Forex analysis review |

- Forecast for GBP/USD on December 13, 2019

- Forecast for USD/JPY on December 13, 2019

- Fractal analysis for major currency pairs on December 13

- Development of trading ideas for USD/CAD and oil

- Euro and Christine Lagarde. Gold and Yen

- GBP/USD. December 12. Results of the day. Fate of the election will decide the "doubting" regions of the UK

- EUR/USD. December 12. Results of the day. Eurozone economic reports disappointed. ECB left rates unchanged

- EURUSD. Lagarde press conference and unexpected news from the Chinese front

- GPB/USD: Boris Johnson must try very hard, otherwise the pound may be under $1.20

- EURUSD: There are enough problems in the eurozone, indicated by data on industrial production and German inflation. ECB will

- Dollar = winner?

- EUR/USD: Fed decided to hold their horses. Will the ECB change the rules of the game?

- December 12, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- Ichimoku cloud indicator short-term analysis of Gold for December 12, 2019

- EURUSD reaches short-term target but gets rejected

- Evening review for EURUSD for 12/12/2019

- December 12, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC 12.12.2019 - End of the upward correction ABC, watch for selling opportunities

- USD/JPY analysis for December 12, 2019 - Symmetrical triangle pattern in creation, watch for the breakout to confirm further

- Gold 12.12.2019 - Both upward targets reached, potential for consolidation day

- Technical analysis of EUR/USD for December 12, 2019

- Trading plan for EUR/USD for December 12, 2019

- GBP/USD: plan for the US session on December 12. The pound fell slightly after updating the next highs before the elections

- EUR/USD: plan for the US session on December 12. The euro fell before the decision of the European Central Bank

- EUR/USD. December 12. Powell is pleased with the condition of the US economy and monetary policy

| Forecast for GBP/USD on December 13, 2019 Posted: 12 Dec 2019 07:33 PM PST GBP/USD The preliminary official results of the British parliamentary elections became known this morning: the Conservatives won a resounding victory, gaining a parliamentary majority of 368 seats, and the Laborites had only 191 seats. In third place is the Scottish National Party with 55 parliamentary seats, and the Brexit Party has not received a single seat. The pound soared by 346 points in the Asian session. Of course, this is one of the many paradoxes of the market - the growth of the currency is threatened by the country's exit from the EU with a bad deal, and in the coming weeks. To date, the price has overcome the Fibonacci level of 238.2% on the daily chart. We allow growth to continue to the Fibonacci level of 271.0% at the price of 1.3648 (near the September 2017 high). But the price may not reach the designated goal, retreating under pragmatic ideas. The growth looks so rapid on the four-hour chart that we do not receive any additional information. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on December 13, 2019 Posted: 12 Dec 2019 07:25 PM PST USD/JPY The dollar jumped 75 points yesterday against the yen due to Donald Trump's Twitter post about getting "very close to a big deal with China." It is assumed that the amount of duty-paid Chinese goods will be reduced to 360 billion dollars, respectively, new tariffs scheduled for December 15th will not be introduced. Despite the growth of the stock market (S&P 500) by 0.86% and the current rise of the China A50 by 1.18% and the Japanese Nikkei 225 by 2.17%, it is still difficult to make a decision based on the same messages from Trump on the social network, because before he wrote about a "big deal", which is about to be, but did not advance, and was even called into question by the Chinese side itself. We believe that you should not rush to conclusions and wait for a new week. From a technical point of view, the situation with the USD/JPY pair is increasing completely - the signal resistance range of 109.30/50 has been overcome on the daily timeframe, the Marlin oscillator is in the growth zone, the target is open at 110.00 on the trend line of the green price channel. Overcoming the level will open the important goal of 110.46 - this is the upper limit of the red price channel, originating in August 2015, exit from which opens up the prospect of growth by another three figures. The price is briskly growing above the balance and MACD lines on the four-hour chart, Marlin in the growth zone. It is likely that growth will still slow down, as the development of yesterday's news has already taken place. The material has been provided by InstaForex Company - www.instaforex.com |

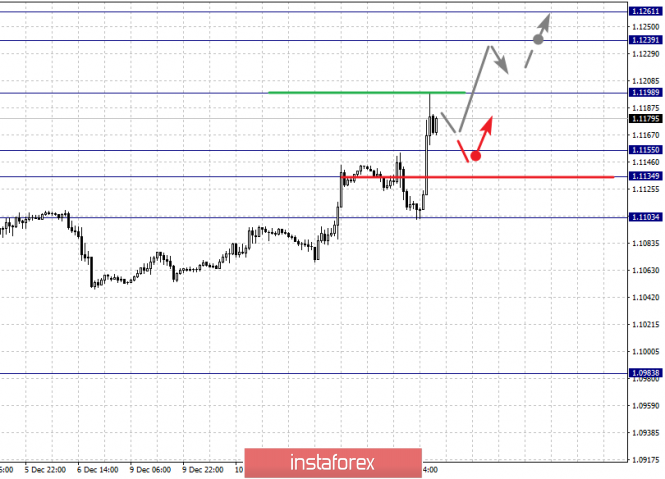

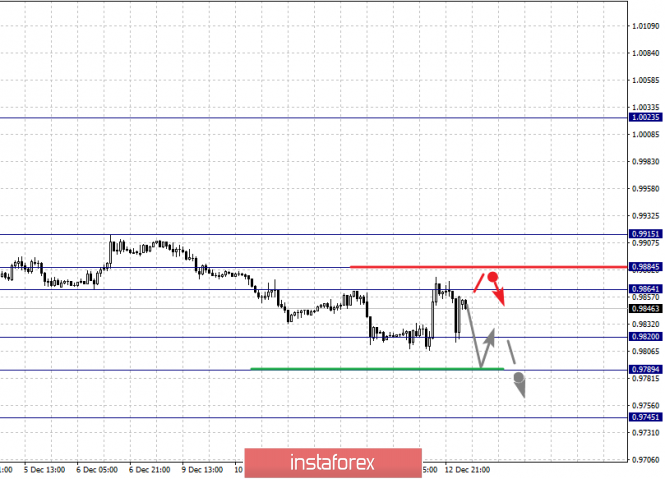

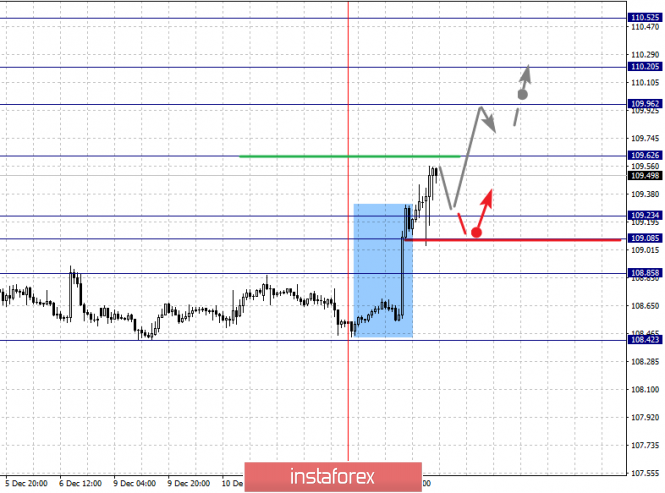

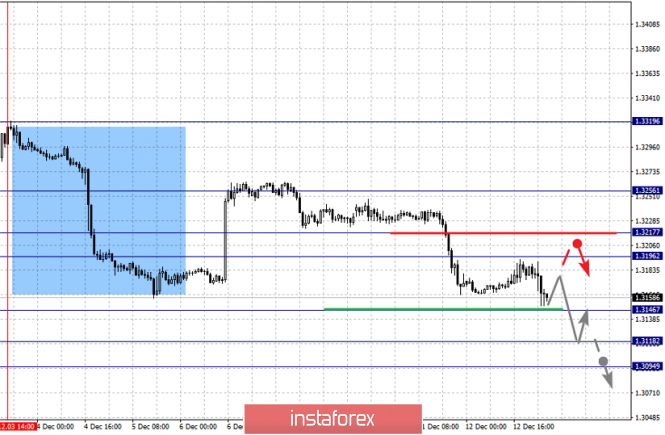

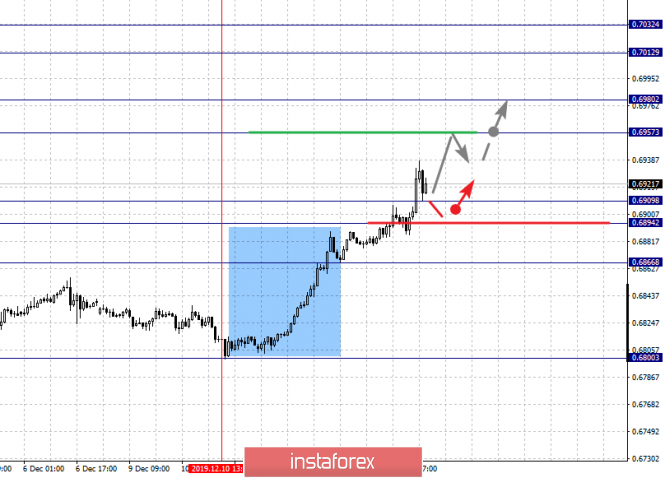

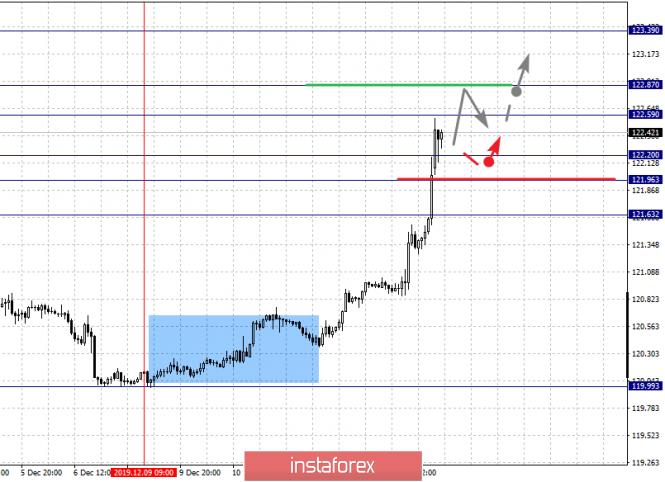

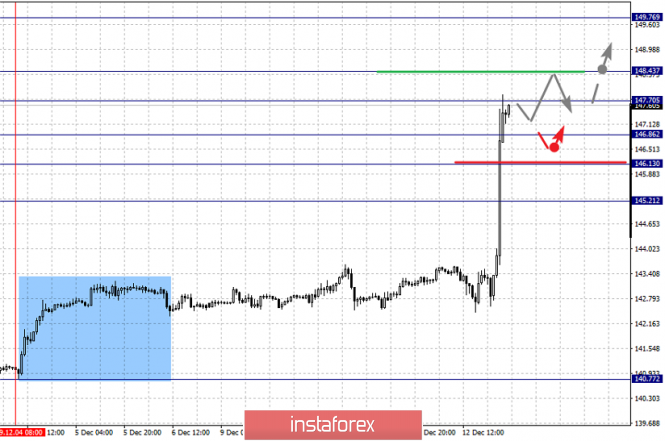

| Fractal analysis for major currency pairs on December 13 Posted: 12 Dec 2019 06:17 PM PST Forecast for December 13: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1261, 1.1239, 1.1198, 1.1155, 1.1134 and 1.1103. Here, we are following the development of the upward cycle of November 29. The continuation of the movement to the top is expected after the breakdown of the level of 1.1198. In this case, the target is 1.1239. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.1261. Upon reaching this value, we expect a rollback to the correction. Short-term downward movement is expected in the range 1.1155 - 1.1134. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1103. This level is a key support for the upward structure. The main trend is the upward structure of November 29 Trading recommendations: Buy: 1.1198 Take profit: 1.1239 Buy: 1.1241 Take profit: 1.1261 Sell: 1.1155 Take profit: 1.1135 Sell: 1.1132 Take profit: 1.1103 For the pound / dollar pair, the key levels on the H1 scale are: 1.3732, 1.3598, 1.3534, 1.3417, 1.3360 and 1.3268. Here, the subsequent targets for the top were determined from the medium-term ascendant structure on November 27. Short-term movement to the top is expected in the range 1.3534 - 1.3598. Hence, there is a high probability of a reversal in the corrective movement. The breakdown of the level of 1.3600 will lead to a movement to a potential target - 1.3732. We consider the movement to this level as unstable. Short-term downward movement is possibly in the range of 1.3417 - 1.3360. The breakdown of the last value will lead to a long correction. Here, the target is 1.3268. This level is a key support for the upward trend. The main trend is the upward cycle of November 27 Trading recommendations: Buy: 1.3535 Take profit: 1.3596 Buy: 1.3600 Take profit: 1.3680 Sell: 1.3417 Take profit: 1.3360 Sell: 1.3358 Take profit: 1.3280 For the dollar / franc pair, the key levels on the H1 scale are: 0.9915, 0.9884, 0.9864, 0.9820, 0.9789 and 0.9745. Here, we are following the development of the downward structure of November 29. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9820. In this case, the target is 0.9789. Price consolidation is near this level. The breakdown of the level of 0.9789 should be accompanied by a pronounced downward movement. In this case, the potential target is 0.9745. We expect a rollback to correction from this level. Short-term upward movement is possibly in the range of 0.9864 - 0.9884. The breakdown of the latter value will lead to in-depth movement. Here, the target is 0.9915. This level is a key support for the downward structure of November 29. The main trend is the downward structure of November 29 Trading recommendations: Buy : 0.9864 Take profit: 0.9883 Buy : 0.9885 Take profit: 0.9913 Sell: 0.9820 Take profit: 0.9791 Sell: 0.9787 Take profit: 0.9745 For the dollar / yen pair, the key levels on the scale are : 110.52, 110.20, 109.96, 109.62, 109.23, 109.08 and 108.85. Here, the price canceled the development of the downtrend and at the moment, has issued the expressed initial conditions for the top of December 12. The continuation of the movement to the top is expected after the breakdown of the level of 109.62. In this case, the target is 109.96. We expect a short-term upward movement, as well as consolidation in the range of 109.96 - 110.20. For potential value for the top, we consider the level of 110.52. Upon reaching which, we expect a rollback to the correction. Short-term downward movement is expected in the range 109.23 - 109.08. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.85. This level is the key support for the upward structure from December 12. Main trend: initial conditions for the top of December 12 Trading recommendations: Buy: 109.63 Take profit: 109.96 Buy : 109.98 Take profit: 110.20 Sell: 109.23 Take profit: 109.08 Sell: 109.06 Take profit: 108.85 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3256, 1.3217, 1.3196, 1.3146, 1.3118 and 1.3094. Here, we continue to monitor the long-term descending structure of December 3. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3146. Here, the target is 1.3118. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.3094. Upon reaching which, we expect a consolidated movement. Short-term upward movement is possibly in the range of 1.3196 - 1.3217. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3256. We expect the expressed initial conditions to formulate for the upward cycle up to this level. The main trend is the long-term descending structure of December 3 Trading recommendations: Buy: 1.3196 Take profit: 1.3215 Buy : 1.3218 Take profit: 1.3252 Sell: 1.3145 Take profit: 1.3119 Sell: 1.3116 Take profit: 1.3095 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.7032, 0.7012, 0.6980, 0.6957, 0.6909, 0.6894 and 0.6866. Here, we continue to monitor the development of the ascending structure from December 10. At the moment, we expect movement to the level of 0.6957. Short-term upward movement is possibly in the range 0.6957 - 0.6980. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 0.7012. For the potential value for the top, we consider the level of 0.7032. Upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 0.6909 - 0.6894. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.6866. This level is a key support for the upward structure. The main trend is the local structure for the top of December 10 Trading recommendations: Buy: 0.6958 Take profit: 0.6980 Buy: 0.6983 Take profit: 0.7012 Sell : 0.6909 Take profit : 0.6895 Sell: 0.6892 Take profit: 0.6870 For the euro / yen pair, the key levels on the H1 scale are: 123.39, 122.87, 122.59, 122.20, 121.96 and 121.63. Here, we are following the development of the ascending structure of December 9. Short-term upward movement is expected in the range of 122.59 - 122.87. Hence, there is a high probability of going into the corrective movement. The breakdown of the level of 122.87 will allow us to count on movement to the limit value - 123.39. We expect consolidation and a pullback to the bottom near this level. Short-term downward movement is possibly in the range of 122.20 - 121.96. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 121.63. The main trend is the upward structure of December 9 Trading recommendations: Buy: 122.60 Take profit: 122.80 Buy: 122.90 Take profit: 123.20 Sell: 122.20 Take profit: 121.98 Sell: 121.94 Take profit: 121.66 For the pound / yen pair, the key levels on the H1 scale are : 149.76, 148.43, 147.70, 146.86, 146.13 and 145.21. Here, we are following the ascending structure of December 4. Short-term movement to the top is expected in the range of 147.70 - 148.43. The breakdown of the last value will lead to a pronounced movement. Here, the potential target is 149.76. From this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 146.86 - 146.13. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 145.21. This level is a key support for the top. The main trend is the local ascending structure of December 4 Trading recommendations: Buy: 147.70 Take profit: 148.30 Buy: 148.50 Take profit: 149.50 Sell: 146.80 Take profit: 146.15 Sell: 146.10 Take profit: 145.35 The material has been provided by InstaForex Company - www.instaforex.com |

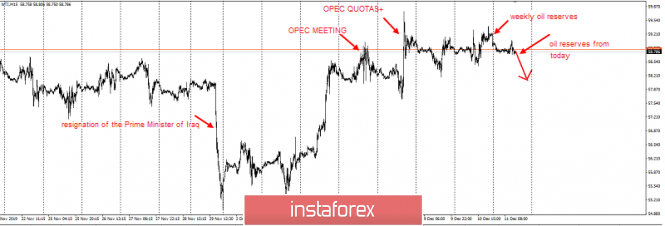

| Development of trading ideas for USD/CAD and oil Posted: 12 Dec 2019 03:31 PM PST Good evening traders! Congratulations to those who used our USD / CAD trading idea and oil last time. Trading idea for USD / CAD: Development of trading idea for USD / CAD: Trading idea for oil: Development of trading idea for oil: |

| Euro and Christine Lagarde. Gold and Yen Posted: 12 Dec 2019 02:51 PM PST Recommendations: EURUSD - purchase up to 1.11800 - 1.12 Gold - purchase up to 1480 - 1484 USDJPY - sell up to 108.2 - 107.9 The material has been provided by InstaForex Company - www.instaforex.com |

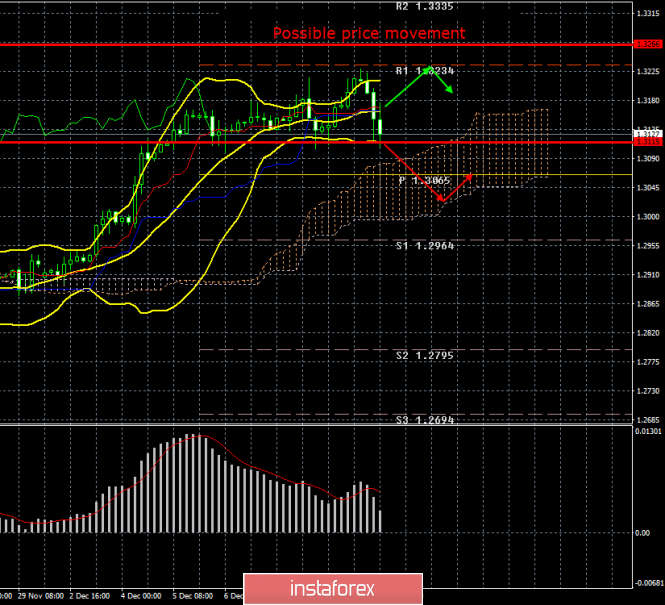

| Posted: 12 Dec 2019 02:41 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 65p - 66p - 50p - 82p - 108p. Average volatility over the past 5 days: 75p (average). The GBP/USD currency pair began a new round of correction movement less than 12 hours before the results of voting in the UK become known. There were no important macroeconomic publications today either in the UK or in the United States, and, in principle, it doesn't matter, since the pound has not responded to any macroeconomic statistics for the last two months, completely focusing on the parliamentary elections, which they consider crucial. The correction of the pound/dollar pair is connected with the banal desire of traders to be certain before the appearance of decisive data. As we wrote a day earlier, with a 80% probability, the party of Boris Johnson will win the election with the necessary advantage, which will create a "majority government". However, there remains a 20% probability that the Conservatives will not be able to get the necessary advantage, then the Parliament will again be in limbo, like Brexit. In theory, such a scenario has a 20% probability. In practice, the likelihood of a Conservative defeat is much greater. The fact is that in at least 100 out of 650 districts, the difference in the political ratings of Corbyn and Johnson is literally a couple of percent. That is, the regions that unequivocally support the leader of the Labour Party or the leader of the Conservative Party are known in advance. It is on the data from these regions that the majority of forecasts of the outcome of the vote are built. But as we have already mentioned, about a hundred regions are hesitating, which means that potentially as many as 100 deputy mandates can be on either side or the other. That is why we are not sure of the victory of Johnson. Moreover, let's focus on the "homespun truth". Johnson needs a majority of votes in Parliament. His party was ruling even before the current election, but this did not make it possible to realize Brexit, since there were not enough votes all the time. Even at the expense of the allies. Given the fact that the Conservative Party's own forces amounted to about 290 deputies (after all the dismissals and expulsions from the party), then Johnson could not even collect 37 additional votes to accept the Brexit deal. Thus, Johnson needs an unconditional victory in this election, any other result will not solve the problems for which the re-election was started by the prime minister. Also, do not forget that of the allies, the Conservative Party only has the Brexit Party, which will receive an extremely small number of votes in Parliament due to its low popularity in the UK. Nigel Faraj and his party members propose a "hard" Brexit script that is not welcomed by almost all UK residents. Thus, even a coalition with the Brexit party will not bring Johnson a large number of additional votes. So, you need to win on your own. The Labour camp is a completely different matter. Both Liberal Democrats and Scots can support the initiatives of Jeremy Corbyn (the main of which is to prevent Brexit in the form of Johnson's deal). Accordingly, there aren't many Laborites and need a victory in the elections. If Johnson's party fails and does not form a majority government, then everything is practically guaranteed to come to a second referendum, since there is simply no way out of this situation. And almost all opposition parties can help block Johnson's agreement once again. Thus, in this situation, it is best to wait for the morning voting results and then build any trading plans for the coming days. The upcoming weekend is an opportunity to move away from any outcome of the vote and calm down. Starting next Monday, the pound/dollar currency pair can be traded in the usual way. Trading recommendations: GBP/USD has started a downward correction, which may develop into a full-fledged downward trend. Especially if the Conservative Party does not win the parliamentary elections. Thus, it is now recommended to wait until the situation becomes clear and only after that will you resume trade, depending on the election results and the technical picture at that time. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

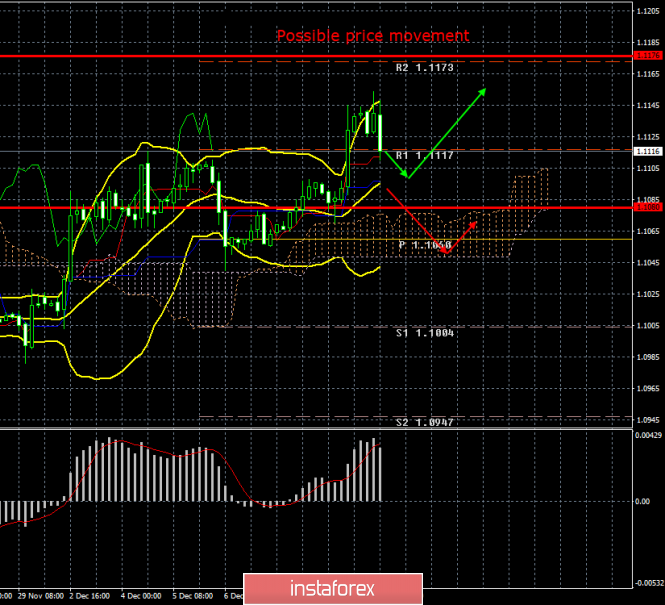

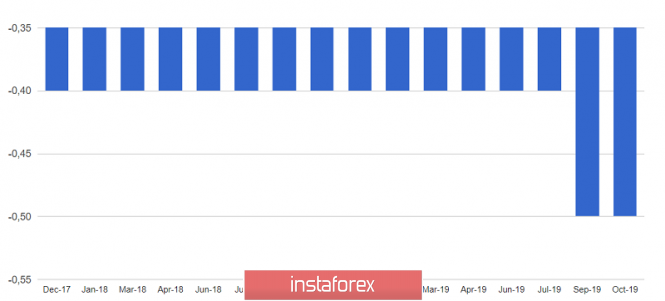

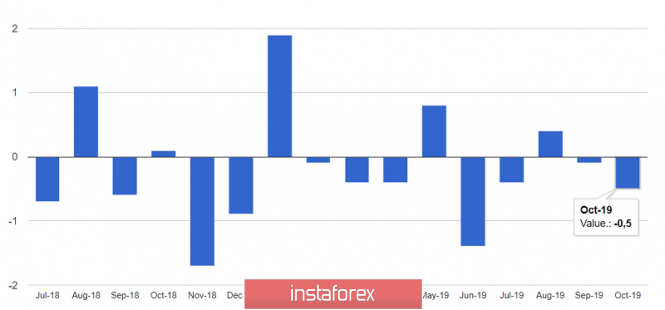

| Posted: 12 Dec 2019 02:41 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 31p - 70p - 25p - 35p - 75p. Average volatility over the past 5 days: 48p (average). The EUR/USD currency pair began a downward movement on Thursday, December 12, which, from our point of view, suggested itself yesterday. To begin with, we still consider the Federal Reserve meeting absolutely neutral. All of Jerome Powell's statements were completely mundane. Even his words about the possible redemption of short-term assets, "if necessary," should not be regarded as hints of concrete actions in the near future. A small decrease in GDP forecasts for 2019-2022 could also not cause a fall in the US currency. Moreover, we would like to immediately note that the main fall of the US dollar has already happened at night, that is, during the Asian trading session. US traders and investors, and European, thus did not work out the Fed meeting and its results by selling the dollar. And if we recall the publication of the November inflation report in the United States, which grew to 2.1% YOY, and the fact that the Fed does not plan any new easing of monetary policy in the coming months or even years, it becomes clear that fundamentally, there was much more reason to strengthen the US dollar than for it to fall. However, the drop did not happen, which again forces us to pay attention to the paradoxical situation in which there are certain reasons for the euro/dollar pair to decline, but they are not sufficient for the bears to resume sales near two-year lows. The fundamental background for the euro/dollar pair has not changed at all today. We remind you that we continue to regard the economic news and reports from the European Union as weak, and the US data as strong. Thus, the fundamental background for the EUR/USD pair remains unambiguously on the side of the US currency. Today, inflation was first published in Germany in November, which remained at the level of the previous month and amounted to + 1.1% YOY. On the one hand, such a CPI value may seem quite good, but we recall that the German economy is the locomotive for the EU, so inflation in other EU countries is even weaker, and the pan-European one, according to recent data, does not exceed 1.0% YOY . A little later, a report was published on industrial production in the European Union for October, where it was absolutely expected that a drop of 2.2% YOY and 0.5% MOM was recorded, which almost perfectly coincides with the forecast values. And what is the result of today? The next two quite important reports from the EU were disappointing, and the euro currency in began a downward correction. The results of the ECB meeting, which traders already expected, took place. Both key interest rates, deposit and credit, remained unchanged, -0.5% and 0.0% respectively. In principle, none of the market participants expected the easing of monetary policy even more at the first meeting of the ECB under the leadership of Christine Lagarde. At a press conference, the head of the ECB said that the risks of a slowdown in the EU economy are becoming less pronounced. In addition, Lagarde again called on the governments of the EU member states to provide more stimulus to their own economies. Such rhetoric by Christine Lagarde also completely falls under the definition of "neutral." Based on this, the euro did not receive any reason to strengthen on the penultimate trading day of the week. You can also pay attention to the ECB forecasts for GDP and inflation for the next few years. According to the regulator, GDP in 2019 will grow by 1.2%, and in the next - by 1.1%. Inflation should accelerate to 1.6% YOY only by 2022. From our point of view, it is precisely such forecasts of the main indicators that are the most important today. They mean, in fact, that the ECB is not expecting dramatic improvements in the economic situation in the coming months. That is, the quantitative incentive program will continue to operate for 20 billion euros per month, and rates will remain "ultra-low" for a long time. Moreover, we would like to draw attention to the fact that acceleration of the EU economic growth rate is not expected, but their slowdown is quite possible. The reasons for the negative scenario may be the escalation of trade conflicts in the world, as well as inciting new ones. As a result, a slowdown in the global economy and a similar decline in the economy of each individual country. Based on this, we still believe that it will be extremely difficult for the euro to form an upward trend in the long term. From a technical point of view, a downward correction against an upward trend has begun for the EUR/USD pair. The upward trend itself remains extremely weak, but the euro is still creeping up, often ignoring macroeconomic reports, which should supposedly support the dollar. Volatility has grown to 48 points in recent days, but this is still not a high enough indicator. Given all the factors, we are still waiting for the resumption of the downward trend. Trading recommendations: EUR/USD began a new round of correction. Thus, long positions formally remain relevant with the goal of a second resistance level of 1.1173, but after the completion of the current correction. But overcoming the critical Kijun-sen line may just provoke the resumption of the downward trend with the first goals of 1.1080 and Senkou Span B. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD. Lagarde press conference and unexpected news from the Chinese front Posted: 12 Dec 2019 02:41 PM PST Today was the final ECB meeting for this year - and at the same time the first one that is chaired by Christine Lagarde. Contrary to the fears of some analysts, she did not bring down the European currency with her dovish intentions. Lagarde was clearly trying to maintain a certain balance in her rhetoric (following the manner of Mario Draghi), and she almost succeeded. The EUR/USD pair did not slump, but did not jump - by and large, following the results of the December meeting, the pair remained in the same positions as before the meeting of the ECB members. The pair retreated to the bottom of the 11th figure after the fact - for other reasons, which we will discuss below. Returning to the direct results of the ECB meeting, it should be noted that they turned out to be quite neutral - neither the bulls nor the EUR/USD bears were able to become beneficiaries of this event. Lagarde noted both the pros and cons of the current situation, while making it clear that the European regulator is ready to implement one of two scenarios: either the central bank softens its monetary policy in 2020 or maintains a wait-and-see attitude. The option of raising the rate is not considered now, however, as is the option of expanding incentives. In general, such rhetoric was taken into account in quotes, so it did not make much impression on traders. But the updated economic forecasts included positive surprises for the euro, due to which the EUR/USD pair slightly grew after Lagarde's press conference ended. Speaking in the language of numbers, the situation is as follows. The ECB has revised its forecast for economic growth in the eurozone for the current year upward (up to 1.2% from the previous value of 1.1%), but at the same time downward revised its forecast for the next year (up to 1.1% from the previous mark 1 , 2%). For the first time, forecasted GDP indicators for 2022 were published - according to ECB members, the economy will grow to 1.4% (a similar value for 2021). As for inflation, the situation here is mirror-like: if the forecast for this year was maintained at the previous level, then the regulator announced more optimistic estimates for the next year (1.1% instead of 1.0%). The inflation forecast in 2021 was revised to 1.4% (the previous estimate was 1.5%), and for 2022 it remained at 1.6%. As you can see, the published forecasts do not allow bears or bulls to declare their dominance. Nevertheless, traders focused on the growth of the inflation forecast for the next year - this fact supported the euro. The subsequent rhetoric of Lagarde complemented the optimistic picture, after which the pair again touched the middle of the 11th figure. First, she stated that bearish risks for inflation have become "less significant", although they still prevail. Secondly, Lagarde positively evaluated the latest macroeconomic releases (apparently, we are talking about the CPI and ZEW) - in her opinion, now we can say that there are "the first signs of a slowdown in the economy." Thirdly, the head of the ECB again appealed (albeit very indirectly) to the leaders of the countries "with budgetary opportunities" with an appeal to take "decisive action". Although Lagarde did not specify her requirements today, the hint was more than transparent. The fact is that over the past two months she has repeatedly called on Germany and the Netherlands, with their "chronic budget surpluses", to increase investment and government spending. Today she once again conveyed a concealed greeting to these countries. In contrast to optimistic estimates, Christine Lagarde again recalled that the risks for the eurozone economy remain downward, so "if necessary", the central bank is ready to use the available levers of influence on monetary policy. However, this phrase even under Mario Draghi has become familiar and to some extent a "duty". Thus, despite the caution of the head of the ECB, the euro received some support from the European regulator. Following the results of the December meeting, the EUR/USD pair not only maintained its position, but also received an occasion for short-term price jumps of an impulsive nature to the region of the middle of the 11th figure. Why did the situation change dramatically during the US session on Thursday? The pair sharply turned and headed towards the 10th figure, and already after the fact of the ECB meeting. According to most currency strategists, Trump played a role here, who, using Twitter, again forced traders to turn their attention to themselves. He published a very short but capacious post, in which he stated that "China is close to a deal." At the same time, the US president added that the American side also wants to sign a trade agreement. On the one hand, the market is used to similar tweets - for the most part they are emotional, so to speak, "without practical continuation". But along with Trump's message, encouraging information came from the Wall Street Journal. Journalists of this influential publication reported that the White House finally offered Beijing the long-awaited compromise solution: the United States reduces duties on Chinese imports by 50% (worth $360 billion) and refuse to introduce duties, which should take effect on December 15 (worth $160 billion dollars). The dollar jumped across the market amid such news, reflecting increased demand. The EUR/USD pair was no exception: with a high degree of probability it will return to the framework of the 10th figure today. If the above rumors are indeed confirmed, then the downward trend may continue, at least to the first support level of 1.1030 (the lower boundary of the Kumo cloud on the daily chart). Having broken this level, the bears will open their way to the lower line of the Bollinger Bands indicator on the same timeframe, which corresponds to the level of 1.0970. The material has been provided by InstaForex Company - www.instaforex.com |

| GPB/USD: Boris Johnson must try very hard, otherwise the pound may be under $1.20 Posted: 12 Dec 2019 02:41 PM PST The United Kingdom is hosting the third national parliamentary election in the last four years. The new alignment of forces in the House of Commons should determine the vector of the country's development for the next five years and decide the fate of Brexit. While Euroscepticist Boris Johnson is focusing on promises to withdraw Great Britain from the EU by January 31, 2020 without new delays or delays, his opponents show completely different views on the country's successful future. In particular, the head of the Labour Party, Jeremy Corbyn, is promoting the idea of a second referendum on Brexit, which he plans to hold in the first six months after coming to power. The Labour leader has already announced the nationalization of railways and British companies involved in energy and water supply in the event that he takes the prime minister's chair. Liberal Democrats, led by Joe Swinson, intend to completely abandon the "divorce" from the EU. For Prime Minister Johnson to be able to advance his plans for Brexit, which had to be postponed again in the fall, the Tories need to get an absolute majority in the House of Commons, that is, at least 326 out of 650 seats. Despite the fact that opinion polls predict victory for Conservatives, even a small shift in the mood of voters can change the whole balance of power. According to the Best for Britain organization, the votes of only 40 thousand people in 36 constituencies will be able to deprive the majority of the Tories. According to experts, the election results will be crucial for the dynamics of the pound. In case of a negative scenario, the sterling could fall to $ .20, while it might grow to $1.35 in the opposite situation. "The results of all recent polls confirm that the Conservative Party, led by Johnson, will be able to form an effective majority in Parliament, which will allow the prime minister to successfully implement the Brexit bill, and the pound to rise to the $1.33 area," Westpac said. "The main issue is the scale of the pound rally in case of a consensus election result. With this outcome, the GBP/USD pair may reach 1.3500," Saxo Bank analysts said. "It will not be easy for the pound to rise well above current levels in the near future if the Conservatives do not get a large majority in the House of Commons," the MUFG believes. "There is still a lot of good news in the pound, as the most likely scenario is getting the majority of the Tories. Meanwhile, the Tory advantage of 20-30 or less places will not be so favorable for the British currency. This alignment of forces will make the new government more dependent on support from "hard" brexitors in negotiations on a free trade agreement with the EU," said MUFG strategist Fritz Lowe. "The biggest surprise will be the coalition led by the Labour Party, which will not only hurt the pound, but also hit the UK government bonds," said Andrew Wischart of Capital Economics. He predicts that in this case, the pound will plummet (possibly to $1.20). According to estimates by Jordan Rochester, a Nomura specialist, the pound could fall 3% on news of a minority government led by Labour. "The hung Parliament promises Britain a continuation of political chaos, and even the reduction of most of the Tories is fraught with bleak prospects. If Conservatives do not show good results, the pound could significantly weaken in the wake of disappointment. The news of an unstable majority of Tories in Parliament will send the GBP/USD pair to test the area of 1.2985–1.3015. A deeper correction is also possible - in the direction of 1.2880 and further to 1.2820," TD Securities experts noted. Very soon we will find out whether the Tories will be able to win the majority of the votes. Otherwise, Prime Minister Johnson may lose his seat on Downing Street, and the party that wins will be given the right to form a government and determine what the UK's relationship with the EU will be. The material has been provided by InstaForex Company - www.instaforex.com |

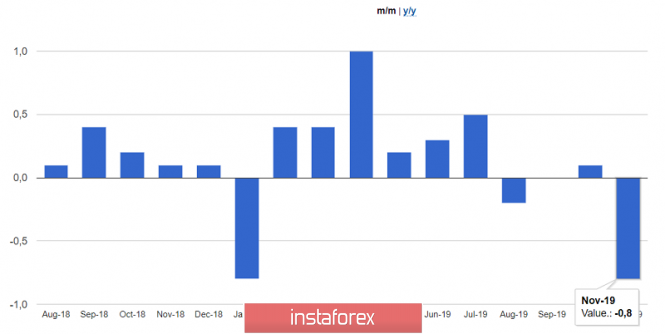

| Posted: 12 Dec 2019 02:41 PM PST Two reports came out in the morning that weighed on the European currency. First of all, the weakness of industrial production, which has been observed throughout the year, continued to pull down the economy into recession. It is impossible not to mention German inflation, which declined in November this year, which creates a number of problems for the European Central Bank to stimulate growth. Most likely, the measures that were introduced in the early fall of this year, and we are talking about lowering the deposit rate and returning to the bond redemption program, are clearly not enough to renew inflationary pressures. The final meeting of the European Central Bank for this year will take place today, at which, apparently, rates will also remain unchanged at zero. It is unlikely that by the end of the year the European regulator will make any significant changes in the course. However, it is expected that the ECB will be forced to continue lowering rates in the first quarter of 2020 if the measures that were taken in the early fall of this year do not bring a gentle result. So far, no special economic recovery has been observed. As I noted above, the problems of the industrial sector did not end, and judging by the report, they only worsened. Recent data from the Purchasing Managers Index for the manufacturing sector, which is a leading indicator, only confirmed a further decline in production at the end of this year. According to a report by the statistics agency Eurostat, industrial production in the eurozone decreased by 0.5% in October of this year compared with September, and immediately fell by 2.2% compared to October last year. The data were slightly worse than economists' forecasts. According to revised data, production also declined in September, but only by 0.1%, completely erasing the expectations of traders for restoration in the future. Production in the eurozone also declined in the second and third quarters of this year, and, most likely, the reduction will be observed in the fourth quarter. German inflation data did not put much pressure on the euro, as it was completely predicted by economists. According to the report, the final CPI of Germany in November this year decreased by 0.8% compared with October and grew by only 1.1% compared to the same period in 2018, which clearly does not reach the level of about 2.0% established by the European Central Bank. The data completely coincided with the forecasts of economists. As for Germany's consumer price index, harmonized by EU standards, it also decreased by 0.8% in November this year compared with October and grew by only 1.2% compared to last year, which fully coincided with the forecasts of economists. As for the technical picture of the EURUSD pair, the growth can continue only on condition of positive statements from the new president Christine Lagarde. A break of resistance at 1.1160 will provide risky assets with an upward movement to the highs of 1.1200 and 1260. If the pressure on the euro returns, intermediate support will be in the area of 1.1120, but larger levels are concentrated at the lower boundaries of the channel in the areas of 1.1070 and 1.1030. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Dec 2019 02:41 PM PST The US currency is constantly under the pressure of economic factors. This week, the US Federal Reserve meeting became an indicator of its condition. According to experts, it determined the further dynamics of the dollar. The result of the US central bank meeting was the preservation of the interest rate in the range of 1.50% –1.75%. Next year, the Fed intends to stop on the issue of rates. As for tightening monetary policy, these measures are possible no earlier than 2021. According to analysts, the current decision of the regulator led to a short-term decline in the greenback against world currencies. After the Fed meeting, the European currency has significantly risen in price. According to experts, since the beginning of this week the euro has been pleased with the markets with its positive dynamics. The single currency was supported by the publication of positive macroeconomic data on Wednesday, December 11. Recall, the index of economic expectations of investors ZEW in Germany soared to 10.7 points from the previous -2.1 points, although experts expected a zero indicator. Despite the prevalence of major sentiment, the market is far from positive. It is in suspense due to upcoming events, which include the ECB meeting and elections in the UK. Market participants were a bit confused by the recent speech by Fed Chairman Jerome Powell. He called the series of interest rate cuts recorded in 2019 a mid-cycle correction. Experts believe that this is a signal for the next rise in rates. According to analysts, after the stabilization of the situation, the Fed may begin to raise rates to target values. Many leading agencies gave negative forecasts in case of further escalation of the trade war in Washington and Beijing. Even if this conflict is resolved, next year US GDP growth will still slow down to 2.1%, experts emphasize. In a similar situation, the dollar will be under pressure, analysts said. A slight fall in the pound's rate supported the greenback on Wednesday, December 11. The British currency is currently growing actively, while the greenback's position is a bit shaken. The EUR/USD pair showed an upward movement yesterday, reaching the level of 1.1093. Subsequently, the trend intensified. The EUR/USD pair started on a positive note on Thursday, December 12, cruising in a high range of 1.1137–1.1138. The pair tried to gain a foothold at these levels, and managed to succeed for a long time. Subsequently, the EUR/USD pair slipped to 1.1128. The pair found it difficult to stay on the conquered peaks, and slightly retreated. Experts are certain that the upcoming ECB meeting will not pull down the EUR/USD pair and will not disappoint the market. They are counting on maintaining a balance between the greenback and the euro. According to analysts, the long-standing struggle for primacy among the world's leading currencies has tempered the dollar. Experts believe that the greenback has developed the ability to withstand negative influences precisely in this fight. The US currency has gained stability and strength, which is demonstrated to this day, confirming its right to leadership. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Fed decided to hold their horses. Will the ECB change the rules of the game? Posted: 12 Dec 2019 02:41 PM PST The EUR/USD pair soared to the highest levels since the beginning of November in the region of 1.1140 due to the results of the final US central bank meeting this year, which left the interest rate unchanged and announced plans not to raise it all year in 2020. After three consecutive interest rate cuts, the regulator seems to have decided to stop. Noting the strength of the US labor market, a steady increase in consumption and moderate economic growth in the country, the Federal Reserve made a unanimous decision for the first time since May and kept the cost of borrowing at 1.50% –1.75%. At the same time, the Fed's plans for the next year have significantly changed. If in September nine of the seventeen FOMC members were in favor of raising the rate, now there are only four. The vast majority (thirteen people) vote for the rate to remain unchanged throughout 2020. The central bank intends to return to toughening the policy in 2021: the majority - nine people - speak out for two or three rate hikes. At the same time, supporters of both a sharp tightening (one vote) and continuing soft politics (four people stand for an unchanged rate) remain in the minority. "Before raising the rate, I would first like to see a substantial and steady increase in inflation. This is my personal opinion," said Fed Chairman Jerome Powell. Given the stubborn reluctance of the personal consumption spending index to move to the Fed target of 2% and the regulator's fear that lowering inflation expectations will hinder actual inflation, we can conclude that the threshold for monetary tightening is much higher than for expansion, which is a bearish factor for the greenback. The USD index updated its monthly low of around 97 points at the December FOMC meeting. "The Fed has signaled that it has done its job and can leave: the adjustment within the cycle has taken place, and it is enough to keep inflation and economic growth within the framework of forecasts (1.9% and 2%, respectively)," said James Knightley, economist at ING. The derivatives market continues to expect more from the US central bank and lays in the quotes for another federal funds rate cut by 0.25% in September 2020. "The Fed remains hostage to the head of the White House, Donald Trump and his trade negotiations with China. If the deal breaks down and the United States introduces a new, most painful round of duties that will hit $155 billion in Chinese goods, both the markets and the economy will suffer, and the Fed will have to rush to help again, filling the fires with cheap money, " Knightley said. "If Trump has problems before the election, he will not hesitate to make Powell a scapegoat, blaming him for all the problems of the economy. And although Trump's attacks alone are unlikely to turn the Fed off its track, a general deterioration in market sentiment is quite capable of doing this," he added. In any case, the Fed has spoken, now it is the turn of the European Central Bank. Most experts do not expect a new change in the central bank's world outlook in the field of monetary policy from ECB President Christine Lagarde. Meanwhile, JP Morgan experts do not rule out a reduction in the deposit rate by 25 basis points and QE expansion from €20 billion to €40 billion per month in the foreseeable future. BofA Merrill Lynch experts, in turn, believe that the derivatives market may begin to build expectations for a deposit rate increase to zero after the first Lagarde press conference. Currently, the quotes contain the probability of a rate cut in March 2020. If Lagarde turns out to be a smaller dove than her predecessor Mario Draghi, then we can count on the continuation of the EUR/USD rally. However, the ECB has never welcomed the strengthening of the euro, so hints of a willingness to act if necessary are unlikely to disappear from the regulator's rhetoric somewhere. Today, along with the ECB meeting, parliamentary elections will be held in the United Kingdom. The direction of the pound will depend on the behavior of EUR/USD. The sharp rise in the pound in the event of a confident victory for the Conservatives may lend a helping hand to the bulls of EUR/USD, allowing them to push the pair above 1.1200. At the same time, a "hung" parliament could provoke the pound's collapse, which will pull down the euro to the bottom. The material has been provided by InstaForex Company - www.instaforex.com |

| December 12, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 12 Dec 2019 08:48 AM PST

Since October 2, the EURUSD pair has been trending-up until October 21 when the pair hit the price level of 1.1175. The price zone of (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 offering valid bearish positions few weeks ago. On the other hand, the price levels around 1.1000-1.0995 stood as significant DEMAND zone which has been offering adequate bullish SUPPORT for the pair so far. Thus, the EUR/USD pair remained trapped between the price levels of 1.1000 and 1.1085 (where a cluster of supply levels was located) until Yesterday. Earlier this week, considerable bullish recovery was manifested around 1.1040 allowing the current recent bullish breakout above 1.1110 to occur within the depicted newly-established bullish channel. Currently, the price level of 1.1110 stands as a recent demand level to be watched for bullish rejection and a possible BUY entry. However, on the other hand, bearish breakout below 1.1080 invalidates this bullish scenario. If so, Bearish projection target to be located around 1.1040 and 1.1010. The material has been provided by InstaForex Company - www.instaforex.com |

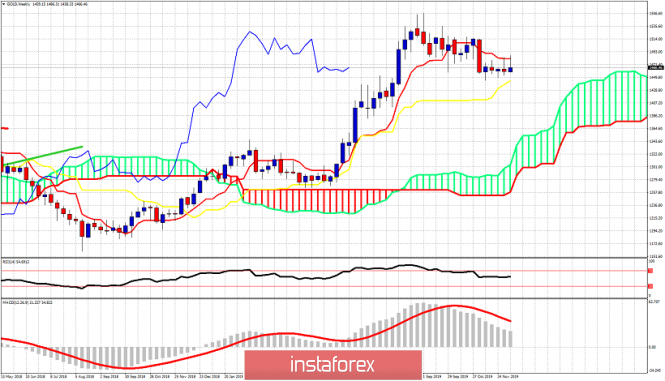

| Ichimoku cloud indicator short-term analysis of Gold for December 12, 2019 Posted: 12 Dec 2019 08:17 AM PST Gold price bounced towards the major resistance of $1,490-$1,500 today and got rejected once again. Price reached $1,486 and made a higher high relative to last week, but bulls were unable to hold it and price has pulled back $20 since that high.

|

| EURUSD reaches short-term target but gets rejected Posted: 12 Dec 2019 08:11 AM PST EURUSD has broken short-term resistance and as expected from our previous analysis it has reached very close to our 1.1160 target. However resistance is strong there and an initial rejection is being witnessed. If however bulls manage to end the week around 1.1160 or higher, this would be a bullish sign.

|

| Evening review for EURUSD for 12/12/2019 Posted: 12 Dec 2019 08:06 AM PST

The euro gained momentum last night after the Fed. Despite the Fed's decision to leave the rate unchanged at 1.625% - buyers went up the level of 1.1115. The next obstacle is 1.1180 (on the way up). On the ECB's decision to leave rates unchanged, the euro made a new attempt at growth, while uncertain. We can say that the speech of the new head of the ECB, Christine Lagarde, did not make a strong impression on the market. The market is waiting for data on the elections in Britain - late tonight. A conservative victory will help the euro and pound rise. We keep purchases of euros from 1.1035, purchases from kickbacks are possible. The material has been provided by InstaForex Company - www.instaforex.com |

| December 12, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 12 Dec 2019 07:52 AM PST

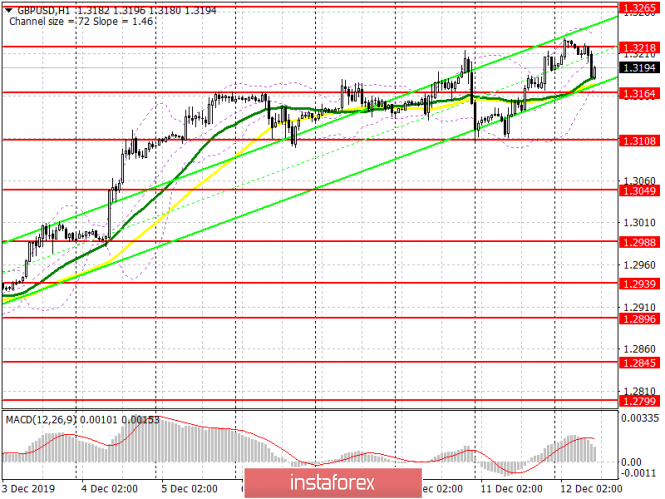

On October 21, the GBP/USD pair was demonstrating an ascending wedge reversal pattern while approaching the depicted SUPPLY-zone (1.2980-1.3000). For the following few days, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Thus, a high probability of bearish reversal existed around the mentioned price zone. Hence, a quick bearish movement was initiated towards 1.2780 (Key-Level) where bullish recovery was demonstrated on two consecutive visits. That's why, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.3000) until Wednesday when bullish breakout above 1.3000 was achieved. Short-term technical outlook remains bullish as long as consolidations are maintained above 1.3000 on the H4 chart. On the other hand, the pair was recently testing the upper limit of the newly-established depicted short-term bullish channel around 1.3165. Moreover, a triple-top pattern was being established around the same price level with neckline around 1.3100. However, this was followed by an exhaustion bullish spike towards 1.3225 which returned back towards 1.3144 quickly. That's why, high probability of bearish reversal exists around the current price levels. Bearish closure below 1.3100 (neckline) is needed to enhance further bearish decline towards 1.2980 where bullish recovery may be anticipated. Trade Recommendations: Risky traders can have a valid SELL entry either upon a bullish pullback towards 1.3185 or a bearish closure below 1.3100. T/P level to be located around 1.2980. On the other hand, conservative traders should wait for a bearish pullback towards 1.2980-1.3000 for a valid BUY signal with bullish target around 1.3120 and 1.3150. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 12.12.2019 - End of the upward correction ABC, watch for selling opportunities Posted: 12 Dec 2019 05:47 AM PST Bitcoin has been trading upside in last few hours at the price of $7.167. Anyway, I see that there is potential for end of the intraday upward correction and possible more downside towards the levels at $7.094 and $7.048.

Stochastic oscillator is showing overbought condition based on the 30M time-frame and fresh new bear cross, which is sign that sellers are present and that buying is risky. Resistance levels are seen at the price of $7.202 and $7.286 Support levels are set at the price of $7.094 and $7.048 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Dec 2019 05:29 AM PST USD/JPY has been trading sideways for days at the price of 108.60. Anyway, there is the symmetrical triangle pattern in creation, which is sign that very soon, we may expect the breakout and directional move.

To open long positions you will need: USD/JPY would need to breakout the 108.85 in order to confirm potential test of 109.18 and 109.40. To open short position: USD/JPY would need to breakout the support at 108.46 in order to confirm test of 107.90 Watch for the breakout to confirm further direction... The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 12.12.2019 - Both upward targets reached, potential for consolidation day Posted: 12 Dec 2019 05:13 AM PST Gold has been trading upwards, exactly what I expected yesterday. Gold reached both of my upward targets from yesterday at the price of $1.469 and $1.479. I do expect today consolidation day or potential downward correction towards support at $1.469

In case of the breakout of $1.479, there is potential test of $1.483 MACD oscillator is showing upside momentum and reading above the zero, which is sign that buyers are still in control. Stochastic oscillator is showing overbought condition and potential for downward correction. The material has been provided by InstaForex Company - www.instaforex.com |

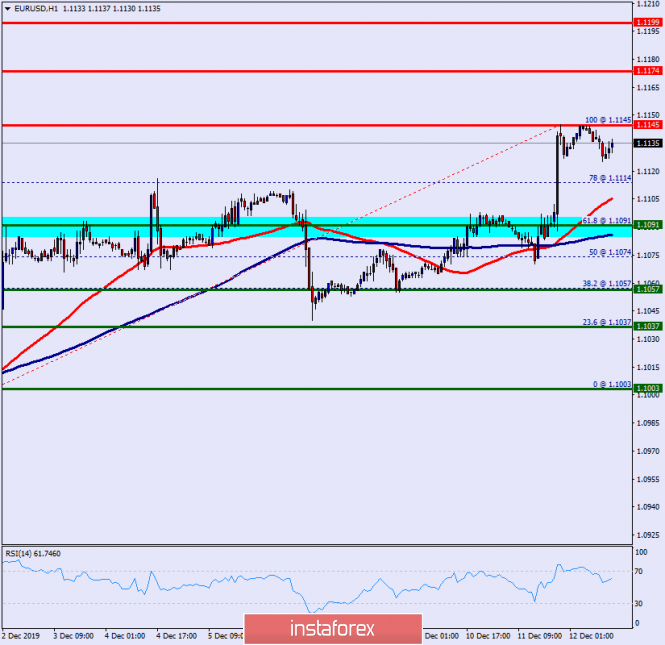

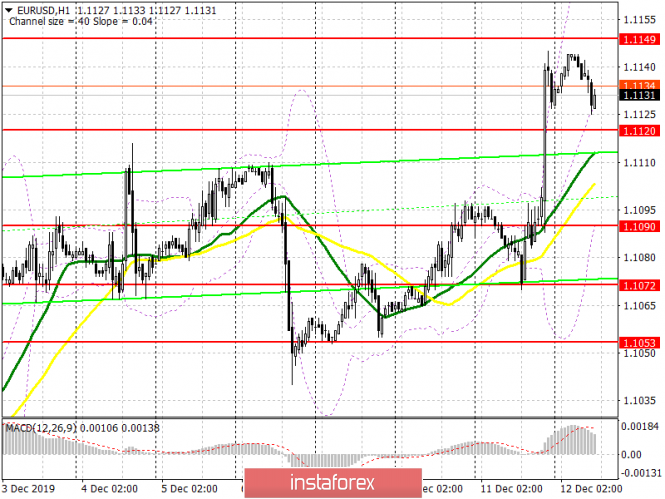

| Technical analysis of EUR/USD for December 12, 2019 Posted: 12 Dec 2019 05:04 AM PST Overview: On the one-hour chart, the EUR/USD pair continues moving in a bullish trend from the support levels of 1.1057 and 1.1091. Currently, the price is in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. As the price is still above the moving average (100), immediate support is seen at 1.1091, which coincides with a golden ratio (61.8% of Fibonacci). Consequently, the first support is set at the level of 1.1091. So, the market is likely to show signs of a bullish trend around the spot of 1.1091. In other words, buy orders are recommended above the golden ratio (1.1091) with the first target at the level of 1.1145. Furthermore, if the trend is able to breakout through the first resistance level of 1.1145. We should see the pair climbing towards the double top (1.1174) to test it. The major resistance will bet set at the point of 1.1199. It would also be wise to consider where to place a stop loss; this should be set below the second support of 1.1037. The material has been provided by InstaForex Company - www.instaforex.com |

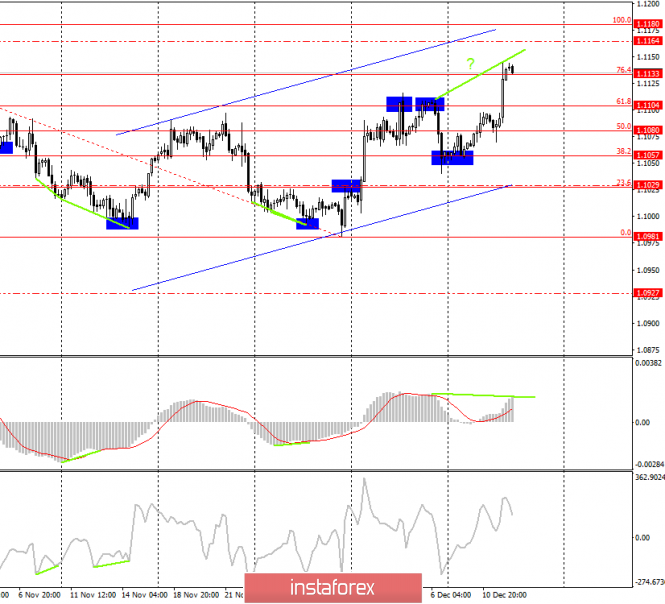

| Trading plan for EUR/USD for December 12, 2019 Posted: 12 Dec 2019 03:25 AM PST

Technical outlook: EUR/USD might have carved a higher low at 1.0981 earlier and seems to be progressing higher printing higher highs and higher lows. As highlighted here on the 4H chart view, the support zone is still around 10940/1.0981 levels and hence probabilities still remain for a drop there before the rally could resume. A safe trading strategy could be to again book partial profits on long positions taken earlier and wait for a drop towards the support zone, to buy again. Intermediary support is seen at 1.1040 levels and a break below that would confirm a further drop to 1.0980/40 levels respectively. On the flip side, a continued push above 1.1181 confirms that bulls are in total control and the price is heading towards 1.1500 and higher. Due to bearish divergences seen right now, it is not advisable to open fresh long positions around current price at 1.1128/30. Bottom line for EUR/USD remains buying on dips, until prices stay above 1.0879 levels. Trading plan: Remain long and buy on dips with stop at 1.0879, the target is 1.1500 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Dec 2019 03:12 AM PST To open long positions on GBPUSD, you need: Bulls have retreated from the market and are waiting for the results of the parliamentary elections in the UK. As noted in the morning review, the victory of the Conservative Party and the majority in parliament will lead to a new sharp wave of growth of GBP/USD, and a break above the maximum of 1.3220 will only drag new major players into the market, which will allow reaching the levels of 1.3265 and 1.3316, as well as test the resistance of 1.3375, where I recommend taking the profits. In the scenario of the absence of a majority of the conservatives, it is best to return to long positions after the correction in the area of large support levels of 1.3049 and 1.2988. It is best to open long positions from the lower border of the current side channel around 1.3108 if a false breakout is formed. To open short positions on GBPUSD, you need: You can count on short positions in the pound only on the condition that the next UK elections again will not allow the formation of a majority in the parliament of any party, which will leave the current impasse with Brexit unchanged. If Labor won, then the pressure on the pound will increase. A break below 1.3108 will lead to a larger downward movement with a return to the lows of 1.3049 and 1.2988, where I recommend taking the profits. However, the further targets of the bears will be the levels of 1.2939 and 1.2896. In the scenario of the pound growth, it is best to return to short positions only after updating the next annual highs around 1.3265 and 1.3316, as well as a rebound from the resistance level of 1.3375. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 daily averages, the breakout of which will increase the pressure on the British pound. Bollinger Bands Breaking the lower border of the indicator around 1.3164 will lead to a larger sell-off of GBP/USD.

Description of indicators

|

| Posted: 12 Dec 2019 03:02 AM PST To open long positions on EURUSD, you need: In the first half of the day, weak data on the reduction of industrial production in the eurozone put pressure on the European currency, but the bears did not manage to go beyond the established morning range. Production fell by 0.5% in October, after falling by 0.1% in September this year. At the moment, buyers will wait for the press conference of the head of the ECB, Christine Lagarde, as interest rates will remain unchanged, which will not lead to market changes. Protection of the support level of 1.1120 will be the main goal of the bulls, and the formation of a false breakdown there in the afternoon will be a good signal to open long positions in the expectation of a return and a break above the resistance of 1.1149, which will lead to the updating of new highs in the areas of 1.1174 and 1.1226, where I recommend fixing the profits. In the case of a decline below the level of 1.1120, it is best to look at purchases after updating the lows of 1.1090 and 1.1072. To open short positions on EURUSD, you need: Sellers will wait for the assessment of further economic prospects from the European Central Bank and count on the breakthrough of the support of 1.1120 since it is from this level that the further growth of EUR/USD depends. If the bears manage to gain a foothold below this range, the pressure on the euro will increase, which will update the lows of 1.1090 and 1.1072, where I recommend taking the profits. If the ECB rate remains unchanged, it is possible to continue the growth of EUR/USD above the resistance of 1.1149. In this scenario, I recommend opening short positions immediately on the rebound from the highs of 1.1180 and 1.1226. Indicator signals: Moving Averages Trading is above the 30 and 50 moving averages, which indicates the continued growth of the euro. Bollinger Bands If the euro falls after the ECB decision, the lower border of the indicator around 1.1090 will provide support, while the growth will be limited to the upper level of the indicator in the area of 1.1160.

Description of indicators

|

| EUR/USD. December 12. Powell is pleased with the condition of the US economy and monetary policy Posted: 12 Dec 2019 02:12 AM PST EUR/USD - 4H.

On December 11, the EUR/USD pair performed a reversal in favor of the European currency after rebounding from the correction level of 38.2% (1.1057) and resumed the growth process within the upward trend area. As a result, the closing above the Fibo level of 76.4% (1.1133) was performed, which allows traders to count on the continuation of growth in the direction of the next correction level of 100.0% (1.1180). At the same time, a bearish divergence is brewing in the MACD indicator, which also allows us to expect a reversal in favor of the US dollar and some drop in the quotes. Until the closing of the euro-dollar pair under the Fibo level of 76.4%, the upward mood among traders is likely to remain. The key events of the day, of course, were the meeting of the Fed and the speech of Jerome Powell. However, it is safe to say that the traders were waiting for disappointment. The president of the Fed didn't tell the markets anything supernatural. Jerome Powell's usual rhetoric on duty, in which he continued to pay attention to inflation, the labor market, unemployment, and the threat of trade conflicts, which could further slow down the global economy. Of the really interesting messages from Powell, we can only highlight the words about inflation, which the Fed expects "about 2%" in the next few years. Thus, although yesterday the US inflation report for November showed 2.1% y/y, the Fed still does not believe that such inflation levels will be able to keep in the long term. The Fed also believes that in the long term, GDP growth will slow. We are talking about no more than 0.1% per year, but it is a decline. Most likely, this is due to the trade conflicts in which Donald Trump got involved in America. And if so, the Central Bank does not expect them to end any time soon. Jerome Powell also made it clear to traders that there will be no new cuts in key rates in the coming months. However, the Fed is also completely not looking in the direction of raising rates. In principle, this is the kind of rhetoric that traders expected from Powell. It is unlikely that anyone expected that after three consecutive rate cuts, the Fed would suddenly announce that it was preparing to raise it. Powell has called those three rates cuts corrective. Now, accordingly, the rate correction has been completed and a period of stability has come. Also, Jerome Powell said that "now is not the situation to buy short-term coupon securities." Let me remind you that a few months ago, some Federal Reserve banks began to buy short-term securities, which gave rise to a lot of speculation about the resumption of the Fed's QE program. However, this stage of buying securities had a short-term character, and now it was confirmed by Powell himself. Today, the next meeting of the European Central Bank and summing up its results. I believe that the ECB will also leave the rate unchanged, so the most interesting thing will happen at the press conference with Christine Lagarde. The probability that her speech will be "dovish" is very high. In the coming months, the ECB may go for a new cut in key rates. Forecast for EUR/USD and trading recommendations: On December 11, traders will closely monitor economic data from the European Union. Depending on the rhetoric of Christine Lagarde, as well as the strength of industrial production in the EU, the euro will continue to grow today or begin to fall. Closing below the Fibo level of 76.4% will work in favor of the US currency and the resumption of the fall and may coincide with the nature of the information background today. The Fibo grid is based on the extremes of October 21, 2019, and November 29, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment