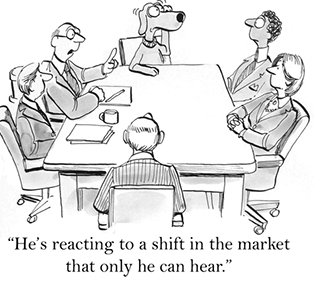

It was less than a week ago that the market popped on news of a potential vaccine candidate.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can unsubscribe here. |  |  |  | |

|  |  Good morning. It was less than a week ago that the market popped on news of a potential vaccine candidate. Good morning. It was less than a week ago that the market popped on news of a potential vaccine candidate.

There wasn't much follow through this week, but Thursday slipped into the close as the same hopeful attitude about the potential treatment failed its first trial.

To be honest, I'm not necessarily wanting to be a guinea pig, but the market wants to see one get better from COVID-19. | |  | |  |  |

|  |  |  | DOW 23,515.26 | +0.17% |  | |  | S&P 2,797.80 | -0.05% |  | |  | NASDAQ 8,494.75 | -0.01% |  | |  | | *As of market close |  | | • | Stocks fell yesterday, on news of COVID-19 drug trial by GILD. |  | | • | Oil rose 24%, as production cuts help ease storage constraints. |  | | • | Gold rose 0.72%, as it approaches its April 14 high of $1788. |  | | • | Cryptocurrencies traded higher, with Bitcoin finishing 6.25% higher closing at $7560. | |  | | | |

|  | | 3 COVID-19 Vaccination and Treatment Stocks to Watch |  |  |  | As the U.S. starts to emerge from the quarantine, the grasp that state authorities are holding on the economy is having trouble letting go. The goal posts keep shifting and the move toward contact tracing, testing and an eventual vaccine is the direction they are heading.

The timeline for a vaccine will likely be a year away, but much of the opportunity is occurring now as investors try to weigh the possibility of a viable vaccine.

» FULL STORY |  | | |  |

|  |  | | TOP |  | | XEC | 12.537% |  |  | | LVS | 12.016% |  |  | | APA | 11.465% |  |  | | ODFL | 10.137% |  |  | | ADS | 10.115% |  |  | | BOTTOM |  | | IVZ | 21.133% |  |  | | CTXS | 6.678% |  |  | | FTI | 6.659% |  |  | | GWW | 6.41% |  |  | | STX | 5.617% |  |  | |  |

|  |  |  | | The hope as of last week was that Gilead could take the fear of dying off the table, which would result in a much quicker, cleaner, faster recovery. If that's less likely today than it was yesterday, it is perfectly reasonable for the market to have sold off. |  | - David Katz, chief investment officer at Matrix Asset Advisors, quoted by Reuters |  |

|

No comments:

Post a Comment