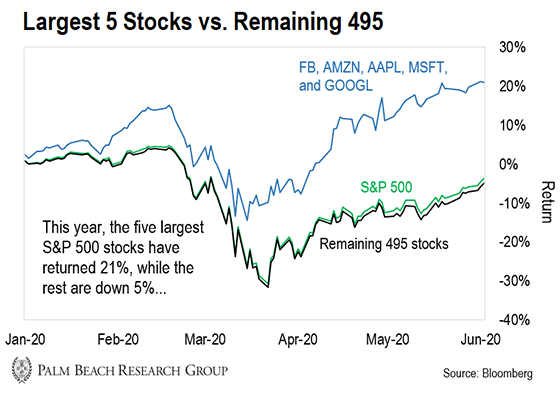

| By Chaka Ferguson, managing editor, Palm Beach Daily If you follow the markets, then you may believe we live in a topsy-turvy world. Since the S&P 500 cratered on March 23, it’s rallied over 39%. And it seems nothing will hold it back – at least for now. We’re still in the midst of a pandemic… Civil unrest is spreading across the country’s major cities… And President Trump is threatening to deploy the active military to patrol the streets. Yet, the market continues to climb. But there’s a dirty little secret behind the market’s rise. And if you don’t know what it is, you could be missing out on massive gains or – even worse – losing money on the wrong stocks. And today, I’ll share it with you… | Recommended Link | | Raw and Unscripted Video Making Rounds on the Internet E.B. Tucker has something extraordinary that you need to see. It's a raw and unscripted video of E.B. making rounds on the internet. E.B. was in Denver investigating a life-changing stock market story. One that will be responsible for massive wealth creation in 2020. What was E.B. doing in Denver and what was he investigating? | | | -- | The Secret Is in This Chart Take a look at the chart below…

It compares the performance of the five largest S&P 500 stocks to that of the remaining 495 and the S&P 500 overall. As you can see, these five stocks are doing most of the heavy lifting: Amazon, Apple, Facebook, Google, and Microsoft. Combined, they’re up an average of 21% year-to-date. Meanwhile, the remaining 495 stocks are down an average of 5%. At PBRG, we have a special name for companies like Amazon, Apple, Facebook, Google, and Microsoft. We call them “outliers.” “Tech Royalties” could be the answer to a fruitful retirement And there’s no one better at finding these companies than Palm Beach Trader editor Jason Bodner. You see, only a handful of stocks really carry the market higher. In fact, over the past 100 years, just 4% of stocks have accounted for nearly all the market’s profits each year. And the outliers are the 1% that account for nearly half of all the profits of the market each year – stocks that can make you 10x, 100x, or even 1,000x your money. For instance, just 2% of stocks have accounted for over 45% of the S&P 500’s 39% rally since its March 23 lows. As Jason says, if you’re not targeting these companies, you’re basically wasting your time as an investor. Of course, it’s not easy to unearth outliers. It’s like trying to find a needle in a haystack. But Jason has found a way to track them down: Follow the big money. As he says… Big institutional money accounts for about 70% of all trading volume every single day. These massive investors collectively manage trillions of dollars. They have multimillion-dollar budgets and a small army of professional analysts conducting research. And when they start buying a stock, they lift the price higher and higher. These “outlier” stocks – the 1% of the 1% – are where the big money is hiding out. So to sniff these stocks out, Jason created his own “unbeatable” stock-picking system that follows the big money’s movements… | Recommended Link | Available Now: New Retirement Blueprint from America's Most Trusted Options Trader Jeff Clark has helped people retire wealthy… But he hasn't done it the usual way. He uses options. Options probably seem risky. Reckless, even. But his options strategy is different – unlike anything you've probably seen before. It helped him retire at 42. And thousands of others have used it to make $10,000… $100,000… even $1 million or more – in some rare cases. Which is why he's offering his never-before-released blueprint… and a year of his guidance… for just $19. | | | - | Green Means Big-Money Buying Jason used his experience from nearly two decades at prestigious Wall Street firms like Cantor Fitzgerald and Jefferies – regularly trading more than $1 billion worth of stock for major clients – to make sure his system is highly accurate, comprehensive, and effective. It scans nearly 5,500 stocks every day, using algorithms to rank each one for strength. It also looks for the movements of big-money investors. Urgent: Cell Phone Owners Beware When it sees them piling into or getting out of a stock, it raises a yellow flag. Then, he puts these yellow flags through another filter. If the flag turns red, it means the big money is selling. If it turns green, it means the big money is buying…

It’s that simple: When you see red, the big money is selling. And when you see green, it’s buying. Jason’s system takes all the emotions out of investing. Now, these green flags are the market’s next outliers. To find out where the next outliers are hiding, I asked Jason where he sees the green flags popping up. | Recommended Link | | A Sneak Peek Inside Apple’s 5G iPhone? 5G will really kick off on or around September 22. That’s when Apple is expected to release their first 5G iPhone. Details are scarce. But this video gives you a sneak peek at what’s inside. And there’s one piece that’s critical to these phones. Silicon Valley’s top angel investor, Jeff Brown, thinks one company behind this piece could be… | | | -- | Where the Outliers Are Hiding Jason told me that big-money buying was in full force last week. There was only one sell signal across all the main market sectors. Even lagging ones like energy saw some institutional buyers pile in. And the chart below ranks the main market sectors based on their strength, as measured by his system. The higher the number, the more big money the sector is seeing – and the stronger it is… | Sector | Strength Ranking | | Technology | 64.8 | | Healthcare | 60.9 | | Staples | 55.8 | | Discretionary | 55.6 | | Industrials | 54.8 | | Materials | 53.5 | | Communications | 52.0 | | Financials | 51.0 | | Utilities | 50.5 | | Real Estate | 47.9 | | Energy | 46.6 | This means most of the green flags are popping up in the technology and healthcare sectors. So if you’re looking for outliers, that’s where you want to look. Now, if you want broad exposure to these sectors, consider buying the Invesco QQQ Trust (QQQ) exchange-traded fund. It holds 53 top infotech and healthcare stocks. As always, do your homework before making any investment. And don’t bet more than you can afford to lose. Regards, Chaka Ferguson

Managing Editor, Palm Beach Daily P.S. To truly profit from this market rebound, you have to target the outliers – the stocks that’ll rebound even higher than the broad market. And as I’ve shown you, Jason’s system is designed to track them down. In fact, it identified one life sciences software stock for subscribers to his Palm Beach Trader service days before the market’s bottom. Now, it’s up over 78% in less than three months. (And three of his other tech picks are already up by triple digits, with a fourth on the way.) But don’t worry. You can still join Jason to find the next outlier. He’s even put together this special presentation about his system so you can learn how…

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… Do You Know About "Tech Royalty" Investing? Silicon Valley venture capital (VC) investors are going all-in on a brand-new kind of tech investment called "Tech Royalties." This is the exact kind of insider opportunity the general public usually never hears about. But this time is different… Because globetrotting tech guru Teeka Tiwari discovered "Tech Royalties" in 2018. And best of all, Teeka knows a way for regular folks to profit – before 99% of the investing public catches on. A top Silicon Valley VC recently said: "[Tech Royalties] will revolutionize our society the way the internet did more than twenty years ago. Smart investors stand to make 21 times their money over the next few years." The former CEO of Nasdaq called it, "The biggest opportunity we can think of over the next decade." And Apple co-founder Steve Wozniak calls it, "the next major IT revolution." The best part? You can get started with a small amount in this idea… Retire in a year… and collect $180,472… year after year.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment