Forex analysis review |

- EUR/CAD facing bullish pressure, potential for further upside

- NZDUSD reacted below descending trendline resistance and further push down expected!

- Forecast for EUR/USD on June 19, 2020

- Forecast for GBP/USD on June 19, 2020

- Forecast for AUD/USD on June 19, 2020

- Forecast for USD/JPY on June 19, 2020

- Hot forecast and trading signals for the GBP/USD pair on June 19. COT report. Jerome Powell speech. Bears need to overcome

- Hot forecast and trading signals for the EUR/USD pair on June 19. COT report. Buyers expect the EU summit to end with "northerners"

- Overview of the GBP/USD pair. June 19. Trump is at the epicenter of a new political scandal in the United States.

- Overview of the EUR/USD pair. June 19. The fight at the EU summit promises to be tough. 750 billion euros are at stake. The

- GBP/USD. Pound knockdown

- Dollar in the process of forming a growth trend

- Oil prospects for June and July 2020

- Oil prices are declining: no factors for growth

- New cases of COVID-19 infection affects ATP stock indices

- Greenback seeks points for growth

- Comprehensive analysis of movement options for EUR/GBP, GBP/JPY, and EUR/JPY (H4) on June 19, 2020

- Gold bulls unable to reclaim key resistance

- EURUSD weakness continues

- GBPUSD: It's time for pound buyers to flee the market. The Bank of England surprised by the dryness of statements and a wait

- GBP/USD: plan for the American session on June 18

- EUR/USD: plan for the American session on June 18

- Evening review on EURUSD for June 18, 2020

- RUB may attack it opponents

- Era of USD's excellence coming to end

| EUR/CAD facing bullish pressure, potential for further upside Posted: 18 Jun 2020 08:45 PM PDT

Trading Recommendation Entry: 1.52195 Reason for Entry: horizontal swing low support, 78.6% fibonacci retracement Take Profit: 1.53273 Reason for Take Profit: 100% fibonacci extension, horizontal pullback resistance, 61.8% fibonacci retracement Stop Loss: 1.51718 Reason for Take Profit: horizontal swing low support, 76.4% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| NZDUSD reacted below descending trendline resistance and further push down expected! Posted: 18 Jun 2020 08:08 PM PDT

Trading Recommendation Entry: 0.64186 Reason for Entry: Graphical overlap Take Profit: 0.63813 Reason for Take Profit: 161.8% Fibonacci extension, graphical swing low Stop Loss: 0.64389 Reason for Stop Loss: 50% Fibonacci retracement, descending trendline resistance The material has been provided by InstaForex Company - www.instaforex.com |

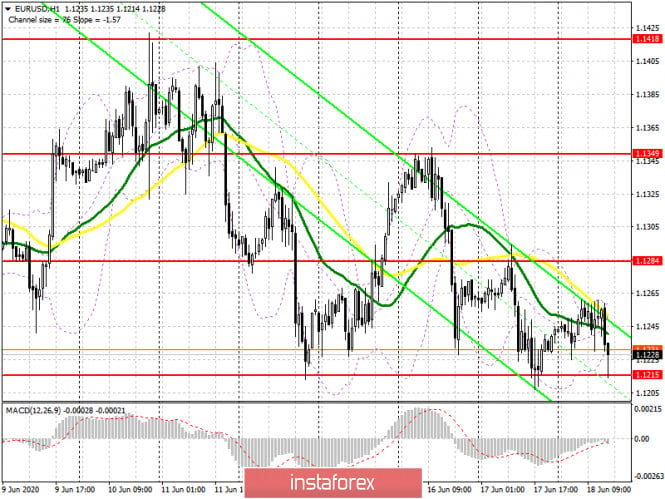

| Forecast for EUR/USD on June 19, 2020 Posted: 18 Jun 2020 07:58 PM PDT EUR/USD The dollar continues the offensive. The euro fell by 37 points yesterday, having reached the bears' target level of 1.1195. The signal line of the Marlin oscillator almost touches the border of the downward trend territory. Marlin's transition to the zone of negative values will allow the price to move even deeper, to the target of 1.1120, from which a correction of about fifty points could follow. The Marlin oscillator forms a convergence on the four-hour chart, but just like last time, yesterday, the support of the convergence line could be broken and, as a result, it will not form at all. If the price consolidates below 1.1195, we expect a decline to the target of 1.1120. |

| Forecast for GBP/USD on June 19, 2020 Posted: 18 Jun 2020 07:58 PM PDT GBP/USD The Bank of England increased its asset repurchase program to its balance sheet by £ 100 billion on Thursday, bringing the total program to £745 billion. As a result, the pound closed the day by going down 132 points. The price fulfilled the target at the Fibonacci level of 138.2%. Marlin has infiltrated the declining trend zone, while the price is below the balance indicator line. The purpose of the decline is formed by the range of the Fibonacci level of 161.8% (1.2237) and the MACD line (1.2185). The price is consolidating below the Fibonacci level of 138.2% on the four-hour chart, the Marlin oscillator is in the zone of negative values. Convergence can form on the oscillator, but it could also be suppressed by a stronger trend on the daily scale. Consolidating the price under yesterday's low (1.2401) will be a signal for the pound to move to the specified target of 1.2185-1.2237. |

| Forecast for AUD/USD on June 19, 2020 Posted: 18 Jun 2020 07:58 PM PDT AUD/USD The Australian dollar remained aloof from European events and fell by only 30 points yesterday. Perhaps the aussie is waiting for commodities or new data on China to decline in order to act more confidently. Iron ore (-0.63%) and a number of non-ferrous metals (nickel -0.32%, lead -0.40%) are among the key products for Australia that are still declining. The Marlin oscillator has penetrated into the decreasing trend zone on the daily chart. The Australian dollar is aiming for 0.6680, the peak of May 27 and March 9. The price has been recorded under the balance indicator line on the four-hour chart - the prospect of a downward movement. The Marlin oscillator is on the zero line, waiting for the direction in which the price will swing – in the current situation, Marlin is in a guided position. We are waiting for the situation to develop according to the main downward scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on June 19, 2020 Posted: 18 Jun 2020 07:58 PM PDT USD/JPY The movement of the USD/JPY pair turned out to be weak on Thursday - it ended the day with a loss of five points. But the price has been recorded under the MACD indicator line, which shows us the direction of the trend and the future movement of the asset, depending on where its quote is located - above or below this line. The Marlin oscillator is going down in the negative area. The purpose of the decline of 105.90 is the embedded line of the price channel of the higher timeframe. Furthermore, movement to the second target 105.40 is possible. The price develops directly on the balance indicator line on the four-hour chart, which indicates the neutrality of the last day. The signal line of the Marlin oscillator moves along the border of two trends - rising and falling. Taking into account the pressure of the higher timeframe, we are waiting for the neutral situation to shift downward and for the price to reach the designated goal. |

