Forex analysis review |

- Hot forecast and trading signals for the GBP/USD pair for August 7. COT report. Britain fears no trade deal with the US if

- Hot forecast and trading signals for the EUR/USD pair on August 7. COT report. Trump complains about Russia, laments the

- Overview of the GBP/USD pair. August 7. The Bank of England makes "ultra-optimistic" forecasts and is not going to introduce

- Overview of the EUR/USD pair. August 7. Joe Biden: the trade deal with China is collapsing. Donald Trump benefits from "coronavirus"

- GBP/USD. Bank of England eased investors' fears, but sharp growth did not take place

- Analysis and trading signals for beginners. How to trade the EUR/USD pair on August 7? Analysis of Thursday. Preparation

- August 6, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- August 6, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- August 6, 2020 : EUR/USD daily technical review and trade recommendations.

- Pound sterling resume to conquer new highs

- EUR / USD: Dollar may continue to fall

- GBP / USD: Bank of England to still introduce negative rates despite Brexit deal

- Trading recommendations for the GBP/USD pair on August 6

- US stock exchanges experienced enthusiastic rise while Europe and Asian stocks went stably

- Analysis of EUR/USD and GBP/USD for August 6. Dr. Anthony Fauci: Testing for coronavirus as it is now is basically meaningless

- GBPUSD fundamental analysis. Pound advances after BoE decision

- BTC analysis for August 06,.2020 - Upside breakout of the ascending triangle and potential for test of $12.150

- Analysis of Gold for August 06,.2020 - Another ascending triangle in creation and potential for test of $2.100

- Comprehensive analysis of movement options for Palladium & Platinum (H4) on August 7, 2020

- EUR/USD analysis for August 06 2020 - Third target at 1.1900 reached but with potential for re-visit and even test of 1.2000

- Black gold hits five-month high

- GBP/USD On The Way Up!

- GBP/USD: plan for the American session on August 6

- EUR/USD: plan for the American session on August 6

- EUR / USD: dollar strives to regain lost ground

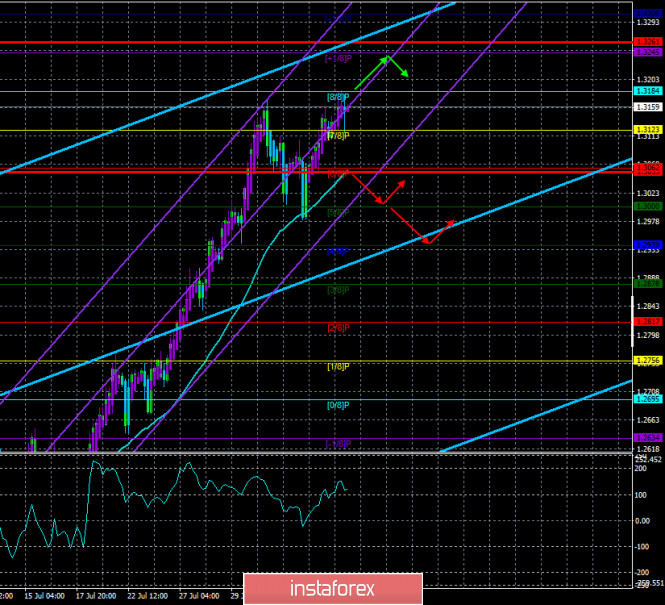

| Posted: 06 Aug 2020 06:33 PM PDT GBP/USD 1H The GBP/USD pair moved almost identically to the European currency on August 6, although the pound had extremely important fundamental factors at its disposal that the euro did not have. However, the quotes of the pound/dollar pair rose to its previous local high of 1.3169 and also failed to overcome it. Thus, in the case of the British pound, buyers were unable to overcome an important resistance and continue forming an upward trend. Therefore, the bears get a new chance to start a downward movement with the lowest level near the previous local low – 1.2980. The question is: do they need these chances? GBP/USD 15M Both linear regression channels are directed upwards on the 15-minute timeframe, and signal an upward trend in the most short-term plan. The latest Commitments of Traders (COT) report for the British pound was even more suspicious than the previous one. The COT report for July 15-21 showed that non-commercial traders opened more Sell-contracts than Buy-contracts, however, the British pound continued to grow during this period. The COT report for July 22-28 showed approximately the same picture. The non-commercial category of traders, which is considered the "engine" of the market, opened 2,700 Sell-contracts and closed (!) 8,700 thousand Buy-contracts. Thus, the net position for this category of traders has fallen even further, which generally means that the bearish mood has increased. It turns out that professional traders have been getting rid of Buy-contracts or opening Sell-positions for two weeks, and the pound has been falling for only a few days and has already managed to win back all the losses. We believe that this particular behavior of non-commercial traders still indicates that the market is preparing for a new and prolonged fall in the British currency. By and large, this discrepancy between the actions of professional traders and what is happening in the market is called divergence which usually warns of a possible change in the trend. The fundamental background for the GBP/USD pair remained the same on Thursday, August 6, although Bank of England Governor Andrew Bailey managed to give additional optimism to buyers of the pound, stating that "BA is not going to move to negative rates in the near future", and also raising forecasts for GDP for 2020. However, it seems that even without this information, the pound would have continued to grow today, as the euro did, for example. Meanwhile, the UK is beginning to worry that US President Donald Trump will be defeated in the election and then the trade deal between the UK and the US will not come to fruition, which British Prime Minister Boris Johnson is counting on. Not that it was harder to negotiate with Joe Biden, but rather the opposite. However, the Democrat is a proponent of more global views on trade and will certainly not appreciate London's offer. Plus, we should not forget that the potential deal between London and Washington is almost a personal promise of Trump to Johnson. And at the same time, the US leader wants Britain to have no trade deals with the European Union. Formally, the first meetings to discuss trade issues between the two countries have already been held, but the negotiations have not officially started yet. And if Trump loses the election, it may not start. As we can see, there are still countries in the world that are interested in Trump's re-election. There are two main options for the development of events on August 7: 1) The buyers quickly returned the initiative to their own hands. However, they cannot go above the previous high of 1.3169. Thus, we recommend opening new purchases of the British currency, but not before we overcome 1.3169 with targets at the resistance levels of 1.3240 and 1.3400. Potential Take Profit in this case is from 40 to 200 points. 2) The bears missed the chances given to them, but still have the opportunity to start a new course down. You are advised to open new short positions in the pound/dollar pair while aiming for the Senkou Span B line (1.2908) and the support level of 1.2850 in case consolidating the price below the Kijun-sen line (1.3083). Potential Take Profit in this case is from 140 to 190 points. The material has been provided by InstaForex Company - www.instaforex.com |

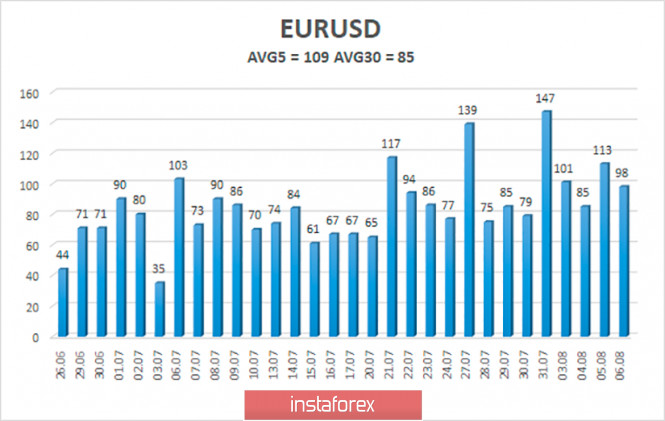

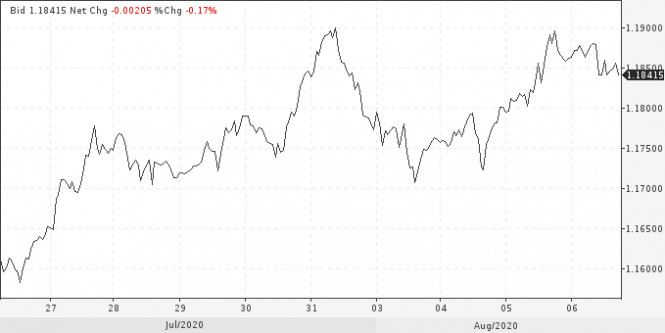

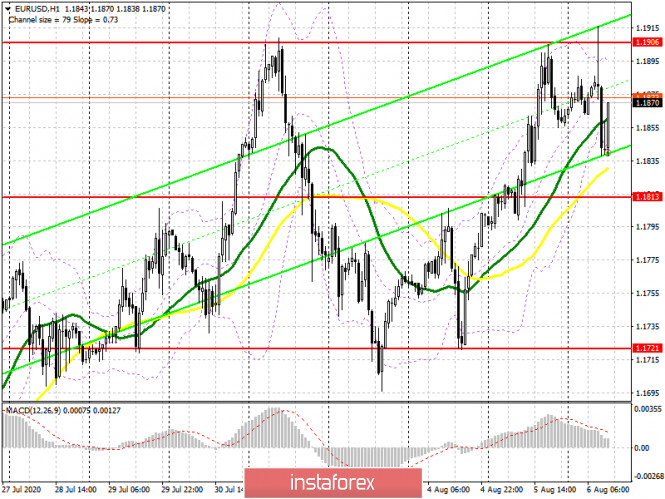

| Posted: 06 Aug 2020 06:31 PM PDT EUR/USD 1H The euro/dollar pair returned to the resistance level of 1.1911 on the hourly timeframe of August 6, which it had previously reached. However, yesterday this level was not overcome, so sellers again have the chance of forming a new downward trend or at least a noticeable downward correction. However, at the same time, we have to admit that the bears are now extremely weak and have no desire to sell the currency pair. Bulls can resume active trading if they still manage to overcome the resistance area of 1.1886-1.1910. EUR/USD 15M The lower channel turned down again on the 15-minute timeframe, which should be expected, given the next rebound from the 1.1911 level. The latest Commitments of Traders (COT) report showed a significant increase in bullish sentiment among major traders. The category of non-commercial traders opened 36,000 new Buy-contracts during the reporting week (July 22-28). This category has opened only 3,700 Sell-contracts. Thus, the net position (the difference between purchases and sales) immediately increased by 32,000, which indicates a sharp strengthening of the bullish mood. However, this was obvious even without the COT report, since the euro continued to grow non-stop over the past four weeks. As for other categories of traders, their actions in the currency market do not matter much now. Mostly commercial traders opened Sell positions, which did not affect the chart of the currency pair in any way. But commercial traders usually trade against the trend. This is not surprising. The most interesting thing now is what will be the actions of professional traders according to a new report that will be released this Friday. The euro began to decline at the beginning of the trading week and it even seemed that a downward trend would now begin. However, on Wednesday, the pair recovered all the losses of the previous days and reached its local and at the same time two-year highs of about $1.19. Thus, logically, the mood of professional traders should not have changed much. Recall that the next COT report will include data for July 29-August 4. In other words, the rest of this week will not be counted in it. The "four US crises" remain sources of pressure on the US dollar: epidemiological, economic, social and political. During these crises, the US dollar has fallen very much against the euro over the past three months, but it is not a fact that market participants are ready to continue selling the greenback. However, US President Donald Trump is doing everything to ensure that its national currency continues to depreciate. For those who do not remember, Trump wanted the dollar to be as "cheap" as possible from the very beginning of his presidential term, so the current weakening of the US currency is in his favor. At the same time, it is unlikely that Trump is doing everything he does specifically to make the dollar cheaper. For example, Trump has previously openly stated that China does not want him to win the election and openly supports the party of Joe Biden, even regularly holding talks with them and funding them. Now Trump has accused Russia of the same, though as the reasons he called the increase in military spending to ensure NATO in Europe, which is not beneficial to Moscow, since it wants to weaken the EU. Today, we advise you to closely monitor the report on Nonfarm Payrolls, which will be released in the afternoon. Based on the above, we have two trading ideas for August 7: 1) Buyers continue to hold the initiative and have returned once again to the 1.1911 level. Now, in order to continue making purchases, you need to wait for the price to be pinned above this level. Then we will recommend new purchases with the target at the resistance level of 1.2043. In this case, the potential Take Profit is about 100 points. 2) The bears failed to use their chances. Now the same 1.1911 is the key level for them. If the bulls fail to overcome it, then the downward movement may resume. However, for greater confidence, we recommend waiting for the price to be pinned below the critical line (1.1806) and only after that open shorts with the first target of the Senkou Span B line (1.1724). The potential Take Profit in this case is about 50 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2020 05:41 PM PDT 4-hour timeframe

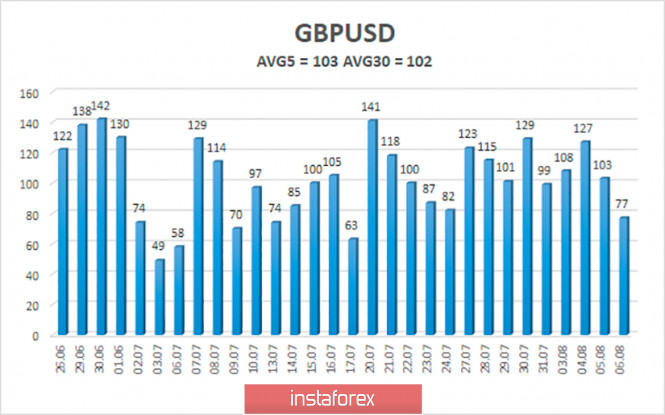

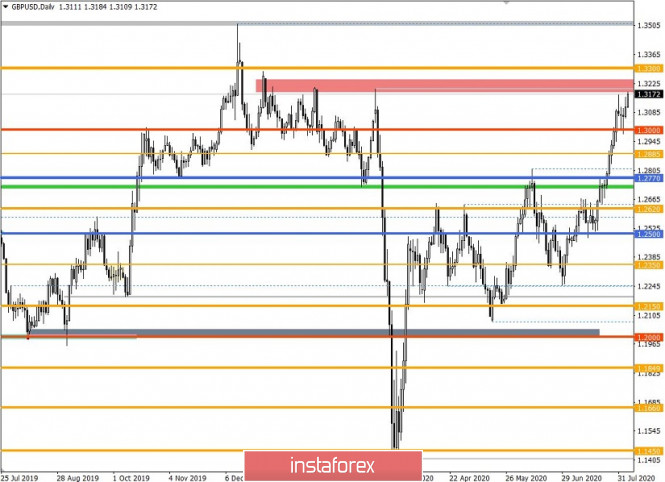

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 116.2358 For the British pound, yesterday was quite important. Even if you omit the meeting of the Bank of England and the speech of its head Andrew Bailey, traders of the pound/dollar pair had to decide whether they were ready to overcome the previous local high or intend to start a new downward trend. The day is over, and we have not received a clear answer to this question. By the end of the day, the pair's quotes reached the Murray level of "8/8" - 1.3184, which is located near the previous local maximum of 1.3169, but they did not manage to clearly and confidently overcome it. Thus, we still believe that new long positions are extremely dangerous at this time. Especially those for which Stop Loss levels are not set. Despite the fact that the trend is clearly upward and continues to persist, we still draw the attention of traders to the fact that the pound has already risen quite strongly against the dollar, and the sane correction since June 30 was only once. Market participants did not expect much from the Bank of England meeting. However, you can always expect surprises from this scale of events. The British regulator left the key rate at the same level of 0.1%, the program of buying bonds from the open market at the same level of 745 billion pounds, and all 9 members of the monetary committee voted for the unchanged rate. However, the final communique of the regulator said that by the end of 2020, the British economy could lose 9.5%, which would be the worst indicator in the last 100 years. However, earlier the Bank of England announced a figure of -14.5% of GDP by the end of 2020, so the forecasts have improved. The question is only based on what? On the basis of what does the Bank of England expect that the losses will be less? On the basis of what he expects that during 2021, GDP growth will be 9%, which will almost completely offset all losses in 2020? Both the Fed and the ECB refrain from such optimistic forecasts, and in the UK, whose economy has been suffering for 4 years due to Brexit and whose damage from the pandemic is the highest among the EU countries, they expect a reduction in losses and a rapid recovery? So the regulator and the government of the Kingdom are not afraid of a second "wave" of coronavirus? BA made equally optimistic forecasts for inflation, which should rise to 2.3% y/y by 2023, and for unemployment, which may rise to 7.5% by the end of this year. Experts of the Bank of England believe that in the medium term, it will be possible to return inflation to the target level of 2%, and it does not matter that the last time inflation in Britain at this level was in July 2019, and since the beginning of 2018, it has been steadily falling. However, the statement of the monetary policy committee still states that the risks associated with the "coronavirus" pandemic still remain high, so most forecasts for the coming years can be adjusted depending on the epidemiological situation. But what really supported the British pound was the speech of Bank of England Governor Andrew Bailey. The chairman directly stated at a press conference that "negative rates are part of the BA toolkit, but at the moment the regulator is not going to introduce them". Bailey also said that two main risks remain for the British economy – the lack of a trade deal with the EU and "coronavirus". Meanwhile, Donald Trump is working on all fronts. The US leader has declared war on the Chinese social network TikTok and plans to ban it on American territory. The claims of the American government are simple. Trump believes that the social network collects personal data of American users and transmits it to the Chinese government. Of course, this hypothesis cannot be supported by evidence. TikTok management said that it does not transmit any information to the Chinese intelligence services or the government, and that it "does not plan to leave the American market". However, Trump spoke clearly and clearly: "We prohibit TikTok in the United States. Immediately." Some may think that this war between Trump and the Chinese social network is far-fetched. However, we recall that about a month ago, when Trump held his first campaign rally in the American city of Tulsa, it was with the help of this social network that his speech was disrupted. It was with the help of TikTok that Trump's opponents among voters agreed to fail the rally, registered en masse to participate in it, and then simply did not come. As a result, the stadium where Trump spoke was filled by about one-third, despite the fact that all the tickets were sold out. However, Trump is not against another scenario – if the TikTok platform is sold to the American company Microsoft, which offers about $ 30 billion for it. In this case, all claims to the social network will be withdrawn. Well, the final thing is not to ignore the topic of the upcoming presidential elections in the United States, which are already a little less than 3 months away. Trump continues to push the idea that voting by mail can be rigged to the masses. In addition, the US President believes that it may take months or even years to count the votes. He said that in the last election in New York state, where remote voting was used, the vote count lasted several weeks, and its results were revised several times. There is a certain logic and meaning in the words of the US leader. One thing is for sure, we are looking forward to a terrifically fun end to 2020. Elections in America can become an event that will not leave the pages of all publications for several months. On the last trading day of the week in America, several extremely important reports are planned, the main of which is NonFarm Payrolls. If the value of this report is weak (weaker than the forecast +1.6 million), then we can expect a new weakening of the US currency in a pair with the pound. However, in general, Friday is a good day to start a new round of corrective movement, which may later develop into a full-fledged downward trend. We are still leaning more towards this option. No macroeconomic reports are expected from the UK today.

The average volatility of the GBP/USD pair continues to remain stable and is currently 103 points per day. For the pound/dollar pair, this value is "high". On Friday, August 7, thus, we expect movement within the channel, limited by the levels of 1.3055 and 1.3261. Turning the Heiken Ashi indicator downward will indicate the beginning of a new round of corrective movement. Nearest support levels: S1 – 1.3123 S2 – 1.3062 S3 – 1.3000 Nearest resistance levels: R1 – 1.3184 R2 – 1.3245 R3 – 1.3306 Trading recommendations: The GBP/USD pair resumed its upward movement on the 4-hour timeframe, but could not yet overcome the Murray level "8/8" - 1.3184. Thus, today it is recommended to stay in the longs with the goals of 1.3245 and 1.3264 while the Heiken Ashi indicator is directed upwards. Or close long positions near the level of 1.3184. Short positions can be considered no earlier than fixing the price below the moving average with the first goals of 1.3000 and 1.2939. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2020 05:41 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 83.7564 The EUR/USD currency pair has resumed its upward movement over the past two trading days after failing to break the moving average line. However, yesterday, after reaching the previous local maximum, the bulls retreated and a new round of downward correction began within the ascending trend. Based on this, we can conclude that buyers still doubt the feasibility of further purchases of the euro currency near its two-year highs and are frankly afraid of them. However, in order for the upward trend to change to a downward trend, you need not only the fear of bulls, but also the desire of bears to take the initiative. This is not the case now. Unfortunately, now only technical factors are on the side of sellers, and even then, not so much "factors" as "assumptions". "Foundation" does not help them in any way. In fact, the fundamental component remains the same all this time, since no new information is received from the US on the most important key topics. "Coronavirus" in America continues to spread at the same rate. The US government also continues to be inactive and does not want to impose a quarantine. There is little news about the escalation of trade and economic relations with China. Dr. Anthony Fauci, the country's chief epidemiologist, goes on the air much less often than before, and is much more cautious in his comments. Well, Donald Trump still continues to amuse the public with his discouraging statements aimed at distracting Americans from their own internal problems. No important information has been received from Europe in recent weeks. It is still unclear whether the European Parliament is going to approve the budget plan for 2021-2027 and the EU economic recovery fund, which were adopted with such difficulty at the last EU summit. However, from time to time, information still comes from overseas that deserves attention. For example, yesterday, Joe Biden said in an interview that the trade deal with China that Donald Trump reached is "collapsing." According to Biden, the trade deficit between the US and China increased by 5% in June this year, data from the US Department of Commerce shows that Beijing does not fully meet its obligations to purchase American goods. We would like to clarify Joe Biden's statement. It is not "the deal is crashing," but "the first phase of the trade is failing while the negotiations for the second phase have not even started yet". We want to remind traders that there is no talk of any truce between Washington and Beijing now, and most of the duties and sanctions between the countries remain in force. The first phase of the agreement implied the abolition of only part of the duties, most of them remaining in effect. At the same time, Donald Trump continues to get into stories that are worthy of some American schoolboy, but not the President of the United States. For the first time, Facebook deleted a message from Donald Trump that contained a small video. In this video, Donald Trump himself, in an interview with FOX, states that "American children have almost complete immunity from coronavirus", so "schools should be opened in September". Recall that a new wave of rallies and protests has now begun in the United States, which are organized this time by teachers who oppose the opening of schools this fall due to a massive pandemic. However, Trump believes that "school children are immune". Unfortunately, no one else thinks so. Neither doctors, nor other politicians and officials, nor Facebook. Representatives of Facebook said that the video contains absolutely false statements about "coronavirus" and violates the policy on the dissemination of false information about COVID-2019. Also, another social network Twitter, which completely blocked the official page of the US President's staff, reported that this decision will remain in force until the video is removed. In the video, the US President also says that "by some miracle, children have a stronger immune system and they do not have problems with this coronavirus". "The facts show that they are not affected by this problem, and we must reopen our schools," Trump concluded. Unfortunately, Trump is not supported by official healthcare institutions. For example, the US Centers for Disease Control and Prevention reports that children are equally at risk of contracting the virus with adults. In principle, even the governors of most states of America do not listen to Trump at this time – most of them have decided not to open schools until at least January 2021 and to conduct classes remotely. And of course, officials from the Trump campaign immediately accused social networks Facebook and Twitter of favoring the Democrats. In general, half of the country is now against Trump. And we understand why, if the president makes such statements every day, but in order to stop the spread of the "coronavirus", he does nothing. However, the closer the elections, the more we are inclined to believe that in the current situation, with a serious lag behind Joe Biden, Trump is even benefiting from the epidemic. If the epidemic continues to be high on November 3, it will really be a great reason, if not to postpone the election, then at least to block or complicate voting in many cities and states, especially those that are under the power of Republicans and in which Biden can potentially win. Based on this, we are increasingly inclined to the view that these elections can be as "dishonest and falsified" as possible, as Trump himself said. However, the US President hardly meant himself... There will be no important publications in the European Union on the last trading day of the week. Only in Germany will there be several reports, one of which is on industrial production. The main macroeconomic data will come from overseas, where the average wage for July, the unemployment rate for July and the number of new jobs created outside the agricultural sector (NonFarm Payrolls) will be published. Special attention should be paid to the latest report, although the unemployment rate is also very important. We believe that the data may be worse than forecasts (1.6 million for NonFarm Payrolls and 10.5% for unemployment), as this week's ADP report was significantly worse. Accordingly, from a fundamental point of view, the US dollar may again be under pressure from traders. But from a technical point of view, a strong downward movement has been suggested for a long time.

The volatility of the euro/dollar currency pair as of August 7 is 109 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1765 and 1.1983. The reversal of the Heiken Ashi indicator downwards signals a new round of downward correction within the framework of the still continuing upward trend. Nearest support levels: S1 – 1.1841 S2 – 1.1719 S3 – 1.1597 Nearest resistance levels: R1 – 1.1963 Trading recommendations: The EUR/USD pair is trying to continue its upward movement, but is not yet able to overcome the level of 1.1909. Thus, at this time, it is formally recommended to continue to stay in long positions with the goals of 1.1963 and 1.1975 until the Heiken Ashi indicator turns downward. But the pair may not overcome the previous high of 1,1909. It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first target of 1.1719. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Bank of England eased investors' fears, but sharp growth did not take place Posted: 06 Aug 2020 02:35 PM PDT The macroeconomic statistics both in the UK and in the United States did not match the forecasts in any way, and oddly enough, this strengthened the pound. Which should have happened if all the expectations were confirmed. This happened only due to a single indicator. But about everything in order. A kind of arbiter in this situation will be Nonfarm, who will either support the dollar or drown it, allowing the GBP/USD bulls to seize the initiative. Another major fundamental factor, which is equivalent to Nonfarm, is political in nature. We are talking about a new package of assistance to the US economy, which is already being discussed in Congress for the second week. The combination of these fundamental factors (against the background of medical reports on the spread of COVID-19 in the US) will determine the fate of the GBP/USD pair. At the same time, British events will play the role of second fiddle - unless they touch on the topic of Brexit. First of all, let's understand – why was the British currency so impressed with the Bank of England, which strengthened throughout the market at the end of the August meeting. By and large, nothing supernatural happened: the central bank simply did not implement the most pessimistic scenario, and, in addition, voiced a cautiously optimistic position on the future prospects. The market clearly expected more dovish rhetoric, so the pound shot up - first after the announcement of the results of the meeting, and then after the press conference of BoE Governor Andrew Bailey. On the eve of this meeting, there was no consensus among experts on how the central bank would react to recent events. On one side of the scale is the growth of key macroeconomic indicators (although the most recent releases were outdated - labor market indicators were for May, and inflation indicators were for June; but in both cases, positive dynamics were recorded). On the other side of the scale - the increase in the number of cases of coronavirus in the UK, the tightening of quarantine in several large regions of the country and the prolongation of the current restrictive measures. Some analysts assumed that against the background of such trends, the central bank would be pessimistic about the prospects for the recovery of the British economy, and Andrew Bailey would again talk about the likelihood of a negative rate. Also, many assumed that at least two members of the Committee would vote for a rate cut. But none of the points of the pessimistic scenario were realized. On the contrary, the BoE showed some optimism. First, the central bank published updated economic forecasts, in which it stated that the consequences of the "coronavirus strike" will not be as large as initially thought. Secondly, none of the Committee members voted to cut the interest rate. Thirdly, Bailey neutralized concerns about the introduction of a negative rate: he assured journalists that this issue was not on the agenda. Such news flow encouraged buyers of GBP/USD, after which the pair approached the boundaries of the 32nd figure. But they could not overcome this line. The bears seized the initiative again during the US session, taking advantage of the dollar's correctional growth. Looking ahead, it should be emphasized that the greenback is still a vulnerable currency: the coronavirus factor and the failed ADP report continue to exert background pressure. But today the US received support from Congress. The fact is that both the Speaker of the US House of Representatives Nancy Pelosi (who represents the Democrats) and Senate Majority Leader Mitch McConnell expressed absolute confidence that the parties will come to an agreement on a new financial aid package. According to them, the negotiators only need to agree on "only a few points", but overall there is no doubt that the legislators will be able to agree on a program to help the economy. In addition, the dollar was also slightly supported by the initial jobless claims. This weekly report was released today in the green zone - for the first time in the last three weeks. Let me remind you that this indicator began to rise again after a 14-week stable decline, reflecting the unhealthy trends. After the disappointing ADP report (the indicator came out at the level of 167,000 instead of an increase of one and a half million), today's release became a kind of bonus that slightly calmed the dollar bulls. But the overall situation is uncertain. The dollar will slump again if tomorrow's data on the US labor market turns out to be much worse than expected. As you can see, GBP/USD traders have already played the August meeting of the BoE – now the pair's prospects depend on the behavior of the US currency, which, in turn, is waiting for the Nonfarm data. Therefore, traders have two options for the development of events. Either opening longs from the current positions and aiming for 1.3200 (a very risky option, given tomorrow's release), or a wait-and-see position before the Nonfarm report is released. And here it is worth recalling that although ADP reports have a high correlation with official data, they do not always signal real trends in the US labor market. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2020 02:35 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair reached the 1.1903 level again on Thursday, August 6, which we mentioned as an important resistance level in the previous review. This is the peak from July 31, and we could not overcome the price on August 5. Thus, we already have three rebounds from this level. The latter formed today, and the MACD indicator gave us a sell signal a day earlier, and since then it has not turned up. Thus, the rebound from the 1.1903 level can and should have been rejected with the goal of 1.1802. Unfortunately, trade was not that active today. The euro/dollar pair went down by only 40-50 points for eight hours (starting from the morning article). In principle, this is not very little, but also not much. Therefore, novice traders could earn 30-35 points on this trade. And the conclusions are quite simple: sellers are extremely weak now and could not even pull down the pair by at least 100 points after three rebounds from an important level. Thus, it is possible that buyers will make a fourth attempt to overcome the 1.1903 level by tomorrow. Fundamentally, the pair was trading using America's global problems again. Also, traders of the EUR/USD pair were only interested in one report during the day. This is the data on applications for unemployment benefits, which, incidentally, showed a decrease in the total number of repeated applications to 16.1 million from 17.0. Thus, unemployment in the US continues to fall, which cannot but please the buyers of the dollar. However, the US currency did not rise in price for a long time, and the upward trend in general remains. Thus, sellers cannot seize the initiative in any way. Three important US reports will be released at once on Friday, August 7. The unemployment rate and the average wage level are not the most important. But the Nonfarm Payrolls report – the number of new jobs created outside the agricultural sector is extremely important. Forecasts say that 1,600,000 new jobs were created in July. If this forecast is surpassed, the US dollar will simply have to rise in price, although in general it will take a serious excess of forecasts to outweigh all the negative that is coming from America now. Thus, if the value of Nonfarm payrolls is higher than 2 million, you can expect the dollar to increase based on this report. The following scenarios are possible on August 7: 1) Purchases are still relevant, as the price has left the ascending channel and cannot overcome the 1.1903 level. However, given the euro's growth in the past three days, it is possible for the upward trend to resume. Therefore, for novice traders, we still recommend buying the euro if the price closes above the 1.1903 line, which passes through the last three price highs. The targets in this case will be the resistance levels of 1.1966 and 1.2026. Although it is recommended to take profit near the first target. 2) Selling the currency pair is still more promising now, but sellers are very weak. The pair has already rebounded from the 1.1903 level three times, and each time, the fall was less than the previous one. Thus, we are leaning towards the option that forming a new downward trend will be postponed again for an indefinite period, judging by the technical data that are now available in the illustration. What's on the chart: Support and Resistance Price Levels - Levels that are targets when buying or selling. You can place Take Profit levels near them. Red lines - channels or trend lines that display the current trend and show which direction it is preferable to trade now. Arrows up/down - indicate when you reach or overcome which obstacles you should trade up or down. MACD indicator is a histogram and a signal line, the crossing of which is a signal to enter the market. It is recommended to use in combination with trend lines (channels, trend lines). Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners in the forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| August 6, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 06 Aug 2020 11:28 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1150 then 1.1380 where another sideway consolidation range was established. Hence, Bearish persistence below 1.1150 (consolidation range lower limit) was needed to enhance further bearish decline. However, the EURUSD pair has failed to maintain enough bearish momentum to do so. Instead, the current bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1600 (Fibonacci Expansion 78.6% level) which failed to offer sufficient bearish pressure. That's why, further bullish advancement pursued towards 1.1730 (Fibonacci Expansion 100% level) which failed to offer sufficient bearish rejection for a few days until Today. Bullish persistence above 1.1730 will probably favor further bullish advancement towards 1.2075 (161% Fibo Expansion Level) in the intermediate-term. On the other hand, bearish re-closure below 1.1730 indicates lack of bullish momentum and enhances further bearish decline initially towards 1.1600. Trade recommendations : Conservative traders should wait for the current bullish movement to pause and get back below 1.1730 as an indicator for lack of bearish momentum for a valid SELL Entry.T/P levels to be located around 1.1600 and 1.1500 while S/L to be placed above 1.1800 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| August 6, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 06 Aug 2020 11:14 AM PDT

Since April, the GBPUSD has been moving sideways within the depicted consolidation range extending between (1.2265 - 1.2600)On May 15, transient bearish breakout below 1.2265 (consolidation range lower limit) was demonstrated in the period between May 13 - May 26, denoting some sort of weakness from the ongoing bullish trend. However, immediate bullish rebound has been expressed around the price level of 1.2080 bringing the GBPUSD back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection. Further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where another episode of bearish pullback was initiated. Short-term bearish movement was expressed, initial bearish targets were located around 1.2600 and 1.2520 which paused the bullish outlook for sometime & enabled further bearish decline towards 1.2265. Significant bullish rejection was originated around 1.2265 bringing the GBP/USD pair back towards 1.2780, where the mid-range of the depicted wedge-pattern failed to offer enough bearish rejection. Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.2780 (Depicted KeyLevel) on the H4 Charts. On the other hand, significant bearish rejection was demonstrated around the price level of 1.3160 in the form of (Bearish Engulfing Candlesticks). Hence, upcoming bearish reversal should be expected provided that early bearish breakout occurs below 1.2980 (the depicted wedge pattern upper limit). Trade recommendations : Technical traders are advised to wait for any upcoming bearish breakdown below 1.2980 as a valid SELL Entry. Initial T/p level is to be located around 1.2780. On the other hand, bullish re-closure above 1.2980 invalidates this trading scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| August 6, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 06 Aug 2020 11:09 AM PDT

The EURUSD pair has been moving-up since the pair has initiated the depicted uptrend line on May 25. On June 11, a major resistance level was formed around 1.1400 which prevented further upside movement for some time and forced the pair to have a downside pause. Recently, the EURUSD demonstrated an ascending wedge around the mentioned price level of 1.1400.However, recent negative fundamental data from the U.S. have caused the EUR/USD to achieve another breakout to the upside. By the end of last week, the EURUSD has been approaching the price levels around 1.1900 where signs of downside pressure were enhanced by the negative fundamental reports from Germany on Friday. Intraday traders should be considering the current breakdown of the depicted short-term uptrend line. A Breakdown below the price level of 1.1650 is going to give a better confirmation for a valid SELL Position. Estimated targets would be located around 1.1550, 1.1500 then 1.1450. On the other hand, Conservative traders should consider the current bullish pullback to retest the backside of the broken short-term uptrend for another SELL Position with a lower risk. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound sterling resume to conquer new highs Posted: 06 Aug 2020 09:33 AM PDT

The pound sterling continues to strengthen significantly climbing to a new high level, which allowed it to cross the highest mark in the last five months. The reason for the next impulse of the pound was the intention of the Bank of England to make changes in the base interest rates in the near future. At the same time, the hints of the bank regarding the introduction of negative rates may now become a reality. All these allowed the pound to strengthen again and break through the wall from the maximum five-month level against the US dollar. The sterling is now worth $ 1.32 per pound. As soon as it became clear that it would be impossible to avoid a fall in rates below zero, the pound felt a new surge of vivacity. Even the extremely slow pace of economic recovery in the country from the consequences of the crisis associated with the coronavirus pandemic cannot prevent this. After the official speech of the representatives of the Bank of England, the pound immediately jumped by 0.5%, which moved it to the level of $1.3184 per sterling. However, after that, there was some pullback. The correction happened to the level of $1.3112, which is still 0.3% higher than the previous value. The pound also showed a rise of 0.4% against the euro which moved it to the area of 90.14 pence per euro. Note that the maximum value of 90.10 pence per euro was already fixed earlier, which, meanwhile, was quickly passed. Although there is no serious and urgent need to introduce negative base rates yet, this went well for the pound sterling itself which has risen in price on the news of this alone. Moreover, according to experts, the growth will continue in the short term. The decision to change interest rates was given to the regulator quite easily. All council members voted unanimously in favor of this initiative. In addition, the idea of increasing the bond buyback program was also supported. Meanwhile, the Central Bank claims that a return to the previous size of the economy is impossible this year and that, it is also unlikely to be achieved on the following year. All that remains is to gain strength and use all the tools available to beat the desired results in a shorter time frame. And the negative rate is by no means the only means that the Central Bank can use. Moreover, some analysts believe that it will do more harm than good. The material has been provided by InstaForex Company - www.instaforex.com |

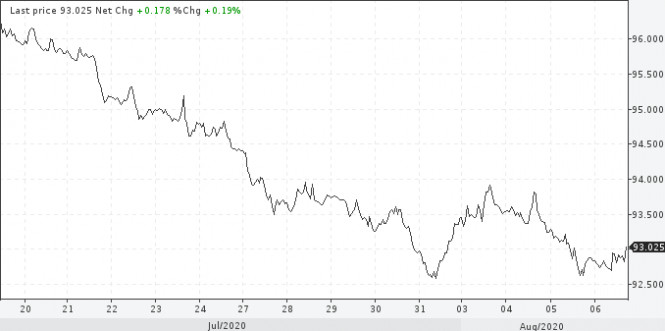

| EUR / USD: Dollar may continue to fall Posted: 06 Aug 2020 09:02 AM PDT

There was no unidirectional movement in the dollar index on Thursday. Indicator volatility and attempts to slow down at around 93 points were observed. This is logical after the dwindling decline in recent sessions. In general, the greenback remains under pressure. The downward trend is also based on the behavior of the stock and commodity markets. The Dow Jones Index rapidly tested the 27155 marks, where the current line of the current upward trend is located. The growing Dow, however, as well as oil, which is trying to gain a foothold higher, negatively affects the position of the dollar. USDX

The upcoming presidential elections in the United States, the loss of its high profitability advantage due to the actions of the Fed and the government, as well as an increase in the budget deficit and the current account of the country's balance of payments are not on the side of the dollar. The growth of the national debt, coupled with the money supply, makes one fear a rise in inflation and an even greater fall in the exchange rate of the US dollar. Moreover, the lack of progress in negotiations on the amount of disaster aid to the US economy also adds as one of the negative factors pulling the dollar downward. As well as the growing contradictions between the United States and China and, of course, the continued increase in the number of people infected with the coronavirus. A new surge in infection last month could have paused the ongoing economic recovery. Quarantine measures in the country left millions of Americans unemployed, especially in the tourism and retail sectors. Other sectors also suffered, such as construction and financial services. According to ADP, the number of jobs in the US nonfarm private sector increased only by 167,000 weaker than the expected growth of 1.5 million. Note that the ADP report is not directly related to the official data of the US Department of Labor, the publication of which is scheduled on Friday. However, they are likely to fall short of market expectations, pointing to a decline in non-farm jobs instead of an expected 1.6 million increase. This is happening at a time when millions of Americans have lost their higher unemployment benefits. Until new support measures are taken, the Fed may enter the scene. The regulator will be forced to take further steps to ease monetary policy, which is another factor that urges the decline of the dollar. Meanwhile, in Europe, conditions are now completely different for a smooth and faster economic recovery. It is also worth considering the recently adopted support program in the form of an expenditure package of 1.8 trillion euros. An improvement in the situation in the EU countries is evidenced by macroeconomic statistics, European assets look more attractive than American ones. Everything speaks in favor of the growth of the euro, so the EUR / USD pair maintains positive dynamics and a tendency to further increase. On Thursday, at the start of the European session, the pair rose to a new 26-month local maximum, at the moment exceeding 1.1900. Although the euro rolled back in the American session, this does not mean that it will not catch up in the very near future. The next target for growth is around 1.2000. EUR / USD

The movement of the main pair is now in the medium-term ascending channel. Correction to the level of 1.1831 is admissible, then again the upward movement to the levels of 1.1928-1.1949 and above. If the price still consolidates below 1.1790, then it is worth considering the scenario of a hike to 1.1720. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP / USD: Bank of England to still introduce negative rates despite Brexit deal Posted: 06 Aug 2020 08:04 AM PDT

Over the past few weeks, the pound sterling was appreciated significantly. This was largely due to the weakening of the greenback's position, but the increased hopes for a positive outcome of the Brexit negotiations also contributed to it. "A balanced and sustainable deal is still possible, even if it is less ambitious," said Michel Barnier, the EU's chief Brexit negotiator. The evidence that on a number of controversial issues the positions of the parties began to converge served as a positive signal for the pound bulls. However, currency strategists at Bank of America believe that the reaction in the format "when there is a deal - sterling rises, no deal - the pound falls" looks primitive and does not take into account the nuances. "The lack of a deal will be disastrous for the pound, especially in the current environment, when the British economy is very slowly recovering from the COVID-19 pandemic. However, the conclusion of the deal does not guarantee growth for the pound sterling, "the bank's experts noted. They draw attention to the fact that the rapprochement of positions of London and Brussels on the details of the separation became possible due to a noticeable softening of the requirements of the British side. "Now everything is moving towards the fact that the deal will be very limited. This implies the restoration of a number of duty-free barriers and a reboot of the United Kingdom's relations with individual EU states. Such a development of events means that even with the conclusion of the deal, the British economy will feel a new blow, which increases the likelihood of further easing of the monetary exchange rate of the Bank of England, which may nevertheless decide to introduce negative interest rates, " BofA experts believe. The bank revised its forecast for the GBP / USD pair at the end of 2020 downward - from 1.34 to 1.17. On Thursday, the pound against the US dollar renewed five-month highs in the 1.3184 region. Most of the pound's gain occurred shortly after the announcement of the results of the next meeting of the Bank of England. The regulator left the interest rate unchanged at 0.1% and kept the size of the asset purchase program at £ 745 billion. Commenting on the Central Bank's decision on monetary policy, the head of the Bank of England, Andrew Bailey, said that negative interest rates remain one of the possible instruments of monetary policy, but at the moment they are not on the agenda. "The Bank of England will most likely prefer to refrain from applying a policy of negative interest rates until there is clarity on the issue of EU-UK relations from 2021. Now the derivatives market puts in the quotes the probability that interest rates may go into negative territory early next year, " analysts at ING said. The material has been provided by InstaForex Company - www.instaforex.com |

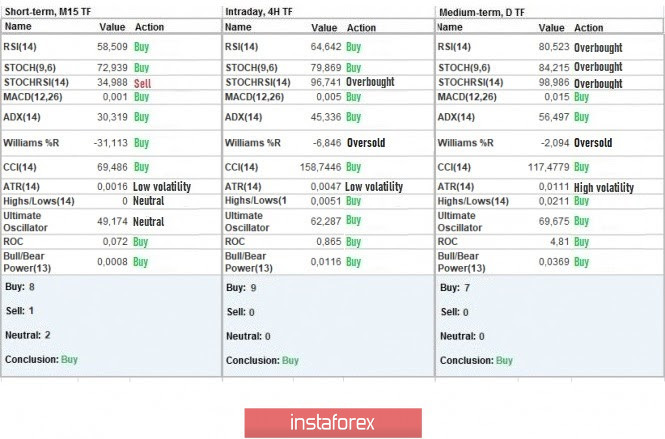

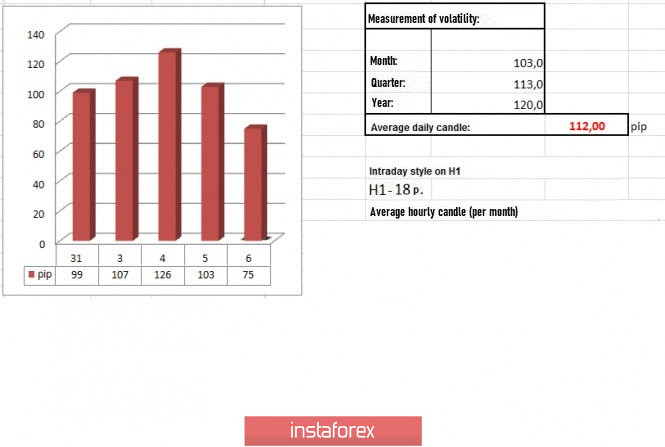

| Trading recommendations for the GBP/USD pair on August 6 Posted: 06 Aug 2020 05:44 AM PDT The GBP / USD pair successfully avoided going into a correction, mainly due to the bulls who appeared on the psychological level of 1.3000, which kept the bears from pulling the quote down in the price chart. Hence, the pound is still overbought, and the speculators who are currently holding the market do not care about this factor. As a result, the pair has still not undergone a correction, and the pullback of quotes end instead with the strengthening of speculative positions. Using technical analysis, we can see that the current movement is carried out within the price range 1.2770 // 1.3000 // 1.3300, in which the quote almost reached the upper limit, which may affect the volume of long positions. So, if we analyze the past trading day in detail, we will see that the main surge in speculation, which began at 09:00, led to a movement towards the price level of 1.3060, after which the quote rose even further, up to the local high at 1.3169. Such resulted in a volatility above 100 points, which indicates the superiority of speculators in the market. Meanwhile, as discussed in the previous review , traders already expected a rise towards the local high on July 31, after the quote consolidated above the level of 1.3125. Thus, in the trading chart (daily period), a Shooting Star pattern appeared at first on July 31, and then was refuted on August 3 and 4 when Doji candles appeared, which indicates indecision and uncertainty among market participants and possible price jumps. Meanwhile, news published yesterday included data on business activity in the UK services sector, which grew from 47.1 to 56.5 as the preliminary estimate reflected an increase to 56.6. Composite PMI also increased from 47.1 to 57.0 in July. Such good data helped increase demand for the pound in the market. In the afternoon, a report on employment in the US private sector was released by the ADP, which revealed that a total of 167,000 workers were hired in July, much lower than the forecast of 1,550,000. This suggests that the US labor market is still going through hard times, and high rates of CVID-19 infection exacerbate the situation in the economy. Today, the Bank of England announced its decision on interest rates, maintaining it at 0.1%, and also left the quantitative easing program unchanged at the level of 745 billion pounds. The Bank of England estimates that UK GDP will return to pre-crisis levels no earlier than the end of 2021, and its forecast for 2020 is a fall to 9.5%, which will be the worst figure in a century. With regards to inflation, the bank does not exclude the possibility that the indicator may reach negative values in July, but in the long term, they expect it to grow to 2.3% (by 2023). "The committee does not intend to tighten monetary policy until there is clear evidence that significant progress has been made in eliminating spare capacity and achieving the 2% inflation target on a sustainable basis," the Bank of England said. Today, the weekly report on unemployment claims in the US will be published, the forecast of which is an increase in initial claims from 1,434,000 to 1,450,000, and a decrease from 17,018,000 to 16,900,000 on repeated ones. Further development Analyzing the current trading chart, we can see that when the Bank of England announced its decision on interest rates, volatility soared, on the basis of which the local high was broken (1.3169 ---> 1.3181). Holding the quote above the said level may signal a prolonged upward move, which could lead the quote to the upper limit of the price range 1.2770 // 1.3000 // 1.3300. At the same time, the pound remains on the verge of fatal overbought, which means that the movement is unstable and that everything can change quickly in the market. The range 1.3200 / 1.3250 reflects the interaction of trade forces, which may affect the reduction of long positions. Indicator analysis Analyzing the different sectors of time frames (TF), we can see that the indicators of technical instruments on the minute, hourly and daily periods signal "buy" due to the passing of quotes above the local high. Weekly volatility / Volatility measurement: Month; Quarter; Year The measurement of volatility reflects the average daily fluctuation, calculated per Month / Quarter / Year. (August 6 was built, taking into account the time this article is published) Volatility is currently 75 points, which is 33% below the average daily value. Its dynamics still has the ability to expand, the tolerance of which is 70-120 points. Key levels Resistance zones: 1.3200 (1.3250) **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support Zones: 1.3000; 1.2885 *; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1.1000; 1.0800; 1.0500; 1.0000. * Periodic level ** Range level *** Psychological level Also check the trading recommendations for the EUR/USD pair here, or the brief trading recommendations for the EUR / USD and GBP/USD pairs here. The material has been provided by InstaForex Company - www.instaforex.com |

| US stock exchanges experienced enthusiastic rise while Europe and Asian stocks went stably Posted: 06 Aug 2020 05:40 AM PDT

The Asian stock market began the day in a stably on Thursday. The main stock indicators preferred to stay in place and not show general dynamics. US stock market, on the other hand, was marked by steady and rapid growth. Market participants are still worried about the US stimulus package. It should be noted that the country's situation with the coronavirus crisis remains tight, which indicates the urgent need to extend stimulus measures in order to create conditions for a faster and more comfortable economic recovery after the crisis. So far, the securities market takes with enthusiasm only the very fact that the incentives will be ratified, but the decision-making process itself turned out to be too protracted, which may ultimately be reflected at the level of stock indicators. Every day the government and the opposition are getting closer to consensus, which pleases investors. According to experts, the relevant document should be signed no later than the end of this week. However, the negativity in the market still exists which is mainly brought by the continuous spread in the number of COVID cases in the US and in several countries, which indicates that the second wave of the pandemic may still cover the world. China's Shanghai Composite Index fell 0.73% Thursday morning, while Hong Kong Hang Seng Index sank even more by 1.56%. Japan's Nikkei 225 Index is down by 0.55%. South Korea's Kospi index went contrary to the negative trend of its colleagues and showed an increase of 1.08%. The Australian S & P / ASX 200 supported the positive and rose 0.48%. Wednesday's trading on the US stock markets was so successful that it even exceeded all the analysts' expectations. This is mainly due to the positive statistics and news on the vaccine against coronavirus infection. The Dow Jones Industrial Average index immediately increased by 1.39% or 373.05 points, which moved it to the level of 27,201.52 points. This is the fourth time in a row that the indicator rushes up. The Standard & Poor's 500 index increased by 0.64% or 21.26 points. Its level was within the range of 3,327.77 points, which also indicates the fourth positive day in a row. The Nasdaq Composite Index supported the trend and increased by 0.52% or 57.23 points. This sent it to the 10,998.40 point mark. The growth of the index has been going on for six trading sessions in a row. In addition, during the day its value exceeded 11,000 points for the first time, which indicates the stability and firmness of its position. On Wednesday, the largest US company Johnson & Johnson, which is also engaged in the production of medical products, announced that it is ready to conclude an agreement with the country's government on the production of drugs against coronavirus infection if the vaccine passes all the required clinical trials and proves its effectiveness. The contract amounts to $ 1 billion. Investors were enthusiastic about the announcement, which immediately boosted the company's shares by 8.8%. Due to this, market participants did not even take great interest in US unemployment data from the ADP. According to the report, only 167 000 jobs were added in the private sector for the month of July which was weaker than the expected 1.5 million jobs in the preliminary forecasts. Against this background, the current figures look extremely unconvincing and even sparked some concerns, but market participants are in no hurry to react to this. Investors are tuned in to official unemployment data from the US Labor Department tomorrow. Meanwhile, the statistics on US foreign trade balance can be viewed positively. Its deficit in the first month of the summer narrowed to $ 50.7 billion compared to the $ 54.8 billion in May. However, this positive is diluted with some disappointment, as experts expected better data. It was assumed that the decline could reach the level of 50.1 billion dollars. Among other things, the US government began to put forward rather encouraging theories about economic growth in the second half of this year. For example, the deputy chairman of the main US regulator - the FRS - said that the second part of the year will be more successful for the country's economy, which will move to a sustainable recovery. Moreover, business activity may be the same as it was before the crisis associated with the coronavirus pandemic, and by the end of 2021 - step over pre-crisis indicators. European stock markets, on the other hand, started the day with a negative recording a decline in almost all directions, the reason for which was the next portion of the reporting data of the companies and the result of the meeting of the main regulator of Great Britain - the Bank of England. The general index of large enterprises in the European region Stoxx Europe 600 fell 0.42% to 363.64 points. The UK FTSE 100 Index dropped 1.26% at once. While the German DAX index added insignificantly by 0.02%. France's CAC 40 index went down 0.6%. Italy's FTSE MIB Index declined 0.85%. Spain's IBEX 35 Index parted from 0.71%. The reason for the rather serious negative was the decision of the Bank of England to keep the base interest rate at a low level of 0.1%. In addition, the volume of the government securities buyback program was left unchanged. It should be noted that like the previous one, the current level was within 745 billion pounds. Among other things, the main regulator of Great Britain has revised the forecast for economic recovery in the country this year towards its improvement. So, according to the latest data, the decline should be no more than 9.5%, while earlier a rebound of 14% was approved. The material has been provided by InstaForex Company - www.instaforex.com |

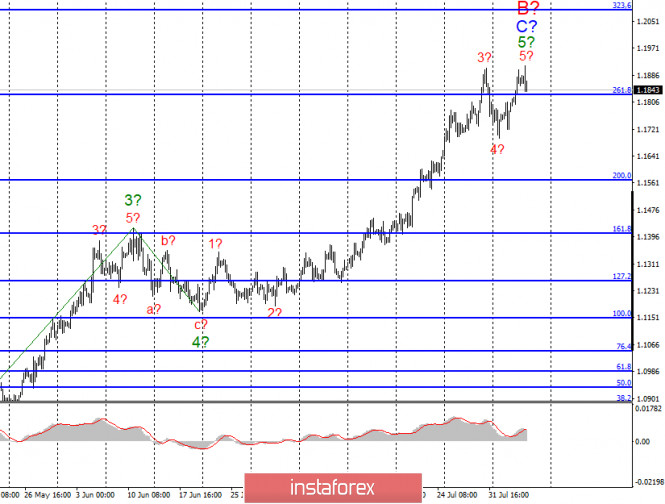

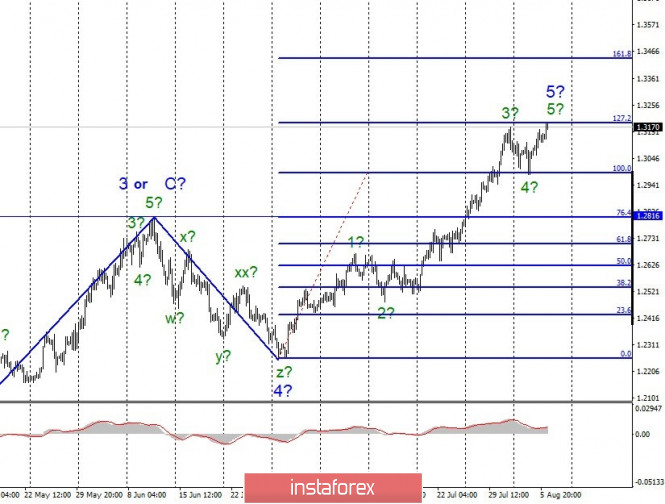

| Posted: 06 Aug 2020 04:58 AM PDT EUR / USD On August 5, the EUR/USD pair gained about 60 pips and presumably completed the construction of wave 5 at 5 at C at B, since the quotes began to move away from the previously reached highs already today, and the current wave counting took a fully completed form. If this assumption is correct, then the decline in quotes will continue with targets located around 15 and 16 figures as part of the construction of a new downward trend section, which, in turn, may also take a very extended form. Fundamental component: Yesterday was fairly neutral in terms of information. There were a lot of news and economic reports, yet none of them were "loud". Thus, the markets considered that there is still an opportunity to buy the European currency, especially against the background of the current wave markup, which implies the construction of a new downward trend section. The most interesting topic of the coronavirus epidemic in the United States began to gradually disappear from the front pages of newspapers. The number of cases of diseases is gradually decreasing, and many States have weak quarantine restrictions and two-week isolation for those who cross state borders. However, these measures are extremely weak in order to stop the spread of the COVID-19. All Donald Trump speeches regarding the virus and pandemic in America are not taken seriously by the markets, since their essence is very different from reality. Meanwhile, Dr. Anthony Fauci, director of the US National Institute of Allergic and Infectious Diseases, said that there was basically no point in testing for coronavirus. Fauci believes that each test takes too long to perform, which makes it impossible to conduct it, because until the results are known, a potentially infected person can infect as many other people as he wants. "Testing for coronavirus should take no more than 10 minutes to be effective," said Dr. Fauci. Economic reports yesterday created moderate pressure on the dollar. If the indices of business activity in the US service sector were at a fairly high level, especially the ISM index, then the ADP report on the number of employed in the private sector was frankly weak. General conclusions and recommendations: The euro/dollar pair has presumably completed the construction of the upward wave C in B. Thus, at this time, I do not recommend new purchases of the instrument, but I recommend closing the old ones. I also recommend starting to look closely at sales with the first targets, which are about 15 and 16 figures, since the instrument can now move on to building a global wave C. GBP / USD On August 5, the GBP/USD pair gained about 40 pips. Thus, the instrument rose to the level of 127.2% Fibonacci, and made an unsuccessful attempt to break it at the moment. Thus, around this level, the increase in the instrument quotes may end, since the entire wave 5 has taken on a fairly full-fledged form. If this is true, then the construction of a new downward trend section will begin already from the current price values. Fundamental component: The demand for the US currency declined again and was paired with the pound for the same reasons. Today, the results of the meeting of the Bank of England were summed up in Great Britain and it became known that all the main aspects of monetary policy remained unchanged. Nonetheless, the concerns of the markets that the Bank of England may resort to easing monetary policy during 2020 remained. The results of the meeting had no effect on the British pound. On the contrary, the pound continued to be in demand early this morning. General conclusions and recommendations: The pound/dollar instrument is expected to have completed an upward wave 5 around 1.3183. Therefore, I recommend at this time to close all purchases at least until a successful attempt to break through the 127.2% Fibonacci level and tune in to a possible long-term decline in quotes within a new downward trend section with the first targets around 27 and 28 figures. The material has been provided by InstaForex Company - www.instaforex.com |

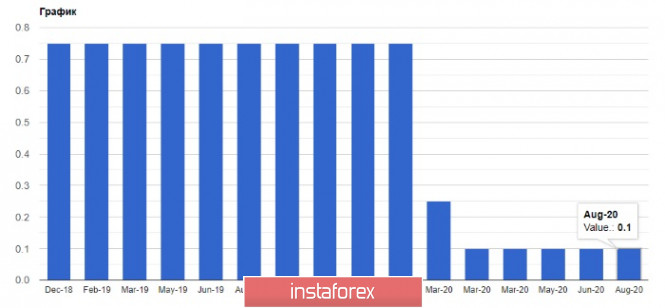

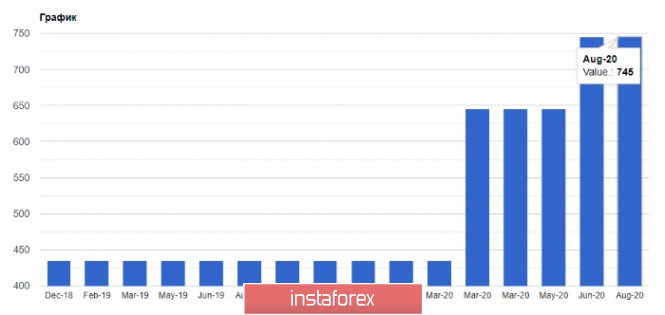

| GBPUSD fundamental analysis. Pound advances after BoE decision Posted: 06 Aug 2020 04:42 AM PDT Today, policymakers of the Bank of England unanimously decided to retain the interest rate at a record low, thus providing support for the pound sterling, which continued strengthening against the US dollar. However, if we take a closer look at the results of the meeting, it becomes clear that the regulator is unlikely to give help to the UK economy in the future, which is also a clear bearish signal. Therefore, major market players continue increasing the number of their short positions for a reason every time the pound is growing. Reports from the futures market tell us about this in detail. Thus, the COT report indicated that during the reporting week, short non-commercial positions increased to 64,738, while long non-commercial positions, on the contrary, declined to 39,392. As a result, the negative value of the non-commercial net position increased and amounted to -25 409 versus -15 080. This fact shows that the pound sterling is likely to fall sharply after the greenback recovers its positions.

The pound strengthened mainly because the Bank of England refused to cut interest rates below zero meanwhile chances were quite high. In addition, traders took well the revised forecasts of UK GDP contraction. The nine-member Monetary Policy Committee voted to hold the interest rate at 0.10%. Nobody of the members voted to increase the interest rate. Also, the bank retained the size of the asset purchase programme at GBP 745 billion. However, it seems like the introduction of new stimulus measures will be necessary. Most likely, this autumn, the regulator will implement a new stimulus package aimed at protecting the UK economy from the consequences of the coronavirus pandemic and Brexit. New measures may be announced as early as October this year. If that happens, the pound has little chance to continue growing.

As for the forecasts, the Bank of England expects the unemployment rate to rise to around 7.5% by the end of the year, while GDP is projected to recover by the end of 2021. According to the Bank of England estimates, UK GDP contracted by 21% in the second quarter. Overall, the economy is forecast to contract by 9.5% in 2020, significantly below May estimate of a 14% reduction. This is a positive signal for the pound. The regulator noted that, despite the revision of forecasts, the balance of risks is shifted to the negative zone. Therefore, inflation will remain below the target level of close to 2% and will return to it no earlier than in a few years.

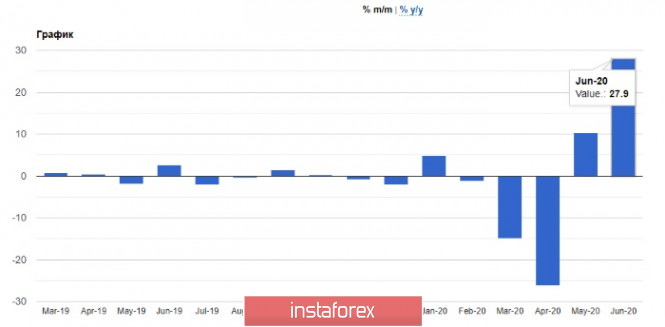

Thus, long positions in the pound increased after it was announced that negative interest rates were currently less effective. However, it is better to be careful, as in his interview, the Governor of the Bank of England noted that negative interest rates remained the instrument for adjusting the monetary policy, but now they did not seem appropriate. The governor did not exclude the possibility of their use in the future if the state of the economy changes dramatically. The most favorable moment for negative interest rates, according to the head of the Bank of England, is precisely the time of economic recovery, and not during a crisis. Bailey also believes that although the UK economy is recovering, it is doing it quite unevenly. Apart from that, he also welcomed local lockdown measures, which were the right step for the economy. As for the technical analysis, the GBPUSD pair continued to grow and broke through monthly highs. Then, the upward movement stopped, which could result in a serious problem, since the bulls only managed to fight off the first wave of the pound correction, which was formed at the beginning weeks, while the second correction looms on the horizon. If the trading instrument returns to today's lows in the 1.3100, it will be an alarming signal for buyers. EUR/USD The euro increased slightly after the release of a strong data on the growth of orders in the manufacturing sector in Germany, which leaves hope for a V-shaped economic recovery. However, traders were quick to take profits in the absence of support from major market players. An increase in external and domestic demand, as well as in orders will have a positive impact on the pace of economic recovery in Germany in the post-crisis period.

Currently, domestic activity accounts for 90% of the pre-crisis volumes. Now, factory orders have returned to 90% of the pre-crisis levels. According to the Destatis report, orders advanced 27.9% on a monthly basis, faster than the 10.4% increase seen in May. Economists had forecast a 10.1% rise for June. Compared to June last year, factory orders declined 11.3% in June. Domestic orders advanced 35.3% and foreign orders climbed 22% from the previous month. The price failed to break out at the resistance level of 1.1905. Also, it is important to make sure that the situation in the American labor market has not yet completely deteriorated due to the recent increase in the number of coronavirus cases. If the pressure on risky assets resumes by the end of the week, we can expect the EUR/USD to return to 1.1810 - to the middle of the channel - and then to update its lower border in the 1.1720 area. The short term direction will be determined by the level the price will be able to reach. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2020 04:40 AM PDT  As I discussed in the previous review, the BTC managed to trade higher and break the ascending triangle pivot at $11,450, which is strong sign for further upside continuation. Further Development Analyzing the current trading chart, I found that buyers are still in control and there is potential for test of $12,140. Key Levels: Resistance: $12,150 Support levels: $11,450 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2020 04:25 AM PDT Latest data released by Markit - 6 August 2020"The PMI data suggest that the constructor sector is yet to escape from its recent slump, although there are some signs of improvement in the detail. The residential building sector looks to be more resilient to the troubles being caused by the COVID-19 pandemic, with housing activity returning to growth in July and helping to at least partially offset the subdued trends in both commercial and civil engineering activity.

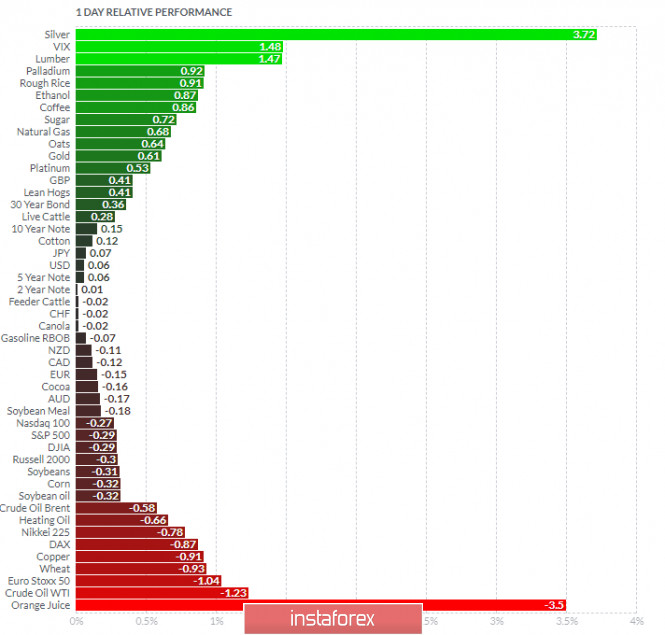

As I discussed in the previous review, the Gold managed to reach projected target at $2,050 but I still see strong upside momentum and potential for another upside swing to develop. The level at $2,055 seems like an major pivot and top of the another new ascending triangle on the hourly time-frame. Further Development Analyzing the current trading chart, I found potential for the upside continuation in case of the upside breakout of the $2,055. The projected target for the new ascending triangle is set at $2,100. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Silver and Lumber second day in a row today and on the bottom Crude Oil and Orange Juice. Key Levels: Resistance: $2,055 Support levels: $2,040, $2,030 The material has been provided by InstaForex Company - www.instaforex.com |

| Comprehensive analysis of movement options for Palladium & Platinum (H4) on August 7, 2020 Posted: 06 Aug 2020 04:22 AM PDT Minute operational scale (H4) I will continue to prepare the situation for Palladium & Platinum - an overview of the options for the movement of these instruments from August 7, 2020. ____________________ #PAF (Palladium) Current Month From August 7, 2020, the movement of #PAF (Palladium) will be determined by the development and direction of the breakdown of the range:

If the resistance level of 2274.00 is broken, the development of the Palladium movement will begin in the 1/2 Median Line channel (2274.00 - 2323.00 - 2370.00) of the Minuette operational scale fork with the prospect of reaching the equilibrium zone boundaries (2424.00 - 2505.00 - 2586.00) of the Minute operational scale fork. In case of breakdown of ISL38.2 Minuette - support level of 2238.00, the development of the #PAF movement will return to the equilibrium zone (2238.00 - 2181.00 - 2120.00) of the Minuette operational scale fork and the 1/2 Median Line channel (2166.00 - 2120.00 - 2072.00) of the Minute operational scale fork with the prospect of reaching the warning line LWL61.8 Minute (2003.00). The markup of #PAF (Palladium) motion options from August 7, 2020 is shown in an animated chart.

____________________ #PLF (Platinum) Current Month The development of the #PLF (Platinum) movement from August 7, 2020 will be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (1040.0 - 1020.3 - 1005.0) of the Minuette operational scale fork - details of the movement marking in this equilibrium zone are shown on the animated chart. The breakdown of the support level of 1005.0 at the lower border of ISL38.2 of the equilibrium zone of the Minuette operational scale fork will make it possible (with the subsequent breakdown of the support level 1000.0) the development of the Platinum movement in the 1/2 Median Line Minuette channel (1000.0 - 990.0 - 977.0) with the prospect of reaching the initial SSL line Minuette (967.0) and channel boundaries of 1/2 Median Line (958.0 - 937.0 - 915.0) pitchfork Minute. If the resistance level of 1040.0 breaks at the upper border of ISL61.8 of the balance zone of the Minuette operational scale forks, confirmation of the development of the #PLF movement in the balance zone will be received (1020.3 - 1057.0 - 1093.0) of the Minute operational scale fork. Details of the #PLF (Platinum) movement options from August 7, 2020 are shown in the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2020 04:15 AM PDT Comments by BOE governor, Andrew Bailey

Bailey is making a firm plea to markets not to price in the possibility for negative rates just yet but his remarks on the economy sort of says otherwise.

As I discussed in the previous review, the EUR managed to test and reject of my third upward target at the price of 1,1900 The level at 1,1900 seems like solid resistnace for the price today buy I still see that trend is bullish with potential for even fourth target to test at 1,2000. Further Development

Analyzing the current trading chart, I found that the sellers became exhausted around the 1,1850, which might be the good area for buy for further re-test of 1,1900 or 1,2000. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Silver and Lumber second day in a row today and on the bottom Crude Oil and Orange Juice. EUR is currently negative but with potential for the increase... Key Lvels: Resistance: 1,1900 Support levels: 1,1850, 1,1800 The material has been provided by InstaForex Company - www.instaforex.com |

| Black gold hits five-month high Posted: 06 Aug 2020 04:05 AM PDT

Brent crude oil was trading at $45, 46 per barrel in March. It was the highest level. Then, the global oil market faced a collapse due to the COVID-19 pandemic. September's futures of Brent crude rose by 1.68% to trade at $45.07 per barrel. At the same time, September's futures of WTI grew by 0.93% to $42.09 per barrel. Finally, oil prices have moved out of the $40-45 per barrel range. The rise was triggered by the recovery in fuel demand, as many countries left the quarantine. Also, in the United States, oil reserves fell by 8.6 million barrels in a week to 520 million barrels, although analysts had expected reduction by only 3 million barrels. Oil quotes were also supported by hopes for the approval of a new aid package to maintain the US economy and the aggravation of the situation in the Middle East after the explosion in Beirut. Moreover, an advance in the number of coronavirus cases in the United States has slowed down. Curiously, now the oil market may face a slight shortage, as analysts say. What will happen next? API's experts believe that due to the recovery in demand, there are no risks of increased supply of raw materials in August. This means that oil prices may continue to rise, but they are unlikely to be significantly higher than the $45 per barrel level. Nevertheless, some experts are not so optimistic, as the risks of falling oil prices still exist. Saudi Arabia may offer discounts on its elite Arab Light crude, cutting the price by $0.48 per barrel. In this case, the price of Brent may again fall below $45 per barrel. Despite the fact that the number of people infected with COVID-19 in the United States has decreased, in the world, on the contrary, the coronavirus outbreak has been fixed. Some countries are reintroducing and even tightening restrictive measures. Moreover, there is still no effective vaccine against the coronavirus. The second wave is becoming a real threat, said Mark Bradford, an expert at BCS Global Markets. In addition, a new agreement signed by the OPEC + countries came into force on August 1 to increase oil production by 2 million barrels per day. Repeated lockdowns will easily nullify oil demand. Economists noted that the market's positive sentiment is being held back by the sharp weakening of the US dollar. Oil prices are likely to ride a roller coaster in the near future. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2020 03:31 AM PDT