Forex analysis review |

- Coronavirus: likelihood of a crisis and recession is much higher than a quick victory over the epidemic

- Around 15 to 70 million people can die from the coronavirus. Three scenarios have been developed for the global economy

- GBP/USD. March 15. Results of the week. Pound drops 10 cents in a week. We are only at the beginning of a new crisis. We

- GBP/USD. How low will the pound fall?

- Ichimoku cloud indicator short-term analysis of Gold for March 16, 2020

- Technical analysis on EURUSD

| Posted: 15 Mar 2020 03:55 PM PDT Unfortunately, the key topic for the whole world is the pneumonia virus called COVID-2019. All currency pairs and instruments continue to trade in full alert mode. All macroeconomic factors continue to be ignored by market participants, and experts in the medical field believe that the coronavirus is likely to continue to spread across the planet. Unfortunately, humanity faces various diseases from time to time, but if the previous disease was localized and defeated relatively quickly (SARS virus), this does not mean that the current disease will also be quickly defeated. A lot of films have been made on this topic, some of them surprisingly accurately reflect the spread of infection (for example, the 2011 film "Contagion", which was noted by all scientists as a reliable reflection of scientific facts). In the current conditions, this film can be recommended for viewing by everyone. Once again, it should be said that, in principle, predicting the spread of any infection is divination on coffee grounds. It is impossible to accurately predict the extent of the virus, when it is not even known for sure how long it can live outside of a living organism and what all the ways of its transmission are. Usually, when predicting a similar case of the disease, parallels are drawn between the rate of spread, mortality, number of people who have recovered, and so on... In fact, now that there is no vaccine against the virus, the main task of all countries of the world is to localize the disease, that is, stop its spread. But for this, as it turned out, you need to enter a quarantine, isolate all sick or infected people. It is obvious that such measures will have a very bad impact on the economy. For example, in Italy, a country where tourism is extremely developed and is one of the main sources of income, the quarantine will have devastating consequences. In addition, in any case, industrial production is reduced, companies are closed for quarantine, business activity falls accordingly, and so on. And in each country, the same will be observed, taking into account the local specifics. A big problem, in addition to the relative ease of distribution, is also the huge number of questions that scientists do not yet have answers to: 1) What will be the extent of the disease in non-developed countries? Will efforts to control and contain the virus in developed countries be in vain if less developed countries remain infected? 2) China managed to contain the pandemic, will it be possible to do this in other countries? 3) Is the disease seasonal? In other words, is the virus susceptible to heat or cold, and is it equally dangerous in summer, spring, and winter? 4) What is the percentage of fatalities in developed and undeveloped countries? 5) what is the probability of new waves of infection in countries that seem to have already managed to stop the spread of the virus? As we have already found out in the previous article, in any case, the consequences for the economy will be negative. In any case, individual sectors of the economy will suffer very much. For example, airlines. Given the fact that many countries, especially such large ones as the United States, have closed partially or completely air traffic, it is natural that airlines will incur losses. At least, during the second quarter of 2020. If the epidemic can be contained quickly, recovery may begin in the third quarter. What if we can't localize it quickly? Some companies may suffer losses so large that they will be forced to declare bankruptcy. The longer air transport and any international transport in general will remain quarantined, the longer the quarantine will be in effect in countries, the more the demand for oil will decrease and, consequently, the price of all types of fuel will be extremely low. In turn, this will hit commodity countries and their currencies, and cause a certain crisis and economic slowdown. The worst thing for us, traders, is that the situation in the currency market is unlikely to stabilize in the near future. Market participants, major players, and investors either panic or urgently transfer their funds to the safest assets, which, of course, negatively affects risky assets and currencies. When the EUR/USD pair regularly passes 100-150 points per day, this makes it completely unattractive to trade for most traders who are used to volatility of 40-60 points. Thus, our personal forecasts are as follows: the currency market crisis will continue for at least some time, perhaps two or three weeks; until we find ways to completely block the spread of infection or find an effective vaccine against it, we should not wait for the global economy to recover. In the near future, the macroeconomic indicators of all countries of the world may begin to fall synchronously, despite the actions of central banks to stimulate. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Mar 2020 03:55 PM PDT The Chinese COVID-2019 pneumonia virus has already captured more than 100 countries around the world. More than 130,000 people are infected and about 5,000 have died. However, scientists and analysts around the world warn that this may only be the beginning. The new virus differs from the others in that it spreads very easily. Scientists suspect that the virus can survive even outside the human body, for example, on ordinary surfaces made of plastic, iron and others that a person touches. Moreover, it may take up to two weeks before a person feels unwell and goes to a doctor or self-isolates at home. How many people can it infect in two weeks? And how many people from this number who are already infected will transmit the virus, in turn, to other people, also without knowing that they are carriers of the virus? Australian scientists have tried to model the picture of the spread of the virus and calculate possible losses. According to the most conservative estimates, the CODID-2019 virus will take the lives of about 15 million people. It is difficult to say how accurate and correct these calculations are if the death rate is no more than 5%, but if the virus really continues to spread with such ease, these figures will no longer seem improbable. The losses of the world economy in this case will exceed two trillion dollars. This variant was modeled on the "Hong Kong flu" of 1968-1969, which killed a million people. However, scientists also report that a more severe scenario is possible, in which more than 70 million people will die, and it will spread like the "Spanish flu" in the 20s of the previous century. If you can't find a vaccine for this virus (meaning in the near future) and you have to fight it with traditional medicines, but you can't prevent the disease in any way, then sooner or later everyone on the planet can get infected, despite the quarantines imposed in many countries and the termination of air traffic. In this case, the virus can become an annual phenomenon that worsens during certain periods of the year. Then the epidemic can take the lives of 15 million people every year. The damage to the global economy will amount to tens of trillions of dollars. Also, Australian scientists note that it is too late to close the borders, since the virus has already spread across the planet. Meanwhile, economists and analysts are also developing possible scenarios for the consequences for the global economy. According to experts, there are three possible options: a rapid economic recovery based on a successful outcome of the fight against the virus, a global economic slowdown and further spread of the virus, and a global recession. Under the first scenario, global economic growth is expected to fall to about 2% this year. The largest economies, the US and China, will recover fully in the second quarter. However, it is noted that this option is too optimistic and implies a seasonal spread of the virus. It is also assumed that the population will remain economically active, and the measures taken by the governments of the countries will be as effective as in China. In the second scenario, it is also assumed that the virus is seasonal but it more realistically reflects the inequality of opportunities in many countries. Therefore, the fight against coronavirus in some countries (developed) will be successful, in others (less developed) – not. In this way, some countries will be able to control the epidemic, while others will not, and the spread of the virus will continue. In this case, the growth rate of world GDP will be reduced by half, but a recession will still be avoided. Small and medium-sized businesses are expected to suffer the most. In the last, third, variant, it is assumed that the virus is not seasonal, which means that at any time of the year it will spread freely and easily. In this case, it will spread around the world, including hotter and colder countries. In this case, the growth of the world economy may be reduced to -1.5%. This is already a recession. The entire year 2020 will be fully dedicated to the fight against the new disease. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Mar 2020 03:55 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 103p - 165p - 233p - 172p - 358p. Average volatility over the past 5 days: 207p (high). What can we say about the past week for the GBP/USD pair? In short, the markets have been in absolute panic all week. Once again, we can note the collapse of oil, quotes of US stock indexes, as well as many currencies. We still believe that it is impossible to predict the movement of any currency pair based on fundamental events or macroeconomic statistics. Technical analysis predicts the future more or less accurately now. From the last local high (March 9 – Monday), the pound/dollar pair lost 930 points. For a week – 930 points! Almost 10 cents... What can explain such a collapse in quotes, if not panic? No fundamental events could provoke such a fall, especially given the fact that the pound was steadily rising in price just a week ago. Of course, you can link what is happening on the pair with the decisions of the Federal Reserve and the Bank of England on monetary policy. First, the Fed lowered the rate by 0.5%, and then the British regulator made a similar decision. The fall of each currency did not start with the central bank meeting. But from a technical point of view, everything is logical. On the 24-hour timeframe, traders tried to start a new upward trend (absolutely unfounded fundamentally), but failed to overcome the Senkou span B line, after which the downward movement began. If you do not pay attention to what is happening now in the world (in the last two weeks), we have long warned that sooner or later the pound will fall. No, the pound has not had and will not have any reason to grow in the near future. The only thing that can really provide long-term support for the British currency is if the Fed reduces the key rate so much that it will be lower than in the UK. This is the only chance for the pound to change the unfavorable balance of forces with the US currency. However, at the moment, the rate in the United States is 1.25%, and in Britain – 0.25%. Thus, Donald Trump will need to make a lot of effort to convince Jerome Powell to go for more and more easing of monetary policy. And even taking into account the most important factor – the difference in the strength of monetary policies between countries, note how much the pound rose when the Fed lowered the rate, and how much the dollar rose when the BoE lowered the rate. Thus, we do not expect that something will change dramatically in this factor in the near future. The overall picture remains as unsightly in the UK as it was. Just now all the problems in Britain, of which there were extremely many, are multiplied by the coronavirus, which only makes things worse. We would like to remind you that the epidemic will end sooner or later, hopefully without major losses. The question is with what losses each country will come out of it and how much the economy of each individual country will slow down. Recall that before the panic of the last two weeks, the British macroeconomic statistics from time to time disappointed traders, while the US data were strong and stable. Thus, even if we assume that both these economies will suffer the same losses, then again the balance of power will not change between the British pound and the US dollar. Thus, it is best to wait for the end of the epidemic, or at least its localization, or at least a slowdown of its spread. Without this, it is naive to expect that the markets will calm down and return to normal. Any macroeconomic statistics do not matter now. The economy of each individual country may begin to shrink. The coronavirus is likely to continue to spread. Panic is already present not only in world markets, but also among the civilian population, especially in European countries, where everything is being swept off the shelves in grocery stores. People buy food and do not go out on the street once again. On the one hand, this is good, there is a chance that the growth rate of the epidemic will decrease. At the same time, if people stay at home, it means that production and services are not being provided. The economy is not working, and GDP is declining. Thus, we believe that we are only at the very beginning of a crisis that is only gaining momentum. From a technical point of view, the main question now is when the correction will begin. The MACD indicator can start to run low at any time, since it cannot fall constantly. Neither currency can fall constantly, but in the current conditions, the movement in one line can continue for a very long time. You need to be prepared for any scenario. Recommendations for short positions: On the 4-hour timeframe, the pound/dollar pair continues its strongest downward movement and overcame all the target levels for this week. Those traders who remain in sell positions can hold them for the purpose of the support level on the 24-hour timeframe of 1.2152. A reversal of the MACD indicator up with a parallel price increase may indicate the beginning of a correction. Opening new shorts, from our point of view, is dangerous now. Recommendations for long positions: It is recommended to buy the GBP/USD pair only if the quotes return to the area above the critical line with the goal of the first resistance level of 1.3150. However, this development is not expected in the near future. When opening any positions, it is recommended to act as carefully as possible and keep in mind the heightened risks. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. How low will the pound fall? Posted: 15 Mar 2020 03:54 PM PDT The British currency was among the most affected assets at the end of the week: it plunged by almost a thousand points against the greenback: if GBP/USD tested the 31st figure on Monday, March 9, yesterday, traders updated the annual low at 1.2260. It is worth noting that at the end of Friday's trading, the dollar index paused its growth, allowing many currencies of the major group to slightly win back their positions. The euro, Canadian dollar, franc, Australian dollar – all these currencies showed a slight correction when traders began to take profits. The pound was an exception to this list – the British pound fell almost to the last minute of trading, demonstrating its helplessness and vulnerability. It is worth recalling that the GBP/USD pair demonstrated amazing resilience for a long time: despite rumors of a rate cut by the Bank of England, the decline in key macroeconomic indicators, disagreements between London and Brussels - all these powerful fundamental factors - the price stayed around the 30th figure. Even the strengthening of the dollar was often ignored by GBP/USD traders - the pound was in its coordinate system, allowing it to gradually build up long positions. But last week, the US currency made a splash, unfolding in all pairs. Market participants began to use the dollar as a defensive asset, disappointed in all other instruments of a similar nature: the yen has lost almost 800 points over the past five days, gold has fallen from 1702.95 to 1504.33 (Friday low). If earlier panic in the market put pressure on the greenback, now panic is a catalyst for its growth. Macroeconomic reports and even prospects for easing the monetary policy of the Fed play a secondary role in this context. The market focuses only on the theme of the spread of coronavirus, sharply reacting to key events. For example, yesterday US President Donald Trump declared a state of emergency in the country. This regime grants broad powers to the Minister of Health, which will no longer be restricted by certain existing laws and regulations. In addition, this regime allows you to allocate up to $50 billion to fight the pandemic from the national disaster management fund. At the same time, the number of cases of coronavirus in the United States exceeded 2,000 people, 47 of them died. The state of emergency in the United States has become another symptom of the escalation of the crisis, so the panic mood in the market has only increased. And since the main beneficiary of this situation is now the dollar, it has strengthened its position in all pairs, including the pair with the pound. The British currency was the most vulnerable in comparison with the other participants of the major group. First, the coronavirus has not spared the UK. The total number of confirmed cases there rose to 800 (while on Thursday this figure barely crossed the 500-digit mark). At the same time, the British Ministry of Health admitted that the actual number of infected people may be from 5 to 10 thousand people. Because of the epidemic, local elections have already been postponed, not to mention sports tournaments. Second, the pound is under additional pressure from complex Brexit negotiations. The parties are still in different positions, demonstrating their peremptory attitude. There is also information that the next round of negotiations will be canceled due to the pandemic. In this case, it is unclear how London will be invested in the previously agreed terms, which are set by law. Most likely, the Parliament will still move the deadline – but the current uncertainty on this issue puts significant pressure on the British currency, which is compounded by the general strengthening of the greenback. We can assume with a hundred percent probability that the situation with the coronavirus will only worsen this weekend – the number of infected and dead will increase. This means that panic moods will continue to dictate their terms to the market, providing support for the US currency. In such conditions, you can only count on a correction of GBP/USD due to strong oversold, but you can only talk about a trend reversal if the dollar weakens overall. From a technical point of view, the situation is as follows. On almost all the higher time frames (except MN), the GBP/USD pair is located on the lower line of the Bollinger Bands indicator under all the lines of the Ichimoku indicator, which formed a strong bearish Parade of Lines signal. This shows a clear advantage of the downward movement. The main goal of the downward movement is located on the lower line of the Bollinger Bands indicator on the monthly chart, i.e. at 1.2110. The material has been provided by InstaForex Company - www.instaforex.com |

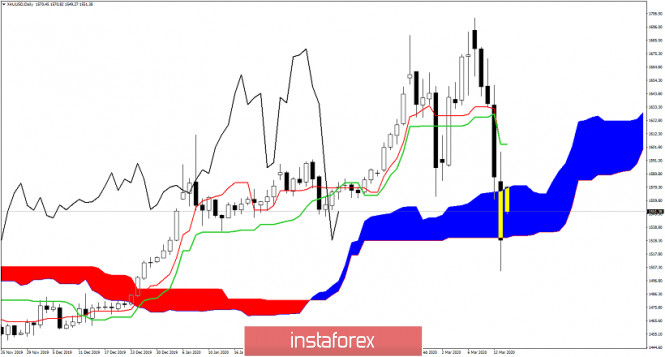

| Ichimoku cloud indicator short-term analysis of Gold for March 16, 2020 Posted: 15 Mar 2020 03:12 PM PDT Gold price ended last week on channel support. With Fed putting pressure on the Dollar Gold price opens higher in early Monday trading but still below key cloud resistance. It is important for bulls to break above the cloud otherwise we should expect new lows.

Red lines - bullish channel Gold price is trading around $1,550 at the open of the early Monday session. Gold price could pull back towards Friday's levels before continuing higher, if Dollar weakness remains.

|

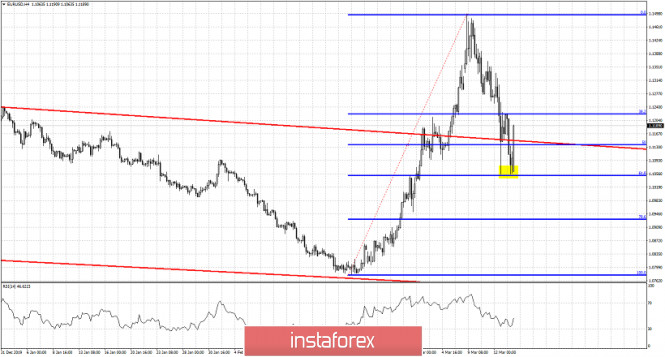

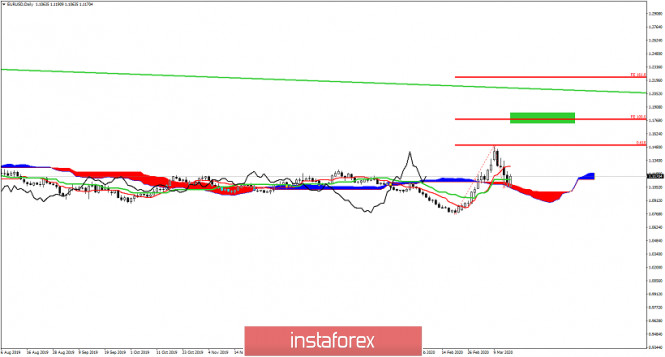

| Posted: 15 Mar 2020 02:44 PM PDT Minutes ago the FED announced that its cutting rates to zero and the launch of a $700billion quantitative easing program. This will at least initially put USD under lots of pressure. As we explained in our last analysis EURUSD bulls want to see a higher low.

Blue lines -Fibonacci retracement Yellow rectangle- key support level EURUSD is bouncing again after the FED intervention. Price had stopped at a major support level as we explained in our last analysis. EURUSD could very well have formed a higher low and could now start its new upward move that will eventually push price towards 1.17-1.18. For this to come true we need to see a sequence of higher highs and higher lows. At the same time we should not see price break below the yellow rectangle area and last week's lows.

Key short-term support is at 1.1050. Bulls do not want to see this level broken. We are bullish as long as price is above this level. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment