| By William Mikula, analyst, Palm Beach Daily Sometimes we reap. Other times we sow… Regular PBRG readers know we use several high-powered strategies to extract income from the markets. One of our favorites is “farming for income.” And this year, the soil has proven fruitful. And it all has to do with the chart below…

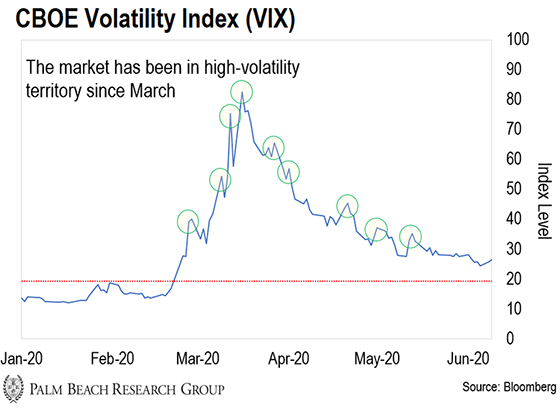

We call the CBOE Volatility Index (VIX) the market’s “fear gauge,” because it measures the S&P 500’s expected volatility over the next 30 days. The chart above shows the VIX levels from the start of 2020. A reading over 20 signals fear and uncertainty – or a high-volatility market. And a reading below 20 tells us the market is calm and complacent – or a low-volatility environment. | Recommended Link | | Exclusive opportunity at 10 a.m. ET Monday – click for details If you like the idea of seeing 816% in just 24 trading hours, this update may prove more valuable to you than any other idea this year. That's because it's about a rare situation – starting Monday at 10 a.m. ET – that can pay off for you no matter, what happens in the wider stock market and economy. It's a low-risk investment opportunity that we believe could put you on the path to seeing some serious gains over the next 12 months. Our research proves this is so powerful, believe it or not, you may never need to buy another newsletter ever again. This is a time-critical opportunity. It will last for 24 trading hours only. And it won't be suitable for everyone. So please click here to get the details immediately, and listen to this urgent briefing carefully. | | | -- | Using our strategies, large, easy profits are generally made when the VIX is above 20. And we generate quick boosts in income when the VIX has sudden, rapid spikes. Sticking with our “farming for income” analogy, we use these spikes to sow our crop. Then, when the VIX drops and fear recedes, we reap our profits. Today, I’ll show you how this strategy works… Ideal Conditions Ahead for More Profits Longtime readers may recognize “farming for income” as a strategy we call “Instant Cash Payouts.” It’s when we offer shareholders a form of “insurance” with “low-ball offers.” In technical terms, it’s called selling put options. That simply means, using a unique aspect of the options market, we agree to buy investors’ shares for a certain price and a certain length of time, in exchange for an upfront cash payout. “Tech Royalties” could be the answer to a fruitful retirement The cash (called the “premium”) is ours to keep – no matter what happens with the underlying stock. And we only have to buy shares if they drop to our agreed-upon price (which we like, anyway). The bottom line: We get paid to buy companies we love – at a discount. That’s what makes this strategy so powerful. Here’s the thing… | Recommended Link | The Tech Royalty Retirement Plan can help anyone live like royalty For the first time ever, a new type of tech investment could help you make more money than you will need for the rest of your life. It's called the Tech Royalty Retirement Plan. It's an income stream that allows you to collect cash in your hand every day, week, or month – on new technology. Now, if you aren't familiar with royalties, they're some of the most exciting investments in history. Royalties are periodic payouts… but they're much better than stock dividends. While "tech royalties" are different from traditional royalties, just a handful of "tech royalties" could hand you enough income to live life on your own terms. | | | -- | You can make easy profits when the VIX is above 20. And when it skyrockets, options premiums spike, increasing our income – and generating bigger profits. In the chart above, we circled several of these quick hits we’ve already made this year in our elite Alpha Edge service. For example, on April 28, the VIX spiked, closing at a reading of 33.6. We took advantage of this by striking on three new trades. One of our targets was Oracle (ORCL). We agreed to buy shares of the tech giant if they dropped to $51.50 by May 29. In exchange, we earned $100 per contract for opening the trade. On expiration, Oracle shares closed at $53.77. This means our offer to buy shares at $51.50 expired. We kept the $100 per contract and locked in a potential annualized return of 22.9%. On the same day, we entered a new trade on supermarket giant Kroger (KR). We agreed to buy shares if they dropped to $32 by June 5. For our offer, we generated $127 per contract in upfront income. Urgent: Cell Phone Owners Beware Last Friday, Kroger closed at $32.48. This means our offer to buy shares for $32 expired. Again, we kept the income payout and notched a generous potential 38.1% annualized return. These are just two examples. Since 2012, we’ve made 349 trades just like this. And 341 of them have closed for a profit. That’s a 97.7% win rate. Now, selling put options does come with some risk. There’s a chance the companies could drop significantly in price – and you’re “put” the stock and show a loss on paper. But we only make low-ball offers on the best companies in the market. These are companies that dominate vital industries. They gush free cash flow and profits, and they look after their shareholders. And if you’re put the stock, we have other strategies to generate income from your new shares. (Regular Alpha Edge subscribers can read about those strategies right here. If you’re not an Alpha Edge subscriber, you can learn more right here.) | Recommended Link | | 200 of the Richest Families on Earth Go All In on New Tech… The rich rarely reveal their secrets… But in a stunning new report from UBS, 200 of the richest families on earth – worth an average $1.2 BILLION – let slip they believe a new technology will “fundamentally change the way we invest.” “You can feel the electricity,” said one of the families. “It’s almost like what you felt in the 1990s with the Internet.” One of America’s most esteemed (and successful) investors recently met with 4 different billionaires. And he reveals the truth about this revolutionary new technology. As well as what it means for regular investors… | | | -- | Now Is the Time to Strike Our strategies allow us to view the market differently from ordinary investors. Whether we face an economic, health, or political crisis… we’ve got a playbook to profit. The S&P 500 is up over 40% since its March lows. And the VIX continues to drift lower. This means we can gather our dry powder for the next inevitable spike in fear. If you’ve never tried this strategy, now is the perfect time to learn… as the next spike could come any day now. In the meantime, if you want to “farm for income,” consider these three trades I’m watching closely. Once the levels I’ve marked are hit, we plan to strike… Stock | Ticker | Wait for price to drop to… | Make a low-ball offer to buy shares at… | This will give you a “cushion” of… | And target an annualized return of… | Stop making low-ball offers when the price hits… | Home Depot | HD | $225 | $205 | 9% | 25% | $235 | Johnson & Johnson | JNJ | $135 | $125 | 7.4% | 32% | $165 | UPS | UPS | $100 | $90 | 10% | 30% | $115 | If you don’t know how to make a low-ball offer (sell a put option), then consider buying shares when they drop to the level I’ve indicated in the fourth column. Wall Street wants you to believe options are tricky and complicated – in other words, not meant for Main Street. But we disagree. By harnessing our elite, hedge fund-level strategies, we can lock in returns normally reserved for the Wall Street fat cats. So don’t let Wall Street get the final word. Start farming for stock market income today. Invest wisely, William Mikula

Analyst, Palm Beach Daily P.S. Like I said, Daily editor Teeka Tiwari and I use elite hedge fund-level strategies at the Alpha Edge to farm for income from the markets. But in our Palm Beach Venture service, we use another elite strategy to pinpoint private companies showing high growth potential – before and during this coronavirus pandemic crisis. And the latest one we’ve found is thriving… You see, this gaming company’s industry has gone parabolic during the pandemic. And it’s reinvented itself, picking up right where Nintendo left off. To learn more about how you can invest in this company before it closes its doors, click here.

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… Stocks Falling? Do This Immediately… Americans were living through one of the strongest economies in recent years. And yet, the stock market recently erased multiple years’ worth of gains. Americans lost millions. It’s rumored that was just Act 1… As you’ll see at the end of an urgent public message just released online… What comes next will be a political and financial crisis. Please click here.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment