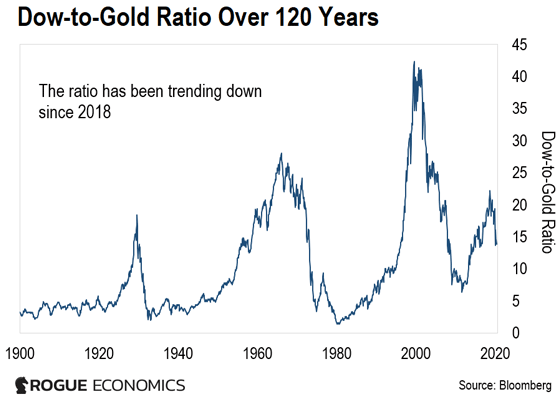

By Tom Dyson, editor, Postcards From the Fringe I left my job almost two years ago. Kate and I sold all our things. (We’re divorced.) We hit the road with our three kids. We don’t have anywhere to live. We left “the matrix” in another important way, too. When we left America, we drained our bank accounts and retirement accounts of cash and converted all our savings into gold and silver. Why did we do this? We don’t want to be “in the system” anymore. It’s unbalanced and unstable. When we made our move, I saw a total rejection of saving in favor of debt. I saw efforts to prop up the markets using unsound money and financial engineering. Things like quantitative easing (QE), artificially lowered interest rates, and huge government deficits. The economy seemed almost like it was begging to liquidate itself. And yet the feds kept pushing it up and talking it up. That’s why for the past two years, we’ve been sitting on the sidelines in precious metals, until it’s safe to return to the financial system. When it finally is safe, we’ll sell all our gold and invest in a select group of stocks. Our money will stay there – I hope – generating bigger and bigger dividends for the rest of our lives. How will we know when it’s safe, though? For that, we follow the Dow-to-Gold ratio… | Recommended Link | "The Man Who Refused $100 Million" Legendary stock picker Teeka Tiwari—who picked Apple way back in 2003… and Bitcoin in 2016—was recently asked to manage $100 million… But he refused. Why? Because he recently discovered what he believed will be his single biggest investment winner… A novel technology (not 5G!) the World Economic Forum believes will grow 295,762% over the next 7 years… And Teeka wants "the average" guy to get a shot, too. "This shouldn't stay in the hands of the elite only," says Tiwari. As you'll see in Teeka's new exposé, his reasons for doing this are personal. And it could lead to a stunning $1.6 million windfall… | | | | The Ultimate Barometer The Dow-to-Gold ratio is the ultimate barometer of systemic “health.” The Dow is the aggregated stock price of 30 of the largest, most iconic businesses in the world. Gold is an inert metal. It’s the investment equivalent of hiding your money under the floorboards. By presenting these two as a ratio, I get a barometer. I’ve looked through over 100 years of stock market history. The last times the system “reset,” depending on how bad things got, the ratio went below 5. On the flip side, when things were ripping – as they were in the late 1990s, for example – the ratio got as high as 41. The thing about this barometer is, unlike other price series in financial markets, it doesn’t bounce around much. Once it begins a trend, it tends to stay in that trend for many years. The charts below tell the whole story…

When we started our travels and arrived in Africa in November 2018, the barometer was above 20. Today, it’s at 13.8. It’s falling again. | Recommended Link | Silicon Valley guru Jeff Brown: "The first trillionaires will come from this" Is it possible for a lone investor to become a trillionaire? According to Silicon Valley experts… including a billionaire "Shark" from the popular business show… The answer is yes! All it takes is the right opportunity. And the new device you see above is expected to grow into a $15.7 trillion market. Better yet, only three companies dominate this technology. You can get in now for around $226. | | | -- | I believe this is the start of a longer trend… a signal that the system is going to break soon. Maybe it’s started to break already? Either way, while we wait for the Dow-to-Gold ratio’s “rendezvous with destiny” (as Bill Bonner calls it), we remain in our financial “cabin in the woods.” The system still looks to me like the Titanic speeding through an ice field. The government is still “managing” the economy – with more financial engineering, more unsound money, bigger deficits, and more soothing words… except it’s unraveling even faster now. We’re sticking with gold and silver. Regards,

Tom Dyson

Editor, Postcards From the Fringe P.S. As you know, as part of our revelation two years ago, Kate and I also went “all in” on gold. I invested nearly $1 million of my own money in our Dow-to-Gold strategy. But there’s more to it than just buying bullion. And on Wednesday, May 20, I’m sharing the details in an urgent briefing. To make sure you don’t miss it, reserve your spot right here.

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… On May 20th, Tom's $1 million trade goes public Two years ago, Tom Dyson dropped out of society. A self-made British millionaire, he made a series of controversial moves that left his colleagues speechless. First, he quit his job in South Florida, losing the business he'd helped create over the previous decade… Then, he sold all of his possessions… And finally, he put nearly ALL of his money into an investment that—at the time—everyone thought was crazy. On Wednesday, May 20th, he'll reveal the full story… And why you could gain financial security – for life – if you're willing to execute a single trade immediately. Click here to learn more.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment