Forex analysis review |

- Forecast for EUR/USD on September 4, 2020

- Forecast for GBP/USD on September 4, 2020

- Forecast for AUD/USD on September 4, 2020

- Forecast for USD/JPY on September 4, 2020

- Hot forecast and trading signals for GBP/USD on September 4. COT report. Bulls reluctant to release the pound. Bears need

- Hot forecast and trading signals for EUR/USD on September 4. COT report. Bears take a short break, await Nonfarm Payrolls

- Overview of the GBP/USD pair on September 4. Brussels and London announced a new failure in negotiations on the deal.

- Overview of the EUR/USD pair on September 4. The last months of Donald Trump pass without improving the situation in America.

- Analytics and trading signals for beginners. How to trade EUR/USD on September 4? Getting ready for Friday session

- EUR/USD. All attention on Nonfarm Payrolls report

- EURUSD respects support and bounces

- USDCAD bounces as per our expectations towards channel resistance

- Gold price forms a triangle pattern

- Comprehensive analysis of movement options for the main currency pairs EUR/USD & EUR/JPY & GBP/JPY (H4) on September

- Evening review on September 3, 2020

- Trading recommendations for the GBP/USD pair on September 3

- EUR/USD: time to exchange dollars to euros?

- Analysis of GBP / USD for September 3, 2020

- Analysis of EUR/USD on September 3. Markets did not pay attention to the statistics and are trading according to the instrument's

- EURUSD and GBPUSD: Traders sharply recalled Brexit and negative interest rates in the UK

- September 3, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- September 3, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- September 3, 2020 : EUR/USD daily technical review and trade recommendations.

- BTC analysis for September 03,.2020 - BTC is in cretion of the C leg and I see potential drop towards the $10.650

- EUR/USD analysis for September 03 2020 - Potential for drop towards the 1.1705

| Forecast for EUR/USD on September 4, 2020 Posted: 03 Sep 2020 08:17 PM PDT EUR/USD The euro was down by more than 60 points on Thursday, but then it increased in the evening and eventually ended the day by only losing two points. The reason for the correction was the weekly data on applications for unemployment benefits - the indicator showed 881,000 applications, which business observers considered a high value, slowing down the recovery of the labor market. But here we will take note of two points: the forecast was 955,000 and last week there were 1,011,000 applications, that is, there is definitely an improvement. An even more important factor is that unemployed people are in no hurry to look for a new job while they have compensation payments from the government. Relatively speaking, the labor market does not experience a shortage of workers; it will fill up as the economy further opens. Today's employment data for August will show a more objective market reaction. The forecast for the unemployment rate is 9.8% against 10.2% in July, 1,375,000 new jobs are expected in the non-agricultural sector. These are good numbers and we expect the dollar to strengthen. The daily chart shows that the balance indicator line stopped yesterday's decline – the market has not yet decided on a clear trend change, but there is such a possibility today. The Marlin oscillator settled in the zone of negative values. The four-hour chart shows that the price is under both the balance line and the MACD line. Marlin is also in the bearish zone. We are waiting for the price to reach the first target of 1.1720 – on the daily MACD line. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for GBP/USD on September 4, 2020 Posted: 03 Sep 2020 08:17 PM PDT GBP/USD The pound sterling lost 67 points on Thursday, now it is growing correctively in the Asian session. The 23.6% Fibonacci level limits growth at 1.3328. After completing the correction, we expect the pound to decline towards 1.3213 and 1.3120 targets, set by the Fibonacci levels of 38.2% and 50.0%. This grid is visible on the daily and four-hour charts. The price is under pressure from the divergence on the Marlin oscillator. The price is trying to break away from the support of the MACD line upwards on the four-hour chart, it can succeed, but the resistance is the 23.6% Fibonacci level at 1.3328. The Marlin oscillator is in the downtrend zone. We are waiting for the price to turn around and move towards the bearish targets that were mentioned. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on September 4, 2020 Posted: 03 Sep 2020 08:16 PM PDT AUD/USD The Australian dollar lost 66 points yesterday, weighed down by external markets; oil -1.28%, copper -1.81%, dollar index 0.14%. The price reached the MACD indicator line (0.7255) this morning, now it should gain a foothold below it in order to head for a medium-term decline. The first target is 0.7075 - the August 3 low. We expect a powerful triple divergence in the Marlin oscillator to provide help in this task. The price settled below the balance and MACD indicator lines on the four-hour chart, while Marlin is in the downward trend zone. We are waiting for the price to fall. |

| Forecast for USD/JPY on September 4, 2020 Posted: 03 Sep 2020 08:16 PM PDT USD/JPY The price almost reached the 106.60 target on Thursday, set by the embedded price channel line. We can assume that the goal was reached, if we take into account the errors of linear constructions and the actual price fluctuation. But the task is different - it needs to gain a foothold above this level in order for the price to continue growing. Subsequent yen targets: 107.00, 107.35, 107.90. The price is staying above the red balance indicator line, which means that the market is still interested in growth. The price is above the balance line and the MACD line on the four-hour chart. Yesterday, the Marlin oscillator turned around from the border where the downward trend is located. We are waiting for the price to move up even further. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Sep 2020 06:36 PM PDT GBP/USD 1H The GBP/USD pair, in contrast to the euro, moderately moved down for most of the day on September 3, Wednesday. Therefore, we believe that the upward trend is coming to an end. At least now it looks as if the bulls have finally had enough and are ready to put the initiative in the bears' hands. Consolidating quotes below the ascending channel was an important signal. Now the Senkou Span B is in the way of the sellers' plans to move down, which is the strongest among the Ichimoku indicator lines. If traders manage to overcome it, then the chances of forming a new downward trend will significantly increase. GBP/USD 15M Both linear regression channels continue to be directed downward on the 15-minute timeframe, since the pair has started a correction. The latest Commitments of Traders (COT) report for the British pound, which came out on Friday, was completely neutral. Professional traders did not open new Buy-contracts during the reporting week on August 19-25, despite the fact that the UK currency has grown against the dollar and continues to do so at the beginning of the new week. On the contrary, 9,700 Buy-contracts and 9,100 Sell-contracts were reduced. Thus, the net position for the non-commercial category of traders even slightly decreased. However, this change is so insignificant that it makes no sense to draw conclusions on it. Therefore, the general attitude of big traders remains the same. Trading days from August 26 to September 1 will not be included in the new COT report, and the pound grew in price on such days. Thus, we can see that non-commercial traders seriously increased their net position in the new COT report, while the fall from the last 24 hours is unlikely to be reflected in the report. However, take note that the fall itself is not that strong, currently at 230 points. Therefore, it is unlikely in principle to be reflected in the COT report. The fundamentals for the British currency were very weak on Thursday. However, despite the fact that another round of talks between Brussels and London failed, which further reduces the chances of concluding a deal by the end of 2020, traders are in no hurry to get rid of the pound sterling. All of the downward movement looks like a correction now, and afterwards, an upward trend will resume. Market participants continue to attach great importance to the "four crises" in the US, and this is why the majority of investors and traders are afraid of serious investments in the dollar. At least two important reports will be released in the United States on Friday: the unemployment rate and Nonfarm Payrolls. And since traders are currently ignoring all the news and data from the UK, we recommend focusing on these two reports instead. If results show that forecasted values are exceeded, then we can expect a new round of growth for the US currency. If not, then it could offset the bears' efforts again. We have two trading ideas for September 4: 1) Buyers continue to be in the shadows. The quotes of the pound/dollar pair have settled below the ascending channel, therefore, it is not relevant to buy the pound at the moment. So far, there are no prerequisites for reviving the upward trend. We can expect buyers to return to the market only if sellers fail to cross the Senkou Span B line. But it is not recommended to consider buy positions until the Kijun-sen line is crossed. The targets are 1.3451 and 1.3555. 2) Bears continue to slowly exert effort, so short positions remain relevant while aiming for the Senkou Span B line (1.3208). The 1.3005-1.3025 area will be the next target for the shorts, but you are advised to trade with this target after overcoming the 1.3148 level. Take Profit in this case will be about 100 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Sep 2020 06:34 PM PDT EUR/USD 1H The hourly timeframe on September 3 shows that the euro/dollar pair reached the first support level of 1.1803 and failed to overcome it. Therefore, a correction is overdue, after the euro fell for almost two days. We continue to hope that the current downward movement from the 1.2000 level is a correction against the euro's three-month growth, which has been brewing for more than a month. One way or another, the bears got another chance to move down. To do this, they need to stay below the Senkou Span B line, then today, September 4, the quotes can fall to the level that previously served as the lower border of the side channel – 1.1700. EUR/USD 15M Both linear regression channels are directed downward on the 15 minute timeframe, signaling a downtrend now. A new Commitments of Traders (COT) report was released last Friday. Take note that its pattern has not changed at all compared to previous COT reports. Professional traders continue to increase their net position despite the fact that the euro/dollar has been trading within the side channel for more than a month. In other words, non-commercial traders (the most important group of traders) are increasing the number of Buy-contracts, while the number of Sell-contracts is decreasing. The non-commercial category of traders opened 1,302 Buy-contracts and closed 11,310 Sell contracts during the reporting week on August 19-25. Thus, the net position (the difference between the number of Buy and Sell contracts) increased by 12,000. Therefore, we can draw the same conclusions as a week ago and two weeks ago: professional traders continue to view the euro as a more attractive currency to invest in than the US dollar. The euro continued to steadily grow for five trading days (August 26-September 1), which will be included in the next COT report. The fall only began on the evening of September 1, thus, it is unlikely that the new report will reflect the fall in the euro's quotes. Moreover, as before, the euro has not sharply fallen. All the same notorious 200 points. The eurozone released several business activity indices for the services sector of European countries, as well as for the EU as a whole on Thursday, September 3. We can immediately say that traders were not impressed by the figures, as they did not signal any major changes. Therefore, the retail sales report was more important, which showed a drop in volumes by 1.3% in July instead of an increase of 1.3%. This may have helped the European currency, which has been moderately rising for most of the day. As for US data, the number of secondary applications for unemployment benefits reached 13,254,000, which is much lower than the previous value and forecast. This means that real unemployment continues to fall, which is good for the dollar. In addition, the business activity index for the ISM services sector remained at a high level, which, as we feared, may begin to decline due to the ongoing coronavirus epidemic in the United States. However, this news did not provide any support to the US currency. It can do so tomorrow, if the reports on unemployment and Nonfarm Payrolls do not turn out to be weak, as the report from ADP in the middle of the week. We have two trading ideas for September 4: 1) Bulls continue to take profits after reaching the 1.2000 level and do not intend to return with new long deals yet. Since the price has settled below the Kijun-sen and Senkou Span B lines, which are the two strongest lines of the Ichimoku indicator, it is not recommended to open new purchases until the price settles above the 1.1886-1.1910 area. In this case, long positions will again be relevant with the targets at the resistance levels of 1.1961 and 1.2020. Take Profit in this case will be from 30 to 90 points. 2) Bears got an opportunity to start forming a new downward trend, as they managed to gain a foothold below the Senkou Span B line (1.1860). If, following the results of night and morning trading, they manage to stay below this line, then downward trading can resume with targets at the level of 1.1803 and the support area of 1.1705-1.1728. In this case, the potential Take Profit ranges from 30 to 100 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Sep 2020 05:31 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -110.1244 In recent weeks, the British pound has been trading identical to the euro/dollar pair. The upward movement of the pound was slightly stronger. At the moment, the quotes of the pound/dollar pair are fixed below the moving average line, which predicts a change in the trend. However, the picture for this pair is the same as for EUR/USD: each subsequent minimum and maximum price is higher than the previous one. Thus, the upward trend continues although the pair is fixed below the moving average line. Moreover, if traders have been actively buying the British currency and selling the dollar over the past few months based on the fundamental background from America, nothing has changed in recent weeks. Consequently, the British pound can continue to grow, as the fundamental background in America has not changed at all, and the entire British background is ignored by traders recently. We have already talked about the problems of the British economy that it has already faced. For example, the loss of 20% of GDP in the second quarter, which is not so much different from the 32% loss of GDP in the US. Moreover, the British economy will face new challenges from January 1, 2021. This will be an additional blow to the economy. Also, it is completely unknown what will happen to the coronavirus epidemic in the Foggy Albion with the arrival of the cold season. If the epidemic continues to rage in the United States at this time (and this factor has also been worked out by the market with a vengeance), then a second "wave" may begin in Britain with the arrival of autumn. This is not only an epidemiological problem but also a new economic one. And let's not forget that the Kingdom may face its own "ScExit" (from Scotland Exit) in the coming years. Scotland has been hinting to London for more than a year that it does not want to remain part of the Kingdom and wants to return to the EU. London does not give the go-ahead for a new independence referendum, however, this does not mean that the desire of Scots to remain in the European Union has disappeared. In general, the problems in Britain are no less than in America, however, it is the British pound that has grown steadily in recent months. Even if this is true, since before that there was a collapse in the British currency quotes at the very beginning of the "coronavirus" epidemic, now the quotes have fully recovered and we need a banal pullback down. Therefore, no matter how you look at the situation for the pound/dollar pair, a significant downward correction is necessary. Meanwhile, London and Brussels have managed to hold another round of negotiations on a future agreement that no one believes in anymore. Angela Merkel, for example, has already openly stated that her country does not want to participate in the negotiations and "waste time". Michel Barnier said on September 2 that he returned from London and saw no change in the UK's position. "I am disappointed and concerned," the chief negotiator said. At the same time, British negotiator David Frost said that "the parties have maintained serious differences", but at the same time called the talks "useful". "We remain in close contact with the EU and look forward to the next round of talks next week in London," said David Frost. Thus, the negotiations continue to proceed formally. London is taking its time, showing full readiness to remain without an agreement, and there is less of the time left. There is no progress on key issues. Thus, it is highly likely that the parties will not sign any agreement in 2020. Also this week, the head of the Bank of England, Andrew Bailey, made a statement. He said that in the near future, the British regulator is not going to resort to the introduction of negative interest rates, however, he did not say anything about a possible new expansion of the quantitative stimulus program. According to traders' expectations, by the end of the year, the Bank of England will once again expand the QE program by 50-100 billion pounds. Also, Andrew Bailey stated that "the risks due to a new outbreak of the coronavirus epidemic are higher than the risks of Brexit". Thus, it is also impossible to interpret Bailey's speech as positive. As for macroeconomic statistics, at the beginning of the new week, it was also few in the UK. Business activity indices for manufacturing and services declined slightly. American statistics were more important, however, market participants cheerfully ignored them. Thus, it turns out that the pound/dollar pair depends on everything on technical factors and the banal desire or unwillingness of traders to buy the pound or sell the dollar. As a result, we have a change in the downward trend, however, there are no special prospects for strengthening the US currency. The whole country continues to be in limbo and the main issue that concerns everyone - who will win the election? Because a lot will depend on this: the future domestic and foreign policy of the country, health care in the country, as well as its relations with China. Thus, now the situation indicates an upward trend where the technique speaks in favor of sales in the short term and both channels of linear regression (medium and long-term perspective). The fact that the price does not manage to overcome the last local minimum also suggests that the bears are extremely weak and are not ready to form a downward trend. In general, the situation is extremely confusing, and there are a huge number of factors that need to be taken into account now in medium and long-term trade. Therefore, we recommend paying more attention to intraday trading.

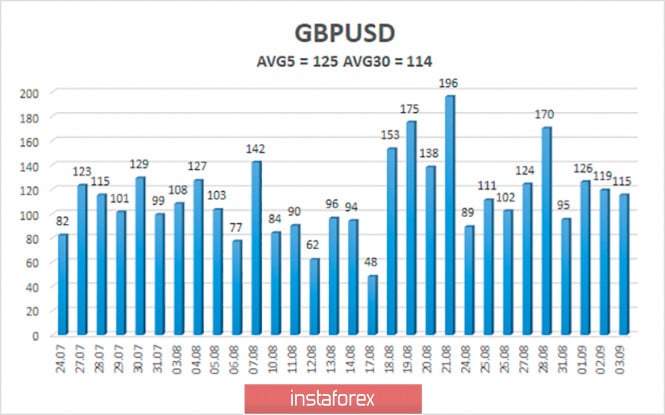

The average volatility of the GBP/USD pair is currently 125 points per day. For the pound/dollar pair, this value is "high". On Friday, September 4, therefore, we expect movement within the channel, limited by the levels of 1.3140 and 1.3390. A reversal of the Heiken Ashi indicator to the top will indicate a possible resumption of the upward trend or a round of upward correction. Nearest support levels: S1 – 1.3245 S2 – 1.3184 S3 – 1.3123 Nearest resistance levels: R1 – 1.3306 R2 – 1.3367 R3 – 1.3428 Trading recommendations: The GBP/USD pair started a downward movement on the 4-hour timeframe. Thus, today it is recommended to continue trading lower with the goals of 1.3184 and 1.3140 until the Heiken ASHI indicator turns upward, which will indicate a round of correction. It is recommended to trade the pair for an increase with the goals of 1.3367 and 1.3390 if the price returns to the area above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Sep 2020 05:31 PM PDT 4-hour timeframe

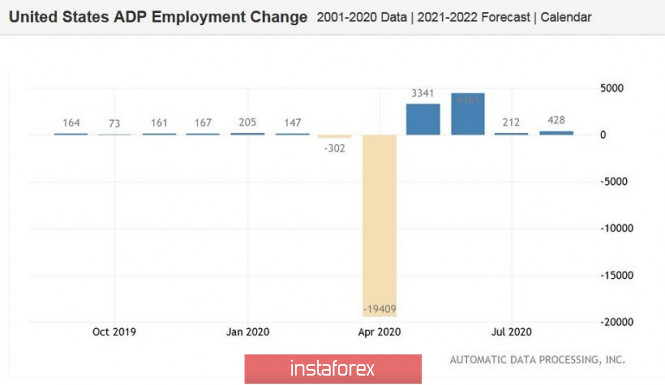

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -82.4114 The EUR/USD currency pair has started a new round of downward movement. Based on this, we can conclude that it will be as weak and indistinct as the previous three. I would also like to note that each next minimum price is higher than the previous one. In other words, bears can't even update the previous minimum for more than three months. This applies even to trades during the last month. Thus, if the downward movement does not continue from the current positions, then traders will be entitled to expect a new upward movement to the area of the previous maximum – 1.2011. By the way, an interesting feature is that each previous maximum price is also lower than the next. Thus, we have a classic upward trend like in the textbook. Based on this, the future of the US currency is still unclear because it is not the increased demand for the dollar that caused its strengthening. Presumably, it was buyers in the market who fixed some of the positions to buy that provoked another pullback down. Meanwhile, it is still very difficult to say what guides major traders when making trading decisions. The fundamental background remains very extensive. There are a huge number of factors that can hypothetically influence the preferences of traders. For convenience, we can combine all the negatives from overseas into one group: "coronavirus" epidemic, "coronavirus" crisis, lack of a vaccine, political crisis (the confrontation between Democrats and Republicans), social crisis (racial scandals, rallies, and protests), high unemployment, strongest drop in US GDP, possible constitutional crisis (if Trump refuses to accept the election results), fall in US bond yields. Thus, the situation has recently become slightly better only in the epidemiological sphere. The number of daily recorded cases of the "coronavirus" has decreased to 30-40 thousand. However, this is where the positive news from overseas runs out. On closer inspection, even this single positive point can hardly be called "positive", since the COVID-2019 virus continues to spread among Americans. Thus, slowing down the economic recovery and severely reducing economic and business activity. There is no real positive news. Moreover, huge problems arose with the adoption of a new package that stimulates the economy. Democrats and Republicans should have come to a common decision in early August when the previous package of assistance to the economy ended. However, fierce negotiations were going on throughout August, and their result was a failure. The maximum that Donald Trump's party agreed to do is to increase the offer to $ 1.3 trillion. Democrats also agreed to lower the proposed package to 2.2 trillion. Thus, there are still 0.9 trillion "disagreements" between the parties. House Speaker Nancy Pelosi said this week that "the differences remaining between the parties are serious". According to Pelosi, the administration of Donald Trump does not realize the seriousness of the situation in which Americans who lost their jobs due to the "coronavirus crisis" found themselves. "During our conversation, I once again expressed my hope that Republicans will sit down at the negotiating table and work to save the lives and livelihoods of Americans," Pelosi said. Democrats believe that it is impossible to save on vital things in times of crisis and offer to finance the unemployed, small businesses, children, schools, and so on with a new package. Republicans are concerned about the 4 trillion national debt for 2020, so they suggest saving on a new aid package, which should also motivate unemployed Americans to return to work, rather than sitting at home on benefits. As for ordinary macroeconomic statistics, on Wednesday, September 2, a fairly important report on the change in the number of employees in the US private sector from ADP was published in the States. This report is considered to be the second most important after Nonfarm Payrolls. Its value was 428,000, while forecasts predicted an increase of 950,000. Yesterday, in the European Union, business activity indices were slightly higher than forecast values, and retail sales, on the contrary, were much worse. But these statistics did not have much impact on the course of trading. What conclusions can be drawn in the end? America is full of preparations for the elections. Most of the news from this country is now related to Donald Trump or Joe Biden. There is simply no news about the "coronavirus" or the trade standoff with China right now. It seems that these topics are put on pause and everyone is waiting to see who will win the election. After the answer to this question is known, the topics will be "taken off the pause". In general, the fundamental background does not change and certainly does not become more favorable for the US currency. Thus, from a fundamental point of view, the US dollar should not grow strongly compared to the euro currency now. At the same time, there is zero news from the European Union. Thus, there is no point in trying to take the European fundamental background into account at all. As for macroeconomic statistics, most of the reports continue to be ignored by market participants. Thus, it turns out that attention should now be paid to technical factors that should be passed through the prism of the general fundamental background. If something in America changes for the better, then we can reasonably expect to continue moving down. Up to this point, the fall in quotes can continue solely on the desire of buyers to get rid of purchases of euro currency (to fix profits on them). However, until the price breaks the last local minimum (1.1754 or 1.1762), the downward movement will also not be able to continue. Also, do not forget about the election, as this will remain the hottest topic in the United States. According to the latest information, Donald Trump began to reduce the gap from Joe Biden.

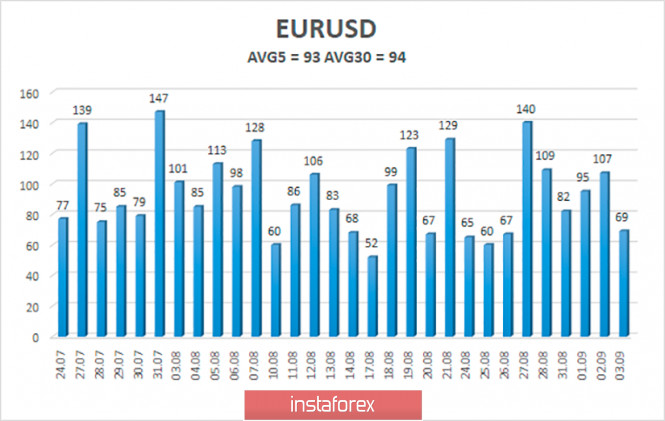

The volatility of the euro/dollar currency pair as of September 4 is 93 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1750 and 1.1936. A reversal of the Heiken Ashi indicator back down will signal a possible resumption of the downward movement, as well as a price rebound from the moving average line. Nearest support levels: S1 – 1.1719 S2 – 1.1597 S – 1.1475 Nearest resistance levels: R1 – 1.1841 R2 – 1.1963 R3 – 1.2085 Trading recommendations: The EUR/USD pair may continue its downward movement. Thus, it is recommended to open new short positions after the end of the upward correction round, which is signaled by a downward reversal of the Heiken Ashi indicator or a rebound from the moving average, with the goal of 1.1750. If the price is fixed above the moving average, it is recommended to trade for an increase with the goals of 1.1936 and 1.1963. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Sep 2020 02:29 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair began to correct on Thursday, September 3 and continued to do so throughout the day. The MACD indicator produced a signal for the correction, which was quite timely. As we expected, the pair needed to correct after almost two days of continuous decline. Trading during the day was extremely calm, and no new sell signals were formed. Thus, at the moment, novice traders can take a rest until the MACD produces a new signal. The trend is currently downward, so we continue to work on sell signals. Unfortunately, it is quite problematic to build a downward trend line or channel, since there are practically no reference points for these patterns at the moment. In general, we continue to consider the option of quotes falling to the 1.1700 level as the working course of action. There have been quite a large number of data releases of various kinds both in the European Union and America today. For example, the business activity index for the service sector was published in the European Union, which was slightly higher than expected. Also, the EU published a report on changes in retail sales, which was much worse than expected (the decrease was 1.3% compared to the previous month). Meanwhile, the report on the balance of foreign trade was released in the United States, which reached -63.6 billion dollars in July, which means that America sold goods and services worth 63.6 billion less than they purchased. A negative trade balance is considered a negative factor for a country and its currency, but in this case, it is absolutely normal. But the number of new applications for unemployment benefits was 881,000, not 955,000, as expected by traders. The ISM index of business activity in the service sector was 0.1 lower than forecast, which is not critical at all. In general, there was a lot of macroeconomic data, but the markets were not really impressed with any of them. The most important ISM index almost completely coincided with the forecast value and market participants were not impressed either. Therefore, it is quite understandable that it was a quiet trading day. All of the major events on September 4, Friday are to be expected in the United States. First, the unemployment rate will be released, which, although it began to decline in recent months, still remains at a very high level (10.2% in July). Second, the number of new jobs created outside the agricultural sector will be published, which is the number one report in terms of relevance for determining the state of the labor market. Thirdly, changes in average wages will be released. However, the most important report will of course be the Nonfarm Payrolls (item number 2). Possible scenarios for September 3: 1) Novice traders are advised to not consider buy positions at this time, since the pair has settled below the upward trend line, so the trend has now changed into a downward trend. There are no signals or technical patterns that currently support the upward trend. Therefore, buyers have to wait for trend lines or channels that would show an upward trend. 2) Sell positions continue to look more relevant, but after a two-day drop in quotes, an upward correction has begun. Thus, novice traders are advised to wait until it ends and can only consider opening new short positions after the MACD indicator has turned down. The closer the MACD indicator turns to zero, the better. A reversal may occur tonight, but we recommend evaluating the situation tomorrow morning. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. All attention on Nonfarm Payrolls report Posted: 03 Sep 2020 02:29 PM PDT The euro-dollar pair is in a difficult situation due to the contradictory fundamental background. On the one hand, we have the European Central Bank representatives worried about the high euro exchange rate, on the other hand, the weak dollar, which is still under pressure from the Federal Reserve's latest decisions. In addition, the US macroeconomic data is also showing mixed dynamics: if the ISM manufacturing index came out better than forecasts, the ISM composite index for the non-manufacturing sector disappointed investors. In such conditions, the EUR/USD pair failed to develop a downward momentum, and did not return to its previous positions, in the area of the 19th figure. Traders are stuck at the crossroads, on the middle line of the BB indicator on the daily chart (1.1840). The August Nonfarm Payrolls report is a kind of arbitrator in this situation, which is set to be released at the beginning of the US session on Friday. What happened? As mentioned above, the fundamental picture for the euro-dollar pair is quite ambiguous. The US currency fell on all fronts for almost an entire week, after the Fed announced that it has decided to resort to a new strategy of targeting average inflation. Fed Chairman Jerome Powell made it clear that rates will remain at the current level for a long time – much longer relative to earlier forecasts. Now, not only should US inflation approach the two percent level, but also gain a foothold above this target level. Only then will the Fed return to the issue of tightening monetary policy. The Fed will also focus on key data on the labor market. That is why the Nonfarm Payrolls report will play such a big role for the dollar pairs tomorrow. But let's talk about the Nonfarm data a little later on, and focus on the problems of the European currency now, which arose quite suddenly. Let me remind you that the latest data on inflation growth in the euro area turned out to be much worse than the forecast values. The recession is serious - Europe has faced deflation for the first time in four years. There are many reasons for this weak inflationary dynamics. In particular, outbreaks of coronavirus were reported in many EU countries in August (first of all, we are talking about Spain, France and Germany).The memory of the spring lockdown is still fresh in people's minds, when economic activity actually stopped in Europe, and the unemployment rate, on the contrary, increased. Therefore, as soon as the first reports of repeated outbreaks of COVID-19 appeared in the press, the consumer activity of Europeans significantly decreased . People began to save more and spend less on non-essential goods. But the weak growth of European inflation is due to another reason, the high euro rate. The European currency has strengthened against the dollar by a thousand points in recent months. If the pair traded within the 1.08-1.09 price range in the spring, now the price niche is located much higher - in the 1.18-1.20 area. Not only does currency revaluation have a negative impact on inflationary processes, but also on foreign trade - on the export sector. That is why, as soon as the EUR/USD pair touched the 1.20 mark, the ECB immediately became concerned about this fact. In particular, the ECB Chief Economist Philip Lane said that the current euro rate is "unacceptable for the central bank." Traders were alarmed with this rhetoric: rumors spread throughout the market that the central bank would conduct a currency intervention to devalue the single currency. The pair dropped to 1.1790 due to this factor. However, the pair's bears failed to gain a foothold in the area of the 17th figure. First, most analysts still tend to believe that ECB members will limit themselves to verbal interventions for the time being, reserving more powerful levers of influence for the future. Secondly, the US ISM index in the non-manufacturing sector was published today. Contrary to growth forecasts, it fell to 56 points (from the previous value of 58.1 points). Third, an extremely weak ADP report was released yesterday. According to ADP, only 428,000 jobs were created in August (the forecast was at the level of one and a half million). Traders do not risk investing in selling the EUR/USD pair for these reasons. If the key data on the growth of the US labor market comes out worse than projected, the dollar will be under great pressure, and buyers of the pair will be able to return to the area of the 19th figure and possibly test the resistance level of 1.2000. According to preliminary forecasts, the number of people employed in the non-agricultural sector should increase by 1,500,000 people. For comparison: this figure increased by 1,700,000 in July. The unemployment rate should remain within 10 percent. But salaries might disappoint: in both monthly and annual terms, the indicator should demonstrate negative dynamics. In this case, the dollar will react negatively, even if other components enter the green zone. Inflationary indicators are now under special scrutiny, so weak wage growth will hit dollar bulls. How to trade? You should take a wait-and-see attitude before the Nonfarm Payrolls report is released. If the data supports the greenback, the pair may fall to the lower line of the BB indicator on the daily chart, that is, to the 1.1730 level and below, to the bottom of the 17th figure. If the Nonfarm Payrolls report disappoints (or at least the wages does), the price may return to the 19th figure. In view of this uncertainty, trading decisions should now be delayed. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD respects support and bounces Posted: 03 Sep 2020 12:19 PM PDT EURUSD remains inside the medium-term bullish channel. Price came very close to the lower channel boundary and support at 1.1760 today. Today's low around 1.1780 is now a key level. Bulls do not want to see this level broken downwards. Today's candlestick is a bullish one as it shows buying demand around 1.18.

Green rectangle - target area Pink line - support trend line EURUSD is bouncing strongly off the pink support trend line. As long as price holds above the 1.1780-1.1760 support we remain bullish expecting 1.21. Price remains inside the channel and so do we remain bullish. Only failure to hold 1.1760 will make us turn bearish for a move towards 1.16 The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD bounces as per our expectations towards channel resistance Posted: 03 Sep 2020 12:16 PM PDT In our previous analysis we noted that USDCAD remained in a bearish trend but bears better be cautious as price justified a bounce towards 1.31-1.3150. Today price has most probably completed this bounce that reached the channel resistance. From this level I expect USDCAD to move lower.

USDCAD has reached key resistance area. We might see price push above the channel but if this happens I believe it will be short lived. I expect price to get rejected at current levels. As long as price is below 1.3230 we remain bearish and consider each bounce as a selling opportunity. This bounce came as we expected and this is our selling opportunity before the next leg down towards 1.29 starts. Key support is found at 1.3030. Breaking below this level will confirm our bearish view for a move towards 1.29. At 1.3130 I prefer to be short with 1.3230 stop and target 1.29. Below 1.3030 I prefer to add to my short position as such a break down confirms our bearish view. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price forms a triangle pattern Posted: 03 Sep 2020 12:11 PM PDT Gold price is forming a triangle pattern. The inability to break above $1,960-70 resistance and the weakness by bears to break below $1,925 support, has lead price to form a triangle pattern. I expect this pattern to break to the upside, as the main trend so far has been bullish.

Pink lines -triangle pattern Gold price currently favors bullish positioning. Because price is at the lower triangle boundary and our most probable outcome is an upward break out of the triangle. Target is new highs towards $2,100. Failure to hold above $1,920-$1,900 will be a bearish sign that will most probably lead price to $1,850-$1,800. This is the least probable scenario. Resistance remains key at $1,960-70. Bulls need to break above this level to confirm our view. The material has been provided by InstaForex Company - www.instaforex.com |

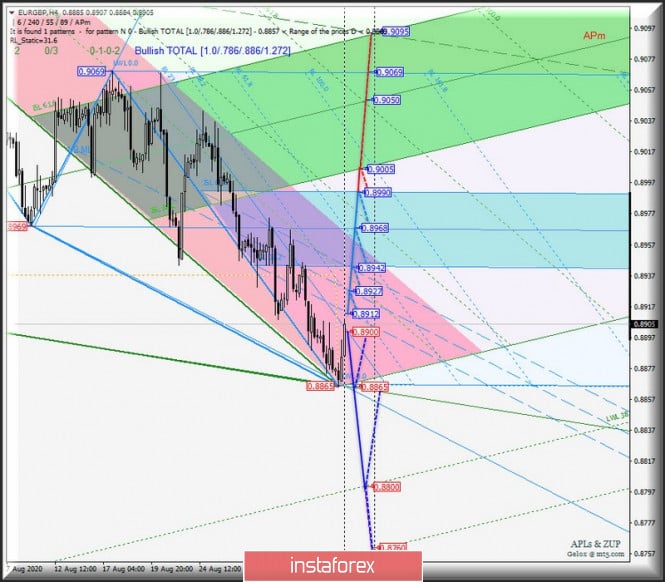

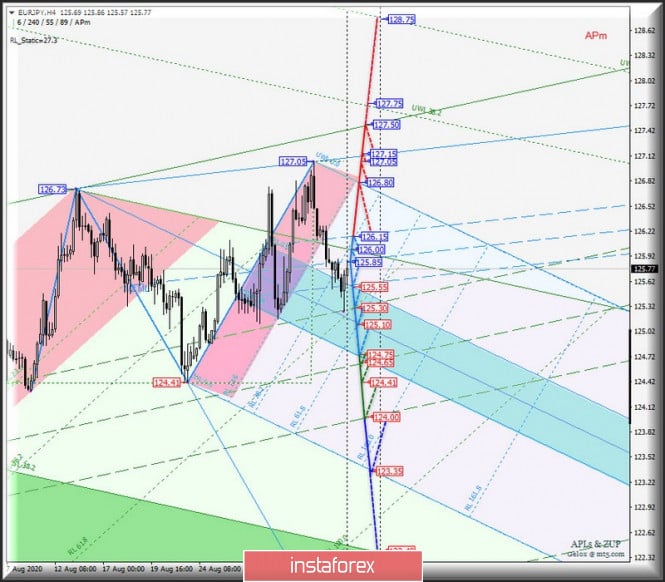

| Posted: 03 Sep 2020 09:04 AM PDT Minute operational scale (H4) The first half of the first month of autumn - options for the development of the EUR/JPY & GBP/JPY movement in the H4 timeframe from September 4, 2020. ____________________ Euro vs Great Britain pound The movement of the "main" cross-instrument EUR/GBP from September 4, 2020 will occur depending on the development and direction of the breakdown of the range:

A break of the resistance level of 0.8912 will determine the development of the EUR/GBP movement within the boundaries of the 1/2 Median Line channel (0.8912 - 0.8927 - 0.8942) and equilibrium zones (0.8942 - 0.8968 - 0.8990) of the Minuette operational scale forks with the prospect of reaching the lower limit of ISL38.2 (0.9005) of the equilibrium zone of the Minute operational scale forks. If this cross-instrument returns below the reaction line RL23.6 Minuette - a breakdown of the support level of 0.8900 - it will be possible to resume the downward movement of EUR/GBP and it will be directed towards the targets:

Details of the EUR/JPY movement since September 4, 2020 are shown on the animated chart.

___________________ Euro vs Japanese yen The movement of the cross-pair EUR/JPY from September 4, 2020 will continue depending on the development and the direction of the breakout of the channel borders 1/2 Median Line (125.55 - 125.85 - 126.15) of the Minuette operational scale forks - the markings of the movement within this channel are shown in the animated chart. In case of breaking the resistance level of 126.15 on the upper border of the channel 1/2 Median Line Minuette, the upward movement of the EUR/JPY will be directed to the goals:

A breakout of the lower border of the channel 1/2 Median Line Minuette - support level of 125.55 - option of the movement of EUR/JPY within the zone of equilibrium (125.55 - 125.10 -124.75) of the Minuette operational scale fork and channel 1/2 Median Line (125.30 - 124.65 - 124.00) of the Minute operational scale fork. We look at the EUR/JPY movement options from August 27, 2020 on an animated chart.

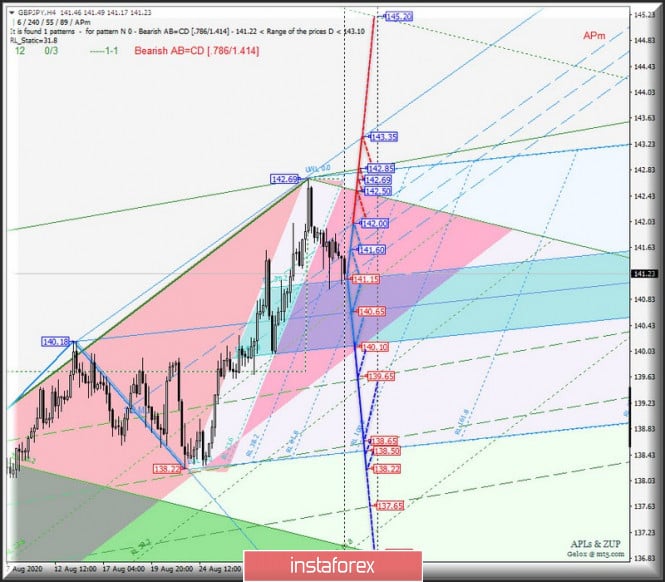

____________________ Great Britain pound vs Japanese yen From September 4, 2020, the movement of the GBP/JPY cross instrument will also develop depending on the development and direction of the breakdown of the boundaries of the 1/2 Median Line (141.15 - 141.60 - 142.00) of the Minuette operational scale fork - the markup for working out these levels is shown in the animated chart. The breakdown of the upper border of the channel 1/2 Median Line operational scale Minuette fork - resistance level 142.00 upward movement of this cross-tool will continue to order:

A breakout of the lower border of the channel 1/2 Median Line Minuette - support level of 141.52 - will make the actual continuation of the development of the movement of GBP/JPY in the zone of equilibrium (141.15 - 140.65 - 140.10) of the Minuette operational scale forks of the achievement of the channel borders 1/2 Median Line (139.65 - 138.65 - 137.65) of the Minute operational scale forks. Details of the development of the GBP/JPY movement from September 4, 2020 can be found on the animated.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers, and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on September 3, 2020 Posted: 03 Sep 2020 07:55 AM PDT

EURUSD : The euro slightly rise despite the strong employment report in the US. According to the report, the number of long-term unemployment fell to 13.25 million while the ISM service sector rose to 56.9%. Despite such positive data, the euro still managed to slightly trade upward. You may consider buying from 1.2012 - but it is likely that we will see a new entry level by morning. You may sell from 1.1760. The material has been provided by InstaForex Company - www.instaforex.com |

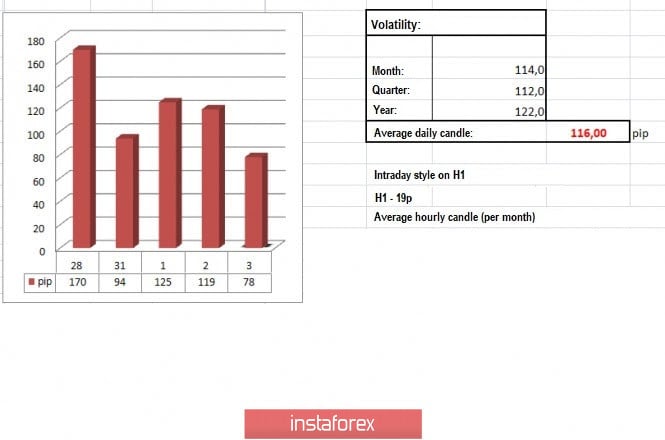

| Trading recommendations for the GBP/USD pair on September 3 Posted: 03 Sep 2020 07:37 AM PDT GBP / USD is trending in a bearish mood since September 1, as a result of which the quote moved down by about 200 pips, returning the price to 1.3300. High speculation was one of the reasons why the pound underwent a correction, and this can be seen through the repeated rebounds from the price level of 1.3513. Thus, in the M15 chart, short positions surged at 01: 00-16: 15 yesterday, because of which GBP / USD reached a price level of 1.3300. However, afterwards, there was a slowdown, and the quote underwent a pullback in the price chart. Such gave a volatility of about 119 points, which is 2.5% above the average level. This means that speculation is then stable, and that the quote could now move within impulses. It also followed the suggestions from the previous review , that is, to trade positions with targets aimed at 1.3300. Now, the most anticipated thing is the development that will occur within the level, as such will determine the further direction of GBP / USD. As for the daily chart, the same movements can still be seen, which is a price correction from 1.2500. However, if the quote breaks out of 1.3513, the balance of trade forces may change. Level of employment in the US private sector came out noticeably weaker than forecasted, as ADP's report indicated that jobs were only up by 428 thousand, much lesser than the expected 1.25 million. Nonetheless, it still reflected an improvement, and it is quite impressive considering that the pandemic is still a problem until now. As for another indicator on the state of the US labor market, that is, applications for unemployment benefits, data is scheduled to be published today, and it is expected that initial applications will decrease by about 56 thousand, while repeated ones will be down by 535 thousand. If these expectations are met, the dollar could rise again in the market. Further development As we can see on the trading chart, GBP / USD is currently trading around 1.3300, particularly within 1.3275 / 1.3335. In order to continue a bearish mood, the quote has to consolidate below 1.3270, as such will give a local acceleration towards 1.3200. Meanwhile, price will increase instead, if the quote consolidates above 1.3365, as such will indicate the end of the initial correction. Indicator analysis Looking at the different time frames (TF), we can see that the signals on the minute period are quite neutral, mainly due to the fluctuations along 1.3300. The hourly period, on the other hand, signals sell due to a price correction. As for the daily period, the indicators emit a buy signal in reflection of the current upward trend. Weekly volatility / Volatility measurement: Month; Quarter; Year Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year. (The dynamics for today is calculated, all while taking into account the time this article is published) Thus, volatility is at 78 points today, which is 32% below the average. It may sharply increase though, as soon as market participants breakout or consolidate on 1.3300. Key levels Resistance zones: 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support Zones: 1.3300 **; 1.3200; 1.3000 ***; 1.2885 *; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411). * Periodic level ** Range level *** Psychological level Also check trading recommendations for the EUR/USD pair here, or brief trading recommendations for the EUR/USD and GBP/USD pairs here. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: time to exchange dollars to euros? Posted: 03 Sep 2020 07:02 AM PDT

Experts predicted that a sharp fall of the American currency by 36% against the euro may happen in 2021. The US currency has lost approximately 11% from its peak in 2020 against a basket of major currencies. Hedge fund rates against the dollar hit a record high in ten years. Besides, traders often bet on the US dollar fall. At the beginning of the year, the dollar exchange rate was 1.12 per euro, and now it is already 1.18. Despite low-interest rates, stimulus to mitigate the COVID-19 consequences, unprecedented money printing, the US economy continues falling. In this regard, analysts say that the depreciation of the American currency is inevitable. Goldman Sachs analysts estimate that in 2023 one euro will cost $1.3. Others, however, believe that the American currency will find support if the US economy improves. And BlackRock experts are confident that the US dollar will be able to avoid its collapse, as the world depends on the American currency. Nevertheless, rates of the euro and the US dollar will fluctuate slightly. Economists believe that the market will stabilize in the near future, despite the existing financial risks. Others believe that sharp fluctuations in the currency will occur in autumn, especially after the presidential elections in America. Experts explain that a strong euro harms the export-oriented economy of the EU. Products made in the European Union are getting more expensive for American customers. Moreover, the second wave of coronavirus is beginning in the eurozone, which could lead to a deeper crisis. Naturally, there is a risk of the euro collapse. However, it is more likely that the American currency will continue to depreciate as the economic situation in the US is dire. Experts believe that the greenback will rise in price as means of payment, storage, funding, and exchange due to measures of stimulating the US economy. As a result, investors may lose interest in the US dollar and switch to other currencies. Is it reasonable to exchange dollars to euros? There is a difference of opinion between the experts. Both currencies are global and have the same risk exposure. Therefore, experts advise keeping funds in both the US dollars and the euros. Also, you may use the currencies of other countries, as well as purchase gold coins. If you choose other currencies, you should take a closer look at the Swiss franc, as experts advise. The material has been provided by InstaForex Company - www.instaforex.com |

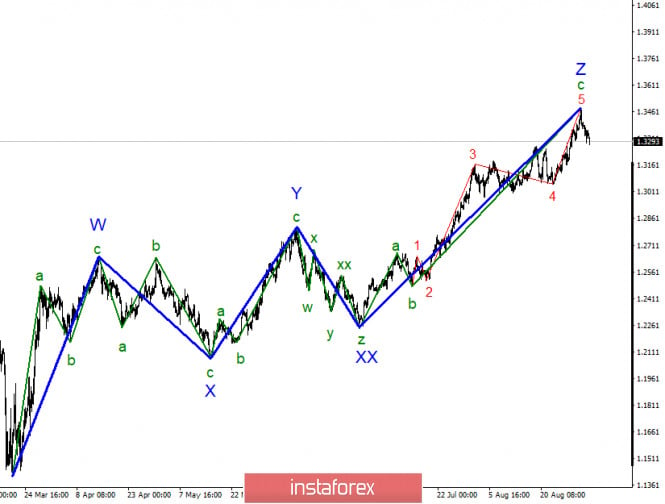

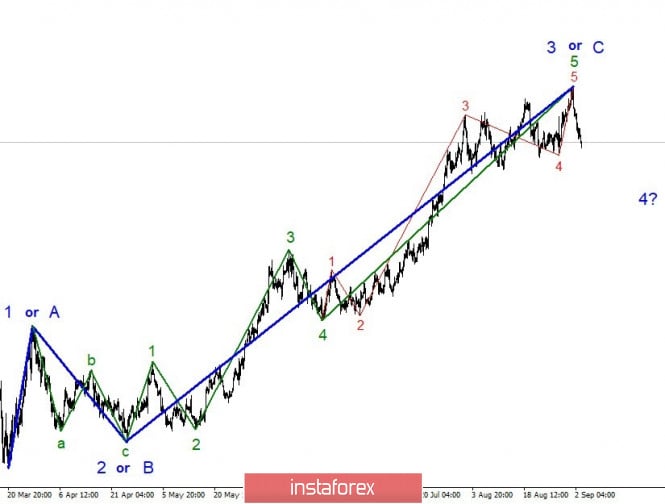

| Analysis of GBP / USD for September 3, 2020 Posted: 03 Sep 2020 06:26 AM PDT

It is presumed that the wave structure of the upward trend is now completed. From the looks of it, wave Z is already complete, which might mean that the upward trend has already ended, thus the instrument will move on to building a new downward trend with targets around 25 and 27 marks. Much, of course, will depend on the news background as well. The strong rise in the pound sterling in recent months cannot be called absolutely logical. Nevertheless, even the wave marking indicates the beginning of the downward trend structure.

The current wave pattern suggests that the wave z has become more complicated. The wave c in Z, in particular, was significantly longer, and the wave 4 in c in Z has established a triangle formation. The very same tool has carried out a successful attempt to break the level of 200.0% Fibonacci but later began to retreat from the highs, which suggests the completion of the construction of wave 5 in Z. As initially stated, the internal wave structure of the wave Z can be so complicated almost indefinitely. Its current appearance, alone, already implies that it is completed. Thus, the working option at this time is to build a new downward wave. The news background from Great Britain at the beginning of the current week turned out to be rather weak. On Wednesday, the Governor of the Bank of England, Andrew Bailey gave optimism to the markets, through his speech, saying that the use of negative interest rates in the near future is not planned. "They are part of our toolbox, but we are not going to use them anytime soon," Bailey said. However, the optimism in Bailey's rhetoric did not last long, as he almost immediately stated that the risks to the economy still remain at a fairly high level, since the problems of coronavirus and Brexit have not gone away. Moreover, the risks associated with the pandemic are even higher than the risks associated with Brexit. In addition, the Bank of England may decide to increase the asset repurchase program by 50 or 100 billion pounds in the coming meetings. Another speech by the Governor of the Bank of England will take place this afternoon, important information is expected to be heard. In general, however, I cannot say that Wednesday's comments or statistics triggered a market reaction. Thus, the news background is now having a strong influence on the movement of the instrument. Moreover, the index of business activity in the US services from ISM is expected today and market participants expect an increase of 57%. Any reading below this level could lead to a slight drop in the US dollar. General conclusions and recommendations: The Pound-Dollar instrument has presumably completed the construction of the upward wave Z. Thus, at the moment, I would recommend selling the instrument with targets located around 1.3158 and 1.2960, which corresponds to 161.8% and 127.2% Fibonacci. The upward part of the trend may take on a more complex form, but for this, you need to wait for a successful attempt to break the current high of wave 5 in c in Z. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Sep 2020 06:26 AM PDT Globally, the formation of the wave pattern of the EUR/USD pair is fully complete again. The quotes left the highs recently, which suggest that the formation of wave 3 or C is already completed. If so, then the decline in quotes will continue with targets located below the low of the wave 4 in 5 in 3 or C. It is possible that wave 4 will be built, and after the quotes are completed, the formation of the upward trend section within wave 5 will continue. Moreover, it is possible that the entire section of the trend, which begun in March, will take a three-wave form and will be completed around the level of 1.2011. At the same time, the wave pattern on the lower chart shows that wave 4 in 5 in 3 or C has taken on a longer form than originally assumed, while wave 5 in 5 in 3 or C has already completed its construction. If the current wave pattern is correct, the quotes will continue to decline with targets located near the 200.0% Fibonacci level. In turn, the markets will prepare for further sales of the euro, considering that the low of wave 4 is broken through. On another note, the news background from America remains negative – coronavirus, which infected more than 6 million people and killed 185 thousand in US, a 32% economic collapse in the second quarter due to the "lockdown", the upcoming presidential elections, and trade war with China, did not please the markets, which lead to dollar's low demand in recent months. But at the same time, any trend comes to an end sooner or later. Now, we should wait for the downward wave 4 to be formed. After that, everything will depend on the news background. If it improves even slightly for the dollar, then we can expect the upward trend to continue to be formed around 1.2011. In Germany, retail sales for July were released yesterday. The annual indicator rose by 4.2%, which is better than what was expected, however, the monthly indicator fell by 0.9%, which is worse than the market expectations. In addition, the ADP report was even more disappointing – markets expected 950,000 new employees, but they got 428,000 instead. Nevertheless, the demand for the US currency remained stable the whole day. Therefore, it is believed that the wave pattern is now more important than the news background. Today, there are indices of business activity in the service sector in the US, while retail sales in the EU and business activity. These reports may slightly affect the direction of trading. General conclusions and recommendations: Since the euro/dollar pair has already completed the construction of a global wave 3 or C, selling the pair is recommended with targets located near the calculated level of 1.1571 or 200.0% Fibonacci. Now, If wave 4 is currently being built, then it can take on a three-wave form. The quotes, in turn, will continue to decline within the framework of wave c to 4, after an upward pullback. The material has been provided by InstaForex Company - www.instaforex.com |

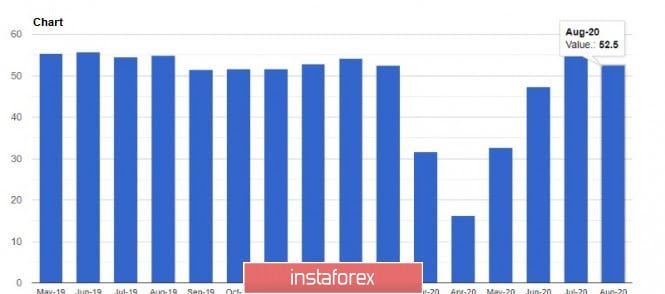

| EURUSD and GBPUSD: Traders sharply recalled Brexit and negative interest rates in the UK Posted: 03 Sep 2020 06:26 AM PDT The European currency is not feeling in the best shape at the beginning of autumn this year against the background of major profit-taking, which occurred after the recent statement of the ECB's Governing Council, Philip Lane. This triggered the closing of several long positions on risky assets. I have also already paid attention to this point, as hard times are still ahead for the euro. Although some fundamental data that are persistently ignored by the market do not affect the euro exchange rate, this does not make the European Central Bank's problems any less. The self-evident strengthening of the euro will also harm exports because it will make national goods more expensive, which will not add to optimism in a weak economy. Many assume that at its next meeting, the European Central Bank will still tighten its rhetoric against the euro and take additional monetary stimulus measures, which may negatively affect the quotes of risky assets and lead to their decline. However, many experts already say that the ECB has enough space to fight the further strengthening of the single European currency and the reversal of this trend in the coming quarters. However, while the yields of American and some European securities will be similar, and all because of a sharp decline in the attractiveness of treasuries and a sharp rise in the price of gold, it will be wrong to talk about a reversal of the upward medium-term trend in the European currency. Most likely, even against the background of negative fundamental statistics on the Eurozone, which will cause downward corrections, the general trend for strengthening the euro will continue. The only moment that can affect the euro exchange rate in the short term is a technical correction. An unsuccessful attempt to take the 20th figure at the end of summer and the first days of autumn resulted in a sell-off of risky assets, which can only get stronger. The only hope remains the September meeting of the European Central Bank, before which the euro may remain afloat. Most likely, major support levels will be concentrated in the area of 1.1760, as a break in this level will lead to a more powerful sell-off of risky assets already in the area of 1.1710 and 1.1590. It will be possible to talk about the return of control over the market by euro buyers only after the trade returns above the level of the 19th figure. Only after that, you can count on a repeat test of the maximum of 1.2000 and its breakout. However, this requires adequate fundamentals, although the weakness of the US dollar, which depends on the attractiveness and yield of US bonds and demand for gold, may again lead to the uncontrolled growth of the euro. Today's statistics on activity in the services sector of the Eurozone countries once again prove the cooling of the bullish momentum of the European economy. Germany is the only country that has managed to demonstrate a more or less stable state of health. Repeated outbreaks of coronavirus infection have slowed the recovery of the economies of Italy and Spain. The risk of a second wave of the epidemic is also holding the back activity in the service sector due to low demand. The maintenance of social distancing measures and the quarantine regime in some European countries also do not improve the situation of the service sector. According to a report by Markit, the purchasing managers' index (PMI) for the Italian services sector in August this year fell below the 50-point mark, indicating a reduction in the activity. Low tourist flow against the background of the coronavirus pandemic in late summer did not allow the indicator to stay above the growth mark. So the index fell to 47.1 points in August, against 51.6 points in July. The PMI for Italy's services sector was forecast at 49.0 points. Another problem for Italy remains employment, which is likely to continue to decline in the next 12 months. The end or partial curtailment of the employment support program, which assumes a reduced working day, the end of which is December 31, will necessarily lead to a sharp increase in the unemployment rate. Let me remind you that employment increased in July for the first time since February, but at the same time, the unemployment rate rose to 9.7%. Meanwhile, in France, the same purchasing managers' index (PMI) for the services sector in August this year fell to 51.5 points, against 57.3 points, while it was forecast at 51.9 points. As noted above, Germany has more firmly experienced the final stage of summer growth. There, the purchasing managers' index (PMI) for the services sector in August was 52.5 points, up from 55.6 points in July, while a decline of 50.8 points was forecast. The German labor market is also returning to its former form. At least the IFO Institute report shows that the number of part-time employees in Germany fell to 4.6 million in August. The share of part-time workers in the total number of employees fell to 14% from 17% in July. In the Eurozone as a whole, the purchasing managers' (PMI) indices for the services sector managed to keep the territory above 50 points, however, the line is quite close. We learned above that there is a very sharp difference in the recovery of activity across the Eurozone countries. According to the data, the purchasing managers' index (PMI) for the Eurozone services sector in August was 50.5 points, compared with 54.7 points a month earlier. The indicator was projected at 50.1 points. The composite index, which takes into account both the service sector and the manufacturing sector, was at 51.9 points in August, up from 54.9 in July. Another report on retail sales, which reflects how quickly the pace of recovery in the Eurozone is slowing, disappointed traders. The EU statistics agency noted a 1.3% decline in retail sales in the Eurozone in July compared to June. Economists had forecast an increase of 1.2%. As you can see, the deferred demand is coming to naught, as well as the easing of restrictions on the operation of stores. Compared to the same period of the previous year, retail sales in the Eurozone increased by 0.4% in July. GBPUSD Meanwhile, the British pound continues to actively lose its position against the US dollar, having played the technical model of a head-to-shoulders reversal. The breakout of the large support of 1.3310, which was not possible yesterday, led to a new wave of the decline of the trading instrument to the area of the lows of 1.3240, keeping the larger level of 1.3165. The continued growth in activity in the UK services sector in August did not help the bulls implement their plans to return the pound to the level of 1.3380. According to a report by IHS Markit and CIPS, the purchasing managers' index (PMI) for the UK services sector in August was revised up to 58.8 points from a preliminary reading of 60.1 points. Back in July, the indicator was equal to 56.5 points. Index values above 50 indicate an increase in the activity. But many economists continue to emphasize that the current figures should not be perceived as the most accurate, as the UK government is taking active measures to support the economy after the coronavirus crisis. The pressure on the pound is expected to return in early autumn when the next round of trade negotiations between the UK and the EU is about to start. In front of investors, the Bank of England is also waving the possibility of introducing negative interest rates in the UK in the autumn of this year. And although the Governor of the Bank of England, Andrew Bailey, recently stressed that the Central Bank does not currently plan to lower rates into negative territory, it is not certain that it will not change its mind tomorrow. The material has been provided by InstaForex Company - www.instaforex.com |

| September 3, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 03 Sep 2020 05:35 AM PDT

Transient bearish breakout below 1.2265 (consolidation range lower limit) was demonstrated in the period between May 13 - May 26. However, immediate bullish rebound has been expressed around the price level of 1.2080 bringing the GBP/USD back towards 1.2780 (Previous Key-Level) where another episode of bearish pullback was initiated. Short-term bearish movement was expressed towards 1.2265 where Significant bullish rejection was originated bringing the GBP/USD pair back towards 1.2780 where this key-level failed to offer enough bearish rejection. Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.2780 (Depicted KeyLevel) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475.That's why, short-term bearish reversal shouldbe excluded provided that bearish persistence is maintained below the current price level Of 1.3300. Trade recommendations : Intraday traders are advised to look for continuation of bearish rejection below the price levels of (1.3300) as a valid SELL Entry. Initial T/p level is to be located around 1.3300, 1.3200 and 1.3100. On the other hand, bullish persistence above 1.3350 invalidates this trading scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| September 3, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 03 Sep 2020 05:01 AM PDT

On May 14, the EUR/USD has expressed evident signs of Bullish rejection as well as a recent ascending bottom around the price zone of (1.0815 - 1.0775).Thus, enhancing the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1150 then 1.1380 where another sideway consolidation range was established. The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1700 (Fibonacci Expansion 150% level) which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) remains a strong SUPPLY-Zone to be watched for bearish reversal. However, Conservative traders should be waiting for bearish re-closure below 1.1700. As this indicates lack of bullish momentum and enhances further bearish decline initially towards 1.1600 and 1.1500. Trade recommendations : Conservative traders should wait for the current bullish movement to get back below 1.1700 as an indicator for lack of bearish momentum for a valid SELL Entry.T/P levels to be located around 1.1600 and 1.1500 while S/L to be placed above 1.1760 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| September 3, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 03 Sep 2020 04:48 AM PDT

The EUR/USD pair has been moving sideways within the depicted expanding channel since August 3. Previously, a temporary resistance level was formed around 1.1900 which prevented further upside movement for and forced the pair to have a downside pause for sometime. On August 31, the EURUSD pair achieved another breakout above the previously mentioned resistance zone. Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. Currently, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800. More downside movement is expected towards the lower limit of the movement pattern around 1.1770-1.1750. Any downside pullback towards this price zone around 1.1750 should be considered for a BUYING opportunity. Initial target would be located around 1.1860 while Stop Loss should be placed just below 1.1720 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Sep 2020 04:44 AM PDT Further Development

Analyzing the current trading chart BTC I found that my yesterday's idea is stil active and I expect further downside movement towards the levels at $10,650 $9,900 In my opinion, the BTC is in creation of C leg to complete major ABC correction. Most recently I found that BTC is in consolidation but I see it like confrontational for the downside. Key Levels: Resistance: 1,1825 Support levels: 1,1760-1,1705 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for September 03 2020 - Potential for drop towards the 1.1705 Posted: 03 Sep 2020 04:36 AM PDT Says that GOP are moving even further in the wrong directionThe battle rages on between US lawmakers on the coronavirus relief plan and Schumer's remarks above are pretty much the same as what we have heard for over a month now. The clock is ticking as we move further down the fiscal cliff, as time will tell how much of a hit the US economy faces in the coming months with this issue going nowhere.

As I discussed in the previous review, the EUR started the down cycle and in my opinion is heading to test major pivot support at 1,1760-1,1705. Further Development

Analyzing the current trading chart EUR, I still expect more downside roation towards the 1,1760-1,1705. 1-Day relative strength performance Finviz Based on the graph above I found that on the top of the list we got Lean Hogs and Palladium today and on the bottom Heating Oil and Lumber. EUR is on the bottom of the list with no evidence of counter rection, which is good sign for further continuation. Key Lvels: Resistance: 1,1825 Support levels: 1,1760-1,1705 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

'

'

No comments:

Post a Comment