Forex analysis review |

- Forecast for EUR/USD on February 13, 2020

- Forecast for GBP/USD on February 13, 2020

- Forecast for USD/JPY on February 13, 2020

- Fractal analysis of the main currency pairs for February 13

- Comprehensive analysis of movement options of #USDX vs USD/JPY vs EUR/JPY vs GBP/JPY on February 13

- EUR/USD: coronavirus factor, Biden failure and eurozone industrial production slowdown

- GBP/USD. February 12. Results of the day. Great Britain will be cut off from EU financial markets after Brexit

- EUR/USD. February 12. Results of the day. Weak European macroeconomic statistics

- GBP/USD: although the pound is rapidly growing, it might be short-lived

- Evening review 02/12/2020 EURUSD. US elections and weak eurozone data

- EUR/USD: dollar retreats, but does not give up, euro risks weakening further

- Is the dollar a risk catalyst for the US economy?

- USDCHF breaks out, back tests and bounces

- GBPUSD should see price move lower towards 1.29 and below once again

- USDCAD is pulling back as expected

- Weekly EURUSD analysis

- February 12, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- February 12, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- EURUSD and NZDUSD: Eurozone industrial production is hindered by the euro. Reserve Bank of New Zealand interest rates support

- EUR/USD. February 12. Strong support for the euro. Getting ready for the purchases of the pair?

- GBP/USD. February 12. A rebound from the level of 1.3000 is possible with the resumption of the fall of the "Briton"

- GBP/USD: plan for the US session on February 12. Buyers of the pound continue to fight for the level of 1.2976, but the support

- EUR/USD: plan for the US session on February 12. Bears are not allowed above the level of 1.0922. We are waiting for the

- Gold 02.12.2020 - Downside pressure and potential for more downside and test of $1.547

- GBP/USD 02.12.2020 - Broken Multi pivot at the prrice of 1.2950, upside confirmed

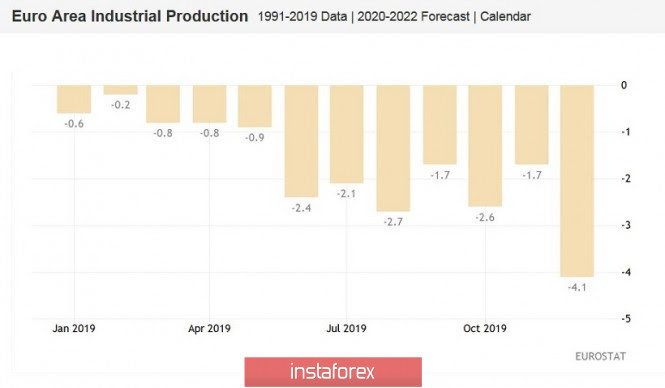

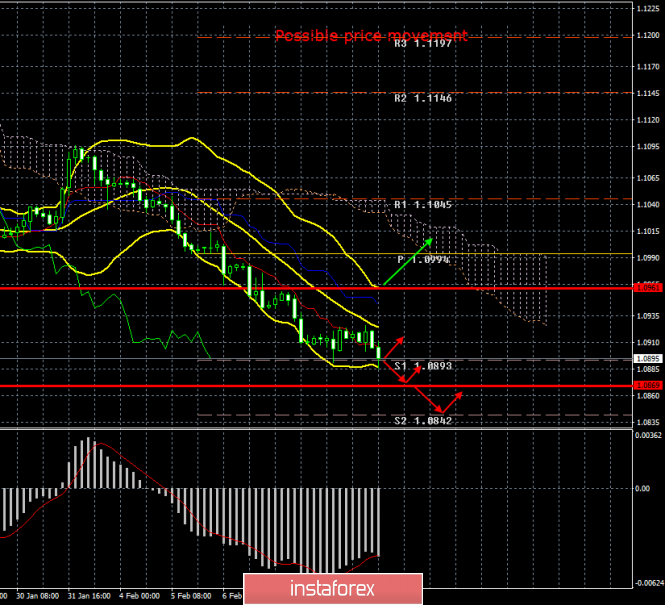

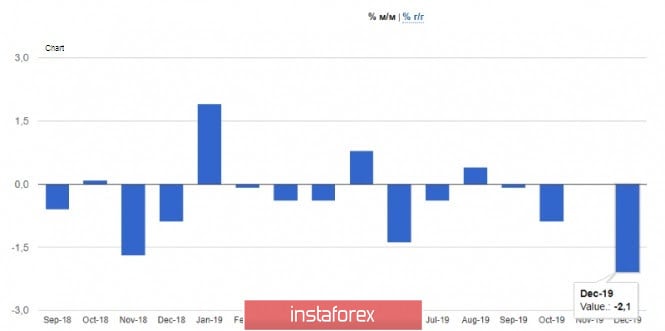

| Forecast for EUR/USD on February 13, 2020 Posted: 12 Feb 2020 07:26 PM PST EUR/USD Yesterday's publication of data on industrial production in the eurozone was worse than expected - the December decline was-2.1% versus the expected -1.8%. In Europe, they talked about a potentially even greater economic failure due to the epidemic in China. But China itself predicts that the epidemic will decline in April. The euro lost 40 points on Wednesday. The 1.0880 target was fulfilled, there was a consolidation under the lower TF. The following goals are determined by Fibonacci levels: 161.8% - 1.0840, 200.0% - 1.0745. A convergence is outlined on the four-hour chart on the Marlin Oscillator, this is a sign of a slight correction before a further decline. Consolidation will likely take place before the level of 1.0905. |

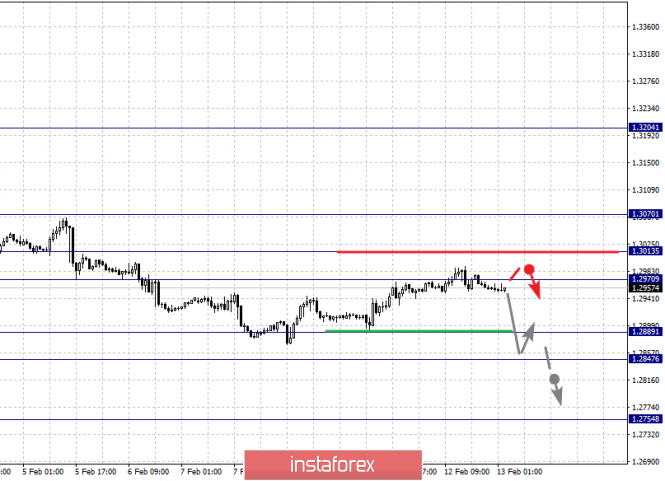

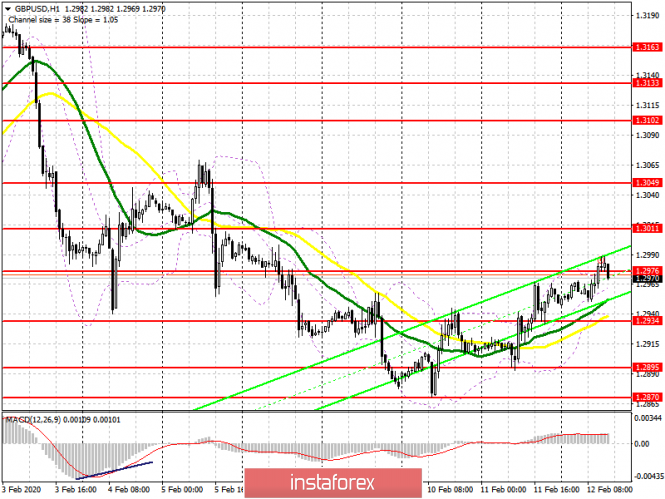

| Forecast for GBP/USD on February 13, 2020 Posted: 12 Feb 2020 07:24 PM PST GBP/USD On Wednesday, the British pound tested the Fibonacci level of 161.8% at the last forces, and today it opened below this level. The Marlin oscillator is weakening, and we are waiting for the indicator and the price to reverse. The goal of the decline is the Fibonacci level of 138.2% at the price of 1.2820. A significant correction is possible from this level (in depth or time), since the signal line of the Marlin oscillator can turn from its own line of the descending channel (marked by a dashed line). If this preventive reversal does not happen, the price will continue to decline to lower targets, the closest of which will be the 1.2728/58 range. The MACD line stopped the price on the four-hour chart. The signal line of marlin decreases, but still remains in the positive trend zone. For the generated signal to sell, it is necessary to wait for it to go into the zone of negative values. This will happen when the price drops to 1.2910. The material has been provided by InstaForex Company - www.instaforex.com |

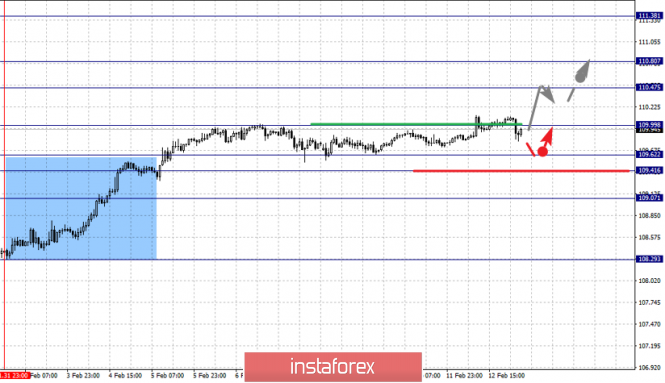

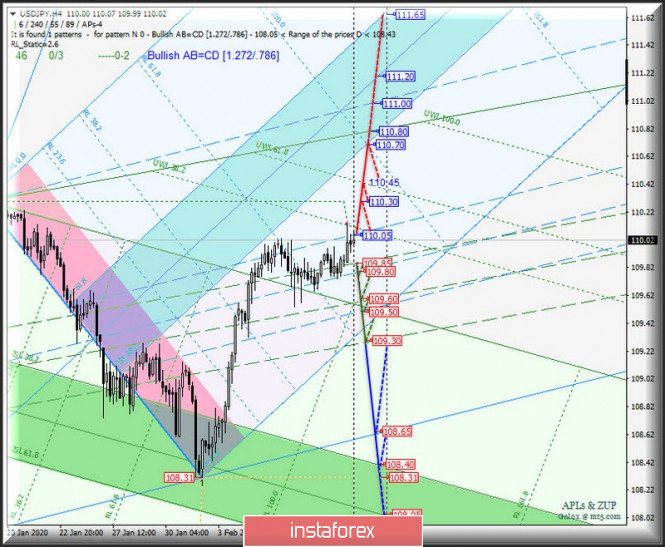

| Forecast for USD/JPY on February 13, 2020 Posted: 12 Feb 2020 07:22 PM PST USD/JPY With notable effort, the dollar against the yen breaks through the resistance of the MACD line and the trend line of the red price channel on the daily chart. The US stock market provided help, having grown by 0.65% (S&P 500) on traditional expectations that the outbreak of coronavirus will soon end. A recession is expected in China at the end of March. Today, the Japanese Nikkei 225 index added 0.08% to the Asian session, while the Chinese China A50 -0.07%. Now the price faces a new challenge - overcoming the resistance of the green price channel at 110.25. Success will make it possible for the price to rise to the target range of 110.83/98. On the H4 chart, the price is developing above the red indicator line of balance, which indicates the preservation of a growing trend. The Marlin oscillator briefly entered the territory of the bears, but already shows its intention to return back to the growth zone. The material has been provided by InstaForex Company - www.instaforex.com |

| Fractal analysis of the main currency pairs for February 13 Posted: 12 Feb 2020 06:35 PM PST Forecast for February 13: Analytical review of currency pairs on the scale of H1:

For the euro / dollar pair, the key levels on the H1 scale are: 1.0938, 1.0910, 1.0888, 1.0864 and 1.0827. Here, the price is near the limit values for the downward cycle, and therefore, we expect a correction. Short-term upward movement is expected in the range of 1.0888 - 1.0910. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.0938. This level is a key support for the downward structure. The breakdown of the level of 1.0864 will be accompanied by an unstable movement to the bottom. Here, the potential target is 1.0827, when this level is reached, we expect to go to the top. The main trend is a downward structure from January 31, we expect a correction Trading recommendations: Buy: 1.0888 Take profit: 1.0910 Buy: 1.0912 Take profit: 1.0936 Sell: 1.0862 Take profit: 1.0845 Sell: Take profit:

For the pound / dollar pair, the key levels on the H1 scale are: 1.3070, 1.3013, 1.2970, 1.2889, 1.2847 and 1.2754. Here, we are following the development of the downward structure of January 31. At the moment, the price is in correction. Short-term downward movement is expected in the range of 1.2889 - 1.2847. The breakdown of the last value should be accompanied by a pronounced movement to the bottom. In this case, the potential target is 1.2754. We expect consolidation, as well as a pullback to the top near this level. Short-term upward movement is possibly in the range of 1.2970 - 1.3013. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3070. This level is a key support for the downward structure. The main trend is the descending structure of January 31 Trading recommendations: Buy: 1.2970 Take profit: 1.3011 Buy: 1.3015 Take profit: 1.3070 Sell: 1.2889 Take profit: 1.2848 Sell: 1.2845 Take profit: 1.2756

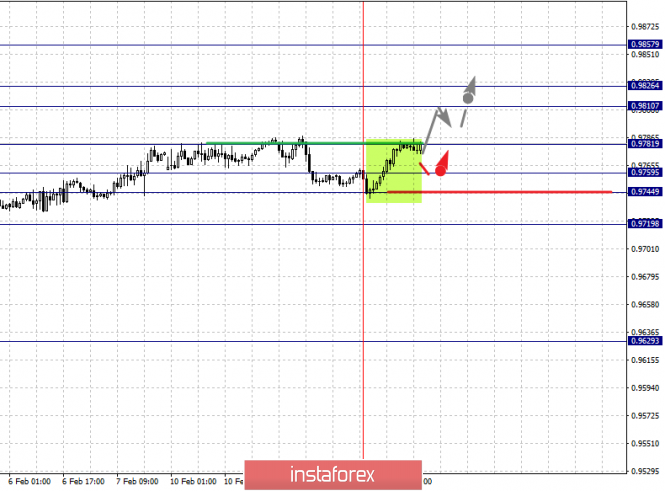

For the dollar / franc pair, the key levels on the H1 scale are: 0.9858, 0.9826, 0.9810, 0.9781, 0.9759, 0.9744 and 0.9719. Here, we are following the development of the ascending structure of January 31, and the price has formed a local potential for the top of February 12. The continuation of the movement to the top is expected after the breakdown of the level of 0.9781. In this case, the target is 0.9810. Price consolidation is in the range of 0.9810 - 0.9826. For the potential value for the top, we consider the level of 0.9858, upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9759 - 0.9744. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9719. This level is a key support for the upward structure. The main trend is the upward cycle of January 31, the local potential of February 12 Trading recommendations: Buy : 0.9782 Take profit: 0.9810 Buy : 0.9826 Take profit: 0.9858 Sell: 0.9759 Take profit: 0.9745 Sell: 0.9742 Take profit: 0.9720

For the dollar / yen pair, the key levels on the scale are : 110.80, 110.47, 109.99, 109.62, 109.41 and 109.07. Here, we are following the development of the ascending structure of January 31. The continuation of the movement to the top is expected after the breakdown of the level of 110.00. In this case, the target is 110.47. Price consolidation is near this level. For the potential value for the top, we consider the level 110.80, upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 109.62 - 109.41. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 109.07. This level is a key support for the top. Main trend: upward structure of January 31 Trading recommendations: Buy: 110.00 Take profit: 110.45 Buy : 110.49 Take profit: 110.80 Sell: 109.60 Take profit: 109.42 Sell: 109.38 Take profit: 109.10

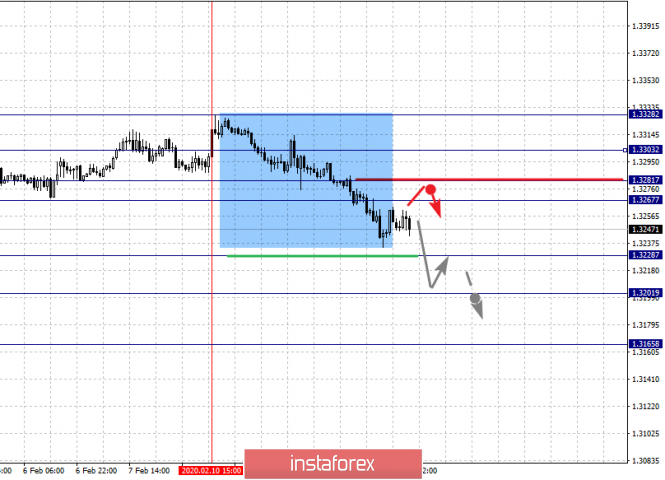

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3303, 1.3281, 1.3267, 1.3228, 1.3201 and 1.3165. Here, the descending structure of February 10 is considered as a medium-term. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3228. In this case, the target is 1.3201. Price consolidation is near this level. The breakdown of the level of 1.3200 will lead to the development of pronounced movement to the bottom. Here, the potential target is 1.3165. We expect a pullback to the top from this level. Short-term upward movement is possibly in the range of 1.3267 - 1.3281. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3303. This level is a key support for the downward structure. The main trend is the formation of medium-term initial conditions for the downward movement of February 10 Trading recommendations: Buy: 1.3267 Take profit: 1.3281 Buy : 1.3283 Take profit: 1.3303 Sell: 1.3226 Take profit: 1.3203 Sell: 1.3199 Take profit: 1.3167

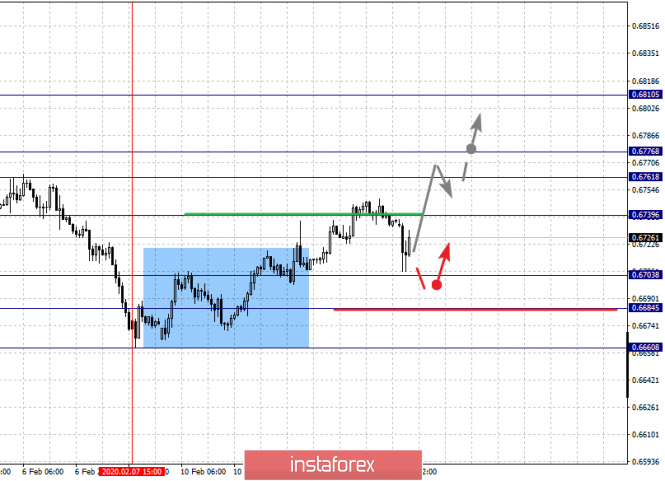

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6810, 0.6776, 0.6761, 0.6739, 0.6703, 0.6684 and 0.6660. Here, we are following the development of the ascending structure of February 7. The continuation of the movement to the top is expected after the breakdown of the level of 0.6740. In this case, the target is 0.6761. Short-term upward movement, as well as consolidation is in the range of 0.6761 - 0.6776. For the potential value for the top, we consider the level of 0.6810. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6707 - 0.6731. Hence, there is a high probability of a reversal to the top. The breakdown of the level of 0.6684 will lead to the formation of a downward structure. Here, the potential target is 0.6660. The main trend is the upward structure of February 7 Trading recommendations: Buy: 0.6740 Take profit: 0.6761 Buy: 0.6762 Take profit: 0.6775 Sell : 0.6703 Take profit : 0.6687 Sell: 0.6682 Take profit: 0.6660

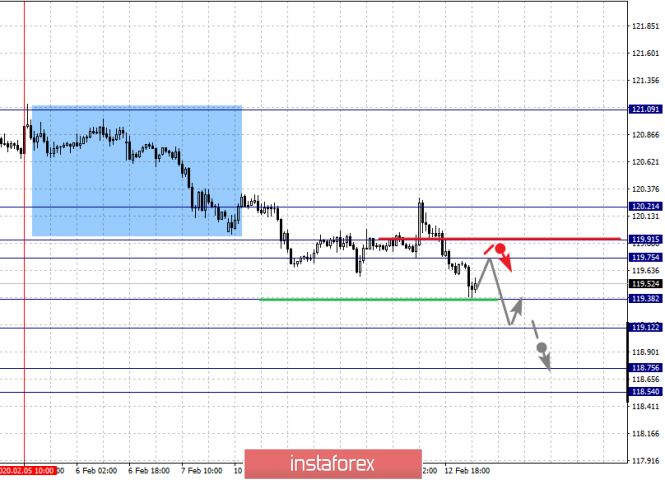

For the euro / yen pair, the key levels on the H1 scale are: 120.21, 119.91, 119.75, 119.38, 119.12, 118.75 and 118.54. Here, we are following the descending structure of February 5. Short-term downward movement is expected in the range of 119.38 - 119.12. The breakdown of the latter value will lead to the development of a pronounced downward movement. Here, the goal is 118.75. For the potential value for the bottom, we consider the level of 118.54. Upon reaching which, we expect consolidation in the range of 118.75 - 118.54, as well as a rollback to the top. Short-term upward movement is possibly in the range of 119.75 - 119.91. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 120.21. This level is a key support for the downward structure. The main trend is the descending structure of February 5 Trading recommendations: Buy: 119.75 Take profit: 119.90 Buy: 119.93 Take profit: 120.21 Sell: 119.36 Take profit: 119.14 Sell: 119.10 Take profit: 118.75

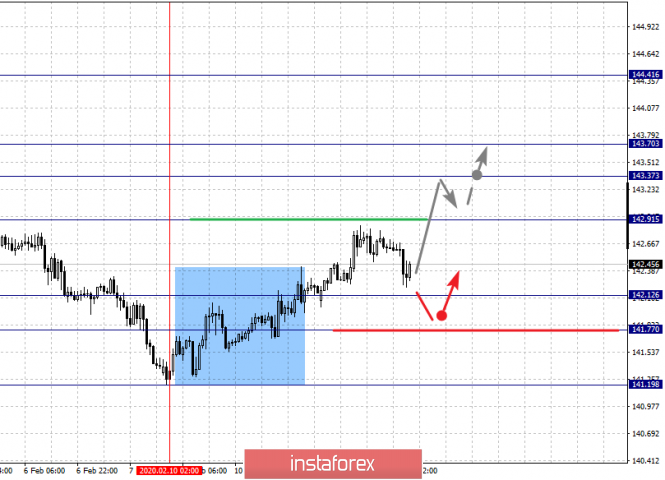

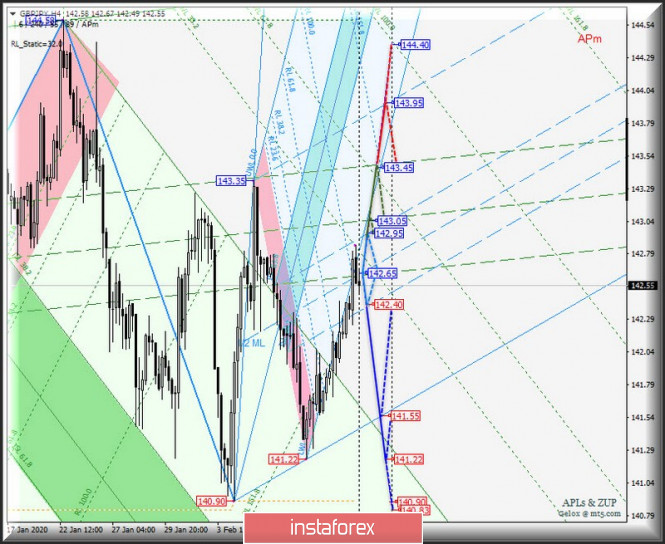

For the pound / yen pair, the key levels on the H1 scale are : 144.41, 143.70, 143.37, 142.91, 142.12, 141.77 and 141.19. Here, we are following the development of the ascending structure of February 10. The continuation of the movement to the top is expected after the breakdown of the level of 142.91. In this case, the target is 143.37. Short-term upward movement, as well as consolidation is in the range of 143.37 - 143.70. The breakdown of the level of 143.70 will allow you to count on movement to a potential target - 144.41, upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 142.12 - 141.77. Hence, the probability of a turn to the top is high. The breakdown of the level of 141.70 will lead to the formation of initial conditions for the downward cycle. Here, the potential target is 141.20. The main trend is the rising structure of February 10 Trading recommendations: Buy: 142.91 Take profit: 143.35 Buy: 143.38 Take profit: 143.70 Sell: 142.10 Take profit: 141.82 Sell: 141.74 Take profit: 141.35 The material has been provided by InstaForex Company - www.instaforex.com |

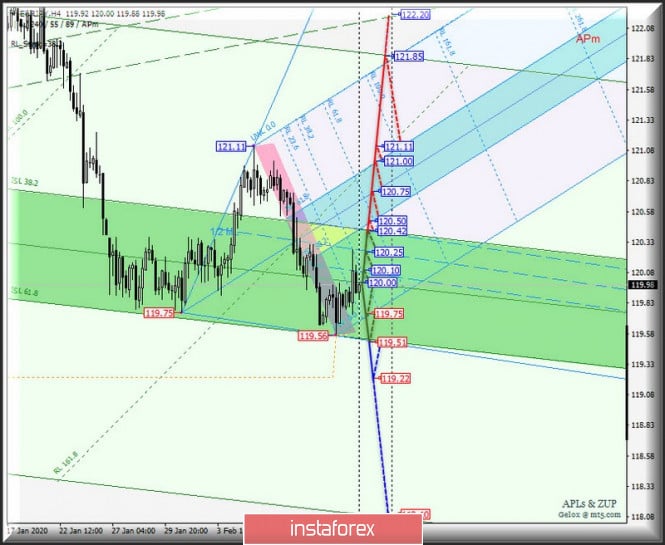

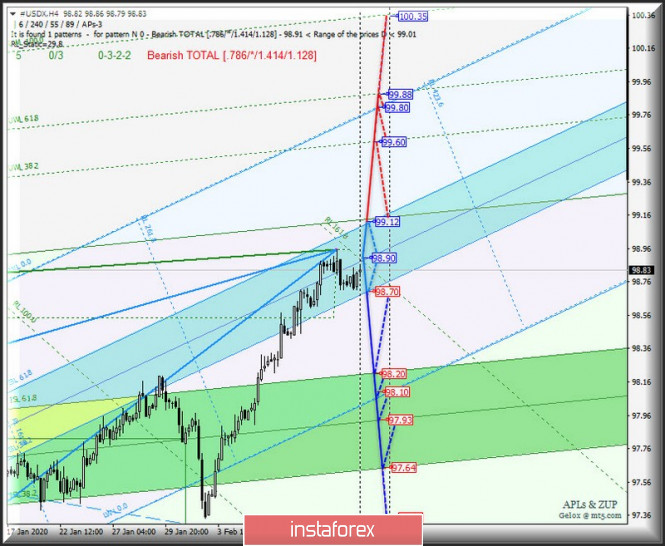

| Comprehensive analysis of movement options of #USDX vs USD/JPY vs EUR/JPY vs GBP/JPY on February 13 Posted: 12 Feb 2020 04:37 PM PST Let us consider how the development of the movement of the dollar index #USDX, the currency of the "country of the rising sun" USD / JPY and its cross instruments - EUR / JPY and GBP / JPY will begin to flow from February 13, 2020. Minuette (H4 time frame) ____________________ US dollar index The development of the movement of the dollar index #USDX from February 13, 2020 will continue to be determined by development and the direction of breakdown of the boundaries of the equilibrium zone (98.70 - 98.90 - 99.12) of the Minuette operational scale forks. We look at the traffic markings inside this zone on the animated chart. In case of breakdown of the lower boundary of the equilibrium zone ISL61.8 (support level of 98.70) of the Minuette operational scale forks, the development of the downward movement of the dollar index will be directed to the boundaries of the equilibrium zone (98.20 - 97.93 - 97.64) of the Minuette operational scale forks. On the other hand, if the upper boundary of ISL61.8 (resistance level of 98.40) is broken, the equilibrium zone of the Minuette operational scale forks, the upward movement #USDX can be continued to the warning line UWL38.2 (99.60) of the Minuette operational scale forks and the final line FSL Minuette (99.80). The marking options for the movement of #USDX from February 13, 2020 is shown on the animated chart.

____________________ US dollar vs Japanese yen The development of the USD / JPY currency movement of the "country of the rising sun" from February 13, 2020, just like before, will also be due to the development and direction of the breakdown range :

The breakdown of the support level of 109.85 and 1/2 of the Median Line Minuette (109.80) will determine the development of the USD / JPY movement in the 1/2 Median Line Minuette channel (109.85 - 109.60 - 109.30) with the prospect of reaching the LTL control line (108.65) of the Minuette operational scale forks and the upper boundaries of ISL38.2 (108.40) of the Minuette operational scale forks. Alternatively, in case of breakdown of the upper boundary of the 1/2 Median Line Minuette channel (110.05), the upward movement of the currency of the "country of the rising sun" can be continued to the local maximum 110.30 and when updating, it will be possible to reach the warning line UWL61.8 (110.45) of the Minuette operational scale fork and the lower boundary ISL38.2 (110.70) of the Minuette operational scale forks. We look at the details of the USD / JPY movement from February 13, 2020 on the animated chart.

____________________ Euro vs Japanese yen The development of the EUR / JPY cross-instrument movement from February 13, 2020 will be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (119.51 - 120.00 - 120.42) of the Minuette operational scale forks taking into account the development of the 1/2 Median Line channel (120.10 - 120.25 - 120.42) of the Minuette operational scale forks. The details of the development of the above levels are shown on the animated chart. The breakdown of the upper boundary of the ISL38.2 (resistance level of 120.42) equilibrium zone of the Minuette operational scale forks will allow us to reach the boundaries of this cross-instrument of the equilibrium zone (120.50 - 120.75 - 121.00) of the Minuette operational scale forks, and in case of breakdown of ISL61.8 Minuette (121.00), the EUR / JPY movement can be continued to the local maximum 121.11 and the final line FSL Minuette (121.85). On the contrary, if the support level of 119.51 is broken down at the lower boundary of the ISL61.8 equilibrium zone of the Minuette operational scale forks, the update of the local minimum 119.22 will become relevant. The details of the movement of EUR / JPY, depending on the development of this range, are presented on the animated chart.

____________________ Great Britain pound vs Japanese yen The development of the movement of GBP / JPY cross-instrument from February 13, 2020, as before, will continue to be determined by developing the boundaries of the 1/2 Median Line (142.40 - 142.65 - 142.95) of the Minuette operational scale forks. The details of the development mentioned levels are shown on the animated chart. A sequential breakdown of the upper boundary of the 1/2 Median Line Minuette channel - resistance level of 143.20 and 1/2 Median Line Minuette (143.05) will determine the continuation of the upward movement of GBP / USD to the upper boundary of the 1/2 Median Line channel (143.35) of the Minuette operational scale forks and the final Shiff Line Minuette (145.95). On the other hand, the breakdown of the lower boundary (support level of 142.40) of the 1/2 Median Line Minuette channel will lead to the continuation of the downward movement of GBP / JPY to the initial SSL line (141.55) of the Minuette operational scale forks with the prospect of updating local minimums (141.22 - 140.90 - 140.93). The details of the GBP / JPY movement, depending on the breakdown direction of the above 1/2 Median Line Minuette channel, are shown in the animated chart.

____________________ The review was compiled without taking into account the news background. Thus, the opening trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6%; Yen - 13.6% ; Pound Sterling - 11.9%; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: coronavirus factor, Biden failure and eurozone industrial production slowdown Posted: 12 Feb 2020 02:51 PM PST The EUR/USD bears again storm the eighth figure, returning to the lows of last year. Judging by the dynamics of decline, sellers will nevertheless overcome the low of 1.0879 and head towards the lower line of the Bollinger Bands indicator on the monthly chart (mark 1.0810). This state of affairs reflects the strength of the US economy - the greenback is in demand both in periods of a surge in anti-risk sentiment and in calmer periods. On the other hand, further revaluation of the dollar will soon turn against the US economy, slowing inflationary growth and negatively affecting the export sector. At the end of 2016 and at the beginning of 2017, the EUR/USD pair sank to the third figure, and the probability of parity was seriously discussed in the market. But then the expensive dollar "hit on" the Federal Reserve with a slowdown in inflation and other related side effects. Now it's too early to talk about parity, but at the same time, the dollar is actively demolishing many of the barriers that previously held back the sellers of the pair. For example, since the fall of last year, the bears have made countless attempts to gain a foothold below the 10th figure. Even if they plunged under the 1.1000 mark, the pair attracted buyers at these levels, after which the price continued to be suspended between 10 and 12 figures. To date, the situation is somewhat different. It is quite difficult for the pair's bulls to return lost points even during periods of rare corrections, while the dollar receives support both from macroeconomic statistics and from the Fed, which continues to hold a wait-and-see position. In turn, the European currency is under large-scale pressure from all sides: inflation in the eurozone has slowed, Christine Lagarde voices pessimistic forecasts, and Brexit did not bring the long-awaited relief. All this suggests that the dollar will continue to dominate in the near future, if only January inflation does not alarm dollar bulls (the release is scheduled for tomorrow, February 13). It is noteworthy that the US currency calmly reacted to the Fed report, where regulator members expressed concern about the spread of the Chinese coronavirus. Speaking in Congress, Jerome Powell, on the one hand, focused his attention on this issue. But at the same time, he noted that it is too early to talk about any negative impact on the US economy. In addition, today it became known that the deadly virus has slowed the pace of "planet conquest." Despite the fact that the number of dead and sick has increased, the pace of infection has slowed. But the number of recovered has increased - up to 4740 people (that is, 745 people per day). China also reported the lowest daily number of new cases of coronavirus since late January. Although such news cannot be called encouraging, the foreign exchange market reacted positively to them. The dollar was not afraid of the political factor either. Although all the preconditions for the greenback reduction were: yesterday, former US Vice President Joe Biden, who was considered the favorite of the presidential race from the Democratic Party, lost the second primaries. But Senator Bernie Sanders, who calls himself a "democratic socialist," unexpectedly took the lead in the election race among the Democrats. Young people voted for him, as well as representatives of the African American and Spanish communities in the United States. According to experts, he currently wins with a score of 48% versus 42% in the competition with Trump. Sanders has a reputation for being almost a "communist," as he offers US society to introduce the principles of free medicine, free college education, a program of guaranteed jobs and write-offs of student debts. He also advocates for narrowing the wage gap between top managers and employees. According to some experts, if Sanders wins (and this option can no longer be ruled out), the budget deficit will increase in many ways, and "the printing press will work without stopping." Naturally, such prospects, albeit still hypothetical in nature, could exert background pressure on the US currency. But the market has so far calmly reacted to such trends. Apparently, traders do not yet believe that a "democratic socialist" will be able to remove the Republican president (although Trump's victory also seemed extremely unlikely at the time). And Trump's rating significantly increased after his impeachment in the Senate failed miserably. According to a survey by the University of Monmouth, most US citizens are confident that the president will achieve re-election. According to the study, 66% of U.S. voters predict Trump's victory in the November elections, and only 28% believe he will lose. Therefore, dollar bulls so far ignore Sanders' breakthrough, although, in my opinion, this is a time bomb. It is also worth noting that the European currency is too weak to compete for leadership in tandem with the dollar. Today it became known that the volume of industrial production in the eurozone countries fell to -2.1% on a monthly basis and to -4.1% on an annualized basis. Both indicators came out in the red zone, not significantly reaching the forecast values. Such dynamics put additional pressure on the euro, which is still knocked down after the slowdown in inflation growth and soft comments of ECB members. Thus, the EUR/USD bears have every chance to update the low of the current and previous year. Sellers of the pair may come to the middle of the eighth figure tomorrow, especially if US inflation will surprise investors with significant growth. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Feb 2020 02:51 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 114p - 79p - 80p - 74p - 74p. Average volatility over the past 5 days: 85p (average). The British currency ends Wednesday, February 12, by continuing upward correction. The pound =dollar pair managed to overcome the critical line, or rather, it did without any problems. And although now the further downward movement has been called into question, it is still impossible to say that an upward trend has begun to form. We continue to believe that the UK macroeconomic statistics and the country's prospects for at least 2020 and 2021 remain so vague that considering the long-term growth of the pound is absolutely groundless. Nevertheless, it should be recognized that the market is not always and not everything is determined by fundamental factors. A banal example: a large player enters the market with a deal to buy a large amount of pounds. He does not pursue the goal of earning exchange differences or making money on this transaction. He needs pounds sterling, for example, to buy British securities or invest in a British company. Thus, the pound may begin to rise in price, as demand for it will sharply increase, and other smaller investors can pick up this movement, which will provoke an upward trend. True, even in this case it is unlikely to be long. Today it became known that after its final "divorce" with the European Union, the UK will lose access to the financial markets of the bloc. In principle, this is very logical, and Michel Barnier has repeatedly stated that London will not be able to enjoy all the privileges of membership in the EU, while not in the EU. It's clear that Boris Johnson wants to keep as many of Britain's contacts with the EU as possible beneficial to Britain, but at the same time not obey Brussels in any sphere. On the contrary, Brussels wants to tie London to itself as much as possible, and only in this case will it be ready to offer it a really good deal. Not a single important macroeconomic report was published in either the United Kingdom or the United States during the third trading day of the week. However, traders still seem to be impressed by the fourth quarter GDP in the UK. We have already said that this report did not show any increase or improvement. The GDP indicator simply did not change compared to the previous period. The growth rate completely decreased in quarterly terms. However, most traders considered the non-fall in GDP to be great news, as forecasts predicted a decline in growth rates to 0.8% y/y. We still believe that the macroeconomic statistics in the UK continue to deteriorate, and the economy slows down, and this process will continue throughout 2020. Thus, we still consider it appropriate to work out all the sell signals that Ichimoku or any other trading system will generate, since the fundamental background remains in favor of the US currency. At the moment, the upward movement is already a priority, as the Kijun-sen line is left behind. However, before overcoming the important and technically strong line of Senkou Span B, it is not recommended to seriously consider buying the British currency. We believe that, despite the new "golden cross", the pound/dollar pair may turn down at any moment and resume the downward trend. Trading recommendations: GBP/USD continues to adjust against a downward trend. Thus, selling the British pound with targets at levels 1.2863 and 1.2772 can now only be possible after the price has consolidated below the critical line. Purchasing the pair in small lots can now be considered with the first goal of the Senkou Span B line, but it should be understood that the fundamental factors do not remain on the side of the British currency. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. February 12. Results of the day. Weak European macroeconomic statistics Posted: 12 Feb 2020 02:51 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 50p - 43p - 43p - 49p - 34p. Average volatility over the past 5 days: 46p (average). The EUR/USD currency pair resumed the downward movement on Wednesday, February 12, even without a minimal correction (!!!). There was simply no correction after a six-day continuous fall. The pair stood at the same place most of the night and day trading, and at the US trading session it resumed its downward movement, updated the previous local low, once again worked out the support level of 1.0893. These are the results of the third trading day of the week. We can immediately note that there was no reaction from market participants - neither to yesterday's speech by Jerome Powell, nor to Christine Lagarde's from today. In fact, the heads of central banks did not inform the traders of anything new. Thus, in fact, there was nothing to react to. Thus, no changes in the monetary policies of the ECB and the Fed in the near future are still not expected, and traders are still encouraged to pay increased attention to macroeconomic reports from the eurozone and the United States. Only one macroeconomic report has been published today. We are talking about industrial production in the European Union. Its value decreased from -1.5% in November to -4.1% yoy in December 2019. In monthly terms, industrial production decreased by 2.1%, while a month earlier an increase of 0.2% was recorded. Forecasts on these indicators were naturally higher, but they were not destined to come true. Thus, we got 14 consecutive months, when industrial production in the EU fell, and also the decline in December was a record for all these 14 months. In monthly terms, we have the largest volume decline in the last 23 months. Despite the fact that this indicator still does not have such a serious impact on the euro exchange rate, such as inflation or GDP, with values that will clearly negatively affect the same GDP, a more serious fall in the European currency could be expected. However, while traders are near two-year lows, the probability of a rebound from the level of 1.0879 and the beginning of an upward trend remains. Just because the bears may again stop selling the euro, for fear of too low price values for the EUR/USD pair. Thus, since the signal for correction was, but was offset (a rebound from the level of 1.0893 yesterday), you can still sell the pair, however, remember that an unexpected upward movement of the pair may occur around the level of 1.0879, even if it will not be substantiated from a macroeconomic point of view. Meanwhile, US presidential elections are approaching, and various research institutes continue to calculate the likelihood of Trump being re-elected to them. According to another study by the University of Monmouth, 66% of US voters believe that Donald Trump will win the upcoming elections. However, only 42% believe that he should be re-elected for a second term. In other words, Trump's support is now at 42-45%, but most Americans believe that the president will stay for a second term. U.S. elections are becoming more like the British prime minister's election last summer or the MP elections this winter. By and large, here and there there is one odious charismatic applicant, who is criticized a lot, but who is constantly in sight, constantly flashes in the media, in social networks, constantly differs in resonant actions and statements. What do you, dear traders, remember, for example, Joe Biden? In addition, it was precisely because of him that the process of impeachment of Trump began, which, in fact, the incumbent president won. In general, it is difficult to say who will win the US election, but if we were asked who would win, then we would also bet on Donald Trump. From a technical point of view, the downward movement continues, and the signs of correction all evaporated. A new rebound from the level of 1.0893 may again provoke a rise in the price of the euro, however, given the current macroeconomic statistics from the eurozone, it will be difficult for traders to find reasons for buying the euro. Trading recommendations: EUR/USD continues to move down. Thus, it is now recommended that you keep selling the euro while aiming for 1,0893, 1,0869 and 1,0842. An increase from any of these levels will allow you to close sell positions. It will be possible to consider purchases of the euro/dollar pair in small lots with the goal of the Senkou Span B line, if traders manage to gain a foothold above the Kijun-sen line, which is not expected in the near future. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

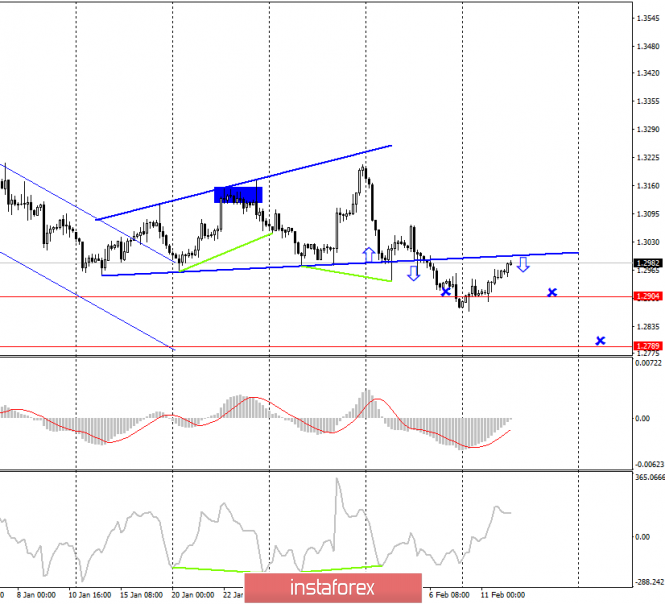

| GBP/USD: although the pound is rapidly growing, it might be short-lived Posted: 12 Feb 2020 02:51 PM PST The British currency has taken a hit in recent days, falling from $1.3220 to $1.2900 against the US dollar since the beginning of February and experiencing its worst week since the December MP elections. However, the GBP/USD pair did not trade for long at 1.2900. After a short drawdown, it reversed, rebounding from 2.5-month lows, and rushed to local highs near 1.30. The data released on the eve showed that the British economy managed to avoid a recession in the fourth quarter, and production activity in the country recovered in December after the November recession. Signs of a recovery in the economy after the Conservative Party confidently won early elections allowed the Bank of England not to cut interest rates last month. BoE Chief Mark Carney said yesterday that the central bank could refrain from lowering rates at the next meeting on March 26, as the British government is preparing projects to stimulate the national economy through fiscal policy. Public spending, according to Carney, will contribute to inflation, which allows the regulator to take a break to assess the prospects for economic growth in the United Kingdom. Based on the fact that the prospects for Great Britain's economy are quite positive, the pound's decline in February is only a fairly strong correction and a return to a powerful support zone at the level of 1.2850–1.29. When you repel from this zone, a reversal pattern begins to take shape upward, which is still not very clearly formed. The cautious positive of recent statistics supports this movement. With its development, the nearest targets may be the levels of 1.3050–1.31. However, in the first quarter of 2020, the rate of economic growth in the UK may slow down due to investor concern over the course of trade negotiations between London and Brussels. This will inhibit the investment activity of British companies. Uncertainty surrounding Brexit could increase when there is doubt about the ability of the UK and the EU to close the deal before the end of the year, when the transition period should end. In this regard, despite the current recovery of the pound, its upward trend may turn out to be short-lived. An alternative scenario, also possible with increasing pressure from the dollar, is to overcome the GBP/USD down the area of 1.2830-1.2850. In this case, we should expect the pair to fall to the support of 1.2750. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review 02/12/2020 EURUSD. US elections and weak eurozone data Posted: 12 Feb 2020 02:51 PM PST Main news: Eurozone: eurozone output sharply fell to 4-year lows. This is bad for the euro. US: the election race begins. If everything is clear with the Republican candidate - Trump is running for the second term, then the Democratic candidate is just beginning to clear up. The first primaries were held - in New Hampshire: Sanders won with a small margin while Pete Buttigieg was in second. Sensation: Warren and Biden, who were considered favorites for a long time, remained far behind. This is not Sanders' final victory. of course. but a very serious claim that Sanders will be a candidate. Sanders is very left-wing. He is a firm supporter of free medicine and free education. The battle will be interesting. EURUSD: the euro remains under pressure after weak data on the eurozone economy. We keep selling from 1.0990. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: dollar retreats, but does not give up, euro risks weakening further Posted: 12 Feb 2020 02:51 PM PST As the number of new cases of coronavirus infection decreases, the demand for risks returns to markets. Against this background, the US dollar retreated from a four-month high against the euro. The EUR/USD pair, having noted new local lows, was able to attract buyers in the area of 1.0890–1.0900. Meanwhile, the comments made yesterday by Fed Chairman Jerome Powell confirmed the view that the US central bnk is unlikely to change interest rates in the near future. Even taking into account risks such as uncertainty in trade policy and a slowdown in global growth, the Fed chief made it clear that he sees no reason to adjust interest rates in the United States, unless new events lead to a significant reassessment of current prospects. Concerns over the economic consequences of coronavirus have boosted the US dollar's appeal as a safe haven asset, while recent statistics have reinforced the view that the US economic outlook is stronger than in the eurozone. Upbeat US data confirmed the contrast in the performance of these regions, paving the way for pulling down EUR/USD from the psychologically important level of 1.10. It should be noted that all indicators relate to December - the period that preceded the appearance of the coronavirus epidemic on investor radars. Therefore, the data, which usually have a short-term effect on the euro, this time launched the sale of the single currency at key levels. At the moment, the closest support level for EUR/USD is the area of 1.0880, from where the pair pushed off in early October. It is assumed that Germany, and with it the entire eurozone, will suffer significantly more from the influence of coronavirus than the United States, which will require additional incentives from the ECB. Thus, a significant pressure on the euro is exerted by the difference in current indicators and near-term forecasts, paving the way for a further decrease in EUR/USD to 1.0750 by the end of the month. Such a movement fits into the downward trend for the euro, formed in early 2018 along with the first "volleys" of the Washington and Beijing trade war. An outbreak of coronavirus may be the factor that can accelerate the euro's decline against the US dollar to $1.05 or even lower by the end of the first quarter. If the American economy maintains healthy growth rates by the middle of the year, while the European and Chinese continue to slow down, then we can expect a drop in EUR/USD up to parity by the beginning of the third quarter. The material has been provided by InstaForex Company - www.instaforex.com |

| Is the dollar a risk catalyst for the US economy? Posted: 12 Feb 2020 02:51 PM PST According to some experts, the current situation around the greenback strengthening provokes the risk of a slowdown or even weakening of the US economy. A significant strengthening of the dollar's position to its highest value over the past four months has become another possible barrier to the growth of the national economy, experts said. Many experts are convinced that the attractiveness of greenbacks as a safe haven significantly increases the risks for the US economy. Fuel to the fire is adding concern about the virus epidemic, which accumulate tension and thicken clouds over the US economy. According to analysts, the status of a reserve currency, like a safe haven asset, is both a blessing and a curse. The positive side of the coin is that the country issuing the main international reserve currency will still take its toll in the face of a budget deficit. The negative side is the fact that a constant trade deficit can weaken the US industrial base. In addition, experts and representatives of the Federal Reserve fear the negative consequences of the coronavirus epidemic. Experts say that this creates additional risks for the global economy. At the same time, the regulator is not configured to change either the interest rate or the monetary policy in 2020. Analyzing the situation with the strengthening of the greenback, experts pay attention to the fact that the position of the issuer of the global currency has both significant advantages and side effects. The pluses of this situation are analysts to receive goods from abroad without the need to produce the same volumes of exported products. At the same time, other countries are deprived of such a privilege and must export their goods in order to pay for the import received. The US issuing global currency occupy an exclusive position in the global financial market. This situation is extremely favorable for the greenback, and it always seeks to take advantage of it, squeezing the euro. Experts expect a strong correction regarding the European currency. At present, there are no signs of acceleration of the European economy, so a dark streak has come for the euro. According to experts, the ECB needs to either monitor the current situation or intervene again, using incentive measures to revive monetary policy. The current state of affairs makes the EUR/USD pair experience the strongest volatility, which was recorded on Tuesday, February 11. Yesterday, the pair dropped to 1.0911, trying to move to new heights. It partly did. On Wednesday, February 12, the EUR/USD pair, rapidly gaining momentum, soared to 1.0922. Currently, the pair runs in this range, trying to climb higher. According to analysts, the dollar has nothing to fear at the moment, because the US economy is showing signs of acceleration, which cannot be said about the euro. However, things can change in the long run, experts warn. They record a growing discrepancy between the position of the US economy in the world and the role of greenbacks in the global economy. Such a bias can upset the fragile balance between them, experts said. In the event of a reduction in US economic power, privileges for the greenback will remain less and less, experts conclude. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCHF breaks out, back tests and bounces Posted: 12 Feb 2020 01:54 PM PST USDCHF is breaking upwards. Price is following our bullish scenario we noted a couple days earlier. This break out was followed by a back test and as price has retested the broken resistance trend line, now it is bouncing higher.

Green line - bullish divergence Red line - expected size of upward move similar to first leg USDCHF has back tested the 0.9750 area which was once resistance and now support. Holding above the blue broken trend line resistance, will open the way for a move towards 0.99. We remain bullish USDCHF as long as price is above the 0.9750 support. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPUSD should see price move lower towards 1.29 and below once again Posted: 12 Feb 2020 01:49 PM PST GBPUSD remains vulnerable to a move lower. Price bounced off the 38% Fibonacci retracement of the longer-term upward move from 1.1958 to 1.3514. Price is in bearish trend also in the short-term and I continue to expect price move lower.

|

| USDCAD is pulling back as expected Posted: 12 Feb 2020 01:40 PM PST USDCAD is 40 pips lower since our last analysis where we pointed out that price should move lower as a bearish reversal signal was given. Price could continue lower towards 1.32-1.3225 where we could see a back test of the broken trend line resistance.

Red line - broken resistance trend line Green lines - bullish channel USDCAD remains inside the bullish channel since December low. Price is now pulling back as expected and is testing both the lower channel boundary and the broken trend line resistance. If price holds above 1.32-1.3225 then we could have a successful back test and a bounce to resume the up trend. Anyone taking advantage of the short-term bearish reversal signal, should now protect their short positions at break even. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Feb 2020 01:35 PM PST EURUSD remains in a bearish trend. This week started on a negative note for bulls as price was under selling pressure from the beginning. With price breaking below important support levels, it was a matter of time to see price below 1.09.

EURUSD is making new weekly lows relative to the September lows. This has important bearish implications. As long as price is below 1.11 weekly trend is bearish. Price will most probably move towards the lower red trend line around 1.07-1.0750. Only in the 4 hour chart we can see warning bullish divergence signs. At the end of the week we could see a bounce towards 1.0950-1.10 but I would not expect anything higher. The material has been provided by InstaForex Company - www.instaforex.com |

| February 12, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 12 Feb 2020 08:25 AM PST

On December 30, a bearish ABC reversal pattern was initiated around 1.1235 (Previous Key-zone) just before another bearish movement could take place towards 1.1100 (In the meanwhile, the EURUSD pair has lost much of its bearish momentum). One more bullish pullback was executed towards 1.1175 where the depicted key-zone as well as the recently-broken uptrend were located. Evident signs of bearish rejection were demonstrated around 1.1175. That's why, quick bearish decline was executed towards 1.1100 then 1.1035 which failed to provide enough bullish SUPPORT for the EURUSD pair. Further bearish decline took place towards 1.1000 where the pair looked quite oversold around the lower limit of the depicted bearish channel. Hence, significant bullish rejection was able to push the pair back towards the nearest SUPPLY levels around 1.1080-1.1100 where a confluence of supply levels (including the upper limit of the channel) were located. Since then, the pair has been trending within the depicted bearish channel. Hence, further bearish decline was expected towards 1.0950 where (Fibonacci Expansion level 78.6%) and the lower limit of the channel are located. Bearish closure below 1.0950 allowed another bearish decline to occur towards the next key-level 1.0910 (Fibonacci Expansion level 100%). Intraday traders are advised to look for signs of bullish recovery around the price level of (1.0910) as a valid intraday BUY signal. Overall, The intermediate technical outlook remains bearish as long as bearish persistence below 1.1000 is maintained on the H4 chart. However, the EUR/USD pair looks quite overpriced after such a long bearish decline and if bullish recovery is expressed above 1.0910, further bullish advancement would be expected towards 1.0950 and probably higher (around 1.0990) if enough bullish momentum is expressed above 1.0950. On the other hand, bearish persistence below 1.0880 invalidates the previous short-term bullish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| February 12, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 12 Feb 2020 08:21 AM PST

On December 13, the GBPUSD pair looked overpriced around the price levels of 1.3500 while exceeding the upper limit of the newly-established bullish channel. On the period between December 18th - 23rd, bearish breakout below the depicted channel followed by temporary bearish closure below 1.3000 were demonstrated on the H4 chart. However, immediate bullish recovery (around 1.2900) brought the pair back above 1.3000. Bullish breakout above 1.3000 allowed the mentioned Intraday bullish pullback to pursue towards 1.3250 (the backside of the broken channel) where bearish rejection and a new wide-ranged movement channel were established between (1.3200-1.2980). Moreover, new descending highs were recently demonstrated around 1.3200 and 1.3080. During the past few days, signs of bullish rejection were temporarily manifested around 1.2980-1.3000 before obvious bearish breakdown could occur. Intraday technical outlook is supposed to remain bearish as long as the pair maintains its movement below 1.3080 (the most recently-established descending high). Bearish breakdown below 1.2980 enhanced further bearish decline towards 1.2890 where Intraday traders were advised to watch price action carefully (the lower limit of the movement channel). Since Monday, early signs of bullish rejection have been expressed allowing the current bullish pullback to pursue towards 1.3000 where bearish rejection and another SELL entry can be offered. On the other hand, bullish breakout above 1.3000 will enable further bullish advancement towards 1.3100 and probably 1.3200. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Feb 2020 06:28 AM PST The euro continued to stagnate in one place after a weak report on industrial production, which declined at the end of last year, which was quite expected against the background of a sharp drop in many European countries. And if a partial solution to the trade conflict between the US and China could bring growth to the sector, the slowdown in the global economy and problems with Brexit continued to make a negative contribution to the indicator. According to the report, industrial production in the eurozone in December 2019 decreased by 2.1% compared to November and fell by 4.1% compared to December 2018. Economists had expected a less active decline of 1.6% and 2.5%, respectively. Data for November was revised downward to -1.7% per annum. A decrease in orders and a slowdown in the manufacturing activity index also made a negative contribution to the overall indicator. Given that no other important fundamental data is expected today, the market may continue to show very low volatility. At the North American session, Federal Reserve Chairman Jerome Powell is expected to deliver a speech on the economy and monetary policy before the Senate Banking Committee. However, we will not hear anything new since Powell will read out the same report that he made on the eve of the Committee on Financial Services of the House of Representatives. Let me remind you that at the end of last year, the Fed stopped lowering rates amid signals that global growth is stabilizing. At present, the US economy looks quite resilient to global problems. During yesterday's speech, the Fed Chairman said that the current monetary policy is appropriate and the central bank will only change it if the situation forces a more significant revision of forecasts. Among the positive changes, the head of the Federal Reserve noted the labor market, which continued to support the economy, strengthening last year, but consumer spending at the same time became more moderate by the end of 2019. Problems remain in companies' investments and exports. As for the technical picture of the EURUSD pair, there are no changes here. Just keeping buyers of risky assets at 1.0900 is not enough to turn the market in their direction. Building the lower border of the new ascending channel from yesterday's lows and breaking the resistance at 1.0930 are the bulls' priorities for today. Only a break in the range of 1.0930 will open a direct path to the highs of 1.0975 and 1.1030. If the pressure on the euro returns, the breakdown of the support of 1.0890 will quickly push the trading instrument to the lows of 1.0860 and 1.0830. NZDUSD The New Zealand dollar "flew into space" after the Central Bank said it would keep the interest rate unchanged. According to the data, the Reserve Bank of New Zealand left the official interest rate unchanged at 1.0%, saying that keeping interest rates low is necessary for inflation to remain near the target level. The regulator also believes that the coronavirus outbreak is a downside risk for the economy, but the impact of the epidemic on New Zealand will be short-term. Despite this, the RBNZ has enough time to make the necessary decisions as new information becomes available. The average official interest rate is expected to be 1.0% in the fiscal year 2021, and the average official interest rate is expected to be 1.3% in 2022. The growth of the New Zealand dollar was against the expectations of traders, who predicted that the regulator would lower interest rates or make direct hints about lowering rates in the future. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. February 12. Strong support for the euro. Getting ready for the purchases of the pair? Posted: 12 Feb 2020 05:59 AM PST EUR/USD – 4H.

Good day, dear traders! A few weeks ago, I gave a long-term trading idea about selling the euro currency on the signal of a rebound from the upper line of the downward trend corridor. A little later, there was a second sell signal in the form of fixing the pair's rate under the upward trend line. Today, I am happy to report that the target level is almost fulfilled. At the moment, the euro/dollar pair has performed a fall to the low level of October 1, so it is possible to rebound from it, a reversal in favor of the European currency and some growth. Given the fact that the initial target level of 1.0850 remains no more than 50 points, I consider it appropriate to close long-term sales near this low level. And almost immediately, we have a new trading idea associated with the level of 1.0890. If a rebound from it is completed, which is very likely, it will be interpreted as a buy signal with targets near the upper line of the downtrend corridor, which continues to determine the mood of traders as "bearish". Otherwise, we will close below the level of 1.0890 with a further drop in the quotes in the direction of the level of 1.0850, and possibly even lower. In any case, a new signal can be received today or tomorrow. Also, in the event of a rebound, traders will get a "double bottom" graphic pattern, which is a strong signal to buy. Forecast for EUR/USD and trading recommendations: The new trading idea is to buy the euro with an approximate target around the level of 1.1100 (the upper line of the trend area) when rebounding from the level of 1.0890. The rebound can be said to have already been completed, so you can already try to buy the euro with a Stop Loss at 1.0890. I recommend selling the pair if you pass the low level of 1.0890 for bear traders. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Feb 2020 05:59 AM PST GBP/USD – 4H.

Good day, dear traders! As seen on the 4-hour chart, the "Briton" continues the growth process after an unsuccessful attempt to consolidate under the low level of 1.2904, which was the first target level for the trading idea of closing under the global correction line. The pair performed a reversal in favor of the pound and started moving back to this correction line. Thus, I believe that the rebound of quotes from this line from the bottom will work in favor of the US dollar and the resumption of the fall in the direction of both target levels announced earlier - 1.2904 and 1.2789. At the same time, I will consider the completion of the current trading idea if the pair makes a fix over the correction line. There are no divergences formed on February 12 for any indicator, although a bearish divergence is brewing for the CCI indicator. Rebound from the correction line and divergence may coincide and strengthen the sell signal. Forecast for GBP/USD and trading recommendations: The new trading idea is to sell the pound with targets of 1.2904 and 1.2789 when rebounding from the correction line (marked with a down arrow). If this condition is met, I recommend selling the pound/dollar pair again. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Feb 2020 04:52 AM PST To open long positions on GBPUSD, you need: The upward trend is maintained. In the morning review, I paid attention to the level of 1.2976, which is a serious obstacle for the buyers of the pound. A test of this area in the first half of the day and an attempt to consolidate above this range still keeps the chance of continuing the growth of GBP/USD in the area of the highs of 1.3011 and 1.3049, where I recommend taking the profits. However, if the bulls miss this range, it is best to look at new long positions after the test of the minimum of 1.2934, and you can buy GBP/USD immediately on the rebound from the minimum of 1.2895. There is no news related to the negotiations between the UK and the EU on a trade agreement, which also plays on the side of buyers of the British pound. To open short positions on GBPUSD, you need: Sellers of the pound missed the level of 1.2976, but active purchases above this range are also not visible, which may lead to a decrease in the pair in the second half of the day under the above range. The formation of a false breakdown, as I mentioned in the morning forecast, will be a good signal for opening short positions in the pound, which will lead to an update of the minimum of 1.2934. However, the longer-term goal, which will lead to a reversal of the upward correction, will be at least 1.2895, where I recommend fixing the profits. In the scenario of further growth of GBP/USD, and this can happen only after the speech of Fed Chairman Jerome Powell, who can completely repeat his speech yesterday, it is best to consider new short positions from the highs of 1.3011 and 1.3049. Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily averages, which indicates the likely formation of an upward correction of the pound. Bollinger Bands In the case of a downward correction, the lower border of the indicator around 1.2934 will provide support.

Description of indicators

|

| Posted: 12 Feb 2020 04:52 AM PST To open long positions on EURUSD, you need: A weak report on the reduction in the volume of industrial production in the eurozone did not allow the bulls to get above the resistance of 1.0922. As a result, volatility has remained very low, and nothing has changed from a technical point of view. Those who bought the euro on a false breakdown around the level of 1.0905 can count on a breakout and consolidation above the resistance of 1.0922. However, only after this can we talk about continuing the upward correction to the area of the highs of 1.0950 and 1.0975, where I recommend fixing the profits. In the scenario of a EUR/USD decline in the afternoon, which may occur after the speech of Fed Chairman Jerome Powell, new long positions can only be returned to the support test of 1.0894, provided a false breakdown or buy the euro to rebound from the lows of 1.0869 and 1.0840. In the meantime, the bulls have built the lower border of the ascending channel from the level of 1.0905, which in itself is a good signal for further strengthening of the euro. To open short positions on EURUSD, you need: Sellers waited for another weak data on the European economy, but this did not lead to a major sale of the euro. Currently, a false breakdown is formed in the resistance area of 1.0922, which keeps the probability of a downward movement of the euro in the second half of the day to the support area of 1.0894, but the bearish momentum is very weak. Only a break in the range of 1.0894 will return the bearish trend to the market, which will open the way to lows in the area of 1.0869 and 1.0840, where I recommend taking the profits. In addition to important data on industrial production, there is no more news today, so if there are no active sales during the speech of Fed Chairman Jerome Powell, it is best to postpone short positions until the resistance test of 1.0950 or sell the euro at all for a rebound only from the maximum of 1.0975. Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 moving averages, which indicates market uncertainty in the short term. Bollinger Bands Volatility is very low, which does not give signals to enter the market.

Description of indicators

|

| Gold 02.12.2020 - Downside pressure and potential for more downside and test of $1.547 Posted: 12 Feb 2020 04:50 AM PST Technical analysis:

Gold has been trading downwards as I expected. The price rejected of the median Pitchfork line and is heading to test the lower diagonal of Pitchfork line and swing low at $1.547. Watch for selling opportunities on the rallies using the intraday frames 5/15/30 minutes in order to find best entry. MACD oscillator is showing negative reading below the zero and the slow line is turned to the downside, which is sign that sellers are in control. Resistance levels are seen at the price of $1.568 and $1.577 Support levels and downward targets are set at the price of $1.552 and $1.547. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 02.12.2020 - Broken Multi pivot at the prrice of 1.2950, upside confirmed Posted: 12 Feb 2020 04:34 AM PST Technical analysis:

GBP has been trading upwards as I expected. The price broke our key resistance pivot at 1.2960 and I expect further upside on the GBP. Next pivot resistance is seen at the price of 1.3065. Watch for buying opportunities on the dips using the intraday frames 5/15/30 minutes in order to find best entry. MACD oscillator is showing increasing momentum to the upside, which is good confirmation for our upside view. Resistance levels are seen at the price of 1.3065 and 1.3080 Major pivot support level is set at 1.2960 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment