Forex analysis review |

- Forecast for EUR/USD on September 23, 2020

- Forecast for GBP/USD on September 23, 2020

- Forecast for AUD/USD on September 23, 2020

- Forecast for USD/JPY on September 23, 2020

- Hot forecast and trading signals for GBP/USD on September 23. COT report. Andrew Bailey failed to affect the markets with

- Hot forecast and trading signals for EUR/USD on September 23. COT report. Powell's speech did not stop the dollar from appreciating

- Overview of the GBP/USD pair. September 23. The speeches of Jerome Powell and Andrew Bailey did not add clarity to the markets.

- Overview of the EUR/USD pair. September 23. Joe Biden's victory will lead to a change in US trade policy.

- How will the US and China share the TikTok Global app?

- Evening review- 2 for EURUSD from 22.09

- Analytics and trading signals for beginners. How to trade GBP/USD on September 23? Getting ready for Wednesday session

- GBP/USD. Fight in the House of Commons, tightening quarantine in Britain and strengthening the greenback

- Analytics and trading signals for beginners. How to trade EUR/USD on September 23? Getting ready for Wednesday session

- September 22, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- September 22, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- September 22, 2020 : EUR/USD daily technical review and trade recommendations.

- Stocks US and Asia continue to trade in negative zone while Europe wins back losses

- 09/22/2020 GBP/USD Analysis: Andrew Bailey gave hope to the British Pound but demand for the Pound remains low

- EUR/USD analysis on September 22. ECB and Fed are going to take stock of their programs to aid the economy during the pandemic

- Outlook for GBP/USD and EUR/USD. Bad news for pound sterling. BoE warns about negative rates

- USDCAD is moving higher approaching target area.

- Evening review on September 22, 2020

- Ichimoku cloud indicator Daily analysis of EURUSD for September 22nd, 2020

- BTC analysis for September 22,.2020 - Breakout of the daily bear flag and potential for bigger drop towards $9.000

- Ichimoku cloud indicator Daily analysis of Gold

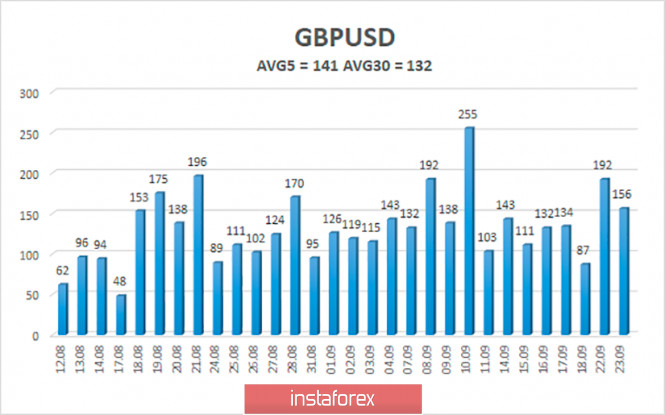

| Forecast for EUR/USD on September 23, 2020 Posted: 22 Sep 2020 08:18 PM PDT EUR/USD Yesterday, the euro came out of a two-month range and today, it approached the first target of 1.1620 during the Asian session. There are no reversal signs on the daily chart. We are waiting for the price to quickly fall to the third target of 1.1480, about a week. On this path, the second target (1.1550) is located in front of the price – the low of November 2017. The price has formed a small convergence with the Marlin oscillator on the four-hour chart, which could mean that it would take some time for the price to reach the target level of 1.1650. This is expected, as the price fell by one and a half figures over the previous two days. |

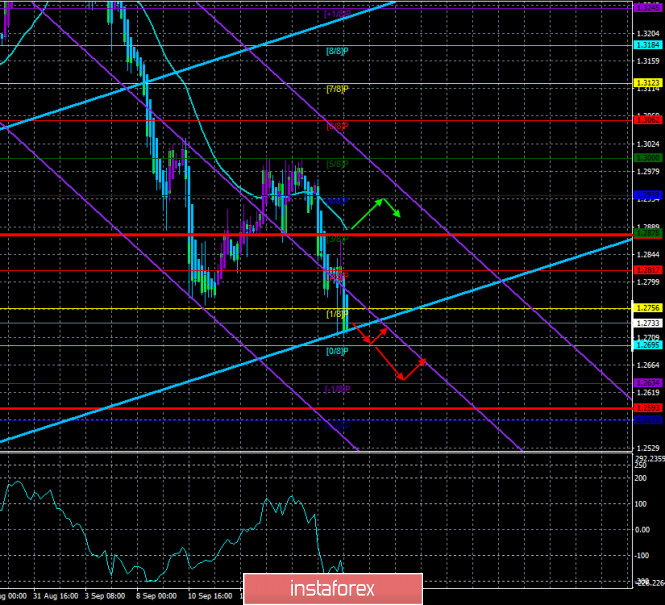

| Forecast for GBP/USD on September 23, 2020 Posted: 22 Sep 2020 08:18 PM PDT GBP/USD The pound sterling has lost 240 points over the past three days in order to hit the first target of 1.2725, Fibonacci 100.0% (Feb 28 low). A slight convergence has formed on the Marlin oscillator on the daily chart. Now the price has a choice - either it will go into the correction right now, or do so later on from the 1.2645 level. However, if the correction starts from the current levels, then it will most likely take the form of a horizontal consolidation, since the formation is not strong. Furthermore, the price has the following targets for Fibonacci levels: 1.2535, 1.2424. The price declines with no clear reversal signs on the four-hour chart. This makes it more likely for the price to fall to 1.2645 today. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on September 23, 2020 Posted: 22 Sep 2020 08:18 PM PDT AUD/USD The Australian dollar continues to rapidly fall to the target range of 0.7065-0.7110, which is formed by the lows of July 24 and August 12. According to the main scenario, we expect the price to fall to the embedded line of the price channel in the 0.6970 area. The Marlin oscillator is already entering the oversold zone on the daily chart, therefore, we expect a deep correction of the Australian dollar from the 0.6970 level back to the 0.7065-0.7110 range. The four-hour chart shows that there are no clear indications of a reversal for the leading Marlin oscillator, which makes it possible for the aussie to reach the target range by the end of the week. We expect it to reach 0.6970 on Tuesday, September 29th. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on September 23, 2020 Posted: 22 Sep 2020 08:18 PM PDT USD/JPY The dollar has grown by more than 50 points against the yen over the past day, the price is already attacking the resistance of the embedded price channel line on the daily chart. Main US stock indices gained more than 1% yesterday, the market is forming a correlation between the stock market's growth and the strengthening dollar, which creates the basis for the greenback's appreciation in the medium-term. The 103.75 target has not yet been reached. The price formed a strong convergence with the Marlin oscillator, its potential is enough to bring the price to the 107.35 target, set by the 76.4% Fibonacci level on the weekly timeframe. But for now, the closest target for the yen is the Fibonacci level of 100.0% at 106.00. The price broke through the area above both indicator lines on the four-hour chart - the balance line and the MACD line. Marlin is actively growing in the positive zone. We are waiting for the price to settle above the embedded price channel line and continue growth. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Sep 2020 06:43 PM PDT GBP/USD 1H The GBP/USD pair continued to trade with a downward bias on September 22. A new descending channel appeared, within which trading is taking place at this time. Thus, after pausing for about a week, bears began to put pressure on the pound/dollar pair again. We saw an expressive rebound from the Kijun-sen line yesterday, which increases the likelihood of the pair's decline. The bulls have completely released the initiative from their hands, due to the UK's fundamental background. But more on that below. Traders will only get a chance of a small upward movement if they manage to gain a foothold above the descending channel. GBP/USD 15M Both linear regression channels are directed downward on the 15-minute timeframe, which fully corresponds to the pair's current trend. The new Commitments of Traders (COT) report for the British pound, which came out last Friday, was very expressive. The previous report shows that professional traders became more bullish despite the fact that the British currency fell 700 points in price. The new COT report turned out to be much more logical. Non-commercial traders closed 4,500 Buy-contracts (longs) and opened 7,000 Sell-contracts (shorts) from September 9 to 15. Thus, the net position for the "non-commercial" category of traders decreased by 11,500 contracts at once. This is very significant, since this group has 81,000 contracts. Therefore, this time the data of the COT report coincides with the nature of trading in the foreign exchange market. Commercial traders were even more interesting, as they closed 37,000 Buy-contracts and 45,000 Sell-contracts in just a week. This suggests that many large players are currently not interested in the pound as an investment currency. The future of the UK and its economy is so uncertain that traders are not interested in buying or selling. Commercial traders are hedgers and, judging by the COT report, they simply switch to other currencies rather than use the pound in their accounts. The new COT report, to be released this Friday, may show minor changes, however, the sentiment of non-commercial traders is likely to become even more bearish. The fundamental background for the pound/dollar pair was fairly neutral on Tuesday, despite the speeches of Federal Reserve Chairman Jerome Powell and Bank of England Governor Andrew Bailey. The speeches were interesting, but they didn't really influence the general trend. Bailey tried to convince the markets that the British central bank is not going to apply negative rates in the near future, but this still did not save the pound sterling from new short positions. On Wednesday, traders are advised to pay attention to the indices of business activity in the services and manufacturing sectors in the UK, as traders traditionally react to these reports more readily than to European or American ones. However, no major changes are expected in these figures. Therefore, if there are no surprises, then it is unlikely that traders will work out these numbers. We have two trading ideas for September 23: 1) Buyers have let go of the initiative and now they have to work hard enough to get it back. We can talk about long positions on the British currency, but first the price should settle above the descending channel with the first target at the resistance level of 1.3020. However, given the fundamental background and the general mood of market participants, it is unlikely for the trend to change to an upward one in the near future. Take Profit in this case will be about 120 points. 2) On the other hand, sellers can only trade down at this time. The nearest targets are support levels 1.2667 and 1.2558. It is best to sell the pair from the upper area of the descending channel, however, to do this, the quotes should rise in that area. Price rebounds from the Kijun-sen line (1.2857) or the upper channel line can be used to open new positions. Take Profit in this case can range from 50 to 170 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Sep 2020 06:42 PM PDT EUR/USD 1H The EUR/USD pair finally fell into the support area of 1.1702-1.1726 on the hourly timeframe on September 22, where it had not been in for a long time. However, this area is the lower border of the $1.17-1.19 horizontal channel, which we have mentioned every day for almost two months now. We say that because the euro/dollar pair spent 90% of these two months within this channel. The quotes continue to trade in flat and even fell during the last two trading days, and this still does not change the overall technical picture. If the bears manage to confidently overcome the 1.1702-1.1726 area, then one can expect quotes to fall towards targets of 1.1663 and 1.1588. Globally, such a downward correction has been brewing a long time ago, since after rising by 1300 points, the pair corrected by only 200, which is very little. EUR/USD 15M Both linear regression channels are directed to the downside on the 15 minute timeframe, signaling a downward movement. The EUR/USD pair continued to trade in the horizontal channel of 1.17-1.19 last week. Therefore, even if there were changes in the mood of large traders, it did not show on the pair's chart. And there were changes. Non-commercial traders closed as many as 17,000 Buy-contracts (longs) and only 1,500 Sell-contracts (shorts) during the reporting week (September 9-15). Thus, the sentiment of the most important group of traders, "non-commercial", has shifted towards bearish. The net position for this group also decreased by 15,000 contracts. In turn, this means that professional traders began to look towards buying the US dollar and selling the euro. Commercial traders actively closed both types of contracts. However, we are less interested in this group. We still haven't seen results from all these changes. And the nature of the pair's movement hasn't changed much from September 16 to 22. We still failed to get out of the horizontal channel, and falling towards the 1.1700 level is not something extraordinary. Thus, the new COT report, which will be released on Friday, may signal new changes, but there were none on the foreign exchange market during the reporting period. No important speeches or publications in the European Union on Tuesday, September 22. Federal Reserve Chairman Jerome Powell delivered a speech in the US Congress, but traders were not that impressed, who, in principle, were anticipating the speech. Powell reiterated that economic recovery entirely depends on the success of the fight against the coronavirus epidemic and called on Congress to approve a new package of assistance to all the most affected areas of the economy. Powell is scheduled to make another speech in Congress today, which will most likely repeat yesterday's one with accuracy. Thus, traders can pay more attention to the indexes of business activity in the services and manufacturing sectors of Germany, the European Union and the United States. Changes in these indicators are expected to be minimal, therefore, most likely, market participants will ignore all these reports. We have two trading ideas for September 23: 1) Buyers released the EUR/USD pair to the lower area of the $1.17-1.19 horizontal channel. Therefore, we recommend considering long positions if the pair remains inside the horizontal channel, and the bulls manage to settle above the Kijun-sen line (1.1782), while aiming for the Senkou Span B line (1.1835) and the resistance area of 1.1894-1.1910... Take Profit in this case will be from 40 to 90 points. 2) Bears pulled down the pair in half to the lower area of the 1.17-1.19 horizontal channel, but now they have to overcome the lower border. If this attempt is successful, we recommend trading down with targets at the support levels of 1.1663 and 1.1588. The potential Take Profit in this case is from 25 to 90 points. Otherwise, the pair will start a new round of upward movement inside the horizontal channel. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

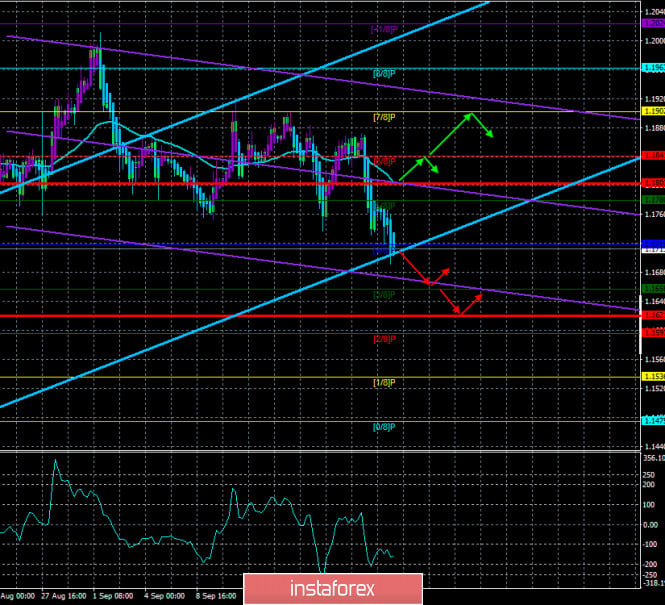

| Posted: 22 Sep 2020 05:59 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. CCI: -178.8262 On the third trading day, the British pound traded in a downward movement again, although it made a significant upward leap during the day. Such versatile trading and sharp changes in the direction of the pair's movement during the day were caused by two speeches by the heads of central banks (America and the UK). Recall that last week, with a difference of one day, meetings of the Bank of England and the Fed were held, during which all the parameters of both monetary policies remained unchanged. But if Jerome Powell was optimistic enough in his statements, Andrew Bailey was not. However, neither the first nor the second event had a special impact on the movement of the pound/dollar pair. For the British currency, the topic of the lack of a free trade agreement with the European Union, as well as the resonant bill of Boris Johnson, which can finally divide Brussels and London, remains much more important. Thus, we can make almost one hundred percent conclusion that the British pound resumed falling based on this fundamental background, although there have been no new reports on the two above-mentioned topics in recent days. We also remind you that the euro/dollar remains flat for two months, which is not observed for the pound/dollar pair. Jerome Powell's speech to the US Congress was expected by traders, as well as any of his other speeches. However, we have warned in our recent articles that it is unlikely that Jerome will report anything fundamentally important and new, since just recently the Fed meeting took place, after which he could report everything that was required. According to Powell, the risks to the US economy remain extremely high. Financial assistance ($4 trillion approved by the US Congress in March) has had a mitigating effect on the consequences of the "coronavirus epidemic". However, the future of the US economy depends entirely on how well the fight against the epidemic is conducted in the future. Powell stressed that the pandemic has not gone anywhere, and there was no end to the "wave". States continue to be in a permanent state of development of the epidemic. The head of the Fed also noted that recently there has been an improvement in macroeconomic indicators, which, however, should not be misleading, since the "lockdown" is over, and the economy would have revived after that in any case. Powell is very concerned about the country's unemployment rate, which remains well above pre-crisis levels. The head of the Federal Reserve has also stated several times that before the complete victory over the "coronavirus", it makes no sense to expect a full recovery in business and economic activity. In other words, the US economy will not be able to return to pre-crisis levels until there is a complete victory over the pandemic. Powell also called on the US Congress to consider and approve a new package of assistance to the US economy, which will go to support those industries that have suffered the most from the pandemic. In principle, Powell's speech fairly accurately reflects our own opinion. We have repeatedly stated that the most important thing for America is the confrontation with the "coronavirus". Donald Trump failed to fight the epidemic, perhaps Biden will be able to cope with it. In any case, the approach needs to be changed, as 40-45 thousand new cases of the disease continue to be recorded daily in the United States. Jerome Powell's colleague Andrew Bailey also made an interesting statement. The head of the Bank of England said that in the near future, the regulator is not going to resort to the introduction of negative rates, although this topic has been discussed by traders and economists for several months. Recall that many market participants believe that sooner or later the Bank of England will have to resort to this step since the economy fell by a record 20% in the second quarter, and the risks of the UK leaving the EU without a "deal" are growing every day. Moreover, thanks to Boris Johnson and his new bill "on the national market of Great Britain", the chances of a quarrel with the alliance are also growing, which will undoubtedly affect the British economy. Thus, many traders are waiting for new stimulating steps from the BA. They are equally waiting for a reduction in the key rate and an expansion of the quantitative stimulus program. Thus, Andrew Bailey refuted traders' expectations for the rate in the near future. "It would be a mortal sin to say that we have a tool that we can't put into practice," the BA chief said. Bailey also added that the regulator's statement following the September meeting was only intended to make sure that banks are ready to switch to negative rates. Meanwhile, the most famous American publication the Washington Post reports that during the reign of Donald Trump, the "prestige" of the United States fell. Although the President regularly declares in his interviews that he has returned America to its "former greatness", practice shows that the opposite is more likely the case. A study conducted this summer shows that the attitude of countries such as France, Canada, Japan, Australia, France and other "first players" of our world has fallen to the lowest level in the last 20 years. The approval rating, therefore, is 34%, although in 2016 it was less than 52%. 86% of respondents said that America has completely lost the fight against the epidemic. Further, the biggest reason for the unpopularity of the United States is called Donald Trump. It should also be noted that all the leaders of the "Big Eight" scored more approval ratings than Trump. As for the near-term outlook for the pound/dollar pair, it is likely to remain downward. Too many negative things are happening in the Foggy Albion right now. In the United States, as we have repeatedly noted, there are also enough problems, however, the UK managed to "surpass" America. At the same time, almost all the problems in Britain are "short-playing" in nature. In other words, they may start to have an impact (or they already do) on the economy in the very near future. Thus, the outlook for the pound remains even bleaker than for the US dollar. However, both of these currencies are still absolute outsiders in 2020. From a technical point of view, the downward trend resumed after a minimal upward correction. Bulls finally left the market as the pound has been rising since March 20. Further, we have repeatedly said that its growth cannot be called fully justified.

The average volatility of the GBP/USD pair is currently 141 points per day. For the pound/dollar pair, this value is "high". On Wednesday, September 23, thus, we expect movement inside the channel, limited by the levels of 1.2593 and 1.2876. A reversal of the Heiken Ashi indicator to the top signals the beginning of an upward correction. Nearest support levels: S1 – 1.2695 S2 – 1.2634 S3 – 1.2573 Nearest resistance levels: R1 – 1.2756 R2 – 1.2817 R3 – 1.2878 Trading recommendations: The GBP/USD pair resumed a strong downward movement on the 4-hour timeframe. Thus, today it is recommended to keep open short positions with targets of 1.2695 and 1.2634 as long as the Heiken Ashi indicator is directed downward. It is recommended to trade the pair for an increase with targets of 1.2939 and 1.3000 if the price returns to the area above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

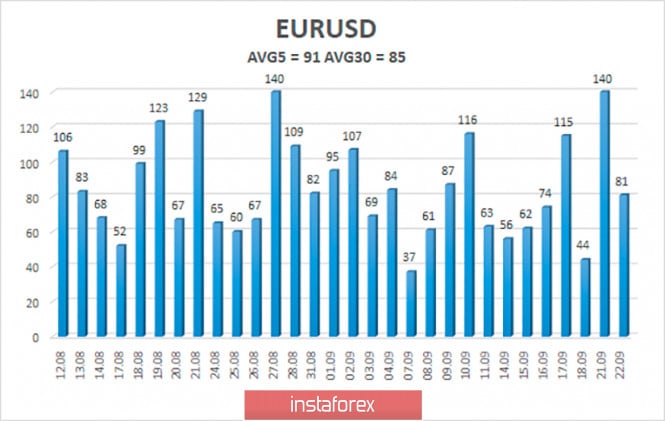

| Posted: 22 Sep 2020 05:59 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) – down. CCI: -156.3390 The EUR/USD pair continued its downward movement for the second trading day, although the pair's quotes are located near the lower border of the side channel of 1.17-1.19, where it is more logical to consider long positions. However, market participants decided otherwise. In any case, the flat should end sooner or later. Why not now? We are not saying that it has already been completed, however, the fall in the euro currency quotes should not cause too much surprise either. Recall that after the European currency rose by 1300 points, which caused almost a panic in the ranks of the European Central Bank, there was no normal correction. All the traders managed to do was lower the pair by 200 points, which is very small to be called a "correction". Moreover, the euro/dollar pair has been trading in a 200-point sideways range for two months, thus, it is too early to talk about the end of the flat because the pair is declining for the second day in a row. Meanwhile, the "battle for the seat" continues in the States. We are talking about the presidential election, which will be held on November 3. We have repeatedly written about this event, stating that this event is now the most important and significant for the country and the dollar. This is not an event that can have a momentary impact on the movement of the US currency. However, for a long-term perspective, it is of great importance. In the last two trading days, the US currency has become more expensive, but if the flow of negative news resumes from overseas, the dollar's strengthening may be very short. In the meantime, Donald Trump and Joe Biden continue to mutually insult each other, believing that this will somehow increase their chances of winning in a month and a half. We have repeatedly conducted an analysis, during which it became clear that the upcoming elections will be one of the most interesting in the history of the United States. Neither Trump nor Biden will accept defeat, thus, there will probably be "foul play" and various "tricks", after which the fight for the president's seat can safely move to the courts. Meanwhile, the democratic presidential candidate Biden said that the States suffered from the "coronavirus" more than other countries in the world because the current president did not take all the necessary measures. According to Biden, Donald Trump failed to keep his cool at an extremely important moment for a multi-million-strong country, which caused the loss of more than 200,000 human lives. However, this is far from the end, because, despite all Trump's promises to create a vaccine in the near future, the real vaccination of the population will begin at the beginning of next year. And in America, about 40,000 people are infected with the "coronavirus" every day. "All his life, Donald Trump has been running from the problems he faced. In light of this crisis, when it took the president to play a leading role, he failed, and all of America paid the price," Biden told supporters in Wisconsin. "More than 200,000 people have died in the past six months. So many lives have been lost because the only thing the president cares about is the stock markets and the election," Biden added. Joe Biden also calls the US president a "fool" who "does stupid things and shows false masculinity". To this insinuation, Trump responded as follows: "Look at sleepy Joe, how did he handle the swine flu? It was a failure, a nightmare." However, Trump did not say what exactly was the "failure" and "nightmare". Therefore, his accusations against Biden do look rather weak. Especially because Biden was not president at the time, which means that he can not be blamed completely for any events taking place in the United States when he was Vice President under Barack Obama. Meanwhile, many US trade partners are counting on Joe Biden to win the election. They are counting on him because they hope for a change in US trade policy. According to sources close to Biden, it is unlikely to expect strong changes, however, it may become softer and more consistent. Although Biden also promises to reduce US dependence on China, he may still be more lenient in negotiations and strike a fairer deal that ends the trade war that is negatively affecting both the US and Chinese economies, as well as the global economy. By the way, a change in trade strategy would be in the hands of the States themselves. As we have said several times, the trade deficit has only increased under Donald Trump. Thus, it doesn't matter what deal was made with China or how much the trade deficit with that country has shrunk. In fact: the overall trade balance for America continues to shrink. If something doesn't work as expected, then you need to change your strategy. Trump can't provide a new strategy, however, Biden can. Joe Biden promises to use a wider range of tools in his trade policy. In general, Biden's proposals are in many ways similar to Trump, however, they are more loyal, which means they have a better chance of positive implementation. Because we once again remind you that negotiations are always at least two countries. While Washington can negotiate with weak and small countries from a position of strength, it cannot do so with Russia and China. Biden understands this and Trump doesn't. Thus, we believe that if Joe Biden wins the election, the demand for the US dollar will automatically grow. Simply because it will mean the end of the war with American manufacturers, whose production has been operating for years in China, Taiwan, and other countries with cheap labor, as well as the possible end of the trade war with China, which is almost openly supporting the democratic candidate. As for the near-term perspective, until the euro/dollar pair leaves the channel of 1.17-1.19, there is no need to talk about any trend movement. Near the Murray level of "4/8" - 1.1719, an upward turn may occur and a new round of upward movement will begin inside the same side channel.

The volatility of the euro/dollar currency pair as of September 23 is 91 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1621 and 1.1803. The reversal of the Heiken Ashi indicator back upward signals a round of upward movement in the remaining side channel of $ 1.17 - $ 1.19. Nearest support levels: S1 – 1.1719 S2 – 1.1658 S3 – 1.1597 Nearest resistance levels: R1 – 1.1780 R2 – 1.1841 R3 – 1.1902 Trading recommendations: The EUR/USD pair is fixed below the moving average line but remains in the side channel. Thus, formally, you can now hold short positions with targets of 1.1658 and 1.1621 until the Heiken Ashi indicator turns upward. It is recommended to re-consider options for opening long positions if the pair is fixed above the moving average with the first targets of 1.1841 and 1.1902. The material has been provided by InstaForex Company - www.instaforex.com |

| How will the US and China share the TikTok Global app? Posted: 22 Sep 2020 04:49 PM PDT

The popular Chinese app "TikTok" is considered to be a national security threat by the US government. D. Trump expressed concern that the Chinese government could collect data on Americans and transfer it to Chinese intelligence agencies using smartphones of TikTok users. CIA representatives said that this is possible, but they could not prove it. Therefore, the head of the White House issued a statement that the United States will be banned from downloading TikTok and WeChat through the App Store and Google Play, as well as other applications from September 20, 2020. Otherwise, the Internet company ByteDance, the owner of TikTok, must sell the local division of any American company so that its application in America will not be blocked entirely. Microsoft, Walmart and Oracle were initially considered as potential buyers. According to Reuters, D. Trump agreed to a deal between the IT giant Oracle and the Chinese company ByteDance. Moreover, he approved participation in the deal by the American retailer Walmart. The US Department of Commerce agreed to postpone a possible ban on TikTok downloads for a week. As a result, American citizens can use this application until September 27. A new company, TikTok Global, will be created to manage the TikTok business, which is designed to keep the service running both in the United States and in most countries of the world. On Monday, September 21, ByteDance confirmed that it managed to negotiate with Oracle and Walmart to own 80% of TikTok Global, while the two American companies will acquire the remaining 20% of the popular application. According to the agreement signed by D. Trump, Oracle will buy 12.5% of the shares of the new company, and Walmart will receive 7.5%. With Oracle and Walmart stakes, the TikTok Global app is expected to become fully controlled by US investors. As for the board of directors of the new company, it will include the founder and current chairman of the board of directors of ByteDance, as well as the chief executive of Walmart. TikTok Global management plans to improve the transparency of corporate governance. According to TikTok, there are about 100 million users of the app, and about 19 million users of the WeChat app in the US. Thus, America accounts for about 26% of total TikTok traffic. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review- 2 for EURUSD from 22.09 Posted: 22 Sep 2020 02:24 PM PDT EURUSD, daily. So, it seems that the euro has broken down (but this is inaccurate). How about targets down? The move looks corrective to the previous strong rally. The fall might stop near the 100-day moving average - or else at 1.1460 If the fall continues, we take everything or part of the positions at 1.1460. In the event of a reversal to the upside, buy from 1.1875. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Sep 2020 02:22 PM PDT Hourly chart of the GBP/USD pair Trading is about to end at this time and it is quite difficult for the GBP/USD pair. The MACD indicator generated two sell signals here, each of which was weak and unconfirmed. The downward trend line only appeared in the evening, and was not available during the day. Thus, the downward trend for the pound/dollar pair has been extended and, one might even say, has intensified, since now traders have a trend line at their disposal. We advised not to trade up in the morning article, and also recommended waiting for the price to settle below 1.2774, which is the previous local low. At the moment, we can conclude that this level has been overcome, which means that the path for a long term decline is open for traders. New targets for trading will appear tomorrow, but for now the closest one is the support level of 1.2659. The fundamental background is still the main reason why the pound's quotes are falling in September. Moreover, speeches from Federal Reserve Chairman Jerome Powell and Bank of England Governor Andrew Bailey do not affect the mood at the moment. And neither did the central bank meetings last week. Traders are only fixated on events related to Brexit and the future relationship between the UK and the European Union. The pound started to fall when it was announced that two regular rounds of negotiations with Brussels regarding a free trade agreement have both ended in failure. And the pound also continued to move down when Prime Minister Boris Johnson's resonant bill was announced, this bill allows the UK government to violate its agreement with the EU on the Northern Ireland border. These two factors pull down the pair. Bailey delivered a speech today, but he only said one thing. Negative rates will not be introduced in the near future, although the Bank of England allows their use in the future. This is positive news for the pound, as we remind novice traders that any rate cut or expansion of the quantitative stimulus program is a bearish factor for the currency, the central bank of which is doing this. Therefore, one might say that Bailey even managed to please some buyers of the pound. But they could not take advantage of the given chances. Indexes of business activity in the service and manufacturing sectors will be published tomorrow in the UK and the United States, which are currently not important. You shouldn't skip them, however, they are unlikely to be followed by a serious market reaction. Possible scenarios for September 23: 1) We still do not recommend buying the pound/dollar pair, since a strong downward trend has currently appeared. We believe that quotes will continue to decline in the near future, therefore, to be able to open long positions, you should wait until the trend changes to an upward one. That is when the price settles above the new descending trend line. This is unlikely to happen in the next few hours, so we recommend waiting at least in the morning. 2) Sell positions, from our point of view, are much more convenient now. They can be kept open until the MACD indicator reverses to the upside and then you can aim for the support level of 1.2659, if novice traders still entered the market using one of today's MACD signals. In general, as long as the downward trend line remains relevant, you are still advised to trade for a fall. It is recommended to study the possibilities of opening new sell orders tomorrow morning. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Sep 2020 02:22 PM PDT The pound continues to plunge down. After a short rise, the GBP/USD pair fell to the bottom of the 27th figure, opening new price horizons for itself. The pair traded in the 1.24-1.27 range throughout July, after which it went up against the background of a weakening dollar and optimism about negotiations on the Brexit trade deal. At the moment, we are observing a mirror situation: the greenback is strengthening throughout the market, and hopes for a deal are dwindling every day, amid consideration by the House of Commons of the resonant draft UK Internal Market Bill. The threat of a second wave of the coronavirus epidemic in Great Britain organically complements the negative fundamental picture for the pound, which is why it is forced to retreat throughout the market. Let's start with the political battles within the walls of the British Parliament, where a scandalous bill is being considered for the second week, which, in fact, crosses out some of the provisions of the Brexit deal. Prime Minister Boris Johnson continues to insist that this law will ensure the integrity of the UK internal market after the end of the transition. However, according to European and many British politicians, this legislative initiative violates the norms of international law. Just today, the German Minister for European Affairs Michael Roth made a rather harsh statement, saying that the Brits should "stop playing games in negotiations with Brussels." But despite the powerful political confrontation, the resonant bill passed the first reading - 340 deputies of the Lower House of Parliament voted for it. A second vote is expected this week. During the discussion of the amendments, Johnson agreed to the amendments, according to which the "last word" in the issue of changing the Brexit deal will remain with the House of Commons, and not with the government. On the one hand, this is a compromise, but on the other hand, it does not change anything in the context of relations with Brussels. As the former British Prime Minister Theresa May noted, "a violation of international obligations will still remain a violation of international obligations, regardless of whether it is allowed by the prime minister or Parliament." A similar position is voiced by EU representatives, threatening to withdraw from the negotiation process to conclude a deal if the law is still adopted. The pound was afloat for some time due to the notorious position of the House of Lords. Most peers do not support Conservative initiatives, especially anti-European ones. But at the end of last week, representatives of the British government recalled the existence of the Salisbury Convention, according to which members of the House of Lords should "without delay pass bills aimed at implementing the election program of the winning party or coalition." According to Johnson, his legislative initiative falls within the scope of this convention. In addition, take note that the Upper House of the British Parliament is not an appellate instance that can overturn or block certain bills. Peers can express their opinions in the form of amendments, which can later be rejected by members of the Lower House. In other words, GBP/USD buyers have lost an important advantage of a fundamental nature that kept the pair at the borders of the 30th figure. If the second vote is in favor of the controversial bill, the pound will accelerate its decline. In addition, details of tightening quarantine restrictions in the UK have become known today. Ahead of which, Johnson has ruled out a second nationwide lockdown, but investors were not pleased with the latest measures either. In particular, now all pubs, bars, restaurants and other similar establishments must close no later than 22:00. The list of places where it is necessary to wear masks will also be expanded, and compliance with the rules will be stricter - even the military will be involved in helping the police. It is obvious that the tightening of quarantine will negatively affect the recovery process of the economy. First of all, the labor market will suffer, consumer activity will decrease, and the service sector, which has just begun to show signs of life, will be under attack. To be fair, the GBP/USD pair is decreasing not only due to the weakening of the pound, but also due to the general strengthening of the dollar. The greenback is in high demand amid a surge in anti-risk sentiment - a loud scandal with FinCEN, as well as coronavirus anti-records make investors nervous. In addition, US Treasury Secretary Stephen Mnuchin just announced that the White House is working with Congress representatives on the next program to help the economy. This rhetoric provided additional support for the greenback. All this suggests that the downward dynamics will continue for the GBP/USD pair. At the moment, bears are testing the lower border of the Kumo cloud on the daily chart, which corresponds to the 1.2730 level. If sellers overcome this support level (which I personally have no doubt about), then they will open their way to the lower line of the Bollinger Bands indicator - to the 1.2630 level. Short positions are a priority both in the short and (even more so) in the medium term. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Sep 2020 02:22 PM PDT Hourly chart of the EUR/USD pair Instead of a normal correction, the EUR/USD pair continued to move down on Tuesday, September 22, and by the end of the day it reached the lower boundary of the horizontal channel at 1.1700-1.1900. The price has reached the extreme lower point of the horizontal channel, below which it will be possible to count on the resumption of the downward movement. True, it has not yet been possible to overcome this line. Thus, it is quite possible that a rebound will follow, the euro/dollar pair will start a new round of upward movement, and therefore, the relevance of the horizontal channel will be preserved. We mentioned in our morning review that it is more convenient to consider buying the pair in the lower area of the horizontal channel. However, we have already pointed out more than once that no trend lines or channels within the 1.17-1.19 range have appeared in recent days, so any signals from the MACD are weak and unconfirmed. Today the price turned down very quickly, and the MACD indicator, due to the fact that it wasn't near the 0 mark, failed to react to the completion of the upward movement in time. We generally advise novice traders to not consider selling the currency pair today. And, as you can see, this was very difficult to implement, since both sell signals from the MACD appeared very late, again because the indicator did not have time to discharge enough and return to the zero mark. Therefore, it was extremely difficult to trade today. The fundamental background was quite interesting on Tuesday, as Federal Reserve Chairman Jerome Powell made a speech in the US Congress, and the text of his speech was publicized much earlier than the speech itself. Powell attaches great importance to the coronavirus pandemic, the government's fight against it, and he connects the prospects of the American economy with its outcome. In other words, Powell believes that the US economy will not be able to fully recover without defeating the epidemic. In addition, Powell called on the US Congress to approve a new stimulus package, in other words, new cash injections into the economy, which Democrats and Republicans are still fighting over. Powell will deliver another speech in the US Congress on Wednesday, September 23, but this time in front of a different committee. Powell speaks to Congress twice a year, so we can confidently say that both texts of his speech are the same. Thus, there is no point in expecting any new information tomorrow. Today markets have barely noticed his speech. Most likely it will be the same tomorrow. In addition, the European Union and America will release business activity indices in the manufacturing and services sectors, which may affect the movement of the euro/dollar pair only if they go below 50.0 (below this mark it is believed that a decline has begun in one area or another ). Judging by experts forecasts, no field in any country will go below 50.0. Possible scenarios for September 23: 1) Novice traders are still not recommended to place buy positions at this time, since there isn't a single signal. Although, it is more convenient to consider buy orders from the lower area of the 1.17-1.19 horizontal channel. Especially after the pair fell by around 170 points and reached the lower channel line. Thus, at a minimum, to open buy positions for the pair, you need to wait for the price to rebound from the 1.1700 level. And even in this case, you are still advised not to forget about the Stop Loss level. 2) Selling does not seem appropriate at all at this time, since the pair has already gone down 170 points and is currently trading near the lower border of the horizontal channel. Therefore, novice traders are recommended either to wait for the price to settle below the horizontal channel and, accordingly, for a new downward trend to appear, or you can wait for quotes to return to the upper area of the channel, from where you can again trade for a fall. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| September 22, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 22 Sep 2020 08:11 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the key-level level of 1.3300. A quick bearish decline took place towards 1.2900 then 1.2825 where some bullish recovery was recently expressed. The price zone of 1.3130-1.3150 (the backside of the broken trend) remains an Intraday Key-Zone to offer bearish pressure if retested again. The GBPUSD pair is showing lack of sufficient bullish momentum to pursue above the price level of 1.3000. That's why, bearish persistence below 1.3000 enabled further bearish decline initially towards 1.2800 where another episode of bullish recovery may be executed. Trade recommendations : Conservative traders are advised to wait for bullish pullback towards 1.3130-1.3150 (the backside of the broken trend) for a valid SELL Entry. Initial T/p level is to be located around 1.3050 and 1.2900 if sufficient bearish pressure is maintained. On the other hand, bullish persistence above 1.3200 invalidates this trading scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| September 22, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 22 Sep 2020 08:02 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1700 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) stood as a strong SUPPLY-Zone to offer bearish reversal. Conservative traders should be considering the recent bearish closure below 1.1700 - 1.1750 as this indicates lack of bullish momentum and enhances further bearish decline initially towards 1.1645 and 1.1600. Trade recommendations : Conservative traders should consider the current bearish persistence below 1.1750 as an indicator for lack of bearish momentum for a valid SELL Entry. T/P levels to be located around 1.1645, 1.1600 and 1.1500 while S/L to be placed above 1.1800 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| September 22, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 22 Sep 2020 07:49 AM PDT  The EUR/USD pair has been moving sideways within the depicted expanding channel since August 3. Previously, a temporary resistance level was formed around 1.1900 which prevented further upside movement for and forced the pair to have a downside pause for sometime. On August 31, the EURUSD pair achieved another breakout above the previously mentioned resistance zone. Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. Recently, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800. More downside movement was expected towards the lower limit of the movement pattern around 1.1770-1.1750 which has been providing Support for the EUR/USD pair until earlier Today. Earlier Yesterday, a breakout to the downside was executed below the price level of 1.1750 (KeyZone). Hence intraday technical outlook has turned into bearish. Intraday traders should be waiting for any pullback to the upside towards the depicted key-zone (1.1750-1.1770) for a vali SELL Entry. On the other hand, a breakout above 1.1820 (Exit Level) will probably enable further upside movement towards 1.1860-1.1900. The material has been provided by InstaForex Company - www.instaforex.com |

| Stocks US and Asia continue to trade in negative zone while Europe wins back losses Posted: 22 Sep 2020 07:44 AM PDT

The US stock exchanges experienced another significant downfall on Tuesday. Nevertheless, the indexes remain far from their minimum marks. The risks for the stock markets are growing, and investors are reconsidering their activities. The Dow Jones Industrial Average index lost 1.84% or 509.72 points, which moved it to the level of 27147.70 points. The S&P 500 index parted with 1.16% or 38.41 points. Its current mark has stopped at 3281.06 points. It was the fourth consecutive decline and the longest period of decline in nearly eight months. The Nasdaq Composite index also went down by 0.13% or 14.43 points, which pushed it to the area of 10778.80 points. Concerns are now growing amongst market participants.The situation with delays in the adoption of the new US economic stimulus program makes investors wonder whether it will be ratified at all. The US presidential elections adds tension and uncertainty. Another indicator of concern is the conflict between Washington and Beijing, which is only gaining momentum and has no solution yet. As well as the possibility of introducing a new portion of restrictive quarantine measures associated with repeated outbreaks of coronavirus infection in America and other states. The negotiation process for a new stimulus package in the US is moving very slowly. Congressional representatives have begun issuing a statement about expanding the incentive package for restaurant companies, as well as air carriers, as they suffered more than others during the coronavirus pandemic. Note that the Democrats proposed an incentive budget totaling $3.4 trillion, however, there has been a lot of changes since its proposal in May of this year. Thus, it is no longer considered relevant at present. Another event that negatively affected the market was the banning of China developed mobile applications Wechat and TikTok in the USA. The response from Beijing was not long in coming. Over the weekend, the Chinese authorities published a new list of foreign companies and individuals who are persona non grata for the country, as they threaten the national security and sovereignty of the state. Thus, the conflict not only does not end, but also gains new momentum. Meanwhile, new cases of coronavirus infection are continue to be recorded around the globe. The UK authorities have announced the second wave of the pandemic in the country and urged residents to be prepared for the next batch of restrictive quarantine measures. The total number of COVID-19 patients in the US already exceeded the mark of 7.41 million on Monday. The number of cases is also increasing in India, where there are already more than 5.56 million total cases. Brazil also contonues to record news cases and has totalled to 4.56 million. In General, there are about 31.45 million COVID cases worldwide. However, the most dangerous, according to experts, is still ahead, the second wave is unlikely to be avoided. The number of deaths are also growing rapidly, and at present there are about 50,000 cases per week. All this makes the prospects for investors in the stock markets not too bright, who in the current situation prefer not to take risks and adjust their work. The Asian stock exchanges also traded in a negative zone on Tuesday. The major stock indexes are reducing their positions following the fall in the US stocks. The threat of the second wave of the pandemic also induces anxiety amongst market participants. Experts hint that the European region will not be able to avoid new restrictive quarantine measures to counteract coronavirus infection. This, in turn, will be another blow to the economy of the region and the world as a whole. Thus, Asian investors are not showing too much interest in risk right now. Trading platforms in Japan remain closed due to public holidays in the country. China's Shanghai Composite Index dropped 0.37%. The Hong Kong HangSeng index split the negative trend and sank 0.57%. South Korea's Kospi index sank quite deeply by 2.33%. Australia's S & P / ASX 200 Index lost 0.52%. Europe stock markets, on the contrary, traded in a green zone. The major stock indexes showed strong growth, which allowed them to compensate for the significant losses that occurred the previous day. On Monday, a notable decline was recorded in European stocks where indices recorded the same losses for three months. The general index of large enterprises in the European region StoxxEurope 600 rose 0.7% Tuesday morning, which allowed it to move to the level of 359.31 points. Note that it sank 3.2% during Monday's trading. The German DAX index gained 1.07% and became the leader of the rise. France's CAC 40 Index added 0.42%. The UK FTSE 100 Index is up 0.27%. Italy's FTSE MIB went up 0.95%. Spain's IBEX 35 Index also rose 0.26%. The material has been provided by InstaForex Company - www.instaforex.com |

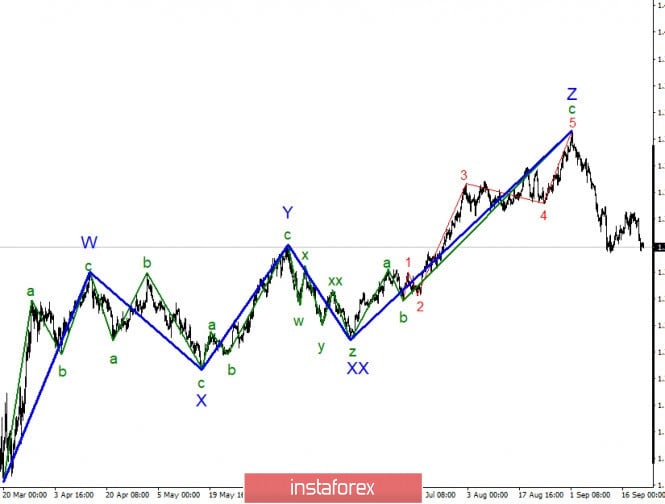

| Posted: 22 Sep 2020 07:10 AM PDT The construction of a new downward section of the trend continues. The continued decline in quotations suggests the completion of the construction of wave 2 as part of this section has taken a rather shortened form. A successful attempt to break through the minimum of the expected wave 1 allows us to conclude that the markets are ready for further sales of the British Pound. The chart clearly shows the drop in demand for the British currency in recent weeks. Thus, the downward section of the trend is likely to continue its construction. During the last trading day, the GBP/USD instrument lost about 120 basis points, and today, it lost several dozen more. There are more and more chances that the construction of the expected correction wave 2 or b is completed despite the unsuccessful attempt to break the 61.8% Fibonacci level. At this time, quotes may start moving away from the reached lows but according to the current wave markup, wave 3 or C has already begun its construction and should continue it with goals located below the 61.8% Fibonacci mark. The Pound had some good news today. The Bank of England's Governor, Andrew Bailey, spoke at the Association of British Chambers of Commerce webinar. During his speech, he said that the Bank is not going to lower interest rates below zero in the near future. Let me remind you that over the past few months, there has been persistent speculation in the foreign exchange market that the central bank of Great Britain may lower rates even more since the current parameters of monetary policy are not enough for the economy to recover at the right pace. In the coming months, the UK economy may face new problems in the form of a second wave of COVID-2019, as well as the lack of a free trade agreement with the European Union. Thus, it is almost 100% likely that new incentives will be needed. One of the strongest incentive tools is just lowering the key rate, which is currently already at the minimum level of 0.1%. The markets have long been waiting for the transition to the negative area. According to Bailey, the Bank of England should be confident that it can lower rates at the right time but this does not mean that this will necessarily happen in the near future. After these words, the demand for the British pound increased slightly, which helped it to add even about 90 points from the day's low. However, in the future, I believe that the decline in the instrument's quotes will continue, since the wave markup assumes this scenario. General conclusions and recommendations: The Pound-Dollar instrument has presumably completed the construction of the upward wave Z and the entire upward trend section. At the same time, there is a high probability of building a correction wave 2 or B, which could also have already completed its construction near the level of 38.2%. An unsuccessful attempt to break this mark allows the markets to start selling the instrument with targets located around 1.2721 and 1.2539, which is equal to 61.8% and 76.4% according to Fibonacci, based on the construction of the third wave. The material has been provided by InstaForex Company - www.instaforex.com |

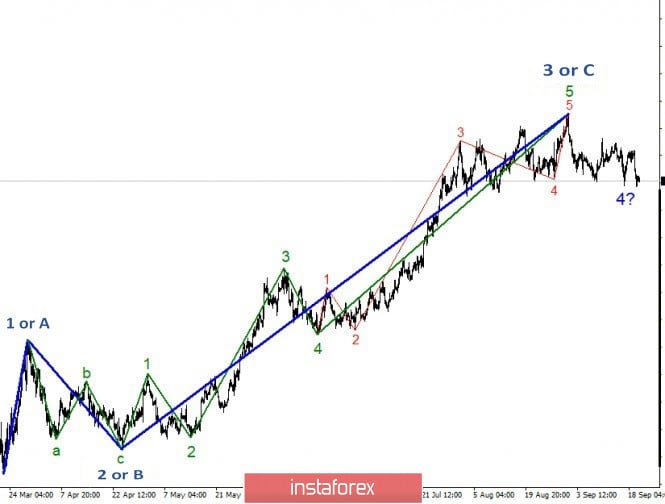

| Posted: 22 Sep 2020 07:07 AM PDT The EUR/USD instrument's wave marking still looks quite globally convincing in everything that concerns the upward section of the trend, which presumably ended with wave 3 on the first of September. After this said day, the problems began. Wave 4 (assumed) first took the form of a three-wave, but yesterday's decline in quotes led the previous low to a breakdown. Therefore, the entire wave that originates after September 1 takes a more complex and ambiguous form. The smaller-scale wave layout shows that three smaller-scale waves have already been built inside the proposed wave 4, and there is a possibility that a fifth wave is also being built at this time. Thus, the entire wave 4 takes the form of a zigzag and, accordingly, can be more extended. Nevertheless, the instrument's quotes have not yet been able to fall even to the 23.6% Fibonacci level. Therefore, further decline of the instrument is still questionable, and the upward trend section can resume its construction at any time. The US currency has been in moderate demand in recent days. Another decline in the instrument's quotes began on Monday, and it is still unclear what caused it. Nevertheless, a decline in quotes is allowed form the wave point of view, so it is better to not sound the alarm yet and not to hurtle in making adjustments to the current wave markup. From my perspective, the prospects for the Euro currency still look more attractive, in spite of the fact that the construction of wave 4 is delayed. Yesterday, it became known that Christine Lagarde, the ECB President, is going to conduct a thorough assessment of the PEPP program, which was designed to help the EU economy during the pandemic crisis. In addition, Lagarde said that the exchange rate of the Euro currency has really grown quite strong recently, which may negatively affect the bloc's economy. Lagarde also takes the COVID-2019 pandemic very seriously and requires a thorough analysis of data on its development in the European Union. According to the ECB President, economic growth is uncertain and difficult to predict. "The sustainability of the recovery remains very uncertain, as well as uneven and incomplete. It remains highly dependent on the future evolution of the pandemic and the success of containment policies," Lagarde said. Meanwhile, the Federal Reserve is following the same path. Today, there is going to be a speech by Jerome Powell, who will have to give a report on the funds spent from the 4 trillion allocated by Congress in March, also in the framework of countering the economic crisis. Hence, both of these events can provide crucial information to the markets. General conclusions and recommendations: The EUR/USD pair presumably completed the construction of the global wave 3 or C and the second corrective wave as part of the trend section that begins on September 1. At this time, it is still recommended to sell the instrument with targets located near the calculated levels of 1.1706 and 1.1520, which corresponds to 23.6% and 38.2% Fibonacci, for each MACD signal down. However, it is also possible that wave 4 has already been completed. The material has been provided by InstaForex Company - www.instaforex.com |

| Outlook for GBP/USD and EUR/USD. Bad news for pound sterling. BoE warns about negative rates Posted: 22 Sep 2020 05:56 AM PDT The speech provided by Bank of England Governor Andrew Bailey at The British Chambers of Commerce webinar had an extremely negative influence on the pound sterling. Besides, there are other facts that go on weighing on the trading instrument. However, bears managed to benefit from the situation and brought the British pound back to the level of 1.2775 thus halting a strong downtrend. From the technical point of view, the pound/dollar pair showed no changes compared to the morning forecast. Everything depends on the fact whether bears have enough strength to make the pair break the support level of 1.2775. However, the first break of the level showed that traders avoid sell deals. If buyers' activity remains sluggish, the pound sterling is likely to slump to the lows of 1.2675 and 1.2585. However, if the trading instrument returns to the resistance level of 1.2870, it may jump to the high of 1.3000. So, why did Andrew Bailey's speech push the pair to the support level of 1.2775? In fact, he almost openly said that the central bank was planning to cut interest rates. It means that the regulator will switch to negative rates. Of course, the information is not new. The main shock was caused by the news that the regulator may take such a decision as early as February instead of next summer. Buyers of the pound sterling were really surprised. This reaction led to the currency's depreciation. However, there are other facts that weigh on the British pound. Of course, the Brexit issue puts pressure on the currency. However, the jump in the number of coronavirus cases has a more significant influence. There are rumors that the UK's government may resort to emergency measures, namely, a two-week quarantine around the country. If these predictions come true, the pound sterling may nosedive against the US dollar as it will lose attractiveness compared to other risky assets. Moreover, the BoE's governor also emphasized that the regulator would not raise the key interest rate until inflation reached the targeted level of 2.0%. According to Andrew Bailey, soon after the UK economic recovery slows down, the country will face difficult times that will require serious decisions. Notably, the population support program ends in October. After that, economists will see the real picture of unemployment in the country. However, there are rumors that this program could be extended. Mr. Bailey also reiterated that the Bank of England will do everything possible to support the economy, but it will be impossible without fiscal measures. At the same, the central bank is likely to extend its quantitative easing program in November in order to stimulate economic growth. However, in February 2021, it will introduce negative interest rates. EUR/USD Given the absence of important fundamental statistics today, the pressure on the euro was also limited in the first half of the day. After an unsuccessful attempt to break below the monthly lows, the pair returned back to the opening level. From a technical point of view, nothing has changed. Bears will continue to focus on breaking through and fixing below the low of 1.1735. If the pair easily reaches the level, it may drop to new support levels of 1.1695 and 1.1645. If the price returns to 1.1770, the buyers will become more active. However, if the quote goes above 1.1770, it may jump to 1.1820. A rather interesting report was published today by the Ifo Institute. Thus, economists upwardly revised the situation in the German economy. It is expected that further growth will be no less active than in the summer period. The Institute's economists forecast that the eurozone's main economy will contract by 5.2% in 2020, rather than by 6.7% as expected in the summer, as the GDP drop in the second quarter was less than expected. A smaller reduction in activity is also expected this year. According to forecasts, the economy will grow by 5.1% in 2021, while in 2022 it will advance by only 1.7%. However, the worsening epidemiological situation will shape the control measures and social distancing that could be imposed later. Moreover, if the EU and the UK fail to sign an agreement, a new trade war may break out. As far as the labor market is concerned, the number of unemployed people in Germany in 2020 is expected to rise to 2.7 million compared to 2.3 million last year. In 2021, the indicator could fall to 2.6 million. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD is moving higher approaching target area. Posted: 22 Sep 2020 05:18 AM PDT USDCAD is moving above 1.33 and is approaching our bounce target of 1.3350-1.34. Price has broken out of the bearish channel and after the back test at 1.3160 we turned bullish looking for a move towards 1.3350-1.34.

Green rectangle - support Black lines - Fibonacci levels USDCAD is bouncing higher and so far price has broken above the 38% Fibonacci retracement of the latest downward move. Next target is the 1.3420 where we find the 61.8% Fibonacci level. As long as price is above the 1.3160 green rectangle area we remain bullish.

|

| Evening review on September 22, 2020 Posted: 22 Sep 2020 05:13 AM PDT

The euro traded downward and has broken through monthly lows at 1.1735. After this, it sharply rebounded, and then renewed its minimum again. At present, it again attempts to make a rebound. However, there is a serious struggle at the level of 1.1700. You may keep keep selling at 1.1735 with a stop at 1.1780. You may sell from 1.1720. In case of a rebound, you may open purchases from 1.1875. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of EURUSD for September 22nd, 2020 Posted: 22 Sep 2020 05:13 AM PDT EURUSD is trading below key technical support of 1.1760. In Ichimoku cloud terms price is vulnerable to a move towards 1.16-1.1565 if price breaks inside the Kumo. Price is now challenging the upper boundary of the Kumo (cloud).

|

| Posted: 22 Sep 2020 05:11 AM PDT Further Development

Analyzing the current trading chart of BTC, I found that my analysis from yesterday is still valid and there is potential for further drop towards the levels at $9,873 and $9,050 My advice is to watch for selling opportunities on the rallies in order to catch the downside cycle. Stochastic oscillator is showing the fresh downside cross, which is another confirmation for the downside continuation... Key Levels: Resistance: $11,000 Support levels:$9,873 and $9,050 The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of Gold Posted: 22 Sep 2020 05:09 AM PDT Gold price is under pressure. Price has broken below key support of $1,910 and is challenging $1,900 although yesterday price fell as low as $1,882. Short-term trend is bearish as price is making lower lows and lower highs after breaking the triangle pattern to the downside.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment