| |

Hello,

Wow! It has been a wild 24 hours. We've had so much interest in our brand new "Simplified Options Superstars" that we thought we'd take a couple minutes and answer your top questions so far and share more results:

A few of the top questions & answers we've been receiving:

Q. How many extra trade alerts will I receive?

You will receive two to four trades per week on average.

Q. What type of options will be used?

These trades are only straight calls and straight puts. Margin accounts are not required, nor are high balance options accounts required (pattern day trader) due to our frequency and holding time. Figure on $200 - $800 capital per trade.

Q. What is the typical holding time?

It will likely be shorter than our other programs - on average, 3 to 10 days pending the market movement.

Q. What are the targets?

Typically, we'll have a fixed target at about 100% of our initial investment. We'll then trail the second half of our trade (if you take 2+ contracts) for the larger, trending momentum moves. We've seen these breakout/breakdowns run for 200% - 500% at times.

Q. What is the typical risk?

Similar to other strategies, we'll look to risk some of the options premium but not all. Usually, between 30% - 60% of the options premium is at risk.

Q. What will we be trading?

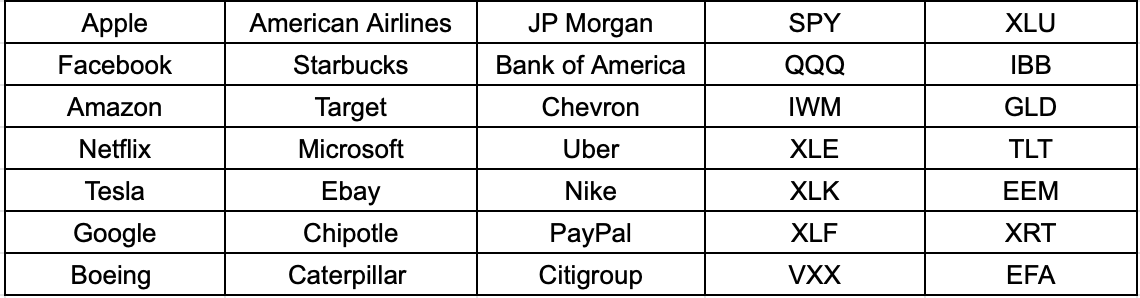

Here's a sample of the Watch List we're using to scan for trade setups:

See the Brand New Simplified Options Superstars

Here's an example of a recent trade on Chewy/CHWY where we experienced a 271% return taking $325 to $1,205:

Does every trade work? We take every trade assuming it will be successful. However, realistic trading means we'll have losing trades as well. Here's the same market, different trade. We do strive to risk a fraction of what we are targeting on a successful trade:

Here's a trade for Netflix. Another example where the first half of the trade gave us a double, though we exited our trailer for a break-even. Sometimes they explode to 200% - 500% - sometimes we get out with our gains. Keep in mind to trade Netflix as a stock would have taken almost $100,000 (!) - - but as an options trade, controlling the same amount of shares under $1,000.

Worried about it all being too complicated? Never had much experience or success with options?

Don't worry - you are not alone in that thinking. However, this service was designed to only trade the most basic options contracts/strategies. That means only buying a Call Option or a Put Option to open the trade. We'll also tell you the exact one to buy - and when to sell.

Not so complicated, right?

Make sure you get the full scoop now since availability is quite limited:

Go Now: Watch the Brand New Simplified Options Superstars - Take the Next Alert Setting Up Now

See you there!

NetPicks

P.S. The window is open just for a few days to enroll. Based on current demand, we expect to close down enrollment sooner than expected. Get on over here to get all the details you need:

Go Now: Watch the Brand New Simplified Options Superstars - Take the Next Alert Setting Up Now

|

| |

These Are the Answers To Your Questions

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment