Forex analysis review |

- Overview of the GBP/USD pair. February 11. Today could be a black day for the pound

- Overview of the EUR/USD pair. February 11. Industrial production slows down eurozone economy. Powell's speech can be neutral

- Comprehensive analysis of movement options for #USDX vs EUR/USD vs GBP/USD vs USD/JPY (DAILY) on February 10

- Comprehensive analysis of movement options for AUD/USD vs USD/CAD vs NZD/USD vs #USDX (DAILY) on February 10

- Analysis and forecast of GBP/USD on February 10, 2020

- GBP/USD: under pressure from Scottish question and in anticipation of data on GDP growth

- GBP/USD. February 10. Results of the day. Pound slightly grew ahead of a significant day. New collapse could follow tomorrow

- EUR/USD. February 10. Results of the day. Fed fears US economy slows down due to coronavirus

- Evening review 02/10/2020 EURUSD. Virus - or US economy?

- Dollar still on horseback, while euro and pound may continue to fall

- Principle: bitcoin rose above $10,000 and fell again

- GBPUSD in bearish trend is expected to see below 1.29 again.

- Technical analysis of USDJPY for February 10, 2020.

- Ichimoku cloud indicator analysis of EURUSD

- Short-term Ichimoku cloud indicator analysis of Gold

- EUR/USD. February 10. Inflation in Switzerland threatens to turn into deflation

- GBP/USD. February 10. The situation in Brexit and negotiations with the European Union continues to dominate the pound

- February 10, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- February 10, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC analysis for 02.10.2020 - Strong liquidation at $10.000, watch for bearish continuation

- Gold 02.10.2020 - Median line reached, resistance is found and potential downside is in the play

- EUR/USD for February 10,2020 - Falling wedge in the backgrournd and lack of selling power, watch for rise on the EUR

- Trading recommendations for EURUSD currency pair on February 10

- GBP/USD Technical Analysis / Hot Scenario For 10.02.2020

- EUR/USD Bearish Movement May Not Be Over Soon. Trading Scenario For 10.02.2020

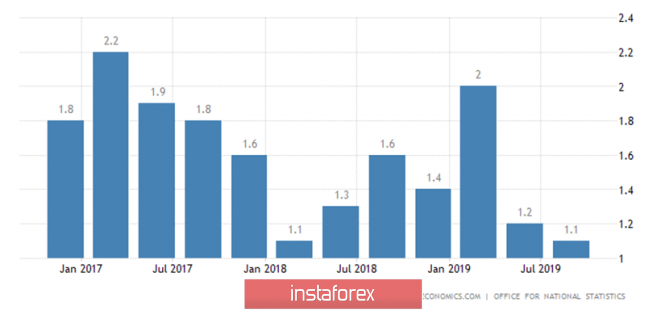

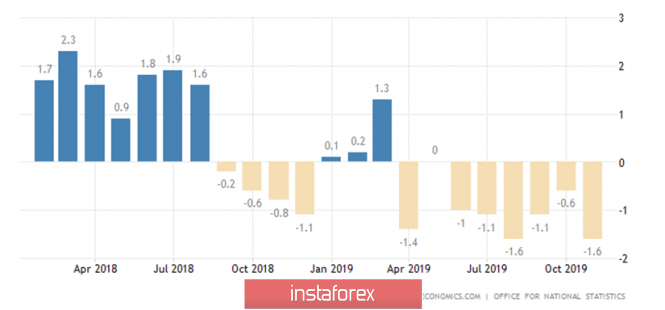

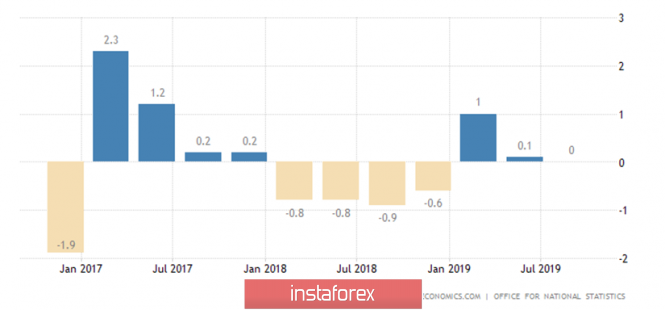

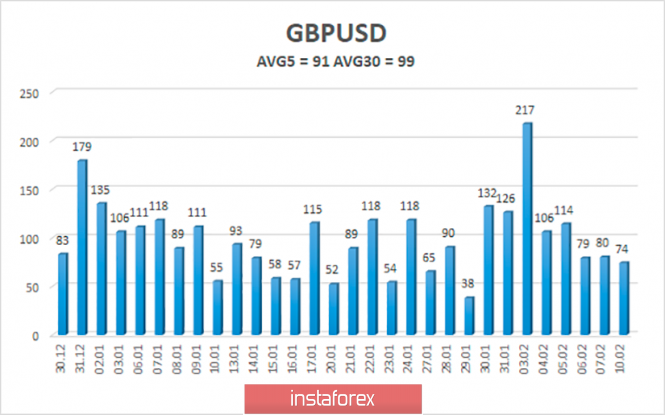

| Overview of the GBP/USD pair. February 11. Today could be a black day for the pound Posted: 10 Feb 2020 07:39 PM PST 4-hour timeframe Technical details: Higher linear regression channel: direction - up. Lower linear regression channel: downward direction. Moving average (20; smoothed) - down. CCI: -79.5400 The GBP/USD currency pair continues to adjust on February 11. After the pair worked the Murray level "3/8" - 1.2878, there was a rebound, which provoked the beginning of the correction. Also there weren't any important publications or speeches by top officials in the United Kingdom and the United States on the first trading day of the week. Thus, traders were deprived of fundamental recharge on February 10. Therefore, Monday was, in principle, a good option for a correction, although we expected that the downward movement will continue. However, the Heiken Ashi indicator turned up and signaled a temporary break in the downward movement. It should also be noted that on Tuesday, that is, today, information from the UK that is of a very important degree of significance will come from the UK. Therefore, before such an important block of macroeconomic data, traders recorded part of the profit on short positions previously opened. Now we turn directly to macroeconomic statistics. The most significant indicator, of course, will be the indicator of GDP. However, you should immediately make a reservation that tomorrow there will be at least four variations of this indicator, moreover, with different values. For example, GDP for December will be published, that is, in monthly terms with a forecast of +0.2%. An estimate of GDP growth rates from NIESR for January will also be published with a forecast of +0.2%. Preliminary data on Gross Domestic Product for the fourth quarter in annual and quarterly terms with forecasts of +0.8% and +0.0% from the National Statistics Office will be published. We believe that it is the last two indicators that are the most significant. Take a look at the chart. Over the past three years, UK GDP has shown even more or less strong GDP growth. That is, each quarter there was an increase in comparison with the same quarter of the previous year by no less than 1.1%. 1.1% is, of course, not much, however. GDP forecasts for the fourth quarter of 2019 indicate that growth rates may decline to 0.8% y/y. That is, for the first time in the last three years (and in fact for the first time since 2010), the growth rate will be less than 1% y/y. This is what we have repeatedly said when we covered the problem of a slow down in Great Britain's economy. The economy continues to lose money, problems associated with Brexit and the uncertainty surrounding the trade deal with the European Union continue to negatively affect the business climate and the desire of entrepreneurs to invest. Moreover, certain companies are leaving the UK, some are cutting production on its territory, some are moving their financial centers outside of Great Britain. Of course, all this negatively affects the economy. The next indicator is industrial production. Here things are even worse than with GDP. In annual terms, industrial production has been declining for a year and a half almost every month. Tomorrow it is expected that this indicator will lose its regular 0.8% in annual terms, and will add 0.3% in monthly terms. It is clear that even if the annual indicator is slightly better than expected, it is still unlikely to get out of the negative zone. Thus, both main indicators of tomorrow should significantly exceed forecast values in order to trigger purchases of the British pound. We would also like to draw the attention of traders to the indicator of the volume of commercial investments, which, although not as important as the first two indicators, still reflects the essence of what is happening. Judging by the data for the last 12 months, investment volumes are also more often declining than growing. For tomorrow, the forecast is -1.3% in the fourth quarter on an annualized basis. And what do we have in the end? The three most significant indicators for the UK economy over the past year and a half have only been doing so, which are declining. For tomorrow, all three indicators have negative forecasts. What growth of the British pound in the long run can be discussed with such macroeconomic statistics? We are still wondering why the Bank of England didn't soften monetary policy at the last meeting and where did it see "economic recovery after the December elections"? We notice only an even greater reduction in key indicators. And again, it is worth noting that all this happens before the official breakdown of all ties between London and Brussels, which is scheduled for December 31, 2020. That is, in fact, Brexit has not even begun. Now only preparations are underway for him. From a technical point of view, all indicators show a downward movement, except for the higher linear regression channel. Thus, the overall trading strategy remains the same - downward trading, especially since there are not even any corrections now. The average volatility of the pound/dollar pair has dropped to 91 points over the past five days, and the volatility illustration clearly shows that in the last 6 days it has been reduced. According to the current level of volatility, the working channel on February 11 will be limited by the levels of 1.2821 and 1.3003. The resumption of the downward movement would be very logical on Tuesday, given the fundamental background. A turn of the Heiken Ashi indicator down will indicate the completion of a round of corrective movement. Nearest support levels: S1 - 1.2878 S2 - 1.2817 S3 - 1.2756 The nearest resistance levels: R1 - 1.2939 R2 - 1,3000 R3 - 1.3062 Trading recommendations: GBP/USD is adjusted. Thus, traders are now advised to wait until the correction is completed and resume selling the pound with goals of 1.2878 and 1.2821. It is recommended to consider purchases of the British currency after the price is consolidated above the moving average line with the first objectives of 1.3062 and 1.3123. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of illustrations: The highest linear regression channel is the blue unidirectional lines. The smallest linear channel is the purple unidirectional lines. CCI - blue line in the indicator regression window. Moving average (20; smoothed) - a blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

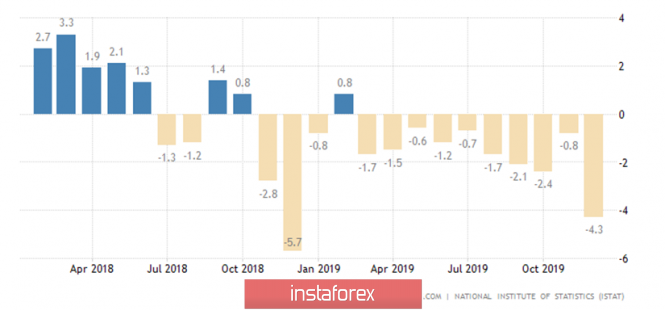

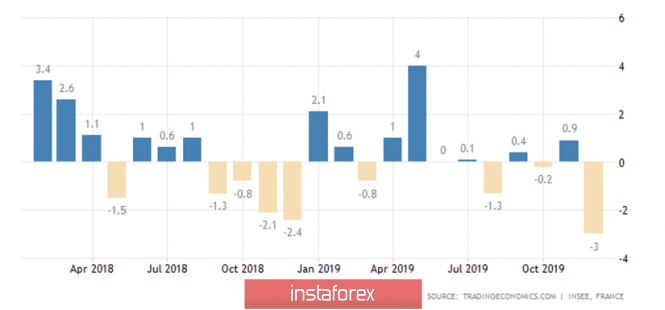

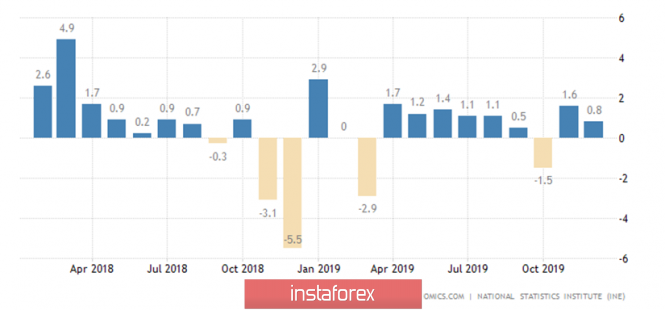

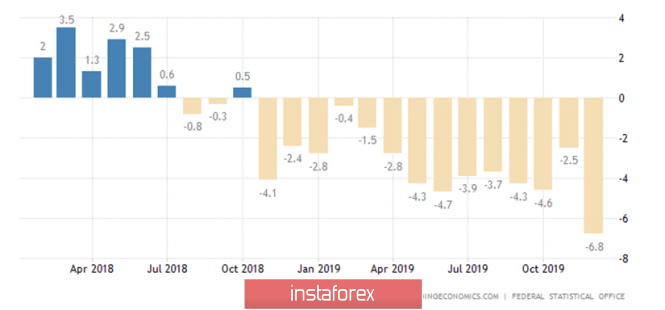

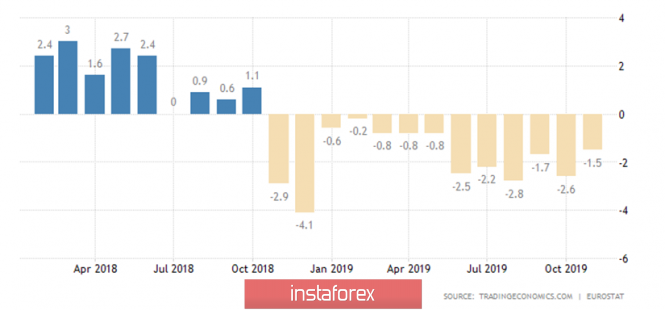

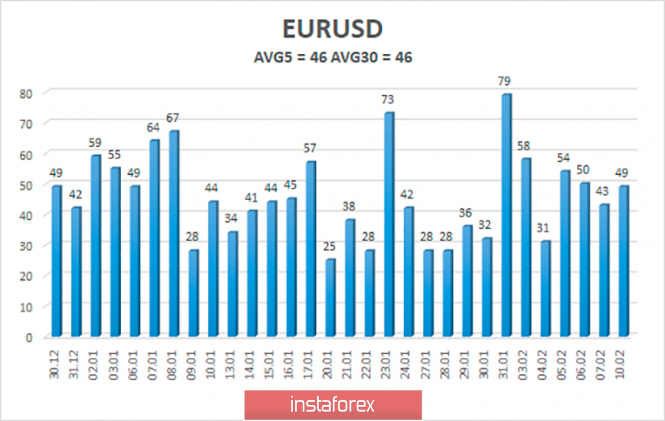

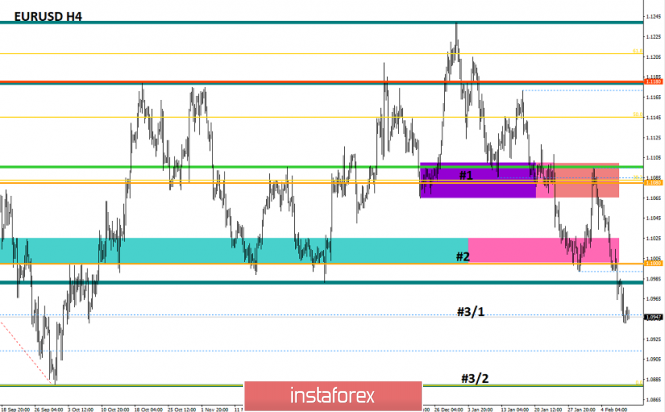

| Posted: 10 Feb 2020 07:33 PM PST 4-hour timeframe Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: downward direction. Moving average (20; smoothed) - down. CCI: -148.5069 The EUR/USD currency pair did not start a highly anticipated upward correction on Friday or Monday. Instead, it continues to retreat for the seventh day in a row and came close to two-year lows near the level of 1.0879 yesterday. Since the fall in this price area was rapid and recoilless, it is most likely that these lows will be updated the other day. However, now we would like to note the groundlessness of the euro's fall on Monday, February 10. There was no important news that day. No macroeconomic publications or speeches by top officials of the United States or the European Union. Why, instead of a very logical correction, did the fall continue? Yes, we have repeatedly said that the fundamental background remains entirely on the side of the US dollar. But the euro is "now empty, then thick." Either the currency pair stomps on the spot when there is every reason for the trend movement, then it tumbles down when more calm trading can be expected. In any case, despite some strangeness of the current downward movement, from a fundamental and macroeconomic point of view, it is fully justified. The only macroeconomic report of the past day was industrial production in Italy. We believe that this is far from the most significant indicator, however, let us examine in more detail the indicators of industrial production in other EU countries. The graph clearly shows the state of industrial production in Italy over the past two years. Eight out of 24 months showed a decrease compared to the same period last year. Moreover, it should be understood that the current -4.3% y/y refers to the period of the previous year, in which a decrease of 0.8% y/y was also recorded. That is, a decrease of 0.8% was recorded in December 2018 and 2019 - a decrease of another 4.3%. Accordingly, the decline in industrial production is now no longer relative, but absolute. Let's look at the pictures in other EU countries. France. The situation is a little better; there is no monthly income reduction as certain as in Italy. However, there are few reasons for joy. The values of the indicator over the past two years signal stagnation, that is, the absence of a clear increase. Spain. The situation is a little better than in France. In the last year, almost all months closed with minimal, but still growth. Although, a fall of 5.5% was suddenly recorded in November 2018. In the case of Germany, everything is not just bad, but is actually a failure! The rate of decline in industrial production is huge, the last month with a value of -6.8% is evidence of this. We can say with confidence that it is precisely the German indicator that pulls down the pan-European indicator of industrial production to the greatest extent. The indicator of industrial production throughout the eurozone. Everything is in the red in the last thirteen months. Is it worth it to once again make a correlation between industrial production and GDP, the main indicator of the state of any economy? GDP in the eurozone has slowed to 1.0% y/y in recent months, while it remains at a very decent level of + 2.1% in the United States. Maybe this is the reason for the continued fall of the European currency? No important macroeconomic publications are planned in the European Union on the second trading day of the week. Traders will have to focus on the speech of Fed Chairman Jerome Powell in Congress, the essence of which, by and large, is already known and understood. But now what to expect from the euro is very difficult to say. Given the groundlessness of the new fall of the euro on Monday, this movement may continue on Tuesday and Wednesday. Very much like an uncontrolled collapse. Thus, the overall trading strategy for the euro/dollar pair remains the same - selling before the appearance of signals for correction. The average volatility of the euro/dollar currency pair again fell slightly and is now 46 points per day. Despite the decrease in volatility, the downward movement continues completely without corrections. Thus, on Tuesday we expect movement between the boundaries of the volatility band of 1.0863 - 1.0955. We are still expecting a correction, but earlier we did not recommend shortening shorts before the Heiken Ashi indicator reversed upwards. Nearest support levels: S1 - 1,0864 S2 - 1,0803 S3 - 1.0742 The nearest resistance levels: R1 - 1,0986 R2 - 1.1047 R3 - 1,1108 Trading recommendations: The euro/dollar continues to move down. Thus, selling the euro while aiming for 1.0864 and 1.0803, until the Heiken Ashi indicator is up, are still relevant. It is recommended to return to buying the EUR/USD pair no earlier than the bulls overcoming the moving average line, which will change the current trend to an upward one, with the first goals of 1.1047 and 1.1108. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of illustrations: The highest linear regression channel is the blue unidirectional lines. The smallest linear regression channel is the purple unidirectional lines. CCI - blue line in the indicator window. Moving average (20; smoothed) - a blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

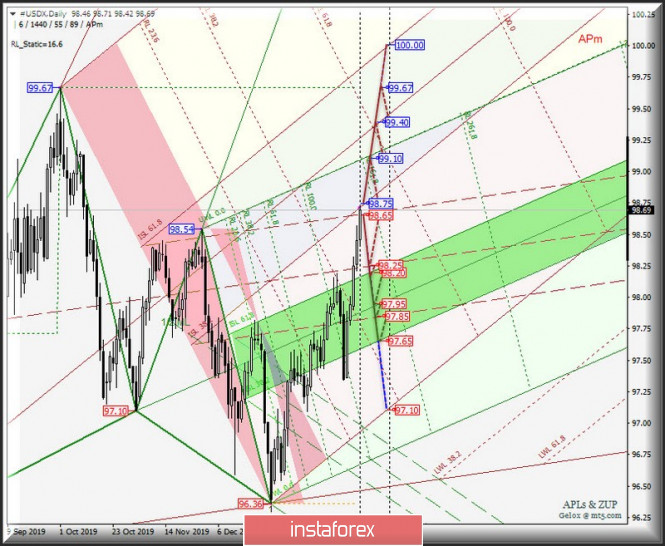

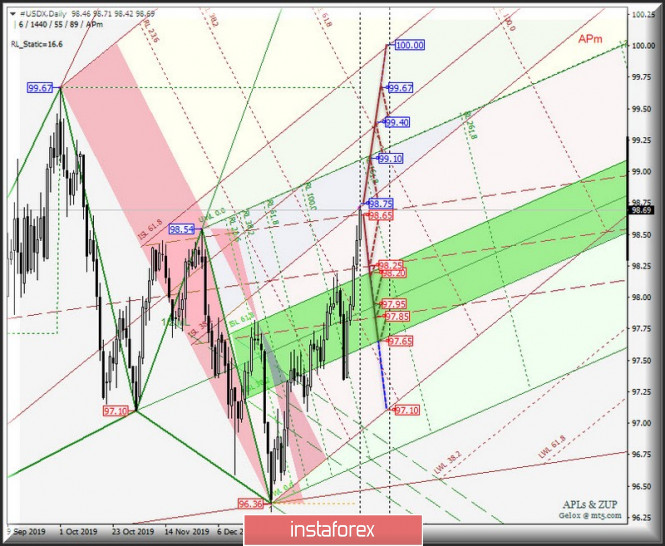

| Posted: 10 Feb 2020 03:29 PM PST Here's a variation of movement of the main currency instruments - #USDX, EUR / USD, GBP / USD and USD / JPY - DAILY in a comprehensive form from February 10, 2020 Minor (daily time frame) ____________________ US dollar index The US dollar index #USDX will determine the development of its movement from February 10, 2020, depending on the breakdown direction of a fairly narrow range : - resistance level of 98.75 - lower boundary of the ISL38.2 equilibrium zone of the Minor operational scale forks; - support level of 98.65 - the upper boundary of the 1/2 Median Line Minor channel. The breakdown of ISL38.2 Minor - resistance level of 98.75 - will make the development of #USDX movement in the equilibrium zone (98.75 - 99.40 - 100.00) of the Minor operational scale forks relevant. The breakdown of support level 98.65 - the development of the dollar index movement will continue within the 1/2 Median Line channel (98.65 - 98.25 - 97.85)of the Minor operational scale forks and the equilibrium zone (98.20 - 97.95 - 97.65) of the Minuette operational scale forks. The markup of #USDX movement options from February 10, 2020 is shown on the animated chart. ____________________ Euro vs US dollar The development of the single European currency EUR/USD from February 10, 2020 will be determined by the development and direction of the breakdown of the channel boundaries 1/2 Median Line (1.0900 - 1.0950 - 1.1000) of the Minor operational scale forks. We look at the animated chart for the details. The breakdown of the support level of 1.0900 on the lower boundary of the 1/2 Median Line Minor channel and the update of minimum 1.0879 will confirm the continuation of the downward movement of the single European currency to the warning line LWL38.2 (1.0755) of the Minor operational scale forks. On the other hand, in case of breakdown of the resistance level of 1.1000 (upper boundary of the 1/2 Median Line Minor channel), the development of the EUR / USD movement will continue in the equilibrium zone (1.1000 - 1.1035 - 1.1070) of the Minuette operational scale forks with the prospect of reaching the boundaries of the 1/2 Median Line Minuette channel (1.1130 - 1.1155 - 1.1188). The details of the EUR / USD movement options from February 10, 2020 are shown on the animated chart. ____________________ Great Britain pound vs US dollar The development of Her Majesty's GBP/USD currency movement from February 10, 2020 will continue depending on the breakdown direction of the range :

In case of breakdown of the lower boundary of the 1/2 Median Line channel (1.2870) of the Minor operational scale forks, the downward movement of Her Majesty's currency can continue to 1/2 of the Median Line Minuette (1.2790), and in case of breakdown it will become possible to reach GBP / USD boundaries of the equilibrium zone (1.2645 - 1.2420 - 1.2200) of the Minuette operational scale forks. On the contrary, in case of breakdown of the upper boundary of the 1/2 Median Line Minuette channel (1.2965), the development of GBP / USD movement in the 1/2 Median Line channel (1.2870 - 1.3150 - 1.3435) of the Minor operational scale forks will be confirmed. The details of the GBP / USD movement options from February 10, 2020 are shown on the animated chart. ____________________ US dollar vs Japanese yen The development of the currency movement of the "country of the rising sun" USD / JPY and from February 10, 2020 will be determined by the development and the direction of the breakdown of the range :

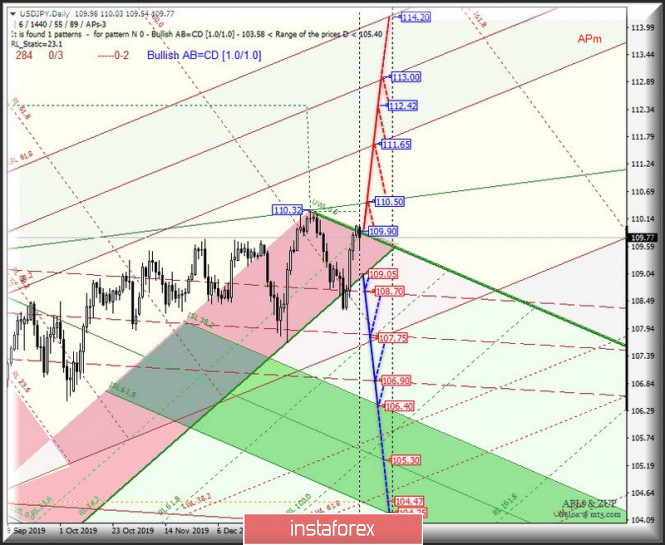

The breakdown of the initial SSL Minuette line - resistance level of 109.90 - will lead to the continuation of the development of the upward movement of USD / JPY to the control line UTL (110.50) of the Minuette operational scale forks with the prospect of reaching the boundaries of the equilibrium zone (111.65 - 113.00 - 114.20) of the Minor operational scale forks. Successive breakdown of support levels : - 108.50 - reaction line RL38.2 Minute; - 109.55 - the upper boundary of the 1/2 Median Line Minor channel; will make it possible for the currency of the "land of the rising sun" to continue to develop in the 1/2 Median Line channel (108.70 - 107.75 - 106.90) of the Minor operational scale forks with the prospect of reaching the upper boundary of ISL38.2 (106.40) equilibrium zone fof the Minuette operational scale forks. We look at the details of the USD / JPY movement options from February 10, 2020 on the animated chart. ____________________ The review was compiled without taking into account the news background. Thus, the opening trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power factors correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

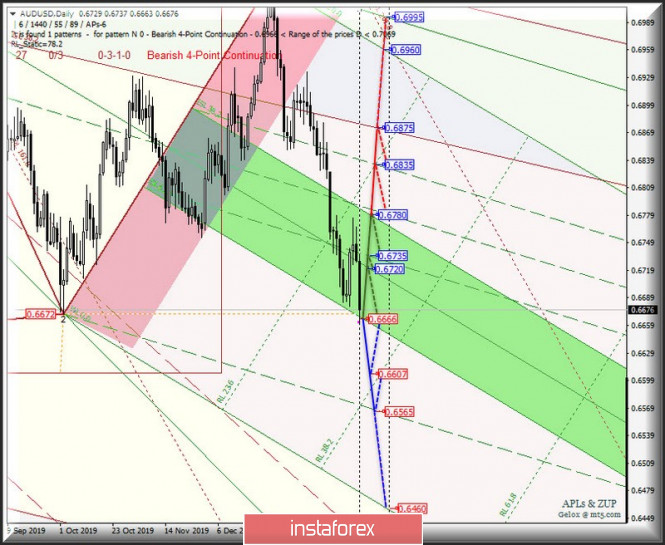

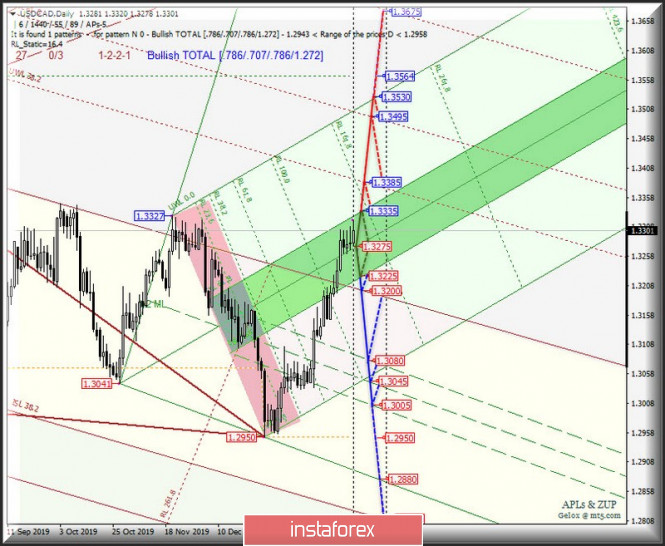

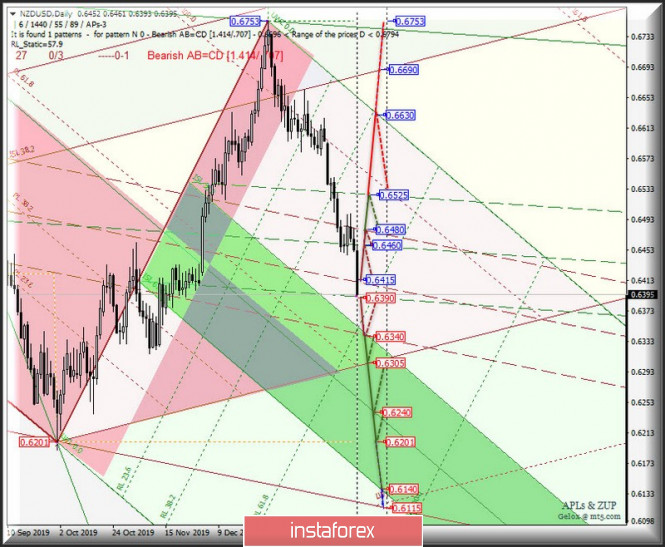

| Posted: 10 Feb 2020 03:29 PM PST US dollar index The dollar index #USDX will determine the development of its movement from February 10, 2020, depending on the breakdown direction of a quite narrow range: resistance level of 98.75 - lower boundary of the ISL38.2 equilibrium zone of the Minor operational scale forks; - resistance level of 98.75; - support level of 98.65 - the upper boundary of the 1/2 Median Line Minor channel. The breakdown of ISL38.2 Minor - resistance level of 98.75 - will make the development of #USDX movement in the equilibrium zone (98.75 - 99.40 - 100.00)of the Minor operational scale forks relevant. On the other hand, the breakdown of the support level of 98.65 - the development of the dollar index movement will continue within the 1/2 Median Line channel (98.65 - 98.25 - 97.85) of the Minor operational scale forks and the equilibrium zone (98.20 - 97.95 - 97.65) of the Minuette operational scale forks. The markup of #USDX movement options from February 10, 2020 is shown on the animated chart. ____________________ Australian dollar vs US dollar The movement of the Australian dollar AUD/USD from February 10, 2020 will be determined by developing the boundaries of the equilibrium zone (0.6666 - 0.6720 - 0.6780) of the Minuette operational scale forks. We look at the animated chart for the details. The breakdown of the lower boundary of the JSL61.8 equilibrium zone of the Minuette operational scale forks - support level of 0.6666 - will lead to the continuation of the downward movement of the Australian dollar towards the targets: - local minimum 0.6607 ; -ultimate Shiff Line Minuette (0.6565). On the contrary, the breakdown of the resistance level of 0.6780 at the upper boundary of the ISL38.2 equilibrium zone of the Minuette operational scale forks - an option for the development of the upward movement of AUD / USD to the targets: - upper boundary of the 1/2 Median Line Minuette channel; (0.6835); - the lower boundary of ISL38.2 (0.6875) equilibrium zone of the Minor operational scale forks. We look at the layout of the AUD / USD movement options from February 10, 2020 on the animated chart. ____________________ US dollar vs Canadian dollar The development of the movement of the Canadian dollar USD / CAD from February 10, 2020 will also depend on the development and direction of the breakdown of the boundaries of the equilibrium zone (1.3225 - 1.3275 - 1.3335) of the Minuette operational scale forks. The markup of movement inside this equilibrium zone is presented on an animated chart. In case of breakdown of the upper boundary of ISL61.8 (resistance level of 1.3335) of the equilibrium zone of the Minuette operational scale forks, it will be possible to continue the upward movement of USD / CAD to the warning UWL38.2 (1.3385) and UWL62.8 (1.3495) to the lines of the Minor operational scale forks with the prospect of reaching the final line FSL Minuette (1.3530). Meanwhile, in case of successive breakdown of the lower boundary of ISL38.2 (support level of 1.3225) of the equilibrium zone of the Minuette operational scale forks and the initial SSL line (1.3200) of the Minor operational scale forks, the downward movement of the Canadian dollar can continue to the boundaries of 1/2 Median Line Minuette channel (1.3080 - 1.3045 - 1.3005). We look at the markup of the USD / CAD movement options from February 10, 2020 on the animated chart. ____________________ New Zealand dollar vs US dollar The development and the breakdown direction of the range :

The breakdown of the lower boundary of the 1/2 Median Line Minuette channel - support level of 0.6390 - will lead to the continuation of the development of the downward movement of the New Zealand dollar to the boundaries of the equilibrium zone (0.6340 - 0.6240 - 0.6140) of the Minuette operational scale forks. Alternatively, the breakdown of 1/2 Median Line Minor - resistance level of 0.6415 - it will be possible to develop an upward movement of NZD / USD to the goals: - 1/2 Median Line Minuette (0.6460); - the upper boundary of the 1/2 Median Line Minor channel (0.6480); - the upper boundary of the 1/2 Median Line Minuette channel (0.6525); with the prospect of reaching the initial SSL line (0.6630) of the Minuette operational scale forks. We look at the layout of the NZD / USD movement options from February 10, 2020 on the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6%; Yen - 13.6%; Pound Sterling - 11.9%; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

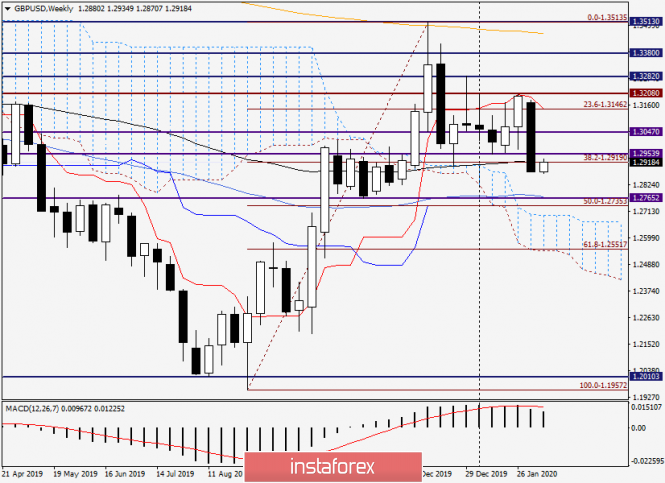

| Analysis and forecast of GBP/USD on February 10, 2020 Posted: 10 Feb 2020 02:54 PM PST Another important week for sterling Good day to all! As many people know (or guessed), last week the pound became the undisputed leader of the fall against the US dollar. The GBP/USD currency pair's loss amounted to 2.38%, but could have been even greater, so the pound was lucky to some extent. I believe that in the situation with the pound, recent statistics have had minimal impact on price dynamics. Of course, besides very important and significant, such as Nonfarm Payrolls and decisions of the Federal Reserve and Bank of England. Much more influence on the sterling had and will continue to do this news and events related to Brexit. Let me remind you that Great Britain officially left the European Union on January 31. However, some issues in trade relations remained unresolved, and Prime Minister Boris Johnson is trying to solve them, of course, in favor of the United Kingdom. According to market participants, the rigid Brexit and the equally tough position of Boris Johnson, which he took in negotiations with the EU on trade, and led to such a strong drop in the pound. Moreover, this is only talks and the final result is not yet known. Nevertheless, the pound was sold just in case. Weekly A huge black candle just shows the full extent of the pressure that the British currency was under during the trade on February 3-7. As a result of the fall, the support for 1.2954 and the 89 exponential moving average are broken. Usually there is a correction on Mondays, which we are observing today. If it continues, the quotation may rise to the area of 1.2950-1.2975. Returning above the psychological mark of 1.3000 and closing the current week above this significant level will make you think about changing moods in favor of the sterling. However, the most likely scenario, in my opinion, is the continuation of the downward trend after the completion of the corrective retreat that occurs at a given point in time. If this happens, the pair's road will lie in the strong technical area 1.2775-1.2750. Here are 50 simple moving averages and several significant levels for market participants. Daily 89 EMA has also been broken on the daily chart of the pair, but at the moment there has been a pullback to this move, and a lot will depend on the closing price of today's trading. If the session ends above 89 exponentials, and even more so above 1.2954, we will look at the future prospects of the GBP/USD pair a little differently, since in this case the bearish sentiment will somewhat weaken. In this case, the rise in the strong technical zone 1.3040-1.3060, where the Tenkan and Kijun lines of the Ichimoku indicator are also located, is not excluded. This appears to be a good area to open short positions on the pound/dollar pair. However, there is still a lot of incomprehensibility, it is better to wait a couple of days. Significant events from the US were written in a review on EUR/USD, here I will highlight important data from the UK. Tomorrow the markets are waiting for what changes have occurred in the volume of commercial investments, industrial production and GDP data. That's, in fact, everything about macroeconomic statistics from the UK. I believe that on Wednesday a couple of things may become clear, then look for interesting trading ideas and points for opening deals on the GBP/USD pair. Good luck The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: under pressure from Scottish question and in anticipation of data on GDP growth Posted: 10 Feb 2020 02:53 PM PST Bears of the pound-dollar pair could not keep the price in the area of two-month lows, that is, within the 28th figure. Today, buyers tried to take revenge, but corrective growth was rather uncertain. The pair got stuck around 1.2930, drifting in anticipation of tomorrow's data. Almost all fundamental factors now play against the British currency (as well as technical factors, however), so the current price rebound is temporary. The "civilized" Brexit did not bring the long-awaited relief to GBP/USD traders. On the contrary, uncertainty only increased, and negotiations between London and Brussels are conducted in the language of ultimatums. Johnson threatens to end the dialogue on the conclusion of a trade deal, the Europeans, in turn, promised Madrid to support Spain's territorial claims over Gibraltar. This start of the negotiation process disappointed investors, after which the pound began to slowly but surely slide down. Although certain events still kept the GBP/USD pair afloat. For example, the Bank of England, contrary to numerous rumors, did not lower the interest rate at its January meeting. In addition, the pound received support from UK labor market data. In particular, traders were pleased with the growth rate of salaries, which exceeded the expectations of most experts. But in general, the fundamental background for the pair is bleak. Therefore, tomorrow's release of data on the growth of the British economy can either increase pressure on GBP/USD, or even out the downward momentum - for a while. According to preliminary forecasts, in the fourth quarter the UK economy grew by only 0.8% on an annualized basis and by 0.1% on a quarterly basis. This is a rather weak result (for example, in annual terms, the indicator last time was at such a low level at the end of 2018). If we talk about the growth of the British economy in December, then a very weak growth is also expected here - only 0.2% on a monthly basis. Data on the growth of industrial production in Britain will also be published tomorrow. Here the forecast is also quite pessimistic: in annual terms, the indicator will remain in the negative area, confirming the slowdown of key economic indicators. Thus, releases can put additional pressure on the pound, increasing the strength of the downward movement. Even if the indicators come out at a forecasted level, the pound still will not be able to take revenge, as the market will again talk about the fact that the English regulator will decide to lower the interest rate at its next - March - meeting. Let me remind you that in January, the BoE made it clear that it was ready to continue to maintain a wait-and-see attitude, but subject to the restoration of key parameters of the British economy. Recent trends did not go unnoticed - the regulator lowered its forecast for economic growth, while recognizing that inflation would remain below target level until the end of next year. In addition, the central bank excluded the wording that it was ready for "moderate gradual tightening of monetary policy." But at the same time, the alignment of forces among the members of the Committee did not change - only Saunders and Haskel voted for the interest rate cut. On the eve of the January meeting, rumors were circulating in the market that Gertjan Vlieghe and Silvana Tenreyro would join them, voicing the dovish comments. If these rumors were confirmed, four out of nine members of the Committee supported the easing of monetary policy. That is, the decision to lower the rate would depend on one member of the English regulator. According to a number of experts, tomorrow's data can push the skeptics Vlieghe and Tenreyro to cast their vote in favor of easing monetary policy. In any case, a further slowdown in the British economy will increase the likelihood of such a scenario. It is also worth noting that the pound is under the background pressure of the "Scottish Question". The first minister of this region of Great Britain, Nicola Sturgeon, announced that Scotland intends to return to the European Union "as an independent nation." She specified that she would continue to seek a second referendum on independence, despite the categorical refusal of London. Let me remind you that in 2014 the Scots refused to leave the UK, but at the same time in 2016 more than 60% of the region's population voted against Brexit. In other words, if a second referendum on independence is held, Scotland will most likely leave Britain and join the EU in the future. Obviously, the prospects for political instability are also putting pressure on the pound. From a technical point of view, the pair on the daily chart is on the lower line of the Bollinger Bands indicator, under all the lines of the Ichimoku indicator, which also formed a bearish "Parade of Lines" signal. This indicates the potential for further decline. The nearest support level is located quite far - at around 1.2740 (this is the Kijun-sen line on the weekly chart). If tomorrow's numbers come out in the red zone, the pound will be able to test this price target this week - especially if Powell does not put significant pressure on the dollar. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Feb 2020 02:53 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 217p - 106p - 114p - 79p - 80p. Average volatility over the past 5 days: 120p (high). The pound sterling paired with the US currency on February 10 began a weak upward correction. We expected exactly the same development of events from the EUR/USD pair, but only the pound/dollar pair began to adjust. Although, from our point of view, the British currency is generally quite overbought, despite the fact that in recent years it has only become cheaper. The first trading day was rather boring and uninteresting, since no macroeconomic publications were planned for that day. Thus, traders decided to consolidate part of the position before an extremely important Tuesday, when a large amount of important macroeconomic information will be published. By and large, the pound will depend on tomorrow. If, on the whole, macroeconomic statistics turn out to be at least not a failure, then perhaps the upward correction will continue. There is very little hope of Jerome Powell in Congress. It is unlikely that out of the blue, following strong reports on the US labor market, the Fed chief will change his rhetoric to a dovish one. Thus, Powell's speech at best will simply not trigger new purchases of the US dollar. But it is extremely difficult to expect the same effect from UK statistics. In principle, only one indicator of GDP is enough, which according to preliminary estimates should slow down from 1.1% to 0.8% in the fourth quarter. Of course, GDP can be, for example, 1.0%, which will still be worse than the previous value and above the forecast. Traders can decide that not everything is so bad, and not continue to sell the pound. Thus, it is not a fact that tomorrow we will definitely see a fall in the British currency. But all market participants are well aware that in the long term, the pound will still be subject to decline, since nothing in the UK is changing for the better. All risks relating to Brexit remain. All risks relating to negotiations with the European Union on a trade agreement remain. The economy continues to lose money. What will happen after 2020 is not known at all. Thus, our forecasts for the whole of 2020 remain the same - a fall and only a fall. It may not be a landslide, it may not be panic, it may not be quick, but it will fall. What to expect from a currency pair in technical terms? First, the movement to the critical line. If the pair reaches this line and bounces off it, then the downward movement will resume, and traders will receive an eloquent signal for selling the pound sterling. Secondly, the preservation of a long-term downward movement, as on the 24-hour chart Bollinger bands began to expand downward, which indicates the completion of a 5-month upward trend. Trading recommendations: GBP/USD began to adjust against the "dead cross". Thus, selling the pound with the target support level of 1.2772 is still relevant, but after the completion of the current correction, which can be determined by the rebound from the Kijun-sen line or by turning the MACD indicator down. Purchases of a pair by small lots can be considered if the price returns to the area above the Kijun-sen line with the first goal of the Senkou Span B. line Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. February 10. Results of the day. Fed fears US economy slows down due to coronavirus Posted: 10 Feb 2020 02:53 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 31p - 54p - 50p - 43p - 43p. Average volatility over the past 5 days: 48p (average). The EUR/USD currency pair ends the first trading day of the new week in a downward movement. The upward correction did not start, although we expected it on Friday (but on this day strong macroeconomic statistics from across the ocean and weak from Germany did not make it possible for the euro currency to go up), and then today. The chances of starting a correction were at its highest today, since the calendar of macroeconomic events was completely empty. That is, the fundamental factor had almost no effect on the euro/dollar currency pair. It is unlikely that traders were so disappointed with the indicator of industrial production in Italy (which fell by 4.3% y/y) that they rushed to get rid of the euro on Monday. The fact that industrial production in all EU countries is experiencing serious problems is no secret. On Friday, for example, disastrous German production plus the strongest NonFarm Payrolls data resulted in just a 40-point downward movement. And the total volatility was 43 points. Today, the pair has already passed 36 with an empty calendar. Thus, it seems that this time it is not a matter of macroeconomic data. It seems that the patience of traders simply burst. We have repeatedly talked about the paradoxical situation in recent months, which, from our point of view, was the reason for the lack of a fall in the euro below 1.0900. Although at the moment this level is still not overcome, the bears' mood this time seems to be very serious. In any case, traders definitely have such a virtually recoilless movement that can last a very long time. One negative is that the MACD indicator cannot constantly fall, so it will discharge from time to time. For example, the discharge occurred this morning, when the indicator reacted by turning upward to the pair's minimal growth (only 10 points). Tomorrow, meanwhile, the first speech by Fed Chairman Jerome Powell will take place in the US Congress. Powell will present a semi-annual report on monetary policy to the House Committee of Financial Services. This report is not a secret, and some of its details are already known. As we expected at the weekend, the general rhetoric of the head of the US regulator will not change. The Fed will note to Congress a reduction in risks for the US economy by relieving trade tensions, as well as by revitalizing global economic growth. The US economy has been growing for 11 consecutive years, which is a kind of record. The labor market is in excellent condition, as evidenced by the latest reports on NonFarm Payrolls, as well as ADP. Unemployment has even slightly increased, however, experts say that there is nothing wrong with this, since the indicator itself remains at its lowest level. However, the Fed also notes the risks associated with the coronavirus. The report notes that the epidemic in China has already led to the closure of a number of cities, the fall of the tourism industry (for obvious reasons), and can lead to a significant drop in the economic growth rate. The Chinese economy is directly and very closely connected with the American one. Thus, the further spread of the virus in China will lead to increasingly serious consequences. From our point of view, coronavirus is dangerous, but so far it is not a global problem. We draw the attention of traders to the fact that Powell stubbornly does not want to touch on the topic of slowing GDP growth, as well as falling industrial production in the United States. The Fed has repeatedly noted that the current level of rates is sufficient to maintain the desired business climate in the country. However, industrial production continues to decline in the past year and a half. GDP fell from 3.5% to the current 2.1% over the past year and a half. Of course, this is not such a problem, as, for example, in the EU, where GDP is 1.0%, or, for example, in the UK, where GDP can drop to 0.8% altogether. But nonetheless. These factors must be taken into account. The technical picture still signals a continuing downward movement, and now it is even difficult to imagine how a correction should be expected. This week, in addition to Powell's speech in Congress, there will also be important macroeconomic publications. It turns out that expectations will be connected precisely with these publications. We, as before, recommend trading with the trend, not trying to guess the turns up. For this, there are indicators MACD and Heiken Ashi. Trading recommendations: EUR/USD continues to move down. Thus, it is recommended to continue selling the euro with the target support level of 1.0893, until the MACD indicator reverses (may discharge) or a rebound from the first target. It will be possible to consider purchases of the euro/dollar pair in small lots with the goal of 1.1045 if traders manage to gain a foothold above the Kijun-sen line, which is not expected in the near future. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review 02/10/2020 EURUSD. Virus - or US economy? Posted: 10 Feb 2020 02:53 PM PST EURUSD: Hold sales from 1.0990, stop 1.1035, target 1.0890 Markets at a crossroads: strong optimism about the US economy is pushing markets to grow - however, a long overdue correction in the US market has a tempting reason - a virus epidemic in China. Yes, the virus is positive - the huge efforts of the Chinese authorities to combat the epidemic have had an effect. China said that the number of new infections in all provinces, except the most affected, is declining. That is, it was possible to localize the epidemic within China. But the number of cases still grows, and the rate does not fall below +10% per day. We are waiting for the reaction of the markets. P.S. Who buys US stock at such high prices? Growth is going on at low volumes - the main investments are not in stocks, but in bonds - of those companies that have high chances to survive the new crisis if it happens in the coming year. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar still on horseback, while euro and pound may continue to fall Posted: 10 Feb 2020 02:53 PM PST The EUR/USD pair fell out of the four-month range of 1.10–1.12 towards the end of the previous week. The euro reached a local low near 1.0940 against the dollar on Friday. The last time the main currency pair was spotted at this level was early October 2019. Up to a multi-year low, 1.0878 remains within easy reach. It is possible that the decline in EUR/USD, which began in early January, is the start of the trend towards strengthening the US dollar, which will lead to growth by about 10% within a few months. Amid a worsening risk appetite in global markets, the greenback is in demand as a safe haven. At the same time, the yield on the US public debt, despite the recent decline, is still the highest among developed countries. Thus, the dollar simultaneously acts both as a highly profitable currency and as a defensive asset. The United States remains firmly on its feet, while alarming fears for the state of the European economy are growing, expectations for an expansion of the quantitative easing (QE) policy in the eurozone are growing, and confidence is growing that the Federal Reserve interest rate will remain unchanged. "Coronavirus has a particularly strong impact on investor confidence in Europe, as market participants are well aware of the vulnerability of the region's economy to external shocks. Such vulnerability was shown during the trade war between the United States and China, as well as amid the continuing threat hanging over its automotive sector," analysts at JPMorgan Chase noted. "If the eurozone economy cannot escape the low growth swamp, then the inflow of foreign capital to the region's stock market may stop, or even turn into an outflow," they added. JPMorgan revised the forecast for EUR/USD at the end of the year to the downside (from 1.14 to 1.11) and warns about the risks of an intermediate fall of the pair to 1.08. Following the euro, it lost ground against the dollar and the pound. In addition to strengthening the greenback, pressure on the British currency is worrying that the UK will not be able to negotiate a deal with the European Union during the transitional period after Brexit. Last week, the GBP/USD pair completed at 1.2880 - in the area around which it revolved from the end of October to the beginning of December 2019. Therefore, the nearest boundaries of its fluctuations are likely to be the levels of 1.2800 and 1.3000. However, the drop in GBP/USD over the past week by as much as 320 points suggests that it may not be able to stay in the specified range. In this case, the next target of the bears could be the levels of 1.2400-1.2580. The situation with Brexit and the monetary policy of the Bank of England makes the pound's prospects very vague. "We do not consider the pound to be a structurally or fundamentally undervalued currency, as the UK is turning into a country with prospects for low growth and low rates. In addition, do not forget about the uncertainty in trade negotiations with the EU," strategists at JPMorgan said. "The trade negotiations between London and Brussels will inevitably create a news buzz that could pull down the pound," they said. The bank lowered its forecast for GBP/USD for the first quarter from $1.32 to $1.27, and at the end of the year from 1.33 to 1.30. The material has been provided by InstaForex Company - www.instaforex.com |

| Principle: bitcoin rose above $10,000 and fell again Posted: 10 Feb 2020 02:53 PM PST Sharp ups and downs are a common thing in the cryptocurrency sphere, so many traders took for granted the sharp increase in the MTC this Sunday, February 9. However, the joy was short-lived, and the no. 1 cryptocurrency was again beginning to lose ground. According to experts, the leading digital asset exceeded the $10,000 mark for the first time in 2020. The no. 1 cryptocurrency last traded at this level more than three months ago in October 2019. Nevertheless, the beginning of a new week did not bring the expected positive to Bitcoin. On Monday, February 10, the leading virtual asset was unable to maintain its position and collapsed. It dropped to $9988 in the BTC/USD pair, demonstrating a tendency to a steady decline. Experts believe that the downward trend will continue in the near future. Hopes of most market participants after overcoming the BTC mark of $10,000 were in vain. Many in the crypto community hoped that Bitcoin would continue to grow. However, this did not happen, and the market was gripped by disappointment. However, some crypto enthusiasts are confident that the leading digital asset will reach lost heights and even exceed them in the medium term. According to Anthony Pompliano, a partner at Morgan Creek Digital, an investment company, by the end of 2021 MTC will skyrocket to a whopping $100,000. The key factors behind this growth will be limited emissions and increased demand. Other forecasts look more realistic. For example, Robert Slammer, an analyst with Fundstrat, claims that in the near future Bitcoin will be trading in the range from $10,000 to $11,000. Institutional and retail investors are also confident in the rise of the first cryptocurrency. A positive note was also made by the leading rating agency Weiss Ratings, which assigned Bitcoin with an A- rating (excellent). The reasons for the rating increase were the improvement of fundamental indicators of BTC and the optimistic price dynamics of bitcoin before the upcoming halving. However, not all market participants are positive about the leading virtual asset. According to Joe DiPasquale, CEO of Bitbull Capital, in the event of a lull in the global market, bitcoin could drop to $6,800. The expert is certain that bitcoin will increase in price only if the situation with the Chinese coronavirus worsens and if gold prices rise. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPUSD in bearish trend is expected to see below 1.29 again. Posted: 10 Feb 2020 06:58 AM PST GBPUSD is bouncing above 1.29 after briefly moving below it. Price has produced a bearish signal once support at 1.30-1.2985 broke.

Red line - resistance GBPUSD is in a bearish trend. Price is bouncing today but as long as price is below the green broken trend line support, we remain bearish expecting a move towards 1.27. Possible bounce target is at 1.30 for a back test of the breakdown area. Bears would ideally get a bounce and rejection at 1.30 area. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of USDJPY for February 10, 2020. Posted: 10 Feb 2020 06:55 AM PST USDJPY is trading 20 pips lower from where saw it last week and we said that here is important resistance area. Around 110 USDJPY was a good selling opportunity with the stop close by at 110.30.

Price got rejected once again at the blue trend line resistance. Price has not made a new higher high. The short-term trend is changing back to bearish.

The weekly resistance of the USDJPY has been hit once again.Will we see another rejection? I believe the chances favor a rejection here and a pull back towards 107-108 at least. Time will tell. Any move above 110.30 would be a bullish sign. The material has been provided by InstaForex Company - www.instaforex.com |

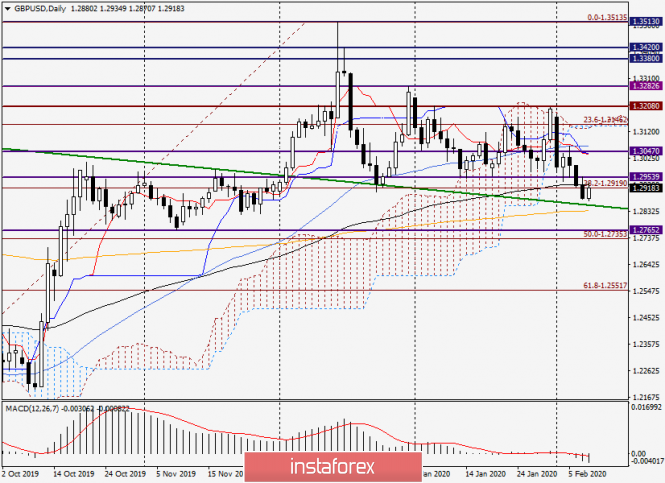

| Ichimoku cloud indicator analysis of EURUSD Posted: 10 Feb 2020 06:47 AM PST EURUSD is making new lower lows towards 1.09. Price is moving lower as expected after breaking below 1.10 support level.

|

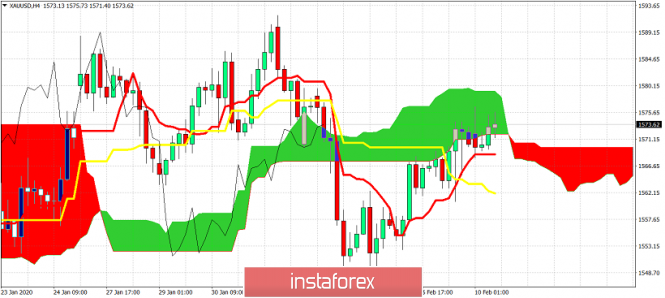

| Short-term Ichimoku cloud indicator analysis of Gold Posted: 10 Feb 2020 06:41 AM PST Gold price is challenging important short-term resistance area of $1,570-75. We have a weak sell signal as the tenkan-sen has crossed below the kijun-sen and at the same time price is below the kijun-sen.

|

| EUR/USD. February 10. Inflation in Switzerland threatens to turn into deflation Posted: 10 Feb 2020 06:05 AM PST EUR/USD – 4H.

Good day, dear traders! As seen on the 4-hour chart, the EUR/USD currency pair continued to fall instead of starting to rise towards the upper line of the downward trend corridor. However, as can be seen from the chart of the pair, the new fall was not strong. Thus, I still believe that today or tomorrow there will be a reversal in favor of the European currency and the growth process will begin in the direction of the level of 1.1030. This scenario would be the most logical and at the same time would completely preserve the current mood of traders – "bearish". I can't say that the current expectation for the growth of the euro currency is a signal or a trading idea. After the previous trading idea was worked out, no new ones were formed. There are no pending divergences, no rebounds from important correction levels. Thus, purchases (which, by the way, will be counter-trend) will be at the risk of each trader. At the same time, if the "bearish" mood among traders persists, it would be possible to assume a continued drop in quotes, but the lower line of the corridor may contain it. Do not forget about the information background. On Friday, traders were happy to work out all the news and reports that were received in the news feeds. First of all, I note American Nonfarm Payrolls, which rose by 225,000 in January. Second, the US unemployment rate, which has also increased, but in the context of this indicator, growth is a negative phenomenon. However, there is absolutely nothing to worry about, since unemployment in America remains at 50-year lows. Today, traders learned about the level of industrial production in Italy - a drop of 4.3% y/y and 2.7% m/m, as well as inflation in Switzerland - 0.2% y/y and -0.2% m/m. As you can see, inflation is a headache not only in the entire European Union but also in many individual countries. Moreover, if the pan-European indicator still balances around 1.0-1.5% y/y, then in some countries, such as Switzerland, it threatens to fall into the "deflation zone". Well, bull traders do not want to talk again about industrial production, which in Germany showed a record reduction of 6.8% y/y last week. Official reports show that this is a disease not only in Germany but also in Italy, where the losses were slightly less. Forecast for EUR/USD and trading recommendations: The new trading idea is to buy the euro currency with an approximate target around the level of 1.1030 (about 50% of the drop in quotes between January 31 and February 7). However, the information background may continue to force traders to sell the euro currency, so counter-trend purchases are generally not a noble activity. If we consider them, then in small volumes and short stops. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Feb 2020 06:05 AM PST GBP/USD – 4H.

Good day, dear traders! As seen on the 4-hour chart, the "Briton" worked out the low level - 1.2904, which I gave as the first goal for a new trading idea about the pair's exit from the expanding triangle or simply about closing under the global correction line. On February 10, the pair performed a reversal in favor of the British currency and began the process of growth in the direction of the same correction line, which now has every chance to work out from below. However, first of all, I believe that the fall of the GBP/USD pair will resume, and, secondly, although the "Briton" is growing today, there are not many reasons for traders to buy the pound. Thus, if the pound does not go too far up, then it will be possible to sell it at the new close under the low level of 1.2904. With a stronger and longer correction, I will consider other entry points to the market. Information background. It's probably the one that means the most to the pound right now. The vast majority of traders believe that the UK will not be able to agree on a deal with the European Union until the end of 2020. Thus, bull traders are nervous and wary of buying the pound. British Prime Minister Boris Johnson also regularly adds fuel to the fire, saying that the country will not submit to the euro bloc after Brexit in any of the areas. London wants a fair trade agreement from the euro bloc but Brussels wants certain guarantees from London, cooperation in many areas, and not just agreement on trade terms. Traders are very concerned about the tough position of Boris Johnson in the negotiations and cannot consider long-term investments in the pound. By and large, Britain now continues to walk on a thin rope, because if the negotiations fail, then Brexit will be without a deal. Traders would like Boris Johnson to make every effort to ensure that there is a deal with the EU. Probably, this is what British investors, businessmen, entrepreneurs, and ordinary citizens would also like. However, Johnson clearly has his own plan of action. Forecast for GBP/USD and trading recommendations: The new trading idea is to sell the pound with a target of 1.2789. Now, the process of growth has begun, most likely corrective. Thus, I recommend selling the pound after the pair's quotes are re-anchored below the low level of 1.2904. Tomorrow, traders will need an extreme degree of caution, as reports on GDP and industrial production will be published in the UK. Also, Jerome Powell will give a speech. Thus, both strong growth and a strong drop in quotes are possible. Before you start receiving this information in the news feeds, I recommend that you secure all open transactions as much as possible. The material has been provided by InstaForex Company - www.instaforex.com |

| February 10, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 10 Feb 2020 05:34 AM PST

On December 30, a quick bullish spike towards 1.1235 (Previous Key-zone) ended up with significant bearish rejection and a valid SELL entry. Moreover, a bearish ABC reversal pattern was demonstrated just before another bearish movement took place towards 1.1100 when the EURUSD pair has lost much of its bearish momentum. That's why, one more bullish pullback was executed towards 1.1175 where the depicted key-zone as well as the recently-broken uptrend were located. Evident signs of bearish rejection were demonstrated around 1.1175. That's why, quick bearish decline was executed towards 1.1100 then 1.1035 which failed to provide enough bullish SUPPORT for the EURUSD pair. Further bearish decline took place towards 1.1000 where the pair looked quite oversold around the lower limit of the depicted bearish channel. Hence, significant bullish rejection was able to push the pair back towards the nearest SUPPLY levels around 1.1080-1.1100 where a confluence of supply levels (including the upper limit of the channel) were located. Since then, the pair has been trending within the depicted bearish channel. Hence, further bearish decline was expected towards 1.0950 where (Fibonacci Expansion level 78.6%) and the lower limit of the channel are located. Bearish closure below 1.0950 allows a quick bearish decline to occur towards the next key-level 1.0910 (Fibonacci Expansion level 100%). The intermediate technical outlook remains bearish as long as bearish persistence below 1.1000 is maintained on the H4 chart. On the other hand, intraday traders can be looking for evident signs of bullish recovery around the price level of (1.0950) as a valid intraday BUY signal. The material has been provided by InstaForex Company - www.instaforex.com |

| February 10, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 10 Feb 2020 05:34 AM PST

On December 13, the GBPUSD pair looked overpriced around the price levels of 1.3500 while exceeding the upper limit of the newly-established bullish channel. On the period between December 18th - 23rd, bearish breakout below the depicted channel followed by temporary bearish closure below 1.3000 were demonstrated on the H4 chart. However, immediate bullish recovery (around 1.2900) brought the pair back above 1.3000. Bullish breakout above 1.3000 allowed the mentioned Intraday bullish pullback to pursue towards 1.3250 (the backside of the broken channel) where bearish rejection and a new wide-ranged movement channel were established between (1.3200-1.2980). Moreover, new descending highs were recently demonstrated around 1.3200 and 1.3080. Intraday technical outlook is supposed to remain bearish as long as the pair maintains its movement below 1.3080 (the most recently-established descending high). During the past few days, signs of bullish rejection were temporarily manifested around 1.2980-1.3000 before obvious bearish breakdown could occur. Conservative traders were advised to wait for bearish breakdown below 1.2980 as a signal for further bearish decline towards 1.2890 and possibly 1.2780. In the Meanwhile, Intraday traders should watch price action carefully around 1.2890 where the lower limit of the movement channel can provide intraday bullish rejection before further bearish decline can be expressed towards 1.2780. On the other hand, any bearish decline towards the next key-level (around 1.2780) should be watched for bullish rejection and a valid BUY entry provided that enough bullish momentum is expressed. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for 02.10.2020 - Strong liquidation at $10.000, watch for bearish continuation Posted: 10 Feb 2020 05:30 AM PST Industry news:

Bitcoin recently surged past its crucial resistance at $9.9k and held on above $10k for some time. However, as sellers' pressure increased, the coin could not hold on to $10k and its price slumped by 4.55% within a few hours. Bitcoin was valued at $10,195 before it experienced a downward force and was pulled back under the $9,731, causing a flurry of liquidation on BitMEX Bitcoin longs. According to data provided by Datamish, a total of $56.3 million longs were liquidated in the last 6 hours, with $600k worth short contracts expiring. This decline in price also helped to fill a gap left at the end of trading on Friday on the CME futures. The Futures on CME group ended last week at $9,850 and on 10 February, the drop in price brought BTC back to the $9.8k range. Technical analysis: BTC got strong rejection of our Pitchfork median line, which is strong sign that more selling can come. My advice is to watch for selling opportuntieis with the target at $9.040.. MACD oscillator is showing bearish divergence on the daily time-frame, which is good confirmation for our short bias. Support levels are set at the price of $9.570 and $9.040 Resistance level is seen at $10.000 The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 02.10.2020 - Median line reached, resistance is found and potential downside is in the play Posted: 10 Feb 2020 05:19 AM PST Technical analysis:

Gold has been trading sideways at the price of $1.573. Due to the rejection of the Pitchfork median line, I do expect potential rotationl around the median line and eventual downside movement towards the level of $1.561-$1.552. Watch for selling opportunities on the rallies. There is possibility to bigger symmetrical triangle to create. MACD oscillator is showing bearish divergence, which is good confirmation for our short bias. Support levels are set at the price of $1.561 and $1.552 Resistance levels are set at: $1.576 and $1.593 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Feb 2020 05:08 AM PST Technical analysis:

EUR has been trading sideways at the price of 1.0950. Due to the breakout of falling wedge in the background, I do expect rise on the EUR and potential testing of 1.0976-1.1000. Watch for buying opportunities on the dips or wait for the breakout of the 1.0957 to confirm the upside movement. Be very careful with chasing eventual breakdown due to poor structure for downside continuation. MACD oscillator is showing bullish divergence, which is good confirmation for our long bias. Support level is set at 1.0940 Resistance levels are set at: 1.0957, 1.0976 and 1.1000 The material has been provided by InstaForex Company - www.instaforex.com |

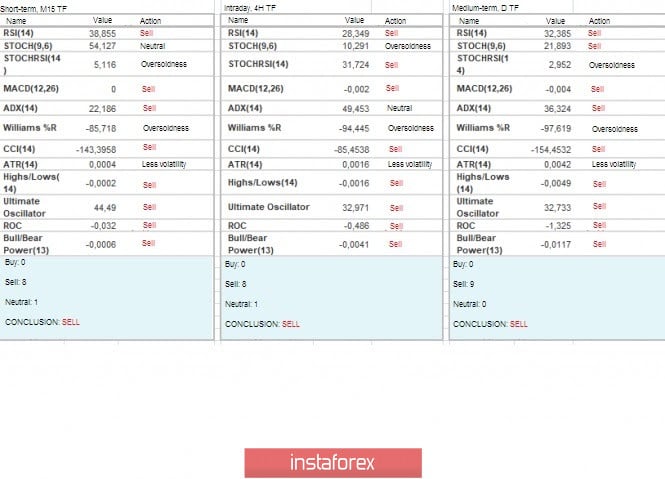

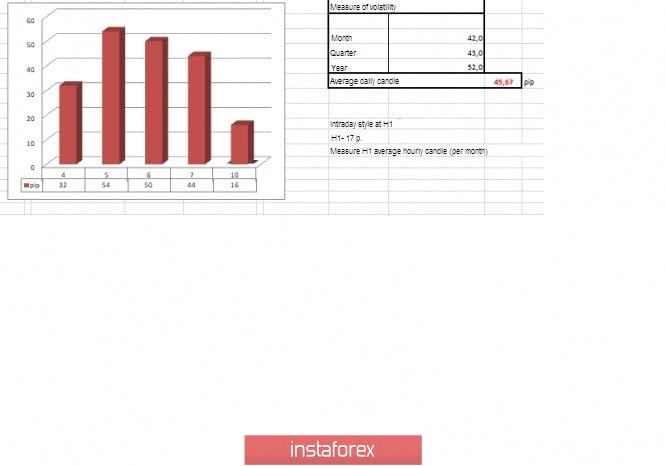

| Trading recommendations for EURUSD currency pair on February 10 Posted: 10 Feb 2020 04:08 AM PST From a comprehensive analysis, we see the price-fixing at the third stage of 1.0950, which can be considered a success, and now about the details. The downward movement has been held on the market for more than five weeks. During this time, we managed to see the price return to the area of October last year. Steps #1 (1.1080) and #2 (1.1000) already passed the quote, and the recent price-fixing at the stage #3/1 (1.0950) reflected the production of 82% relative to the entire value of the oblong correction, and this is the first time. Against this background, experts spoke with one voice about the fact that the minimum of last year, reflecting the step #3/2 (1.0879), will be passed soon, and historical lows are already considered as real prospects. This development is real, however, we should not unnecessarily catch up with FOMO, since, for example, we will go down to the level of 1.0879 and even lock in below. After that, we are immediately faced with an extremely strong psychological range of 1.0000/1.0500, which speculators are afraid of. That is, no one rules out a repeat of the pattern of 2015 and the beginning of 2007. Believe me, speculators will behave in the same way due to the high risk of a rebound. We still have a long way to go before such reflections. First, let the quote go to the area of 1.0880, and then it will be visible. Perhaps we will see significant support for the information background. In terms of volatility, we see stable indicators that are close to the daily average, which indicates a healthy tact and market sentiment. In this case, a stable tact can give more profit than a local jump. Do not forget about this. Analyzing the Friday every minute, we see almost stable downward interest, where both impulses and inertia were present. The most remarkable time was the period of transition of the European session to the American one, where we saw ups/downs against the background of the news. The subsequent oscillation was again in terms of downward inertia. As discussed in the previous review, traders have been actively working on the decline since the price was fixed below 1.0980. Step #3/1 played the role of regrouping trading forces, where you can fix the profit for the subsequent re-entry. Looking at the trading chart in general terms (the daily period), we see the recovery process that has been waiting for so long. Let me remind you that the oblong correction has been maintained on the market for as long as 4.5 months. This value is comparable to the medium-term trend. This kind of hovering was last recorded during the correction from November 2018, however, we did not see such a large scale, perhaps the background from historical lows has affected the correction. Friday's news background had a report from the United States Department of Labor, where the expectations that came to the US from the ADP report coincided and we saw a significant increase in new jobs (225,000) compared to the previous period (147,000). In turn, the unemployment rate accelerated from 3.5% to 3.6%, but the share of the labor force in the total population gave a greater increase from 63.2% to 63.4%. At the same time, we should not forget that the stimulus for the growth of the US currency came to us not only from the States but also from Europe. So, at the beginning of the European session, we had extremely weak data on industrial production, where Germany recorded an acceleration of the decline from -2.5% to -6.8%. But in France, the growth of industrial production changed from a growth of 0.9% to a decline to -3.0%. Now, we understand that the dollar was the most profitable asset. In terms of the general information background, we did not have something supernatural. The noise of the coronavirus, as well as the upcoming negotiations between England and Brussels, remains in the minds of market participants. The only thing I want to add to this section is the range of events of the current week. So, on Tuesday and Wednesday, Federal Reserve Chairman Jerome Powell will deliver a semi-annual report to the US Congress, which is worth looking at. On Thursday, data on inflation in the United States will be published, and this parameter is key in determining monetary policy and the Fed's rhetoric. Today, in terms of the economic calendar, there is silence on all fronts, thus work is being done on the analysis of the external background, as well as technical factors. Further development Analyzing the current trading chart, we see a distinct accumulation in the area of the step #3/1 (1.0950), where the quote forms an extremely narrow amplitude oscillation. In fact, we see how much sellers are stuck in the market, which does not give the opportunity to roll back even at the moment of regrouping of trading forces, which would be a good step in this case. This kind of retention suggests that recovery theory is going through better times. Detailing the available time interval per minute, we see a fluctuation within the range of 1.0941/1.0957, where the value of 1.0950 is the main one in this amplitude. In terms of the emotional mood of market participants, we see a strong influx of traders, which was not observed before, probably due to a significant recovery of the quote relative to the oblong correction. In turn, traders carefully analyze the behavior of the quote at the third stage, since there is a chance of further progress. It is likely to assume that holding the downward trend and fixing the price below 1.0940 will lead to a new influx of volumes that will be directed to the final stage #3/2 (1.0880). Based on the above information, we will output trading recommendations: - Buy positions will be considered if the price is fixed higher than 1.0960, with the prospect of a move to 1.0980-1.1000. - Sell positions are held towards 1.0880. If we have no deals, it makes sense to consider the point of 1.0940, fixing on H4. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments unanimously signal sales, which confirms the general background of the market. Volatility for the week / Volatility Measurement: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation, based on the calculation for the Month / Quarter / Year. (February 10 was based on the time of publication of the article) The volatility of the current time is 16 points, which is extremely low value in terms of dynamics. It is likely to assume that the acceleration in the event of an exit from accumulation is still possible, but it will be expressed within the average indicator. Key levels Resistance zones: 1.1000***; 1.1080**; 1.1180; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.0900/1.0950**;1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD Technical Analysis / Hot Scenario For 10.02.2020 Posted: 10 Feb 2020 04:03 AM PST GBP/USD seems to be determined to reach fresh new lows after it has ignored the 1.2952 - 1.2904 support area. The pair lost 1.14% in the last three days, now is trading at 1.2888 level. It could resume the downside momentum if stabilizes below the 1.2900 psychological level. The USD is very strong lately and it could appreciate further versus the major currencies, GBP/USD could drop towards the 1.2735 level, 50% Fibonacci line on the short term. It is somehow expected to drop further after the breakdown from the ascending channel.

We could have a great selling opportunity if the price tests and retests the 1.2952 - 1.2904 area, the 38.2% retracement level and the sliding parallel line (SL1) of the major ascending pitchfork. The next downside target could be at the 50% Fibonacci level, GBP/USD could be attracted by the confluence area between the sliding line (sl) of the descending pitchfork and the 50% retracement level. A larger drop could be confirmed only after a valid breakdown below these downside obstacles. Personally, I would like to see a retest before the price drops further, it's risky to sell without a retest because the price could come back at the uptrend line and at the median line (ML) on the short term.

GBP/USD is under massive selling pressure and it could reach new lows without a retest on the Daily chart. We'll have a great selling opportunity if the price retests the 1.2904 level, the 38.2% level and maybe the SL1. The pair is targeting the inside sliding parallel line (sl) of the descending pitchfork, we could have a downward channel between sl and sl1 of the major descending pitchfork. The retest will give us the chance to place the Stop Loss above the nearest former high. Technically, the major downside target is somehow at the lower median line (LML) of the ascending pitchfork, or at the median line (ml) of the descending pitchfork. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD Bearish Movement May Not Be Over Soon. Trading Scenario For 10.02.2020 Posted: 10 Feb 2020 04:01 AM PST EUR/USD is trading deep in the seller's territory and it could approach the next downside targets at 1.0925 and lower at 1.0884 level. The US dollar has driven the pair as the USDX has managed to reach new highs. A further USDX's growth will signal a EUR/USD drop in the upcoming days. Unfortunately, the US Unemployment Rate and the Average Hourly Earnings disappointed on Friday, but the unexpected NFP data has maintained the EUR/USD lower. The US has created 225K jobs in January, beating the 165K expectations and the 147K jobs reported in December.

EUR/USD is trading at 1.0950 according to the H4 chart, the outlook is bearish as long as the price is trading below the median line (ml) of the descending pitchfork. The price has tested the broken 250% Fibonacci line, the next downside target is seen at 1.0925 level. I've said in my analysis that a drop below the 1.1 psychological level and below the 250% line will signal a larger drop. The price could be attracted also by the second warning line (WL2) of the previous ascending pitchfork and by the lower median line (lml) of the descending pitchfork.

It is not advised to go short on EUR/USD at this moment, we had a short opportunity after the aggressive breakdown below the median line (ml) and below the 250% line. However, a median line (ml) retest and rejection, or a failure to retest this dynamic resistance could bring another short opportunity. As I've said, the major downside target could be at the 1.0884 level, the price is somehow expected to reach the WL2 and the lower median line (lml). USDX maintains a bullish bias, so a further increase will send the EUR/USD pair towards the mentioned targets. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment