Forex analysis review |

- Hot forecast and trading signals for GBP/USD on October 13. COT report. BoE will lower the key rate

- Hot forecast and trading signals for EUR/USD on October 13. COT report. Lagarde is thinking about introducing a digital euro

- Overview of the GBP/USD pair. October 13. The European Union is going to tighten the provisions of the Brexit deal due to

- Overview of the EUR/USD pair. October 13. Donald Trump is back in line and the US dollar is falling again. Democrats and

- GBP/USD. Pound hopes for "fish compromise"

- Technical analysis of Gold

- Ichimoku cloud indicator Daily analysis of EURUSD

- AUDUSD tests short-term resistance

- Analytics and trading signals for beginners. How to trade EUR/USD on October 13? Getting ready for Tuesday session

- USD to continue its downtrend

- Bitcoin & Altcoins: buzz in crypto market reveals robust speculative activity

- Evening review on October 12, 2020

- October 12, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- October 12, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- October 12, 2020 : EUR/USD daily technical review and trade recommendations.

- Celebrity Investment: Robert Downey Jr.

- A tough week for Pound

- EUR / USD: dollar recovery may be short-lived, euro's struggle amid COVID continues

- EUR/USD Temporary Retreat?

- Experts advise to pay attention to Bitcoin

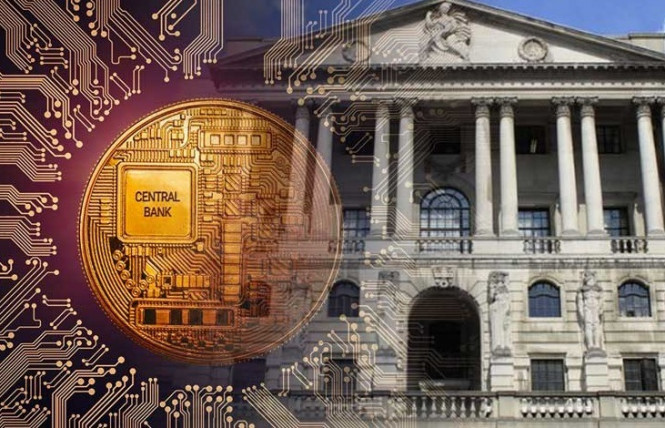

- New digital world: global currency of world regulators

- Pound dynamics amid Brexit and US Presidential elections

- GBP/USD: plan for the American session on October 12 (analysis of morning deals)

- EUR/USD: plan for the American session on October 12 (analysis of morning deals)

- USD dynamics against the background of stimulus negotiations

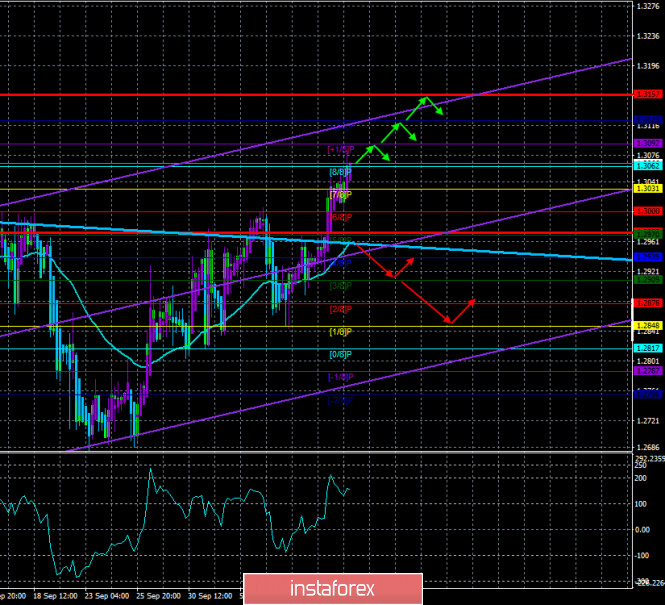

| Hot forecast and trading signals for GBP/USD on October 13. COT report. BoE will lower the key rate Posted: 12 Oct 2020 06:45 PM PDT GBP/USD 1H The GBP/USD pair tried to start correcting on October 12, as did the EUR/USD pair, but failed. Traders failed to settle below the 1.3005-1.3025 area, which is now a support area. Thus, the upward movement resumed, though not strong. In general, the upward trend continues, which is eloquently signaled by the ascending channel. Corrections, as well as on the euro, are now quite frequent, however, bulls have the initiative. The bears will be able to count on a favorable scenario only after the quotes settled below the critical line. GBP/USD 15M Both linear regression channels are directed upward on the 15-minute timeframe, which is a sign of the continuation of the upward movement on the hourly timeframe. There are no signs of the beginning of a downward correction on the smallest timeframe at the moment. COT report A new Commitments of Traders (COT) report on the British pound showed that non-commercial traders were practically resting between September 29 and October 5. The pound increased by about 140 points in this period, which, in principle, is not so much, a little more than the average daily volatility of this currency. The "non-commercial" group of traders opened 1,093 Buy-contracts (longs) and closed 435 Sell-contracts (shorts) during this time. Thus, the net position of professional traders slightly increased by 1,500 contracts. However, as with price changes, these changes in the mindset of professional traders are purely formal. It is impossible to draw any conclusions or predictions about the pair's future movement based on them. In general, the "non-commercial" group has been decreasing its net position since the beginning of September, which means that their bearish mood is strengthening. In principle, this particular behavior from large traders completely coincides with what is happening on the market during this period of time, but despite the pound's growth in the last few trading days, it still goes back to falling. Nonprofit traders have more sell contracts, and UK fundamentals remain extremely weak and dangerous for the pound in terms of the outlook for the rest of 2020 and all of 2021. One important event in the UK on Monday, October 12 - a speech from the Bank of England Governor Andrew Bailey. More precisely, not even quite a speech. The central bank conducted a survey among commercial banks regarding their readiness for negative rates. Recall that the British regulator has long been circling around a new cut in the key rate, which is now 0.1%. However, the economy (even before the official Brexit and before calculating the official losses from the second wave of the COVID-2019 epidemic) is failing again and requires additional stimulation. And additional incentives are the expansion of the quantitative easing program (which traders have no doubt about) and a decrease in the key rate to the negative area. Within a week, commercial banks must respond to the BoE's request. Although, by and large, this is called preparing for the introduction of new rates. Although representatives of the British central bank say that such polls do not mean a new easing of monetary policy in the near future. In any case, this is a bearish factor for the pound. And market participants did not take it into account on October 12. We continue to state that traders continue to ignore most of the macroeconomic information. Unfortunately. Only the general fundamental background matters. And even then, at this time, the US fundamental background is taken into account and the British one is ignored. We have two trading ideas for October 13: 1) Buyers continue to have the initiative in the market for the pound/dollar pair. Therefore, you can consider long positions while aiming for resistance levels 1.3105 and 1.3177. Take Profit in this case will be from 30 to 90 points. However, we draw the attention of traders to the very frequent corrections of the pair, so it is possible that a fall into the area of the lower line of the ascending channel will take place. 2) Sellers tried to seize the initiative several times, but they did not have enough strength to develop their success. Now the bears need to at least settle below the Kijun-sen line (1.2950) in order to be able to trade down with the targets at the support level 1.2903 and the Senkou Span B line (1.2845). Take Profit in this case can range from 30 to 90 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

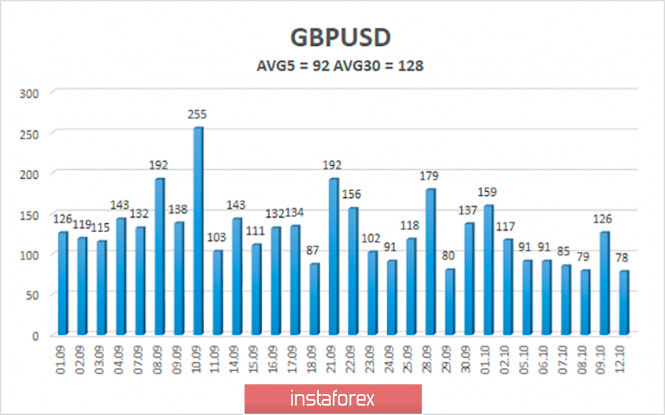

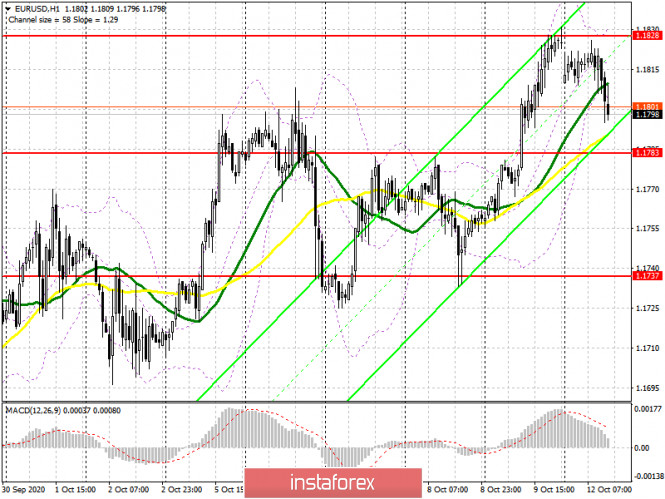

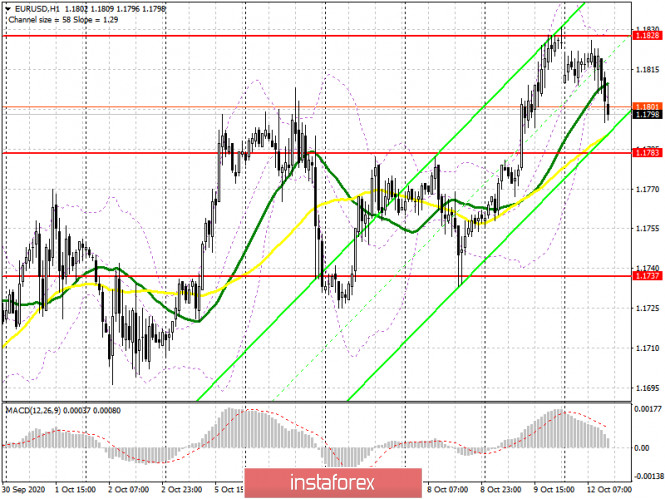

| Posted: 12 Oct 2020 06:42 PM PDT EUR/USD 1H The EUR/USD pair began to correct on the hourly timeframe on October 12, rebounding off the upper line of the ascending channel. Thus, the pair's quotes have an excellent opportunity to go down to the Kijun-sen line or even to the lower channel line. This option is absolutely possible given the nature of the pair's movement last week. At the same time, as long as the price continues to move within the channel, the upward trend remains. It is not too strong, we have already said that traders are afraid of making new critical longs on the euro around its two-year highs and they are also cautious due to the words of the European Central Bank representatives about the "too high rate". Bears see no reason or reason to sell the currency pair, given the fundamental backdrop from America. EUR/USD 15M The lower linear regression channel turned to the downside on the 15-minute timeframe, which fully corresponds to the picture of what is happening on the hourly timeframe. Thus, there are signs of starting a downward correction, respectively, on the hourly timeframe, the pair may go down to the two designated targets. COT report The EUR/USD pair has risen in price by about 120 points during the last reporting week (September 29 - October 5). But in general, there are still no significant price changes for the pair. In fact, all trades are held in a horizontal range of 250-300 points. Thus, data from any Commitment of Traders (COT) report can only be used for long-term forecasting. The latest COT report showed that non-commercial traders, which we recall, are the most important group of traders in the forex market, closed 10,784 Buy-contracts (longs) and opened 2,078 Sell-contracts (shorts). Take note that two weeks earlier, the "non-commercial" group was relatively active in building up long positions, but now it is decreasing its net position for the second consecutive week. This may indicate that the upward trend for the pair is over. Or it is about to end. We have already said that the lines of the net positions of the "commercial" and "non-commercial" groups (upper indicator, green and red lines) diverge strongly when a trend change occurs. If this is the case, the peak point of the upward trend will remain at $1.20. The net position of non-commercial traders was at its highest (green line) at this point. After reaching this level, it falls steadily. Thus, the pair may try to make another upward breakthrough as a final assault on the bulls, but you should hardly expect the pair to go much higher than the 20 figure. No macroeconomic background for EUR/USD on Monday, October 12, although ECB President Christine Lagarde delivered a speech. However, this time her speech at the video conference was not devoted to the monetary policy of the ECB, but to the possible creation of a digital euro. According to Lagarde, a final decision on this issue has not yet been made, and the digital euro is in no way seen as a replacement for fiat money, but only as an addition to it. Lagarde believes that the process of creating an electronic state currency will be very laborious and slow, but in the end, the electronic euro will be much more profitable than printed money, and at the same time it will be much faster, cheaper and safer. There were no other important messages and macroeconomic reports that day. Thus, quiet trading with volatility of no more than 40 points is absolutely logical and easy to explain. We have two trading ideas for October 13: 1) The pair continues to trade within the ascending channel, which has a small slope. In other words, the upward trend is not strong and with frequent corrections. Thus, buyers can continue to trade the pair upward while aiming for 1.1868 and the resistance area at 1.1888-1.1912 as long as the price is above the Kijun-sen line (1.1778). Take Profit in this case will be up to 80 points. You can open new longs in case the price rebounds from the critical line. 2) Bears are not in control of the market at the moment. Thus, sellers need to wait for the next chance and get the price to settle below the rising channel to be able to open new short positions while aiming for the Senkou Span B line (1.1710). In this case, the potential Take Profit is up to 40 points. Further downward movement will entirely depend on overcoming the Senkou Span B. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Oct 2020 05:07 PM PDT 4-hour timeframe

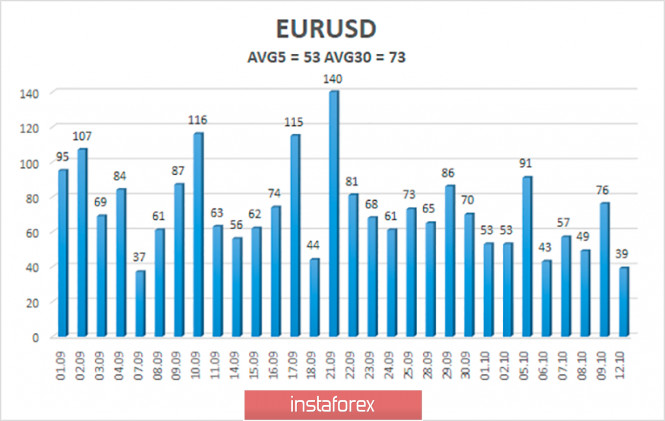

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 155.4216 The British pound spent Monday in a weak upward movement again. However, after another price rebound from the moving average line (as in the case of the euro), the upward movement resumed, and on Monday there was not even a significant correction. Thus, the British pound continues to stay afloat, although the fundamental background can bring it down at any time. The only thing that keeps the pound from falling again is the fact that traders do not want to buy the dollar in the run-up to the presidential election and against the background of all the uncertainty and crisis that is currently observed in America. If there were not so many problems in the United States now, there is no doubt that we would be catching the pound somewhere in the range of $ 1.10- $ 1.20. However, we can still do this in the coming months. We have repeatedly said that there are so many economic problems in the UK now that we simply can't count on anything other than the fall of the pound in the long term. And the British economy may face even more problems next year, which the country will finally spend outside the European Union. Experts estimate that over the next 10 years, the negative effect of the termination of all ties and agreements with the EU will not reach the British economy 3-4% of GDP. Thus, the British economy will not start to recover next year. It will continue to fall. A long-term decline or a contraction. And if the "coronavirus" fails to curb the British government in the near future, the Kingdom risks getting another serious blow from the second "wave" of the epidemic. In recent days, the incidence rates in Britain have declined and do not exceed 13 thousand per day. However, this is still a lot. Meanwhile, as we said earlier, any negotiations between London and the European Union or other international partners may become much tougher. All thanks to the "Johnson bill", which has already been passed by Parliament in the second reading and simply violates the previous agreements between London and Brussels on the border on the island of Ireland. It is reported that during the EU summit on October 15-16, EU leaders will insist on tightening the rules for compliance with any bilateral agreements with the UK, as well as on improving the mechanism of sanctions and penalties for non-compliance with them by one of the parties. Simply put, Brussels has realized that Boris Johnson can break any agreement at any time, so they want to prescribe clear rules on how to act in such cases. Naturally, these rules will mean tougher penalties for London. The European Union wants to get the right to take any unilateral temporary measures in response to London's non-compliance with the agreements. We believe that any international partners of the Kingdom will now want to prescribe similar mechanisms in any agreement with the British. Boris Johnson also had two phone conversations over the weekend. With German Chancellor Angela Merkel and French President Emmanuel Macron. Naturally, Brexit was discussed, and the British Prime Minister told his European colleagues that his country is ready to return to the WTO trade regime with the European Union. "The Prime Minister stressed that while reaching a deal in the coming days would be in the interests of both sides, the United Kingdom is also ready to start trading with the EU on the same terms as Australia after the end of the transition period if an agreement is not possible," 10 Downing Street said in an official statement. Johnson also expressed hope that a trade deal will still be possible, but few people still believe this. For example, the head of the Ministry for Foreign Affairs of Ireland Simon Coveney doesn't believe this. Coveney said that there remain serious differences between the parties on all key issues, in particular the issue of fishing and the issue of fair competition. "It is obvious that we will not reach a comprehensive agreement on the relationship between the European Union and Britain, but serious differences also remain on the way to agreeing on a deal in its most basic version," Coveney said. The Irish Foreign Minister also called the possible entry into force of the "Johnson bill" "a colossal mistake of British diplomacy and a gross violation of legal norms". At the same time, the UK is going to introduce a new three-level system of countering the "coronavirus". It is expected that the entire country will be divided into districts based on the risk of infection. The first one will be the safest, and the third one will be the most dangerous. In areas of the third level, a "hard" quarantine or even a complete "lockdown" can be introduced. Bans in such areas will even apply to the movement of citizens on the streets. The process of fighting the pandemic is complicated by the dissatisfaction of British citizens. It is reported that the British are not happy with the new quarantine measures, high fines, and overall results of the government's fight against the epidemic. Meanwhile, Bank of England Governor Andrew Bailey once again spoke about "negative rates". The regulator still states that it collects information from the banking system about the readiness or unwillingness of commercial banks to take such a step on the part of the Central Bank. The head of the BA also states that collecting information on this issue does not mean that such measures will be taken in the near future. However, as they say, "there is no smoke without fire". Market participants are waiting until the end of the year, at least, to expand the quantitative easing program from the current 745 billion pounds to 795 or 845 billion. However, the key rate is likely to be lowered again, possibly even before the end of the year. Most experts agree that the rate will be lowered with a 95% probability until May 2021. Thus, the Bank of England shows that the fears of traders and investors in the future of the British economy are absolutely not in vain. 2021 may be even more negative for the British economy than 2020. Well, the British pound in such conditions is unlikely to show stable growth. Unless the flow of disappointing fundamental and macroeconomic information from the US does not stop. Or Donald Trump will remain president for a second term.

The average volatility of the GBP/USD pair is currently 92 points per day. For the pound/dollar pair, this value is "average". On Tuesday, October 13, therefore, we expect movement inside the channel, limited by the levels of 1.2973 and 1.3157. A new reversal of the Heiken Ashi indicator downwards signals a new round of downward correction. Nearest support levels: S1 – 1.3031 S2 – 1.3000 S3 – 1.2970 nearest resistance levels: R1 – 1.3062 R2 – 1.3092 R3 – 1.3123 Trading recommendations: The GBP/USD pair continues its steady upward movement on the 4-hour timeframe. Thus, today it is recommended to stay in long positions with targets of 1.3123 and 1.3157 as long as the Heiken Ashi indicator is directed upwards. It is recommended to trade the pair down with targets of 1.2909 and 1.2848 if the price returns to the area below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Oct 2020 05:07 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward CCI: 83.4164 For the EUR/USD pair, the first trading day of the week was fairly calm and corrective. We were worried that the pair might go up sharply on Monday, contrary to common sense and traders' expectations, however, nothing happened. A normal corrective Monday with a minimum of macroeconomic and fundamental information. The upward trend for the pair remains fully maintained, thus, after a small correction to the moving average, the movement to the north may resume. Recently, the pair's quotes are very fond of bouncing off the moving average line to resume growth later. In general, the euro/dollar pair continues to trade in a very narrow price channel in the long term, with a width of no more than 300 points. This is a big channel for intraday or medium-term trading, but not for long-term trading. The fundamental background for the pair did not change on Monday and could not have changed if only Donald Trump had not done something new and discouraging. However, none of this has happened, and the US currency continues its slow decline against the euro. We have already talked about this many times. In Europe, the economic situation remains more or less stable. The authorities are afraid of the negative impact on the economy of the second "wave" of the COVID-2019 epidemic, however, the virus is still more or less under control. At least in many EU countries. As for politics, the European Union is doing well on this issue. There is unity. At the key moment, the EU countries show their unity and commitment to a common goal, which helps to make the necessary decisions (like the budget for 2021-2027 or the fund for economic recovery after a pandemic). However, in the United States, the exact opposite of European reality. The number of daily recorded cases of "coronavirus" is so large and stable from day to day that it has even ceased to surprise anyone. The media write about the huge growth rates of the disease in France or the UK, however, they don't even remember about the States, although 40-60 thousand new cases are still registered every day, and the total number of infections has already exceeded 7.7 million. However, in the near future, the States may be pushed back from the first place of this anti-rating by India, which already has 7.1 million diseases. However, this fact can hardly console the US and the US currency. Politics in America is even worse. Many media outlets and experts are now wondering whether Donald trump's COVID-2019 infection was staged? There is an opinion that Trump understands that it is the issue of the epidemic and the fight against it that can cost him victory in the election and is trying to belittle the seriousness of the virus in the eyes of voters. At the very least, Trump's infection three weeks before the election and his easiest recovery in 10 days raise some doubts about this issue. Moreover, Trump is quite capable of anything from the category of not quite fair play. The US leader has done other things before. Therefore, Trump may not have any illness at all. With this false illness, the president probably wanted to show that he (a 74-year-old elderly man with a decent excess weight) was easily and calmly cured of the "coronavirus" using the usual medications available to everyone. Will Americans believe him or not? The result will be known after the election. Also, the issue of providing a new package of assistance to the American economy and American citizens is not being resolved and is not moving forward. According to not fully confirmed information, Steven Mnuchin had a conversation with Nancy Pelosi, during which he proposed a package of $ 1.8 trillion. According to preliminary information, the Democrats will refuse this offer, however, negotiations are still ongoing between the parties, and the difference in views on the scale of assistance to the American economy is less and less different (the Democrats insist on $ 2.2 trillion). Thus, there is still hope for reaching an agreement, but quite unexpectedly, several dozen Republican senators criticized this new project, calling it "excessively expensive". Thus, this aid package can be blocked by the Senate. The meaning is completely different. There are about three weeks left until the elections, and if the parties do not agree in the near future, then a week before the elections, no one will deal with this issue. For Trump, this stimulus package is still a way to increase his popularity among voters (the president wants to give Americans $ 1,200 in checks with his signature), and for Democrats, it is a way to provide comprehensive assistance to the American economy. However, for example, White House economic adviser Larry Kudlow believes that the Senate will still approve the aid project if Democrats and Republicans eventually agree. Well, the US dollar does not react to this information. Market participants do not need hopes to help the economy in the future. Market participants are waiting for the improvement of the epidemiological situation, resolution of the political crisis, completion of elections, and all processes related to them (for example, legal proceedings on the grounds of possible fraud). And while this is nothing, they simply do not see any reason to buy the dollar. The euro currency also becomes more expensive very reluctantly. But here everything is easily explained. The euro has grown by 1,300 points since April, so this is its strongest period of growth since 2017. Traders are simply wary of continuing to buy the European currency near its two-year highs. If the pair still corrected down by 500-600 points, buyers would cheer up and resume long positions at relatively low price values. However, there was no strong correction. There was a two-month flat, and the way the pair is currently trading cannot be called a trend movement. Thus, we continue to stand by our opinion, which was voiced a few weeks ago. The US currency is unlikely to be in demand before the election. It may remain inside the 1.1620-1.1940 channel, which, although not completely sideways, is still close to it.

The volatility of the euro/dollar currency pair as of October 13 is 53 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1753 and 1.1859. A reversal of the Heiken Ashi indicator back to the top may signal the end of the next round of corrective movement. Nearest support levels: S1 – 1.1780 S2 – 1.1719 S3 – 1.1658 Nearest resistance levels: R1 – 1.1841 R2 – 1.1902 R3 – 1.1963 Trading recommendations: The EUR/USD pair continues to be located above the moving average line and has started a new round of corrective movement. Thus, today it is recommended to open new long positions with targets of 1.1841 and 1.1859 after the Heiken Ashi indicator turns up. It is recommended to consider sell orders if the pair is fixed below the moving average with the first targets of 1.1753 and 1.1719. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Pound hopes for "fish compromise" Posted: 12 Oct 2020 04:52 PM PDT The first trading day of the week shows a low level of volatility: first, the macroeconomic calendar on Monday is almost empty for the main currency pairs, and secondly, the States celebrate Columbus day, ergo American trading platforms are closed today. The market is preparing for the main events of the "shortened" week, which promises to be quite eventful. The results of another national poll regarding the ranking of Trump and Biden will be announced, key data on inflation growth will be published in the US and China, and an EU summit will be held in Brussels, which could decide the fate of the trade deals between the UK and the European Union. Anticipating the latest event is the British currency, which continues to ignore negative signals of a fundamental nature, including those related to the spread of coronavirus in Great Britain. Brexit is the most anticipated topic for the pound, so all the attention of traders of the GBP/USD pair (as well as other cross-pairs with the participation of the British) will be focused on the results of the meeting of EU leaders, which will be held on October 15-16.

Last week, the GBP/USD pair pushed off from the support level of 1.2860 (the middle line of the Bollinger Bands indicator coincides with the lower border of the Kumo cloud on the daily chart) and headed up. For three trading days, which is until the weekend, the pair moved almost without recoil, and on Friday it showed an impulse growth, breaking the resistance level of 1.3000. The immediate reason for this price movement was the general weakening of the greenback, against the background of political uncertainty in the United States and the next failure of negotiations on a package of stimulus measures. However, the growth of GBP/USD was not only due to the decline of the greenback. Traders reacted to another batch of rumors from the fields of negotiations on a trade deal. It is worth recalling that another discourse between representatives of London and Brussels ended on Friday. The heads of the negotiating delegations were stingy with comments, but still managed to put together a general "puzzle" from the fragmentary information. It became clear that the so-called "fish issue" was almost the last, but the most difficult issue in the negotiations. If the parties fail to reach an agreement by the end of the transition period, Britain could theoretically block access to its waters for EU vessels. First of all, the fishing fleets of France, Denmark, and Belgium will suffer. It was reported last week that the chief negotiator from the EU, Michel Barnier, is ready to back down on this issue – he proposed a model based on the principle of "zonal binding" – that is, the British quota shares will depend on the length of stay of fish populations in the waters of the Kingdom. However, following the last negotiations, it became clear that the British categorically rejected this option. There was another piece of information over the weekend, or rather, another compromise scenario. According to rumors, Brussels is offering to compensate fishermen from EU countries for the damage by redistributing catch quotas that were allocated to British fishermen. Moreover, ahead of a key EU summit, Barnier called on Europeans to "curb their appetites" about maintaining existing fishing quotas in British waters. Based on what he said, it is necessary to "really assess the current situation" in the context of mutual compromise concessions. In conclusion, the ball is currently away from the British, but on the side of the Europeans – if representatives of those two countries whose fleets are fishing in British waters agree to the proposed scenario, it will be a big step towards concluding a trade deal by the end of November. Most importantly, the position of the French is quite interesting for it has always taken the toughest position towards London in the Brexit negotiations. The outcome of the EU summit, which will begin in a few days, largely depends on their position. By and large, there is an optimistic mood among traders of the GBP/USD pair. A spokesman for Boris Johnson said that the British side "will do everything possible this week to conclude a trade deal" today. Earlier, it became known that during telephone conversations between Johnson and Macron, the British leader confirmed his desire to conclude a deal with the EU.

There is also another piece of information that indicates the desire of the parties to find a compromise. According to the German press, Michel Barnier met with German Chancellor Angela Merkel, with whom he agreed on all the "red lines" and acceptable compromises, last Monday. In turn, the German leader took a conciliatory position – at the end of last week, she even called on the EU to show flexibility in negotiations with London. This is an important trump card in the hands of the British, not only because of Merkel's significant influence on European politics, but also from the point of view of the fact that Germany holds the presidency of the EU Council until the end of this year. Therefore, the fundamental background for the British currency has significantly improved – primarily (and mainly) due to Brexit-related news. All other fundamental factors are negative for the currency – the situation with the coronavirus (quarantine measures are expected to be tightened in Britain) and macroeconomic reports (which indicate a slowdown in recovery processes) – play against the pound. But, as mentioned above, Brexit is the most relevant topic for GBP/USD traders so, on the eve of the EU summit, the pound paired with the dollar is holding above the key mark of 1.3000. The pair is testing the resistance level of 1.3070 (the average line of the Bollinger Bands on the daily chart) at the moment. If buyers can overcome and gain a foothold above it, then we can consider long positions to the next resistance level, which is located much higher, at 1.3220 – the upper limit of the Kumo cloud on the same time frame. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Oct 2020 02:53 PM PDT Gold price broke out and above the downward sloping trend line resistance. This week started on a negative note but as long as price is above $1,890 we remain optimistic for next few weeks.

Blue line -support Since the bottom in mid-September, price is making higher highs and higher lows. Support is at $1,890-$1,900. Holding above this level is key for bulls. If price breaks below this level we expect Gold to reach $1,860-$1,800. Next resistance level Gold bulls need to overcome is at $1,965-75. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of EURUSD Posted: 12 Oct 2020 02:46 PM PDT EURUSD although is trading inside the Kumo the bullish scenario remains the primary one as price has moved above key resistance levels. We use the Ichimoku cloud indicator to find more points of interest.

|

| AUDUSD tests short-term resistance Posted: 12 Oct 2020 02:38 PM PDT AUDUSD is trading just above 0.72 having made higher highs and higher lows starting at 0.70 near the end of September. Price has reached important trend line resistance and for price to continue higher, we should first see resistance break.

Green rectangle- support Blue rectangle -target area AUDUSD price is challenging the resistance at 0.7235. A break above this level will open the way for a move towards 0.74. On the other hand bears need to see price get rejected here at 0.72 and break below 0.71 for a deeper correction to unfold. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Oct 2020 02:02 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair began the expected corrective movement on Monday, October 12, rebounding from the upper line of the ascending channel. At the moment, it is clear that there will most likely be several rounds of a downward correction, since an upward pullback followed after the first round. Thus, the euro/dollar pair can still go down to the area of the lower line of the ascending channel. And rebounding from this line would be an ideal signal to open new long positions. Unfortunately, the MACD indicator gave a false signal to traders today. Its upward reversal could be regarded as a buy signal, but in reality the price did not go up any further and the indicator turned down again on the next candlestick. Losses on this deal could be about 10 points, which is not a lot. Therefore, novice traders can expect this correction to continue. Also in the morning we admitted the possibility of opening short positions when rebounding from the upper channel line, but we called this option risky, because it involves trading against the trend. Nevertheless, traders could earn several tens of points of profit on this trade. There is absolutely nothing to note in terms of macroeconomic news on Monday. However, the fact that there was no news and reports that day is evident from the pair's volatility. Only 39 points were passed from the low to the high of the day. Even the speech of the head of the ECB Christine Lagarde did not change the situation, since the topic of monetary policy was not touched upon. Lagarde talked about creating the digital euro and its advantages over fiat money. There was nothing more interesting in her speech. There was even little news from the White House and from US President Donald Trump. Democrats and Republicans still cannot agree on providing a cash aid package to all the citizens and sectors of the US economy in need. Therefore, the US dollar may continue to fall moderately. Several minor macroeconomic reports from the European Union are scheduled for Tuesday, October 13, but the most important report will be published in America. The consumer price index for September will be released in the afternoon, which is forecast to rise to 1.4% y/y. In general, inflation in the US has been pleasing lately. Recall that both the ECB and the Fed are targeting stable inflation at 2% y/y. However, inflation in the eurozone has been negative for three consecutive months. And it is only slightly below the target in the United States. However, one should not be prematurely happy and prepare buy positions on the dollar. Inflation in the US is relatively high because the dollar has dropped quite seriously over the past six months against a number of currencies. The same is true for the eurozone. Inflation in the EU is low because the euro has appreciated strongly against the dollar. Possible scenarios for October 13: 1) Buy positions on the EUR/USD pair remain relevant at the moment due to the fact that the upward trend line was canceled, and a rising channel was formed. However, we still advise novice traders to wait for the price correction to the lower area of this channel, as well as for the MACD indicator to discharge to zero. Afterwards, you can finally open new long positions with targets around 1.1800 and slightly higher. 2) Sell positions have lost their relevance at the moment. Traders could have earned several tens of points on the signal of a price rebound from the upper channel line. However, at this time, we would not recommend opening new short positions. To do this, you need to wait until the current upward trend has been cancelled, that is, for the price to settle below the upward channel. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (10,20,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

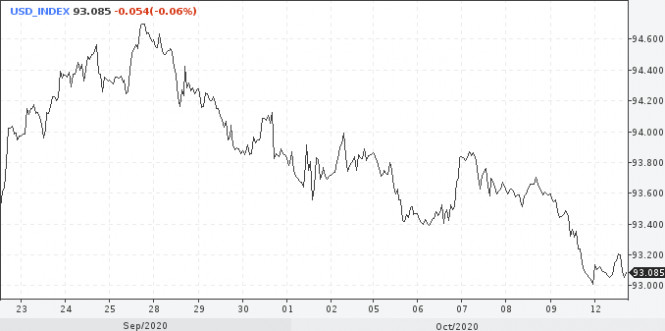

| Posted: 12 Oct 2020 08:16 AM PDT This week, market players will closely focus on the US dollar which showed high volatility during the close of the previous session. The US dollar index slipped by almost 1%, having tested the level of 93.00. In September, USDX bounced from this level following the extension of the correctional movement. Notably, the US dollar decline might be swift and easy while it is still holding above the levels reached in early September. The question is how the authorities of other countries will react to the rise in their currencies. The EUR/USD and GBP/USD pairs returned to their recent local highs. Meanwhile, the greenback slightly advanced this afternoon amid rumors that negotiations over a stimulus package for the US economy were stalled once again. However, this is not the reason for further strengthening of the US currency. As expected, the US dollar recovery was short-lived. Besides, according to the forecast of the reputable investment bank Goldman Sachs, the dollar will return to the lows of 2018. Back then, the US dollar index collapsed to 89 points. The main reason for the current US dollar's weakness is Joe Biden's growing approval rating. This indicates a high probability of his victory in the upcoming US presidential elections in November. Investors seem to re-asses the stimulus measures and their impact on the US dollar. Markets are now betting that the aid package will be adopted in January under the new US administration. In addition, the focus from this topic was shifted to the nomination of Amy Coney Barrett for the vacant Supreme Court seat. Her candidacy was proposed by President Donald Trump. The markets remain mostly positive. The prevailing risk appetite continues to weigh on the US dollar. Besides, the decline in 10-year Treasury yield, which retreated from 4-month highs, has also affected the USD rate. The yield of the Treasury bonds is likely to drop further. This means that the sell-off in the US dollar will continue. The question is how deep the greenback may fall. In the meantime, USD is moving steadily to the downside both in the long and medium term. Amid this downtrend, selling USD seems the most relevant thing to do. Although it may still attempt to rise, buying is not the best option at least until the US dollar index breaks above the level of 93.20. The immediate strengthening of commodity assets and stocks, which have a negative correlation to the US currency, certainly puts additional pressure on the US dollar. Both gold and the Dow Jones Industrial Average are currently trading in an uptrend. Meanwhile, investors will keep an eye on the third-quarter corporate earnings reports. Markets hope that American companies have eventually managed to overcome difficulties. The material has been provided by InstaForex Company - www.instaforex.com |

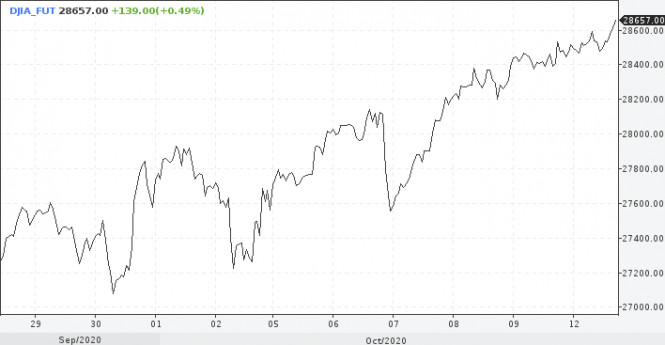

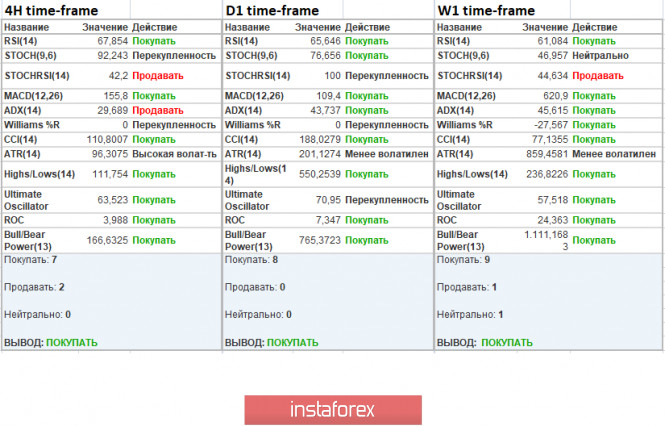

| Bitcoin & Altcoins: buzz in crypto market reveals robust speculative activity Posted: 12 Oct 2020 07:55 AM PDT Two weeks have passed since the review of the crypto market. I'm eager to share good news with you! The crypto market is reviving from a sleeping mode. This buzz is not about optimistic trading expectations but it reveals a strong chance of hitting a new local high. Greetings to all crypto hamsters and savvy crypto fans! Two weeks have passed since the review of the crypto market. I'm eager to share good news with you! The crypto market is reviving from a sleeping mode. This buzz is not about optimistic trading expectations but it reveals a strong chance of hitting a new local high. A slump in the crypto market which took place in early September spooked a crowd of traders. Lots of them went into a panic. We cannot blame them at all. The bitter experience of the recent years highlighted that sometimes the crypto market can enter a protracted losing streak. So, crypto investors have to survive a so-called severe crypto winter. I mean that the crypto asset used to tumble 30%, 50% and even 80% of its value. You may wonder why the crypto market is going to develop in a different way nowadays. The year of 2020 is challenging for the global economy. Investors want to play safe. So, they try to diversify their risks as much as possible. This trend is confirmed by regular news on humongous investment in Bitcoin and Altcoins by large investment funds. *The Tudor Investment hedge fund announced a Bitcoin purchase to the amount of $50 million in June. *The Grayscale Investments crypto fund sent $1 billion to buy Bitcoin in July. *In August, MicroStrategy bought 21,454 BTC for $250 million. In September, another deal followed with 16,796 BTC worth $175 million. *The Square payment firm, established by Twitter CEO, invested $50 million in Bitcoin in October. The above-said deals have been leaked in the media. There are much more deals which remain a mystery to the public because they are anonymous over-the-counter deals. In the meantime, decentralized financial apps like DeFi (Decentralized Finance) have launched a mechanism which has been pumping up huge cash into the crypto market. This hype is still going on. Such buoyant demand for crypto currencies is almost the same like in 2017 when crypto assets were developing a stunning bullish run. Now there is a growing likelihood that we will see soaring prices both of Bitcoin and Altcoins. Interestingly, the market environment based on the hype looks quite similar in 2017 and 2020. There is something more in common from the point of technical patterns. The recent downward correction of Bitcoin is like the one of 2017 in terms of its structure and dynamic. Besides, everyone knows that the price hits new highs following the correction. The Bitcoin's advance in the latest days could set the tone for market developments and dispel fears. So, Bitcoin is on track to hit the strongest level of the current year - $12,486 per token. Besides, the bullish trend of Bitcoin will entail a rally of other Altcoins that suggests lucrative investment opportunities. Trading prospects Since October 7, Bitcoin skyrocketed by over $9,000. Isn't it amazing? Persisting this pace of growth, there is a good chance that Bitcoin will be able to rebound to $11,900/$12,300 where the most popular cryptocurrency will enter a crucial stage. In case the price fixes above the level of $12,486 and breaks it, Bitcoin could test the local 2019 high of $13.868. The crypto market develops in such a way that the market is very sensitive. If there is sharp surge or a tailspin, the market will develop either like a powerful flood tide or ebb tide. This ensures a clear-cut trend. Overall market environment Analyzing the overall market capitalization of the crypto industry, we can see that the total market cap gained $42 billion to nearly $365 billion at present. The steady recovery is evident even in terms of trade volumes. Let me turn your attention to the corridor of $320/$355 billion that has been passed lately. This is a good signal for reviving trading interest. Market Cap: $365,365,274,357 BTC Dominance: 58.2% The emotional index (or the fear and euphoria index) for the crypto market added another 10 points to 52. It does not indicate that overwhelming fear flying over the market in early September. Market Cap: $ 365 365 274 357 BTC Dominance: 58,2% Indicator analysis Various timeframes show that technical indicators signal buying opportunity. This is true about a 4-hour, daily, and weekly timeframes. This sentiment is confirmed by the BTC uptrend. |

| Evening review on October 12, 2020 Posted: 12 Oct 2020 07:40 AM PDT

Markets are closely monitoring the US presidential elections and are looking forward to pleasing results in November. Nevertheless, it is clear that the main competitors of the dollar are preparing an unpleasant rally for it - all together. You may keep buying the euro with a stop and downward reversal from 1.1720. Buy from 1.1830. The material has been provided by InstaForex Company - www.instaforex.com |

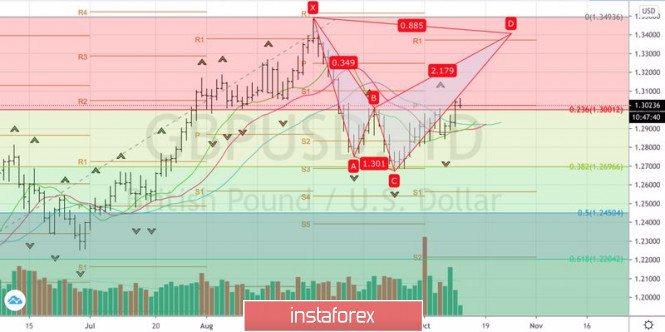

| October 12, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 12 Oct 2020 07:33 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the newly-established key-level of 1.3300. A quick bearish decline took place towards 1.2900 then 1.2780 where considerable bullish rejection has been expressed during the past few weeks. The price zone of 1.3130-1.3150 (the backside of the broken-trend) remains an Intraday Key-Zone to offer bearish pressure if retested again. Bullish Persistence above the depicted price zone of 1.2975 -1.3000 was needed to allow bullish pullback to pursue towards 1.3100. However, the GBPUSD pair has shown lack of sufficient bullish momentum to pursue above the price level of 1.3000 upon the past few bullish trials. Hence, another bearish decline towards the price level of 1.2780 was expected to gather enough bullish momentum. Instead, earlier signs of bullish rejection were expressed around 1.2850. Currently, the currentbullish breakout above 1.2980-1.3000 should be maintained to enable further bullish advancement initially towards 1.3100 and 1.3150. The material has been provided by InstaForex Company - www.instaforex.com |

| October 12, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 12 Oct 2020 07:31 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1750 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) constituted a SOLID SUPPLY-Zone which offered bearish pressure. Intraday traders should have noticed the recent bearish closure below 1.1700 - 1.1750 as an indicator for a possible bearish reversal. On the other hand, the price zone of 1.1850 - 1.1870 remains a solid SUPPLY Zone to be considered for bearish reversal upon any upcoming bullish pullback by Intermediate-term traders. Trade recommendations : Conservative traders should wait for the current bullish pullback to pursue towards the recently-broken Uptrend Line around 1.1850 for a valid SELL Entry. T/P levels to be located around 1.1770, 1.1645 and 1.1600 while S/L to be placed above 1.190 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| October 12, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 12 Oct 2020 07:28 AM PDT

On September 25, The EURUSD pair has failed to maintain enough bearish momentum to enhance further bearish decline. Instead, recent ascending movement has been established within the depicted movement channel leading to bullish advancement towards 1.1750-1.1780 which failed to offer sufficient bearish pressure. Intraday traders should have noticed the recent breakout above 1.1750 as an indicator for a possible bullish continuation towards 1.1880 where the upper limit of the movement channel comes to meet the pair. Hence, the price level around 1.1880 remains a targeted level for Intraday Traders as long as bullish persistence above the depicted KeyZone of 1.1750-1.1780 is maintained. Any downside pullback towards 1.1750-1.1780 should be considered for bullish reversal hence, a valid Intraday BUY Entry. Trade recommendations : Conservative traders should wait for the current bullish pullback to pursue towards the upper limit of the movement channel around 1.1880-1.1900 for a valid SELL Entry. The material has been provided by InstaForex Company - www.instaforex.com |

| Celebrity Investment: Robert Downey Jr. Posted: 12 Oct 2020 07:11 AM PDT

American actor and producer Robert Downey Jr. topped the Forbes list as the highest-paid actor in Hollywood from 2013 to 2015. The actor gained popularity after playing the role of Tony stark in the film adaptation of the Marvel comics "Iron Man", as well as Sherlock Holmes from the Guy Ritchie trilogy. The actor's fee for the movie "Avengers: Infinity War" ranges to $75 million. Downey received the same amount for the blockbuster "Avengers: Endgame". Such an impressive amount can be spent on real estate, cars, and various luxury items. The list of what Robert Downey Jr. prefers to invest in includes very interesting projects. 2011 was the year of the birth of Iron Man's investment company Downey Ventures, which invests in digital telecommunications startups and also incubates consumer entertainment technology companies. Downey Ventures is part of the larger entertainment film company Team Downey, which implements film and television projects. Team Downey has an extensive staff of writers, producers, designers, researchers, and engineers. It was based at Warner Bros. since 2010, and although left the largest concern in 2016, it still remains a part of such Warner Bros. projects as the film adaptation of Pinocchio and Sherlock Holmes: A Game of Shadows. A year after its founding, Downey Ventures invested in the media company Maker Studios. Initially, Maker Studios was a mechanism for collaboration on content, a community of authors of popular Youtube channels. Gradually, this community transformed into a large business, providing services for promotion, marketing, sales, and distribution of content. And in 2014, when Maker Studios had 380 million subscribers, it was acquired by Walt Disney for $500 million. An equally important step for Downey Ventures is investing in the online platform MasterClass to provide educational courses from celebrities. Through MasterClass, you can access acting lessons from Natalie Portman or Samuel L. Jackson, and learn the basics of filmmaking from Martin Scorsese. In 2019, at his speech at the Amazon Re: Mars conference in Las Vegas, Robert Downey Jr. announced the creation of an equally interesting project than all his previous ones – the Footprint Coalition investment group. This is a new organization designed to use robotics and artificial intelligence to clean up the Earth and reduce its carbon footprint within a decade. The official launch of the Footprint Coalition took place in April 2020. It is noteworthy that in September of this year, the Footprint Coalition, along with the Greycroft Venture Fund, actors Ashton Kutcher, Gwyneth Paltrow, Uber CEO Dara Khosrowshahi, and other famous people, invested $3 million in a new Cloud Paper startup. Cloud Paper company produces toilet paper based on bamboo, that is, without the use of primary wood. According to Cloud Paper, the production of toilet paper destroys 15% of all forests, and for the production of paper towels and toilet paper in the United States, about 40,000 trees are destroyed every day. The Cloud Paper approach should serve as an example and a call to stop deforestation for paper production and thus preserve nature. In the future, the company plans to produce products without the use of wood for other areas. Recently, it was reported that Downey's Footprint Coalition investment group also invested in the French startup Ynsect, which is engaged in growing insects for fertilizing plants, producing food for fish, and other Pets. It is worth noting that, according to research by Arcluster, the global insect market in the next five years will be more than $4.1 billion. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Oct 2020 06:04 AM PDT The further dynamics of the pound depends on whether the Brexit negotiations will fail or reach a new finish line this week The forecast is still positive, both sides – the EU and the UK are positive about the prospects for a deal. On the eve of a few days before Britain leaves the European Union, Boris Johnson held telephone talks with Emmanuel Macron. The Englishman told his French counterpart about his plans to explore all avenues for a deal. He also made it clear that he is ready to leave the EU with Australian-style conditions if necessary. As a result, the parties agreed that the agreement should be concluded in October to ensure the necessary time for its ratification. The deadline was set by the British unilaterally this coming October 15 for a trade deal will be unlikely to make a difference in sterling, according to the currency strategists. If the position of the parties come closer, the negotiations may last for several weeks. The pound should take such news with moderate optimism and fix above the 1.30 mark in a pair with the dollar. An unexpected failure in the negotiations will trigger a sharp drop in the British currency up to the value of 1.25. Today, the GBP/USD currency pair went up to the highest level in 1 month and is approaching the 1.3060 mark as the pair is setting up for consolidation. Sterling manages to stay at high levels not without the help of a weak dollar. In addition, he previously reacted positively to the UK GDP report for August. The economy expanded by just 2.1% against a 6.4% gain a month earlier. However, the market was satisfied because the important thing for investors is not the size of the figure but the positive dynamics, which is recorded for the fourth time in a row. The economy sank for two quarters but it is now recovering. In August, when compared with the depth of the dip in April, GDP adjusted by 21.7%. The figure is relative but it shows well what is happening in the housekeeper who is gradually returning to normal. Of course, not as fast as we would like. It is worth noting that the statistics published last Friday gave a signal for a need to stimulate the economy. If the employment report that will be released this week is unsatisfactory, the probability of further quantitative easing before the end of the year will increase, which is negative for the pound. With this, the market is interested in the speech of the head of the Bank of England, Andrew Bailey. From the point of view of technical analysis, the market today worked out the growth structure in the GBP/USD currency pair to the level of 1.3030. The probability of forming a narrow range of consolidation around this maximum is allowed. If the pound will go down, you should prepare for a correction to the level of 1.2922. Next, the pound is waiting for another wave of growth, this time above 1.31. Meanwhile, the US dollar was able to strengthen slightly at the beginning of the new week. Market players adjust their positions before important events – the EU - UK negotiations and the discussion of stimulus measures in the US. In addition, the uncertainty associated with the US presidential election is increasing. This means that the current high volatility of the GBP/USD currency pair will continue throughout the week. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: dollar recovery may be short-lived, euro's struggle amid COVID continues Posted: 12 Oct 2020 05:30 AM PDT

The greenback fell sharply after the White House proposed a new $1.8 trillion stimulus package on Friday. However, over the weekend, both House Democrats and Senate Republicans opposed the proposal. The former believe that it is not comprehensive enough, while the latter is concerned that it will increase the country's accumulated debts. Against this background, the USD index was able to move away from the minimum levels reached at the end of last week in the region of 93 points. However, according to strategists at The Goldman Sachs, the dollar recovery will be short-lived. They predict that the USD index will fall below 89 points due to the growing likelihood of Joe Biden winning the US presidential election and progress in the development of a vaccine against COVID-19. "Risks are still biased towards a weakening dollar. We see a relatively low chance of the most positive result for a greenback - a victory for Donald Trump. Along with the favorable news about the timing of vaccinations, this could bring the USD index back to its 2018 lows," The Goldman Sachs noted. Meanwhile, Bank of America experts believe that the greenback could strengthen even more thanks to its status as a defensive asset. "The global economy is already starting to weaken. We expect the reintroduction of restrictive measures in most countries, especially in Europe, which could affect the results for the fourth quarter," they said. According to the BofA forecast, the EUR / USD pair in the fourth quarter may fall to 1.1400. After rising to two-week highs in the area of 1.1830, the major currency pair returned to levels below 1.1800 on Monday. The main support factor for the euro remains an investor appetite for risk, which is fueled by hopes for a new aid package for the US economy. At the same time, the strengthening of the euro is constrained by concerns about the future prospects of the eurozone economy in the face of a new wave of the coronavirus pandemic. According to ECB chief economist Philip Lane, the economy of the currency bloc is in a precarious state after an initial recovery. The euro still maintains its recently gained advantage against the US dollar, but the EUR / USD pair may well turn south. Experts call the serious worsening of the epidemiological situation in the EU, among the arguments that can convince investors to abandon the euro, as well as negative forecasts regarding the state of the region's economy. The latter may lead to an expansion of stimulus measures from the ECB, including an increase in the QE program. In addition, on the eve of or following the results of the presidential elections in the US, investors may begin to massively fix profits on the stock market, which will lead to a sharp rise in the USD and a fall in the EUR. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Oct 2020 05:16 AM PDT

EUR/USD is traded lower at 1.1792 level, but this could be only a temporary decline. The rate has managed to jump and stabilize above the downtrend line signaling a potential leg higher, upwards movement. It has decreased to test the former high before resuming the swing higher. The critical support stands at 1.17 psychological level, so the bias will remain bullish as long EUR/USD is traded above it. The next upside targets are seen at 1.19 and 1.2 levels. A new higher high, jump above 1.1831 could bring a long, buying, opportunity.

Buy if EUR/USD reaches the 1.1840 level. The immediate target is represented by the 1.19 psychological level. Sell from below 1.17 with a downside target at 1.14 psychological level. The material has been provided by InstaForex Company - www.instaforex.com |

| Experts advise to pay attention to Bitcoin Posted: 12 Oct 2020 05:05 AM PDT Today, investing in cryptocurrency is a simple way to increase your savings, but with one important "but" – virtual money is quite a risky asset, and no one can guarantee the growth of its value in the future. In addition to this, there is another old proven option – bank deposits. However, the risks here seem even worse. Aside from having low profitability, deposits often suffer from inflation. The second alternative is stacking, which many choose as an attractive investment method. But this investment option may actually be unprofitable, since it is currently extremely difficult to predict the fate of a particular currency, even for the future 5-10 years. Therefore, let's return to a new and frightening, but still more profitable type of investment – cryptocurrency. This high-risk asset, with a certain approach and a large share of luck, can bring a profit of tens, and sometimes thousands of percent.

Experts of cryptocurrency neobanks say that the crypto market still stably remains in the positive zone at the end of a certain period (for example, a calendar year) regardless of short-term market declines. The price of digital currency is increasing from year to year, and therefore, it becomes in demand not only among ordinary people, but also among the richest people in the world and even the largest banks. Analysts say that if you invest $ 200-300 in cryptocurrency every month, you will be able to make a significant profit within a year. The capitalization of the digital financial assets market, the volumes of purchases of virtual currencies by both ordinary citizens and funds are increasing. As a result, cryptocurrencies are beginning to confidently take their rightful place in the world as the future of the financial and economic system. Many experts in their forecasts go even further and confidently declare that investing in Bitcoin can provide us with a comfortable future. This can be done using a cryptocurrency with a relatively average profitability and low risks. Thus, it makes sense to invest in Bitcoin, which has grown from $ 3,800 in 2020 to over $ 10,000. And, judging by the forecasts, the price of this currency will confidently rise, since it becomes the equivalent of gold and acquires the function of a protective asset. The indicated cryptocurrency is expected to rise to $ 20,000 in the near future and break the $ 100,000 mark within a few years. However, if you are afraid to deal with this, experts advise to pay attention to Ethereum and other cryptocurrencies that have existed on the market for a long time and are characterized by stable growth. By the way, many countries can already share their experience in this experiment. So, some cryptocurrency companies and services in America in 2019 opened the possibility of forming retirement savings with a certain share in Bitcoin. Employees of these companies can transfer a certain portion of their income to personal accumulative retirement accounts before taxes. Nevertheless, participants in this innovation are not exclusively limited to Bitcoin and can choose between more than 20,000 all kinds of assets, including private equity and real estate. Although this cryptocurrency is interesting, we should not consider it as a complete security for a pension, since digital money is a very volatile and high-risk financial instrument. The only digital currency option that can be quite attractive in terms of profitability and low in risk is products from the DeFi line, which for example is related to the provision of current cryptocurrency liquidity. However, this option should not be considered as the main investment product. The material has been provided by InstaForex Company - www.instaforex.com |

| New digital world: global currency of world regulators Posted: 12 Oct 2020 04:45 AM PDT

Information about the development of a global virtual payment tool has been circulating in the financial world for a long time. Thus, experts have high hopes for a new global digital currency that leading regulators are ready to provide. Currently, a global financial project providing for the transition to cryptocurrencies on a global scale is gaining impulse. Experts believe that the introduction of virtual currencies under state control will save the world financial system from collapsing, but this option may only work temporarily. Here, the price of potential financial stability will be high: citizens will have to pay for it with freedom. According to the plan of the world Central Bank, each citizen will have an individual digital account, with which all payments are made. This account will be the only one controlled by the state and so, customers will lose their choice with the simultaneous introduction of a global digital currency and the cancellation of Fiat money. Experts say that total state control will become an integral part of any monetary transactions. In such a situation, we can't stop protests among the population. The monetary authorities of most countries understand this, but they see no other way to save the existing system – old financial instruments no longer work, while new ones are still in the process of being created, and their implementation is difficult. Analysts consider the COVID-19 pandemic and the subsequent strict quarantine, which triggered the collapse of financial markets, to be the impulse for the collapse of the global financial system. Central banks have managed to capitalize on this situation by flooding the markets with large amounts of unsecured money. At the same time, regulators cut interest rates to minimum values. Due to the actions of the world central banks, the global financial markets received a small respite. Despite the overheating, the global financial system is trying to function as before. However, further reduction of interest rates and their transition to the negative zone can destroy the banking system. To restore it, additional cash injections will be required, and this will be the next step towards the financial abyss. But these measures may not be sufficient, since consumer demand will plummet along with mass unemployment. This can lead to an oversupply of goods and put most of the world's economies at risk. In case of another massive cash infusion, estimated in trillions of dollars, the global economy will face hyperinflation. This is very dangerous globally, as control over the situation will be lost. If a moderate rise in inflation is part of the ECB and Fed's plan, then hyperinflation raises concerns of the monetary authorities. For ordinary citizens, the consequences will be extremely negative: they are expected to rise in consumer prices. Experts note that the most important trump card of world regulators is the total financial illiteracy of the population. Many citizens are not well versed in current global processes, believing that inflation is a natural phenomenon in the economy. However, experts draw attention to the manageability of this process, which is necessary for the global Central Bank to reduce the debt burden. Analysts are confident that central banks will declare themselves as the "saviors" of the economy at the right time and offer the population the only way out – a digital bank account that provides a basic guaranteed income for everyone. There will be a gradual transition of the global financial system to a new level, involving the total digitalization of payment processes. Experts are confident that it is inevitable in the long term, and they expect the start of a new project in the near future. The financial environment continues to debate the advantages and disadvantages of this innovation, and it is difficult to predict the long-term impact on the global monetary system. The material has been provided by InstaForex Company - www.instaforex.com |

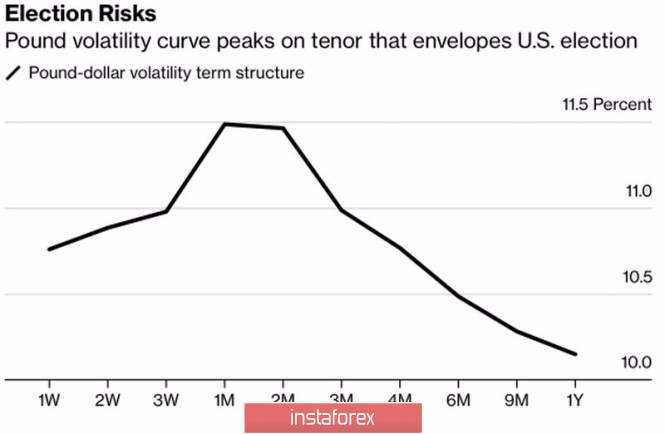

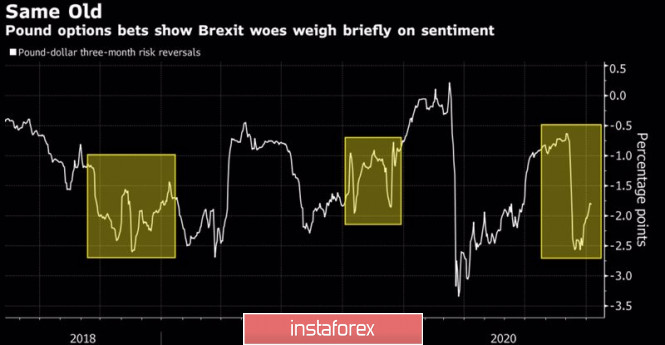

| Pound dynamics amid Brexit and US Presidential elections Posted: 12 Oct 2020 04:42 AM PDT What is more important for the British pound: Brexit or the US presidential election? The options market helps to answer this question. The monthly volatility of the sterling is the highest along the entire curve, which clearly shows that the main concerns of the traders of the GBP/USD pair are related to the voting on November 3. At the same time, the approaching EU summit on October 15-16 does not particularly frighten market players, but it may decide the fate of the divorce treaty of London and Brussels. Pound volatility curve:

Despite the threatening headlines about Brexit, investors remain optimistic about the future. The European Union threatens to abandon negotiations if Boris Johnson considers the deal impossible by October 15. Britain responds that with such language on the part of the EU, it intends to do just that. It would seem that with such rhetoric, an agreement is impossible, but experienced politicians know that quite often the worst moments in negotiations happen shortly before the deal is concluded. London and Brussels have repeatedly put their signatures on the documents in a falling flag. Donald Trump announced a few days ago that he was ending negotiations with Democrats on fiscal stimulus and then opened a new proposition in the amount of $1.8 trillion. While opponents throw thunder and lightning at each other, the pound falls, but then quickly recovers, which once again proves that the US presidential election is more important than Brexit. This is clearly seen in the risk of a sterling reversal, an indicator that reflects the ratio of premiums for call and put options. Dynamics of sterling reversal risks:

It is fascinating that despite the approaching EU summit, the demand for options to buy the pound is growing. Their share of total sales increased from 44% in September to 63% in October, and CME Group reported that it had concluded the largest deal in history with a fixed-term contract for sterling. This is a 3-month call option with a strike of $1.4. Of course, the signing of an agreement with the EU is a clear positive for the GBP/USD bulls. The pair's quotes take into account too many political risks, and a mass closing of short positions will throw the pound to $1.33-1.34, and then higher. On the other hand, the growing popularity of Joe Biden puts pressure on the US dollar. The market believes in the Democrat's victory, uncertainty is decreasing, and demand for safe-haven assets is falling. At the same time, the probability of expanding the double deficit, trade balance and budget is growing, which suggests a long-term bearish outlook for the US dollar. Stock indexes aren't even intimidated by the prospect of corporate tax increases. When the US administrations took such a step in the past, in 1987 and 2013, the S&P 500 was marked by a short-term correction, and then found the strength to restore the upward trend. The current rally in the US stock market is bad news for the dollar. Technically, the target of 88.6% for the Shark pattern, which is located in the area of 1.34-1.345, is still not fulfilled, but the GBP/USD bulls continue to look forward to this. You may continue to buy the pound on pullbacks on expectations of a breakthrough in relations between Britain and the EU. Do not forget about stop orders, which will help us in case there is no deal. GBP / USD daily chart:

|

| GBP/USD: plan for the American session on October 12 (analysis of morning deals) Posted: 12 Oct 2020 04:21 AM PDT To open long positions on GBP/USD, you need: In the first half of the day, a signal was formed to buy the British pound, which led to losses, as the bulls failed to maintain the momentum gained at the end of last week. Let's look at the 5-minute chart and analyze the deal. Buyers of the pound achieve a breakdown of the resistance of 1.3045 and test it from top to bottom, which forms a good entry point for the continuation of the bullish trend. However, we did not see a more powerful upward wave, after which the bears returned the pair to the area of 1.3045. Unfortunately, it was not possible to wait for the test of this level from the reverse side to form a sell signal, and the market went down.

As for the current picture of the GBP/USD pair, it has not changed much. Only another breakout and consolidation above the resistance of 1.3052 forms a signal to open long positions, which may lead to the demolition of a number of sellers' stop orders and strengthen the upward trend of the pair to the area of the maximum of 1.3106. A longer-term goal will be the area of 1.3178, where I recommend taking the profit. However, do not forget that today is Columbus Day in the United States and volatility, along with trading volume, will be at a fairly low level, especially in the afternoon. In the scenario of a further decline in the pair, the emphasis will be placed on the protection of the area of 1.2991, where the moving averages also pass, which are now playing on the side of the pound buyers. However, only the formation of a false breakout will be a signal to open long positions. If there is no activity on the part of the bulls at this level, I recommend that you do not rush to buy, but wait for the test of the 1.2925 area and buy the pound there for a rebound in the expectation of correction of 30-40 points within the day. To open short positions on GBP/USD, you need: Sellers defended the resistance of 1.3045, slightly changing it to 1.3052. Now all the emphasis is placed on the pair's return to the support area of 1.2991. However, only fixing below this level, where the moving averages also pass, will return the initiative to the bears and lead to the formation of a larger movement to the area of 1.2925, where I recommend fixing the profits. In the scenario of a repeated growth of the pound and a breakout of the resistance of 1.3052, especially in the absence of important fundamental statistics, it is better not to rush to sell, as the market may continue to implement Friday's bullish momentum. Most likely, the bears will resort to the protection of the resistance of 1.3106. Otherwise, you can sell GBP/USD immediately for a rebound from the maximum of 1.3178, based on a correction of 30-40 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for October 6, there was a minimal increase in short non-commercial positions from the level of 51,961 to the level of 51,996. Long non-profit positions slightly increased from the level of 39,216 to the level of 40,698. As a result, the non-commercial net position remained negative and amounted to -11,298, against -12,745, which indicates that sellers of the British pound remain in control and have a minimal advantage in the current situation. The higher the pair grows, the more attractive it will become for sale. Signals of indicators: Moving averages Trading is above 30 and 50 daily averages, which indicates a possible continuation of the pound's growth in the short term. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1. Bollinger Bands A break of the upper limit of the indicator in the area of 1.3052 will lead to a new major wave of growth of the pound. A break of the lower border of the indicator in the area of 1.3010 will increase the pressure on the pair. Description of indicators

|