Forex analysis review |

- EUR/USD and GBP/USD. Results of April 9. Third consecutive weak report on US jobless claims ends the dollar. Euro steadily

- EUR/USD. Buying the pair is risky, despite the Fed's "monetary surprise"

- Comprehensive analysis of movement options for #USDX vs Gold & Silver (H4) on April 10, 2020

- April 9, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- April 9, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- EUR/USD: euro needs consensus

- The Fed is allocating a new $ 2.3 trillion in loans to support employment. EURUSD is growing

- Evening review for EUR/USD on April 09, 2020

- Short-term Ichimoku cloud indicator analysis of EURUSD

- Gold price approaches our short-term target of $1,670-80.

- BTC analysis for 04.09.2020 - Potential drop on BTC is coming, the main objective is set at the price of $5.813

- Analysis for Gold 04.09.2020 - Watch for reaction at the major pivot high at $1.674 to confirm further direction

- Trading recommendations for GBPUSD pair on April 9

- EUR/USD analysis for 04.09.2020 - Bear flag pattern on the 8H timeframe, potential for drop towards the level of 1.0770

- Trading plan for EURUSD for April 09, 2020

- Technical analysis of GBP/USD for April 09, 2020

- Trading recommendations for EUR/USD on April 9, 2020

- Analysis and trading ideas for USD/CAD on April 9, 2020

- Trading plan for EUR/USD on April 9, 2020

- Trader's diary for April 9, 2020

- Simplified wave analysis of EUR/USD and AUD/USD for April 9

- Analysis and forecast for EUR/USD on April 9, 2020

| Posted: 09 Apr 2020 09:49 AM PDT 4-hour timeframe Average volatility over the past five days: 103p (high). The EUR/USD pair resumed the upward movement on Thursday, April 9, as we expected. After spending more than a day near the critical Kijun-sen line, the pair still found the strength to continue working out our scenario called "correction against correction". Thus, we believe that the upward movement will continue to the level of 1.0967 (the level of volatility for today), and, most likely, to the psychological mark of $1.10. We can expect the upward movement to be completed in the 1,1000 area, but continue to rely on technical indicators and their readings when making trading decisions. Volatility has increased today compared to yesterday, but remains within reason - 100 points. For the first time in a long time, we can finally say that market participants reacted to macroeconomic statistics. They reacted the way they used to. Even if there was no ambiguity in today's events. In fact, one of the most significant macroeconomic reports of the day caused a sell-off of the US currency against the euro. We are talking about the report on applications for unemployment benefits in the United States. Recall that over the past two weeks, a total of about ten million people have applied for benefits in the United States. Of the 164 million economically active population, that is, able-bodied. Today it was announced that another 6.6 million Americans have lost their jobs. Thus, a total of approximately 16.8 million people lost their jobs in the United States in just three weeks. This is a huge number. Not only that, this figure is comparable to unemployment rates in the thirties of the last century during the Great Depression. Not only is the unemployment rate moving towards the "optimistic" forecasts of James Bullard, who spoke of 25-30%. It is not enough that all these people do not work, that is, they do not contribute to the economy, which is already suffering from quarantine measures. So, unemployment benefits must now be paid to an additional 17 million people in the United States. This is a serious blow to the US economy, and it's not over yet... no wonder the dollar is falling on such news. However, we would like to warn traders against incorrect and one-sided conclusions. We believe that the situation in Europe is no better. It's just that indicators like US Nonfarm Payrolls or applications for unemployment benefits are not published in Europe. There is only the official unemployment rate, which is published once a month. Since it has not been released yet, we simply do not know how things are in the European Union, how many people there have applied for unemployment. Thus, until this data is in the hands of traders, it does not make sense to rush to sell dollars. We continue to believe that the market is in the stage of calm, or, in other words, consolidation. According to our calculations, the final stage of consolidation will take place between the 1.09 and 1.10 levels. After that, the euro/dollar pair can move with new strength in any direction. We have repeatedly said that if the majority of market participants or, on the contrary, large market participants buy dollars en masse, this currency will become more expensive, regardless of any fundamental and macroeconomic data. It is supply and demand that determines the price and exchange rate. Until recently, the US dollar was growing like crazy simply because traders considered it the safest currency in times of total collapses of world markets. Who says this scenario can't happen again? After all, the epidemic is not only not over, it is in full swing. The number of sick people is increasing around the world every day. There is a certain decline in the growth rate of infection and mortality in some countries, but this does not mean that humanity has triumphed over coronavirus. A second wave of the epidemic is possible, it is possible that the virus will be seasonal in nature, like normal flu. Thus, it is too early to talk about the abolition of quarantine measures, and even more so about the end of the epidemic. Consequently, the economies of all countries of the world will continue to decline. And the more they contract, the longer they will recover. Indeed, recession and growth, unfortunately, are taking place at completely different rates... From a technical point of view, the euro/dollar pair has now worked out the Senkou Span B line, from which it may well rebound. But we believe that the upward movement will continue today and tomorrow. In any case, there are currently no signals to the beginning of the downward correction. 4-hour timeframe Average volatility over the past five days: 159p (high). The GBP/USD currency pair also continues its upward movement on April 9. However, there has been an open flat between the levels of 1.2200 and 1.2450 for the last two weeks. At the moment, the upper boundary of this side channel has been worked out, so a rebound and a downward movement can follow to the lower boundary of the channel, that is, to the 1.2200 level. If one confidently overcomes the 1.2450–1.2470 area, then the upward trend may resume. The pound/dollar volatility is around 130 points for today and yesterday, which is quite a small indicator in the current conditions. Markets calm down in the GBP/USD pair's case. And this is good. There was also something to pay attention to in the UK. Monthly GDP indicators were published in the morning, as well as changes in industrial production. The first indicator showed a decrease of 0.1%, the second - a decline of 2.8% in annual terms. These were the values for February. It will be hard to imagine what will happen in the UK at the end of March, if we see such figures as a result of a calm February. Although something can already be said about March. Today, the March quarterly GDP value from NIESR was also published, which showed a 4.8% reduction in the main indicator of the state of any economy. This is only the beginning. Recall that quarantine in the UK remains, Boris Johnson is still in the hospital, the total number of infected people is already 61.5 thousand, and the number of deaths has exceeded 7 thousand. Recommendations for EUR/USD: For short positions: The EUR/USD pair does not continue to move up too much on the 4-hour timeframe. It is advised to consider selling orders before reverse price taking below the Kijun-sen line with the first target as the level of volatility is 1.0761. For long positions: At the moment, it is recommended to stay in purchases of the pair with targets at a volatility level of 1.0967 and a resistance level of 1.1043 and manually reduce longs when rebounding from any target or in case the MACD indicator turns down. Recommendations for GBP/USD: For short positions: The pound/dollar pair continues to trade inside the side channel, limited by the 1.2200 and 1.2450 levels. Thus, it is recommended to trade either on the rebound from the upper or lower boundary of the channel, or wait for the end of the flat. Short positions can be considered after overcoming the level of 1.2200 with the goal of the Senkou span line B. Or when the price rebounds from 1.2450 – 1.2470, with the goal of 1.2200. For long positions: You will not be able to buy the GBP/USD pair until the price is consolidated above the 1.2450–1.2470 area with the goals of 1.2568 and 1.2693 levels. At the moment, the pair is just testing the strength of the specified area. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Buying the pair is risky, despite the Fed's "monetary surprise" Posted: 09 Apr 2020 09:47 AM PDT The euro-dollar pair received unexpected support today, after which the bulls were able to test the ninth figure and even approach the resistance level of 1.0950 (the Tenkan-sen line on the daily chart). Although there were no prerequisites for such price spikes in the morning: traders froze in anticipation of new negotiations between the EU finance ministers, and the euro-dollar pair, respectively, fluctuated in a narrow price range, reacting sluggishly to the accompanying rumors and assumptions. But, as it often happens in the foreign exchange market, the situation changed after the Federal Reserve unveiled a program to help the USeconomy. After this, dollar bulls lost their footing. The package provides loans to businesses and households, as well as support for municipal debt obligations. As the Fed noted, households and companies (representatives of both small and large businesses), as well as local authorities will receive assistance. First, the regulator will create a mechanism to support the lending fund worth $350 billion – this step is part of the overall package of incentives totaling two trillion dollars (it was approved in the previous month). Second, the Fed will support local authorities, both at the state and municipal levels. The aid will be provided through loans worth $500 billion. In addition, members of the Fed created a new Main Street Lending Program worth $600 billion – to help medium-sized companies (the number of employees should not exceed the 10,000 mark, and annual revenues in the pre-crisis period should be less than $2.5 billion). The essence of the program is to provide loans for four years with deferred principal and interest for a year. The regulator also expanded primary and secondary lending to corporations and a program of term loans secured by asset-backed securities. Under another mechanism, the regulator will buy short-term bonds worth up to $500 billion directly from states, counties and cities. After the US central bank announced the new measures, Fed Chairman Jerome Powell commented on the current situation during his speech, which was held online. Following his reputation, the Fed chief tried to maintain a balance in his rhetoric. On the one hand, he said that the US economy will show "very strong weakness" in the second quarter. He also warned of a sharp rise in the unemployment rate. By the way, the figures published today quite eloquently illustrated his words. The number of applications for unemployment benefits is growing at a tremendous pace for the third consecutive week: this figure jumped to three million the week before last, to 6.8 million last week, and it came out at 6.6 million today. And although the latest Nonfarms showed an increase in unemployment to 4.4%, in fact, the situation is much worse now (judging by the growth rate of the number of applications mentioned above, the real unemployment rate may be at the level of 10-12%). Still, Powell tried to "sweeten the pill." In his opinion, the US economy will recover at the same rapid pace as it is now falling down. He also praised his colleagues, expressing confidence that the Fed's actions have contributed to improving market conditions. Well, in the end, he suggested that the situation will normalize in the second half of the year, but in the meantime, the Fed is ready to"lend a support shoulder". The market has reacted quite volatile to recent events. First of all, the level of anti-risk sentiment decreased - the dollar as the main protective asset began to lose positions in all pairs. Indirect support for the EUR/USD bulls was provided by the oil market, where a truce is also brewing: according to one information source, Russia is ready to reduce oil production by 1.6 million barrels per day, according to other data, Saudi Arabia and Russia have agreed on a stronger reduction in oil production. Today, during a video conference, key OPEC+ players will try to find a compromise solution, and, according to many experts, they will be able to come to an agreement. Such prospects also put pressure on the greenback, as overall demand for safe haven currencies declined. Nevertheless, despite the seemingly unambiguous fundamental background, it is still not worth rushing to trade decisions on the EUR/USD pair. The fact is that the next online negotiations between the finance ministers of the EU countries started today. Officials will again try to agree on a plan to support the European economy. There are conflicting rumors around this event – according to one information, an agreement will still be reached today (although negotiations may drag on until tomorrow morning), according to another information, representatives of the South (Italy, Spain) still insist on crown bonds, while representatives of the North (Germany, the Netherlands, Finland, Estonia) are against this idea, defending other mechanisms. And here it is worth noting that any outcome of these negotiations will provoke strong volatility for the pair. The European currency will either strengthen its success against the dollar and enter the 10th figure, or lose all the positions it has won and plunge to the local low of 1.0763. It is also worth remembering that due to low liquidity (many European markets will be closed because of Catholic Good Friday tomorrow) reactions can be too rough, so at the moment, it is better to wait and not play the guessing game. The material has been provided by InstaForex Company - www.instaforex.com |

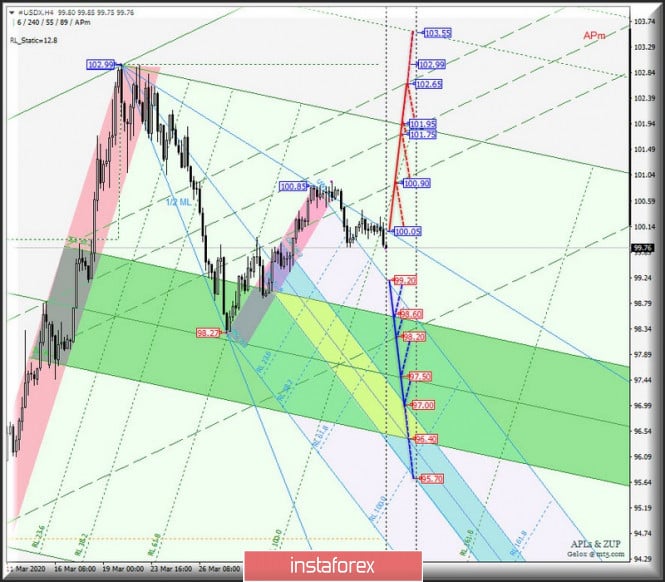

| Comprehensive analysis of movement options for #USDX vs Gold & Silver (H4) on April 10, 2020 Posted: 09 Apr 2020 09:07 AM PDT Minutte operational scale (H4 time frame) The continuation of the battle for metal. #USDX vs Gold & Silver - review of the movement's development from April 10, 2020. ____________________ US dollar index The movement of the dollar index #USDX from April 10, 2020 will be determined depending on the development and direction of the breakdown of the range:

If the support level of 99.20 on the starting line SSL of the Minuette operational scale forks will determine the continuation of the downward movement of the dollar index to the borders of the zones of balance fork operational scale Minute (98.60-97.50-96.40) and Minute (97.00-96.40-95.70). The breakdown of the resistance level at 100.05 on the line of control UTL fork operational scale Minuette - variant development of the upward movement #USDX to the borders of the channel 1/2 Median Line (100.90-101.75-102.65) Minuette operational scale fork. The layout of the #USDX movement options from April 10, 2020 is shown on the animated chart.

____________________ Spot Silver The development of the Spot Silver movement from April 10 2020 is likely to continue in the equilibrium zone (13.940-14.760-15.600) of Minuette operational scale forks, taking into account the direction of the breakdown of the range:

Details of the movement within the zone equilibrium are shown on the animated chart. In case of a breakdown of the top border ISL61.8 zone equilibrium Minuette operating scale forks - resistance level of 15.600 - option to continue development of the upward movement of Spot Silver to the ultimate Shiff Line Minute (16.550). A break of the support level of 13.940 on the lower border ISL38.2 zone equilibrium Minuette operating scale forks will confirm that the development of the movement Silver will continue in Spot within the boundaries of the channel 1/2 Median Line Minute (14.260-13.520-12.750). Details of the Spot Silver movement options from April 10, 2020 are shown in the animated chart.

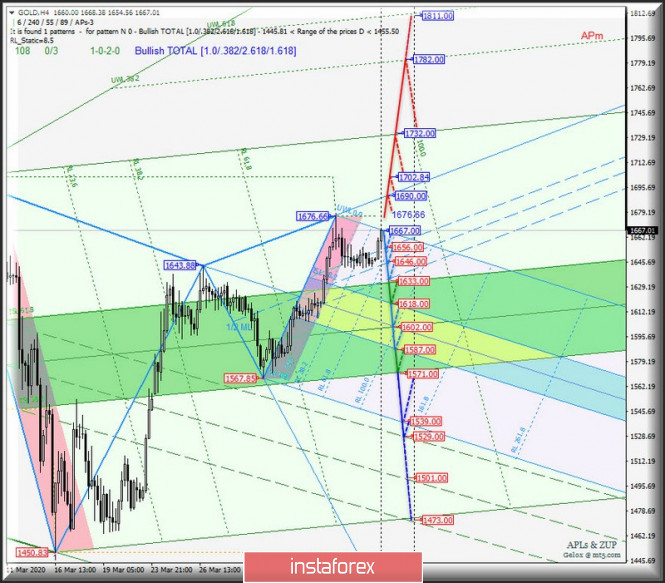

____________________ Spot Gold The development of the Spot Gold movement from April 10, 2020 will be determined by the development and direction of the breakdown of the range:

When you update a local maximum - the level of resistance 1676.66 with the subsequent breakdown of the control line UTL (1690.00) Minuette operating scale forks will become important update maximum 1702.84 from March 9, 2020, and the continuation of the upward movement of Spot Gold to the end - FSL (1732.00) and control UWL38.2 (1782.00) lines Minuette operating scale forks. And in case of return of the Spot Gold below the initial line SSL Minuette operating scale forks - support level of 1667.00 - option of the movement of the tool to the borders of the channel 1/1 Median Line Minuette (1656.00-1646.00-1633.00) and zones of equilibrium Minuette operating scale forks (1633.00-1602.00-1571.00) and Minute (1618.00-1602.00-1587.00). Details of the movement of Spot Gold in April 2020 can be seen in the chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| April 9, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 09 Apr 2020 08:52 AM PDT

Recently, the GBPUSD has reached new LOW price levels around 1.1450, slightly below the historical low (1.1650) achieved in September 2016. That's when the GBP/USD pair looked very OVERSOLD around the price levels of 1.1450 where a double-bottom reversal pattern was recently demonstrated. Technical outlook will probably remain bullish if bullish persistence is maintained above 1.1890-1.1900 (Double-Bottom Neckline) on the H4 Charts. Bullish breakout above 1.1900 (Latest Descending High) invalidated the bearish scenario temporarily & enabled a quick bullish movement to occur towards 1.2260. Next bullish targets around 1.2520 and 1.2680 were expected to be addressed if sufficient bullish momentum was maintained. However, early bearish pressure signs have originated around 1.2470 leading to another bearish decline towards 1.2265. That's why, H4 Candlestick re-closure below 1.2265 is needed to hinder further bullish advancement and enhance the bearish momentum on the short term. If so, Initial Bearish target would be located around 1.1900 provided that quick H4 bearish closure below 1.2265 is achieved. On the other hand, the current bullish persistence above 1.2265 would probably enhance another bullish pullback movement up to the price levels of 1.2500-1.2550 where bearish rejection should be expected. Trade recommendations : Conservative traders should be waiting either for another bullish pullback towards 1.2500 or another H4 bearish closure below 1.2265 as a valid SELL signal. T/P level to be located around 1.2100 and 1.2000 while S/L should remain above 1.2550. The material has been provided by InstaForex Company - www.instaforex.com |

| April 9, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 09 Apr 2020 08:16 AM PDT

Since December 30, the EURUSD pair has trended-down within the depicted bearish channel until the depicted two successive Bottoms were established around 1.0790 then 1.0650 where the EUR/USD pair looked OVERSOLD after such extensive bearish decline. Few weeks ago, the EURUSD pair has expressed significant bullish recovery around the newly-established bottom around 1.0650. The following bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibonacci Level 50%). Key Supply-Levels in confluence with significant Fibonacci levels are located around 1.1075 (50% Fibonacci) and 1.1175 (61.8% Fibonacci) where bearish rejection was highly-expected. Moreover, a Head & Shoulders continuation pattern was demonstrated around the price levels of (1.1000 - 1.1075). Shortly after, further bearish decline was demonstrated towards 1.0800 where the nearest demand level to be considered was located near the backside of the broken channel (1.0800-1.0750). Early signs of Bullish rejection have been manifested around the price zone of (1.0800-1.0750) leading to the current bullish spike up to 1.0930. This supports the bullish side of the market as long as bullish persistence is maintained above the recently-established ascending Bottom around 1.0770. Further bullish advancement is expected to pursue towards 1.1000 and 1.1075. On the other hand, any bearish breakout below 1.0770 invalidates the previously-mentioned outlook. Trade recommendations : Intraday traders can wait for another bearish pullback towards the mentioned demand-zone around 1.0800 - 1.0750 for a valid short-term BUY signal. S/L to be placed below 1.0740 while Initial T/P level to be located around 1.0870, 1.0920, 1.1000 and 1.1075. For those who caught the initial bullish trade just above 1.0800, Stop Loss should be elevated to 1.0800 to offset the associated risk of the trade. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Apr 2020 07:54 AM PDT

The news that the sixteen-hour talks of the Finance Ministers of the Eurozone countries ended without result, unpleasantly surprised market participants and did not allow the EUR/USD pair to continue the rally even against the backdrop of the rise in US stock indices. In an environment where each leader is trying to pull the blanket over himself and prove that it is his country that has suffered more than others from the coronavirus epidemic, it is difficult to count on collective help. We have to be content with only internal resources, which leads to an increase in the national debt to GDP and even deeper drowns the already underwater economy. According to experts, the failure of EU members to agree on coordinated efforts in the face of a severe crisis will send a very negative signal to investors and make them doubt the ability of Europe to remain united. "Even if the Eurogroup does agree on something, this may only be a temporary solution, which, even on a large scale, will not set a stable alignment in the EU financing conditions and will not pave the way for debt generalization," said John Hardy, chief currency strategist at Saxo Bank. "Either the economic and monetary union will seriously start generalizing debt, or the EU will move to a free trade zone with many currencies. The current state won't last long. If the path to strengthening ties in the Alliance is not soon identified, the risk of "redenomination" – pressure on the currency at one level or another – will be extremely high. It is still difficult to assess the potential for implementing the EU's internal problems in the short term, since the ECB can keep its heavy hand on yield spreads lowered," he added. While the governments of the Eurozone countries can not agree among themselves, it is the ECB that has to patch the "holes".

The head of the Bank of France, Francois Villeroy de Galo, said that he supports the use of "helicopter money" (a mechanism that provides for the direct transfer of liquidity from the regulator to the business). This view has previously been heavily criticized by the German lobby in the ECB's Governing Council. In particular, Bundesbank President Jens Weidmann argued that "helicopter money" blurs the line between fiscal and monetary policy. Officials from France can be understood. According to the forecast of the local Central Bank, the country's economy declined by 6% in the first quarter, which is comparable only to the 5.3% decline in 1968, when there were mass strikes. In the second quarter, the indicators may be even worse. German economists are also under no illusions about this. According to the estimates of five leading German institutions, the country's GDP in April-June will fall by 9.8%, and by the end of the year – by 4.2%. The Eurozone's "locomotive" is at risk of suffering the worst losses since accounting began in 1970. At the same time, we can not say that there is optimism among Americans. According to a consensus estimate of 57 analysts polled recently by the Wall Street Journal, unemployment in the US will rise from the current 4.4% to 13% by June. Job losses by the end of 2020, compared to February, may amount to 14.4 million. 85% of respondents believe that the recovery of the American economy will begin in the second half of the year. It is expected that in the third quarter, the indicator will expand by 6.2%, in the fourth – by 6.6%, but at the end of the year, it will decrease by 4.9%. At the same time, about 45% of respondents predict that the recovery will be U-shaped, and not rapid, as the head of the White House, Donald Trump, would like. Experts expect a modest increase in the Dow Jones index – up to 24,700 points by the end of 2020. This implies the continuation of increased volatility and plays into the hands of the "bears" for EUR/USD, who keep hoping to restore the downward trend with the help of the 1.0770 support storm. The main currency pair continues to trade in the weekly range of 1.0770-1.0930. The next strong resistance is located at the lows of the end of January in the area of 1.0990-1.0995. Only a breakdown of the 200-day moving average around 1.1065 will ease the downward pressure. The material has been provided by InstaForex Company - www.instaforex.com |

| The Fed is allocating a new $ 2.3 trillion in loans to support employment. EURUSD is growing Posted: 09 Apr 2020 07:44 AM PDT

The Fed introduced a new volume of loans of $ 2.3 trillion to support employment, at a time when the report showed a new increase in applications for unemployment benefits - 6.6 million for the week. Large amounts are provided within the package for the following: support for small and medium-sized businesses to save jobs; loans to an employee assistance program; large amounts of loans to local authorities to support employment. EURUSD - The euro gave an upward signal. We buy from 1.0930. Stop at 1.0840. Target - 1.1140. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for EUR/USD on April 09, 2020 Posted: 09 Apr 2020 07:12 AM PDT

EUR / USD The euro is waiting for two things today: 1) Report on the negotiations regarding new assistance that would help the EU economy fight the effects of the coronavirus - we are talking about a package worth more than 500 billion euros. 2) The weekly US unemployment report. US report: More than 6.6 million Americans lost their jobs last week. 7.5 million are unemployed for more than 2 weeks already. Although there is no economic data for April, these figures allow us to assess the depth of the crisis in the United States. According to Bloomberg analysts, the global economy will lose about 5 trillion dollars, which is about 6-7% of the annual global GDP. Experts believe that the crisis will last at least 1 year. EUR / USD: The euro may reverse upwards. Open buy positions at 1.0930. Open sell positions at 1.0765. The material has been provided by InstaForex Company - www.instaforex.com |

| Short-term Ichimoku cloud indicator analysis of EURUSD Posted: 09 Apr 2020 06:21 AM PDT EURUSD bulls have managed to recapture 1.09 and are now challenging important short-term cloud resistance. We have a weak bullish signal by the crossing of the tenkan-sen above the kijun-sen but bulls need to show more signs of strength.

|

| Gold price approaches our short-term target of $1,670-80. Posted: 09 Apr 2020 06:13 AM PDT In yesterday's analysis we mentioned that Gold price is vulnerable to the downside, but trend remained bullish as long as price is above $1,638 and we can see a new higher high towards $1,670-80.

|

| Posted: 09 Apr 2020 05:42 AM PDT news:

Technical analysis: BTC has been trading downwards as I expected. The price broke the Pitchfork mini upward channel and it gave us the first signal for the potential chage in the trend from bullish to bearish. My analysis from yesterday is still active and valid. Watch for selling opportunities. The area around $7.500-$7.600 looks like good zone for sell posiitons.Downward targets are set at the price of $6.595 and $5.813. MACD oscillator is showing decreasing on the upside momentum and the slow line turned to the downside, which is indication for potential change in the trend. Major resistance pivot zone is set at $7.600-$8.000 Support levels are set at the price of $6.600 and $5.813 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Apr 2020 05:31 AM PDT Corona virus news:

Japan's health ministry said Thursday that the country had more than 500 new cases for the first time on Wednesday, bringing the national total to 4,768 excluding hundreds from a cruise ship quarantined near Tokyo earlier this year. The continuous climb comes two days after Prime Minister Shinzo Abe declared a state of emergency in Tokyo and six other hard-hit prefectures, while asking people to reduce at least 70% of human interactions.Speaking in parliament on Thursday morning, he defended his government's handling of the Covid-19 crisis and said the continuing lockdown, which has been in effect since 14 March, was the best way to tackle contagion Technical analysis: Gold has been trading upwards. The price tested the level of $1.664. The important pivot is set at the price of $1.674. Watch for the price action at the important pivot to confirm further direction. The eventual failures to test or break the pivot resistance at $1.674, may lead Gold downside towards the levels at $1.64 and $1.618. The eventual upside breakout of the resistance at $1.674 may lead the Gold towards the level at $1.700. Stochastic oscillator is showing fresh upside flimp, which is indication of the upside cycle. Resistance levels are set at the price of $1.674. Support levels are set at the price of $1.640 and $1.618. The material has been provided by InstaForex Company - www.instaforex.com |

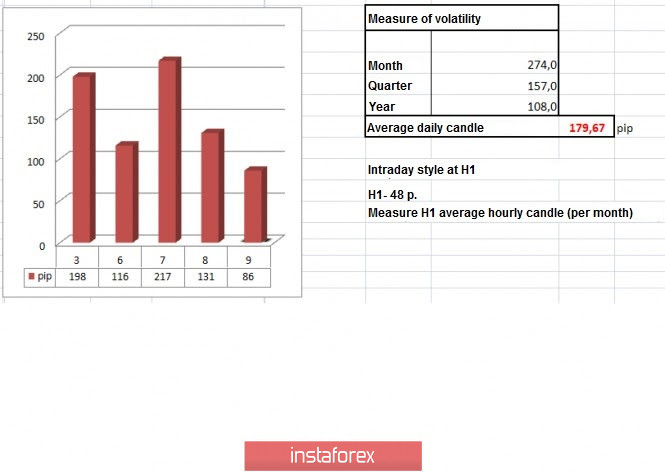

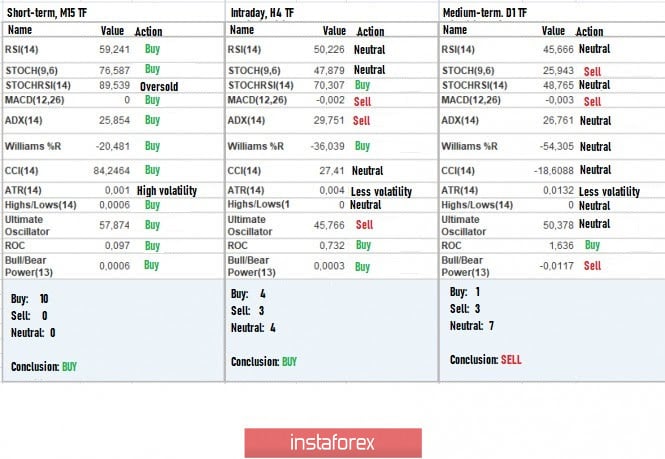

| Trading recommendations for GBPUSD pair on April 9 Posted: 09 Apr 2020 05:27 AM PDT From a comprehensive analysis, we see that for almost two weeks, the quote has been moving in a sideways corridor, with variable frames. And now about the details. The widest range of 1.2150-1.2480 (1.2500) is precisely at such scales that we have an oscillation within the boundaries of which local amplitudes are formed. In other words, there are characteristic cycles in the structure of which there are small-scale amplitudes on the sideways and subsequent impulses based on them. All this structure is not constant and is limited by the main range of 1.2150-1.2480 (1.2500). It turns out that in order for the main move to occur, the quote first needs to overcome the boundaries of the main range, otherwise we are waiting for a long and painful sideways move, as it was before the first downward inertia. At the same time, the current oscillation has already grown from a slowdown at the peak of the upward inertia to a full-fledged sideways move, which means that the subsequent movement is expected to be more extensive than a correction or a local prostration. Analyzing the last trading day, we see that the concentration of the price below the level of 1.2350 still did not lead to a significant downward move, and in the afternoon there was an upward turn that not only secured the quote above the level of 1.2350 but also overcame the mark of 1.2383. It turns out that during the recent upward movement, the quote returned to the original range, which is where it all started. In terms of volatility, we see a slight slowdown of 26% relative to the daily average. It is worth noting that on the scale of our corridor, this volatility is considered by no means small. Details of volatility: Monday-165 points; Tuesday-245 points; Wednesday-172 points; Thursday-358 points; Friday-359 points; Monday-144 points; Tuesday-271 points; Wednesday-676 points; Thursday-354 points; Friday-522 points; Monday-267 points; Tuesday-296 points; Wednesday-333 points; Thursday-452 points; Friday-352 points; Monday-148 points; Tuesday-227 points; Wednesday-108 points; Thursday-126 points; Friday-198 points; Monday-116 points; Tuesday-217 points; Wednesday-131 points. The average daily indicator, relative to the dynamics of volatility, is 179 points (see the table of volatility at the end of the article). As discussed in the previous review, traders considered fluctuations within the boundaries of 1.2280/1.2350 (1.2380), where local buy positions were eventually opened. Looking at the trading chart in general terms (the daily period), we see two large-scale inertia moves, where a sideways move was formed at the top of the second inertia. The news background of the last day did not contain any noteworthy statistics on Britain and the United States. In terms of the general information background, the state of British Prime Minister Boris Johnson, who was recently transferred from self-isolation to the department of intensive theory, is actively discussed. The fact that the Prime Minister was diagnosed with coronavirus is no longer news, but the further acceleration of the case of infection with the virus among British citizens puts pressure on investors and the country's economy. In turn, the European side, which is actively involved in negotiations on trade relations after Brexit, can no longer contain its emotions. So European officials believe that the British feed themselves the illusions of striving to conclude a deal before the end of this year. The current circumstances with the COVID-19 virus have complicated the negotiation process, where, according to the German Ambassador to the EU, Michiel Claus, the work is only at 25% of the total capacity. Let me remind you that the European Commission has repeatedly offered to consider extending the transition period, but the British side is silent. Next week, the heads of the British and EU Brexit negotiating teams, David Frost and Michel Barnier, are due to agree on a further schedule of negotiations. Barnier, who was diagnosed with a coronavirus on March 19, is already recovering. Today, in terms of the economic calendar, we have already received data for the UK, where indicators for industrial production continue to decline by -2.8%. In turn, the GDP data continued to show a slowdown from 0.7% to 0.3% In the afternoon, we expect data on applications for unemployment benefits in the United States, where nothing good can be expected. The US labor market is experiencing one of the worst times, unemployment is growing weekly and this time forecasts say that the growth of initial applications will be 5,150,000, and repeated applications - 6,990,000. However, it is not excluded that the data will come out even worse than expected. Naturally, this is a bad factor for the US economy, but investors understand that the consequences of the COVID-19 virus will affect other countries, and it is now in a protective asset more acceptable, with a general risk. Further development Analyzing the current trading chart, we see that the quote has already moved closer to the area of interaction of trading forces 1.2440/1.2480, where there were a slowdown and signs of a rebound. In fact, traders assume that a repeat of the story of the past is possible in the current segment, where there will be a round of short positions and a return of the price to the lower limit of the main range. In terms of the emotional background, we see constant speculative interest, which makes it possible to accelerate the quote above the 100-point mark every day. We can assume that the area of interaction of trading forces 1.2440/1.2480 will be able to exert proper pressure, during which the quote will be able to fall in the direction of values 1.2350-1.2320. The subsequent development will hang, from the set course, as there is a place to go down. Based on the above information, we will output trading recommendations: - Positions for sale are considered in the direction of 1.2350-1.2320. - Buy positions are considered as a sharp change in the mood, where the quote needs to be fixed higher than the level of 1.2500. Indicator analysis Analyzing different sectors of timeframes (TF), we see that due to the return of the price to the upper limit of the main range, the indicators of technical instruments on the hourly and daily periods have taken an upward position. In turn, minute intervals work for the primary rebound, signaling a sale. Weekly volatility / Measurement of volatility: Month; Quarter; Year. Volatility measurement reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (April 9 was based on the time of publication of the article) The current time volatility is 86 points, which is 51% lower than the daily average. It is possible to assume that the speculative mood will still be able to disperse the quote but within the average norm. Key levels Resistance zones: 1.2500; 1.2620; 1.2725*; 1.2770**; 1.2885*; 1.3000; 1.3170**; 1.3300**; 1.3600; 1.3850; 1.4000***; 1.4350**. Support zones: 1.2350**; 1.2280 (1.2240); 1.2150**; 1.2000*** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1.1000; 1.0800; 1.0500; 1.0000. * Periodic level ** Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Apr 2020 05:22 AM PDT Corona virus summary:

The number of people killed by the coronavirus in Spain passed 15,000 on Thursday, but the daily death toll fell to 683 after two consecutive days of rising above 740, Sam Jones reports from Madrid. Figures released by the health department suggest that the spread of the virus is continuing to slow down: between Wednesday and Thursday, the rise in the number of new cases was 3.9%, compared with a daily average of 12% at the end of March and 20% in mid-March. Spain's prime minister, Pedro Sanchez, is once again seeking congress' approval to extend the state of emergency - this time until 26 April.Speaking in parliament on Thursday morning, he defended his government's handling of the Covid-19 crisis and said the continuing lockdown, which has been in effect since 14 March, was the best way to tackle contagion-to date, Spain has confirmed 152,336 cases of the virus, and 15,238 deaths. However, there are growing doubts over the way in which the country is counting the dead.. Technical analysis: EUR/USD has been trading sideways at the price of 1.0870. Anyway, I found that on the 8H time-frame there is the bear flag and rejection of the middle Bollinger band, which is sign that potential downside trend may resume. Watch for selling opportunities with the downward targets at 1.0770 and 1.0635. Stochastic oscillator is showing potential bear cross and currently is at the level of 50. Resistance levels are set at the price of 1.0920. Support levels and downward targets are set at the price of 1.0770 and 1.0635. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EURUSD for April 09, 2020 Posted: 09 Apr 2020 04:42 AM PDT Technical outlook: EURUSD is trading around 1.0856 at this point of writing after printing intraday lows at 1.0829 yesterday. As seen on the chart here, prices had broken out of resistance trend line earlier and managed to print highs at 1.0927. The recent boundary is located between 1.0768 and 1.0927 and EURUSD has bounced off the Fibonacci 0.618 retracement at 1.0829. Prices are likely to stay above 1.0768 and push higher towards 1.1090 levels. Immediate resistance is seen at 1.1039 and a break higher should encourage bulls to push further. Please note that the overall structure still remains bullish with 1.0636 support intact. It is pointing a push towards 1.1500 resistance in the medium term. Trading point of view, EURUSD remains a good candidate to be bought on dips until prices stay above 1.0636. Trading plan: Remain long against 1.0636 target is 1.1500 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

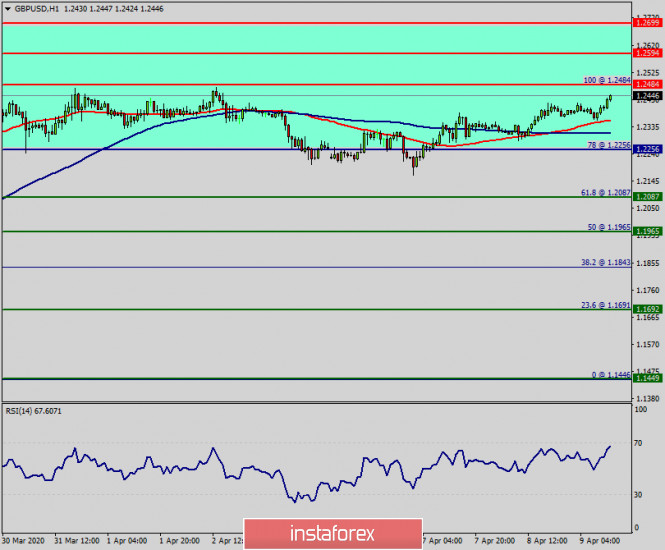

| Technical analysis of GBP/USD for April 09, 2020 Posted: 09 Apr 2020 03:59 AM PDT Overview: The GBP/USD pair started recovering until it reaches the top point of 1.2484. Amid the previous events, the price is still moving between the levels of 1.2256 and 1.2484. Pivot point sets at the price of 1.2256. Resistance and support are seen at the levels of 1.2484 (also, the double top is already set at the point of 1.2484) and 1.2256 respectively. Therefore, it is recommended to be cautious while placing orders in this area. So, we need to wait until the sideways channel has completed. The current price is seen at 1.2338 which represents a key level today. The level of 1.2484 will act as the first resistance today. Hence, if the pair fails to pass through the level of 1.2484, the market will indicate a bearish opportunity below the strong resistance level of 1.2484. Sell deals are recommended below the level of 1.2484 with the first target at 1.2256. The level of 1.2256 represents the daily pivot point. If the trend breaks the support level of 1.2256, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.2087. The weekly pivot is seen at the level of 1.2256. The market is still in a downtrend. We still prefer the bearish scenario in long term. However, the sop loss should be placed above the last bullish wave around the spot of 1.2500. The material has been provided by InstaForex Company - www.instaforex.com |

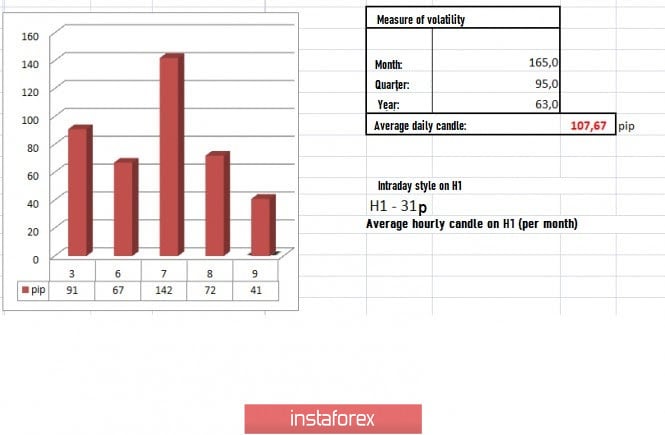

| Trading recommendations for EUR/USD on April 9, 2020 Posted: 09 Apr 2020 02:55 AM PDT A slowdown within the variable level of 1.0850 occurred during the recovery process. The corrective movement from the support level of 1.0775 did to update the local high for the second time, but focused instead on the variable level of 1.0850. In fact, we got a kind of accumulation within it, where the amplitude is just over 40 points. If we focus on recovery and accumulation, a clear sell signal arises, which means that there is a chance to update the lows. Regarding further development, the last review revealed signs of a downward trend. To confirm that judgment, traders do not only need to go below 1.0775, but sellers need to update the lows of 1.0636. Otherwise, a slowdown may occur, which will take the form of a wide flat, and will drag on for a very long time. Analyzing the past trading day, we see that the most remarkable jump in prices occurred at the start of the European session. The quote went down to the area of 1.0830, but quickly reversed upwards. All subsequent fluctuations had variable boundaries of 1.0850 / 1.0885, which embodied the accumulation. In terms of volatility, there's a slowdown in activity, where the daily dynamics was 72 points, or 32% less than the average. This is not surprising as the market is just adapting to the external background, and the dynamics of the pair will still return to the standards of 50-80 points [average daily activity, with the usual external background]. Details of volatility: Monday - 155 points; Tuesday - 183 points; Wednesday - 115 points; Thursday - 278 points; Friday - 166 points; Monday - 151 points; Tuesday - 234 points; Wednesday - 243 points; Thursday - 326 points; Friday - 194 points; Monday - 191 points; Tuesday - 160 points; Wednesday - 133 points; Thursday - 188 points; Friday - 194 points; Monday - 134 points; Tuesday - 127 points; Wednesday - 136 points; Thursday - 147 points; Friday - 91 points; Monday - 67 points; Tuesday - 142 points; Wednesday - 72 points. The average daily indicator, relative to the dynamics of volatility, is 107 points [see table of volatility at the end of the article]. As discussed in the previous review, traders saw the accumulation process and waited for possible bursts of activity. However, the key coordinates of 1.0830 / 1.0890 were not affected. Considering the trading chart in general terms [the daily period], we see that the quote is still in the structure of the downward movement of March 30, where the existing fluctuation did not change the structure. The news background yesterday did not contain any noteworthy statistics on Europe and US, except the Fed's minutes of the meeting. Yesterday, the minutes of the Fed's last two emergency meetings, which took place on March 2 and 15, were published. Recall that during the first meeting, the interest rate was reduced by 0.50% to 1.00-1.25%. At the second meeting, the rate was reduced by 100 basis points, to the level of 0.00-0.25%. According to the minutes, the regulator followed the threats of a sharp decline in economic activity, as well as the worsening market conditions in the United States caused by the COVID-19 virus. "The timing of the resumption of growth of the US economy will depend on the measures to curb the spread of coronavirus, as well as on the success of these measures and other responses, including fiscal policy," the protocol says. Charles Evans, head of the Federal Reserve Bank of Chicago, believes that employment and production in US will plummet this quarter, but the economy will begin to recover in the second half of the year. Regarding the COVID-19 virus, the total number of confirmed coronavirus cases across the world has already passed 1.5 million. The data on the applications for unemployment benefits in the United States has exceeded its forecasts twice. The current indicators are not an exception. But, although the results of the index may again not coincide with forecasts, market participants understand that the consequences of the COVID-19 virus will affect not only US, but also other countries where the indicators are probably not better, so investors continue to hold a protective asset - the dollar. Regarding applications, the forecasts are as follows: Initial applications - 5,150,000; Repeated applications - 6,990,000. Further development Analyzing the current trading chart, we see that the quote has been fluctuating within 1.0850 / 1.0885 for more than 25 hours. There were attempts to break through the lower frame, but relative to the hourly period, this is just punctures by shadows. The accumulation process remains on the market, which means that the acceleration of activity is just around the corner. The fluctuation in the range of 1.0850 / 1.0885 may not last very long. Many hope that the downward movement will resume. The main strategy now is really a downward development, so we should work on the existing accumulation, where if the breakdown of borders occur, we will open local positions in the market. Based on the above information, we have the following trading recommendations: - Consider sell positions if the price consolidates below 1.0825, with the prospect of moving to 1.0775. The main movement will happen after the price consolidates below 1.0775. - Consider buy positions if the price consolidates above 1.0890, with the prospect of moving to 1.0925. Further movement will happen after the price consolidates above 1.0930, with the prospect of 1.0960–1.1000. Indicator analysis Analyzing the different sector of timeframes (TF), we see that due to the corrective movement, as well as the current accumulation, the indicators on the daily and hourly periods give a variable buy signal. Daytime periods, on the other hand, work on the direction of the main movement, where a sell signal is present. Volatility per week / Measurement of volatility: Month; Quarter; Year The measurement of volatility reflects the average daily fluctuation calculated for Month / Quarter / Year. (April 9 was built taking into account the time of publication of the article) The current volatility is 41 points, which is 61% lower than the daily average. As soon as the accumulation framework is broken, volatility will at least double. Key level Resistance zones: 1,1000 ***; 1.1080 **; 1,1180; 1.1300; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support zones: 1,0850 **; 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level * * Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

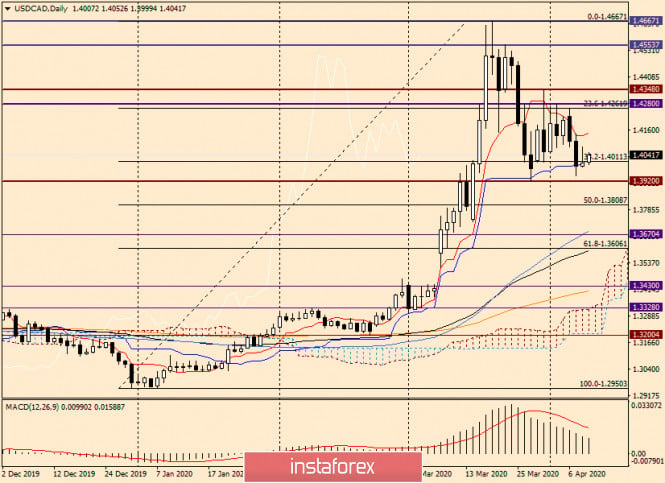

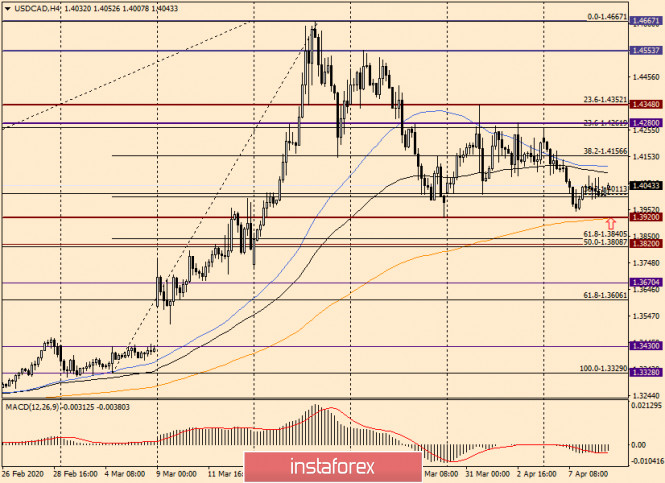

| Analysis and trading ideas for USD/CAD on April 9, 2020 Posted: 09 Apr 2020 01:44 AM PDT Good day! Although the USD/CAD pair grew at the end of the last five-day trading session, the relatively long upper shadow of the last candle kept the probability that the quote will decline this week. At the time of writing this article, this is exactly what is observed. We will move on to the technical picture for the pair of North American dollars a little later, but for now, it is worth noting that yesterday's FOMC minutes did not give market participants new food for thought and the trading on April 8 ended without a certain pronounced direction. Daily

As you can see, at yesterday's trading, the pair rose to the level of 1.4080, but the bulls could not hold the course near this mark and retreat. As a result, the candle for April 8 had a very long upper shadow and a small bullish body. Usually, after the appearance of such candles, there is a decrease in the quote, but the calendar of today's eventful macroeconomic events can affect the technique, and to a large extent determine the results of today's trading. From Canada, at 13:30 (London time), data on the labor market will be received, which will be an important factor for the currency of the Maple Leaf country. From American statistics, it is worth highlighting the initial applications for unemployment benefits, as well as the producer price index. These reports will also be published at 13:30 London time. Separately, it is necessary to note the speech that will be delivered at 15:00 (London time) by the head of the Federal Reserve, Jerome Powell. I believe that these events will significantly affect the price dynamics of the USD/CAD pair. If you are guided by the technical picture, a true breakdown of the support of 1.3920 will indicate a bearish market. The bulls have much larger and more complex tasks for this pair. To increase the rate, traders need to break through the Tenkan line of the Ichimoku indicator, which runs at 1.4146. After that, raise the quote to the strong resistance of sellers near 1.4280 and pass this level. But this is not all. The breakout of resistance at 1.4348 will significantly convince us of the bullish prospects for the USD/CAD pair. However, even higher, as we can see, there are strong and important resistance levels of 1.4555 and 1.4666. Given yesterday's candle, I am more inclined to a downward scenario. Let's see what the situation is on the lower timeframes. H4

At the moment, the pair is trading in a relatively narrow range. Strong support is expected in the case of a decline to 1.3920, where in addition to the level itself, there is also a 200 exponential moving average. Resistance can be provided by 89 EMA and 50 MA, which are located in the price area of 1.4092-1.4117. H1

According to the hourly chart, the pair is going to follow in a northerly direction. This is indicated by the highlighted Doji candle, after which growth is observed. The main trading idea for the USD/CAD pair is sales, which are better considered after the growth in the price zone of 1.4090-1.4120. You can look for more attractive prices for opening short positions if the price rises to the area of 1.4260-1.4280. For those who have a bullish view of this instrument, it is aggressive and risky to try to buy from current prices. It is less risky to open long positions after a short-term decline in the price zone of 1.3940-1.3920. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR/USD on April 9, 2020 Posted: 09 Apr 2020 01:36 AM PDT

Coronavirus update as of the morning of April 9: Europe: The situation in Italy and Spain is now stable. The increase in new cases of infection is approximately +3 to +4%. The number of deaths is still high, at the level of +550 to +750 (the death toll in Spain is 750). The total number of infected people in Italy is 139 thousand, and in Spain, 148 thousand. Unpleasant news: The death rate in Britain is 938 deaths per day; In Germany, there's +5600 new cases of infection. US: There's already 435 thousand confirmed COVID-19 cases across the US. The death toll is 14,800, with a rate of around 1,940 deaths per day. New York: There's 151 thousand coronavirus cases in the city. It increases daily by about 8,800, or approximately +6%. This indicates that the situation is starting to stabilize. The number of deaths increase by +780 per day, or about +13%. EUR/USD: The European Commission will discuss today new options of financial assistance to countries affected by the pandemic. The package will be worth more than 500 billion euros. In addition, the latest report on US unemployment will come out at 13:30 London time. The forecast is not lower than +5 million. EUR/USD Open buy positions at 1.0930. Open sell positions at 1.0765. The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's diary for April 9, 2020 Posted: 09 Apr 2020 01:30 AM PDT

Oil is holding above $ 25, awaiting the OPEC-Russia-US deal. Russia announced that it is ready to reduce oil production by 1.5 million barrels. However, even after the deal, demand for oil will remain at low levels, so a new decline is possible. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis of EUR/USD and AUD/USD for April 9 Posted: 09 Apr 2020 01:27 AM PDT EUR/USD Analysis: The euro continues to form an upward wave from March 23. In its structure, the first 2 parts (A-B) have been completed. Since April 3, a reversal structure is formed for the beginning of the final part of the wave (C). Forecast: Today, we expect to complete preparations for an upward price surge. In the European session, a flat mood is more likely to move along the support zone. The start of the growth can be expected in the afternoon. If the exchange rate changes, a sharp increase in volatility is possible, with a puncture of the lower support border. The reference point is the time of the news block's release from the United States. Potential reversal zones Resistance: - 1.1030/1.1060 - 1.0920/1.0950 Support: - 1.0840/1.0810 Recommendations: Euro sales today are unpromising. It is recommended to track all emerging signals for the purchase of the instrument.

AUD/USD Analysis: The rising wave of the Australian dollar from March 19 has sufficient potential to change the direction of the medium-term trend. The price is approaching the lower border of a powerful potential reversal zone. Forecast: Today, the "Aussie" chart shows the most likely overall upward movement rate. In the next session, short-term pressure on the support zone is not excluded. The calculated resistance shows the upper limit of the expected daily course of the pair. Potential reversal zones Resistance: - 0.6300/0.6330 Support: - 0.6220/0.6190 Recommendations: Today, the pair's sales are unpromising on the market. It is recommended to track signals for buying the instrument in the settlement support zone.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements. Note: The wave algorithm does not take into account the duration of the tool movements in time! The material has been provided by InstaForex Company - www.instaforex.com |

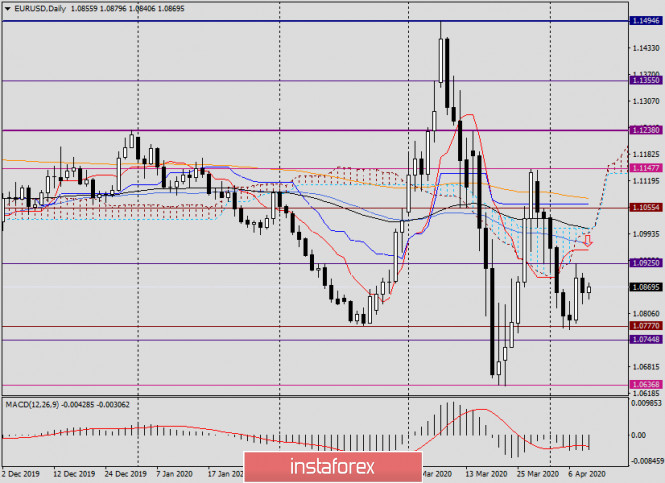

| Analysis and forecast for EUR/USD on April 9, 2020 Posted: 09 Apr 2020 12:52 AM PDT Fed protocols and Eurogroup meetings were ignored by investors. Hello, traders! Yesterday's minutes of the Federal Open Market Committee (FOMC) of the US Federal Reserve, as expected, revealed the uneasy mood of the Fed's leaders. Well, what else can be the mood when the COVID-19 epidemic continues to spread around the world, and the focus of the pandemic is located in the United States of America? The minutes referred to a significant decrease in liquidity and very difficult trading conditions, including in the treasury securities market. FOMC members rated the prospects for the US economy as significantly worse and extremely uncertain. In general, the minutes of the Open Market Committee was quite pessimistic, but this factor was not a revelation for market participants. Everyone is well aware of the current situation and the extremely negative consequences of the pandemic for the American and global economy. The Fed expressed its readiness to keep rates at current levels until the situation stabilizes and the US economy recovers from the negative effects of COVID-19. Since there was nothing unexpected or extraordinary in the minutes, the market simply ignored them, as well as the latest catastrophically bad data on the US labor market. But labor reports for March have not yet given a full picture of the consequences of COVID-19. The peak of the epidemic has not passed, and we regret to admit that the worst is yet to come. In the meantime, one of the most acute problems in the United States is an acute shortage of medical personnel. It has reached the point where medical students receive their degrees in absentia and take the Hippocratic Oath over the phone. Perhaps this has not been seen even in the coolest fantasy blockbusters. But today - the reality is this. As for Europe, there is a small but steady decline in the number of new coronavirus infections, but the situation remains tense and it is still very early to relax. The Eurogroup conference, which was held in a video format, did not yield any results. Finance Ministers of 19 countries failed to agree to support the European economy from the consequences of COVID-19 in the amount of 500 billion euros. As usual, in such situations, the wealthiest countries, namely Germany and the Netherlands, refused to share the financial burden. Thus, Italy and Spain continue to remain virtually without the help of their European "friends-partners". If we go to the analysis of the technical picture for the EUR/USD currency pair, it has not undergone any changes, as the price charts eloquently indicate. Daily

Following the results of yesterday's trading, the pair slightly declined and ended the session on April 8 at 1.0855. However, yesterday's candle formed a long lower shadow, which may indicate the market's reluctance to decline and lead to another attempt to rise to the maximum values of trading on April 7 - the level of 1.0925. However, it is worth noting that passing above this level may be limited by the price zone of 1.0955-1.1005, where the Tenkan line of the Ichimoku indicator, 50 simple moving average, the lower border of the cloud and 89 exponential are located. H4

On this timeframe, at the moment of completion of the review, there is a consolidation, after which there is often a strong directional movement. Given the current situation, it is very difficult to predict the future price behavior. If we take into account the technical picture, then sales on this chart look good from the area of 1.0955-1.1005. Although, if the pair breaks the red resistance line 1.1484-1.1443, 200 EMA and gets fixed higher, you can try buying on the pullback to the broken line and 200 exponential. However, I am more inclined to assume that the main trading idea for the euro/dollar is sales after growth in the area of 1.0955-1.1005. At the moment, it is likely that the breakdown of the red resistance line and the 200 EMA will fail, that is, it will be false. Today, a large block of macroeconomic statistics will come from the US, and at 15:00 (London time), Federal Reserve Chairman Jerome Powell is scheduled to speak. Perhaps these events will have an impact on the price dynamics of the major currency pairs and will help investors to determine the direction. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment