Forex analysis review |

- Forecast for EUR/USD on July 8, 2020

- Forecast for GBP/USD on July 8, 2020

- Forecast for AUD/USD on July 8, 2020

- Forecast for USD/JPY on July 8, 2020

- CADJPY coming close to descending trendline resistance! Drop incoming!

- CADJPY coming close to descending trendline resistance! Drop incoming!

- Hot forecast and trading signals for the GBP/USD pair on July 8. COT report. Buyers taking advantage of the opportunities

- Hot forecast and trading signals for the EUR/USD pair on July 8. COT report. Buyers and sellers currently do not dominate

- Overview of the GBP/USD pair. July 8. "Trump is part of a coronavirus disaster." The European Commission lowered its forecasts

- Overview of the EUR/USD pair. July 8. The European Commission expects a stronger economic downturn than before. Paolo Gentiloni

- EUR/USD. European Commission report disappointed, but bears could not take advantage of the situation

- July 7, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Evening review on EURUSD for July 7, 2020

- Short-term Ichimoku cloud indicator analysis of EURUSD for July 7, 2020

- Gold price following Inverted head and shoulders pattern from end of June

- GBPUSD and EURUSD: An informal meeting of Brexit negotiators pushes the pound up. Germany's recovery will not be as active

- Pound sterling fails to update its maximum

- Comprehensive analysis of movement options for Gold and Silver (H4) on July 8, 2020

- EUR/USD: USD seems to be hard nut to crack but EUR fighting to keep afloat

- Stock markets of Europe, US, and Asia go to different sides

- Oil under pressure

- Evening review on EURUSD for July 07, 2020

- Gold about to hit $1,800 per ounce

- Threat of second global quarantine strengthens US dollar

- GBP/USD: plan for the American session on July 7

| Forecast for EUR/USD on July 8, 2020 Posted: 07 Jul 2020 07:38 PM PDT EUR/USD The euro continued to grow on Tuesday, having previously tested support for the target level of 1.1265 from above. As yesterday, the price is developing above the balance and MACD indicator lines on the daily chart, but the Marlin oscillator has not been able to move into the positive (growing) trend zone. The euro's growth is risky not only due to the observed excessive risk appetites, but also from a technical aspect – the euro increasing towards the target levels of 1.1420 and 1.1465 will form a reversal divergence on the Marlin oscillator, followed by a medium-term decline. The growing scenario is already at risk of failure. The Marlin signal line turned from the border of the growth territory. Consolidating the price at 1.1265 can reset the price to the lower support of 1.195, which will automatically move the price under the balance line, and this is already a shift in the interests of players to further pull down the euro and overcome 1.195, opening the way to 1.1100. The euro's reversal from yesterday (the low of the day) occurred from the balance line on the four-hour chart and synchronously with this, the signal line of the Marlin oscillator turned from the border with the territory of the downward movement up. At the moment, the Marlin line shows the intention to turn around from this border. Consolidating the price under the support of 1.1265, of course, will force the Marlin to gain a foothold under its own border in the negative trend zone. So, a rise in the price above 1.1300 will allow the price to continue growing to 1.1420, a consolidation under 1.1265 opens the way to a fall to 1.195. The material has been provided by InstaForex Company - www.instaforex.com |

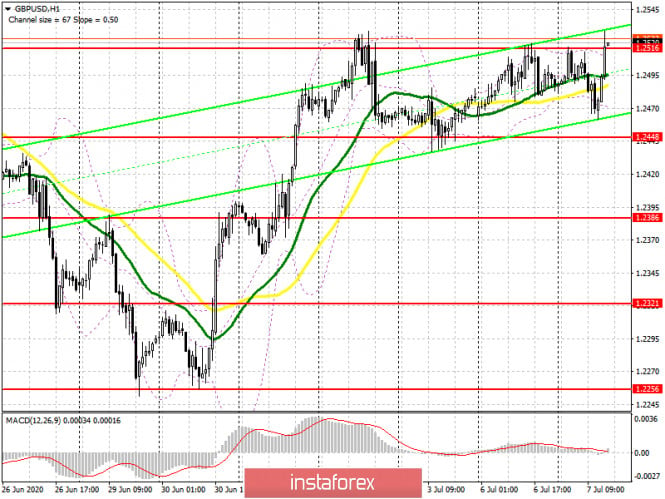

| Forecast for GBP/USD on July 8, 2020 Posted: 07 Jul 2020 07:37 PM PDT GBP/USD The pound successfully overcame the resistance of the 123.6% Fibonacci level at 1.2540 yesterday. The Marlin oscillator has invaded growth territory on the daily chart. The price is directly held by the balance indicator line. Now the nearest target of the pound is the Fibonacci level of 110.0% at the price of 1.2645. Overcoming this level opens the second target for the Fibonacci level of 100.0% (February 28 low) at the price of 1.2725. The price was pinned above the Fibonacci level of 123.6% on the four-hour chart, the signal line of the Marlin oscillator turned up from the border of the negative trend zone – the market is set to grow further. The following circumstance can prevent growth – a divergence with the price is formed on the Marlin, and the signal line leaving to the negative zone will finally form it. In this case, we expect the pound to fall to support the MACD line (1.2400), just below the Fibonacci level of 138.2%. In turn, pinning the price below the Fibonacci level of 138.2% will indicate the intention to overcome the support of the indicator line and move deeper down to the Fibonacci level of 161.8%, in the area of the MACD line on the daily chart. It is possible for growth to resume after overcoming yesterday's high of 1.2591. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on July 8, 2020 Posted: 07 Jul 2020 07:37 PM PDT AUD/USD The Australian dollar fell by 70 points yesterday in the morning due to the introduction of a re-quarantine in Melbourne due to the onset of the second wave of coronavirus infection. However, investors were so keen on beating the US dollar that, despite the fall in the stock market (Euro Stoxx 50 -0.85%, S&P 500 -1.08%), the main currencies returned to growth, including the Australian dollar. It wasn't until late in the evening that the bears took over. As a result, the aussie fell by 26 points. The Reserve Bank of Australia meeting, being neutral on the results, did not affect the exchange rate. The signal line of the Marlin oscillator lies on the border of the negative trend zone on the daily chart, the 1.7080 target (July 19 high) can be reached within the next day. Next, we expect growth to continue in the target range of 0.7190-0.7225, since it is very likely that the price and the Marlin oscillator are preparing to form a triple divergence, and the distance between the oscillator and the forming line is still significant. The price found support on the balance line on the four-hour chart, which indicates that the trend is under strict control of buyers. The Marlin oscillator fluctuates at the border of trends. In general, the 0.6923/79 range, determined by the local extremes of yesterday, is an area of uncertainty. The exit of the price above its upper limit will give the price the opportunity to continue growing to 0.7080, leaving the price below 0.6923 will allow you to test the strength of the MACD line in the area of 0.6892. Consolidating at 0.6892 will reveal the market scenario for a decline to 0.6680. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on July 8, 2020 Posted: 07 Jul 2020 07:37 PM PDT USD/JPY Our comment from yesterday about how it is difficult for the USD/JPY pair to grow due to significant technical resistance was realized as the price re-tested the target level of 107.77 and a quick subsequent pullback from it. But the daily candle remained white and once again the price attacked an unstable level this morning. Success will make it possible for the price to develop an offensive to the next target of 108.38. A sign of this success is the opening of today's session above the balance indicator line. The Marlin oscillator is in the growth zone. The price is trying to go above the balance line on the four-hour chart, Marlin is in a growing position. An alternative scenario assumes that the price will fall under the MACD line (107.30) followed by an attack of strong support on the daily scale of 107.07. The first sign of price development in this scenario will be its decline to the nearest extreme of 107.51. The material has been provided by InstaForex Company - www.instaforex.com |

| CADJPY coming close to descending trendline resistance! Drop incoming! Posted: 07 Jul 2020 07:35 PM PDT

Trading Recommendation Entry: 79.260 Reason for Entry: Moving average resistance, 61.8% Fibonacci retracement, descending trendline resistance Take Profit: 78.883 Reason for Take Profit: -27% Fibonacci retracement, 100% Fibonacci extension Stop Loss: 79.424 Reason for Stop Loss: Recent swing high The material has been provided by InstaForex Company - www.instaforex.com |

| CADJPY coming close to descending trendline resistance! Drop incoming! Posted: 07 Jul 2020 07:35 PM PDT

Trading Recommendation Entry: 79.260 Reason for Entry: Moving average resistance, 61.8% Fibonacci retracement, descending trendline resistance Take Profit: 78.883 Reason for Take Profit: -27% Fibonacci retracement, 100% Fibonacci extension Stop Loss: 79.424 Reason for Stop Loss: Recent swing high The material has been provided by InstaForex Company - www.instaforex.com |

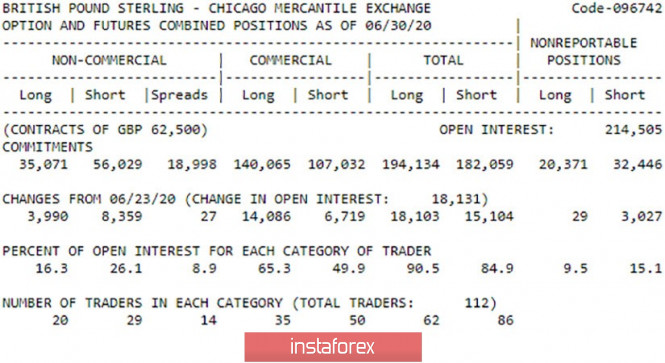

| Posted: 07 Jul 2020 05:33 PM PDT GBP/USD 1H The GBP/USD currency pair, in contrast to EUR/USD, was trading higher on Tuesday, traders managed to reach the resistance level of 1.2589, and also overcome the level of 1.2530, from which the quotes rebounded three times earlier. At the moment, the pound/dollar pair is being corrected, but a new upward trend is emerging. Since there are no trend lines or ascending channel at the moment, visually buyers may not have a clear advantage in the market. However, they are now supported by the Kijun-sen line, we do not expect the pair to be below it in the coming days. Despite the fact that the fundamental background from Britain is not too favorable, the pound continues to be in demand against the US dollar. GBP/USD 15M Both linear regression channels continue to be directed upwards on a 15-minute timeframe, so the overall trend remains upward in the short term. There are no signs of the beginning of correction at the moment. The COT report The latest COT report, which covers the dates of June 24-30, shows that major traders actively traded the pound at this time. If the major market participants mainly reduced contracts for the euro, they increased contracts for the pound. Professional market participants increased the number of contracts for purchase by 4,000,and 8,400 for sale. Thus, the net position decreased by 4,400 contracts only in the non-commercial category. It is logical for the pound to become cheaper during this period of time. The commercial group, which does not set goals to make a profit through currency operations, naturally bought the pound to a greater extent. Since if someone sells currency, then who buys it. The total net position for the pound increased during the reporting week (18,000-15,000 = +3,000). The pound sterling grew after the report expired, so we can assume that professional market participants are already looking in the direction of buying the British currency. The fundamental background for the GBP/USD pair was completely absent on Tuesday. From time to time, news is received regarding negotiations between London and Brussels on a free trade agreement, but they are not being promoted. It's just that there are constant reports that a new round of negotiations has begun, a new round of talks has ended, British Prime Minister Boris Johnson is personally going to negotiate, the meeting with EU leaders has been rescheduled, and that's all, no progress. Thus, we cannot conclude that the pound began to strengthen on Tuesday on the basis of some optimism regarding this topic. Most likely, the pound resumed growth on the basis of technical reasons, successfully breaking the level of 1.2530, which hindered buyers from going up before that. Nothing is changing for the better in the United States, therefore, the high risk of a new quarantine or just a serious blow to the economy as a result of the coronavirus outbreak may force investors to turn their backs on the dollar. Industrial production can continue to work and recover, but ordinary Americans cannot be forced to show economic activity at the level as if everything was fine. Thus, while a new outbreak of COVID-2019 is raging in the country, the US currency may continue to remain under pressure. There are two main scenarios as of July 8: 1) The upward movement has more prospects now since the resistance level of 1.2530 was passed. Thus, we recommend buying the pair while aiming for the resistance level of 1.2698, if the bears do not lose the initiative in the near future and do not fall below the Kijun-sen line. For more confidence, we recommend waiting until the first target of 1.2589 is reached. The potential Take Profit in this case will be about 100 points. 2) Sellers are advised to wait until the pair consolidates below the support area of 1.2404-1.2424, and at the same time, the Kijun-sen and Senkou Span B lines. In this case, the downward trend will again take place, and the first targets for sell orders will be 1.2311 and the support area of 1.2196–1.2216. Potential Take Profit in this case will be from 70 to 170 points. The material has been provided by InstaForex Company - www.instaforex.com |

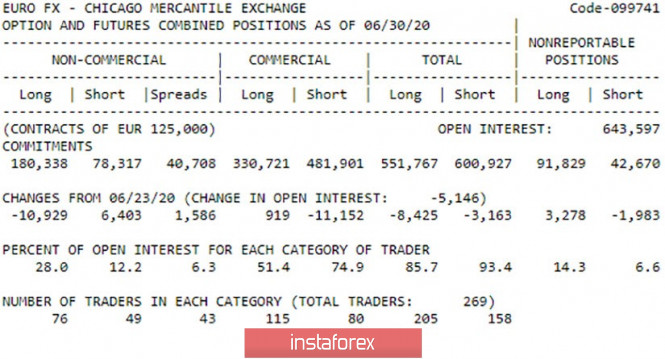

| Posted: 07 Jul 2020 05:32 PM PDT EUR/USD 1H The EUR/USD pair continued its downward movement on the hourly timeframe on July 7 after it reached the resistance area of 1.1326–1.1342 for the third time. The pair fell to the important Senkou Span B line, then rebounded from it, rose to the resistance level of 1.1304 and began to fall again since it failed to overcome it. Thus, we conclude that buyers still do not have enough strength to develop their own success. Bears still can not boast of anything, but in general, there is a sideways movement, which is most clearly visible on the higher timeframes. Thus, between the areas of 1.1326–1.1342 and 1.1227–1.1243, we do not recommend trading at all, since there is no trend in this area, and neither bulls nor bears have advantages. EUR/USD 15M. The lower channel of linear regression turned down on the 15-minute timeframe, signaling the beginning of a correction. This is exactly what happens on the hourly chart, as traders failed to overcome 1.1326–1.1342. The COT report The new COT report, which was released on Monday, showed that professional traders were busy closing buy contracts and opening sell contracts during the reporting week (June 24 – 30). It is interesting that the European currency fell in price during this period of time, but not too much, not by -17,000 contracts in the net position. At the same time, from a technical point of view, the euro/dollar pair is now in a flat, which is clearly visible on the 4-hour timeframe and higher. Therefore, we cannot conclude that major market participants have completely abandoned euro purchases. It should also be noted that market participants who hedge their risks, closed contracts for sale with the same zeal in the reporting week, thus slightly offsetting the actions of speculators. In total, 8,500 Buy-contracts and 3,000 Sell-contracts were closed. Thus, almost in any case, the euro should have fallen in price during the reporting week. But the future prospects of the euro are difficult to track on the COT report. All recent changes have not been trending. The overall fundamental background for the EUR/USD pair did not change again on Tuesday. The European currency has been trading lower for most of the day, but at the same time there is no talk of forming a new downward trend yet. There was bad news for the euro. The European Commission updated its March forecasts for economic growth in the eurozone in 2020-2021, and they were worse than the previous ones. In addition, if a free trade agreement with London is not reached, the current forecasts (-8.7% of GDP) will be revised for the worse. On the other hand, mostly negative information is being received from overseas as well. In most cases, it concerns either the coronavirus or US President Donald Trump. All information regarding Trump has little effect on the current movement of the pair and the mood of traders. But daily news about new tens of thousands of Americans infected with COVID-2019 may not allow the US dollar to resume growth. However, we have already said that the European economy and the euro have a certain advantage over the US economy and the dollar in the current conditions. The only question is whether traders have fully worked out this advantage or are we waiting for another round of strengthening of the euro? Based on all of the above, we have two trading ideas for July 8: 1) Buyers reached the area of 1.1326-1.1342 for the third time in the last month and have also failed to gain a foothold higher for the third time. Thus, we advise you to buy the euro but not before you have overcome this area with the goals of resistance levels 1.1362 and 1.1422. Potential Take Profit is up to 80 points. 2) The bears show a certain desire to return to the game, but so far their initiative is clearly not enough. The pair performed, as we expected, falling to the two strong lines of the Ichimoku indicator - Senkou Span B (1.1258) and Kijun-sen (1.1278). However, we are still waiting for the 1.1226 – 1.1242 support area to be overcome, and after that we advise you to open short positions with the goals of 1.1186 and 1.1126. The potential Take Profit in this case is from 35 to 95 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Jul 2020 05:19 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 179.4777 The British pound resumed a strong upward movement in the second half of the past day and overcame the Murray level of "5/8"-1.2512, which we called key for the prospects of the British currency. Thus, the bulls showed their best side, in contrast to the bulls on the euro/dollar pair. We just need to figure out what caused the sharp increase in demand for the British pound on Tuesday, July 7. After all, in recent days, only negative news has been coming from the UK, mainly concerning negotiations on a free trade agreement. At the end of last week, negotiations again failed, top EU officials again condemned London, saying that Britain does not want to sign a compromise agreement, and the EU is not going to sign it "at any cost." A little later, the representative of the European Commission Paolo Gentiloni warned the UK and the EU that if an agreement is not reached, it will be an additional blow to both the European and British economy. Current, far from optimistic forecasts for 2020 and 2021 implies that a trade agreement will be concluded. If not, the EU's GDP may be much weaker in 2021 than the 5% expected now. Thus, the British pound has nothing to be happy about. However, the reasons for the strengthening of the pound should be found in Britain, since the euro currency has not risen in price in pair with the dollar. Let's return to the Brexit negotiations, which unexpectedly resumed in London today. According to most experts, the current probability of reaching an agreement between London and Brussels does not exceed 10%. And this value, which is already low, falls as the end date of the "transition period" approaches. Both chief negotiators reiterated that "the parties are too far from understanding", as well as "significant differences in positions". German Chancellor Angela Merkel said that all 27 EU countries should prepare for a no-deal Brexit. Well, Boris Johnson continues to assure that the agreement, which took 7-8 years with other countries, can be reached in about a month. By the end of July, the British Prime Minister is going to agree on everything with Brussels. How this is possible is clear only to Boris Johnson. Meanwhile, British businesses that are experiencing serious problems due to the "coronavirus crisis" are calling on the British government to let them know as soon as possible whether there will be an agreement with the EU or whether it is time to launch emergency action plans in case of emergencies. UK businesses have suffered from a lack of understanding between London and Brussels in the past few years, with some companies moving their offices and factories outside of the Foggy Albion, however, there was still hope that the parties would agree. Now, only ardent optimists can believe in reaching an agreement between Brussels and London. The key differences remain the issues of competition between British and European companies, the judicial issue, the issue of fishing in British waters by European sailors, as well as the issue of compliance with European norms and standards. Thus, there was no positive news for the British pound. Moreover, the European Commission lowered its forecasts for UK GDP for 2020. According to the European Commission, the British economy will shrink by 9.7% in 2020, and not by 8.3%, as expected in March. According to the calculations of the European Commission, in the second quarter of 2020, British GDP lost 18.2%, which is more than that of any EU country. The forecast of economic growth for the UK for 2021 remained unchanged and is +6%, but only if a free trade agreement is concluded with the European Union. Otherwise, the recovery of the British economy will be slower and weaker. "The recovery in company investment is expected to be slower due to the pressure on balance sheets as a result of the COVID-19 pandemic and uncertainty around the future trade relationship between the EU and the UK," the European Commission said in a report. Also, the European Commission believes that even if the agreement is concluded, it will not be as profitable for both sides as it is now. This means that this will lead to negative consequences that will be more pronounced for Britain than for the European Union, the report says. As we said in earlier articles, Donald Trump is now mercilessly criticized by half of America and it will be difficult for him to win the election. Many officials, who are known throughout America, openly blame the American President for the fact that COVID-2019 infected about 3 million Americans and 130 thousand deaths. New York mayor Andrew Cuomo openly stated that the US leader contributes to the spread of the "coronavirus". Cuomo recalled that it was Trump who at the beginning of the epidemic repeatedly stated that "in 99% of cases, the virus does not carry any danger", and that "it will not live even until the summer". According to Cuomo, this led to the fact that the Americans did not observe the quarantine. The mayor of New York said that "Donald Trump is part of the disaster that we are in". Trump's political ratings are also bad. According to the latest polls, Joe Biden's advantage remains at around 10%. It is noted that the research was conducted by both Democrats and Republicans and gave approximately the same results. It is especially important that "wavering states" like Wisconsin, Arizona, and Florida, which in 2016 secured a victory for Trump, this time intend to vote for Biden. Many political analysts also note the fact that in some ways, Trump was just unlucky. Many Americans who do not support Trump have nothing personal against him, however, they are opposed to events related to the US President. And this is the trade war with China, "coronavirus", racial protests and rallies, high unemployment, and so on. However, political analysts also advise not to write off Trump ahead of time from the accounts. Many believe that the situation may still change before November. Experts believe that one of the main advantages of Trump, which can still help him win, is the fulfillment of his campaign promises. It was Trump who was able to build a tough dialogue with China on trade injustice, and migration policy was also changed. But Trump still has a lot of problems. One of them is racial. Many experts believe that the black population of the United States can come to the elections with only one goal – to prevent Trump from winning by casting their votes for Biden.

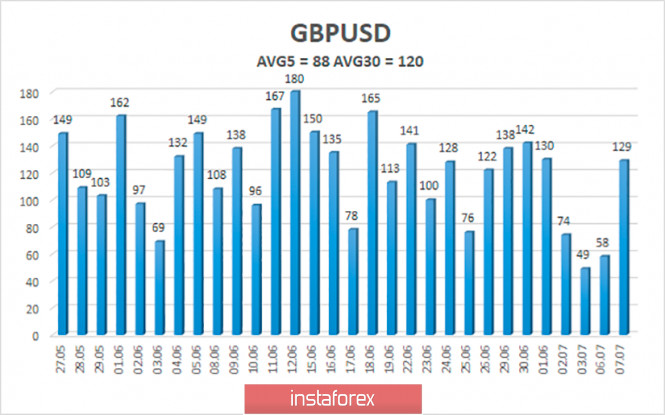

The average volatility of the GBP/USD pair continues to remain stable and is currently 88 points per day. For the pound/dollar pair, this indicator is "average". On Wednesday, July 8, thus, we expect movement within the channel, limited by the levels of 1.2459 and 1.2635. Turning the Heiken Ashi indicator downward will indicate a new round of downward correction. Nearest support levels: S1 – 1.2512 S2 – 1.2451 S3 – 1.2390 Nearest resistance levels: R1 – 1.2573 R2 – 1.2634 R3 – 1.2695 Trading recommendations: The GBP/USD pair continues its upward movement on the 4-hour timeframe. Thus, today it is recommended to buy the pound/dollar pair with the goals of 1.2634 and 1.2695 and keep them open until the Heiken Ashi indicator turns down. It is recommended to sell the pair after fixing the quotes below the moving average with the first goals of 1.2390 and 1.2329. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Jul 2020 05:10 PM PDT 4-hour timeframe

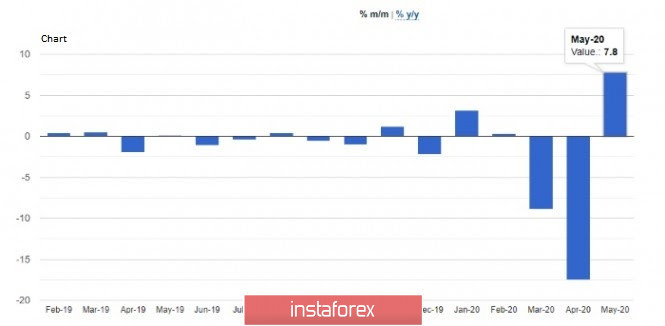

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 49.1665 The second trading day for the EUR/USD pair in more than prosaic trading. The pair worked out the Murray level of "5/8"-1.1353 for the third time, bounced off it for the third time, and adjusted to the moving average line. Thus, it is possible that now the pair's quotes will go below the moving average and try to resume the downward trend, but in general, the euro/dollar pair remains within the side channel, where it has been for about a month. Thus, in technical terms, nothing changed on Tuesday, July 7. Buyers are still afraid of new long positions, as a small amount of positive information is received from the European Union. At the same time, it does not come from the US at all, so the dollar purchases are now in doubt. However, sooner or later, the quotes will leave the side channel, we can only wait. On Tuesday, from the macroeconomic events, we can only note the publication of industrial production in Germany for May. This indicator was worse than experts' forecasts and amounted to -19.3% in annual terms and +7.8% in monthly terms. Thus, market participants expected a stronger recovery of the indicator and did not wait. Perhaps even the fall of the European currency in the first half of the day was triggered by this report, although it is difficult to believe since traders regularly ignore much more significant publications. Moreover, the pair was ready to fall due to technical reasons. However, the negative from the European Union continued to arrive. The European Commission published a summer economic forecast yesterday, in which it indicated that it expects a stronger economic downturn, despite the measures taken by the EU government and the ECB. "Our summer forecast shows, first of all, that the path to economic recovery is still paved with uncertainties," said European Commission member Paolo Gentiloni. According to new forecasts, the Eurozone's GDP will shrink by 8.7% in 2020 and grow by 6.1% in 2021. The European Commission explained that the quarantine measures were lifted and eased at a slower pace than expected in the spring, so the impact of the pandemic on economic activity was deeper, therefore the decline in 2020 will be stronger. Paolo Gentiloni also made five conclusions on the development of the EU economy for the next two years: 1) "The pandemic has hit the European economy harder than expected." 2) "Rapid and decisive policy measures have enabled and are preventing the collapse of European labor markets." 3) "The difference between EU states is increasing. The European states have been hit by the same pandemic, but the consequences are different in the member states." 4) "Inflation will remain relatively low in 2020." 5) "Uncertainties remain high, and the risks that weigh on this forecast are downward-oriented." Thus, the statements of the European Commission are full of depressing conclusions, forecasts, and expectations. With such a fundamental background, it is difficult to expect the euro to strengthen. Gentiloni also touched on the topic of global economic recovery, saying: "The decline in global GDP in 2020 due to the epidemic will be greater than we expected in the spring, reaching 4%, and the recovery will begin in 2021 at the level of 5% of GDP." Also, Gentiloni said that the accuracy of the current forecasts of the European Commission leaves much to be desired, as there are a huge number of uncertainties and factors that can turn the picture upside down, which may again harm economic growth. Also, Gentiloni noted the high risks of "divorce" of the UK and the European Union without an agreement. According to the politician, the current forecast for 2021 is based on the fact that London and Brussels will sign a free trade agreement. Gentiloni also noted that the current crisis will lead to an increase in poverty, which will have to be fought for many years. In this regard, the member of the European Commission called on the EU countries to quickly accept the 750-billion package of assistance to the European economy, which will be discussed at the EU summit on July 17-18. Earlier, several EU summits have already touched on the issue of allocating 750 billion euros to the most affected EU member states, of which about 66% of the funds will be provided on a non-refundable basis. However, the "Northern countries", the so-called "stingy four", Austria, the Netherlands, Denmark, and Sweden, are opposed to granting distribution of money and are ready to agree only to the option of lending. Thus, even at the next summit, it is far from certain that any positive decision will be made. As we said earlier, the longer the European Council considers this recovery plan, the more the economy and individual countries (Spain and Italy) will sink as a result of the "coronavirus crisis". Thus, we need to rush to approve the sources and methods of distribution of the recovery fund. In the United States, meanwhile, all attention is focused on the "coronavirus", which is breaking records every day. Although the White House remains completely calm, and Donald Trump even calls for opening all schools from the first of September, the epidemic continues to infect 40-60 thousand Americans every day, and the total number of recorded cases of the disease is already almost 3 million. However, Donald Trump continues to think only about the upcoming elections, has planned several more trips to American cities with campaign rallies, and did not miss the opportunity to "prick" the Democrats and personally Joe Biden, writing on Twitter: "Corrupt Joe Biden and the Democrats do not want to open schools in the fall for political reasons, not because of health. They think it will help them in November. Wrong, people will understand everything." Also, Donald Trump did not forget to "ride" and "false media", writing: "The death rate from the Chinese virus has decreased by 39% while our best testing program in the world continues to work. Why are fake media silent about the fact that mortality is declining? All because they are fake!" On the third trading day of the week in the European Union and the United States, no important information is planned again. In the EU, only the ECB Vice-President Luis de Guindos, who rarely makes important and high-profile statements, will make a speech. And even more so, how else can the ECB Vice-President spoil the mood of euro buyers after yesterday's forecasts and conclusions of the European Commission and regular "ultra pessimistic" speeches by Christine Lagarde? Thus, today the euro/dollar pair can remain inside the side channel, limited by the levels of 1.1200-1.1353.

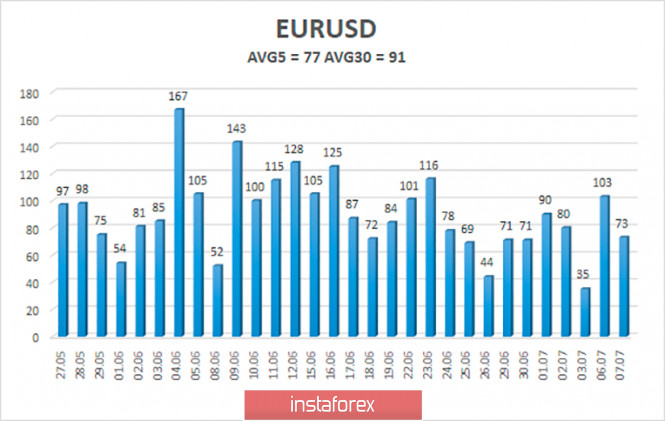

The volatility of the euro/dollar currency pair as of July 8 is 77 points and is characterized as "average". We expect the pair to move between the levels of 1.1205 and 1.1359 today. A new turn of the Heiken Ashi indicator upward will signal a new round of upward movement within the side channel. Nearest support levels: S1 – 1.1230 S2 – 1.1108 S3 – 1.0986 Nearest resistance levels: R1 – 1.1353 R2 – 1.1475 R3 – 1.1597 Trading recommendations: The EUR/USD pair continues to trade near the moving average line, inside the side channel. Thus, at this time, it is recommended to trade down if traders manage to overcome the level of 1.1200, which is the approximate lower limit of the channel, with the goal of 1.1108. It is recommended to open buy orders not earlier than the Murray level of "5/8"-1.1353 with a target of 1.1475. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Jul 2020 01:57 PM PDT The euro-dollar pair retreated from its local highs today, plunging to the middle of the 12th figure. The downward correction was primarily due to the weakening of the euro-traders, who reacted negatively to the updated forecast of the European Commission, which was more pessimistic than the spring version. However, the corrective decline was temporary: bears could not pick up the banner and impulsively pull down the price to the support level of 1.1260 (the average line of the Bollinger Bands indicator coincides with the Tenkan-sen and Kijun-sen lines), although some pressure is still maintained on the pair. There is a positional struggle between buyers and sellers: according to its results, the price will either gain a foothold in the area of the 13th figure, or return to the area of the 11th price level. On the one hand, the European Commission report was really disappointing: according to updated forecasts, the eurozone economy will contract by almost nine percent this year (8.7%), and, accordingly, will grow by 6.1% next year. The forecast was revised downward relative to the spring estimates. At that time, Brussels predicted a 7.7% decline in the European economy. But as Europe left the quarantine "at a slower pace than previously thought," EC economists revised their previous estimates. If we talk about specific countries, France, Italy and Spain are among the most affected. There, the volume of GDP in 2020 will be reduced by more than 10%. But the European Commission has not changed its forecast for Germany: the German economy should contract by 6.3% (the forecast was at the level of -6.5% back in May). It is noteworthy that according to EC experts, the Polish economy will experience the smallest recession in the European Union (-4.6%) this year. According to the report, the Polish economy has demonstrated relative stress tolerance due to the low level of impact on the affected sectors and a "diversified economic structure". As for the inflation outlook, weak dynamics are also expected. Despite the growth of the oil market and rising food prices, the impact of these factors on the overall inflation rate will be offset by weak economic growth and low consumer activity. The euro-dollar pair plunged to the middle of the 12th figure after the disappointing report was released. But the weak position of the US currency prevented the bears from developing a downward momentum. Sellers gave up after several attempts to storm the support level of 1.1260. This was partly facilitated by Isabel Schnabel, a member of the European Central Bank's Executive Board. According to her, the latest macroeconomic reports "were very positive", and this, in her opinion, indicates that the coronavirus crisis may be less destructive, and the recession is not as deep as previously assumed. She also clarified that "the main scenario for the development of the situation" is currently being implemented in Europe. This rhetoric sharply contrasted with the published forecast of the European Commission. Therefore, the euro-dollar pair is stuck in place following sharp price fluctuations, waiting for the next information. Meanwhile, the greenback shows a downward trend throughout the market: the dollar index has returned to the area of 96 points, reflecting a decline in demand. To one extent or another, the US currency has weakened in almost all key pairs (to one degree or another). Despite US President Donald Trump's reassuring admonitions about reducing deaths from COVID-19 in the US, traders remain concerned about the rate of spread of the coronavirus in the country. The daily growth rate of infected people is stable above 40,000, and has been above 45,000 new cases since June 30. The dynamics are clearly upward, so the dollar is under background pressure. On the one hand, the White House clearly does not intend to close the country to quarantine, but on the other hand, state authorities can tighten (and are already tightening) restrictive measures at the local level. This ambiguous fundamental background determines the flat movement of the EUR/USD pair. Given the fact that the economic calendar is almost empty on Wednesday, American doctors will be the main newsmakers of the currency market – the greenback will show weakness if the growth rate of the number of infected exceeds the 50,000 mark again, allowing the bulls to seize the initiative. From the technical point of view, buyers still manage to stay above the support level of 1.1260 - the average line of the Bollinger Bands indicator on the daily chart, which coincides with the Tenkan-sen and Kijun-sen lines. In turn, the Ichimoku indicator shows a bullish Parade of Lines signal. All this indicates the priority of longs to the first resistance level of 1.1360 – this is the upper line of Bollinger Bands on the same timeframe. This scenario has almost been realized today – the pair has risen to the level of 1.1332. The situation has not technically changed at the moment: buyers can still prove themselves by testing the above resistance level. The material has been provided by InstaForex Company - www.instaforex.com |

| July 7, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 07 Jul 2020 11:30 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) then 1.1315 (78.6% Fibonacci Level) where bearish rejection was anticipated. Although the EUR/USD pair has temporarily expressed a bullish breakout above 1.1315 (78.6% Fibonacci Level), bearish rejection was being demonstrated in the period between June 10th- June 12th. This suggested a probable bearish reversal around the Recent Price Zone of (1.1270-1.1315) to be watched by Intraday traders. Hence, Bearish persistence below 1.1250-1.1240 (Head & Shoulders Pattern neckline) was needed to confirm the pattern & to enhance further bearish decline towards 1.1150. Moreover, bearish breakdown below the depicted keyzone around 1.1150 is mandatory to ensure further bearish decline towards 1.1070 and 1.0990 if enough bearish pressure is maintained. Trade recommendations : The current bullish movement towards the price zone around 1.1300-1.1330 (recently-established supply zone) should be followed by Intraday Traders as a valid SELL Signal.T/P levels to be located around 1.1175 then 1.1100 while S/L to be placed above 1.1350. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EURUSD for July 7, 2020 Posted: 07 Jul 2020 09:35 AM PDT

EURUSD: In the morning, the euro was sold strongly until almost 1.1250. However, at about 13:00 UTC, it was bought back strongly to 1.1300. The euro was then again sold almost to the lows of the day, but it was quickly bought up again. You may keep purchases from 1.1245 until further developments. Stop at 1.1240 with a target up to 1.1500. The material has been provided by InstaForex Company - www.instaforex.com |

| Short-term Ichimoku cloud indicator analysis of EURUSD for July 7, 2020 Posted: 07 Jul 2020 08:44 AM PDT EURUSD remains in a bullish trend according to the Ichimoku cloud indicator as price is above the Daily Kumo (cloud). In our previous analysis we noted the importance of the 1.1285-1.13 area. This was once resistance and is now support.

|

| Gold price following Inverted head and shoulders pattern from end of June Posted: 07 Jul 2020 08:39 AM PDT Back in June we pointed out an inverted head and shoulders break out to the upside with this analysis. Then our first target was $1,780. This level has been reached and price continues to be supported and continues to make higher highs and higher lows. Gold could be heading towards the second target of $1,820.

Black line - support trend line Red lines - expected size of upward breakout Gold price is now making new 2020 highs. Trend remains bullish as we have been saying in all of our analysis. Yes bulls need to be cautious and raise their stops to protect their profits. Support is now found at $1,773 for the short-term. Medium-term support is at $1,740 area. Gold should continue higher this week towards our second target. The material has been provided by InstaForex Company - www.instaforex.com |

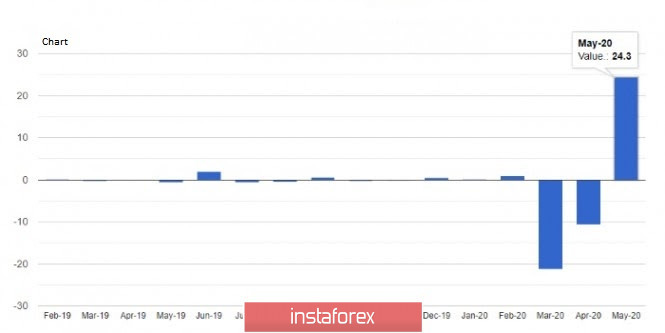

| Posted: 07 Jul 2020 08:36 AM PDT The euro declined against the US dollar, and the British pound surged higher after the appearance of another rumor related to the secret Brexit negotiations. Pressure on the euro was exerted by today's reports on Germany, as well as the forecast of the European Commission, which was filled with one negative. However, the current movement of the euro/dollar pair is purely corrective, and so far, buyers of risky assets are still quite far from panicking. Now let's look at the report on industrial production in Germany, which caused the fall of the European currency in the first half of the day. Even though the monthly growth rate has broken all records, serious problems for the German economy cannot be avoided. The data fell short of economists' forecasts, which suggests that a return to normal life will be quite difficult. Given the fact that orders also did not show strong growth, and it will be possible to make a full assessment of the damage from the coronavirus only in the late autumn of this year, it is rather premature to say that the recovery of the industry will remain at a high level. Most likely, the movement will be undulating, and much will depend on how Germany copes with the second wave of the epidemic. According to the Federal Bureau of Statistics Destatis, in May of this year, due to the easing of quarantine measures, compared with April, industrial production in Germany increased sharply. The indicator includes an assessment of the manufacturing industry, energy, and construction. Thus, industrial production jumped immediately by 7.8%, while economists expected growth of 10%. Compared to May last year, industrial production decreased by 19.3%. If we take the indicator separately by direction, manufacturing production in May increased by 10.3%, while the production of intermediate goods decreased by 0.1%. The main growth was in the capital goods sector by 27.6%, while consumer goods increased by only 1.4%. It is already clear that a more active recovery of the Eurozone economy will require the adoption of the European Commission's proposed plan to stimulate the economy. However, this issue is unlikely to be raised until the meeting of EU leaders scheduled for July 17-18. If the agreement is approved, and Germany and other Northern countries do not become very resistant, given the latest macroeconomic statistics, the demand for the European currency may increase even more. Therefore, do not be surprised if the euro strengthens closer to the summit, even against the background of negative data, as many institutional investors will gain long positions on risky assets. However, any delay in negotiations is fraught with downside risks for both the Eurozone economy and the European currency. Another unpleasant report was the forecast of the European Commission, according to which they revised their attitude to GDP for 2020. According to the data, economists now forecast a reduction in Eurozone's GDP in 2020 by 8.7%, whereas a little earlier it was only a reduction of 7.7%. As for Germany, it is the only country where the report was revised in a positive direction. The economy is expected to contract by 6.3% against 6.5% in 2020. Italy's GDP is likely to fall by 11.2% against 9.5%, while France's GDP will shrink immediately by 10.6% against the previous estimate of 8.2%. The revision came after the initial analysis and response of these countries to the coronavirus pandemic after the opening of economies and the lifting of quarantine measures. As for Italy, a report was released today, which indicated a sharp increase in retail sales after the gradual lifting of quarantine measures and the reopening of stores. According to statistics agency Istat, in May 2020, the retail sales index increased by 24.3%. The growth was mainly due to a sharp jump in non-food products by 66.3%. Meanwhile, the panic eased, and sales of food and essential goods fell by 1.4% compared to April. As for the technical picture of the EURUSD pair, now a lot will depend on how traders behave at the level of 1.1270, which was formed today in the first half of the day after a sharp decline in the trading instrument against the background of negative fundamental statistics. If the bulls again show enough activity, as it was in the first half of the day, we can count on a repeated return of the EURUSD to the resistance of 1.1300 and its breakout, which will provide an influx of new buyers who can drive the euro to weekly highs to the levels of 1.1350. Meanwhile, the British pound shot up after breaking through the 1.2520 resistance, which was the main focus of buyers in the first half of the day. The increase came after rumors that representatives of the UK and the European Union will soon hold informal trade talks. As you may remember, no significant progress was made last week, as the European side still insists on following common rules and standards in the field of trade. Likely, Prime Minister Boris Johnson may also take part in the informal meeting. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound sterling fails to update its maximum Posted: 07 Jul 2020 08:27 AM PDT

This morning, the pound sterling continues to remain near its maximum value. However, it did not manage to overcome it and go further. Market participants are waiting for further decisions from the government regarding the growing expenditures on the infrastructure of the state. The pound continues to hold maximum defense against the greenback. Its value has risen in relation to the euro. All this became an echo of the general trend, which reflects the interest of market participants in risky assets. The pound was no exception, especially since it was supported by the expectation of a detailed action plan for further monetary policy, which was supposed to be presented by the UK government. Investors are waiting for the chancellor's speech tomorrow, while it should address the issue of expanding the government spending program. Prior to this, the country's prime minister has already said that the authorities want to spend an additional 5 billion investment specifically on infrastructure development. Rishi Sunak announced payments in the amount of 500 pounds or 624 dollars, one of which will be made per adult, the other 250 pounds per child. It is assumed that the money will be spent and support exactly the sector of the economy that really needs it. It is precisely on these indirect investments that the UK government is betting. The previous course of Boris Johnson was recognized as not too effective and insufficient. Investors are tuned in to the financing proposed by the chancellor, as it will be evidence of greater generosity from the state, and this in turn will support the national currency. The value of the pound this morning has slightly decreased in relation to the dollar. Its new level is in the range of 1.2475 dollars per pound. At the same time, it is very close to its maximum value of 1.2568 dollars per pound. Meanwhile, in relation to the euro, the pound sterling, on the contrary, grew a little by 0.1% and began to consolidate in the region of 90.49 pence. However, not all market participants share a positive view on the future growth prospects of the pound. So, there are those who behave in restraint reminding everyone of the unresolved issue of a trade agreement between the UK and the EU. Recall that the negotiation process on Brexit continues to this day and is quite difficult. So far no clear decisions have been made. This factor is a significant constraint on the growth of the pound, and the fact that it is not being recouped by investors now does not mean that they have forgotten about it forever. This caution of market participants was visible at the moment when the currency was trying to cope with a height of 1.25 dollars, which was a long and stressful one. So this time, the pound will most likely not be able to take a new height with ease. Everything will largely depend on the mood of the greenback, which plays a decisive role in this pair. The material has been provided by InstaForex Company - www.instaforex.com |

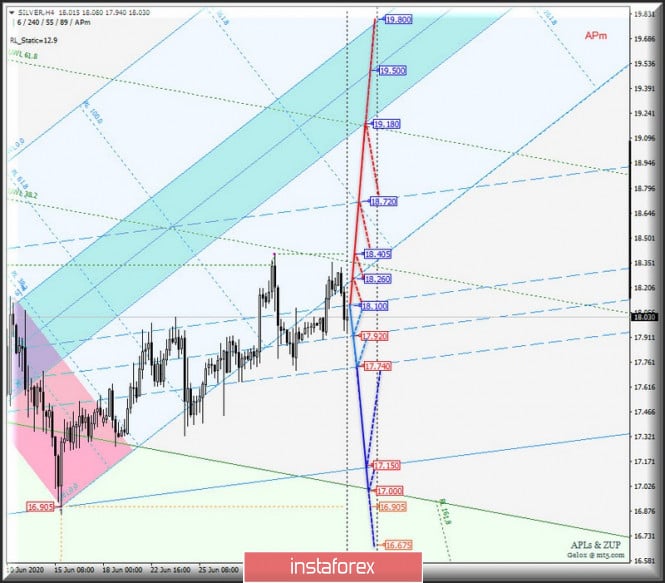

| Comprehensive analysis of movement options for Gold and Silver (H4) on July 8, 2020 Posted: 07 Jul 2020 08:09 AM PDT Minute operational scale (H4) Gold and Silver - overview of movement options from July 8, 2020. ____________________ Spot Gold The development of the Spot Gold movement from July 8, 2020 will continue to be determined by the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1772.80 - 1778.80 - 1784.80) of the Minuette operational scale fork - details of working out these levels are shown on the animated chart. Breakdown of the lower border of the channel 1/2 Median Line of the Minuette operational scale fork - support level of 1772.80 - a variant of the development of the downward movement of Spot Gold to the goals: final Shiff Line (1765.00) of the Minute operational scale fork; equilibrium zone (1759.00 - 1749.00 - 1740.00) of the Minuette operational scale fork; with the prospect of reaching the boundaries of the channel 1/2 Median Line Minute (1729.00 - 1717.17 - 1707.00). If the upper border of the channel is broken 1/2 Median Line Minuette - resistance level of 1784.80 - option to continue the development of the upward movement of Spot Gold to the goals: local maximum 1788.73. UTL control line (1803.00) of the Minuette operational scale fork; upper bound of ISL61.8 (1808.80) balance zone of the Minute operational scale fork. Details of the Spot Gold movement from July 8, 2020 can be seen on the animated chart.

____________________ Spot Silver The development of the Spot Silver movement from June 25 2020 will also be due to the development and direction of the breakdown of the 1/2 Median Line channel boundaries (18.100 - 17.920 - 17.740) of the Minuette operational scale fork - we look at the animated chart for details of the processing of the above levels. Breakdown of the lower border of the channel 1/2 Median Line Minuette - support level of 17.740 - continuation of the downward movement of Spot Silver to the control line LTL (17.150) of the Minuette operational scale fork and the initial line SSL (17.000) of the Minute operational scale fork. When the upper border of the channel is broken 1/2 Median Line Minuette - the resistance level of 18.100 - a variant of the upward movement of Spot Silver to the goals: initial line SSL Minuette (18.260); local maximum 18.405; ultimate Shiff Line Minuette (18.720); with the prospect of reaching the boundaries of the equilibrium zone (19.180 - 19.500 - 19.800) of the Minuette operational scale fork. Details of the Spot Silver movement options from July 8, 2020 are shown in the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: USD seems to be hard nut to crack but EUR fighting to keep afloat Posted: 07 Jul 2020 06:56 AM PDT Investors are seeking shelter in light of the news on the COVID-19 front. The US reports a surge of new coronavirus cases, Australia re-imposed lockdown measures, and a new outbreak has been recorded in Asia. Such developments boost demand for safe haven assets. Amid risk aversion, the greenback has regained footing versus major rival currencies. The US dollar index has got firmly stuck at a trading range of 96 – 98 points, analysts at the National Australia Bank noted. They reckon a serious shift towards risk-on mood is needed to see the index testing the lower border of that trading range. The non-manufacturing PMI from ISM came out beyond expectations. The indicator of the service sector's business activity jumped to 57.1 in June, much higher than the projected 50.0 score. Nevertheless, this has not dispelled fears about the devastating pandemic impact on the US economy. Citing Raphael W. Bostick, the Federal Reserve Bank of Atlanta President, the fragile recovery of the US economy is running the risk of being disrupted due to a spike in coronavirus cases in the South and West of the country. Amid the broad-based advance of the US dollar, EUR/USD retreated from two-week highs at near 1.1329. Meanwhile, the euro is weighed down by a sluggish economic recovery. On Tuesday, data showed that Germany's industrial production rebounded 7.8% in May following a record slump of minus 17.5% in April. Nevertheless, experts had projected more robust expansion of 10.0%. It proves that business activity in the key sector of the German economy remains subdued. Today, the European Commission posted a revised GDP outlook for 2020. The eurozone's economy is expected to plunge 8.7% this year. This is going to be the steepest contraction on record. In the previous forecast released in May, the European Commission had reckoned a 7.7% drop this year. "The economic impact of the lockdown is more severe than we initially expected," Vice President of the European Commission Valdis Dombrovskis said in a statement accompanying the release of the downgraded forecasts. The EU economy is on a roller coaster facing a lot of headwinds, including a threat of a new pandemic wave, he added. The European Commission warns that Europe's capacity to exit recession is crippled by the COVID-19 damage to the US economy and key emerging markets for EU exports like Latin America and India. Among the EU countries, Italy, Spain, and France are expected to reveal the sharpest rates of GDP contraction this year. Their national economic output is projected to plummet 11.2%, 10.9%, and 10.6% respectively. According to analysts at OCBC, EUR/USD is now flirting with local lows at near 1.13 amid the US dollar's advance across the board. The most popular currency pair again failed to break the level of 1.1350 which confirmed its status of strong resistance. Its breakout could open the door for the bulls to the area of 1.1420 – 1.1430. Support is seen at 1.1280. Under such market conditions, it would be a good idea to wait until one of the borders of the trading range is clearly breached. This direction will determine a further trajectory of EUR/USD. The material has been provided by InstaForex Company - www.instaforex.com |

| Stock markets of Europe, US, and Asia go to different sides Posted: 07 Jul 2020 06:53 AM PDT Today, the stock markets of the Asia-Pacific region have not registered any significant changes. The markets failed to take one side or the other showing almost no dynamics. Japan's Nikkei 225 index fell by 0.64%. At the same time, the level of consumer spending in the country significantly decreased in the last month of spring. The indicator dropped by 16.2% compared to the same period last year. Preliminary data was slightly better. Economists had expected a decline of 12.2%. China's Shanghai Composite rose by 1.42%. However, Hong Kong's Hang Seng index declined by 0.59%. Among the leaders of a rise are car manufacturer Geely Automobile Holdings Ltd., which shares managed to increase by 5.4%, as well as insurance company China Life Insurance Co.. Its shares jumped by 4.9%. Wharf Real Estate Investment Co. showed the largest decrease of 3.7%. South Korea's Kospi index lost 0.98% in the morning. At the same time, during the day, it managed to get close to this month's high. The success was driven by hopes for a rapid economic recovery to the level that existed before the crisis caused by the coronavirus pandemic. Leading companies in the country such as Samsung Electronics Co., Kia Motors Corp., and Hyundai Motor Co noted a reduction in the value of shares. The Australian S&P/ASX 200 index also went down, but the fall is not significant. It inched down by 0.03%. In the previous days, it managed to advance against the background of news on monetary policy. Today, the main regulator of the state decided to leave the key rate at the same extremely low level of 0.25%. In addition, it was noted that under the current extremely difficult economic conditions in the world, a slump in the Australian economy is still not as deep as, for example, in the United States or other countries of the region. The stock markets of the United States began to experience a wave of positive emotions this week. The rise was recorded in all major areas following the results of yesterday's trading day. The growth was triggered by positive data on business activity in the country's services sector in June. The figures exceeded the forecasts of market participants and economists. In addition, the data reflected a stable and rapid recovery of the world's second largest economy. At the same time, investors have almost stopped reacting to the increase in the number of new virus cases despite the fact that its pace is accelerating every day. The US services PMI in June climbed to 57.1 points, while earlier, in May, it was at the level of 45.4 points. This advance is really important as it has demonstrated an increase in consumer confidence in this sector. Market participants have also priced in the report that reflected the Chinese economic recovery. Moreover, they are showing interest to risky currencies such as the Chinese yuan which soared against the US dollar. China's securities also moved up for the fifth consecutive trading session. The US statistical data is also rather strong. So, there was a jump in the number of jobs, which affected the Nasdaq index. It hit its record high. The S&P500 index increased by 40% compared to the previous minimum value recorded at the end of March. Growth in stock markets has not been stopped even by the severe epidemiological situation in the United States and the whole world. However, there is a strong possibility of the second wave of the COVID-19 pandemic. Investors will hardly ignore this fact: some negative correction should occur. The only question is how strong and prolonged it will be. The Dow Jones index rose by 1.78% to reach the level of 26,287.03 points. The S&P 500 index jumped by 1.59% to 3,179.72. At the same time, the Nasdaq Composite index became the leader of the US market: it soared by 2.21% to 10,443.65 points. The European stock markets are still in the negative zone. Almost all indices fell today. The main reason is weak statistical data from Germany. Thus, Germany's industrial production figures were unexpectedly disappointing. The total output in the German industrial sector for the last month of spring was 7.8% higher compared to the previous month. At the same time, an advance in May was not as significant as analysts had expected. Negative figures from Germany were slightly softened by data from Italy. There, economists logged a rapid increase in retail sales. The indicator jumped by 24.3%. In the previous month, retail sales dropped by 10.7%. However, the European Commission did not take into account the Italian statistical data and lowered the forecasts for the EU's economic growth in 2020-2021. After adjustment, the economy may contract by 8.3% this year and rise by 5.8% in 2021. The previous data showed a fall of no more than 7.4% this year and an increase of 6.1% in 2021. The overall STOXX Europe 600 index of the eurozone businesses fell by 1% to the level of 367.48 points. The UK's FTSE 100 index declined by 1.15%. Germany's DAX index was down by 1.35%. France's CAC index lost 1.09%. Italy's FTSE MIB index dropped only by 0.37%. Spain's IBEX 35 index slid by1.23%. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Jul 2020 06:49 AM PDT

The cost of crude oil this morning moved to a negative trend. The main reason for the decline lies in the extreme concern of investors regarding the introduction of new restrictive quarantine measures related to coronavirus infection. New cases of infection are noted not only in the United States and Latin America but also throughout the interval from Japan and Australia to Iran. Moreover, in America itself, the number of patients is growing rapidly. At present, their total number of cases has exceeded to 3 million. In order to stop the spread of infection, the authorities of some American states had to resort again to restrictive measures, which earlier had already begun to be systematically lifted. This situation looks extremely tense for market participants who are already tuned in to a quick strengthening of the oil market. Analysts warn that the growth rate of demand for black gold will greatly decline in the near future also due to the re-implementation of quarantine measures. It should be noted that the first wave of the pandemic already sent demand to the negative zone. The enthusiasm of market participants, which was noted against the backdrop of the lifting of quarantine and the removal of restrictive measures, almost completely disappeared along with a partial return to them. According to analysts, gasoline consumption in the United States of America during the weekend holiday not only did not increase but also decreased quite significantly by 22%. According to preliminary forecasts by experts, the next report on stocks of raw materials in America should reflect an increase in the total volume of gasoline by about 1 million barrels. At the same time, crude oil inventories should be reduced by 3 million barrels. And distillates, in turn, will grow by 500,000 barrels. The price of Brent crude oil futures for delivery in September at a trading floor in London this morning fell by 0.65% or $ 0.28. Its current level was at around 42.82 dollars per barrel. Recall that yesterday's trading session ended with a slight increase of 0.7% or 0.3 dollars. The price of WTI light crude oil futures for August delivery on an electronic trading floor in New York fell by 0.71% or $ 0.29, pushing it to $ 40.34 a barrel. Yesterday, its value stopped at a growth of 0.9% or 0.36 dollars. While the raw materials hold the defense and did not fall below strategic importance for the further strengthening of the mark of $ 40 per barrel. However, the market is now beginning to face serious external pressure, which could lead to even more powerful subsidence. Some support for black gold does exist. So, it is worth waiting for from the side of reducing raw material production in the United States. Earlier it was reported that the mining companies tried to take advantage of the increase in oil prices in order to earn and win back the opportunities lost in the crisis. For this purpose, previously frozen production was resumed. However, it has now become clear that prices just above $ 40 per barrel are clearly not enough to start large-scale production. The largest companies came to the conclusion that increasing production will not only not save them from accumulated debts, but will also have a very negative impact on the world market and prices, respectively, which will complicate their work in the long term. In this regard, corporations decide to abandon the launch of additional stations until better times, According to the United States Department of Energy, oil production in the country declined significantly in the first month of summer, reaching 10.5 million barrels per day. Recall that in March it was at around 13 million barrels per day. In just eleven weeks, it was possible to significantly reduce production, which was a record for the pace. OPEC countries also support the current trend, which is already having a positive effect on the global raw materials market. The price of oil has strengthened well, which means that the organization's policy and its actions under the agreement on the reduction of oil production have borne fruit. Nevertheless, while prices have not been able to reach even last year's level for the same period. In the future, the prospects for the increasing demand for raw materials remain very vague. So far, only one thing is clear: as long as the epidemiological situation in the world is not stabilized, the oil market has a significant pressure factor, which will be very difficult to overcome. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EURUSD for July 07, 2020 Posted: 07 Jul 2020 06:15 AM PDT

EURUSD: In the morning, the EUR/USD bulls were depressed due to the strong fall of the euro which has canceled the growth that was happening several times in June. However, by 13:00 UTC, the picture has changed radically. Now the growth resumes with the initial target at 1.1340 and upon breaking through this level, it may continue towards 1.1420 and further to 1.1500. We'll see how the rest will unfold. So far, you may keep purchases from 1.1245 with a stop at 1.1258. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold about to hit $1,800 per ounce Posted: 07 Jul 2020 05:42 AM PDT

Despite the threat of the second wave of coronavirus, gold remains stable. Commodities analyst Jigar Trivedi believes that gold will be strong despite the contentious relationship between the US and China. Moreover, the American economy is reviving. That is why there is no reason to worry about the prospects of gold. Today, gold is trading at $1,774.84 per troy ounce. Silver rose by 0.72% to $18.17 per ounce. Palladium became cheaper by 0.5% to $1,913.56 per ounce. The price of platinum grew by 1.45% to $811.45. BCS Global Markets analysts believe that gold could surge soon, because last week it exceeded the level of $1,800. However, by the end of the week, gold fell again to the levels of the previous week. Experts argue that the potential for further growth in gold prices remains high. The material has been provided by InstaForex Company - www.instaforex.com |

| Threat of second global quarantine strengthens US dollar Posted: 07 Jul 2020 05:37 AM PDT

After falling on Monday, the US dollar is stable against most major currencies. Melbourne was plunged into quarantine again as virus infections are rising in the city. In this regard, the Australian dollar fell from a monthly high. Investors hope to avoid large-scale closures. They are paying close attention to the number of new COVID-19 cases in the United States and India. Chris Weston, head of research at Melbourne's Pepperstone brokerage company, says the country is not experiencing a spike in diseases, but the growing number of infected people is alarming. Mr. Weston believes that sudden signs of a sell-off in the Treasury market, could lead to serious consequences. He is sure that it is better to leave things as they are. Then, the market may see a rise. The euro dropped slightly below its two-week high on Monday to $1.1311 while the pound sterling remained unchanged at $1.2505. The Chinese yuan strengthened amid the rapid growth of the Chinese stocks to 107.36 per dollar. According to the latest data, last month, activity in the US services sector recovered almost to the level that was before the pandemic. However, there are still risks that quarantine may be resumed. In this regard, the US dollar may become weak, according to strategists from Singapore's OCBC Bank. At the same time, coronavirus continues to spread throughout the world. In the United States, virus infections have grown by tens of thousands across the country. More than 130,000 people died. Also, in Australia, borders between the two most populous states are closed in order to contain the virus spread. Despite this news, analysts at National Australia Bank are confident that the dollar will stay in the range of 96-98. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on July 7 Posted: 07 Jul 2020 05:23 AM PDT To open long positions on GBPUSD, you need: In the first half of the day, the bears tried to put pressure on the British pound, however, they failed to even get to the support of 1.2448, after which the bulls quickly rehabilitated. Now the task of buyers of the pound is to keep the pair above the resistance of 1.2516. If you look at the 5-minute chart, there is already a breakout and a test of this level, which is a signal to enter the market. However, it is necessary to understand that without high activity of bulls above this range and under the most weekly highs, it is impossible to do. If there is no growth at the beginning of the North American session, it is best to postpone long positions until the update of the larger support of 1.2448, which I spoke about in the morning forecast. There you can buy GBP/USD immediately on the rebound in the expectation of a correction of 35-40 points within the day. But while trading will be conducted above the level of 1.2516, we can expect continued growth of the pound in the area of the maximum of 1.2585, and then the exit to a new resistance of 1.2676, where I recommend fixing the profits.

To open short positions on GBPUSD, you need: Sellers should protect the level of 1.2516, and the formation of a false breakout on it in the second half of the day will be a direct signal to open short positions in the hope of returning and updating the support of 1.2448, which has been discussed quite a lot recently. Only a breakdown of this level will lead to the resumption of a bearish trend that can collapse the pound to the lows of 1.2386 and 1.2321, where I recommend fixing the profits. If the demand for GBP/USD continues, then it is better not to rush with sales. The optimal scenario will be short positions after the resistance test of 1.2585, however, major players will focus on the maximum of 1.2676, from which you can expect a correction of 30-40 points within the day.

Signals of indicators: Moving averages Trading is conducted just above the 30 and 50 daily averages, which leaves a chance of continuing the upward correction of the pound. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower border of the indicator at 1.2470 should increase pressure on the British pound. Breaking the upper limit of the indicator around 1.2515 will lead to a new growth of GBP/USD. Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment