Forex analysis review |

- USDCAD bounce in progress towards descending trendline resistance!

- GBP/USD facing bearish pressure from descending trend line

- GBP/USD facing bearish pressure from descending trend line

- Forecast for EUR/USD on July 1, 2020

- Forecast for GBP/USD on July 1, 2020

- Forecast for AUD/USD on July 1, 2020

- Forecast for USD/JPY on July 1, 2020

- Short-term technical analysis of AUDUSD

- Gold price continues its advance

- Dollar may eventually depreciate

- GBP / USD: sell pound on spurts of optimism

- June 30, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- June 30, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Greenback rushed up, leaving the pound behind

- Gold& Silver – Daily. APLs & ZUP comprehensive analysis of possible price movements in July 2020

- Disrupted security in foreign exchange: risky assets gains attention

- Trading plan for US Dollar Index for June 30, 2020

- Calm before the storm: gold prepares to challenge record highs

- EURUSD and GBPUSD: Fears about the collapse of the Eurozone have eased, and China is not happy with the US action. The recovery

- Pound goes down

- Stock exchanges in Europe, America and Asia are growing at a positive economic statistics

- BTC analysis for June 30,.2020 - Watch for the potential drop on BTC towards the 8.900

- EUR/USD analysis for June 30 2020 - Downside pressure on the EUR with potentia lfor test of 1.1100

- Oil

- Analysis of Gold for June 30,.2020 - Upside channel in control and potential for the bigger rally towards the $1.800

| USDCAD bounce in progress towards descending trendline resistance! Posted: 30 Jun 2020 08:29 PM PDT

Trading Recommendation Entry: 1.35809 Reason for Entry: Moving average resistance, Ascending trendline resistance. Take Profit: 1.34968 Reason for Take Profit:161.8% Fibonacci extension Stop Loss: 1.36153 Reason for Stop Loss: 38.2% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD facing bearish pressure from descending trend line Posted: 30 Jun 2020 08:28 PM PDT

Trading Recommendation Entry: 1.24425 Reason for Entry: Horizontal overlap resistance, 78.6% fibonacci extension and 61.8% fibonacci retracement Take Profit: 1.22637 Reason for Take Profit: Horizontal overlap support, 76.4% fibonacci retracement, 61.8% fibonacci extension Stop Loss: 1.25461 Reason for Take Profit: Horizontal swing high resistance, 50% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD facing bearish pressure from descending trend line Posted: 30 Jun 2020 08:28 PM PDT

Trading Recommendation Entry: 1.24425 Reason for Entry: Horizontal overlap resistance, 78.6% fibonacci extension and 61.8% fibonacci retracement Take Profit: 1.22637 Reason for Take Profit: Horizontal overlap support, 76.4% fibonacci retracement, 61.8% fibonacci extension Stop Loss: 1.25461 Reason for Take Profit: Horizontal swing high resistance, 50% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for EUR/USD on July 1, 2020 Posted: 30 Jun 2020 08:05 PM PDT EUR/USD The euro traded in the range of 72 points on Tuesday, having reached both target levels - upper and lower - 1.1195, 1.1265. Traditionally, a wide-range day with a relatively small close (-7 points) is a sign of the upcoming strong movement. Data on employment and retail sales in Germany, US private sector employment, US ISM Manufacturing PMI for June (forecast 49.5 versus 49.6 in May) will be released today, there are enough reasons to start a new one to two-week movement. The Marlin Oscillator continues to decline in the area of negative values on the daily chart. Moving the price below the level of 1.1195 will open the way to the first goal of 1.1103 - to support the trend line of the price channel of the monthly timeframe. The price is currently above the MACD line (blue indicator) on the four-hour chart, but below the balance line (red indicator), Marlin is in the decline zone, the price can return to the MACD line and resume the downward movement. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for GBP/USD on July 1, 2020 Posted: 30 Jun 2020 08:05 PM PDT GBP/USD The pound sterling slightly fell short of its first goal of 1.2230 as the junction between the Fibonacci level of 161.8% and the MACD line on the daily chart. The price went above the balance indicator line, which indicates the potential for the market to grow even higher, an attempt to overcome the Fibonacci level of 138.2%. Success can bring the price to the Fibonacci line 123.6% at the price of 1.2540. The weak point of this scenario is the Marlin oscillator; it has not yet shown its intention to enter the growth zone. The price stopped growing at the resistance of the MACD line on the H4 chart. The Marlin oscillator in the growth zone. The price exit above the Fibonacci level of 138.2% (1.2424) will be the first condition for further growth to the target of 1.2540. A price fall below the signal level of 1.2335 (June 22 low) will become a condition and a signal to move up to 1.2230. |

| Forecast for AUD/USD on July 1, 2020 Posted: 30 Jun 2020 08:05 PM PDT AUD/USD The Australian dollar grew by 36 points as a result of yesterday's trade, which was based on the growth of commodities, metals and basic agricultural products without a uniform movement of major world currencies, that is, against the backdrop of the inactivity of the US dollar. Continuing this situation will allow the aussie to reach the target level of 0.7080, but there are no signs of this yet. The Marlin oscillator is growing on the daily chart, but is still in the negative zone. Marlin is already in the positive zone on the four-hour chart, and the price is higher than both indicator lines - balance and MACD. The Marlin convergence is weak, it could already be reached, but it has not yet exhausted itself at the moment. A reliable condition for growth to 0.7880 is when the price goes above the June 23 high at 0.6976. A condition for a downward movement is price taking below the signal level of 0.6842. The first target will be the level of 0.6680 - the March 9 peak. |

| Forecast for USD/JPY on July 1, 2020 Posted: 30 Jun 2020 07:44 PM PDT USD/JPY The dollar grew by 34 points against the yen on Tuesday, this morning the price grew by 25 points in the moment, the pair reached its first bullish target at 108.10 and sharply turned down. If this is a real reversal, then we can see the price on the support line of the price channel in the region of 105.78. The first sign of such a downward movement will be price taking at 107.77, after which it will become possible to decline to the first target of 107.10 - to the nearest line of the price channel of the monthly timeframe. The signal line of the Marlin oscillator is still in the positive area on the four-hour chart, which, of course, does not create a reliable condition for pulling down the price, respectively, for opening the short position early on. It is advisable to wait for the price to go below yesterday's low of 107.53. In this case, the price could fall to the MACD line at 107.00, which is close to the target on the daily chart of 107.10. Price taking below 107.10 opens the way to 105.78. |

| Short-term technical analysis of AUDUSD Posted: 30 Jun 2020 01:20 PM PDT AUDUSD remains inside the medium-term bullish channel and inside the trading range since the start of June. Price so far respects medium-term support and bulls are pushing price higher from the lower channel boundary.

Blue lines - bullish channel AUDUSD is respecting channel support and is bouncing off the lower boundary. Resistance remains at 0.6975 at the upper trading range boundary. A break above this level will push price towards 0.72 and the upper channel boundary. A break below 0.68 could lead to more selling pressures pushing price towards 0.66. Short-term trend is unclear as price mostly moves sideways. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price continues its advance Posted: 30 Jun 2020 01:15 PM PDT Gold price is making new higher highs today. Price remains in bullish trend after the pull back towards $1,750. The RSI is now showing some warning signs as price is making new higher highs. The RSI indicator however is not making new higher highs as we see in the 4 hour chart.

Gold price is inside the bullish channel as we already have noted in previous posts. Price continues to make higher highs and now that the $1,780 level has been captured, I feel we should expect price to continue higher towards $1,800-$1,825. Any pull back towards $1,760 is justified. This level is channel support and recent low. So bulls need to defend that area. Failure to hold above it will open the way for a move towards $1,740. The RSI is showing divergence signs as it does not follow price to new higher highs. This is not a reversal signal, only a warning. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar may eventually depreciate Posted: 30 Jun 2020 09:59 AM PDT

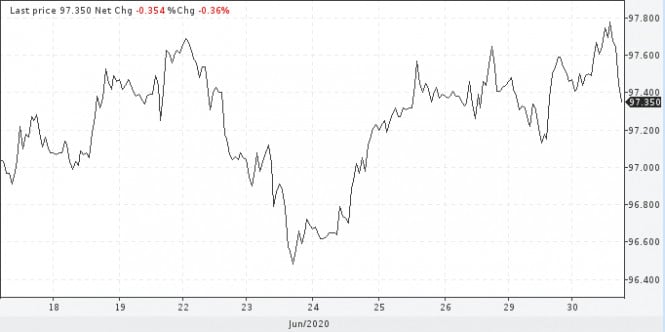

Wall Street is showing mixed dynamics today. Investors are torn between hopes of economic recovery and news of the spread of the virus. US stocks opened in negative territory, but internal statistics have improved the mood of investors who have received another batch of positive macroeconomic data. The growth in the consumer confidence index in the US in June significantly exceeded market expectations. Analysts had forecast an increase of 91.8 points from 86.6 points in May, while the indicator rose to 98.1 points. Earlier, strong indicators on the US economy were also published, which spurred market enthusiasm. Key stock index futures went up, while the dollar index lost ground. On Tuesday, the markets are waiting for another test upon the speech of Jerome Powell and Steven Mnuchin. Financial authorities speak to a committee of the US House of Representatives. This event will set the tone for the trading session on Wednesday. Powell should touch on the topic of coronavirus and regulatory support for the economy. An optimistic tone will support stock indices and put even more pressure on the position of the US dollar, which showed growth for the fifth day in a row. USDX

Meanwhile, talking about the return of risk appetite will be premature, since there are plenty of pressure factors on risky assets. China passed a law on security in Hong Kong, tightening control over the former autonomous city. Washington did not have to wait long for the reaction, the United States terminated the city's special trade status that was granted earlier to Hong Kong. The World Health Organization warns that the pandemic situation is not over yet, and many countries remain vulnerable to the virus. Moreover, the world has now entered a new dangerous phase of the spread of coronavirus. The second wave may prove even more powerful in its negative impact on the global economy. A shadow of the lockdown loomed over the markets. In this situation, the US dollar has a chance to restore positions, but so far the growth has been limited to maximum marks in more than three weeks. The dollar index has managed to expand the trading range at the moment. The greenback is spreading its wings, but there are not enough forces and triggers to take off in the form of an economic slowdown due to the pandemic. Meanwhile, Freedom Finance's sentiment index is at 13 out of 100. The indicator shows that market anxiety about the negative effects of the pandemic is decreasing. The separation of the indicator from the minimum values may indicate an improvement in prospects. Now there are a lot of forecasts and speculations on where the dollar will go. Hugh Hendry, an independent macroeconomist, suggested that the US Treasury should lower the dollar to 60 in the index. Quantitative easing programs do not work, he said, so you need to pay attention to the value of the dollar. "When I look at the macro world, I think that everything tells us that we need a lower dollar exchange rate. We need the Treasury, not the Fed so that it is resolved and tells the world that we are going to lower the dollar index to 70 or even to 60. This would change the world, "Hendry said. The material has been provided by InstaForex Company - www.instaforex.com |

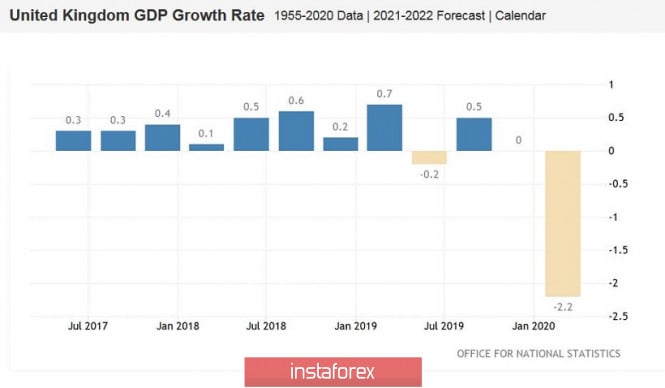

| GBP / USD: sell pound on spurts of optimism Posted: 30 Jun 2020 09:59 AM PDT The pound paired with the dollar tested the 22nd figure for the first time in four weeks. The last time the pound was at such price bottom was at the end of last month. The downward price dynamics were primarily due to harsh statements by Boris Johnson regarding the prospects of the negotiation process between London and Brussels. The data on the growth of the British economy published today only increased the pressure on the pound, after which the GBP / USD pair again fell to the middle of the 22nd price level. But only for a few hours as the pair's bears could not develop the southern impulse because first, the pound received unexpected support from Johnson, and second, the dollar again demonstrated its vulnerability. In the afternoon, the dollar index reached its ceiling which is located at around 97.6 points, turned 180 degrees, and headed back to its previous positions - in the middle of the flat corridor, in which it has been oscillating for almost a month. This turn of events somehow affected the dynamics of all dollar pairs, and the GBP / USD pair was no exception.

It is worth noting here that the recent growth of the dollar, like its current decline, is unsteady. Yesterday, the greenback reacted positively to the release of secondary macroeconomic data in the US housing market, while today it actually ignored the growth in the indicator of American consumer sentiment. Meanwhile, major stock indices opened today with growth, after which the dollar came under slight pressure. Also, one should not forget about the coronavirus, the pace of the spread of which scares many experts. Over the past day, the number of new cases of Covid-19 in the United States has exceeded 40 thousand. This sad figure exceeds the 40,000th mark for the fourth time in the last five days, while the total number of infected people in the United States is already approaching 2.7 million. Most likely, the dollar index will continue to fluctuate within the above range, responding to the current news flow and waiting for Nonpharm, which will be published on Thursday. The fundamental picture for the pound, in turn, is also ambiguous. On the one hand, disappointing macroeconomic data were published in Britain today. It became known that according to the final assessment, the country GDP in the first quarter grew by only 2.2% - this is the weakest growth rate since 1979. The slowdown has been recorded in all key sectors of the British economy. Most of the affected were industrial production by 1.5%, construction by 1.7%, and the services sector by 2.3%. In addition, household spending fell by almost 3%. On the other hand, the pound received support from Boris Johnson today (who literally drowned him with his statement yesterday regarding Brexit's prospects). Today, the head of the British government promised to allocate 5 billion pounds to support the country economy. According to him, these funds will be used to modernize the infrastructure, repair hospitals, roads, and the needs of schools. He also promised to build new hospitals, schools, and colleges, noting that this would help create jobs. The pound also reacted positively to comments by Bank of England spokesman John Cunliffe, who was skeptical of the idea of introducing a negative rate. Let me remind you that during the last meeting of the English regulator, Andrew Bailey unexpectedly returned to this topic, putting significant pressure on the British currency. But the rest of the Committee members are cautious enough about this issue, and so does Cunliffe. As you can see, the pound is trading in conditions of conflicting "news noise" where the bears and bulls of the GBP / USD pair struggle to either push the pair to the middle of the 22nd figure or returns it to the 23rd price level. But if you look at a wider time range (for example, over the past four weeks), you can come to the conclusion that the pound is gradually moving with sharp upward pullbacks, but still slides down. And in my opinion, this trend will continue until London and Brussels find a common denominator in the protracted negotiations. Therefore, in the medium term, the trading strategy for the pound should remain unchanged: sale for any more or less significant growth. Notice how just one phrase dropped by Johnson in a conversation with his Polish counterpart Mateusz Morawiecki brought down the pound throughout the market. Let me remind you that the British Prime Minister announced the possibility of interacting with the EU on conditions similar to those of Australia. Canberra did not conclude a single trade agreement with Brussels, so the exchange of goods takes place according to the rules of the WTO. At the same time, for some types of goods, both Australians and Europeans concluded separate transactions. Johnson wants to copy this kind of relationship algorithm. Downing Street confirmed that they are considering a similar scenario but only if the ongoing negotiations in Brussels fail.

This fundamental factor had a short-term impact on the pound, since the main stage of face-to-face negotiations is yet to come (namely in July). But here it is necessary to pay attention to how sharply the pound reacts to negative comments, rumors, and news regarding Brexit's prospects. This sensitivity makes the pound very vulnerable - for example, at the beginning of this week, the GBP/USD pair fell even against the backdrop of a general weakening of the dollar. Thus, it is still advisable to use the growth of the pair as an occasion to open short positions. The closest resistance level is at 1.2410 (Tenkan-sen line on the daily chart). The next, most strong resistance level is the price of 1.2520 (the middle line of the Bollinger Bands indicator, which coincides with the Kijun-sen line on the same timeframe). From the above levels, sales can be considered, counting on a medium-term time period. The material has been provided by InstaForex Company - www.instaforex.com |

| June 30, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 30 Jun 2020 09:07 AM PDT

Recently, Bullish breakout above 1.2265 has enhanced many bullish movements up to the price levels of 1.2520-1.2590 where temporary bearish rejection as well as a sideway consolidation range were established (In the period between March 27- May 12). Shortly after, transient bearish breakout below 1.2265 (Consolidation Range Lower Limit) was demonstrated in the period between May 13 - May 26. However, immediate bullish rebound has been expressed around the price level of 1.2080. This brought the GBPUSD back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection. Hence, short-term technical outlook has turned into bullish, further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where signs of bearish rejection were expressed. Short-term bearish pullback was expressed, initial bearish destination was located around 1.2600 and 1.2520. Moreover, a bearish Head & Shoulders pattern (with potential bearish target around 12265) is being demonstrated on the chart. That's why, bearish persistence below 1.2500 ( neckline of the reversal pattern ) pauses the bullish outlook for sometime and should be considered as an early exit signal for short-term buyers. Any bullish pullback towards 1.2520-1.2550 (recent supply zone) should be watched by Intraday traders for a valid SELL Entry. Trade recommendations : Intraday traders can wait for the current bearish movement to persist below 1.2340 for another valid SELL Entry. S/L should be placed above 1.2375 while T/P level to be located around 1.2265 and 1.2200. The material has been provided by InstaForex Company - www.instaforex.com |

| June 30, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 30 Jun 2020 09:03 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) then 1.1315 (78.6% Fibonacci Level) where bearish rejection was anticipated. Although the EUR/USD pair has temporarily expressed a bullish breakout above 1.1315 (78.6% Fibonacci Level), bearish rejection was being demonstrated in the period between June 10th- June 12th. This suggested a probable bearish reversal around the Recent Price Zone of (1.1270-1.1315) to be watched by Intraday traders. Hence, Bearish persistence below 1.1250-1.1240 (Head & Shoulders Pattern neckline) was needed to confirm the pattern & to enhance further bearish decline towards 1.1150 Trade recommendations : Any bullish pullback towards the price zone around 1.1300-1.1350 (recently-established supply zone) should be watched by Intraday Traders as a valid SELL Signal.T/P levels to be located around 1.1175 then 1.1100 while S/L to be lowered to 1.1350 to offset the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| Greenback rushed up, leaving the pound behind Posted: 30 Jun 2020 08:15 AM PDT

The demand in greenback continues to grow amid increasing risks of the second wave of the COVID-19 pandemic in the world. According to the World Health Organization, the peak of the incidence rate is only ahead, and much will depend on how well-coordinated the actions of the governments of states aimed at a common victory over the infection. So far, a general trend has not been observed, and the situation continues to escalate. This morning, the US dollar index against a basket of six major world currencies rose slightly by 0.1% and reached a level of 97.645. This indicates that the greenback began to regain its former reputation. The ratio of the euro and the dollar decreased by 0.3%. Today's level was at around 1.1212 dollars per euro. Meanwhile, the dollar against the Japanese yen, on the contrary, increased by 0.1% and was in the region of 107.64 yen per dollar. Yesterday, the head of the US Federal Reserve made a statement in which, among other things, he drew attention to the fact that the world's largest economy has very vague prospects for development in the current crisis conditions. The main thing that the whole course of further events will depend on is the containment of the second wave of the coronavirus pandemic, as well as measures to support a weakened economy. In the morning, the pound sterling felt the greatest pressure, which was caused by the publication of the latest statistics on the level of GDP in the country. According to statistics, in the first quarter of this year, the UK economy fell by 2.2% which is more serious than the previously expected fall. Recall that the previous forecasts noted a decrease of no more than 2%, but in reality, the numbers turned out to be worse. Such a decline has not been noted for more than forty years, which, of course, seriously affected the exchange rate of the national currency. The course of the pound sterling against the US dollar in the morning showed a decrease of 0.2%, which pushed it to the mark of 1.2276 dollars per pound. This level is slightly higher than the minimum value for the current month, which was recorded on Monday and was in the region of 1.2252 dollars per pound. The pound in relation to the euro is also declining. The fall is still insignificant with -0.1%. The current level is at around 0.9133 euros per pound. Recall that yesterday there was a rapid growth, which allowed the currency pair to reach the level of 0.9175 euros per pound. Thus, the pound today has lost 1.6% against the euro. Market participants also express serious and well-founded concerns about the planned financing of the infrastructure sector, as announced by the UK government. As it became known after the speech of the Prime Minister of the country Boris Johnson, the state plans to increase the line of these expenses, which, in turn, is very ambiguous by investors. The uncertainty in negotiations with the EU over trade relations is hanging over the currency like a sword of Damocles. So far, no significant progress has been made in the negotiation process. Consensus has not been reached, which means that this problem will continue to put pressure on the pound, forcing it to adjust downward. Thus, there were practically no factors for the growth of the pound sterling, while the greenback seemed to find its foothold again and went up. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Jun 2020 07:33 AM PDT Minor operating scale (Daily time frame) The July battle of the metals: analysis of possible price movements from July 1st From July 1st, 2020, the spot gold price will depend on the price direction when it breaks the range. Resistance level – 1,805.00 – the UTL control line Support level – 1,764.02 – local high The spot gold price may go on rising if it breaks the UTL control line of the pitchfork that acts as the resistance level of 1,805.00 to move towards the lines of UWL61.8 (1,863.00) and UWL100.0 (1,953.00). A downward movement will be possible, if the price breaks the support level of 1,764.02 (a local high) and the UTL control line (1,753.00) to reach the initial SSL line (1,720.00) and the limits of the ranges of 1,705.00 – 1,678.00 – 1,645.00 and 1,645.00 – 1,610.00 – 1,575.00. Spot Silver From July 1st, 2020, the spot silver price will also depend on the price direction when it breaks the range. Resistance level – 18.180 – the UTL control line. Support level – 17.100 – the initial SSL line. The uptrend of the spot silver price may continue if the price breaks the resistance level of 18.180 which acts as the UTL control line to hit the local high of 18.340. Besides, the price may start moving towards the line of UWL61.8 (19.160), the high of 19.610, and the line of UWL100.0 (20.450). The spot silver price may start falling if it breaks the initial SSL line that acts as the support level of 17.100. The price may move towards the initial SSL line (16.300) and limits of range of 15.400 - 14.570 - 13.700.Detailed information of the spot silver price movement from July 01, 2020 could be seen on the animated *. gif chart (it will be opened in a new tab). The review was prepared regardless of the news background and trading sessions of the main financial centers. It is not a guide to set "sell" or "buy" orders. You can find more analytical article on the InstaForex website. ZUP and Andrew's Pitchfork (terms and definitions). Materials to study ZUP & APL's analysis The material has been provided by InstaForex Company - www.instaforex.com |

| Disrupted security in foreign exchange: risky assets gains attention Posted: 30 Jun 2020 06:41 AM PDT

This morning, the value of safe currencies showed a downward correction. The reason for this was the positive statistics on economic growth coming from different regions, which becomes evidence of the recovery from the crisis associated with the coronavirus pandemic. All this has a positive impact on risky assets, which are beginning to gain popularity among investors. These, in particular, include the national currency of Australia and China. The pound sterling, on the other hand, turned out to be outside the zone of interests of market participants, due to serious pressure from the uncertainty surrounding government spending on UK domestic goals. Statistics from the United States proved to be more than positive. It became evidence of the growing economic growth in the country. So, a rapid rise was recorded in the sector of preliminary sales of houses. The value of yen fell in the morning by 0.2% against the US dollar. Its current level stopped at around 107.77 yen per dollar. The dollar index against a basket of six major world currencies rose slightly after a rather long decline. It increased by 0.13%, which sent it to the mark of 97.665. Meanwhile, the swiss franc which is also one of the safe currencies reduced its value by 0.13% and reached the level of 0.9523 dollars per franc. It also fell by 0.07% In relation to the single European currency and began to cost 1.0685 francs per euro. However, restrained trends continue to dominate the currency market. Participants are not in a hurry to take risks and try to keep their assets in safer areas. To date, the four currencies of the Big Ten have thoroughly strengthened against the US dollar. Among them, it is worth highlighting the yen, the euro, the Swedish krona and the Swiss franc. All of them were able to return to their pre-crisis positive trade balance level. At the same time, the aussie also decreased in value by 0.15% and was at around 0.6407 dollars per aussie. Kiwi is also down by 0.19%. Its level is in the range of $ 0.6407 per kiwi. The Chinese yuan grew slightly by 0.13% and began to cost 7.0702 yuan per dollar in the official market. The cost in offshore is slightly lower which is 7.0696 yuan per dollar. This reflected an increase of 0.08%. The euro also slightly fell today. Its decline amounted to 0.23%, and the current level was at around 1.1214 dollars per euro. The pound also fell by 0.18%, which sent it to the mark of 1.2274 dollars per pound. Recall that yesterday it also declined and even reached the minimum values for the last month. The reason for the negative here was statements from official authorities about their intentions to expand the program of financing the state's infrastructure against the backdrop of the crisis connected with the COVID-19 pandemic. Investors are seriously concerned that the government does not intend to support a weakening economy and continue to stimulate it. In general, foreign exchange markets are experiencing a change in trends. From safe areas, investors began to turn their attention to risky assets that are becoming more popular. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for US Dollar Index for June 30, 2020 Posted: 30 Jun 2020 06:20 AM PDT

Technical outlook: US Dollar Index might have carved a meaningful bottom around 95.72 levels on June 10, 2020. The index has rallied since then and is seen to be trading around 97.64 levels at this point in writing. The recent boundary that is being worked upon is between 96.40 and 97.80 respectively. Please note that fibonacci 0.618 retracement of the recent upswing is seen around 96.90 levels. We can expect a bullish bounce around 97.00 levels if prices manage to reach there. Interim resistance is seen towards 97.80, while support is seen towards 96.40 respectively. Trading point of view, the US Dollar Index remains a buy on dips until 96.40 support remains intact. Trading plan: Buy @ 96.90 and 97.00, stop @ 95.80, target @ 100.56 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Calm before the storm: gold prepares to challenge record highs Posted: 30 Jun 2020 06:16 AM PDT

The gold rush continues amid the threat of the second wave of the COVID-19 pandemic. Last week, the price of gold rose to $ 1,796 per troy ounce, almost reaching the mark that has remained unattainable over the past nine years. Recall, the IMF has worsened its forecast for the state of the global economy. According to the estimates of a reputable organization, in 2020 world GDP will decline by 4.9%, while earlier it was expected to decrease by only 3%. The blame is on the pandemic that erupted with renewed vigor in the United States and Europe and is also gaining momentum in South America, Asia, and Africa. WHO representatives called the situation "dangerous" and warned that it could worsen due to the lack of global cooperation in this direction. The growing number of coronavirus cases in the world makes investors nervous and close positions on risky assets, such as stocks, while investing in gold and bonds. According to Emerging Portfolio Fund Research (EPFR), over the past week, almost $ 20 billion was received in bond funds. At the same time, funds focused on investments in precious metals raised $ 2.9 billion making it the highest amount since mid-May. Although the rally of gold stalled, experts do not rule out that in July the precious metal could challenge record highs in the region of $ 1,900. "After testing new multi-year highs, gold is always consolidating, and this is a good time to buy precious metals before it rises even higher," said Afshin Nabavi, senior vice president of MKS SA. "There is great uncertainty around the economic recovery in the US, which implies a higher price of gold in the future. The level of $ 1,770 indicates further growth. The next resistance will be $ 1,780 and ultimately $ 1,800, "he added. According to analysts, gold attracts attention not only amid falling demand for stocks but also due to increased support for economies and markets from governments and central banks, which increases inflationary expectations. Morgan Stanley, UBS, and JPMorgan Private Bank advise their customers to stock up on gold, allocating at least 10% of their investment portfolio. Citi strategists have revised their three-month gold forecast upward from $ 1,715 to $ 1,825 an ounce. "We maintain a bullish attitude towards gold as a protective asset and a hedge against inflation. In 2021, it is possible to update record highs in the region of $ 2,000 per ounce, "they said. Recall that the current historical maximum is $ 1 920 and was recorded in September 2011. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Jun 2020 06:02 AM PDT While the European currency and the British pound continue to decline against the US dollar, China has made it clear that it will not tolerate US interference in the internal affairs of the state, thereby responding harshly to yesterday's decision by Washington to suspend the preferential treatment of relations with Hong Kong. During today's speech, Foreign Ministry spokesman Zhao Lijian said that China is ready to take decisive measures in response to the actions of the United States, which has long interfered with Hong Kong's domestic policy and prevented the adoption of the national security bill. Yesterday's decision by the White House to exclude Hong Kong from export restrictions and stop all deliveries of defense sector products, including dual-use products, caused indignation among Chinese officials. The US has been taking such measures for quite a long time, which has now further worsened relations between the two countries, including trade. Against this background, the growth of the US dollar is not so unexpected, especially in the context of another surge in the incidence of COVID-19 worldwide. The only thing that buyers of the European currency could count on today was the data on inflation in the Eurozone, which turned out to be better than the forecasts of economists. Slowing inflation in the services sector of the Eurozone is very much affecting the deflationary effect caused by the coronavirus pandemic. Reducing the supply is not a problem. The problem is just a strong reduction in demand, which is unlikely to recover so quickly against the background of the cancellation of quarantine measures. The underlying price pressure will increase only after demand overtakes supply, and as expected by leading economic agencies, this scenario is unlikely to be implemented this year, which will allow the European Central Bank to keep the current monetary policy at lows for quite a long time. If we take the consumer price index as a whole, the increase was mainly due to higher energy prices and the easing of quarantine measures. According to the statistics agency, the consumer price index (CPI) of the Eurozone in June 2020 increased by 0.3% compared to May, while energy prices increased by 1.7% compared to the previous month. As for core inflation, which does not take into account volatile categories, it slowed to 0.8% against 0.9% in May. Central Bank economists expect that this year, inflation in the Eurozone will not exceed the figure of more than 0.3% and will accelerate only to 0.8% in 2021. As for individual countries, yesterday Germany surprised with its indicators, which can not be said about France, where the preliminary consumer price index (CPI) in June fell by -0.1% and grew by only 0.1% year-on-year. Economists had expected growth of 0.2% and 0.4% in June, respectively. As for the EU-harmonized consumer price index in France, it slowed to 0.1% per annum in June, compared to 0.4% in May. Italy also did not Shine in this direction. According to the report, the preliminary consumer price index (CPI) of Italy in June increased by 0.1% compared to May and fell by 0.2% per annum, with economists' forecasts for growth of 0.1% and a reduction of 0.3%. As a recent study shows, fears about the collapse of the Eurozone eased in June this year, however, the strengthening of the European currency was not affected. Today, the Sentix index was released, which fell to 7.7% from 12.9% in May and 15.0% in April. The reduction of fears is more political than economic, which is the basis for all the disagreements. The report indicates that the index decreased due to the assessment of the improvement of the situation with the pandemic and the control of the spread in all EU countries. As for more economic issues, a confrontation between the German federal court and the European Central Bank is also likely to be avoided after the recent resignation of its Chairman. As for the technical picture of the EURUSD pair, the market remained on the side of the euro sellers, whose main task is to break the lows of last week in the area of 1.1195. If this happens, the bearish trend will continue with a new force, which will lead to a test of the lows of 1.1160 and 1.110. It will be possible to talk about a return to the market of buyers only after overcoming the upper limit of the channel in the area of 1.1290. GBPUSD The pound remained under pressure in the pair with the US dollar after today's report, which included revised data on the growth of the UK economy for the 1st quarter of this year, and they were revised for the worse. Thus, according to the final estimate, in the 1st quarter compared to the 4th quarter, the UK GDP decreased by 2.2%, and not by 2%, as originally thought. According to updated data, compared to the 1st quarter of last year, GDP decreased by -1.7%, and not -1.6%, as previously reported. The negative current account balance of the UK's balance of payments also increased to 21.1 billion pounds against 9.2 billion pounds in the previous quarter. Economists had forecast a deficit of 15.7 billion pounds. As for the technical picture of the GBPUSD pair, the pound has already reached the support of 1.2250, the breakout of which will further increase the pressure on the pair and lead to an update of the lows of 1.2185 and 1.2120. It will be possible to talk about a break in the downward trend only after the trading instrument returns to the resistance of 1.2320, and an update to the maximum of 1.2390 will strengthen the corrective bullish impulse. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Jun 2020 05:39 AM PDT

Amid the ongoing uncertainty around Brexit, the British pound is not stable and cannot take advantage of global weakening of the US dollar. It is a real challenge for investors. British currency fell to a monthly low again on Monday. At the same time, British Prime Minister is going to double government spending on investments in order to mitigate the coronavirus impact on the economy. UK Secretary of State for the Home Department Priti Patel hopes that the government will be able to reach a trade agreement with the European Union, which could allow the pound to strengthen. Nevertheless, the pound eased against the US dollar to $1.2324. Meanwhile, the US dollar is weakening amid rising fears over the second wave of COVID-19. Against the euro, the sterling dropped by 0.3% to 91.20. It is the lowest level since March 26. Since January 31, 2020, the UK is not a member of the EU. During this time, the British government has been discussing the conditions of future trade relations with Europe, but made little progress. Boris Johnson responded to the situation, saying that the UK is ready to quit the current transitional agreement with the EU "on Australia terms" if the new agreement on their future relations is not reached. In addition, big changes are expected in the Parliament after the resignation of a UK civil servant due to a conflict with Johnson's chief political adviser. Moreover, the Prime Minister eases quarantine restrictions, so pubs, restaurants, and bars could open since July 4. However, worries over the second wave of coronavirus infection do not fade away. The material has been provided by InstaForex Company - www.instaforex.com |

| Stock exchanges in Europe, America and Asia are growing at a positive economic statistics Posted: 30 Jun 2020 05:14 AM PDT

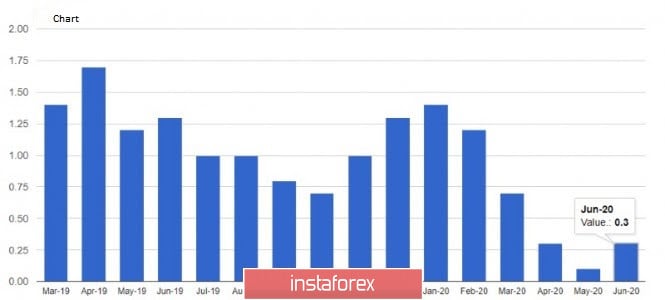

This morning, the stock markets of the Asia-Pacific region are in a positive mood: the rise is observed almost everywhere. The positive dynamics were provided by the stock market of the United States of America, which began to grow the night before. In addition, encouraging statistics on the state of the economy in the countries of the region began to arrive, which also pleased investors. According to information provided by the State Statistical Office, the PMI index in the processing industry of China for the first month of the summer of this year became larger and reached 50.9 points. It can be recalled that its previous value stopped at around 50.6 points. The fact that this index is above 50 points is evidence of the growth of business activity in the sector. If it falls below 50 points, then activity disappears. In the current period, the rise took place again, which became the fourth in a row, while up to this point in the last winter month, there was a significant drop, which occurred against the background of the COVID-19 pandemic. The current positive level was a surprise for experts who, in their preliminary forecasts, argued that the indicator could not rise above 50.4 points, and according to some reports – above 50.5 points. Now, even more positivity came from the statistics of the service sector. According to the data, the PMI of the services and construction sectors in China jumped significantly in June - to 54.4 points. The previous value was at the level of 53.6 points. This is the fourth consecutive rise after a massive decline. Thus, the indicator has already reached the maximum values recorded in January of this year. China's Shanghai Composite Index in the morning has already risen by 0.73% and Hong Kong's Hang Seng Index followed suit, but slightly rose - plus 0.1%. Statistics from Japan was not so confident. Thus, the unemployment rate in the country over the last month of spring rose to 2.9%, although this indicator was around 2.6% in the previous month. This low level has not been around for more than three years. Of course, unemployment is rising amid the coronavirus pandemic, but no one expected such leaps. According to preliminary data from analysts, the increase should not have been higher than the 2.8% mark. It can be recalled that over the same period last year, unemployment was around 2.4%. Japan's Nikkei 225 Index gained 1.33% in the morning. The greatest successes in the corporate sector were achieved by investment companies, as well as car and electronics manufacturers. The South Korean Kospi Index rose 1% in the morning. The economic statistics of the state were also quite good. Retail sales in May were up 4.6%, and in terms of the year, they grew by 1.7%. This came as a complete surprise to experts who claimed that a reduction of 1% and 1.4% would occur. Australia's S & P/ASX 200 Index jumped 1.42%. Positive emotions were added by the country's chief regulator, who decided to leave the base interest rate unchanged at the lowest historical level of 0.25% for an indefinite period. Following this news, significant growth began to be observed in the banking sector of Australia: the largest banks were able to increase the value of their securities on average from 1% to 2%, and this is not the limit. The stock indices of the United States of America ended their trading on the rise yesterday. The most rapid of all was the Dow Jones index, which recorded rapid growth in one day, while its total increase per day was greater than the growth for three consecutive weeks. The reason for this positive was the extension of measures to stimulate and maintain economic growth in the state. This was enough to rise, even though the number of new patients with coronavirus continues to increase steadily. The Dow Jones Industrial Average index increased by 2.32%, or 580.25 points, which moved it to a level of 25,595.80 points. Such a significant one-day result has not been seen for a long time. The Standard & Poor's 500 Index also rose by 1.47%, or 44.19 points. Its current level has stopped at around 3 053.24 points. Meanwhile, the Nasdaq Composite Index jumped 1.20%, or 116.93 points, which sent it to 9,874.15 points. American statistics released last night were very encouraging. Thus, the index showing unfinished transactions for the sale of housing in the country became 44.3% higher in May compared with the previous similar period. At the same time, a serious decline in this indicator was noted in April, and a record rise was recorded in May, which has not been recorded in the entire history of the indicator. Analysts' preliminary forecasts were also much more modest than real numbers. According to them, the growth was to take place no more than 18.9%. However, the index has not yet been able to achieve last year's indicators: relative to May 2019, it is still less by 5.1%. All this suggests that the country's government still has a lot of work that needs to be done in order for the US economy to begin to return at least to the pre-crisis level. As it turned out, the pace of recovery is much better than previously expected, and if the situation with the second wave of the pandemic does not cover the world, then the state's economy will return to normal earlier than planned. Of course, such news pleased the stock market participants. Although there is one problem, news was added that almost 40% of the companies included in the S&P 500 index would not be able to release their reports for the current quarter and year on the market, as the next outbreak of COVID-19 made its own adjustments and put the company in an uncertain position. On the European side, the stock market was also positive yesterday. And even a possible second wave of coronavirus ready to sweep the whole world could not exert pressure. The overall index of enterprises in the European region Stoxx Europe 600 became higher by the results of yesterday's trading session by 0.44% and reached the level of 359.89 points. The UK FTSE 100 index rose 1.08%. German DAX index also grew, albeit slightly - by 0.18%. The French CAC Index gained 0.73%. In turn, the Italian FTSE MIB index showed the highest jump - plus 1.69%, while Spain's IBEX 35 Index was up by 1.39%. According to data released yesterday, the index of business and consumer confidence in the EU economy for the first month of summer was able to reach as much as 75.7 points. This is a significant increase, which was not recorded from the very beginning of the application of the indicator. It can be noted that its May level was at around 67.5 points. However, preliminary expert forecasts were higher than real data, an increase of up to 80 points was expected. Thus, the growth of the index was still a positive moment for investors. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for June 30,.2020 - Watch for the potential drop on BTC towards the 8.900 Posted: 30 Jun 2020 04:59 AM PDT Corona virus summary:

China has stopped almost all imports of pork from the Netherlands, following Covid-19 outbreaks at some of the largest Dutch slaughterhouses. China banned meat delivered by four of the largest Dutch abattoirs on Sunday, a Dutch government spokeswoman said on Tuesday. It gave no specific reason for the ban, but workers at all of the abattoirs have recently been infected with coronavirus, said Elise van den Bosch. "Clearly, China is looking for the source of its second wave of COVID-19 infections, which they might feel could come from imported meat", she said. "But there is no scientific evidence for the possible transmission of the virus through food or packaging materials." Technical analysis: BTC has been trading in consolidation at the price of $9,145. I see bearish flag pattern in creation and potential for the bearish continuation. Downward targets are set at $8,900 and $8,665. Due to bear flag in creation and the downward slopping trend-channel, my advice is to watch for selling opportunities with the targets at $8,900 and $8,665. Resistance is set at $9,330 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for June 30 2020 - Downside pressure on the EUR with potentia lfor test of 1.1100 Posted: 30 Jun 2020 04:48 AM PDT Corona virus summary:

The premier of Victoria, Australia, Daniel Andrews has announced the reintroduction of stage 3 stay-at-home orders for hotspot suburbs in the state. From 11.59pm tomorrow night people living in those suburbs — which I'll list shortly — will only be allowed to leave their home for four reasons. The orders will be in place until 29 July. Victoria has been battling a new outbreak of coronavirus, which has seen double-digit one-day case increases for the last several days. Technical analysis: EUR/USD has been downwards. The price tested the level of 1,1195. I see further downside movement towards the last week low and even test of 1,1100. The material has been provided by InstaForex Company - www.instaforex.com |

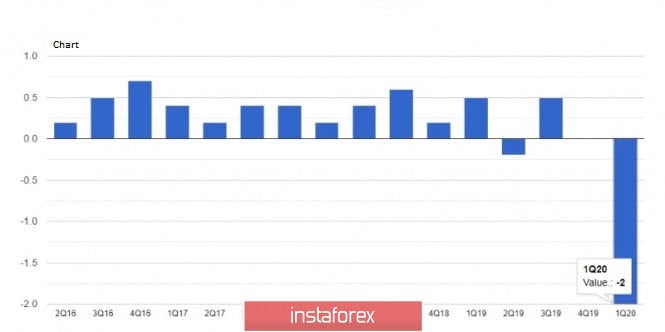

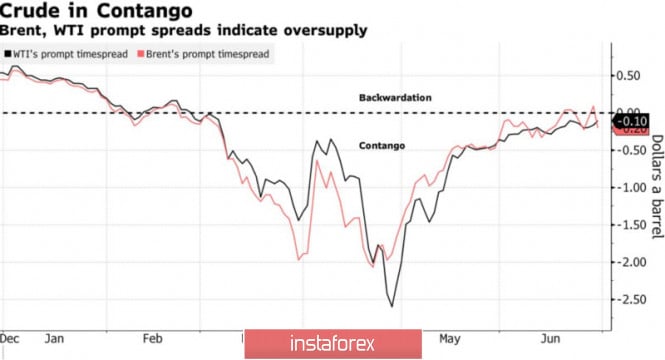

| Posted: 30 Jun 2020 04:43 AM PDT The strengthening of the US dollar, the deterioration of the epidemiological situation in the US, and rumors about the resumption of Libyan oil exports in previous volumes do not allow the "bulls" for Brent and WTI to continue the rally. Although the North Sea variety has strengthened by 17% since the beginning of June, the Texas variety by 10%, and the black gold market situation looks significantly better than in March-April, alarm signals about global demand problems and the W-shaped recovery of the American economy are bringing the "bears" out of hibernation. The rise in the number of infected in the United States to record highs gives rise to talk of a second lockdown, reduces demand for gasoline, and leads to an increase in American oil reserves to a record high of 540.7 million barrels. At the same time, concerns about a double-dip recession are warming the ears of fans of safe-haven assets, primarily the US dollar. Black gold is quoted in the US currency, so the growth of its exchange rate often leads to sales of Brent and WTI. If Libya manages to solve its internal problems and return to pre-crisis export levels of 1.1 million b/d (currently about 0.1 million b/d), OPEC will find it much more difficult to stabilize the oil market. This fact, paired with weak American demand for gasoline, the struggles of many refiners with low margins, the strengthening of the dollar, and the fact that global consumption of black gold is still far from pre-pandemic levels, is putting the market back in contango mode. Long-term futures contracts are cheaper than short-term ones, which is encouraging for the bears. Dynamics of oil market conditions

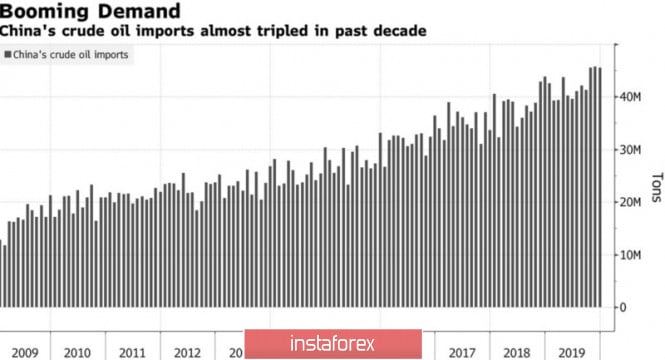

At the same time, you need to understand that someone will face a V-shaped recovery, someone-with a U-shaped, and someone will be forced to wind down the business altogether. According to Standard Chartered research, only 9 of the 20 countries that are the largest consumers of black gold have an increase in the number of COVID-19 infections. In Europe, the indicator is declining, in China, it is scanty, while the rapid growth of the economy of the Middle Kingdom allows us to expect that global demand for oil will be alright. According to Bloomberg, the largest processors of black gold in China, which account for about 5 million b/d of imports, which is equivalent to a fifth of OPEC production, intend to create a group that will participate in tenders for the purchase of African, Russian and Brazilian oil. A centralized increase in demand usually leads to an increase in prices. Let's not forget that Beijing must fulfill its obligations to the United States to increase energy purchases. In January-May, we were talking about 3% of the total volume, however, the rapid growth of the Asian economy hints that everything will be fine. Dynamics of Chinese oil imports

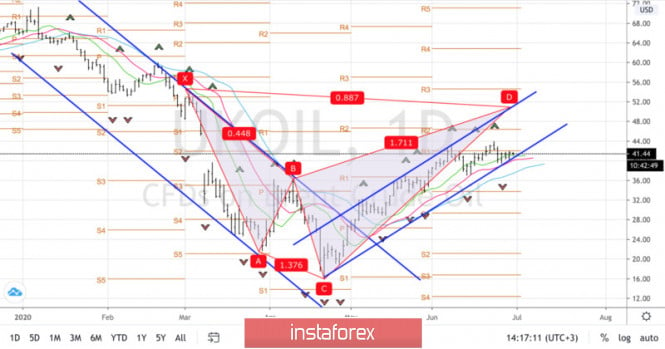

Technically, the situation is under the control of the "bulls" for Brent. Futures quotes are moving within the ascending trading channel, and a break in the support in the form of moving averages will signal a correction in the direction of $ 37.8, $ 36.8, and $ 36.1 per barrel. From these levels, the North Sea variety should be actively purchased. Brent, the daily chart

|

| Posted: 30 Jun 2020 04:29 AM PDT Corona virus summary:

Most visitors from the US are set to remain banned from entering the European Union because of the country's rising infection rate in a move that risks antagonising Donald Trump. In an attempt to save the European tourism season, a list of 15 countries from where people should be allowed into the EU from 1 July has been agreed by representatives of the 27 member states. Travellers from China will be among those permitted entry if Beijing reciprocates despite doubts over the accuracy of the information coming out of the country. Technical analysis: Gold has been trading sideways at the price of $1,769. My analysis from yesterday is still active. I see further upside movement and potential rise towards the $1,800-$1,820. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment