Forex analysis review |

- EUR/USD and GBP/USD. Results of May 15. Macroeconomic US data supported the euro, but could not help the pound

- Stock markets indecisive

- EURUSD-1.0 Waiting for the euro to be on par with the dollar?

- Gold price making new 2020 highs as expected.

- May 15, 2020 : Short-term technical analysis of USDJPY

- May 15, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- May 15, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Native walls help the dollar

- EURUSD: Germany needs to save other Eurozone countries, otherwise its economy may suffer

- BTC analysis for May 15, 2020 - Rejection of the main pivot resistance at $10.000. Watch for potential downside movement

- GBP/USD: plan for the American session on May 15 (analysis of morning deals). Bears continue to sell the pound. We have a

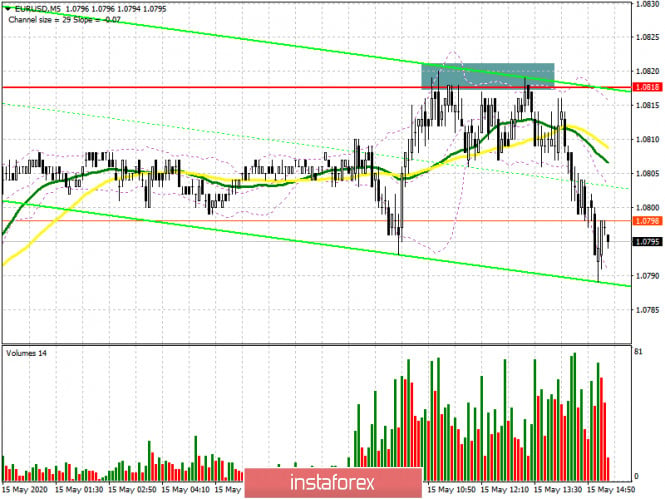

- EUR/USD: plan for the American session on May 15 (analysis of morning deals). The bears have defended the resistance of 1.0818

- Analysis for Gold for May 15,.2020 - Massive upward momentum and our first target at $1.746 is reached. Still more chance

- EUR/USD analysis for May 15, 2020 - Rejection of the massive support at the price of 1.0780, watch for buying opportunities

- EUR / USD: A weakening dollar, negative US rates and second wave of the coronavirus

- Technical analysis of GBP/USD for May 15, 2020

- Analysis of EUR/USD and GBP/USD for May 15. Andrew Bailey: "The Bank of England is not going to lower rates, but this option

- Trading recommendations for EUR/USD pair on May 15

- Technical analysis recommendations for EUR/USD and GBP/USD on May 15

- EUR/GBP Bullish Reversal!

- Instaforex Daily Analysis - 15th May 2020

- Pound: Is it time to reach the bottom?

- Trading plan for EUR/USD on May 15, 2020. The markets ignored the weak data on the economy. Coronavirus in the world.

- EUR/USD. May 15. COT report: bear traders have slowed down and still cannot overcome the important resistance. Eurozone GDP

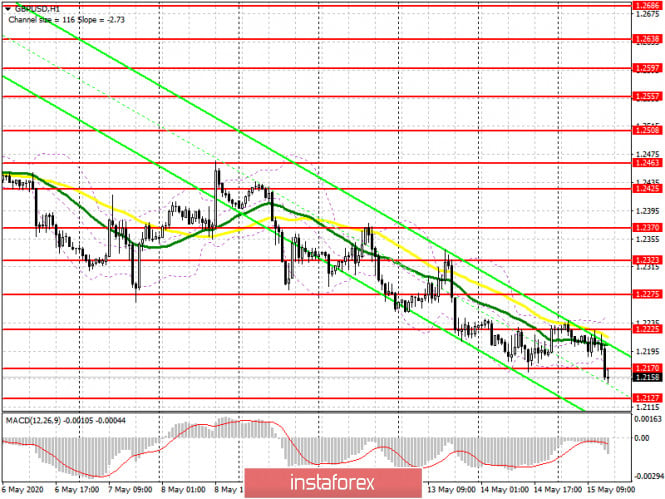

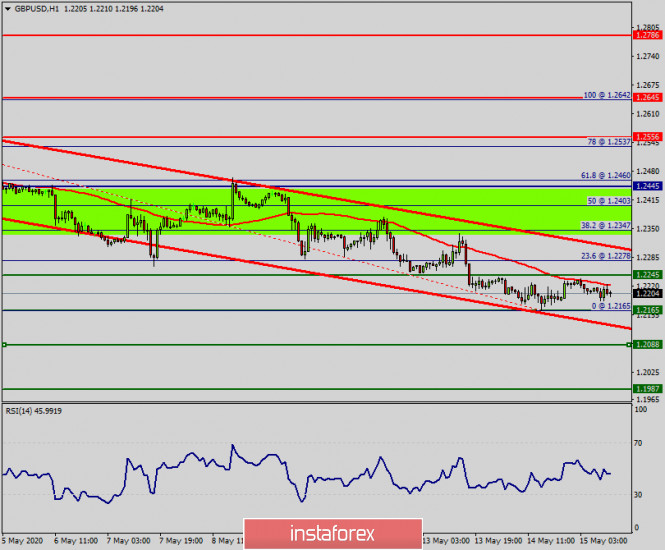

- GBP/USD. May 15. COT report: major players amplify the "bearish" mood. Bear traders still need to take the level of 1.2184

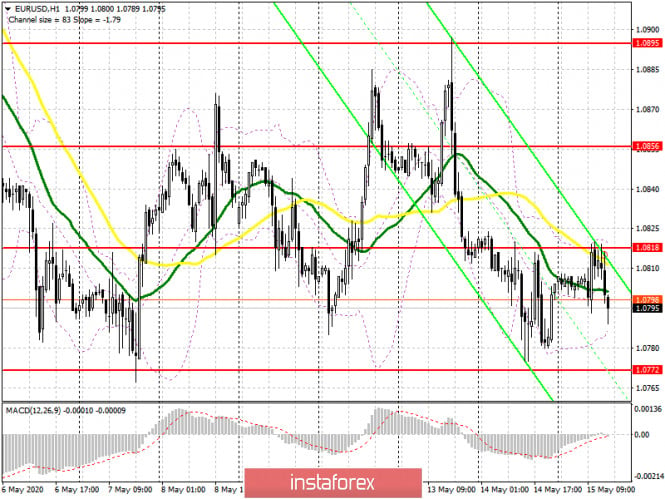

| Posted: 15 May 2020 12:14 PM PDT 4-hour timeframe Average volatility over the past five days: 70p (average). The EUR/USD pair began a new round of correctional movement on Friday, May 15. However, the correctional one is only for formality, since there is no trend right now, and therefore movement in the side channel cannot be called corrections. Yes, even though the pair has been stubbornly trading over the last few days of the consolidation channel 1.0750 - 1.1000, the price still cannot leave it. Moreover, in recent days this channel has narrowed to 100 points and now trading takes place in the 1.0774 - 1.0882 range. Thus, we have at our disposal not just a consolidation channel, but an open flat. Today, when macroeconomic data were published only in the EU and the US, the euro/dollar rose in price for the euro and the pound/dollar rose in price for the dollar. Given the fact that macroeconomic data were weak in both the European Union and the United States, it is surprising that there is no correlation between the two main pairs. But this fact allows us to conclude that the macroeconomic background continues to be ignored by market participants. Or traders react very selectively to reports. In the second case, the picture does not become easier, since it is impossible to predict in advance which report will be ignored. GDP in Germany for the first quarter in a preliminary estimate was released today. According to this report, GDP fell by 2.3% in annual terms, which isn't a lot. But the fact that the German economy most staunchly opposed the coronavirus was not a secret. Thus, the German economy is likely to suffer the smallest losses among all EU member states. Afterwards, a similar indicator was published in the European Union. Things were worse here than Germany, and GDP declined 3.2% on an annualized basis. However, firstly, these figures are not final, that is, the final values may be worse, and secondly, GDP may continue to slow down in the second quarter, although many countries begin to weaken quarantines. In general, any contraction in the economy is a contraction, which is bad for the currency. However, the euro has been growing against the dollar since the morning, so we conclude that traders have ignored GDP data. In the afternoon, overseas data on retail sales came in, which not only turned out to be bad, but was just completely disappointing. The main indicator of retail sales decreased in April by 16.4% m/m, retail sales excluding automobile sales decreased by 17.2%, and the retail control group lost 15.3%. Market participants were expecting almost half as weak data. Industrial production also lost more than 10% in April, namely 11.2%, but traders were ready for such losses. Immediately after their publication, the European currency accelerated its growth, therefore, it is possible that these reports, and only in the euro / dollar pair, were won back by market participants. Meanwhile, the news flow from the White House does not stop for a single day. Today we learned that Donald Trump lost five of his acquaintances because of the coronavirus epidemic, two of whom were friends. Trump did not disclose who exactly died from his circle of friends. And on the one hand, this statement can be considered as Trump's acknowledgement, and on the other hand, the US president can once again mislead Americans and the whole world, as has already been done several times. Recall that a few months ago, YouGov calculated that Trump makes approximately 14.7 false or untrue statements on the day. Everyday. Therefore, the "Trump's friends" may be ordinary porters in one of his hotels. We do not claim that Trump did not lose anyone, but such a message may be designed to bring the American president closer to the American population, which has already lost more than 80,000 of its fellow citizens. 4-hour timeframe Average volatility over the past five days: 117p (high). The GBP/USD pair continued its downward movement on May 15 and it fell to the second support level of 1.2164 by the end of the day. This is the lowest level of April 7 and, most likely, it will be overcome today. If this happens, the pound/dollar pair will leave the side channel and begin forming a new downward trend. Market participants continue to ignore macroeconomic data. For example, today two quite important reports were published in the United States, which turned out to be absolutely disastrous. Nevertheless, it was the US dollar that continued to rise in price on the last trading day of the week. The general fundamental background, it should be noted, does not remain on the side of the British pound, as in the UK a serious economic contraction is expected due to the coronavirus crisis, as well as due to Brexit, due to the lack of trade deals with the European Union and the United States, for Boris Johnson's reluctance to extend the transition period. Thus, even in conditions when all the economies in the world are experiencing serious problems, the British remains one of the first places on this list. Consequently, the pound coils fall again, to the lows of March 20 - about 1.1411. Recommendations for EUR/USD: For short positions: The EUR/USD pair started a new upward movement and worked out the critical Kijun-sen line on the 4-hour timeframe. Thus, it is recommended to consider selling the euro while aiming for the 1.0780 - 1.0750 range just in case the price rebounds from the Kijun-sen line. For long positions: It is recommended to open new long positions in small lots with the aim of the Senkou Span B line, if traders overcome the critical line. Recommendations for GBP/USD: For short positions: The pound/dollar pair continues a rather strong downward movement. Thus, traders are advised to sell the pair with targets 1.2078 and 1.2062. For long positions: It is recommended that purchases of the GBP/USD pair be considered with a view to the Senkou Span B line after consolidating quotes above the critical line, but in small lots. The material has been provided by InstaForex Company - www.instaforex.com |

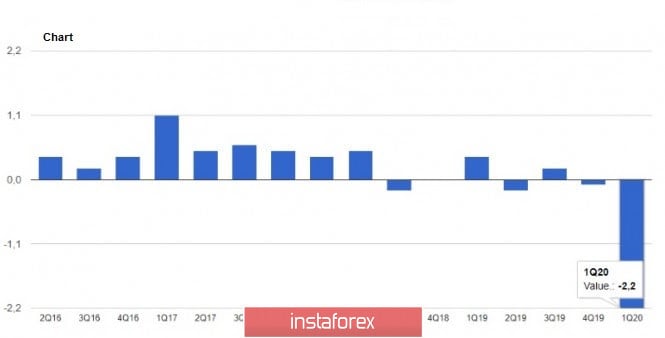

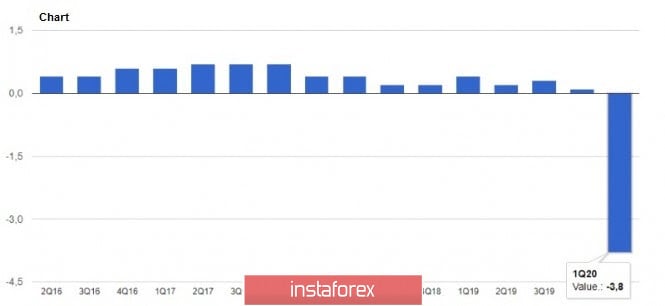

| Posted: 15 May 2020 12:14 PM PDT The stock market in Europe has been on the rise today. Most indices rose in price. The reason for all the positive attitude of market participants from America. Recall that yesterday's trading session has become one of the strongest in recent years. China also added some positive news, as it was able to achieve the best pace in industrial production, despite very modest forecasts. The German DAX index rose 1.3%, the French CAC 40 index also rose 0.9%, and the UK FTSE index, which grew 1.2%, did not lag behind. Pleased with the market data on the growth of industrial production in China. It is reported that this indicator became 3.9% higher in April compared to the previous month. Moreover, the growth rate of industrial production in reality turned out to be much higher than the expected values. Most analysts were inclined to believe that they could not rise above 1.5%. The increase in positive dynamics may indicate that China's industry, contrary to estimates, is moving to a process of active recovery. Some fears can only be caused by the fact that retail sales in the state have plunged quite seriously, their decline amounted to about 7.5%. But even this could not spoil the mood in the market. However, not without negativity. Thus, Germany's GDP unexpectedly seriously declined. The fall amounted to 2.2%, such figures have not been recorded for more than ten years since the crisis of 2009. At the same time, the Asian stock market remained indecisive from news of the strengthening of the Chinese economy. So, the Shanghai Composite index became slightly higher - by 0.02%, which was some compensation for the fall that occurred with it a day earlier. The Shenzhen Component Index, by contrast, declined 0.04%. The Hong Kong Hang Seng Index followed, which fell 0.35%. Japan's Nikkei 225 Index posted an increase of 0.05%, while Korean KOSPI fell 0.02%. However, the Australian ASX 200 Index achieved the most significant results, an increase of 0.87%. The Asia-Pacific region, in addition to data on industrial production in China, also estimated other statistics. So, the attention of investors was focused on the total number of unemployment claims in the United States of America. Recall that their number for the current week reached 2.981 million, and this reflects an increase of 36 million. In addition, tensions between the US and China continue to worsen amid accusations by President Donald Trump towards his Chinese counterpart. Recall that the US leader believes China is guilty of the widespread spread of coronavirus infection, under the influence of which the economies of many countries of the world are collapsing. So far, none of the analysts has decided to judge what this tension will lead to and what sanctions against China will take effect. However, it is already clear that this process itself confuses market participants by limiting their actions. There is also serious pressure on concerns about the new wave of the COVID-19 pandemic. Many experts believe that the removal of quarantine measures is too premature. One way or another, analysts believe that in the short term, forecasts are more than favorable, but long-term ones may be in deep negative. Naturally, this does not add to the positivity of investors who still prefer to work discreetly in the market. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD-1.0 Waiting for the euro to be on par with the dollar? Posted: 15 May 2020 12:14 PM PDT Hello. The world is gradually plunging into the chaos of negative interest rates and sliding into a swamp of economic stagnation. Unemployment in the United States has reached 36 million. Central banks and governments are feverishly seeking a way out of this situation. The economy hit the bottom, but continues to slide into the abyss of depression, and only stock markets, bouncing cheerfully from the lows, returned to last summer's figures. There has been a relative lull in the foreign exchange market, following the jump in volatility back in March, which can explode in a storm and parity between the euro and the dollar, which analysts and traders have been talking about for many years, may come true much earlier than we expect, for example, this fall. This is of course just a hypothesis, but I have grounds for this assumption, with which I will introduce the readers of this article. To begin, let's recall the fundamental tenets of the forex market, which, despite all the efforts of central banks to turn the world upside down, continue to work. All things being equal, investors prefer the US dollar; Any investment is compared to an investment in government treasury bonds; Since you and I live in the era of the US dollar, which is the globally recognized equivalent of value, there must be good reason for investors or ordinary citizens to keep money in other currencies. A resident of Europe is unlikely to want to have a dollar in his pocket, because he simply does not need it. Goods in European stores are not sold for dollars; services within the EU are not sold for dollars. However, considering investment opportunities, a resident of the European Union will immediately see that investing in dollars will bring him more income than investing in euros. So, at least, it was before the start of the Covid-19 epidemic. And now, investments in Europe are associated with significant difficulties. An international investor acts from a different position, on the contrary, he needs the greenback, because he can get everything that his heart desires using the dollar, while he can buy only a limited amount of assets with the euro. In other currencies, the situation is even worse, assets denominated in RMB, pounds, or rupees are catastrophically small, and most importantly, investing in these assets, the investor acquires additional currency risk. So why should an investor buy the euro, where for several years now, government bond yields have been negative, the situation with the coronavirus epidemic is not much better than in the United States, and there are very few stock assets showing stable growth. The depreciation of the euro that we observed in 2018-2020 was a reflection of the difference in interest rates between the euro and the dollar. It would seem that now, when the rates in these currencies are practically equal, the markets should go into the trading range, but you need to clearly understand that a priori - the euro is the dominant currency, and the dollar is the dominant currency, and while the situation in the eurozone will be the way it is now or worse, the euro will be under pressure. For the sake of objectivity, it should be noted that foreign investors are now actively leaving the US market. This is clearly seen in Open Interest (OI) in the euro futures contract traded on the CME. According to the Commitment of Traders report (COT), OI in the futures of the euro decreased from 754 to 605,000 contracts since March 13, and the total position of institutional investors decreased by a third, from 305 to 226,000 contracts. However, this rather means a loss of interest of European investors in investments in dollars, rather than an increase in the desire to invest in euros. So how are things in Europe? The prospects for the eurozone are now significantly worse than those of the United States. According to the IMF forecast, according to the results of the COVID-19 epidemic, the European economy will fall by 7.5%, while the US economy will fall by about 5%. Thus, in the current situation, the euro is doomed to stay in a downward trend simply because Europe cannot offer investors anything attractive right now. Of course, you need to understand that the central banks strictly monitor exchange rates, and Donald Trump will not fail to reproach the European Union for manipulating exchange rates, and promises to introduce duties against it. However, in the fall, Trump will not be in the EU, he would win the election and stay for a second term, so the euro has a window of opportunity for reduction. Moreover, in conditions of falling demand, dumping, including currency dumping, is a good way to conquer markets. However, Saudi Arabia did not succeed. From a technical point of view, the EURUSD currency pair has been in a declining trend since 2018, and in March - April 2020 formed a graphic "pennant" figure, which, according to the postulates of technical analysis, should be broken down by the size of a flagpole, which is about 800 points. If this happens, the course will drop to the level of parity - 1 to 1. By the way, a similar situation was four years ago, when the US president just took office. Then, the EURUSD rate was also on the verge of parity, but through agreements and direct manipulations, the Federal Reserve and the European Central Bank managed to raise the euro to the level of 1.27 against the dollar. In general, it can be assumed that none of the parties is interested in depreciating, but now the conditions in the markets are somewhat different than they were in 2016-2017. It is possible that the US's European allies will decide to take advantage of Trump's election campaign or simply don't agree with the Fed in the face of a falling European economy, which could result in the European currency's collapse. Not the fact that this will happen, no one knows the future, including myself, but we need to take such a scenario into account. Risk of EU collapse, according to Black Rock Corp. Institute of Analysis The European Union is now very weak. Here is what the analysts of the Black Rock investment corporation write about this: - "After the initial disagreements in Europe, a united front emerged, characterized by a common approach to border control and export restrictions, as well as widespread unconditional support from the ECB to help finance costs, related to the pandemic. Efforts are currently underway to develop a comprehensive, significant and overall recovery strategy after isolation. Significant progress has already been made, but the shock is COVID-19, and the economic consequences will test the cohesion of the EU as never before. At the present time, we believe it unlikely surge of populism, but its renewal is likely once the acute phase of the outbreak will take place and will clear the scale of the economic damage." As we can see from the chart, a surge of negativity associated with the inability of the European Commission to respond quickly to the emerging crisis and tension between the Italian government and Brussels, trade contradictions and the uncertainty associated with Brexit create additional problems for Europe. Although in its history the European Union has experienced many crises, the economic consequences that have arisen after the pandemic, if they do not lead to the collapse of the EU, can significantly weaken the euro in the confrontation with the dollar. However, there is no doubt that the Euro-Atlantic elites will make every effort to prevent the collapse of the monetary union of the euro and the dollar. Be careful and cautious, follow the rules of money management. May the coronavirus pass us by! The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price making new 2020 highs as expected. Posted: 15 May 2020 12:09 PM PDT Gold price is making new 2020 highs as we expected from our previous posts. Gold price has first managed to recapture $1,700 which was a crucial pivot point and many battles were given there. Once support was solid, bulls broke above the lower highs trend line resistance.

Gold price remains in a bullish trend. We noted in our previous analysis that a break above $1,720 would bring price to new 2020 highs. Now $24 higher we are above the resistance trend line and still above both the tenkan-sen and the kijun-sen. Support is found at $1,716 and next at $1,694. The latter is the most important one. Gold price could continue higher towards $1,770-80 area before making at least a short-term top.

Green rectangle - target Gold price is making new highs. The weekly RSI is not. What does this mean? A reversal could come over the coming weeks. This reversal will be confirmed on a break below $1,694. As I explained in our latest posts, although I'm bearish Gold around $1,740-50, this time is different, because the break out pattern points to higher levels. $1,770-80 is very possible targets. Yes another bearish divergence may come, but I prefer to wait and look for short positions near that target green area. The material has been provided by InstaForex Company - www.instaforex.com |

| May 15, 2020 : Short-term technical analysis of USDJPY Posted: 15 May 2020 11:53 AM PDT USDJPY as we noted in a previous analysis was forming a downward sloping wedge pattern. Price has broken decisively above the wedge pattern producing a bullish signal. Price has now made a higher low and seems ready to start its next leg higher.

USDJPY is expected move higher towards 108.70-109. Short-term support is found at 106.70 and as long as price is above this level we remain short-term optimistic. Resistance is at 107.80. I expect this price to be broken upwards next week followed by a move towards 108.50-109. As long as price is above 105.95 we remain optimistic for a bigger bounce higher. The material has been provided by InstaForex Company - www.instaforex.com |

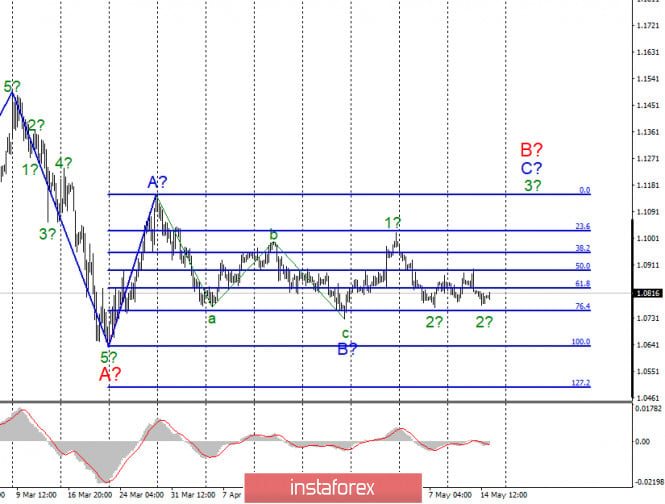

| May 15, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 15 May 2020 08:49 AM PDT

Few weeks ago, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibo Level 50%). Around the price zone between (1.1075-1.1150), a bearish Head & Shoulders pattern was demonstrated. That's why, Further bearish decline was demonstrated towards 1.0800 where the nearest demand level to be considered was located near the backside of the broken channel (1.0800-1.0750). Evident signs of Bullish rejection have been manifested around the price zone of (1.0800-1.0750) leading to the recent bullish spike up to 1.0990. The short-term technical bullish outlook remains valid as long as bullish persistence is maintained above the recently-established ascending Bottom around 1.0770. Further bullish advancement was expected to pursue beyond 1.1000 towards 1.1175 where 61.8% Fibonacci Level is located. Bullish breakout above 1.1000 was needed to enhance further bullish movement towards 1.1075 and probably 1.1150. However, lack of bullish momentum brought another recent bearish decline towards the depicted price zone around 1.0800. The price zone of (1.0815 - 1.0775) still stands as a prominent Demand Zone which can provide quite good bullish support for the pair. However, Any bearish breakdown below 1.0770 should be marked as an early Exit signal for all short-term BUY trades. Trade recommendations : Intraday traders are advised to consider the current bearish pullback towards the price zone of 1.0815 - 1.0775 as another valid short-term BUY trade. S/L should be placed at 1.0750 while T/P levels to be located around 1.0930, 1.1000 then 1.1075 if sufficient bullish momentum is maintained. The material has been provided by InstaForex Company - www.instaforex.com |

| May 15, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 15 May 2020 08:33 AM PDT

Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.1890-1.1900 (Double-Bottom Neckline) on the H4 Charts. Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April). Currently, Atypical Bearish Head & Shoulders reversal pattern may be in progress. The pair was recently demonstrating the right Shoulder of the pattern. Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. By the end of Last Week, Intraday traders were advised to wait for bearish pullback towards the price levels of 1.2300-1.2280 where a low-risk short-term BUY trade could be taken. The recently demonstrated Lower High around 1.2440 endangered the previously-mentioned short-term bullish scenario. That's why, the price zone of 1.2300-1.2280 failed to provide enough bullish support for the pair. Thus, the suggested short-term BUY trade was invalidated shortly after. The current bearish breakdown below 1.2265 should be taken into consideration as it confirms the previously-mentioned reversal-top pattern. Hence, further bearish decline would eventually be enabled towards 1.2020 as a projection target for the reversal pattern. Currently, the price zone of 1.2265-1.2300 (Backside of the broken Uptrend) stands as a recently-established SUPPLY-Zone to offer bearish rejection and a valid SELL Entry for the pair in the short-term. Trade recommendations : Intraday traders can wait for upcoming bullish pullback towards 1.2265-1.2300 for a valid low-risk SELL entry. T/P level to be located around 1.2150, 1.2100 and 1.2000 while S/L should be placed above 1.2265. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 May 2020 08:00 AM PDT The risks of the second wave of pandemics and an escalation of the US-China trade conflict have returned investors' interest in the dollar. As soon as the S&P 500 turned down, the rest of the G10 currencies lost strong support and began to remember their own weaknesses. The euro has plenty of them. Along with the recession, the inability of governments in the currency bloc to agree on ambitious fiscal stimulus (the use of resources of the European financial stability fund up to 2% of GDP seems a halfway measure) and unresolved issues for Brexit, it added an unexpected verdict of the German court on QE, which could trigger a constitutional crisis in the EU. The success of the US dollar could have been more significant if not for the rumors about the Fed's introduction of a negative federal funds rate and the reluctance of US stock indices to go south. If in April they grew thanks to hopes for a V-shaped economic recovery, in May, investors are in no hurry to get rid of stocks, even in the face of losing faith in a rapid rebound in GDP. I believe that one of the reasons is the outperformance of the S&P 500 and other "Americans" over their global counterparts. It shows that the United States is likely to get back on its feet faster than the rest of the world, which increases the chances of implementing the dollar smile theory. Dynamics of stock indices

"Bulls" for EUR/USD are strained by the mouse fuss over the relationship between China and the United States. It seems that the chief negotiators on both sides expressed confidence in fulfilling their obligations under the January agreement, but this was not enough for Donald Trump. Not only did the owner of the White House forbid the federal pension fund, which manages about $ 600 billion, to buy Chinese shares, but he also began to talk about a complete break in US relations with the Middle Kingdom. What happens in this case? According to the President, the United States will save $ 500 billion on foreign trade. At the same time, Donald Trump calls on the Fed to make a gift to the economy in the form of reducing the federal funds rate below zero. Although Jerome Powell and his colleagues reject this idea, the futures market still expects negative rates by June 2021. They say that recent history knows many examples when the Central Bank first resisted, and then did what the owner of the White House wanted. Along with the projected expansion of the Federal Reserve's balance sheet to $ 9.63 trillion by the end of next year, rumors of a drop in borrowing costs below zero do not allow the "bears" for EUR/USD to develop an attack. The main events of the week to May 22 are the releases of data on the German economic sentiment index from ZEW and European business activity from Markit. Leading indicators will give a hint on which way the Eurozone economy will go. Their growth will allow the euro to recover and create prerequisites for opening long positions on the breakout of the resistance at $ 1.09-1.091. Technically, the pivot level and the upper border of the "Rhombus" pattern are located near this area. On the contrary, sales of EUR/USD will become relevant in the event of a confident storm of support at 1.077-1.0775. EUR/USD, the daily chart

|

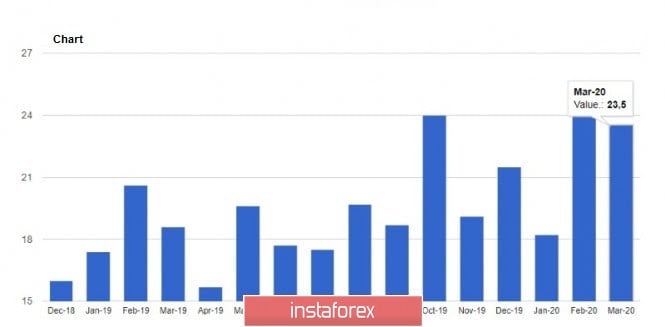

| EURUSD: Germany needs to save other Eurozone countries, otherwise its economy may suffer Posted: 15 May 2020 08:00 AM PDT Today, all the attention in the first half of the day was focused on data on the German economy, as market participants tried to understand how much it declined in the first quarter of this year when the pandemic only partially affected activity. Despite the fact that the German economy in the 1st quarter of this year showed the most significant reduction since the global financial crisis, there is a reason for some optimism. The coronavirus and the quarantine measures introduced in mid-March did not affect the economy much, at least compared to other European countries. According to the report of the Federal Bureau of Statistics of Germany Destatis, German GDP in the 1st quarter decreased by 2.2% compared to the previous quarter, which was much better than the forecasts of economists, who expected a fall of 2.5%. No one denies that in the 2nd quarter there will be a larger decline in economic activity, but the easing of restrictive measures, which will take effect from May 20 this year, may slightly smooth the indicators for the 2nd quarter of this year. The revised data also noted that German GDP in the 4th quarter of 2019 declined by 0.1%, while it was previously reported that it remained unchanged. It is already clear that the division of the northern and southern countries is not just being carried out. The north of the EU was less significantly affected by the coronavirus pandemic than the southern part of the region, where, for example, preliminary data on the reduction of GDP in Italy in the 1st quarter showed 4.7%, and in France, the same indicator fell by 5.8%. The Spanish economy is likely to lose 5.2%. Today's report on Germany once again reminded traders of the split that is now brewing in the ranks of the European Central Bank, where the north refuses to save the south at its own expense. No wonder the German Bundesbank can withdraw from the European bond repurchase program in 2.5 months. However, if you look from a different point of view, without a sharp recovery in the economies of other countries, and we are now talking about neighboring countries, the German economy will also lack the necessary momentum. The country is largely focused on exports, which will primarily suffer due to weak demand from southern countries. From this, we can conclude that if Germany does not want to continue to finance debts and inflate the budget deficit of the member countries of the Eurozone, then it will lose itself. Many experts believe that Germany has enough strength to support neighboring countries that have suffered more severe damage from the coronavirus pandemic. Today, the Eurozone GDP report was released, which did not make significant changes to the market, as it fully coincided with the forecasts of economists. According to data, the GDP of the Eurozone in the 1st quarter of this year decreased by 3.8% compared to the 4th quarter and by 3.2% per annum, which almost completely coincided with expectations. The Eurozone's foreign trade surplus continued to decline in March to 23.5 billion euros, compared to 25.6 billion euros in February. The changes were due to a sharper 8.9% drop in exports. As for the technical picture of the EURUSD pair, it did not change much in the first half of the day. A breakout and consolidation above the resistance of 1.0820 may increase the demand for risky assets, which will lead to an upward correction of the trading instrument to the upper border of the side channel of 1.0895. If the reports on the US economy fail to please market participants, the pressure on risky assets may return, which will lead to the breakdown of a large minimum of 1.0770 and further movement of the euro down to the area of 1.0700 and 1.0630. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 May 2020 06:25 AM PDT Corona virus summary:

threat of cutting ties Technical analysis: BTC has been trading downwards. As I expected yesterday,BTC traded downside and got solid rejection of the massive resistance at the price of $10,000. I still see potential for the downside towards the level of $8,140. The material has been provided by InstaForex Company - www.instaforex.com |

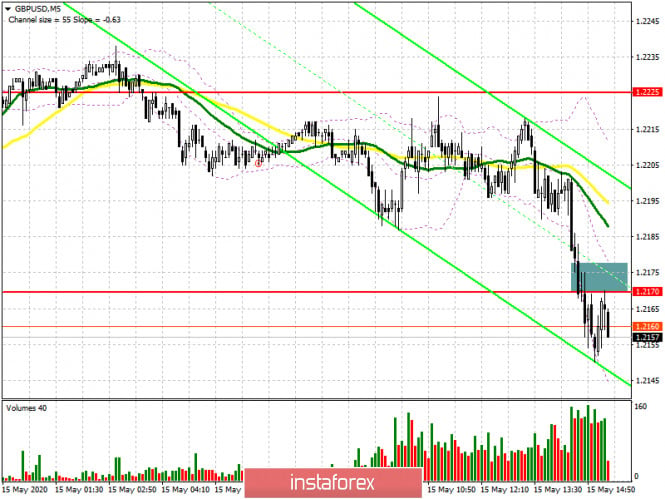

| Posted: 15 May 2020 06:05 AM PDT To open long positions on GBPUSD, you need: Unfortunately, in the first half of the day, such a sweet sell signal as it was in the European currency was not formed in the GBP/USD pair, and therefore only those who sold yesterday and followed the trend further remained in the market. At the moment, if you look at the 5-minute chart, you can see how the bears managed to take the level of 1.2170, from which buyers did not even make a single attempt to correct. An important task for the second half of the day will be to return the pound to this range, since only in this scenario can we talk about an upward movement of GBP/USD to the area of the morning resistance of 1.225 and count on updating the maximum of 1.2275, where I recommend fixing the profits. If after the release of the report on retail sales in the US, there will be no activity from buyers in the area of 1.2170, it is best to postpone long positions until the update of the larger lows of 1.2127 and 1.2030, counting on correction of 30-35 points within the day.

To open short positions on GBPUSD, you need: Bears have reached the support of 1.2170, and while trading is below this range, we can expect a further decline of the pair to the area of lows of 1.2127 and 1.2030, where I recommend fixing the profits. If the pressure on the pound is not formed at the beginning of the North American session, it is possible that speculative traders will rush to fix profits at the end of the week, which will lead to the pair's return to the level of 1.2170. In this scenario, it is best to count on short positions after an upward correction to the resistance area of 1.2225 or sell immediately on a rebound from the maximum of 1.2275.

Signals of indicators: Moving averages Trading is below the 30 and 50 daily averages, which indicates a continuation of the bearish trend. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower border of the indicator at 1.2155 will increase pressure on the pair, while growth will be limited by the upper border of the indicator at 1.2230. Description of indicators

|

| Posted: 15 May 2020 06:05 AM PDT To open long positions on EURUSD, you need: In my morning forecast, I recommended opening short positions after forming a false breakout in the resistance area of 1.0818. If you look closely at the 5-minute chart, you will see that buyers tried several times to break above this range, but each time they failed, which eventually led to a decrease in EUR/USD. However, a more powerful downward momentum was also not formed, as the data for the Eurozone fully coincided with the forecasts of economists, and ahead of the report on the volume of retail trade in the United States, which may cause a mess in the market. As for buyers, their task has not changed. A breakout and consolidation above the level of 1.0818 will lead to the continued growth of the euro in the area of 1.0856. The longer-term goal will be a maximum of 1.0895, where I recommend fixing the profits. Another important task is the support of 1.0772, where the formation of a false breakout in the second half of the day will be a signal to buy the euro. Otherwise, with worse data on the US economy, it is best to consider new purchases of the euro from the minimum of 1.0728 or open long positions immediately for a rebound from the support of 1.0636 in the expectation of correction of 30-40 points within the day.

To open short positions on EURUSD, you need: Sellers kept control of the level of 1.0818 and formed a false breakout there. While trading will be conducted below this range, we can expect to maintain pressure on the euro and reduce the pair to the lower border of the side channel 1.0772. The further direction of the market will depend on the breakdown of this level. If the bears manage to gain a foothold below this range after weak fundamental statistics for the US, then most likely, sales will increase, which will lead to a test of the lows of 1.0728 and 1.0636, where I recommend fixing the profits. If there is no serious downward movement in the second half of the day, it is best to postpone short positions until the test of the maximum of 1.0856 or sell immediately for a rebound from the resistance of 1.0895 in the calculation of correction of 30-35 points within the day.

Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 daily moving averages, which indicates the lateral nature of the market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the upper limit of the indicator around 1.0818 may lead to a larger increase in the euro. Bears will return to the market only after breaking the lower border of the indicator in the area of 1.0785. Description of indicators

|

| Posted: 15 May 2020 05:57 AM PDT Corona virus summary:

China marks one month with no new coronavirus deaths announcedChina has gone a month Technical analysis: Gold has been trading very strong to the upside as I expected.The price is close to reach my first upward target at the price of $1,746.I stil expect the price to continue with the upside and eventually test second target $1,789. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 May 2020 05:36 AM PDT Corona virus summary:

Technical analysis: The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: A weakening dollar, negative US rates and second wave of the coronavirus Posted: 15 May 2020 04:02 AM PDT

Fed Chairman Jerome Powell was the last in the parade of FOMC officials who turned their backs on the idea that the regulator could push the interest rates into negative territory. This allowed the USD index to stay above the psychologically important mark of 100 points. On Wednesday, Powell said that the Federal Reserve is not disposed to the introduction of negative rates, because the monetary policy tool has shown dubious effectiveness in Europe and Asia, and has the possibility of turning into an insurmountable obstacle to new bank lending. "Another major setback in the US economy may prompt the Fed to consider lowering interest rates on negative territory," experts at the Goldman Sachs believe. According to them, the trigger can be the second wave of the coronavirus pandemic, which can disrupt the upcoming recovery of the US economy. "In the event of a second wave of the coronavirus pandemic in the US, another strong recession may occur, which will open up the possibility of new assistance measures by the Fed," experts said. "Although we believe that even with this scenario, fiscal policy will come first, the Central Bank may want to try something new, especially if the economy has to fight the virus for a certain period. Therefore, the regulator may consider negative interest rates," they added.

An interest rate below zero in the United States may lead to the weakening of the dollar. But in the meantime, demand for the dollar as a defensive asset remains, since market participants fear that the recent rhetoric of US President Donald Trump could lead to the introduction of new import duties, which will further darken the prospects of global economic growth. As for the main currency pair, after the ups and downs in February-March, it, like a ship, sways along the waves, the amplitude of which is becoming smaller. The bulls failed to break above the level of 1.0900, and the attempts of the brears to overcome the support level of 1.0700 was unsuccessful as well. Obviously, the pair needs a fresh driver that could take it beyond the specified boundaries, but no such driver has been found yet. Meanwhile, the euro is supported by the growth of US stock indices, which were impressed by the decrease in the figure of unemployment in the country, as well as on the data in industrial production in China, which showed a 3.9% increase in April in annual terms. Retail sales and investments in China, on the other hand, continue to decline, as US President Donald Trump refuses to continue the negotiations with Chinese President Xi Jinping. Trump also seems to be considering a complete breakdown in relations with Beijing, since the tension between the two parties continues to escalate. The situation has brought naught but fears and nervousness to everyone, as everyone remembers how much negative the trade war between the United States and China brought for the export-oriented economy of the eurozone in 2018-2019.

Thus, the euro is unstable, and if it were not for the US stock indices clinging to any positive news, not for the factors of long-term weakness of the dollar, the EUR / USD pair would have long gone below the levels of 1.0770-1.0775. The colossal debt of the US, as well as the increase in the Fed's balance sheet to $ 9.29 trillion by December 2020, prevent investors from relaxing, and they are now acutely concerned on when it will be necessary to sell the dollar. "The US dollar, which is currently overvalued by 20%, could drop significantly in the foreseeable future as the global economy recovers," strategists at the Goldman Sachs believe. "US interest rates have been a major factor in providing good USD support over the past few years, and this source of support has now disappeared. Rates in the United States are now much closer to the minimum levels that we have seen in the rest of the world," they explained. Bloomberg experts estimate that at the end of 2020, the EUR / USD pair will value 1.12. Although it fell from the 1.15 expected in January, bulls still believe that the euro will recover, and the necessary conditions for it are the absence of trade war between US and China, as well as the rapid growth of the world economy in the second half of the year. In the meantime, the EUR / USD pair is enjoying the calm and does not intend to leave the borders of the trading range of 1.0700–1.0900. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for May 15, 2020 Posted: 15 May 2020 02:46 AM PDT A general review: The GBP/USD pair. Trend: sideways trend. The bias remains bearish in the nearest term testing 1.2202 or lower. Immediate support is seen around 1.2165. This week, the GBP/USD pair didn't make any significant movements yesterday. There are no changes in our technical outlook. A clear break below that area could lead price to the neutral zone in the nearest term. Price will test 1.2202, because in general, we remain bearish on May 15th, 2020. Yesterday, the market moved from its bottom at 1.2165 and continued to rise towards the top of 1.2202. On the one-hour chart, the current rise will remain within a framework of correction. However, if the pair fails to pass through the level of 1.2245 (major resistance), the market will indicate a bearish opportunity below the strong resistance level of 1.2245 Since there is nothing new in this market, it is not bullish yet. Sell deals are recommended below the level of 1..2245 with the first target at 1.2165 so as to test the double bottom. If the trend breaks the double bottom level of 1.2165, the pair is likely to move downwards continuing the development of a bearish trend to the level of 1.2080 in order to test the weekly support 2. At the same time, the breakdown of 1.2278 will allow the pair to go further up to the levels of 1.2445 in order to retest the weekly pivot point again (blue line). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 May 2020 02:10 AM PDT EUR / USD On May 14, the EUR/USD pair lost about 20 basis points, but could not reach the minimum of the expected wave 2 in C to B, stopping at a distance of several points from it. Thus, wave 2 in C in B can take on a pronounced three-wave form and, in any case, has already complicated its internal structure. The markets are clearly experiencing problems with the construction of an upward wave 3. And if the moment of its construction continues to be delayed, the entire wave picture may require adjustments and additions. Fundamental component: The entire information background on Thursday was reduced to a report on applications for unemployment benefits in the United States. Another week brought America another 3 million primary applications for benefits, and the total number of secondary applications (from people who have not been able to find work for some time) is already almost 23 million. This news is bad for the US economy, however, demand for US currency has not declined. Thus, the construction of the alleged wave 3 is still delayed due to low demand for the euro. This morning, a report on GDP for the first quarter was already released in Germany, which showed a decrease of 2.3% y / y. Now, it remains to find out how much the GDP of the entire eurozone has decreased. The corresponding report will be released soon. In the afternoon, markets will witness a report on US retail and the University of Michigan consumer confidence index. An April industrial production report will also be released. These data are unlikely to support the demand for the US currency, so, the quotes for the instrument may begin to rise in the afternoon. Moreover, the determination of China's guilt and the list of possible punishments for it by the White House are also taking place in America. At least, such conclusions can be drawn from recent interviews with Donald Trump and people as close to him as possible. Thus, the world may very well need to prepare for a new conflict between Beijing and Washington. General conclusions and recommendations: The euro/dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0%, or near the peak of wave A on a new MACD signal "up". At the same time, a successful attempt to break through the minimum of wave B will require corrections and additions to the current wave marking. GBP / USD On May 14, GBP/USD pair lost a few basis points and continues to decrease with great difficulty, thus resuming the construction of the expected wave C in 2 or B. A successful attempt to break the 38.2% Fibonacci level will further complicate this wave. At the same time, the entire wave 2 or B can take on a more elongated, 5-wave horizontal appearance. On the other hand, an unsuccessful attempt to break through the level of 1.2170 will indicate that the markets are not ready for further sales of the British pound and the transition to building an upward wave. Fundamental component: The Bank of England Chairman, Andrew Bailey, delivered a speech in the UK yesterday. The country's chief economist said that the Central Bank is not considering the option of introducing negative rates in the near future, but "everything is possible, especially in the current pandemic." Thus, the markets were able to exhale, however, strictly speaking, no one expected that the Bank of England would continue to lower rates, as the ECB did at the time. No economic reports are expected from the UK today. General conclusions and recommendations: The pound/dollar instrument is nearing completion of the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with targets around the 26th figure, counting on building a wave of 3 or C or d in 2 or B on a new MACD signal "up" or in case of an unsuccessful attempt to break through the level of 1.2170. At the same time, a successful attempt to break the level of 1.2645 will allow you to buy the pound more confidently. The material has been provided by InstaForex Company - www.instaforex.com |

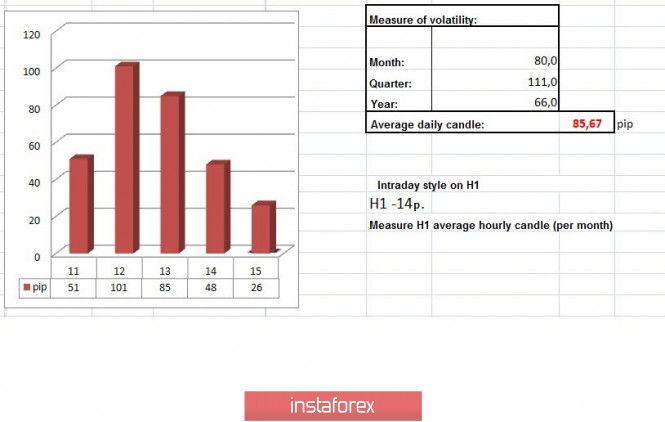

| Trading recommendations for EUR/USD pair on May 15 Posted: 15 May 2020 02:10 AM PDT From the point of view of complex analysis, you can see another touch of the control level, and now about the details. The trading week is coming to an end, where you can confidently say that it was not boring. The quote tested the range level of 1.0775 twice, and also worked out the variable level of 1.0885 in a row, as a result, having a conditional recovery formation. The restraint of the downward mood speaks for itself, where the level of 1.0775, which focuses on itself trading forces, no longer seems impassable, and this is the third attempt to break it since the beginning of the month. Thus, the chance of further downward movement is high, and the level of 1.0775 will soon be broken. Regarding the theory of downward development, which we have been adhering to for a long time, another proposition has appeared. So, an analysis was made of the comparison of the EUR/USD and GBP/USD currency pairs, where a positive correlation is known in history. The pound is now located near the control area of the interaction of trade forces 1.2150 / 1.2180, where in case of breakdown, the main downward movement can resume. In turn, the euro/dollar, as well as the pound/dollar, is at a critical level, which means the market direction is similar, where theoretically trading instruments can pull each other in a certain direction. Analyzing the past trading day every minute, you can see a low activity, where the quote with surgical accuracy produced a level 1.0775, after which a pullback occurred. As discussed in the previous review, the positions of traders were directed to the level of 1.0775, where the profit was taken. Further sales operations were planned after the price consolidated below 1.0760. Speculative operations on the rebound were also considered and may have been applied in the work of some traders. In terms of volatility, the lowest indicator for 24 trading days was recorded and this is in some sense considered a signal of readiness of market participants for the subsequent acceleration. A similar pattern is found on the pound/dollar pair, where a slowdown was recorded relative to previous periods. Considering the trading chart in general terms, the daily period, you can notice a sequence of descending paths that stretch from the month of March. At the same time, the last seven trading days had an increased concentration of trading forces between levels 1.0775//1.0850//1.0885, which indicated the process of accumulating short positions. The news background of the past day had another data on the labor market in the United States, where the symmetry with the Great Depression is cited, only now. So the number of initial applications for unemployment benefits was 2,981,000, which in terms of statistics is considered the lowest figure for 8 weeks, but in terms of common sense, it is still a very high value. In turn, the number of repeat applications was 22 833 000, and this is a new record. The market did not react to US statistics again, as it was in previous periods. The reason for the out of sync of fundamental analysis lies in the global risk caused by coronavirus. In terms of the general informational background, one can see a surge of activity regarding the relationship between the United States and China, which is more like a reality show created in order to distract the public from the global problems caused by the coronavirus. So, at first, US President Donald Trump swore at Beijing that they did not provide timely information on the epidemiological situation and the spread of COVID-19. After which, Trump expressed dissatisfaction that China does not comply with the implementation standards of the 1st part of the trade agreement. Now, during the Fox Business Channel broadcast, Trump threatened to completely break off relations between the United States and China by playing in public, so to speak. "We could do a lot of things. We could completely break the relationship. If you did this, what would happen? We would save $ 500 billion if we broke off completely," said Donald Trump. The head of state also added that he did not want to talk with Chinese President Xi Jinping now, and repeated that he did not intend to resume negotiations on a trade deal with China. Today, in terms of the economic calendar, they will publish the second estimate of European GDP, where the economic decline in the first quarter should be -3.3%. In the afternoon, the figures for retail sales in the United States will be published, where they expect a further decline from -8.4% to -12.0%. A little later, data on industrial production will come out, where the decline can accelerate from -5.5% to -16.4%. Analyzing the current trading chart, you can see a variable price fluctuation in the range 1.0775 / 1.0820, where the quote is in the stage of conditional pullback from the level of 1.0775. In fact, the followers of the downward development are still at the lead, where the concentration of trading forces is going through the roof, otherwise the quote would have gone from a pullback to a correction. Our theory of the downward movement remains the main strategy for the future, and now the main goal is to breakdown the level of interaction of trade forces 1.0775. At the same time, we must make a profit on our trading deposit and not sit around constantly on the fence, waiting for the theory to be executed. Thus, the local position is valid and it is not necessary to exclude a more significant rebound from the level of 1.0775, as it was a period earlier. The upcoming trading week in terms of the economic calendar contains a package of macroeconomic data in the European Union and the United States, where the quarantine measures introduced earlier are becoming more and more vivid in the economy. The most interesting events displayed below ---> Tuesday, May 19 USA 12:30 Universal time - The volume of construction of new houses (April) USA 12:30 Universal time - The number of construction permits issued (April) Wednesday, May 20 EU 9:00 Universal time - Inflation Thursday May 21 USA 12:30 Universal time - Applications for unemployment benefits USA 13:45 Universal time - Index of business activity in the manufacturing sector (PMI) (May) USA 13:45 Universal time - Business Activity Index (PMI) in the services sector (May) USA 12:00 Universal time - Sales in the secondary housing market (Apr) Friday May 22 EU 8:00 Universal time - Markit Manufacturing PMI (May) PRELIMINARY EU 8:00 Universal time - Business activity index in the Markit services sector (May) PRELIMINARY Further development It can be assumed that the temporary fluctuation is within the range of 1.0775/1.0820, where the tactics of work will be both the breakdown method and the rebound, in the case of a more significant change. Based on the above information, we derive trading recommendations: - We consider selling positions lower than 1.0760, towards 1.0700. - We consider buying positions in terms of local operations in consolidating prices higher than 1.0825, towards 1.0850. Indicator analysis Analyzing a different sector of time frames (TF), we see that the indicators of technical tools are prone to sales on hourly and daily periods, but in case of delaying the existing pullback / stagnation process, I do not exclude that hourly intervals will change indicators locally. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation calculated for Month / Quarter / Year. (May 15 was built taking into account the time of publication of the article) The volatility of the current time is 26 points, which is considered an extremely low indicator relative to the average daily value. It can be assumed that in case of breakdown of the main level, volatility will increase significantly. Key levels Resistance zones: 1.0850 **; 1.0885 *; 1,1000 ***; 1.1080 **; 1,1180; 1.1300; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support Areas: 1.0775 *; 1.0650 (1.0636); 1.0500 ***; 1.0350 **; 1.0000 ***. * Periodic level ** Range Level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

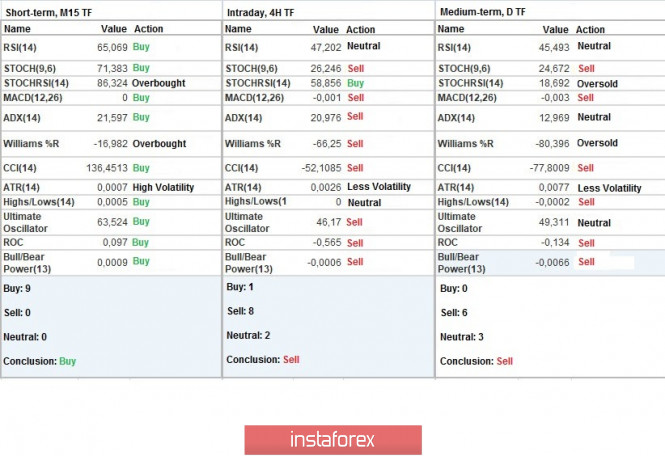

| Technical analysis recommendations for EUR/USD and GBP/USD on May 15 Posted: 15 May 2020 02:10 AM PDT Economic calendar (Universal time) Today, there are a lot of diverse statistics. You can highlight the following for the rest of the day: Basic retail sales index (12:30, USA); Retail sales (12:30, USA); The number of open vacancies in the labor market (14:00, USA). EUR / USD Retesting the historical support located at 1.0778 indicated a slowdown again. The players to decline failed to break through the level. As a result, the pair continues to remain in the zone of the established daily consolidation on the last working day of the week. The historical level of 1.0778 retains its significance, then bearish landmarks are located at 1.0727 - 1.0636 (minimum extrema + trend line). The resistance of the day cross led by Kijun (1.0873) today did not also change its location and significance. Yesterday, the support for the higher halves strengthened the first classic pivot level, this was the reason for the next slowdown and the development of an upward correction. The key low level resistance levels today are in the range of 1.0801 - 26 (central pivot level + weekly long-term trend). Consolidating above will give the advantage of lower halves to players increasing, while the pair will remain in the daily consolidation zone, so a significant change in the nature of the movement in the near future may not happen. Also today, the resistances of the classic pivot levels are located at 1.0827 - 1.0850 - 1.0876, while support is located at 1.0778 - 1.0752 - 1.0729. GBP / USD The pair failed to break through the support of the weekly Fibo Kijun (1.2214), closing the last day above the level. Today, the result is important and interesting when closing the week. The development of an upward correction can quickly return the pair to resistance 1.2309 - 24 (daily cloud + Tenkan). Consolidating above will return the benefits to players on the rise, whose interests will continue to rest on the final frontier cross lines (1.2406 - 63), strengthened by several other high-side resistance (1.2460 - 1.2540 - 50). A breakdown of the current support (1.2214) will make it possible to 100% develop the target for a breakdown of the H4 cloud and open the way to other landmarks. On H1, the pair is in the correction zone and is fighting for the central pivot level (1.2211). The next guideline for the development of the upward correction is the weekly long-term trend (1.2294). If you exit the correction zone and resume the decline, the intraday support will be the classic pivot levels 1.2135 and 1.2106. Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 May 2020 01:40 AM PDT EUR/GBP is trading in the green today and is fighting to confirm a further increase in the short term. EUR is quite strong today after the last two session's indecision, another higher high, a breakout above the 0.8876 level will suggest buying and further increase. The German Prelim GDP will be released later, the indicator is expected to drop by 2.2%, better than expected data from the Eurozone could support the EUR appreciation in the short term.

EUR/GBP has found strong support at 0.8682 level, it has tested and retested this level, confirming it as a strong downside obstacle. The price action has developed a minor triangle, the price has registered an aggressive breakout from this pattern, it has closed above the median line (ML) of the major descending pitchfork and now is challenging the R1 (0.8848) level. The price development could be considered also as a Double Bottom after the failure to close below the 0.8682 level, this pattern will be confirmed if the price closes above the 0.8863 static resistance.

Buy - EUR/GBP will validate an increase if it makes a valid breakout (close and stabilize) above the 0.8863 level. Another higher high, an increase above 0.8876 will give us a chance to buy this pair with a potential target at R2 (0.8999) level and higher at the inside sliding line (SL) of the major descending pitchfork. An upside breakout is favored after the median line (ML) retest, a strong consolidation above the R1 (0.8848) level and above the 0.8863 could signal a larger increase, even above the sliding line (SL), and above the R3 (0.9088) level, towards the upper median line (UML). Sell - The price seems strongly bullish in the short term, but EUR/GBP could drop again if it is rejected by the 0.8863 level. The pair is trading within an extended sideways movement, between the 0.8682 and 0.8863 levels, an upside false breakout with great separation or a bearish engulfing will signal another drop towards the 0.8682 support. The material has been provided by InstaForex Company - www.instaforex.com |

| Instaforex Daily Analysis - 15th May 2020 Posted: 15 May 2020 12:57 AM PDT Today we take a look at USDCAD and see how we are going to play the bounce! We use Fibonacci retracements, extensions, support/resistance, momentum and trend lines to identify trading opportunities in this exciting pair today! The material has been provided by InstaForex Company - www.instaforex.com |

| Pound: Is it time to reach the bottom? Posted: 15 May 2020 12:50 AM PDT The conflicting dynamics of the British currency from time to time confuses the market. A little earlier, the pound was gaining impulse confidently, but now it is sliding at the same pace. Experts fear that the pound will reach the bottom, and it will not have the strength to move. Analysts agree that the "British" currency still demonstrates the deepest drawdown among the currencies of developed countries. According to experts, many market indicators indicate that the worst for the pound is yet to come. Moreover, technical indicators on the charts along with the cost of options reflect the ever-increasing risk for the British currency. The chart, presented by analysts at Bloomberg, shows a figure called the "double top", which clearly signals the risk of a further decline of the GBP/USD pair. Based on technical analysis, the pound has already violated the so-called foundation line with the low closing price recorded at the previous session. According to experts, the nearest projected target could be the area from 1.1800 to 1.1900. Therefore, it is believed by the analysts that the pound may test the support levels around the $1.1850 mark in the near future. By the end of this week, the pound approached in a minor mood, showing a clear downward trend. This morning, the GBP/USD pair began quite cheerfully, remaining within the range 1.2212 - 1.2213. However, the strength of the pair ran out. Later, the GBP/USD pair headed down to the levels of 1.2206 - 1.2207. It can be noted that the pound declined by more than 3% last month, and its losses strengthened more this week. Experts believe that the reason for this is a sharp decline in macroeconomic data, indicating that the British economy could fall into a deep hole in the recession, the most intense over the past 300 years. And they emphasized that the situation is complicated by a prolonged and debilitating pandemic of the COVID-19 pandemic. Current negative factors significantly weaken the pound. The British currency was also supported by recent economic reports released on Wednesday, May 13. Despite the relatively positive background of these releases, they were unable to mask the deafening recession of the British economy. Experts fear a further worsening of the situation, since current data mainly reflect the economic picture of March, and the height of the COVID-19 pandemic in the UK fell in April 2020. Consequently, analysts are sure that new reports will be much worse, and the market should prepare for the next anti-records. According to experts, the "red" zone has covered almost the entire British economy. The growth of negative trends causes serious concerns of market participants. In addition, based on the reports, the country's GDP slipped by 2% on a quarterly basis and by 1.6% on an annualized basis in the first quarter of 2020. According to experts, the absolute decline in UK GDP over the reporting period was -7.7%, which is the most powerful decline since 2008, that is, since the global financial crisis. Experts draw attention to the sharp decline in British consumer spending by 1.7% compared with the previous quarter. Analysts note again that the last time such a failure was recorded at the end of 2008. In a state of shock, the market plunged the indicator of industrial production in the UK, which almost reached the bottom. According to the report, in March it hit 4.2%, which is the maximum drop since January 1971. At the beginning of this month, the April PMI for the country's manufacturing sector was published. In March 2020, it amounted to 47.8 points, but it was revised to a critical minimum of 36.6 points in April. However, shocking news for the market was the data on the PMI index for the UK services sector. Last month, it fell with a deafening crash to 13.4 points. Experts unanimously consider this a plummeting to the bottom. It can be recalled that the indicator was 34.5 points in March 2020, and a value below 50 points is critical for business activity. The total weakening of the British currency is caused not only by economic, but also by political factors. One of them is the "hanging" question about Britain's exit from the EU. To date, negotiations between London and Brussels have been paused, but before the pandemic, they also did not lead to a positive result. The parties could not reach a mutually beneficial compromise, so the "soft" Brexit is postponed indefinitely. Experts do not exclude the "hard" option for the country to exit the Eurobloc, which does not add optimism to the British currency. The combination of a number of negative fundamental factors exerts strong pressure on the GBP, which will continue in the near future. According to economists, the rapidly falling pound may lie at the bottom, however, it will be much more difficult for it to rise from the depths than just push off and move quickly upwards. Now, experts expect the pound to take decisive action, although they warn that the decline in the British economy will be much stronger than ever in the second quarter of 2020, and it will not be possible to return to pre-crisis levels until 2022. Against this background, the national currency will have to actively move around to stay on the surface, and there is no discussion about the increase yet, analysts sum up. The material has been provided by InstaForex Company - www.instaforex.com |

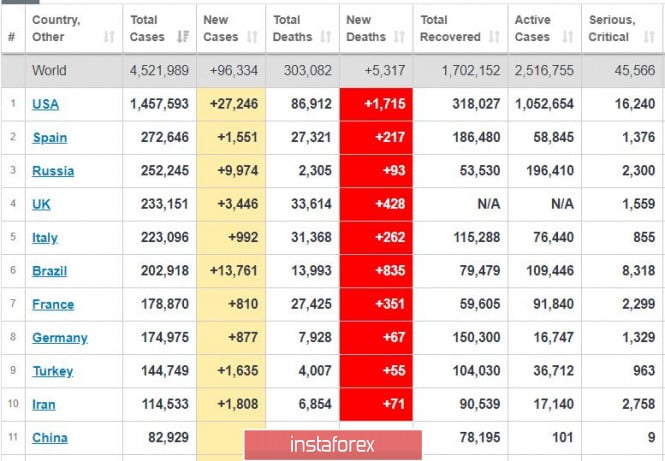

| Posted: 15 May 2020 12:44 AM PDT

Updates on the coronavirus as of May 14. The daily increase of new cases in Russia is still about 10 thousand. With such a figure, there are no doubts that by Monday, the country will overtake Spain and take the second place in the highest number of infections after the US. Meanwhile, Brazil records a daily increase of new infections by about 14 thousand per day, to which in 3-4 days, the country may take the 4th place in the highest number of cases in the world. The pandemic has mostly receded in Europe, and many countries are starting to open their economies. The most difficult situation is still in Britain. The US is also in the process of opening its economy, but the pandemic has not fallen enough there.

S&P 500: Optimism despite the reality. Unemployment has grown over the week by a whopping 3 million people. Fed Chairman Jerome Powell warned of a possible prolonged economic downturn, but investors still believe on a quick recovery.

EUR/USD: The pair failed to consolidate below 1.0870. Movement today may either be upwards or downwards. Open sell positions from 1.0825, stop at 1.0870. Open buy positions from 1.0900. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 May 2020 12:40 AM PDT EUR/USD – 1H.

Hello, traders! On May 14, the euro/dollar pair made a consolidation under the upward trend corridor on the hourly chart. Thus, the mood of traders, according to this signal, has changed to "bearish", and the process of falling quotes can be continued today. Meanwhile, all the world's media continue almost to broadcast live from the White House, where the American leader, Donald Trump, shares new comments every day about China and possible sanctions against it for the spread of coronavirus across the planet. Of course, "all over the planet" does not interest Donald too much, but "all over America" - very much. According to the latest statements of Trump, the US can generally stop any cooperation with Beijing for an indefinite period. This will be the answer to China's inappropriate behavior on the issue of the pandemic. Also, do not forget about the bill of one of the Republican senators, which will allow the President to impose serious sanctions against China, Chinese officials, and Chinese companies, severely restricting their access to American markets. EUR/USD – 4H.

As seen on the 4-hour chart, the quotes of the euro/dollar pair fall again to the ascending trend line and a new rebound from this line. This time, the quotes rolled back up very slightly and in the coming hours may make a new attempt to consolidate under the trend line. In this case, on this chart, the mood of traders will also change to "bearish", and so far it does not confirm the readings of the hourly chart, so the further fall in quotes is questionable. Today, the divergence is not observed in any indicator. Closing the euro/dollar exchange rate under the trend line will increase the probability of continuing to fall towards the next Fibo level of 0.0% (1.0638). EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed a new consolidation under the corrective level of 23.6% (1.0840), which is not a strong level at this time. Thus, according to this close, the drop in quotes can be continued in the direction of the lower line of the descending corridor, but this signal is weak and the 4-hour chart does not yet confirm it. EUR/USD – Weekly.

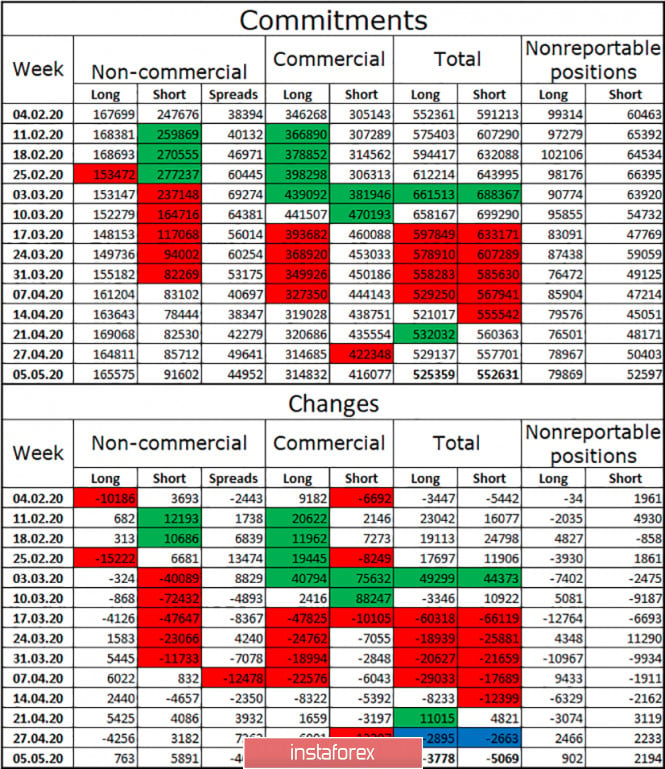

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to count on some growth in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and a new, possibly long fall. Overview of fundamentals: On May 14, a report on primary and secondary applications for unemployment benefits was released in America. It turned out that the number of the first increased by another 2.98 million, and the second was 22.8 million. However, the US dollar did not come under pressure from traders after this report. News calendar for the United States and the European Union: Germany - change in GDP (08:00 GMT). EU - change in GDP (11:00 GMT). US - change of the volume of retail trade (14:30 GMT). US - change in the volume of industrial production (15:15 GMT). On May 15, several major reports are planned, but most attention will be drawn to the report on GDP in the European Union for the first quarter. It is expected that the figure will decrease by 3.3% y/y and 3.8% in the previous quarter. COT (Commitments of Traders) report:

The latest COT report again showed minimal changes. In the reporting week of May 5, major players increased short-contracts, the number of which increased by 6,000. Speculators bought the euro currency very reluctantly, only +763 contracts. Thus, for three weeks in a row, large speculators have increased sales for euros, although the total number of long contracts remains twice as large as short and over the past 7 weeks, the "Non-commercial" group has increased them too. Thus, we can say that both types of contracts are in demand among large traders. During the reporting week, the "Commercial" group got rid of short contracts. In general, during the reporting week, the number of both long and short contracts decreased (due to the closing of opposite positions "spreads" and short positions by hedgers). And the overall advantage remains with sales contracts. Forecast for EUR/USD and recommendations to traders: I suggest that new sales of the euro currency be made after the pair closes under the upward trend line on the 4-hour chart with the goal of 1.0638. I still do not recommend buying a pair, even if it breaks away from the trend line. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 May 2020 12:38 AM PDT GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair continues to fall in quotes within the downward trend corridor, due to which the current mood of traders is characterized as "bearish". Thus, today the process of falling can be continued. Closing the pair's rate above the descending corridor will allow traders to count on a reversal in favor of the British currency and some growth, the goals of which can be obtained on the senior charts. Meanwhile, there is very little economic news from the UK again. They weren't there yesterday, and they won't be there today. However, the other day the network got information about a certain document that provides a detailed report for the British government on the economic consequences of the COVID-2019 pandemic. According to it, the UK economy will lose from 300 to 500 billion pounds, which is from a third to half of its GDP. Thus, on top of Brexit, the British economy may also face huge financial losses due to the epidemic, in which Britain suffers the greatest human losses among European countries. GBP/USD – 4H.

As seen on the 4-hour chart, the pound/dollar pair fall to the lower line of the sideways trend corridor, from which it rebounded for the first time, however, it is now making a new attempt to consolidate under it. Closing the pair's exchange rate below this line will allow traders to expect a further fall in the direction of the corrective levels of 38.2% (1.2095) and 23.6% (1.1834). No indicator has any pending divergences today. The final rebound of the pair from the corridor line will work in favor of the British currency and the beginning of growth in the direction of the corrective level of 61.8% (1.2516). GBP/USD – Daily.

On the daily chart, the pair's quotes fell to the corrective level of 38.2% (1.2215). The rebound from this level, combined with the rebound from the lower line of the corridor on the 4-hour chart, allows traders to expect a reversal in favor of the British currency and some growth in the direction of 1.2463. However, there is no release on this graph yet. GBP/USD – Weekly.

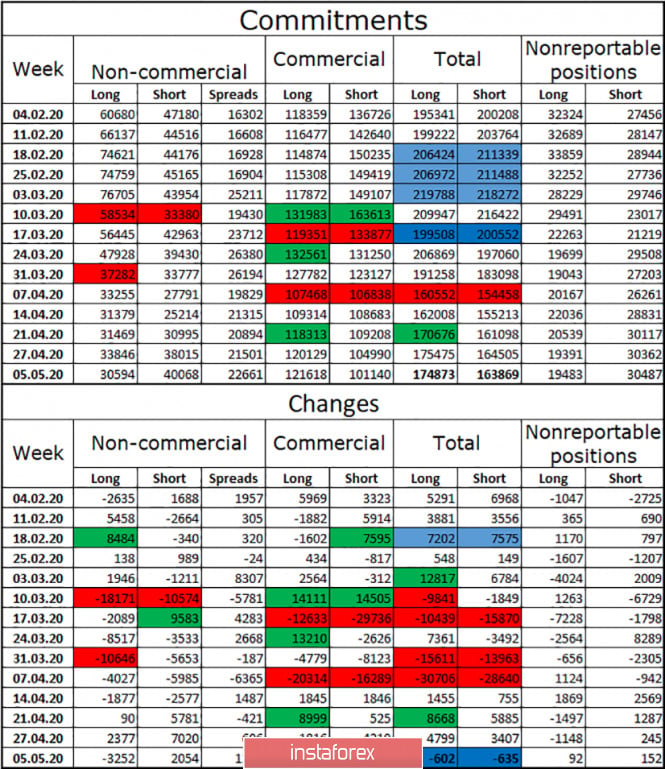

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of the top two trend lines, but in the long term. Overview of fundamentals: On Thursday, the UK hosted a speech by Bank of England Governor Andrew Bailey, in which he said that he was not going to reduce the key rate below zero. Jerome Powell, the Fed's President, has previously made a similar statement. However, this speech by the BA President did not support the British, it still continued to fall yesterday in pair with the dollar. The economic calendar for the US and the UK: US - change of the volume of retail trade (14:30 GMT). US - change in the volume of industrial production (15:15 GMT). On May 15, the UK's calendar of economic events is empty. In America, there are two relatively important reports on retail sales and industrial production, each of which may decline by 10%. COT (Commitments of Traders) report:

The latest COT report showed that professional market players were getting rid of long contracts (-3,252) and increasing short (+2,054). However, in general, all changes in the number of contracts in all groups of traders are minimal, no more than 4,000. Major players continue to prefer the euro to the pound. The "Commercial" group was mainly engaged in reducing short contracts, and in general, during the reporting week, both types of contracts lost only 600 units, that is, almost equal and at the same time the minimum number. In recent days, the British currency has clearly headed down, so the next COT report, which will be released today, may show a strengthening of the "bearish" mood among major players. Forecast for GBP/USD and recommendations to traders: I recommend selling the pound in the current conditions only after closing at 1.2184 (the lower line of the corridor) with the goals of 1.2095 and 1.1834. I recommend buying the British currency if it closes above the descending corridor on the hourly chart. Terms: "Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors. "Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations. "Non-reportable positions" - small traders who do not have a significant impact on the price. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |