With all the talk of what we need to do to be good citizens and practice social distancing, it is disconcerting to see a stimulus package get shelved by Congress.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can unsubscribe here. |  |  |  | |

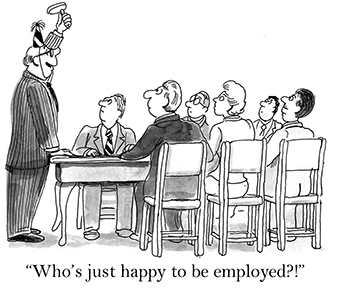

|  |  Good morning. With all the talk of what we need to do to be good citizens and practice social distancing, it is disconcerting to see a stimulus package get shelved by Congress. When you find out that the last-minute breakdown was over stuff that has nothing to do with providing relief, it makes it even more apparent that they have bigger political objectives than lessening the burden of coronavirus restrictions. Good morning. With all the talk of what we need to do to be good citizens and practice social distancing, it is disconcerting to see a stimulus package get shelved by Congress. When you find out that the last-minute breakdown was over stuff that has nothing to do with providing relief, it makes it even more apparent that they have bigger political objectives than lessening the burden of coronavirus restrictions.

The market didn't like the news either, which places even more pressure to get something done, and soon. This the time to suspend all pork and focus on what the economy really needs right now. | |  | |  |  |

|  |  |  | DOW 18,591.93 | -3.04% |  | |  | S&P 2,2347.40 | -2.93% |  | |  | NASDAQ 6,860.67 | -0.27% |  | |  | | *As of market close |  | | • | Stocks fell 4.34%, as the failure to pass a stimulus package create late day selling. |  | | • | Oil rallied 5.39%, as it stayed above $20 and indicates it may be oversold. |  | | • | Gold rallied 5.13%, as the dollar fell with news the Federal Reserve has removed limits to its purchases. |  | | • | Cryptocurrencies traded higher, as Bitcoin finished over 9.18% higher to close at $6375. | |  | | | |

|  | | 3 'Golden' Opportunities as the Fed Infinitely Expands its Balance Sheet Following COVID-19 Rout |  |  |  | While Congress continues to hash out the details of a trillion-dollar-plus stimulus package, the Federal Reserve has stepped forward with their own package as Chairman Powell had his own "whatever it takes" moment.

Any limits that were previously announced have been lifted. Their commitment, they will buy bonds "in the amounts needed to support smooth market functioning." It's in this environment that makes the current position of gold similar to 2008.

» FULL STORY |  | | |  |

|  | This Stock Has the Highest Numbers of Insiders Selling and It Will Surprise You |  |  |  | What does it say when a company has its product thrust into the spotlight for the first time and the insiders start dumping shares of the company? Now, insiders aren't always the best at timing the market, but it does tell you a little bit about how much they believe in their product that they won't bet part of their fortune on their product gaining more mass adoption.

Slack Technologies Inc (WORK) has been in the news a lot as the work-from-home trend, but its insiders are dumping shares. What does it mean?

» FULL STORY |  | | |  |

|  | COVID-19 Cancellations of the NBA and MLB Have Hit Hard, Option Traders Say It's Not Done |  |  |  | It's been a couple weeks since the NBA and other professional sports cancelled their seasons. It wasn't just the players and the fans that were disappointed by the announcement, the sporting goods industry has been hit just as hard.

While the impact on interest in licensed products would take an expected hit, the closure of stores delivered even larger blows to company's like Foot Locker Inc (FL) and others. Option traders are betting the full impact hasn't been fully felt.

» FULL STORY |  | | |  |

|  |  | | TOP |  | | RCL | 18.396% |  |  | | COTY | 14.955% |  |  | | FLIR | 13.519% |  |  | | ADS | 12.595% |  |  | | HAS | 12.492% |  |  | | BOTTOM |  | | M | 20.1% |  |  | | KSS | 17.413% |  |  | | HFC | 16.248% |  |  | | VLO | 15.623% |  |  | | LKQ | 14.724% |  |  | |  |

|  |  |  | | If its price trajectory proves similar to 2008, we could see the precious metal's benefits resurging as market stress continues to assert itself |  | - Catherine Doyle, Investment specialist at Newton Investment Management, quoted by Bloomberg  |  |

|

No comments:

Post a Comment