Forex analysis review |

- AUDUSD broke above descending trendline resistance! Further rise expected!

- AUDUSD broke above descending trendline resistance! Further rise expected!

- Overview of the GBP/USD pair. July 27. The week after the Fed meeting and US GDP for the second quarter. Boris Johnson admits

- Overview of the EUR/USD pair. July 27. 100 days of Donald Trump. The entire American public is waiting for "surprises" from

- GBP/USD. Boris Johnson's prospects as prime minister and the future of Great Britain

- EUR/USD. The world is on the verge of a global US-China confrontation

| AUDUSD broke above descending trendline resistance! Further rise expected! Posted: 26 Jul 2020 06:41 PM PDT

Trading Recommendation Entry: 0.71070 Reason for Entry: Ascending trendline support, Descending trendline support, 23.6% Fibonacci retracement Take Profit: 0.71619 Reason for Take Profit: -61.8% Fibonacci retracement Stop Loss: 0.70872 Reason for Stop Loss: 61.8% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD broke above descending trendline resistance! Further rise expected! Posted: 26 Jul 2020 06:41 PM PDT

Trading Recommendation Entry: 0.71070 Reason for Entry: Ascending trendline support, Descending trendline support, 23.6% Fibonacci retracement Take Profit: 0.71619 Reason for Take Profit: -61.8% Fibonacci retracement Stop Loss: 0.70872 Reason for Stop Loss: 61.8% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Jul 2020 06:12 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward.. Moving average (20; smoothed) - upward. CCI: 129.5589 The British pound continues its upward movement, although for some time it could not overcome the Murray level of "+1/8" - 1.2756. Nevertheless, on Friday, it still managed to do so, and traders continued to trade for an increase, despite the absolutely failed fundamental background from the UK. Because from the United States, it is even more failed. Thus, at the moment, we can draw approximately the same conclusions as in the case of the euro/dollar pair. Macroeconomic statistics are almost irrelevant for traders now. Only the most important reports can affect their mood and be reflected on the chart. Technical factors may have a greater impact on the pound/dollar pair. Or the general fundamental background, which has not changed in recent weeks. The fundamental background will probably not change in the new week. We do not expect drastic changes in the negotiation process between London and Brussels, we do not expect to calm down at least one of the 4 crises currently raging in the United States. As for macroeconomic publications, there will be none in the UK. The US news calendar also contains potentially important news, which we will focus on in more detail now. The first thing to note is the report on orders for durable goods in the United States. This indicator will be released on Monday and is quite important, since this category of goods itself has a high cost, respectively, in the aggregate, orders and sales of these goods strongly affect GDP. However, there will be more important events this week. For example, the Fed meeting, which is scheduled for Wednesday, July 29. We believe that this meeting will be absolutely passing, however, it is clearly not necessary to lose sight of such an important event. The key rate is unlikely to be changed, however, anything important can be reported by the head of the Federal Reserve Jerome Powell. Well, on Thursday, July 30, the United States will publish a preliminary value of the GDP indicator for the second quarter, which, according to experts, will be -34% compared to the first quarter. This value may well "finish off" the US currency. It can only rely on the understanding of market participants that approximately the same figures will be recorded in all countries of the world in the second quarter. Although, to be honest, none of the GDP figures planned for this week is expected to be reduced in this way. In Germany, only -9% q/q is expected, in Spain -16%, in Italy -13%, in the European Union -12%. Thus, after comparing all the figures for the fall in the economy in the second quarter of the EU and the US, the dollar may continue to fall on all fronts of the currency market. By the way, even in the UK, which objectively suffered the most in Europe from the "coronavirus crisis", the reduction in GDP, according to experts, may be 20% compared to the first quarter. True, this indicator will be published only on August 10, but nevertheless. Thus, quite unexpectedly, the United States becomes almost the main outsider in 2020 in economic terms. Earlier, we were wary of the words of Christine Lagarde and Andrew Bailey, who predicted serious cuts to their economies this year. However, it is really necessary to worry about America, and not for European countries. Meanwhile, Boris Johnson gave an extensive interview to the BBC, in which he said that "some things his government could have done differently", answering the question of why 45 thousand people died from the "coronavirus" in the UK. The Prime Minister admitted that initially his government misjudged the COVID-2019 virus and failed to correctly assess the scale of the threat to the British. However, Johnson was not completely frank with the interviewer and did not clearly analyze the government's actions in the first months of the pandemic. According to Johnson, "there will still be time for this, but in the meantime, we need to focus all our efforts on a possible second wave of the disease this fall and winter". Well, as expected, Johnson was immediately criticized by the British opposition. "Boris Johnson has finally admitted that his government has done a poor job of responding to the coronavirus. It took too long to recognize the threat of the virus, too long to introduce lockdown, and too long to take the crisis seriously, " said health Minister Jonathan Ashworth. Asked specifically if it was too late for the government to impose a quarantine, Johnson said: "We didn't understand the virus enough in the first weeks and months. We didn't see how widespread it spread asymptomatically from person to person." In addition, Johnson is fiercely criticized for missing 5 meetings of the emergency government committee in January and February, after selling a batch of personal protective equipment to China, and in April, these very protective equipment was not enough in British hospitals. Thus, this week, the first place will be taken by US GDP data, the Fed meeting and technical factors. The pound/dollar pair may well continue to grow, and only strong news from overseas or banal saturation of traders with sales of the US currency can stop the process of falling. By the way, at the moment, the quotes of the GBP/USD pair came close to the previous local maximum – 1.2812. This level can become a rather serious obstacle to further strengthening of the British pound. And vice versa. If buyers manage to push through this level, the upward movement can potentially continue to the next high of the past – 1.3199. And this is a serious strengthening of the British currency, which has not been observed since the fall of last year, when the pound grew on expectations of the imminent completion of Brexit, as first Boris Johnson won the election, and then the Conservative Party. Then the pound rose by about 15 cents, now - by 14.

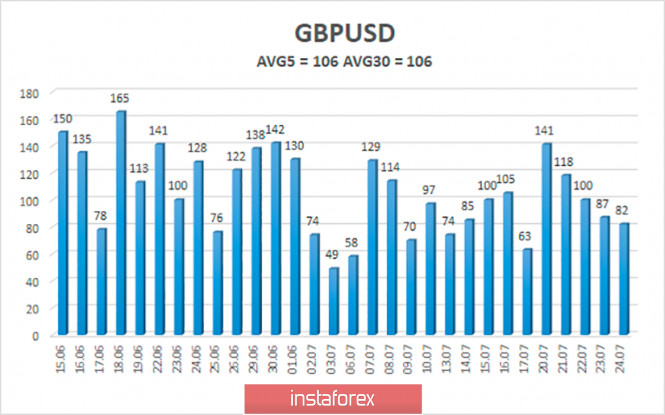

The average volatility of the GBP/USD pair continues to remain stable and is currently 106 points per day. For the pound/dollar pair, this value is "high". On Monday, July 27, thus, we expect movement within the channel, limited by the levels of 1.2684 and 1.2896. Turning the Heiken Ashi indicator downwards will indicate a new round of downward correction. Nearest support levels: S1 – 1.2753 S2 – 1.2695 S3 – 1.2634 Nearest resistance levels: R1 – 1.2817 Trading recommendations: The GBP/USD pair resumed its upward movement on the 4-hour timeframe. Thus, it is recommended to continue trading for an increase with the goals of 1.2817 and 1.2896 (the level of volatility on Monday), until the Heiken Ashi indicator turns down. Short positions can be considered after fixing the price below the moving average with the goals of 1.2634 and 1.2573. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Jul 2020 06:12 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 122.7900 The EUR/USD currency pair as a whole continues to trade with an increase, absolutely not breaking the upward trend, which is supported by the moving average line and two linear regression channels. Thus, during the past week, absolutely nothing has changed, from a technical point of view. As for the macroeconomic background, there was very little of it last week. Almost all published macroeconomic reports were ignored, and market participants continue to be much more interested in the "coronavirus" epidemic in the United States and the scale of its spread than in economic figures. The new trading week will be quite interesting. However, with the slightest analysis, it becomes clear that the macroeconomic background will again not be a priority for traders. Even the Fed meeting that will take place on Wednesday is unlikely to cause any market reaction, since it will most likely become completely passable. At least, no one expects the Fed to make a drastic change in the parameters of monetary policy. Several reports will be published immediately on Monday in the European Union, Germany and the United States. If European reports can be safely ignored, since they are unlikely to have any impact on the currency market, then American reports are extremely important. We are talking about changing the volume of orders for durable goods. In addition to the main indicator, three more derivatives will be published: excluding defense orders, excluding transport orders, and excluding defense and aviation orders. In fact, it does not matter what a particular indicator will be. It is important that overall forecasts are exceeded. Important for the US dollar. The US currency is now in such a state that it needs good reasons for traders to stop selling it. And it is unlikely that support for the US currency should be expected from macroeconomic reports. However, in the case of really strong numbers, the US currency can get some support. While the US currency is stalling and can't find support, there are exactly 100 days left until the US presidential election. Perhaps never before in America has there been such a stir around this process. According to many publications, in a little over three months before the election, Trump is very much losing to Biden in the ratings. In general, voters are not satisfied with the work of the presidential administration in countering the pandemic and in the conditions of mass unrest. However, in the last election in 2016, Trump was also an outsider. As shown by more in-depth research that takes into account the specifics of the US electoral system, Biden wins about 100 "electoral votes" from Trump. To win the election, 270 such votes are required and Biden already has 222 at his disposal. Most importantly, states like Michigan, Wisconsin, Pennsylvania, Ohio, and Florida are now ready to give their votes to Biden, even though they voted for Trump in 2016. And this is the loss of 5 states at once and a huge number of "electoral votes". After all, for example, Texas is also changing its mind and is going to vote for Biden despite the fact that it is a native "Republican state". Nevertheless, the huge number of cases of "coronavirus" makes its own adjustments to the mood of the electorate. Well, most of all, there are doubts about Donald Trump among people who systematically track his statements and follow his speeches. We have repeatedly listed almost the entire list of Trump's statements about the "coronavirus". This salad is absolutely opposite in meaning and essence statements can confuse just about anybody. However, these statements were made not by a mental patient, but by the president of the country with the largest economy in the world, who also says in the last two weeks that his main rival Biden will not be able to pass an IQ test. This is not a test that we all know that really measures IQ, but a test that simply shows that there are no abnormalities in development. In fact, any teenager can pass this test, since most of the questions in it are elementary, and we are left to wonder whether Trump tried to prick Biden as much as possible in this way, or did not see this test in his own eyes? Wearing masks in a pandemic is also confusing, according to Trump's rhetoric. The President of the United States openly refuses to wear a mask, without setting any example to the Americans, then the president offers to wear a mask in public places, and he boasts that he looks like a hero of westerns in a mask. Everything is complicated for Trump and with protesters across the country. At first, Trump wanted to disperse all the rioters almost with the help of the regular army, which has not happened in the history of the country yet. Then Trump criticized the authorities of all cities and states where it was not possible to suppress the protests (which are generally allowed under American law), then he supported the protesters several times, and then sent several security forces to Portland. Now in Portland there are not just protests and rallies, now there are clashes with the police, security forces and even greater riots than there were before the arrival of Trump's special forces. Not surprisingly, protesters across the country had slogans calling for Trump's resignation. The only really strong trump card in Trump's hands is the economy. Not surprising, given that Trump is a businessman. Most Americans would strongly trust the economy to Donald, not Joseph. Unfortunately, this is the only area in which Trump leads unconditionally. However, many experts also note that Trump is not going to win the usual way. Most likely, Trump's strategy will again be to win in those states where it is most likely, with a furious run with those states where voter opinion fluctuates. That is, Trump is not going to fight for victory in all states. Rather, he will try to win the states he needs, which will be enough for the overall victory. Plus, we should not forget that America is currently in chaos, crises, unrest and discord. That is exactly the element in which Trump feels like a fish in water. Therefore, it is absolutely possible that we will witness a huge number of surprises in the elections. The US dollar remains under market pressure. And it can only count on support either due to technical factors (the markets will simply get enough of the pair's purchases), or due to a strong fundamental background (which is not even looming on the horizon yet).

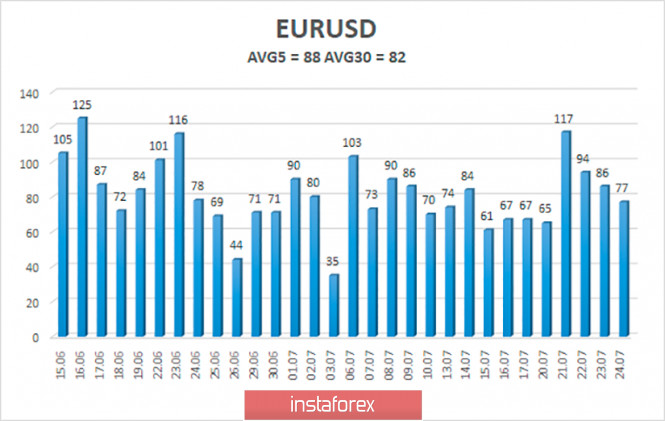

The volatility of the euro/dollar currency pair as of July 27 is 88 points and is still characterized as "average". Thus, we expect the pair to move today between the levels of 1.1567 and 1.1743. The reversal of the Heiken Ashi indicator downwards signals a turn of a downward correction within the framework of an upward trend. Nearest support levels: S1 – 1.1597 S2 – 1.1475 S3 – 1.1353 Nearest resistance levels: R1 – 1.1719 R2 – 1.1841 R3 – 1.1963 Trading recommendations: The EUR/USD pair continues to strengthen its upward movement. Thus, it is now recommended to stay in purchases of the euro currency with the goals of 1.1719 and 1.1743, until the Heiken Ashi indicator turns down (1-2 bars of blue color). It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first target of 1.1353. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Boris Johnson's prospects as prime minister and the future of Great Britain Posted: 26 Jul 2020 03:35 PM PDT 24 July - exactly a year since Boris Johnson won the election of prime minister. During this time, much has changed in the world, in the UK. The only thing that hasn't changed is Johnson's desire to leave the European Union as quickly as possible and build a new, independent Britain. Throughout the entire term of Boris Johnson's rule, we have repeatedly analyzed his actions, the decisions he made, and also looked forward to the victories of the current prime minister. Each analyst, expert and political scientist has his own point of view. We believe that Johnson's victories as prime minister can be counted on the fingers of one hand. On the one hand, Johnson did not become such a destructive figure for the world community and a violator of harmony as Donald Trump. Nevertheless, there are no significant victories in Johnson's career yet. Here anyone can immediately object to us. They say that Johnson still brought Brexit to the end, now the UK will still leave the European Union, an epic that could have lasted for years under other leaders ended quickly enough under Johnson. However, we fundamentally disagree with this interpretation and formulation of this problem. First, the decision to leave the EU was made by the British citizens themselves. Whether this referendum was fair or not, whether all residents voted or someone forgot to do it, it doesn't matter anymore. The people of Britain have expressed their desire to leave the EU. Thus, logically, it would have to happen anyway sooner or later. Secondly, from the very beginning, Brussels and London negotiated the most lenient divorce so that neither the EU economy nor the UK's economy would suffer. This was the main goal of the UK government, which was entrusted with the implementation of Brexit. You don't need to have a lot of intelligence just to sever all ties with the EU and start from scratch. Anyone could handle this, even a plumber from the nearest housing office. But to make sure that the British economy suffered minimally from the break with the EU, for this you need leadership qualities, the ability to negotiate, the ability to yield. Johnson did not demonstrate all these qualities during the year of his premiership. At first, just like Theresa May, he failed to agree with Parliament and did not find anything better than to simply dissolve it. The courts began, which Johnson lost, Parliament was reconvened, and thanks to the prime minister, a shadow fell on the Queen of England Elizabeth II, who, in fact, gave the go-ahead for the dissolution of Parliament. As a result, new battles began in Parliament, during which Johnson was unable to convince anyone of the need for a "hard" Brexit. Only Nigel Farage's Brexit party, created just a year before these events, supported Johnson. As a result, everything came to the parliamentary elections, which Jeremy Corbyn lost. In fact, it was Corbyn, who has long been accused of lacking a clear position on Brexit, who did not create real competition in the elections. The people of Britain did not vote for the Conservatives this time. They voted for the early completion of this "Marlezon ballet", which lasted for four years. Therefore, it cannot be said that the Conservatives defeated Labour and other parties thanks to Johnson's charisma and leadership, his position on Brexit. They won the election simply because the people of Great Britain were simply tired of living in constant limbo. Well, then, as soon as Johnson received full and unconditional power in the country, he immediately announced that the "transition period" would not be extended, and Brussels and London should agree on everything in nine months, or there would be no deal between them at all. And he gave the command to David Frost, who is negotiating with Michel Barnier, not to yield to Brussels on the most important issues. As a result, the negotiations, which could not end in anything worthwhile, even if the parties had been actively working on them for all nine months, hit a dead end literally in the very first month. And they are there to this day. Johnson's last loud statements concerned the fact that he himself would personally travel to Brussels and try to agree on everything with Ursula von der Leyen and other EU leaders. However, until now Johnson has not gone anywhere, and Barnier is already tired after each round of negotiations to declare that London does not make any concessions and is not eager to sign an agreement at all. As a result, Britain returned to Johnson's original plan - a complete severing of all ties and agreements and a hard Brexit. And what is the result? There is no agreement with the EU. There is no agreement with America. Brexit will be as hard as possible. Trade will be conducted with the EU under WTO rules starting in 2021. Coronavirus has dealt another blow to the British economy, so that its losses will be the highest among the EU countries. But it is Johnson's government that is accused of being at least a month late with the quarantine and not taking COVID-19 seriously from the very beginning. Thus, now we can safely say that Johnson, of course, implemented Brexit, but, in fact, did not transform Britain in any way. Moreover, the British prime minister managed to spoil relations with Scotland, which now wants a second referendum on independence and return to the EU. And there is no doubt that Nicola Sturgeon will continue to push this desire in London. And there is no doubt that relations between Scotland and England will deteriorate, because the situation is quite logical: the majority of the Kingdom's inhabitants live in England; if the whole of England votes "for" leaving the EU, then the opinion of the Irish, Scots and Welsh will not even be needed; however, the residents of these countries did not decide to leave the EU, so the claims are quite justified. Therefore, the future of the British pound remains very vague and uncertain. So are the prospects for the British economy. One is good for the pound. In recent months, there has been such chaos in the US that investors and traders have forgotten about all the British problems and switched to selling the US currency on all fronts. However, this cannot go on forever. At least, it seems that way at the moment. Recommendations for the GBP/USD pair: The pound/dollar pair continues its upward trend, so we recommend continuing to buy it using mainly the 4-hour timeframe. Volatility remains the same, about 100-130 pips per day, and is comfortable for trading. The nearest targets for buy orders are located around $1.28, then quotes can continue to grow up to 31 figures. Questions are raised only by the fundamental background, which the British pound supports today, but tomorrow it may stop doing this, since, as we have already said, there are a great many economic problems in Britain. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. The world is on the verge of a global US-China confrontation Posted: 26 Jul 2020 03:35 PM PDT In the past two years, only the lazy one has not paid attention to the confrontation between China and the United States. There has always been hostility between major and superpowers. That's not news. However, from time to time, relations heat up and then the whole world freezes in anticipation of events and their consequences. Now is the time. In general, 2020 can be called the year of cataclysms and emergencies. Now even the trade war between China and the United States, which began back in 2018, does not look like something serious. Not to mention the Ebola virus and the swine flu epidemic. However, we have to keep looking ahead and keep asking questions, what will the world expect in the near future? Because the answers to these questions will also suggest what the currency market is waiting for. The conflict between the United States and China continues to heat up. The parties have accumulated too many claims against each other. Moreover, if earlier these claims came mainly from the US and were more of a verbal rather than effective nature, now both sides are actively imposing sanctions against each other and accuse each other of all mortal sins. The most interesting part is that there is no evidence of guilt of one or the other. And it is absolutely certain that no one will ever provide this evidence to the broad masses. That is, in fact, the truth does not matter, because the truth is a relative concept. In every conflict, each side has its own truth. There is one truth. But when the national interests and the future of the country is the priority, the truth does not matter. The main thing is to win, to win in this confrontation, in this war. This is exactly what happens constantly between all the big (and not large) players. At this time, the whole world is trying to recover from the "Chinese" virus. Moreover, the virus was somehow defeated too quickly in China itself, or the Chinese government is openly hiding a lot of what is happening now on their territory. Considering that China is one communist party, it is not at all surprising if the coronavirus is also present in the PRC, it is just that the government is hiding this information from the whole world. Actually, Washington is accusing Beijing of withholding information. And in collusion with the World Health Organization, which the US has already cut ties with. Now, who can say how, why, and under what circumstances the virus left the lab in Wuhan? Who can say with certainty that it was an accident or vice versa? However, it is also impossible to deny the fact that China is to blame for this, since it was from its laboratory that the virus "escaped". And now the whole world quite reasonably can and should bill China. True, it is not clear in what form it will be. In international law, there are no articles and laws that would determine the procedure for action and penalties in such a global event as an epidemic. However, one thing is an incomprehensible and unexplored virus that came out of nowhere. The other is a laboratory-created virus that has broken free. Thus, the whole world has the right to make claims to China. The second very important and controversial point is Hong Kong. And here, too, the US is not the only one who has claims. The United Kingdom, the European Union, Canada, and Australia also have complaints over the Chinese government's violation of Hong Kong's autonomy. Of course, this is not a question of coronavirus issue, but more and more experts are beginning to note that China has begun to violate the principles of international law too often and grossly, and the damage that COVID-2019 has caused to the entire world is generally difficult to calculate. All this can, on the one hand, lead to a serious conflict between the US and China, including disconnecting the latter from the SWIFT international payment system, introducing new portions of sanctions and duties, a diplomatic war, and so on. On the other hand, the whole world can turn against China, or at least the most developed and powerful countries that can afford to cut ties with China or at least reduce their dependence on Chinese imports. Two points should also be noted here. First, more and more political scientists believe that China has set a course to become the only superpower in the world. Second, the United States has set a course to form a coalition against China. Of course, neither Donald Trump nor XI Jinping will publicly declare such intentions. However, US Secretary of State Mike Pompeo, who met with Dominic Raab in London this week, has already begun to hint at the creation of an anti-Chinese coalition. Pompeo was extremely correct in expressing his thoughts at the press conference, but still noted that the actions of the Chinese Communist party contradict the principles of world law and order and the creation of a coalition can convince Beijing of the inexpediency of such a foreign and domestic policy. Mike Pompeo recalled, in addition to the coronavirus and Hong Kong, the conflict in the South China sea, the standoff between India and China, and attempts to steal intellectual property by Chinese hackers on the orders of the authorities of this country. The last question is generally very complex and it is not clear whether Chinese hackers made an attempt to steal confidential information about the development of vaccines and drugs against the coronavirus, or whether this was the case of the US intelligence services. Recall that not so long ago in the United States, an employee of the laboratory in Wuhan allegedly escaped from China spoke about the actions and orders of the Communist Party of the People's Republic of China, as well as that of the transmissibility and contagiousness of the virus COVID Chinese government knew almost the very beginning. The speech is interesting, but it is hard to believe that the employees of the most important laboratory in the world in 2020, which attracts the attention of the whole world, were able to get out of China so easily and simply. Now, a press release has been posted on the website of the US Department of Justice, which says that two Chinese hackers have been charged with hacking aimed at obtaining secret information about COVID-19 research. It is noted that hackers have a huge track record. Previously, they stole information and developments from other technologically advanced countries, such as Australia, Belgium, Germany, Japan, Lithuania, Spain, and others. In general, we believe that the conflict between America and China will not de-escalate in the near future. Moreover, before January 2021 (when the president may change in the United States), the conflict may go so far that it will take years to soften it and return to the levels of relations in 2016-2017. Even if Joe Biden wins the presidential race, it will not mean that relations with China will get better. First, Joe Biden is not the only one who will decide on the fate of China, but there is also the Congress and the Senate, which in any case will be crowded with Republicans. Secondly, it is possible that Beijing itself simply does not want to establish relations with Washington. Trading recommendations for the EUR/USD pair: The technical picture of the EUR/USD pair shows that the price continues its upward movement and overcame all resistance levels last week, but no intelligible correction has begun. Thus, buy orders remain relevant, and targets will be formed at the beginning of a new trading week, at its opening. It will be possible to consider selling the pair with minimum lots if the price consolidates below the Kijun-sen line with the first target being the Senkou Span B line. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment