Forex analysis review |

- Control zones for USDCAD on 04/06/20

- Control zones for NZDUSD on 04/06/20

- EUR/USD. Preview of the week. OPEC+ meeting. Waiting for the peak of coronavirus infection. Trump's refusal to wear a protective

- GBP/USD. Preview of the week. Morgan Stanley analysts predict the collapse of the US economy. +100,000 infected over the

- GBP/USD. Result of the week. The US economy could be affected more by the epidemic than by the 2008 mortgage crisis

- EUR/USD. Result of the week. More than 1.1 million people have already been infected with the "coronavirus". Tests of the

- Market Review. Trading ideas. Answers on question

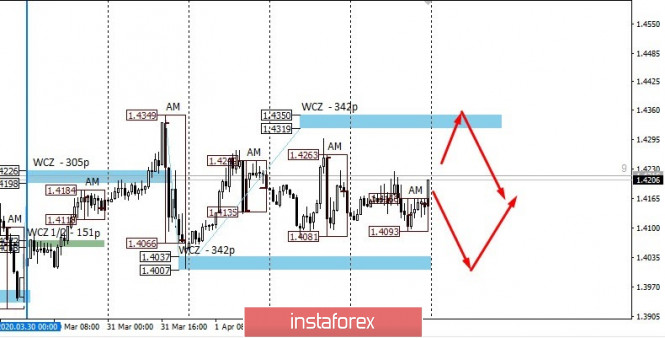

| Control zones for USDCAD on 04/06/20 Posted: 05 Apr 2020 10:22 AM PDT The pair has formed an accumulation zone over the past five days. The boundaries that will hinder further movement are the extremes of the previous week. The upper reference point is the weekly CZ 1.4350-1.4319. Support is the weekly control zones of 1.4037-1.4007. Tests of the specified zones should be perceived as an opportunity to search for deals inside the range. Work within the framework of the flat involves inputs and outputs at its boundaries so that transactions will be limited to the range. To exit the flat, you will need to consolidate the pair above one of the weekly control zone positions during the US session. This will allow you to change the trading style to an impulsive one. Closing trades above 1.4350 will allow you to consider medium-term purchases, while a consolidation below 1.4007 will indicate the beginning of a change in the medium-term momentum to a bearish one. Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year. Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which changes several times a year. Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Control zones for NZDUSD on 04/06/20 Posted: 05 Apr 2020 10:22 AM PDT The pair settled below the weekly CZ of 0.59170.5902 on Friday. This makes it possible to hold sales that were opened earlier and look for new opportunities to open a short position. Favorable prices for selling are within the range of the WCZ 1/2 0.5922-0.5915. The first target of the decline will be the 0.5777 level. The weekly control zone of 0.5752-0.5737 is located just below this mark. Work in the downward direction can become the main one for the entire current week.This will allow you to hold part of the position in order to reach the March low in the medium term. The alternative growth model has a low probability and will develop only if an absorption pattern forms below the daily level. Monday's close should be above Friday's high. This will allow you to consider the bullish direction of trading and refuse to sell. Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year. Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which changes several times a year. Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

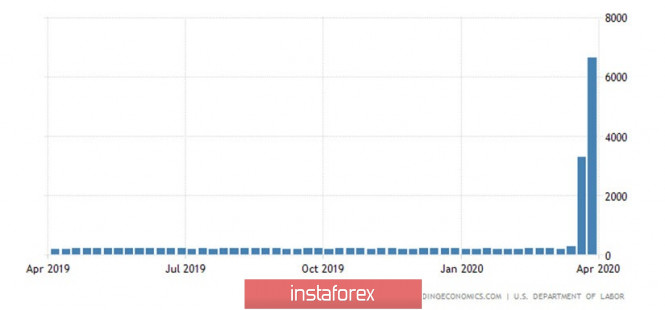

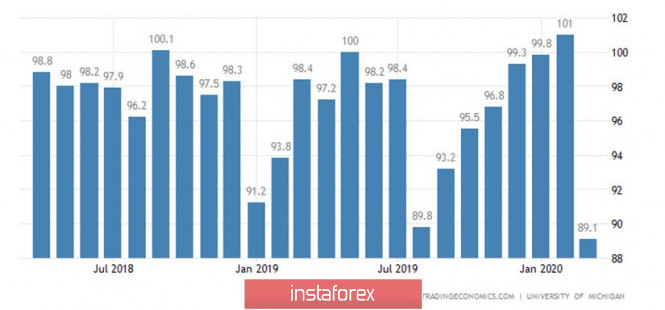

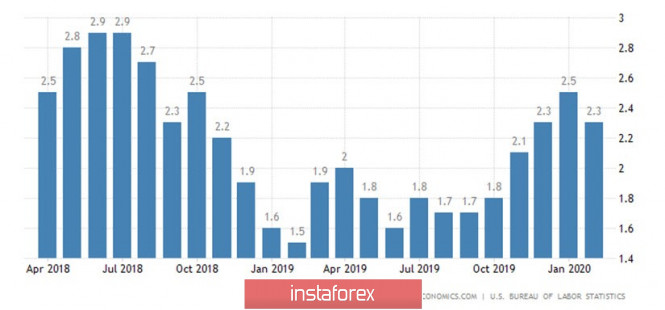

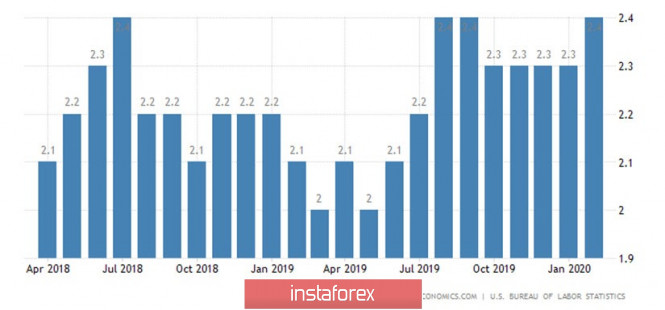

| Posted: 05 Apr 2020 05:46 AM PDT What do traders expect in the new trading week? We have already described all possible options for the movement of the currency pair. Thus, we can only consider all the macroeconomic events that are planned for this week and hope that they will cause at least some reaction from market participants. So, let's start with Monday. No important economic data will be available to traders on April 6. And, from our point of view, this will be a good opportunity to start a correction. The euro/dollar pair began to show signs of a corrective movement at the end of Friday. However, they were so weak that they cannot be taken seriously. Perhaps, the euro currency will get a little support on Monday, as we have already talked about a new round of consolidation of the currency pair up. On Tuesday, Germany will publish an industrial production indicator for February. And even taking into account the fact that in February there was no such scale of the epidemic as in March, and the quarantine has not yet been introduced, the production rate may still fall by 3.9% in annual terms, and by 1% in monthly terms. However, looking at the long-term chart of changes in the indicator, it becomes clear that almost two years ago, the rate of production growth began to decline, and then slow down. Thus, the cause is not the coronavirus epidemic. But thanks to the help of coronavirus, the growth rate of industrial production in the country - the locomotive of the European economy can decrease even more. But this will become clear by the end of March. There will be no publication of economic reports on Wednesday, April 8, but in the evening there will be the publication of the minutes of the last meeting of the US Federal Open Market Committee. It is rare for the minutes to have a serious impact on the currency market. Most likely, even now it will be ignored by traders. The next report on applications for unemployment benefits in the United States is scheduled on Thursday, which has recently become one of the most important reports. The last two weeks showed that the number of applications initially increased by 3.3 million, and then by 6.6 million. According to experts' forecasts, in the week up to April 4, the number of new applications for unemployment will be another 5-5.15 million. Thus, the labor market is highly likely to continue to shrink, but we should also recall the words of US Treasury Secretary Steven Mnuchin who urged not to pay too much attention to this indicator, as the Fed and the US government provided unprecedented assistance to the economy, which should stop its decline. However, it takes at least three weeks to feel the positive effect of the measures taken. As these three weeks have not yet passed, we are still seeing it with the decline of the US economy and the decline of the labour market. Also scheduled for this trading day is the University of Michigan's consumer confidence index, which fell from 101 to 89.1 in March, and could decline further in April, to a value in the 70-75 range. The release of inflation for March is planned on the final trading day of the week, which, according to experts' forecasts, should slow down from the current 2.3% to 1.5-1.6% in annual terms. The core consumer price index is likely to remain unchanged from February at 2.3% YOY. Thus, according to these two indicators, all goods and services in the United States, except for consumer and energy resources, will not change the growth rate of their rise in price. But inflation, taking into account consumer goods and, most importantly, oil, will slow down its growth rate. The package of macroeconomic information in the new week will be quite small. And if you reject all the news, which is 90% likely to be ignored by traders, then there is only one report - on applications for unemployment benefits. It is possible that a virtually zero macroeconomic background will lead to an even greater decrease in volatility, which we will consider as another step towards stabilizing the situation in the world. However, the OPEC+ meeting can also significantly help stabilisation, as part of which a decision can be made to reduce production volumes by key market players. The meeting was originally scheduled for April 6, and oil prices soared on Friday amid upcoming talks. However, today it became known that the summit participants decided to postpone the meeting to April 8 or 9, which will give additional time to agree on the terms of future agreements. Recall that due to the coronavirus pandemic, the demand for oil around the world has significantly decreased, which negatively affected the prices of black gold. However, in addition, the OPEC countries could not agree on changing the parameters of the deal to reduce the volume of oil production, or on its extension. Russia wanted to maintain the existing conditions, and Saudi Arabia insisted on further reducing oil production. As a result, all previous agreements ceased to operate and Saudi Arabia increased production on April 1, which finally finished off the price of oil of all varieties. Even on weekends, US President Donald Trump continues to be the main news-maker in the world. At a time when the pandemic has taken over the whole world, and the largest number of infected citizens is observed in the United States, Trump believes that wearing a mask is "just a recommendation". He said that wearing a mask in the White House does not correspond to the status of the president. "I feel good. I just don't want to do it. Sitting in the oval office at a beautiful, large desk and wearing a mask, greeting presidents, prime ministers, dictators, kings... This is not for me, " Trump said. It should be noted that opinions among doctors about wearing a mask in order to reduce the spread of infection are divided. Some doctors believe that there is no special sense in masks, since they should not be used for more than two hours in any case, after which they should be thrown out. That is, an ordinary citizen may need from 1 to 5-6 masks per day. Such a number of masks simply does not exist and it makes no sense to produce them, given the fact that the coronavirus is spread not only "through the air". People can become infected when they come in contact with the surface which was previously touched by an infected person. However, most doctors still agree that wearing a mask reduces the rate of growth of the pandemic. Recommendations for the EUR/USD pair: We believe that the influence of the fundamental background next week will not be too strong. Thus, more attention should still be paid specifically to the technical picture of 4-hour timeframes. On both trading systems that we represent, short positions are currently relevant with targets near 1.0742 and 1.0673, but there are no signs of the beginning of a correctional movement. Nevertheless, a reversal to the top of the MACD or Heiken Ashi indicator may indicate a round of upward correction. The material has been provided by InstaForex Company - www.instaforex.com |

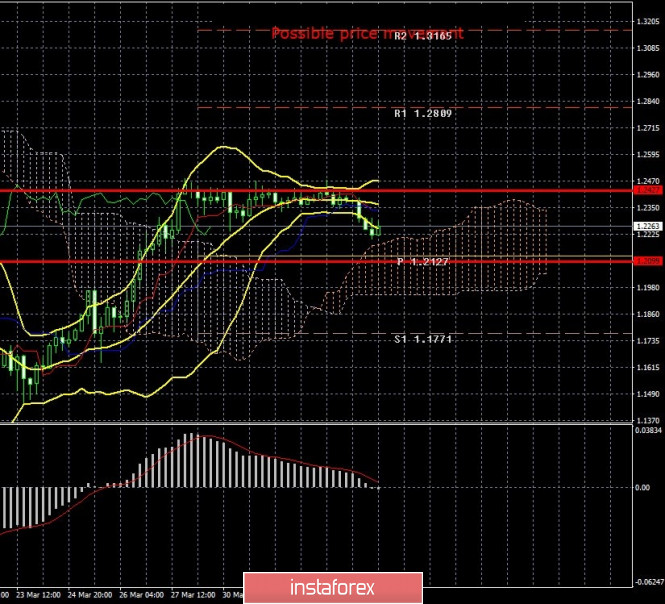

| Posted: 05 Apr 2020 05:46 AM PDT The British pound, which seems to have resumed its downward trend at the end of last week, is unlikely to be dependent on macroeconomic statistics next week. Throughout the week, three more or less significant reports will be published in the UK. However, given the fact that market participants continue to ignore statistics, it is likely that traders will continue to trade in accordance with technical factors. We have already described all possible options for the pair's movement in the near future. However, do not forget that in addition to technical factors, there are so-called non-speculative transactions on the currency market. There are a huge number of agents on the market who carry out transactions to buy and sell any currency not for profit, but for current needs, to maintain operating activities, to hedge future risks, and to form portfolios designed to preserve the value of assets. Thus, many large market participants can continue to trade within their strategies, which strongly affects the movement of all pairs, including the pound/dollar. Well, the coronavirus is still the main cause of panic in the currency and global markets. As of the morning of April 5, about 1.2 million diseases were registered worldwide. In the United States - 312,000 cases, in the UK - 42.5 thousand cases. Thus, the epidemic continues to spread and it is not yet possible to stop it. Despite the fact that we have concluded that the participants of the foreign exchange market will calm down, if the situation with the pandemic does not improve, we may well witness a second wave of panic. After all, a pandemic, as we have said many times, is not just a sore that you can get over and forget about it. For the world economy, this is the source of a new crisis, recession, and perhaps even depression for many years to come. In addition, this is also a loss of life. In Britain, 708 people have died in the past day... The situation in the United States is also frightening. We have already informed readers of the forecasts of Donald Trump and some other members of Congress, who believe that the COVID-19 virus can kill up to 200,000 Americans. The numbers really look terrible. Meanwhile, things are very bad in New York state. The epidemic hit this state and the city of New York the most. US President Donald Trump has decided to send 1,000 military personnel to help in the fight against the coronavirus. 10,000 ventilators are also being sent to the state. No macroeconomic reports will be published in Britain on Monday, Tuesday and Wednesday. Traders will witness more or less significant data only on Thursday. On this day, data on GDP in February will be available, as well as a preliminary estimate of the GDP growth rate for March. We believe that this data will not interest the majority of market participants at all. The report on industrial production in the UK will also not cause any interest, as it will relate to February. No data will be received from Great Britain on Friday. Thus, the macroeconomic background will be extremely weak for the pound/dollar this week. The only really important report will be the data on applications for unemployment benefits in the US. However, in the past times, traders also did not react too zealously to it, despite the unprecedented growth in the value of this indicator. Meanwhile, global rating agencies, banks, and conglomerates continue to calculate possible losses for the US (and global) economy in 2020. For example, analysts at Morgan Stanley believe that the US economy will shrink by 3.4% in the first quarter of 2020. The world's largest economy will collapse by 38% in the second quarter. The unemployment rate will be 15.7% in the second quarter. It should be noted that the forecasts of the US Congress are much more optimistic. For example, GDP may decline by only 7-8% in the second quarter. Other sources say that the US economy is already in the largest recession in the last 80 years. If you look at the latest reports on NonFarm Payrolls and applications for unemployment benefits and compare them with similar data for 2008 (the time of the mortgage crisis), it immediately becomes clear that the current crisis and the fall in the economy will be much stronger. World experts agree that if the pandemic persists for a month or two, all the measures taken by the US government will not have a beneficial effect and will not stop the economic downturn. Moreover, they are not enough to keep companies from continuing mass layoffs, not enough to support ordinary Americans and those who lost their jobs. It is quite possible that they will not be enough to support all companies that are on the verge of bankruptcy (first of all, we are talking about airlines). Thus, the Trump administration nearly has no choice. The longer the crisis will last, the greater must be the new stimulus injections into the economy of the United States. Most likely, the trillion-dollar package of measures that was adopted relatively recently will clearly not be the last. Recommendations for the pair GBP/USD: The pound/dollar is now trying to resume the downward trend. Therefore, we recommend considering trading on the downside at the beginning of the new week. According to the Ichimoku indicator, the system speaks of the permissibility of sell positions with a target level of volatility of 1.2099 on Monday. Buying the British pound is not recommended until the price consolidates above the Kijun-sen line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Apr 2020 09:10 AM PDT 24-hour timeframe The British pound remained in one place for most of the past week. At the same time, its movement cannot be called flat in the literal sense of the word, since the pair continued to pass 100-200 points daily. Only on Friday, April 3, an attempt was made to resume the downward movement, and the price returned to the area below the critical line. However, from our point of view, it is too early to talk about resuming the downward movement. We believe that the currency market is beginning to calm down smoothly and therefore not only volatility will fall, but also the strength of movements. Based on this, if the markets do not again fall into a state of panic (which can only be caused by an emergency), the price is unlikely to fall to the support level of 1.1481 in the near future. Most likely, the channel of movement of the pound/dollar pair will now gradually narrow. In the final article for April 3, we already said that now the pair has two main options for the development of events. Either a resumption of the downward trend or a "correction against correction". To be honest, we are still leaning towards the second option. Thus, we expect the pair to fall to the area of 1.18. However, as has been said many times, much will depend on the coronavirus epidemic, on the timing of the invention of the vaccine, on the duration and scale of the pandemic, and on the amount of damage that the epidemic will cause to the economy of each country. Thus, from an economic point of view, we may well witness a "second wave" of panic in the currency, commodity and stock markets. Now the number of infected people around the world is 1.1 million. Representatives of the health sector suggest that the "peak" has not yet passed. This means that there will only be more infected people every day. So the quarantine measures will be extended. This means that the economy will not recover and will continue to decline. And this is a very real prospect for the next one and a half to two months. In the UK, the number of people infected with the virus is approaching 40,000. In the last 24 hours, 684 people died, which is 20% more than the previous day. The total number of dead is 3,611. On this indicator, Britain is already ahead of China. Temporary field hospitals will be built in the country specifically for patients with the COVID-2019 virus. Macroeconomic statistics in the UK on Friday were presented only by the index of business activity in the service sector, which fell from 53.2 to 34.5. In principle, all the countries in the eurozone were marked by similar reductions, so traders did not pay attention to this report. But in the United States, the economic information package deserved the highest attention. First, the unemployment rate for March was published. According to experts' forecasts, unemployment was expected to increase to 3.8%, but in reality, the growth was up to 4.4%. Given more than 10 million new applications for unemployment benefits in the 2 weeks of March, this level of unemployment is still quite good. Although in almost any case, it will grow and in April may begin to approach forecasts of the member of the monetary committee of the Fed, James Bullard, who talked about 20-25%. A hidden unemployment rate was also published by the US Statistics Office, which reflects not only the number of people temporarily unemployed, but also those who have work, but are dissatisfied with it and want, but cannot, change it. This indicator increased from 7% to 8.7%. The least important and significant indicator of changes in average wages in the current conditions increased in March by 3.1% in annual terms and by 0.4% in monthly terms. Finally, the number of new jobs created outside the agricultural sector Nonfarm Payrolls was -700 thousand, with a February value of +275 thousand and a forecast of -100 thousand. The last time a comparable NonFarm value was recorded was in 2008-2009, during the mortgage crisis. However, then everything started with a gradual reduction and only after 12 months, the absolute minimum value of about -800 thousand jobs was reached. Now it all started immediately with a drop of 700 thousand, which suggests that, first, the next months for NonFarm Payrolls will not be much better, but most likely worse, and, secondly, the American economy may suffer from the "coronavirus" epidemic much more than from the mortgage crisis. This crazy day, in terms of statistics, ended with the publication of business activity indices in the US services sector. According to Markit, in March, business activity decreased from 49.4 to 39.8, and according to ISM – from 57.3 to 52.5. And from our point of view, the ISM index is completely untrue. Recall that any business activity value above 50.0 is considered positive. In other words, this sector of the economy is growing. How could there have been growth in the US service sector in March, when the epidemic was already raging and about 10 million people were applying for unemployment benefits? But in any case, traders could only fix in their notes the entire package of statistical information from overseas to use them in the future. Despite absolutely failed statistics from the United States, the US currency rose in price on Friday and did not pay any attention to the published information. Thus, it follows from all the above that technical factors remain the most important and significant. The macroeconomic background can only show certain temporary moments when the mood of market participants may change. But it is recommended to trade 90% based on technical factors. On the 24-hour timeframe, we expect that the Bollinger Bands will begin to narrow, thus working out the fall in volatility. However, we recommend trading, as in the case of the euro/dollar pair, solely based on the analysis of the 4-hour timeframe. Moreover, it is on the 4-hour timeframe that the possible start of a new downward trend is now visible. The last thing I would like to report is that British Prime Minister Boris Johnson remains in self-isolation in his residence at Downing Street, as he was previously infected with the "coronavirus" and at the moment he still has a high temperature and other signs of illness. On Twitter, he wrote: "Although I feel better and spent a week in isolation, unfortunately, I still have important symptoms. I still have a fever. According to government policy, I need to remain in isolation until all symptoms disappear. But we continue to work on our program to defeat this virus." Trading recommendations: On the 24-hour timeframe, the pound/dollar pair is trying to resume its downward movement, but we believe that it will not be as strong as the previous one. However, both timeframes (4h and 24h) indicate a resumption of downward movement. Therefore, it is recommended to consider sell positions and goals on the 4-hour timeframe. It is recommended to return to purchases of the British pound not before fixing the price above the Kijun-sen lines on both timeframes. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Apr 2020 09:09 AM PDT 24-hour timeframe All that we described in the final article for April 3 is more clearly visible on the 24-hour timeframe. If you close your eyes to the abnormal volatility in the last month and a half, you can see the following. The EUR/USD currency pair first went about 700 points up (for no good reason), then 860 points down (an even stronger movement, which means a new trend), and then began to adjust. The first round of correction up – about 500 points, the next round of correction down – about 370 points (at the moment). Thus, volatility decreases and the price returns to the levels at which it was before the panic in all world markets. It is this moment that gives hope for the recovery of the currency market and the return of its participants to normal trading. So far, we believe that the markets continue to recover after the first two strong up and down impulses. And it may take another week or two. Unfortunately, the situation with "coronavirus" is not improving. According to the latest information, about 1.1 million people are infected worldwide. In the most interesting United States and the European Union, about 278,000 and more than half a million people are infected, respectively. In the United States, more than 1,300 people died from the COVID-2019 virus over the past day, and the total number of victims exceeds 7,000. The situation in the European Union is no better. In Italy, Spain, and France, the problems of the epidemic are most acutely felt. In Italy, the total number of victims is already almost 15,000 (more than other countries in the world), in Spain and France, a total of about 20,000 deaths. Thus, it is still impossible to say that the peak of the epidemic has passed and now things will go on the mend. In Australia, the United States, Israel, and some other developed countries, the development of a vaccine against "coronavirus" was announced. In the United States, the first tests of the vaccine were conducted on mice and scientists called them encouraging. The American vaccine provokes the immune system of mice to produce antibodies to the virus and neutralize its particles. Thus, now the trials, after appropriate permits, will be conducted on volunteers and, if successful, the vaccine can start being produced in a few months. However, given the current state of affairs, "in a few months" does not sound too optimistic. But it's better than nothing. This week, a large amount of macroeconomic information was published in the European Union and the United States. The news flow started on Tuesday with the report on inflation in the European Union (slowing from 1.2% y/y to 0.7% y/y in March), as well as the unemployment rate in Germany (5.0%). Slowing inflation in the EU is logical since hardly anyone expected that against the background of falling demand for entire categories of goods (in fact, the demand is now only for food and medicine), prices will rise. Next month, inflation may decline even further. But the German unemployment rate, of course, pleased traders, as it did not change in comparison with February. If the German mark still existed, it could expect to grow in a pair with the dollar. On Wednesday, the unemployment rate in the European Union was published, although, for February, it fell from 7.4% to 7.3%. Since this report did not refer to March, it did not arouse any interest among market participants. Well, on Friday, even though all the main macroeconomic data came from overseas, the European Union also had something to pay attention to. The least interesting report (retail sales for February) showed an increase of 3.0% in annual terms and 0.9% in monthly terms. In general, the business activity indices in the services sectors of the EU countries were even more failed than experts expected, and the indicated preliminary values for March. The Spanish index fell in March from 52.1 to 23.0, Italian – from 52.1 to 17.4, French – from 52.5 to 27.4, German – from 52.5 to 31.7, and the pan-European – from 52.6 to 26.4. Without going into details, we can say that over the past 12 years, there have never been such weak levels of business activity in the services sectors of the EU countries. Even during the mortgage crisis of 2008-2009. This data means that the service sector is completely worth it. Which, in principle, is not surprising, given the widespread quarantine associated with the epidemic. Now we can only wait for GDP data for the first quarter of 2020 or separately for March and estimate the losses of the European and American economies in absolute terms. It looks like the numbers will be extremely low and disappointing. All macroeconomic statistics for the States are reviewed in the article on GBP/USD. How will all this affect the euro/dollar pair? Unfortunately, it is unlikely that we will see a reflection of macroeconomic statistics on the chart. After a month and a half of ultra-volatile trading, the pair is now at about the same price levels as before the panic. So, nothing has changed in the past month and a half. From a technical point of view, the 24-hour timeframe is currently not suitable for forecasting. Formally, we have a "dead cross" sell signal, and the price is located below the Ichimoku cloud. However, for example, the Bollinger indicator is so wide at this time (the distance between the upper and lower bands is more than 800 points) that it allows almost any variants of price movement. In this review, we said that there is a high probability that a new round of upward correction that will start at this time. On a 24-hour chart, this option is not obvious. All target levels (support/resistance) are located far away and are unlikely to be worked out, given the gradually decreasing volatility. The MACD indicator regularly changes the direction of movement but is very late with these reversals relative to price reversals. Thus, we recommend paying more attention to the 4-hour timeframe, where the picture is more suitable for analysis and forecasting. The last thing I would like to note is the growth of black gold quotes at the end of the week. WTI crude rose to $28.79 per barrel, while Brent crude rose to $34.90 per barrel. The gradual recovery of the oil market is also a good signal for traders. Trading recommendations: On the 24-hour timeframe, the euro/dollar pair can be said to have resumed its downward movement after a strong correction to the Kijun-sen line. However, we believe that it is best to trade now using the 4-hour timeframe analysis since there is a high probability of an upward correction. Sell positions are still more relevant now since there is no sign of the beginning of a corrective movement at the moment. The material has been provided by InstaForex Company - www.instaforex.com |

| Market Review. Trading ideas. Answers on question Posted: 03 Apr 2020 10:52 PM PDT Trading recommendations: WTI oil for purchase up to $ 27 and 28 Gas - for purchase up to $ 2 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment