Forex analysis review |

- Forecast for EUR/USD on March 3, 2020

- Forecast for GBP/USD on March 3, 2020

- Forecast for AUD/USD on March 3, 2020

- Fractal analysis of the main currency pairs for March 3

- GBP/USD. Results of March 2. Pound remains calm amid start of negotiations between the delegations of Michel Barnier and

- EUR/USD. Results of March 2. Conflicting data on business activity in the EU and the US. Louis de Guindos following Powell

- EUR/USD. Guindos's unexpected speech, Washington's state of emergency, and Powell's dovish statement

- EURUSD: Euro breaks above the 11th figure, and Trump again puts pressure on the Fed to lower rates. Eurozone manufacturing

- Evening review 03/02/2020 EURUSD. Euro insists on upward trend

- EUR/USD: dollar changes tactics, or why is the euro rally at risk of crashing into a brick wall?

- Gold pendulum: advantage in a falling direction

- March 2, 2020, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- March 2, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- BTC analysis for 02.03.2020 - Bigger drop is expected towards the levle of $7.650, watch the downbreak of smaller Pitchfork

- EUR/USD analysis for 02.03.2020 - Strong daily momentum to the upside and potential for test of the Pitchfork upper parallel

- Analysis for Gold 02.03.2020 - Massive drop in the background and both targets reached, still space for more downside and

- GBP/USD: plan for the US session on March 2. Buyers of the pound are in no hurry to return to the market. Hope at 1.2760

- EUR/USD: plan for the US session on March 2. Any responses from sellers to growth are accompanied by new purchases of the

- Trading recommendations for EURUSD pair on March 2

- Market review. Trading ideas. Q&A

- Preparing the bridgehead for the reverse movement. EUR/USD review for March 02, 2020

- Yen uses the old connection

- Collapse of China's PMI increases likelihood of emergency measures to support the economy. Euro loses momentum, pound gets

- USD/JPY and its crosses' prospects for March

- Two reasons for a rebound at once. GBP/USD review for March 03, 2020

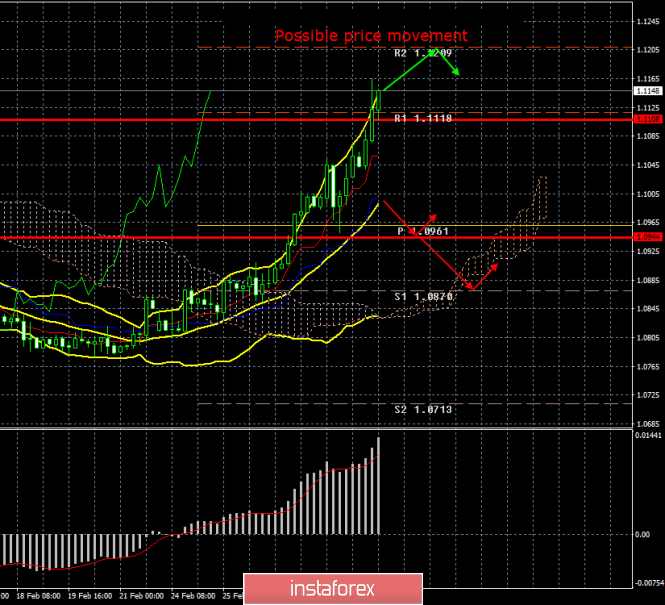

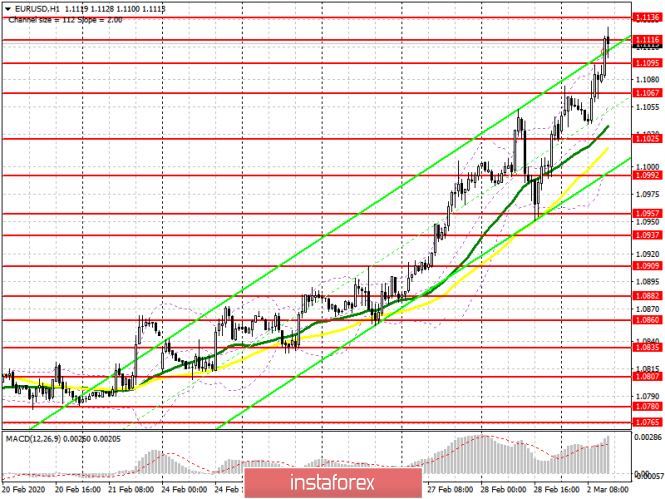

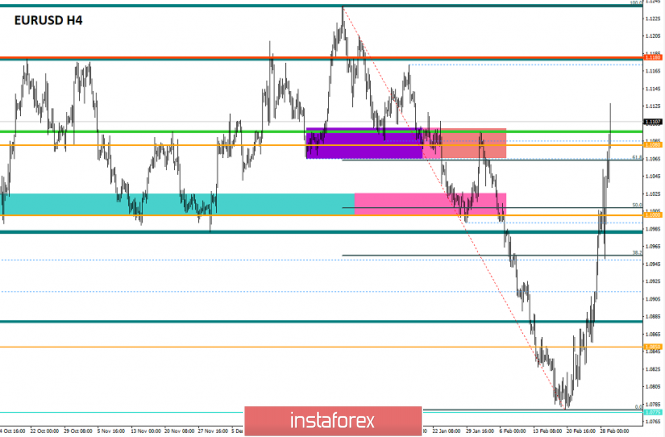

| Forecast for EUR/USD on March 3, 2020 Posted: 02 Mar 2020 07:50 PM PST EUR/USD The euro grew by 107 points on Monday, the highest growth of the day was 160 points. Euro purchases were at their highest daily volumes in the last 13 months. Such a rush is possible on only one idea - to be certain that the Fed will lower the rate by 0.5% in March. We are still not sure about this. The Fed may be proactive, but only if there are signs of economic failure, they are not there yet. The stock market crash of 12.75% between February 20 and 28 is far from a sign of economic drawdown; on the contrary, it is useful for the economy with the goal of reorganizing it from plankton - various firms that tighten business chains. Pension funds, insurance companies, regional budgets can be hit, all those who, by law, are obliged to place reserves in financial markets. But here, large investors withdrew money from the stock market throughout the past year, transferring funds to less risky instruments. Indeed, the yield on 10-year US bonds last year steadily declined, under the influence of debt purchases, the yield fell from 1.921% to the current 1.145%. Last year, the main buyers of US Treasury bonds were domestic investors. For a one-time reduction of the base rate by 0.5%, there must be a very good reason, for example, the bankruptcy of a large bank. Over the past week, the euro has grown by 350 points and this is enough to absorb one rate cut by 0.25%. The euro reached the target level of 1.1175, the Marlin oscillator entered the overbought zone and showed the first sign of a reversal. Now we are waiting for, if not a price reversal down, then a correction, the purpose of which will be to support the MACD line at 1.1035. The signal line of the Marlin oscillator returned to the consolidation range on the four-hour chart, there are no other signs of a reversal. It remains to wait. The Reserve Bank of Australia makes a decision on the rate today at 2:30 London time. A decrease is expected from 0.75% to 0.50%. If the euro's reaction to this decrease is negative, that is, there will be no price increase, then this will become an indirect sign of the completion of the expected reduction in the rate and the Fed itself. The material has been provided by InstaForex Company - www.instaforex.com |

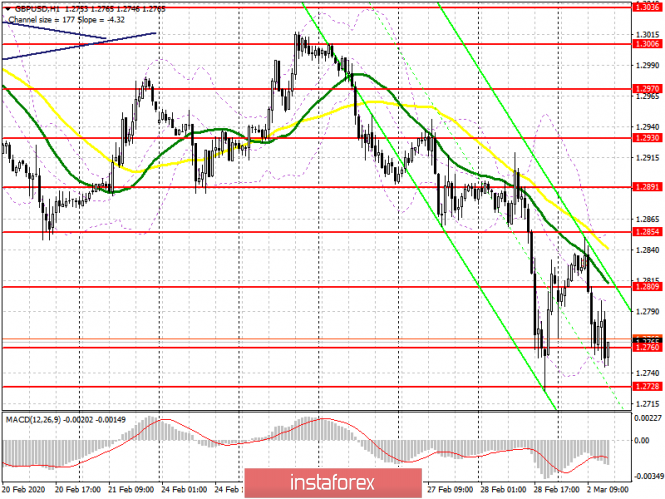

| Forecast for GBP/USD on March 3, 2020 Posted: 02 Mar 2020 07:48 PM PST GBP/USD The quote of the British pound remained at the Fibonacci level of 123.6% for two days. Investors are waiting for news from the negotiations of the British delegation with European politicians. The current stage of negotiations will end on Thursday. Consolidating the price under yesterday's low opens the target at the Fibonacci level of 138.2% at the price of 1.2670. The second target is 161.8% at 1.2530. It is also possible to continue trading in the range, then the price can once again be marked at the Fibonacci level of 110.0% (1.2844). On the four-hour chart, the signal line of the Marlin oscillator is moving up, which may be a warning of another local increase before the medium-term decrease (potential, expected). Here, the resistance is the MACD line, which moves to the Fibonacci level of 110.0%. The Marlin oscillator by this time will reach the boundary with the growth territory and will turn down from it. |

| Forecast for AUD/USD on March 3, 2020 Posted: 02 Mar 2020 07:46 PM PST AUD/USD The Australian dollar fulfilled the target of 0.6457 on Friday, then returned to the range of Fibonacci levels of 261.8-271.0%, and now it shows its intention to move once again to the level reached and overcome it. The intention to fall to the 0.6370 target in terms of the Fibonacci level of 361.8%, we see in the signal line of the Marlin oscillator that is extremely compressed into a wedge. The RBA makes a decision on the rate today at 2:30 London time. Investors expect a drop from 0.75% to 0.50% as a support to the economy after losses in the extremely hot Australian summer. Also, losses due to disruptions in trade relations with China. The price is developing under the lines of balance (indicator red) and MACD (indicator blue) on a four-hour chart, the Marlin oscillator in the territory of the bears. We are waiting for the decision of the RBA and the Australian dollar to fall in the main scenario. In an alternative scenario, the price may rise in the 0.6580-0.6600 range - to the Fibonacci level of 238.2% at the point of intersection with the embedded lines of the price channel (daily). The material has been provided by InstaForex Company - www.instaforex.com |

| Fractal analysis of the main currency pairs for March 3 Posted: 02 Mar 2020 04:59 PM PST Forecast for March 3: Analytical review of currency pairs on the scale of H1:

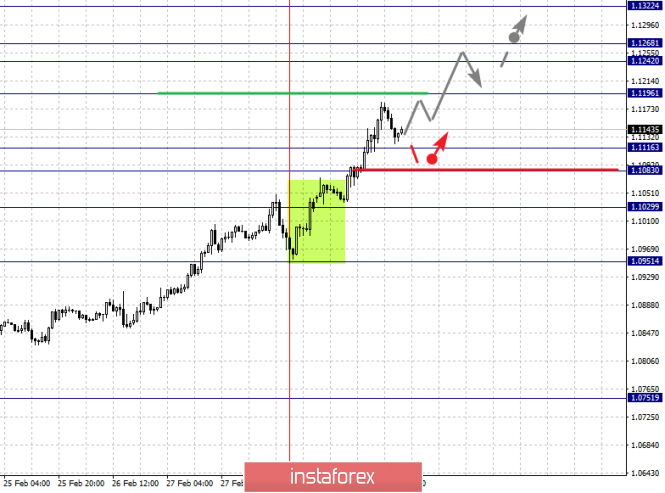

For the euro / dollar pair, the key levels on the H1 scale are: 1.1322, 1.1268, 1.1242, 1.1196, 1.1116, 1.1083 and 1.1029. Here, we are following the local upward cycle of February 28. The continuation of the movement to the top is expected after the breakdown of the level of 1.1196. In this case, the target is 1.1242. Price consolidation is in the range of 1.1242 - 1.1268. For the potential value for the top, we consider the level of 1.1322. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is expected in the range 1.1116 - 1.1083. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1029. This level is a key support for the top, its passage at the price will lead to the formation of initial conditions for the downward cycle. The main trend is the local upward cycle of February 28 Trading recommendations: Buy: 1.1196 Take profit: 1.1242 Buy: 1.1268 Take profit: 1.1320 Sell: 1.1116 Take profit: 1.1084 Sell: 1.1081 Take profit: 1.1030

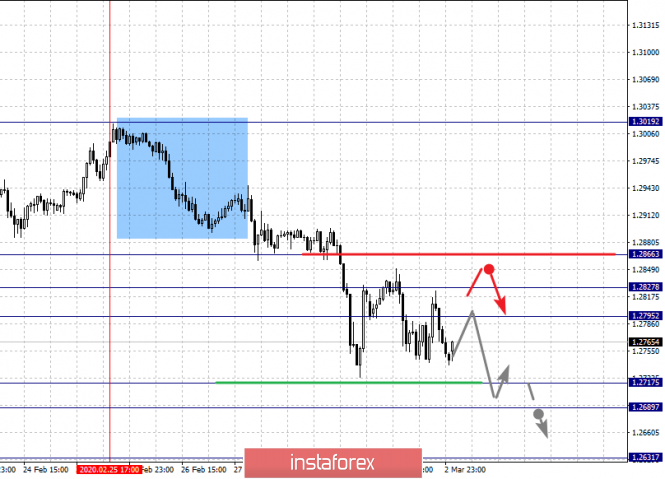

For the pound / dollar pair, the key levels on the H1 scale are: 1.2866, 1.2827, 1.2795, 1.2717, 1.2689 and 1.2631. Here, we are following the development of the downward cycle of February 25. Short-term movement to the bottom is expected in the range of 1.2717 - 1.2689. The breakdown of the last value will lead to movement to a potential target - 1.2631, when this level is reached, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.2795 - 1.2827. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2866. This level is a key support for the downward movement. The main trend is the downward cycle of February 25. Trading recommendations: Buy: 1.2795 Take profit: 1.2825 Buy: 1.2828 Take profit: 1.2864 Sell: 1.2717 Take profit: 1.2690 Sell: 1.2686 Take profit: 1.2634

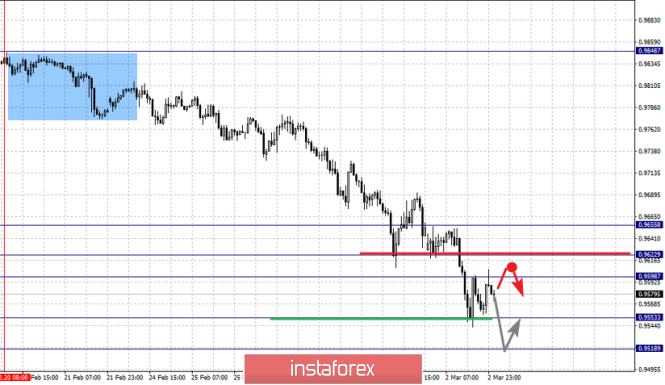

For the dollar / franc pair, the key levels on the H1 scale are: 0.9655, 0.9622, 0.9598, 0.9553 and 0.9518. Here, the price is near the limit values for the descending cycle of February 20. In connection with which, we expect a correction. Short-term upward movement is possibly in the range of 0.9598 - 0.9622. The breakdown of the latter value will lead to in-depth movement. Here, the target is 0.9655. This level is a key support for the downward structure. Short-term downward movement is possibly in the range of 0.9553 - 0.9518. From here, we expect a key reversal to the top. The main trend is a downward cycle of February 20, we expect a correction Trading recommendations: Buy : 0.9598 Take profit: 0.9621 Buy : 0.9624 Take profit: 0.9653 Sell: 0.9551 Take profit: 0.9520 Sell: Take profit:

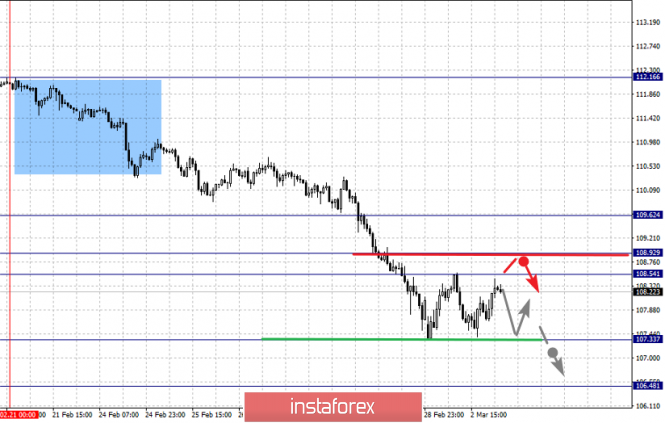

For the dollar / yen pair, the key levels on the scale are : 109.62, 108.92, 108.54, 107.33 and 106.48. Here, we are following the development of the downward cycle of February 21. The continuation of movement to the bottom is expected after the breakdown of the level of 107.33. Here, the potential target is 106.48. We expect a pullback to the top from this level. Short-term upward movement is possibly in the range of 108.54 - 108.92. The breakdown of the last value will lead to an in-depth correction. In this case, the target is 109.62. This level is a key support for the downward structure. The main trend: the downward cycle of February 21 Trading recommendations: Buy: 108.54 Take profit: 108.90 Buy : 108.94 Take profit: 109.60 Sell: 107.30 Take profit: 106.55 Sell: Take profit:

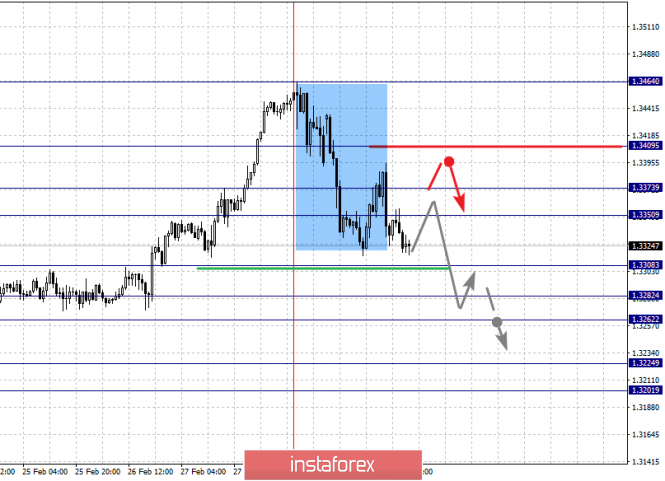

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3409, 1.3373, 1.3350, 1.3308, 1.3282, 1.3262, 1.3224 and 1.3201. Here, we are following the formation of the descending structure of February 28. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3308. In this case, the target is 1.3282. Price consolidation is near this level. The passage at the price of the noise range 1.3282 - 1.3262 should be accompanied by a pronounced downward movement. Here, the target is 1.3224. For the potential value for the bottom, we consider the level of 1.3201. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 1.3350 - 1.3373. The breakdown of the latter value will lead to in-depth movement. Here, the target is 1.3409. This level is a key support for the downward structure. The main trend is the formation of the downward structure of February 28 Trading recommendations: Buy: 1.3350 Take profit: 1.3371 Buy : 1.3375 Take profit: 1.3409 Sell: 1.3308 Take profit: 1.3282 Sell: 1.3260 Take profit: 1.3225

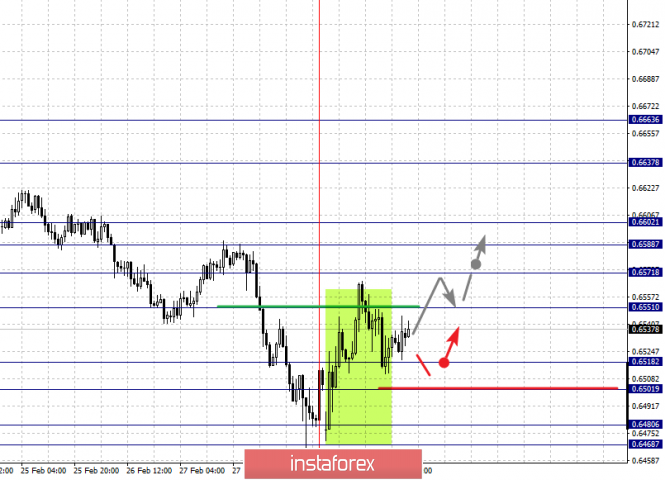

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6637, 0.6602, 0.6588, 0.6571, 0.6551, 0.6518, 0.6501, 0.6480 and 0.6468. Here, we are following the formation of the initial conditions for the top of February 28. The continuation of the movement to the top is expected after the breakdown of the level of 0.6551. In this case, the target is 0.6571. The breakdown of this value will allow us to expect movement to 0.6588. Price consolidation is near this level. Meanwhile, passing by the price of the noise range 0.6588 - 0.6602 will lead to the development of pronounced movement. Here, the target is 0.6637. For the potential value for the top, we consider the level of 0.6663, from which we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6518 - 0.6501. The breakdown of the latter value will lead to the formation of a local descending structure. In this case, the target is 0.6480. The main trend is the formation of initial conditions for the top of February 28 Trading recommendations: Buy: 0.6551 Take profit: 0.6570 Buy: 0.6572 Take profit: 0.6586 Sell : 0.6518 Take profit : 0.6503 Sell: 0.6500 Take profit: 0.6482

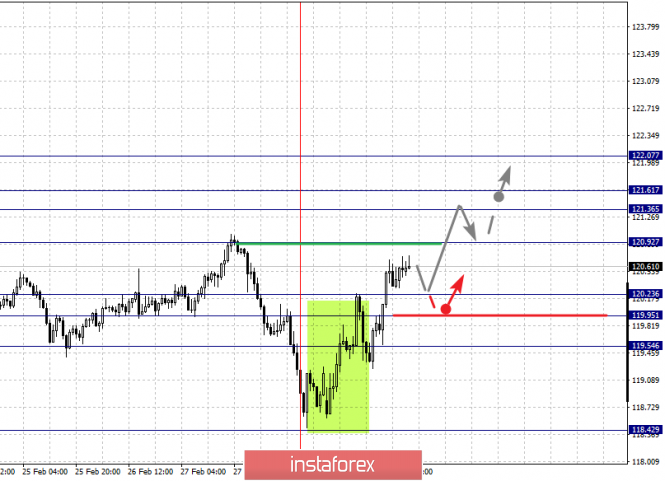

For the euro / yen pair, the key levels on the H1 scale are: 122.07, 121.61, 121.36, 120.92, 120.23, 119.95 and 119.54. Here, we are following the formation of the initial conditions for the top of February 28. The continuation of the movement to the top is expected after the breakdown of the level of 120.92. In this case, the target is 121.36. Price consolidation is in the range of 121.36 - 121.61. For the potential value for the top, we consider the level of 122.07, upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 120.36 - 119.95. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.54. This level is a key support for the upward structure. The main trend is the formation of initial conditions for the top of February 28 Trading recommendations: Buy: 120.92 Take profit: 121.36 Buy: 121.62 Take profit: 122.07 Sell: 120.23 Take profit: 119.95 Sell: 119.93 Take profit: 119.55

For the pound / yen pair, the key levels on the H1 scale are : 140.18, 139.34, 138.82, 137.44, 136.91 and 136.11. Here, we are following the downward cycle of February 21. Short-term downward movement is possibly in the range of 137.44 - 136.91. The breakdown of the latter value will allow us to count on movement to a potential target - 136.11. We expect a pullback to the top from this level. Short-term upward movement is possibly in the range of 138.82 - 139.34. The breakdown of the latter value will lead to the development of an in-depth correction. Here, the goal is 140.18. This level is a key support for the downward cycle. The main trend is the downward cycle of February 21. Trading recommendations: Buy: 138.82 Take profit: 139.30 Buy: 139.38 Take profit: 140.18 Sell: 137.44 Take profit: 136.94 Sell: 136.88 Take profit: 136.15 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Mar 2020 02:58 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 68p - 104p - 108p - 87p - 194p. Average volatility over the past 5 days: 113p (high). The British pound spent the first trading day of the week as it should be. Firstly, there were no abrupt and unreasonable movements. Secondly, the British pound traders clearly worked out macroeconomic statistics. Thirdly, there was no panic. And most importantly, what needs to be said right away: the euro currency did not move today on the basis of macroeconomic data. Trading on the pound/dollar pair proved ot. However, first things first. In general, today perfectly fits the definition of correctional Monday. There were few important posts today. Therefore, the volatility remained not too high. We spoke about indexes of business activity in the US manufacturing sector, Markit and ISM, in the article on the euro. In the UK, the index of business activity in the manufacturing sector was slightly lower than experts' forecasts and amounted to 51.7. It was this publication that provoked a slight drop in the British currency in the European trading session. After lunch, when it became known about business activity in the US manufacturing sector, the quotes of the pair rushed up, working out already weak statistics from across the ocean. As a result, everything is logical and reasonable. In the meantime, delegations of Michel Barnier and David Frost have officially begun negotiations on a trade deal that provides for a turnover of 500 billion euros annually. The first round of negotiations is expected to last three days. The next round of negotiations will also take place in March, each subsequent one will take place in two to three weeks. Both sides express a desire to conclude a trade deal before the end of 2021. It is noted that the European side wants to provide Britain with access to a single market without duties and quotas, but they want to receive guarantees in return that the British government will prevent dumping and ensure fair competition for British and European companies. The European Union also wants to gain access to fishing in British waters. In turn, London wants to completely get out of the jurisdiction of the European Union, not to submit to the European Court. Negotiations have begun, and in the near future we can get the first information on this topic. We, as before, believe that the probability of a trade deal within the next 3-4 months is extremely low. It is 3-4 months, not ten, since Boris Johnson has already stated that if it is not clear that the deal has prospects before mid-summer, the British delegation will leave the negotiations with the Europeans. Thus, this is not even a year of talks, but just a few months. What are the chances that a huge deal will be agreed in such a short time? The British pound will be, as they say, keep abreast of the negotiations, being in a ready mode at any moment to fall if information is received that the parties cannot come to a common denominator. In recent days, the downward trend seems to have resumed, but so far it cannot be said that it is confident. We would also like to mention the speeches of Mark Carney and Jerome Powell. Recall that both central bank chairmen said they would respond if necessary to the consequences of the coronavirus epidemic, which, according to Carney, is already negatively affecting the British economy. But his American counterpart also stated high risks of a slowdown in the economy due to the Chinese virus and hinted that the Fed would cut the rate in the near future. In fact, the British pound did not react to any one or the other statement, because they offset each other. Thus, now we can expect a softening of both the British monetary policy and the US one, which will not change the balance of power between the currencies, unless the Fed reduces the rate immediately by 0.5%. Only such a step can provide the British currency with more or less long-term support. From a technical point of view, the pound/dollar has now begun to adjust, which again is logical after Friday's drop in quoted. The MACD indicator has not yet managed to turn up, but will do so soon. Thus, we recommend now waiting for news from the UK, waiting for new macroeconomic publications, waiting for the completion of the correction. The downward trend continues. Trading recommendations: The GBP/USD pair continues the upward correction. Thus, it will be possible to sell the British pound again with targets at 1.2700 and 1.2686 (first support level) after completion of the current correction (MACD indicator turns down or rebounds from the Kijun-sen line). We recommend considering the pair's purchases with targets at the level of 1.2926 and the Senkou Span B line in small lots if the bulls are able to gain a foothold above the Kijun-sen line. In any case, the fundamental background remains not on the side of the pound. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

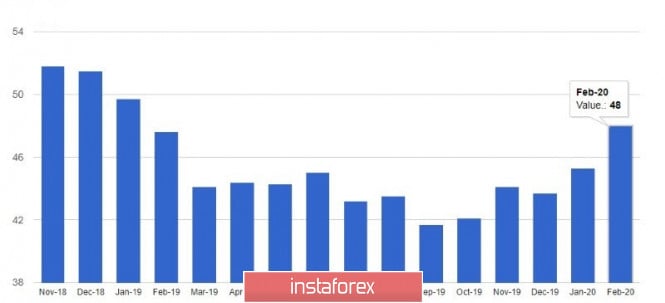

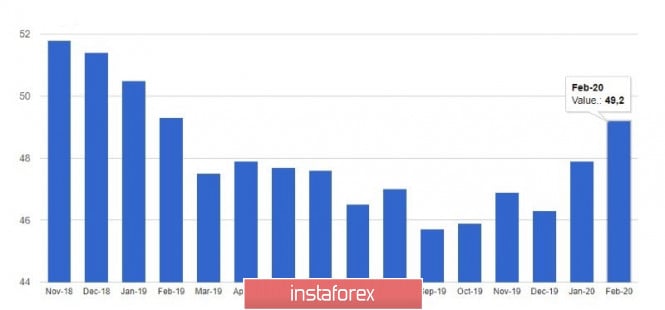

| Posted: 02 Mar 2020 02:58 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 67p - 60p - 54p - 127p - 102p. Average volatility over the past 5 days: 82p (average). The first trading day of March and the new week ends surprisingly with the continuation of the strengthening of the European currency, although most of the traders were waiting for a correction today. However, we warned that you should not catch a correction, it is better to respond to the readings of technical indicators, which at the very beginning of the Asian trading session turned up again (we are talking about the MACD indicator). Thus, despite the fact that there were not a large number of macroeconomic events today, traders continued to buy euros almost from the very moment trade had opened. What does this mean? This suggests that market participants continue to ignore macroeconomic data and continue to panic by getting rid of the US currency, and only in pairs with the euro and the franc. The pound was prone to fall against the dollar during the day. Thus, the current movement, which began as a banal technical correction, now looks like a strong upward trend. And most importantly, it's hard enough to say what the trend is based on, besides over panic. Yes, the US stock market suffered serious losses last week. Yes, coronavirus is spreading, including in the United States, where the first death has already been recorded. Yes, the Fed almost openly stated that it was ready to lower its key rate at the March 18 meeting. But why doesn't the pound sterling rise in price? After all, no important and disappointing information has been received in the UK in recent days. Traders cannot be upset by the negotiations with the European Union, since they have not yet begun, and no information has been received on this subject. In general, a paradox. We are no longer talking about the fact that coronavirus will first of all hit the already weak European economy. Many countries in the eurozone are already balancing on the brink of recession, showing low GDP growth. The Chinese virus could finally drive the EU economy into recession. It is the EU economy, not the American one. However, traders, as we have said, are openly panicking. Nothing else can explain the euro's strongest growth by 120 points on Monday. But the day has not even ended. The average daily volatility of the pair has been no more than 50 points in the past few months... Indirectly, the macroeconomic reports of the day influenced the euro's growth today. However, we believe that they were frankly contradictory and could not, with all the desire, cause such a strong movement. Two key business activity indexes in the manufacturing sectors of Germany and the entire European Union were higher than forecasted and amounted to 48.0 and 49.2, respectively. However, despite this increase, both indicators remained in the so-called red zone. That is, business activity in the locomotive country of the entire EU and the EU itself remains at a low level to talk about the restoration of industrial sectors. Thus, European data were not unambiguous. But US business activity indices were no less ambiguous. According to Markit, in the US manufacturing sector, business activity fell from 50.8 to 50.7 in February. According to ISM, from 50.9 to 50.1. Thus, both indices showed a reduction and both remained in the green zone, which indicates the growth of the industrial sector. Even more conflicting data. Thus, although formally in the EU statistics turned out to be higher than forecasts, and in the US - lower, we do not think that traders even paid any attention to it at all today. The most interesting event of the day is the speech of the ECB Vice President Luis de Guindos, who is almost as straightforward as Jerome Powell last Friday, said that the regulator is ready to take all necessary measures and adjust all monetary instruments to ensure a steady inflation rate of its target level. Thus, in a veiled way, de Guindos completed a series of speeches by the heads of the largest central banks in the world, confirming the traders' concerns about easing monetary policies of the EU and the US. However! Traders ignored this information, although, in essence, it means that the ECB will also lower the rate, as well as the Fed. Only the Fed will mitigate monetary policy from the current 1.75%, and the ECB from -0.5%. This is the whole difference, but the euro is still continuing to rise in price. Therefore, we recommend that traders, as before, follow the trend, and at the same time, be aware of all the groundlessness of the current strengthening of the euro. Consequently, be prepared for a new sharp reversal of the price down and a strong fall in the euro. Moreover, the upward movement is now almost vertical. From a technical point of view, the pair continues its steady upward movement and overcomes the first resistance level for this week, at 1.1118, as well as the upper limit of the volatility channel on March 2. There are no signs of correction at the moment, and the MACD indicator may begin to discharge at any time. Trading recommendations: The EUR/USD pair is still upward movement. Thus, now it is possible to stay in long positions with the target at the resistance level of 1.1209, until the MACD indicator turns down while prices are decreasing in parallel. It will be possible to sell the pair with the target of 1.0870, when traders will be able to gain a foothold back below the critical line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Guindos's unexpected speech, Washington's state of emergency, and Powell's dovish statement Posted: 02 Mar 2020 02:54 PM PST The euro-dollar pair continues its upward rally: today, the price broke through two resistance levels at once: this allows the bulls to count on final consolidation in the 11th figure area. In the morning, buyers broke the level of 1.1070 (the upper line of the Bollinger Bands indicator on the daily chart), and a little later, they easily broke through the level of 1.111 (the upper and lower borders of the Kumo cloud coincided on the same time frame at this price point), reaching the lower border of this clouds are already on the weekly chart. If the EUR/USD bulls consolidate above the level of 1.1150, they can already count on testing the 12th figure - after all, the next, most strong resistance level in this case will be the price level of 1.1240 (the upper line of the Bollinger Bands indicator on the weekly chart). However, such heights now seem unattainable - but the 11th figure was also an unattainable goal for EUR/USD buyers not so long ago. Over the past three weeks, the pair has "stepped up" almost 400 points, and recently, growth rates have accelerated significantly, primarily due to the weakening dollar.

A new wave of sales of the American currency occurred after a statement by the head of the Federal Reserve Jerome Powell on Friday, and within the framework of which, he warned in almost direct text about the interest rate cut in the very near future. And although he literally voiced a more hidden phrase (that "the Central Bank will act appropriately to support the economy"), the market interpreted his words quite clearly. Many currency strategists of large banks (in particular, Danske Bank) have warned their customers that the US regulator can make an appropriate decision already at the March meeting, which will be held on the 18th. Moreover, according to some analysts, there are several scenarios of possible actions on the part of the Federal Reserve: the regulator can reduce the rate by 25 basis points in March and April, and if necessary, in the fall. According to another scenario, the Central Bank at the next meeting will cut the rate immediately by 50 basis points, after which it will take a wait and see position until the fall. The most optimistic scenario suggests one decline in March or April. As you can see, the market has little doubt that the Fed will react to the current situation by easing monetary policy. The only question is how large the actions of the regulator will be. At the same time, other fundamental factors put additional pressure on the dollar. The yield on 10-year Treasuries today declined to a historic low of 1.043%, while the stock market continues to lose ground. The news of a second death from a coronavirus in the United States (a man died in one of the nursing homes and a 50-year-old woman died on the eve) only aggravated the situation. In general, the number of confirmed cases of coronavirus in the United States has reached more than 60 people - four of them are in serious condition. A state of emergency was declared in the state of Washington: the governor instructed state bodies to use "all necessary resources" to prepare and respond to the outbreak of coronavirus, including the human resources of the National Guard. Donald Trump hastened to reassure Americans that the process of creating a vaccine against coronavirus is moving "quickly and very well". However, the director of the American National Institute of Allergy and Infectious Diseases disagreed with his optimism - he said that the corresponding vaccine would be ready for use no earlier than in a year and a half. Thus, all factors such as Powell's resonant statement, a sharp decline in the yield on the Treasuries, the decline of the US stock market, the state of emergency in Washington and lastly, the first deaths from a new virus in the United States, hit the dollar in one powerful front. Nevertheless, the European currency received unexpected support from the European Central Bank and macroeconomic statistics today. Thus, the Vice President of the ECB, Luis de Guindos, said that it is necessary to respond to the current situation not with the help of monetary policy, but with the help of financial. By the way, the head of the Central Bank, Christine Lagarde, has for several months been calling for tax incentives for Germany and the Netherlands, which could use their budget surpluses. So, Luis de Guindos has voiced a similar argument, thus supporting the euro.

In addition, PMI production indices in European countries for February were published today. Many indicators have been revised upwards contrary to neutral forecasts. For example, the German indicator - from 47.8 to 48, the French - 49.7 to 49.9, the Italian - from 48.8 to 48.9 points. At the same time, the pan-European index has also been revised upward - from 49.1 to 49.2. And although the positive "shift" was mostly minimal, this factor also helped the euro strengthen its position. In other words, the EUR/USD pair retains the potential for its further growth, and may even test the 12th figure in the foreseeable future. In my opinion, the upward dynamics of the pair will continue until the European Central Bank declares the need to lower the interest rate in response to the crisis. At the moment, surprisingly, the ECB takes a more restrained position on this issue compared to the Fed - for example, today's rhetoric of Guindos helped the European currency gain a foothold in the 11th figure. If the probability of a Fed rate cut in March grows (primarily due to "dovish" comments by representatives of the Federal Reserve), and the ECB remains at least silent about the prospects for its policy, the pair will easily breaks through price lines and test the main resistance level of 1.1240 (the upper line of the Bollinger Bands indicator on the weekly chart). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Mar 2020 02:54 PM PST Buyers of the euro continue to ignore the problems that the eurozone economy is facing amid the spread of coronavirus, as well as the fact that the European Central Bank will need a lot of effort, including expanding the bond redemption program to keep the eurozone from slipping into recession. However, at the time of writing, EURUSD is trading around 1.1150, updating the next daily high. It is also not necessary to say that the euro is supported by fundamental reports, and despite a slight increase in the index of production activity, the sector continues to decline in all countries of the eurozone. It is important to note that the February growth of the purchasing managers index for the manufacturing sector does not yet affect the problem of the spread of coronavirus in the eurozone. Data were provided for the period from February 12 to 21, before a sharp increase in the number of cases in Italy. Most likely, the March indicators will again begin to decline. Let's go through the key countries. A report from the Markit statistics agency indicated that the PMI supply manager index for Italy's manufacturing sector slightly fell to 48.7 points this February, while it was forecasted to be 49.1 points. The index is at 48.9 points in January. A similar index in France fell to 49.8 points in February, while experts expected a larger drop to around 49.7 points. In January, the indicator was above the mark, at 51.1 points. The data turned out to be much better than forecasts in Germany, however, they did not work beyond the mark of 50 points. According to the report, the PMI for Germany's manufacturing sector rose to 48.0 points in February, compared to 45.3 points in January. On the whole, the index has already come close to the level of 50 points in the eurozone, the achievement of which will indicate an increase in activity in the sector. According to the data, the index of purchasing managers for the manufacturing sector of the eurozone rose to 49.2 points in February against 47.9 points in January and the economists forecast 49.1 points. From a technical point of view, the next update of sufficiently large resistance levels in the region of 1.1160 maintains a bullish trend in the market, although, as was the case with the US dollar a couple of weeks ago, there are no objective reasons for such a large increase except for conversations and discussions on the issue of lowering the Federal Reserve interest rates. As for activity in the UK manufacturing sector, it grew more slowly than expected. The main production problems were associated with Brexit and coronavirus, which negatively affected demand. Thus, the index of purchasing managers for the UK manufacturing sector was at 51.7 points in February versus 51.9 points (preliminary estimate). Today, following the Bank of America, the Organization for Economic Commonwealth and Development published its forecast for global GDP growth. In it, economists lowered their forecast for world economic growth in 2020 to 2.4% from 2.9% amid the spread of coronavirus. The OECD expects economic recovery in 2021, which led to an increase in the growth forecast to 3.3% from 3.0%. As for China, the organization expects growth to slow down to 4.9% in 2020 from the past 5.7%. The US economy will slow down to 1.9%, but the impact of coronavirus on the United States will be limited. Following the collapse of stock markets, US President Donald Trump once again announced that he was counting on the support of the Federal Reserve. Trump's favorite pastime is putting pressure on the committee to lower interest rates, especially during times of economic uncertainty. One can safely say that last year it was the position of the White House that led to the beginning of a cycle of easing monetary policy. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review 03/02/2020 EURUSD. Euro insists on upward trend Posted: 02 Mar 2020 02:40 PM PST EURUSD The euro has broken up an important level of 1.1100. For an even stronger signal to the top, a breakthrough above 1.1240 is needed - then the movement will be very strong. In general, some calm begins in the markets after a week of stress on the coronavirus. Nevertheless, the euro continues the trend of last week - up. We buy the euro from kickbacks - from 1.1010 and below. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: dollar changes tactics, or why is the euro rally at risk of crashing into a brick wall? Posted: 02 Mar 2020 02:39 PM PST Concerns about the slowdown in the US economy, the correction of the US stock market, the dovish rhetoric of the Fed made it possible for the EUR/USD pair to rise above the level of 1.1060. Last Friday, Federal Reserve Chairman Jerome Powell said that the regulator is closely monitoring the development of the coronavirus situation and will act, as appropriate, to support the national economy. This led to a further weakening of the greenback. The head of the US central bank said the same thing in June last year, after which the rate on federal funds fell by 75 basis points. The derivatives market is almost 100% certain of its reduction in March and puts in the quotes an 80% probability of a decline from 1.75% to 1% by the end of 2020. Amid increased expectations of monetary expansion by the Fed and increased risks of a global recession, the decline in yield on US Treasury bonds is much faster than that of its German counterparts. This provides support to the bulls on EUR/USD. According to the President of the Bundesbank, Jens Weidmann, German GDP will grow somewhat slower than expected in December (0.5%) because of the coronavirus epidemic. At the same time, he believes that the interest rates of the ECB are already too low, and calls on the German government to provide fiscal stimulus, for which Italy affected by the epidemic has already decided. Rome announces €3.6 billion in tax credits for local companies Washington is not yet ready to cut taxes. According to the head of the White House, Donald Trump, Democrats may not support him now, so all hope for the Fed, which the US president called the "leader." He clearly changed tactics and uses compliments instead of blaming and criticizing the Fed. The beginning of the current week was marked by some recovery in risk appetite, which may be due to speculation about the introduction of monetary incentives by large central banks to combat the negative impact of coronavirus on the global economy. It is possible that the period of rapid sales is coming to an end for the S&P 500. The chances of consolidating EUR/USD in the range of 1.0950–1.1140 will increase if the situation on the US stock market stabilizes. At the same time, it is hardly worth counting heavily on continued growth of EUR/USD, since the coronavirus is spreading rapidly throughout Europe. The economies of Germany and Italy were under attack even before it became known about the new disease. The virus has already hit the industrial center of Italy, and 2020 could be another difficult period for the EU. Italy was one of the weakest European economies in 2019, and Germany barely escaped a recession. For these reasons, the EUR/USD rally can quickly crash against a brick wall. Bank of America strategists believe that the negative consequences for the global economy and financial markets caused by the spread of coronavirus can go beyond the first quarter and provoke the flight of investors into the US dollar, which is considered as the main reserve currency as a safe haven asset. "Now we expect that the appreciation of the dollar will materialize later this year, as global economic activity will recover later," they said. The Bank lowered its forecast for EUR/USD for the first quarter from 1.10 to 1.08, for the second quarter - from 1.12 to 1.10 and for the third quarter - from 1.14 to 1.12. The material has been provided by InstaForex Company - www.instaforex.com |

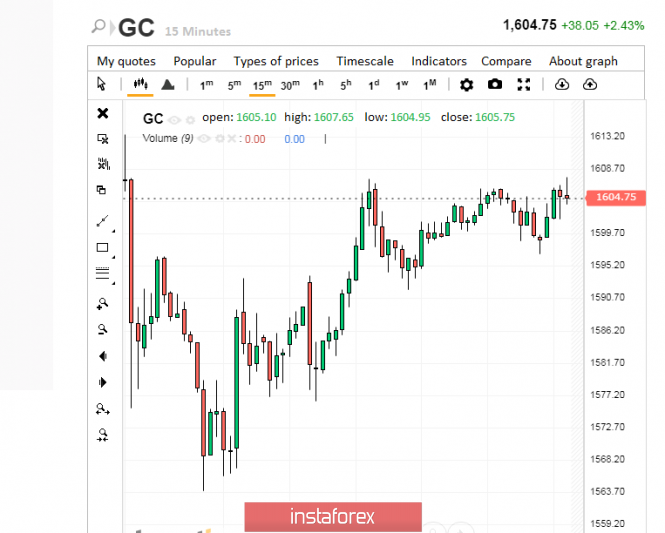

| Gold pendulum: advantage in a falling direction Posted: 02 Mar 2020 02:39 PM PST The market has been in favor of the yellow market over the past few weeks. Its price has been steadily growing, but the joy of investors was short-lived. The precious metal began to rapidly become cheaper since the end of last Friday, February 28. Experts fear that it will be difficult for gold to recover in such a situation. The end of last week brought a collapse of gold and silver quotes along with shares of major companies. The price of the yellow metal fell by 4% in just a day, which is the highest drop over the past seven years. According to analysts, such a collapse has not been observed in the precious metals market since 2013. Gold fell to $1,586 per ounce, and in the futures market, the drop in precious metals traded in euros reached 5%. Nevertheless, the yellow metal began a new week on a positive side, having recouped its previous losses a bit. On Monday, March 2, gold futures are trading in the range of $1,604– $1,605 per ounce, trying to rise higher. Subsequently, gold quotes managed to overcome this barrier, reaching $1,608 per ounce, but then it fell again. Many experts were alarmed that the collapse of prices for precious metals occurred along with the fall of the stock market. Experts believe that if defensive assets are destabilized, the stock market may collapse. This happened during the global financial crisis of 2008, experts recall. The reason for the rapid decline in the precious metals market and the stock market, analysts believe the intervention of a number of central banks. According to experts, regulators fear a rise in the price of gold, as this could lead to the devaluation of fiat currencies. As a result, banks had to intervene to urgently stop the yellow metal price rally. An important role in the fall of the leading precious metal was played by a certain weakening of the US currency. Recall that the dollar lost ground due to market expectations regarding a further reduction in interest rates by the US Federal Reserve. A powerful correction recorded on the stock market provoked a liquidity shortage among hedge funds. As a result, traders decided to take profits from precious metals, which brought high profitability. However, the massive sale of gold and silver put a lot of pressure on their value, causing a collapse in quotes, analysts conclude. According to experts, the current week in the gold and silver market will be very busy. Experts do not exclude an intensive outflow of funds from the gold ETF funds, as large institutional investors will need additional liquidity. This can cause profit taking on their part. The current drop in the precious metals market will be in the hands of long-term investors, analysts said. They will have a great chance to increase their investments. However, gold will be able to regain its position in the medium term, experts said. The material has been provided by InstaForex Company - www.instaforex.com |

| March 2, 2020, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 02 Mar 2020 09:17 AM PST

In the period between December 18th - 23rd, bearish breakout below the depicted previous bullish channel followed by quick bearish decline below 1.3000 were demonstrated on the H4 chart. However, immediate bullish recovery (around 1.2900) brought the pair back above 1.3000. Bullish breakout above 1.3000 allowed the mentioned Intraday bullish pullback to pursue towards 1.3250 (the backside of the broken channel) where the current wide-ranged movement channel was established between (1.3200-1.2980). Since January 13, progressive bearish pressure has been built over the price zone of 1.2980-1.3000 until February 5. On February 6, recent bearish breakdown below 1.2980 enhanced further bearish decline towards 1.2890 (the lower limit of the movement channel) where two episodes of bullish rejection were manifested on February 10th and 20th. This was followed by the recent bullish pullback towards the price zone of 1.2980-1.3000 which has offered considerable bearish rejection. On the other hand, the lower limit of the channel around 1.2850 has failed to provide enough bullish Support for the pair. That's why, a quick bearish decline was expressed towards the nearest DEMAND level around 1.2780 where significant bullish rejections is being demonstrated. Bullish recovery is expected to pursue towards 1.2980 provided that bullish breakout is achieved above 1.2850 once again. On the other hand, bearish persistence below 1.2780 enhances the bearish side of the market probably towards lower bearish targets (1.2650). The material has been provided by InstaForex Company - www.instaforex.com |

| March 2, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 02 Mar 2020 08:50 AM PST

On December 30, a bearish ABC reversal pattern was initiated around 1.1235 (Previous Key-zone) just before another bearish movement could take place towards 1.1100 (In the meanwhile, the EURUSD pair was losing much of its bearish momentum). One more bullish pullback was executed towards 1.1175 where the depicted key-zone as well as the recently-broken uptrend were located. Since then, the pair has been down-trending within the depicted bearish channel until two weeks ago, when extensive bearish decline established a new low around 1.0790. This was where the EUR/USD pair looked oversold after such a long bearish decline. Hence, Intraday traders were advised to look for signs of bullish recovery around the price levels of (1.0790). By the end of Last week, recent signs of bullish recovery were manifested around 1.0790 leading to the current bullish movement towards 1.0910, 1.0950 and 1.1000. The price level of (1.1000) constituted a temporary SUPPLY level in confluence with the upper limit of the current movement channel. That's why, transient bearish pullback was executed towards 1.0950 where another bullish swing was initiated. Currently, a quick bullish spike is being expressed above 1.1100 (Previous Key-Level). Further bullish advancement is anticipated towards 1.1175 and probably 1.1235 where price action should be watched cautiously for bearish rejection and a possible bearish pullback at least towards 1.1100. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Mar 2020 06:17 AM PST Industry news:

Decentralized cryptocurrency exchanges based on the Ethereum blockchain platform recorded all-time high transaction volumes in February, according to data from Dune Analytics.What HappenedThe decentralized exchanges, better known by the acronym DEX, recorded $372.2 million in transaction volume in the month, as first reported by The Block, up 62% from January's $229.2 million.The highest ever transaction volume recorded by the DEXs, according to Dune Analytics, ahead of February was the $358.5 million posted in July last year.Technical analysis: BTC has been trading sideways at the price of $8.832. My analysis from last Friday is till acrive, I still expect more downside and potential testing of $8.190 and $7.695. The most recent drop did start after the BTC breakdown of the bear flag that we mentioned last Friday. Watch for selling opportunities on the rallies using the intraday frames like 15/30 minutes... Stochastic oscillator is showing rally and its good to wait Stochastic to become again overbought. Resitance levels and potential sell levels are set at $8.950 and $9.270. Support levels and downside targets are set at the price of $8.190 and $7.657. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Mar 2020 06:03 AM PST Technical analysis:

EUR/USD has been trading stronly to the upside. THe price tested the level of 1.1162 with the strong momentum. I do expect further upside continuation towards the Pitchfork upper parallel lines and test of 1.1230-1.1275. Watch for buying opportunities on the dips using the intraday frames 15/30 minutes. Stochastic oscillator is showing new momentum to the uspide, which is good indication for the strong buying pressure. Short-term support is set at the price of 1.1094 Resistance levels are set at the price of 1.1230 and 1.1270 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Mar 2020 05:53 AM PST Technical analysis:

Gold did drop strongly on Friday as I expected . Both my targets at the price of $1.612 and $1.595 from last Friday has been reached. The cause of the recent drop was the Rejection of the Pitchfork Warning line 2. I still see potentila for more downside and test of $1.562 and $1.541 (Pitchfork lower parallel and warning line 2). Watch for selling opportunities Stochastic oscillator is showing new momentum to the downside. Short-term resistance is set at the price of $1.625 Support levels and downward targets are set at the price of $1.612 and $1.541 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Mar 2020 05:27 AM PST To open long positions on GBPUSD, you need: In the morning forecast, I paid attention to the possibility of reducing the pound to form the lower border of a new ascending channel, which happened. However, there is clearly not enough buyer's activity yet, and the rebound from the support of 1.2760 did not lead to the resumption of the upward correction. The task of the bulls for the second half of the day will be to hold the range of 1.2760, which will allow us to count on growth in the area of the larger resistance of 1.2809, fixing on which will give GBP/USD a boost to growth in the area of the maximum of 1.2854, where I recommend fixing the profits today. In the scenario of a further decline in the pound, I would not expect a rebound from the minimum of 1.2728, and it is best to open long positions from it after forming a false breakdown. But it is better to postpone larger long positions to the lows of 1.2664 and 1.2609. To open short positions on GBPUSD, you need: The sellers achieved their goal and returned the pound to the level of 1.2809, however, the key task will be to close the day below the support of 1.2760, which will keep the pair in a downward trend that can update the lows in the area of 1.2664 and 1.2609, where I recommend fixing the profits. It is unlikely that buyers will try to do anything from the lows of last month in the area of 1.2728. In the scenario of an upward correction, only the formation of a false breakdown in the resistance area of 1.2809 will signal the opening of short positions, but I recommend selling immediately for a rebound from the maximum of 1.2854. As I have repeatedly noted, the direction of the pound will depend on any news on the negotiations between the EU and the UK. Signals of indicators: Moving averages Trading is conducted below the 30 and 50 daily averages, which indicates a slight advantage on the part of sellers of the pound. Bollinger Bands A break of the lower border of the indicator in the region of 1.2755 will increase the pressure on the pair. Growth will be limited by the upper level at 1.2854.

Description of indicators

|

| Posted: 02 Mar 2020 05:26 AM PST To open long positions on EURUSD, you need: Data showing an improvement in the manufacturing sector in the eurozone allowed the euro to update the next highs and get to the level of the 11th figure. Each test of resistance, which I discussed in more detail in the morning forecast, was met with active sales from the bears. However, this only strengthened the position of buyers. At the moment, a confident consolidation above the support of 1.1067 and a breakdown of the resistance of 1.1095 will allow us to count on further growth to the highs of 1.136 and 1.1180, where I recommend fixing the profits. In the scenario of a decline in the euro in the second half of the day, it is best to return to long positions on a false breakdown from the minimum of 1.1067 or open long positions immediately on a rebound from the support of 1.1025. The US dollar can be supported by good data on the ISM manufacturing index. To open short positions on EURUSD, you need: Sellers are trying to return to the market, however, short positions from the level of 1.1095 only allowed us to make sure that large buyers are already in the support area of 1.1067. At the moment, I do not recommend rushing to sell euros, as there is a clear bullish trend. Only the formation of a false breakdown in the area of 1.1136 will be the first signal to open short positions, while it is best to sell the euro for a rebound at the highs of 1.1158 and 1.1180. However, I would not expect a correction of more than 20-30 points from these levels. An equally important task for sellers of the euro will be to consolidate below the level of 1.1095, which will increase the pressure on buyers and force them to close long positions. This will update the lows of 1.1067 and 1.1025, where I recommend fixing the profits. Signals of indicators: Moving averages Trading is above the 30 and 50 moving averages, which indicates that the euro will continue to grow in the short term. Moving averages will also act as support. Bollinger Bands The downward movement can be limited to the middle of the indicator around 1.1067, however, you can buy euro immediately on the rebound from the lower border of the indicator in the area of 1.0992.

Description of indicators

|

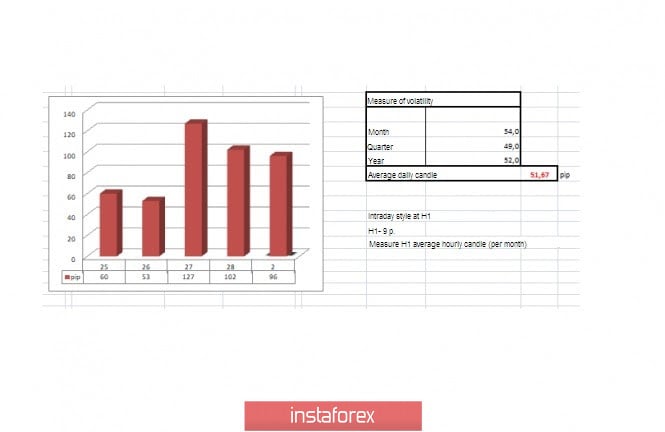

| Trading recommendations for EURUSD pair on March 2 Posted: 02 Mar 2020 05:26 AM PST From a comprehensive analysis, we see an inertial upward move that did not spare short positions and brought the quote back to the boundaries of the previously passed oblong correction. Now, about the details. The Mariana trench, which is what traders dubbed the V-shaped oscillation, where it took only 6.5 trading days to reverse, and 14 days to descend. A remarkable point was that during the descent, there were no rollbacks and corrections. All the movement was inertial. In the second case, there was an acceleration, which led to a reduction in the return time by half. In fact, the naked eye can see the overheating of long positions. However, the market does not care. It goes further, locally exceeding the level of 1.1080. I do not think it is worth keeping the theory of downward development, but in view of such a significant risk, you need to be insured and throw off excess volumes. Many experts refer to the fact that this movement is a temporary surge in the market, where circumstances have overlapped. However, the general depressing background for the single currency has not gone away, and will still return to its original course. This assumption has a lot of indirect evidence, where the information background has inflated interest in the coronavirus. The stock market which somehow got sideways under the influence of this virus and adjusted for quite different reasons. However, what remains unchanged is the deterioration of the situation in the eurozone economy, where everyone wakes up sooner or later. In terms of volatility, we see the same acceleration that was discussed above. The quote retains the impulse behavior, where the daily average beats on a daily basis. In fact, everything that happens can be called FOMO (lost profit syndrome) since there is no other explanation. Volatility details: Thursday-127 points; Friday-102 points. The average daily indicator relative to the volatility dynamics is 51 points (see the volatility table at the end of the article). Analyzing the Friday day every minute, we see that the pullback was still in the period of 11:30-16:30, where the quote returned to the value of 1.0950. However, after everything resumed, we rushed back to the maximum point of the day. As discussed in the previous review, traders divided into two factions: some talking about a technical correction, others considering the move to the next level of 1.1080, where it was possible to earn in both cases. Looking at the trading chart in general terms (daily period), we see something similar, where a V-shaped oscillation was formed, with high volatility. However, the main trend resumed in the end. Friday's news background included preliminary data on inflation for a number of EU countries, where the expected indicators did not come out in the best light, except for Germany, where everything is unchanged at 1.7%. In terms of American statistics, we see that personal income increased by 0.1%, and spending by 0.4%, which is not something drastic. At the same time, wholesale inventories in the United States decreased by 0.2% according to preliminary data. We can't say that the statistics helped strengthen the euro. This whole background was somewhere nearby, but definitely not in the flow of quotes. In terms of the general information background, we had one of the strongest noises raised against the background of the "fall" of the US stock market and the coronavirus, where the media seemed to break down, throwing all the loud, terrible headlines. On this noise, unscheduled statements from high-ranking officials began to appear. So, the head of the Federal Reserve System, Jerome Powell, announced the readiness of the Fed to begin measures to support the economy "The Federal Reserve is closely monitoring events and their consequences for the economy. We use our tools for the necessary steps to support the economy," Jerome Powell said. His words were immediately used as a kind of weapon, shouting about new rounds of interest rate cuts. Against such a thick background, US President Donald Trump could not resist saying that regardless of the impact of the coronavirus and the stock market, the Federal Reserve should lower the interest rate to support the economy. As we can see, there is a characteristic wave, on the crest of which fear and emotions reign, which make up such virtuoso leaps on the market. Today, in terms of the economic calendar, we have data on the index of business activity in the manufacturing sector of the eurozone, where we recorded an acceleration from 49.7 to 49.8. In the second half of the day, the index of business activity in the manufacturing sector from the US ISM is expected to decline from 50.9 to 50.4. At the same time, talks will start today in Brussels with the participation of the main characters Michel Barnier from the EU and David Frost from Britain. Any noise on the subject of trade relations can lead to a surge in the market, and if you consider that there are quite a lot of disagreements, then it is likely to hear criticism, which will lead to a weakening of the euro. Further development Analyzing the current trading chart, we see that the quote literally broke the level of 1.1080 without stopping, returning us to the area of January this year. In fact, there is already a signal of a possible return in the form of a rollback or correction, so you need to be ready to change trading positions for sale. In the article above, I described the speed of the existing upward move in comparison with the decline before. We see a kind of discrepancy since statistics confirm that the decline is always faster than the growth. Thus, the process will be very fast in terms of reduction. I want to clarify that now we are talking about a pullback/correction since the quote needs to calm down in terms of the background and return to the area below 1.0950. In terms of emotional mood, a high coefficient of speculative positions is visible, as well as a characteristic FOMO syndrome. Detailing the available period every minute, we see that the turn of the upward movement occurred at the opening of the European session, where at the moment the quote managed to reach the level of 1.1128. In turn, traders who had growth prospects to 1.1080 have already left their positions and now the benchmark is for a correction. It is likely to assume that the technical correction/rollback is already close and against the background of such a significant overheating, we will return to the area of 1.1080, and possibly lower. Based on the above information, we will output trading recommendations: - Buy positions are risky to consider since the quote is already very high. - Sell positions in the form of a technical correction are considered during the change of trading interest, possibly for smaller periods, with a perspective 1.1080-1.1065-1.1040. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments are on the background of an inertial course, having a single buy signal. It is worth taking into account that during the technical correction, indicators for minute and hour periods will quickly change their values. Volatility for the week / Volatility Measurement: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation from the calculation for the Month / Quarter / Year. (March 2 was based on the time of publication of the article) The current time volatility is 96 points, which is already 88% higher than the daily average. It is likely to assume that volatility is already high and further development will take place within the existing framework. Key level Resistance zones: 1.1180; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1080**; 1.1000***; 1.0950**; 1.0850**; 1.0775*; 1.0700; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Market review. Trading ideas. Q&A Posted: 02 Mar 2020 04:44 AM PST Trading recommendations EUR/USD - neutral GBP/USD - neutral GOLD - neutral The material has been provided by InstaForex Company - www.instaforex.com |

| Preparing the bridgehead for the reverse movement. EUR/USD review for March 02, 2020 Posted: 02 Mar 2020 03:52 AM PST The single European currency is compelled to move forward no matter what. It aims for growth. However, there were no objective reasons for this. Rather, the dollar should increase its price. So, honestly, we can say that this is just the panic that the media spread around the coronavirus. Although the number of people in China who have recovered is already beginning to exceed the number of its affected cases. And although the virus is clearly spreading to other countries, the dynamics there will be clearly no worse. Everything will, most likely, smooth out as the doctors have clearly already worked out some treatment methods to help cure and eradicate the epidemic. Consequently, the growth of the single European currency is exclusively emotional and even speculative in nature. Well, this suggests that a reversal is inevitable, and it will be sharp and strong.

Nevertheless, European statistics are causing more and more concern. Probably the only thing that can be attributed to positive factors is the invariance of unemployment and inflation in Germany. The good news ends here. In France, they regretfully recognized that the pace of economic growth slowed down from 1.4% to 0.8%. Amidst this chaos, a decrease in inflation was reported from 1.5% to 1.4%. In Italy, they also recorded a decrease in inflation from 0.5% to 0.4%, which was also recorded in preliminary data. The most interesting part of the situation lies in the fact that they were waiting for its growth to 0.6%. Thus, there was simply no reason for the growth of the single European currency. At least, macroeconomic data for the three largest countries in the euro area suggest otherwise. GDP growth rate (France):

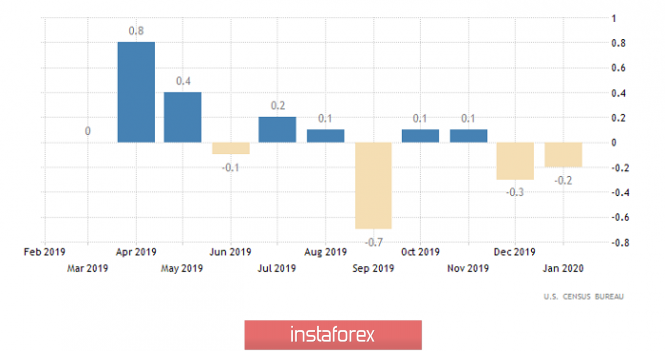

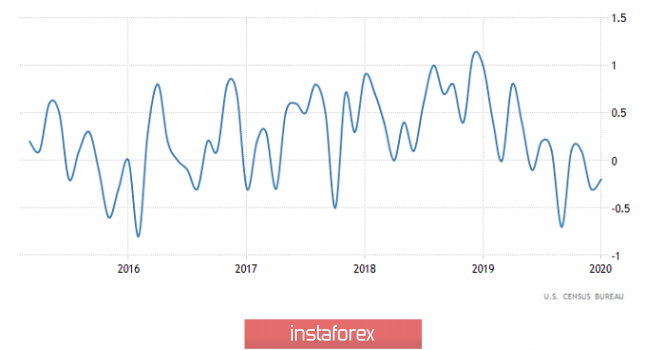

It is ridiculous, but American statistics did not give rise to the growth of the single European currency. Of course, we can say that, they say, personal incomes of Americans grew by 0.6%, and expenses by only 0.2%. Well, outstripping growth in incomes more likely indicates an increase in savings and a decrease in consumer activity. Which, of course, is a negative factor for the dollar. However, do not forget that in the previous month, revenues grew by 0.1%, and expenses by 0.4%. Consequently, the outstripping growth of income in the reporting period is nothing more than the balancing of imbalances and does not entail any risks. Moreover, wholesale inventories decreased by 0.2%. And this is their second consecutive reduction, which inspires optimism in the growth potential of the industry, which is still showing a decline. Wholesale Stocks (United States):

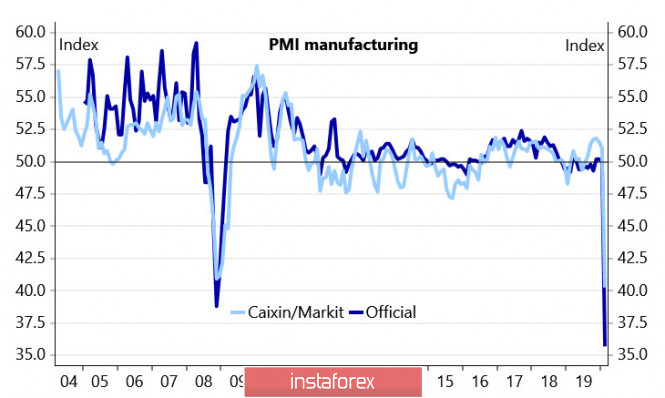

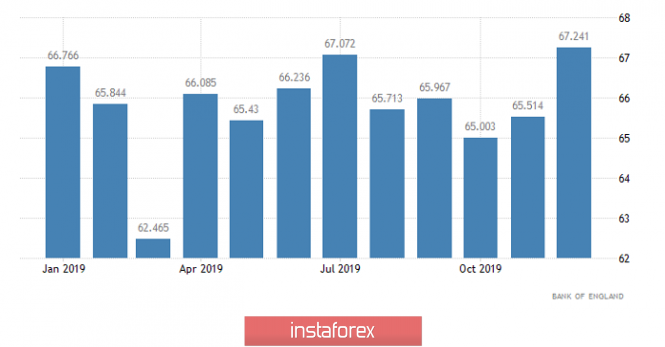

In the morning, contradictory data began to come from Europe, which were nevertheless received with optimism. Everyone paid attention only to the pan-European index of business activity in the manufacturing sector, which grew from 47.9 to 49.2. The bottom line is that growth was projected to 49.1. This is largely due to Germany, where the index of business activity in the manufacturing sector grew from 45.3 to 48.0 and not to 47.8. Spain, on the other hand, also performed well, where the index of business activity in the manufacturing sector grew from 48.5 to 50.4 with a forecast of 49.1. Incidentally, Spain reported on a further decline in the number of tourists whose total number is now by 1.4% and not by 0.9% less than the previous year. And I want to note that this is data for January when we did not think about any coronavirus in Europe yet. Then generally actively discussed that the virus spreads only among ethnic Chinese. In France, they were already waiting for a decrease in the index of business activity in the manufacturing sector from 51.1 to 49.7. But in fact, everything turned out to be a little better, since it was reduced only to 49.8. Meanwhile in Italy, the index of business activity in the manufacturing sector fell from 48.9 to 48.7. And even though the decrease is small, and you can just wave it off, it is worth noting that preliminary data showed an increase to 49.5. In any case, it is too early to talk about some kind of revival of the European economy, since the situation in the largest countries is completely different. Somewhere signs of improvement are visible, and somewhere deterioration. Germany alone is unable to pull out the whole of Europe. Manufacturing PMI (Europe):

Nevertheless, there is every reason to believe that at least today the growth of the single European currency will continue, as American statistics do not inspire optimism. Yes, the Markit manufacturing activity index should show a decline from 51.9 to 50.8. However, it was already taken into account by the market even at the time of publication of the preliminary data. This can not be said about similar data from ISM, which can show a decrease in the index of business activity in the manufacturing sector from 50.9 to 50.2. So the hopes for the restoration of industry, which appeared after the publication of wholesale stocks, should be put aside until better times. Thus, there is still hope for construction costs, which may grow by 0.5%. But after a decrease of 0.2%, this is more likely to equalize, rather than to increase activity in this sector. In addition, these data are coming out quite late, and the only thing they will be able to do is to stop the growth of the single European currency. Manufacturing PMI (United States):

Thus, a single European currency may well test the 1.100 mark. But at this point, it clearly cannot gain a foothold above. Rather, preparations for the next wave of decline will begin from this level. Also, the correction has been asking for a long time making investors having a hard time bearing it thus, conducted it without any clear reason.

|

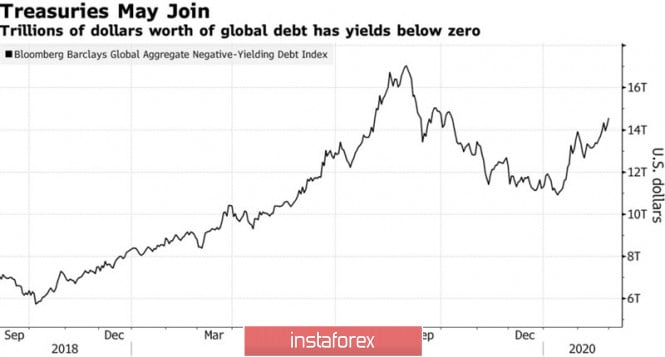

| Posted: 02 Mar 2020 03:12 AM PST While investors' attention is focused on the fastest correction of the US stock market from the levels of record highs in history, and the weekly correlation of the S&P 500 and USD/JPY has grown to 64%, it is not surprising that the most interesting currency on Forex is the yen. A few days ago, it was wandering in the area of the 10-month bottom against the US dollar, but then events began to develop so rapidly that the strengthening of the currency of the Land of the Rising Sun to a 20-week high is no surprise to anyone. Jerome Powell's statement that the Fed will act depending on the circumstances raised the chances of three acts of monetary expansion in 2020 to 80%. The futures market is absolutely sure that the federal funds rate will be reduced from 1.75% to 1.5% at the meeting on March 17 and 18, and there are rumors on forex that the central bank will do this earlier at an unscheduled meeting. The main goal is to keep US stock indices from further selling off. The weakening of monetary policy is a "bearish" factor for any currency, so the sellers of USD/JPY, thanks to the "dovish" rhetoric of the Fed Chairman, managed to conduct the most rapid daily attack since May 2017. They were not deterred even by Haruhiko Kuroda's statement that the Bank of Japan would seek to ensure liquidity and stability in financial markets through asset purchases. Rumors have spread around the market that central banks issuing G10 currencies intend to implement a coordinated easing of monetary policy in order to counteract the slowdown in global GDP. In such circumstances, the scale of the global debt market with negative yields is growing, which is good news for the yen. Since mid-January, the figure has increased from $11 trillion to $14 trillion. In Japan, the yield is negative, and the reduction of the differential with US Treasury bonds is a strong argument in favor of selling USD/JPY. Dynamics of the global debt market with negative rates

The increased attention to the yen is due not only to the S&P 500 correction but also to the saturation of the economic calendar across the States. Releases of data on business activity in the manufacturing sector and in the service sector, as well as statistics on the US labor market, will help answer the question of whether the US economy will actually slow down in the first quarter. If not, then interest in stocks issued in the United States will return, investors will talk about a good opportunity to buy, and the USD/JPY pair will find a bottom. On the contrary, disappointing statistics can add fuel to the S&P 500 pullbacks and further strengthen the yen. One of the factors of its weakening at the end of the second decade of February was the increased risks of a recession in the Japanese economy. Nevertheless, Prime Minister Shinzo Abe said that in order to fight the coronavirus, he is ready to expand the fiscal stimulus by another $2.5 billion. Technically, the USD/JPY pair came within arm's length of the target by 113% using the "Shark" pattern. There is also an important pivot level, which increases the probability of bottom formation with subsequent correction in the direction of 23.6%, 38.2% and 50% of the CD wave. USD/JPY, the daily chart

|

| Posted: 02 Mar 2020 02:45 AM PST On Friday night, Fed Chairman Jerome Powell announced his readiness to use their tools and act accordingly to support the economy. This statement means that the Fed regards the threat of a large-scale recession amid the spread of coronavirus which is most likely requiring an immediate reaction, and therefore, scenarios of rate cuts in September became irrelevant. Markets are inclined to believe that the rate will be reduced by 0.25% in March. Moreover, forecasts have already appeared that a decrease of 0.5% is possible right away while delaying the exit from the liquidity expansion program. These steps so far seem redundant, but the Fed, apparently, intends to prepare the markets for a sharp deterioration in the situation. There are grounds for such a conclusion and this is a strong and hardly controlled fall in China, which will entail a drop in activity around the world. The PMI Caixin index in the manufacturing sector fell to 40.3, and the official one to 35.7, which is worse than during the 2008 crisis, the service sector drop is completely unprecedented from 54.1p to 29.6p.

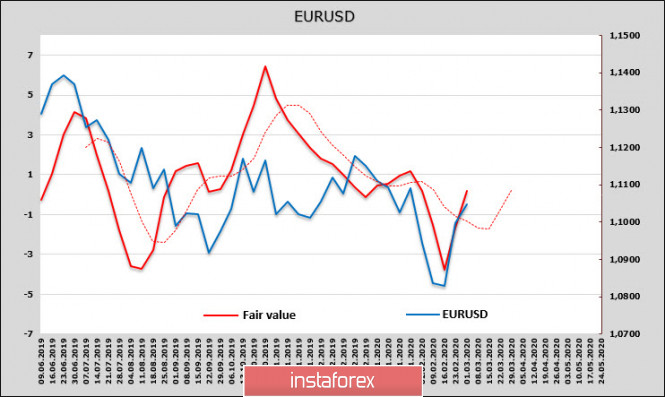

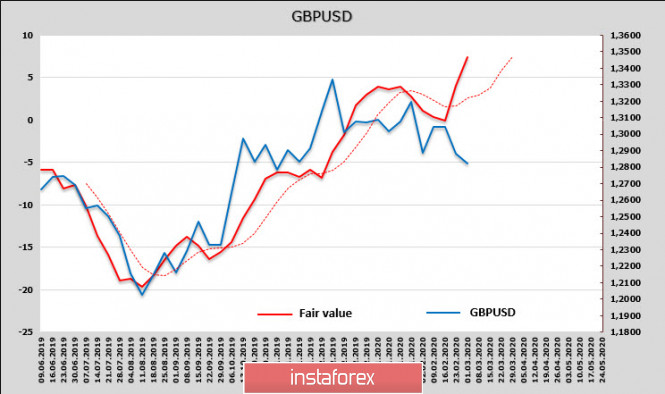

A wave of decline in activity will inevitably lead to a drop in consumption, and the latest reports published on Friday confirm this conclusion that both spending and price indices in the US in January fell more than what was forecasted, and it is obvious that data for February will be much worse. Powell's speech provoked a massive correction of the dollar, its depth will depend on the reaction of other Central Banks. This morning, the Bank of Japan has already announced emergency measures to support banks, so the weakness of the dollar is likely to be short-lived. EURUSD Bearish sentiment against the euro has increased significantly - net shorts increased by $ 3.1 billion, the volume reached 15.5 billion, or 11.4 thousand contracts. This is the biggest bearish rate on the euro in more than 3 years, and now we need to understand whether this long-term trend will develop or if the dollar is waiting for a pullback in the light of Powell's recent statements. There are two points to pay attention to. Firstly, the strong preponderance of euro shorts did not lead to a further fall in the estimated fair price, that is, this parameter is balanced by others, such as the state of stock markets and the dynamics of returns. Secondly, the estimated and spot prices are close, so there are currently no reasons for a strong movement in one direction or another.

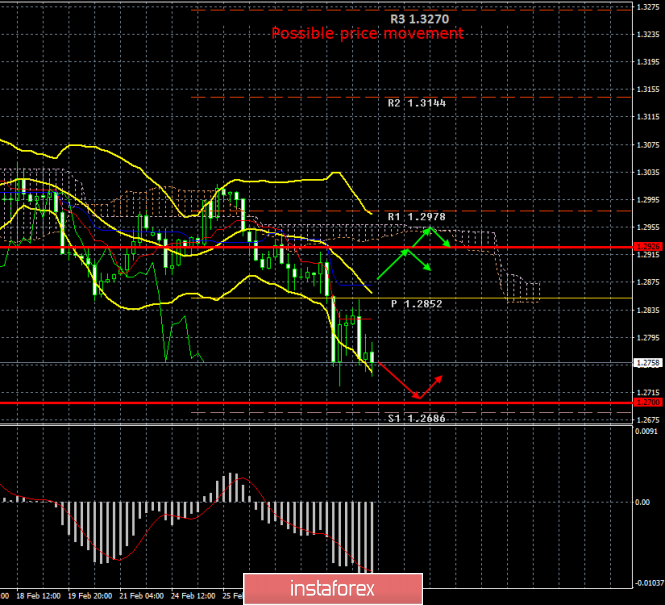

Further movement of the euro will largely depend on the ECB's response to the changing situation. Lagarde said last week that coronavirus would not have a lasting effect on inflation and would not require monetary policy measures. Philip Lane has a different opinion - policy mitigation should be prioritized. Jens Weidmann from the Bundesbank put it even more vaguely, saying that he could imagine higher prices due to shock supply problems. On Friday, the probability of a decrease in the ECB rate was estimated at about 50/50, today it can grow slightly, this will restrain the strengthening of the euro. In the meantime, the upward movement should be considered a priority, an attempt to test the resistance 1.1238 is likely if it is possible to pass the nearest resistance 1.1172 on the current wave. GBPUSD The UK PMI in the manufacturing sector fell slightly in February from 51.9p to 51.7p, and consumer and mortgage lending also increased in January, which gives a good chance of consumer activity in February and will support the pound. The estimated fair price is confidently looking up, a strong gap with the spot price gives reason to look for support at levels close to current and the resumption of growth of the pound.

Today, the EU and the UK begin a negotiated marathon on a trade agreement after Brexit. If the pound holds above the 1.2730 / 40 zone and there are no new panic comments in the next day, then the pound is likely to grow, the resistance is 1.2848, 1.2903, the goal is to return to the upper border of the downward channel 1.2940 / 50. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY and its crosses' prospects for March Posted: 02 Mar 2020 02:45 AM PST USD / JPY

In February, the bullish players made a new attempt to break through the accumulated resistance. The attempt again failed. February closed under the values of the end of January, casting up a long shadow of unrealized opportunities. As a result, the situation did not undergo significant changes and uncertainty remained. What can be expected in March? The zone of attraction, holding back the development of the situation, remains a fairly wide area of accumulation of various levels of senior time intervals in the region of 107.67 - 110 (daily cross + daily cloud + weekly cross + weekly cloud + monthly cross) . The most significant resistances remain the trend line and the monthly cloud, 110.70 - 111.20 - 112.44 may be the main value in this direction. The potential of the long upper shadow of February can now contribute to the consolidation of the pair under the monthly cross (108.34), in the bearish zone relative to the weekly cloud (107.67). In this case, the main interest of the players to lower will be directed to the fulfillment of the daily goal for the breakdown of the cloud (105.71 - 106.36), with further testing of the lower trend line and updating the minimum extremum of 104.46. EUR / JPY

For the entire month of February, the couple spent in the zone of attraction of the weekly golden cross, having failed to liquidate it (final line 118.51). The zone of attraction and containment in February was a fairly wide area of accumulation of strong levels from different time intervals, located between 118.51 - 120.59 (daily cross + weekly cross + lower boundary of the weekly cloud + monthly Tenkan). In March, this union of levels will retain its meaning and function. The closest bearish target is the descending target for the breakdown of the daily Ichimoku cloud (117.38-93). Furthermore, the testing and updating of the minimum extremes (117.06 - 115.84) will be important. In case of consolidation above the designated zone of attraction (120.59), the breakdown of the daily cloud (121. GBP / JPY

Also, the downward trend players managed to continue the weekly downward correction last month and achieved important support in the region of 137.14, where the weekly medium-term trend and the monthly short-term trend are now joining forces. Consolidation below will strengthen the bearish position and will allow you to expect a further decline. The closest reference point in this direction will be the lower border of the weekly cloud (134.51), overcoming the support will help to form new bearish prospects where the goal is to break the weekly cloud. Among the important resistance for the month of March, that we can identify is the area of 141.10-54 (daily cross + weekly cross + monthly Kijun), then the breakdown of the daily cloud (143.62), the elimination of the weekly cross Ichimoku (145.09) and exit from zones of weekly correction (147.93). Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| Two reasons for a rebound at once. GBP/USD review for March 03, 2020 Posted: 02 Mar 2020 02:45 AM PST Surprisingly, the pound on Friday reacted to US statistics, which the common European currency ignored. Another thing is that the pound ignored its own statistics, which were quite positive. But no growth was noticed.

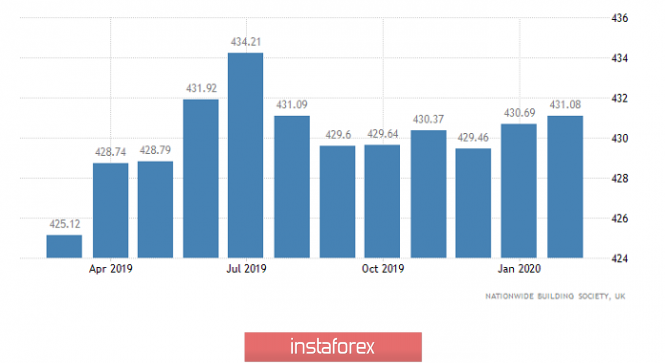

Nevertheless, nationwide data showed an acceleration in the growth rate of housing prices from 1.9% to 2.3% with a forecast of 2.0%. Given that the real estate market is almost the main criterion for determining the investment attractiveness of the UK economy, the rise in housing prices is an extremely positive factor. But strangely enough, the pound did not react to such good news. Nationwide Housing Price Index (UK):