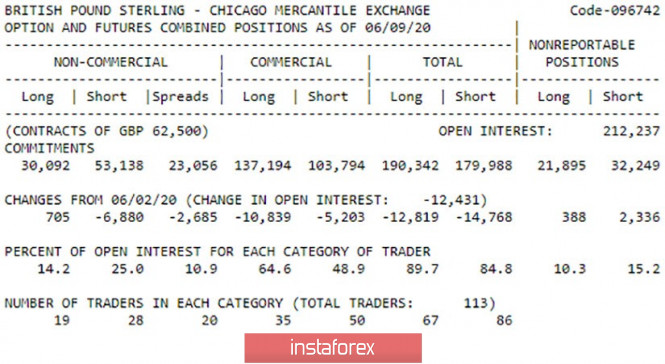

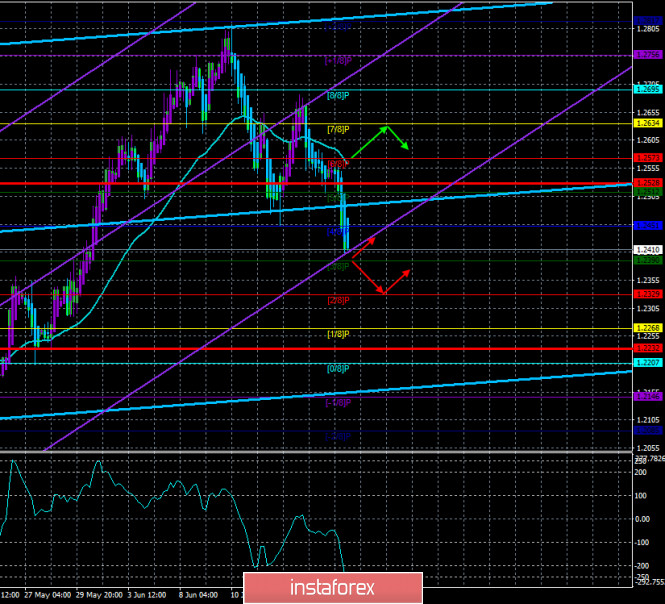

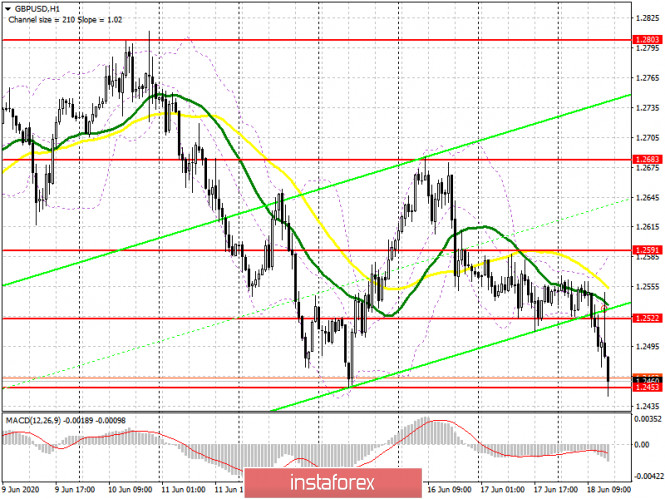

| Posted: 18 Jun 2020 05:55 PM PDT GBP/USD 1H The pound/dollar pair significantly lost more than the euro/dollar pair yesterday, thanks to the decision of the Bank of England to expand the program of repurchase of securities by 100 billion euros. As a result, the British currency fell into the support area of 1.2400-1.2420 by the end of the day. Thus, further downward movement will now depend on overcoming this area. In addition, traders managed to overcome the upward trend line, which now makes life easier for bears. GBP/USD also continues to remain inside the downward channel, so the prospects for declining further are good. If quotes rebound from the support area of 1.2400-1.2420, then the bulls will be able to seize the initiative and try to raise the pair, at least, to the critical Kijun-sen line. And further movement will depend entirely on whether the pair remains inside the channel. GBP/USD 15M Both linear regression channels are again directed downward on the 15-minute timeframe, so the pair continues to show its willingness to continue moving down. COT Report The latest COT report for the British pound, published on Friday, showed a strong drop in the number of open purchase contracts among professional traders. Their number decreased by almost 7,000, but there were only 705 new open buy-positions. Thus, traders didn't buy the pound sterling very much, and nevertheless, the British currency rose in price in the reporting week. If you look at the behavior of large traders in all categories, then they closed both purchase contracts and sale contracts. A total of 25,000 contracts were closed. Thus, in general, the pound was not in demand, but at the same time it was growing against the dollar. The pair is falling quite strongly this week, so today's COT report is likely to show a decrease in net positions for the British pound. The fundamental background for the GBP/USD pair is starting to be negative. There are still no fundamentally new statements or news on the main topic for the pound sterling - Brexit. But traders reacted to the rapid sales of the British currency after it became known that the Bank of England had expanded its asset repurchase program by £100 billion. Also, market participants are seriously worried that at the next meetings may resort to negative rates, since, according to the general opinion, the British economy will not cope with the consequences of the coronavirus crisis, Brexit and the absence of a trade deal with the European Union. Additional stimulation will be required. And any stimulation of the economy and additional easing of monetary policy is a bearish factor and is likely to lead to a new fall of the British pound. Federal Reserve Chairman Jerome Powell is set to hold his next speech on Friday, June 19. However, it is unlikely that Powell will add anything else to what was already mentioned this week in Congress. Therefore, the pound/dollar might slightly recover today after what happened on Thursday. There are two main scenarios as of June 19: 1) The initiative for the pound/dollar pair passed completely into the hands of sellers, since the upward trend line was overcome. Therefore, short positions are currently relevant with a view to the support level of 1.2268. However, we consider it appropriate to first wait until the support area of 1.2400-1.2420 is overcome. Potential Take Profit in this case will be 120 points. 2) Buyers were not able to cope with the onslaught of bears and had let go of the pair. Thus, it is advised to consider purchase orders now but not before you consolidate quotes above the downward channel. In this case, the bulls will be able to count on further growth with the goals of the Senkou Span B line and the resistance level of 1.2740. However, such a development is not expected in the coming days. Potential Take Profit in this case is from 50 to 150 points. The material has been provided by InstaForex Company - www.instaforex.com |

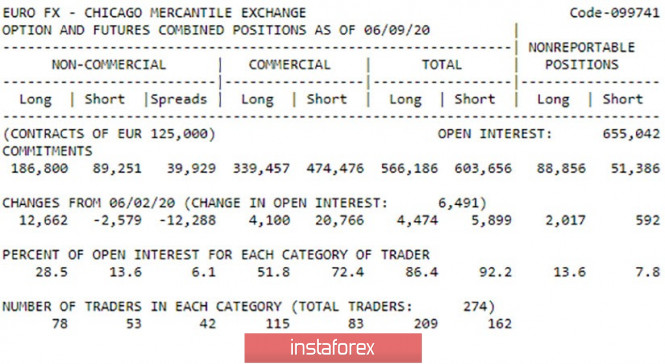

| Posted: 18 Jun 2020 05:55 PM PDT EUR/USD 1H The EUR/USD pair continued its downward movement clearly inside the descending channel on the hourly timeframe, on June 18, showing the moderate intentions of the bears. As a result, the pair almost reached the support level of 1.1171 by the end of the trading day, which we gave as the main target level yesterday. Since overcoming this level has not yet happened, and an upward trend line lies nearby, which continues to provide support to traders who aim for an increase, so far future prospects for the US currency are vague. If traders manage to overcome the trend line, then the bears can get a new reason to be optimistic and continue to sell the pair (buy the dollar) further. Given the fact that we have a clear downward channel, then buyers will wait for it to be overcome and only after that will they be able to enter the market. EUR/USD 15M Both linear regression channels are directed downward on the 15-minute timeframe, clearly signaling a downward trend in the shortest term. There are currently no signs of a possible turn up. COT Report The European currency continued to go up for most of the past week. Thus, we made assumptions that professional market players have invested in the euro, respectively, according to the latest COT report, the number of buy positions should have significantly increased. Or the number of contracts for selling the euro will sharply decrease. As a result, the report showed the implementation of the first option. The number of open buy positions increased by 12,662, while sales contracts were also reduced by professional traders (-2,579). Thus, a double effect was obtained. As for the general changes among all categories of traders in the COT report, the number of sell deals have grown over the past week. However, as we all perfectly understand, speculators drive the market, and accordingly, we find their actions interesting. The trend is already different this week. Speculators stopped opening new contracts for the purchase and, possibly, even reduced their number. We expect the new COT report to show a decrease in the net position in the European currency. The overall fundamental background for the EUR/USD pair remains neutral, from our point of view. Traders had nothing to turn their attention to over the past day. Absolutely. Federal Reserve Chairman Jerome Powell's second speech in the US Congress completely echoed the first. There were no important macroeconomic publications. No important reports are planned either on the last trading day of the week. Thus, volatility may decrease today, and no currency should have advantages. At the same time, one should not forget that traders often trade illogically in recent coronavirus months. Thus, it does not mean that trading will be sluggish today, and that the movement will be counter-trend. Moreover, there is always US President Donald Trump who can flood news feeds with his sayings. His statements have little effect on the movement of the currency pair, however, it is difficult to pass them by. In addition, a video summit of the EU countries will be held today, which will discuss the issue of financing and the size of the Recovery Fund. The most important thing that we need to learn from its results is whether it will be possible to convince the "northern" countries to voluntarily and almost free of charge help the "southerners". If so, then the plan to help the European economy is likely to be approved, and the euro can get support in the short term. Based on the foregoing, we have two trading ideas for June 19: 1) The bulls remain in the shade so far, so the EUR/USD pair could continue the downward movement. Today we recommend that you stay in sales with a support level of 1.1171. If the bears manage to overcome the upward trend line, then short positions can be maintained with the support levels of 1.1088 and 1.0962 as targets. Potential Take Profit after overcoming the trend line is from 75 to 200 points. 2) We advise you to consider the option of resuming the EUR/USD pair's growth only when the bulls manage to gain a foothold above the downward channel. In this case, we will recommend buying the euro while aiming for the resistance area of 1.1327-1.1341 and resistance levels 1.1380 and 1.1506. Potential Take Profit in this case is from 30 to 200 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Jun 2020 05:12 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -228.0870 The British pound fell yesterday after the results of the Bank of England meeting were summed up. In principle, this is what we talked about a day earlier when we warned that the expansion of the quantitative stimulus program is a "dovish" measure that means easing monetary policy. And such a step is almost always accompanied by a fall in the national currency. However, we were not sure that the British currency would continue to fall due to this measure of the British regulator. After all, in recent months, market participants often ignore macroeconomic statistics. However, this time, traders could not pass by such an important event. If we look at the Central Bank's meeting in more detail, the regulator is still shaping monetary policy by achieving the 2% inflation target. All members of the monetary committee voted to keep the base rate at the same level of 0.1%. The Bank of England says that after a 20% drop in GDP in April, this indicator has begun to recover. The outlook for the British and global economy is uncertain. Everything will depend on the results of the fight against the "coronavirus" epidemic. The Bank of England also said that it is ready to ease monetary policy again if the situation requires it. From our point of view, absolutely "dovish" results. Meanwhile, a new political scandal related to Donald Trump is breaking out in America. Former national security adviser John Bolton, who was fired by Trump in September 2019, has written a book. This book contains a lot of information compromising the current president, and the presidential administration has already banned the distribution of this book in the public domain. However, several copies of the book have already fallen into the hands of journalists, so the most interesting parts of the book have already been published in relevant articles. One of Bolton's most high-profile statements is that the current US President asked Chinese leader Xi Jinping to help him win the 2020 election in exchange for signing new trade agreements. Also, Bolton reports that the Chinese leader in a personal meeting with Trump told him about concentration camps for Uighur Muslims, to which Trump replied that he fully approves of it. Also, the former adviser to the president tells in his book about a lot of meetings and conversations between Trump and the leaders of Japan, North Korea, and the UK, in which the US president showed himself to be completely ignorant, each decision of which was aimed at increasing his popularity and reflected a desire to remain in power for a second term. Bolton also claims that during the impeachment procedure, the Democrats incorrectly built an accusatory line. According to Bolton, Trump should have left office not because of pressure on Ukraine, but because of a series of wrong foreign policy decisions. Trump himself has also already spoken out about the yet-to-be-released book, accusing Bolton of divulging classified information. Well, the political crisis in the US continues to gain momentum. However, at this time, it does not have any impact on the US dollar, however, it is extremely important for both America and the dollar. We have repeatedly said that a lot will depend on who becomes the next US President. Returning to the matters of the moment and the dynamics of the pound/dollar pair, we can say the following. There are no publications scheduled for the last trading day of the week in the UK and the US. However, there is no doubt that soon, traders will receive new information on the subject of John Bolton's book, Trump's reaction to it, as well as China's reaction to the US law supporting Uighurs. However, the GBP/USD pair is likely to continue its decline anyway, as it has previously grown quite strongly. At the same time, we continue to recommend paying special attention to technical indicators. For example, a reversal of the Heiken Ashi indicator to the top will signal a round of upward correction, which can then develop into a full-fledged upward trend. The main thing is not to trade against the trend.

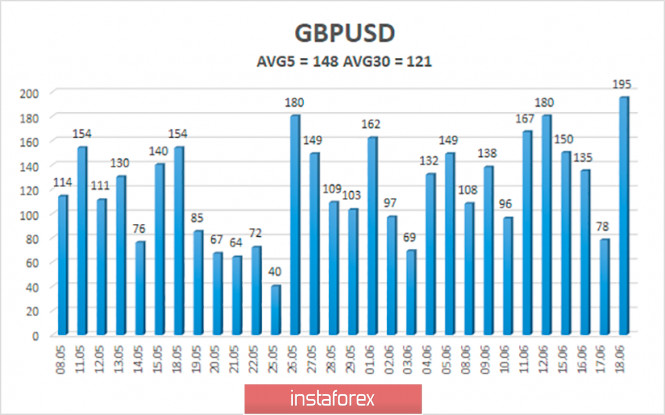

The average volatility of the GBP/USD pair continues to remain stable and is currently 148 points. For the pound/dollar pair, this indicator is "high". On Friday, June 19, thus, we expect movement within the channel, limited by the levels of 1.2232 and 1.2528. A reversal of the Heiken Ashi indicator upward will indicate a possible new round of upward movement. Nearest support levels: S1 – 1.2390 S2 – 1.2329 S3 – 1.2268 Nearest resistance levels: R1 – 1.2451 R2 – 1.2512 R3 – 1.2573 Trading recommendations: The GBP/USD pair continues its downward movement on the 4-hour timeframe. Thus, today it is recommended to continue trading the pound/dollar pair for a decrease with the goals of 1.2329 and 1.2268. It is recommended to buy the pound/dollar pair not before fixing traders above the moving average, with the first goals of 1.2634 and 1.2695. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Jun 2020 05:12 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -173.3454 The fourth trading day of the week again passed in fairly quiet trading, although no important macroeconomic reports and events were planned for this day. Moreover, many topics have recently been frankly "extinguished", so market participants, without fundamental support, do not know how to trade them in the medium term. One of the most interesting and important topics for the European Union now remains the issue of providing a package of assistance to the countries and economic sectors most affected by the "coronavirus crisis". We will remind that earlier there were several offers, starting from "coronabonds", ending with the current offer for 750 billion euros. In fact, all these proposals are either loans of the required amount on the financial markets with further repayment over several decades by all EU member states or raising funds from the contributions of each EU country with further redistribution of funds. However, one way or another, some countries will have to pay for the recovery (as well as miscalculations, lack of savings and budget violations) of others. This is the main stumbling block. "Northern" countries, which are famous for their economic discipline and economy, are not going to give grants to "southern" countries, which are considered spenders. It is one thing when it comes to providing loans, even if they are free, however, it is another thing when you are offered to give away tens of billions of euros for nothing. This whole situation is very similar to an emergency high-rise building, where some residents can't pay for repairs, so everyone else who can must pay twice as much. Naturally, the wealthier and more economical ones are protesting and are not going to simply finance the "southerners", and even on a gratuitous basis. This is the main topic at tomorrow's EU summit, which will be held in a video format. For our part, we would like to say that, as for such an important event, the media and press are currently paying very little attention to it. In fact, there is no information about tomorrow's summit and possible solutions. There are no new comments from Angela Merkel, or Emmanuel Macron, or Ursula von der Leyen, or representatives of the "Northern" countries. Thus, we believe that tomorrow we will simply discuss the proposed plan for the formation of a recovery fund. No important decisions will be made, so the negotiation process will be delayed, like the negotiations between Brussels and London on Brexit. Accordingly, we would not expect any important information from the summit tomorrow. Meanwhile, a new point of conflict between China and the United States has emerged (or rather "surfaced"). Donald Trump signed an executive order that would impose sanctions on China for violating the rights of Uighurs. It is expected that those people and organizations that are involved in the persecution of the Uighur people will fall under the sanctions. The sanctions involve freezing the assets of all those involved in the persecution, as well as a ban on entering the United States. Well, China, in turn, immediately replied that "this law is a gross interference in the internal affairs of the country". Actually, nothing new. Washington imposes sanctions, threatens, accuses, and China fights back with the phrase "gross interference in the internal affairs of the country" and shows a strong protest. In addition, it is reported that US Secretary of State Mike Pompeo held a virtually secret meeting with the Chinese Foreign Minister in Hawaii. No details were given, however, the meeting was allegedly initiated by China amid a significant deterioration in relations between the two countries, which have the largest economies in the world. However, according to other information, the meeting lasted more than 7 hours, and no progress was made in the negotiations. The parties just set out a list of demands and claims against each other and that's it... However, in addition to all the contentious issues between Beijing and Washington, some experts insist that America is now trying to warn China by all means available to it against an even more unacceptable act – interference in the 2020 presidential election. Naturally, most of all, Donald Trump himself does not want this, because, in his opinion, China favors Joe Biden, and Joe Biden has never hidden his sympathy for China. Thus, Trump fears that Beijing may support its main competitor, which will reduce the chances of winning the election by another ten percent. Thus, in the opinion of many experts, relations between China and the United States may heat up even more in the next six months against the backdrop of exclusively presidential elections. However, they are already at a fairly "hot" point. During the past day, only one significant report was published in the United States, and none in the European Union at all. Therefore, in principle, quite weak volatility during the day is quite understandable. The number of primary applications for unemployment benefits increased by 1.5 million, although forecasts predicted a maximum of +1.3 million, and the total number of secondary applications for benefits was 20.5 million, although forecasts predicted no more than 20. Thus, the situation with unemployment in the US remains quite difficult and once again I would like to ask the US Bureau of Statistics how, according to their version, unemployment managed to fall in May? On the last trading day of the week in the United States and the European Union, no macroeconomic publications or events are planned at all. Thus, volatility on the last trading day of the week may be low, unless the markets are stirred up by some unexpected information. From a technical point of view, the euro/dollar pair continues to adjust against the upward trend that has been maintained in the past two weeks. In general, the bears continue to push the pair slowly down, so there are also quite high chances of forming a new downward trend. The technical picture on the lower time frames also implies a continuation of the downward movement, at least to the level of 1.1171. At the same time, it should be noted that the downward movement is certainly weak, which is clearly not enough for one of the channels of linear regression to begin to turn down.

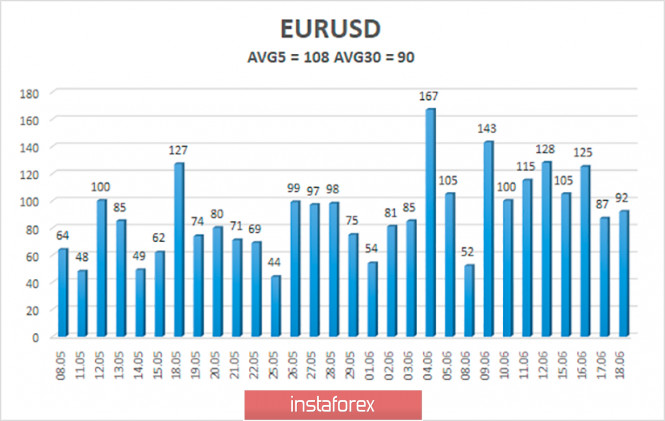

The average volatility of the euro/dollar currency pair as of June 19 is 108 points. Thus, the value of the indicator is still characterized as "high", thanks to the last two weeks. We expect the pair to move between the levels of 1.1062 and 1.1278 today. A reversal of the Heiken Ashi indicator upward will signal a new round of upward correction. Nearest support levels: S1 – 1.1108 S2 – 1.0986 S3 – 1.0864 Nearest resistance levels: R1 – 1.1230 R2 – 1.1353 R3 – 1.1475 Trading recommendations: The EUR/USD pair continues its downward movement. Thus, at this time, sell orders with the goals of 1.1108 and 1.1062 remain relevant until the Heiken Ashi indicator turns up. It is recommended to return to buying the pair not before fixing the price above the moving target of 1.1347 and 1.1475. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Jun 2020 01:59 PM PDT So, contrary to conflicting rumors, the Bank of England still implemented the dovish scenario today. Although the regulator left the interest rate unchanged, and the asset buyback program was expectedly expanded by £100 billion, the pound was still knocked down, primarily due to subsequent comments by BoE Governor Andrew Bailey. On the eve of the June meeting, experts voiced different opinions regarding possible decisions of the English regulator. So, according to some analysts, the central bank should have taken a wait-and-see attitude - that is, limited itself to expanding the asset buy-back program without announcing further steps to mitigate monetary policy. At the same time, supporters of the hawkish version (if the term can be used at all in the current conditions) admitted that regulator members would "close their eyes" to catastrophic macroeconomic reports that reflected the peak of the coronavirus crisis. By and large, the data for April was actually published in June, when Britain was quarantined. Therefore, BoE members could only note a record slowdown in the economy, but at the same time shift the emphasis of their rhetoric on the prospects for the recovery process (as did, for example, members of the Reserve Bank of Australia). But the BoE decided to go its own way, taking a more dovish position. Commenting on the latest macroeconomic reports, Bailey mentioned the "prevalence of negativity" - both in the labor market and in relation to inflationary trends. Moreover, according to him, labor market indicators "are more relevant for assessing inflation risks." Let me remind you that the latest data showed that the number of applications for unemployment benefits jumped to 528,000, while salary data came out in the red zone - both in annual and monthly terms. Including premiums, this indicator slowed down to 1%, excluding bonuses - up to 1.7% (for comparison, in March this indicator was at the level of 2.7%). Also, Bailey reiterated that the British economy slowed down by 20% in the first quarter, and apparently, the same value will slow down in the second quarter. If Bailey limited himself to only the above comments, the pound would hardly have reacted with such a sharp decline. However, the head of the English regulator curtailed the GBP/USD bears, talking about the prospects of negative rates. This is a very painful topic for the pound, which he had previously repeatedly raised, provoking volatility. This time, Bailey said that central bank economists are "trying to figure out the implications for the UK economy from the experiences of other countries with negative rates." Here you have to go a little deeper into the background of the issue. For the first time, rumors that the BoE could introduce a negative rate appeared in early May, when more operational macroeconomic indicators signaled the extent of the economic catastrophe. At first, these conversations seemed empty - after all, Bailey himself, who had just been appointed then to the position of head of the central bank, initially rejected this idea. But that was back in March, when Britain just met the coronavirus. And when Covid-19 actually closed the country (and with it almost the whole world) for a month and a half, Bailey's position changed dramatically. Speaking to members of the Lower House of the British Parliament, he said that the central bank "is actively considering the option of reducing the rate to zero." Such a statement sounded like a bolt from the blue, so it is not surprising that the GBP/USD pair then slumped to two-month lows in a matter of hours, that is, to the middle of the 20th figure. But then the market came to the reasonable conclusion that the head of the central bank did not have the power to solely lower or raise the rate, while the rest of the Committee did not declare such intentions. The market has been hesitating for a long time on this issue, but then the BoE Chief Economist Andrew Haldane put a point in this discussion. According to him, the English regulator "didn't even come close to the decision to switch to negative interest rates." He also mentioned the negative effects of negative rates on UK banks and lenders who will experience margin pressure. In addition, Haldane noted that a similar move by the central bank "will affect confidence in the economy as a whole." After that, the issue of reducing interest rates was discussed only in the context of a possible reduction to zero. But even such an option seemed unlikely to many experts, given the weakening of quarantine (in Britain and in most countries of the world) and a restart of the economy. That is why Bailey's words sounded so "loud" today. The head of the BoE tried to maintain a balance in his rhetoric, noting that the issue of negative rates "is complicated", and if they are introduced, "there may be problems with their implementation and communication policy." But the market, as they say, heard only the first half of the phrase - that the central bank is considering the likelihood of "going to zero." Resumed talk of a negative rate has become the main driver of the GBP/USD decline. And in my opinion, the pound has not yet fully won back this fundamental factor: if the bears can overcome the support level of 1.2410 in the near future (the upper border of the Kumo cloud on the daily chart, which coincides with the Kijun-sen line), then they can reach the bottom of the 23rd figure, where the lower border of the above cloud is located. Short positions in the pair are still relevant given the outcome of today's meeting, as well as the high degree of uncertainty with the Brexit issue. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar in the process of forming a growth trend Posted: 18 Jun 2020 01:59 PM PDT All the actions and comments of officials of the Federal Reserve indicate that the economic recovery from coronavirus is not going as fast as we would like. Putting on a V-shaped recovery is at least a mistake, especially now that the number of infected people has begun to increase. People are talking about the second wave of the pandemic, but it is worth noting that the first one has not yet been overcome. A dangerous increase in coronavirus diseases is observed in the United States, a worrying situation in Germany, a new outbreak in China. All this has cooled the ardor of investors who are now taking note of the real world situation and who previously ignored these risks. Wall Street has been trading negative for the second day, playing back, among other things, the Fed's negative forecasts and Jerome Powell's pessimistic statements. This year, the fall in US GDP could reach 6.5%. Therefore, unemployment in the country will increase, despite all the encouraging results from drug developers against COVID-19. At this time, authorities and employers will try to find more effective methods of employment that will allow the use of a smaller staff. The data on initial applications for unemployment benefits in the United States once again showed how long and time-consuming the process of economic recovery will be. The number of applications for unemployment benefits in the US for the week decreased by only 58,000 and reached 1,508,000, the Ministry of Labor reported on Thursday. At the same time, the markets hoped for a more significant decrease in the indicator. According to their estimates, it was supposed to decrease by 242,000 to 1.3 million. Wall Street suffered another disappointment today, while the dollar perked up a bit. Demand for protective assets grew, and the dollar, which has the status of a safe haven currency, received another chance for growth. But whether it will turn out to be used is not yet entirely clear. This week, the dollar index rebounded from lows, but you can't call this promising, since overall US economic data are recovering, like the stock market, despite the current correction. Dollar growth is also limited by promises by the US monetary authorities to provide the economy with even more incentive to recover. The long-term outlook for the dollar remains negative, most investors get rid of positions to increase it. Nevertheless, an upward trend is now taking place in the greenback. The dollar index crossed the border of 97.10, and thus an impulse to buy was formed. USDX |

| Oil prospects for June and July 2020 Posted: 18 Jun 2020 08:49 AM PDT Oil is the most important asset for us, and today I would like to consider its prospects for June and July 2020, especially since last week new data were released from the US Energy Information Agency (US EIA), which allows us to look at the oil market not only from a technical but also from a fundamental point of view. In the two months since the collapse of oil, quotes of black gold around the world have grown rapidly and are now at about $ 38 per barrel for the North American grade WTI #CL. Brent crude oil is trading near the 41 dollar mark, Urals crude oil has surpassed the 40 dollar mark. In many respects, the growth in quotes was due to reductions in the production of the OPEC cartel and the countries that joined it, as well as a decrease in US oil production by 1.5 million barrels to 11.4 million barrels per day. Moreover, the United States did not sign the OPEC + agreement, and production reduction occurred there naturally, primarily due to a decrease in the share of shale producers. According to Baker Hughes's service company, the number of active rigs in North America has declined to its lowest levels since 1987. At the same time, the commercial stocks of the countries of the Organization for Economic Cooperation and Development - OECD, which are the main global oil consumers, still remain at high values, significantly exceeding the weighted average five-year range of 58-66 million barrels (Fig. 1). Figure 1: Commercial Oil and Distillate Reserves in the Organization for Economic Co-operation and Development - OECD In its June short-term forecast, the US EIA predicts that in the second quarter of 2020, global demand for petroleum products and liquid fuels will average to 83.8 million barrels per day. This is 16.6 million less than at the same time last year. The Agency expects that in the third quarter, liquid fuel consumption will increase to an average of 94.9 million and predicts that worldwide in 2020, oil and liquid fuel consumption will average to 92.5 million barrels per day, and then increase by 7.2 million barrels in 2021. As the global economy recovers in the second half of this year, stocks will gradually decrease, which will support oil prices, but stocks will reach average levels no earlier than next summer. In general, the short-term forecast from the US Energy Information Agency suggests that the price of WTI crude oil in 2020 will be $ 35.34 / b (Fig. 2). In turn, the Brent brand will be traded at $ 37 / b, and in 2021 its price will rise to an average of $ 48 / b. Moreover, as follows from chart 2, NYMEX traders expect a more gentle recovery of WTI #CL oil prices this and next year, assuming a weighted average price of about $ 40 with significant deviations in both directions. Figure 2: Oil Earnings Forecast from US EIA and NYMEX Traders By the way, it is NYMEX traders who need to be thanked in many respects for such a sharp increase in oil prices, which we saw in April and May of this year. A group of speculative traders called Money Manager began to build up a long position when the price of WTI #CL oil reached $ 25. It was then that private investors from the United States began to actively buy oil through the ETF US OIL stock exchange fund, and these investors in April suffered the most from the decline in oil prices in the negative zone. Despite the fact that some speculators lost money when the price fell, purchases by the manager's money were continued, which ultimately led to the recovery of WTI oil prices up to the value of $ 40, and at the moment, long positions of speculators are at maximum levels since the summer of 2018 of the year. This fact against the background of the lack of an influx of new money to the market, as evidenced by the indicators of Open Interest, speaks of optimistic sentiments prevailing in the circles of speculators, which may turn into bitter disappointment. Speculators are following the trend, and WTI #CL oil has already once broken the "double top" reversal pattern, which can be seen in the four-hour time zone. Therefore, theoretically, one can count on the continuation of the #CL trend to the level of $ 45. However, in my opinion, such growth will be the final phase, after which the market is likely to see a reversal of #CL with a subsequent decline to the level of $ 25. In this regard, within one to four weeks for #CL, we can assume the formation of a range in the range of 38-45 dollars per barrel, after which, presumably, a correctional decline will begin on the market, which is associated with a number of unfavorable factors, which will be discussed below. As you probably know, oil futures are trading one month ahead of the lag, and the August contract, which expires in mid-July, is most actively trading. Then the September contract comes, but in late August and early September, numerous tropical storms collapse on the Gulf of Mexico, which often leads to a halt in oil refining and filling up storage facilities. This, in turn, leads to lower oil prices. However, the storage facilities are already full. In addition, the car season ends in August, which this year was not particularly active due to the numerous lockdowns associated with the Covid-19 pandemic. According to OPEC + sources, a meeting of the technical committee held on June 17 did not give any recommendations for further reductions. The parties to the transaction decided to focus on the implementation of agreements already reached to reduce production by 9.7 million barrels. Moreover, in May, members of the cartel and the countries that joined them fulfilled the agreement by 87%, which shows a rather high responsibility, given the low level of self-discipline. Summing up, I can assume that at the end of June and the first half of July WTI #CL oil can still add value and grow to the level of $ 45. However, with a high degree of probability, the impulse of movement has already exhausted itself and is in the final phase. In this regard, in the second half of July, we can expect a new wave of decline in oil prices. From this point of view, investments in the oil and refining sectors are somewhat premature, so before buying oil and other assets of the industry, think about why they did not grow after the quotes of black gold and whether they will become even cheaper. Be careful and follow the rules of money management. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil prices are declining: no factors for growth Posted: 18 Jun 2020 08:38 AM PDT

The price of crude oil this morning is again correcting down. Market participants are seriously worried about the real possibility of a second wave of the coronavirus pandemic in the world. Nobody wants to experience such a situation for the second time in a row, especially the black gold markets, which are probably the worst hit. At least, the demand for raw materials has become so low that it has beaten anti-record. The industry may simply not survive the new decline in demand for fuel. More recently, investors expressed unreasonable hopes that the cost of oil will increase both in the short and long term. The market was tuned for early recovery and a return to at least the previous pace of work. However, the situation has changed against the background of an increase in oil reserves in the United States of America. In addition, pressure on the market was felt from the side of not too confident growth in the global economy. As it became clear from the latest statistics, in various regions of the world, economic growth after the crisis will not be as rapid as analysts and market participants hoped. The already difficult situation is aggravated by news about new COVID-19 infections, which could be the beginning of another wave of a pandemic and a more grave crisis. Thus, the restoration of the oil market goes a very thorny path, the end of which is not yet visible. And the increase in demand for raw materials remains a big question. Last week, the number of newly recorded COVID-19 patients in Beijing began to increase. Authorities hastened to make statements that they might have to return to quarantine measures to prevent another massive spread of the virus. Almost simultaneously with this, an outbreak of the disease was recorded in several US states, where the number of infected again breaks daily records. The situation on the oil market is complicated by new statistics that arrived yesterday from OPEC. As it became known, the organization left the forecast for a reduction in demand for black gold in the world at the same level in annual terms. Thus, demand should fall by 9.1 million barrels per day, which will send it to the mark of 90.6 million barrels per day. Meanwhile, the expected supplies of raw materials from the territory of non-OPEC countries will be higher by about 0.3 million barrels per day, which will make this figure go to the level of 61.8 million barrels per day. In general, the supply for the year from the territory of non-OPEC will be 3.23 million barrels per day less than the same period last year. Meanwhile, the stocks of petroleum feedstocks in the United States of America rose quite substantially last week. According to the State Department of Energy, the increase was 1.215 million barrels. At the same time, gasoline inventories decreased by 1.677 million barrels, distillates also decreased by 1.358 million barrels. All this would be a good support for the market, if not for the preliminary forecasts of experts who expected a more global decline on all fronts. So, crude oil was supposed to become 3.5 million barrels less, which did not happen, and market participants could not help but notice this. The cost of Brent crude oil futures for delivery in August on a trading floor in London this morning fell by 0.42% or 0.17 dollars, which dropped it to the mark of 40.54 dollars per barrel. Recall that the last trading session also turned out to be in the negative zone for this brand at about 0.6% or 0.25 dollars, and the level was fixed in the region of 40.71 dollars per barrel. The cost of oil futures for WTI light crude oil for delivery in July at auction in New York today also fell. It declined by 0.82% or 0.31 dollars, which forced the raw materials to move to the level of 37.65 dollars per barrel. According to the results of yesterday's session, black gold fell by 1.1%, or 0.42 dollars, reaching $ 37.96 per barrel. As can be seen from the dynamics of the price of the WTI brand, it still cannot pass the strategically important threshold of $ 38 per barrel. For several days in a row, its cost has been in a narrow corridor and remains without major changes. All this may indicate that market participants cannot yet determine their mood and are looking for new, more compelling factors for moving in one direction or another. Quite slurred demand as well as an increase in stocks of raw materials are just some of the reasons for the negative dynamics. If any support factor does not appear, it is quite possible that the price of black gold will continue the downward trend. The material has been provided by InstaForex Company - www.instaforex.com |

| New cases of COVID-19 infection affects ATP stock indices Posted: 18 Jun 2020 08:37 AM PDT

Today, the Asia-Pacific stock markets are declining. After several weeks of almost continuous growth, a period of doubt and a rollback followed, provided by news of a possible recurrence of events associated with the coronavirus pandemic. At least, the sharp increase in the number of cases in China and the United States of America seriously frightened market participants who had not fully recovered from the previous shock. Yesterday, Chinese authorities announced new cases of infection in Beijing, after which they hastened to return quarantine measures to the city center and surrounding areas. However, while the outbreak could not be suppressed: the number of cases continues to increase and has already exceeded 150 people. In America, some states also began to record a record number of cases, which has been gone for more than five weeks. Latin America is not far behind negative statistics. In Brazil, incidence records began to be recorded and the total number of infected people was already close to 35 thousand people. All this was an extremely unpleasant and unexpected moment for the PRC, where the government had already begun to relax, as it considered that it had successfully coped with COVID-19. However, now the situation may repeat itself, and this, of course, does not cause any particular joy among the authorities or the market participants. The same tense situation is also currently happening in the United States of America. The increase in the number of cases is primarily associated with the ongoing opening of enterprises. This can only mean one thing: quarantine measures began to be removed too early. In this regard, it is not yet clear what the further policy of the official authorities will be. Australia's ASX 200 index declined by 1.32% in the morning. The main reason was the extremely high unemployment rate in the country, which was announced the day before. Over the last month of spring, unemployment rose to 7.1%. This figure was not so huge for almost twenty years. Hong Kong's Hang Seng Index is down by 1.21% today. China's Shanghai Composite Index fell by 0.36%, while the Shenzhen Component, on the contrary, rose to 0.28%. This was almost the only positive trend of the day. Japan's Nikkei 225 Index lost 1.17% and the South Korean KOSPI index fell by 0.58%. Thus, the downward trend has touched almost all indicators, with rare exceptions. In general, the market is dominated by pessimistic sentiment. The positive that has arisen over the continuation of soft stimulating policies in most countries, as well as the more rapid pace of global economic recovery, is gradually disappearing. In its place come quite serious fears that the economic crisis may become even deeper, and the way out of it will drag on for years. However, there are optimists among market participants who do not see a problem in new outbreaks of coronavirus infection, since the world already knows how to cope with this, and timely measures taken will immediately bear fruit. Nonetheless, until investor sentiment improves, the decline in Asian stock markets will continue. And according to some analysts, it can become very protracted. The material has been provided by InstaForex Company - www.instaforex.com |

| Greenback seeks points for growth Posted: 18 Jun 2020 08:37 AM PDT

This morning, the greenback declines in relation to the euro and the Japanese yen. At the same time, both the aussie and kiwi are getting cheaper against the US dollar amid the release of not very encouraging data on the unemployment rate in Australia and GDP in New Zealand. Yesterday, the head of the Federal Reserve of the United States of America issued a statement that incentive programs that support small businesses and homeowners are too early to be shutdown. They were taken as measures to help combat the crisis caused by the global pandemic COVID-19, which continues to devastate to this date. Moreover, the attention of market participants is focused on the release of statistics on the number of applications for unemployment benefits in the United States of America, which is traditionally represented by the country's Ministry of Labor. Another important event for investors will be a meeting of the Bank of England. Most analysts are confident that the main regulator will decide to expand the stock repurchase program. It is estimated that an increase in the incentive program could reach £ 100 billion. All this should support the country's economy and provide the necessary stability to financial markets. Kiwi is under heavy pressure, which was caused by statistics on the level of GDP. As it became known, in the first quarter the indicator showed a rather substantial (1.6%) decrease compared to the previous similar period. Thus, New Zealand's current GDP indicator is now at around 310 billion New Zealand dollars, which corresponds to 200 billion US dollars. Compared with last year's figures of the same period where a drop of 0.2% was recorded. Such not-too-pleasant results were last noted more than ten years ago, which indicates a serious crisis in the country's economy. Australia follows a negative trend and also reduces its cost. Here, the main pressure comes from rising unemployment. In the current situation, this indicator is increasing in almost all countries, but in Australia, the rise was sharp and solid up to 7.1%. Recall that the previous unemployment rate was 6.4%. Such high results in the country have not been observed for nearly twenty years. Moreover, the growth rate of unemployment turned out to be even slightly, but higher than the experts' forecasts of 7%. The Chinese national currency is growing against the US dollar. Inspiration arose amid a cut in the rate on two-week reverse repurchase agreements ratified by the People's Bank of China. The decrease amounted to 20 points at once, which corresponds to 2.35%. At the same time, the rate of weekly operations remained unchanged at 2.2%. Thus, the regulator made financial injections in the amount of 120 billion yuan or 16.95 billion dollars. The euro supported the positive trend and grew against the dollar by 0.11%, thus reaching a level of 1.1256 dollars per euro. Recall that yesterday's togas stopped at around 1.1244 dollars per euro. In relation to the Japanese national currency, the euro took a stable position, which remained virtually unchanged. Its current level is around 120.3 yen per euro. At the same time, the exchange rate of the US dollar against the yen fell by 0.08%, which sent it to the level of 106.92 yen per dollar, while yesterday trading closed at 107.01 yen per dollar. The value of the pound sterling also shows a decline in relation to the dollar. In the morning, its value was reduced by 0.04% and was at the level of 1.2550 dollars per pound. Yesterday, its level was 1.2555 dollars per pound. Meanwhile, it grew by 0.16% in relation to the euro and began to cost 1.1148 euros per pound. Yesterday at auction, it closed at around 1.166 euros per pound. Kiwi fell by 0.3% and was at the level of 0.6441 dollars per kiwi. Aussie, on the other hand, sank by 0.12% and began to cost 0.6876 dollars for the aussie. The index of the US dollar against a basket of six major currencies of the world (ICE Dollar) decreased by 0.11% compared with the previous day. The dollar index against sixteen world currencies (WSJ Dollar) is also negative by 0.02%. The material has been provided by InstaForex Company - www.instaforex.com |

| Comprehensive analysis of movement options for EUR/GBP, GBP/JPY, and EUR/JPY (H4) on June 19, 2020 Posted: 18 Jun 2020 08:30 AM PDT Minuette operational scale (H4) What will happen with the EUR/GBP, GBP/JPY, and EUR/JPY currency pairs in the H4 timeframe - options for the development of the movement from June 19, 2020. ____________________ Euro vs Great Britain pound Starting June 19, 2020, the development of the movement of the "main" cross-instrument EUR/GBP will be determined by the direction of testing and the direction of the breakdown of the channel boundaries 1/2 Median Line (0.9070-0.9035-0.9005) of the Minuette operational scale forks - details of movement inside this channel are shown on the animated chart. A breakdown of the support level of 0.9005 on the lower boundary of the 1/2 Median Line Minute channel will direct the downward movement of the "main" cross-instrument to the initial SSL line (0.8975) of the Minuette operational scale forks, as well as to the borders of the 1/2 Median Line Minuette channel (0.8945-0.8925-0.8905) and the equilibrium zones of the operational scales pitchforks - Minute (0.8905-0.8863-0.8815) and Minuette (0.8875-0.8845-0.8815). If the resistance level of 0.9070 breaks at the upper border of the channel 1/2 Median Line in the Minuette operational scale, the upward movement of EUR/GBP can be continued to the warning line UWL38.2 Minute (0.9130). The EUR/GBP movement options from June 19, 2020 are shown on the animated chart.

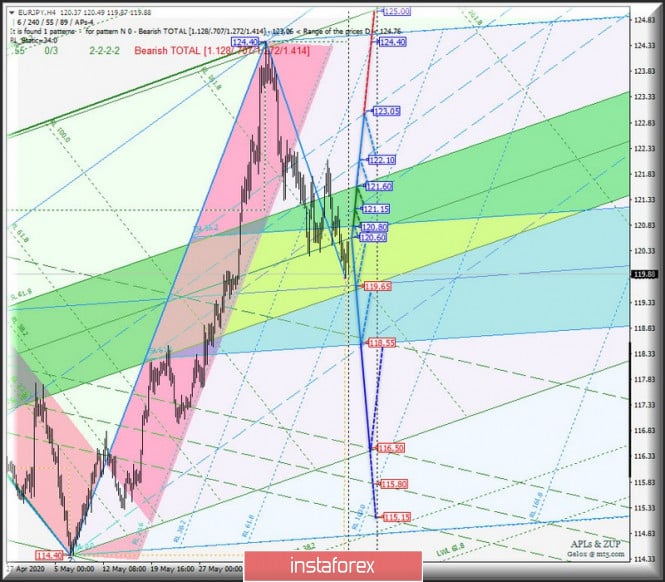

____________________ Euro vs Japanese yen The development of the movement of the EUR/JPY cross-instrument from June 19, 2020 will depend on the development and direction of the breakdown of the boundaries of the equilibrium zone (120.80-119.65-118.55) of the Minuette operational scale pitchfork - details of movement within the specified balance zone are shown on the animated chart. Breakdown of the lower border of ISL61.8 of the balance zone of the Minuette operational scale forks - support level 118.55 - the continuation of the downward movement of EUR/JPY to the borders of the channel 1/2 Median Line (116.500-115.80-115.15) of the Minuette operational scale forks. The breakdown of the top border ISL38.2 equilibrium zone of the Minuette operational scale forks - resistance level 120.80 - will be important in the development of the movement of EUR/JPY to the borders of the channel 1/2 Median Line Minuette (121.15-122.10-123.05). From June 19, 2020, we look at EUR/JPY movement options on the animated chart.

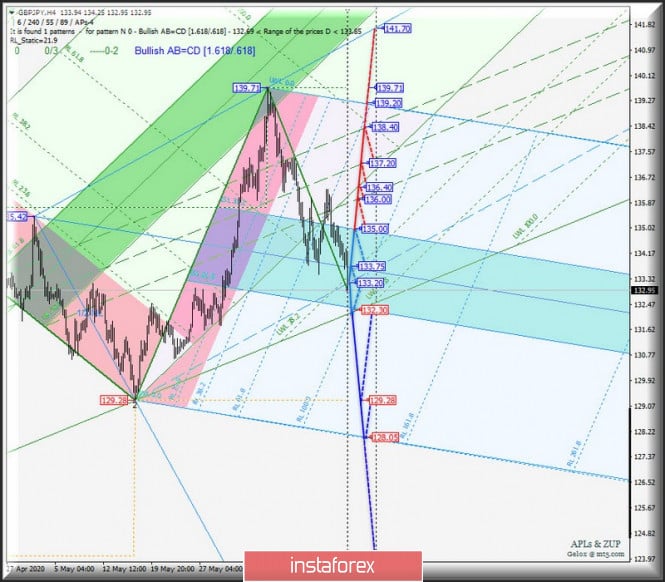

____________________ Great Britain pound vs Japanese yen The development of the GBP / JPY cross-instrument movement from June 19, 2020 will also be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (135.00-133.75-132.30) of the Minuette operational scale forks - the markup of movement inside this equilibrium zone is presented on the animated graph. A breakdown of the lower border of ISL61.8 of the balance zone of the Minuette operational scale forks - support level of 132.30 - will determine the continuation of the downward movement of GBP/JPY to the local minimum of 129.28. In case of a breakdown of the top border ISL38.2 equilibrium zone of the Minuette operational scale forks - resistance level of 135.00 - the upward movement of the GBP/JPY can be continued to the boundaries of the channel 1/2 Median Line (136.00-137.20-138.40) of the Minuette operational scale forks. Details of the development of the EUR/JPY movement from June 19, 2020 are shown on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers, and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| Gold bulls unable to reclaim key resistance Posted: 18 Jun 2020 07:51 AM PDT Gold price briefly pushed above $1,730 key resistance today but sellers were stronger and price is making a bearish reversal now. Price is entering the short-term Ichimoku cloud now and combined with the rejection at the $1,730 resistance, this is a bearish sign.

Gold price is again below both the tenkan-sen and kijun-sen. Bulls did not want price to get rejected at $1,730 and definitely they did not want price to break inside the cloud. Price has now potential to move towards $1,706 support and the lower cloud boundary. Breaking below this level would be a bearish sign. Resistance remains at $1,730. In order for the bullish scenario to be confirmed, we need to see price break this resistance. Today's price action confirms the importance of this resistance level. Let's see now if support holds. Bulls are still alive but need to come back if they want to see price move higher towards $1,780. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Jun 2020 07:37 AM PDT EURUSD is breaking below short-term support confirming our bearish view for a move lower towards 1.1150. Price continues to make lower lows and lower highs and the RSI continues to trade below the key resistance trend line.

Black line - RSI resistance Red lines- expected path EURUSD is expected to reach the 38% Fibonacci retracement. Price is in bearish trend. EURUSD has potential to reach the 100% extension in this leg down similar to the first decline from 1.1420 to 1.1212. Support is found at 1.1175 and 1.1135. Resistance is at 1.1265 and 1.1290. The RSI is still not in oversold levels and below the black trend line. As long as this is the case, we continue to expect price to move lower. The material has been provided by InstaForex Company - www.instaforex.com |

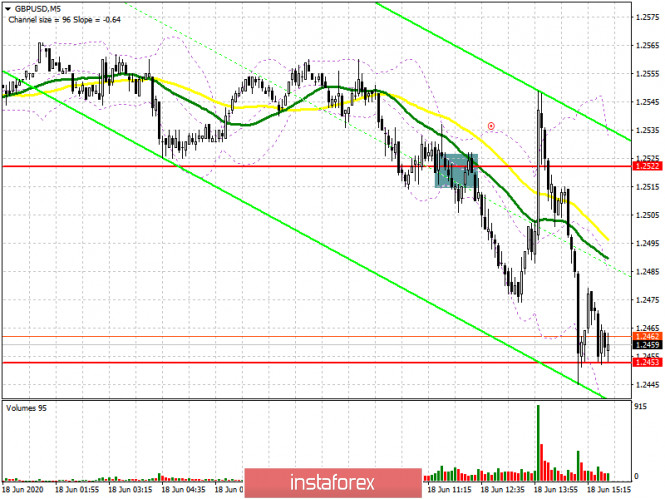

| Posted: 18 Jun 2020 07:11 AM PDT All the arguments about what measures the Bank of England will take quickly came to naught since in general everything was predicted by the market, and the Central Bank was surprised by its dryness and only a couple of statements that did not clarify the situation much. Most likely, a wait-and-see position is now the best scenario for the UK economy. It was expected that the regulator would say something about the effectiveness of recently implemented rate cuts, which could affect the reduction in the cost of borrowing in commercial banks, however, this did not happen. Let me remind you that during the coronavirus pandemic, the Bank of England twice lowered the key interest rate, which in March fell to 0.1% from 0.75%. There is also no information about whether the TFSME program, which gives banks and building societies access to four-year loans at a rate close to the key interest rate, has been changed. The only solution was to increase the bond purchase program, which gives the market a delay until the August meeting, before which traders will again return to talk about the introduction of negative interest rates. However, this outcome is still unlikely. In general, the UK banking system, as in other developed countries, is not designed for such changes in monetary policy, and if the Bank of England does make such a decision, it will have a serious impact on the income and profits of banks, insurance companies, and pension funds. Accordingly, the reaction of the British pound to this decision will be similar. However, you should not be afraid that the fall will occur simultaneously since markets will approach this scenario gradually and the fact that the key interest rate has already been introduced will be taken into account in the quotes. So don't be surprised if the British pound resumes its bearish momentum in the summer months under the pretext of a lack of progress in trade negotiations and fears of a second wave of coronavirus. But back to today's decision. The Bank of England left its key interest rate at 0.1%. The decision to keep the key rate at 0.1% was made with a vote ratio of 9 to 0. The regulator also increased the bond purchase program by 100 billion pounds, to 745 billion pounds, and only the chief economist of the Bank of England, Haldane, voted to keep the bond purchase program at 645 billion pounds. The Bank said that it is ready to take further measures if the economy needs support, thereby making it clear that it is still going according to their plan and the economy does not need additional stimulus. As for the technical picture of the GBPUSD pair, the bulls did not receive the necessary support from the statements of the Bank of England, which involved the pound in a new bearish trend. The next major support levels, if the bears achieve a breakout of the week's lows in the area of 1.2450 today, will be seen only in the area of 1.2370 and 1.2290. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on June 18 Posted: 18 Jun 2020 06:11 AM PDT To open long positions on GBPUSD, you need: In the first half of the day, a rather interesting signal was formed for the sale of the British pound, which I paid attention to in my morning forecast. If you look at the 5-minute chart, you will see how the bears achieved a breakout of the support of 1.2522, and the repeated test of this level from the bottom up became the starting point for opening short positions, which have already led to an update of the minimum of 1.2453. The bulls need to protect this area. The Bank of England's decision on interest rates further discouraged investors from opening long positions, as it was quite expected and coincided with all the forecasts of economists. On the 5-minute chart, you can see how the bulls have already formed one rebound of about 30 points from the support of 1.2453, however, a repeated test of this area may lead to a breakdown. Therefore, you should not rush to open long positions in this range. It is best to wait for the update of the larger lows of 1.2376 and 1.2290 and buy the pound there immediately for a rebound in the expectation of correction of 30-40 points within the day. An equally important task for the bulls will be to regain the resistance of 1.2522 since only this scenario will allow the market to maintain hope for a recovery of the pound in the short term.

To open short positions on GBPUSD, you need: The pressure on the pound has increased, and the bears have a great chance to resume a downward correction. A break in the support of 1.2522 and active sales at the low of 1.2354 may lead to a larger decline in the pair in the second half of the day. Bears need to gain a foothold below the level of 1.2354, since only in this scenario can you increase short positions in the pair and wait for the update of the minimum of 1.2376, where I recommend fixing the profits. The longer-term target of the bears remains the area of 1.2290, which coincides with the beginning of the June bullish trend. In the case of an upward correction of GBP/USD in the afternoon, it is best to return to short positions only when a false breakdown is formed in the resistance area of 1.2522, and you can sell the pound immediately for a rebound from a maximum of 1.2591 per 30-40 points correction by the end of the day.

Signals of indicators: Moving averages Trading is below the 30 and 50 daily averages, which indicates that the bear market will continue in the short term. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands If the pound rises, the average border of the indicator in the area of 1.2525 will act as a resistance. Description of indicators

|

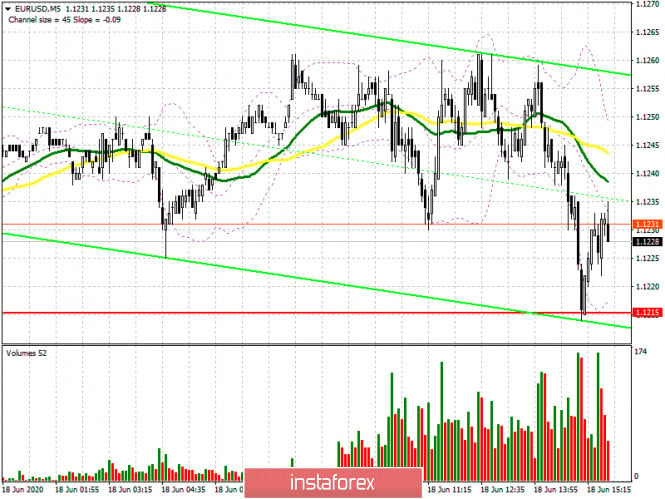

| EUR/USD: plan for the American session on June 18 Posted: 18 Jun 2020 06:10 AM PDT To open long positions on EURUSD, you need: In the first half of the day, trading was conducted in a fairly narrow side channel against the background of the absence of important fundamental statistics, and neither buyers nor sellers showed much activity. If you look at the 5-minute chart, the bulls did not pull the pair into the resistance area of 1.1284, but, on the contrary, retreated again to the lower border of the side channel of 1.1215, where trading is currently being conducted. By the way, the test of this level has already led to a rebound of the pair up, and its protection remains a priority for buyers of the European currency. In the absence of further upward movement and good data on the US labor market, it is best to postpone long positions in EUR/USD until the new lows of 1.1164 and 1.1106 are updated, in the expectation of a rebound of 30-40 points by the end of the day. An equally important task for the bulls will be the return of EUR/USD to the resistance and its breakdown, which will lead to a new upward wave to the highs of 1.1349 and 1.1418, where I recommend fixing the profits.

To open short positions on EURUSD, you need: The main goal for the second half of the day will be to test the lower border of the side channel 1.1215, however, we can only talk about the resumption of the downward trend in the euro after fixing below this level, which will quickly push the pair to new lows of 1.1164 and 1.1106, where I recommend fixing the profits. In the scenario of euro growth in the second half of the day after the data on the US economy and the state of the labor market, it is best to wait for the update of the resistance of 1.1284 and re-open short positions if a false breakout is formed there. It is still best to sell EUR/USD immediately on a rebound after updating the larger maximum of 1.1349 in the expectation of a correction of 30-40 points within the day.

Signals of indicators: Moving averages Trading is conducted below the 30 and 50 daily moving averages, which indicates that the pressure on the pair remains. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower border of the indicator in the area of 1.1225 may increase pressure on the euro. Description of indicators

|

| Evening review on EURUSD for June 18, 2020 Posted: 18 Jun 2020 05:45 AM PDT

The number of applications for benefits in the US for the week reached 1.5 million which is at the same level as the previous week. Meanwhile, there is no significant improvement in the long-term unemployment which is at 20.6 million. However, a very strong Philadelphia business activity index came out with a 27.5 contrary to the forecast of -32. During his speech, Fed Chairman Jerome Powell spoke out against premature curtailment of support for citizens and businesses. EURUSD: Prepare to buy from 1.1270. Sell from 1.1205. We are waiting for significant movements. The material has been provided by InstaForex Company - www.instaforex.com |

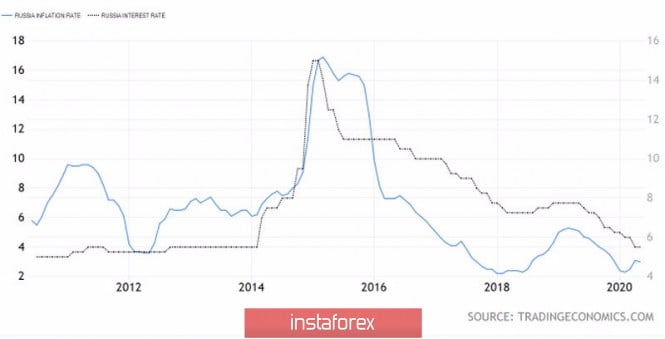

| Posted: 18 Jun 2020 05:43 AM PDT The USD/RUB bears are frightened by the second coronavirus wave in China, a surge in the number of infected people to record high in some US states, and pessimistic speeches provided by Jerome Powell. They have even allowed their opponents to raise the quote above the psychological level of 70. However, their actions look like a game of cat and mouse. The Russian ruble will keep its current positions as S&P 500 is above 3,000, Brent crude is trading higher than $40 a barrel, there is no shortage of cheap liquidity in financial markets, and the Bank of Russia leaves the door open for the monetary policy easing. During the previous regulator's meeting, Elvira Nabiullina said that the key interest rate could drop to 4.5%. Experts at Reuters suppose that this may happen as early as June 19th. At the same time, some other specialists interviewed by Bloomberg are less aggressive. They believe that the central bank will cut the key rate by 75 basis points to 4.75%. In April and May, Russia's inflation accelerated. Easing of the Russian monetary policy usually leads to the consolidation of the national currency. This may significantly complicate the return of consumer prices to the 4% target. Russia's Inflation Rate and the CBR's Key Interest Rate As a rule, lowering of the benchmark rate is a bearish factor for the national currency. However, the high yield of the Russian debt market attracts foreign investors. During the last three months, marlet participants who choose carry trade earned about 21% by means of the ruble-related assets. At the same time, further easing of the monetary policy may contribute to an increase in bond prices, which will allow traders to sell the previously purchased securities with a decent profit. According to the comments provided by Jerome Powell, the US Fed is not planning to change its ultra-soft monetary policy. The Fed's Chairman called on Congress to continue to support the economy that is getting back on track. Powell supposes that the country's economy will be able to hit the pre-crisis levels only if people are completely sure that the spread of COVID-19 is under control. S&P 500 will be cushioned by both the Fed and the White House. Donald Trump said that the virus would die, but still it would be perfect to have vaccine against it. The US administration is considering plans to increase infrastructure spending by $1 trillion. This, in turn, may boost both state-issued stocks and all risky assets. While Donald Trump is confident that the S&P 500 rally will continue, Saudi Arabia claims that the OPEC+ agreement to reduce production and restore global demand will lead to a return of oil prices to normal levels. Most likely, Riyadh expects Brent to rise to $60-65 per barrel. I suppose that the S&P 500 correction will hardly be deep and demand for the US dollar as a safe-haven asset will be confidently dropping amid stable epidemiological situation and absence of trading wars. Thus, we may follow the previous selling strategy for the dollar/ruble pair with the targets at 261.8% and 161.8% by the patterns AB=CD and "Crab". Daily chart for USD/RUB |

| Era of USD's excellence coming to end Posted: 18 Jun 2020 05:22 AM PDT

Eminent economist Stephen Roach suggests a 35% fall in the US dollar due to the widening national deficit and reducing savings. The expert does not recommend buying the US dollar. The US currency may weaken over the coming few years amid the souring trade relations with China. The US is focused on separation from the rest of the world, the country is avoiding globalization. This, in turn, could be the end of the US dollar dominance. The economist is confident that the dollar could drop very sharply, because the administration spends trillions of dollars to mitigate the consequences of COVID-19. Roach published an article in which he stated that the coronavirus pandemic has greatly weakened the US economy. Besides, he supposes that at the beginning of 2020, the country already entered recession amid a health crisis that would only make the greenback weaker. However, the financial expert believes that the Chinese currency is becoming more attractive for investors, because China is undergoing economic reforms. The country is moving away from a heavy industrial economy to one that is focused on services. In other words, economic growth will be based on consumer spending. The dollar is the world's reserve currency, because it is believed that the United States is a country with a stable economy. Nevertheless, the situation is changing. The growing deficit would ultimately strike the dollar. In his opinion, even a change of the US power in November would not improve the situation. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment