Forex analysis review |

- AUDUSD holding above ascending trendline support! Further upside potential!

- USDCAD testing downside confirmation, possible drop!

- Overview of the GBP/USD pair. July 28. Only 20% of Americans believe that the country is moving in the right direction. The

- Overview of the EUR/USD pair. July 28. Epidemiological chaos in the US is finishing off the dollar. Trump is criticized in

- GBPCAD approaching support, potential bounce!

- Hot forecast and trading signals for the GBP/USD pair for July 28. COT report. Will Beijing deal a devastating blow to the

- Hot forecast and trading signals for the EUR/USD pair on July 28. COT report. No good news from America. Sellers still out

- Stock markets experiencing difficulties: falling indices noted almost everywhere

- EUR/USD. Depressed dollar and promising euro: 18th figure appears on the horizon

- When will panic dollar sales end?

- July 27, 2020 : EUR/USD daily technical review and trade recommendations.

- July 27, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- July 27, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Gold in strong up trend approaches our target

- EURUSD approaches our 1.18 target

- Bitcoin price moves higher after bullish signal

- US dollar crash

- US dollar continues to lose ground

- Oil: Price of raw materials decreases again

- Trading recommendations for the EUR/USD pair on July 27, 2020

- Paper money and precious metals: fantasy vs reality

- Comprehensive analysis of movement options for the commodity currencies AUD/USD & USD/CAD & NZD/USD (H4) on July

- EURUSD: dollar loses attractiveness as investors turn to gold and risky assets

- EUR / USD: dollar loses luster

- Evening review on July 27, 2020

| AUDUSD holding above ascending trendline support! Further upside potential! Posted: 27 Jul 2020 06:54 PM PDT

Trading Recommendation Entry: 0.71399 Reason for Entry: Ascending trendline support, Moving average support, 23.6% Fibonacci retracement Take Profit: 0.71882 Reason for Take Profit: -27.20% Fibonacci retracement Stop Loss: 0.71995 Reason for Stop Loss: 38.2% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD testing downside confirmation, possible drop! Posted: 27 Jul 2020 06:41 PM PDT

Trading Recommendation Entry: 1.3363 Reason for Entry: 61.8% fib extension Take Profit :1.3274 Reason for Take Profit: 127% fib extension Stop Loss:1.3440 Reason for Stop loss: Horizontal overlap resistance The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Jul 2020 06:40 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 190.3118 We would like to start this article with "but the British pound is more expensive because...", but the British pound is not expensive, it depreciates the US dollar. It is getting cheaper on all fronts of the currency market. Even gold, which is now trading around 2000 per troy ounce, has increased in price in part because the US currency has fallen in price. Thus, we can't say anything remarkable for the British currency at the end of Monday. No macroeconomic publications were scheduled for this day in the UK. The only macroeconomic report from the US was ignored by traders. No important events occurred on this day. Everything still revolves around the "coronavirus" epidemic in the US, around mass riots and absolutely inexplicable actions of the US government. It is completely unclear what Donald Trump and his subordinates are going to do with so many people infected with COVID-2019. It is not clear why Trump does not listen to the advice of doctors and Anthony Fauci personally in a situation when it is the doctors who should be asked for advice. It is absolutely unknown what will happen to the country if the rate of virus spread continues to remain at 60-70 thousand per day. After all, even if all this is explained by Trump's desire to restore the economy, it will not recover if half the country becomes ill. People will not lead an active life, will not go to work, will not take part in the economic recovery. They will only receive unemployment benefits and wait for the epidemic to end. Thus, from our point of view, the presidential administration is digging a hole for itself. And the main contender for the post of President in the 2020 election, Joe Biden, does not even need to comment on anything. Trump's ratings continue to fall, not only Democrats are criticizing him, but the public's confidence in Biden is growing. An interesting opinion poll was conducted by the NORC Research Center in the USA. According to this poll, an absolute majority of Americans, 100 days before the presidential election, believe that the country is going in absolutely the wrong direction. Only 32% of respondents are satisfied with how the current presidential administration is coping with the pandemic, only 38% of respondents believe that the country's economy is in good condition, and 80% of respondents believe the current political course is wrong. By and large, this is another sociological study that shows that Trump will not be re-elected in November. The economist periodical made an even broader and deeper analysis, according to which, the probability of winning the election of Joe Biden is 91%. This forecasting model takes into account not only social opinion, but also the situation with the epidemic in each state. According to the same study, Biden is 99% likely to win the majority of American votes in the election. However, given the peculiarities of the American electoral system, in which the winner is not the candidate who will get the most votes, but the one who will get the most "electoral votes", this indicator is not too important. Trump may not get a majority of American votes, but still win the election if the most "important" states give a large number of "electoral votes" for him. However, the forecast model of the economist also says that Biden will get about 250-415 electoral votes, while 270 will be enough to win. Thus, Biden's chances of winning the election are 91%. The prediction model also allows you to predict what the results of voting for individual states will be. So Biden is highly likely to win in 25 states, and Trump - in 20.5 more states are called "controversial" and the results for them are unpredictable. But for traders of the pound/dollar pair, the question remains extremely important:when will the market "remember" that the situation in the UK is no better? If things are relatively calm in the European Union, they are not in the UK. The fact that the prospects for the UK economy are vague and this applies not only to this year, but also to the next, and 2022, has not been written or spoken about yet except by a lazy person. There were no trade agreements with the European Union and the United States. The economy is already weakened by two blows, Brexit itself and the "coronavirus crisis". Thus, in the situation with the pound, we can draw a conclusion with 100% probability: the pound is growing only because the dollar is falling. There is no reason to strengthen the British currency now and there can not be. Even positive and optimistic rumors about the negotiations for Brexit now, and it is on them that the pound has repeatedly shown growth in the period 2016-2019. But now there is not even this, because the government of Boris Johnson puts almost ultimatums in negotiations with Brussels. And the European Union does not follow London's lead. Who will lose the most from this will become clear in 2021. No major publications are scheduled for Tuesday, July 28 in the UK and America. However, traders do not need statistics right now. There are enough reports that things are still bad in America for the dollar to keep getting cheaper. Thus, we recommend that market participants continue to trade "on the trend", without trying to predict a downward turn. The end of the upward trend can happen tomorrow, or in two weeks. There are no technical signs of the end of the upward trend at the moment, neither on the lower timeframes nor on the higher ones. During this week, at least two important events will occur for the US currency. Publication of GDP for the second quarter in the US, as well as summing up the results of the Fed meeting. On the one hand, these two events can "finish off" the US dollar, and on the other hand, it is unlikely that traders will pay attention to the economic problems of the dollar and sell it even more. Thus, it is absolutely possible that both of these very high-profile events will simply be ignored by the markets, but the US currency will still continue to fall. In any case, we will know this on Wednesday, when the Fed's meeting results and Jerome Powell's press conference will take place.

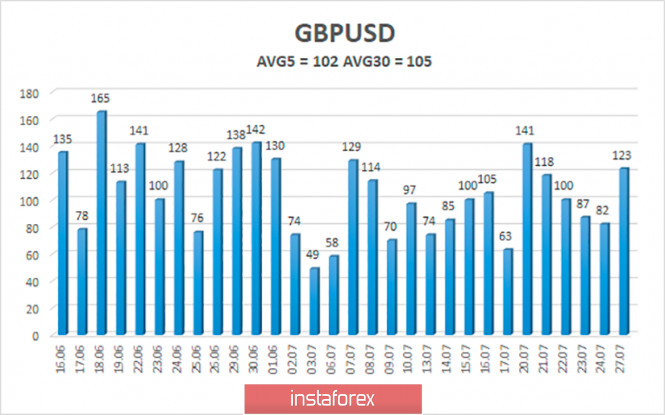

The average volatility of the GBP/USD pair continues to remain stable and is currently 102 points per day. For the pound/dollar pair, this value is "average". On Tuesday, July 28, thus, we expect movement within the channel, limited by the levels of 1.2769 and 1.2973. A downward turn of the Heiken Ashi indicator will indicate a downward correction. Nearest support levels: S1 – 1.2817 S2 – 1.2756 S3 – 1.2695 Nearest resistance levels: R1 – 1.2878 R2 – 1.2939 R3 – 1.3000 Trading recommendations: The GBP/USD pair continues to move up on the 4-hour timeframe. Thus, it is recommended to continue trading for an increase with the goals of 1.2939 and 1.2973 (the level of volatility on Tuesday), until the Heiken Ashi indicator turns down. Short positions can be considered after fixing the price below the moving average with the goals of 1.2695 and 1.2634. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Jul 2020 06:40 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 172.3765 The EUR/USD currency pair continued to rise in price on Monday without the slightest sign of a correction. In principle, what is currently happening in the currency market is called a "collapse". Just on the chart, the pair is moving up, however, the US currency continues to collapse against its main competitors. Needless to say, on Monday, when the dollar began to fall immediately from the opening of trading, there was still no news, reports, publications or anything at all that could cause such a strong sell-off in the US currency? And do traders need any economic or political news at all? We have repeatedly written that the United States is experiencing almost all possible types of crises. We don't remember such a nightmare in America, which is considered a "superpower", a country with the strongest economy in the world, for a very long time. The epidemiological crisis in general goes beyond the borders of reality. This weekend, it became known that US doctors wrote a collective letter to the White House calling for the resumption of the quarantine. Doctors believe that the best decision of the government should not be to "open the economy", but to "save lives". Health officials believe that by November 1, the number of victims from the "coronavirus" may reach 200,000 people. And if the quarantine is not tightened, then even more. However, despite the monstrous scale of the epidemic, people in the United States continue to go to bars, hairdressers, restaurants, tattoo salons, and so on, doctors complain. That is, they do not do very important things in times of a global pandemic. Well, Donald Trump at a time when 60-70 thousand Americans are infected every day, decided to once again brag to the whole world, saying that in America, a total of 55 million tests have already been conducted since the beginning of the pandemic. "We do far more tests than any other country in the world," the US president said. The American president did not forget to once again criticize the "false TV companies and media", in particular the CNN company for absolute bias in covering the problems of the pandemic. Trump accused CNN that the TV company just wants Joe Biden to win the election in November, so in any case, it will criticize him, even if the country will be conducted 10 times more tests for "coronavirus". Well, the news that the country's chief epidemiologist, Anthony Fauci, has started receiving life-threatening letters looks absolutely incredible. To him and his family. Of course, no one knows who the letters come from, but we remind you that it was Fauci who warned both the White House and Donald Trump personally from the very beginning that the "coronavirus" is not a runny nose and, if we do not take appropriate measures, the United States can reach 100,000 infections a day. Now - 60-70 thousand, and the US government continues to ignore Fauci. Despite the fact that in words, Trump agrees with the chief epidemiologist, calling him a "literate person", but the head of state does not take any actions to curb the spread of COVID. The head of the White House believes that Dr. Fauci made several important mistakes, although what exactly Trump did not tell the public. However, this is not surprising. Earlier, Trump promised to present indisputable evidence of China's guilt "in a couple of weeks". It's been a couple of months. At the same time, the speaker of the house of representatives Nancy Pelosi, who has repeatedly openly clashed with Trump, gave the US president a new nickname. This time, Pelosi called Trump "Mr. Make-It-Worse". Thus, the Democrats and the speaker of Congress personally blame the mistakes in the fight against the "coronavirus" not on Fauci or China, but on Trump. By the way, we have rarely seen accusations of China's culpability in the epidemic not from Trump and his supporters. According to Pelosi, it is Trump who is to blame for the huge number of diseases and deaths from "coronavirus" in the United States. "Since the beginning of the pandemic, it has made things worse," Pelosi says. – At first he hesitated, then denied it, then said it was a hoax, then that it would magically disappear." In such conditions, how can the dollar be in demand in the foreign exchange market? Well, do not forget that mass rallies and protests continue in the country, which are gradually reorienting from the death of George Floyd and the "Black Lives Matter" movement to the call for Donald Trump to resign. What is happening now in Portland, Oregon, can generally be called a war between the protesters and special forces of Trump, who were sent to this city, "where the authorities can not or do not want to suppress the rallies". And Trump's intention is to send the relevant units to other cities in America. In general, against the background of all this chaos, traders are not interested in macroeconomic statistics at all. Yesterday, quite important reports on orders for long-term products were published in the United States. The main indicator increased by 7.3% m/m, the indicator excluding defense and aviation orders added 3.3% m/m, the indicator excluding defense – by 9.2%, and excluding transport – by 3.3%. Two and four indicators were only 0.1% better than the forecast values, and 2 out of 4 were worse than the forecasts. Thus, in total, we can conclude that this package of statistics could not support the US currency. Because of its weakness and unconvincing. Due to the fact that this week is expected to be a disastrous report on GDP (forecast -35% in the second quarter). Due to the fact that the epidemiological and social situation in the country completely overrides any weak economic optimism, which in turn is overlaid by the upcoming GDP report. To date, the United States has not scheduled any important reports, as well as in the European Union. However, now traders do not need economic data to continue selling the US currency. Now this upward movement can only end when buyers are banal enough and begin to fix profits. First, this will lead to a correction, and then everything will depend on sellers and their desire to start investing in the dollar. At the moment, we see few fundamental reasons for the bears to become more active. Can everything change this week after the publication of the GDP report (unlikely) and after the results of the Fed meeting?

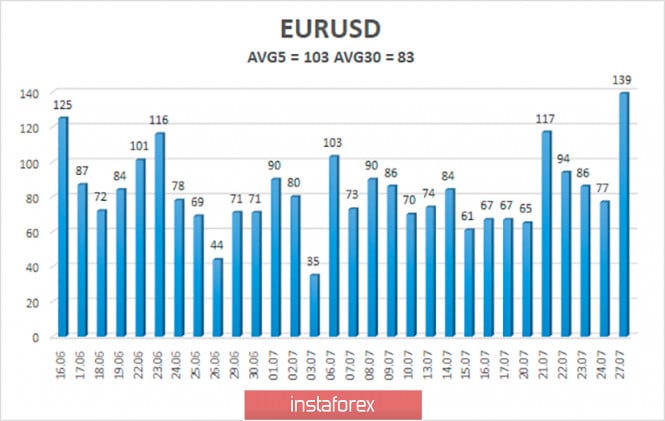

The volatility of the euro/dollar currency pair as of July 28 is 103 points and is still characterized as "average". Thus, we expect the pair to move today between the levels of 1.1660 and 1.1866. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction within the framework of an upward trend. Nearest support levels: S1 – 1.1719 S2 – 1.1597 S3 – 1.1475 Nearest resistance levels: R1 – 1.1841 R2 – 1.1963 Trading recommendations: The EUR/USD pair continues to strengthen its upward movement. Thus, it is now recommended to stay in purchases of the euro currency with the goals of 1.1841 and 1.1866, until the Heiken Ashi indicator turns downward (1-2 bars of blue color). It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first target of 1.1475. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPCAD approaching support, potential bounce! Posted: 27 Jul 2020 06:39 PM PDT

Trading Recommendation Entry: 1.70845 Reason for Entry: Ascending trend line, 100% fibonacci extension and 61.8% fibonacci retracement and horizontal pullback support Take Profit: 1.73784 Reason for Take Profit: 100% fibonacci extension Stop Loss: 1.69823 Reason for Stop Loss: Horizontal swing low support The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Jul 2020 06:34 PM PDT GBP/USD 1H The GBP/USD pair also continued to trade higher on Monday, ignoring the long-maturing technical need for a correction. However, the trend is now quite strong, and to be more precise, the fundamental background for the pair is very strong. It continues to push the quotes up. The upward trend line continues to support buyers, although a few days ago there were a couple of precedents that signaled a possible change in the trend. This is also indicated in the Commitment of traders (COT) report (see below). Thus, if the upward trend in the euro does not raise any questions, it is still not so confident in the pound. The fundamental background also leaves sellers the opportunity to switch on and enter the market at any time. The first call to change the trend will be to break the trend line. GBP/USD 15M Both linear regression channels are still directed upward on the 15-minute timeframe, so there are no prerequisites for changing the trend direction at the moment. The latest COT report on the British pound sterling is very alarming. The fact is that during the reporting period (July 15-21), the British currency grew against the dollar, but the non-commercial, which is the most important category of traders, was actively opening Sell-contracts at that time. In just a week, non-commercial traders opened 4,500 new Sell-contracts and only 3,000 Buy-contracts. Thus, the net position decreased by about 1,500, which implies that the bearish mood among the major players is strengthening. However, as we said, the pound was growing during that time period. The most interesting thing is that the commercial category also did not open Buy contracts. Quite the opposite, it got rid of them, closing almost 5,000. Thus, both groups of traders did NOT increase longs, nevertheless, the pound rose in price and continues to grow in price to this day. We believe that this is a signal for an emerging trend change, but this does not mean that it will happen on Tuesday. It is rather strange to observe the currency's growth, which is mostly sold by the major players. The fundamental background for the GBP/USD pair can be described as mutually negative. Because it is equally bad in the United States and in the UK. However, traders for once completely ignore the negative from Great Britain or consider it insignificant. But at the same time, they completely focus their attention on what is happening in the United States. And we see a large number in the US. There is so much negativity that it is not clear how the country will get out of this hole, in which it fell in just six months. Do not forget that the trade deal with China is also in danger of being disrupted since relations between Beijing and Washington continue to heat up. If China decides to terminate the first phase, it will not only mean an escalation of the trade conflict, but also put an end to the hopes of the world community for the second phase of the agreement. And this will just be a verdict for US President Donald Trump, since a huge number of American farmers will lose their market, which is unlikely to cause them indescribable delight. And, accordingly, it is unlikely that they will run to the polls on November 3 to cast their vote for Trump. Beijing may well strike a similar blow, since it has long ago realized that it will not be possible to negotiate a good deal with Trump. One hope is for Joe Biden, who is already about 90% likely to become the next president of the United States. There are two main options for the development of events on July 28: 1) The outlook for the bulls continues to be very positive while the pair continues to stay above the trend line. The first target for the week was reached on Monday - the resistance level of 1.2889. The bulls did not manage to overcome it, so now a correction to the trend line is possible, and it is advised to open new longs after breaking the 1.2889 level with a target of 1.2988 or after the correction has been completed. In this case, the potential Take Profit will be about 80 points. 2) Sellers are advised to start considering the possibility of opening short positions with the target of the Senkou Span B line (1.2622), but for this they need to wait until the Kijun-sen line (1.2773) and, accordingly, the trend line is overcome. In this case, the potential Take Profit is about 120 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Jul 2020 06:24 PM PDT EUR/USD 1H The euro/dollar pair continued its upward movement all day on the hourly timeframe of July 27. The fact that there were no particularly important news and publications on Friday or Monday, and yet traders continued to actively buy the euro and sell the dollar, suggests that there are simply no bears on the market now, and buyers are not ready to take a pause even for a couple of days to adjust the currency pair. Bulls do not even want to consolidate the profit, which should already be quite high, given the strength and duration of the upward trend. The price managed to overcome the first resistance level of 1.1741 on the first trading day of the week and in general, nothing prevents the pair from moving up. The price is moving further away from the ascending channel, which indicates the strengthening of the upward trend. EUR/USD 15M Both linear regression channels are still directed upward on the 15 minute timeframe, signaling an upward trend in the short term and no signs of an emerging trend reversal. Well, the latest Commitments of traders (COT) report showed a major change in favor of buyers. Professional traders (non-commercial category in the COT report) opened 9,500 new Buy-contracts during the reporting week (July 15-21) and at the same time (!!!) closed 8,000 Sell-contracts. Obviously, the net position for this category of large traders, which is the most important and believed to drive the market, grew by 17,500 at once. The euro continued to rise in price after July 21 and is doing so to this day. Consequently, non-commercial traders have continued to ramp up their purchases of the euro. Thus, even the COT report does not give any reason to suppose the completion of the upward trend in the euro. Even 36,000 Sell-positions opened by the commercial category of traders did not have much significance, only, perhaps, they slightly slowed down the euro's growth. Although it's scary to imagine how quickly the euro would have risen in price if it had not been for these 36,000 Sell contracts. The fundamental background for the EUR/USD pair obviously did not change on Monday, since the very nature of the pair's movement remained the same. Macroeconomic statistics from overseas did not have any impact on the course of trading. However, in any case, it was neutral at best and could not support the dollar in any way. Significant data from either the US or the EU will not be released on Tuesday, July 28. Thus, the only hope for the dollar is that unexpected positive news will come from America (for example, a vaccine against coronavirus will be invented or rallies and protests will be completely suppressed), or that buyers will simply get enough and stop buying the euro. We do not see any more chances of strengthening the dollar now. The White House, led by Donald Trump, is doing everything to make the economy sink even more, and the US president himself is doing everything to avoid being re-elected in November for a second term. Thus, the political, sociological and epidemiological chaos that reigns in the US does not contribute to the good mood of the bears of the euro/dollar pair. Based on the above, we have two trading ideas for July 28: 1) Buyers continue to dominate the market. Buy orders remain relevant with the nearest target at the resistance level of 1.1827, to which, by the way, is around 80 points. Thus, you are advised to either stay in the pair's purchases with the designated target, or to open new longs with the target of 1.1827, since the 1.1741 level was overcome. You can also open new longs on an upward signal of some indicator, such as MACD, after a downward correction, if any. In this case, the potential Take Profit is up to 80 points. 2) The bears continue to rest and wait for the bulls to give them at least a chance to seize the initiative in the market. This requires price consolidating below the Kijun-sen line (1.1602). In this case, you are advised to sell the pair with the target at the support level of 1.1486. It is recommended to consider more serious sales after the price consolidates below the rising channel with the target at the support level of 1.1317. Potential Take Profit in this case is from 90 to 260 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Stock markets experiencing difficulties: falling indices noted almost everywhere Posted: 27 Jul 2020 03:51 PM PDT There is a multidirectional movement on the stock exchanges of the Asia-Pacific region today, the cause of which, first of all, is the growing tension between the United States of America and China. In addition, previously presented concerns about a slowdown in economic recovery in the region seem to be starting to materialize. Despite the fact that the world's stock markets for the most part managed to recover all the losses that were associated with the crisis caused by the coronavirus pandemic, there is still a long way to a final recovery and sustained growth. Experts argue that a fast pace of recovery will also bring the economy more problems than positive things in the long run. Moreover, the growth in the number of infected with COVID-19 does not stop and even begins to grow rapidly in certain regions and countries. The situation is especially serious now in the United States of America. But even more problems may arise against the backdrop of an escalating conflict between Washington and Beijing. Any news on this topic is extremely important for market participants. Thus, reports that the American diplomatic mission in the city of Chengdu, located in Sichuan province, stops its activities at the insistence of the Chinese authorities, caused some panic in the markets. Recall that this was a retaliatory measure against the United States after the American authorities decided to close the Chinese Embassy in Houston, Texas. Market participants began to fully realize that the conflict between the countries is protracted and will only gain momentum in the near future. China's Shanghai Composite index went up 0.29% this morning. The Hong Kong Hang Seng index showed a negative trend, which reached 0.37%. According to the statistics received, the profits of the largest Chinese enterprises in the industrial sector in the first month of the summer increased again. This was the second growth in a row, which may be evidence of a gradual recovery of the country's economy from the crisis. The total profit margin was approximately 20 million yuan higher than the previous figures, which speaks for a rather significant increase of 11.5%. Thus, profit reached the level of 666.55 billion yuan, or 95.22 billion dollars in terms of dollars. At the same time, the growth rate became one of the highest in the last year. Let's remember that this indicator was at the level of 6% in May. Japan's Nikkei 225 index began to fall, the morning drop was 0.17%. On the contrary, South Korea's Kospi index found support for growth, as it grew to 0.8% to the previous level. The Australian S&P/ASX 200 was also in positive territory, adding 0.24%. US stock markets ended last week's working day on a minor note, the reduction was noted almost everywhere. The negative side of strained relations between Washington and Beijing is also weighing on investors here. However, another important topic is still corporate reporting, the season of which has not yet come to an end. The Dow Jones Industrial Average dropped 0.68%, or 182.44 points, which moved it to the level of 26469.89 points. The S&P 500 index lost 0.62%, or 20.03 points. Its current mark was around 3215.63 points. The Nasdaq Composite index lost more than the rest at -0.94%, or 98.24 points. This forced it to settle within 10363.18 points. In general, the main US indicators showed a moderate negative trend over the past week. The DowJones ended up 0.8% in the red, interrupting its four-week winning streak. The S&P 500 parted with 0.3%, and the Nasdaq became the leader of the decline, which it had 1.3% for the second straight week. The epidemiological situation in America also remains tense, which market participants are closely monitoring. According to experts, uncertainty will persist for a long time in the markets, which will be reflected in the level of volatility, which is now quite high and will remain so for a long time. On the other hand, the statistics are pretty good. For example, sales of new buildings in America over the past month increased to their highest values in the last thirteen years. There were 13.8% more new houses in June of this year, and their total number reached around 776,000. The figure was more modest in the last month of this spring - 682,000 new homes, but even it exceeded preliminary forecasts of 676,000. However, while even positive statistics in the economy are not able to keep stock indicators in a positive zone, they have started a correction, the limit of which is not yet clear. European stock markets supported the global downward trend and also mostly moved into the negative zone. The conflict between the US and China here is played the least, the focus of investors is news about the mandatory quarantine of arriving on the territory of Spain and the UK. The tourism industry is again beginning to experience unpleasant difficulties, which is reflected in the general mood of market participants. The general index of large enterprises in the EU Stoxx Europe 600 is still slightly falling by 0.08%. The UK FTSE 100 Index is down 0.3%. France's CAC 40 index lost 0.32%. Spain's IBEX Index became the leader in the fall, losing 1.44%. The German DAX index is the only one showing positive dynamics at +0.21%. The Italian FTSE MIB index remains indecisive and unchanged. The material has been provided by InstaForex Company - www.instaforex.com |

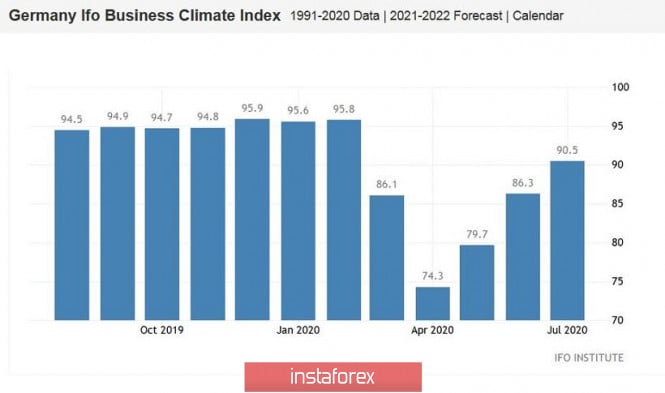

| EUR/USD. Depressed dollar and promising euro: 18th figure appears on the horizon Posted: 27 Jul 2020 03:27 PM PDT The US currency continues to fall across the entire market, while the euro-dollar pair continues to renew its multi-month highs. The fundamental background is clearly against the greenback, but the single currency is supported by many factors. Taking into account the latest trends, the market started talking about the return of the EUR/USD price to the area of 20 figures, although today it is too early to talk about it. What happened? It should be emphasized right away that the growth of the EUR/USD pair is primarily due to the weakness of the US currency. The rapid spread of the coronavirus in the United States amid massive protests in many American cities is putting tremendous pressure on the greenback. In addition, relations between Washington and Beijing have deteriorated recently. All these fundamental factors reduce the attractiveness of the US currency, while the euro looks pretty good, especially against the background of today's macroeconomic releases. And rumors around Brexit have increased interest in risky assets, which can include the euro. However, about everything in order. The coronavirus theme is the "# 1 theme" for EUR/USD traders. By and large, market participants are interested not so much in the fact of the spread of the epidemic in the United States, but in the reaction of the state authorities to existing trends. But since these factors are interrelated, traders react very painfully to the increase in the number of infected people in the country. The daily increase in COVID-19 patients is stable above the 60,000 mark. A slight decline was only recorded last Sunday: 45,000 new patients. However, this alarming indicator then went up again, showing negative trends. COVID-19 was found even in the US president's national security adviser, Robert O'brien. All this has led to the fact that doctors and scientists have called on the US authorities to return the country to strict quarantine. The open appeal, which was supported by the country's chief epidemiologist, was signed by more than 150 specialists and doctors. Some state governors and mayors have already increased quarantine restrictions. The dollar reacts negatively to such news, as the return of lockdown (even on the scale of individual cities and states) may slow down the recovery process of the American economy. The news from Capitol Hill did not help the dollar either. The fact is that today the US treasury secretary presented a bill on additional financial assistance to the country's economy in connection with the coronavirus. The volume of this bill is $1 trillion. The White House presented the bill just days before the expiration of federal unemployment benefits for millions of Americans (due to expire on Friday). However, this news provided rather weak and temporary support to the greenback. According to many experts, the proposed aid package will act as a patch, while the American economy needs more powerful infusions. For example, the Democrats have drafted their $3 trillion bill. They were able to receive him in the Lower House of Congress, but did not find support in the Upper House. Now the situation has acquired a mirror image. Republicans control the Senate, while Democrats have a majority in the House of Representatives. In turn, the adoption of the aid package from the White House is impossible without agreements between the leaders of the two chambers of Congress. Representatives of the Democratic Party have already criticized the initiative of their political opponents. But not only internal political battles are weighing on the dollar, but also external ones. Political relations between the US and China continue to deteriorate. Here we need to recall the background of the issue: on July 21, Washington demanded that the Chinese diplomatic mission in Houston be closed within 72 hours. A little later, US Secretary of State Mike Pompeo explained the decision of the White house, accusing China of spying and stealing American intellectual property. The response measures from the PRC were announced yesterday: Beijing has demanded to close the US Embassy in the Chinese city of Chengdu. Relations between the superpowers cooled during the peak of the pandemic and are now continuing to deteriorate. All this suggests that representatives of Washington and Beijing will not sit down at the negotiating table for the second part of the trade deal in the foreseeable future. Against the background of such pessimism, the European news looked quite optimistic. In particular, the German business environment indicator from the IFO (which is quite closely correlated with the dynamics of the German economy) today came out better than expected: instead of the expected July growth to 89 points, the indicator rose to 90.5 points. The indicator is growing for the third month consecutive month, reflecting the recovery of the German economy. Rumors around Brexit also had a positive effect on the dynamics of the EUR/USD pair. According to Reuters, the EU's chief negotiator Michel Barnier is confident that a "balanced deal" is possible, albeit less ambitious than previously thought. Also, journalists learned that British Prime Minister Boris Johnson actually intends to conclude a trade agreement, despite the fact that he says he is ready for Brexit without a deal. How do I trade? The EUR/USD pair still retains the potential for further growth. Now the price is testing the resistance level of 1.1750 (lower border of the Kumo cloud on the monthly chart). This is an extremely important level, overcoming it will open the way for the bulls of the pair to the 18 price level, and to the 20 figure in the future. The current pause and a small price pullback are associated with the discussion of the Republican bill on providing the US economy with financial assistance. Therefore, you should not rush to open long positions now. But as soon as buyers consolidate above 1.1750, longs can be considered with the first target at 1.1800. The material has been provided by InstaForex Company - www.instaforex.com |

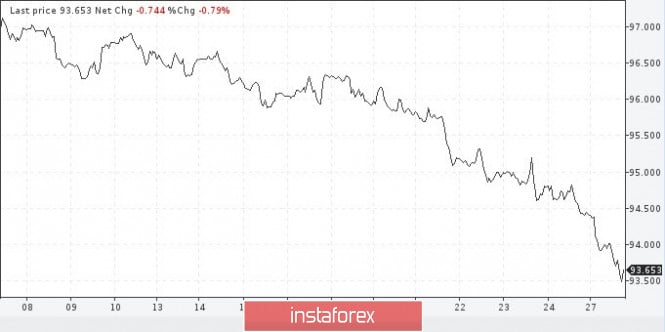

| When will panic dollar sales end? Posted: 27 Jul 2020 03:27 PM PDT The dollar made another downward spurt despite being oversold. The dollar index dropped below 94 points on Monday. EUR/USD rallied above 1.1700. Thus, the expectations that the rate of the main pair will go into correction after reaching the 1.1500 mark did not come true. Market players, apparently, are inclined towards the fact that the authorities will reduce the degree of social discontent with generous interventions and distribution of money to the population before the presidential elections. This factor speaks in favor of a weakening dollar. The greenback is also under pressure from heightened tensions between the US and China. If earlier the greenback could benefit from the confrontation between the two giants, now everything is different. As a safe haven, traders are now buying the yen and the Swiss franc. The Japanese currency strengthened against the dollar to a 4-month high, located around the 105.17 level. Meanwhile, the franc reached a 5-year high of 0.9167 against the dollar. This week, traders are focusing on the Federal Reserve meeting, which starts on Tuesday. No major announcements are expected, but financial officials may start laying the groundwork for further action in September or later this year. The rhetoric of Fed Chairman Jerome Powell can send the dollar in one direction or another. The most likely is a downward movement. The Fed Chairman previously expressed hope that the economy can recover in the second half of the year, but the current epidemiological situation has confused all the cards and, it seems, will force Powell to radically change his views. Any mention of negative rates will hit the already weak dollar, which is expected to decline both before the Fed meeting and after. USDX The data on economic growth in the US, which will be published on Thursday, may also affect the dollar. Despite signs of slowing down, COVID-19 is still spreading at a high rate in the United States. Market players have doubts about the rapid economic recovery. Traders are preparing for the fact that in the second quarter, GDP fell by 34% on an annualized basis, in the first quarter it fell by 5%. Considering a whole train of negative factors for the dollar, large American investment banks are unanimously lowering their forecasts for the national currency. The pessimism towards the dollar is really hard to dispute when it comes to the long term. In the medium term, things may be a little different. The dollar exchange rate has now fallen catastrophically and needs to be corrected. It is expected that the correction will start at 1.1700 when paired with the euro. A technical pullback to the 1.1600 area is possible, after which the transition to the 1.1370 area will be justified. Lower is unlikely. Here, most likely, we will see long-term bearish positions being formed on the greenback. Thus, July may be the worst month for the dollar in the last ten years. EUR/USD So, the rates for further depreciation of the US currency are likely to grow. The main reasons: the aggravation of the conflict between Beijing and Washington, the alarming epidemiological situation in the United States, the growing expectations of the FRS rate cut. Do not forget about the November presidential elections in the country, which carry many uncertainties. The material has been provided by InstaForex Company - www.instaforex.com |

| July 27, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 27 Jul 2020 10:37 AM PDT

The EURUSD pair has been moving-up since the pair has initiated the depicted uptrend line on May 25. On June 11, a major resistance level was formed around 1.1400 which prevented further upside movement for some time and forced the pair to have a downside pause. For a few days, the EURUSD demonstrated an ascending wedge around the depicted price level of 1.1400 affected by a couple of contradictory Fundamental data from the U.S.However, Last week a few negative fundamental data from the U.S. have caused the EUR/USD to achieve another breakout to the upside. The EURUSD is currently approaching the price levels around 1.1750 pair where some signs of downside pressure are manifested. Intraday traders should be waiting for a upcoming breakdown of the depicted short-term uptrend (1.1650) to the downside to be able to have a valid SELL Position. Estimated targets would be located around 1.1550, 1.1500 then 1.1450. The material has been provided by InstaForex Company - www.instaforex.com |

| July 27, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 27 Jul 2020 09:23 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1150 then 1.1380 where another sideway consolidation range was established. Hence, Bearish persistence below 1.1150 (consolidation range lower limit) was needed to enhance further bearish decline. However, the EURUSD pair has failed to maintain enough bearish momentum to do so. Instead, the current bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1600 (Fibonacci Expansion 78.6% level) which failed to offer sufficient bearish pressure. That's why, further bullish advancement pursued towards 1.1730 (Fibonacci Expansion 100% level) which is being tested now. Trade recommendations : Conservative traders should wait for the current bullish movement to pause and get back below 1.1730 as an indicator for lack of bearish momentum for a valid SELL Entry.T/P levels to be located around 1.1600 and 1.1500 while S/L should be placed above 1.1800 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| July 27, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 27 Jul 2020 09:09 AM PDT

Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.2265 (Previous Consolidation range Lower Limit) on the H4 Charts. On May 15, transient bearish breakout below 1.2265 (the depicted demand-level) was demonstrated in the period between May 13 - May 26, denoting some sort of weakness from the current bullish trend. However, immediate bullish rebound has been expressed around the price level of 1.2080 bringing the GBPUSD back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection. Further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where another episode of bearish pullback was initiated. Short-term bearish movement was expressed, initial bearish targets were located around 1.2600 and 1.2520 which paused the bullish outlook for sometime & enabled further bearish decline towards 1.2265. Significant bullish rejection was originated around 1.2265 bringing the GBP/USD pair back towards 1.2780, where the mid-range of the depicted wedge-pattern failed to offer enough bearish rejection. This indicates a continuation of the current bullish movement towards 1.2970-1.2980 where the upper limit of the depicted pattern comes to meet the pair. Trade recommendations : Intraday traders can consider the current bullish pullback towards the depicted Supply-Level (1.2980) for a valid SELL Entry. Stop Loss should be tight, it can be placed above 1.3050 while initial T/P level to be located around 1.2780 & 1.2600. The material has been provided by InstaForex Company - www.instaforex.com |

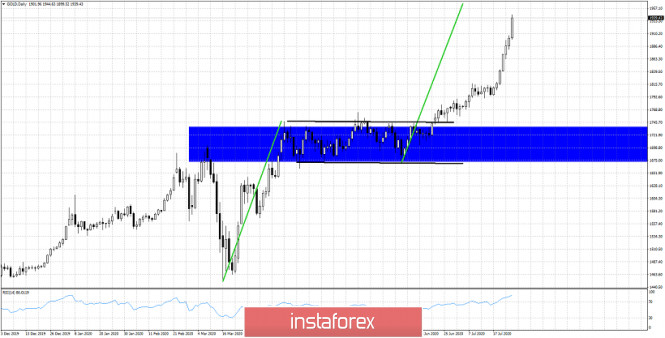

| Gold in strong up trend approaches our target Posted: 27 Jul 2020 07:52 AM PDT Gold price continues to move higher above $1,900 making new all time highs. Gold price is approaching our second target of $1,964, There is no sign of bearish divergence by the RSI and we continue to expect price to move higher towards our target without any major pull back.

Green lines- equal size move expectations Blue rectangle - support zone Gold price is moving higher in a parabolic phase. This is no time to go against this trend as we said in previous posts. Target of $1,964 has been given since price broke above $1,850 area last week. The RSI had canceled the bearish divergence confirming the new higher high in price. Major support for Gold is now at $1,750-30 area. Next target after $1,964 is at $2,010. The material has been provided by InstaForex Company - www.instaforex.com |

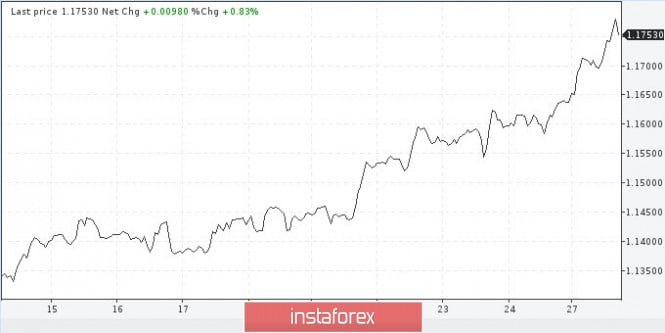

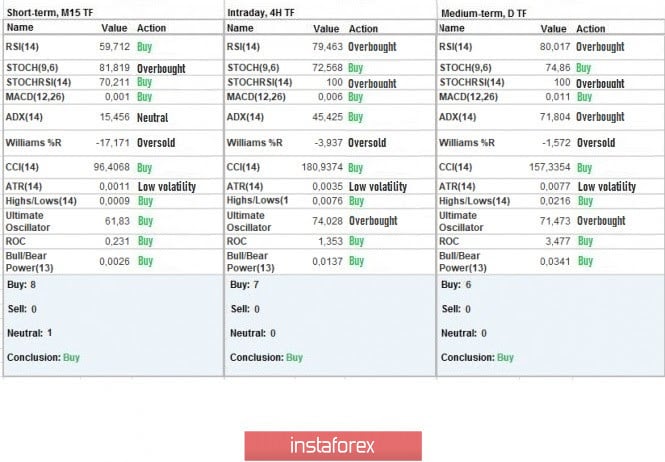

| EURUSD approaches our 1.18 target Posted: 27 Jul 2020 07:39 AM PDT In my last analysis I mentioned the importance of the 1.18-1.1850 price level. This was our next target and the major long-term resistance bulls face now. Trend remains bullish and as I mentioned in my last analysis, we have to wait for a pull back only after we reach the 1.18 level.

EURUSD has now reached very close to our target. Our target is also a major resistance area. This is where we find the 61.8% Fibonacci retracement of the decline from 1.2540 to 1.0640. There we also find the green downward sloping resistance trend line that comes from 2008 highs. This is a very important area of resistance. Even if we recapture 1.18 and move above 1.19 area, I expect to see some fighting back by the bears. I do not expect this resistance area to break easily. Keep in mind that we have no RSI bearish divergence even in the 4 hour chart so I would not expect any major pull back any time soon. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin price moves higher after bullish signal Posted: 27 Jul 2020 07:33 AM PDT In a previous analysis we pointed out a triangle pattern in play for Bitcoin. In my analysis I pointed out that a break above the upper triangle boundary would be a bullish signal and price could go towards the blue rectangle target area near $10,700.

Blue rectangle- bullish signal target Green rectangle -bearish signal target In my analysis I suggested that traders should be patient and wait for the signal. Wait for the break out. The break out was to the upside and price is now above $10,200 getting closer to our target. The first target is at the $10,700 area with potential to move even higher. Traders should now raise their protective stops right at the point of the break out. So the risk for this trade is now zero. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Jul 2020 07:31 AM PDT

The US economic recovery has been delayed. It seems that it will not happen soon. This pushes investors away from the world's reserve currency. Traders speculate that the Federal Reserve would resort to another state of adaptive monetary policy change. The stability of the US dollar is far from ideal. The American currency fell to a four-month low against the yen. Moreover, the greenback dropped to a new 22-month low against the euro and a five-year low against the Swiss franc. Gold, in turn, has reached historic highs amid a weakening US dollar. The US central bank tries to stabilize the market hinting at the benefits of an average inflation target. Chris Weston, a head of research at Melbourne brokerage Pepperstone, noted that the US dollar was adapting to live with low market rates over a long period of time. In other words, the Fed's rate is unlikely to grow in the next five years, as well as the value of the US dollar. However, investors are very optimistic as they open short positions ahead of the Fed's meeting. The number of such positions on the US dollar has reached a record 2-year high in a week. The euro rose by 0.5% to trade at $1.1725. The pound sterling and the Singapore dollar reached highs of $1.2842 and $0.7134, respectively. At the same time, the number of people infected with the Chinese virus in the world is only growing. Besides, political tensions between the countries are mounting. For example, China removed the American flag from the US consulate in Chengdu in response to the closure of the Chinese consulate in Houston. The revival of the global economy has also been delayed. The market froze in a nervous strain. Moreover, the recovery in the US labor market has unexpectedly stalled, while Europe is recovering and moving forward. This is another cause of trouble. In this regard, the Fed's leaders will meet to discuss further actions. The US government will analyze the timing of some US unemployment benefits extensions. The problem is that it is necessary to reach the unanimous agreement between Republicans and Democrats. The White House and Senate Republicans have agreed on a $1 trillion aid package, but approval from Democrats, who are pushing for the big spending, has not come yet. Steve Englander, head of research on G10 FX at Standard Chartered in New York, argues that if additional fiscal measures are not taken, the market will have to go through severe shock. But the expert hopes for a large stimulus package from the US government. The material has been provided by InstaForex Company - www.instaforex.com |

| US dollar continues to lose ground Posted: 27 Jul 2020 06:49 AM PDT This morning, the US national currency has fallen to its lowest level for the last four months against the Japanese currency. As for the common European currency, the US dollar sank even lower. It hit its two-year low against the euro. The reason for such a sharp downtrend was the news that the country's main regulator is preparing to adopt a new stimulus package aimed at recovering the economy from the global coronavirus pandemic. The next meeting of the Fed is scheduled for tomorrow and the day after tomorrow. Ahead of this meeting, experts make forecasts of some possible steps which could be taken by the authorities. Some analysts believe that the Fed will not propose any measures but will just prepare the ground for the next stimulus packages, which may be introduced in early autumn. In addition, the Central Bank is likely to report on the average inflation rate, which is currently of greater importance. Thanks to this, it will be possible to keep the interest rates at a fairly low level for some time. Analysts believe that the US currency will adjust to the current market situation and stop overreacting to the news. A higher inflation rate has its advantages. Thus, the regulator will be able to leave the economy overheated for a longer period of time. Meanwhile, the total value of short dollar positions in the foreign exchange market has grown significantly over the past week. Now it is around $18.81 billion, while it was $16.65 billion last week. The US dollar index lost 0.5% and reached the level of 93.962 against six major currencies. At the same time, the national currency of Japan continued to gain ground against the greenback. It added 0.48% to the level of 105.61 yen per dollar. The common European currency is also extending gains: this morning, the currency has advanced by 0.45% to the level of 1.1707 dollars per euro. The British currency went up by 0.3% , reaching 1.2827 dollars per pound sterling. The national currency of Australia increased by 0.38%, moving to the area of 0.713 per aussie. The New Zealand dollar also jumped by 0.38% to the level of 0.6669 dollars per kiwi. China's national currency added 0.2% and managed to stay firmly at around 7.0002 yuan per dollar. Thus, It can be concluded that the US dollar continues to experience difficulties related to geopolitical and epidemiological problems putting strong downward pressure on its value. According to most analysts, the greenback will hardly be able to recover in the near future. Therefore, it may be time to get ready for an even greater collapse. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil: Price of raw materials decreases again Posted: 27 Jul 2020 06:33 AM PDT

Crude oil prices have moved into a negative correction this morning after gaining some strength late last week. Market participants are seriously concerned about several points. First, investors are directing their views towards the escalation of the conflict between Washington and Beijing, which could significantly undermine the already not very positive market situation. Secondly, the next wave of the coronavirus pandemic is growing in the United States, with the number of infected cases rapidly increases daily. The price of futures contracts for Brent crude oil for September delivery on the trading floor in London fell slightly lower by 0.09% or $ 0.04, which sent it to the level of $ 43.3 per barrel. Note that Friday's trading ended with a rise in the price of raw materials by 0.07% or $ 0.03, and the price stopped at $ 43.34 per barrel. The price of futures contracts for WTI crude oil for September delivery on the electronic trading floor in New York is also slightly fell by 0.07% or $ 0.03, and sent it to the level of $ 41.26 per barrel. Friday's trading reflected an increase of 0.5% or $ 0.22, and the price reached $ 41.29 per barrel. Thus, Brent crude oil over the past week was able to increase in value by 0.5%, while WTI rose even more by 1.3%. The geopolitical situation in the world, particularly the conflict between the United States of America and China, began to recoup investors in the raw materials market. Another exacerbation happened on Friday, which allows us to say that further hostility between the countries will only grow. Recall that on the last working day last week, the Chinese authorities decided to close the US diplomatic mission in Chengdu, Sichuan province. This was a response to the US government's demand to shut down the Chinese consulate in Houston, Texas. The situation on the oil markets is already quite tense now, and a new wave of conflict between the United States and China can only aggravate the situation. The recovery of the world economy from the consequences of coronavirus infection, which is going on rather difficult, may receive additional pressure, which is now completely useless, especially since the epidemiological situation is still quite aggravated. But there is still progress made: in America, the number of cases recorded every day is starting to depreciate. In the states of Florida, California, Texas, the number of cases is gradually decreasing. Their daily number is already becoming less than 1,000 people. However, this does not mean give such assurance since the risk of a second outbreak still persists. In order to understand whether the situation is beginning to stabilize, market participants should see a steady decline in the number of COVID-19 cases in about two or more weeks. Only then will it be possible to take a breath. However, there is another important factor that is putting serious pressure on oil quotes - the increase in the total number of oil production facilities in the United States of America. As it became known at the end of last week, one unit started working again, which means that, possibly, there will be an increase in the extraction of raw materials in the country. The start-up was the first return to the operation of an existing plant after regular displacement reductions for more than four months. Thus, the total number of stations was 181. All this suggests that production will increase in the long term. The demand for shale oil is gradually increasing, so as its price. However, no one can guarantee that the potential for price recovery in the oil market will not shake. Moreover, many analysts warn of an imminent correction, which can only exacerbate the situation. The material has been provided by InstaForex Company - www.instaforex.com |

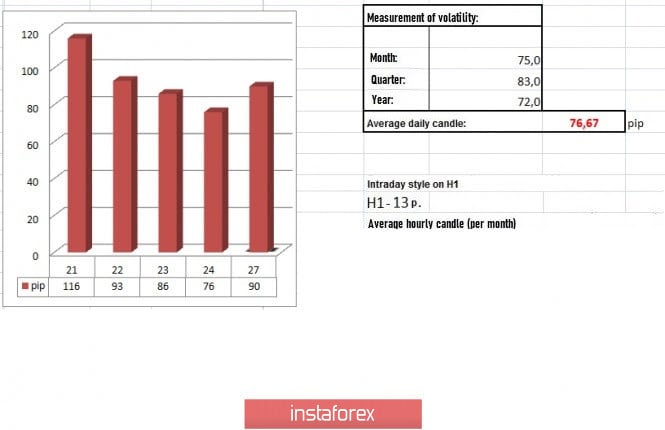

| Trading recommendations for the EUR/USD pair on July 27, 2020 Posted: 27 Jul 2020 06:20 AM PDT The European currency has recently become so expensive that it is now overbought and has no boundaries. Its exchange rate since the beginning of July has led to a movement that is vertical, in which the medium-term downward trend was greatly affected. Back in mid-May, the rate of EUR / USD fluctuated around the level of 1.0775. Now, the movement has passed to almost +1,000 points, and that is 56% relative to the downward trend in January 2018. Hence, the main question now is whether this current acceleration will become the new medium-term trend in trading. For the last 5-10 weeks, the US dollar has been selling-off in the market, and investors are quite happy with this. There is speculation that the depreciation of the currency is deliberate, and it will help the US economy become the most agile in the global trading arena. At the same time, Bloomberg said that a cheap dollar may become a target for long positions at the end of August, thereby preparing strategic positions for the autumn season. Thus, there are clear doubts on the long-term upward trend and a growing confidence that there is currently market manipulation. Nevertheless, volatility was not lower than the daily average, which means that activity in the market is high, so is the speculative mood of traders. As discussed in the previous review , traders worked on a local slowdown, in which an upward movement was set towards the level of 1.1650. The transactions were placed after a consolidation above the said level. So, in the daily chart, there is an almost vertical price movement, where the quote broke through the area 1.1550 / 1.1650 without much difficulty. In addition, the same movement was also observed before, on almost the same date as this time, on July 21-26, 2017. As for news, the reports published last Friday included the preliminary data on the index of business activity in Europe, which came out with positive dynamics. The index in the service sector rose from 48.3 to 54.8, while the manufacturing sector recorded an increase from 47.4 to 51.1. The composite business activity index also grew from 48.5 to 54.8. Such figures led to a rise in the euro and decline in the US dollar on the trading chart. In the afternoon, a similar data for the United States came out, where a growth in the index was also recorded. According to the report, the PMI in the US manufacturing sector rose from 49.8 to 51.3 (forecast 51.5), while the service sector grew from 47.9 to 49.6 (forecast 51.0). Such statistics further declined the US dollar in the trading chart. Today, data on durable goods in the US will be published, in which economists forecast orders to grow by 5%. If the real data comes out worse than the forecast, the US dollar will remain declining, but if it turns out better, a very sharp change towards increasing will occur in the USD trading chart. Further development Analyzing the current trading chart, we can see the further rise of the European currency, in which the quotes reached new highs and increased the volatility. Because of this, a convergence in the area of 1.1800 is possible, but within it the movement may stop, and if the data on durable goods in the United States turns out to be at a level of 5% or higher, a reversal towards 1.1650 -1.1550 will occur immediately. But, an alternative scenario will arise if the data turns out to be worse than expected. The quote will consolidate above 1.1800, overheating the European currency. Indicator analysis Analyzing the different sectors of time frames (TF), we can see that the indicators of technical instruments on the minute, hourly and daily periods signal "buy" due to the movement of quotes towards the highs of the current year. Weekly volatility / Volatility measurement: Month; Quarter; Year The measurement of volatility reflects the average daily fluctuation, calculated per Month / Quarter / Year. (July 27 was built, taking into account the time the article is published) The volatility at this current time is 90 points, which is 18% higher than the average daily value. It is assumed that speculative activity is driving up the excitement in the market, which may lead to further increase in volatility. Key levels Resistance zones: 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support Zones: 1,1500 1.1350; 1.1250 *; 1.1.180 **; 1.1080; 1.1000 ***; 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1.0500 ***; 1.0350 **; 1.0000 ***. * Periodic level ** Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Paper money and precious metals: fantasy vs reality Posted: 27 Jul 2020 06:16 AM PDT

Tensions between the USA and China and the coronavirus outbreak hit the US dollar. Due to this, prices of major precious metals continue to reach new highs. Thus, the price of gold has hit a new record for the first time since 2011. Gold rose by 1.57% and reached $1,930.9 per troy ounce. Silver also broke records and increased by 5.87% to $24.07 per ounce. At the same time, palladium grew by 0.98% to trade at $2,241.03 per ounce, as well as platinum added 1.78% to trade at $930.5 per ounce. Edward Mayer, an analyst at ED&F Man Capital Markets, noted that people invest heavily in gold amid the weakening the US dollar. The expert also believes that precious metals will continue growing, as the epidemiological situation is becoming worse, while the market expects to receive new great incentives for a long period of time. By the way, why do prices of silver and gold bullion denominated in both euros and US dollars continue to rise? The fact is that the money supply in the US and in the EU is expanding. For example, the United States is printing money unprecedentedly, and the European Union has approved a €750 billion ($868 billion) Recovery Fund. However, the situation is not that rosy. When the money supply cannot keep up with the economic growth (which is not seen in the US), the value of the currency inevitably decreases. If money can be printed at any time, the amount of precious metals is limited. Therefore, such a rise in the value of gold and silver was simply caused by the currency devaluation. The material has been provided by InstaForex Company - www.instaforex.com |

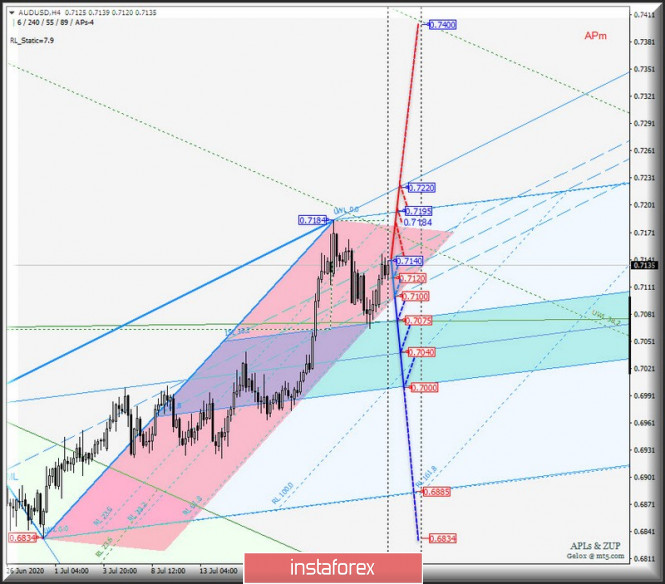

| Posted: 27 Jul 2020 05:59 AM PDT Minute operational scale (H4) End of July - What's next? Review of options for the development of the movement of AUD/USD & USD/CAD & NZD/USD (H4) on July 28, 2020. ____________________ Australian dollar vs US dollar The development of the movement of the Australian dollar AUD/USD from July 28, 2020 will continue to be determined by the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (0.7140 - 0.7120 - 0.7100) of the Minuette operational scale fork - look for details on the animated chart. In case of breaking the lower border of the channel 1/2 Median Line Minuette - support level of 0.7100, the movement of AUD/USD may continue to equilibrium zone (0.7075 - 0.7040 - 0.7000) of the Minuette operational scale fork, with the prospect of achieving the ultimate line FSL Minuette (0.6885). The breakdown of the resistance level 0.7010 at the upper border of the 1/2 Median Line Minuette channel will make it relevant to continue the development of the upward movement of the Australian dollar towards the targets:

The AUD/USD movement options from July 28, 2020 are shown on the animated chart.

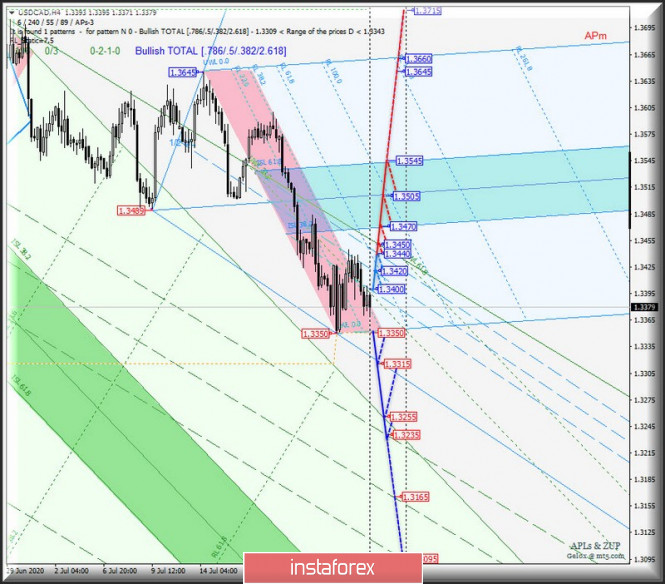

____________________ US dollar vs Canadian dollar Further development of the movement of the Canadian dollar USD/CAD from July 28, 2020 will occur depending on the development and direction of the breakdown of the range:

In case of a breakdown of the resistance level at 1.3400, the USD/CAD movement will continue in the 1/2 Median Line Minuette channel (1.3400 - 1.3420 - 1.3440) with the prospect of reaching the UTL control line (1.3450) of the Minute operational scale fork and the equilibrium zone (1.3470 - 1.3505 - 1.3545) of the Minuette operational scale fork. If the support level of 1.3350 breaks on the initial line of the SSL of the Minuette operational scale fork, it will be possible to continue the development of the downward movement of the Canadian dollar towards the goals:

Options for USD/CAD movement from July 28, 2020 are shown on the animated chart.

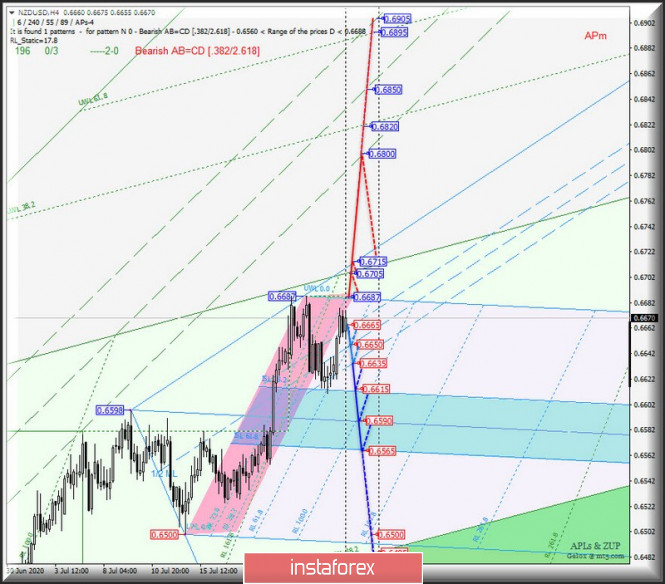

____________________ New Zealand dollar vs US dollar Further development of the movement of the New Zealand dollar NZD/USD from July 28, 2020 will also occur depending on the development and direction of the range :

A breakdown of the support level of 0.6665 will determine the development of the movement of the New Zealand dollar within the boundaries of the channel 1/2 Median Line Minuette (0.6665 - 0.6650 - 0.6635) with the prospect of reaching the equilibrium zone (0.6615 - 0.6590 - 0.6565) of the Minuette operational scale fork. When the initial line of the SSL of the Minuette operational scale fork is broken - resistance level of 0.6687 - the upward movement of NZD/USD can be continued to the goals:

The markup of the NZD/USD movement options from July 28, 2020 is shown on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and it is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: dollar loses attractiveness as investors turn to gold and risky assets Posted: 27 Jul 2020 05:59 AM PDT The euro continues to break through the highs, gradually approaching the 18th figure. The sharp rise in risky assets during the Asian session continued through the European trading after the release of the data showed that Germany is confidently on the path of recovery, and the Ifo business sentiment index rose for the third month in a row. The situation around the yield of US Treasuries adjusted for inflation is putting pressure on the US dollar, which only forces market participants to bet on the growth of European currencies. Before the release of the leading statistics on Germany, the euro slightly went on correction, but the downward movement was of a purely technical nature, after which the expectations that the growth of the German economy in the 3rd quarter will be very strong, gave the euro a new impetus. The removal of stop orders above 1.1720 only strengthened the demand for the euro. However, despite the current indices, you need to understand that the economy will not recover to pre-crisis levels soon, and the risk of a second wave of a surge in coronavirus infections could seriously affect the indicators, since exports, which Germany is targeting, may remain at rather low levels. The number of cases in Spain, Germany, and France is already growing, and many doctors unanimously say that the second wave of the outbreak cannot be avoided, but it will have to be in the winter. There is also an option that the high debt burden of German companies, which occurred at the time of the outbreak of the pandemic, would hinder investment. Labor market problems, which will only have to be dealt with at the end of next year, will have a negative impact on private consumption. Now let's get back to the numbers. According to the Ifo Institute, the index of business sentiment in Germany in July this year jumped to 90.5 points against 86.3 points in June. Economists had expected the index to reach 89.0 points in July. The situation has also improved with the indicator of the current situation, which in July rose to 84.5 from 81.3 points in June. A significant increase was also noted in the indicator of expectations, which jumped to 97.0 from 91.6 points. This suggests that many companies are optimistic about the future and believe in a quick return of the economy to life after the end of the Covid-19 pandemic. The euro is also supported by the agreement on the EU recovery fund, which was signed early last week. However, this does not mean that now all European countries can sleep peacefully. To receive assistance, it is necessary to develop detailed plans, which will then be approved, and without significant reforms, especially in Italy, it will be difficult to achieve approval. First of all, we are talking about making changes in the fiscal sphere and policy of European countries, Italy, in particular since it is in this country that the deficit is very calmly inflated and without much nervous tension they take budget holes and national debt as a matter of course, which is outside the scope of the current eurozone agreement. As I noted above, the pressure that the US dollar is now experiencing is primarily associated with a decrease in the real yields of US Treasury bonds, adjusted for inflation. The outflow from the dollar is obvious, since even the news that the US and China are closing each other's consulates did not lead, as it did before, to the strengthening of the greenback as a safe-haven asset. On the contrary, all the money now goes into gold, which is the most protected from inflation. Given the fact that the real profitability of American securities is scanty, investors are looking for profitability in riskier assets. Given that the Federal Reserve will continue to pump money into the economy and keep rates close to zero, the outlook for the US dollar is not that exciting. Therefore, the prospect of strengthening the Euro, the pound, and other risky currencies, along with an update to the level of 2000 dollars per Troy ounce for gold, is quite real. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: dollar loses luster Posted: 27 Jul 2020 05:49 AM PDT

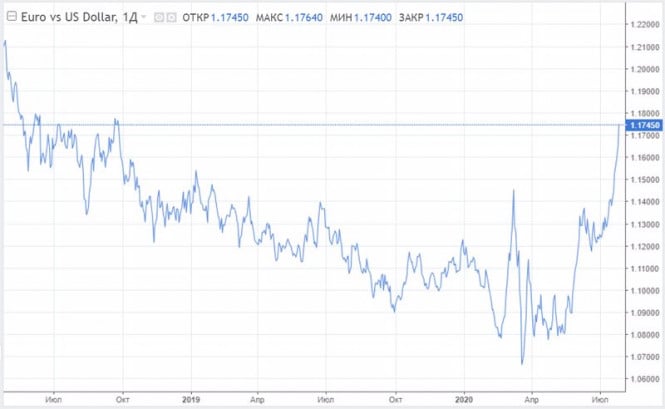

The EUR / USD pair has reached 22-month highs against the backdrop of a broad US dollar weakness. The main factor of pressure on the greenback is the deterioration of diplomatic relations between Washington and Beijing. US Secretary of State Mike Pompeo called China's political regime tyrannical and called for the creation of a new democratic alliance against China. In theory, such a development of events could support the greenback as a traditional defensive asset, but not this time. Apparently, investors are worried that the US government may not be able to control the spread of COVID-19 in the country, which in turn casts doubt on the prospects for an early recovery of the national economy. On Thursday, data on US GDP for the second quarter will be published. For most of the second quarter, virtually all US states were in a tight quarantine regime, and experts predict a 35% slowdown in the country's economy. However, they admit that the data may be even worse. The Federal Reserve Bank of Atlanta, in particular, expects a reduction of 52.8%. Another strong pressure on the USD is the Fed's monetary policy. In early spring, the regulator sharply lowered interest rates, thereby reducing the differential between rates in the US and in other countries. Also, the American Central Bank launched a large-scale asset repurchase program. The next FOMC meeting will take place this week.

A few weeks ago, the Federal Reserve chair Jerome Powell said that the US economy remains in a state of extreme uncertainty. Since then, the country's economic outlook has deteriorated. The unemployment benefit supplement has already expired, and the packages of measures discussed by the US Congress may not impress market participants. Taking this into account, the Fed has no choice but to continue to adhere to the dovish position, pledging to pursue a stimulating monetary policy. Last month, FOMC officials noted that US interest rates will remain near zero until at least 2022. It is assumed that the dynamics of the dollar will depend on the tone of Powell's statements. In June, the Fed chair said that the US economy could recover in the second half of the year, however, due to the worsening epidemiological situation in the country, he could reconsider his views. The USD index slipped to almost 2-year lows around 93.7 points. Any hint by Powell about negative interest rates will be a powerful blow to the greenback. The EUR / USD crossed the 1.1700 mark, marking peak highs since September 2018.

It seems that Europe, which recently agreed on an economic recovery fund, has begun to look like a new safe haven in the eyes of investors. The German IFO business optimism index rose to 90.5 points in July against 86.3 points recorded in June. "The German economy is gradually recovering. Positive dynamics is observed in trade, industry, services, and construction, "- follows from the report of the Munich Institute for Economic Research. Meanwhile, on Thursday, data on the GDP of Germany and the whole of the eurozone will be released, which will show the extent of the economic downturn caused by quarantine restrictions in the second quarter. German GDP is expected to contract by 9% and the eurozone economy by 11.2%. Technical indicators signal that in overbought conditions, the EUR / USD pair may undergo downward correct in the short term. Support is located at 1.1495 (March high). A break of this level will be contained in the 2-month upward trend area at 1.1383. In general, the pair remains positive, and the upward movement seems to be the path of least resistance. At least as long as the EUR / USD is trading above the 200-day moving average, which is currently in the area of 1.1073, the rally could continue. Absorption of recent highs around 1.1730 will clear the way for the bulls to 1.1815 and 1.1850. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on July 27, 2020 Posted: 27 Jul 2020 05:41 AM PDT

Gold, monthly chart. As observed, the gold rewrote it's 2011 high. Those who managed to hold purchases up to this moment, great fellows, but now is a good time to take profit and buy with a reduced volume from a strong pullback of at least a daily scale.

The situation with the EURUSD is the same. Whoever holds purchases are brilliant. However, of course this will have to end soon and if you do not fix it now, then tighten the stops. Although they can be removed so why lose part of the profit? The goals of the movement have been fulfilled so far. You should consider purchases upon a strong downward pullback. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment