Forex analysis review |

- Daily Video Analysis: XAUUSD High Probability Setup

- AUDUSD push up above ascending trendline support!

- USDCAD retesting 1st resistance, further drop expected !

- EURUSD has reversed from first resistance, potential for drop!

- October 2, 2020 : EUR/USD daily technical review and trade recommendations.

- October 2, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- October 2, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- EUR/USD: sluggish eurozone's inflation and controversial US nonfarm payrolls

- USD unlikely to benefit from Trump's COVID-19 diagnosis

- Technical analysis of Gold

- Technical analysis of AUDUSD

- EURUSD expected to turn lower

- Analysis of EUR/USD on October 2. Inflation in the European Union continues to slow down.

- Bed Bath & Beyond sees all-time gain amid quarantine

- Stocks on October 2: what quotes require attention?

- Technical recommendations for EUR/USD and GBP/USD on October 2

- Trading recommendations for the GBP/USD pair on October 2

- USD and JPY strengthen again

- Optimism in the US stock market

- BTC analysis for October 02,.2020 - Market in contraction, watch for the breakout to confirm further direction

- Wait and hope or wait and worry: Forex is covered by a wave of volatility

- EUR/USD analysis for October 02 2020 - Potential for the rally towards 1.1769

- Analysis of Gold for October 02,.2020 - Bull flag pattern on the 30M time-frame and potential for the new upside leg

- Stock indexes in Japan and Australia declined on Friday

- Euro follows fashion

| Daily Video Analysis: XAUUSD High Probability Setup Posted: 02 Oct 2020 10:33 AM PDT Today we take a look at XAUUSD. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD push up above ascending trendline support! Posted: 02 Oct 2020 10:33 AM PDT

AUDUSD holding above moving average support and 23.6% Fib retracement. MACD is above 0 as well showing room for further bullish momentum. A short term push up towards 1st resistance at 76.200 can be expected. Trading Recommendation Entry: 0.71498 Reason for Entry: 50% fib retracement, moving average, ascending trendline support Take Profit : 0.72031 Reason for Take Profit: Recent swing high Stop Loss: 0.71011 Reason for Stop loss: Recent swing low The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD retesting 1st resistance, further drop expected ! Posted: 02 Oct 2020 10:32 AM PDT

USDCAD is going up to retest our 1st resistance and might reverse further from there towards 1st support where the horizontal pullback support is. EMA(89) is also showing signs of bearishness. Trading Recommendation Entry: 1.3324 Reason for Entry: 38.2% fib retracement Take Profit: 1.3242 61.8% fib retracement Stop Loss: 1.3381 Reason for Stop Loss: 76.4% fib retracement, horizontal pullback resistance The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD has reversed from first resistance, potential for drop! Posted: 02 Oct 2020 10:31 AM PDT

Price has reacted off our first resistance which is in line with 61.8%, 100%, 127.2% Fibonacci extension and horizontal graphical area, where we could potentially see price dropping towards our first support. RSI is also showing bearish pressure at the 59.69 level. Trading Recommendation Entry: 1.17686 Reason for Entry: 61.8%, 100%, 127.2% Fibonacci extension and horizontal graphical area Take Profit: 1.16530 Reason for Take Profit: 78.6% fibonacci retracement and 38.2% Fibonacci extension. Stop Loss: 1.18120 Reason for Stop Loss: 78.6%, 127% fibonacci Extension, and horizontal graphical resistance The material has been provided by InstaForex Company - www.instaforex.com |

| October 2, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 02 Oct 2020 09:41 AM PDT

By the end of August, the EURUSD pair has achieved a temporary breakout above the previously mentioned resistance zone located around 1.1900. However, Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. That's why, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800 then 1.1770-1.1750 which failed to offer sufficient Support for the EUR/USD. Earlier Last week, a breakout to the downside was executed below the price level of 1.1750 (Lower limit of the depicted movement pattern). Hence intraday technical outlook has turned into bearish. Intraday traders should consider any pullback towards the recently-broken key-zone (1.1750-1.1770) for a valid SELL Entry. On the other hand, a breakout above 1.1820 (Exit Level) will probably enable further upside movement towards 1.1860-1.1900. The material has been provided by InstaForex Company - www.instaforex.com |

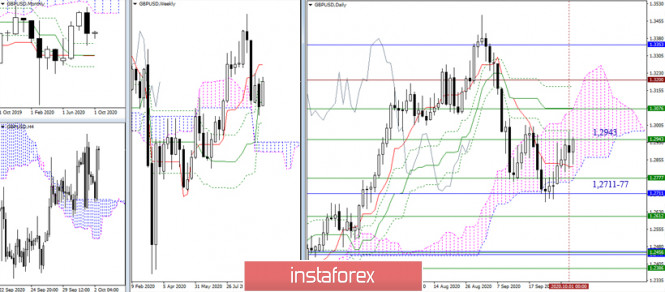

| October 2, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 02 Oct 2020 09:25 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the newly-established key-level of 1.3300. A quick bearish decline took place towards 1.2900 then 1.2780 where considerable bullish rejection has been expressed during the past few weeks. The price zone of 1.3130-1.3150 (the backside of the broken trend) remains an Intraday Key-Zone to offer bearish pressure if retested again. However, the GBPUSD pair has shown lack of sufficient bullish momentum to pursue above the price level of 1.3000 upon the past few bullish trials. Bullish Persistence above the depicted price zone of 1.2975 -1.3000 is currently needed to allow bullish pullback to pursue towards 1.3100. Otherwise, further bearish decline would be expected towards the price level of 1.2600. Trade recommendations : Conservative traders are advised to wait for the current bullish pullback to pursue towards 1.3130-1.3150 (the backside of the broken trend) for a valid SELL Entry. Initial T/p level is to be located around 1.3050 and 1.2900 if sufficient bearish pressure is maintained. The material has been provided by InstaForex Company - www.instaforex.com |

| October 2, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 02 Oct 2020 09:21 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1750 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) constituted a SOLID SUPPLY-Zone which offered bearish pressure. Intraday traders should have considered the recent bearish closure below 1.1700 - 1.1750 as an indicator for a possible bearish reversal. The price zone of 1.1775-1.1850 remains a solid SUPPLY Zone to be considered for bearish reversal upon any upcoming bullish pullback by Intermediate-term traders. Trade recommendations : Conservative traders should wait for the current bullish pullback to pursue towards the recently-broken DEMAND Zone around 1.1800 - 1.1850 for a valid SELL Entry. T/P levels to be located around 1.1770, 1.1645 and 1.1600 while S/L to be placed above 1.1860 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

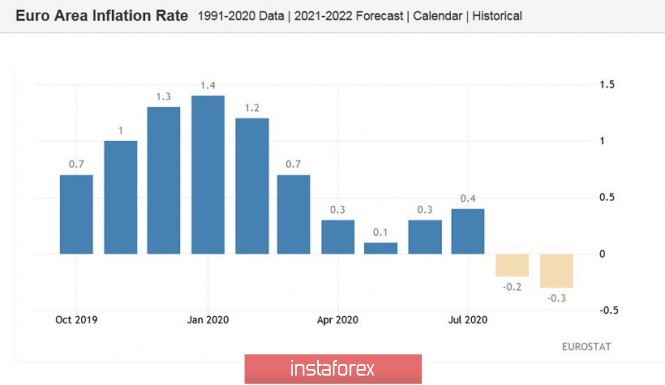

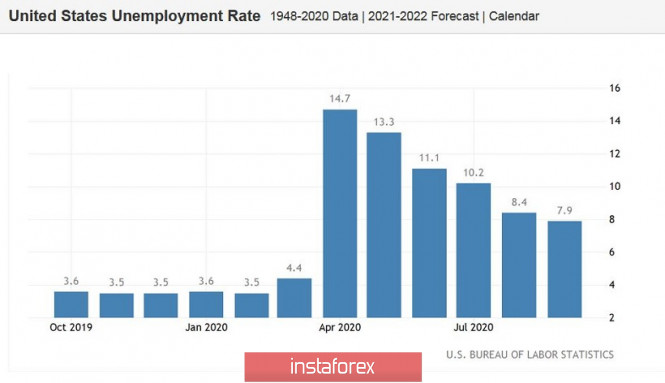

| EUR/USD: sluggish eurozone's inflation and controversial US nonfarm payrolls Posted: 02 Oct 2020 09:05 AM PDT The economic news released today discouraged both the bulls and bears. None of them found support from macroeconomic metrics. As a result, the currency pair is still treading water. The US dollar gained a minor advantage, though the pair showed a downtick. Both the euro and the US currency are vulnerable. So, traders are hesitant to open both long and short positions. European inflation disappointed in the first half of Friday. Both the headline indicator and the core CPI entered the "red zone", having failed to reach the weak forecast values. Thus, the headline consumer price index remained in the negative area, falling to the level of -0.3%. The indicator was at such lows for the last time in March 2015, that is, more than five years ago. The core consumer price index (excluding volatile energy and food prices) showed similar dynamics, dropping to 0.2%, defying the forecast for 0.5% climb, the weakest growth rate on record. In response to this release, EUR/USD dropped to almost 1.17 and even tested a lower level but quickly rebounded. Firstly, the market was ready for such downbeat scores, especially after the release of data on sluggish inflation in Germany. Let me remind you that in Germany the consumer price index also remained in the negative area - both in annual and monthly terms. Indicators also entered the "red zone", signaling similar trends on a pan-European scale. The predictions came true: Germany's inflation seen as a barometer for the whole euro area confirmed its status and at the same time softened the blow from the European figures. In addition, immediately after the release, the published data was commented on by Vice President of the ECB Luis de Guindos. He reacted rather cautiously to the situation, noting that inflation in the eurozone is likely to remain in the negative territory until the end of this year. However, he expressed confidence that the recovery will take place in the first half of next year. Gindos also explained that prices are falling mainly due to low energy prices and weak consumer demand. In other words, the ECB vice-president reacted rather calmly to the inflation anti-records set today, allowing the buyers of EUR/USD to hold the upper hand in anticipation of the US Nonfarm payrolls. In turn, the US data on the labor market left a mixed impression. In general, American Nonfarm payrolls bring a surprise: as a rule, one of the components defies the expected levels, disclosing the ambiguity of the situation. Therefore, the first reaction of the market is often false: traders evaluate the significance of one or another indicator in the context of other indicators and in the end make their own "verdict". Today the situation is similar. On the one hand, there is a decrease in unemployment and an increase in the number of people employed in the public and private sectors. On the other hand, there are all the other components that fell short of the projected values. Thus, the number of people employed in the non-agricultural sector increased by 660 thousand, while analysts expected this indicator to be much higher - almost at the level of a million (980 thousand). Wages also disappointed, which turned out to be much worse than the expected values. Average hourly earnings fell to 0.1% on a monthly basis, while traders expected to see it at 0.5%. In annual terms, the index also slowed down. This suggests that inflation is unlikely to gain momentum in the near future. However, today's release also had a positive side. The unemployment rate, which dropped to 7.9%, was a kind of "spoonful of honey". The increase in the number of people employed in the private sector of the economy amounted to 877 thousand, better than the forecast of growth by 850 thousand). In the manufacturing sector, this figure jumped immediately by 66 thousand (according to forecasts, it should have been twice as low). Thus, today's macroeconomic reports could not clear up market sentiment on EUR/USD. By and large, the price remained in the same trading range within the corridor 1.1620-1.1830 (the lower line of the BB and the upper border of the Kumo cloud in the daily chart). The news that Donald Trump is tested positive for COVID-19 forced traders to be cautious. As a result, the pair has been drifting at near 1.17, waiting for the next information drivers. It is risky to open any deals today, as the market has already responded to the published data. By Monday, the fundamental background for the pair may change significantly. Trading sentiment will depend on how Trump's coronavirus disease progresses, on the results of negotiations between the Republicans and Democrats over a new stimulus package, as well as on the outcome of negotiations between the British Prime Minister and the head of the European Commission. As you can see, the weekend is expected to be packed with events. So, EUR/USD is likely to open with a gap on Monday. The question is open whether it will be upward or downward. The events of the coming days may determine the trajectory of EUR/USD in the medium term. The material has been provided by InstaForex Company - www.instaforex.com |

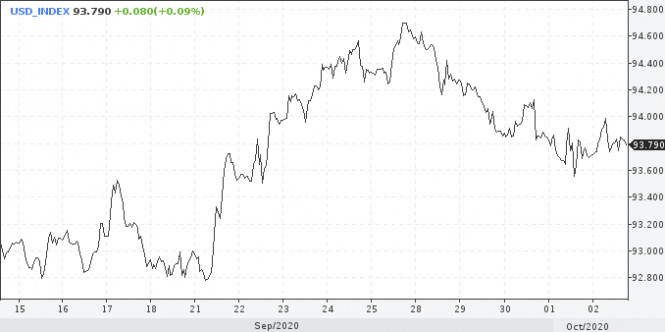

| USD unlikely to benefit from Trump's COVID-19 diagnosis Posted: 02 Oct 2020 08:42 AM PDT US dollar's first reaction to the news about Donald Trump's coronavirus diagnosis was positive. This is where the defensive asset factor came into play. The American currency rose moderately against its major rivals. Only the Japanese yen and the Swiss franc resisted the dollar's growth as their status of safe have assets is stronger than the one of the US dollar. But when the markets get over the first shock, what their reaction will be? At the moment, the uncertainty around the presidential elections has increased. Trump appears to have contracted the virus from its senior aide Hope Hicks. Friday news reminded that the country is still in the midst of a crisis. Markets are now focusing on the spread of the coronavirus and its impact on the economy. Over the past day, more than 43,000 new cases of infection have been confirmed in the US, and over 850 people have died. The head of the White House along with the First Lady are now in quarantine. This stops Donald Trump from participating in the planned pre-election events. So, market players have already made their bets. Analysts think that Trump's disease could further weaken his position as a presidential candidate and contribute to the victory of his main opponent Joe Biden. Some market participants are almost sure that a representative from the Democratic Party will become the next US president. Historically, the US dollar has a tendency to change its trend dramatically when a new president from another party enters the White House. For example, during the first presidential term of Republican Ronald Reagan, greenback showed a multi-year steep rise thanks to the victory of Fed Chairman Paul Volcker over inflation. A similar situation was observed during the presidency of Bill Clinton, the representative from the Democrats. The US dollar has seriously advanced amid the improvements in the labor market and the reduction of national debt. When Republican George W. Bush took office, budget deficit deepened, causing the US currency to depreciate. Under Obama, the dollar hit the bottom, but then rose again and has been consolidating ever since. As for the current possible change of the leader, the following scenario is expected. If Donald Trump loses to Joe Biden, Democrats will win a majority in both houses of Congress. Thus, budget spending in the United States will expand together with the budget deficit, and the US dollar will collapse. In the meantime, the greenback stays cautious and does not make any serious movements. On Friday, US dollar posted some minor gains while trading between the two important levels. The breakdown of one of them will indicate future prospects of the US currency. If the dollar settles above 94 points, this should help it resume the uptrend. On the other hand, the breakthrough below the mark of 93.75 will indicate the continuation of the downtrend. At the moment, the markets are driven by the coronavirus news, while the existing positive factors are largely ignored. Thus, markets have downplayed the news about the approval of a $2.2 trillion stimulus package. This Friday, key data on the US labor market was published. This could slightly adjust the dollar's trajectory, depending on investors' expectations. According to the report, the number of new jobs in non-agricultural sectors increased by 877 thousand, while it was projected to rise by 850 thousand. What is more, the US unemployment rate in September fell to 7.9% from 8.4% in August. Markets had expected unemployment to be at 8.2%. At the moment, investors are closely watching the health condition of the US President. If coronavirus symptoms are mild, Trump will soon be ready to get back to the election race. Besides, if there are no serious consequences for his health, Trump will be able to make bold statements. For instance, he might claim that even elderly people like him can avoid serious complications. So, the criticism of his opponents against his coronavirus policies would have no ground in this case. If Trumps' disease has a more severe form, like that of British Prime Minister Boris Johnson, everything will get more complicated. The president's energy will decrease and his ambitious plans will be put on halt. Besides, Trump's critics will gain support, and doubting voters might take the side of Joe Biden. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Oct 2020 07:35 AM PDT Gold bulls are fighting at the key resistance area of $1,900-$1,910. As we said many times before, this is very important resistance area. This area was tested as support four times before being broken. It will not be easy for bulls to recapture it.

Red rectangle - resistance Red line - resistance trend line Gold price is back testing the break down area. As long as price is below the red downward sloping trend line we prefer to be bearish and consider each bounce as a s selling opportunity. Price is near key resistance and that is why we prefer to short Gold now as stops are very close. The most likely scenario for us is to see Gold price reverse and move lower towards $1,800. Key short-term support levels are at $1,870 and $1,850. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Oct 2020 07:31 AM PDT AUDUSD has bounced towards 0.72 from 0.70. Price is back testing broken support that is now resistance. AUDUSD is at a critical junction. A rejection here and a move below short-term support at 0.71 could lead to another leg lower towards 0.69.

Red line - trend line resistance If price breaks above the green trend line, we next expect price to challenge the red downward sloping resistance trend line. At 0.7165 where we are currently, I prefer to be short with stop at 0.7215 and target 0.71-0.69. If price breaks above 0.7215 I expect price to reach 0.7260 at least. My preferred scenario is to see a rejection and reversal at current levels. The material has been provided by InstaForex Company - www.instaforex.com |

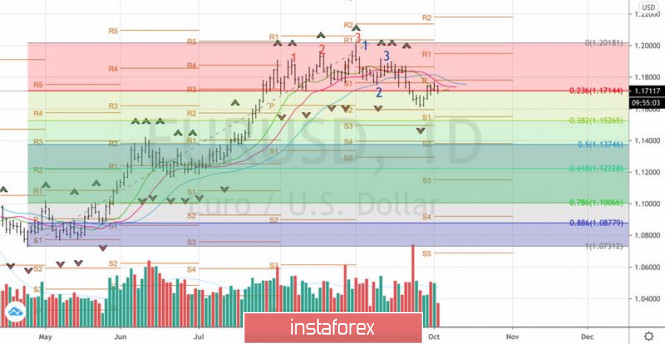

| Posted: 02 Oct 2020 07:26 AM PDT EURUSD is trading around 1.1710 after reaching as high as 1.1770 this week. Bulls were unable to hold above 1.1750 and price got rejected at key resistance levels. We continue to expect price to fall towards 1.15 as long as price is inside the bearish channel.

Red line -expected direction EURUSD has back tested 1.1750 which was previously support and now resistance. Price is forming a bearish channel and we see signs of a new rejection and turn lower. From next week I expect stronger selling pressure on EURUSD for a move towards 1.15. Support is at 1.1685 and next at 1.1615. Resistance remains at 1.1750-1.18. We prefer to be bearish as long as price is below 1.18 targeting 1.15. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of EUR/USD on October 2. Inflation in the European Union continues to slow down. Posted: 02 Oct 2020 07:02 AM PDT The wave marking of the EUR/USD instrument in global terms still looks quite convincing. According to the current wave pattern, the expected wave 4 as part of the upward trend section could have already completed its construction. The upward section of the trend can still take a longer 5-wave form. This scenario requires only a strong news background for the euro and a weak one for the dollar. So far, this is exactly what it is now. The smaller-scale wave marking shows that three smaller-order waves were built inside the assumed wave 4, and three more waves of an even smaller order were built inside the assumed wave b or 4. Thus, the entire wave 4 may already be completed. If this is true, then the increase in quotes will continue from the current levels with targets located above the peak of wave 3 or C. How much higher will depend on the news background for the instrument. The next trading week on the Forex market is coming to an end. During this week, the euro/dollar instrument presumably completed its decline. So now I'm waiting for the price increase to resume. The news background throughout the week was quite disorderly. Markets spent most of the week debating the outcome of the debate between Donald Trump and Joe Biden. However, according to many media and experts, this was the most disastrous and shameful debate in the history of the United States. I can't say that they affected the movement of the instrument in any way. Most likely, it was just an interesting event. Meanwhile, the situation with the coronavirus in America is not improving in any way and it is getting worse in the European Union. The EU government has already announced the beginning of the second wave of the pandemic, with some countries, such as Spain and France, recording very high levels of disease, up to 30,000 cases a day. For comparison, in America, about 40,000 cases continue to be recorded daily. However, comparing the number of residents of the United States and France does not make sense. Thus, the Eurozone is moving towards a deterioration of the epidemiological situation, and at the same time the economic situation, since it is naive to believe that the second wave of the epidemic will not leave a mark on the economy. I would say that so far the euro currency is just on the edge, but it can collapse at any moment. It keeps afloat because of America and the US dollar. Let me remind you that the US economy collapsed even more seriously in the second quarter, and Congress cannot agree on a new package of stimulus measures that will help it continue to recover. Also in the United States, the date of the presidential election is approaching, and today it became known that US President Donald Trump and his wife were infected with the coronavirus. In general, the whole world continues to be covered by the COVID-2019 virus, and in the current conditions it is impossible to make a forecast for any tool for a month or more. I recommend starting from wave marking as a more objective and unambiguous type of analysis at this time, rather than a fundamental one. The increase in quotes means that the news background should not be against the euro and the dollar. General conclusions and recommendations: The euro/dollar pair presumably completed the construction of the global wave 3 or C and wave 4. Thus, at this time, I recommend buying a tool with targets located near the calculated mark of 1.2012, which corresponds to 0.0% Fibonacci, for each MACD signal up, in the calculation of the construction of the global wave 5. The material has been provided by InstaForex Company - www.instaforex.com |

| Bed Bath & Beyond sees all-time gain amid quarantine Posted: 02 Oct 2020 06:56 AM PDT

The management of Bed Bath & Beyond could well throw off a celebration because during the period of massive decline in sales, the company was able to achieve the exact opposite. For the first time in the last four years, and even in such an unusual period, the retailer's quotes climbed as much as 33.47%, reaching a level of $ 19.99. Shares have also risen, following the release of this strong second quarter report. Like any other store, Bed Bath & Beyond relied on online sales that is quite logical in the context of the pandemic. Surprisingly, it provided an unprecedented jump in revenue, more than 80% of its usual earnings. This indicates that during the quarantine period, people equipped their homes, buying up all the goods necessary for coziness and comfort. Their second quarter report said that the company attracted about 2 million new customers during the pandemic, which resulted in high sales amid low advertising costs. Nevertheless, Bed Bath & Beyond executives did not make projections based on annual results, as apparently, they are frightened to drive off luck. The company does not even plan to relax despite the improving coronavirus situation, so not so long ago, it announced the development of a nationwide product delivery service, which is planned to be implemented in cooperation with Shipt and Instacart. It also increased its management staff this year, but at the same time reduced some jobs and closed unprofitable outlets. Now, the company expects to save up to $ 350 million a year. On October 2, Bed Bath & Beyond has a scheduled online investor meeting, and its purpose is to outline future plans for its business. The material has been provided by InstaForex Company - www.instaforex.com |

| Stocks on October 2: what quotes require attention? Posted: 02 Oct 2020 06:20 AM PDT

Today, anxiety arose in the stock market, and this is due to Donald Trump's announcement that he and his wife tested positive for the coronavirus. His statements caused a 1.75% collapse in S&P 500 index, as well as a depreciation on some risky assets. As for oil, trading shows a 3.23% drop in Brent futures, returning the quote to a price of $ 39.44 per barrel. Traders, being careful amid a surge in coronavirus incidents, are choosing not to trigger sudden movements, especially since the market has recently been full of doubts over new restrictive measures implemented by the government. In addition, supply has boosted since September, which is due to increased oil production of OPEC countries. Compared to August, production has now climbed up by 160 thousand barrels per day, most of which is from Iran. Meanwhile, the trade war between the United States and China continues to strike the markets as well, and one of their latest competition is the technological developments of their country. It is already clear that the US government will not bow down in terms of technological breakthroughs, however, China has the same attitude as well, which only escalates the rivalry between the two counties. For example, electric car manufacturer, Tesla, is projected to suffer, as according to experts' forecasts, its sales will suffer big losses, with which by 2030, it will most likely fall to zero. Regardless, CEO Elon Musk aims specifically at the Chinese market with his developments, as evidenced by the electric car factory he built in China. Today, investors are also awaiting the publication of data on trading volume for September, which will be provided by the Moscow Exchange. In August, the total trading volume increased by 9.3%, and this is due to the stock market having positive dynamics of about 76.5%. If the latest report indeed shows a significant increase in volumes, shares in the trading floor will rise sharply as well. The material has been provided by InstaForex Company - www.instaforex.com |

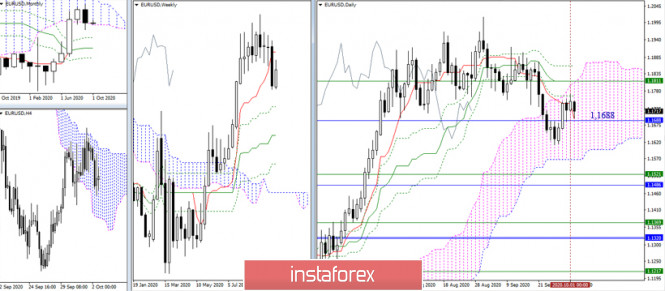

| Technical recommendations for EUR/USD and GBP/USD on October 2 Posted: 02 Oct 2020 06:09 AM PDT EUR / USD We are near the end of a new trading week. In September's closing, the bulls managed to prevent the most optimistic final for the opponent. The support (1.1688) for monthly cloud is relevant again and the pair is in the correction zone. Moreover, further stages of strengthening bullish moods can now be described as follows: elimination of the daily dead cross and restoration of support for the weekly short-term trend (weekly Tenkan 1.1811 + daily Kijun 1.1812 + daily Fibo Kijun 1.1859); recovery of the upward trend (high extremum 1.2011); and rise to the upper limit of the monthly cloud (1.2167). If the bears manage to break through the support at 1.1688 and restore the trend (1.1612), the result of interaction with a fairly wide support zone of 1.1567 (the lower limit of the daily cloud) - 1.1521 (weekly Fibo Kijun) - 1.1486 (monthly Fibo Kijun) will be important. On the other hand, the bulls in the smaller time frames are now fighting for the advantages that they successfully got earlier, but the situation is quite risky. The support of the loss of the weekly short-term trend (1.1700) is now being tested and may swing the scales again in favor of the downward trend. The next task will be to restore the downward trend (1.1612). These H1 prospects are now in unity with the expectations of the upper time frames, and support for the weekly short-term trend (1.1700) is strengthened by the monthly level (1.1688). If the bulls manage to keep what they have achieved and regain the central pivot level (1.1745), then the resistance of the classic pivot levels will be the further upward pivot points (1.1773 - 1.1798 - 1.1826) within the day. GBP / USD The pair reached a strong and important support level at 1.2777 (weekly Kijun + lower limit of the daily cloud) - 1.2711 (monthly Fibo Kijun) before September's trading closed. However, reaching this zone did not allow the bulls to consolidate the maximum bearish sentiment in September and so, the sentiment that formed a long lower shadow on the monthly candlestick remains and is likely to be reflected at the current close of the week. For the bulls, the next important levels are now located at 1.2943 (weekly and daily Fibo Kijun) - 1.3077 (upper limit of the daily cloud + daily Kijun + weekly Tenkan) - 1.32 (historical level + the final line of the day Ichimoku cross). Meanwhile, for the bears, the zone of 1.2777-11 is still very important. The nearest support can be noted at 1.2612 (weekly Fibo Kijun), then the most strengthened and defining zone will wait for the bears in the area of 1.2450, where many strong levels have accumulated from different time frames. In the smaller time frames, bulls try to defend their current advantages by using the key supports on H1 - the central pivot level (1.2895) and the weekly long-term trend (1.2853). The pivot points for further growth within the day are the resistances of the classic pivot levels 1.2971 - 1.3054 - 1.3130. In case of consolidation below (1.2895-53), the current balance of power will change at H1, and the main task of the bears will be to restore the downward trend (1.2674). Here, the nearest supports are found at (S1) 1.2812 and (S2) 1.2736. Ichimoku Kinko Hyo (9.26.52), Pivot Points (Classical), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

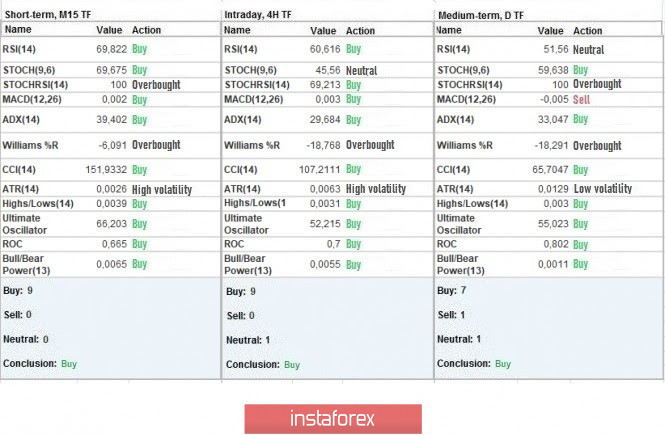

| Trading recommendations for the GBP/USD pair on October 2 Posted: 02 Oct 2020 05:53 AM PDT Like the euro, the GBP / USD pair is still under a correction, however, the only difference is that the pound has a high degree of speculation amid a high concentration of information noise. Thus, as a result, the quote fluctuated more than 350 points, which is almost the same as the surge last March. The main driver of this development is the uncertainty over latest news, especially in the UK and the US. Hence, it is important to always monitor the occurrences around the world, as such will enable traders to be on the wave of speculative jumps as quickly as possible. One example is the pattern on the M15 chart for the GBP / USD pair, which, if we review closely, we will see three bursts of activity: 08: 30-09: 45 [DOWN]; 12: 00-12: 30 [UP]; 13: 45-14: 45 [DOWN]. It is quite a rare occurrence when full-fledged V-shaped formations can be seen in such a short period of time. In terms of daily dynamics, the indicator has recorded as much as 158 points, which is 26% higher than the average level. This suggests that the amount of speculative positions is off the charts, and that this is definitely not the end. So, if we look at the trading chart in general terms, that is, the daily period, we will see a correction, during which the quote practically touched the psychological level of 1.3000. The news yesterday was the impetus for such a development, and this is the EU's legal action against the UK over the controversial internal market bill. According to European Commission President Ursula von der Leyen, the Commission has sent an official letter to London, notifying the country of its breach of obligations. The first speculative jump in the pound occurred during this time. "This is the first stage of the procedure for violating the law. This letter invites the United Kingdom to provide us with its comments within one month, "von der Leyen said. A spokesman from the British government said that the UK will respond in due time, but at the same time defended that London just wants to protect the integrity of the British home market and the Northern Ireland peace process. In turn, EU chief negotiator Michel Barnier said that the EU gives an absolute priority to the full and effective implementation of the Brexit treaty. In another note, the latest report on jobless claims in the US was published yesterday, and the data for which indicated that the US labor market continues to recover. According to the report, initial applications for unemployment benefits have decreased from 873,000 to 837,000, while repeated applications have reduced from 12,747,000 to 11,767,000. The US Department of Labor will add up an employment report today, publishing the latest unemployment rate in the country. The projection is a drop from 8.4% to 8.3%, and a rise of about 915.00 new jobs outside agriculture. The upcoming trading week has a sparse economic calendar. Thus, the pound will move according to the latest news, particularly on Brexit, COVID-19 and the US elections. Monday, October 5 UK 09:30 - Service PMI (September) US 15:00 - ISM business activity index for the services sector (September) Tuesday, October 6 US 15:00 - JOLTS (August) Wednesday, October 7 US 19:00 - latest FOMC protocol Thursday, October 8 US 13:30 - jobless claims Friday, October 9 UK 07:00 - volume of industrial production (August) UK 07:00 - volume of construction (August) Further development As we can see on the trading chart, the constantly high speculative activity in the market led to large price jumps in the GBP / USD pair. So, as a result, a zigzag pattern has formed on the M15 chart. Meanwhile, the correction is clearly seen on the daily chart, during which the pound practically traded at a quote of 1.3000. Now, the pound is most likely to continue a bullish momentum, but it will just be a local move. Everything could change once the US trading session starts, that is, a reversal towards the level of 1.2830. Indicator analysis Looking at the indicators on the different time frames (TF), we can see that the minute, hourly and daily periods signal BUY, and it is because of high speculative activity in the market. Weekly volatility / Volatility measurement: Month; Quarter; Year Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year. (The dynamics for today is calculated, all while taking into account the time this article is published) Volatility is currently at 115 points, which is already very high considering that it is speculators who are the main drivers on the market. Key levels Resistance zones: 1.3000 ***; 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support Zones: 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411). * Periodic level ** Range level *** Psychological level Also check trading recommendations for the EUR/USD pair here, or brief trading recommendations for the EUR/USD and GBP/USD pairs here. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Oct 2020 05:47 AM PDT

Today, it was announced that US President Donald Trump and his wife tested positive for COVID-19. Following this news, the US dollar and the Japanese yen increased in value. Now the President and First Lady of the United States are in quarantine. However, Donald Trump continues to work as usual in the White House. Earlier, President's trusted advisor Hope Hicks also tested positive for the coronavirus infection. The US dollar Index, which measures it against a basket of six other currencies, grew by 0.1% to hit 93.797. USD/JPY fell by 0.4% to settle at 105.11, the lowest level this week. EUR/USD fell by 0.1% to trade at 1.1732, GBP/USD decreased by 0.2% to 1.2870, and risk-sensitive AUD/USD dropped 0.3% to 0.7160 as well. Analysts note that the situation in the market is extremely tense and unstable: Treasury yield, shares, and futures fell in price, while the US dollar, on the contrary, advanced. Investors are wary of this situation and turn to cash. The start of cold season plays into the hands of the coronavirus, which is increasingly spreading across the United States. According to statistics, the number of infected people has increased by 4.4% weekly since September. The virus has not gone anywhere, and it is still dangerous. Investors avoid risk as a new $ 2.2 trillion fiscal stimulus package has not yet been approved. The House of Representatives, or rather the Democrats, have approved the law. Whether the Republican-dominated Senate will approve it, remains a question. However, the news about Donald Trump's infection had a negative impact on the European indices. Thus, the DAX index in Germany fell by 0.8%, the CAC 40 in France decreased by 0.8%, and the British FTSE index lost 0.7%. Danske Bank analysts are worried about how the virus will affect the president's health and his presidential campaign. There is also a risk that other members of the US government may also be infected. Speaking of Europe, Equinor ASA shares fell by 0.5%. Many major oil companies tumbled, with BP, Royal Dutch Shell, and Repsol falling to 52-week lows. Rolls-Royce shares lost 6.8% However, not everyone is doing badly. Renewable energy company Orsted, for example, and wind turbine maker Siemens Gamesa have reached new record highs. Oil also fell in price. US crude oil went down by 2.4% to trade at $37.80 per barrel, while Brent collapsed by 2.7% to settle at $39.83. Gold futures also dropped by 0.1% to $1,915.70 per ounce. The material has been provided by InstaForex Company - www.instaforex.com |

| Optimism in the US stock market Posted: 02 Oct 2020 05:45 AM PDT

There was a clear growth in the US stock indices this early October: The Dow Jones Industrial Average rose by 0.13%, Standard & Poor's 500 by 0.53%, and NASDAQ Composite by 1.42%. Yesterday, the Dow Jones indicator also did not yield its positions and was able to increase by 1.2%, the S&P 500 by 0.83%, and the NASDAQ by 0.74%. Recently, the US stock market has also been marked by optimism, although it is worth recognizing that the results of September still demonstrated a negative trend when compared with March's achievement. On the other hand, shares of several major US companies also increased yesterday: PepsiCo shares rose by 1.6%, Ford Motor by 1.4%, Bed Bath & Beyond by 25.1%, and General Motors by 2.7%. However, Constellation Brands' quotes declined by 2.6%. This week's discussion of a new package of measures to restore the US economy may alarm the market. If the agreement to support the economy will not be clearer, consumers may well cut their spending. Thus, this will negatively affect the US economy, which already needs serious recovery. Either way, consumption is the driving force and to support it, it is necessary to implement the second law on measures to rescue the US economy soon. Against the background of the expectation of such a law, the Fed decides to extend the restrictions on the payment of dividends, as well as the ban on the repurchase of shares by the largest US banks for 3 months. The restrictions affected 33 US banks that have more than $100 billion in assets in stock. The US unemployment statistics published last week showed that the number of Americans who applied for unemployment benefits for the first time was 837 thousand, while it was 873 thousand a week earlier. The US population experienced a 2.7% decline in income in August when compared to the previous month. However, the expenses of the Americans increased by 1%. In September, there was also a decline in the index of business activity in the US manufacturing sector (to 55.4 points), which reached 56 points in August. Analysts predicted the index to rise to 56.4 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Oct 2020 05:43 AM PDT Further Development

Analyzing the current trading chart of Bitcoin, I found that there is still sideways regime and contraction watching the daily time-frame. My advice is to watch for the breakout of the support or resistance to confirm furher direction. The breakout of support at $10,150, might confirm downside movement towards $9015 The upside breakout of the resistance at $11,100 might confirm the bullish movement towards $12,000 Key Levels: Resistance: $11,100 Support level: $10,150 The material has been provided by InstaForex Company - www.instaforex.com |

| Wait and hope or wait and worry: Forex is covered by a wave of volatility Posted: 02 Oct 2020 05:39 AM PDT

Reports that US President Donald Trump has tested positive for the coronavirus have triggered a new wave of volatility in the markets and spurred demand for defensive assets. Greenback gained about 0.6% against the risk-sensitive Australian namesake. The yen showed the steepest jump in more than a month. Despite such growth, the USD / JPY pair has fallen by almost 0.5%, reaching a weekly low near 104.95. "The results of Trump's coronavirus test fuel rumors that Joe Biden will lead the presidential race, and provoke the growth of the yen and the dollar," strategists at Mizuho Securities said. Risk sentiment was also undermined by the fact that the promotion of the next fiscal stimulus package stalled in Washington. House Speaker Nancy Pelosi and US Treasury Secretary Stephen Mnuchin have so far failed to bridge differences over the size of the aid package. "Wait and hope or wait and worry - market sentiment fluctuates between these two states," said Bank of Singapore. Reports of Trump's health have supported the dollar as a safe haven asset ahead of the U.S. employment report. However, the greenback may suffer if US labor market data disappoint, showing slower job creation in September.

The main currency pair is stuck in a flat at 1.1700-1.1770. The chances of additional easing of monetary policy by the ECB are growing in response to the increased risks of a slowdown in the pace of economic recovery in the EU. In addition, uncertainty about the agreed European economic assistance fund has increased. Analysts at Commerzbank said, "Lingering divisions within the EU heighten fears that the fund will not be ready to roll out as planned on January 1." "This could weaken the euro and limit its upside, at least until it becomes clear that the fund is finally ratified," they added. Meanwhile, GBP / USD continues to serve as a barometer of sentiment around Brexit. The pair fluctuated between 1.2820 and 1.2980 on Thursday, depending on the news that came out. The pound collapsed after the EU notified the United Kingdom of the possibility of filing a legal action in case London does not amend the pending internal market bill. Then upon the reports of a possible compromise between the parties on government aid, the pound sterling immediately jumped. However, a few hours later, an EU official denied reaching an agreement. The likelihood of a trade deal between London and Brussels is currently estimated at 50/50. Therefore, further volatility of the GBP / USD pair should not be surprising. It is expected to continue trading between 1.2700 and 1.3000 in the coming weeks. The material has been provided by InstaForex Company - www.instaforex.com |

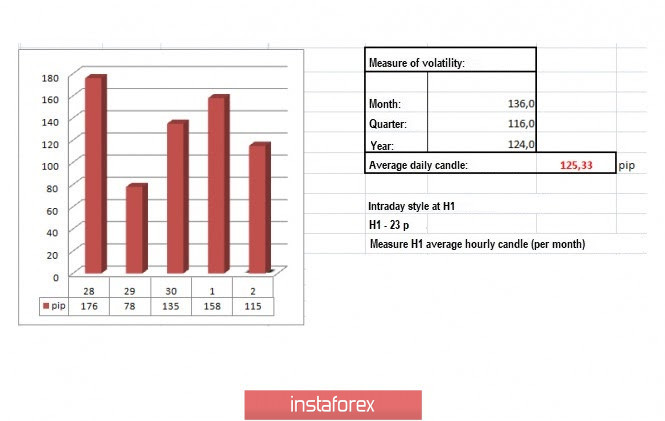

| EUR/USD analysis for October 02 2020 - Potential for the rally towards 1.1769 Posted: 02 Oct 2020 05:24 AM PDT The "risk off" trade is on as the market reacts to the news that President Trump has tested positive for Covid-19 virus. VP Pence has tested negative. The JPY is the strongest. The AUD is the weakest. The USD is more strong with gains vs all major currencies with the exception of the GBP and JPY. The GBP is higher on news that PM Johnson is inserting himself into the Brexit negotiations picture and will meet with EU president von der Leyen tomorrow. The US stocks are lower. Of course, we have US jobs at 8:30 AM ET/1230 GMT with expectations for 850K (vs 1.37M last month). The unemployment rate is expected to come in at 8.2% from 8.4%. As I discussed in the previous review, the EUR is holding the support at 1,1700, which might be the sign that buyers are in control. Further Development

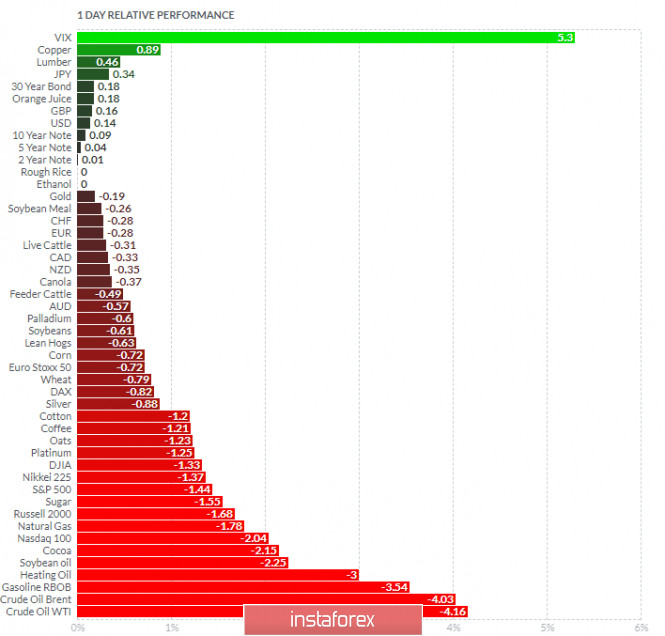

Analyzing the current trading chart of EUR, I found that there is the successful test of the low at 1,1705, which is positive for the further upside movement. 1-Day relative strength performance Finviz Based on the graph above I found that on the top of the list we got VIX and Copper today and on the bottom Crude Oil and energry sector. The EUR is neutral on the relative list and is waiting for the Non-Farm Employment Change numbers. Key Levels:

Resistance: 1,1740 Support level: 1,1705 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Oct 2020 04:53 AM PDT ECB's de Guindos: Hopes to finish strategy review by the middle of next year Recently, they have tried to push the 'symmetrical' narrative on their inflation outlook/mandate but then Lagarde tried to make some inroads to 'average' inflation targeting - similar to the Fed - earlier in the week here. As much as the ECB wants to try to build a similar narrative as the Fed, let's be real. It'll be good work if they can help price pressures recover fromthe lows seen today, but to consistently overshoot 2% for a period of time? That's nothing but a pipe dream. As I discussed in the previous review, the Gold managed to keep the upside pressure and in my opinion, there is the room for further upside swing to develop. Further Development

Analyzing the current trading chart of Gold, I found that the buyers are in control and that you should watch for buying opportunities on the dips. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got VIX and Copper today and on the bottom Crude Oil and energry sector. The Gold neutral on the relative list and is waiting for the Non-Farm Employment Change numbers. Key Levels: Resistance: $1,920 and $1,936 Support levels: $1,905 and $1,890 The material has been provided by InstaForex Company - www.instaforex.com |

| Stock indexes in Japan and Australia declined on Friday Posted: 02 Oct 2020 04:42 AM PDT The main stock indexes in Japan and Australia declined on Friday amid extremely low activity during the trading session. The markets in China, Hong Kong, and South Korea are still closed due to the holidays. Meanwhile, the Tokyo Stock Exchange was able to open today after a massive disruption that occurred yesterday. All problems have been fixed, and the system is functioning properly. However, this did not save stock market indexes in Japan from declining, especially in the light of the country's poor economic results. In particular, the unemployment rate was 3% higher in August compared to the previous month, when a 2.9% decrease was recorded. All this indicates that the crisis is still ongoing and that Japan has not been able to tackle it yet. Moreover, this is the highest unemployment rate recorded in the last three years. In addition, the new job offers to applicant ratio, a leading indicator for the labor market, decreased in August. Previously there were 108 open vacancies per 100 applicants. Now, there are 104. This has been the lowest level for almost six years. Japan's Nikkei 225 index dropped by 0.8% today. The Australian S&P/ASX 200 index plunged by 1.45% in the morning. The statistics here have not been the best lately. Thus, retail sales in the last summer month decreased immediately by 4% compared to the previous reading. This has not happened in the last five months. The main stock indicators also decreased in Europe this morning. This happened after the American president announced that he tested positive for the coronavirus. The Stoxx Europe 600 index of large enterprises in the European region declined by 0.41% to 360.32 points. The UK FTSE 100 Index sank by 0.59%. The German DAX index fell by 0.73%. France's CAC 40 index went down by 0.67%. Italy's FTSE MIB Index lost 0.42%. Spain's IBEX 35 Index dropped by 0.16%, the smallest decline in the region so far. The material has been provided by InstaForex Company - www.instaforex.com |

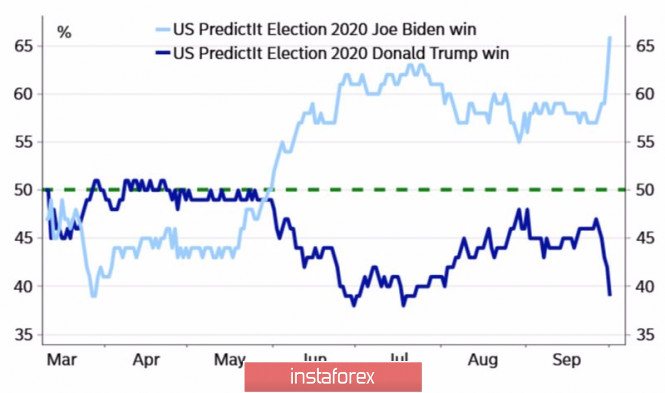

| Posted: 02 Oct 2020 04:35 AM PDT With about a month left before the US presidential election, it's no surprise that financial markets are getting deeper into politics. The EUR/USD pair did not react much to statistics on American business activity, applications for unemployment benefits, and income-expenditure of the population, preferring to closely monitor the twists and turns of political events. The debate between Donald Trump and Joe Biden did not reveal a winner. Many called the debate the worst in US history and a new day in presidential politics. Opponents interrupted each other and did not skimp on insults. The main achievement of the Democrat is to maintain a high rating after the discussion. Dynamics of the rating of candidates for the post of President of the United States

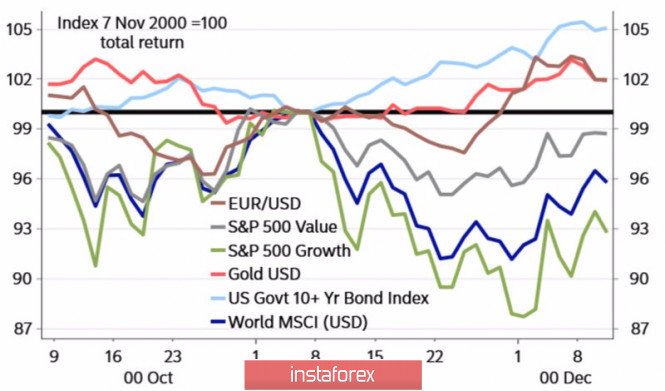

Looking at the growing popularity of Joe Biden, it becomes clear that the "bears" in EUR/USD do not want to develop a correction. In 2017-2020, the market has a firm belief that what is good for Donald Trump is good for the US dollar, thus, the Republican's failures are a reason to sell the US currency. Perhaps its main trump card is uncertainty. This includes uncertainty related to the counting of votes. The current owner of the White House does not intend to admit defeat just like that. He is sure to accuse the Democrats of fraud because of the ability to vote by mail. However, the history of the United States already knows examples when there were problems with the counting of votes. This was the case in 2000 during the Bush and Gore presidential campaign. Then the euro rose against the dollar despite the existing uncertainty. The reaction of the assets on the problems with counting votes in 2000

If we add to the fact that the "bulls" for EUR/USD should not be afraid of the presidential elections in the States, the confident pace of the German and Chinese economies, we can only wonder why the pair is not in a hurry to restore the upward trend. In my opinion, there are three reasons. ECB, Brexit, and the second wave of COVID-19 in the Old World. Despite the fact that the EUR/USD quotes have gone from the psychologically important mark of 1.2 by almost three figures down, the European Central Bank continues to express dissatisfaction with the regional currency exchange rate. This is evident both in comments about its significance for monetary policy and in hints about the regulator's willingness to do more than what it has already done. A new feature was the intention of Christine Lagarde and her colleagues to consider following in the footsteps of the Fed. Targeting average inflation is a fashionable thing, and the ECB is clearly following fashion. In my opinion, the "bears" for EUR/USD should not delude themselves about this. The Fed's transition to a new strategy essentially corrects its past mistake – an early increase in the federal funds rate, while the European Central Bank did not make such a mistake. It has been a long time since it was able to rein in inflation, and the change in wording will not change much. Thus, both the "bulls" and "bears" on EUR/USD have their trumps, thus, the fate of the pair will depend on how well they are played. A break in the resistance at 1.179-1.18 may be a signal for purchases. EUR/USD, the daily chart

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment