Forex analysis review |

- GBP/USD right below resistance, huge downside potential!

- USD/CAD Further drop expected!

- USD/CHF approaching support, potential bounce!

- Fractal analysis of the main currency pairs for December 12

- EUR/USD. US inflation unfairly ignored: market is busy with other problems

- GPB/USD. Pound dilemma: will Britain be able to implement Brexit in the near future, or will it remain hostage to the "suspended

- EURUSD: US interest rates are unlikely to change. Focus is on the Fed statement and quarterly forecasts

- Euro - a box with a surprise?

- Gold holds a punch

- EUR/USD: Fed could do the dollar a disservice, and the ECB - to support the euro

- X hour for the pound: volatility intensifies

- December 11, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- December 11, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Bearish pattern in the Dollar index

- Short-term technical analysis on Gold

- BTC 12.11.2019 - Watch for potential drop on the BTC

- EUR/USD for December 11,2019 - EUR is holding upside, potential for larger upward movement

- Gold 12.11.2019 - Gold is aproaching our first upward target at $1.472, potential for larger upside move

- Evening review for EURUSD for 12/11/2019. We are waiting for the Fed's decision

- Why does oil not want to grow?

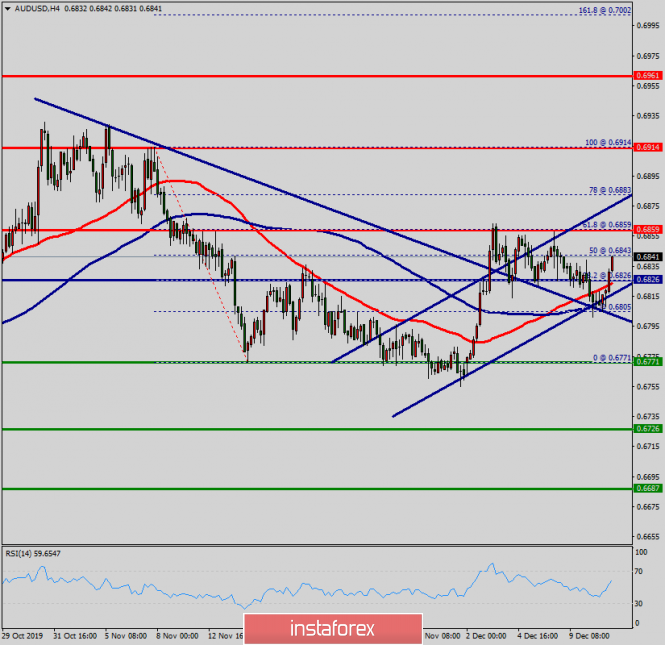

- Technical analysis of AUD/USD for December 11, 2019

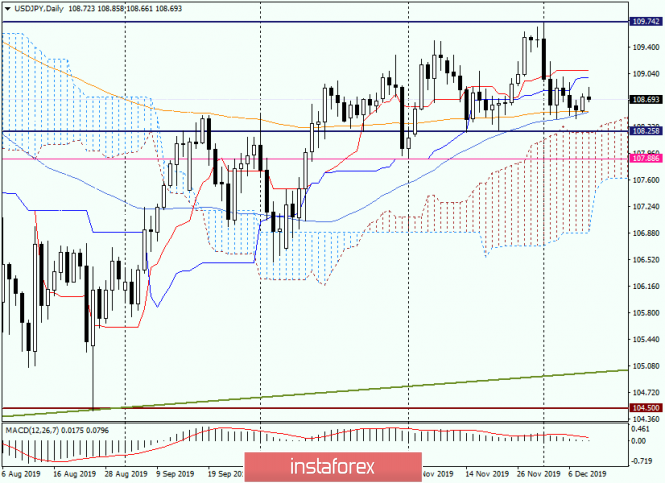

- Analysis and trading ideas for USD/JPY for December 11, 2019

- Trading idea for USDCAD pair

- Overview for EUR/USD for December 11, 2019

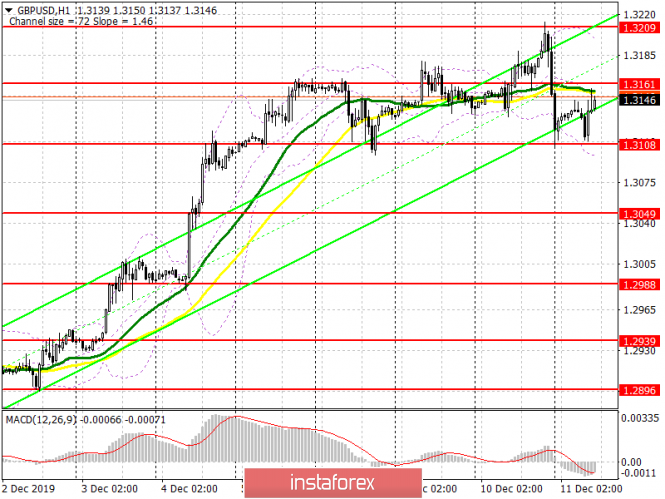

- GBP/USD: plan for the US session on December 11. The pound is trying to regain some positions and the level of 1.3161

| GBP/USD right below resistance, huge downside potential! Posted: 11 Dec 2019 07:01 PM PST

Trading Recommendation Entry: 1.321 Reason for Entry: Graphical swing high Take Profit : 1.3064 Reason for Take Profit: 38.2% Fibonacci retracement Stop Loss: 1.33340 Reason for Stop loss: horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD Further drop expected! Posted: 11 Dec 2019 06:58 PM PST

Trading Recommendation Entry: 1.3180 Reason for Entry: 23.6% Fibonacci retracement Take Profit : 1.31 Reason for Take Profit: 78.6% Fibonacci retracement, 100% Fibonacci extension Stop Loss: 1.327 Reason for Stop loss: Graphical Swing high The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CHF approaching support, potential bounce! Posted: 11 Dec 2019 06:57 PM PST

Trading Recommendation Entry: 0.9815 Reason for Entry: 61.8% Fibonacci extension Take Profit : 0.9918 Reason for Take Profit: horizontal pullback resistance 38.2% Fibonacci retracement Stop Loss: 0.9733 Reason for Stop loss: horizontal swing low support 78.6% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

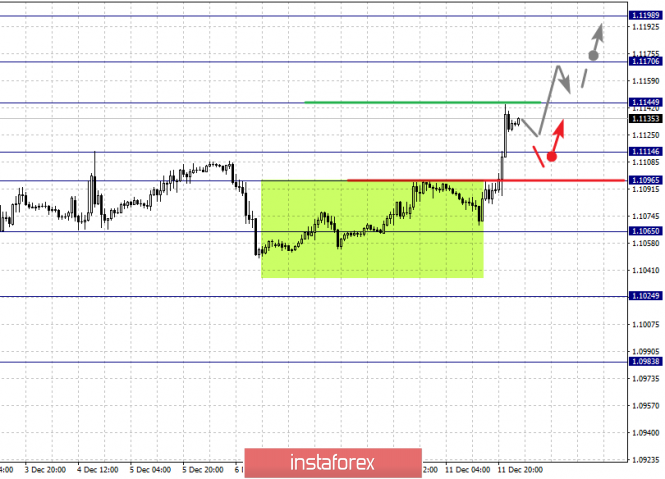

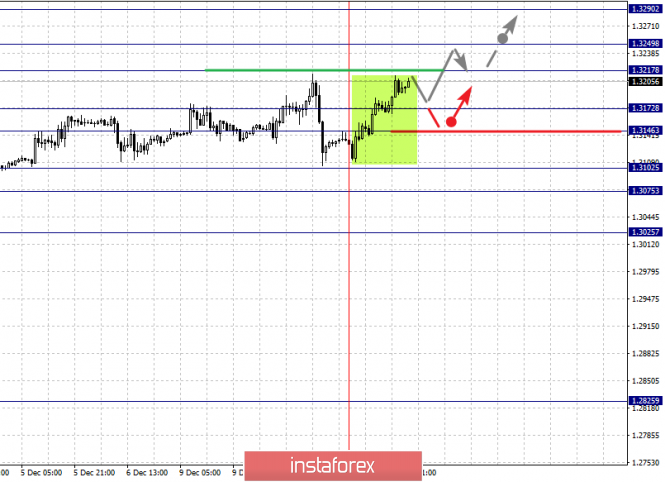

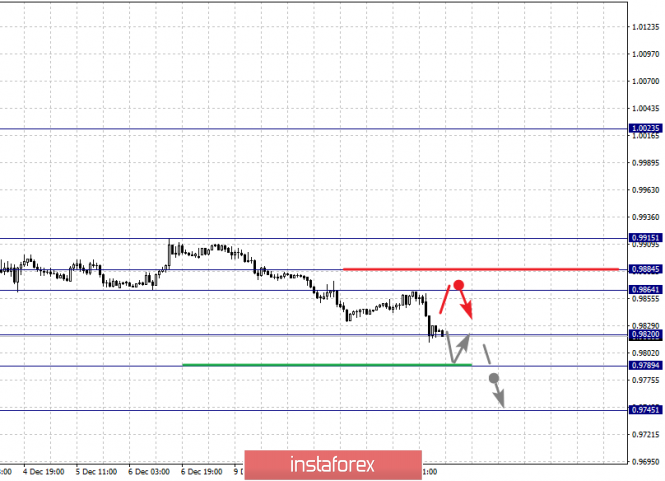

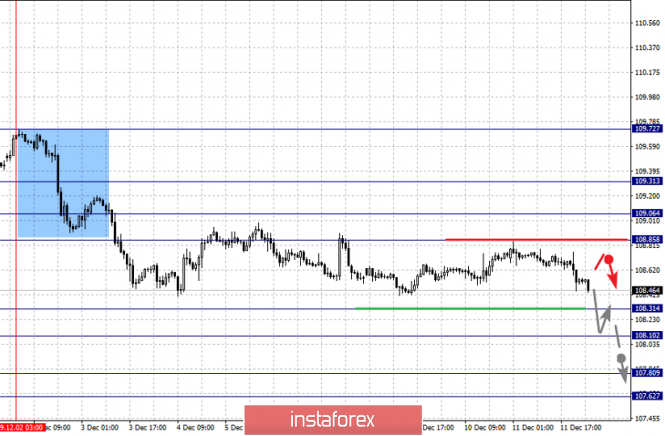

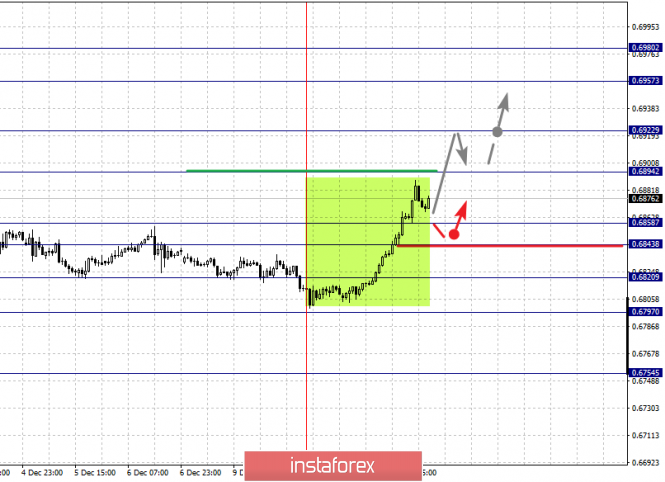

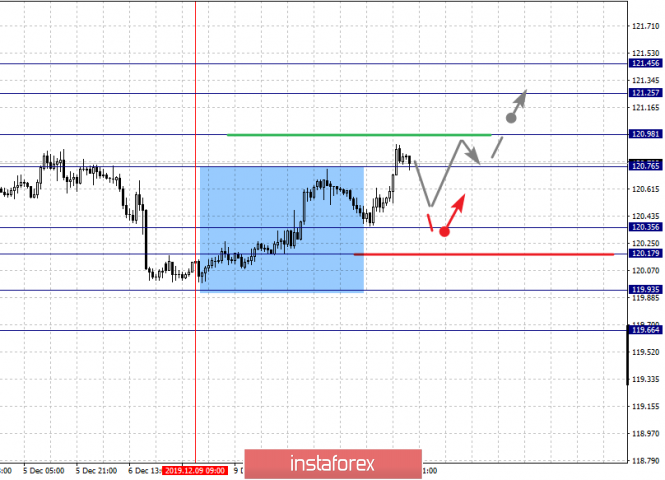

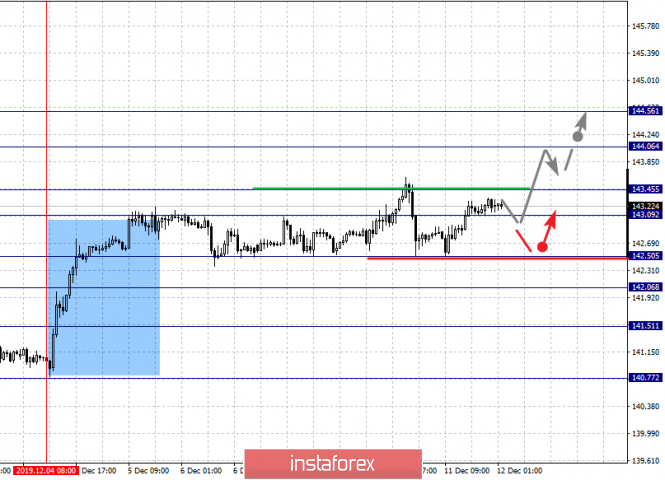

| Fractal analysis of the main currency pairs for December 12 Posted: 11 Dec 2019 05:16 PM PST Forecast for December 12 : Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1198, 1.1170, 1.1144, 1.1114, 1.1096, 1.1065 and 1.1024. Here, we are following the development of the upward cycle of November 29. The continuation of the movement to the top is expected after the breakdown of the level of 1.1144. In this case, the target is 1.1170. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.1198. Upon reaching this value, we expect a rollback to the correction. Short-term downward movement is expected in the range 1.1114 - 1.1096. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1065. This level is a key support for the upward structure. The main trend is the upward structure of November 29 Trading recommendations: Buy: 1.1145 Take profit: 1.1170 Buy: 1.1172 Take profit: 1.1196 Sell: 1.1114 Take profit: 1.1097 Sell: 1.1094 Take profit: 1.1066 For the pound / dollar pair, the key levels on the H1 scale are: 1.3290, 1.3249, 1.3217, 1.3172, 1.3146, 1.3102, 1.3075 and 1.3025. Here, the price forms a local potential for the top of December 11. Short-term upward movement is expected in the range of 1.3217 - 1.3249. The breakdown of the last value will lead to a movement to a potential value - 1.3290. Price consolidation is near this level. A short-term downward movement is possibly in the range of 1.3172 - 1.3146. The breakdown of the last value will lead to a long correction. Here, the target is 1.3102. The range 1.3102 - 1.3075 is a key support for the upward trend and its passage in price will lead to the development of a downward structure. In this case, the first potential target is 1.3025. The main trend is the upward cycle of November 27, the local structure of December 11 Trading recommendations: Buy: 1.3217 Take profit: 1.3247 Buy: 1.3250 Take profit: 1.3290 Sell: 1.3172 Take profit: 1.3147 Sell: 1.3144 Take profit: 1.3104 For the dollar / franc pair, the key levels on the H1 scale are: 0.9915, 0.9884, 0.9864, 0.9820, 0.9789 and 0.9745. Here, we are following the development of the downward structure of November 29. The continuation of movement to the bottom is expected after the breakdown of the level of 0.9820. In this case, the target is 0.9789. Price consolidation is near this level. The breakdown of the level of 0.9789 should be accompanied by a pronounced downward movement. In this case, the potential target is 0.9745. We expect a rollback to correction from this level. Short-term upward movement is possibly in the range of 0.9864 - 0.9884. The breakdown of the latter value will lead to in-depth movement. Here, the target is 0.9915. This level is a key support for the downward structure of November 29. The main trend is the downward structure of November 29 Trading recommendations: Buy : 0.9864 Take profit: 0.9883 Buy : 0.9885 Take profit: 0.9913 Sell: 0.9820 Take profit: 0.9791 Sell: 0.9787 Take profit: 0.9745 For the dollar / yen pair, the key levels on the scale are : 109.31, 109.06, 108.85, 108.58, 108.31, 108.10, 107.80 and 107.62. Here, we are following the descending structure of December 2. Short-term movement to the bottom is possibly in the range 108.31 - 108.10. The breakdown of the last value will lead to a pronounced movement. Here, the goal is 107.80. For the potential value for the bottom, we consider the level of 107.62. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is expected in the range 108.85 - 109.06. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 109.31. This level is a key support for the downward structure. Main trend: descending structure of December 2 Trading recommendations: Buy: 108.85 Take profit: 109.04 Buy : 109.08 Take profit: 109.30 Sell: 108.30 Take profit: 108.12 Sell: 108.08 Take profit: 107.80 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3256, 1.3217, 1.3196, 1.3146, 1.3118 and 1.3094. Here, the price has canceled the formation of the upward potential and at the moment, we are setting targets for the downward trend from the long-term structure on December 3. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3146. Here, the target is 1.3118. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.3094. Upon reaching which, we expect a consolidated movement. Short-term upward movement is possibly in the range of 1.3196 - 1.3217. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3256. We expect the expressed initial conditions to formulate for the upward cycle up to this level. The main trend is the long-term descending structure of December 3 Trading recommendations: Buy: 1.3196 Take profit: 1.3215 Buy : 1.3218 Take profit: 1.3252 Sell: 1.3145 Take profit: 1.3119 Sell: 1.3116 Take profit: 1.3095 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6980, 0.6957, 0.6922, 0.6894, 0.6858, 0.6843, 0.6820 and 0.6797. Here, the subsequent goals for the top we determine from the local structure on December 10. The continuation of the movement to the top is expected after the breakdown of the level of 0.6894. In this case, the target is 0.6922. Price consolidation is near this level. The breakdown of the level of 0.6922 should be accompanied by a pronounced upward movement. Here, the target is 0.6957. We consider the level of 0.6980 to be a potential value for the upward trend, and upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 0.6858 - 0.6843. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6820. This level is a key support for the upward structure. Its breakdown will allow you to count on movement to the first potential target - 0.6797. The main trend is the local structure for the top of December 10 Trading recommendations: Buy: 0.6895 Take profit: 0.6920 Buy: 0.6924 Take profit: 0.6955 Sell : 0.6858 Take profit : 0.6844 Sell: 0.6841 Take profit: 0.6822 For the euro / yen pair, the key levels on the H1 scale are: 121.45, 121.25, 120.98, 120.76, 120.35, 120.17, 119.93 and 119.66. Here, we are following the development of the ascendant structure of December 9. Short-term upward movement is expected after the breakdown of the level of 120.76. In this case, the target is 120.98. Price consolidation is near this level. The breakdown of the level of 121.00 should be accompanied by a pronounced upward movement. Here, the goal is 121.25. For the potential value for the top, we consider the level of 121.45. Upon reaching which, we expect a rollback to the correction. Corrective movement is possibly in the range of 120.35 - 120.17. The breakdown of the last value will have the downward development of December 5, and in this case, the first goal is 119.93. For the potential value for the bottom, we consider the level of 119.66. The main trend is the upward structure of December 9 Trading recommendations: Buy: 120.76 Take profit: 120.96 Buy: 121.00 Take profit: 121.25 Sell: 120.35 Take profit: 120.20 Sell: 120.15 Take profit: 119.95 For the pound / yen pair, the key levels on the H1 scale are : 144.56, 144.06, 143.45, 143.09, 142.50, 142.06 and 141.51. Here, we are following the ascending structure of December 4. Short-term movement to the top is expected in the range of 143.09 - 143.45. The breakdown of the last value will lead to a pronounced movement. Here, the goal is 144.06. For the potential value for the top, we consider the level of 144.56. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 142.50 - 142.06. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 141.51. This level is a key support for the top. The main trend is the local ascending structure of December 4 Trading recommendations: Buy: 143.10 Take profit: 143.44 Buy: 143.50 Take profit: 144.06 Sell: 142.50 Take profit: 142.10 Sell: 142.04 Take profit: 141.54 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. US inflation unfairly ignored: market is busy with other problems Posted: 11 Dec 2019 02:55 PM PST Dollar bulls ignored the release of data on rising US inflation today. The euro-dollar pair is waiting for meetings of the Federal Reserve and the European Central Bank, while the pound-dollar pair awaits early parliamentary elections. The remaining pairs in which the US dollar is a part of are closely watching the prospects of the US-Chinese negotiations in the light of the approaching December 15 - that is, the day when the White House could introduce additional duties on Chinese imports. In other words, the main currency pairs were distracted by other fundamental factors, so one of the key macroeconomic releases was left unattended by traders. Nevertheless, this publication should not be ignored - sooner or later the market will return to these figures, especially if Washington and Beijing come to a certain compromise (according to rumors, Trump is ready to postpone the introduction of new duties in January or February). It's worth noting that the numbers published today came out in the green zone, showing impressive growth. In particular, the overall consumer price index reached 2.1% in annual terms - this is the best result since last November. On a monthly basis, instead of a projected decline to 0.2%, the index rose to 0.4%. The core index also pleased investors: the indicator met expectations at around 0.2% in monthly terms. The indicator came out in the green zone on an annualized basis, exceeding the forecast values (2.3% YOY). This dynamics is primarily due to the increase in energy tariffs (as in the previous period). In addition, medical services, food and transportation costs have risen in price. But all these numbers were left out of the attention of EUR/USD traders (however, like the rest of the dollar pairs). Traders are clearly nervous on the eve of the December meeting of the Fed, the results of which will put dots on the i in many matters. First, the general tone of the accompanying statement is of interest. The dollar's position largely depends on how regulator members place emphasis in their communique. The Fed definitely has reasons for optimism - many macroeconomic reports over the past month have been either better than forecasts, or have been revised upwards. For example, the growth rate of the US economy in the third quarter should have slowed down to 1.8% (with growth up to 3.1% in the first quarter and up to 2% in the second). In reality, the volume of GDP increased by 2.1%, and the component of personal consumption showed the highest growth from the second quarter of the year before last. The price index of GDP remained at the initial level of 1.7% (against the two percent forecast), while this indicator grew by 2.4% in the second quarter. Base RFE also accelerated - to 2.1% after more modest growth in the previous period. The indicator of orders for durable goods also pleased. Here you can recall Nonfarm: the number of people employed in the non-agricultural sector increased to 266 thousand, although, according to data from the ADP agency, this indicator should have fallen below the 100 thousandth mark. Employment in the manufacturing sector also increased (an increase of 54 thousand), after a decrease in the previous month. The unemployment rate has completely decreased to a half-century low - up to 3.5%. It is likely that members of the US regulator in their accompanying statement will reflect the above trends in the economy. However, there is a flip side to the coin - this is the uncertainty about the prospects for trade relations between China and the United States, as well as a slowdown in the manufacturing and export sectors. The ISM index in the service sector, as well as the production ISM, turned out to be much worse than forecasts, reflecting the ongoing decline in activity, in particular, in the manufacturing industry. In addition, the most important inflation indicator for the Fed (base PCE) showed a negative trend, falling to 1.6% in annual terms. Thus, it moved away from the two percent target level. All this suggests that the December meeting of the Fed can bring surprises. According to the forecasts of most experts, the Fed will maintain the status quo, and secondly, it will not hint at a possible interest rate cut in the first half of next year. According to this scenario, a point forecast will signal that the regulator does not intend to mitigate monetary policy in 2020. This is a basic scenario, which is already largely taken into account in prices. In case of deviation from it, the dollar will fall into a storm of price turbulence. The greenback will become significantly cheaper if the Fed allows lower rates next year and, accordingly, more expensive if regulators favor a tightening of monetary policy within the next year. It is also worth considering that today the regulator will publish updated forecasts for the economy, employment and inflation. If they differ significantly from October estimates, then the reaction of traders will also not take long. Against the backdrop of such prospects, today's data on the growth of US inflation remained in the shadow. The movement vector of the EUR/USD pair is completely dependent on the results of the December meetings of the Fed and the ECB. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Dec 2019 02:55 PM PST According to some experts, the pound's rally on the expectations of the Conservative Party victory in the upcoming parliamentary elections in the UK makes it vulnerable to a fall in the actual voting results. Undecided voters will not need much effort to turn the strong majority of Conservatives into a weak one, they said. The pound has risen by about 6% over the past two months, as investors see the Tory's potential victory only as a positive. "We believe that the markets are far ahead of the events, laying down the quotes for Conservatives to receive a significant majority in the House of Commons," said Mark Dowding of BlueBay Asset Management. "These elections remain quite unpredictable. Although the confident victory of the Tories seems the most likely result, we do not think that surprises can be ruled out, "he added. The pound has been acting as a market barometer of political risk since the Brexit 2016 referendum. Having reached an almost three-year low in early September, the GPB/USD pair recovered on the expectation that British Prime Minister Boris Johnson's tactics for holding early elections could be justified if he manages to push through a "divorce" agreement with the EU through the national Parliament. According to the latest YouGov poll, Conservatives can count on 42.6% of the vote and Labor on 33.8%. Toronto-Dominion Bank estimates the probability of a major victory for the Conservative Party at 55%, but believes that this scenario has already been put in quotes. "Confirmation of the confident majority of Tories can lead to a sharp upward movement in the pound, however, it is vulnerable to sell by fact against the background of profit taking and crowding out obsolete positions after the election results are known," said bank expert Ned Rumpeltin. For strategists who bet on a Conservative victory, now it all depends on how many seats the latter can get: the more solid the majority of Tories are, the less likely it is that the Parliament will again be at an impasse and will not be able to approve the Brexit deal promoted by Johnson. His predecessor, Theresa May, did not have a majority in Parliament and was forced to resign because her version of the Brexit deal was repeatedly rejected by lawmakers. "A small Conservative majority is likely to ratify the divorce agreement, but Johnson may not have enough political freedom to extend the transition. In this case, the prospect of the absence of a trade deal at the end of 2020 will lead to a drop in the pound," said Andrew Wishart, a specialist in Capital Economics. It is also likely that Conservatives will not get a majority in Parliament at all, which will open the door for Labour to form a coalition with small British parties. Some market participants believe the Labour-led coalition is ultimately good for the British currency, since Labour leader Jeremy Corbyn has promised to keep the UK in EU Customs Union and put forward a new Brexit deal for a second referendum, but his leftist views imply that the pound may come under pressure in the short term. According to Kenneth Brooks, a strategist at Societe Generale, if this scenario is realized, a decrease in the rate of the British currency to $1.28 may follow. Polling stations in the UK will open on Thursday, December 12, at 07:00 GMT and close at 22:00. The vote count will go on all night, and by Friday morning it will become clear whether the UK will have a chance in the near future to solve the Brexit dilemma and take a step forward, or whether the country will remain hostage to the "suspended Parliament". The material has been provided by InstaForex Company - www.instaforex.com |

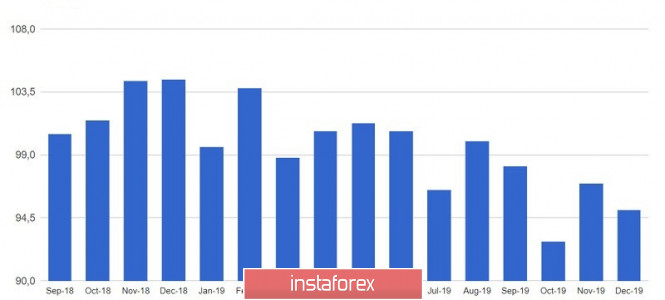

| Posted: 11 Dec 2019 02:55 PM PST The decision of the US Federal Reserve is likely to lead only to a slight strengthening of the US dollar against a number of world currencies, however, provided that the committee leaves interest rates unchanged within the current range of 1.5% -1.75%. More attention will be focused on the Fed statement, from which we can draw conclusions about the future prospects of the economy and interest rates. It is also expected that quarterly long-term forecasts will be given at the meeting. Much will depend on how inflation shows itself today. If the report is better than economists' forecasts, it is likely that the Fed will take a break in the cycle of lowering interest rates. If prices remain at the same levels or even worse, they fall below economists' forecasts, then the central bank will continue to lower rates in the coming months. An additional bonus is November data on US employment, which could make some Fed leaders skeptical about rates change their minds. Let me remind you that just recently, during his speech, Fed Chairman Jerome Powell announced a series of interest rate cuts this year as a mid-cycle correction. This suggests that after the stabilization of the situation, the Fed could begin to raise rates to the target value, or higher. A number of negative forecasts given by global economic agencies in the event that the United States and China fail to come to an agreement negatively affect risky assets. Even if trade conflicts are resolved, in 2020 US GDP growth will still slow to 2.1% from the projected 2.4% this year. However, global economic growth may accelerate to 3.4% in 2020, from 3.0% in 2019. Considering that no important fundamental data were released today in the morning, nothing has technically changed in the EURUSD pair. The bulls did not even try to break above the resistance of 1.1100, which was quite expected before the Fed's decision on interest rates. The whole calculation will be on inflation in the US and on the Fed's decision on interest rates. The return of the trading instrument to support 1.1075 may increase the pressure on the pair, which will lead to its decline in the area of lows 1.1050 and 1.1030. The latest report on consumer sentiment in Australia showed a deterioration in December this year. The consumer sentiment index fell to 95.1 points in December from 97.0 points in November, which casts doubt on the effect of lowering interest rates. The RBA said that the index is consistent with data indicating weak consumer demand. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Dec 2019 02:55 PM PST The euro does not cease to amaze the market. The single currency remained on the sidelines more recently, trying to keep up with the dollar, and now claims to be the first in the EUR/USD pair. Analysts are considering an option in which the dynamics of the euro, which was previously declining, will increase. Experts from a number of major banks positively assess the prospects of the euro in the coming year. Morgan Stanley forecasts that the euro will rise by almost 5% to $1.1600, while experts at ABN Amro Bank NV and Commerzbank AG expect growth to $1.1400 by the end of March 2020. However, such a rise in the Euro currency is possible only with stabilization of the eurozone economy and clarification of the situation with Brexit, analysts emphasize. Potential changes in the ECB policy can also make adjustments to the dynamics of the euro. The new head of the regulator, Christine Lagarde, is convinced of the need to strengthen budgetary incentives to maintain economic growth and inflation in the region. Analysts do not exclude that in the medium term the ECB will have to adjust its inflation target to 2%. This will entail a number of large-scale changes, and the market will have to lay in the price the rejection of negative interest rates that apply in the eurozone. If this scenario is realized, the euro will lose its attractiveness as a funding currency, experts said. This will negatively affect the mood of investors, and they will have to consider other options for using the single currency. Many market participants believe that the euro's use as a funding currency for carry-trade transactions has come to an end. We note that this year the single currency was actively used as part of this strategy and made a profit when investing in 20 of 23 currencies of developing countries, note in the Bloomberg agency. The euro was also supported by a positive report on the eurozone business sentiment index, published on Tuesday, December 10. It turned out to be much higher than the forecasts of economists, as well as data on the index of economic expectations in Germany. According to a document presented by the ZEW Science Center, the index of economic expectations soared to 10.7 points in December from the -2.1 points recorded in November 2019. According to ZEW experts, the large-scale growth of the index is due to the high probability of an increase in exports and an increase in personal consumption in Germany. Positive dynamics was demonstrated by the index of current economic conditions and the mood index in the business environment of the eurozone. The ZEW report said that the mood in the business environment of the region climbed to 11.2 points compared to -1.0 points recorded in November 2019. According to analysts, the dynamics of the European currency may be affected by any signals from the leadership of the US Federal Reserve or the European Central Bank. This impact will be negative if regulators' plans for monetary policy change dramatically. Such changes can provoke an explosive increase in the volatility of the dollar and the euro and trigger another rally of the EUR/USD pair. Currently, the EUR/USD pair is in a global downward trend, which will continue next year, experts said. The classic pair was not very active on Tuesday, December 10, cruising near the levels of 1.1078–1.1079. The EUR/USD pair started at 1.1081 this morning, showing a slight upward trend. The pair traded near the levels of 1.1084–1.1085, not showing much activity. Experts believe that this lull is deceptive. The euro, paired with a greenback, is like a predator hiding in ambush and waiting in the wings. According to analysts, the euro has not yet revealed all its trump cards. The European currency is able to show rapid growth and catch up in the short and medium term. Specialists are confident in the enormous potential of the single currency, which can be fully revealed in the coming year. The material has been provided by InstaForex Company - www.instaforex.com |

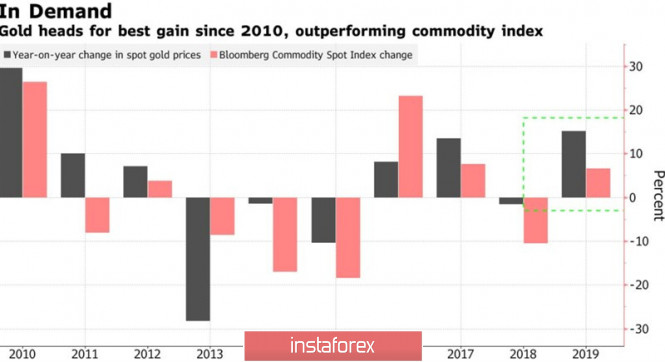

| Posted: 11 Dec 2019 02:55 PM PST The publication of the US labor market report for November was a real disaster for gold. An increase in employment by 266 thousand, a fall in unemployment to 3.5%, the lowest mark for half a century, and an acceleration of average wages to 3.1% YOY led to an increase in the S&P 500 of more than 1%, to a strengthening of the US dollar and an increase in profitability treasury bonds. This created an extremely unfavorable environment for the precious metal, which could not gain a foothold within the previous consolidation range of $1475-1515 per ounce. The value of gold increased by 12% in 2019. This is the best result since 2010. The precious metal is ahead of the Bloomberg commodity market index and is poised to end in the positive for the third year out of the last four. The reasons should be sought in the uncertainty associated with the trade war and Brexit, as well as in the three acts of monetary expansion of the Fed. However, the picture could seriously change in 2020. Washington and Beijing are close to a deal, and Britain is about to leave the EU. The recovery of the economies of China, the eurozone and Great Britain improves the prospects for equity markets, real estate and industrial metals. However, not everyone thinks so. Dynamics of gold and commodity index Goldman Sachs and UBS forecast a gold rally to the level of $1,600 per ounce, which was last seen in 2013. BlackRock calls the precious metal the best option for hedging the risks associated with the correction in the stock markets. Bulls on XAU/USD expect that the period of low inflation, which falls short of the targets, will continue for a very long time, and under such conditions, central banks will remain prone to ultra-soft monetary policy. An increase in geopolitical and political risks, including those associated with the US presidential election, will lead to pullbacks in the S&P 500, which is usually perceived by investors as a deterioration in global risk appetite and is fraught with increased demand for safe haven assets. No wonder ETF fans are in no hurry to get rid of their products, even in the face of falling XAU/USD quotes. Gold ETF Stock Dynamics Investment demand for gold is quite large. Along with interest in specialized exchange-traded funds, central banks show increased activity, which, according to Goldman Sachs, bought up about 20% of the global precious metals supply in the de-dollarization process. Assets like US Treasury bonds are not well suited to implement the idea of reducing dependence on the protectionist states of the United States. Gold is another matter. There is no clarity on the outcome of the trade war. Both sides claim that they are moving towards an agreement, but the White House has repeatedly surprised investors with unexpected escalations in the conflict with China. Who can guarantee that the same will not happen in mid-December? Technically, the bulls for gold leave no hope to return quotes within the previous consolidation range of $1475-1515 per ounce. It will turn out - it will be possible to count on the activation of the Expanding Wedge pattern and on implementing the target by 161.8% according to the Crab pattern. No - risks of the precious metal falling to $1435-1440 will increase. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Fed could do the dollar a disservice, and the ECB - to support the euro Posted: 11 Dec 2019 02:55 PM PST This year has raised a lot of questions, namely: whether the trade war ends in the United States and China; will the United Kingdom succeed in secession from the European Union; whether the eurozone economy will recover; whether the US central bank will return the interest rate to where it started to reduce it for preventive purposes, etc. Thus, 2019 can be safely called the "year of doubt". Is it any wonder then that the EUR/USD pair is trading in the narrowest range in the euro's history, and the volatility of the single European currency has fallen to a record low? As soon as investors begin to win back any idea, the emergence of new information forces them to curtail their positions. Another example of this was the reaction of EUR/USD to the latest statistical data from the EU. A weak release on industrial production in Germany contributed to the reduction of quotes for support at 1.1050. However, the subsequent rise in the European Sentix investor sentiment index above zero for the first time since May and the growth of the ZEW German economic sentiment index to a maximum value in almost two years brought euro buyers back into the game. Progress in trade relations between Washington and Beijing, an increase in the likelihood of a "soft" Brexit, positive from German foreign trade, and the fact that Germany managed to avoid a recession increase the chances of economic recovery in the eurozone, which is a necessary condition for strengthening the single European currency in the next year. Regarding short-term prospects, the upcoming meeting of the ECB Governing Council may provide support to the bulls on EUR/USD, where Christine Lagarde is expected to talk about the side effects of the negative rates policy, as well as the parliamentary elections in the UK, in which the Conservatives will likely take victory. However, rumors are circulating at Forex that if the new head of the European Central Bank refuses to support the position of its predecessor, Mario Draghi, this could undermine confidence in the ECB. Despite the titanic efforts of the ex-president of the ECB, inflation expectations in the eurozone continue to decline, and Lagarde's allusions to the rejection of negative rates will mean that the policy pursued by the regulator has stalled. Meanwhile, the Federal Reserve will have to try very hard to give investors a surprise. Prior to the December FOMC meeting, its representatives claimed that monetary policy was in the right place. The derivatives market believes that until November 2020 monetary expansion from the Fed should not be expected, while the chances of restriction are completely low. Experts expect conservative forecasts on the interest rate from the Fed, as well as statements that it is at a neutral level, which does not slow down or stimulate the US economy. In this regard, the ECB meeting, including the first press conference of Lagarde, the upcoming elections to the British Parliament and the upcoming increase in trade tariffs on Chinese imports by the US authorities seem to be much more significant events. However, as it often happens, a phrase can cause serious changes in quotes. Fed Chairman Jerome Powell has sad experience with such speeches. Any signals on his part about the need to further stimulate the economy, as well as hints of additional injections of money into the system, can trigger a weakening of the greenback and an increase in EUR/USD. If the bulls on EUR/USD manage to storm the resistance at 1.1110-1.1115, then the upward path will be open to them. The material has been provided by InstaForex Company - www.instaforex.com |

| X hour for the pound: volatility intensifies Posted: 11 Dec 2019 02:55 PM PST The British currency is at the forefront of controversy. On the one hand, it is trying to hold on to its positions, and on the other, it is experiencing tremendous tension in connection with the upcoming elections. The market is on the same wavelength with the pound, paused in anticipation of changes in the political arena of Great Britain. The epicenter of events at the moment are the elections that will be held in the country on December 12. On Tuesday, December 10, reports were published showing the state of the UK economy. Experts recorded the absence of any significant changes, including economic growth. According to analysts, this indicates problems associated with Brexit. At the same time, the pound completely ignored these data, focusing on the upcoming results of opinion polls and the expectation of elections. It is expected that a new government will be formed during the elections. Experts believe that Prime Minister Boris Johnson will remain in his post and head the government of Conservatives. At the same time, analysts recall that the Conservative Party will require a majority in Parliament to resolve the situation with the Brexit. In the event of the implementation of such a scenario, Johnson will be able to agree on a deal with the EU in a short time and withdraw Great Britain from the European Union by January 31, 2020. According to experts, such a development of events for Great Britain will be a long-awaited way out of the political impasse in which the country has been for more than two years. Current turmoil and pre-election tension do not reflect well on the dynamics of the pound. Sterling keeps the bar set, fueled by the results of public opinion, confident in the majority vote of the ruling Conservative Party of Great Britain. On Tuesday, the pound tried to maintain its position, but on Wednesday, December 11, it became clear that this attempt failed. Experts expect a downward correction of the GBP/USD pair, which can be stopped by a large support level of 1.3090. The British currency confidently conquered peak after peak on Tuesday, December 10. The GBP/USD pair ran in the range of 1.3172-1.3173, with attempts to move higher. At some point, the pair managed to reach 1.3180, but this turned out to be the highest level. Subsequently, the pound began a downward movement, and the GBP/USD pair lost its advantages. The GBP/USD pair began on a minor note this morning, showing a significant decrease to levels of 1.3122-1.3123. The pair's further trend was downward. The pair went to the levels of 1.3115-1.3116 in an effort to find the bottom. Now the pair runs in this range, trying to get out of tight boundaries. Many experts believe that after the election the situation will not be in favor of the pound. Sterling can significantly subside, and it will take a long time to restore it. However, a number of analysts refrain from negative forecasts, preferring to trust the British currency, which has repeatedly demonstrated stability. The material has been provided by InstaForex Company - www.instaforex.com |

| December 11, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 11 Dec 2019 09:09 AM PST

Since October 2, the EURUSD pair has been trending-up until October 21 when the pair hit the price level of 1.1175. The price zone of (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 offering valid bearish positions few weeks ago. Shortly After, two consecutive bearish movements were executed towards 1.1000-1.0995 where another two episodes of bullish rejection were demonstrated. That's why, the price zone of 1.1065-1.1085 where a cluster of supply levels were located (61.8% Fibo - 50% Fibo levels) prevented further bullish advancement. Thus, the EUR/USD Pair has been trapped between the price levels of 1.1000 and 1.1085 (where a cluster of supply levels is located) until Wednesday when a bullish spike was demonstrated above 1.1085 (towards 1.1110). Initial bearish rejection was anticipated around 1.1110 to bring bearish decline towards 1.1065. Earlier this week, recent signs of bullish recovery were manifested around 1.1040 allowing the current bullish pullback to occur towards 1.1085 while demonstrating bearish divergence as depicted on the H4 chart. Moreover, atypical Head & Shoulders reversal pattern is being demonstrated with neckline located around 1.1065. That's why, bearish persistence below 1.1065 is needed to validate this reversal pattern. Bearish projection target to be located around 1.1010. Trade recommendations : The current bullish pullback towards the price zone around (1.1085) should be considered for a valid SELL entry. Initial T/P levels to be projected towards 1.1045 and 1.1000, while S/L should be placed above 1.1115. Any bullish breakout above 1.1110 invalidates this bearish scenario allowing further bullish advancement to occur towards 1.1140 and 1.1175. The material has been provided by InstaForex Company - www.instaforex.com |

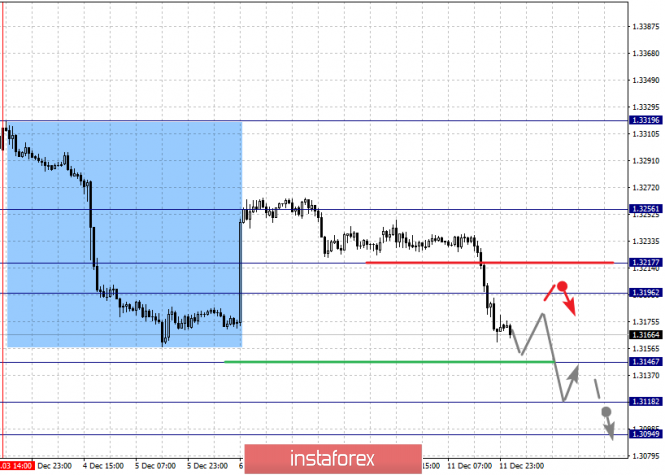

| December 11, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 11 Dec 2019 09:09 AM PST

On October 21, the GBP/USD pair was demonstrating an ascending wedge reversal pattern while approaching the depicted SUPPLY-zone (1.2980-1.3000). Since Then, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was initiated towards 1.2780 (Key-Level) where bullish recovery was demonstrated on two consecutive visits. That's why, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.3000) until Wednesday when bullish breakout above 1.3000 was achieved. Short-term technical outlook remains bullish as long as consolidations are maintained above 1.3000 on the H4 chart. On the other hand, the pair was recently testing the upper limit of the newly-established depicted short-term bullish channel around 1.3165. Moreover, a triple-top pattern is being established around the same price level with neckline located around 1.3100. That's why, high probability of bearish reversal exists around the current price levels. Bearish closure below 1.3100 (neckline) is needed to enhance further bearish decline towards 1.2980 where bullish recovery may be anticipated. Trade Recommendations: Risky traders can have a valid SELL entry upon bearish closure below 1.3100. T/P level to be located around 1.2980. On the other hand, conservative traders should wait for a bearish pullback towards 1.2980-1.3000 for a valid BUY signal with bullish target around 1.3120 and 1.3150. The material has been provided by InstaForex Company - www.instaforex.com |

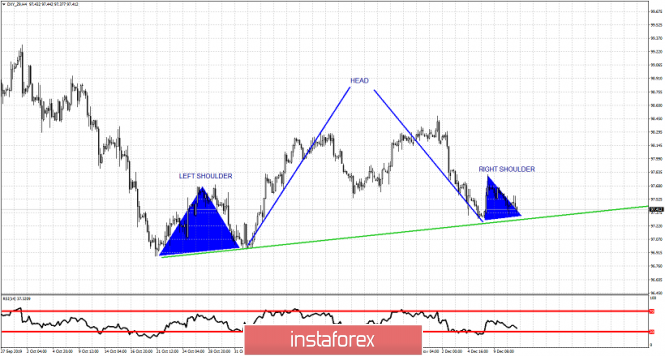

| Bearish pattern in the Dollar index Posted: 11 Dec 2019 07:49 AM PST The Dollar index might be forming a bearish Head and Shoulders pattern. Current price position should be on the right shoulder. The important support neckline is at 97.30 while important resistance is found at 97.80.

Green line - neckline support Blue triangles - shoulders Blue lines - Head The Dollar index has short-term resistance at 97.80 and next at 98.45. Support is at 97.30 while now it is trading at 97.42. If support fails to hold we should expect the Dollar index to move lower towards 96.30 or even lower. Bulls need to be careful if support fails to hold. This pattern is invalidated if we break above 97.80 area. The material has been provided by InstaForex Company - www.instaforex.com |

| Short-term technical analysis on Gold Posted: 11 Dec 2019 07:45 AM PST Gold price is bouncing back above $1,470 after testing the $1,460-50 support zone. Gold price continues to move mostly sideways within the trading range of $1,500-$1,450. This sideways consolidation is expected to end soon.

Green lines - trading range Gold price has support at $1,460-50. The recent pull back respected this support and price is now bouncing again towards the recent highs. If Gold price manages to break and hold above $1,500, then we should expect more upside towards $1,550-$1,600. If price gets rejected once again at $1,490-$1,500 we should expect price to move back towards $1,460-50 with increased chances of breaking below this level. A break down would open the way for a move towards $1,410. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 12.11.2019 - Watch for potential drop on the BTC Posted: 11 Dec 2019 07:33 AM PST Bitcoin has been trading in consolidation mode at the price of $7.166. There is chance for the downside movement. Watch for selling opportunities on the rallies with the first target at $6.570.

Slow line on the MACD oscillator turned into bear mode, which is indication for potential downside movement in the next period. Additionally, there is the breakout of the upward Pitchfork channel in the background, which is another indication that sellers are in control. Support levels are found at the price of $6.569 and $5.910. Resistance levels are found at the price of $7.611 and $7.800. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for December 11,2019 - EUR is holding upside, potential for larger upward movement Posted: 11 Dec 2019 07:27 AM PST EUR/USD has been trading upwards as I expected. EUR is working towards our upward targets at 1.1115 and 1.1172. I still expect further upside movement. Watch for buying opportunities. Most of the markets are waiting for the FOMC statement for potential larger volatility.

Stochastic oscillator is near the overbought zone but it is trying for another bull cross, which may confirm further upward continuation. Most recently, I found rejection of the upward trend line at 1.1075, which adds more potential strength on the EUR Support levels are seen at the price of 1.1075 and 1.1041. Resistance levels are set at 1.1115 and 1.1172. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Dec 2019 07:18 AM PST Today is FOMC day and don't forget to adjust your risk properly. Gold has been trading upwards at the price of $1.467, exactly what I expected yesterday. My bullish view still remains active and I do expect potential test of $1.472 and possible test of $1.479.

MACD oscillator is showing increase on the upside momentum, which is good sign that buyers are in control and that buying on the dips is preferable strategy for today. Stochastic oscillator is showing positive reading Support levels are seen at the price of $1.462 and $1.458.The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for EURUSD for 12/11/2019. We are waiting for the Fed's decision Posted: 11 Dec 2019 06:10 AM PST

News: the data on inflation was released in the United States. Overall retail inflation rose slightly to +0.3% month-on-month - however, the "core" - that is, inflation excluding gasoline and food - is at the same level + 0.2%. The Fed's rate decision will be released today at 20:00 London time. Most traders believe that the rate will remain unchanged at 1.625%. Still, I believe the Fed can make concessions to US President Trump, who has publicly demanded that the Fed cut rates - to lower the dollar and increase the competitiveness of US goods. We keep euro purchases from 1.1035, stop and flip-down at 1.1035. Possible purchases with a break of 1.1115 up. The material has been provided by InstaForex Company - www.instaforex.com |

| Why does oil not want to grow? Posted: 11 Dec 2019 06:10 AM PST Good day, dear traders!. I present to your attention a review for oil. So let's remember where it all started. On December 5, the OPEC summit was held, where the participants agreed to reduce production by 500 tons of barrels per day. The next day, Saudi Arabia unilaterally committed to a reduction of another 400 tons of barrels. Tonight, the American Petroleum Institute predicted an increase in reserves to 1.4 ml barrels. It would seem those titanic efforts were made to keep oil prices rising. Major cuts announced. Although in fact, it is very difficult to control the reduction measures, and the Saudis talked about this at the summit. Moreover, it came to the point that they parted without a joint statement and a common dinner (on the ship). This does not mean that they were full or not, but that there is no agreement within OPEC. They suspect each other of not complying with quotas. On the other hand, it's as if there's nowhere to reduce, and these disputes, claims, and distrust begin. Traders look at all this and they don't buy oil. In fact - the oil was worth at the meeting of 58.5, and now it is 58.7. And in my opinion, the oil bulls may soon get bored. The trigger for the fall in oil may be today's news on oil reserves in the United States from the EIA. And if the Americans pumped a lot - oil can collapse great on the fixation of long positions - traders disappointed in such an increase in oil. Good luck with trading and follow the rules! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for December 11, 2019 Posted: 11 Dec 2019 04:43 AM PST Overview: Pivot point: 0.6826. The AUD/USD pair will continue moving downwards from the level of 0.6826 (this level coincides with the 38.2% of Fibonacci retracement levels in H4 chart). Accordingly, the Aussie is going to show signs of strength at the lowest price of 0.6820. Thus, it will be a good deal to sell below the level of 61.8% of Fibonacci retracement levels on H1 chart with the first target at 0.6771 and further at 0.6726. Equally important, 0.6726 will be acting as a strong support so it is going to be a good place to take profit, it also should be noted that this level of taking profit will coincide with around last bearish wave. On the other hand, in case a reflection takes place and the AUD/USD pair is not able to break through the resistance at the 0.6820 level, the market will further decline to 0.6726 in order to indicate a bearish market. Additionally, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100. According to previous events, the AUD/USD pair has still been trapped between the level of 0.6826 and the 0.6726 level (those levels coincided with the fibonacci retracement levels 61.8% and last bearish wave respectively). It should be noted that the 0.6914 price (around double top at the level of 0.6914) will act as a strong resistance on November 7, 2019. Therefore, it will be too gainful to sell short below 0.6826 and look for further downside with 0.6771 and 0.6726 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 0.6914 level today. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis and trading ideas for USD/JPY for December 11, 2019 Posted: 11 Dec 2019 04:03 AM PST In this article, we will analyze the technical picture and trading ideas for one of the most popular and favorite pairs of the currency market - USD/JPY. Although, to be honest, on the eve of such an important event as the Fed's decision on rates and the press conference of the head of this department, Jerome Powell, it is quite difficult. In general, as you know, forecasts are an ungrateful thing, because it is not a fact that they will come true. Nevertheless, we will try to figure it out. Weekly

So, as you can see on the weekly chart, the previously exposed arrow on the decline was very useful and, as they say, worked. It was in the designated price zone that the pair met strong resistance and turned to decline. The reason for this was technical factors in the form of a 144-exponential moving average, a resistance level of 109.73 and the lower boundary of the Ichimoku indicator cloud. These resistances were so strong that the bulls on USD/JPY abandoned attempts to continue the rise of the rate and gave up the reins of the market to their opponents - the bears. However, as I have repeatedly stressed in previous articles, today may be the most important day at the trading on December 9-13 and will determine the closing price. In other words, depending on the reaction of market participants to the FOMC's updated economic forecasts and Jerome Powell's rhetoric during his press conference, the situation could change dramatically. I do not exclude that with a positive scenario for the US dollar, the long tail of the weekly candle will remain at the bottom and the dollar/yen will end the current five-day trading with an increase. At the moment, we see a small bullish candle with the same small white body. This factor indicates a wait-and-see position of market participants, which is quite understandable and logical. I believe that the main activity and good price movements will begin after the publication of the US consumer price index at 14:30 (London time). At 20:00 (London time), the Fed will announce its decision on the main interest rate, which is likely to remain unchanged. The crowning glory of today at 20:30 (London time) will be the FOMC press conference, which will be held by Federal Reserve Chairman Jerome Powell. It seems that it is precisely the tonality of the speech by the head of the Fed that will have a decisive influence on the course of trading. I would like to remind you that the USD/JPY pair reacts very strongly to such important events from the US. Well, as for the weekly price chart, the nearest target of possible growth will be the mark of 109.24, where the 55 simple moving average is located. A stronger strengthening of the US currency will send the quote to the area of 109.73-109.75, where the past and the year before highs, as well as 144 EMA. In the case of negative reaction of investors to Powell's performance, the pair risks falling first to 107.90, and then to 107.10, where the Kijun line of the Ichimoku indicator passes. Daily

On the daily chart, the pair was locked between 55 MA with 144 EMA, which can provide support, and Kijun and Tenkan lines, whose function will be to restrain a possible rise and provide resistance. I want to emphasize right away that at such important events as of today's, the price in most cases leaves the chosen range, so trading with the indicated support and resistance is already extremely risky. As an option, those who wish can work for a break up of 109.10 by placing buy stop orders or use sell stop for a break of 108.50. But the goals are small! However, this trading idea may not be successful, as the market often changes direction during the speech of important monetary officials, and especially the head of the Federal Reserve. Cautious and unwilling traders should risk closing all open transactions (who has them) today and staying out of the market. Aggressive and risky, I can recommend purchases from current prices and (or) with a decrease in the price zone of 108.50-108.00. Early sales from the price range of 108.90-109.20. At more attractive prices, I recommend considering short positions from a strong technical zone of 109.70-110.20. That's all for now. I wish you success! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Dec 2019 04:03 AM PST Good day, dear traders! I present to your attention the trading idea for the USDCAD pair. One of the most "noisy" instruments stopped in a very narrow range of 20-30p. What is interesting - this range has a very clear border in the lower zone. As a rule, the market does not forgive such "platforms". In this regard, I propose two scenarios of work from this idea. Option number 1. Work on the downside to break the lower border with a take at the quote of 1.3220. Option number 2. Work on the downside to break the quotes of 1.3220 and further hold to 1.3. Option number 3. Work on the downside to break the lower border with the take on the quote of 1.3220 and after a false breakdown, work on the up - to reach 1.3500 and 1.32700. |

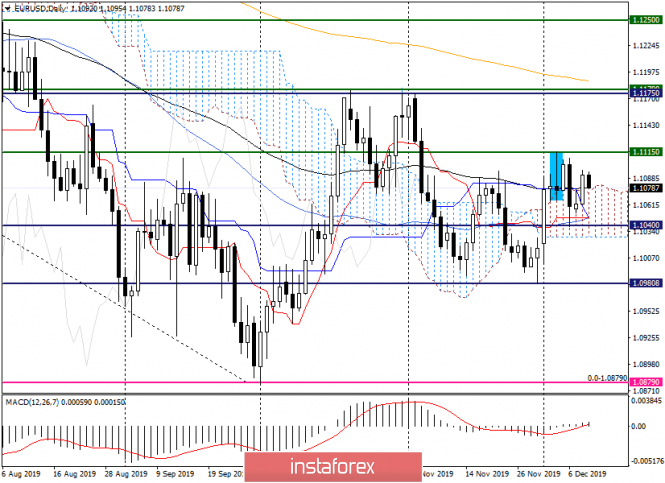

| Overview for EUR/USD for December 11, 2019 Posted: 11 Dec 2019 02:57 AM PST Hello, dear colleagues! If we talk about the external background, the trade negotiations between the US and China are still uncertain, which does not contribute to the activity of market participants. Also, investors are waiting for the outcome of the two-day meeting of the Open Market Committee (FOMC). Today at 20:00 (London time), the Fed will announce its decision on the refinancing rate and will publish updated economic forecasts. It is expected that the Fed will keep the rate at the same level. This means that the main reaction of investors will be determined by the updated forecasts for the US economy. However, I would like to note that the Fed meeting will be extended and will be held in full. It is understood that Fed Chairman Jerome Powell will hold a press conference at 20:30 (London time). I believe that if rates are maintained, the main reaction of market participants will depend on the rhetoric of the head of the Federal Reserve. Before the Fed's decision at 14:30 (London time), data on the US consumer price index will be released. A very significant indicator that affects inflation in the United States. Given the above events, December 11 will be the most important day of the week, and investors will have drivers to increase their activity. As for yesterday's statistics from the eurozone, the positive index of economic sentiment from German investors from ZEW slightly affected the strengthening of the euro against the US currency. The daily chart of EUR/USD currency pair

We see that as a result of yesterday's growth, the trades closed at 1.093, which is above the upper limit of the Ichimoku indicator cloud and above the exponential moving average, as well as above the strong and vicious level of 1.1080. However, it is too early for the euro to fall into euphoria and celebrate success. There are many technical barriers above, among which the nearest will now be the price zone of 1.1110-1.1165. And the main events for the euro/dollar currency pair are still ahead. After today, tomorrow the European Central Bank (ECB) will pick up the baton, which will announce its decision on the basic interest rate, and a little later, the new ECB President Christine Lagarde will hold a press conference. If the goals at the top are clear and visible, then in the case of a downward scenario, the euro/dollar will fall to 1.1073, 1.1060, 1.1048 and 1.1029. If for trading ideas, then yesterday's recommendation to sell after rising to the area of 1.1080-1.1110 was correct. After reaching the highs at 1.1097, the pair turned to decline and at the time of completion of the article, it is trading near the same level of 1.1080. Today, it is difficult to give any specific recommendations. As an option, the technique of selling looks good from the area of 1.1110-1.1160 and buying with a decrease in the area of 1.1070-1.1030. Successful trading! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Dec 2019 02:49 AM PST To open long positions on GBPUSD, you need: From a technical point of view, the situation has not changed. Buyers performed well at the level of 1.3108, which I paid attention to in my morning forecast, which led to a small upward correction and a return of GBP/USD to the resistance of 1.3161. Let me remind you that the British pound fell in Asian trading after the next polls, which indicated that the leadership of the Conservative Party of Great Britain significantly decreased the day before the general election, which makes the result even more unpredictable. The main task of the bulls for the second half of the day will be to return and consolidate above the level of 1.3161, which may lead to a re-update of this month's maximum of 1.3209, where I recommend taking the profits. If the pair declines after the US inflation data, more acceptable levels for opening long positions are seen in the area of 1.3049 and 1.2988, from where you can buy immediately on the rebound. To open short positions on GBPUSD, you need: The bears did not cope with the morning task, as they failed to break below the support of 1.3108. In general, this outcome was quite expected, so the focus in the afternoon should be on important data on inflation in the United States and the decision of the Federal Reserve on interest rates. A repeated return to support of 1.3108 may lead to a larger sell-off of GBP/USD to the low of 1.3049 and 1.2988, where I recommend taking the profits. The formation of a false breakout in the resistance area of 1.3161 will also be a signal to open short positions in the pair. Otherwise, the pound can be sold from the maximum of this month in the area of 1.3209 or immediately on the rebound from the resistance of 1.3265. Likely, the Fed's decision will not greatly affect the British pound, which is preparing tomorrow for the general election in the UK. Indicator signals: Moving Averages Trading is conducted around 30 and 50 daily averages, which indicates the lateral nature of the market. Bollinger Bands The lower border of the indicator around 1.3100 has already supported the pound. The upward trend may be limited by the upper level of the indicator around 1.3200.

Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment