Forex analysis review |

- March 16, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- March 16, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Forex Review: EUR/USD for March 146th. Fed fails to support markets

- Technical analysis of EUR/USD for March 16, 2020

- EUR/USD analysis for 03.16.2020 - Potential for bigger drop towards the level of 1.0830 is very possible

- Analysis for Gold 03.16.2020 - Downside target reacehd at $1.489 but strong selling pressure is still present and new target

- BTC analysis for 03.16.2020 - Another downside movement is expected, watch for selling opportunities towards the $3.135

- EURUSD and USDCAD: Interest rates in the US are again reduced to almost zero. Will this be enough to avoid a recession? The

- Yen ran into trouble

- Analysis and forecast for GBP/USD on March 16, 2020

- Review of EUR/USD and GBP/USD on March 16, 2020

- Analysis and forecast for EUR/USD on March 16, 2020

- Trading recommendations for GBPUSD pair on March 16

- Trader's diary for EUR/USD on March 16, 2020. Update on the coronavirus. Is this a big crisis now or not yet?

- Technical analysis on EUR/USD for the week of March 16 to 21

- Technical analysis of ETH/USD for 16/03/2020:

- Instaforex Daily Analysis - 16th Mar 2020

- Technical analysis of BTC/USD for 16/03/2020:

- Technical analysis of GBP/USD for 16/03/2020:

- Analysis of EUR/USD and GBP/USD for March 16. Jerome Powell has finally complied with Donald Trump's demand

- Technical analysis recommendations for EUR/USD and GBP/USD on March 16

- Technical analysis of EUR/USD for 16/03/2020:

- EUR/USD. March 16. The "killer" decision of the Fed and the dumping of short positions by speculators (COT report) stop the

- GBP/USD. March 16. The COT report maintains a high chance of a further fall in the pound. But perhaps after correction

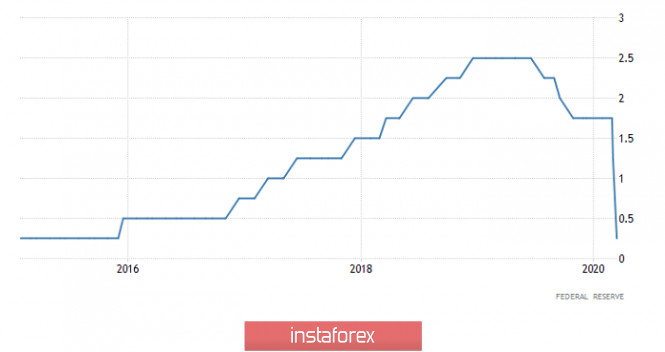

- The Fed unexpectedly lowered its key interest rate to 0.25%.

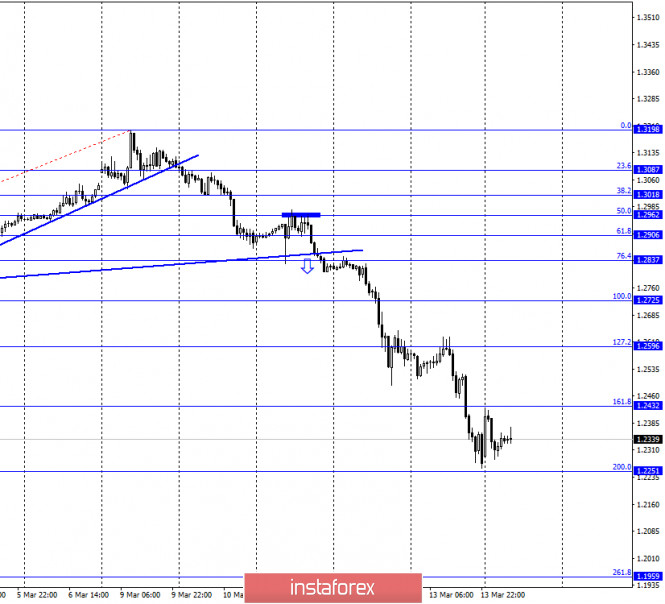

| March 16, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 16 Mar 2020 08:56 AM PDT

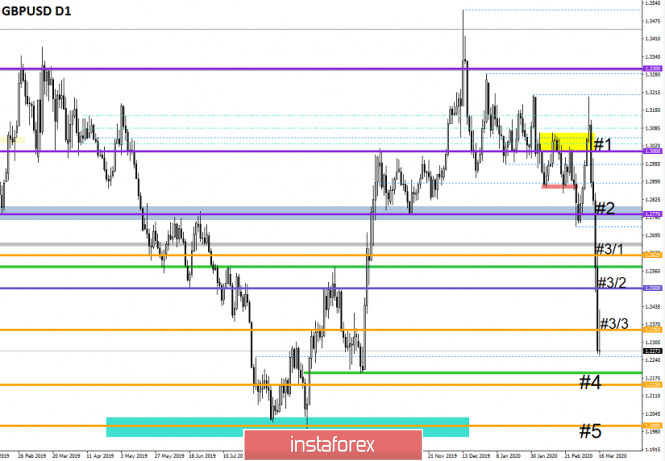

In the period between December 18th - 23rd, bearish breakout below the depicted previous bullish channel followed by quick bearish decline below 1.3000 were demonstrated on the H4 chart. However, Immediate bullish recovery (around 1.2900) brought the pair back towards 1.3250 (backside of the broken channel) where the current wide-ranged movement channel was established below 1.3200. Since January 13, progressive bearish pressure has been built above the price level of 1.2780-1.2800 until March, the 2nd when transient bearish breakout 1.2780 took place. Shortly after, significant bullish rejection and an inverted Head & Shoulders reversal pattern was demonstrated around March 4. Hence, a quick bullish movement was expressed towards the price zone of 1.3165-1.3200 where significant bearish pressure brought the pair back below 1.3000 then 1.2780 via quick bearish engulfing H4 candlesticks. Today, the GBPUSD has reached new low price levels around 1.2220 where the pair looks quite OVERSOLD. Conservative traders should be looking for signs of bullish rejection for a probable bullish reversal opportunity around the current price levels (1.2220). If so, initial bullish target would be located around 1.2520. Further bullish advancement enables higher bullish targets around 1.2600, 1.2680 and 1.2740 to be addressed. The material has been provided by InstaForex Company - www.instaforex.com |

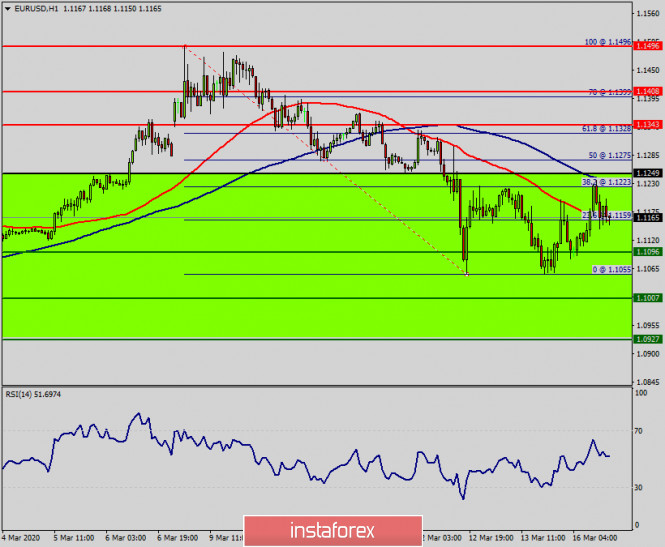

| March 16, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 16 Mar 2020 08:35 AM PDT

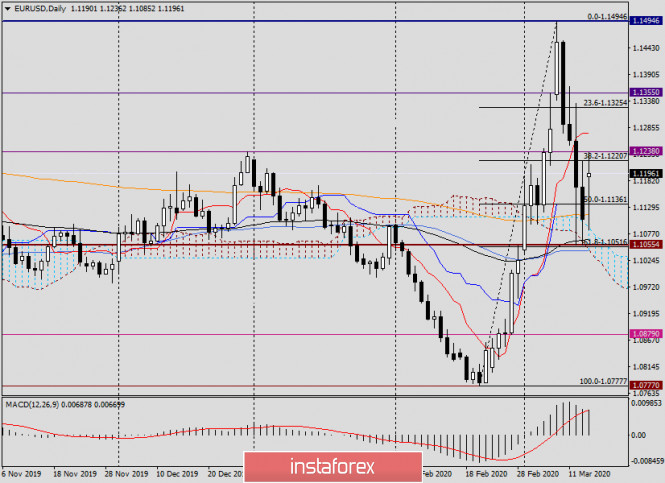

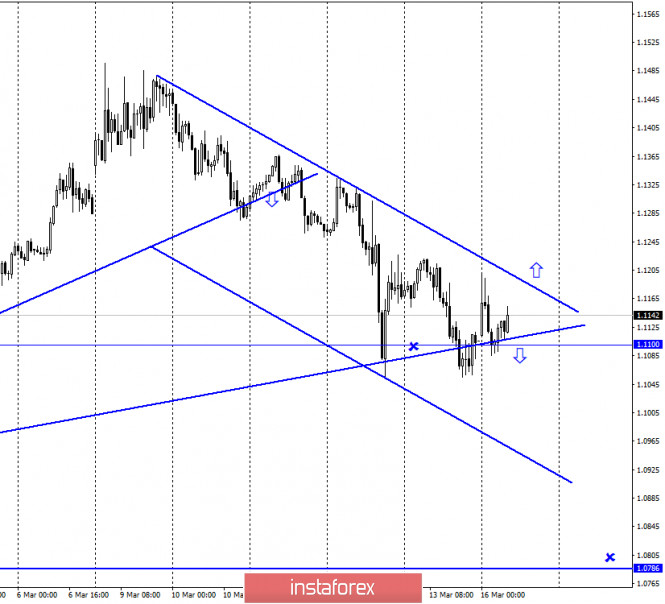

On December 30, a bearish ABC reversal pattern was initiated around 1.1235 which turned the technical outlook into bearish. Since then, the EURUSD pair has trended-down within the depicted bearish channel until few weeks ago, when extensive bearish decline established a new low around 1.0790 where the EUR/USD pair looked OVERSOLD after such extensive bearish decline. On February 20, recent signs of bullish recovery were demonstrated around 1.0790 leading to the recent steep bullish movement towards 1.1000 then 1.1175. The price level of (1.1175) constituted a transient congestion-zone in confluence with the origin of the previously-mentioned ABC pattern. Temporary consolidation range was demonstrated down to 1.1100-1.1095 where another bullish limb was quickly expressed targetting 1.1235, 1.1360 and recently 1.1480. Recently, the price-Levels of 1.1235 (KeyZone) and 1.1360 (100% Fibo Expansion) were being breached to the upside until earlier last week when a (123) bearish reversal pattern was initiated around the price level of 1.1480. This turned the short-term technical outlook for the EURUSD pair into bearish as long as bearish persistence below Keyzone of 1.1235 is maintained on a daily basis. Any bullish pullback towards 1.1235 should be considered for bearish rejection and a valid SELL entry. On the other hand, an intermediate term bearish Head & Shoulders pattern is being demonstrated as depicted on the chart indicating a high probability upcoming bearish decline to be anticipated Bearish persistence below 1.1100 (Neckline) is needed to confirm the mentioned reversalpattern. Estimated bearish targets are projected towards 1.1080, 1.1035, 1.0990 and 1.0940. The material has been provided by InstaForex Company - www.instaforex.com |

| Forex Review: EUR/USD for March 146th. Fed fails to support markets Posted: 16 Mar 2020 07:50 AM PDT The unexpected Fed's decision to lower the benchmark interest rate by 1% and launch $700 billion quantitative easing program have not changed investors' mood. Contracts on S&P500 started the trading day by a 4% drop. Oil prices are falling below $30 amid the price war between Russia and OPEC. The Russian ruble again declined to 75 rubles for one US dollar and to 84 rubles for one euro. EUR/USD: global epidemiological situation is keeping the euro under pressure. In Europe and the US, a number of infected people is advancing by 10% every day. If the situation does not change, market participants are expected to be focused only on the coronavirus issue. Goldman Sachs predicts that a coronavirus-driven recession will hit the US. It sees the country's GDP shrinking by 5% in the 2nd quarter. JPM foresees defaults in many countries. EUR/USD: it is recommended to open sell positions from 1.1053. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for March 16, 2020 Posted: 16 Mar 2020 06:16 AM PDT Overview: The EUR/USD pair movement was debatable as it took place in a narrow sideways channel for a while. The market showed signs of instability. Amid the previous events, the price is still moving between the levels of 1.1249 and 1.0927. The daily resistance and support are seen at the levels of 1.1065 and 1.0927 respectively. In consequence, it is recommended to be cautious while placing orders in this area. Thus, we should wait until the sideways channel has completed. On the H1 chart, the price spot of 1.1249 remains a significant resistance zone. Therefore, there is a possibility that the EUR/USD pair will move to the downside and the fall structure does not look corrective. Pivot point sets at the 1.1249 level. Resistance is seen at the level of 1.1249 today. So, sell below 1.1249 with the first target at 1.1065 to test yesterday's bottom. In overall, we still prefer the bearish scenario as long as the price is below the level of 1.1065. Furthermore, if the EUR/USD pair is able to break out the bottom at 1.1065, the market will decline further to 1.0927. However, it would also be sage to consider where to place a stop loss; this should be set above the second resistance of 1.1343. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Mar 2020 06:03 AM PDT Corona virus news:

Germany has become the latest country to close borders as European nations try to stem the spread of the coronavirus. Its borders with France, Austria and Switzerland were shut on Monday morning, except for commercial traffic. France is considering more stringent lockdowns, with its health chief saying the situation is "deteriorating fast". Latest World Health Organization (WHO) figures list 164,000 confirmed cases and 6,470 deaths worldwide. However, last week it said Europe was now the "epicentre" of the virus and urged governments to act aggressively to control the spread of the Covid-19 disease.Technical analysis: EUR did successful test and reject of the important resistance at 1.1230. Watch for the breakout of the mini Pitchfork upward channel to confirm further downside contination.Downward targets are set at the price of 1.1062, 1.0830 and 1.0785. MACD oscillator is showing new momentum down, which is strong sign of the bearish pressure. Resitance level is set at hte price of 1.1230 Support levels and downward targets are set at the price of 1.1062, 1.0830 and 1.0785. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Mar 2020 05:54 AM PDT Corona virus news:

The Federal Reserve slashed interest rates to near-zero and unveiled a sweeping set of programs — including plans to snap up huge amounts of government and mortgage-backed debt — in an effort to backstop the United States economy as the spread of coronavirus poses a dire threat to economic growth. "The coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States," the central bank said in a statement on Sunday. "The Federal Reserve is prepared to use its full range of tools to support the flow of credit to households and businesses." Technical analysis: Gold did continue with the downside pressure as I expected. Our downward target at the price of $1.489 has been tested. It still stron selling pressure and the recommendation is to watch for selling opportunities on the rallies with the next downward targets at $1.449 and $1.400. The BTC did break the lower Pitchfork parallel line and is heading to test the warning line 1. MACD oscillator is showing new momentum down, which is strong sign of the bearish pressure. Resitance levels are set at the price of $1.507 Support levels and downward targets are set at the price of $1.449 and $1.403. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Mar 2020 05:44 AM PDT Industry news:

Due to the fears surrounding COVID-19, the crypto markets crashed on Thursday and recorded the worst day in their history. Investors are still extremely fearful.Some stablecoins like Paxos Standard (PAX), USD Coin (USDC), and Binance Coin (BUSD) were able to strongly gain liquidity amid these extreme market movements. The latter made issuances for the third time in a row and is now ranked higher than its competitor TrueUSD (TUSD). Excluding stablecoins, all cryptocurrencies are deep in the red. The least bad performer was UNUS SED LEO, the exchange token for Bitfinex and Ethfinex. Compared to Bitcoin, LEO gained +29,5% to trading at 17,016 satoshis. By far the worst performer was the payment platform Swipe. This is peculiar, since Swipe was one of the top performers in January, but has lost ground since and dropped out of the CMC100-ranking for now.In the last week, the total market cap of all listed cryptocurrencies dropped -34.4% to $153.7B. The BTC-dominance dropped 0.3 percentage points to 63.7% Technical analysis: BTC has been trading to the downside as I expected last week. My downside bias is still active and the downward targets are set at $3.86 and $3.134 The BTC ended the upward correction and I do expect another downside movement. I would watch for selling opportunities on the rallies with the downward targets at $3.800 and $3.135. MACD oscillator is showing new momentum down, which is strong sign of the bearish pressure. Resitance levels are set at the price of $5.630 and $6.215 Support levels and downward targets are set at the price of $3.800 and $3.135 The material has been provided by InstaForex Company - www.instaforex.com |

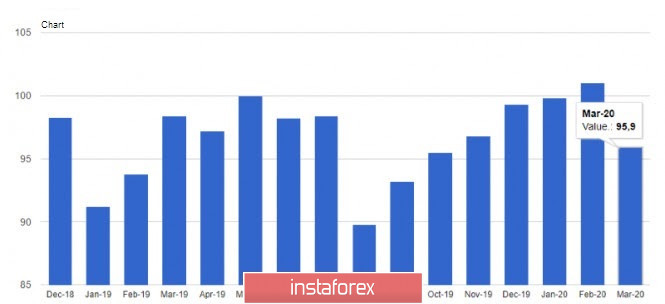

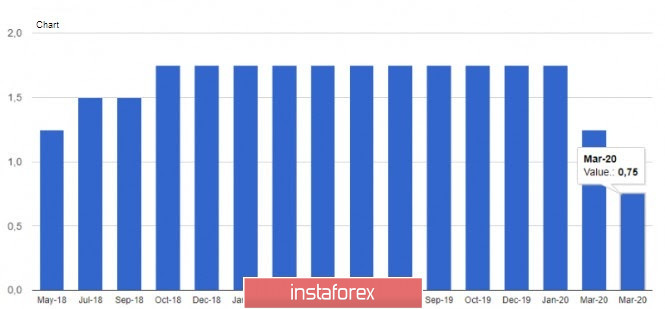

| Posted: 16 Mar 2020 04:09 AM PDT Apparently, the calls of the American leader Donald Trump that interest rates should be lowered to levels comparable to those of competing central banks have had an effect. During an extraordinary meeting this Sunday, the Fed lowered its key rate to almost zero, saying it was starting to buy $700 billion worth of treasury and mortgage bonds. This decision was made in connection with the spread of the coronavirus pandemic. For example, the Federal Reserve has set a range of federal funds interest rates between 0.00% and 0.25%. The Federal Reserve's Open Market Operations Committee voted 9 to 1 for this decision. The regulator said it would keep rates at a new low level for as long as necessary. It requires the economy to return to growth and stock markets to recover. However, it is difficult to predict what the damage from the coronavirus will be since the pandemic continues to grow, and no antiviral agent has yet been found. During a press conference, Fed chief Jerome Powell said that starting Monday, the central bank will buy Treasury bonds for at least $500 billion and mortgage bonds for at least $200 billion, which should help restore the work of financial markets. Let me remind you that last week, US stock markets continued their largest decline since the global financial crisis. The Fed statement also called on the country's banks to use their stored capital and not to slow down lending to companies and households suffering from the effects of the spread of the coronavirus. However, despite the measures taken, many experts and economists say that they are insufficient, which will soon lead a number of developed countries' economies to a large-scale recession. According to surveys, more than 60% of respondents expect a recession in the US and more than 82% in Europe. Although there is no doubt about this, the other question is how quickly the economy will begin to recover. And this is what will indicate the effectiveness of the measures. Let me remind you that the Bank of Canada, the Bank of England and the Reserve Bank of New Zealand also lowered interest rates last week. But the European Central Bank left everything unchanged, only slightly expanding the program of bond repurchases. Donald Trump on Sunday evening said that the government will work with the private industry to speed up testing for the virus, and about half a million additional tests will be available at the beginning of this week. Another five million tests are also expected to arrive within a month. As for fundamental statistics, the data released on Friday did not significantly affect the US dollar. According to a report from the US Department of Labor, import prices in February 2020 fell by 0.5% compared to January, while economists expected a fall of 0.8%. Export prices in February fell by 1.1% compared to January. There was also a deterioration in the US economic outlook, as evidenced by the results of a survey by the University of Michigan. According to the data, the preliminary index of consumer sentiment in March fell to 95.9 points from 101.0 points in February, while economists expected the preliminary index in March to be 95.0 points. The index was affected by the spread of coronavirus, which hit consumer confidence. As for the technical picture of the EURUSD pair, given what is happening in the markets now, I would not bet on the strengthening of risky assets, since the situation is really becoming dangerous. Any signs of a slowdown in the US economy could seriously affect not only the US dollar, but also the general mood of investors, which will further strengthen their faith in the economic crisis, which usually leads to a strengthening of the US dollar. As noted above, the Bank of Canada, following other central banks, lowered its key interest rate to 0.75%, saying that such a decision between meetings was necessary due to the coronavirus pandemic and falling oil prices. According to the regulator, the spread of the coronavirus has serious consequences for the economy, and the recent fall in oil prices only complicates the whole situation, which puts pressure on the growth of the economy. If necessary, the Bank of Canada is ready to further adjust its monetary policy. A more complete assessment of the economy will be presented on April 15. As for the technical picture of the USDCAD pair, the growth is likely to continue due to the lack of signs of recovery in the oil market. WTI oil continues to gradually return to its annual lows in the area of 27.30 dollars per barrel and is now trading at 30 dollars. The breakout of the 1.2865 resistance in the USDCAD pair by buyers will lead to the repeated growth of the trading instrument in the area of the maximum of 1.3970 and provide a new upward wave to the levels of 1.4070 and 1.4170. When the trading instrument declines, support is seen in the range of 1.3735 and slightly lower, around the larger level of 1.3640. The material has been provided by InstaForex Company - www.instaforex.com |

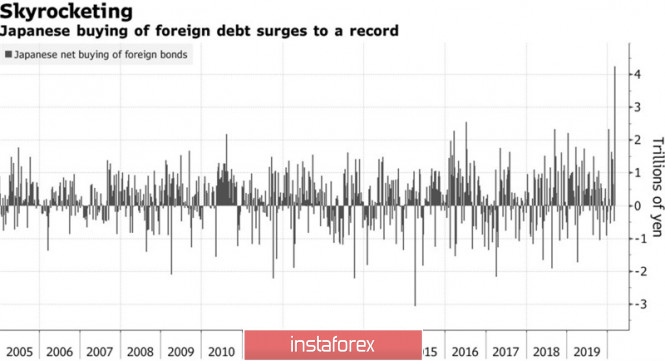

| Posted: 16 Mar 2020 04:09 AM PDT If the "bears" on USD/JPY are not able to stop any aggressive monetary expansion of the Fed, the rumors about the weakening of the monetary policy of the Bank of Japan at the March meeting, or the threat of a recession in the economy of the Land of the Rising Sun in the second quarter, currency intervention should be used. By the end of the week to March 6, Japanese investors registered record purchases of foreign bonds of £4.24 trillion ($41 billion), significantly exceeding the previous maximum of £2.5 trillion, which took place in July 2016. This is the 10th excess of the weekly average for 2019. Although the names of the buyers were not disclosed, there are rumors on the market about the participation in the $1.6 trillion Japanese State Pension Fund. The largest in the world. Dynamics of purchases of foreign bonds by Japanese investors

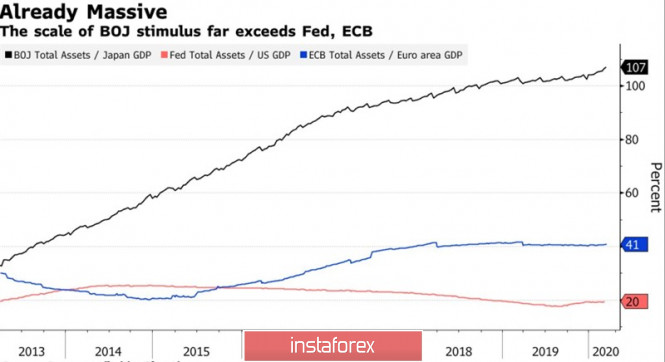

Formally, the principle of "buy what is cheap, sell what is expensive" could be implemented. The fall of USD/JPY to the lowest level since the fall of 2016 clearly did not suit either the BoJ or the government. The Central Bank is already unable to cope with inflation, and then the revaluation of the yen puts a stick in its wheels. On the eve of the March meeting of the Bank of Japan, Minister of Finance Taro Aso said that investors should not worry about an excessively high yen. A dollar at £105 is quite normal. The currency of the Land of the Rising Sun rightfully claims to be the most interesting currency of the week by March 20 at Forex. First, the market turmoil is not over yet, and second, the BoJ meeting risks being very interesting. According to 90% of 41 Bloomberg experts, we should expect the Central Bank to ease monetary policy. First of all, we are talking about increasing purchases of market-oriented ETFs from the current £6 trillion ($58 billion) to a much more serious figure. Purchases of other assets and cheap credit programs for companies affected by coronavirus are also possible. Dynamics of asset purchases by the world's leading central banks

In my opinion, Haruhiko Kuroda and his colleagues are not able to stop the fall of the TOPIX and Nikkei 225. These indices react to the behavior of their American counterparts, and if the Fed failed to put the bears in their place with the help of unexpected and aggressive monetary expansion, it is unlikely that the BoJ will succeed, whose potential is limited. On the other hand, if the Federal Reserve and the White House work together to stabilize the S&P 500, the USD/JPY bulls will have a great opportunity to continue their rally. Technically, on the weekly chart of the analyzed pair, there was a false breakdown of the lower limit of the long-term consolidation range of 105-114. The bears' inability to implement the "surge and shelf" pattern on a 1-2-3 basis indicates their weakness. To continue the upward movement, buyers must take control of the levels of 108.5 and 109.6. USD/JPY, weekly chart

|

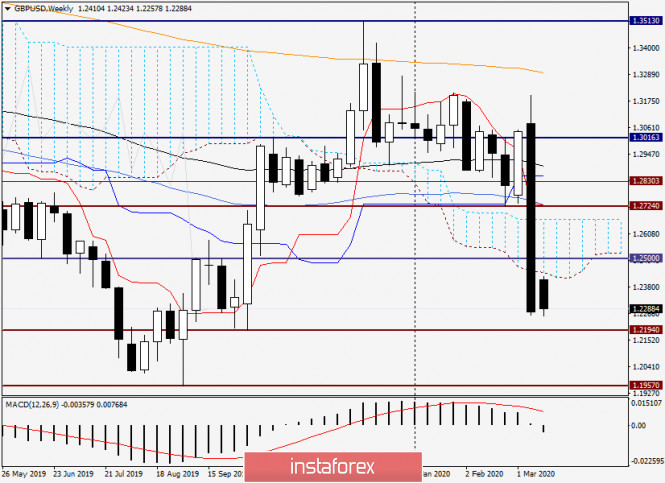

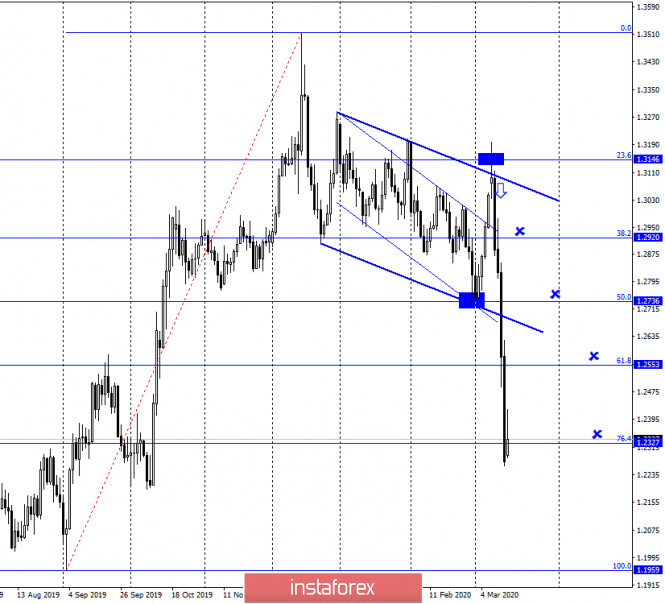

| Analysis and forecast for GBP/USD on March 16, 2020 Posted: 16 Mar 2020 04:09 AM PDT Hello, traders! The situation with the spread of the coronavirus epidemic forces the central banks of the leading economic powers to take necessary and urgent measures to protect the economy of their states. So, on Sunday, unexpectedly and again in an emergency, the Federal Reserve System (FRS) lowered the main interest rate to 0%-0.25% and announced an increase in its balance sheet by $700 billion. There is little doubt that the rest of the world's leading central banks will follow the Fed's example. What to expect from the main currency pairs in this situation is absolutely unclear. We can only assume that there will be virtually no appetite for risk, and the Japanese yen, Swiss franc and the same US dollar will be in greatest demand. As we can see, the situation is unusual and the rate cut is perceived as a measure to support or save the economy, so these measures do not lead to a strong and stable fall in currencies, in particular, the US dollar. In this case, we can rely on technical analysis, which will most likely indicate the further direction of the quote. Weekly

Last week, the pair not only declined, but it also collapsed! During the fall, the 89 exponential moving average, Tenkan and Kijun lines of the Ichimoku indicator were broken, after which the pair entered and exited the Ichimoku cloud, closing trading on March 9-13 under its lower border. A clear bearish scenario, which was not changed even by the unexpected decision of the Fed on Sunday to lower the refinancing rate again. If the collapse of the British currency continues, the pound/dollar pair will go to support at 1.2194, in order to test it for a breakdown. If this mission is successfully completed, the pound bears will lower the quote to the landmark psychological and technical level of 1.1000, the breakdown of which will finally indicate the bearish prospects for sterling. However, the pound is still that figure! The slightest positive and change in market sentiment can lead to a sharp and strong growth of the "British". This has happened many times in my memory. In the meantime, at the time of writing, the pair is rewriting the previous lows at 1.2261. The exchange rate has already fallen lower and visited 1.2258, but at the time of writing, there is a rebound and GBP/USD is trading near 1.2300. It is a difficult situation when there was almost no correction after a strong fall, and it is dangerous and risky to sell at the minimum values. Let's see what the picture is on the lower timeframes. Daily

Judging by the picture on the daily chart, the mark of 1.2300 is the level that the pair is trying to cling to. If today's trading on GBP/USD ends above 1.2300, and the candle is formed in the form of a reversal, we can expect an adjustment of the exchange rate to 1.2430 and 1.2500. Returning and fixing above the important technical and psychological level of 1.2500 will open the way to higher correction goals, among which it is worth highlighting 1.2580, 1.2620 and 1.2700. The continuation of the bearish scenario is signaled by the closing of daily trading below the previous lows of 1.2261. However, trading is so volatile and unpredictable that any news and/or comment about coronavirus can significantly change the situation on the market. Based on this probability, we must be prepared for everything and consider both scenarios. Although it is clear that in the current situation, the pound is under very strong pressure and the chances of a further decline in the GBP/USD are high. However, I do not recommend selling near the minimum values. In the case of a strong rebound or correction of the exchange rate, you can fall under a significant drawdown. And this is at least. If you go back to the monetary policy of the world's leading central banks, there is little doubt that in the very near future, the Bank of England will follow the example of the Fed and once again reduce the main rate, especially since such hints have already been made. By trading ideas. Naturally, the main one remains sales, which are better to open after corrective pullbacks to the levels of 1.2480 and 1.2515. In the case of a more significant exchange rate adjustment, you can look at the opening of short positions after the price rises to the area of 1.2580-1.2620. Purchases are too risky, and there are no corresponding signals for opening long positions yet. Success! The material has been provided by InstaForex Company - www.instaforex.com |

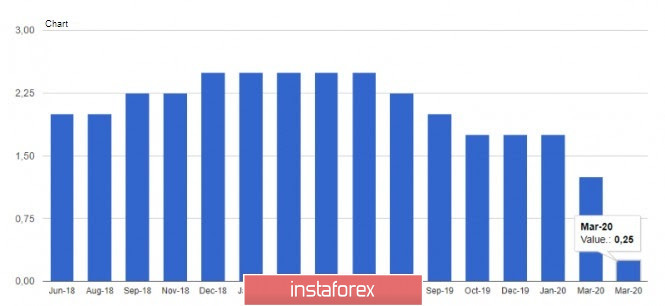

| Review of EUR/USD and GBP/USD on March 16, 2020 Posted: 16 Mar 2020 04:08 AM PDT The Fed's action of lowering the refinancing rate from 1.75% to 1.25% in early March is intended to prevent a collapse in financial markets that could have disastrous consequences for the economy. At the moment, everyone is basically trading on borrowed funds, so, in the event of a decline in stock indexes, many traders will be forced to close their positions to avoid forced closing due to revaluation. The worst thing about this is that all companies, whose shares are traded on the stock markets, have huge debts. Therefore, if the value of their shares go down sharply, banks will be forced to demand early repayment of the loans, which the companies would not be able to pull. As a result, in the event of a stock market crash, many companies may go bankrupt, and the consequences of it are easy to imagine. The Federal Reserve is lowering interest rates in order to reduce this cost of borrowed capital, and support primarily stock market players, who, due to cheaper funds, become less susceptible to growing risks and begin to behave more actively in terms of buying shares. However, the very fact that an emergency meeting was required already inspires many fears, making us think that the real situation may be much worse. The Federal Reserve held another emergency meeting over the weekend and lowered the refinancing rate from 1.25% to 0.25%. However, the meeting is originally scheduled on March 18, so this early meeting is not just critical, but catastrophic. It indicates that the previous reduction was not enough, and that the situation is so critical that American companies began to fall. Even Friday's rise in the US stock indexes is probably a temporary and accidental rebound. Moreover, everyone continues to write off the coronavirus, which is only a trigger mechanism. The panic over the coronavirus only started the process of flight from risk, while the problem itself is much deeper. Even if the coronavirus does not exist and there is no media hysteria about it, nothing would have changed because the collapse was bound to happen anyway, due to the structural economic problems. We can say that all this hysteria only highlighted the extremely low stability of the US and global economy, which means that the growth shown by the United States is in many ways simply illusory. After 2008, during a period of extremely low interest rates, the financial sector swelled so much that the real sector became dependent on the mood of stock speculators, which made the economy even more vulnerable to various fluctuations in financial markets. This dependence should be reduced, but, to be able to do this, we need to raise interest rates, which will lead to mass bankruptcies of companies that live only on cheap loans and constant injections of funds. It is not clear how effective these companies are, but their bankruptcy will lead to mass layoffs and the growth of the unemployed. So, in order to avoid a disaster, it is necessary to make the economy even more dependent on the financial sector, thereby aggravating the situation. It is just a vicious cycle that no one knows where the end is. Given that serious downturns in financial markets occur with enviable regularity, the world economy will now permanently balance on the brink of recession, and the monetary authorities will have fewer and fewer opportunities to regulate the situation. In addition, the actions of the Federal Reserve System over the past two weeks actually further undermine the confidence in the financial system, because in the context of emergency and unplanned actions, it is simply impossible to engage in even medium-term planning, which means that investors will tend to go into protective assets in the form of government debt securities, while the real sector of the economy will experience more and more lack of investment. In such conditions, there can be no question of any development. Large developing countries will work with a vengeance to develop a parallel financial system that will be more reliable and predictable, so the role of the dollar will be reduced. Refinancing rate (United States): The panic in the financial markets are not going away. Only Germany's inflation remained unchanged as France's fell from 1.5% to 1.4%, and Spain's fell from 1.1% to 0.7%. At the same time, in Germany, there are all signs that inflation will go down again, because wholesale prices, which recently grew by 0.3% per year, suddenly showed a decrease of 0.9% in the same year-on-year. Wholesale price index (Germany): The measures of the Fed only scared the markets, precisely for the reason that the reduction of the refinancing rate has become erratic. Asian stock indexes, which were the first to meet the next reduction in the Federal Reserve's refinancing rate, continue to decline. The price of oil is also going down, which means that it is only a matter of time before American oil companies go bankrupt. After all, American share companies live off loans that were issued to them as collateral for future oil production, so, if the price of oil has fallen significantly, these companies will not be able to fulfill their obligations to creditors. Moreover, the shares of many of these companies are traded on stock exchanges, so the above situation may provoke an even greater overall drop in stock indexes. The actions of the Fed did not have the desired effect because they undermine the confidence in the existing financial system. At the same time, the talk that the coronavirus is to blame for everything is actually not true, as it is only related to the hype that the mass agitation and disinformation media have created. According to the Johns Hopkins University, 6,513 people have died from the coronavirus worldwide so far. The common flu virus, on the other hand, kills at least half a million people every year. Journalists must be blamed for all the panic and hysteria. Nevertheless, negative data continues to be received from Europe, as Italy, which is already considered the most affected by the coronavirus, reported a slowdown in inflation from 0.5% to 0.3%. Such a large-scale reduction in the Federal Reserve's refinancing rate has spooked investors, and so far we are seeing a rebound in the single European currency. Inflation (Italy): However, judging by what is happening in the markets, we need to talk about the fact that the growth of the euro is only temporary. Most likely, while market participants are under serious impression, the growth of the dollar will resume, since the situation does not change fundamentally. Capital flight continues, and the probability that the European Central Bank may reduce the refinancing rate to negative values increases significantly. On the market's mood though, the euro may still end the day at 1.1275. The pound is not showing any signs of growth. This is due to the fact that market participants are currently lowering the value of the pound, due to the possible reduction of the refinancing rate by the Bank of England. Moreover, the decline may be quite strong, and the BoE is unlikely to keep its promise not to reduce the refinancing rate below 0.1%. Thus, while the pound is consolidating around 1.2275, the medium-term forecast is at 1.2100. |

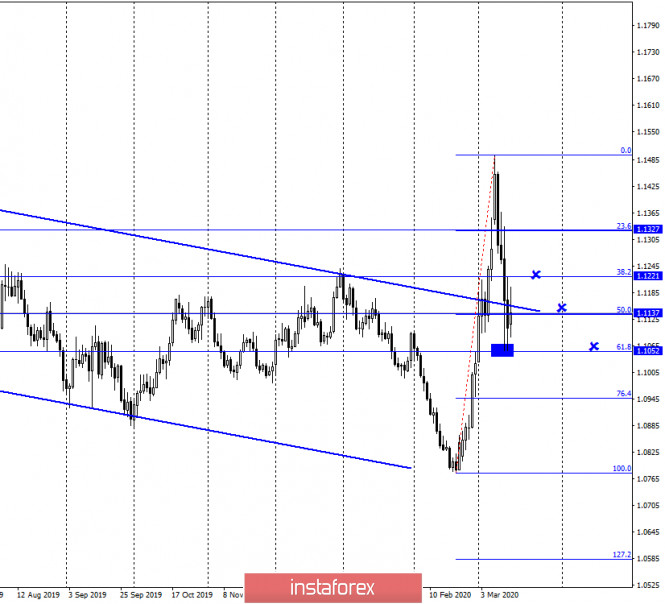

| Analysis and forecast for EUR/USD on March 16, 2020 Posted: 16 Mar 2020 04:05 AM PDT Hello, colleagues! At the auction on March 9-13, all major competitors declined against the US dollar. At the same time, the single European currency showed a minimal decline. This is described in more detail in the technical part of this article, and I will start with the topic of the ill-fated coronavirus. The COVID-19 epidemic continues its deadly march around the world. The virus has already spread to more than 140 countries, including Russia. Unprecedented measures are being taken to prevent further spread of the disease. Borders between states are being closed, mass events are canceled one by one, where the number of participants should not exceed 500 people. From the shelves of European supermarkets, essential goods are rapidly being swept away: hygiene products, canned food, water. The already panicked mood is reinforced by calls from the authorities of various European states to their citizens, without an urgent need not to leave their homes and apartments. Sports competitions, in particular football championships, are being canceled, and Euro 2020 may be postponed to next year. A decision on this issue will be made tomorrow, March 17. It became known that there will be no parishioners at the Easter service in the Vatican, the reason is still the same — an epidemic of coronavirus, the infection of which has already been noted in the Vatican. Naturally, the current situation with the COVID-19 pandemic has a very negative impact on the world economy and increases the likelihood of a new economic crisis comparable to that of 2008-2009. US President Donald Trump intends to allocate $50 billion to fight the coronavirus. The EU has promised to allocate even more funds to help all its members. Unfortunately, in this issue, money can not solve everything. However, support is certainly needed, and no one wants a new financial and economic crisis. Since today's calendar does not shine with an abundance of important macroeconomic events, we will immediately proceed to the technical analysis of the main currency pair of the Forex market. Weekly

As expected, the auction of the current five-day period opened with a price gap up, which was quickly closed. Although last week's candle is the most bearish. The closing price is below 89 EMA, the middle of the previous candle body, the lower border of the Ichimoku indicator cloud, the Kijun line, and 50 simple moving average. It would seem that after the closing of the bullish gap, the euro/dollar will continue the downward dynamics that took place a week earlier. However, this was not the case. We have to admit that in the current situation with coronavirus infection, the market, as in life, is in chaos and confusion. Either the US dollar is a protective asset and is in demand, or, on the contrary, it falls under a wave of sales. If by technique, the pair has come to the falsely broken resistance of 1.1238 and is trying to return above this mark. It should be noted that in addition to the level itself, 89 exponents provide active resistance. However, even the passage of 1.1238 and 89 EMA does not promise an easy life for the euro bulls. Above is a strong technical level of 1.1355, the upper limit of the Ichimoku cloud, 200 EMA and last week's highs at 1.1494. Players on the rise have something to strive for, and solving problems will not be easy. As for the bearish scenario, sellers need to bring the price down again from the Ichimoku indicator cloud, passing 50 MA and Kijun on the decline and then re-test the support at 1.1055 for a breakdown. In my opinion, the further direction of the pair will depend on whether this level of pressure will withstand or not, at least in the weekly cycle. Daily

This is a very interesting and revealing situation. The pair declined, flooded the gap, and then, finding support on the upper border of the Ichimoku cloud and 200 EMA, rushed up. However, near 1.1238, the quote met strong resistance, and at the end of the review, it bounced to 1.1207. If the euro bulls manage to raise the rate not only above 1.1238 but also the Tenkan line (1.1275), closing the auction above it, further progress in the north direction will get good prospects. If the daily session falls and closes below 200 EMA (1.1115), a bearish scenario is most likely. I think that today it is better to observe what is happening and not open new positions. The situation is too uncertain. We will see how today's trading ends, and tomorrow we will try to determine the further direction and entry points. Have a nice day! The material has been provided by InstaForex Company - www.instaforex.com |

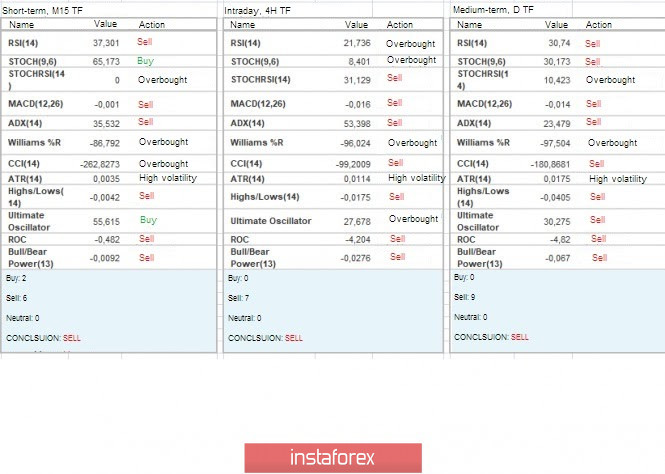

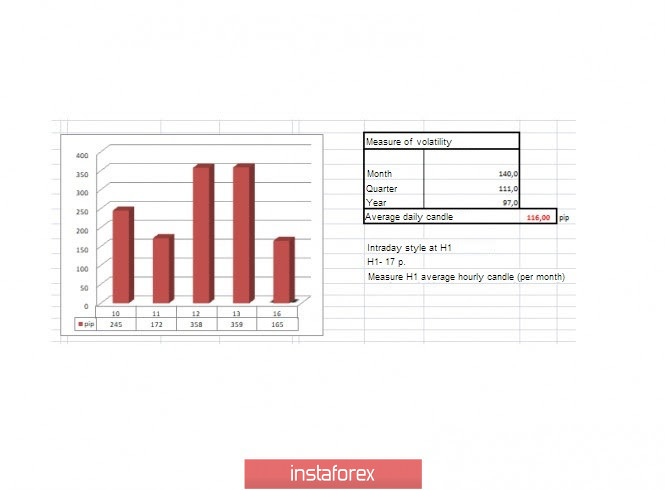

| Trading recommendations for GBPUSD pair on March 16 Posted: 16 Mar 2020 04:05 AM PDT From a comprehensive analysis, we see the execution of the theory of downward development, while having ultra-high volatility. Now about the details. Last week was one of the most active in the calculation of 11 months, where the quote first developed a corrective move, then broke through the range (1.2770//1.2885//1.3000) and moved on to a new stage. In fact, we were waiting for such a development in terms of technical analysis, warning readers about the loss of rigidity of borders (1.2770//1.2885//1.3000), where recovery occurred under pressure from the external background. Regarding the theory of downward development, we see that the change of the clock component did not go in vain, the quote still managed to keep sellers and move to a new stage of development. So, the recovery relative to the medium-term upward trend has reached the level of 79%, which means that the level of #1 (1.3000); #2 (1.2770); #3/1 (1.2620); #3/2 (1.2500); #3/3 (1.2350) are considered broken, and their strength will be lower in the subsequent fluctuation, which will allow sellers to pass the marks without too much effort. There are two main stages on the way to recovery: #4 (1.2150) and #5 (1.2000), which in some sense reflect a peculiar range of interaction of trading forces. In terms of volatility, we see something supernatural for two days in a row. Daily activity was above 350 points, or 208% higher than the average. At the same time, the market activity has not decreased for the fourth week, reflecting the acceleration, all the fault of the massive external background. Volatility details: Friday-193 points; Monday-110 points; Tuesday-102 points; Wednesday-102 points; Thursday-107 points; Friday-103 points; Monday-165 points; Tuesday-245 points; Wednesday-172 points; Thursday-358 points; Friday-359 points. The average daily indicator relative to the volatility dynamics is 116 points (see the volatility table at the end of the article). Detailing the minute-by-minute Friday day, we see that after a slight regrouping of trading forces, the downward interest resumed again, having a descent down to the level of 1.2264. Details: the downward turn was extended in the interval 12:30-22:45 (trading terminal time). As discussed in Thursday's review, traders were waiting for a breakout of the lower limit of the range (1.2770//1.2885//1.3000) with price fixing lower than 1.2725. As a result, we got an excellent point for short positions, which we managed to earn significantly. In turn, medium-term traders, who had positions for sale in early February, calculate the profit, since fixations can occur soon. Looking at the trading chart in general terms (the daily period), we see an inertial downward movement extending for four trading days. In fact, this is the first significant change since the beginning of the year that has cast doubt on the medium-term upward trend. Let me remind you that the global downward trend set by the market back in 2007 remains unchanged. Friday's news background had nothing serious in it in terms of statistics for Britain and the United States. In terms of the general information background, we have a wave-like panic associated with the coronavirus, where China is no longer the epicenter, but the rest of the world updates the maximum number of infected. Against such a terrible backdrop, the Federal Reserve (FRS) is holding another emergency meeting, during which it decides to reduce the refinancing rate by 1% to 0.25%. "The committee expects to maintain this target range until it is confident that the economy has withstood recent events and is on track for maximum employment and price stability targets," an excerpt from the Fed document reads. In fact, the Fed continues to feed the financial wounds with cheap borrowed funds, which can eventually lead to new collapses. Today, in terms of the economic calendar, we do not have any statistics worth paying attention to, and they are not necessary, when we have such strong data from the States in the morning. Further development Analyzing the current trading chart, we see a distinct slowdown within 1.2264/1.2423, where the quote is fluctuating within the #3/3 stage (1.2350). In fact, the existing external background in the face of the Fed's decision locally shot the quote by 147 points, but in the end, everything shrank at the level of the third stage. Thus, the development of a downward course towards stages #4 (1.2150) and #5 (1.2000) is possible. In terms of emotional mood, we see a kind of market "hysteria" where speculators rule the ball. By detailing the minute-by-minute time period, we see the same jump at the opening of a new week (00:00 hours on the trading terminal). With a subsequent oscillation within the framework of 1.2264/1.2423. In turn, traders continue to work on the downside, where the main goals are located in the area of interaction of trading forces 1.2000/1.2150. Having a general picture of actions, we see that the quote is trampling around the base of 1.2264, wherein the case of passing this mark, the downward move can resume in the direction of 1.2150-1.2000. Based on the above information, we will output trading recommendations: - Buy positions are considered in the case of working off the mark of 1.2264, where the movement continues within 1.2264/1.2423. Work on the rebound will be considered higher than 1.2310. - Positions for sale are already underway, further transactions will be laid after fixing the price below 1.2250, with the prospect of a move of 1.2150-1.2000. Indicator analysis Analyzing different sectors of timeframes (TF), we see that due to the rapid downward movement, the indicators of technical instruments unanimously occupy a sell signal. The volatility for the week / Measurement of volatility: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (March 16 was based on the time of publication of the article) The volatility of the current time is 165 points, which is already 42% higher than the daily average. It is likely to assume that the external background will continue to catch up with activity in the market. Key levels Resistance zones: 1.2350**; 1.2500; 1.2620; 1.2725*; 1.2770**; 1.2885*; 1.3000; 1.3170**; 1.3300**; 1.3600; 1.3850; 1.4000***; 1.4350**. Support zones: 1.2350**; 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic level ** Range level *** Psychological level ****The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Mar 2020 03:38 AM PDT

The coronavirus will remain as the main topic until the situation begins to stabilize. Update as of March 16: Italy - 24,700 patients (an increase of more than 10% per day) Spain - 7,800 patients Germany - 5,800 patients France - 4,500 patients Iran - 14,000 patients South Korea - 8,100 patients US - 3,500 (more than + 10% per day). Britain, Norway, Sweden. Holland - 1,000-1,200 patients. There are quarantine measures all over Europe. Is this a big crisis now or not yet? A big crisis will occur when the economy is seriously affected by the pandemic (if several large institutions, banks or States collapse). JPM has already announced the possible default of several states. If there is a default in Italy, a chain reaction will occur. Nevertheless, although the probability of a major crisis is clearly higher than 50%, the situation at the moment is not a crisis yet (my estimate). EUR/USD: Sell from 1.1053. The material has been provided by InstaForex Company - www.instaforex.com |

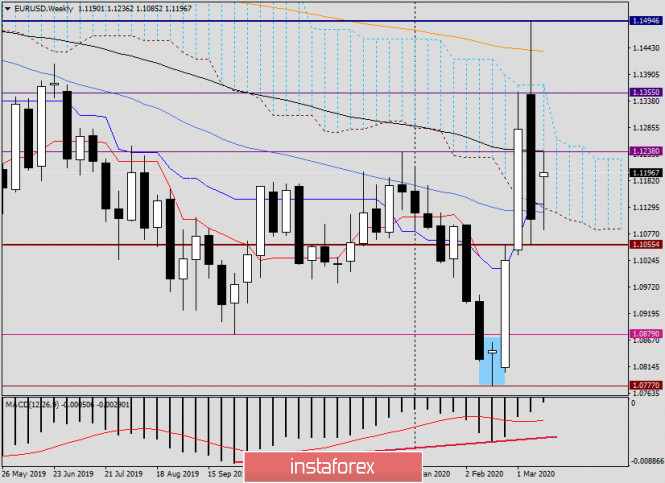

| Technical analysis on EUR/USD for the week of March 16 to 21 Posted: 16 Mar 2020 03:06 AM PDT Trend analysis. This week, the price will move upwards, towards the goal of 1.1196. There's a pullback level of 23.6% (blue dotted line). After reaching it, working upwards to the goal of 1.1331, the resistance line (red bold line), is also possible.

Fig 1 (weekly chart). Complex analysis: - Indicator analysis: up; - Fibonacci levels: up; - Volumes: up; - Candlestick analysis: neutral; - Trend analysis: down; - Bollinger bands: up; - Monthly chart: up. The analysis indicates an upward movement. The overall result of calculating the weekly candle of the EUR / USD pair: the price will have an upward trend this week, with the absence of the first lower shadow of the weekly white candle (Monday – up) and the absence of the second upper shadow (Friday – up). Unlikely lower scenario: from the pullback level of 61.8% - 1.1072 (red dotted line), the price will move downwards to the lower target of 1.0984 – the pullback level of 76.4% (red dotted line). The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of ETH/USD for 16/03/2020: Posted: 16 Mar 2020 02:28 AM PDT Crypto Industry News: There is an Internet list of people from the Ethereum world who have recently participated in industry events. There are popular and well-known names in the community, including Vitalik Buterin, co-creator of Ethereum. The spreadsheet quotes relevant sources and links to statements about the health status of individual persons on the list. The list includes the presence of these people at major Ethereum events in Europe. In addition to the official meetings themselves, the account was also taken of these less formal meetings, which often take place in parallel with the conference. Currently, there are 38 people on the list, of which about 8 have been positively diagnosed with coronavirus.Some participants, after seeing the list, began to report for themselves. Some of them were quarantined.One of the people on the list is Vitalik Buterin. The co-founder of Ethereum was present at one of the industry events - Lighthouse, as well as a conference in Paris. As he allegedly said himself on one of the channels on Telegram, Buterin had a small fever on March 6. According to the previously mentioned list, Vitalik has not passed any tests. It has not been confirmed that it is infected. Some call into question the legitimacy of creating a list when governments around the world declare emergency states. Technical Market Overview: The ETH/USD pair has not been able to rally over the weekend as the bears are in full control over the markets. The bulls, however, had managed to push the price back into the descending channel, but the technical resistance located at the level of $134.12 was too strong for the breakout. Currently, the market is trading around the level of $110.03 which is a short-term technical support. The other support is located at the level of $100.00. The last low was made at the level of $89.01 and might be soon visited again. Weekly Pivot Points: WR3 - $312.98 WR2 - $261.92 WR1 - $190.92 Weekly Pivot - $137.43 WS1 - $68.38 WS2 - $14.40 WS3 - $1 Trading Recommendations: All the Elliott Wave based impulsive wave scenarios have been invalidated due to the important levels violation. The fear of the coronavirus consequences is too strong to traders and it rules on the financial markets, so it is better to stay away from the trading platform until the dust settles. Trade safe.

|

| Instaforex Daily Analysis - 16th Mar 2020 Posted: 16 Mar 2020 02:21 AM PDT Today we take a look at USDCHF and how we can use Fibonacci retracements, Fibonacci extensions, market momentum, trend lines and support/resistance to play this move. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of BTC/USD for 16/03/2020: Posted: 16 Mar 2020 02:14 AM PDT Crypto Industry News: The Italian Red Cross collects donations in bitcoin and other cryptocurrencies to fight the coronavirus pandemic. Helperbit helps him in the process. The proceeds from the collection will reportedly be used to set up an "advanced second-level medical facility to pre-segregate COVID-19 cases in this country." It is expected that a target of EUR 10,000 will be achieved for the purchase of necessary medical equipment and the construction of infrastructure. In addition, BTC will - after converting them to Fiats - also be spent to cover the costs of medical personnel who will be involved in the project. Bruno Pietrosanti, chairman of the Colli Albani Committee, who also participates in the collection, said that in general, "reduce the pressure on hospitalizations" due to the increase in the number of infected patients and the reduced number of places available in Italian hospitals. Added: "We believe that an innovative fundraising tool, such as bitcoin, can help us find the necessary economic resources that are very difficult to obtain at this historic moment." The campaign is also supported by Young Srl, a fintech startup that operates in the cryptocurrency sector to support community initiatives, and by Blockchain Education Network Italy, a non-profit organization that promotes BTC and blockchain in Italy. Technical Market Overview: The BTC/USD pair has hit the level of $5,909 during the weekend, which was a key short-term technical resistance for the market. The Bearish Engulfing candlestick pattern was made at this level and the market reversed towards the level of $4,890. The momentum is still weak and negative, so bears might develop another wave down towards the technical support located at the level of $3,946 soon. Weekly Pivot Points: WR3 - $12,242 WR2 - $10,225 WR1 - $8,024 Weekly Pivot - $5,824 WS1 - $3,603 WS2 - $1,606 WS3 - $10 Trading Recommendations: All the Elliott Wave based impulsive wave scenarios have been invalidated due to the important levels violation. The fear of the coronavirus consequences is too strong to traders and it rules on the financial markets, so it is better to stay away from the trading platform until the dust settles. Trade safe.

|

| Technical analysis of GBP/USD for 16/03/2020: Posted: 16 Mar 2020 02:05 AM PDT Technical Market Overview: Another lower low was made in early Monday morning at the level of 12264 as the coronavirus pandemic continues. The market is trading out of the descending channel in extremely oversold conditions on the H4 timeframe, so some kind of bounce is possible. The overall corrective cycle had been very aggressive so far and the recent breakout from the main channel (marked in brown) does not look good for bulls. The next target for bulls is seen at the level of 1.2411 and 1.2505. The immediate technical support is seen at the level of 1.2282 and in the case of a down move extension, the next support is located at the level of 1.2206. Weekly Pivot Points: WR3 - 1.3660 WR2 - 1.3418 WR1 - 1.2726 Weekly Pivot - 1.2493 WS1 - 1.1781 WS2 - 1.1553 WS3 - 1.0829 Trading Recommendations: The best strategy for current market conditions is to trade with the larger timeframe trend, which is up, so all downward market moves will be treated as local corrections in the uptrend. The key long-term technical support is seen at the level of 1.2231 - 1.2224 and the key long-term technical resistance is located at the level of 1.3512.

|

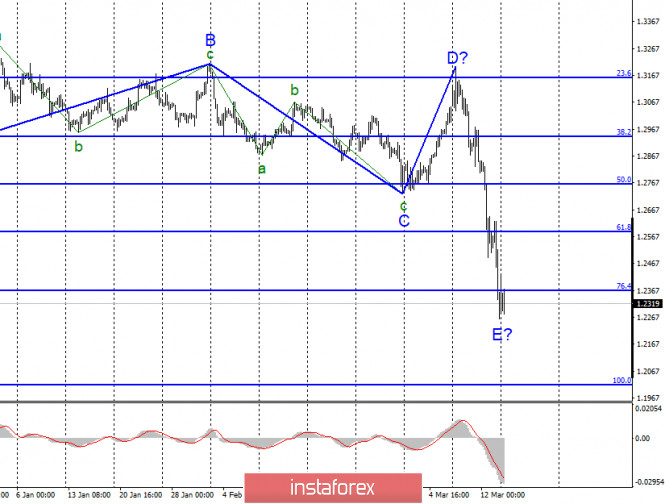

| Posted: 16 Mar 2020 02:02 AM PDT EUR / USD On March 13, the EUR / USD pair lost another 65 basis points and completed the second attempt to break through the Fibonacci level of 61.8%. Since the attempt was unsuccessful, new reasons appeared to suggest the completion of the construction of the alleged wave 2 or b as part of a new upward trend section. If this assumption is correct, then the increase in quotes will continue from current positions with minimal targets located near the level of 0.0% Fibonacci. At the same time, one should not forget that the markets are now in a panic state. Therefore, construction of more ambiguous wave structures is possible than I assume now. Fundamental component: The news background for the EUR / USD instrument on March 13 was very weak. However, the markets did not need any particularly strong news background to continue to trade the euro/dollar instrument down. Well, the key event did not happen on Friday, but on Sunday, the Fed decided to lower the key rate by another 1.00% for the second time in a row, without waiting for the scheduled meeting. In addition, Jerome Powell announced the resumption of a quantitative easing program worth about $ 700 billion. Thus, the Fed will now by all means stimulate the US economy, trying to prevent its slowdown or at least minimize the negative consequences of the epidemic. Will it be possible to do this? The economic statistics for March will show. So far, I can note that the demand for the American currency is supposedly to decline now. This decrease should be enough to complete the construction of wave 2 and move on to the construction of a new upward wave. However, given the current state of the markets, this may not happen. I would also like to note the speech of Jerome Powell, whose rhetoric was excessively "dovish". The Fed President said that the coronavirus epidemic will have very serious consequences for the global economy and the US economy. Thus, we need to wait now for official statistical information to track the real impact of the virus on the economy. General conclusions and recommendations: The euro-dollar pair is supposedly continuing the construction of the upward section. Based on the current wave marking, waves 1 and 2 have completed their construction. Thus, if it were not for the panic state of the market, I would recommend to start buying Eurocurrencies in the calculation of building wave 3 of the upward trend section with targets located about 15 of the figure and above. However, in the current environment, I believe that markets should be careful above all. GBP / USD On March 13, GBP / USD lost about 310 basis points. Thus, the construction of the proposed wave E as part of the non-standard 5-wave downward wave structure continued. Given the size of wave E, it can already be completed or is nearing completion. However, the panic state of the market can easily lead to the fact that wave E will become even more complicated, as well as the entire bearish set of waves, which has already acquired a very ambiguous form. Fundamental component: There was no news background for the GBP / USD instrument on Friday. Nevertheless, panic in the markets persists. In the past two days, the Briton has fallen by 500 points, which is not normal for the normal state of the market. Thus, the highest trading amplitude continues to deter, and the complete uncertainty in the prospects of the instrument does not add a desire to trade. If the EUR / USD instrument has at least some kind of trading logic, and the wave marking looks more or less stable and clear, then everything can change at any time for the pound. It's too late to sell now, and it's dangerous to buy, because it is not clear how long the E wave will turn out. There is no news background for the instrument on Monday. An emergency cut in the Fed rate would have to lower the demand for the dollar, but, as we see, has not yet lowered. General conclusions and recommendations: The pound / dollar instrument continues to complicate the current wave count. Thus, I still do not recommend trading, as the situation in the markets is very unstable. After completing the construction of wave E, using the MACD signal "up", it will be possible to consider the possibilities of buying the instrument. However, the main problem now is that it will be very difficult to determine the completion of both wave E and the entire downward trend section. The material has been provided by InstaForex Company - www.instaforex.com |

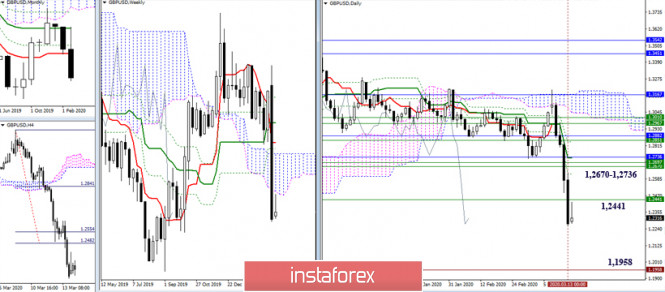

| Technical analysis recommendations for EUR/USD and GBP/USD on March 16 Posted: 16 Mar 2020 01:59 AM PDT Economic calendar (Universal time) The publication of important economic indicators is not expected today. EUR / USD Last week, the pair performed a productive decline, testing the final support of the daily and weekly Ichimoku crosses (1.1052), as well as the daily cloud. At the same time, the Penetrating Lines reversal pattern has been formed in the weeks, so our priority is now on the bearish side. It is possible that the decline will resume only after a slowdown, some backward movement from the met supports and / or retest of the passed levels. The attraction is now exerted by the accumulation of various levels of the upper halves in the region of 1.1137, and the nearest resistance is located at 1.1222 (weekly Fibo Kijun) and 1.1275 (daily Tenkan). In case of breakdown of support of 1.1052 and resumption of decline, bearish reference points will be historical levels and minimal extremes located at 1.0980-90 - 1.0879 - 1.0778. In the lower halves, the pair is in the correction zone. The players to increase tend to take possession of the central Pivot level (1.1127). Reliable consolidation of the above will help strengthen players on the rise, for the support of which some technical indicators have already advocated. The most important reference point for the correction now is the weekly long-term trend (1.1272). This level is able to change the existing balance of power. On the other hand, the nearest resistance can be noted at 1.1200 (R1). In the case of updating the minimum of the last week (1.1055), the bears will most likely continue to actively decline again. The classic Pivot levels 1.1034 - 1.0961 - 1.0868 will act as supports within the day. GBP / USD Perhaps, we can say that the bears exceeded all expectations last week and their weekly absorption is impressive. If the players on the rise can not oppose anything in the near future, then the decline is likely to resume with renewed strength. The reference point now is the monthly minimum extreme of 1.1958 again, then the interests of the bears will be aimed at fulfilling the new weekly target for the breakdown of the cloud. The nearest resistance in this situation can be identified in the areas of 1.2441 (the lower border of the weekly cloud) and 1.2670 - 1.2736 (accumulation of weekly levels and monthly short-term trend). At the moment, the preferences of the analyzed technical elements belong to the players to the downside. The bearish reference points for the downward trend within the day are the support of the classic Pivot levels 1.2147 - 1.2022 - 1.1783. In case of consolidation above the central Pivot level of the day (1.2386), we can expect further development of an upward correction, the main guideline of which on H1 will be the resistance of the weekly long-term trend. Today, this level is located at 1.2780, so the nearest resistance can also be important R1 (1.2511) and R2 (1.2750). Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for 16/03/2020: Posted: 16 Mar 2020 01:58 AM PDT Technical Market Overview: The Federal Reserve reduced interest rates to zero, and the Bank of Japan strengthened its current stimulus at the beginning of the new week. Central banks around the world have taken extensive measures to suppress the economic effects of coronavirus. In response to new information, US futures contracts fell sharply and the bond market jumped. Investors are increasingly afraid that these measures will not be enough to protect the global economy from recession. The market is trying to bounce from the oversold levels on the H4 timeframe and is currently trading around the first important short-term technical resistance located at the level of 1.1210. The next target for bulls is seen at the level of 1.1250 and with increasing momentum on this timeframe, the odds are high. The key technical support is located at the level of 1.1070. Weekly Pivot Points: WR3 - 1.1749 WR2 - 1.1625 WR1 - 1.1316 Weekly Pivot - 1.1171 WS1 - 1.0880 WS2 - 1.0735 WS3 - 1.0438 Trading Recommendations: The downtrend was valid as long as it was terminated or the level of 1.1445 clearly violated, so now all upward moves will not be treated as local corrections in the downtrend, but as a new uptrend. The Ending Diagonal price pattern visible on the larger timeframes like weekly has been completed and the EUR/USD is developing a new wave up.

|

| Posted: 16 Mar 2020 01:56 AM PDT EUR/USD – 1H.

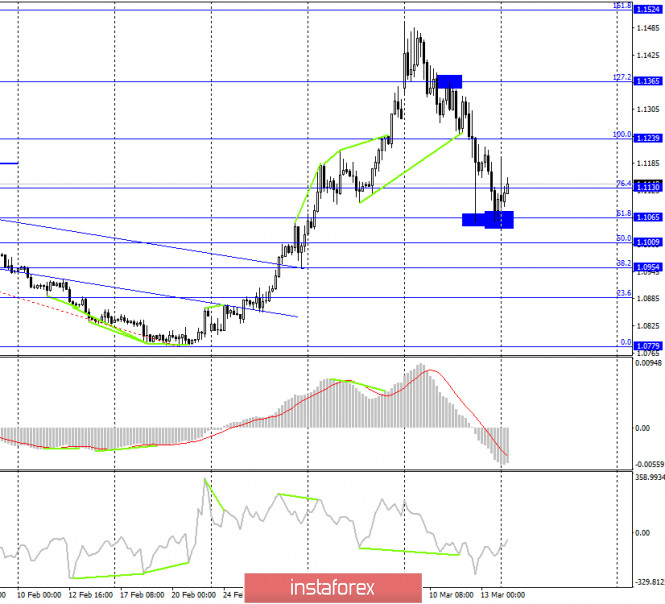

Hello, traders! March 13 was another shocking day for global markets. Stock markets continue to fall, and there is no positive news about the fight against coronavirus. Thus, the fall in quotations continued on Friday. A new downward trend corridor was formed on the hourly chart, which defines the current mood of traders as "bearish". However, the upward trend line remains in effect, around which the euro/dollar pair was trading both on Friday and today. Thus, now I am inclined to the option that the pair will perform a close over the trend corridor, which will serve as a signal to traders to buy and maintain a more global "bullish" mood of traders. EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed the second fall to the corrective level of 61.8% (1.1065) and the second rebound from this level. Thus, a reversal was made in favor of the EU currency and the growth process began, which can last quite a long time. Although traders remain in a state of shock, certain graphical models still continue to work. I would say that the European currency now has a high chance of returning to the highs of the year. There are no pending divergences in any indicator. The rebound of quotes from the Fibo level of 61.8% is considered as a signal to buy. EUR/USD – Daily.

As seen on the daily chart, the euro/dollar pair performed a fall to the corrective level of 61.8% (1.1052) (the same Fibonacci grid as on the 4-hour chart), so the picture here is identical to the younger chart. The same rebound of the pair's quotes and the same high chances of a long-term growth of quotes. The Fed, by the way, by lowering the interest rate by another 1% today, very much increases the probability of a fall in the US currency. And not just in the short term. EUR/USD – Weekly.

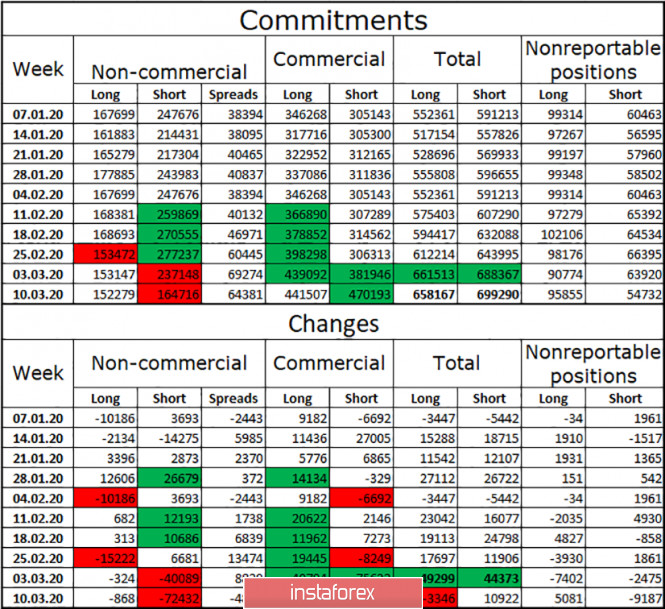

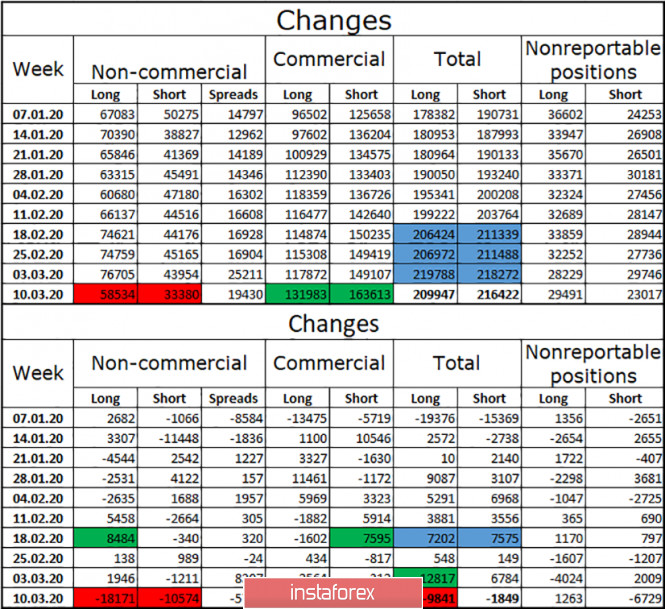

On the weekly chart, the target of 1.1600 (approximate) remains in effect. Thus, if the buy signals on the lower charts are worked out, then the level of 1.1600 will be the final and very realistic goal for bull traders. Of course, the markets as a whole remain in a state of shock, and the actions of the world's central banks, which have regularly lowered rates in the past two weeks, do not add stability and calm. Thus, it is possible that there will be surprises in the pair's movement. Overview of fundamentals: On March 13, traders could pay attention to the consumer price index in Germany and the consumer sentiment index in the United States. However, both reports are now of such low significance that it is unlikely that any of the traders even remember that they came out. The market is now quoted events such as the actions of the Central Bank or global changes in stock and commodity markets, and not inflation in Germany... News calendar for the United States and the European Union: On March 16, important economic reports and events are not included in the calendar of the European Union and the United States. COT report (Commitments of Traders):

The new COT report is out! There is nothing surprising in it. Given that this report comes out three days late, I could already conclude that the total number of Long positions decreased among the major players, and Short positions increased, given the strong fall in the European currency quotes over the past week. However, there are also points that need to be highlighted. First, the total number of contracts continues to grow. That is, the activity of traders does not fall. Second, speculators get rid of Short positions and they are immediately picked up by hedgers. This suggests that market players who specialize in making profits from currency operations do not believe in a further fall in the euro currency. According to our observations, it is speculators who drive the market, and hedgers generally open opposite positions to insure against possible risks. Thus, given the strong reset of Short positions by speculators, I would say that there is a high probability of euro growth in the next week Forecast for EUR/USD and recommendations for traders: For the EUR/USD pair, there are now good chances to start a new upward trend. The overall correction from the previous upward trend was 61.8%. Thus, the growth right now highly likely, and several signal-to-purchase is already available. The targets are 1.1365 and 1.1524. Thus, I would now recommend buying the euro currency. Closing on the hourly chart above the descending corridor will significantly increase the probability of further growth. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

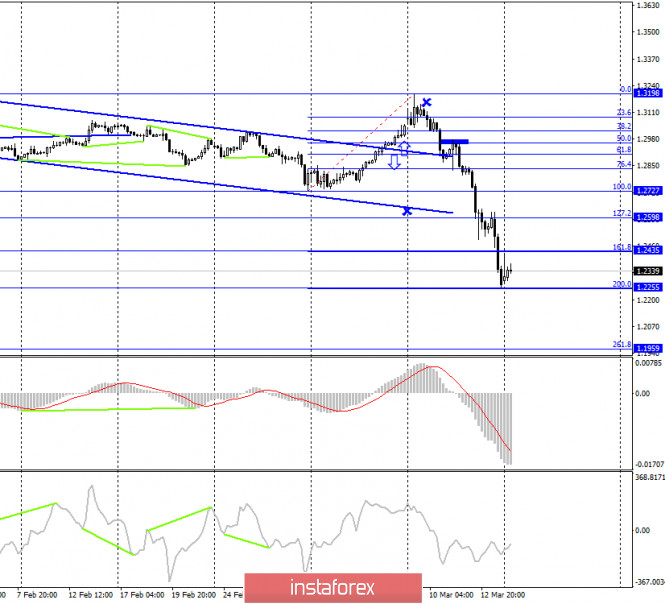

| Posted: 16 Mar 2020 01:48 AM PDT GBP/USD – 1H.

Hello, traders! Unfortunately, all global markets are now driven solely by news about the spread of the coronavirus, as well as news related to measures taken by the Central Bank and governments to stop the spread of the epidemic and mitigate its consequences. For the second time, the Federal Reserve did not wait for a scheduled meeting and again lowered the rate in an emergency mode - this time by 100 points. Thus, now the UK and the US have the same base rate - 0.25%. At the same time, Boris Johnson in the UK suggests isolating all people over the age of 70 at home. According to the hourly chart, the quotes of the pound/dollar pair performed a fall to the Fibo level of 200.0% (1.2251). Despite the important decision of the Fed this night, bull traders are not in a hurry to buy the British pound yet. Fixing the pair's exchange rate below the Fibo level of 200.0% will increase the probability of a further fall in the direction of the next corrective level of 261.8% (1.1959). GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a fall to the same corrective level of 200.0% (1.2255). The rebound of quotes (inaccurate) from this Fibo level worked in favor of the British, but so far the growth of quotes is very sluggish and weak. Thus, the readings of the two lower charts coincide and imply further growth if bear traders fail to close below the Fibo level of 200.0%. Today, the divergence is not observed in any indicator. GBP/USD – Daily.

On the daily chart, the graphic picture remains the most interesting and impressive. All the previous target levels, which I gave on the signal about the rebound from the corrective level of 23.6% (1.3146), have been fulfilled. The collapse has now stopped near the corrective level of 76.4% (1.2327). However, if the quotes close below this level, the probability of a new fall with the goal of the Fibo level of 100.0% (1.1959) will increase many times. There are no new graphical constructions at the moment. Overview of fundamentals: on Friday, there was no important news from the US and the UK. Both countries continue to fight the infection, closing borders, air traffic, and taking internal measures to stop the spread of infection. Tonight, the Fed decided to cut the interest rate by another 100 points. However, as we can see, traders are not particularly impressed with this decision and demand for the US dollar remains. The COVID-19 virus continues to spread, and it is not yet clear when the authorities will be able to defeat the disease. Thus, all currency, stock, and commodity markets remain in a state of shock and danger. Surprises and unexpected movements are possible and highly possible. The economic calendar for the US and the UK: On March 16, important economic reports and events are not included in the calendar of the UK and the US. COT report (Commitments of Traders):

A new report from Commitments of Traders showed that the growth rate of Long and Short positions among speculators has decreased. But they have increased for hedgers. Thus, the total number of contracts for buying and selling among major players has again remained almost unchanged, only slightly decreased. First of all, due to Long positions, which is not surprising, given the strong collapse of the British dollar's quotes. Given the fact that speculators were particularly eager to reduce their Long positions, we can assume that the "bearish" mood will continue. However, almost complete equality in the total number of Long and Short can cause a pullback of quotes up, in other words, the new growth of the pound/dollar pair. The situation is now confusing, and graphical analysis does not give clear signals to buy or sell. Forecast for GBP/USD and recommendations to traders: I believe that in the current conditions, opening any transactions is still associated with high risks, as the market remains in a state of shock. In my opinion, for new sales of the British dollar, you need to wait for the consolidation of quotes under the Fibo level of 200.0% (1.2251) on the hourly chart. Purchases look more promising, but there are no specific signals right now. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| The Fed unexpectedly lowered its key interest rate to 0.25%. Posted: 16 Mar 2020 01:42 AM PDT At the last ECB meeting, Christine Lagarde did not lower euro's rate, which is actually a positive news for the currency. This was caused by the 800p gap in the EUR/USD pair. Now, the weakening of the dollar, associated with the rate cut to almost zero, can push the EUR/USD pair into a third wave in the D1 timeframe: Thus, the potential passage of 4000p to the zone of 1.15 and higher is broken off. I recommend carefully working for the increase, not forgetting that volatility is expected to increase this week due to the huge infusion of the dollar supply in the market. Good luck in trading and control your risks! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

.

.

No comments:

Post a Comment