Forex analysis review |

- Hot forecast and trading signals for GBP/USD on September 30. COT report. Buyers do not see themselves above 1.2915 yet.

- Hot forecast and trading signals for EUR/USD on September 30. COT report. Dollar needs support, but it will be very difficult

- Overview of the GBP/USD pair. September 30. A new round of negotiations of the EU-United Kingdom.

- Overview of the EUR/USD pair. September 30. Donald Trump is losing the trade war with China and is going to start a war with

- Trump vs Biden: Don't trade dollar pairs ahead of the debate

- EUR/USD: dollar participates in the debate

- What to do with USD?

- September 29, 2020 : EUR/USD daily technical review and trade recommendations.

- September 29, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- September 29, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Ichimoku cloud indicator Daily analysis of EURUSD

- Ichimoku cloud indicator Daily analysis of Gold

- USDJPY approaching medium-term trend resistance trend lines

- EURUSD: What can the euro expect in the future with the gloomy outlook for the Spanish economy, a slowdown in German inflation,

- US support masses in a new way amid the COVID-19 pandemic

- Upbeat outlook: US natural gas ready to take off

- Evening review on September 29, 2020

- Analysis of GBP/USD on 29/09: European Union is studying the possibility of going to court and insists on the implementation

- US stocks rise while Asian stocks exhibited multidirectional movement

- EUR/USD analysis on September 29. A rift emerges in the ranks of ECB. Panic arises as the second wave of the pandemic stuns

- EUR/USD: plan for the American session on September 29

- GBP/USD: plan for American session (overview of morning trade). GBP gets stuck sideways. Buyers rely on breakout of 1.2885

- Trading recommendations for the EUR/USD pair on September 29

- Oil price forecast for autumn

- Trading plan for GBPUSD for September 29, 2020

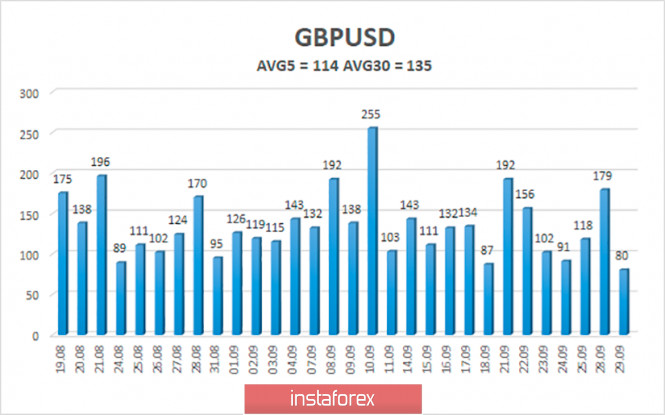

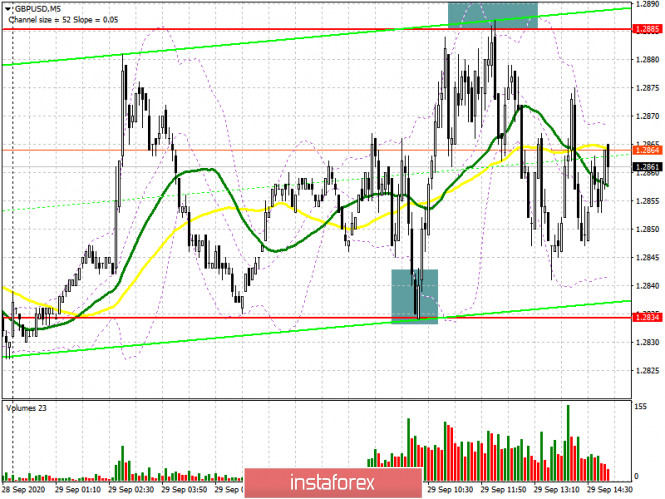

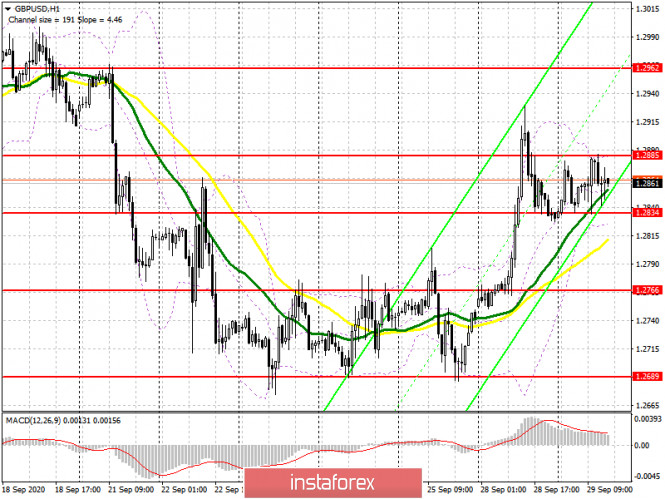

| Posted: 29 Sep 2020 06:36 PM PDT GBP/USD 1H The GBP/USD pair was in a narrow price range between the Senkou Span B line and the resistance level of 1.2915 on September 29. The technical picture has not changed after the previous day. Buyers have taken some important steps forward, but now they need to go beyond the 1.2915 level to expect something more. The bears have a good chance of returning to the market, but they need to take the pair back below the Senkou Span B and Kijun-sen lines. The general trend is more uncertain, as there is no pronounced upward trend now. GBP/USD 15M Both linear regression channels are directed to the upside on the 15-minute timeframe, responding to a strong rise on Monday and a horizontal movement on Tuesday. The latest Commitment of Traders (COT) report for the British pound showed that non-commercial traders got rid of buying the pound and opened Sell-contracts (shorts). A group of commercial traders got rid of huge amounts of both longs and shorts of the pound. We then concluded that the pound sterling is now, in principle, not the most attractive currency for large traders. The new COT report showed absolutely minor changes for the "non-commercial" group. Buy-contracts (longs) fell by 2,000 while Sell-contracts decreased by 1,500. Thus, the net position for non-commercial traders remained practically unchanged for the reporting week (September 16-22). The British pound continued to fall, which can be considered a consequence of the previous reporting week, when the net position of non-commercial traders greatly decreased, by 11,500 contracts. No changes in the rate of the pound/dollar pair on the 23rd, 24th, 25th, which will be included in the next report. Thus, a long term decline in the pound's quotes is quite questionable, although the pound is still the most unattractive currency in the foreign exchange market. Quite big news for the British pound on Tuesday, September 29. Nevertheless, the overall fundamental background remains very strong for the pound. Today or tomorrow, and in principle every day, the market may receive news from the negotiations between Brussels and London, news about the parliamentary vote on the "Johnson Bill", as well as any other information about the relationship between the UK and the EU, current and future. All this information is extremely important for the pound. Both the UK and the US will publish their third quarterly GDP estimates today. The United States is expected to fall by 31.7%, and Britain - by 20.4%. There will be other important macroeconomic reports in America, as well as the debate between Donald Trump and Joe Biden. Therefore, volatility may sharply increase during the day, since there might be a large amount of potentially important news. We have two trading ideas for September 30: 1) Buyers continue to push the pair upward and crossed the Kijun-sen and Senkou Span B lines the day before yesterday, and also reached the first resistance level of 1.2915. Thus, you are advised to stay in long positions while aiming for the resistance level of 1.2915 and the resistance area of 1.3004-1.3024, while the pair remains above the Senkou Span B line. Take Profit in this case will be from 50 to 140 points. The current fundamental background is simultaneously bad for both the pound and the dollar. 2) Sellers failed to keep the pair below the critical line. So now they need to wait for the price to settle below the Kijun-sen line (1.2807), and only after that should you resume trading downward while aiming for the support area of 1.2636-1.2660. Take Profit in this case can be up to 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

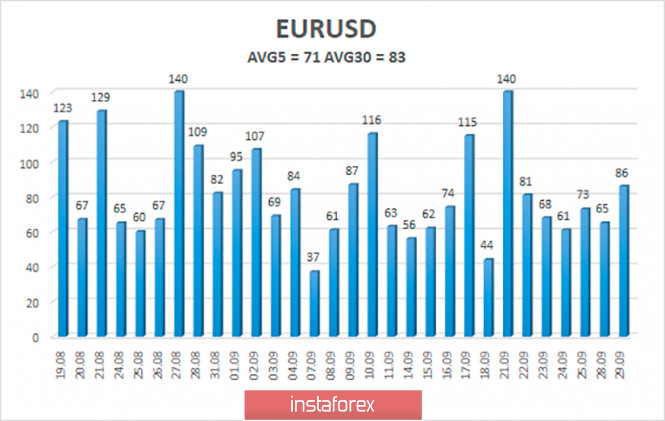

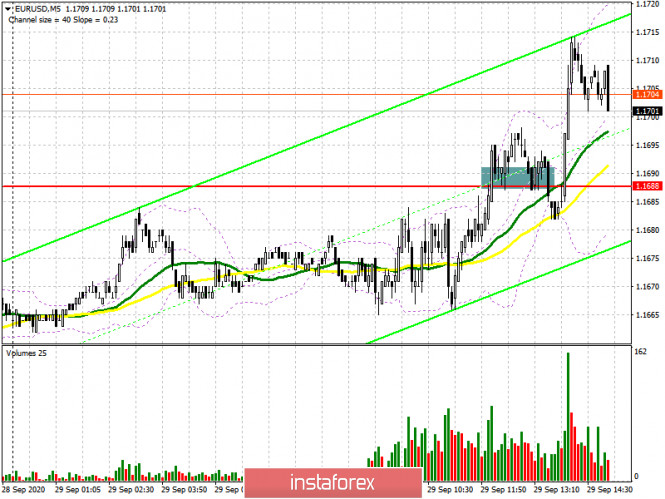

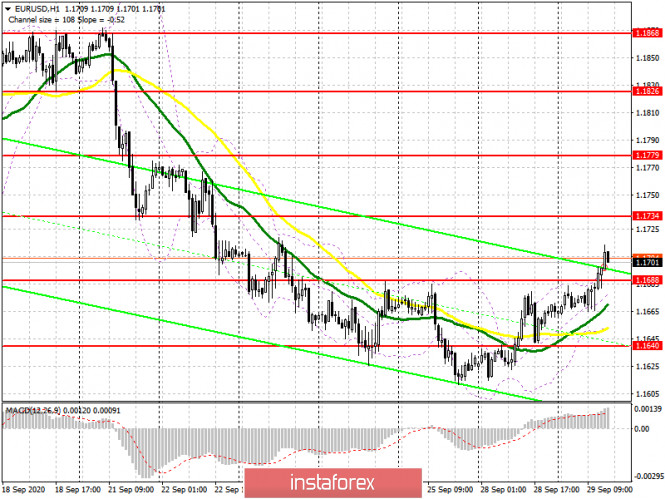

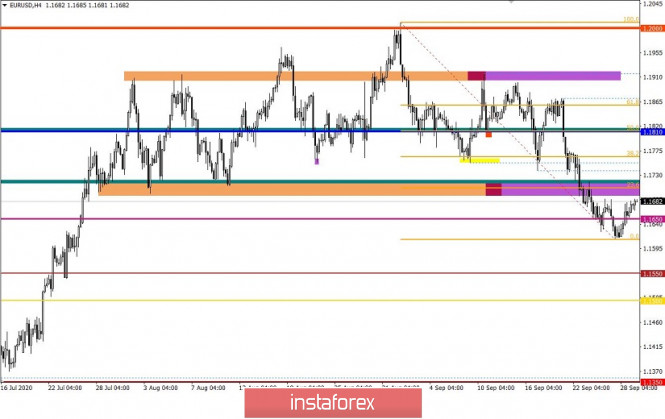

| Posted: 29 Sep 2020 06:34 PM PDT EUR/USD 1H The EUR/USD pair continued to correct throughout the day on the hourly timeframe on September 29. And by the end of the day, it reached the upper line of the descending channel, which still continues to maintain a downward trend. Buyers have taken a major step towards the reversal of the downward trend, but they still need to overcome the channel itself, as well as the Senkou Span B line located very close to it, which is also a strong obstacle. At the same time, the bears retain good chances of renewing their downward movement. To do this, they just need to keep the pair inside the downward channel. Take note that the growth was not that strong for the last couple of days, only about 120 points. For greater confidence in bringing back the downward track, we advise you to wait until it settles below the critical line. EUR/USD 15M Both linear regression channels turned to the upside on the 15-minute timeframe, which indicates that the upward movement will continue. The euro/dollar fell by about one and a half cents last reporting week (September 16-22). Recall that the previous Commitment of Traders (COT) report showed that the "non-commercial" group of traders, which we have repeatedly called the most important, sharply reduced their net positions. Thus, in general, the downward movement that began later on was sufficiently substantiated. The only problem is that it started late. The new COT report, which only covers the dates when the euro began its long-awaited fall, showed completely opposite data. Non-commercial traders opened 15,500 new Buy-contracts (longs) and almost 6,000 Sell-contracts (shorts) during the reporting week. Thus, the net position for this group of traders has increased by around 9,000, which shows that traders are becoming bullish. Accordingly, the behavior of the EUR/USD pair and the COT report data simply do not match. For the second week in a row. However, if you try to look at the overall picture, you can still take note of a very weak strengthening of the bearish sentiment, so the COT report allows a slight fall in the euro. The question is, will it continue to decline or is it already over? The pair even managed to rise by 40 points from September 23-29. Therefore, there are no such changes again. Practically no important messages and events in the European Union and the United States on Tuesday. Markets seem to be fully focused on the current debate between Donald Trump and Joe Biden, the results of which will be announced later in the morning. Although this topic is not economic, nevertheless, everything in the United States now passes through the prism of elections. The US is set to release an important report today. The ADP report on changes in the number of employed in the private sector with a forecast of +648,000. If results turn out to be better than forecasts, then we can expect the dollar to strengthen. In all other respects, the US dollar can hardly count on support tomorrow. Personal consumption spending indices are forecast in negative territory, the third estimate of US GDP for the second quarter is unlikely to be better than the second... We have two trading ideas for September 30: 1) Buyers continue to put pressure on the pair, but these efforts are still not enough to break the current trend. Therefore, we recommend considering long positions if the pair settles above the descending channel with the Senkou Span B line (1.1763) with targets at 1.1798 and the resistance area of 1.1886-1.1910, not earlier. Take Profit in this case will be from 20 to 110 points. 2) Bears try to keep it under control despite the fact that the euro has been growing for three whole days. Still, the latest COT report warns that the dollar's gains could be very short-lived. There is a possibility that the downward movement will resume as long as the price is within the channel. You are recommended to trade bearish below the Kijun-sen line, while aiming for the support level of 1.1538. In this case, the potential Take Profit is up to 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the GBP/USD pair. September 30. A new round of negotiations of the EU-United Kingdom. Posted: 29 Sep 2020 05:10 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 101.2881 On Tuesday, September 28, the GBP/USD pair was in a much weaker upward movement than a day earlier. Buyers kept the pair above the moving average line, thus, the prospects for a new upward trend remain. At the same time, the bulls failed to break through the Murray level of "3/8" - 1.2878, thus, the upward movement stalled near the specified mark. Thus, the technical picture is now ambiguous and it is quite possible to resume the downward movement since the moving average remains very close to the current location of quotes. However, not only the technical picture remains ambiguous. The fundamental background for the GBP/USD pair is probably one of the most interesting right now. There is quite a lot of information coming from the UK, a lot of information coming from the European Union, however, there is no need to talk about the United States. However, all this information is negative in 90% of cases. Negative for the dollar and negative for the British pound. So the equation looks like this: whose negative is more negative? The last few weeks remained for the US dollar, however, we remind you that before that, it was the British pound that grew for a long time. It increased when there were no special reasons for this. It's just that everything was bad and hard in America, thus, the pound grew. However, there was no positive news from the UK during that time period. However, even now, when the dollar began to grow, no positive news comes from the US. Moreover, for traders on the US dollar, a very dangerous situation has developed, which is called "uncertainty". No one really knows who will win the presidential election and what awaits the country in the future. Thus, in principle, the fall of the national currency before the elections is absolutely normal for any country. In general, both the dollar and the pound have very unsightly prospects. Unfortunately for traders, the probability of going north is now equal to the probability of going south. Thus, you only need to rely on technical analysis when making trading decisions. As for the fundamental topics that are important for the pound and the dollar, they remain the same and there is not much news on them. Maros Sefcovic, Vice-President of the European Commission, made comments on the "behavior" of the UK today. In a nutshell, his speech was filled with colorful epithets that condemned London's behavior with its "internal market" bill. Mr. Sefcovic said that the protocol on the regime on the border between Northern Ireland and Ireland is part of the already agreed and ratified Brexit Treaty and London has no right to violate it, change it unilaterally or choose which points to comply with and which not. Thus, Sefcovic recommends that Britain should withdraw the bill as quickly as possible and "to restore the tarnished reputation". If London continues to push through this bill, any further negotiations will be very difficult or even impossible, and Brussels has already begun to study the possibility of applying to the international court of justice. Sefcovic also said that at the moment the UK's position on the Northern Ireland border does not meet the expectations of Brussels at all. Many points of the protocol are not being implemented, and many are not being implemented in full or late. It is noteworthy that yesterday the next round of negotiations on a trade agreement began, which may come into force after the end of Brexit. And on the same day, a second reading vote on the "Johnson bill" was to be held in Parliament. Thus, during the course of today, traders will probably receive a huge number of important and interesting messages from Britain and the EU that relate to the relationship between the Kingdom and the Alliance. Also, a huge amount of important information should come from overseas today, as the debate between Joe Biden and Donald Trump was supposed to take place. So in the morning, all the news feeds will be full of information from that show. According to preliminary information from some media outlets, Donald Trump has significantly reduced the gap from Joe Biden in recent months, although we do not believe this information, since Trump and his administration have not done anything that could raise ratings recently. The constant and daily promises of the imminent invention of a vaccine do not count. Thus, the topic of US elections is beginning to gain special meaning and importance. After all, the election is just over a month away. From a technical point of view, the bulls now need to overcome the Murray level of "3/8" - 1.2878. However, stomping around this level for a whole day suggests a rebound and resumption of the downward movement, since the moving average is located dangerously close. Thus, the reversal of the Heiken Ashi indicator will already warn traders about the dangerous possibility of resuming the downward trend. For the third trading week, in addition to the US debate between presidential candidates and Brexit negotiations, a fairly large number of important macroeconomic publications are also planned. In the first place is the report on UK GDP for the second quarter. Although market participants are already prepared for these figures, they can once again emphasize the difficult economic situation in the Foggy Albion. There will also be important macroeconomic publications in the United States. In general, the day promises to be very interesting, and volatility can be very high.

The average volatility of the GBP/USD pair is currently 114 points per day. For the pound/dollar pair, this value is "high". On Wednesday, September 30, therefore, we expect movement inside the channel, limited by the levels of 1.2747 and 1.2975. The reversal of the Heiken Ashi indicator down may signal about a possible resumption of the downward movement. Nearest support levels: S1 – 1.2817 S2 – 1.2756 S3 – 1.2695 Nearest resistance levels: R1 – 1.2878 R2 – 1.2939 R3 – 1.3000 Trading recommendations: The GBP/USD pair started an upward movement on the 4-hour timeframe and broke the moving average line. Thus, today it is recommended to stay in the longs with the goals of 1.2939 and 1.2975 as long as the Heiken Ashi indicator is directed upwards. It is recommended to trade the pair down with targets of 1.2756 and 1.2695 if the price returns to the area below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Sep 2020 05:10 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. CCI: 236.1671 The US currency continued to fall in price against the euro on Tuesday, September 29. Thus, this is probably all that the bears were able to do in the current market conditions. The pair's quotes are already fixed above the moving average line, thus, the trend has already changed to an upward one. Thus, the upward trend can now resume. Further, from our point of view, this will be a logical development since the euro now looks really stronger than the dollar. In Europe, it is also "not without problems". They officially announced the beginning of the second "wave" of the COVID-2019 epidemic. The inflation rate remains below zero. Thus, the fundamental background remains on the side of the euro. If you try to describe the entire policy of Trump in one word, the concept of "war" will not fit. Still, under Donald Trump, we should pay tribute because America did not get involved in new international military conflicts. Or at least not as actively as under other presidents. Moreover, Trump plans to return home many American soldiers who are now stationed in many hot spots on the planet. In general, under Trump, America's military actions were really not the most active. Therefore, the concept of "conflict" is much more appropriate. The American President got into conflicts with such pleasure that he seemed to get satisfaction from the very process of inciting them. Trump quarreled with the Democrats, with the press, with epidemiologists (when the pandemic began), with the Pentagon, with the Fed, personally with Jerome Powell, with China, with the European Union, and many others. Perhaps its biggest quarrel is the trade war with China. It began two years ago and was designed to offset the injustice of the Chinese towards the American people. After two years of this war, it is safe to say that the injustice was not leveled. First, the US trade balance continues to decline. More precisely, the trade deficit of the United States continues to grow. Therefore, based on this indicator alone, we can make a clear conclusion that the White House did not achieve what it wanted. Moreover, China's trade surplus has grown in recent years. Of course, both countries have a huge number of other countries as trading partners. Therefore, it is impossible to say unequivocally that Washington's actions led to the exact opposite result. Trump has repeatedly stated that from trade relations with China, America loses billions of dollars and gets nothing. However, in addition to this, Trump has repeatedly stated that America is winning the trade war. Although, according to many experts, this is absolutely not the case. First, as a result of this trade war, you can specify the claims of 3,500 American companies against the US government itself. In their opinion, the government had no right to impose duties on imports from China. Among those making claims are Tesla and Ford. Secondly, many Chinese goods as a result of duties have become much more expensive in America, which hits the pockets of the lower strata of the population, who also suffered in 2020 from the "coronavirus crisis". Third, China immediately found other markets for the part of the goods that stopped going to the States due to reduced demand. Fourthly, some authoritative publications claim that Beijing is not fully fulfilling its obligations under the "first phase" of the trade agreement. Fifth, China has started to increase its own high-tech production and export of industrial products. Thus, it is absolutely unclear who benefited from all these perturbations, however, one thing is clear: Washington did not get the desired result. However, Trump is not going to stop there. If he is re-elected for a second term, he is going to start a war with American manufacturers who have located their factories in China and other countries with cheap labor. According to Trump, these companies should return their production to the United States and create jobs in the United States. Those companies that do not want to return to their home country may lose government orders and taxes may be significantly increased for them. It should be understood that any production in America is much more expensive than in China. Thus, on the one hand, Trump's intentions are good, the American President wants to create jobs for Americans, on the other hand, if we were talking about a difference in the cost of production of 15-20%, then with the help of taxes, companies could be forced to return to America. However, the difference in cost can be from 2 to 5 times. Accordingly, if American manufacturers return home, the demand for their products may decrease significantly. Most experts also note that Trump does not want to bring manufacturers home because he understands that this is impossible since he is a businessman. He wants manufacturers to leave China and stop strengthening the main competitor of the United States in the international arena. However, in almost any case, both the trade war with China and the likely war with American manufacturers will again affect both the economies of China and the United States. All this uncertainty in the future makes traders and investors very cautious about buying the US currency. It is absolutely unclear how Trump's second cadence may end, however, the results of the first one are visible to the naked eye. And they can hardly please anyone. Nevertheless, Trump's ratings have grown slightly in recent months and now, according to many opinion polls, the gap between Biden and Trump is no more than 5-6%. Whether this is true or not is hard to say, since there are errors in any opinion poll. And in our case, the error of 2% is a lot. However, the first round of debates between a Republican and a Democrat will take place in America today, so we will soon get a huge amount of important and interesting information.

The volatility of the euro/dollar currency pair as of September 30 is 71 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1666 and 1.1808. A reversal of the Heiken Ashi indicator back down may signal the end of an upward correction. Nearest support levels: S1 – 1.1719 S2 – 1.1658 S3 – 1.1597 Nearest resistance levels: R1 – 1.1780 R2 – 1.1841 R3 – 1.1902 Trading recommendations: The EUR/USD pair is fixed above the moving average line. Thus, it is now recommended to consider long positions with targets of 1.1780 and 1.1808 before the Heiken Ashi indicator turns down. It is recommended to consider sell orders again if the pair is fixed back below the moving average with the first targets of 1.1666 and 1.1597. The material has been provided by InstaForex Company - www.instaforex.com |

| Trump vs Biden: Don't trade dollar pairs ahead of the debate Posted: 29 Sep 2020 02:40 PM PDT Donald Trump and Joe Biden will hold the first election debate. The verbal duel will take place in Cleveland, Ohio. The debate will last 90 minutes, and will be moderated by the famous American journalist Chris Wallace (who works for Fox News, which is considered to be close in spirit to the Republicans). He also chose the main topics of the political battle: these are the results of the work of both politicians in high positions, the coronavirus crisis and methods of combating the pandemic, the economy, racial issues, protest movements and the protection of the electoral process. Actually, this is where all the known elements of this difficult political equation end. Some assumptions, rumors and insiders. So, according to the information agency Associated Press, the campaign headquarters of the Democrats does not attach much importance to the first debate. In their opinion, uncomfortable questions will automatically "corner" the Republican leader. A record recession in the US economy, tens of thousands of deaths from the coronavirus, high unemployment - all these negative factors speak for themselves. As the political strategists of the Democrats believe, Biden only needs to ask leading questions, while the hard-hitting realities of 2020 will "drown" Trump's rating by themselves. In the camp of the Republican Party they think differently. In their opinion, the first debate will be a watershed moment in Trump's campaign, while Biden will look pale against the backdrop of an articulate opponent. On the eve of the debate, the parties have already exchanged verbal jabs: the leader accused the head of the White House that he does not understand either domestic or foreign policy, therefore, during the debates, he will mostly get personal. Donald Trump, in turn, once again called his rival "Sleepy Joe" and urged him to take a test for the presence of illegal drugs in the blood. The results of the latest opinion poll were published on the eve of the debate, which only increased the intrigue. It turns out that Trump now lags behind Biden by only 2%. If 45% of the Americans polled are ready to vote for the current US president, then 47% of the respondents are for the leader of the Democrats. This suggests that support for the head of the White House is growing again after the downturn. Compared to August, the growth is +3%. But Biden is losing the sympathy of the electorate. Its positions have weakened by two percentage points over the past month. According to American experts, US residents positively perceived the non-standard economic steps of the head of the White House. Let me remind you that back in August, Trump issued four executive orders bypassing Congress. First, it partially returned additional payments to unemployment benefits for tens of millions of Americans who lost their jobs due to the coronavirus pandemic (they will be made until December 6 of this year). The federal government has allocated funds from the Emergency Relief Fund for these needs - a total of about $44 billion. The rest of Trump's decrees included deferring payroll tax payments for people earning less than $100,000 a year, extending the student loan moratorium, and helping tenants and homeowners. And although from a legal point of view, the issued decrees were "on the brink of a foul," in the end they brought Trump a political advantage. Therefore, he can use this factor in the course of debates, using the reputation of an "anti-crisis top manager". How will the dollar react to the outcome of the debate? In general, Trump's anti-Chinese rhetoric is putting background pressure on the positions of dollar bulls. According to some analysts, after his re-election, the trade war with China will flare up with a new force. Trump himself does not get tired of accusing China of espionage, theft of intellectual property, the spread of coronavirus, etc. in addition, he has repeatedly threatened to "uncouple" the US economy from China, thereby reducing its dependence on the latter. It's not that Biden shows the opposite feelings towards Beijing, but still he doesn't voice such harsh rhetoric. Therefore, if Trump's electoral victory becomes obvious immediately after the debate, the dollar will be under pressure. Otherwise, the greenback will again receive a reason to grow. If there is no clear winner, then the reaction of traders will follow a little later, when the results of the relevant surveys become known. In any case, trading dollar pairs is risky at the moment. The debate of the main rivals is an important stage of the US election race. Therefore, they can affect not only the electoral distribution, but also the configuration of key dollar pairs. The material has been provided by InstaForex Company - www.instaforex.com |

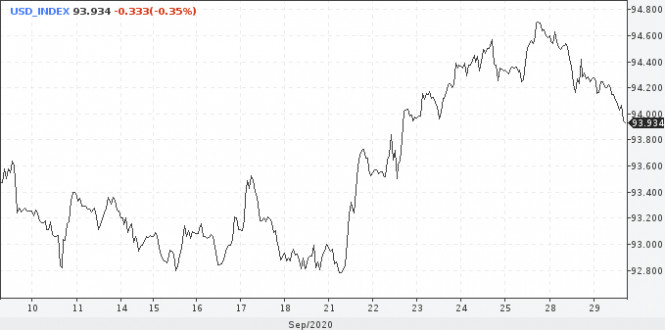

| EUR/USD: dollar participates in the debate Posted: 29 Sep 2020 02:40 PM PDT The first election debate between the presidential candidates Joe Biden and Donald Trump will take place in the United States today. Opinion polls show that Biden is currently leading the way: on average, he is seven points ahead of his rival nationwide. "If the debate weakens Trump's position and Biden maintains leadership, this could lead to investors abandoning the dollar," Mizuho Bank said. However, analysts say that if Trump manages to close the gap, it will only increase the uncertainty about the outcome of the election and support the greenback. "Since mid-September, the dollar has been recovering. However, it is not yet clear what the trend will be in October, "said Mizuho Bank experts, noting that market participants also closely follow any news about fiscal stimulus in the US. Last night, Democrats unveiled a new $2.2 trillion economic aid bill to combat coronavirus, which was called a compromise measure. "If this bill is approved before the November elections, it will support the risk sentiment," OCBC Bank said. Traders are also awaiting the release of statistics to assess the state of the world's largest economy ahead of the elections. So, on Wednesday, the final estimate of US GDP in the second quarter will be released, and on Friday the US employment report for September will be released. If the United States publishes positive macro statistics, it will help strengthen the dollar. So far, hopes for a consensus between Republicans and Democrats on another package of aid to the US economy are pushing stocks up, and the greenback - down. The dollar faced strong resistance around 94.6 points. Bulls have been attacking this level since the middle of last week, but at the beginning of this week the USD index is trading below this level again. According to experts, it is worthwhile to closely monitor the dynamics of the dollar and place bets on its further growth or a new fall already taking into account these dynamics and confident consolidation above or below the 94.6 mark. The continued risk appetite of investors made it possible for the EUR/USD pair to overcome the 1.1700 level. The euro was supported by data published on Tuesday, according to which the composite index of business and consumer confidence in the euro area (ESI) in September rose to 91.1 points from 87.5 points recorded a month earlier. Further recovery in demand for risky assets will be a bad thing for the dollar and will aim for the EUR/USD pair at 1.1800. Meanwhile, concerns about the epidemiological situation in Europe and the uncertain outcome of the US presidential election may return pressure on the major currency pair. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Sep 2020 08:23 AM PDT Markets are focused on the US election race. Today, Republican President Donald Trump and his democratic rival Joe Biden met during the first televised debate. According to polls, at the moment, Joe Biden has more chances to win than Donald Trump. However, the elections of 2016 proved that forecasts could be far from reality. Last time, polls showed a wrong number of people who supported Donald Trump. Now there is no reason to believe that they have suddenly become more reliable. That is why markets have faced increasing uncertainties. Today, the US dollar index continued dropping from the two-month high of 94.70 logged last week. At the moment, both mid-term and long-term trends are downward. Of course, the situation may change, but at the moment, bears prevail. However, the upcoming event will determine the US dollar movement. This year, the US dollar index has been swinging. The recent slump pushed investors to use the strategy that was out-of-date for many years. Thus, investors began to borrow dollars to buy riskier assets. All these points to a change in investors' sentiment. Earlier, they used the Japanese yen to perform such deals. During the last two years, the euro became really popular as the ECB pushed its rates to the negative territory. At the same time, in 2015-2017, the US dollar lost its popularity as the US Fed was actively raising the key interest rate. This year, a difference between the key rates in the US and Europe became smaller. Investors choose to trade on the difference between exchange rates of low-yielding currencies that tend to trade steadily or decline, as this increases their profits. Views on the US dollar Representatives of Lombard Odier, a Swiss bank, believe that the US dollar is overestimated by 10% or 15%. During one year, they were waiting for a drop in the currency. The fact is that they are going to use the greenback to buy the rising currencies of developing economies in Asia, namely the Chinese yuan, the South Korean won, and the Taiwanese dollar. Invesco specialists have the same view, especially amid a possible change in the key rates in the US. They are planning to use the US dollar to buy Mexican government bonds denominated in pesos. The peso jumped by 13% from its March lows. According to Goldman Sachs, it could generate an income of about 2.25% over the next year. Many foreign strategists expect the greenback to decline in the coming years. This is due to the fact that the pace of recovery in other global economies is likely to outpace the growth rate of the US economy. It is worth noting that the bets that the G10 currencies will gain in value against the US dollar are close to a 2-year peak. This year, the US dollar slumped by 2.3% against its major rivals. Its dynamic is likely to be the weakest in the last three years. At the same time, not all analysts and investors foresee a gloomy future for the US dollar. Some economists suppose that the greenback will advance taking into account the results of the presidential elections and a mounting number of new virus cases in winter. Whatever it is said about the US dollar, it has proved several times that it is the best safe-haven asset. If the US dollar starts rising, this may force investors to close their current positions and start buying the dollar. This, in turn, will further spur its growth. The US dollar index jumped by 1.9% last week on concerns about the uneven pace of the economic recovery. Another period of unrest in the stock markets this year may also contribute to its strengthening. News about the global recession may also boost the greenback. The material has been provided by InstaForex Company - www.instaforex.com |

| September 29, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 29 Sep 2020 08:05 AM PDT

The EUR/USD pair has been moving sideways within the depicted expanding channel since August 3. Previously, a temporary resistance level was formed around 1.1900 which prevented further upside movement and forced the pair to have a downside pause for sometime. By the end of August, the EURUSD pair has achieved another breakout above the previously mentioned resistance zone. However, Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. That's why, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800 then 1.1770-1.1750 which failed to offer sufficient Support for the EUR/USD. Earlier Last week, a breakout to the downside was executed below the price level of 1.1750 (Lower limit of the depicted movement pattern). Hence intraday technical outlook has turned into bearish. Intraday traders should be waiting for any pullback to the upside towards the recently-broken key-zone (1.1750-1.1770) for a valid SELL Entry Provided that the recent SUPPORT level around 1.1630 prevents any further decline. On the other hand, a breakout above 1.1820 (Exit Level) will probably enable further upside movement towards 1.1860-1.1900. The material has been provided by InstaForex Company - www.instaforex.com |

| September 29, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 29 Sep 2020 07:33 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1700 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) stood as a strong SUPPLY-Zone to offer bearish reversal. Intraday traders should have considered the recent bearish closure below 1.1700 - 1.1750 as this enhanced further bearish decline initially towards 1.1645 and probably 1.1600 if sufficient bearish pressure is maintained. Trade recommendations : Conservative traders should wait for the current bullish pullback to pursue towards the recently-broken DEMAND Zone around 1.1750 - 1.1770 as a signal for a valid SELL Entry. T/P levels to be located around 1.1645 and 1.1600 while S/L to be placed above 1.1800 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| September 29, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 29 Sep 2020 07:25 AM PDT

On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the key-level level of 1.3300. A quick bearish decline took place towards 1.2900 then 1.2825 where some bullish recovery was recently expressed. The price zone of 1.3130-1.3150 (the backside of the broken trend) remains an Intraday Key-Zone to offer bearish pressure if retested again. However, the GBPUSD pair has shown lack of sufficient bullish momentum to pursue above the price level of 1.3000. This enabled further bearish decline towards 1.2800 then 1.1700 where another episode of bullish recovery may be executed. Initial bullish breakout above 1.2800 is currently needed to allow bullish pullback to pursue towards 1.3100. Otherwise, further bearish decline would be expected towards the price level of 1.2600. Trade recommendations : Conservative traders are advised to wait for bullish pullback towards 1.3130-1.3150 (the backside of the broken trend) as a valid SELL Entry. Initial T/p level is to be located around 1.3050 and 1.2900 if sufficient bearish pressure is maintained. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of EURUSD Posted: 29 Sep 2020 06:45 AM PDT EURUSD is again above 1.17 after reaching our 1.16 target area. We warned bears to be cautious as a bounce was imminent. Trend remains bearish as price is still below cloud resistance. This cloud resistance bulls need to break now in order to continue higher. Otherwise a rejection will be a bearish signal.

|

| Ichimoku cloud indicator Daily analysis of Gold Posted: 29 Sep 2020 06:39 AM PDT Gold price as expected by our last Ichimoku cloud indicator analysis has reached $1,880 target after breaking above the tenkan-sen indicator. Price is now above the kijun-sen indicator and is heading towards the Kumo.

|

| USDJPY approaching medium-term trend resistance trend lines Posted: 29 Sep 2020 06:35 AM PDT USDJPY has risen the few days from a low around our target of 104 back to above 105 as expected. Price remains in a bearish trend as price continues to make lower lows and lower highs since March.

Red line - short-term resistance USDJPY is below both important resistance trend lines. The first important resistance is found at 105.80 and the next one is at 106.60. A rejection at current levels around 106 is highly probable. We remain bearish as long as price is below the pink resistance trend line. Looking for another move below 104. The material has been provided by InstaForex Company - www.instaforex.com |

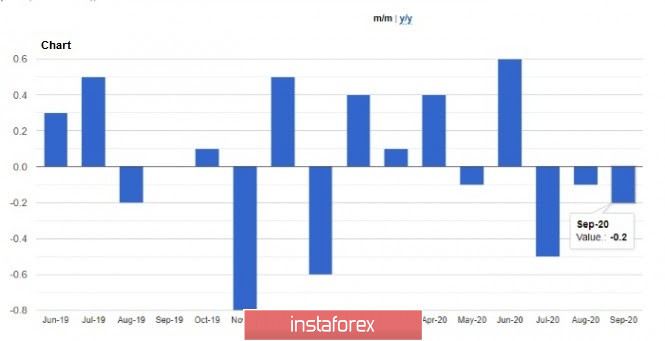

| Posted: 29 Sep 2020 06:16 AM PDT The European currency managed to continue its strengthening against the US dollar after very positive data released today in the first half of the day for the Eurozone. We are talking about the growth of the index of sentiment in the Eurozone economy, which was pulled by the optimistic mood of Eurozone companies. Meanwhile, consumer confidence has not changed much, which may create some difficulties in the future. Given the fact that the surge in coronavirus infections occurred in the second part of September, it is not necessary to regard the surveys of companies in the Eurozone as reliable, since the changed and more optimistic views on the future can be quickly crossed out by a new wave of coronavirus spread, which will force several European countries to introduce new restrictions and resort to stricter social distancing measures. The British authorities are thinking about introducing a ban on visiting each other in the North-East of England. Such measures must be taken because of the growing number of coronavirus infections. As Health Secretary Matt Hancock said yesterday, a sharp increase in infections in Britain in mid-September indicates the beginning of the second wave of the pandemic, which was expected only by the winter of this year. Currently, the number of daily COVID-19 infections in the country is at the level of 6,000 cases, which is the maximum for the entire time of statistics. As for the data from the European Commission, the index of sentiment in the Eurozone economy calculated by it rose to 91.1 points in September against 87.5 points in August. The February value of the index before the start of the pandemic was at 103.4. The most significant increase in confidence was observed in Italy, while in France the index remained unchanged, which is a serious call that the mechanical rebound from the lows reached at the height of the COVID-19 pandemic has ended. The report shows that in September of this year, as in August, the consumer confidence index in France was 95 points. The situation is similar with the Eurozone consumer confidence indicator, which also remained unchanged in September compared to August at its negative value of -13.9 points. Let me remind you that only an increase in confidence in the Eurozone will indicate that the recovery of the Eurozone economy will continue in the autumn-winter period, as the decline in confidence will seriously affect household spending. Today's German inflation data once again confirmed market concerns that the economic recovery is gradually slowing down, and the country itself is completely under deflationary pressure. Although economists had expected a larger slowdown in inflation, the fact that the drop in the index was greater than in August this year already speaks for itself. According to the report, the German consumer price index fell by 0.2% in September this year, after falling by 0.1% in August and falling by 0.5% in July this year. The main reason for this sharp decline was the fall in prices for oil and other energy resources, as well as a reduction in VAT in July this year. Compared to September 2019, inflation also decreased by 0.2%. As for the EU-harmonized index, things are even worse. There was a decrease in the indicator by 0.4% at once. The only good news related to the German economy today is the data on the reduction in the number of part-time employees. This suggests that many are going to work full-time, which in the future will lead to a new wave of economic growth and spur inflation. According to the Ifo Institute, the number of part-time workers in Germany fell to 3.7 million in September from 4.7 million in August. The highest share of part-time workers remains in the manufacturing sector. As for other countries in the Eurozone, a report was published today indicating increased risks to the Spanish economy. Everything is still because of the coronavirus pandemic and its new wave. It is Spain's GDP that may shrink by 12% in 2020 at the end of the year, which makes it almost an outsider among other Eurozone countries. Problems with the tourism sector, which is again beginning to suffer from a new outbreak of coronavirus, may lead to the fact that for the whole of 2021, the economy will recover by only 5.0%, and this is one of the positive forecasts. A sharp decline in activity in the housing market and difficulties in the labor market, where the number of new vacancies is at a very low level, and unemployment is growing like a snowball, all this represents additional risks for the economy. In this regard, the authorities will have to deal with new borrowing to support the economy afloat, which by the end of 2020 may increase the national debt to 120% of GDP. As for the technical picture of the EURUSD pair, the growth of risky assets continues. Despite all the troubles in the economy, the euro has the growth potential, although it is still quite limited. A break of 1.1690 opens new highs for buyers of risky assets in the area of 1.1735 and 1.1780. If trading moves below the level of 1.1690 again, the pressure on the trading instrument may increase significantly, which will lead to a decrease in EURUSD to the area of the month's minimum of 1.1610. The material has been provided by InstaForex Company - www.instaforex.com |

| US support masses in a new way amid the COVID-19 pandemic Posted: 29 Sep 2020 06:15 AM PDT

In March of this year, the US House of Representatives approved a program to support the masses amid the coronavirus outbreak. Representatives offered to allocate tens of billions of dollars from the country's budget in order to help victims who were experiencing significant losses in the field of physical health and material security. The list of proposed measures included financial assistance, unemployment benefits, and free medical care to detect the ill-fated virus. In addition, attention was also paid to supporting the country's economy, which is suffering from the pandemic. Democrats have made critical additions to the previously agreed program that should reduce the cost of the bill. The updated version of the program provides for a new deduction that is intended to support schools, restaurants, small businesses, concert halls, airline employees, etc. Moreover, it will provide $436 billion in emergency aid payments to state and local governments. Most Americans, according to the updated version of the previously agreed program, will be able to receive higher unemployment benefits of around $1,200. According to the proposed bill, payments are also provided for preventing thousands of layoffs in passenger airlines amounting to $25 billion. The bill also defines the transfer of $3 billion to airline contractors. House of Congress Speaker, Nancy Pelosi, has not yet specified a date when the proposal should be voted on. For comparison, here is a similar bill that was proposed by Republicans in early September of this year, and provided for payments of up to $500 billion to support various sectors of the country's economy. To support schools in times of crisis, Republicans proposed allocating $105 billion from the federal budget. As for the development and research of a coronavirus vaccine, the Republicans proposed to allocate another $31 billion in this area. Unfortunately, formal negotiations on a new emergency economic assistance package did not take place in August. The material has been provided by InstaForex Company - www.instaforex.com |

| Upbeat outlook: US natural gas ready to take off Posted: 29 Sep 2020 06:15 AM PDT

The cost of natural gas steadily increases. Optimism about this energy carrier will continue for more than one month due to several factors. The fall in LNG production and the inevitable rise in seasonal demand for it in the US indicate a natural rise in quotes. The expected recovery of the European and Asian markets, whose share in the destination for liquefied natural gas from the US cannot be overestimated, also plays an important role in this regard. The winter months in the US will be characterized by an increase in natural gas prices of more than $3 per MMBtu as announced by the US Department of Energy. Last week's gas price fluctuations are explained by what is known in narrow circles as the "shoulder season". In other words, this is a period when the demand for electricity for air conditioners used in the summer inevitably falls, and the demand for gas for heating in the cold period has not yet come. For this reason, quotes only depended on storage capacity, raging storms, and other factors. October natural gas futures were trading at $2.856 per MMBtu on Thursday, while January futures were trading at $3.44 per MMBtu. It is worth noting that futures for delivery from December to March were trading above $3.20 per MMBtu, which is understandable due to increased demand for gas in the winter in the US, Europe, and Northern regions of Asia. The demand for gas is projected to be high, which is disproportionate to the supply of this energy carrier in the US. Today, there is a much lower supply than a year ago. The reason lies mainly in the low prices of "black gold", which in turn led to a decline in oil production. The low level of oil energy production determined the decline in gas production in the Permian Basin. Liquefied natural gas spot prices in Asia are experiencing strong increases for the first time in many months. This indicator determines the attractiveness of its exports from the US. Note that from January to July, exports of American liquefied natural gas suffered significant losses. It was only in August that exports began to grow. According to the US Department of Energy, in August, natural gas exports were 19% higher than in July. Moreover, according to the forecasts of the DOE, low natural gas production will trigger a sharp increase in the average price of natural gas at Henry Hub in January against the background of strengthening domestic and external demand. It is expected to rise to $3.40 per MMBtu. Analysts say that the specified cost level will not be lower than $3.00 per MMBtu throughout 2021. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on September 29, 2020 Posted: 29 Sep 2020 06:11 AM PDT

The EUR/USD pair signals an upward movement. You may consider buying from the level of 1.1685 and be ready to hold until 1.1875 and beyond. You may consider selling from the level of 1.1610. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Sep 2020 05:50 AM PDT The construction of a new downward section of the trend continues. However, yesterday's departure of quotes from the lows reached suggests that the entire section of the trend, which begins on September 1, has taken a three-wave form that has already completed. If this assumption is correct, then the current positions may continue to increase quotes within the new upward wave as part of the upward section of the trend that began on March 19. Naturally, in this case, it will take an even more complex and extended form. During the last trading day, the GBP/USD instrument gained 70 basis points. Thus, the quotes are approaching the peak of wave 2 or b, and if a successful attempt is made to break this mark, then the probability of completing the construction of a descending wave will be very likely. In this case, the wave structure from September 1 will take a three-wave form. It is still hard to say what the further wave markings will be but it is likely that the increase in the instrument's quotes will continue with targets located near the maximum of the expected wave Z. An unsuccessful attempt to break through the 50.0% Fibonacci level can return the instrument to a downward trend, and wave 3 or C can take a much more complex and extended form. Vice President of the European Commission (EC), Maros Sefcovic, said that the UK is trying to meet some of the conditions of the Protocol on Northern Ireland, but there are still many unresolved issues. Sefcovic believes that the UK's position in implementing this Protocol is extremely far from what the EU can accept. According to the Vice Chairman of the EC, Britain needs to accelerate the implementation of this Protocol, and also called for the withdrawal of the Internal Market Bill by the end of September. "If this bill is passed, it would constitute a serious violation of protocol as an important part of the UK's withdrawal agreement from the EU and international law," Sefcovic said. "The withdrawal agreement must be implemented by London, cannot be revised, let alone unilaterally change some points, ignored or rejected." said the Vice President of the EC. However, according to the British media, today will be the second vote on this bill in the second reading. Many media outlets expect that the bill will be passed this time. Then there will only be a third, final vote, which can take place after the EU summit, at which it should be known for certain whether a free trade agreement will be concluded in 2020 or not. Most likely, London wants to put pressure on the European Union in this way. They say that if there are no concessions from Brussels, the agreement will not be signed, then the Internal Market Bill will be adopted. General conclusions and recommendations: The GBP - USD instrument presumably continues to build a new downward trend. The expected wave 2 or b completed its construction near the level of 38.2%. I continue to recommend selling the instrument with targets around 1.2721 and 1.2539, which is equal to 61.8% and 76.4% for Fibonacci in the expectation of building the third wave, which can be quite long. An unsuccessful attempt to break through the 50.0% Fibonacci level will indicate that the markets are ready for a new decline in quotations. The material has been provided by InstaForex Company - www.instaforex.com |

| US stocks rise while Asian stocks exhibited multidirectional movement Posted: 29 Sep 2020 05:48 AM PDT

The US stock exchanges ascent Monday due to an increase in the value of securities of financial organizations, as well as companies in the energy sector of the economy. This positive in turn was provided by the enthusiasm of market participants regarding the clearer prospects for the adoption of a new incentive program in the country. News of the resumption of negotiations on the next incentive package in the US had a positive impact on the mood of investors and experts. The fact that the negotiations have continued is already a good sign and provides indirect support to the stock market, although there is still some doubt about the positive outcome of these negotiations since previous attempts to reach an agreement were not successful. Delaying the decision on the stimulus program not only negatively affects the mood of investors, but also makes one think that the pace of recovery in the US economy will be slower than the authorities would like. It seems that the government has finally realized the depth of the problem, and a decision on incentives will be made in the near future. Another important point for the stock market was the political situation in the USA. Preparations are already made for the first televised debate between the current US President Donald Trump, and his main rival, Joe Biden, this week. Political tension adds even more uncertainty, which will not be dealt with quickly. Market participants are waiting for one of the most significant periods of volatility, which includes the election campaign and the US presidential election itself. Significant fluctuations are inevitable and will affect all asset classes without exception. In order to avoid unnecessary losses, some investors are starting to use the CBOE Volatility Index, or VIX, in their work. This can be used to protect your assets from sudden risks. At the same time, it should be noted that the situation after the elections does not stabilize immediately. It will be at least another two weeks before everything gets back on track. The Dow Jones Industrial Average rose 1.51% or 410.10 points, by the close of trading on Monday, which allowed it to move to the level of 27,584.06 points. It has been growing for three trading sessions in a row. The S&P 500 Index gained 1.61% or 53.14 points. Its level at the close of trading was 3,351.60 points. The NASDAQ Composite index became the leader of the growth which jumped 1.87% or 203.96 points sending it to 11,117.53 points. Meanwhile, multidirectional dynamics were noted in the major stock indexes in the Asian stock exchanges Monday morning. Japan's Nikkei 225 index rose 0.12%. China's Shanghai Composite Index gained 0.44%. The Hong Kong Hang Seng Index did not support the positive trend and declined by 0.49%. South Korea's Kospi Index gained 1.01%. At the same time, investors do not take into account the ambiguous statistics on economic growth. The level of retail sales in the last month of summer increased by 0.3% on an annualized basis, and this turned out to be the lowest increase in the last four months. The level of industrial production in the country fell by 3%, while the previous figure was also in the red zone falling 2.4%. The business confidence index, in turn, rose to 68 points, although it was 66 points earlier. So far this indicator is the most significant in the current year. Australia's S & P / ASX 200 index did not show any significant changes. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Sep 2020 05:46 AM PDT The wave marking of the EUR / USD instrument in global terms still looks quite convincing. According to the current wave pattern, the expected wave 4 continues its construction as part of the upward trend section. At the same time, much will depend on the news background. If it changes sharply in favor of the euro, then the entire upward section of the trend may take a longer and 5-wave form. The wave marking of a smaller scale layout shows that two smaller waves have already been completed inside the assumed wave 4, and an assumed wave 3 or C in 4 is currently being constructed, within which smaller-scale waves are also visible. Therefore, if the current wave marking is correct, then wave 3 or C in 4 will take a 5-wave form. The decline in quotes will resume in the very near future, and the entire wave 4 will take a very extended form and will cast doubt on whether this is wave 4, and not the first in the new downward section of the trend. Since several news from America continue to be negative recently, it is quite possible to expect the resumption of the construction of an upward trend section. However, the situation in the European Union has also begun to deteriorate in recent weeks, and now the euro does not look like the undisputed leader in a pair with the dollar. Insiders at the ECB announce that there is a strong divergence of opinion in the regulator's camp. Call to mind that, not so long ago, the European Union approved a package of recovery measures for 750 billion euro and a budget for 2021-2027. These documents were adopted with great difficulty and clearly did not imply that the pandemic would resume. After all, the 750 billion euro aimed at economic recovery after the crisis did not mean that the crisis itself would persist and continue. In Europe, the number of coronavirus cases is currently growing, and officials of the European Central Bank cannot agree on how to manage the economy during the second wave of the pandemic. It is reported that some ECB officials are quite optimistic and note a good growth rate of the recovery. Meanwhile, some are pessimistic and believe that more stringent methods of managing the economy should be used to prevent a new decline. Christine Lagarde herself highly appreciates the PEPP program and believes that it has greatly helped in the fight against the consequences of the pandemic and the crisis caused by it. Lagarde reports that the asset purchase program will continue until the end of June 2021 at least. If necessary, the duration of this program will be extended and its scope will be increased. General conclusions and recommendations: Seeing as the euro-dollar pair presumably completed the construction of the global wave 3 or C and the second corrective wave as part of the trend section starting on September 1, it is still recommended to sell the instrument with targets located near the estimated 1.1520 mark , corresponding 38.2% Fibonacci, for each downward signal of the MACD indicator. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: plan for the American session on September 29 Posted: 29 Sep 2020 05:27 AM PDT To open long positions on EURUSD, you need: The Eurozone consumer confidence indicator coincided with the forecasts of economists, which preserved the position of buyers of the European currency and opened up new opportunities for them to strengthen the pair. If you remember my morning forecast and the level of 1.1688, you will surely see that the signal to buy the euro from this range has justified itself. The 5-minute chart clearly shows how the bulls took another resistance of 1.1688, fixing on which made it possible to update the weekly highs. However, we have not yet reached a key goal in the area of 1.1734. This is where I recommend fixing profits. The longer-term goal will be a maximum of 1.1779, however, it will be very difficult to reach this level. In the scenario of a decline in EUR/USD in the afternoon, it is best to return to purchases after the formation of a false breakout in the support area of 1.1688. The larger level is still below the moving averages at 1.1640, where you can buy the euro immediately on the rebound.

To open short positions on EURUSD, you need: Sellers of the euro decided not to force events and retreated from the level of 1.1688, as it was recently with the area of 1.1640. The task for the second half of the day will be to return this range and fix it under it. The bottom-up test of 1.1688 forms a good entry point for short positions in the expectation of a continuation of the bearish trend, which will open a direct prospect for a decline in the euro to the area of the lows of 1.1640 and 1.1585, where I recommend fixing the profits. If the bulls are stronger and continue the upward correction in the pair, then you should not rush to sell. The data on the consumer confidence indicator may likely be worse than economists' forecasts, which will lead to a more powerful bullish momentum for the pair. Therefore, it is best to wait for the update of the maximum of 1.1734 or open short positions immediately for a rebound from the resistance of 1.1779 in the expectation of correction of 20-30 points within the day. Let me remind you that COT reports (Commitment of Traders) for September 22 recorded an increase in both long and short positions, however, the first ones turned out to be more. Such a low euro exchange rate for the first time in the last three months attracts new buyers, even despite the risk of a second wave of coronavirus infection across Europe. For example, long non-profit positions increased from 230,695 to 247,049, while short non-profit positions increased from only 52,199 to 56,227. The total non-commercial net position also rose during the reporting week to 190,822 from 178,576 a week earlier, indicating the bullish market sentiment in the medium term. The more the euro declines against the US dollar, the more attractive it will be for new investors.

Signals of indicators: Moving averages Trading is conducted above 30 and 50 daily moving averages, which indicates the continuation of the upward correction of the euro. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1. Bollinger Bands If the pair declines in the second half of the day, the lower border of the indicator in the area of 1.1655 will provide support. Description of indicators

|

| Posted: 29 Sep 2020 05:13 AM PDT What is needed to open long deals on GBP/USD On the 5-minute chart in the first half of the trading day, the pair formed a clear signal to buy GBP from 1.2834. I turned your attention to this in my morning article. If you look at the chart, you see a fake breakout in progress at 1.2834 after the bears failed to break that level. This created a good market entry point with long positions. The pair continued its growth exactly up to 1.2885, having climbed nearly 50 pips. However, the pair couldn't surpass the level of 1.2885 the first time. If you remember, I recommended opening short deals during the same fake breakout. Now let's discuss the outlook for GBP/USD. From the technical viewpoint, the GBP buyers rely on the same factors. The bulls still foresee a breakout and the price fixation above 1.2885. This creates a new signal for entering the market with long positions. The main target is to hit a new one-week high of 1.2962 where I recommend profit taking. The more distant target is seen at 1.3089 but it will be hard to reach. Under the bearish scenario, another fake breakout of 1.2834 will signal opening long positions. This is going to be the second test of that level. If the bulls fail to hold the upper hand at that level, it would be better to cancel long positions until the price reaches a higher high of 1.2766. Moving averages are passing slightly higher than that which serves the needs of the bulls. Another option is to buy GBP/USD immediately during a bounce from a one-month low of 1.2689 bearing in mind a 30-40 pips intraday correction. What is needed to open short deals on GBP/USD In the meantime, the sellers tried to seize the market under their control but failed. They pursue the same task in the second half of the trading day. For a start, they need to ensure the price to break and stay firmly below support of 1.2834. Testing this level from the opposite side makes a good market entry point for short deals. This will dampen the buyers' optimism that will refresh the first support level of 1.2766 where I recommend profit taking. The more distant target is seen at 1.2689. If tested, this will indicate the end of the bearish trend for GBP. In case GBP/USD extends its growth, that cannot be ruled out under the current conditions, it would be better not to rush selling the pair. It would be a good idea to wait until a fake breakout at near resistance of 1.2885. Another thing, once the bears managed to secure 1.2885. So, the second test could dent their zeal to act aggressively the same way. Thus, we can sell the pair immediately during a bounce only after the price makes another one-week high of about 1.2962 bearing in mind a 30-40 pips intraday correction. For your reference, the Commitment of Traders report from September 22 did not show any serious changes in market sentiment because traders were in the wait-and-see mood. They want to monitor how the British economy develops amid the resurgence of COVID-19. Besides, investors want to see further Brexit developments. Apparently, the sterling will come under pressure again amid the second coronavirus wave. Investors are fretted about the trade talks between the UK and EU as nothing suggests that the parties will arrive at a compromise soon. According to the COT report, the volume of short non-commercial positions decreased to 40,523 last week from 41,508. The amount of long non-commercial positions also declined to 43,801 from 43,487. As a result, the non-commercial net positions remained unchanged at 2,964 against 2,293 a week ago. Signals of technical indicators Moving averages The pair is trading below 30- and 50-period moving averages. It indicates that the market is about to begin a large bullish correction. Remark. The author is analyzing a period and prices of moving averages on the 1-hour chart. So, it differs from the common definition of classic daily moving averages on the daily chart. Bollinger Bands EUR growth will be capped by the upper level of the indicator at near 1.1835. In case EUR declines, the lower border of the indicator at near 1.1755 will act as support. Definitions of technical indicators

|

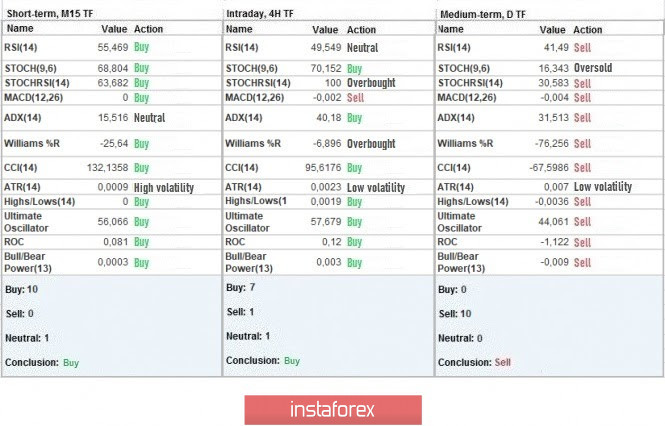

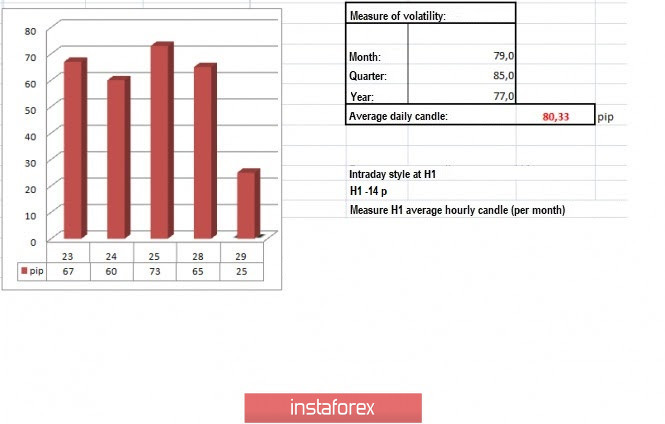

| Trading recommendations for the EUR/USD pair on September 29 Posted: 29 Sep 2020 05:04 AM PDT Long positions surged in the market yesterday, as a result of which the euro reached a price of 1.1686. However, since the quote is still below the seven-week flat (1.1700 / 1.1810 / 1.1910), the EUR / USD could resume its downward movement in the medium term. This is because the market is still controlled by the sentiment of participants, which arises speculative positions. In such a case, local operations are the best trading strategy, especially if you want to avoid getting any losses. Going back to the EUR / USD pair, if we look at the M15 chart, we will see that a wave of long positions appeared around 09:15 am to 12:15 pm, and during it, the quote reached the level of 1.1670 / 1.1666. But since the movement was little with which it failed to even enter the earlier flat, acceleration slowed, so volatility came out below the average level. In addition, if we look in the daily chart, we will see that the correction can hardly be called a pullback, and this is because the quote remained below the earlier price range. With regards to news, the only noteworthy yesterday was the speech of ECB president Christine Lagarde, during which she said that the real GDP of the eurozone would recover to pre-crisis levels at the end of 2022. Rising incidence of coronavirus in Europe also set -off concerns regarding an uncertain economic situation, so the regulator announced that it would expand its program if such a scenario happens. Further development As we can see in the trading chart, the quote traded at a range of 1.1665-1.1666, but then activity decreased, signaling the possible end of the correction. If a bearish sentiment resumes in the market, the euro will return to its low price levels. But if the quote holds at the level of 1.1720, the euro could rise to a price of 1.1780. Indicator analysis Looking at the different time frames (TF), we can see that the indicators on minute and hourly periods signal BUY due to the correction, but the daily period still signals SELL since the current quote is still below the seven-week flat. Weekly volatility / Volatility measurement: Month; Quarter; Year Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year. (The dynamics for today is calculated, all while taking into account the time this article is published) Volatility is at 25 points, which is 68% below the average value. If activity jumps in the market, volatility will rise to at least 35-40 points. Key levels Resistance zones: 1.1700; 1.1910 **; 1.2000 ***; 1.2100 *; 1.2450 **; 1.2550; 1.2825. Support Zones: 1.1650 *; 1,1500; 1.1350; 1.1250 *; 1.1180 **; 1.1080; 1.1000 ***. * Periodic level ** Range level *** Psychological level Also check trading recommendations for the GBP/USD pair here, or brief trading recommendations for the EUR/USD and GBP/USD pairs here. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Sep 2020 05:04 AM PDT

The oil price roller coaster ride continues. Prices rose amid a high level of compliance with the OPEC+ deal after falling the day before. In August, the group fulfilled its obligations by 102%. Moreover, Norway is cutting the production of oil by 20%, as oil companies and trade unions have failed to resolve their contradictions. In addition, last week, the US oil reserves fell by 1.64 million barrels. So, on Monday, Brent rose to $42.9 per barrel, and WTI advanced to $40.6 per barrel. So what will happen to oil prices in the following months? The dynamics of prices directly depend on the introduced quarantine measures. Experts say that a repeated global quarantine will lead to a fall in demand for petroleum products, and this, in turn, will put pressure on oil prices. Otherwise, if the quarantine is not strict, then a rise in prices is possible thanks to a seasonal increase in consumption. Experts are more inclined towards the second case. However, it is difficult to predict now, as there is still a risk of the second wave of coronavirus in the world. Some countries such as Spain, the Czech Republic, Great Britain, South Korea and others have already tightened measures to stop the coronavirus spread. In any case, this will affect the global oil demand and oil products, as air and transport travel will be limited. Moreover, Libya returned to the market and increased production to 250,000 barrels per day. In other words, it is unlikely that prices will go up. According to some reports, more than 33 million cases of coronavirus infection have been recorded in the world. More than a million people have died. By the way, on Monday, Democrats in the US Congress decided to approve another $2.2 trillion package to stimulate the economy, while the country's national debt is still enormous. This may probably lead to an increase in oil prices. However, it will take a long time for this to happen. Nevertheless, experts say that a strong collapse in prices will not happen either. The reason for this is problems with production in the United States. There are few operating rigs, and in order to increase their number, WTI should cost more than $50 per barrel. According to Saxo Bank's head of strategy, Ole Hansen, the price of Brent crude will range between $39.50 and $43.60 per barrel. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for GBPUSD for September 29, 2020 Posted: 29 Sep 2020 04:33 AM PDT

Technical outlook: GBPUSD had managed to produce a pullback in the last two trading session, after printing lows around 1.2675 levels last Friday. The Cable currency pair is seen to be trading around 1.2850 levels at this point in writing and might extend its gain towards 1.3150/80 levels in the next few trading sessions. Please note that GBPUSD has found interim support around 1.2675 levels, which is fibonacci 0.382 retracement of the entire rally between 1.1414 and 1.3483 levels respectively. Also the recent boundary which is being worked upon is between 1.3485 and 1.2675 respectively, which could be retraced up to 1.3150/80 levels before turning lower again. Overall structure continues to remain bearish until prices stay below 1.3500 levels and bears might be targeting lower towards 1.2200 levels. Trading plan: Remain short, stop above 1.3500, target is 1.2200 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts.

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts.

No comments:

Post a Comment