Forex analysis review |

- Forecast for EUR/USD on September 29, 2020

- Forecast for AUD/USD on September 29, 2020

- Forecast for USD/JPY on September 29, 2020

- Hot forecast and trading signals for GBP/USD on September 29. COT report. Pound surged, but how long will the buyers' fuse

- Hot forecast and trading signals for EUR/USD on September 29. COT report. Bulls have good prospects based on foundation and

- Overview of the GBP/USD pair. September 29. Confidence in Boris Johnson continues to fall.

- Overview of the EUR/USD pair. September 29. Donald Trump hasn't paid taxes for 10 years. Democrats and Republicans started

- Analytics and trading signals for beginners. How to trade EUR/USD on September 29? Getting ready for Tuesday session

- GBP/USD. Rise of the pound: is it early for buyers to open champagne?

- September 28, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- September 28, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- September 28, 2020 : EUR/USD daily technical review and trade recommendations.

- Gold prospects ahead of US presidential election

- European Equity Markets Fail

- Pound attracts short term positions

- USDCAD Holding above Ascending trendline support, further rise expected!

- AUDJPY testing upside confirmation , further bounce expected !

- GBPJPY is facing bearish pressure, potential for further drop!

- Daily Video Analysis: EURUSD High Probability Setup

- Outlook for EUR/USD on August 28,2020. Price may reverse

- BTC analysis for September 28,.2020 - Key pivot level at the $11.000 on the test

- EUR/USD analysis for September 28 2020 - Potential for another downside swing towards the 1.1450

- Analysis of Gold for September 28,.2020 - 3-day balance on the Gold but the short-term trend is still downside

- USD turn out to be more resilient than expected

- EUR/USD analysis on September 28. Nancy Pelosi: Democrats are preparing a new proposal to Steven Mnuchin on a package of

| Forecast for EUR/USD on September 29, 2020 Posted: 28 Sep 2020 08:20 PM PDT EUR/USD The euro slightly increased on Monday amid rising risk appetite in the stock market and ahead of the first debate of presidential candidates Trump and Biden on Wednesday. Technically, the growth was reflected in consolidation at the target level of 1.1650. The observed consolidation is likely to continue today. The price must settle below the 1.1650 level in order for a significant downward movement to appear. The first target is 1.1550 (November 2017 low). The price shows an intention to fall from the September 24 and 25 highs. It would be like forming a narrow consolidation, which in turn will act as a technical figure for the trend to continue, that is, a decline. The euro's consolidation growth may continue up to the MACD indicator line at 1.1712. We are waiting for the development of events, the main scenario is decreasing. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on September 29, 2020 Posted: 28 Sep 2020 08:20 PM PDT AUD/USD The Australian dollar added 40 points and entered the consolidation zone of 0.7065-0.7110 yesterday. It is possible for the price to move beyond it, but it will be limited, within the framework of our main scenario, by the MACD line at 0.7137, which coincides with the low on August 20. Setting the price below 0.7065 will be the aussie's second attempt to continue moving towards the first target of 0.6970. The signal line of the Marlin oscillator is marking a downward reversal on the four-hour chart, and although this is not enough to keep the price within the 0.7065-0.7110 range, it is a sign. In any case, setting the price below the lower end of the range will be the primary condition for the price to continue falling in line with our main scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on September 29, 2020 Posted: 28 Sep 2020 08:19 PM PDT USD/JPY The USD/JPY pair traded in a 40-point range on Monday, closing the day with a 7-point decline, which formed a consolidation at the Fibonacci level of 110.0%. The signal line of the Marlin oscillator is embedded into the zone of positive values, the price is ready to continue growing. The first target is 106.00 to match the Fibonacci level 100.0% with the MACD line. Next, we are waiting for the price on the inner line of the price channel of the higher (weekly) scale 106.40. The four-hour chart shows that the signal line of the Marlin oscillator reverses from the border of the downward trend area. This pattern means the end of the consolidation, now we expect the price to reach the first target of 106.00 in 1-2 days. Setting the price under 105.12 will mean that the price would move according to an alternative scenario, the USD/JPY pair intends to go down to the Fibonacci level of 138.2% at the price of 103.75. The material has been provided by InstaForex Company - www.instaforex.com |

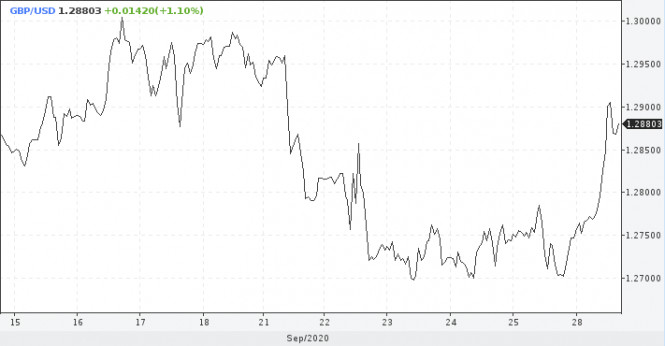

| Posted: 28 Sep 2020 06:03 PM PDT GBP/USD 1H The GBP/USD pair began a stronger round of upward correction on September 28, having managed to overcome both the Kijun-sen line and the Senkou Span B line during the day proved to be correct. Now the upward movement may continue, although a downward correction is highly expected after such a strong growth. One way or another, the bears lost the initiative and now the bulls can take over. The outlook for the British pound looks rather ghostly now, but the US dollar is far from being alright. GBP/USD 15M Both linear regression channels turned to the upside on the 15-minute timeframe, responding to the pair's strong growth on Monday. The latest Commitment of Traders (COT) report for the British pound showed that non-commercial traders got rid of buying the pound and opened Sell-contracts (shorts). A group of commercial traders got rid of huge amounts of both longs and shorts of the pound. We then concluded that the pound sterling is now, in principle, not the most attractive currency for large traders. The new COT report showed absolutely minor changes for the "non-commercial" group. Buy-contracts (longs) fell by 2,000 while Sell-contracts decreased by 1,500. Thus, the net position for non-commercial traders remained practically unchanged for the reporting week (September 16-22). At this time, the British pound continued to fall, which can be considered a consequence of the previous reporting week, when the net position of non-commercial traders greatly decreased, by 11,500 contracts. No changes in the rate of the pound/dollar pair on the 23rd, 24th, 25th, which will be included in the next report. Thus, a long term decline in the pound's quotes is indeed questionable, although the pound is still the most unattractive currency in the foreign exchange market. No major news, reports or events in the UK on Monday, September 28. Talks at the highest level between Brussels and London regarding the Brexit deal will begin today, but there is little hope of success. The parties have a maximum of a month to conclude it. Otherwise, even if they agree, they will not have time to ratify the agreement. This, of course, is not too much of a problem if the deal does not begin on January 1, but on February 1, for example. However, much more important is the lack of progress in the negotiations. Bank of England Governor Andrew Bailey will deliver another speech today. As always, the market's reaction will depend on what the head of the BoE says. In the past six months, there have been many rumors and conversations around the central bank's introduction of negative rates and the expansion of the QE program. Thus, the more speculations and hints at these steps, the more the pound sterling can potentially fall in price. Today, there will be an election debate between Joe Biden and Donald Trump in the United States. Their results can change the balance of power between opponents five weeks before the elections themselves. We have two trading ideas for September 29: 1) Buyers continued to push the pair upward and broke through the Kijun-sen and Senkou Span B lines yesterday, and also reached the first resistance level of 1.2915. Thus, you are advised to open new long positions while aiming for the resistance level of 1.2915 and the resistance area of 1.3004 - 1.3024, if a rebound follows from the Senkou Span B line. Take Profit in this case will be from 50 to 150 points. The fundamental background at this time is simultaneously bad for both the pound and the dollar. 2) Sellers failed to keep the pair below the critical line. So now they need to wait for the price to settle below the Kijun-sen line (1.2800), and only after that should they resume trading down while aiming for the support area of 1.2636-1.2660. Take Profit in this case can be up to 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Sep 2020 06:01 PM PDT EUR/USD 1H The euro/dollar pair began to correct and went to the critical Kijun-sen line, while remaining inside the descending channel on the hourly timeframe on September 28. Thus, the general trend for the pair has not changed; short positions are still relevant. If the pair remains below the Kijun-sen line or, after completing the correction, settles below this line, then movement to the downside is likely to resume. Buyers' prospects look very vague so far, as they have to overcome not only the Kijun-sen line, but also the resistance area of 1.1704-1.1728, the Senkou Span B line and the upper line of the descending channel. However, since the prospects for the US dollar remain even more obscure, this option has a not so low likelihood of execution. EUR/USD 15M The lower linear regression channel turned to the upside on the 15-minute timeframe, also indicating the beginning of a correctional movement. The euro/dollar fell by about one and a half cents last reporting week (September 16-22). Recall that the previous Commitment of Traders (COT) report showed that the "non-commercial" group of traders, which we have repeatedly called the most important, sharply reduced their net positions. Thus, in general, the downward movement that began later on was sufficiently substantiated. The only problem is that it started late. The new COT report, which only covers the dates when the euro began its long-awaited fall, showed completely opposite data. Non-commercial traders opened 15,500 new Buy-contracts (longs) and almost 6,000 Sell-contracts (shorts) during the reporting week. Thus, the net position for this group of traders has increased by around 9,000, which shows that traders are becoming bullish. Accordingly, the behavior of the EUR/USD pair and the COT report data simply do not match. For the second week in a row. However, if you try to look at the overall picture, you can still note a very weak strengthening of the bearish sentiment, so the COT report allows a slight fall in the euro. The question is whether it will continue to decline at all, since we have already seen a "weak fall" from the September highs. It is possible that the strengthening of the bullish sentiment will make it possible for the pair to resume growth. No important macroeconomic publications in the European Union and the United States on Monday. Nevertheless, the dollar simultaneously began to depreciate against the dollar and the euro from the very morning of the previous day. Thus, it is possible that professional traders started the new week by reducing dollar positions, which caused the dollar to weaken itself. Only minor reports from the EU are scheduled on the second trading day of the week, such as the level of consumer confidence or the index of economic sentiment. Market participants will ignore them. FOMC representatives Clarida, Quarles, Williams will deliver a speech in the United States. Speeches by Federal Reserve members happen often enough, but they rarely contain important information. Last week, even Fed Chairman Jerome Powell never managed to surprise the markets, although he had three attempts to do so. Thus, the fundamental background is likely to be weak today. However, it is quite possible that traders do not need help from the "foundation" now. We have two trading ideas for September 29: 1) Buyers remain outside of the market, but they can be active at any time, as evidenced by the data of the COT report. Therefore, we recommend considering long positions if the pair settles above the Kijun-sen line (1.1696), the resistance area of 1.1704-1.1728 and the descending channel with the Senkou Span B line (1.1763) with targets at 1.1798 and the resistance area of 1.1886-1.1910. Take Profit in this case will be from 20 to 110 points. 2) Bears are in control. But the same COT report warns that the dollar's rise may be very short-lived. Nevertheless, as long as the price is below the Kijun-sen line, you are advised to continue trading down with the target at the support level of 1.1538. In this case, the potential Take Profit is up to 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the GBP/USD pair. September 29. Confidence in Boris Johnson continues to fall. Posted: 28 Sep 2020 05:06 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. CCI: 154.9716 On Monday, September 28, the GBP/USD pair was in a fairly strong upward movement. The pair's quotes at the end of the previous week stood firmly in one place and failed to gain a foothold below the Murray level of "0/8" - 1.2695. Thus, we can even assume at the moment that the downward movement is complete. However, if the US dollar looks frankly weaker when paired with the euro currency, then the big question is which currency is less in demand in the market when paired with the pound sterling. Recall that the latest COT reports on the pound showed a sharp reduction in both long and short positions, which means that major players get rid of any contracts for the pound, simply not having the desire to deal with it. Further, this behavior of professional market participants is not at all surprising. We have repeatedly spoken about the uncertainty surrounding the future of America. Thus, the uncertainty surrounding the future of the UK is even "more uncertain". Thus, it is even difficult to give preference to one of the currencies in the pound/dollar pair, so we recommend that traders pay special attention to the technical picture. As for the fundamental background, it does not change for the British currency. From our point of view, the most interesting process in the UK now is the systematic decline in the political ratings of Boris Johnson and the government as a whole. The British are dissatisfied with the way the government handled the first "wave" of the epidemic. Now Boris Johnson has announced a second "wave", tightened quarantine measures, increased fines for non-compliance with these measures, and recorded an increase in the number of cases of "coronavirus" every day in the Foggy Albion. On September 25, an absolute anti-record was set – almost 7,000 cases. We have repeatedly tried to understand the question of what victories the British Prime Minister has won in more than a year of his rule. And they could only remember and come up with "the end of Brexit". Boris Johnson did not distinguish himself in anything else special. However, he collected a huge collection of defeats. We will not list them again. It seems that the British are also beginning to understand that Boris Johnson is exclusively a "Brexit option". Yes, Johnson did what Theresa May did not. However, the price that Britain will now pay seems to be better if Parliament agreed to Theresa May's proposals. Recent opinion polls show that Britons would not vote in such numbers for the conservatives if the parliamentary elections happened now. The conservatives would get 39% of the vote, while labor would get 42%. Of course, every poll has a margin of error. However, the general mood of the British is clear. They are dissatisfied with the "conservative government". Thus, many experts are already speculating about the likelihood of Boris Johnson resigning early. However, this task is not easy. Only his party members can dismiss Johnson. There is a certain discord and split in opinion among the conservatives, however, it has not yet reached its peak. The question is, will it reach? Meanwhile, Boris Johnson himself called on the whole world to participate in the investigation of the causes of the "coronavirus". The British Prime Minister recalled that the entire world has suffered serious economic damage, and 1 million people have already died from the pandemic. Johnson also believes that "answering questions" is not necessary to "punish the perpetrators", but to "prevent this from happening again in the future." Johnson noted that over the past 8 years, there have been eight outbreaks of various diseases on Earth that could well become pandemics. At the same time, the saga of the Brexit negotiations continues. According to British media, the final rounds of negotiations between Brussels and London will take place this week, attended by Michael Gove, a member of the UK Cabinet. Gove will negotiate directly with the Vice-President of the European Commission Maros Sefcovic. Thus, the groups of David Frost and Michel Barnier have pushed aside. Of course, it is reported that both sides will again try to agree on a deal, however, there are very few chances for a successful outcome of the negotiations. Boris Johnson refuses to make concessions and compromises on issues of fishing, the judicial system, European norms and standards, and others. Moreover, as we have repeatedly noted, London does not show a particularly strong desire to conclude any deal with the EU. The most interesting thing is that at the same time, the "Johnson bill" is under consideration in the House of Commons of the British Parliament. There will be no new vote in the near future, however, the situation with this bill is "hanging in the air", and at the same time "suspends" any negotiations with the European Union. Brussels has already stated that if this bill is passed, further negotiations with London will automatically become impossible, and the consideration of all disputed issues will flow from the offices of Brussels to the Court. Thus, this is another factor that practically puts an end to the success of negotiations on the conditions for the future coexistence of the UK and the European Union after 2021. As we have already said, both the British pound and the US dollar look quite weak right now. The fact that the GBP/USD pair is still fixed above the moving average line gives a good chance of growth for the pound. However, to be honest, it is difficult for us to imagine that the markets are actively buying the pound. However, on Monday alone, the pound rose by about 200 points, which is a lot even for the pound. One way or another, you need to be ready for a strong movement in any direction. For the pound, the market is now very "thin", so volatility can grow, and the reaction to almost any important event can be very strong and sharp.

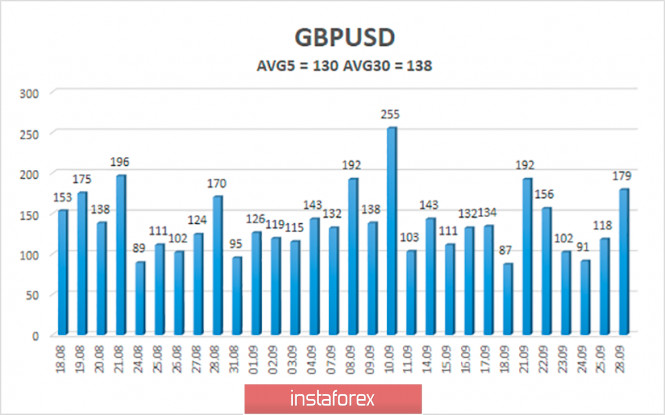

The average volatility of the GBP/USD pair is currently 132 points per day. For the pound/dollar pair, this value is "high". On Tuesday, September 29, thus, we expect movement inside the channel, limited by the levels of 1.2711 and 1.2971. A reversal of the Heiken Ashi indicator back down signals a possible resumption of the downward movement or a turn of the already downward correction. Nearest support levels: S1 – 1.2817 S2 – 1.2756 S3 – 1.2695 Nearest resistance levels: R1 – 1.2878 R2 – 1.2939 R3 – 1.3000 Trading recommendations: The GBP/USD pair started an upward movement on the 4-hour timeframe and broke the moving average line. Thus, today it is recommended to stay in the longs with the goals of 1.2878, 1.2939, and 1.3000 as long as the Heiken Ashi indicator is directed upwards (it was possible to open longs when the price was fixed above the moving average). It is recommended to trade the pair down with targets of 1.2711 and 1.2695 if the price returns to the area below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Sep 2020 05:04 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. CCI: -37.3225 The European currency paired with the US dollar began to adjust on the first trading day of the week. The growth was quite confident, thus, we can even assume that the downward movement is complete. Recall that there were no fundamental reasons for the strengthening of the US currency. There are no improvements in the epidemiological situation, no easing of tension in the political sphere, and no fundamental improvements in the economy. In the economy, we can say that everything is going according to plan. The economy is recovering from the "coronavirus crisis", which cannot even be considered complete yet. The epidemic persists and, first of all, this applies to the States that retain the world's leadership in the number of deaths from this disease and the number of diseases themselves. Thus, we continue to insist that the only reason for the dollar's growth in recent weeks is technical. After the pair grew by 1300 points, traders had to correct it. Further, it took traders more than two months to do this. Thus, from our point of view, the US currency may well resume falling in the near future. Unfortunately, there is still no positive or optimistic news from overseas. On Monday, it became known that Steven Mnuchin and Nancy Pelosi (both Democrats and Republicans) are willing to sit at the negotiating table to still agree with a package of economic assistance to the most affected sectors of the economy and segments of the US population. It seems to be optimistic news, however, Nancy Pelosi immediately announced that her party is preparing a new proposal for $ 2.4 trillion. What's the point if previous similar-sized proposals have already been rejected by Republicans as too costly? Nevertheless, both prominent politicians are preparing to discuss something again, although we believe that all this is no longer important. On the eve of the presidential election (5 weeks left), Democrats and Republicans will not cooperate. They need to put the opposing candidate in the most unsightly light. Therefore, the Democrats are unlikely to reduce the amount of aid offered (they need to make Trump look like a miser who does not understand the seriousness of the "coronavirus" and its consequences for the economy). Also, Trump and his party will not meet the Democrats halfway, since the initiative of a large aid package belongs to them, respectively, it is Biden's political ratings that can grow due to the approval of the economic stimulus package. Also, interesting details from the life of each of the candidates for the post of President-2020 continue to emerge. For example, the New York Times found out that Donald Trump has not paid income tax for 10 years, after getting to his tax returns. It turned out that hundreds of companies that are united in one business empire, 10 of the 15 years before Trump became president, worked at a loss. The article reports that Trump paid $ 750 in income tax in 2016 and the same amount in 2017. At the same time, the publication reports that in 2018 alone, Trump received income of about $ 600 million for participating in a reality show, for permission to use his name, and through investments in two buildings. Thus, the US President had to pay about $ 100 million in taxes. "This equation is a key element of the alchemy of Trump's finances: using the proceeds of his fame to buy and support risky businesses, and then using their losses to avoid taxes," the authors note. Trump himself, of course, called the article "fake" and said that "he paid a lot of taxes to the state of New York". Donald also promised to submit his tax returns as soon as the audit of his accounting, which has been going on for several years, is over. Moreover, the US President has requested and received income tax refunds of $ 73 million since 2010. Meanwhile, the entire country is frozen in anticipation of another reality show – the Trump-Biden debate. The first round will be held today (September 29) in Cleveland. It will be followed by two more rounds. The Commission on Presidential Debates announced that both candidates for the post will have to speak on six points: 1) political "background"; 2) the situation in the Supreme Court over the death of Ruth Ginsburg; 3) COVID-2019 epidemic; 4) the economy and its recovery from the pandemic; 5) racial conflicts and problems; 6) protection of electoral processes. In total, the debate will last for an hour and a half. Many experts expect surprises in the air. It's no secret that Donald Trump is much more powerful in public speaking, and besides, he never reaches for a word in his pocket. However, it is also no secret that in most issues the electorate supports the views of Joe Biden. Thus, we are waiting for a very fun performance, which can be called almost the main event of the current week. And until the debate began, Donald Trump did not forget to once again prick the Democrats. This time, Trump felt that the Democrats were slowing down the process of developing a vaccine against the "coronavirus". As usual, the President did not provide any evidence of his words. Over the past 4 years, everyone has become accustomed to the fact that the American President makes mostly unprovable statements, and often absurd. The last thing I would like to note is that Trump very quickly found a replacement for the prematurely deceased Supreme Court Justice Ruth Ginsburg. Her successor should be 48-year-old, Amy Coney Barrett. Thus, in the near future, the Senate will vote for this candidate, in which the majority of voters are Republicans. Thus, there is no doubt that Amy Barrett will become the new Chief Justice, bringing the number of judges appointed by Republicans to 6 out of a possible 9. We are waiting for the fight between Trump and Biden in the Supreme Court. As for the US dollar, it is likely to continue to remain under market pressure until the election. We still believe that traders and investors will not take risks and will simply wait for the election results before buying the dollar and investing in the US economy. Many fear that Trump will win and start a war with large US companies that have production in China and other countries with cheap labor. Thus, we do not expect strong growth of the US currency in the near future. Fixing the price above the moving average line may even trigger the resumption of the upward trend.

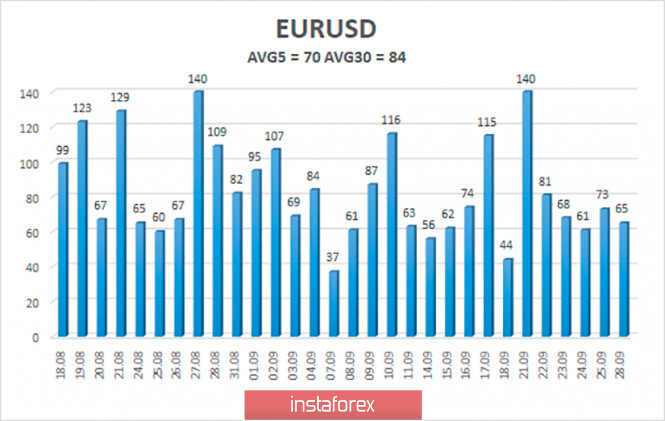

The volatility of the euro/dollar currency pair as of September 29 is 70 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1588 and 1.1728. The reversal of the Heiken Ashi indicator back down to signal the completion of the spiral upward correction. Nearest support levels: S1 – 1.1597 Nearest resistance levels: R1 – 1.1658 R2 – 1.1719 R3 – 1.1780 Trading recommendations: The EUR/USD pair continues its downward movement. Thus, now you can continue to hold open short positions with targets of 1.1597 and 1.1546 until the Heiken Ashi indicator turns up. It is recommended to re-consider options for opening long positions if the pair is fixed above the moving average with the first targets of 1.1780 and 1.1841. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Sep 2020 02:19 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair was trading in line with our morning expectations on Monday, September 28. Recall that we did not recommend traders to trade up, but advised waiting for the correction to end and the MACD indicator to ease to the zero level. At the moment, both of these conditions are met. In the next hour or two, the MACD indicator may turn down and form a new sell signal. Therefore, if novice traders wait for this signal in time, then it is quite possible to resume trading down. As for the general picture of the state of affairs, it did not change on Monday. Volatility was only 65 points during the day, which is below the recent average. The price failed and did not even try to leave the descending channel. No new channels or trend lines can be drawn at this time. There are currently no signs of a change in the trend. No important report published in the US or the EU, and no major event happened or Monday. Everything still revolves around future elections in America. Meanwhile, the situation is more stable in the European Union, but recently there has been an increase in cases of the coronavirus, which may support the dollar in the medium term. Also, with the arrival of a new wave in Europe, a new stimulus package for the economy may be necessary. Recall that the EU agreed on the Economic Recovery Fund worth 750 billion euros with great difficulty. The new package may no longer be approved by all EU members. And it may be necessary if the second wave turns out to be stronger and more destructive than the first. It is also not necessary to attach great importance to the words of the top officials of the EU that there will be no new lockdown. In our humble opinion, if the second wave of the pandemic is indeed stronger than the first, then a lockdown will have to be introduced. Even if this does not happen, there will definitely be a hard quarantine, which in principle will have the same negative impact on the economy as a full-fledged lockdown. The most important thing is people. And you can't kick them out to work, you can't force them to go to cinemas and cafes, and you can't spend money as usual, so that the economy continues to work as the European Central Bank needs. Thus, the second wave is almost 100% equal to a new economic decline. No important events or reports scheduled in the European Union and the United States on Tuesday, September 29. With the exception of one report from Germany, the preliminary inflation figure for September. All inflation indicators (basic and core) are expected to be -0.1% y/y. Thus, deflation will be fixed in Germany for the second consecutive month. Most likely, in the entire European Union too. This is bad for the euro. Possible scenarios for September 29: 1) Novice traders are still not recommended to place buy positions at this time, since there is a clear downward trend, and trading against the trend is not recommended in principle. Thus, you can consider longs but the price should settle above the descending trend channel or there should be a new upward trend supported by a trend line or other channel. 2) Selling remains relevant, since the pair is still inside the downtrend channel. Thus, by tonight or Tuesday you can open new short positions with targets at 1.1600 and 1.1570 after the MACD indicator generates a new sell signal. Goals will be finalized tomorrow morning. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Rise of the pound: is it early for buyers to open champagne? Posted: 28 Sep 2020 02:19 PM PDT The pound soared more than 100 points against the dollar today thanks to optimistic rumors about the outlook for Brexit, as well as encouraging comments from Bank of England member Dave Ramsden regarding the outlook for a negative rate. This set of fundamental factors made it possible for the pound to demonstrate impulsive growth and return to the area of the 28th figure. And yet, despite such a powerful breakout, it must be treated with extreme caution. Sometimes the market sees and hears exactly what it wants to see and hear, leaving out many conflicting nuances. In my opinion, this is exactly the case: traders simply ignore the alarming signals, which in no case should be overlooked. All optimistic comments and statements (which is why the pound grew) are declarative. The fact is that another round of talks began between London and Brussels today, on the eve of which the parties "wished each other good luck" as if before a football match. Thus, the chief negotiator from Great Britain, Michael Gove, expressed confidence that the trade deal would still be concluded, while representatives of the European side expressed hope for a compromise solution. In unofficial comments, British representatives told reporters that London could conclude a trade agreement with the European Union by the end of October, that is, before the EU summit. As a fallback, British diplomats admit the extension of the transition period by several months. According to them, no one discounts this scenario, despite the fact that Prime Minister Boris Johnson excludes such a scenario in the public plane. But, according to the GBP/USD bulls, the head of the British government is bluffing - just like last year during the negotiations on the main deal. Actually, the pound's growth is based on this. Traders drew attention to the unexpected preliminary optimism of the negotiators and to some insider information, which, however, are also declarative. None of the representatives of the parties announced that they were ready to make significant concessions in order to work out a compromise solution. Here you can recall dozens of similar situations in past years, when the parties, figuratively speaking, began for health and ended for peace. We can not explain why Gove and Barnier are optimistic. And this fact should at least alert market participants. Moreover, the Deputy Chairman of the European Commission Maros Sefchovich also assessed the prospects of Brexit. His comments were not so optimistic. In particular, he said that London's position in the negotiations "is very, very far from what the European Union can accept." He also mentioned the controversial draft on the UK Internal Market Bill. Shefchovic stressed that this document constitutes "an extremely serious violation of the Brexit agreement." He warned that this would entail a chain of political events that would not be in Britain's favor. By the way, the bill will be a part of the House of Commons's agenda tomorrow (September 29). The MPs are planning to vote for it in the second reading. MPs are expected to support it, despite a barrage of criticism from both Labour and some Conservatives, as well as from the international community. In their opinion, Johnson's initiative violates international law and destroys the compromise between Britain and the EU regarding customs procedures on the border of Northern Ireland and the Republic of Ireland. In turn, the head of the British government continues to insist that the said bill is a "safety net" if Britain and the EU are unable to conclude a trade deal. And many Conservative MPs agree with the position of the Cabinet of Ministers. Let me remind you that 340 MPs voted for the bill in the first reading. On the one hand, tomorrow's "approval" vote is quite expected. In addition, according to rumors, MPs will not vote for this document in the third (final) reading until the EU summit. On the other hand, tomorrow's events in the House of Commons could turn the GBP/USD pair 180 degrees, as the Parliament will demonstrate its decisiveness in this painful issue for Brussels. It is also worth considering that the voting will take place during the negotiation process - the head of the European delegation will probably comment on the situation, and certainly not in a positive way. Therefore, the optimism of investors regarding the prospects for the negotiation process looks at least premature. According to Gove, the British side has submitted proposals for fishing waters and subsidies. At the same time, he warned in advance that there are "significant differences" between the parties. The European side also very veiledly voiced its optimistic hopes - we did not hear any specifics. All this suggests that pound's growth is not based on reinforced fundamentals. In my opinion, the impulsive growth should either be ignored or used as a short entry. If the negotiators do not "feed" traders' interest in the pound in the near future, the GBP/USD pair will decline at least to the level of today's opening, that is, to 1.2750 (here also the lower border of the Kumo cloud on the daily chart). This target can be viewed as an initial bearish target. The material has been provided by InstaForex Company - www.instaforex.com |

| September 28, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 28 Sep 2020 09:18 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the key-level level of 1.3300. A quick bearish decline took place towards 1.2900 then 1.2825 where some bullish recovery was recently expressed. The price zone of 1.3130-1.3150 (the backside of the broken trend) remains an Intraday Key-Zone to offer bearish pressure if retested again. However, the GBPUSD pair has shown lack of sufficient bullish momentum to pursue above the price level of 1.3000. This enabled further bearish decline towards 1.2800 then 1.1700 where another episode of bullish recovery may be executed. Initial bullish breakout above 1.2800 is currently needed to allow bullish pullback to pursue towards 1.3100. Otherwise, further bearish decline would be expected towards the price level of 1.2600. Trade recommendations : Conservative traders are advised to wait for bullish pullback towards 1.3130-1.3150 (the backside of the broken trend) as a valid SELL Entry. Initial T/p level is to be located around 1.3050 and 1.2900 if sufficient bearish pressure is maintained. The material has been provided by InstaForex Company - www.instaforex.com |

| September 28, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 28 Sep 2020 08:59 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1700 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) stood as a strong SUPPLY-Zone to offer bearish reversal. Intraday traders should have considered the recent bearish closure below 1.1700 - 1.1750 as this enhanced further bearish decline initially towards 1.1645 and probably 1.1600 if sufficient bearish pressure is maintained. Trade recommendations : Conservative traders should wait for any upcoming bullish pullback towards the recently-broken SUPPLY Zone around 1.1750 - 1.1770 as a signal for a valid SELL Entry. T/P levels to be located around 1.1645 and 1.1600 while S/L to be placed above 1.1800 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| September 28, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 28 Sep 2020 08:53 AM PDT

The EUR/USD pair has been moving sideways within the depicted expanding channel since August 3. Previously, a temporary resistance level was formed around 1.1900 which prevented further upside movement and forced the pair to have a downside pause for sometime. By the end of August, the EURUSD pair has achieved another breakout above the previously mentioned resistance zone. However, Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. That's why, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800 then 1.1770-1.1750 which failed to offer sufficient Support for the EUR/USD. Earlier Last week, a breakout to the downside was executed below the price level of 1.1750 (Lower limit of the depicted movement pattern). Hence intraday technical outlook has turned into bearish. Intraday traders should be waiting for any pullback to the upside towards the recently-broken key-zone (1.1750-1.1770) for a valid SELL Entry Provided that the recent SUPPORT level around 1.1630 prevents any further decline. On the other hand, a breakout above 1.1820 (Exit Level) will probably enable further upside movement towards 1.1860-1.1900. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold prospects ahead of US presidential election Posted: 28 Sep 2020 08:17 AM PDT Last week, gold plummeted nearly 5%, having posted the steepest fall over the recent 6 months. Remarkably, the drop occurred amid the decline of the US stock indexes, which seems strange. Indeed, gold has been viewed as a traditional safe haven asset that tends to gain ground on the back of waning demand for riskier assets. The thing is that investors rushed to sell the precious metal with a view of holding open positions on equities. Besides, the gold bulls were caught off-guard amid the sharp advance of the US currency bearing in mind the crater of the US budget deficit and amid fears over the fragile recovery of the national economy contained by the COVID-19 pandemic. The greenback closed last week with the strongest weekly gains since early April. Its index surged to 94.7, the highest level since July. The robust rally of the US dollar badly affected the gold value. The metal broke support of $1,900 and tested two-month lows of $1,849. If the US stock indexes continue their downtrend, the next target for the dollar bulls could be the marks of 95.70 and 97.70. This scenario suggests a further bearish trend for gold. Gold bears could be interested to see the gold price to fall below a 100-period moving average that is nearly $1,845. If this happens, they will expect a further fall towards $1,822 that is 61.8% Fiboncci correction. The nearest strong resistance is seen at $1,875-1,877. Its true breakout could push the price up towards $1,900. Meanwhile, the US currency might stumble over uncertain fundamentals and a serious technical resistance which could reverse the greenback's trajectory in the medium term. Experts reckon that if the US dollar index reverses downwards aiming for the level below 92, this will propel the gold rally to record highs amid the next bullish wave. We cannot rule out a further downtrend of gold. However, uncertainty about the outcome of the US presidential election is creating turbulence. Besides, the US Federal Reserve will have to resort to extra easing its monetary policy. Thus, we maintain the bullish outlook for gold, UBS analysts state their viewpoint. They project the gold price to soar to $2,100 per troy ounce next year. Citigroup believes that gold is capable of hitting new historic highs before the end of 2020. The presidential election could be a powerful catalyst for the gold rally and extreme volatility in Q4 2020 despite the fact that there is no clear-cut pattern of the gold dynamic or its volatility before/after the presidential election in the US, Citigroup experts comment on the situation. They think that investors have not priced in the election outcome yet. So, gold could spike more than $200 from the current level. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Sep 2020 08:06 AM PDT

The overall index of major industries in the Stoxx Europe 600 fell 0.1% to 355.51 points. The indicator lost 3.7% over the previous week which is the maximum weekly drop since mid-June. Germany's most important stock index, the DAX, fell 1.09%, France's CAC 40 lost 0.69%, Italy's FTSE MIB lost 1.1%, and Spain's IBEX 35 lost 0.23%. In this sector, only the most influential stock market indicator in Europe which is the FTSE 100 London stock index, showed a rise of 0.34%. It is obvious that market participants are showing some caution, also paying attention to the situation with continuous coronavirus outbreak. Investors are paying close attention to the possibility of taking additional measures to change the US economy in the circumstances of the pandemic. Analysts at Goldman Sachs Group Inc., and JPMorgan Chase & Co. predict low US GDP growth in the fourth quarter. During a regular hearing in the Committee of the Congress, Fed Chair Jerome Powell stated that the intensification of budget spending brings the achievement of goals in the field of employment and inflation sustainability closer. The consumer confidence index in the UK managed to climb 2 points this month compared to the previous month. This indicator determines the degree of optimism regarding the state of the economy. The indicator is expressed through the consumption and savings of the population. Despite the newly increasing growth of COVID-19 cases, the value of this index has noticeably improved its position. However, Monday's figure is clearly below pre-crisis levels. At the end of May, the index risked falling to its lowest level for the first time in 11 years by 36 points, while at the beginning of March the index held a position less than 9 points. BMW shares were down 2.6% on Friday, shares in British insurance company Aviva Plc were 0.3% more expensive, and Electrolux shares rose 2.9%. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound attracts short term positions Posted: 28 Sep 2020 08:00 AM PDT

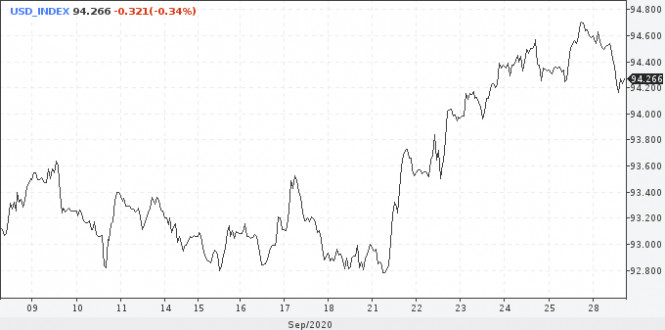

The dollar may take a pause in corrective growth this week. At the same time, negative factors that provoke investors to move to more reliable assets remain. On Monday, the USD index was trading near a 2-month peak, as doubts about the economic recovery remain ahead of a flood of statistical data and political events in the US. However, the dollar failed to maintain its position. It should be noted that the indicator touched a strong resistance at 94.6. Although, it will not be easy to pass it and consolidate higher. It is possible that dollar bulls may not succeed.

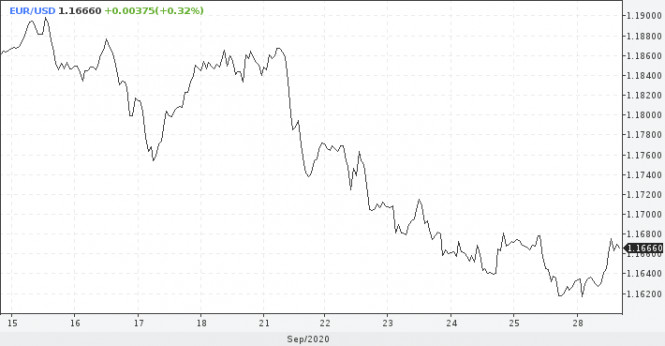

Monday, as is often the case, was light, which did not lead to significant changes in the main instruments. Tuesday, on the other hand, will be more eventful. First, a debate is expected. Second, markets will evaluate updated data on consumer confidence in the US. Meanwhile, the official nonfarm payrolls report will be released on Friday. Statistics from the labor market may disappoint, which will increase the chances of more rapid adoption of new anti-crisis measures. With this development, the US dollar risks ending the week among the outsiders. The main currency pair is still near 2-month lows. If everything is calm today, then the news flow for this pair will be saturated. In addition to the block of statistics, the US employment market will attract attention to data on US GDP for the second quarter. This will be the final assessment of the economic downturn. If the final figure does not provide additional reasons for pessimism, the dollar can get some support. The worst is already taken into account in the quotes. If you pay attention to the technical side of the matter, EUR / USD is currently trading in the structure of the third wave of decline, the goal is 1.1600. Next, a small correction is expected to the level of 1.1740, and then there may be another wave of decline in the area of the 15th figure. This scenario is confirmed by the MACD oscillator.

The dynamics of the GBP/USD exchange rate is similar to the dynamics of EUR/USD. However, there is a slight difference: the pound is too oversold on fears of a no-deal Brexit. This negative should withdraw for a while, and the short-term dynamics of the pound against the dollar should be better than that of the euro. The GBP / USD pair gained more than 1% of its value on Monday. Investors have raised hopes that the UK will be able to conclude a trade deal with the European Union by October or avoid a chaotic exit from the bloc for a number of other reasons. Moreover, the crucial week of negotiations begins on Monday. Earlier, a diplomat from the European Union made it clear that the mood here was "slightly better" after the British Brexit leader Michael Gove expressed confidence in a trade deal.

|

| USDCAD Holding above Ascending trendline support, further rise expected! Posted: 28 Sep 2020 07:03 AM PDT

USDCAD holding above both ascending trendline support and moving average. A short term push up above intermediate support at 1.33783 towards 1st resistance and recent swing high at 1.34183 can be expected. Trading Recommendation Entry: 1.33783 Reason for Entry: 61.8% fib retracement, moving average Take Profit : 1.34183 Reason for Take Profit: Recent swing high Stop Loss: 1.33680 Reason for Stop loss: 61.8% fib retracement, Ascending trendline support The material has been provided by InstaForex Company - www.instaforex.com |

| AUDJPY testing upside confirmation , further bounce expected ! Posted: 28 Sep 2020 07:03 AM PDT

AUDJPY is testing upside confirmation, and if it closes above this level, it could open up more upside from there ! If price could break above the descending trendline, it could also indicate more upside from there. MACD signals more bullishness from there. Trading Recommendation Entry: 74.61 Reason for Entry: 23.6% fib retracement , descending trendline Take Profit: 75.32 50% fib retracement Stop Loss: 73.99 Reason for Stop Loss: Horizontal swing low The material has been provided by InstaForex Company - www.instaforex.com |

| GBPJPY is facing bearish pressure, potential for further drop! Posted: 28 Sep 2020 07:02 AM PDT

Price is facing bearish pressure from our first resistance, in line with our 50% fibonacci extension, 23.6%, 38.2%, 61.8 fibonacci retracement, and horizontal graphical resistance where we could see a reversal below this level to our first support level. The 55 period EMA is showing signs of bearish pressure in line with our first resistance Trading Recommendation Entry: 135.338 Reason for Entry: 50% fibonacci extension, 23.6%, 38.2%, 61.8 fibonacci retracement and horizontal graphical resistance Take Profit: 132.862 Reason for Take Profit: Graphical Support level, 23.6%, and 127% Fibonacci retracement Stop Loss: 136.762 Reason for Stop Loss: 38.2% and 78.6% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Daily Video Analysis: EURUSD High Probability Setup Posted: 28 Sep 2020 07:01 AM PDT Today we take a look at EURUSD. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| Outlook for EUR/USD on August 28,2020. Price may reverse Posted: 28 Sep 2020 06:48 AM PDT EUR/USD: If the pair breaks the level of 1.1685, it will start moving upwards. It is recommended to open buy deals from the level of 1.1685, stop is at 1.1640, traget is at 1.1875 and higher. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for September 28,.2020 - Key pivot level at the $11.000 on the test Posted: 28 Sep 2020 06:28 AM PDT Further Development

Analyzing the current trading chart of BTC, I found that there is strong pivot resistance level at $11,000, which is good level to watch for selling opportunities. My advice is to focus on the selling opportunities if you see the rejection of the resistance at $11,000 Downside targets are set at the price of $10,150 and $9,900. Stochastic looks overbought, which is another sign that buyers might be ehausted. Key Levels: Resistance: $11,000 Support levels: $10,150 and $9,900 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for September 28 2020 - Potential for another downside swing towards the 1.1450 Posted: 28 Sep 2020 06:23 AM PDT

That's an interesting look at the state of play at the ECB. As I discussed in the previous review, the EUR/USD is still in the downward trend and I would prefer selling opportunities on the rallies. Further Development

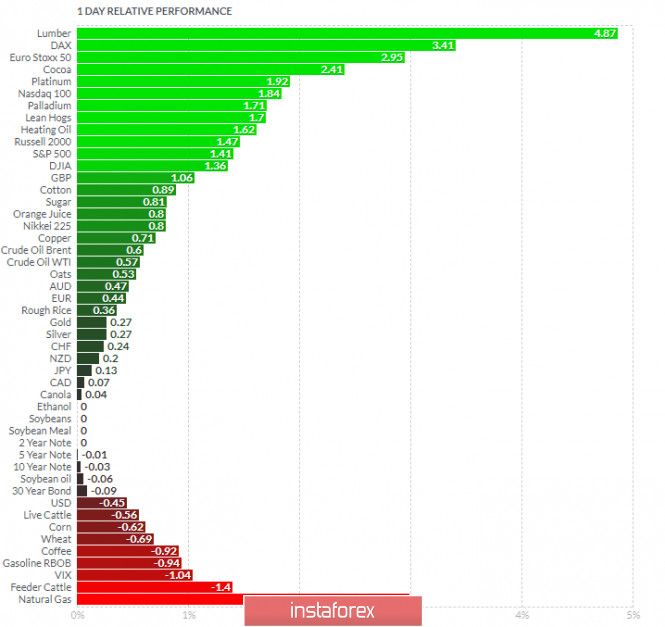

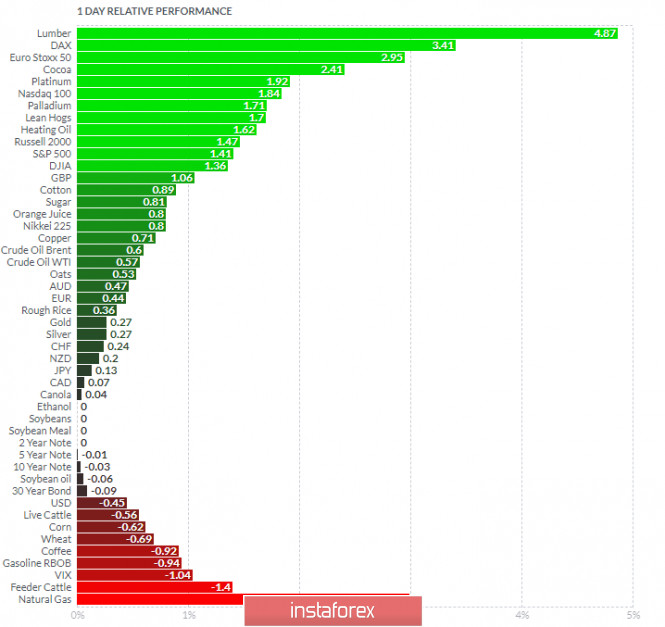

Analyzing the current trading chart of EUR, I found that there is strong pivot resistance level at 1,1680 and 1,1700. II would watch for the selling opportunities on the rallies due to strong downside trend and no evidence of the reversal yet. Downward target is set at the price of 1,1450. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Dax today and on the bottom Natural gas and Feeder Cattle Key Levels: Resistance: 1,1700 Support levels: 1,1450 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Sep 2020 06:06 AM PDT

As I discussed in the previous review, the Gold is still in the downside trend but most recently I have found that 3-day balance. Further Development

Analyzing the current trading chart of Gold, I found that there is the balanced regime between the price of $1,876 (resistance) and support at $1,848. II would watch for the breakout of support at $1,848 to confirm further downside continuation and potential test of $1,810 (projected downside target) 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lumber and Dax today and on the bottom Natural gas and Feeder Cattle Key Levels: Resistance: $1,876 Support levels: $1,84 The material has been provided by InstaForex Company - www.instaforex.com |

| USD turn out to be more resilient than expected Posted: 28 Sep 2020 05:53 AM PDT Market participants are mainly focused on the US presidential elections. Despite gloomy forecasts, the US dollar is still climbing. Although the US epidemiological situation is getting worse and prevents the greenback from gaining in value, the currency has kept its dominance. Moreover, forecasts have become more positive. Gold and foreign exchange reserves of central banks, international settlements, and cross-border lending show an obvious shift of the US currency from the dominant positions. However, the events that took place at the end of September proved that the US dollar would not give up. Previous week, the US dollar index showed the best performance for the first time in six months. In August, investors were actively selling off the greenback because of the divergence in the economic growth of the euro one and the United States. Notably, the euro has no chances to recover amid the S&P 500 correction. The current concerns are associated with the upcoming presidential elections that will be held in November. Donald Trump announced his rejection of the peaceful transfer of power, which outlined rather vague prospects for the markets. Although the market expects a storm after the final voting results are announced, it is expected to be small. In any case, the situation of complete chaos is still poorly understood by investors. At the same time, in an atmosphere of anxious expectation, the focus has shifted to those currencies that previously showed tepid reaction to the US election. For example, the Russian ruble may be seriously affected by the victory of Joe Biden, because the risks of additional sanctions against Russia will begin to grow actively. According to opinion polls, liberal Joe Biden will win the race. However, expectations do not always meet the reality. The dollar is doing its best to keep its positions. According to analysts, it is extremely risky to open buy deals on the EUR/USD pair. The euro still highly depends on the expected second wave of the coronavirus in European countries. If consequences of the impending pandemic turn out to be more serious than this spring, the uptrend will be stopped. The US stock market is likely to be even more volatile in the coming week. This is primarily due to the start of the first debate before the election between incumbent President Donald Trump and Democratic candidate Joe Biden. The uncertainty inherent in the US election, as well as the likely delay in announcing the winner, strongly affected the market picture. Thus, the S&P 500 index showed a drop of 10% after a record high reached in early September. Nevertheless, the greenback is supported by investors' risk aversion as the US dollar is considered to be the most reliable asset among traders. The US macroeconomic statistics, including the release of the final estimate of GDP in the second quarter, as well as the publication of the US unemployment data for September should clarify the situation. The material has been provided by InstaForex Company - www.instaforex.com |

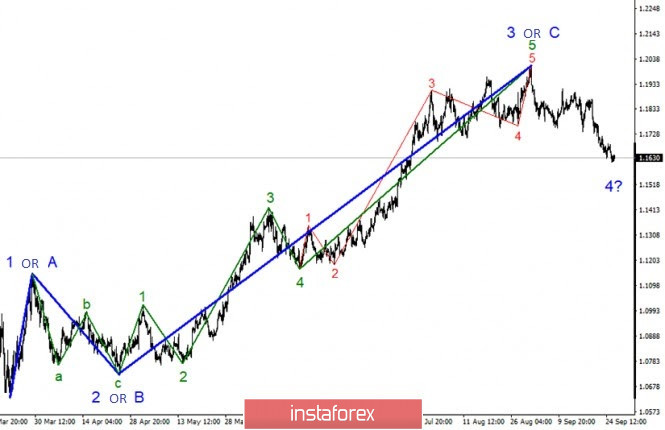

| Posted: 28 Sep 2020 05:49 AM PDT The wave count of EUR/USD pairs in the global plan still looks quite convincing in all that relates to the upward trend, which presumably ended with the wave 3 or C. After September 1, the construction of the proposed wave 4 began and first took the trehvaltsovoj view. But the continued decline in prices led to the complication of the inner wave structure of this wave. Thus, the entire downward wave takes a more complex and extended form and may even not reach at wave 4, but the first wave as part of a new downward trend section. A smaller-scale wave layout shows that two smaller-scale waves have already been completed inside the assumed wave 4, and an assumed wave 3 or C in 4 is currently being constructed within which smaller-scale waves are also being viewed. Thus, most likely, we are now seeing the construction of wave 4, which takes a complex and extended form. A successful attempt to break through the level of 23.6% suggests that the instrument is ready for further decline. The US currency has been in demand for the past days and weeks. The only question is, what was the reason for the growth of the dollar being in demand? There is not much positive news from America at this time. Many key issues remain unresolved and I don't want to talk about the epidemic in the United States, which did not end (unlike many European countries) from the very beginning. If in Europe, the first wave, the second, and so on are clearly visible, then in the United States, the wave is the only one that began in March. This is already the background theme for the US dollar. In addition, Democrats and Republicans have not been able to agree on a new package of assistance to the American economy. Let me remind you that Jerome Powell repeatedly called on Congress to quickly agree and provide all the most damaged sectors of the economy with a new package of financial assistance last week. However, Republicans are opposed to the Democrats proposal to allocate another 2-3 trillion. It should be noted that the validity of the previous assistance package expired in early August. According to the latest information, the speaker of the House of representatives Nancy Pelosi expressed her readiness to sit down again at the negotiating table. According to her, Democrats are now working on a new proposal of about $ 2.4 trillion. Thus, the Democrats refuse again and again to reduce the size of the package to the maximum of 1 trillion required by the Republicans. She added that the public will see why exactly $ 2.2 or $ 2.4 trillion in aid is needed. She also stated that President Trump, "denies the virus and his refusal to work to destroy the virus only makes the whole situation worse." It is also reported that the new package provides assistance to the unemployed, direct payments to Americans, assistance to airlines and funds for loans to small businesses. However, too much difference of opinion about the amount of aid needed could ruin the negotiations this time around. General conclusions and recommendations: The Euro-Dollar pair presumably completed the construction of the global wave 3 or C and the second corrective wave as part of the trend section that begins last September 1. Thus, at this moment, I'm recommending to sell the instrument with targets located near the estimated 1.1520 mark, which corresponds to 38.2% Fibonacci for each MACD signal down. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

\

\

No comments:

Post a Comment