Forex analysis review |

- Hot forecast and intraday trading signals for the GBP/USD pair for May 22. COT report. Bulls did not manage to go above 1.2270,

- Hot forecast and intraday trading signals for the EUR/USD pair on May 22. COT report. Bears stayed below the area of 1.0990-1.1008

- Overview of the GBP/USD pair. May 22. The British pound remains under pressure due to uncertainty about the future of the

- Overview of the EUR/USD pair. May 22. Donald Trump is predicted to suffer a major defeat in the 2020 election. The chances

- Gold price pulls back towards key short-term support

- USDCAD forms a descending triangle pattern

- Bank of Japan emergency meeting: preview

- May 21, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Comprehensive analysis of movement options for EUR/GBP, GBP/JPY, and EUR/JPY (H4) on May 22, 2020

- May 21, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Overview of EUR/USD and GBP/USD on May 21, 2020

- Analysis of EUR / USD and GBP / USD for May 21, 2020

- EURUSD and COVID-19: Mass production of the coronavirus vaccine will begin in September this year. Good indices on activity

- Evening review on EUR/USD for May 21, 2020

- Trading recommendations for the EUR/USD pair on May 21, 2020

- Analysis of Gold for May 21,.2020 - Watch for the downside movement for the completion of the C leg. The level of $1.725

- GBP/USD: plan for the American session on May 21 (analysis of morning deals). Buyers of the pound return to the level of

- EUR/USD: plan for the American session on May 21 (analysis of morning deals). Good PMI indices supported the euro.

- Positive sentiment in oil market prevails

- Dollar overtakes major currencies

- GBP/USD analysis for May 21, 2020 - Completion of the ABC downward correction and start of the new upward swing ? Watch for

- BTC analysis for May 21,.2020 - The drop on BTC started and conifmed our downside view. Downward target is set at the price

- EUR / USD: Franco-German Recovery Fund and US-China trade war

- EUR/USD and USD/CAD: The Fed minutes weakened the risky assets. The Canadian dollar has an open potential for growth.

- USD/CHF overview and trading ideas for May 21, 2020

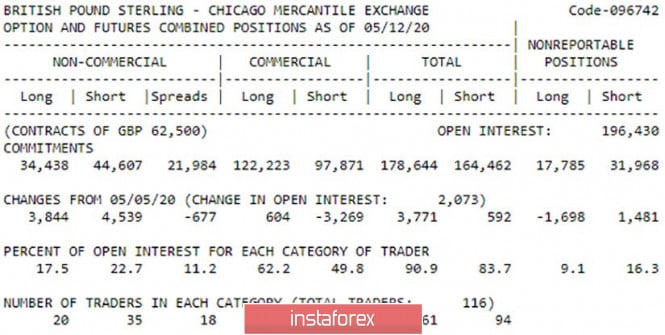

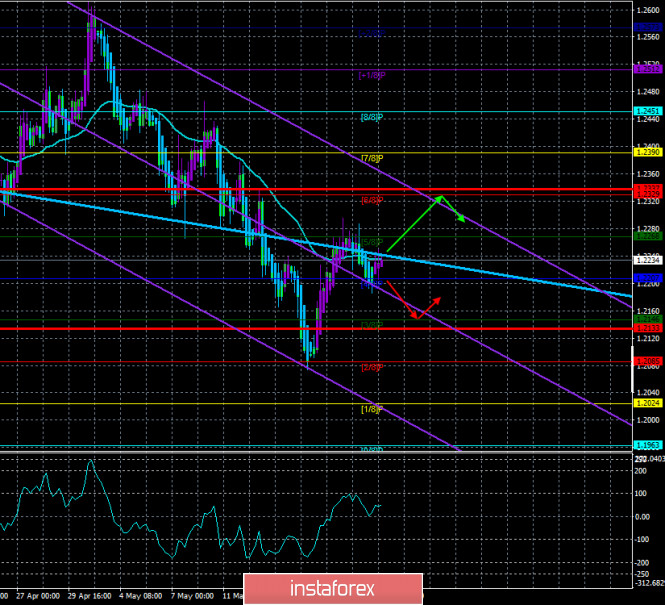

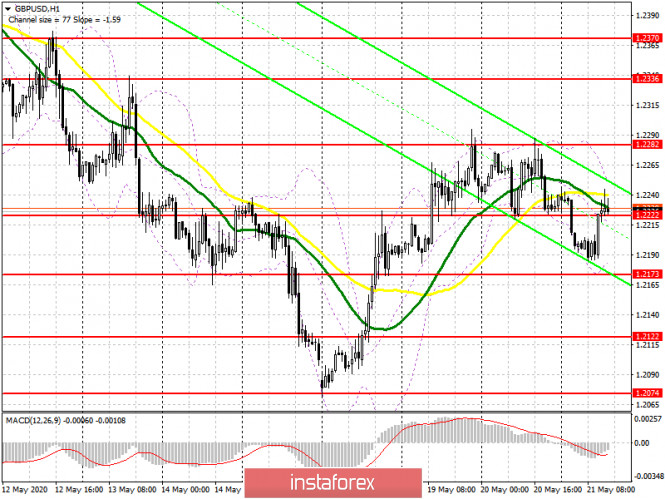

| Posted: 21 May 2020 05:32 PM PDT GBP/USD 1H Lateral movement was observed with a low downward slope on the hourly chart for the pound/dollar pair on May 21. In recent days, traders have not been able to cross the Senkou Span B line, so further upward movement is called into question. However, the bears also failed to cross the Kijun-sen line yesterday, so the resumption of the downward movement is still in question. By and large, now everything depends on which of these two lines traders will overcome. The GBP/USD pair is moving in that direction in the coming days. We believe that a downward movement is more preferable due to the general fundamental background, which is not in favor of the British currency. GBP/USD 15M The higher linear regression channel showed the completion of the upward trend in the short term, turning down on the 15-minute timeframe. But the minor channel of linear regression already signals the completion of the downward movement, at least it turned up. In general, the readings of both channels can be interpreted as uncertainty. Everything will depend on two more significant lines Kijun-sen and Senkou Span B on the hourly timeframe. COT Report The latest COT report for May 12 shows that the total number of buy and sell transactions among large traders per week increased by 4,000, mainly due to purchases. However, the total number of transactions for the purchase is still only 16,000 more than transactions for selling. Such an imbalance persists for a long period of time, and it was not enough for the pair to begin forming an upward trend. In the reporting week, professional traders opened more new deals for selling (4539), which means that most of them are waiting for a new fall in the British currency. A new COT report will be released today, according to which the mood of large traders is unlikely to change to the upward. The fundamental background for the British pound remains sharply negative. Despite the fact that the macroeconomic background is equally disappointing both in the United States and in Great Britain we believe that the UK economy continues to experience much more serious problems than the American one. Moreover, general uncertainty is again associated with the British economy. No one knows how, by what rules and with whom London will trade after 2020. There are no trade agreements with the EUR and the US yet. But investors and traders really do not like uncertainty and try to invest in the economies and currencies of those countries where everything is more or less clearly, clearly and well predicted. Thus, paired with the dollar and the pound, traders prefer to buy the dollar. A retail sales report is scheduled for Friday in the UK, and it is unlikely to support the British currency, even if traders want to work it out. We have two main options for the development of the event on May 22: 1) The initiative for the pound/dollar pair remains in the hands of the bears, despite the fact that the quotes have come out of the downward channel. Thus, we recommend buying the British pound not before consolidating the price above the Senkou Span B line - 1.2270 and, and, preferably, even the resistance level of 1.2325 with the first goal being the resistance area of 1.2404–1.2422. The next target, if this area is overcome, will be the resistance level of 1.2550. Take profit will be about 75 points in the first case and 120 points in the second. 2) Sellers are currently more likely to implement their plans. It will be enough to return the price to the area below the Kijun-sen line and the area of 1.2196-1.2215 to resume sales of the pair while aiming for the low of May 18 at 1.2073 and the support level of 1.1987. In this case, take profit will be about 105 and 190 points. The material has been provided by InstaForex Company - www.instaforex.com |

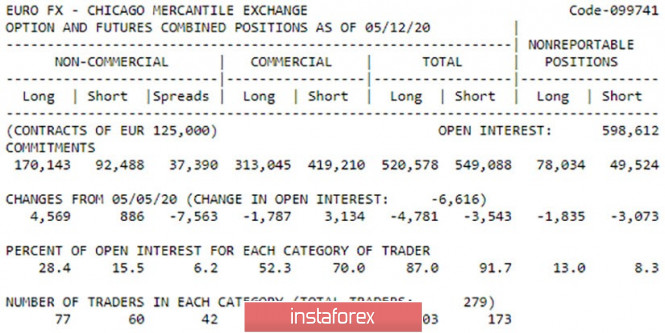

| Posted: 21 May 2020 05:31 PM PDT EUR/USD 1H The EUR/USD pair resumed the upward movement and worked out the April 19 high at 1.0990 on the hourly timeframe over the past day, as well as the resistance level of the 4-hour timeframe at 1.1008. The pair rebounded from these two levels, once again showing that the bulls did not have enough strength to form a new upward trend, and began a downward correction, which, according to the logic of things, should go into a downward movement inside the side channel of 1.0750-1.0990 that we have been relentlessly talking about in recent weeks. In any case, before traders overcome 1,1008, the downward movement and selling the pair are more relevant and probable. EUR/USD 15M We see a weakening upward trend on the 15-minute timeframe. The lowest linear regression channel has already turned down, and the higher is unfolding. This suggests that the fuse of the bulls has dried up and they need new reasons for buying the European currency and continuing the upward trend in the short-term plan. So far, everything suggests that the US dollar will continue to rise in price on the last trading day of the week. COT Report The latest COT report dated May 12 showed a new decrease in the number of buy and sell transactions among large traders, by 4,781 and by 3,554. Thus, the general mood of large traders remains bullish (the total number of purchase transactions is higher, 549,000- 521,000), in addition to this, traders managed to stay above the trend line on the 4-hour timeframe. Also, purchase positions increased among entities engaged in professional activities in the foreign exchange market (+4569 purchase transactions). A new COT report will be released today, and its numbers will show how the mood of large traders has changed over the past week. The previous report, we believe, is more than fulfilled. The fundamental background for the pair at this time remains neutral. This is why there has been a movement in the side channel in recent weeks (unlike, for example, the GBP/USD pair). The top officials of the United States and the European Union regularly appear in public, but their rhetoric, statements and decisions taken do not surprise market participants and, as a result, are not practiced. The coronavirus theme generally receded into the background. Many countries around the world have begun and continue to withdraw quarantine measures while doctors continue to warn of possible new waves of the disease. With a macroeconomic background, it is still easier. Traders have simply ignored it in recent months. In addition, no important macroeconomic publications are planned either in the US or the EU on Friday, May 22. Thus, we believe that nothing should prevent the pair from moving in accordance with the technical picture, that is, down. Based on the foregoing, we have two trading ideas for May 22: 1) It is possible for the pair's quotes to grow if we overcome the resistance range of 1.0990-1.1008, consisting of two corresponding levels. This will mean that the pair has left the side channel and is ready to form an upward trend with the first target, the March 27 high at 1.1147. Potential to take profit in this case will be about 140 points. 2) The second option - bearish - is more likely. You are advised to sell the euro from the resistance area of 1.0990-1.1008, not forgetting about stop loss in case the bulls still continue to push the pair up. There were already two rebounds from the designated area, so we recommend selling the Kijun-sen line (1.0904), Senkou Span B line (1.0831) and the upward trend line (1.0810) for the pair with targets. Potential to take profit in executing this scenario will be from 40 to 140 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 May 2020 05:08 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. CCI: 51.8021 The British pound spent the fourth trading day of the week in a downward movement and settled back below the moving average line, failing to overcome the Murray level of "5/8"-1.2268. Thus, the downward movement may continue on the last trading day of the week, according to the technical picture and the general fundamental background. We have already mentioned in the article on the euro/dollar that traders continue to ignore almost all macroeconomic publications, rightly believing that the economies of all countries of the world are experiencing approximately the same problems. But the fundamental background for the British pound remains particularly negative. Due to Brexit, the policy of Boris Johnson, the low probability of concluding trade agreements with the European Union and the United States. Remember, in the early years of Brexit, when a referendum was already held, but Parliament needed to agree on a breakup plan with Brussels, the pound was regularly cheaper due to commonplace uncertainty. Investors are afraid of instability and uncertainty, so as soon as there is a situation in which it is difficult to make any forecasts, immediately the currency of this country begins to feel pressure on itself. And now we are seeing approximately the same thing. Michel Barnier and David Frost said after the second round of talks that no progress was made again, exchanged mutual accusations and parted ways until the third, final round of talks, after which the parties will have to officially decide on extending the "transition period" on July 1. It is already clear that this period will not be extended. Thus, the future of the UK and its economy is once again shrouded in fog. On the one hand, the British Ministry of Trade said that 60% of goods will be removed from European tariffs. On the other hand, British goods imported into the EU (namely, the EU is the exporter of more than 50% of all goods from the UK) will be subject to tariffs and duties, according to the rules and regulations of the WTO. Thus, London will not be able to solve the issue of the absence of a trade agreement with the EU unilaterally. Plus, do not forget that the UK budget is already suffering so much from the break with the Alliance, and the "coronavirus" pandemic can cost the country from 30% to 50% of the budget according to various calculations. Thus, this missing money will have to be taken from somewhere. Either borrow or raise taxes, fees, tariffs, and other tools to replenish the state Treasury. Accordingly, it is quite difficult to predict what will happen in the country after 2020. That is why the pound is under pressure from traders in recent weeks, while the euro currency feels more or less stable, although the Eurozone has its own problems. On Thursday, the UK also published the index of business activity in the areas of services and products. The first rose from 13.4 to 27.8, and the second from 32.6 to 40.6. Thus, both business activity indices exceeded their forecast values. However, there was no reaction from traders to this data. On the last trading day of the week in Britain, a more significant indicator of retail sales for April is planned, which, according to forecasts, will fall by 22.2% in annual terms and by 16% in monthly terms. However, we believe that this report will be ignored, if only because a similar report in the United States and in the European Union showed approximately the same reduction. This is exactly what we were talking about. The dollar can't have an advantage based on a single report if a similar report in the United States is no better. Thus, on Friday, either the pair will resume its downward movement, according to the technical picture, or it will go flat and spend the entire day in a narrow price range. On Friday, traders can only track unplanned events. And of course, the main newsmaker will remain the US leader Donald Trump. In fact, even many American journalists treat the figure of the US President with irony, since most of his statements most fit the description of the word "fantasy". Most of the accusations coming from the odious leader are not supported by anything. One such recent statement from trump: "China is running a massive disinformation campaign because it really wants' sleepy Joe Biden' to win the presidential race. Then they can continue to pillage the United States, as they did for decades before I came." Thus, in just two sentences, Trump managed to insult Joe Biden, hinting that he would be a lousy president, and once again China. As always, no facts were provided to confirm Trump's words. Thus, all the main theses of the Donald can already be collected in a certain collection called "Trump's Mantra" and no longer read news feeds on the request "Donald Trump", as the American leader repeats the same thing every day. Although there is one more thing that the US leader does not lose sight of. Since the US is currently experiencing an economic shock and crisis, Trump switched from statements about how much the economy has grown under him, to statements about how amazing the next quarter, year, decade will be. "I think we will have a big transition period in the third quarter. I think we will have a very good fourth quarter and an incredible year," Trump said at a regular briefing at the White House. At the same time, the President's economic adviser, Larry Kudlow, said that the economy could grow by 21.5% in the third quarter, which would be the largest growth in the country's history. To be honest, it is even difficult to comment on the next "magnificent" statement of Trump. Naturally, the US President will stop mentioning the failed first and second quarters of 2020, the decline in which will not be able to cover the third and fourth quarters. In the near future, we can also expect new statements in the style of "China wanted to destroy us, but we survived and became even stronger, and it's all thanks to me."

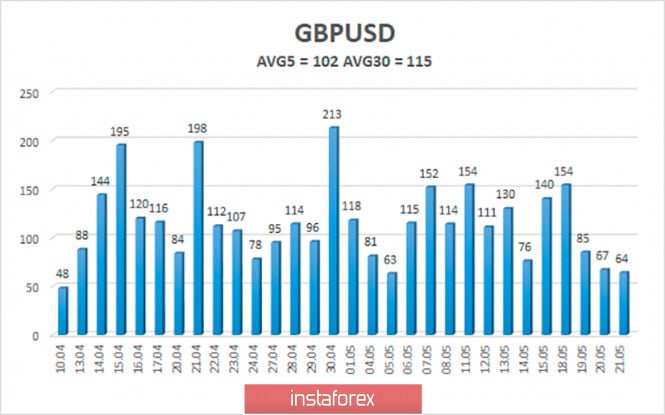

The average volatility of the GBP/USD pair has been steadily declining in recent days and is currently 102 points. On Friday, May 22, thus, we expect movement within the channel, limited by the levels of 1.2133 and 1.2337. A reversal of the Heiken Ashi indicator downwards will indicate a possible resumption of the downward trend. Fixing the price above the moving average will indicate the weakness of the bears. Nearest support levels: S1 – 1.2207 S2 – 1.2146 S3 – 1.2085 Nearest resistance levels: R1 – 1.2268 R2 – 1.2329 R3 – 1.2390 Trading recommendations: The GBP/USD pair on the 4-hour timeframe was fixed below the moving average, so the trend changed to a downward one. Thus, it is now recommended to trade the pound/dollar pair for a decrease with the goals of 1.2146 and 1.2085, but after the reversal of the Heiken Ashi indicator down. It is recommended to buy the pound/dollar pair if traders manage to return to the area above the moving average and after overcoming the Murray level of "5/8"-1.2268, with goals of 1.2329 and 1.2390. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 May 2020 05:08 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 64.2523 The EUR/USD currency pair finished the penultimate trading day of the week as we expected. Traders did not immediately start a downward movement, and finally worked out the area of the $ 1.10 level once again, which is still the area of the upper line of the side channel. Thus, having worked out the third resistance level on the Ichimoku indicator this week - 1.1008, the pair performed a downward turn and began a sharp and quite strong downward movement. Based on this, we assume that the bulls have exhausted their potential and now the quotes of the euro/dollar pair will rush down. According to the "linear regression channels" trading system, the situation is approximately the same. The pair worked out the Murray level of "4/8"-1.0986, which we also called more than once, and rebounded from it. Now it is expected to move down to the moving average line, overcome it, and move further to the level of 1.0750. The macroeconomic background of the last day was quite interesting, but at the same time, most of the published statistics had almost no significance in the current situation. We have repeatedly said that traders do not pay attention to most of the reports, but trade each pair based on the general fundamental background (for example, it is negative for the British currency, which is under pressure) and based on technical factors. In the case of the EUR/USD pair, "technique" is in the first place. However, several interesting indicators were published yesterday, so let's look at them briefly. The day started with the publication of business activity indices in the German services and manufacturing sectors. We will not elaborate on the figures, but we will only say that business activity has started to recover compared to the previous month, but it is still minimal. In the European Union, the situation is approximately the same. The service sector showed an increase from 12 to 28.7 and the manufacturing sector – from 33.4 to 39.5. However, much more interest was aroused by the publication of applications for unemployment benefits in the United States. According to this report, the number of primary applications for the week of May 15 was 2.4 million, and the total number of secondary applications for May 8 was 25 million. These 25 million are considered the real number of Americans who have lost their jobs in recent months. A little later, data on business activity in the US were published, and here the picture is approximately the same as in Europe. Both areas showed improvement compared to April. Now let's analyze the movement of the currency pair during today's day. In the European trading session, when weak business activity indices were released, the euro was growing, and in the US, when the next failed unemployment report was released, the dollar was growing. From this we draw the same conclusion as before: market participants ignore macroeconomic statistics. The fundamental background for the EUR/USD pair is more interesting. For example, yesterday the contents of the minutes of the last meeting of the Federal Reserve became known. According to this document, the Federal Reserve is considering additional opportunities to stimulate the economy and expects that the recovery will be long and unstable. The minutes also said that low rates will continue until the economy begins to show a confident and strong growth rate. It is also reported that members of the monetary committee of the Fed do not consider the possibility of negative rates, despite the fact that this option is supported by Donald Trump. Members of the FOMC are afraid of new waves of the epidemic, which can negatively affect economic activity and further slow down the recovery process. "The Committee may further clarify its intentions regarding its future monetary policy decisions at upcoming meetings," the minutes said. Thus, we see that the US Central Bank is setting itself up for a long recovery and understands that the situation with the "coronavirus" may escalate again at any moment. Meanwhile, analysts at Oxford Economics provided their report and forecast of the results of future US elections. According to this analysis, which is conducted before every election, and has only shown the wrong result twice since 1948, Donald Trump will be defeated in the election in November. The forecast model uses data such as the country's unemployment rate, income, and inflation. According to this model of analysis, Donald Trump will get about 35% of the vote in November. Interestingly, the same analysis conducted before the crisis gave Trump 55% of the vote. The report also says that Trump's key trumps were leveled by the crisis. Economic growth, unemployment, and the labor market - this is what the current US President can no longer boast to voters. The report also says that seven states, which regularly fluctuate between Democrats and Republicans, are the most affected by unemployment and the economic downturn. We are talking about Iowa, Wisconsin, Missouri, North Carolina, Ohio, Pennsylvania, and Michigan. So these states are expected to vote for Joe Biden. In fact, other analysts have come to similar conclusions, including us. Donald Trump is well aware that in the current conditions it will be extremely difficult for him to win and continues to pour mud on everyone who comes to hand. The speaker of the House of Representatives, the Democrats, personally Joe Biden, China are all to blame for what is happening in the United States. For example, Trump's latest tweets say that "China is guilty of mass murder around the world". It means that it was China that spread the "coronavirus" around the world, which has already led to more than 329 thousand deaths. In principle, the American President has no choice but to criticize and blame... On the last trading day of the week, neither the United States nor the European Union has any reports or important news scheduled. This means that nothing should prevent traders from trading in accordance with the technical picture. Thus, we expect a downward movement on Friday, May 22. As a safety net, we recommend considering the option with a new upward movement not earlier than a confident overcoming of the 1.1008 level.

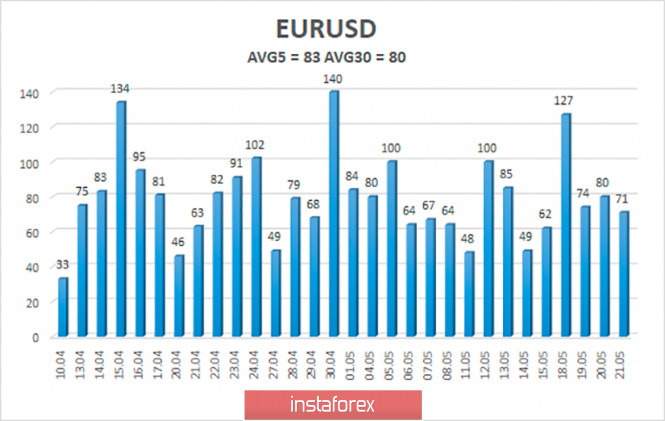

The average volatility of the euro/dollar currency pair as of May 22 is 83 points. Thus, the value of the indicator remains stable and is characterized as "average". Today, we expect quotes to move between the levels of 1.0877 and 1.1043. The upward turn of the Heiken Ashi indicator may signal a new attempt by traders to break out of the channel of 1.0750-1.0990 through its upper border. Nearest support levels: S1 – 1.0925 S2 – 1.0864 S3 – 1.0803 Nearest resistance levels: R1 – 1.0986 R2 – 1.1047 R3 – 1.1108 Trading recommendations: The EUR/USD pair started a correction. The level of 1.1000 has already been worked out twice, so there is a high probability of the pair turning down and turning a downward movement within the side channel of 1.0750-1.0990. Thus, it is recommended to consider selling the pair with the goal of 1.0750. Buy orders are recommended to be considered only above the level of 1.1008 with targets of 1.1047 and 1.1108. For more confidence to sell the euros it will be possible after overcoming the resistance. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price pulls back towards key short-term support Posted: 21 May 2020 02:49 PM PDT Gold price is trading around $1,727 where we find the first support by the tenkan-sen Daily indicator. Key support remains at $1,710-$1,700 area where we find the kijun-sen and the broken downward sloping resistance trend line.

Gold price is back testing the Ichimoku cloud indicators and the broken trend line resistance. Inability to hold above $1,710-$1,700 will open the way for a push towards $1,650-30. Price remains above the kijun-sen. As we explained in previous posts, Gold price might be still in a daily up trend, technicals however show us that price is vulnerable at the area of $1,750-70. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD forms a descending triangle pattern Posted: 21 May 2020 02:44 PM PDT USDCAD since mid March has been making lower highs starting from 1.4343, while the last lower high is at 1.4141. At the same time price is pulling back towards 1.3850 and so far we have seen 3 lows in the same price area.

USDCAD has formed what we call a descending triangle pattern. Price so far respects support and this increases the chances for another bounce towards the upper triangle boundary. Usually this kind of formations break to the downside, but unless we see a clear break down of 1.3850 we should not ignore bulls. Key resistance is at 1.4120. The material has been provided by InstaForex Company - www.instaforex.com |

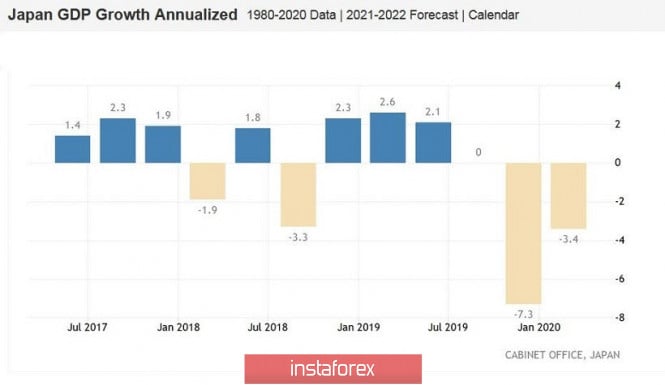

| Bank of Japan emergency meeting: preview Posted: 21 May 2020 12:09 PM PDT The Bank of Japan will hold an emergency meeting tomorrow. As a rule, members of the Japanese regulator do not hold meetings in May - after the April meeting, there is a June meeting. But, to paraphrase a Latin expression, we can say that "desperate coronavirus times require desperate measures." Therefore, Harukiko Kuroda decided to convene the Board of Governors of the central bank a month ahead of schedule. The official notice states that the BOJ will hold a policy meeting to "approve a new lending program to support businesses during the coronavirus crisis." A rather dry and uninformative wording, which, nevertheless, caused some excitement in the market - after a weekly flat within the range of 106.80–107.40, the price of USD/JPY jumped to the 108th figure, however, it could not gain a foothold there: the weakened dollar played a cruel joke with the buyers of the pair. At the same time, contrary to many dollar pairs, USD/JPY did not follow the general trend and maintained its positions near the boundaries of the current price level. It is also worth noting that the 10.10 mark corresponds to the upper border of the Kumo cloud and at the same time to the upper line of the Bollinger Bands indicator on the daily chart. Therefore, if traders can gain a foothold above this target, the Ichimoku indicator will form one of its strongest signals, the Parade of Lines, and the bulls will have access to the next resistance level of 109.10 (the upper limit of the Kumo cloud is already on the weekly chart). This scenario is very likely, especially if Kuroda surprises the market with his ultra-soft decisions at tomorrow's meeting. The formal reason for the emergency meeting was the release of data on the growth of the Japanese economy. Japan's GDP index suddenly fell by 3.4% in the first quarter. The key indicator has been declining for two consecutive quarters, so from a technical point of view, we can say that the Japanese economy has plunged into recession. And although the indicator came out slightly better than the forecasts (most experts predicted a decline to 4.6%), in fact, this fact did not change anything. On a quarterly basis, GDP slowed by 0.9% (against the consensus forecast of -1.2%). But the figure for the fourth quarter was revised downward to -7.3%. The structure of the release indicates a reduction in personal consumption (in quarterly terms, the indicator decreased by 0.7%), capital expenditures (a decline of 0.5%) and export volumes (by 0.6%). It is worth noting that this is the first recession in the last five years, and the country's economy was not affected by the coronavirus crisis in the fourth quarter of last year, since the COVID-19 virus appeared only in November-December 2019. Part of the economic downturn is due to tax policy. After the sales tax was raised in Japan, consumer spending collapsed by three percent at once. Business investment also declined significantly. Similarly, exports showed weak dynamics. The coronavirus factor joined all the economic problems in the first quarter of 2020. Therefore, according to the overwhelming majority of experts, the Japanese economy will show negative dynamics in the period of April-June, indicating the reality of a recession. The BOJ could not ignore such disappointing statistics. The downward trend has become stable, so the regulator is likely to move from words to deeds tomorrow. Last week, Harukiko Kuroda warned that the central bank "will not hesitate to ease monetary policy again if circumstances require it." He clarified that the regulator may expand the asset purchase program or lower rates. At the same time, he admitted that the Japanese economy "for some time" will remain in a difficult state. According to many experts, the BOJ will expand QE at the meeting, but will leave interest rates unchanged. But in my opinion, the risk of lower rates is quite high. It is worth recalling that back in July 2018, the Japanese regulator expanded the range, or rather, the limits of long-term interest rates - this allows the regulator to go deeper into the negative area at any meeting. However, the central bank does have other additional levers of influence in its arsenal. Thus, if the Japanese regulator confines itself to QE expansion tomorrow, the yen may demonstrate short-term weakness, and the pair will temporarily jump to the middle of the 108th figure. But if Kuroda still decides to lower rates, then the pair's growth will take a protracted character. In this case, the yen will weaken to the level of 109.10 (the upper border of the Kumo cloud is already on the weekly chart), indicating a new price horizon in the form of the 110th figure. The material has been provided by InstaForex Company - www.instaforex.com |

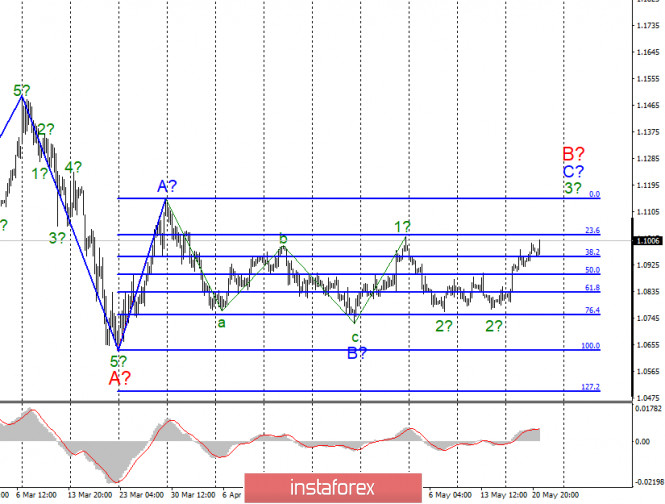

| May 21, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 21 May 2020 09:05 AM PDT

Few weeks ago, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibo Level 50%). Around the price zone between (1.1075-1.1150), a bearish Head & Shoulders pattern was demonstrated. That's why, Further bearish decline was demonstrated towards 1.0800 where the nearest demand level to be considered was located near the backside of the broken channel (1.0800-1.0750). Evident signs of Bullish rejection have been manifested around the price zone of (1.0800-1.0750) leading to the recent bullish spike up to 1.0990. The short-term technical bullish outlook remains valid as long as bullish persistence is maintained above the recently-established Demand Zone around 1.0770. On May 1, Lack of bullish momentum around 1.1000 lead to another bearish decline towards the depicted price zone around 1.0800. However, the price zone of (1.0815 - 1.0775) has been standing as a prominent Demand Zone providing quite good bullish support for the pair so far. Currently, bullish breakout above 1.1000 is needed to enhance further bullish advancement towards 1.1075 and 1.1175. On the other hand, any bearish breakdown below 1.0770 should be marked as an early Exit signal for all short-term BUY trades. Trade recommendations : Intraday traders are advised to wait for bullish breakout above 1.1000 as a valid BUY signal. T/P levels to be located around 1.1075 then 1.1175 if sufficient bullish momentum is maintained while S/L to be located below 1.0950. The material has been provided by InstaForex Company - www.instaforex.com |

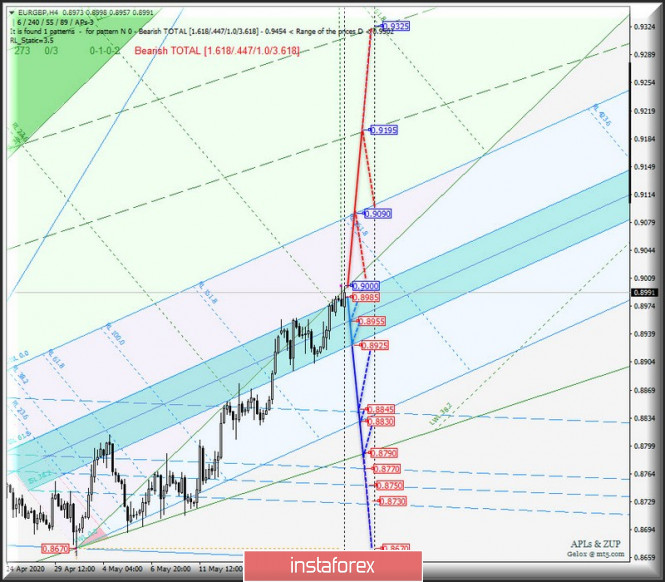

| Comprehensive analysis of movement options for EUR/GBP, GBP/JPY, and EUR/JPY (H4) on May 22, 2020 Posted: 21 May 2020 08:50 AM PDT Minuette operational scale (H4) The main cross-instruments EUR/GBP, GBP/JPY, and EUR/JPY in the H4 timeframe - options for the development of the movement from May 22, 2020. ___________________ Euro vs Great Britain pound The development of the movement of the "main" EUR/GBP cross-instrument from May 22, 2020 will be determined by the direction of the breakout of the range:

When the ISL61.8 Minuette breaks the 0.8985 support level, the movement of the "main" cross instrument will again occur in the equilibrium zone (0.8985-0.8955-0.8925) of the Minuette operational scale fork, and in the case of a breakdown of the ISL38.2 Minuette (0.8925), the downward movement of EUR/GBP can be continued to the goals:

The breakdown of the initial line of the SSL of the Minuette operational scale fork - the resistance level of 0.9000 - will determine the option to continue the development of the upward movement of EUR/GBP to the goals:

The options for the EUR/GBP movement from May 22, 2020, depending on the working out of the above range, are shown on the animated chart.

____________________ Great Britain pound vs Japanese yen Starting on May 22, 2020, the movement of the GBP/JPY currency pair continues inside the channel 1/2 Median Line (133.95-131.60-129.20) of the Minuette operational scale fork with respect to the direction of the breakout of the range:

A breakdown of the support level of 131.60 at 1/2 Median Line Minute will determine the development of the GBP/JPY movement in the 1/2 Median Line channel (131.60-131.00-130.45) of the Minuette operational scale fork with the prospect, after the breakdown of the lower border of the channel 1/2ML Minuette (130.45), the continuation of the downward movement of this cross-tool to the goals:

In the event of an ISL38.2 Minuette breakdown - resistance level 131.90 - further development of the GBP/JPY movement will continue in the equilibrium zone (131.90-132.70-133.50) of the Minuette operational pitchfork with the prospect of reaching the upper boundary of the 1/2 Median Line (133.55) of the Minuette operational scale pitchfork and local maximum 135.42. From May 22, 2020, we look at the GBP/JPY movement options on the animated chart.

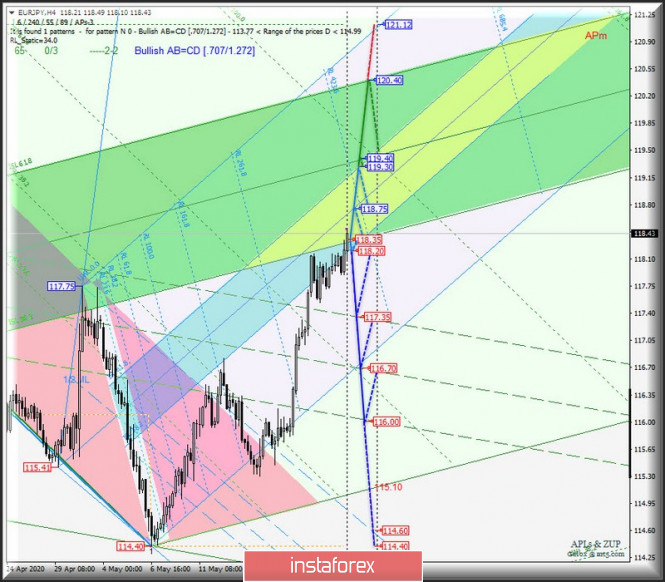

____________________ Euro vs Japanese yen The movement of the cross-pair EUR/JPY from May 22, 2020 will depend on the development and direction of a zone boundary equilibrium (118.20-118.75-119.30) of the Minuette operational scale fork - see the animated chart for opening the borders of this zone. A breakout of the lower border ISL38.2 equilibrium zone of the Minuette operational scale fork - support level of 118.20 will direct the downward movement of the EUR/JPY to the borders of the channel 1/2 Median Line (117.35-116.70-116.00) of the Minuette operational scale fork. In case of breaking the resistance level of 119.30 - the upper bound ISL61.8 equilibrium zone of the Minuette operational scale fork together with the Median Line Minute (119.40) the movement of EUR/JPY may continue to the upper limit of ISL61.8 (120.40) equilibrium zone of the Minuette operational scale fork with the prospect of achieving maximum 121.12. The markup of the EUR/JPY movement options from May 15, 2020 is shown on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| May 21, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 21 May 2020 08:19 AM PDT

Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April). Currently, Atypical Bearish Head & Shoulders reversal pattern may be in progress. The pair was recently demonstrating the right Shoulder of the pattern. Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. By the end of Last Week, Intraday traders were advised to wait for bearish pullback towards the price levels of 1.2300-1.2280 where a low-risk short-term BUY trade could be taken. The recently demonstrated Lower High around 1.2440 endangered the previously-mentioned short-term bullish scenario. That's why, the price zone of 1.2300-1.2280 failed to provide enough bullish support for the pair. Thus, the suggested short-term BUY trade was invalidated shortly after. The current bearish breakdown below 1.2265 should be taken into consideration as it confirms the previously-mentioned reversal-top pattern. Hence, further bearish decline would eventually be enabled towards 1.2020 as a projection target for the reversal pattern. Currently, the price zone of 1.2265-1.2300 (Backside of the broken Uptrend) stands as a recently-established SUPPLY-Zone to offer bearish rejection and a valid SELL Entry for the pair in the short-term. Trade recommendations : As mentioned before, Intraday traders can consider any bullish pullback towards 1.2265-1.2300 for a valid low-risk SELL entry. T/P level to be located around 1.2150, 1.2100 and 1.2000 while S/L should be placed above 1.2340. The material has been provided by InstaForex Company - www.instaforex.com |

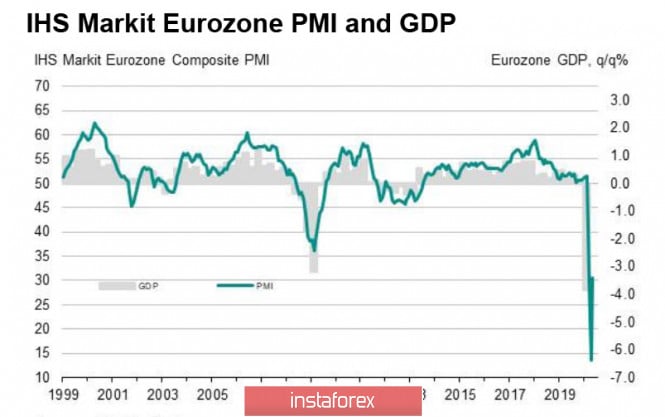

| Overview of EUR/USD and GBP/USD on May 21, 2020 Posted: 21 May 2020 07:07 AM PDT US labor market data may be a cold shower for those who believe in renewed growth due to the completion of quarantine measures. The growth of initial applications gained to 2.438 thousand, repeated more than 25 million, which is significantly worse than forecasts. The US economy has not yet begun its recovery, and stock indices at the opening are likely to go into the red zone. EURUSD As you would expect, the May PMI indexes from Markit confirmed a clear improvement in the business climate, noted in a similar study from ZEW. The general mood can be expressed in one phrase - it is expected that the summer will begin an economic recovery. PMI indices both in the manufacturing sector and in the services sector are still deep in the negative zone, but investors regard the dynamics as positive and assume that the bottom was fixed in April and the phase of economic growth begins. Only this can explain the fact that the PMI is 28.7p. (service industry) or 30.5p. (manufacturing sector) are perceived as optimistic.

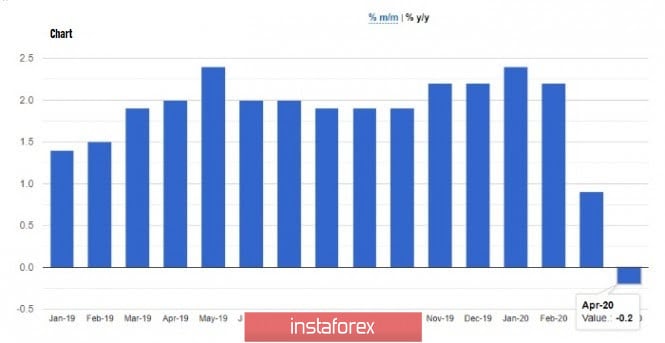

The proposal by France and Germany to create a fund of 500 billion euros to support the economies of the eurozone countries supports the euro, contributing to a growing interest in risk. It is important here that the ECB, with which the Bundesbank is in opposition, involves the implementation of similar measures. The only question is under whose direction will the restoration of the eurozone goes. Who will receive dividends from process management is the main issue, and the need for large-scale incentives is not denied by either side. This means that in any case, risky assets will receive support. Objectively, the situation is in favor of the euro, EURUSD may break the resistance of 1.1017 and go beyond the range, in this case, growth to 1.1150 at the current impulse is possible. If the resistance persists, then the likelihood of a rollback to intermediate support 1.0830 / 40 will increase. GBPUSD On Wednesday, the UK placed government bonds with negative yield, the placement volume is low, and this placement was made for the first time in history and gives investors reason to believe that the Bank of England will nevertheless introduce negative rates at one of the next meetings. One of the reasons voiced is a sharp decline in inflation. This is not entirely true as in April, the consumer price index graduated to -0.2% m / y year-on-year, price growth slowed down to 1.4%, that is, even quarantine could not lower inflation lower than in the United States and most countries of the eurozone. Moreover, is the coronavirus to blame? As shown in the graph below, inflation has been slowing for three consecutive years, that is, it has deep economic roots, and is not at all a consequence of the pandemic.

Here is a CBI report that is much more informative. According to the latest monthly research by CBI Industrial Trends, production volumes for the three months to May fell at the fastest pace in the history of research (since July 1975). Production fell in 15 of 17 sectors, and industrialists expect the decline to continue in the next three months. The manufacturing sector is not preparing to improve the situation, as might be expected from the PMI Markit results, but to reduce it further. In addition, average sales prices are expected to fall at the fastest pace since April 2009 over the next three months. It turns out that quarantine measures are lifted, a revival of business activity is expected, and prices, on the contrary, will decline. Therefore, issuing bonds with negative returns is not a response to the current pandemic crisis, but a response to a combination of reasons in which a pandemic is only one of many and probably not even the main one. The pound is trying to roll back from the low of 1.2077 formed on May 18. The general growth of optimism helps strengthen the GBP, however, the resistance zone 1.2245 / 65 has not been overcome, the trend remains bearish, the probability of movement to 1.2182 and further to 1.2077 is high. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of EUR / USD and GBP / USD for May 21, 2020 Posted: 21 May 2020 06:42 AM PDT EUR / USD On May 20, the EUR / USD pair gained about 50bp and thus continued construction supposed wave 3 in C in B. If the current wave marking is correct, then the increase in quotes will continue with targets located around 11 and 12 figures. And then a successful attempt to break the wave A maximum will confirm the intentions of the markets for further purchases of the Euro currency. In the near future, it is necessary to perform a successful attempt to break through the peak of wave 1 in C in B. Fundamental component: On Wednesday, the European Union released a report on the consumer price index for April which showed figures that are not very pleasing in the market. This is due to a large number of diverse news background at present, particularly inflation. The consumer price index, as expected, continued to decline and reached the level of 0.3% per annum. The core consumer price index fell to 0.7% y / y. However, in the evening a more important and significant event took place, which is the minutes of the last meeting of the Fed monetary policy committee. Markets are always interested in these kinds of events since the Central Bank can indicate which direction the economy will look in the next few months or years. And on May 20, it became known that the American economy will look towards zero interest rates in the next few years. The outcome of the meeting said that rates will remain unprecedentedly low until the US economy begins to recover. Moreover, this is not about minimal recovery after an obvious crisis. The economy should gain pre-crisis growth rates, only, in this case, we will talk about its tightening. Let me remind you that before the crisis caused by the pandemic, the key rate in the US was at 1.75%, and Jerome Powell and his colleagues did not increase, as the GDP growth slowed in recent years due to the trade war with China. But still, they amounted to about 2% per year. Thus, it can be assumed that until the US economy reaches a stable 2%-3%, the Fed will not tighten rates. Also in the final statement, it was noted that the tension in the stock markets slightly subsided, and the markets themselves partially recovered. There are also excellent results from the banking sector, which was able to meet (not without the help of Congress and the fed) credit demand and generate the necessary reserves. General conclusions and recommendations: The EUR/USD pair is supposedly continuing to build the rising wave C from B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0%. The low of wave B has not been updated, so the current wave marking remains intact. GBP / USD On May 20, the GBP / USD pair lost only a dozen base points, however, this change is so small that it did not affect the current wave counting. Thus, the proposed wave 3 or C of the upward trend section, which originates on March 19, continues its construction. The increase in quotes may continue with targets located near the peak of wave 1 or A and above. At the same time, an alternative option involves a significant complication of wave 2 or B, which can take a 5-wave form. However, in this case, I also expect an increase in quotes with targets located about 26 of the figure within the internal wave of 2 or B. Fundamental component: Bank of England Governor Andrew Bailey spoke in the UK yesterday, which allowed the possibility of lowering the key rate in the negative area in the coming months. This can be done in order to further stimulate the economy, although until recently, the Central Bank stated that it was not considering negative rates. An inflation report was also released in the UK yesterday, which showed a decline to 0.8% per annum from the last 1.5%. The pound sterling during yesterday and today is more reduced, unlike the euro. Markets turn to different factors when trading these instruments. General conclusions and recommendations: The GBP/USD tool supposedly completed the construction of the second wave of a new upward trend section. Thus, now I recommend buying a pound with goals located around 26 and 27 figures, based on the construction of wave 3 or C or d in 2 or B (if the wave becomes more complicated). A successful attempt to break the 1.2645 mark will allow you to buy the pound more confidently. The material has been provided by InstaForex Company - www.instaforex.com |

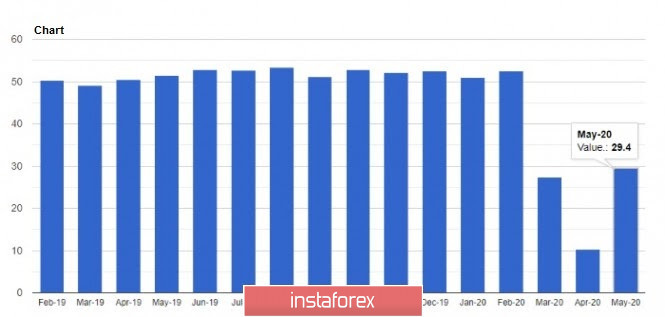

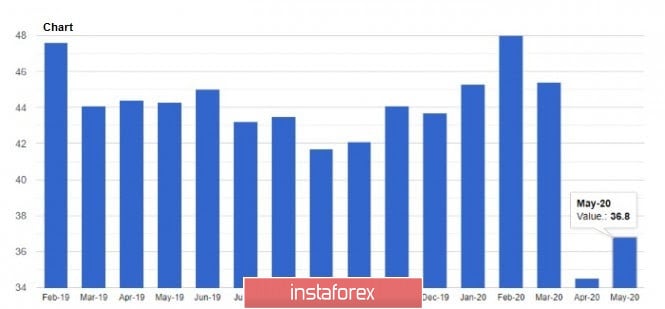

| Posted: 21 May 2020 06:08 AM PDT While the number of detected cases of coronavirus infection in the world has exceeded 5 million, many states are beginning to remove restrictive and quarantine measures, which is gradually reviving the economy, as evidenced by preliminary indices of activity in the service and manufacturing sectors. In some regions, there are also signs of normalization of the situation with coronavirus. No one will be surprised that the 2nd quarter of the world GDP will show an unprecedented drop, but the growth of PMI indices also suggests that the decline is beginning to slow down, and the easing of quarantine measures will lead to an even greater recovery of the economy this summer, the prospects for which remain quite gloomy. Yes, we can safely say that the lows have passed, but we still see only a slowdown in the reduction of activity, while its recovery is still very far away, not to mention a return to pre-crisis levels. Let me remind you that the index level below 50 indicates a decrease in activity compared to the previous month. Now let's run through the leading countries of the Eurozone and see what indicators were released today by the statistics agency Markit. The report on France said that the preliminary purchasing managers' index (PMI) for the manufacturing sector in May this year was at the level of 40.3 points, while in April it was 31.5 points, and economists predicted at the level of 36 points. The service sector also managed to slow its decline slightly. The preliminary index in May was 29.4 points against 10.2 points in April, which is higher than the forecast of economists, who expected a value of 27.5 points. The German data also appealed to traders. The preliminary purchasing managers' index (PMI) for the manufacturing sector rose to 36.8 points in May this year from 34.5 points in April, while it was forecast at 28.5 points. But the index of the service sector showed almost double growth to 31.4 points in May against 16.2 points in April, with a forecast of 26 points. In any case, the overall recovery in the activity also affected the indicator for the entire Eurozone, where the preliminary purchasing managers' index (PMI) for the manufacturing sector of the Eurozone in May jumped to 39.5 points against 33.4 points in April. The purchasing managers' index for the Eurozone services sector also rose to 28.7 points in May, up from 12 points. However, there are also those who believe that the observed slight slowdown in the decline in activity compared to the previous month only demonstrates the depth of the fall in April, and does not mean that the situation will also improve in the future, let alone the return of the indices to a value above 50 points. The overall composite purchasing managers' index (PMI) for the Eurozone in May was at 30.5 points, compared with 13.6 points in April, when it reached a historical low. As for the technical picture of the EURUSD pair, more than pleasant data on activity led to a new wave of growth in risky assets, and a break in the resistance of 1.0980 in the first half of the day pushed buyers of risky assets towards the maximum of 1.1020, the breakdown of which will easily throw the euro to the 11th figure. Today, a similar report was also released for the UK, where the preliminary composite index of supply managers in May rose to 28.9 points from 13.8 points in April. The manufacturing index jumped to 40.6 points, while the services sector recovered from its historic lows of 13.4 points to 27.8 points in May this year. Returning to the topic of coronavirus, at the beginning of the week, there was news that one of the US biotech companies conducted the first successful phase of trials of a coronavirus vaccine. According to Moderna, clinical trials of the vaccine will end with positive results. The test, which began at the end of April this year on volunteers, shows good results, and after taking the mRNA-1273 vaccine, the number of antibodies of test participants exceeded the corresponding indicator in the blood of people who had COVID-19. But it is more important that the vaccine is safe and tolerated without complications. It is expected that the final stage of testing will be held in July this year. Today, the British pharmaceutical company AstraZeneca announced that it expects to start its mass production of the COVID-19 vaccine, which is currently being developed jointly with the University of Oxford. It is expected that the final September tests will be successful, so the company has already signed the first contracts for the supply of at least 400 million doses. Such news is another blow to the coronavirus pandemic, which many expect will soon be defeated. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EUR/USD for May 21, 2020 Posted: 21 May 2020 05:51 AM PDT

Today, the weekly unemployment report in the US came out and revealed that the number of unemployed already rose to 2.4 million people. This is stabilization at a high level. This is about 20% and by far the highest unemployment rate since the 1930s. Such a huge negative should sooner or later break the growth of the US market. EURUSD: The euro is trying to break through the level of 1.1020. If it ends up successfully and consolidates above, the path will open at 1.1400. You may consider purchases from 1.0855. The material has been provided by InstaForex Company - www.instaforex.com |

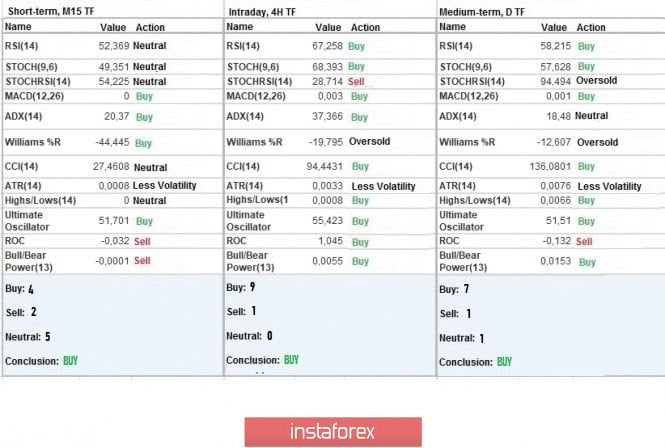

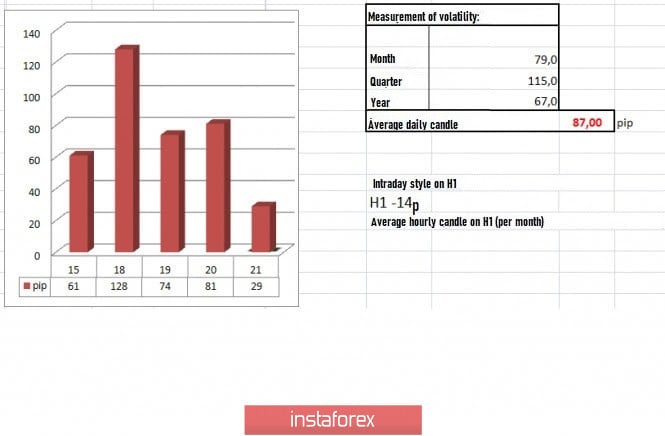

| Trading recommendations for the EUR/USD pair on May 21, 2020 Posted: 21 May 2020 05:23 AM PDT From the point of view of complex analysis, we can see the formation of a flat in the trading chart. The last trading day was more active than expected. The quote managed to resume the upward movement, during which the psychological level of 1.1000 was affected. Market participants completed the cycle from the lower border of the flat 1.0775 to its upper border 1.1000 in just one trading week. The formation of the flat lasted 6.5 weeks, during which three upward and two downward bars were formed. The resistance in the chart is controlled by the fairly wide flat, which is the product of the compression that occurred earlier [March 9 to April 14, 2020]. The compression of amplitudes then turned into stagnation, which delayed the main direction of the market. The medium and long-term trading still has a bearish mood, pursuing a 12-year trend in the market, which remains unchanged despite all the bursts of activity. Analyzing the past trading day in detail, we can see that the round of long positions started at the opening of the daily candle and lasted until the start of the US session. There, the control level of 1.1000 was hit, and a slowdown due to a narrow consolidation was expected. As discussed in the previous review, the quote will concentrate on the upper border of the flat (1.1000), which will make it possible to switch to a new market tact inside the side corridor. The trading recommendation from Wednesday regarding local purchase positions coincided 100%. [Buy positions above 1.0965, towards 1.0990 were opened] In terms of volatility, the indicator recorded a value close to the daily average, which means that market activity is stable. Analyzing the daily chart, we can see that the long-term and medium-term trend has a downward slope. The news published yesterday contained the final data on inflation in Europe, where a decline from 0.7% to 0.3% was recorded, lower than the forecasted 0.4%. Market reaction to the data was practically non-existent, since traders already expected such figures. The minutes on the Fed's April meeting was also published yesterday, which revealed that the committee foresees extreme uncertainty for the US economy both in the near future and in the medium term. The possibility of a second wave of COVID-19 infections was also raised, which would lead to massive bankruptcies of companies and a strong impact on the banking sector. However, the publication of the minutes did not affect the dynamics of the markets in any way, since a lot of comments from Fed representatives thoroughly covered all the information that was missing after the meeting. Today, a preliminary data on business activity in Europe was published, which showed a record growth from 12.0 to 28.7 in the index of the services sector. In the manufacturing sector, a jump from 33.4 to 39.5 was recorded. The composite index also grew from 13.6 to 30.5. Market reaction to the EU PMI was also non-existent, possibly because several EU countries, including locomotives such as Germany and France, are celebrating the Ascension Day. Trading volumes are also reduced. A similar PMI data will be published in the afternoon, but for the United States, where the service sector expects growth from 26.7 to 32.0, while the manufacturing sector expects an increase from 36.1 to 39.0. A rather optimistic forecast for the United States may push the US dollar up. Further development Analyzing the current trading chart, we can see a sluggish, but still a rebound from the border at 1.1000, which returned the quote to the level of 1.0950. Quotes are still at the top of the upward tact, which means that variable fluctuation may still occur before a strong movement in the chart. Prospects are also clear, so by today or tomorrow, a downward move will occur, which will form the third structure of the flat. Only a strong external background, which is currently not available, can prevent the formation of the technical model. A temporary price fluctuation may occur within the range of 1.0950 / 1.1000. If quotes consolidate below 1.0950, movement may reach the areas 1.0900, 1.0850 and 1.0775. However, an alternative scenario will happen, if activity increases due to external background. Such a situation will push the quote above the upper border of the flat, and may even lead to a consolidation above 1.1020. Based on the above information, we derived the following trading recommendations: - Open buy positions above 1.1020, in the direction of 1.1080, but only if the upper border of the main flat falls and the TF of the market changes. - Consider selling positions lower than 1.0950, towards 1.0900, 1.0850, or 1.0775. Indicator analysis Analyzing the different sectors of timeframes (TF), we can see that the indicators of technical instruments signal purchases, relative to the convergence of quotes in the upper border of the flat. Volatility per week / Measurement of volatility: Month; Quarter Year The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year. (May 21 was built, taking into account the time of publication of the article) Volatility is currently 29 points, which is 66% lower than the average daily value. Activity will increase if quotes reach the level of 1.1000. Key levels Resistance zones: 1,1000 ***; 1.1080 **; 1,1180; 1.1300; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support areas: 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 May 2020 05:20 AM PDT Corona News :

A top US scientist has said that people should not count on a Covid-19 vaccine being developed any time soon, as global infections passed 5 million after surges in Latin America, including Brazil, which has recorded nearly 20,000 new cases. William Haseltine, the groundbreaking cancer, HIV/AIDS and human genome projects researcher, has said the best approach to the pandemic is to manage the disease through careful tracing of infections and strict isolation measures whenever it starts spreading. He said that while a vaccine could be developed, "I wouldn't count on it", and urged people to wear masks, wash hands, clean surfaces and keep a distance. Technical analysis: Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

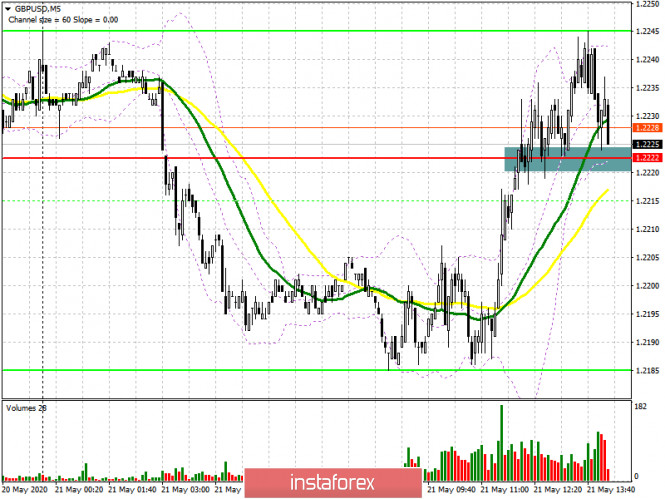

| Posted: 21 May 2020 04:38 AM PDT To open long positions on GBPUSD, you need: Data on services and manufacturing in the UK were much better than economists ' forecasts, which returned demand for the British pound and allowed buyers to attempt to consolidate above the resistance of 1.2222, where trade is currently conducted. If you look at the 5-minute chart, you will see how the bulls are actively fighting now for the support of 1.2222, and as long as the trade is conducted above this range, you can expect the continuation of the upward trend in the pound, formed at the beginning of this week. The nearest target of the bulls is a maximum of 1.2882, the third test of which can lead to a breakdown and a larger upward trend to the area of 1.2336 and 1.2370 levels, where I recommend fixing the profits. In the scenario of a return of GBP/USD to the area of 1.2222, the market will again return to the side of sellers. In this case, it is best to postpone long positions until the support update of 1.2173, where the bears did not reach today or buy GBP/USD immediately on the rebound from the minimum of 1.2122, where the upper border of the new ascending channel will pass.

To open short positions on GBPUSD, you need: In the second half of the day, good data on the US PMI indices are expected, which may allow sellers of the pound to return to the level of 1.2222. This should be done as quickly as possible. Only fixing below this range will increase the pressure on the pair, which will lead to an update of the minimum of 1.2173, and quite possibly to a test of large support of 1.2122, where I recommend fixing the profits since there the bulls will try to form the lower border of a new ascending channel. An equally important task remains the protection of the resistance of 1.2282, where only the next formation of a false breakdown will be a signal to open short positions. With growth above this range, it is best to abandon sales to the large resistance test of 1.2336 or to rebound from a maximum of 1.2370.

Signals of indicators: Moving averages Trading is conducted around the 30 and 50 daily averages, which indicates market uncertainty, but before the breakdown of the average, the market will be on the side of sellers of the pound. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the upper limit of the indicator around 1.2245 will lead to a larger increase in the pound. If the pair declines, the lower border of the indicator around 1.2185 will provide support. Description of indicators

|

| Posted: 21 May 2020 04:36 AM PDT To open long positions on EURUSD, you need: The data released in the first half of the day on activity in the service and manufacturing sectors of the Eurozone provided support to the euro, as a result of which the bulls managed to regain the resistance of 1.0979, which I drew attention to in my morning forecast. The 5-minute chart shows how sellers tried to return to the market after testing this area at the beginning of the European session, but this did not lead to a major downward movement. At the moment, it is necessary to monitor the behavior of bulls above the range of 1.0979, since a second correction to this level from the top down will be a signal to open long positions in the expectation of continuing the upward trend to the maximum area of 1.1013, where I recommend fixing the profits. The longer-term goal for the end of the week will be the resistance of 1.093. If the bulls fail to hold the pair above the support of 1.0979 in the second half of the day, as good reports on the US labor market and PMI indices can return demand for the US dollar, then in this scenario, it is best to return to long positions immediately to rebound from the minimum of 1.0941 with the goal of an upward correction of 20-30 points at the end of the day.

To open short positions on EURUSD, you need: Sellers again have problems and at the moment the most important task is to return EUR/USD under the morning level of 1.0979. Only in this scenario, the pressure on the euro will return, and the bulls will rush to fix the profit, which will lead to a downward movement to the area of the day's minimum and it is likely to update the support of 1.0941, where I recommend fixing the profit. If the demand for the euro persists after the release of the report on the US labor market, and good indicators can further strengthen the risk appetite of investors, then it is best to consider short positions after the resistance test of 1.1013 or sell immediately on a rebound from a large maximum in the area of 1.093. You should also keep in mind the report on the activity index for the non-manufacturing sector of the United States, good indicators of which can be interpreted as a signal to buy the European currency.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily moving averages, which indicates the bullish nature of the market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands In case of a decline, support will be provided by the lower border of the indicator in the area of 1.0952, from which you can buy euros immediately on the rebound. Breaking the upper limit of the indicator in the area of 1.0990 will lead to larger growth of the pair. Description of indicators

|

| Positive sentiment in oil market prevails Posted: 21 May 2020 04:34 AM PDT

Today, crude oil is extending gains amid the record levels over the past ten weeks. The reason is the news about a reduction in the US oil inventories during the second week in a row. In the London Stock Exchange, the price of Brent oil futures rose by 2.15%, which is equivalent to 0.77 US dollars, and reached 36.52 dollars per barrel. On Wednesday, Brent futures for delivery in July grew by 3.2%, or 1.11 dollars, to 35.75 dollars per barrel, which is the highest level since the middle of March. WTI crude for June delivery increased by 2.18%, or 0.73 dollars, to 34.22 dollars per barrel. Yesterday, the price grew to 33.49 dollars per barrel (adding 1.53 dollars to the previous figures) to its highest level since the middle of March. Market participants were focused on oil reserves in the United State. Last week, it became known that stocks decreased by 5 million barrels for the week ended on May 15. Consequently, oil reserves have been declining for the second week in a row which was a surprise to most analysts. Experts projected stocks to rise by 2.4 million barrels. Thus, this good news from the US Department of Energy has only improved positive sentiment in the oil market. Petrol inventories, by contrast, were up by 2.8 million barrels, while distillates increased by 3.8 million barrels. Oil reserves at the terminal in Cushing plunged by 5.6 million barrels. The oil market relies on the fact that the global economy has managed to cope with the main wave of the crisis and that the peak of the recession has already passed. Thus, the situation in the aviation industry is improving. The securities of many world's airline companies which significantly reduced their activities show steady growth. Therefore, the industry intends to fully recover. Analysts were surprised by the news of the reduction in US inventories. However, even in this situation, they hastened to explain the current trend. First of all, they refer to a decrease in the import and production of oil, while the processing of raw materials, on the contrary, has increased. The storage filling rate has slowed down due to a significant reduction in production. As a result, it may balance the physical market. The statement of Mohammed Barkindo, the Secretary General of OPEC, who believes that the oil market is gradually recovering, has also supported Brent crude oil. Moreover, most experts are now inclined to believe that in the short term, the price of oil futures will continue rising. The raw materials will be supported by the ongoing lifting of quarantine across the majority of countries. Economies are gradually opening which has a positive impact on the oil market. However, concerns over the global economic growth rate, as well as strained relations between China and the United States remain. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar overtakes major currencies Posted: 21 May 2020 04:33 AM PDT

According to this morning's data, it became clear that the dollar was able to recover some of the losses that were recorded at the very beginning of the trading week. This was made possible due to the fact that most market participants are in limbo and are very restrained against the backdrop of increasing tensions between the two largest economic powers – China and the United States. Weak economic data, as well as reduced trade between countries, are forcing investors to weigh all risks more carefully. The tension was felt and slowed down the Australian dollar immediately, which is extremely sensitive to such incidents. This morning, a decline of 0.62% was recorded, which sent it to the level of 0.6554 US dollars. Thus, it took a step back from the maximum ten-week value that it was able to reach this Tuesday. The New Zealand dollar also declined, its fall amounted to 0.52%, and the current level - 0.6114 US dollars. The Australian dollar led the mood of today. Most experts say that the negative dynamics of S&P futures seriously puts pressure on it, which, in turn, demonstrates a general large-scale trend. The parallel can be traced quite clearly. Futures for stocks in the United States of America declined by almost the same percentage as the national currency of Australia. Perhaps, this can not be a coincidence. Investors also saw a situation with growing tensions between China and America. The diplomatic relations of these countries have noticeably worsened recently, which market participants could not help but pay attention to. However, this is not the only conflict situation in the world. Tension is also rising between China and Australia. And the reason remains the same: the Australian authorities are increasingly urging an international investigation into the origin and spread of COVID-19. It can be recalled that there was another surge of negativity after the speech of the President of America yesterday, who continued to accuse China of silent information and the spread of coronavirus around the world again. The Chinese authorities did not support this attack. he controversy. However, the yuan exchange rate this morning became slightly more expensive than the expected level, which may indicate the government's intention to support the national currency before the annual parliamentary session, which could initiate the ratification of new stimulus measures to restore the economy. To date, the US dollar has risen against the yuan by 0.2%. The Chinese currency is trading at 7.1049. In general, in relation to the currency basket, the dollar began to cost 0.25% more and reached the level of 99.426. Further dynamics of the currency will determine the level of business activity in Europe as a whole, the UK, in particular, and the United States. So, analysts already say that the Central Bank of the UK is likely to decide to switch to negative rates, since weak inflation does not provide other options. The national currency of England is also under pressure from the US dollar, which has become more expensive to the pound by 0.4%. The pound was in the region of 1.2188 dollars, which is very close to the minimum values over the past two weeks. In addition, the Japanese yen began to feel pressure. So, the Ministry of Finance of the country made a statement this morning that export last month has catastrophically declined, which amounted to around 21.9% in annual terms. Thus, it turns out that Japan's exports have been declining for 17 consecutive months, due to a reduction in global demand and the impact of the COVID-19 pandemic. The yen fell 0.07% against the euro and took the level of 117.99 yen per euro. It can be noted that the last trading session closed with a reading of 118.07 yen. Today, the dollar was higher than the yen by 0.16%, which sent it to the level of 107.7 yen per dollar. The single European currency also declined against the dollar. The euro began to cost 0.23% lower, which drove it to around 1.0955 euros per dollar. Yesterday, its level was 1.0980 euros per dollar. In turn, the ICE Dollar index increased (6 currencies), an increase of 0.29% compared to the previous trading session. The WSJ Dollar indicator (16 currencies) jumped 0.26%. So far, there is a reason that the rise of the dollar in the currency market will continue further on the background of incoming economic news. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 May 2020 04:25 AM PDT Corona News :

Europe is no longer a distant theory, according to the director of the EU agency responsible for advising governments – including the UK – on disease control. "The question is when and how big, that is the question in my view," said Dr Andrea Ammon, director of the European Centre for Disease Prevention and Control (ECDC). It has been the unenviable task of scientists to tell it as it is through the coronavirus pandemic. While politicians have been caught offering empty reassurances, the epidemiologists, a job title new to many, have emerged as the straight shooters of the crisis, sometimes to their detriment. Technical analysis: GBP has been trading downwards. The price tested the level of 1,2185 and rejected, which is sign that buyers took control. I see GBP higher due to the potential completion of the ABC downward correction. Trading recommendation: Support level is set at 1,2185 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 May 2020 04:18 AM PDT News :

Some of the world's leading hedge funds are losing the profit-making race to smaller rivals with high exposure in the Bitcoin market. Hedge fund research group HFR found that bitcoin-focused investment partnerships earned 13.4 percent yields this year, which came to be better than the average 6.7 percent YTD loss across the non-crypto hedge fund industry. The crypto industry flourished despite losing 26.62 of its capitalization on average in March 2020. Pantera Capital, for instance, bore a 33.6 percent loss via its Digital Assets Fund in March. But its recovery in April took its YTD profits to 32.5 percent. Technical analysis: BTC has been trading downwards. As I expected, the BTC broke the upward channel and test the level of $9,200. I still see BTC downside and the next downward target is set at the price of $8,150. Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: Franco-German Recovery Fund and US-China trade war Posted: 21 May 2020 04:12 AM PDT

Despite a fall in mid-March from $ 1.14 to $ 1.07, the euro has risen in price against the US dollar by almost 1.5% over the past three months. The EUR / USD pair started this week around 1.08 and is currently trading at 1.0970. According to The Goldman Sachs, the euro rose this week after France and Germany proposed the formation of a fund to help the EU countries which are most affected by the coronavirus pandemic, which was a significant positive surprise for the single European currency. However, the implementation of the Franco-German plan is still far from certain, and there are many questions that encourage investors to be wary of such news. The joint initiative of Paris and Berlin involves the distribution of grant aid, not loans, and should be unanimously approved by the 27 EU member states, as well as the European Parliament. "The key questions arising from the proposal by France and Germany relate to when the funding program will begin, during what period the EU countries will be" fed "by the funds and how much new money they will ultimately raise," said Jordan Rochester, strategist at Nomura. Rochester added, "Since this may become part of negotiations on the EU budget for 2021–2027, this stimulus is unlikely to appear in the near future. You may have to wait until the first quarter of 2021 when the EU finally decides on a joint issue of bonds, and for the countries of the alliance for 6-7 months - a long waiting time in the face of the fight against COVID-19, " "Clarity on this issue will appear after the plan is presented by the European Commission next week. If the proposed funds, which make up about 3.5% of the EU's GDP, are provided within just one year, this will be a significant contribution. However, if the amounts are distributed during the seven-year budget of the EU, this may be a limited contribution of one year to GDP," the expert believes.

Although someone had a proposal from Germany and France about € 500 billion to help the eurozone countries affected by the pandemic, it might have caused a desire to buy euros, but for a stable rally, EUR / USD requires the efforts of both parties. Traders should have a firm belief that the time has come to sell greenbacks. Neither the expansion of the Fed's balance sheet, nor the increase in the US public debt, nor the country's huge foreign trade deficit discourages investors from wanting to keep the American currency in their portfolios. Despite the constant decline in the share of US GDP in the global indicator, the share of the dollar in global payment and trade operations has not changed much. In addition, central banks still hold about 60% of their foreign exchange reserves in USD. Apparently, one of the main reasons for the primacy of the greenback is the lack of alternatives. Neither the single European currency nor the Chinese yuan is able to compete with the dollar. Its dominant role in the global financial system, apparently, explains the fact that investors are still oriented to the Fed. Obviously, much depends on the decisions of the American regulator, and not only in the United States. The minutes from the April FOMC meeting somewhat cooled the ardor of EUR / USD buyers. Last month, the Central Bank seriously discussed the possibility of using Japan's experience in targeting the yield curve of government bonds. The strategy involves keeping debt rates at a certain level. At the same time, the Bank of Japan does not need as many resources as were expected when launching quantitative easing (QE). The balance of the Fed will not grow rapidly, and this is good news for the greenback. Support for the EUR / USD bears is provided by increased tension in relations between Washington and Beijing. On Wednesday, the US Senate passed a bill that could deprive some Chinese companies of listing opportunities on US exchanges if the latter do not follow US auditing standards and rules. This measure, put forward by Republican John F. Kennedy and Democrat Chris Van Hollen, was unanimously approved. However, for entry into force, it must be approved by the House of Representatives and signed by US President Donald Trump. Meanwhile, Trump continues to pour accusations against China saying, "They could easily hold back the pandemic, but they didn't do it,". Trump also accused China of a large-scale disinformation campaign designed to undermine his chances of re-election. This negatively affects the mood of the markets, puts pressure on stock indices, and strengthens the protective dollar. However, while the main currency pair holds above 1.09, the bulls do not abandon their intentions to resume attacks. The material has been provided by InstaForex Company - www.instaforex.com |