Forex analysis review |

- Forecast for AUD/USD on June 2, 2020

- Forecast for USD/JPY on June 2, 2020

- Overview of the GBP/USD pair. June 2. Boris Johnson's ratings are beginning to fall in proportion to the decline of the British

- Overview of the EUR/USD pair. June 2. The social crisis, the US-China conflict, the highest unemployment, and the lifting

- Hot forecast and trading signals for the GBP/USD pair on June 2. COT report. EU is not going to give London any "special

- June 1, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- June 1, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- USDJPY is trading below key resistance

- USDCAD continues lower towards our second target

- Comprehensive analysis of movement options for #USDX vs AUD/USD & USD/CAD & NZD/USD (Daily) on June 2020

- Evening review on EURUSD for June 01, 2020

- Gold found support, plans to increase its value

- To continue the bullish trend, the euro must overcome $ 1.12, and the pound, $ 1.24

- Europe and Asia stocks are trading in positive territory

- Trader's diary. June 1, 2020. Covid-19 in Russia. EURUSD. Russian rouble

- Trading recommendations for the EUR/USD pair on June 1, 2020

- EURUSD and GBPUSD: Fundamental data slightly spoiled the mood of buyers of risky assets. The chance of growth for the pound

- BTC analysis for June 01,.2020 - Broken upward channel and potential for the bigger drop towards the $8.750 and Pitchfork

- Analysis of Gold for June 01,.2020 - Overbought condition and breakout of the upward trendline. Watch for potential downside

- EUR / USD: Euro's recovery and continuation of US-China trade war

- Oil market caution atmosphere

- GBP/USD analysis for June 01, 2020 - Rejection of the resistance trendline. Watch for the downside rotation towards the 1.2335

- Oil and USD/CAD

- GBP/USD: plan for the American session on June 1 (analysis of morning deals). The bulls did not manage to break above the

- EUR/USD: plan for the American session on June 1 (analysis of morning deals). Another failed attempt by the bulls to break

| Forecast for AUD/USD on June 2, 2020 Posted: 01 Jun 2020 07:21 PM PDT AUD/USD The Australian dollar showed a solid increase of 130 points on Monday, barely reaching the first target level of 0.6825 (October 2016 low). But the aussie is upbeat and ready to continue growth to the next goal along the price channel in the area of 0.6935. The Marlin oscillator in the zone of positive values. The signal line of the Marlin oscillator is looking down on the four-hour chart, but a more significant pattern is needed for a reversal sign. Possible consolidation of the price (about a day) under the level of 0.6825, after which we expect continued growth to 0.6935. This morning Australia's optimistic balance of payments for the first quarter has already been released: 8.4 billion against the forecast of 6.3 billion and 1.7 billion in the previous period, the investor has to wait for the comments of the Reserve Bank of Australia after its meeting on monetary policy, which will be a little later, at 6:30 London time. GDP for the first quarter will be published tomorrow - the forecast is -0.4%, but there is already hope for a better indicator. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on June 2, 2020 Posted: 01 Jun 2020 07:20 PM PDT USD/JPY There was no decisive breakout of the pair up, which we expected yesterday, did not happen. The price remained at the signal level of 107.78. The day's low tested the support of the price channel, the closing of the day took place above the balance indicator line (daily). But the price still does not give up. Today we are waiting for a second attempt to go above the signal level and further growth of the dollar against the yen. Target at 108.30. The price currently overcomes the resistance of the MACD indicator line (blue line) on the four-hour chart, the signal line of the Marlin oscillator is in the zone of positive values - in the growth trend zone. Patiently waiting for the price to increase. |

| Posted: 01 Jun 2020 05:10 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 230.3879 The British pound unexpectedly rushed up on the first trading day of the week. It is also unexpected how the European currency rose in price over the past week. At the same time, the reasons for such a strong growth of the British currency are again quite difficult to find. They can be "invented", you can find some kind of coincidence, but now everything is not as obvious as it was in quiet times. In our article on the euro/dollar, we explained why the fact that mass protests and rallies against the police and government in the United States is not the reason for the strengthening of the euro currency. Now the same applies to the pound, which can not show growth at all if we are talking about a fundamentally sound growth. If what is happening in the United States can now be called a social crisis, chaos, political confusion, and this applies to everything that is happening, and not just the protests related to the murder of a black guy, then in the UK, the regime of ethereal silence continues. Recently, Boris Johnson aired only a few times, who did not say anything important or interesting. The markets, however, Johnson's entourage still learned that in the second half of June, the Prime Minister intends to negotiate a comprehensive agreement with EU leaders personally. However, according to many experts, this step will not lead to any positive results. The UK has also abandoned strict quarantine measures, and health officials are already sounding the alarm. In their opinion, the contagion index (an index showing how many people each carrier of the virus infects; if it is higher than 1, it is considered that the rate of virus spread is increasing) has just fallen below 1, so any relaxation of quarantine measures can lead to a new wave of epidemics. Scientists also report that in recent days in the UK again recorded a large number of cases of infection, about 8,000 per day. John Edmunds, a professor at the London School of Hygiene and Tropical Medicine, believes that the UK government needs to think about how to contain the epidemic, not about its political ratings. At the same time, a new international conflict is brewing, this time between China and the UK. And also because of Hong Kong. The UK, which has signed an agreement with Beijing under which Hong Kong has a special autonomous status until 2047, is going to simplify the procedure for granting Hong Kong citizens British citizenship. According to the same agreement with Beijing, Hong Kong residents do not have the right to permanent residence in the UK. However, as Beijing and Hong Kong authorities are going to make some laws that strengthen control over the autonomous region by the Chinese authorities and its autonomy may be purely formal, the US, UK, and other countries dissatisfied with what is happening. China itself is also dissatisfied, threatening to respond with countermeasures to all states that will take measures because of the adoption of the law "on national security in Hong Kong". According to Beijing, China has the right to adopt this law and does not violate any international agreements and rights. Hong Kong is a part of China, although it is autonomous. Chinese Foreign Ministry spokesman Zhao Lijian said last week: "If the UK continues to change its current policy, it will violate not only its own position and obligations but also the basic norms of international law. We oppose this and reserve the right to take retaliatory measures. China hopes that the UK will objectively and fairly consider the national security bill in Hong Kong, as well as respect China's position and concerns, and will not interfere in Hong Kong's affairs." Earlier, British Foreign Minister Dominic Raab said that London is ready to provide Hong Kong residents with British passports with the opportunity to live and work in the Kingdom without any restrictions. He also stressed that London will take such a step if Beijing passes the law "on national security", which violates the previous agreement on the special status of Hong Kong. It is also worth noting that the Brexit negotiations remain at an impasse. Michel Barnier, the chief negotiator for the European Union, accuses London of disrupting the timing of the negotiation process and says that Brussels will not agree to a deal if the UK does not meet the conditions and obligations that were previously agreed. Michel Barnier recalls that about 50% of British exports go to the EU, while the EU exports to Foggy Albion only 7% of the goods produced. This statement was made on the eve of the fourth round of negotiations, which begins today. Naturally, London also blames the opposite side, i.e. Brussels, for the breakdown of the negotiations. Although in general, it does seem that London is not in a hurry to reach agreements, it is not in a hurry to concede and not in a hurry at all. It is difficult to say what Boris Johnson is counting on. A huge number of international economists and experts say in one voice that if London and Brussels part without a "deal", in the first place, it will be a blow to the British economy. And this opinion existed even before the crisis caused by the "coronavirus", which hit the UK the most in Europe. Thus, London risks being left without a free market with the European Union in 2021, and Boris Johnson's political ratings, according to some studies, have begun to decline. If in December last year Johnson won his most striking victory (before that there were only defeats), now we can assume that this victory will remain the only one, because Johnson is more proud of the post of head of state. The fight against the epidemic has failed, there is no trade agreement with the European Union, and there is no agreement with America. Johnson strictly stands by his position of "hard" Brexit, and pay for all the government's decisions will be ordinary Britons, who in 2021 may strongly regret that it was Boris Johnson who won last year. Recent research suggests that the Labor Party is recovering its political ratings after a failure in the parliamentary elections and is already on the heels of Boris Johnson and his party. The activities of their leader, Keir Starmer, are approved by 40% of the population and 17% do not approve. Boris Johnson has a higher number of satisfied voters - 57%, but the number of dissatisfied is much higher - 35%. Other polls also confirm that the overall support rating for the Labor leader is now higher. And the last factor in the fall of the British currency is the possible negative rates of the Bank of England. We believe that this is an almost inevitable step for the British regulator since the economy simply cannot withstand so many shocks. And if 2020 is still somehow managed to bring to an end, then in 2021, without a trade agreement with the European Union, the British economy will require new large-scale incentives.

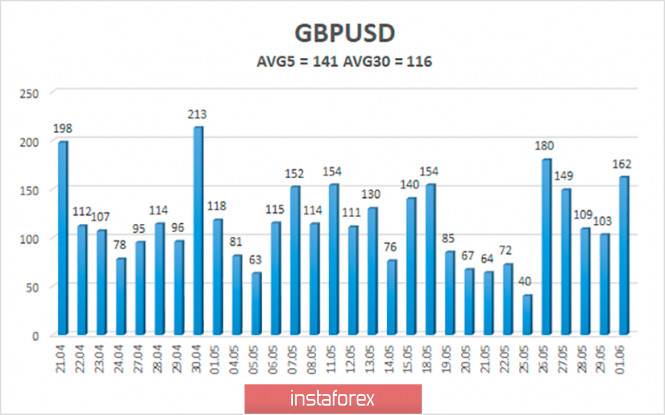

The average volatility of the GBP/USD pair has increased over the past 5 days and is now 141 points. On Tuesday, June 2, thus, we expect movement inside the channel, limited by the levels of 1.2338 and 1.2620. A downward turn of the Heiken Ashi indicator will indicate a downward correction. Fixing the price below the moving average will change the downward trend. Nearest support levels: S1 – 1.2451 S2 – 1.2390 S3 – 1.2329 Nearest resistance levels: R1 –1.2512 R2 – 1.2573 R3 – 1.2634 Trading recommendations: The GBP/USD pair on the 4-hour timeframe continues the upward movement that has strengthened today. Thus, today it is recommended to continue trading the pound/dollar pair for an increase with the goals of 1.2512 and 1.2573 and keep the longs open until the Heiken Ashi indicator turns down. It is recommended to sell the pound/dollar pair when the bears manage to return to the area below the moving average, with the first targets of 1.2268 and 1.2207. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Jun 2020 05:09 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - up. CCI: 93.4107 A new month begins, and the euro/dollar currency pair continues the same upward movement that was very difficult to imagine a few weeks ago. In recent years, the euro/dollar pair has developed a steady downward trend. In recent years, the euro has been repeatedly corrected, showing a growth of several hundred points or even more. However, perhaps none of these segments and periods caused so much surprise as what is happening on the pair now. Of course, explanations of what is happening can always be found. A huge number of technical, fundamental, macroeconomic, and even political factors can influence the exchange rate of any pair. And even if any central bank suddenly wants to buy several hundred billion dollars on the international currency market, the dollar rate will increase sharply, as demand for it will grow sharply, and there will be no explicable and objective reasons for the growth of this currency. Thus, in the Forex currency market, you can never be 100% sure of something. It is this confidence that usually leads to disastrous consequences. However, let's return to reality. Recently, the euro currency continues to grow. Analysts and traders expected that on Friday – the last trading day of the week and month – traders will start recording profits on long positions and the correction will begin. However, nothing like this happened. The bulls continued to buy the euro currency as if nothing had happened. And only on Monday, June 1, the pair began some sort of correction. The macroeconomic background on Monday was extremely uninteresting. Business activity indices in the manufacturing sector are important reports in themselves, however, in the current reality, they do not have much significance. Yesterday, it became known that business activity in Germany was 36.6, and in the European Union – 39.4. However, what do these figures say? Only that business activity in the manufacturing sectors of the Eurozone countries continues to be "negative". Any value below 50 indicates that the economy is shrinking. Thus, since the beginning of the "coronavirus" crisis, when business activity in almost all countries of the world collapsed to minimum values, almost nothing has changed. The numbers have started to recover a little, but so far there is no question of any recovery in production and the economy. In many countries of Europe and the world, quarantine restrictions are beginning to be lifted under the friendly warnings of doctors and representatives of the health sector about the second wave of the epidemic. However, almost every developed and developing country now faces a huge dilemma and a difficult choice. Further downsizing of the economy can simply finish it off, bring it to a state where there will be nothing to restore, or it will take years to restore it. If the quarantine is completed, the economy will at least stop shrinking, and if there is no second wave of the epidemic, and scientists will create a vaccine at least by the end of 2020, then everything will be relatively good. The question is, no one knows if there will be a second wave? Many doctors believe that "coronavirus" will be a seasonal disease, that is, it will return in the cold season. This means that it can start hitting people again in the fall. Thus, many governments act at their own risk. And the risk is great. As for the fundamental background, there are so many topics now that it is even difficult to select a few to fully sanctify them and draw a conclusion about their impact on the mood of traders and the movement of the currency pair. What is happening now in the US is very difficult to describe in words and even more difficult to link it to the currency market. We have repeatedly said that a new standoff with China could cause another blow to the American economy. The highest unemployment rate, as well as the fear of people returning to their usual life and looking for work due to the "coronavirus", continues to slow down the economy. Jerome Powell on Friday said that the Fed did everything it could in the current situation. However, the Fed chief has previously called on Congress and the White House to provide more assistance to the economy. Thus, the current volume of incentives is not enough. And at the same time, protests, riots, and outright lawlessness begin in the United States. All because a black guy was killed by a white cop. At the same time, the details covered in the media differ so much that it is very difficult to draw any unambiguous conclusion. Rallies, marches, protests, pogroms, skirmishes with the police, all this happens because of one murder and a racist scandal blown out of the blue. We do not support any of the parties to this conflict in any way. However, every day in America, as well as around the world, a huge number of people die, from all sorts of causes, most of which are not "natural". If every death causes the entire country to "rear up", then... However, investors and traders understand that instead of people returning to work in a country where many states have also relaxed quarantine measures, people are rioting, striking, rallying, and protesting. This means that the economy continues to fall, not recover. And it seems that all the events combined now are the reasons why the dollar is declining. However, it should be noted that, for example, the pound is growing extremely reluctantly. You can say that the pound itself is under strong market pressure because of Brexit, the failed negotiations between London and Brussels, the complete uncertainty about the future of the country and its economy. Good! The Japanese yen is also not particularly expensive when paired with the dollar. To be more precise, it has been getting cheaper in recent weeks. It turns out that the social crisis in the United States is not the reason for the fall of the dollar against the euro. Or, at least, this reason for the decline in the US currency looks very doubtful. By and large, the world, markets, and participants in these markets continue to be agitated because of everything that has happened in recent months. Thus, perhaps, in the euro/dollar, we are now just witnessing the second wave of panic, since it is quite difficult to find unequivocal reasons for the growth of the euro currency by 250 points in 5 days. If so, then traders may begin to get rid of the euro currency in the near future, realizing that it has risen in price unreasonably.

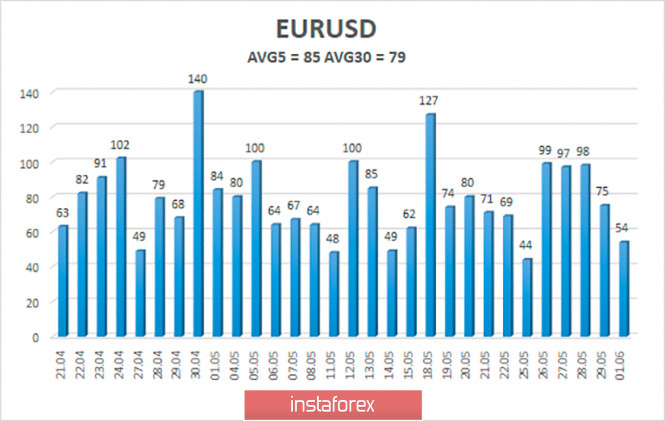

The average volatility of the euro/dollar currency pair as of June 2 is 85 points. Thus, the value of the indicator is still characterized as "average". Today, we expect the pair to move between the levels of 1.1045 and 1.1215. The reversal of the Heiken Ashi indicator downwards signals a downward correction after strong growth. Nearest support levels: S1 – 1.1108 S2 – 1.1047 S3 – 1.0986 Nearest resistance levels: R1 – 1.1169 R2 – 1.1230 R3 – 1.1292 Trading recommendations: The EUR/USD pair continues its strong upward movement. Thus, after overcoming the psychological level of 1.1000, buy orders became relevant, now with the goals of 1.1169 and 1.1215, which are recommended to hold until the Heiken Ashi indicator turns down. It is recommended to return to selling the pair not before the price is re-anchored below the moving average line with the first goals of 1.0986 and 1.0925. The material has been provided by InstaForex Company - www.instaforex.com |

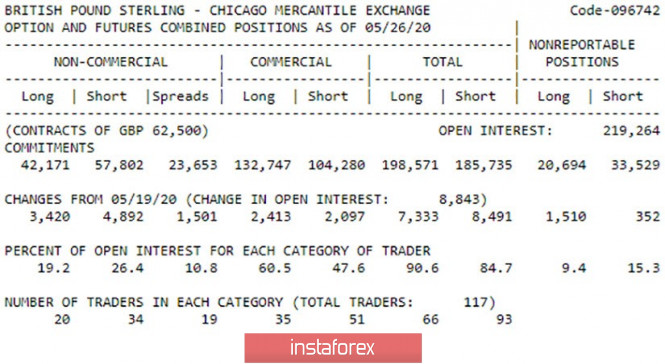

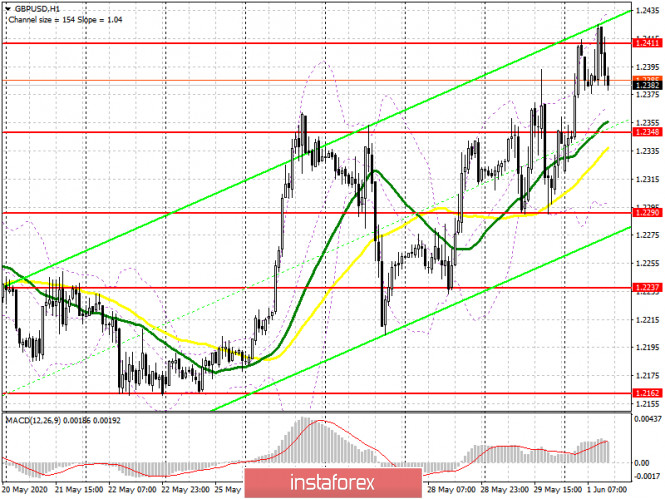

| Posted: 01 Jun 2020 05:08 PM PDT GBP/USD 1H The pound/dollar unexpectedly continued its upward movement on Monday, which also increased. Buyers managed to overcome the resistance area of 1.2403-1.2423, as well as the first resistance level for this week at 1.2434. Therefore, the path to growth is now clear until the next resistance level of 1.2529, to which, however, there isn't much, only 30 points. If the bulls do not pause near this target, then it will be possible to trade for an increase with the target of 1.2664. Although, from our point of view, all this sharp rise in the pound's price raises questions and doubts about its validity. Of course, the pound cannot constantly get cheaper, and the situation in America is also discouraging and dangerous, there are also enough uncertainties, however, the British currency's growth has begun too sharply. In any case, while the technical data speaks in favor of continuing the upward movement, the trend line confidently supports the traders to increase. GBP/USD 15M Both linear regression channels continue to be directed upward on the 15-minute timeframe, therefore, there are no signs of ending the upward trend here, just as there are no signs of the beginning of the correctional movement. COT Report Despite the fact that, in total, among all major market participants, the demand for the pound sterling did not change during the reporting week (a total of 8600 contracts for buying and selling were opened), professional traders mostly bought the pound sterling - +5205 contracts, and on the contrary, they got rid of the contracts for selling at -1,686 transactions. Thus, the mood of traders remains upward, and at the end of last week the situation, in principle, has not changed. But in order for the upward movement to continue, it is necessary that large traders continue to invest in the British currency, and for this we need reasons and reasons, which, in the pound's case, are now quite difficult to find. Nevertheless, the GBP/USD pair continues to grow at the beginning of the new week, which means that the demand for the pound does not decrease. The fundamental background for the British pound remains negative in spite of the fact that this currency continues to go up together with the dollar. On the first trading day of the week, the report on business activity in the UK manufacturing sector, which was 40.7 with a forecast of 40.6, is not particularly important at this time. No important publication in the United Kingdom and the United States for today. On Monday, a new, fourth round of negotiations between Brussels and London began on an agreement that could take effect on January 1, 2021 and would determine the relationship between the UK and the EU. However, yesterday it became known that the chances of making any progress during this round are as small as in previous times. The European Union published a document stating that David Frost and Britain as a whole may not expect to receive any privileges from the EU that were given to other partners of the bloc. The EU believes that each agreement is "unique" and should be discussed until both parties are satisfied. In the case of Great Britain, which is forcing events and even during the time of the global pandemic and global crisis, does not want to postpone the "transition period", which could give additional time for negotiations, this will not work. Thus, the chances of a deal continue to fall, and the chances that the British economy will be even harder next year are growing. There are two main scenarios as of June 2: 1) The initiative for the pound/dollar pair remains in the hands of the bulls and, since several important resistance has been overcome, traders are advised to stay in purchases with targets at resistance levels of 1.2529 and 1.2664. The movement was very strong on Monday, therefore, the correction can be strong and begin abruptly and unexpectedly. Take Profit will be about 30 points in the first case and 160 in the second. 2) Sellers continue to remain in the shadow and will be ready to return to the market only below the ascending trend line. Of course, short positions can be considered before, but now there are no prerequisites for this at all. We consider the minimum necessary condition for sellers to overcome the area of 1.2403-1.2423. Then it will be possible to sell the pair while aiming for the Kijun-sen line (1.2344) and the trend line (1.2300). In this case, Take Profit will be from 55 to 115 points. The material has been provided by InstaForex Company - www.instaforex.com |

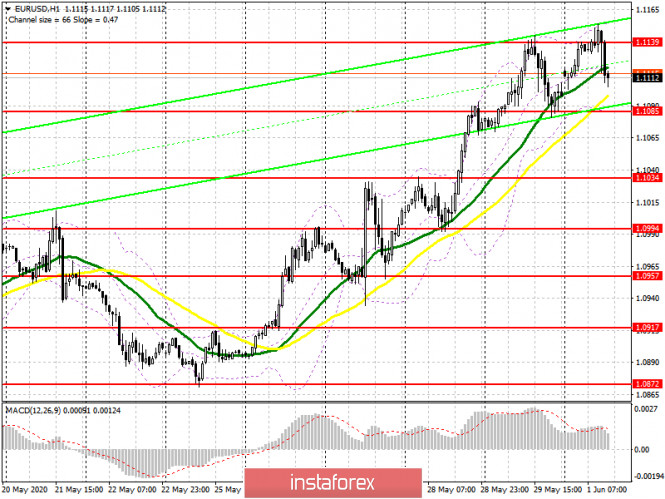

| June 1, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 01 Jun 2020 10:32 AM PDT

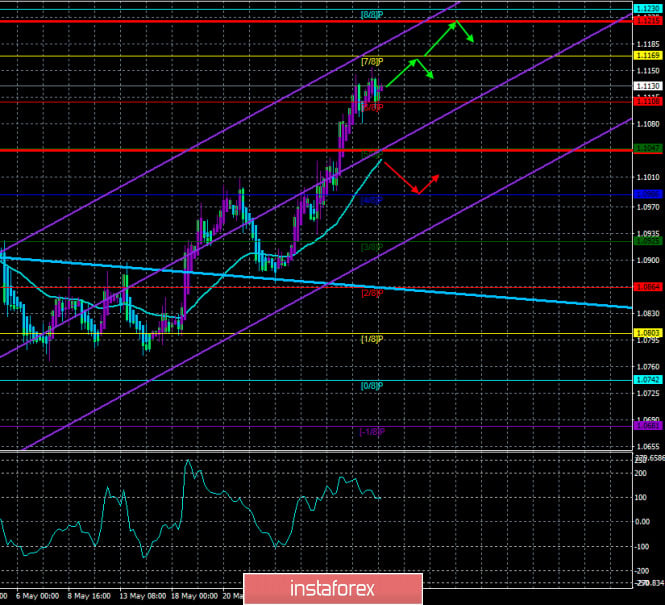

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibo Level 50%). Shortly After, a bearish Head & Shoulders pattern was demonstrated around the price zone between (1.1075-1.1150). That's why, Further bearish decline was demonstrated towards 1.0800 where the nearest demand level to be considered was located near the backside of the broken channel (1.0800-1.0750). Evident signs of Bullish rejection have been manifested around the price zone of (1.0800-1.0750) leading to the recent bullish spikes up to 1.0990. On May 1, Lack of bullish momentum around 1.1000 lead to another bearish decline towards the depicted price zone around 1.0800. However, the price zone of (1.0815 - 1.0775) has been standing as a prominent Demand Zone providing quite good bullish support for the pair so far. Moreover, a recent ascending bottom has been established around 1.0870 which enhances the bullish side of the market in the short-term. Short-term technical bullish outlook remains valid as long as bullish persistence is maintained above the recently-established ascending bottom around 1.0850-1.0870. Currently, the recent bullish breakout above 1.1000 should be maintained to enhance further bullish advancement towards 1.1075 and 1.1175. On the other hand, any bearish breakdown below 1.0930 should be marked as an early Exit signal for all short-term BUY trades. Trade recommendations : Intraday traders are advised to wait for any upcoming bearish pullback towards 1.1000 as a valid BUY signal. T/P levels to be located around 1.1075 then 1.1175 if sufficient bullish momentum is maintained while S/L to be located below 1.0900. The material has been provided by InstaForex Company - www.instaforex.com |

| June 1, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 01 Jun 2020 10:26 AM PDT

Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.1890-1.1900 (Double-Bottom Neckline) on the H4 Charts. Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April). Moreover, Atypical Bearish Head & Shoulders reversal pattern was in progress. The GBP/USD pair was demonstrating the Right Shoulder of the pattern. Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. Moreover, the price zone of 1.2300-1.2280 corresponding to a short-term uptrend was breached to the downside failing to provide enough bullish support for the pair. Thus, enhancing the bearish side of the market. Temporary bearish breakout below 1.2265 was demonstrated in the period between May 13 - May 26. However, immediate bullish rebound has been expressed since then. Currently, the price zone of 1.2470 - 1.2520 (Backside of the broken Uptrend) stands as a recently-established SUPPLY-Zone to offer bearish rejection and a valid SELL Entry for the pair in the short-term. Hence, further bearish decline would be expected to be enabled towards 1.2020 as a projection target for the reversal pattern provided that no bullish breakout above 1.2550 is expressed. Trade recommendations : Intraday traders can still consider the current bullish pullback towards the price zone of 1.2470 - 1.2520 as a valid SELL Entry. T/P level to be located around 1.2345, 1.2265 and 1.2150 while S/L should be placed above 1.2570. The material has been provided by InstaForex Company - www.instaforex.com |

| USDJPY is trading below key resistance Posted: 01 Jun 2020 09:24 AM PDT USDJPY is moving sideways. Price cannot break above the key short-term resistance at 108. Price continues to trade right below this horizontal resistance and as long as price is below it, we prefer to be bearish looking for a pull back towards 105.50. Only a break above this resistance will change our mind.

Green rectangle - resistance USDJPY has 108 as resistance. Things are very clear. Below it we are bearish. Above we are bullish expecting to reach 109 first and 111.70 later. But for now we prefer to be bearish as price is below the horizontal resistance. Support is at 107. Breaking below this level will open the way for a move towards 105.50. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD continues lower towards our second target Posted: 01 Jun 2020 09:13 AM PDT USDCAD has broken down below key support. In our previous analysis we noted the bearish signals from the break down of the bearish descending triangle formation. Price has so far achieved our first target at 1.37 and is moving towards our second target of 1.35.

USDCAD is making new lows at 1.36 and below. Price is clearly in a bearish trend making lower lows and lower higher. After breaking below the lower triangle boundary we mentioned our two targets. The first target has been achieved. The RSI continues to move lower and has still more room to fall into oversold levels. Our 1.35 second target looks very probable to be reached. Resistance is now found at 1.38-1.3840. What was once support is now resistance. The material has been provided by InstaForex Company - www.instaforex.com |

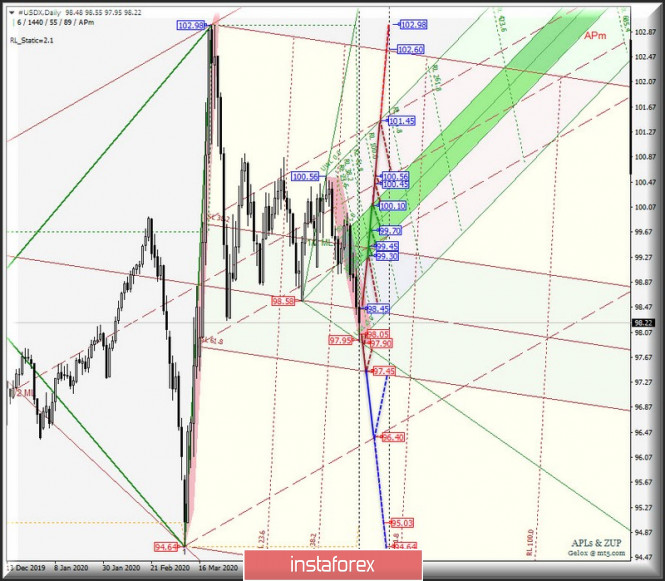

| Posted: 01 Jun 2020 09:02 AM PDT Minor operational scale (Daily) Beginning of summer - options for the development of the movement of the dollar index #USDX and "raw" currencies AUD/USD & USD/CAD & NZD/USD in June 2020. ____________________ US dollar index In June 2020, the movement of the dollar index #USDX will be determined depending on the direction of the breakdown of the range:

Breakdown of the Median Line Minor - resistance level 98.45 - development option of the upward movement of the dollar index to the borders of the equilibrium zone (99.30-99.70-100.10) of the Minuette operational scale forks and channel 1/2 of the Median Line (99.45-100.45-101.45) of the Minor operational scale forks. If the initial - SSL (support level 98.05) and control - LTL (97.90) of the Minuette operational scale forks are consistently broken, the downward movement of #USDX can be continued to the goals:

The layout of the #USDX movement options in June 2020 is shown on the animated chart.

____________________ Australian dollar vs US dollar The development of the movement of the Australian dollar AUD/USD in June 2020 will depend on the development and direction of the breakdown of the range:

When the FSL terminal line of the Minor operational scale forks breaks down - support level 0.6650 - the downward movement of the Australian dollar to the borders of the 1/2 Median Line channel (0.6425-0.6290-0.6180) and the equilibrium zone (0.6120-0.5970-0.5810) of the Minor operational scale forks will be determined. If the resistance level of 0.6795 breaks through on the UTL control line of the Minor operational scale forks, the upward movement of AUD/USD can be continued towards the targets:

The markup of the AUD/USD movement options in June 2020 is shown on the animated chart.

____________________ US dollar vs Canadian dollar The development of the movement of the Canadian dollar USD/CAD in June 2020 will be due to the development and direction of the breakdown of the boundaries of the equilibrium zone (1.3645-1.3850-1.4050) of the Minor operational scale forks - look at the animated chart for the details of movement within this zone of equilibrium. If the resistance level 1.4050 at the upper boundary ISL38.2 zone equilibrium of the Minor operational scale forks will make possible the continued development of the movement of the Canadian dollar to the borders of the channel 1/2 Median Line (1.4220-1.4380-1.4550) and equilibrium zone (1.4430-1.4660-1.4920) of the Minuette operational scale forks. A breakdown of the support level 1.33645 at the lower border of ISL61.8 of the Minor operational scale forks will direct the development of the USD/CAD movement to the final Shiff Line Minor (1.3300) and to the final FSL line Minor (1.3000). The markup of the USD/CAD movement options in June 2020 is shown on the animated chart.

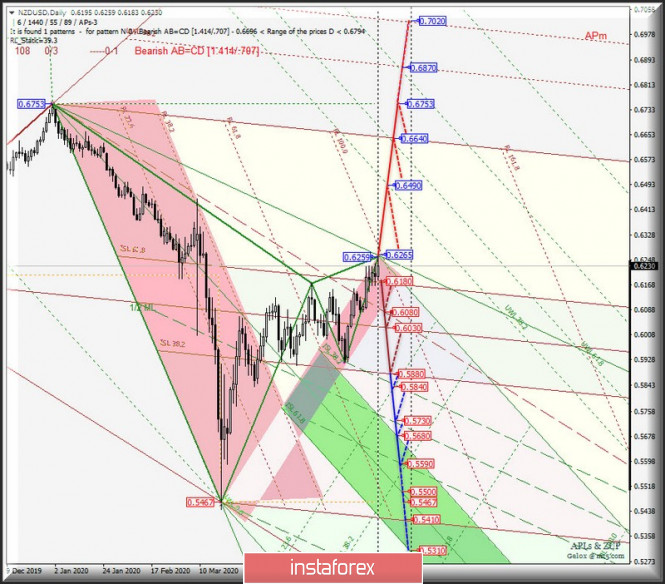

____________________ New Zealand dollar vs US dollar The development of the movement of the New Zealand dollar NZD/USD in June 2020 will depend on the development and direction of the breakdown of the range:

The breakdown ISL61.8 Minor - support level of 0.6180 will determine the refund, the movement of the New Zealand dollar in the zone of equilibrium (0.6180-0.6030-0.5880) of the Minor operational scale fork with the prospect of the channel borders 1/2 Median Line (0.5840-0.5730-0.5590) of the Minuette operational scale fork. If the resistance level of 0.6265 breaks through on the UTL control line of the Minuette operational scale forks, the upward movement of NZD/USD will be directed to the warning lines - UWL38.2 (0.6490) and UWL100.0 (0.6640) of the Minuette operational scale forks with the prospect of updating the local maximum of 0.6753. We look at the layout of the NZD/USD movement options in June 2020 on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers, and is not a guide to action (placing "sell" or "buy" orders). The formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of currencies in the basket: Euro - 57.6 %; Yen - 13.6 %; Pound - 11.9 %; Canadian dollar - 9.1 %; Swedish Krona + 4.2 %; Swiss franc - 3.6 %. The first coefficient in the formula brings the index value to 100 on the starting date - March 1973 when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EURUSD for June 01, 2020 Posted: 01 Jun 2020 08:21 AM PDT

The ISM Industrial Index for May came out at 43.1, as what forecasts expected. This is not bad for the current situation, and it is in fact better than the 41.5 in April. Construction costs fell by -2.9% which is much better than the -6% forecast. On the whole, the news is positive amid the crisis situation. Next, we wait for the main news which is the unemployment forecast expected on Wednesday-Friday. EURUSD: The pair is moving in an upward trend. Aggressive - buy from 1.1155 upon the breakdown. Conservative - buy in case of a pullback from 1.1060 and below. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold found support, plans to increase its value Posted: 01 Jun 2020 08:02 AM PDT

The price of gold increased this morning, caused by riots in major cities in the United States of America. Market participants are already so scared by the ongoing escalation of the US-China trade war, and the news of the riots only added agitation. Against this background, investors chose to keep their assets in a calmer and safer harbor, which is the precious metals market. The start of the weakening of the greenback only adds fuel to an already well-flaming fire. The price of gold this morning has increased by 0.66% and reached the level of $ 1,737.68 per troy ounce. As it became known, the American authorities had to resort to the National Guard detachments in fifteen states at once, since other measures to contain the riots that had begun were ineffective. Recall that the protests unfolded against the news of the death of African-American George Floyd, who had previously been detained by the police. Later, the protest moved to a more serious level and was accompanied by fierce clashes with the police and looting. The tension is also growing on the news that the conflict between Washington and Beijing still will not go into the stage of reconciliation and compromise. The situation around Hong Kong is heating up, although at a less significant pace, which analysts expected. This will force investors to abandon risky transactions and move to the precious metals sector. According to experts, such a situation will last at least until the end of this year, from which we can conclude that for a long-term plan, gold will now come in handy. Market participants are looking for a safe-haven asset, which gives an opportunity to the bulls to intensify their activities. Meanwhile, the cost of palladium decreased by 0.19% and reached the mark of 1,940.74 per troy ounce. Silver, on the contrary, increased significantly by 1.81% in price and stood at $ 18.16 per troy ounce. The cost of platinum also rose by 0.49%, which allowed it to move to the level of 842.34 dollars per ounce. The material has been provided by InstaForex Company - www.instaforex.com |

| To continue the bullish trend, the euro must overcome $ 1.12, and the pound, $ 1.24 Posted: 01 Jun 2020 06:56 AM PDT

The US dollar has fallen today against other currencies, which surprised everyone. News that could significantly affect the dynamics of the currency are non-existent, except for the Friday press conference, from which US President Trump promised a response against China. Fed Chairman Jerome Powell also did not say anything new, and investors appear to be convinced that the economy is soon to recover as soon as the pandemic recedes. Nevertheless, other world currencies grew, including the Australian dollar, which has now confidently entered the area of the 67th figure. The euro is also trading in a positive area today, continuing the "bullish" trend formed last week. EUR / USD The positive outlook of traders regarding the global economy raised the demand for risky assets, such as the euro. It negated the fears caused by the recent US-China conflict, since despite the threats and harsh rhetoric between the two countries, the first phase of their trade agreement remains in force. These recent occurrences fueled the "bullish" mood of the EUR / USD pair, which today updated Friday's high. The focus today of market participants are the macroeconomic statistics that will be published on both the US and the eurozone. It may support the bulls in reaching the level $ 1.12, or even the level $1.13. If the growth of the EUR / USD rate is fast, the first goal of bulls, which is $ 1.12, may be reached immediately. The support level is located at $ 1.1105. GBP / USD The British pound is also in a bullish mood today. Attempts of a consolidation above $ 1.2 are being conducted, as the bulls are supported by the corrective movements in the dollar. The quotes have successfully moved away from the moving averages 144, 34, 55 and 89, which are the support levels of $ 1.2318, $ 1.2280, $ 1.2259, $ 1.2246. The MACD line is also in the positive zone and above its signal line. In addition, the Stochastic Oscillator has partially entered the overbought zone, showing the same bullish signal. However, it is advisable to wait for a breakout from $ 1.2414, as the failure of if will resume the downward correction, and possibly bring the quotes to the levels $ 1.2343, $ 1.2316 and $ 1.2293. The material has been provided by InstaForex Company - www.instaforex.com |

| Europe and Asia stocks are trading in positive territory Posted: 01 Jun 2020 06:52 AM PDT

Trading on stock exchanges in the Asia-Pacific region positively began today. Almost universal growth began after it became clear that US President Donald Trump is not going to take the most extreme measures and impose sanctions in the trade sector. His presentation, although rather harsh, still was not as bad as experts had expected. One thing is clear today, the United States intends to strip Hong Kong of its status as a global financial center, as well as of the privileges that followed. Perhaps the most significant thing that the US will do now is the removal of the status of an independent customs territory in Hong Kong. However, nothing has been done so far regarding the cancellation of the trade agreement between the United States and China, which was signed in January of this year. This supported the stock markets very well, which, one might say, was relieved because they expected much more serious measures from the US. China's Shanghai Composite Index is up 2.2% this morning. Hong Kong's Hang Seng Index went even further to 3.4% gain. The PMI in China's manufacturing sector last month fell below 50.6 points, while a month earlier it was 50.8 points. Nevertheless, when this index exceeds 50 points, this indicates an increase in activity in this area. When the index falls below 50 points, there should be a noticeable decrease in the activity. Recall that in China, this index is above the strategic level of 50 points for three months in a row after the devastating reduction that took place against the backdrop of the COVID-19 pandemic. The current situation indicates that an increasing number of companies are joining the work after a long and forced break. Meanwhile, there is some regression in the growth, which should alert the experts, since earlier they argued that the increase should continue, and the PMI level should pass the mark of 51 points. In the corporate sector, the leading position in trading growth in Hong Kong today was taken by Country Garden, whose shares rose in price by 7.5%. It is followed by Sunny Optical Technology Group Co. Ltd and AAC Technologies Holdings Inc., both of which added 6.3% each. AIA Group also increased the value of its securities by 5.8%, while Tencent Holdings went up by 4.1%. Japan's Nikkei 225 Index is up by 0.5%. This raised it above the strategic mark of 22 thousand points, which happened for the first time in the last three months. In addition, the costs of companies began to grow in Japan. For example, in the first quarter of this year, they grew by 4.3% and recall that before this, a decrease of 3.5% was recorded. It also means that business activity is growing and the industry sector is gradually emerging from stagnation. Securities of SoftBank Group rose in value by 3.4%. The same rise was recorded by the manufacturer of cosmetics Shiseido. Electronics maker Sony is up by 0.7%. At the same time, a decrease was recorded in the car manufacturers market. So, Toyota Motor shares fell by 0.7%. The South Korean Kospi Index rose by 1.5% this morning. Corporate news from South Korea is also positive. Shares of a major electronics manufacturer, Samsung, went up by 0.6%, and securities of car manufacturer Kia Motor by 0.7%. Australia's S & P / ASX 200 Index rose to 0.75% this morning. Here, mining leaders BHP and Rio Tinto, which increased their capitalization by 3% and 3.8%, respectively, became the leaders in the rise. Trading on the stock markets of Western Europe today also began a new week positively. The main news they played here was a sharp escalation of the conflict between Washington and Beijing, which, apparently, will not be. The general index of enterprises in the Stoxx Europe 600 region increased in the morning by 0.53% and reached 352.22 points. The UK FTSE 100 index gained 0.66%, the French CAC index rose by 0.77%, Italy's FTSE MIB index rose to 0.58%, and Spain's IBEX 35 index showed the best performance rising to 1.29%. The statistics released this morning showed an increase in the PMI in Europe over the last spring month of this year. Nevertheless, this did not help him get too far from the minimum value that was recorded this year. According to recent data, the index was 39.4 points, but earlier, according to preliminary forecasts, it was expected to rise slightly higher up to 39.5 points. In general, the situation on the stock exchanges in Europe and Asia is quite positive, which will most likely help to maintain further growth. The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's diary. June 1, 2020. Covid-19 in Russia. EURUSD. Russian rouble Posted: 01 Jun 2020 06:48 AM PDT

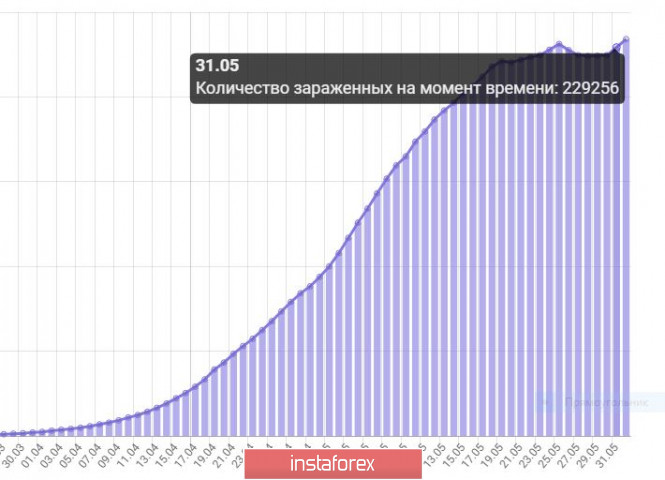

This is the most important epidemic chart: the number of people receiving medical treatment as of June 1 in Russia. As we can see, the cart is trying to turn up after some stabilization. It should be noted that the stabilization of the coronavirus situation in Russia was associated with a sharp drop in new cases in Moscow; and a large number of people who recovered in Moscow as well. At the moment, new cases of infection in Moscow decreased by 30%. Meanwhile, the number of new cases increased in provinces. In addition, people recover slowly there. Today, Russia, excluding Moscow, recorded a new maximum of +6700 cases of the coronavirus infection. Clearly, the peak of the epidemic has not yet been passed.

The Russian ruble is growing again amid a relatively high oil price and the support from the Central Bank of Russia. It is better to refrain from buying the currency as support has been broken out. I believe that it is a false breakout.

EURUSD: it is preferable to buy the pair from 1.1040 and below. The material has been provided by InstaForex Company - www.instaforex.com |

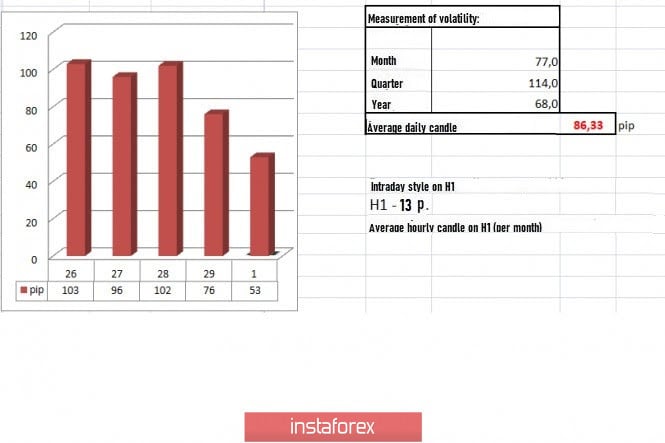

| Trading recommendations for the EUR/USD pair on June 1, 2020 Posted: 01 Jun 2020 06:43 AM PDT From the point of view of complex analysis, we can see that the quotes reached the control area of interaction of trade forces. The past trading week had in itself not just an upward spiral of long positions, but also the first radical change in market tacts in a long time. The flat 1.0775 // 1.0885 // 1.1000, which traders focused on for two months, lost its major role and was replaced by an upward impulse, which confirmed the bullish mood of traders and consolidated the quotes above the value of 1.1080. However, movement did not stop there, and the quotes managed to reach March 27's high, 1.1147, as well as the area of interaction of trade forces, 1.1150 / 1.1200. Such occurrences further fueled the interest in the current movement. Traders, inspired by the dramatic changes, began to discuss the further course of the pair, having forgotten that the trend is still downward, and attempts to change it have been recorded repeatedly in the market. One sound idea is that the market is again active, so local positions may be considered as main trading operations. Analyzing Friday's trading in detail, we can see that the upward trend started at the Asian session, from which the quotes managed to pass the level of 1.1145, and reached March 27's high, 1.1147. The following movement was a local rebound, on which the trading week ended. In terms of volatility, a slight slowdown was observed, relative to Friday. However, if we take into account the entire past week, the average daily indicator is 84 points, which is already considered the norm of an active market. As discussed in the previous review, traders held long positions for more than one day, from which the area 1.1150 / 1.1190 was supposed to become a platform for opening transactions. Looking at the daily chart, we can see the third attempt of traders in changing the medium term downward trend. The trend in long-term trading is also downward. Meanwhile, the news published on Friday contained preliminary data on inflation in Europe, which came out worse than expected, having a decrease from 0.3% to 0.1%. The indicator, in anticipation of the ECB meeting on June 4, escalates the fear of investors, as inflation rate has always been considered in the regulator's actions in monetary policy. In the US, another street war occurred, which was replaced up by the death of African-American George Floyd. More than 25 major cities in the country, as well as several states, including the District of Columbia, were surrounded by protests, riots and looting, which in all saw not only the abuse of law enforcement and interracial hatred by individuals, but also the tiredness and hopelessness of citizens who perhaps lost the only source of income amid quarantine measures. The riots will soon come to naught, but local pressure was already exerted on the US dollar. With regards to the coronavirus, which severely undermined the economy of the United States, Fed Chairman Jerome Powell, during a video conference, expressed his concerns on the risks of a second wave. "I worry that a second wave will undermine confidence and lead to a slower and weaker recovery, as a full economic recovery depends on people's confidence that it's safe to go out and take part in a wide range of economic activities," Powell said. Today, the Manufacturing PMI in the Eurozone was published, in which the data concided with the economists forecast, and recorded an increase from 33.4 to 39.4. The forecast was 39.5. A similar PMI is to be published in the United States, where an increase from 41.5 to 43.0 in the index is expected. Further development Analyzing the current trading chart, we can see that the quotes managed to pass March 27's high, 1.1147, but fell again from the area of interaction of trading forces, which lies between 1.1147 and 1.1180 / 1.1200. The movement led to the consolidation of long positions and initial rebound of quotes. Continued pressure may lead to a technical correction. The bullish mood may temporarily be replaced by a slowdown, from which in case of growth and consolidation of prices lower than 1.1080, a technical correction will develop. Meanwhile, if the quotes consolidate above 1.1160, and then fix above 1.1200, the trend will change. Given the above information, we present these trading recommendations: - Open sell positions lower than 1.1080, towards 1.1000. - Open buy positions higher than 1.1060, towards 1.1200. Subsequent transactions will depend on the consolidation of prices. Indicator analysis Analyzing the different sectors of time frames (TF), we can see that the indicators of hourly and daily periods signal a bullish mood, influenced by the trend change and focus of quotes on March 27's high. Volatility per week / Measurement of volatility: Month; Quarter Year The measurement of volatility reflects the average daily fluctuation calculated for the Month / Quarter / Year. (June 1 was built, taking into account the time of publication of the article) Volatility is currently 53 points, which is lower than the daily norm. With this, we can assume that if a slowdown does not occur, the speculative mood will do its job and accelerate the quotes. Key levels Resistance areas: 1,1000 ***; 1.1080 **; 1,1180; 1.1300; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support areas: 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

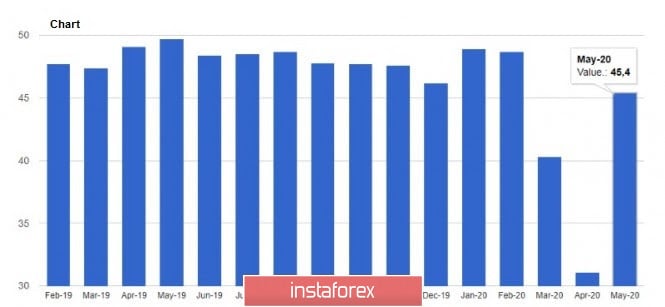

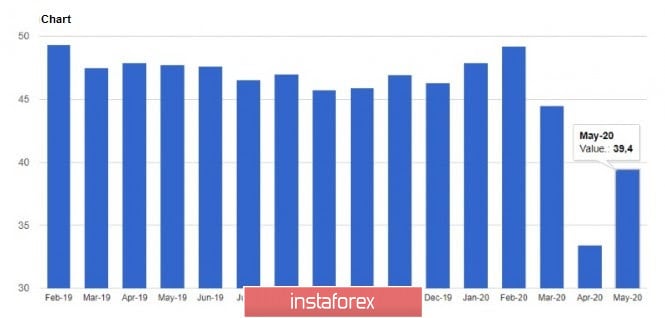

| Posted: 01 Jun 2020 06:00 AM PDT Today, data on manufacturing activity in the Eurozone countries were released, which slightly quieted the ardor of bulls betting on further strengthening of risky assets. The euphoria from the European Commission's proposed support plan for the European economy last week for 750 billion euros will continue to drive the bulls. Now the important question is whether the EU leaders will agree on the stimulus package since the north and south have opposite views on this issue. Of course, if the agreement is adopted, then from the market, the momentum towards fiscal consolidation will increase the stability of the Eurozone and support the European currency in the medium term. The easing of quarantine restrictions is supporting the manufacturing index, which is groping the bottom after a shocking fall in April this year. Many companies are resuming their work, which will have a positive impact on the indicators in the future and return the economy to normal. A report from the statistics agency IHS Markit indicated that the purchasing managers' index (PMI) for the Italian manufacturing sector in May jumped to a level of 45.4 points against 31.1 points in April, with a growth forecast of 37.0 points. Italy, perhaps, was the only one of the countries in the Eurozone where the indicator showed such active growth. For example, in France, the purchasing managers' index for the French manufacturing sector rose to 40.6 points in May, after 31.5 points in April and a forecast of 40.3 points. But the leading economy of the European Union, Germany, is not doing as well as many expected. According to the report, the purchasing managers' index (PMI) for the German manufacturing sector in May rose only to 36.6 points, which was even worse than the forecasts of economists, who expected an indicator of 36.8 points. In April, the PMI showed a drop to 34.5 points. As for the Eurozone as a whole, the final value of the index turned out to be worse than the preliminary value, which slightly moderated the growth of the euro in the short term. According to the IHS Markit report, the purchasing managers' index (PMI) for the manufacturing sector in May 2020 fell to 39.4 points against 39.5 points (preliminary data). In April, the index was at 33.4 points, indicating a sharp decline in activity in the sector. Economists had expected the index to remain unchanged in May. As for the technical picture of the EURUSD pair, nothing has changed significantly. An unsuccessful attempt by the bulls to break above the resistance of 1.1140 left everything in its place. Only if this area is broken, the bullish momentum in risky assets will return, which will lead to a test of new highs of 1.1230 and 1.1340. If the pressure on the trading instrument begins to gradually increase, a downward correction to the support area of 1.1085, and then a test of a larger level of 1.0990, is not excluded. GBP The British pound also attempted to grow against the US dollar for the same reason as the European currency, after data on manufacturing activity, which continued to decline, although at a less noticeable pace, was released. Problems with the growth of the pound remain, and they are related to the Brexit negotiations, as unexpected progress on them in the near future should not be expected. However, the pound is supported by the Bank of England's refusal to introduce negative interest rates, which Governor Andrew Bailey made clear last week. As for negotiations on trade relations between the EU and the UK, they will resume tomorrow, but no one is waiting for a significant breakthrough in this direction, but also does not rule out the possibility of agreeing on Brexit at the last minute. As for activity in the UK manufacturing sector, as noted above, it continued to decline. Problems related to coronavirus and quarantine measures are putting pressure on the sector. According to the report by IHS Markit and CIPS, the final purchasing managers' index (PMI) for the UK manufacturing sector in May 2020 was 40.7 points against the preliminary estimate of 40.6 points and the April value of 32.6 points. As for the technical picture of the GBPUSD pair, the bulls' problems with the level of 1.2420 remain quite serious. Only a break in this range can trigger the demolition of bears' stop orders, which will lead to the exit of the trading instrument to the highs of 1.2470 and 1.2550. If the pressure on the pound returns, the activity of bulls will be noted in the area of 1.2235, but larger buyers will prefer to postpone entering the market until the update of the minimum of 1.2075. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Jun 2020 05:07 AM PDT Corona virus summary:

Technical analysis: BTC has been trading upwards. The price tested and rejected of the level at $9,600. I see further downside rotation towards the levels at $8,760 and $8,650.. Trading recommendation: Watch for selling opportunities on the BTC due to overbought condiiton on the Stochastic oscillator. I also found the breakout of the upward channel in the background, which is another sign for the weakness. The downward targets are set at $8,760 and $8,650. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Jun 2020 05:00 AM PDT Corona virus summary:

Technical analysis: Gold has been trading upwards. The price tested and rejected of thelevel at $1,743. I see further downside rotation towards the levels at $1,722 and $1,712. Trading recommendation: Watch for selling opportunities on the Gold due to overbought condiiton on the Stochastic oscillator. I also found the breakout of the upward trendline in the background, which is another sign for the weakness. The downward targets are set at $1,722 and $1,712. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: Euro's recovery and continuation of US-China trade war Posted: 01 Jun 2020 04:51 AM PDT

Investors welcomed Trump's decision on Friday not to immediately end the special privilege regime for Hong Kong and not change the parameters of the trade deal between Washington and Beijing. In addition, Fed Chairman Jerome Powell, said the Central Bank which is actively building up its balance sheet, has not even come close to any limits. Against this background, the USD index reached its lowest level since the middle of March at around 97.8 points. It would seem that rumors about the expansion of the European QE should have led to sales of the euro, but at the end of spring, the EUR / USD pair soared into the area of two-month highs, thanks to the expectations of new steps by the ECB to save the eurozone economy. If the regulator adds at least € 500 billion to the quantitative easing program, Italian bonds may be the best four-week rally since 2003, and a drop in their yield will indicate the end of the storm in the European debt market. The ECB meeting is undoubtedly a key event at the beginning of summer. In May, representatives of the financial institute talked a lot about the need to expand the quantitative easing program, and market participants almost believed that the regulator would bring QE to € 1.6 trillion.

According to ECB President Christine Lagarde, previous forecasts for a 5% decline in Eurozone GDP in 2020 are likely to be outdated, in fact, the region's economy could shrink by 8%-12%. The deterioration of its prospects, along with a slowdown in inflation in the currency bloc to 0.1%, is a strong argument in favor of a further weakening of the ECB's monetary policy. An important driver for the growth of EUR / USD is calm in the debt markets of the Eurozone. A decrease in the yield differential of Italian and German government bonds signals a decrease in political risks in the EU, as well as unity in the ranks of the alliance. It is enough to recall how the euro soared after the victory of Emmanuel Macron over the Eurosceptics in 2017 to understand how important the common future of the eurozone countries is for the common European currency. Of course, the success of the EUR / USD bulls would not have been so impressive if it were not for the rally of US stock indices, forcing investors to dismiss defensive assets. Obviously, the American economy has plunged into a deep hole. In April, consumer spending in the United States fell 13.6% after a decrease of 6.9% in March. According to forecasts by Bloomberg experts, employment in the country's non-agricultural sector will decrease by another 8 million after a decline of 20.5 million in April, resulting in unemployment rising to 19.5%, reaching its highest level since the Great Depression. However, investors, apparently, still believe in a V-shaped recovery of US GDP in the second half of the year. Under such conditions, only very bad news can trigger a wave of stock sales. The market expected that such would be large-scale US sanctions against China due to the introduction of the national security law in Hong Kong. However, the White House was actually limited to half measures, which allows the EUR / USD bulls in the event of a successful assault of resistance at 1.1150 to count on the continuation of the rally in the direction of 1.1220 and 1.1240. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Jun 2020 04:48 AM PDT

The price of crude oil on Monday morning showed a decline that followed a steady rise after last month's results. The price of black gold has come under significant pressure amid US President Donald Trump's speech. A statement criticizing China's actions came on the last business day last week. Trump intends to deprive Hong Kong of the status of a global financial center since it can no longer be considered territory independent of the Chinese side. Recall that the Chinese authorities decided to develop a bill protecting the national security of Hong Kong, which did not appease Washington. Despite the fact that theUS is determined to wage an uncompromising struggle, the US president did not say anything about the retaliatory measures in the field of trade, which were so eagerly discussed earlier. It added positive and support to the markets. In addition, the news of American statistics also positively affects the situation. As it became known last Friday, the drilling rigs in the country, continuing active work on the extraction of oil raw materials, decreased by 17 pieces last week. Thus, the 301 drilling station continues its work today. The number of oil rigs also decreased last week by 15 units, 222 were left. It was not possible to expand the dynamics in the opposite direction on the oil market even against the background of the participants' fears after China announced that it was ready to repel American attacks by introducing countermeasures. According to Chinese officials, the bill that the United States is now trying to ratify in relation to China is extremely offensive, which is essentially direct interference in the country's internal affairs. While investors in the black gold market pretend that they do not notice this verbal skirmish between the leading economic powers of the world, a correction can begin at any time, which will be caused by growing negativity and the aggravation of the conflict. Many experts note that the growth of oil quotes is now taking place on very controversial grounds, which can unexpectedly stagger and disappear. So, market participants practically didn't react at all to the fact that oil reserves in the United States became larger, and also to the fact that OPEC member countries are not too keen to comply with agreements on reducing raw material production. Recall that two months ago, an agreement was signed, according to which there should have been a significant (9.7 million barrels per day) decrease in oil production. Since May 1, the contract has entered into force, its validity lasts two months. Thus, market participants are looking forward to the next meeting of OPEC countries, scheduled for June 10, where they will raise the question of continuing this policy or its termination. It's already clear that not all states were quick to reform their oil production. So, the most record reduction occurred in Saudi Arabia, where April of this year, the country produced only 11.7 million barrels per day. But countries such as Iraq and Nigeria were in no hurry to reduce their production. They complied with only 38% and 19% of the agreements that were accepted earlier. On the whole, in May it was possible to fulfill the conditions of the signed agreement by only 74%, which, however, can be considered a good result, especially since it provided visible support to the oil market and corrected the rapidly falling demand for oil products. They complied with only 38% and 19% of the agreements that were accepted earlier. The new OPEC meeting is the new agenda of the traders at which, in particular, the extremely exciting issue for the black gold market will be discussed on Russia's withdrawal from the agreement to reduce production. At the moment, there is reason to doubt that Russia will want to extend the term of this agreement, which will force an even greater reduction. According to some reports, the meeting may be postponed to an earlier date - on June 4 and 5 of the current year. And this may mean that this week will be difficult for the oil market in all respects since there will be a lot of pressure and it will be multidirectional. Over the past month, WTI crude oil has become 88.4% higher in value, and this is the highest growth in the history of observations over the month. Brent crude oil also rose well to 39.8% per month. Today, on a trading floor in London, the price of Brent futures for August delivery grew by 0.66%, which is $ 0.25 in cash. Thus, the current price was 37.59 dollars per barrel. This is still lower than the closing price on Friday when oil of this brand was at the level of $ 37.84 per barrel, which reflected an increase of 5%. July contracts also expired last Friday. On the trading floor in New York, futures for WTI crude oil fell in value by 0.59%, or 0.21 dollars, this day which sent it to the mark of 35.28 dollars per barrel. Last Friday, before the weekend, its price rose by 5.28%, or 1.78 dollars, and reached the level of 35.49 dollars per barrel. Thus, today there is a rather restrained and uncertain reduction in the cost of crude oil. However, OPEC will inevitably insist on continuing its policy to reduce production, which is likely to allow oil prices to rise to around $ 49 per barrel. At least, most analysts are counting precisely on this scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Jun 2020 04:44 AM PDT Corona virus summary:

Technical analysis: GBP/USD has been trading upwards. The price tested and rejected of the resistance trendline at the price of 1,2425. I see further downside rotation towards the level of 1,2334 due to overbought condition. Trading recommendation: Watch for selling opportunities on the GBP due to overbought condiiton on the Stochastic oscillator and rejection of the resistance trendline. The downward target is set at the price of 1,2334. Support level is seen at the price of 1,2334. The material has been provided by InstaForex Company - www.instaforex.com |

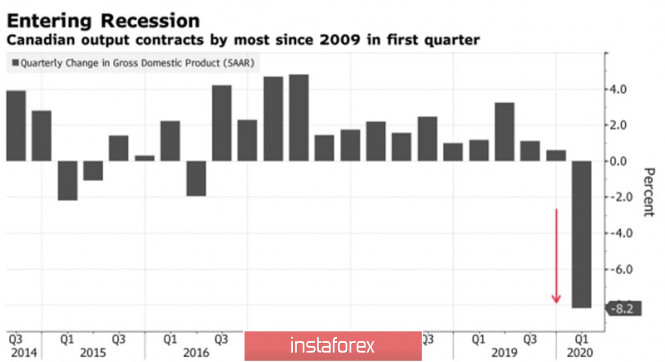

| Posted: 01 Jun 2020 04:19 AM PDT The meeting of the Bank of Canada, the release of data on the labor market of the Maple Leaf Country, and expectations of the June OPEC+ summit attract investors' close attention to the Canadian dollar. In May, the "loonie" strengthened against its American namesake by 2.6%, ignoring the sad statistics on GDP for the first quarter, the growth of the BoC balance sheet from CA $ 120 billion in mid-March to CA $ 400 billion, and concerns about a credit rating downgrade that could trigger capital outflows from the securities market of the northern state. In January-March, the Canadian economy declined by 8.2% y/y to CA $ 2.1 trillion. It was worse only in the first quarter of 2009 when the subsidence was 8.7%. Given the fact that the US GDP decreased by 5%, and in the second quarter, the Maple Leaf Country's gross domestic product may decline by 45%, the USD/CAD pair should have grown in response to the sad statistics. The opposite happened. Bloomberg experts expected -10%, however, they turned out better. Ottawa may be able to avoid the worst-case scenarios in April-June, especially since the government has gone on a large-scale fiscal stimulus. Dynamics of Canadian GDP

According to the outgoing head of the Bank of Canada, Stephen Poloz, the economy can cope with the consequences of COVID-19, as it was in good shape before the pandemic, although it may take a year or two to return to the trend. According to the IMF forecasts, the Maple Leaf Country's GDP will decline by 6.2% in 2020 and grow by 4.2% in 2021. Data on May employment may strengthen the view that the worst will be avoided. According to Bloomberg experts, employment will fall by 500 thousand after -2 million in April, and the unemployment rate will rise from 13% to 15%. If the actual statistics are better than expected for both Canada and the US, you can safely sell USD/CAD in the direction of 1.358 and 1.3515. The fact is that the improvement in the US labor market will contribute to the growth of stock indices, increase global risk appetite and reduce the share of safe-haven assets, primarily the US dollar, in investment portfolios. But we must admit that the S&P 500 and oil rallies are the main drivers of the strengthening of the Canadian dollar. Black gold is steadily moving north on expectations of growth in global demand due to the opening of major world economies. Production in the United States is falling very quickly (for 2 months by 1.6 million b/d or 12%, although adjustments by the US Energy Information Administration can bring the final figure to 2.6 million b/d), and frightened by the fall of WTI below zero, OPEC+ has never previously fulfilled its obligations to reduce production so zealously. It is unlikely that at the summit on June 10, we can expect a repeat of the scenario when the cat ran between Russia and Saudi Arabia and the oil war began. Technically, the break of the lower border of the "shelf" (the consolidation range of 1.385-1.415) of the "surge and shelf" pattern allowed the "bears" in USD/CAD to take the initiative and send quotes to the target of 161.8% on the AB=CD model. Just below 1.358 are important pivot levels. USD/CAD, the daily chart

|

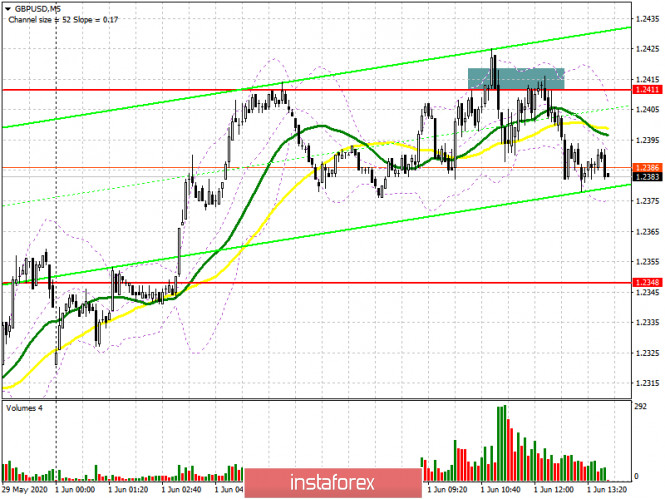

| Posted: 01 Jun 2020 04:05 AM PDT To open long positions on GBPUSD, you need: From a technical point of view, nothing changed in the first half of the day. In my morning forecast, I paid attention to the possibility of forming a false breakout in the resistance area of 1.2411 and recommended opening short positions in this scenario, which happened. If you look at the 5-minute chart, you will see how an unsuccessful attempt to break above the resistance of 1.2411 led to the pair returning to this level, and then a repeated test of this area from the bottom up became a signal to open short positions. At the moment, the task of the bulls is to consolidate above the resistance of 1.2411, which was not possible to do even for the second time during the European session. Only in this scenario, the bulls will be able to maintain a good upward momentum, which can lead the pair to new highs in the area of 1.2463 and 1.2508, where I recommend fixing the profits. In the scenario of a decline in GBP/USD this afternoon, and this may happen after good data on business activity in the US manufacturing sector, a false breakout in the support area of 1.2348 will signal the opening of long positions, otherwise, it is best to consider buying immediately for a rebound from the support of 1.2290, which repeatedly helped out last Friday.

To open short positions on GBPUSD, you need: The bears did a great job in the morning, and as long as the trade is below the level of 1.2411, the advantage will be on their side. The task of sellers for the second half of the day is to return GBP/USD to the support area of 1.2348 since only fixing below this range can lead to the formation of a new downward momentum that can collapse the pound to the support of 1.2290, and then to a larger level of 1.2237, where I recommend fixing the profits. In the scenario of growth above the maximum of this week, it is best not to rush to open short positions but wait for the update of the levels of 1.2463 and 1.2508, where you can sell immediately for a rebound in the expectation of correction of 20-30 points at the end of the day.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily averages, which indicates a high probability of continuation of the bullish trend. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the average border of the indicator around 1.23650 will increase the pressure on the pair, while a break in the upper border of the indicator in the area of 1.2420 will lead to a larger increase in the pound. Description of indicators

|

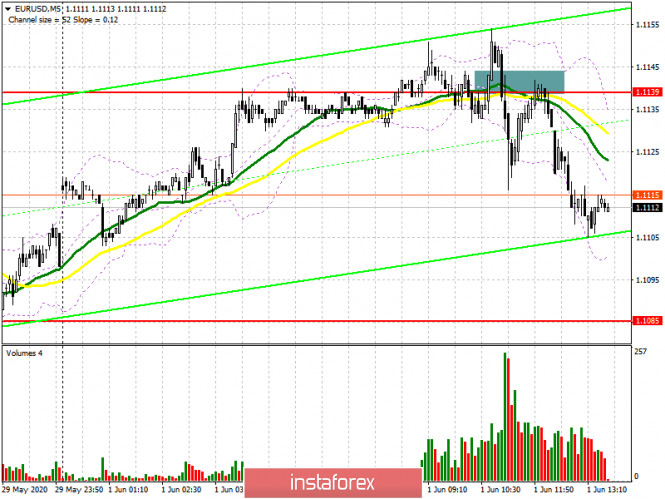

| Posted: 01 Jun 2020 04:02 AM PDT To open long positions on EURUSD, you need: The data released in the first half of the day on business activity in the manufacturing sector of the Eurozone countries were not as optimistic as expected by economists, which did not allow the bulls to continue the growth of the euro/dollar pair. Sellers managed to take advantage of this moment and after forming a false breakout, they began to actively sell the euro. If you look at the 5-minute chart, you will see how an unsuccessful attempt to break above the resistance of 1.139 led to the pair returning to this level, and then a repeated test of this area from the bottom up became a signal to open short positions. The formation of divergence on the MACD indicator was also an additional signal to sell the euro, which I mentioned. At the moment, the market is controlled by bears, and buyers again need to play out the morning scenario. The further upward movement will depend on data on manufacturing activity in the US, as well as on whether the bulls will be able to gain a foothold above the range of 1.1139. Only after a successful breakout, I recommend continuing to open long positions above this resistance with the main goal of updating the maximum of 1.1183 and reaching a larger level of 1.1231, where you can fix profits. If the pressure on the euro continues in the second half of the day, it is best to postpone purchases and wait for a correction to the support area of 1.1085, provided that a false breakout is formed there or open long positions immediately to rebound from the larger lows of 1.1034 and 1.0994.

To open short positions on EURUSD, you need: Sellers coped with the morning task perfectly and did not let the pair go above the resistance of 1.139. As long as trading is below this level, the market will be on their side. Now, to confirm its advantage, we need good data on manufacturing activity in the US, which will increase pressure on the European currency and lead to an update of the minimum of 1.1085, where we can observe the first stop of the current downward momentum formed from the level of 1.139. However, it is best to talk about the possible formation of a downward trend only after fixing below the support of 1.1085, which will collapse the euro/dollar pair to the area of 1.1034 and 1.0994, where I recommend fixing the profits. In a scenario of further growth of the euro in the second half of the day, it is best to return to short positions to rebound from a maximum of 1.1183 or even higher, from a larger resistance of 1.1231.

Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 daily moving averages, which indicates the return of market equilibrium in the short term. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower border of the indicator around 1.1085 will increase pressure on the euro. Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment