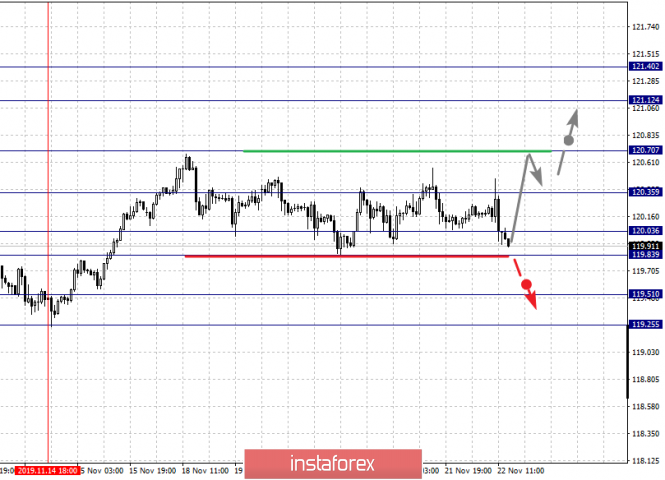

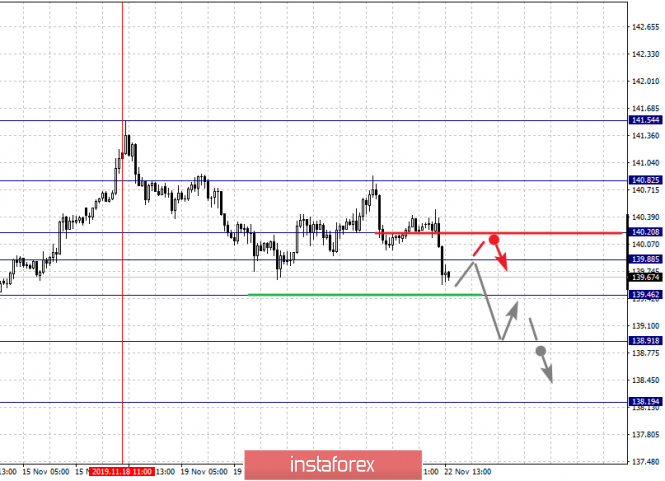

| Fractal analysis of the main currency pairs on November 22 Posted: 22 Nov 2019 04:55 AM PST Forecast for November 22: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1149, 1.1125, 1.1108, 1.1081, 1.1060, 1.1038, 1.1022 and 1.1004. Here, we are following the development of the ascending structure of November 14. Consolidated movement is expected in the range 1.1060 - 1.1081. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1108. Price consolidation is in the range of 1.1108 - 1.1125. For the potential value for the top, we consider the level of 1.1149. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement, we expect in the range of 1.1038 - 1.1022, a breakdown of the last value will lead to an in-depth correction, here the target is 1.1004, this level is a key support for the upward structure, its breakdown will allow us to count on movement to the first potential target - 1.0986. The main trend is the upward structure of November 14. Trading recommendations: Buy: 1.1083 Take profit: 1.1106 Buy: 1.1025 Take profit: 1.1146 Sell: 1.1038 Take profit: 1.1022 Sell: 1.1021 Take profit: 1.1005 For the pound / dollar pair, the key levels on the H1 scale are: 1.3113, 1.3079, 1.3032, 1.2966, 1.2927, 1.2899, 1.2860 and 1.2817. Here, we continue to monitor the development of the upward cycle of November 8. The continuation of the movement to the top is expected after the breakdown of the level of 1.2966. In this case, the target is 1.3032. Price consolidation is near this level. The breakdown of the level of 1.3032 should be accompanied by a pronounced upward movement. Here, the target is 1.3079. For the potential value for the top, we consider the level of 1.3113. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom. Consolidated movement is possibly in the range of 1.2899 - 1.2860. The breakdown of the latter value will have a downward trend. Here, the first goal is 1.2817. The main trend is the upward cycle of November 8, the correction stage Trading recommendations: Buy: 1.2967 Take profit: 1.3030 Buy: 1.3034 Take profit: 1.3079 Sell: 1.2858 Take profit: 1.2818 Sell: 1.2816 Take profit: 1.2770 For the dollar / franc pair, key levels on the H1 scale are: 1.0023, 1.0000, 0.9988, 0.9969, 0.9956, 0.9930, 0.9919, 0.9905 and 0.9898. Here, we are following the development of the ascending structure of November 18. Short-term upward movement is expected in the range 0.9956 - 0.9969. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 0.9988. Short-term upward movement, as well as consolidation is in the range of 0.9988 - 1.0000. For the potential value for the top, we consider the level of 1.0023. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range 0.9930 - 0.9919. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9905. The range 0.9905 - 0.9898 is key support for the top. The main trend is the upward structure of November 18 Trading recommendations: Buy : 0.9956 Take profit: 0.9967 Buy : 0.9970 Take profit: 0.9988 Sell: 0.9930 Take profit: 0.9920 Sell: 0.9895 Take profit: 0.9870 For the dollar / yen pair, the key levels on the scale are : 109.09, 108.91, 108.73, 108.44, 108.27, 108.06, 107.92 and 107.71. Here, we are following the development of the local descending structure of November 18. Short-term downward movement is expected in the range of 108.44 - 108.27. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 108.06. Short-term downward movement, as well as consolidation is in the range of 108.06 - 107.92 . For the potential value for the bottom, we consider the level of 107.71. Upon reaching this value, we expect a rollback to the correction. Short-term upward movement, as well as consolidation, are expected in the range of 108.73 - 108.91. We consider the level of 109.09 to be a potential value for the top. We expect the initial conditions for an ascending cycle to be formed to this level. The main trend: the downward structure of November 7, the local structure of November 18 Trading recommendations: Buy: 108.73 Take profit: 108.90 Buy : 108.94 Take profit: 109.07 Sell: 108.44 Take profit: 108.29 Sell: 108.25 Take profit: 108.06 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3404, 1.3387, 1.3355, 1.3334, 1.3298, 1.3278 and 1.3250. Here, we are following the ascending structure of November 19. Short-term upward movement is expected in the range of 1.3334 - 1.3355. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3387. Price consolidation is in the range of 1.3387 - 1.3404, and from here, we expect a correction. Consolidated movement is possibly in the range of 1.3298 - 1.3278. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3250. This level is a key support for the upward structure. The main trend is the upward structure of November 19, the correction stage. Trading recommendations: Buy: 1.3335 Take profit: 1.3355 Buy : 1.3357 Take profit: 1.3385 Sell: 1.3276 Take profit: 1.3252 Sell: 1.3248 Take profit: 1.3220 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6833, 0.6814, 0.6801, 0.6783, 0.6767, 0.6748, 0.6735 and 0.6717. Here, the price canceled the development of the ascending structure and the subsequent goals we determine from the local initial conditions for the bottom of November 19. The continuation of movement to the bottom is expected after the breakdown of 0.6783. In this case, the target is 0.6767. Price consolidation is near this level. The breakdown of 0.6765 will lead to the development of pronounced movement. Here, the target is 0.6748. Price consolidation is in the range of 0.6748 - 0.6735. We consider the level of 0.6717 to be a potential value for the bottom; upon reaching this value, we expect a correction. Short-term upward movement is expected in the range of 0.6801 - 0.6814. The breakdown of the latter value will lead to the development of an upward structure. In this case, the first target is 0.6833. The main trend is a local descending structure of November 19 Trading recommendations: Buy: 0.6801 Take profit: 0.6812 Buy: 0.6817 Take profit: 0.6833 Sell : 0.6780 Take profit : 0.6768 Sell: 0.6765 Take profit: 0.6750 For the euro / yen pair, the key levels on the H1 scale are: 121.40, 121.12, 120.70, 120.35, 120.03, 119.83, 119.51 and 119.25. Here, we are following the ascending structure of November 14. The continuation of the movement to the top is expected after the breakdown of the level of 120.35. Here, the goal is 120.70. Price consolidation is near this level. The breakdown of the level of 120.70 should be accompanied by a pronounced upward movement. Here, the goal is 121.12. For the potential value for the top, we consider the level of 121.40. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 120.03 - 119.83. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.51. This level is a key support for the upward structure. The main trend is the upward structure of November 14 Trading recommendations: Buy: 120.35 Take profit: 120.68 Buy: 120.72 Take profit: 121.10 Sell: 119.80 Take profit: 119.53 Sell: 119.50 Take profit: 119.26 For the pound / yen pair, the key levels on the H1 scale are : 140.82, 140.20. 139.88, 139.46, 138.91 and 138.19. Here, the price forms the medium-term initial conditions for the downward movement of November 18. The continuation of movement to the bottom is expected after the breakdown of the level of 139.46. In this case, the target is 138.91. Price consolidation is near this level. We consider the level 138.19 to be a potential value for the bottom; upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range 139.88 - 140.20. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 140.82. This level is a key support for the downward structure. Its passage in price will lead to the formation of initial conditions for the upward trend. The main trend is the medium-term downward structure of November 18 Trading recommendations: Buy: 139.88 Take profit: 140.20 Buy: 140.25 Take profit: 140.80 Sell: 139.44 Take profit: 138.95 Sell: 138.86 Take profit: 138.24 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Nov 2019 04:54 AM PST To open long positions on GBP/USD, you need: Weak data on activity in the UK services sector, which continued to decline, led to another fall of the British pound in the area of the support level of 1.2869, which I drew attention to in my morning survey. At the moment, the bulls are holding the pair above 1.2869, but there are no active purchases in this range. Most likely, the focus will be shifted to a similar report on the US composite index. Weak data will lead to the formation of a false breakdown in the area of 1.2869 and the recovery of the pound in the area of resistance of 1.2892, and it is quite possible to return to the area of the maximum of 1.2927, where I recommend taking the profits. In a different scenario, a breakout of 1.2869 will collapse GBP/USD even lower to the support area of 1.2836, from where you can watch long positions immediately rebound. To open short positions on GBP/USD, you need: Sellers coped with the task for the first half of the day and broke through the support of 1.2892, which I paid attention to in the morning forecast. At the moment, the focus is on the level of 1.2869, the breakthrough of which will lead to a larger sell-off of GBP/USD with a test of the lows of 1.2836 and 1.2800, where I recommend taking the profits. In the scenario of the pair growth and upward correction in the second half of the day, you can consider new sales on a false breakdown from the resistance of 1.2892, and open short positions immediately on the rebound is best from the maximum of 1.2927. Indicator signals: Moving Averages Trading is conducted below the 30 and 50 daily averages, which indicates the further formation of a downward correction in the pair. Bollinger Bands In the scenario of the pound growth, the average border of the indicator around 1.2905 will act as a resistance, from which you can see short positions.

Description of indicators

|

| Posted: 22 Nov 2019 04:38 AM PST Good day, dear traders! USDCAD is our hero today. Steve Poloz, the head of the Bank of Canada, spoke last night. The speech was positive, and he assured everyone that Canada was doing well. And the market believed him - the Canadian currency strengthened during this speech, and it happened very quickly, with strong impulses. Not the least role in strengthening the Canadian dollar was played by the growing oil, and it is much more interesting to watch this pair today. At 14:30 (London time), another news will be published, and against this background, you can try to sell USD/CAD with a short goal - to update yesterday's low at 1.3269. Even if the trend continues as an upward one, I think that a breakdown of this mark can be counted on with a high degree of probability. At least for a second. An important detail - this movement can be expected strictly after the news is released at 14.30 (London time). If the news is immediately bullish and there are no bearish impulses, then I do not recommend selling this instrument. If yesterday's fall is fully absorbed, it is a clear sign of further growth towards long-term goals. Therefore, it all depends on the direction of the upcoming news. I wish you success in trading and big profits! The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for EUR/USD on 11/22/19 Posted: 22 Nov 2019 04:27 AM PST News about German industry came out - showing that the decline in production may be coming to an end - and the bottom of the industry slowdown is behind us. However, the euro was negatively affected by the speech of the new head of the ECB Christine Lagarde. The head of the ECB said she aimed at finding policies that would help the economic growth of the eurozone. Investors, in turn, appreciated this as a signal to continue M. Draghi's super-soft policy. As a result, the euro could not show growth to 1.1100 and is slowly falling. EUR / USD: We are ready to buy with a break above 1.1100. We are ready to sell from 1.0985. The material has been provided by InstaForex Company - www.instaforex.com |

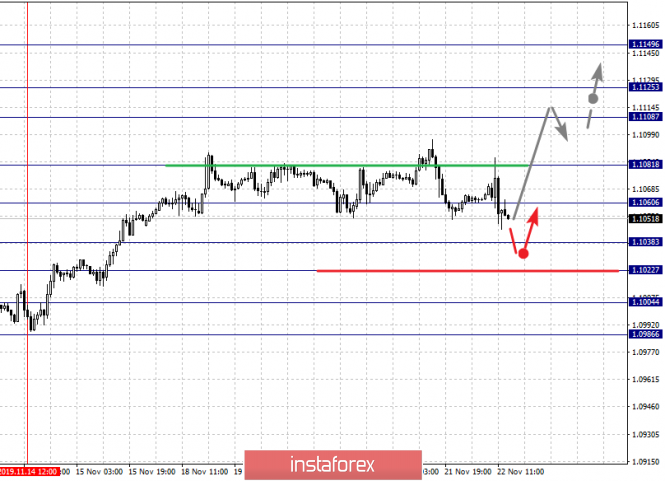

| Posted: 22 Nov 2019 04:27 AM PST To open long positions on EURUSD, you need: Today's data on the growth of manufacturing activity and the services sector of the eurozone countries supported the European currency, however, the bearish activity from the level of 1.1088, to which I drew attention in my morning review, have limited the growth of the EUR/USD and led to the return of the pair to the support area of 1.1056. An important task for buyers of the euro in the second half of the day remains a breakthrough and consolidation above the maximum of 1.1088, which will resume the upward trend and will lead to an update of the levels of 1.1109 and 1.131, where I recommend taking the profits. However, much will depend on what reports on activity in the US will come out. Good indicators will lead to a breakthrough in the support of 1.1056. In this scenario, it is best to consider new long positions after updating the minimum of 1.1028, and I recommend buying the euro immediately on the rebound from the support of 1.0994. To open short positions on EURUSD, you need: Sellers fully coped with the morning task and did not let the pair above the resistance of 1.1088 even on the background of good reports on activity in the manufacturing sector, which is a serious problem for the eurozone economy. In the second half of the day, bears will try to take advantage of the weakness of the euro after the publication of similar data on the US economy, and a breakthrough in support of 1.1056 will lead to a larger sell-off in the area of lows 1.1028 and 1.0994, where I recommend taking the profits. If the demand for the euro returns in the afternoon, it is best to return to short positions only on a false breakdown of the resistance of 1.1088, but you can sell EUR/USD on a rebound from the maximum of 1.1109. Indicator signals: Moving Averages Trading is conducted just below the 30 and 50 moving averages, but we can talk about building a new downward trend only after the breakout of the support of 1.1056. Bollinger Bands Breaking the lower border of the indicator around 1.1056 will lead to a larger sell-off of the euro.

Description of indicators

|

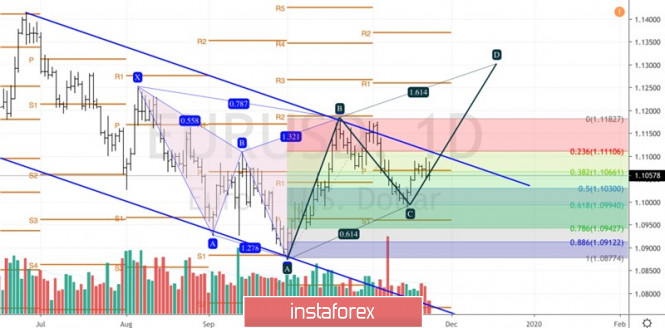

| Posted: 22 Nov 2019 02:53 AM PST The 2019 USD index risks to end in the narrowest trading range since 1976 due to persistent reluctance of EUR/USD to determine the direction of its movement. Throughout the lion's part of the year, the euro does not go beyond $ 1.09-1.14, however, if the short-term prospects of the main currency pair are still covered with fog, then the medium and long-term ones are quite transparent. They will depend on the trade war and the recovery of the global economy. The US dollar, as a rule, strengthens if the dynamics of US GDP looks better than the dynamics of its global counterpart. A typical example is the current year: international trade and global gross domestic product, under the influence of trade wars, have slowed to their lowest levels since the 2009 crisis, while the US economy has just returned to its usual growth rate. To abnormally high (+ 2.9% in 2018), it was dispersed by tax reform, but the positive effect of the fiscal stimulus could not spread infinitely. The divergence factor in economic growth has been won back, and a natural question arises - What's next? The IMF is positive about the future: according to an authoritative organization, global GDP will accelerate in 2020 from 3% to 3.4%. OEDS, on the contrary, predicts the same growth rate of 2.9% in the current and next year. Therefore, the EUR/USD pair will behave depending on which scenario will come true. In the first case, I predict its growth to 1.15-1.16, while in the second, I do not exclude a decline to 1.06-1.07. Now, it's obvious that open economies have become the main victims of the US-China trade war due to supply chain disruptions. First of all, we are talking about Germany, where the share of exports in GDP exceeds 40%. The rebuilding of the German car is a sure sign of the euro strengthening. Due to this, it is not surprising that investors are so closely monitoring leading indicators: business activity and the business climate index from IFO. The indices of purchasing managers in November, in turn, showed mixed dynamics: the manufacturing sector managed to push off the bottom, and the services sector, on the contrary, is disappointing. Is the external contagion beginning to spread to domestic demand? If a trade agreement between Washington and Beijing is signed (and I really want to believe in it), then the chances of accelerating global GDP to 3.4% in 2020 and strengthening EUR /USD to 1.15-1.16 will increase. Moreover, the euro can be supported by the orderly Brexit and the growth of political risks in the USA in connection with the presidential election, which will negatively affect American stock indexes and the inflow of capital to the States. On the other hand, the White House has not yet decided what to do with the tariffs for importing cars from the Old World. Nevertheless, their increase is a clear negative for the single European currency. Technically, the EUR/USD pair froze near significant pivot levels, waiting for clues from Christine Lagarde. If the "bulls" manage to gain a foothold above 1.107, the risks of breaking through the upper boundary of the downward trading channel and performing a target of 161.8% (according to the AB = CD pattern), will increase. Otherwise, the ero is expected moved down to 1.096. Daily chart of EUR/USD |

| Posted: 22 Nov 2019 02:13 AM PST A chess game played on the financial field constantly keeps the EUR / USD pair in good shape. From time to time, victory remains for the dollar, then for the euro. This time, experts declare a possible victory for the "European". A significant day for the European currency will be this Friday, November 22, experts are sure. Today, two important events are expected: a speech by Christine Lagarde, the new chairman of the ECB, and the publication of data on business activity in the eurozone in November. The market froze in tension, especially before the speech of the new head of the ECB. Recall that K. Lagarde, like M. Draghi, is a supporter of fiscal stimulus, considering it a necessary element of maintaining the region's economy. Experts admit that she may agree to strengthen incentive measures. As a result, the situation may develop according to two scenarios, which will have a mutually exclusive effect on the dynamics of the euro. The first involves the hawkish, harsh rhetoric of the ECB. This will allow the EUR / USD pair to rise to the levels of 1,1100-1,1120. Recall that on Thursday, November 21, the European currency paired with the US dollar consolidated near the level of 1.1075. Analysts recorded the strengthening of the "European". The growth driver was the news of a possible compromise during the negotiations between the United States and China. During yesterday's trading, the EUR / USD pair rose to 1.1092, then fell slightly to the level of 1.1086. In the future, the growth of the tandem stopped. In the case of easing monetary policy, the European currency will be overwhelmed by a flurry of volatility, experts are sure. "Pigeon", that is, the soft rhetoric of the regulator is able to lower the EUR / USD pair to 1.1000. The likelihood of such an outcome increases in the case of disappointing statistics on business activity indices. At the same time, experts admit that the optimistic tone of the speech by K. Lagarde will allow the tandem to reach a two-week high and exceed the bar at 1.1100. The optimism regarding the euro is boosted by positive statistics about German GDP growth. This indicator exceeded the expectations of experts and encouraged investors. Experts believe that any changes in the strategy of the ECB management regarding monetary policy may lead to an explosion of volatility in the financial markets, especially in the EUR / USD pair. As already mentioned, softening the rhetoric will lead to the collapse of the euro, and tightening it will strengthen the position of the "European" and the growth of the EUR / USD pair. It will be possible to count on the primacy of the single currency in the EUR / USD pair no earlier than the middle of next year, experts say. This is possible in the case of stabilization of the external background and clear progress in trade negotiations between the USA and China, as well as with a long-term improvement in business activity in Germany and the eurozone. In such a situation, the EUR / USD pair begins to grow, and the European currency receives a powerful boost. Friday morning, November 22, the EUR / USD pair started quite cheerfully. The tandem rose to the level of 1.1073, but could not stay at this altitude for a long time. In anticipation of the speech by K. Lagarde, the EUR / USD pair began to decline, currently plying near the indicators of 1.1054–1.1055. Experts fear that in the wake of this nervousness, the tandem may fall even lower. The current dynamics of the "European" causes conflicting market sentiment. The further movement of the single currency will be determined by the speech of the head of the ECB and statistics on business activity in the eurozone, while experts are counting on a positive scenario. Analysts are also trying to predict the dynamics of the EUR / USD pair for 2020. Many experts rely on the European currency. This does not mean that the dollar will lose its position, but it can significantly weaken. Then the "European" will come on the scene, who has long sought to break out into the lead. Experts believe that in the long term, the euro will be able to implement its plan. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of NZD/USD for November 22, 2019 Posted: 22 Nov 2019 01:58 AM PST Overview: The NZD/USD pair continued moving upwards from the level of 0.6374. Righ ow the price is set at 0.6350. Immediate resistance is seen around 0.6455. A clear break above that area could lead price to the neutral zone in the nearest term. Price will test 0.6455, because in general, we remain bullish today. This week, the market moved from its bottom at 0.6374 and continued to rise towards the top of 0.6423. Today, on the one-hour chart, the current rise will remain within a framework of correction. In consequence, the NZD/USD pair broke resistance, which turned into strong support at the level of 0.6374. The level of 0.6374 is expected to act as the major support today. We expect the NZD/USD pair to continue moving in the bullish trend towards the target levels of 0.6455, 0.6480, 0.6506 and 0.6540. Since there is nothing new in this market, it is not bearish yet. However, if the pair fails to pass through the level of 0.6455 (minor resistance), the market will indicate a bearish opportunity below the strong resistance level of 0.6455 (the level of 0.6455 coincides with tha ratio of 38.2% Fibonacci retracement). If a breakout happens at the support level of 0.6374, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| What is preventing the pound from continuing its rally? Posted: 22 Nov 2019 01:22 AM PST After rising 5.3% last month, which turned out to be the largest since 2009, the GBP/USD pair was stuck in the range 1.2770–1.2970. According to experts, the sluggishness of the pound has a direct reason: the British currency has already shown a stellar rally, rising by more than 8% from the three-year low of September. This means that most short-term traders are still satisfied with profitability. Although Brexit's threat has virtually disappeared without a deal, some analysts remain concerned that the weakening British economy and the prospect of complex trade negotiations between London and Brussels might restrain the strength of the pound. The risks associated with early UK elections next month (especially the prospect of a "suspended" parliament or a coalition led by the Labor Party) are also seen as obstacles to the pound. However, most preliminary polls about who wins the election indicate a stronger pound. This circumstance allows leading banks to issue "bullish" forecasts for the pair GBP/USD. Therefore, Bank of America Merrill Lynch promises a rally of almost 8% in response to the victory of the Conservative Party, which will end the impasse of Brexit. On the other hand, Morgan Stanley does not exclude the rise of GBP/USD to 1.4 in the first quarter of 2020. JP Morgan, in turn, expects to see the pair at 1.33 by the middle of next year, while Goldman Sachs believes that the pound will increase in price to $ 1.35 in a few months. It should be noted that large banks are often mistaken in their forecasts. What is the recommendation of BofA Merrill Lynch at the end of 2017 to buy a pound, which in fact declined by 6% in 2018. However, if we assume that things will go towards an orderly Brexit, and the "bulls" on GBP/USD will be able to hold quotes above 1.2720–1.2760 until the middle of next month, the chances of continuing the rally to 1.35 will increase by leaps and bounds. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBP/USD currency pair - prospects for further movement Posted: 22 Nov 2019 01:10 AM PST From the point of view of technical analysis, we see confirmation of the previously posed theory, which was built on the proposition that a closed oscillation pattern can occur between the mirror level of 1.2885 and the upper boundary of the flat formation of 1.3000, which temporarily narrows the main framework of flat 1, 2770 / 1,3000. The characteristic cyclicality at low amplitude can play into the hands of market participants, subsequently accelerating volatility. What I mean is that now we have a kind of accumulation, that is, an extremely restrained market interest, which on a fine line will distribute buyers and sellers to the market, which as a result, can lead to a surge in activity and is now needed more than ever. Let me remind you that for 20 consecutive trading days we have had a rare occurrence for the GBP/USD pair, expressed in weak volatility, [Dynamics of daily candles from High to Low: 58 -> 65 -> 97 -> 62 -> 75 -> 45 -> 67 -> 58 -> 53 -> 83 -> 53 -> 118 -> 58 -> 40 -> 63 -> 51 -> 81 -> 59 -> 43 -> 76 points] The reason for such an indecisive movement lies in many factors, in particular, in the information background and the emotional mood of market participants. That is, the compression of 1.2885 / 1.3000 is a small part of the flat fluctuation, which has been holding the market from further actions for five weeks already. Analyzing the past hourly hour, we see that almost a solid impulse jumps were recorded in the interval 13:00 - 15:00 UTC+00 [time on the trading terminal] for the first time in a week. In fact, during this period, we saw movement from the upper boundary to the mirror level. Now, here's a few words about the upper boundary. We often put the pointer at the level of 1.3000, but we see the development of the value much earlier - what is the difference? The fact is that the level of 1.3000 is the psychological level in the structure of the current flat, where there are stocks based on fluctuations on October 31 and accumulations on November 18-19. Thus, the convergence of prices with conditional allowances gives a signal to develop the level of 1.3000. As discussed in the previous review, many traders took a waiting position relative to the coordinates of 1.2885 / 1.3000. As we can see from the result, the highlighted values were never broken, thus, no trading operations were performed. Moreover, I do not exclude the possibility that ardent speculators manage to develop within the accumulation [1.2885 / 1.3000], although the risk is great in some cases. Considering the trading chart in general terms [the daily period], we see the same movement within the flat, where the quotation develops within the upper boundaries and its middle. In terms of the main trends, everything is unchanged, the trend is downward. The news background of the past day contained data on applications for unemployment benefits in the United States, where they expected a reduction of 4 thousand, but received an increase of 3 thousand as a result. At the same time, there was no market reaction to statistics due to the same information background. Thus, yesterday, the Laborites in the person of its head Jeremy Corbyin managed to stir up all the media sources with their statements and, most importantly, with the manifesto of their party, where they blamed the entire existing system along the way. What was the main focus? Corbyn emphasized once again that he intends to bring radical changes to the country such as nationalized railways, energy and water companies, as well as royal mail. The total tax revenue of the government will increase by about 10%. This would make it possible to finance higher wages for public sector employees, to promote free tuition at universities, and to transfer to a free care for the elderly and a number of other benefits. He also had a complete list of enemies: billionaires, tax evaders, bad managers. These, he said, are people who cash in on a rigged system. Jerome Corbyn's election campaign is admirable, you just go to his Twitter account, one or another propaganda program is published there almost every hour, as well as accusations against conservatives. From the last tweet: "We can end privatization and save our NHS [National Health Service]. We can defer Brexit and unite our country. We can deal with the climate crisis that threatens us all and we can rewrite the laws of our economy so that the activity is for everyone, not for the elite. The future is ours. #RealChange ", - twitter @jeremycorbyn "It seems that Boris Johnson has stopped the discussion. He doesn't want you to hear the truth: he is bribed by billionaires and is preparing to sell the NHS to Donald Trump, "- twitter @jeremycorbyn In turn, Boris Johnson is trying to keep up with his competitor and plans to introduce a 3% surcharge. In addition to the existing land tax for non-residents who buy British homes. The income received will be utilized on programs to combat homelessness. "The facts show that adding significant volumes of demand to limited housing supply leads non-residents to overstate housing prices. That is why we are introducing a higher rate for non-residents of the United Kingdom, which will help solve this issue," Treasury Secretary Rishi Sunak said in a statement. Today, in terms of the economic calendar, we have a preliminary index of business activity in the services sector from Markit, where the data should be confirmed at the level of 50.0. The upcoming trading week in terms of the economic calendar is highlighted only by US statistics and only at the beginning of the week, since Thursday and Friday are strictly inactive due to Thanksgiving in the United States. At the same time, do not forget about the spontaneous information background, which can bring activity to the market. The most interesting events displayed below ---> Tuesday November 25th USA 14:00 Universal time - Composite housing price index S & P / CS Composite-20 seasonally adjusted (YoY), for September: Prev. 2.0% ---> Forecast 2.1% USA 15:00 Universal time - Sales of new housing, October: Prev. 701K ---> Forecast 707K Wednesday November 26th USA 13:30 Universal time - Basic orders for durable goods, Oct: Prev -0.4% ---> Forecast 0.2% USA 13:30 Universal time - GDP (preliminary): Prev 1.9% Thursday November 27th USA - Thanksgiving Friday November 28th USA - Thanksgiving - Early Closing at 10:00 Further development Analyzing the current trading chart, we see the next local development of the mirror level 1.2885 with a sluggish upward trend. In fact, the development of quotes remains in the same established framework of accumulation where the previously given theory, as described above, is preserved in the market. In terms of volatility, a characteristic weakness persists, but the interest of market participants in the current situation has grown. By detailing the movement per minute, we see a stop within the values of 1.2910 / 1.2925, which is an extremely narrow range and a way out is planned for the near future. In turn, traders are in no hurry to rush to action, the analysis of control coordinates of 1.2885 / 1.3000 is saved in the work. Having a general picture of actions, it is possible to assume that the fluctuation in the accumulation of 1.2885 / 1.3000 focuses on itself increased interest, which as a result, give activity in the market and, as a fact, impulses to breakdown of one or another boundary. If we refer to the general movements and background, then a breakdown of the lower boundary [1.2885] has more probability than a breakdown of the upper boundary. Based on the above information, we derive trading recommendations: - Buy positions are considered in case of breakdown of the psychological level of 1.3000, not a puncture in the shadow of a candle. - Sales positions will resume after a clear fixation of the price lower than 1.2885, not a puncture in the shadow of the candle. Indicator analysis Analyzing a different sector of timeframes (TF), we see that the indicators have a characteristic ambiguity when we look at the indicators of short-term periods and intraday. Meanwhile, medium-term sections retain an upward interest for the reason that we are still hanging near the upper boundary of the flat. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (November 22 was built taking into account the publication time of the article) The current time volatility is 24 points, which is an extremely low indicator for this time section. It is likely to assume that there will still be an acceleration of volatility as soon as the accumulation framework falls. Key levels Resistance Zones: 1.3000; 1.3170 **; 1.3300 **. Support Areas: 1.2885 *; 1.2770 **; 1.2700 *; 1.2620; 1.2580 *; 1.2500 **; 1.2350 **; 1.2205 (+/- 10p.) *; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **. * Periodic level ** Range Level *** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's Diary 22.11: EURUSD Consolidation on the Elections in Britain and the USA Posted: 22 Nov 2019 01:01 AM PST

EURUSD: Consolidation under 1.1080 continues. Meanwhile, a new growth attempt is possible. You can buy a breakthrough of 1.1100 and up. About the elections: One of the important events for the markets, the elections in Britain on December 12 where the campaign is actively ongoing. At the same time, there is a campaign in the United States, although the elections will take place for a year later, in November 2020. Britannia The Brexit question depends, of course, on the outcome of the election. In Britain, there are a lot of people who are unhappy with both Brexit in general and B. Johnson's version. Many would prefer the soft option which is to leave all the issues of trade relations "as before" satisfied with the restrictions on the influx of people from poor countries of Europe. In principle, this is an option of the main opposition party which is the Labor Party. The Labor Party could win, if not for their leader Corbyn. I would say that Corbyn is such a British Zyuganov. To vote for him is harder than to shoot yourself. If there was a strong crisis, then the British could take a chance and choose Corbyn. But now everything is normal in the economy. So, most likely, the conservatives will win and there will be Johnson and his version of Brexit. USA The impeachment procedure is, of course. the main part of the Democrats election campaign. The goal is to drop Trump's support as much as possible. And apparently, this will give a result where Trump's chances are reduced. But, the problem is the same in Britain. To win, Democrats need a candidate who can attract not only the core of the Democrats but also a large mass of moderate, vacillating ones. For the moderate, Elizabeth Warren is too radical. Biden is better but he, like Trump tainted by history with his son and Ukraine. It seems that Michael Bloomberg appeared on the horizon, this is a strong candidate, in my opinion, but will the party accept him as his candidate? I doubt. So, while Trump is more likely to look for a second term, which is not at all very good given the sharp movements of Trump, a trade war with China and an attempt at duties against Europe; rapid exit from Syria with the rejection of the support of the Kurdish allies. Trump's cards can be mixed up by the new Big Crisis if it starts before the election. But so far there are no clear signs of a crisis. We'll see. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis recommendations for EUR/USD and GBP/USD on November 22 Posted: 22 Nov 2019 12:57 AM PST Economic calendar (Universal time) After the speech of the President of the ECB, we are waiting for the continuation of reports on the economy of the European Union and the UK, led by data on business activity in the manufacturing sector and the services sector (UK, 9:30). Moreover, further statistics from the United States are expected, but there are no important indicators there. EUR / USD The week passed in the zone of attraction of the upper boundary of the daily cloud between the resistance of 1.1082-84 (daily Kijun + weekly Fibo Kijun) and support of 1.1040-30 (daily Tenkan + weekly Tenkan). The prospects for leaving the zone of this consolidation were announced earlier and have not changed. On Monday, there may be a change in the location of some levels, so the situation can be re-evaluated. At the moment, players on the downside are fighting for an advantage in the lower halves. A retest of key levels 1.1066-69 is performed (central pivot level + weekly long-term trend). The formation of the rebound as well as the continuation of decline will open the way to the support of the classic pivot levels within the day 1.1042 - 1.1024 - 1.0997. In this case, the passage of the zone 1.1040-30 (levels of high halves) and consolidation in the bearish zone relative to the daily cloud will be of primary importance for players to fall. Meanwhile, consolidation above 1.1066-69 will preserve the uncertainty and influence of the attraction of the upper boundary of the daily cloud (1.1065). GBP / USD This week, the pound did not manage to decide on its preferences. The influence of strong levels, in the attraction zone of which it spent the whole week, did not allow either side to prove itself. Thus, I think that a clarification of the situation can be expected next week. So far, the boundary of the most significant supports remains in the region of 1.2882 (daily cross + monthly Fibo Kijun), and the role of the main resistance is played by 1.2959 - 1.3012 (weekly cloud + maximum extreme). The players on the downside cannot leave the attraction of key low-level halves 1.2923-25 (central pivot level + weekly long-term trend), which weakens their positions. At the same time, consolidating above will give an advantage to the opponent. Therefore, the struggle for priority and excellence continues. Today, support for the classic pivot levels are located at 1.2876 - 1.2846 - 1.2799 while resistances are at 1.2953 - 1.3000 - 1.3030. Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis of GBP/USD and USD/JPY on November 22 Posted: 22 Nov 2019 12:39 AM PST GBP/USD Analysis: For the intraday trader, the greatest interest in the pound market is the last downward wave from October 17. The correction wave is formed in the lateral plane. From November 18, the final section is formed. Forecast: Today, the general flat mood of the pair's movement is expected, mainly with a downward vector. In the first half of the day, a "sideways" is likely. The increase in volatility can be expected by the end of the day. The option of extending down to the next support remains relevant. Potential reversal zones Resistance: - 1.2950/1.2980 Support: - 1.2890/1.2300 Recommendations: Sales of the pound today are possible only within the intra-session. At the end of the current price decline, it is recommended to monitor the reversal signals to find entry points into long positions.

USD/JPY Analysis: Since August, the price has formed a bullish trend in the yen market. The price has reached the lower limit of the potential reversal zone, from which a correction is formed in the last month. The wave is nearing completion. Forecast: Today, the flat mood of the movement is expected to continue. In the first half, a downward course is likely. The completion of the entire decline and the change of the intraday trend is possible today. Potential reversal zones Resistance: - 108.90/109.20 Support: - 108.30/108.00 Recommendations: Sales of the pair are possible today, but it is worth considering the probability of sharp pullbacks. It is recommended to monitor the reversal signals and look for the best points to buy the pair.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted - the expected movement. Attention: The wave algorithm does not take into account the length of time the tool moves! The material has been provided by InstaForex Company - www.instaforex.com |

| The Disappointment of the Pound: Victory was near Posted: 22 Nov 2019 12:24 AM PST The currency of Great Britain once again appeared on the price "swing". Having risen a little, the pound fell again in the middle of the week but found the strength in itself to turn the tide and move up. Analysts recorded the correctional movement of sterling with a bias in the increase, but not yet overcome the attraction of the bottom. This week, the pound was in a fever, and only at the auction on Thursday, November 21, this turbulence declined. Yesterday, the GBP / USD pair began its recovery after the fall, which occurred after the television debate between the leaders of the largest parties in the UK - Prime Minister Boris Johnson and the head of the opposition Conservative Party, Jeremy Corbin. According to polls conducted after the debate, the Conservative Party could receive strong support in the upcoming elections. The positive attitude of the conservatives and the high likelihood of a second referendum provided significant support to the British currency. According to experts, this stopped the pound from further sales. In the course of yesterday's correction, recorded after a two-day recession, the "Briton" confidently went up. GBP / USD rose to the level of 1.2961. The market did not ignore the upward trend of sterling. According to the observations of some experts, yesterday on the daily chart of the GBP / USD pair a rare reversal pattern formed - a potential "triple top". Its implementation would be possible only after the breakdown of the level of 1.2760, but this did not happen. The victorious aspirations of the British currency were interrupted. The tandem went down again, plying near the indicators 1.2948–1.2949. Experts have repeatedly paid attention to the psychologically important level of 1.3000 for the pound. Sterling was one step away from victory, overcoming the attraction of the bottom and actively rushing to this peak. However, the flight of the "Briton" was interrupted, although analysts are sure that yesterday's positive recharge will help him rise. In the event of a rise to 1.3000, the British currency will exceed a six-month high, and then the victory will become a reality. The pound completes the current week on a minor note. His fuse was almost exhausted, and the bearish mood took over. On Friday morning, November 22, the GBP / USD pair was trading at 1.2927 and then began to move down. Currently, the tandem runs in the low range of 1.2913–1.2914, again passing through the price "swing". The dynamics of the pound is full of contradictions: ups are replaced by falls, and negative follows the positive, and vice versa. This confuses the market and requires close attention when working with a pair of GBP / USD. Nevertheless, analysts expect a successful outcome in relation to the pound, which may arise in the near future. The British currency, which at first lost the battle, is able to recover and conquer the next peaks. Experts believe that the further vector of its dynamics will be directed upwards, although they do not exclude slight drops along this path. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD - working out the first goal Posted: 22 Nov 2019 12:20 AM PST Good day, dear traders! Trading recommendation from 11/20/2019 worked on the first goal! Let me remind you that I recommended buying a pair from a false breakdown of the levels presented below: Pay attention to the perfect working out of the entry point! This is due to the use of a certain type of analysis, it is for this tool. I remind you that today at 09:30 London time, Christine Lagarde's important speech as ECB president will take place. We expect increased volatility on EURUSD and working off the following targets. Be careful when trading at this time and observe money management! Good luck with trading and see you at the evening trading idea! The material has been provided by InstaForex Company - www.instaforex.com |

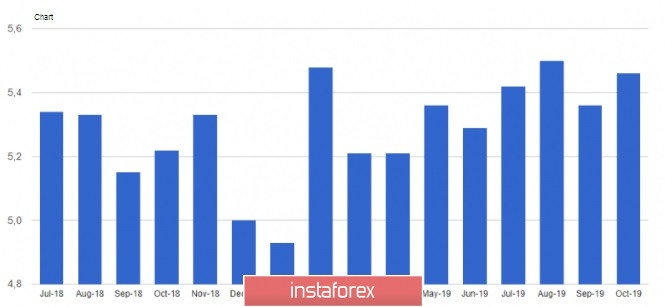

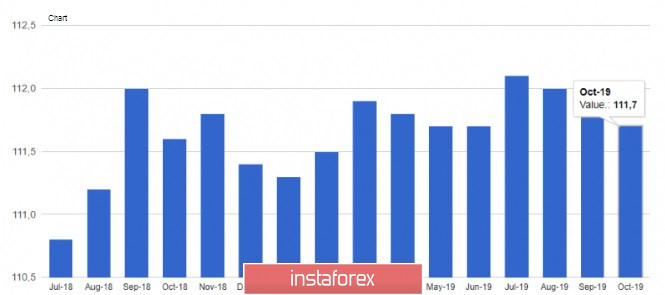

| Posted: 22 Nov 2019 12:17 AM PST Yesterday's minutes of the European Central Bank from its meeting, which took place in October this year, did not shed light on the further policy of the bank, which did not allow risky assets to strengthen their positions against the US dollar. The Central Bank's leadership expressed concern about the slow growth of eurozone GDP, saying that the acceleration of inflation in the eurozone may not happen, given the deteriorating prospects for the economy. In this regard, the leaders urged to wait some time to assess the prospects of the economy and the effects of monetary stimulus. Let me remind you that the asset repurchase program was launched again in November this year. The ECB also said that it is necessary to assess the potential negative effects of monetary stimulus and negative interest rates. The data that came out on the American economy in the second half of the day was versatile, so it is impossible to say unequivocally that it was the reports that returned the demand for the dollar. Most likely, the aggravation of trade relations between the US and China constrains the demand for risky assets. According to the US Department of Labor, the number of initial applications for unemployment benefits for the week of November 10-16 remained unchanged at 227,000. Economists had forecast the number to be 217,000. It should be noted that over the past few weeks, the number of applications shows an increase, but a number of economists attribute this to seasonal volatility associated with the celebration of Veterans Day and Thanksgiving. The moving average of applications for four weeks rose by 3,500 and reached 221,000. The number of secondary applications for unemployment benefits for the week from November 3 to 9 amounted to 1.695 million. Good indicators of industrial activity in the area of responsibility of the Federal Reserve Bank of Philadelphia pleased traders. According to the report, the Fed-Philadelphia PMI for November 2019 rose to 10.4 points from 5.6 points in October, while economists had expected a decline to 5.0 points. The index of new orders in November fell to 8.4 points, and the index of deliveries fell to 9.8 points. Today, data on activity in the services sector and manufacturing activity of the United States are expected, which can provide significant support to the dollar, provided that the data will come out better than economists' forecasts. The manufacturing PMI is forecast at 51.5 points and the services PMI at 51.2 points. Home sales in the US secondary housing market rose in October. This happened after the decline in September this year. According to the National Association of Realtors, sales in the secondary housing market in October 2019 increased by 1.9% and amounted to 5.46 million homes per year. Economists had expected sales growth of 1.5%. Compared to the same period the previous year, sales increased by 4.6%. Data for September were revised downward, to 5.36 million homes a year. The data on the indicator of economic trends in the United States, which declined in October this year, did not allow the US dollar to break below the level of 1.1055 in pair with the euro. According to the report, the Conference Board index of leading indicators in October this year fell by 0.1% to 111.7 points, after falling by 0.2% in September and August. Economists had expected the index to rise by 0.2%. It is not surprising that the most negative contribution was made by orders in the manufacturing sector. As for the technical picture of the EURUSD pair, it remained unchanged. All attempts of buyers of risky assets to get beyond the resistance of 1.1090 failed again. The bullish scenario can still be implemented only after the level of 1.1090 is breached. This will continue the upward correction to the highs of 1.1110 and 1.1140. However, we should not exclude the possibility of a downward correction, as the breakthrough of large support of 1.1050, which the bulls managed to hold yesterday, can push the pair even lower and return it to the lows of 1.1020 and 1.0990. The material has been provided by InstaForex Company - www.instaforex.com |

| Indicator Analysis: Daily review on November 22, 2019, on the GBP / USD Currency Pair Posted: 22 Nov 2019 12:09 AM PST Trend analysis (Fig. 1). Continued upward movement is expected, to the level of 1.2956 - resistance line (yellow thin line). In case of breaking through - movement up to 1.3013 - the upper fractal (blue dashed line). From this level, it is possible to move down to target 1.2956 - the support line (yellow thin line).

Fig. 1 (daily chart). Comprehensive analysis: - Indicator analysis - up; - Fibonacci levels - up; - Volumes - down; - Candlestick analysis - up; - Trend analysis - down; - Bollinger Lines - up; - Weekly schedule - up. General conclusion: On Friday, the price may continue to move up. The first upper target 1.2956 is the resistance line (yellow thin line). In case of breaking through - movement up to 1.3013 - the upper fractal (blue dashed line). An unlikely scenario is a downward movement with the target at 1.2859 - a retracement level of 14.6% (blue dashed line). The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment