Forex analysis review |

- USDJPY control zones 09.09.20

- Hot forecast and trading signals for GBP/USD on September 9. COT report. Pound fell to the psychological level of $1.30.

- Hot forecast and trading signals for EUR/USD on September 9. COT report. Indistinct movements continue. Traders wait for

- Overview of the GBP/USD pair. September 9. The British pound fell again after a long break.

- Overview of the EUR/USD pair. September 9. Donald Trump threatens China and criticizes Joe Biden

- GBP/USD. Pound plunges down: British press make investors nervous

- Analytics and trading signals for beginners. How to trade EUR/USD on September 9? Getting ready for Wednesday session

- Comprehensive analysis of movement options for Gold & Silver (H4) on September 9, 2020

- Evening review on September 8, 2020

- Bitcoin and Altcoin prices start downside correction

- September 8, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- September 8, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Gold vulnerable to a move lower

- EURUSD vulnerable to break bullish channel

- USDJPY rejected at key resistance trend line

- Stock Asia rallies, while Europe falls substantially

- Brent oil faces headwinds

- Analysis of GBP / USD for September 8, 2020

- Analysis on EUR/USD on September 8: European Parliament to start negotiations for recovery fund for the European Union

- Daily Video Analysis: GBPJPY High Probability Setup

- USDCAD holding above ascending trendline support, further rise expected!

- USDCAD facing pressure from 1st resistance, further drop expected !

- GBP/USD: plan for the American session on September 8

- EUR/USD: plan for the American session on September 8

- CADJPY approaching support, potential bounce!

| Posted: 08 Sep 2020 07:25 PM PDT The resumption of the downward movement became possible after yesterday's fall of the pair and the formation of the "absorption" pattern of the daily level. The bearish momentum may continue from the current levels as the formed "market maker zone" has already been worked out. The goal of reduction will again be the WCZ 1/2 105.43-105.28. Work within the medium-term accumulation zone formed by the August extremes remains the main one. Transactions from the flat boundaries must be considered in the first place. The alternative growth model has a probability below 30%, which makes it auxiliary. To change the priority of trading, you will need to close today's trading above yesterday's high. This will allow you to consider purchases of the instrument tomorrow. DCZ - day control zone. A zone formed by important data from the futures market that changes several times a year. WCZ - weekly control zone. The area formed an important marker of the future market, which changes several times a year. MCZ - monthly control zone. A zone that reflects the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Sep 2020 07:12 PM PDT GBP/USD 1H The GBP/USD currency pair, unlike EUR/USD, does not waste time on the flat and continued to sharply fall on September 8, which resulted in reaching the support area of 1.3004-1.3024. Rebounding from this area can provoke an upward correction. However, the trend is likely to remain on the downside in the near future, as the downward channel signals this, and the price even managed to go below it, which fuels the descending movement. Actually, it does not take long to look for reasons why the pound should fall. Unlike the euro, the pound sterling has plenty of them. Therefore, the question now stands as follows: how long do traders intend to get rid of the pound this time, given that the final talks on a trade deal is almost a failure? In case the 1.3004-1.3024 area has been overcome, the next target for the fall will be the 1.2833 level. GBP/USD 15M Both linear regression channels are still directed to the downside on the 15-minute timeframe, so we can conclude that the downward trend will continue. The latest Commitments of Traders (COT) report for the British pound was more unexpected than the euro's report. If non-commercial traders already shorted the euro currency, the same category of traders continued to buy the pound sterling. In total, professional traders opened 5,500 new Buy-contracts and 3,000 new Sell-contracts during the reporting week (August 26 – September 1), so their net position even increased by 2,500, according to a new COT report. In principle, these data perfectly characterize what is happening in the foreign exchange market, since the pound continued to grow during all five trading days included in the report. The pound has been getting cheaper on September 1 to this day, but there is no hint that professional traders have stopped buying the pound in the latest COT report. But the new COT report may show a serious decrease in the net position for the "non-commercial" category. The fundamental backdrop of Tuesday, September 8th, boiled down to Brexit-related topics. In principle, there wasn't any news on it. Market participants continued to sell the British currency, as the chances of a successful outcome of negotiations with Brussels became even less. And if anyone has forgotten, the absence of a deal with the EU is extremely unprofitable for the UK and its economy. However, Prime Minister Boris Johnson continues to pretend that he is ready to trade with the European Union according to the WTO rules. He may be ready, but what will millions of Brits say when delays begin in the supply of certain goods, especially when it comes to essential goods? Prices for goods imported from the EU will rise, and it will be more difficult for British manufacturers to market their products to EU countries. Thus, the current drop in the pound, from our point of view, is fully justified. Now, only the United States can prevent it if their leader starts a new round of discouraging statements or, even worse, actions on the domestic and international arena. This can bring back interest to the British currency. No major macroeconomic releases from the UK or the US are scheduled for Wednesday. We have two trading ideas for September 9: 1) Buyers are out of the market, bears rule the show. Thus, you are advised to consider buying the pound when the price settles above the descending channel with the first target being the Senkou Span B line (1.3266). Take Profit in this case will be about 70 points. 2) Sellers continue to pull down the pair, therefore, short positions remain relevant with the target of the support level of 1.2833, but it is recommended to resume trading downward if the price manages to overcome the support area 1.3004-1.3024, which was already reached yesterday. Take Profit in this case will be about 150 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Sep 2020 07:10 PM PDT EUR/USD 1H The hourly timeframe on September 8 shows the euro/dollar pair moving in a downward direction, inside the same side channel of $1.17-$1.19. The pair fell by only a few dozen points during the day, and at the same time, it reached 5 (!!!) previous local lows: 1.1754, 1.1772, 1.1762, 1.1789 and 1.1781. As you can see, not only do the bears face problems in going below the level of $1.17, but it has even more difficulty with overcoming the 1.1754-1.1789 area, although it does not even appear as a support area, since there is another support area at 1.1703-1.1729, from which the price also rebounded several times earlier. We believe that these are all signs of continuing the flat. It's just that in our case this flat is unattractive, not like in the textbook. Looking at the 4-hour timeframe, we can say that the upward trend is generally preserved. Looking at the lower timeframes, we can conclude that a new downward trend has begun. EUR/USD 15M Both linear regression channels turned down on the 15-minute timeframe, signaling a downward movement at this time. The latest Commitment of Traders (COT) report, which, let me remind you, comes out with a three-day delay and only covers the dates from August 26 to September 1, unexpectedly showed a decrease in the net position for the "non-commercial" category of traders. Let me remind you that non-commercial traders are the most important category of traders who enter the foreign exchange market in order to make a profit. So, during the reporting week, non-commercial traders reduced Buy-positions and opened Sell-contracts. The number of purchases decreased by almost 11,000, while the number of sales increased by 3,000. Thus, the net position immediately decreased by 14,000. We would like to take note that the euro did not really get cheaper during the reporting week, which is covered by the latest COT report. The euro strengthened during all five trading days, and it only started to fall on September 1, which we can now describe as being provoked by professional traders and their sell positions. However, we can not consider the overall downward movement as strong, in contrast to the fall, for example, of the pound, for which the COT report did not show that the bullish mood had weakened among non-commercial traders. The European Union published the GDP for the second quarter in a new estimate. According to the updated data, GDP contracted by 11.8% q/q, instead of 12.1%, as was published a month earlier. Thus, we can say that this report is in favor of the European currency, but the difference between the loss of 12.1% and 11.8% is not large. Therefore, market participants practically did not react to this data in any way, continuing rather vague trades. No important news and data from the US and the EU are scheduled for release today. Therefore, weak volatile trading may continue on September 9. And traders, most likely, will continue to wait for the results of the ECB meeting, which will be summed up on September 10, Thursday. Christine Lagarde's press conference will be held at the same time. We have two trading ideas for September 9: 1) Bulls continue to keep their finger on the pulse of the market and are ready to return at any time and open new buy positions. At least the current fall in quotes is very weak, and the price has not yet managed to even approach the important level of 1.1700, which we consider as the lower border of the side channel. Thus, it will be possible to buy the pair in case it settles above the Kijun-sen line (1.1816) and a descending channel with targets of Senkou Span B line (1.1886) and the 1.1972 level. Take Profit in this case will be from 50 to 130 points. 2) Bears got the opportunity to start forming a new downward trend, but so far they are not taking full advantage of it. Thus, for now, we can recommend selling the pair while aiming for the support level of 1.1742, and even then you have to be extremely cautious, since the movement is very weak. In this case, the potential Take Profit is 40 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the GBP/USD pair. September 9. The British pound fell again after a long break. Posted: 08 Sep 2020 05:50 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -183.5785 The British pound accelerated its fall against the US dollar on Tuesday, September 8. In simpler terms, it collapsed. However, we have been expecting this for a long time, since the British currency has not had any reason to strengthen in the past few months. Its growth is solely due to the United States with its fan of various crises and problems. Thus, the UK currency has grown undeservedly and now begins to slowly repay debts. This process did not start out of the blue. The events of the past week have clearly shown what was clear to many a year ago when Boris Johnson was just starting negotiations with the UK parliament and the European Union. Even then, Johnson clearly stated his position - to leave the European Union without any agreements, according to a "hard" scenario. He was ready to withdraw the country, bypassing the parliament, sending it on forced leave, as he understood that the deputies would not allow him to implement this option of "divorce" with the alliance. However, Johnson's plan failed like many others. Unfortunately for the UK itself, the British people are so tired of living in limbo that they simply gave most of the votes to the Conservative Party, hoping that Boris Johnson will quickly finish the "divorce" from the EU, which only 52% voted for in 2016. Moreover, that's exactly what Johnson has been doing for more than six months. At first, he flatly refused to extend the "transition period", during which there would be a much better chance of agreeing on free trade, and then began to put forward ultimatums to Brussels and conditions that no one in their right mind would accept. Naturally, the European Union did not accept them either. However, to reproach Johnson himself, there is nothing. He is only implementing the plan that he has honestly and publicly stated from the very beginning of his term as Prime Minister. Where Boris Johnson's policy might lead the UK is a completely different question. We see that in the last 4 years, the pound has regularly collapsed. Some may say that the pound has not fallen so much in total over 4 years, losing only about 13-14 cents. The absolute maximum of the pound was reached in 2007 when it cost 2.12 US dollars. The absolute minimum was reached in March of this year - 1.14 US dollars. Thus, even if you take a certain average value of the pound over the past 25 years, it turns out that it is somewhere around the level of 1.65. At the same time, the pound exchange rate is $ 1.30, and we see a clear approach to a new collapse. Meanwhile, Boris Johnson royally granted time until October 15 to complete the negotiations. If the parties fail to reach an agreement before this date (and there is no doubt about this, since London initially did not intend to agree), then the negotiations will be completed. The fact that London was not going to conclude any agreement says a huge number of factors. We believe that 10 Downing Street understood from the very beginning that a comprehensive agreement would leave Britain tied to the EU. London will not get full and total independence, so this option was initially unacceptable. Further, London tried to bluff, threaten and issue ultimatums, trying to scare the European Union with the lack of a deal and at the same time pretend that London itself is completely ready for the option of no agreement and is not afraid of it at all. The goal of these maneuvers was to force the EU to be more accommodating in negotiations. However, the European Union, which loses disproportionately less from breaking all ties with Britain, did not follow Johnson's lead. Therefore, now Boris can only continue to pretend that the UK will live well without the European Union. Further, participants in the foreign exchange market have shown very well in recent years how much they believe in this. In addition to the fact that London is not going to agree with the EU, it may well violate already concluded agreements, for example, on the procedure that will operate on the border between Northern Ireland and Ireland after Brexit. Recall that Northern Ireland will remain in the UK, and Ireland will remain in the EU. Thus, there must be a border, customs, and control between them. But how can this be explained to the Northern Irish and Irish themselves, who fought for 30 years before 1998 for various religious reasons, and who are one people? Under the agreement with the EU, all goods that are sent to Northern Ireland, whose capital will remain part of the EU's single market, must be checked and carefully monitored at the maritime border. However, the UK itself does not benefit from long checks and customs between Ireland and Northern Ireland, as this may provoke an increase in separatist sentiment and a new civil conflict. Therefore, London wants to soften any controls on the island of Ireland as much as possible, while keeping its face to the EU. However, Brussels has already expressed its complaints about the possible actions of London. The very fact that London is considering the option of unilaterally ending compliance with previously reached agreements will not only complicate the already failed negotiations but may also seriously affect the already difficult future relations between the Kingdom and the alliance. So far, everything goes to the fact that Britain will be in a state of conflict with the European Union for a long time. Moreover, Boris Johnson will play the role of Donald Trump. As for the pound itself, it can be saved by Donald Trump and America. Because the worse things are in the US, the better it is for the British pound. Thus, buyers of the British currency can now only hope that things will get even worse in America. And this can easily be achieved by re-electing Donald Trump for a second term. It sounds funny, however, "the results are on the scoreboard". America is going through the worst crisis in 100 years. And this is the fault of Donald Trump.

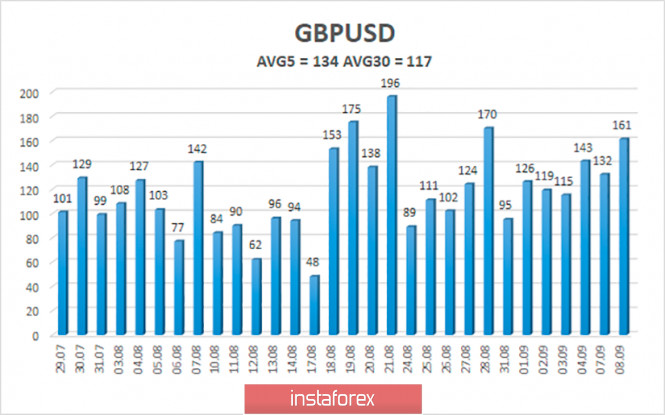

The average volatility of the GBP/USD pair is currently 134 points per day. For the pound/dollar pair, this value is "high". On Wednesday, September 9, therefore, we expect movement inside the channel, limited by the levels of 1.2879 and 1.3147. A reversal of the Heiken Ashi indicator to the top will indicate a round of upward correction within the new downward trend. Nearest support levels: S1 – 1.3000 S2 – 1.2939 S3 – 1.2878 Nearest resistance levels: R1 – 1.3062 R2 – 1.3123 R3 – 1.3184 Trading recommendations: The GBP/USD pair continues its downward movement on the 4-hour timeframe. Thus, today it is recommended to stay in short positions with targets of 1.2939 and 1.2878 until the Heiken Ashi indicator turns upward, which indicates the beginning of a correction. It is recommended to trade the pair for an increase with the first target of 1.3306 if the price returns to the area above the moving average line, which is not expected in the near future. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the EUR/USD pair. September 9. Donald Trump threatens China and criticizes Joe Biden Posted: 08 Sep 2020 05:50 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -134.5105 The EUR/USD pair also passed in quiet trading with low volatility and minimal downward bias for the second trading day of the week. Unfortunately, market participants are still not able to decide at this time on the further trading strategy and are waiting for new important data that can tell them which way to trade the pair. Also, now is a very good time to trade the pound/dollar pair, where there is no lack of fundamental background. Therefore, some of the euro currency traders temporarily ran away to trade the pound. During the past three (or four) months, the EUR/USD pair has generally been getting more expensive. Moreover, it has been standing in one place last month. Thus, it turns out that euro traders are not in a hurry to get rid of long positions yet. Why? Because the situation in the States continues to be quite unsightly. Furthermore, there are many reasons for this. Starting with the "four crises" that we have been talking about for several months and ending with new potentially serious problems and the personality of Donald Trump, who seems to be doing everything to make more enemies in both inside and outside the country. You can only be happy about one thing: the "coronavirus" epidemic in the United States began to recede. In recent weeks, there has been a clear decline in the number of new cases. Moreover, since we are talking about living and ordinary people, this is undoubtedly a positive fact for the country and its national currency. First, the weaker the pandemic, the more socially and economically active the country's residents will be. This means that business activity will grow and the economic recovery will proceed more quickly. People will be more willing to return to work, which means they will have to pay fewer unemployment benefits and "coronavirus allowances". In general, no matter how you look at it, the lower the unemployment rate and the weaker the "coronavirus", the better for the US and the dollar. Unfortunately, this is all positive news from America. We return to the figure of Donald Trump, who resumed daily accusations and insults of everyone who does not support his policies and candidacy in the elections. First, China got it again. This time, Trump said that China does not want his re-election and interferes in the election to achieve a victory for Joe Biden. According to Trump, China incites protests, mass rallies, and riots in the United States, hiding behind racist scandals that provoked the "Black Lives Matter" movement. However, official US intelligence data does not confirm Trump's accusations against China like how they did not confirm his accusations earlier when the US president said that "China specifically infected the whole world with COVID-2019". Next came Joe Biden. Trump once again criticized the Democrat's plan to reorganize the energy sector, saying that "his plans are unrealistic" and he "will simply destroy the entire sector". Further, the US Department of Defense fell under the "distribution", which Trump also "rode like a roller", accusing them of inciting wars for the sake of enriching military enterprises. The US leader believes that leaders in the Pentagon specifically provoke or find conflicts around the world to enrich companies that produce weapons and military equipment. Trump named his priority for the second presidential term as "the return of American military personnel home". Also, Donald Trump again recalled Biden's mental abilities, saying that "he did not understand politics when he was in his prime, and even more so in his current state". Well, the biggest criticism went to American companies that have located their production in China. Donald Trump believes that this way American manufacturers create jobs in the camp of the main enemy and competitor. If he wins the election, the president promised that he would return most of the production to the United States to "end dependence on China", as well as to create jobs in America. Trump promised that all companies that refuse to return home will be forced to pay high taxes to compensate for their departure to China. Those companies that decide to return home, on the contrary, will be subsidized. "If they can't create production here, then let them pay high taxes. We will prohibit granting government contracts to companies that export production to China. We will hold China accountable for allowing the coronavirus to spread around the world. They are strengthening their army with our money, and I don't want that," the American president said. "We will turn America into a manufacturing superpower and end our dependence on China once and for all. We can't rely on China," added Trump, who of course forgot that he had already promised to return American manufacturers before the last election and failed to return any major companies to the United States for 4 years. However, before the new election, Trump started an old record. We believe that Trump's actions are mostly destructive. The direct pressure on American manufacturers may lead to them leaving the United States altogether and producing their products outside of their borders. Because whatever tax benefits Trump offers these companies, it should be understood that the production of any goods in the United States is much more expensive than in almost any other country in the world. Especially if we are talking about developing countries with cheap labor. Thus, it will not be profitable for any company to move production to the United States, as this can increase the cost of production by 50-100%. Naturally, this will harm sales and revenue. Moreover, American workers will have to pay much higher wages than Chinese workers. In general, we do not believe that American manufacturers will return to the States. However, we believe that Trump can start a war against them. After all, Trump knows only a few ways to achieve his own goals: threats, direct pressure, and war. Thus, it is the US president who can contribute to an even greater decline or a slowdown in the US economy if he is re-elected for a second term. This does not bode well for the US dollar in the long run. Against the euro, it is still holding off from a new fall and may even start to rise in price in the coming weeks. However, for a stronger strengthening than a correction, it is necessary to complete at least half of the crises that are currently observed in the United States.

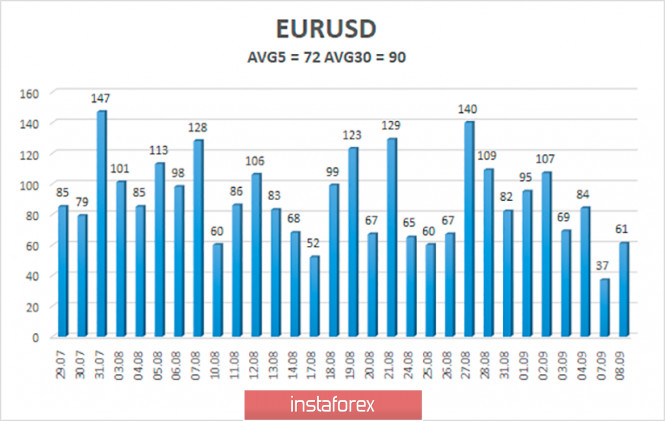

The volatility of the euro/dollar currency pair as of September 9 is 72 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1723 and 1.1867. A reversal of the Heiken Ashi indicator to the top signals a possible round of upward correction. Nearest support levels: S1 – 1.1719 S2 – 1.1597 S3 – 1.1475 Nearest resistance levels: R1 – 1.1841 R2 – 1.1963 R3 – 1.2085 Trading recommendations: The EUR/USD pair may continue its downward movement. Thus, today it is recommended to trade down with the targets of 1.1723 and 1.1719 and hold short positions until the Heiken Ashi indicator turns upward. If the price is fixed above the moving average, it is recommended to trade for an increase with the target of 1.1963. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Pound plunges down: British press make investors nervous Posted: 08 Sep 2020 02:08 PM PDT The British currency is expected to sharply fall throughout the market, even against the dollar. The devaluation of the pound was predictable, given the disposition of the upcoming negotiations between London and Brussels. But, apparently, traders were hoping for a miracle that did not happen. In my opinion, the prospects for the pound were clear last Friday, when the heads of the negotiating groups voiced their assessment of the results of the previous round of talks. The "test shot" was fired over the weekend when Prime Minister Boris Johnson once again called for a deal in the Canadian or Australian scenario (Brussels repeatedly rejected both options) and announced a new deadline for the deal - October 15th. In turn, the head of the European negotiating group said that he was disappointed with the previous dialogue with the British, accusing them of not wanting to compromise. Such a peremptory position of the parties a priori could not lead to any significant breakthrough in the negotiation process. Moreover, today there is information that Johnson may initiate a revision of the deal that was already signed at the end of 2019. Some experts call this a bluff, but do not forget that after the last snap election, the Conservatives control the majority in the House of Commons, and therefore do not depend on the votes of any other parties. Therefore, in my opinion, traders underestimated the existing risk - apparently, many refer to Johnson's initiative as "raising the stakes before the game." Let me remind you that Northern Ireland was the main stumbling block in the four-year talks between London and Brussels. As a result, Johnson was able to find a compromise between Leo Varadkar (who at that time was the Prime Minister of the Republic of Ireland), the local authorities of Northern Ireland, the British Parliament and the leadership of the European Union. According to the compromise reached, there will be no border between Ireland and Northern Ireland, and all goods destined for export to Ireland from England, Wales or Scotland will pass customs control en route to Northern Ireland. In other words, the parties will establish a maritime border "within" the UK. Now Johnson intends to destroy this fragile structure. At least, according to the influential publication The Daily Telegraph, the British prime minister is going to announce this to Brussels in the near future. This initiative will formally be presented under the guise of the fact that the concluded deal on the part of the Irish border undermines the foundations of the integrity of the state structure of Great Britain, since de facto Northern Ireland becomes part of the European Union. But there is another reason that Johnson will not say this in the public plane - the fact is that, within the framework of the agreement concluded, Brussels can prevent Britain from subsidizing business in the UK in full, since Northern Ireland will de jure obey the economic rules of the EU. According to The Daily Telegraph, this week the British Parliament may consider a corresponding amendment, which will allow the government to bypass such restrictions on subsidizing companies and entire industries. How Brussels will react to this is an open question. As mentioned above, many experts do not believe that Johnson will really decide on such shifts that will hit not only the authority of the British government in the world, but also hit the positions of the Conservatives themselves within the country. Therefore, the market's reaction is currently muted, even despite a 150-point decline in the GBP/USD pair. If the concluded deal were under a real threat, the pair would fall by 300-500 points. Nevertheless, Johnson knows how to bluff. And he can convince politicians (and along with them traders) of the firmness of his intentions. The prime minister can indeed submit a relevant bill to the House of Commons, accompanying his actions with anti-European rhetoric. In this case, the pound will continue to lose its positions, even contrary to common sense - the Conservatives will probably not shoot themselves in the foot by revising the points of the long-suffering deal. According to analysts, if London violates the terms of the agreement, the political dispute will end with a lawsuit in the Luxembourg court. According to a court decision, the British can receive significant fines, and a trade war may begin between the UK and the European Union, within which the EU will impose sanctions on British exports. But even if we exclude Johnson's possible political maneuver, it is worth recalling that there are many unresolved issues between London and Brussels at the moment. These include the access of European agricultural producers to the British market, regulation of the activities of European automobile giants, access of the French, Germans, and Spaniards to British waters for fishing, relations between Gibraltar and Spain, and so on. Such fundamental questions require careful and scrupulous study, and in this context, a 4-week time frame (remember that the deadline is set to October 15) looks too short. Obviously, the parties will not have enough time to discuss all the points of the upcoming deal. Therefore, tension regarding the prospects for Brexit will only grow in the near future, putting pressure on the pound. From a technical point of view, the pair has the potential to fall in the long term - at least to the level of 1.2950 (the lower line of the BB indicator on the daily chart). The next support level is located a hundred points lower at 1.2850, which is the upper border of the Kumo cloud on the same timeframe. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 08 Sep 2020 02:08 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair, as a whole, continued to weakly move down on Tuesday, September 8, and eventually it reached the lower line of the small side channel, which is limited by the levels of 1.1790 and 1.1865. The price even managed to gain a foothold below this channel, which we told novice traders to consider as a signal to sell the EUR/USD pair. However, literally on the next candle, the quotes of the pair returned to the channel and are traded there at this time. Thus, the sell signal turned out to be false, as well as the breakout of the lower border of the side channel. The price did not manage to abruptly go up, so losses on this trade should be minimal. In general, the volatility for the pair is extremely low, no more than 60 points a day. Unlike, for example, the pound/dollar pair, which is traded much more actively. Now we need to wait for new possible signals, but in the current situation, when a pronounced rebound from the lower channel line has not occurred, we believe that any signal can be false. Nothing prevents the price from executing a second false breakout at this time. We only had one report to serve as the fundamental background. The eurozone has released the second estimate of GDP for the second quarter. It turned out that this indicator slightly improved compared to its first estimate and reached -11.8% in quarterly terms and -14.7% in annual terms. However, market participants did not appreciate this improvement, considering it insignificant. Thus, the euro did not receive much support after this report was released. In addition, there was practically no news that could have an impact on the pair's movement. US President Donald Trump has traditionally commented a lot on everything that concerns his country at this time, the upcoming elections and his enemies and competitors, but nothing that was particularly interesting to market participants. Many people have long regarded Trump's words as meaningless speeches. Because what Trump says is very rarely true. No macroeconomic data at all on Wednesday, September 9. Therefore, the pair can spend the whole day in absolutely indistinct trading without even moving in a trend within the day. Moreover, the pair can produce false signals near the lower border of the side channel, so we advise novice traders to be extremely careful when opening any positions. The results of the meeting of the European Central Bank will be summed up on Thursday, as well as a press conference by its head Christine Lagarde. That day promises to be more interesting. Possible scenarios for September 9: 1) Novice traders are advised to not consider buy positions at this time, since the trend is formally downward, but in fact - it is going from side to side, but not upward. There are no signals or technical patterns that support the upward movement at the moment. Formally, you can try to trade for a rebound from the lower border of the side channel while aiming for the upper border, but this signal is absolutely indistinct. 2) Sell positions continue to look more relevant despite the fact that the pair is currently within the sideways channel. If quotes settle below this channel again, then formally it will be possible to open short positions again with the targets of 1.1763 and 1.1700. However, today we have already witnessed a false breakout, so we recommend not to make hasty decisions at least until the morning. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Comprehensive analysis of movement options for Gold & Silver (H4) on September 9, 2020 Posted: 08 Sep 2020 09:11 AM PDT Minute operational scale (H4) For the past six days, the US dollar has been winning the battle with precious metals - what's next? Overview of options for the movement of Gold & Silver on September 9, 2020. ____________________ Spot Gold Spot Gold movement will continue from September 3, 2020, depending on the development and direction of the breakdown of the equilibrium zone boundaries (1908.00 - 1921.00 - 1933.00) of the Minuette operational scale fork - the movement markings inside the specified zone are presented on the animated chart. The upward movement of Spot Gold can take place when the resistance level of 1933.00 is broken at the upper border of ISL38.2 of the equilibrium zone of the Minuette operational scale forks and will be directed to the goals:

The continuation of the development of the downward movement of Spot Gold will become possible in case of a breakdown of the lower boundary of ISL61.8 of the equilibrium zone of the Minuette operational scale fork - support level of 1908.00 - and this movement will be directed to the boundaries of the 1/2 Median Line channel (1890.00 - 1868.00 - 1842.00) of the Minute operational scale fork. Details of Spot Gold movement from September 9, 2020 can be seen on the animated chart.

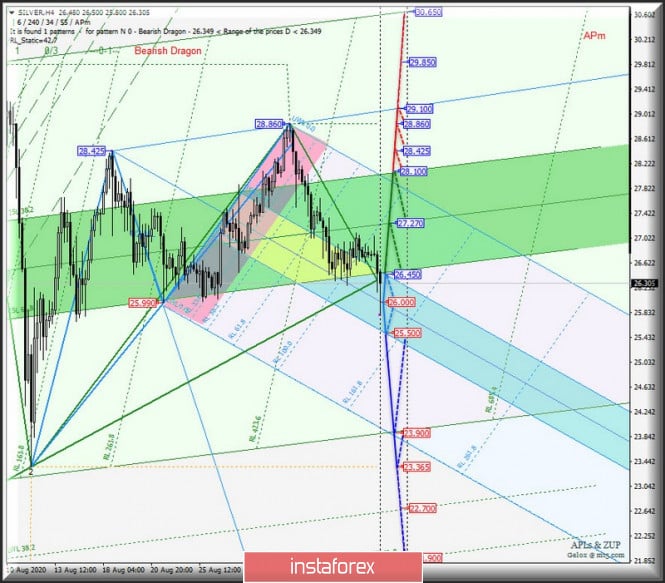

____________________ Spot Silver The development of the Spot Silver movement from September 9, 2020 will also be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (25.500 - 26.000 - 26.450) of the Minuette operational scale fork - details of movement inside the equilibrium zone are shown on the animated chart. If the upper boundary ISL61.8 of the equilibrium zone of the Minuette operational scale fork is broken - the resistance level of 26.450 - the development of the Spot Silver movement will continue in the equilibrium zone (26.450 - 27.270 - 28.100) of the Minute operational scale fork with the prospect of updating local maximum (28.425 - 28.860) and reaching the control line UTL Minuette (29.100). If the lower boundary ISL61.8 of the equilibrium zone of the Minuette operational scale is broken - the support level of 25.500 - the downward movement of Spot Silver can be continued to the final SSL line (23.900) of the Minute operational scale with the prospect of updating the local minimum 23.365. The details of the Spot Silver movement options from September 9, 2020 are shown on an animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on September 8, 2020 Posted: 08 Sep 2020 09:05 AM PDT

EUR/USD The market waits for the main event of the week which is the ECB conference scheduled on Thursday. The euro is refrained from further decline due to purchases from each low. Thus, is compelled to trade upward. Prepare to buy euros from 1.1870. Sell from 1.1760. The material has been provided by InstaForex Company - www.instaforex.com |

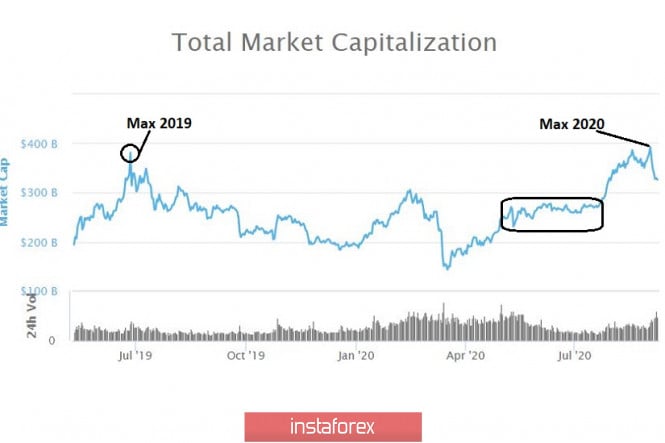

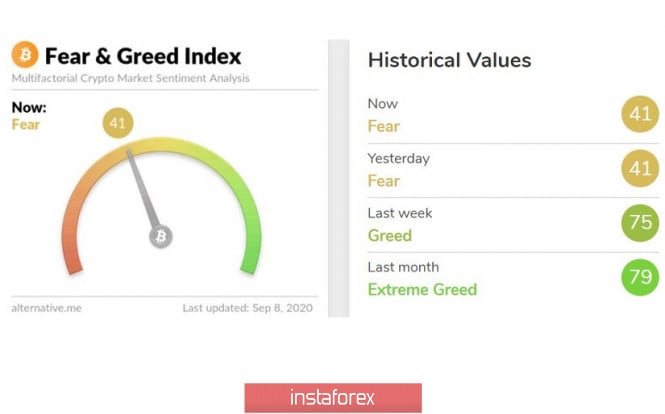

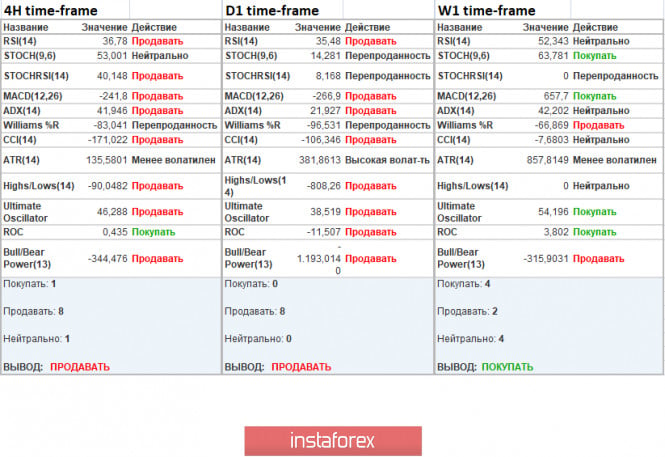

| Bitcoin and Altcoin prices start downside correction Posted: 08 Sep 2020 07:25 AM PDT It is scary to imagine, and even more scary to see a correction of 30, 40 and even 70% from the peak level, but this happens when you trade Altcoins via hype. And this moment came, the cryptocurrencies entered the red zone With the onset of autumn, the market has dramatically changed, the hype of decentralized financial applications [DeFi-Decentralized Finance] like a vacuum cleaner dragged an enormous amount of money into the market, which led to large profits from cryptocurrencies. Income from 500% to 1,000% was something normal for DeFi as assets were growing and millions of new participants were entering the marker. Each of the new market participants wanted to get what mass media was writing about. It was an enormous profit from cryptocurrencies. Every day, the market was becoming more and more overheated. However, the DeFi bubble was also rising and finally reached $9.51 billion on September 2. The day of judgment came, Altcoins dropped losing half of their value. Hamsters are in a panic, and only Bitcoin owners are not really scared. The first cryptocurrency went into correction, losing 15-20% of the peak level, which is still within the acceptable range. Example From September 2, Bitcoin has lost about 18% ($12,000 ---> $9,800), while Altcoin YFI for the same period of time, slumped by 45% ($32,500 ---> $18,000). In order to recover to the levels logged on September 2, Bitcoin needs to advance by 22%, and Altcoin needs a rise of 80%. The first cryptocurrency confirmed its title of a conservative crypto asset that can be invested in with less risk of drawdown. The recovery process is expected to be difficult, the crypto market has an impressive correction, and it will take several weeks or even months to recover. Do not be discouraged, there are plenty of drivers for growth. For example, the upcoming IPO of Coinbase, which may encourage investors to take action. At the same time, we expect the early launch of large-scale crypto project DFINITY, which will push the community to a new level in digital development thus attracting new investors and boosting the crypto market. Correction is not just stress, it is an opportunity to buy an asset at a discount. You can set filtering of market leaders on coinmarketcap: TOP 10/15/25. Current development of Bitcoin and its prospects The quote is at the correction stage, where the psychological level of $10,000 is trying to keep market participants from further decline. Now, everything depends on the depth of fear and the spillage of the entire market, since the maximum correction for Bitcoin is $8,500, but this will be discussed if the price is fixed lower than $9,500. Life hack If Bitcoin declines to the level of $8,500, Altcoins will lose another 30-60% of the current value without any brakes. A positive scenario considers the appearance of a flat formation on the market in the range of $9,800/$11,500, which will provide an opportunity to recover all crypto assets. The sideways movement will be the best scenario, which in the future may boost Bitcoin as well as the entire crypto market. General background of the crypto market Analyzing the total market capitalization of the crypto industry, you can see that Total market lost $70 billion just in a few days and currently stands at $323 billion. The correction is everywhere, if we look at the volume chart in general terms, then first we need to return to the highest level of $385 billion logged in 2019 , which will reflect the recovery of the bullish trend. Then we will update the current maximum of $393 billion. After that, the price may return to the range of $245 billion / $285 billion. Market Cap: $323,621,210,798 BTC Dominance: 57,4% The index of emotions of the crypto market was stable above 80 points on September 2, but now it decreased by almost one half and it is at 41 points. The fear of a crash is not yet reflected in the index figures, but many traders/hamsters are in a panic, which has a detrimental effect on crypto assets. Indicator analysis Analyzing different sectors of timeframes (TF), it is clear that the indicators of technical instruments signal selling due to the correction stage. The weekly period holds the buy signal, reflecting the general trend of 2020. |

| September 8, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 08 Sep 2020 06:48 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1700 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) remains a strong SUPPLY-Zone to be watched for bearish reversal. However, Conservative traders should be waiting for bearish closure below 1.1700 - 1.1750. As this indicates lack of bullish momentum and enhances further bearish decline initially towards 1.1645 and 1.1600. Trade recommendations : Conservative traders should wait for the current bullish movement to get back below 1.1750 as an indicator for lack of bearish momentum for a valid SELL Entry.T/P levels to be located around 1.1645, 1.1600 and 1.1500 while S/L to be placed above 1.1860 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| September 8, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 08 Sep 2020 06:47 AM PDT

Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.2780 (Depicted KeyLevel) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal should be expected provided that bearish persistence is maintained below the current price level of 1.3300. Last week, significant bearish rejection was initiated around 1.3475 followed by a quick bearish decline towards 1.3245 where some transient bullish recovery was manifested. The price level of 1.3320 remains an Intraday Key-level to offer bearish pressure if retested again soon. Earlier Yesterday, Some signs of bearish signs have already been manifested around 1.3300. Trade recommendations : Intraday traders are advised to look for bearish rejection anywhere around the price levels of (1.3320) as a valid SELL Entry. Initial T/p level is to be located around 1.3250, 1.3200 and 1.3100 if sufficient bearish pressure is maintained. On the other hand, bullish persistence above 1.3350 invalidates this trading scenario. The material has been provided by InstaForex Company - www.instaforex.com |

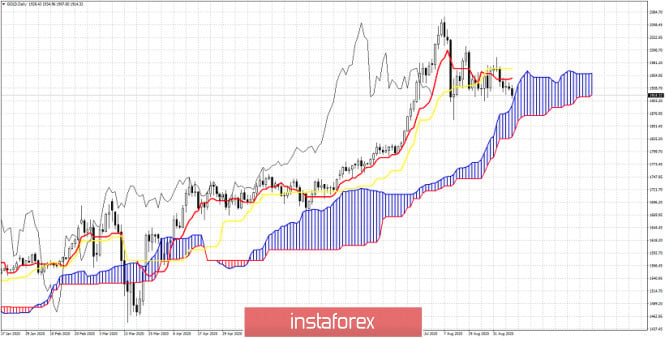

| Gold vulnerable to a move lower Posted: 08 Sep 2020 06:38 AM PDT Gold price has broken short-term support at $1,920 and the triangle pattern to the downside. This is not what we expected but we were prepared for such an outcome. Gold price is now vulnerable to push lower towards $1,900.

|

| EURUSD vulnerable to break bullish channel Posted: 08 Sep 2020 06:31 AM PDT EURUSD is trading below 1.18. In order for our bullish scenario to come true price should have already bounced above 1.1850. The fact that price is so weak and is pushing below 1.18 is a bearish sign. Given current price action we believe that a break of the bullish channel is imminent.

Pink line - short-term support Green rectangle- target if channel holds EURUSD is now challenging 1.1750 support area for the fourth time. The chances are in favor of breaking this support level and moving lower towards 1.17-1.16. Price has not yet broken support but we feel the chances are in favor of this outcome. I will be neutral if the Daily close is below 1.1750 and I would be prepared to look for a bottom around 1.16. The material has been provided by InstaForex Company - www.instaforex.com |

| USDJPY rejected at key resistance trend line Posted: 08 Sep 2020 06:27 AM PDT USDJPY is trading at 106 after getting rejected at the resistance by the downward sloping trend line at 106.50 area. This price action is a sign of weakness and if we see a push below short-term support at 105.30we should expect USDJPY to move even lower towards 104.

USDJPY seems unable to break above the pink line. So far we have three failed attempts. This is a bearish sign and that is why at current levels I prefer to be bearish. I would change my view on a daily close above 106.50. Confirmation of my bearish scenario will come when price breaks below the recent lows at 105.30 The material has been provided by InstaForex Company - www.instaforex.com |

| Stock Asia rallies, while Europe falls substantially Posted: 08 Sep 2020 06:01 AM PDT

The Asian stocks flourished on Monday due to the good statistics on economic development in the countries of the region which gave positive dynamics to the stock market indicators. However, the recently paused tensions between the US and China began to manifest again, which may hint that a new wave of conflict is not far off. US President Donal Trump made a rather ambiguous and frightening statement for investors that in the event of his re-election as president of the United States, he intends to stop all contacts with China, including ending the dependence of the American economy on the Chinese economy, which indicates a complete breakdown of all trade relations. Trump's plans look truly grandiose and ambitious. He assures that the US simply needs to end its dependence on China since this is the only thing that stands in the way of making the US a manufacturing superpower. Trump no longer intends to rely on China, because he considers it an extremely unreliable partner. There are only two ways left: either to completely divide the economy or to introduce incredibly high tariffs, which will naturally force China to withdraw from cooperation with the US. The latter has already been done. Trump openly declares that the state will continue to lose billions of dollars until it ends economic cooperation with China. If the president's deeds do not disagree with words, then a new, and deeper conflict between Washington and Beijing cannot be avoided, which is very much feared by market participants on both sides. Aside from the US-China dispute, investors are also watching the situation around the UK's exit from the EU with trepidation. The continuation of the negotiations on the trade agreement is scheduled on Tuesday. Note that it was temporarily suspended due to deep differences between the parties. The EU authorities assure that they are ready to take any steps, just to come to an agreement as soon as possible, but more and more often hints appear in the press that the trade agreement may simply not take place. Nevertheless, the European Union is ready for this turn of events, however, they express great hope that the UK will still fulfill its obligations under the withdrawal agreement. Japan's GDP statistics for the second quarter of this year turned out to be slightly worse than preliminary forecasts. It was assumed that there will be another reduction of about 7.8%, but the actual decline was about 7.9% compared to the previous quarter. The reason for the negative is still the same - the coronavirus pandemic. Thus, Japan's GDP has been contracting for the third time in a row. Moreover, such rates of decline have become record-breaking. Another important reason for the decline in Japan's GDP was the slowdown in business investment in the country. The indicator dropped 4.7%, while it was previously stated that it would not be lower than 1.5%. On an annualized basis, Japan's GDP for the second quarter plummeted 28.1%. This turned out to be slightly better than the estimated 28.6% in the forecasts. Japanese consumer spending fell 6.5% in the second month of the summer. At the same time, there was an increase in bank lending in the country by 6.7% on an annualized basis. This increase was a record and was provided by the fact that companies affected by the COVID-19 pandemic rushed to turn to banks for financial support. Japan's Nikkei 225 Index rose 0.6%. China's Shanghai Composite Index went up 0.3%. The Hong Kong Hang Seng Index rose slightly by 0.1%. South Korea's Kospi index climbed 0.7%. The Australian S & P / ASX 200 index rose 0.8%. European stock exchanges, on the other hand, slightly moved to necessary correction on Tuesday, after the Stoxx Europe 600 index reached its highest level in the last month. In addition, the pressure continues also from the uncertainty of the US market, which did not traded yesterday due to the holidays. The main event of the week for market participants is the next meeting of the main European regulator - the ECB, which is scheduled this Thursday. Investors are also not letting go of the situation with the negotiations on a trade agreement between the UK and the EU, which is expected for resumption in any day. The European Union authorities have initially stressed that they are doing everything in their power to reach a consensus on all issues in the near future. The statistics presented today showed that the economy in the nineteen EU countries contracted by 11.8%, which turned out to be slightly better than the preliminary forecasts. Experts had expected a drop in GDP within 12.1%. However, the real decline was enough for the region to enter a recession. The general index of large enterprises in the European region Stoxx Europe 600 dipped 0.96% Thursday morning, which forced it to move to the level of 364.42 points. The UK FTSE 100 Index dropped 0.38%. The German DAX Index dropped 0.8%. France's CAC 40 index was down 1.14%. Italy's FTSE MIB Index parted 1.61% to become the leader in the said decline Spain's IBEX 35 Index fell 1.19%. The material has been provided by InstaForex Company - www.instaforex.com |

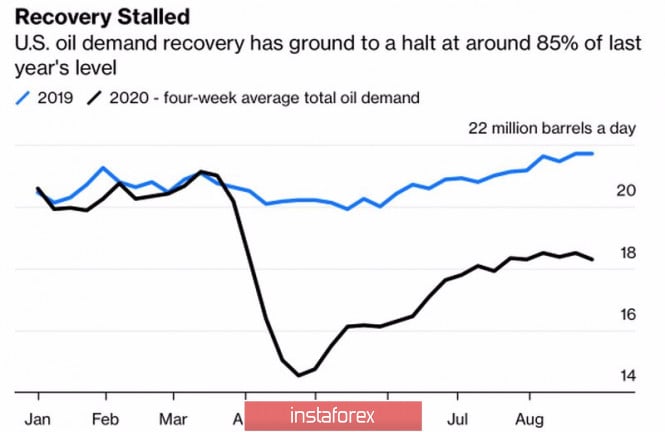

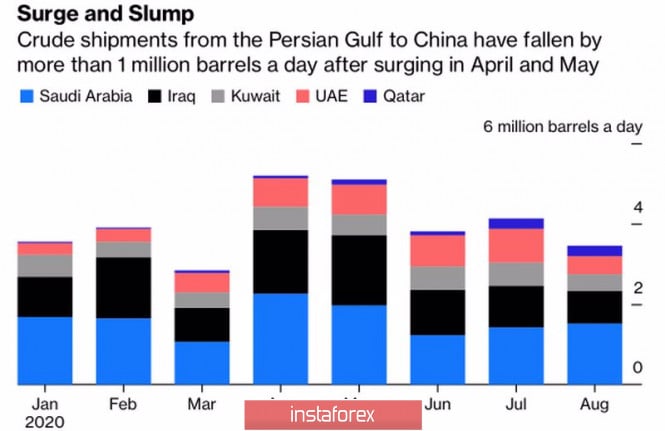

| Posted: 08 Sep 2020 05:36 AM PDT Similar to the rally in US stock market indices, the rapid rise in oil prices from April lows, which continued through the end of summer, looked quite exaggerated. The market has clearly overestimated China's appetite for fuel and the unexpectedly high demand for gasoline in the United States despite the ongoing pandemic. Finally, everyone has counted on the OPEC+ production cuts. As soon as all the mentioned drivers lost their steam, Brent and WTI have entered the downward correction. Moreover, the rising US dollar supports the bearish trend on both the benchmarks. The US oil producers may not be able to return to their pre-crisis output levels. However, the demand for gasoline may offset this factor. This time, the driving season in the United States was less active due to the COVID-19 impact. Thus, before the recession, the oil refineries capacity in the Gulf Coast was 95% in the same period last year, while ahead of Hurricane Laura it dropped to 81%. According to Commerzbank estimates, the demand for gasoline in the US is 8-10% below the levels seen in August-September 2019. Most importantly, the US gasoline demand is unlikely to catch up with the last year's levels. US oil demand dynamics The Asian market provides little support to oil as well. India, one of the world's largest consumers of oil, ranks second in the list of countries most affected by the pandemic. Besides, China's appetite for crude is gradually decreasing. Low crude prices in April and May encouraged China to stock up on oil until it filled up all its tanks. Obviously, China's storage capacity has become limited. This may be the reason why Beijing had to reduce its oil imports from the Middle East by about 1 million barrels per day in summer compared to spring shipments. China's oil imports from Middle East The Brent's fall to $40 per barrel may not seem so surprising given several factors. First of all, the OPEC+ members decided to limit the output cuts the have agreed on earlier this year. Then, we shall not forget about the struggle between Saudi Arabia and Russia for the market share. In addition, the US dollar began to regain ground. In the meantime, Saudi Arabia is cutting its export prices, while Moscow intends to increase production as with the global demand recovers. The fears of the second wave of COVID-19 in Europe and an increase in the number of new cases in 22 out of 50 US states add more pessimism to the market. However, I think that the situation in the energy market is less gloomy as it seems. The drop in the US dollar index came amid concerns about the dovish rhetoric of Christine Lagarde at the ECB September meeting. The US dollar is likely to remain in bear market in the long term. As China's GDP recovers, the demand for black gold in this country will increase. What is more, the coronavirus death rate is low, which is good news for global fuel demand. The plunge in oil prices is closely associated with the correction of US stock indices. As soon as the stock market rebounds, Brent and WTI will again see a bullish trend. I think that the pullback for both grades is limited. So, I suggest buying Brent on a breakout of resistance at $41.5 and $42.2 per barrel. Brent daily chart |

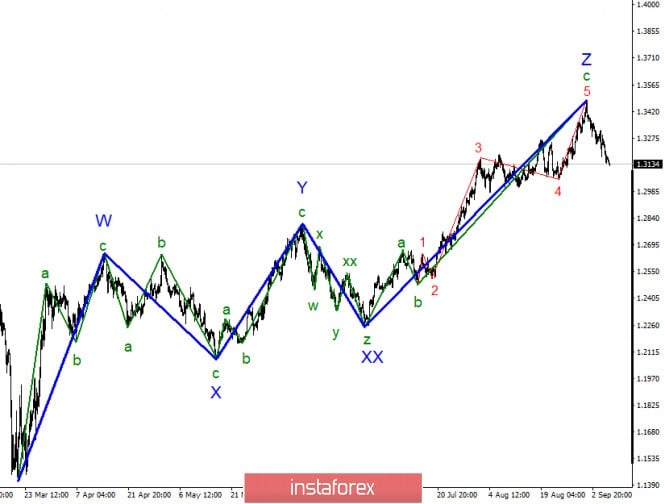

| Analysis of GBP / USD for September 8, 2020 Posted: 08 Sep 2020 05:00 AM PDT

The wave structure of the upward trend section has again taken on a fully completed form. Seemingly, the wave Z is already complete so the entire upward trend can be completed, and the instrument, in this case, has already moved on to building a new downward trend with the first targets located around 25th and 27th figures. However, the movement of the pound sterling will mostly depend on the news background. In recent months, the US dollar has dropped significantly against the pound solely due to the negative news background from the US. Now the situation may reverse as the news coming from the UK has initially turned out to be quite disappointing.

The current wave pattern suggests that the upward trend and wave Z, have become more complicated. The wave c in Z, in particular, has significantly lengthened, while the wave 4 in c in Z has already established a triangle formation. However, the current wave pattern allows us to assume the completion of the construction of the upward trend section, thus, the working option now is to build a downward wave, the first in a new downward section. The news background from the UK has been controversial over the past week and has so far been negative for the current week. British Prime Minister Boris Johnson issued a statement that the parties must complete negotiations by October 15, and if by that time they still fail to agree on a free trade agreement, then the parties will trade with each other from 2021 according to the WTO rules. "We are entering the final phase of our negotiations with the EU. The EU was very clear about its timetable. So was I. The agreement with our European friends should be ready for the meeting of the European Council on October 15, so that it can enter into force by the end of the year. If we cannot agree by then, both sides will have to accept it and move on, "Johnson said. At the same time, information was received from the British Parliament that London may simply abandon certain clauses of the Brexit agreement. We are talking about the control regime, checks on the border between Northern Ireland and Ireland. It was the complete settlement of all issues on the Northern Ireland border in October last year that allowed the parties to move forward in the negotiations. Brussels is now expressing extreme frustration at the fact that London may simply refuse to comply with the terms of the agreement that are disadvantageous to it. Michel Barnier has already turned to his colleague David Frost for an explanation. In any case, the bill should be published only tomorrow and conclusions can only be drawn tomorrow. However, if this bill fails to be passed tomorrow, it could further worsen relations between the EU and Britain and reduce the demand for the pound sterling. General conclusions and recommendations: The Pound-Dollar instrument has supposedly completed the construction of the upward wave Z. Thus, I would now recommend selling the instrument with targets around 1.3158 and 1.2960, which corresponds to 161.8% and 127.2% Fibonacci. The upward part of the trend can take on a more complex form, but for this, you need to wait for a successful attempt to break the current high of wave 5 in c in Z. The material has been provided by InstaForex Company - www.instaforex.com |

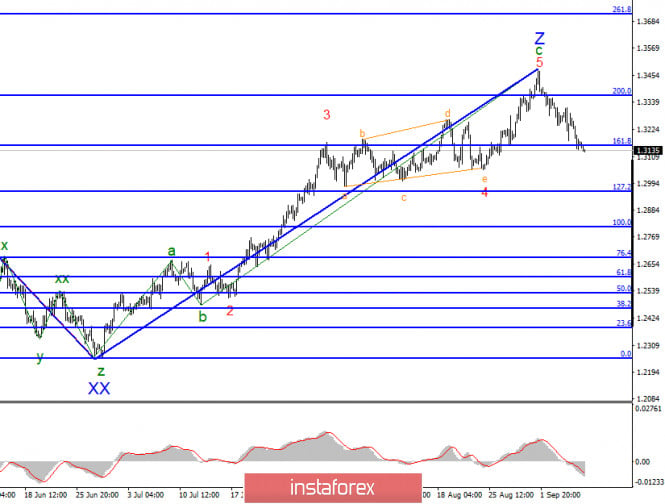

| Posted: 08 Sep 2020 05:00 AM PDT The wave marking of the EUR / USD instrument has become quite integral in global terms. The departure of quotes from the reached highs in recent days once again leads to the conclusion that the construction of wave 3 or C is complete. If this assumption is correct, then lowering the quotes will continue with targets placed below the low of wave 4 in 5 in 3 or C within the construction of the assumed wave 4; after which may be resumed the building of upward trend within the wave 5. It is also possible that the entire section of the trend, which begins in March, will take a three-wave form and will be completed around the 1.2011 mark. A smaller scale wave count shows that the estimated wave 5 in 5 in 3 or C completed its construction. If this is true, then the decline in quotes will continue with targets located near the 200.0% Fibonacci level within the descending wave 4 or, possibly, a new descending set of waves. Wave 4 can take a three-wave form. On Monday, September 7, neither America nor the European Union had any important news, reports, or information at all. Thus, the low trading amplitude is completely explained by the missing news background. Today, the situation should change a little for the better. The EU will release a report on GDP for the second quarter which does not Bode well for the Euro currency. However, it is worth remembering that this indicator was already published last month. The markets are already familiar with its value and in the US, GDP losses in the second quarter were almost 3 times more. Thus, it is unlikely that additional pressure will be created on the Euro currency today. Unless the GDP report is significantly worse than the previous value. The chances of building a corrective wave 4 today should not be lost. Despite the complexity of the current situation in America, the US dollar has already fallen quite strongly against the European currency. In Europe as well, everything is not smooth. Europe is not on a separate planet that Covid-19 could not reach. Its economy has also suffered. The 750 billion Euro economic aid package is also yet to be approved by the European Parliament, which has criticized the recovery fund and the seven-year budget for the Euro zone for putting many different programs under funding cuts. Currently, the European Parliament is on vacation but in the next few days it will come out of them and start new negotiations with the European Council on the already changed project of the recovery fund and budget which was agreed with all countries at the EU summit a month ago. General conclusions and recommendations: The Euro-Dollar pair presumably completed the construction of a global wave of 3 or C. Thus, at this time, I recommend selling the instrument with targets located near the calculated mark of 1.1571 which corresponds to 200.0% Fibonacci for each MACD signal down. If wave 4 is actually being built at this time, it can take a three-wave form. The material has been provided by InstaForex Company - www.instaforex.com |

| Daily Video Analysis: GBPJPY High Probability Setup Posted: 08 Sep 2020 04:40 AM PDT Today we take a look at GBPJPY. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD holding above ascending trendline support, further rise expected! Posted: 08 Sep 2020 04:39 AM PDT

Price holding above ascending trendline support and moving average. A further push up above intermediate support at 1.30760 towards 1st resistance at 1.31616 can be expected. Trading Recommendation Entry: 1.30760 Reason for Entry: 50% fib retracement, Ascending trendline support Take Profit: 1.31616 Reason for Take Profit: horizontal swing high Stop Loss: 1.30519 Reason for Stop Loss: 61.8% fib retracement The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD facing pressure from 1st resistance, further drop expected ! Posted: 08 Sep 2020 04:37 AM PDT

Price is facing bearish pressure from the first resistance level, in line with 61.8% fib retracement where we could see a drop to our support level where the horizontal swing low is. Ichimoku is also showing resistance for the price. Trading Recommendation Entry: 77.54 Reason for Entry: 61.8% fib retracement Take Profit :76.96 Reason for Take Profit: Horizontal swing low Stop Loss: 77.94 Reason for Stop loss: Horizontal swing high The material has been provided by InstaForex Company - www.instaforex.com |

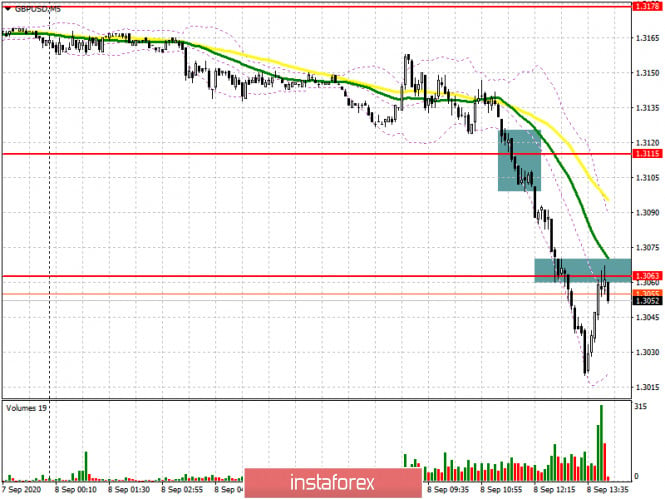

| GBP/USD: plan for the American session on September 8 Posted: 08 Sep 2020 04:37 AM PDT To open long positions on GBPUSD, you need to: In the morning, I drew attention to the high probability of a decline in the pound against the background of recent statements made by the British Prime Minister. On the 5-minute chart, the breakout and consolidation under the level of 1.3115 formed an entry point into short positions for the continuation of the downward trend. A similar entry point was formed below the support of 1.3063, from which the bulls tried to make a nondescript upward rebound. Unfortunately, long positions on the pound from the level of 1.3007 did not work out, as the pair fell just 13 points short of it. Now, after the pair returns to the level of 1.3063, there is a fairly active struggle for this range again. Bulls need to break through above this level and gain a foothold on it, which eventually forms an entry point to long positions in the expectation of restoring the pound to the resistance of 1.3115, where I recommend fixing the profits. However, a more optimal scenario is to buy on the formation of a false breakout in the support area of 1.3007 or immediately on a rebound from the low of 1.2916, based on a correction of 30-40 points within the day.

To open short positions on GBPUSD, you need to: Bears have already formed another entry point for short positions from the resistance of 1.3063, which they actively protect, and as long as trading is conducted below this range, we can expect a return of GBP/USD to the support of 1.3007 and its breakdown. Given that important fundamental statistics are not published in America today, it is likely that after fixing below this level, the bear market will only increase, forming an additional point for sales. In this scenario, we can expect a larger fall of the pair to the area of the minimum of 1.2916, where I recommend taking the profit. If the bulls manage to win back the resistance of 1.3063 in the second half of the day, it is best to wait for an upward correction to the level of 1.3115 and sell from there on a false breakout. I recommend making short positions immediately for a rebound only from the new high of today in the area of 1.3178, based on a correction of 30-40 points.

Signals of indicators: Moving averages Trading is conducted below the 30 and 50 daily averages, which indicates the continuation of a downward correction for the pair. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands In case of growth, the average border of the indicator in the area of 1.3120 will act as a resistance, from which you can sell the pound immediately for a rebound. Description of indicators

|

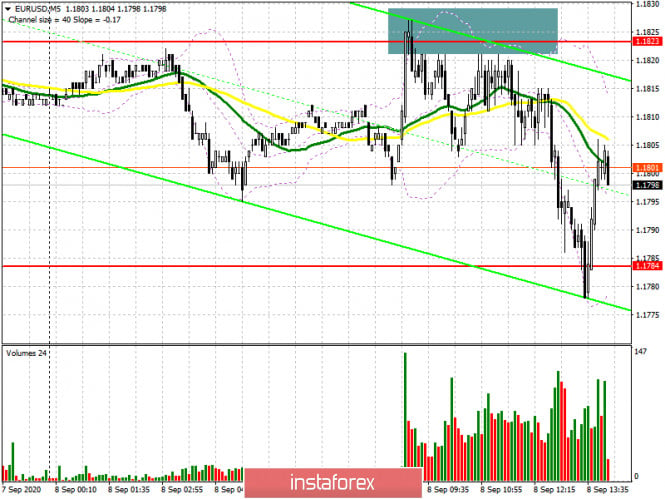

| EUR/USD: plan for the American session on September 8 Posted: 08 Sep 2020 04:37 AM PDT To open long positions on EURUSD, you need to: In the morning, the euro declined again due to the disappointing data on unemployment in the Eurozone. In my morning forecast, I paid attention to the probability of forming a false breakout at 1.1823 and recommended opening short positions from it, which happened. On the 5-minute chart, the bears protected the resistance of 1.1823, forming a great entry point from it. After that, there was a rapid decline in the euro to the support area of 1.1784, which is now being actively fought for. It was not possible to return the level of 1.1823 in the first half of the day and now the entire focus is shifted to the support of 1.1784. So far, the bulls have managed to form a false breakout there, which may lead to a second attempt to break the resistance of 1.1823. However, if there is no bull activity at this level closer to the beginning of the trading session, the fourth test of this range will likely lead to a breakdown. In this case, it is best to postpone long positions until the new low of 1.1750 is updated or buy EUR/USD immediately on a rebound from the larger support of 1.1714 in the expectation of correction of 20-30 points within the day. If the bulls manage to get above the resistance of 1.1823, then only fixing above this range will be a signal to open long positions in the expectation of a correction to the upper border of the side channel 1.1863, where I recommend fixing the profits. The longer-range target remains a maximum of 1.1906.

To open short positions on EURUSD, you need to: As noted above, sellers achieved the formation of a false breakout at 1.1823, and also re-tested the support of 1.1784, which the bulls actively protect. In the second half of the day, a consolidation below 1.1784 will signal the opening of new short positions in the expectation of continuing the decline of the euro to a minimum of 1.1750. A more distant target will be the area of 1.1714, where I recommend fixing the profits. Given that important data is not published during the US session, the bulls may try to regain the level of 1.1823 again. It is best to open short positions from it only after forming a false breakout there, similar to the morning entry point, which I analyzed a little higher. If there is no activity at 1.1823, it is best to postpone sales until the upper limit of the side channel 1.1863 is tested or sell EUR/USD for a rebound from the maximum of 1.1905, based on a correction of 20-30 points within the day.

Signals of indicators: Moving averages Trading is below the 30 and 50 daily moving averages, which indicates that the bears are trying to resume the downward correction of the market. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands A break in the lower limit of the indicator at 1.1800 will increase the pressure on the euro. A break in the upper limit of the indicator at 1.1823 will lead to an increase in the pair. Description of indicators

|

| CADJPY approaching support, potential bounce! Posted: 08 Sep 2020 04:37 AM PDT

Price is approaching our first support in line with our ascending trend line, 78.6% fibonacci extension, 127.2% and 61.8% fibonacci retracement and horizontal pullback support where we could see a bounce above this level. Trading Recommendation Entry: 80.927 Reason for Entry: ascending trend line, 78.6% fibonacci extension, 127.2% and 61.8% fibonacci retracement and horizontal pullback support Take Profit: 81.244 Reason for Take Profit: Horizontal swing high resistance, 61.8% fibonacci retracement Stop Loss: 80.800 Reason for Stop Loss: Horizontal swing low support, 100% fibonacci extension The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment