Forex analysis review |

- Hot forecast and trading signals for GBP/USD on October 28. COT report. Traders waiting for information on the progress of

- Hot forecast and trading signals for EUR/USD on October 28. COT report. Complete flat and hopes for it to finish

- USD/CAD. Preview of the Bank of Canada's October meeting

- Analytics and trading signals for beginners. How to trade EUR/USD on October 28? Getting ready for Wednesday session

- EUR / USD struggles to stay afloat

- USDJPY challenges major support

- Ichimoku cloud indicator Daily analysis of Gold

- Short-term technical view on EURUSD

- October 27, 2020 : EUR/USD daily technical review and trade recommendations.

- October 27, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- October 27, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- European and Asian stocks continue to decline amid growing threat of COVID-19 pandemic

- Evening review of EURUSD on October 27, 2020

- GBP/USD analysis on October 26. The wave pattern allows for continuous growth of the British currency

- Analysis on EUR/USD on 27/10/2020: Interest in the US presidential election is the highest since 1908

- Bitcoin continues to grow, exhibits positive trade prospects

- USD on defensive ahead of presidential election

- GBP/USD: plan for the American session on October 27 (analysis of morning deals)

- EUR/USD. Intrigues of American politicians and a phlegmatic dollar

- BTC analysis for October 27,.2020 - BTC is heading towards my target at $13.830. Strong upside condition

- Currency markets remain calm while the stock markets are declining

- Analysis of Gold for October 27,.2020 - Contraction on the Gold and potential for the breakout

- Trading recommendations for EURUSD pair on October 27

- EUR/USD: plan for US session on October 27 (analysis of morning deals). Bears may hit 1.1788.

- EUR/USD analysis for October 27 2020 - Potential for C wave to complete and more downside movement towards 1.1775

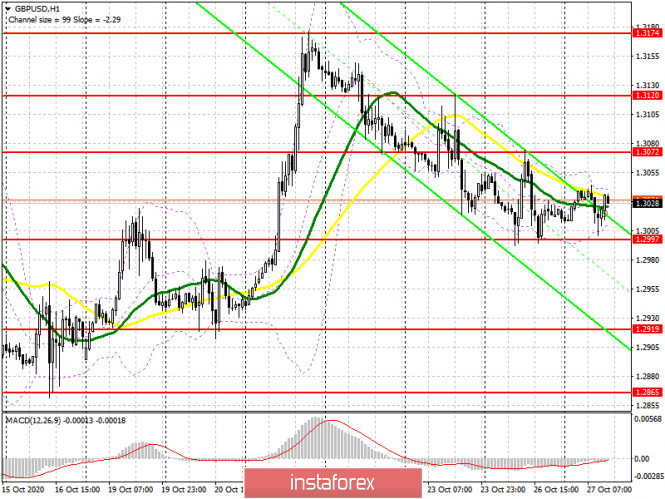

| Posted: 27 Oct 2020 06:38 PM PDT GBP/USD 1H The GBP/USD pair also traded mostly sideways on Tuesday, October 27, between the Senkou Span B and Kijun-sen lines. Therefore, the technical picture for this pair has practically not changed. The only thing that you should take note of is that the pair left the descending channel, which appeared recently, showing the bears' weakness at this time. Traders of the pound/dollar pair are also frankly cautious at this time and do not regret trading more or less actively. Volatility was only about 80 points yesterday, which is not very little, but not much as well. Therefore, buyers need to overcome the critical line in order to bring the pair back to the rising channel and be able to take it back to the resistance area of 1.3160-1.3184. After several attempts, sellers failed to overcome the support area of 1.3004 - 1.3024, so their prospects look even worse now. GBP/USD 15M The major linear regression channel is directed horizontally on the 15-minute timeframe, and the minor channel is directed upward. However, in general, the situation is approximately the same as for the EUR/USD pair - there is no trend movement. COT report The new Commitments of Traders (COT) report for the pound showed that non-commercial traders were quite active during October 13 to 19. However, at the same time, the last few reports have completely made the situation complicated. The "non-commercial" group of traders opened 4,485 Buy-contracts (longs) and closed 4,072 Sell-contracts (shorts). Thus, the net position of professional traders immediately grew by 8,500 contracts, which is quite a lot for the pound. However, the problem is that non-commercial traders have been building up their net position (strengthening the bullish sentiment) over the past few weeks, and before that they have reduced their net position for several weeks (strengthening the bearish sentiment). Thus, over the past months, professional players have not even been able to decide in which direction to trade. The fundamental background continues to be very difficult and ambiguous for the pound/dollar pair, which is why the trades are so confusing. The pound sterling lost approximately 110 points during the reporting period. And the net positions of commercial and non-commercial traders are now practically zero. In other words, both the most important and largest groups of traders have approximately the same number of Buy and Sell contracts open. Naturally, such data from the COT report does not allow any conclusions, either short-term or long-term. No important news from the UK on Tuesday. Not a single macroeconomic report was published, no speeches by Prime Minister Boris Johnson, no comments from persons associated with the negotiations on the Brexit trade deal. Therefore, traders simply had nothing to react to, and they had no desire to trade exclusively on technique. The situation is even more difficult for the pound, because in addition to the elections in the United States, which are very stressful for the markets, the situation with Brexit, the trade deal, and the prospects for the British economy remains completely incomprehensible in the UK. Thus, you need to wait for either new, important information that will force traders to make trading decisions, or the entry into the forefront of major players who will be able to move the pair from a dead center. Again, no macroeconomic report or other important event scheduled for Wednesday. All hope for at least some information about the course of negotiations between Brussels and London. It may appear unexpectedly, and is also impossible to predict. One should trade in such conditions now. We have two trading ideas for October 28: 1) Buyers for the pound/dollar pair failed to stay above the Kijun-Sen line. Thus, long positions are no longer relevant. You are advised to re-consider options for longs in case the price settles higher. However, the pair managed to leave the descending channel, so in case the price settles above the critical line (1.3084), you may open new longs while aiming for the resistance area of 1.3160 -1.3184. Take Profit in this case will be up to 70 points. 2) Sellers took several steps towards the new downward trend, but gave up very quickly and failed to overcome the Senkou Span B line (1.3018) and the support area of 1.3004-1.3024. You may consider options for opening sell orders, but only below this area while aiming for the support level at 1.2897. Take Profit in this case can be up to 90 points. It is extremely difficult to count on more now. Hot forecast and trading signals for the EUR/USD pair Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

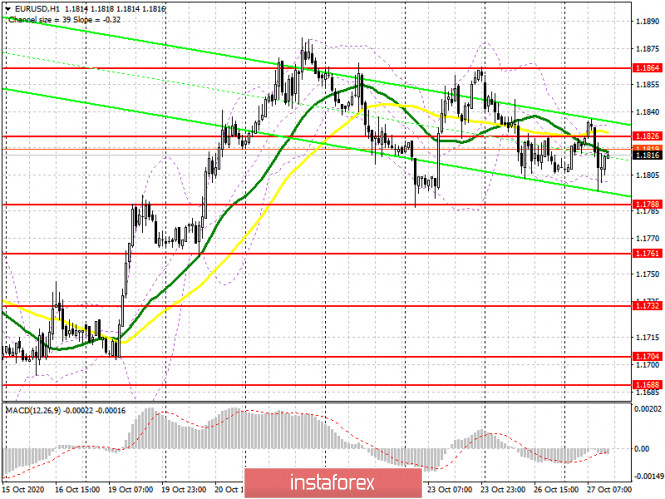

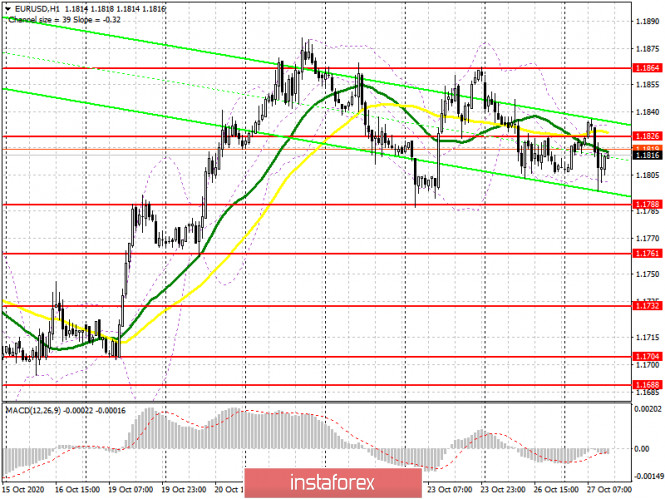

| Posted: 27 Oct 2020 06:36 PM PDT EUR/USD 1H The euro/dollar pair was absolutely flat on the hourly timeframe on Tuesday, October 27. The pair could not even approach the Senkou Span B line during the day, so the bears could not form a favorable situation for themselves. Also, traders failed to overcome the Kijun-sen line, so buyers were also out of work all day. The technical picture has not changed at all. Formally, we now have a descending channel, but it is so blurred and directed more sideways than down. Take note that globally, the pair continues to trade within the $1.17-1.19 horizontal channel. Therefore, it is absolutely flat in all time frames. Accordingly, you need to wait for it to end. EUR/USD 15M The lower linear regression channel turned to the upside on the 15-minute timeframe, indicating a new round of upward movement on the hourly chart. However, in fact, all channel reversals on the current chart have no value, since we still have a flat. COT report The EUR/USD pair fell by around 40 points during the last reporting week (October 13-19). But in general, no significant price changes have been observed for the pair in recent months. Therefore, data from any Commitment of Traders (COT) report can only be used for long-term forecasting. The new COT report showed even fewer changes in the mood of professional traders than the previous one. Non-commercial traders, who, we recall, are the most important group of traders in the foreign exchange market, opened 1,081 Buy-contracts (longs) and 673 Sell-contracts (shorts). Take note that the "non-commercial" group decreased its net position in the last two weeks, which may indicate the end of the upward trend. However, the data provided by the latest COT report does not tell us anything at all. There are no changes, since non-commercial traders have opened almost 300,000 euro contracts. Thus, opening or closing of 1,000-2.000 contracts does not indicate anything. The lines of net positions of the "non-commercial" and "commercial" groups (upper indicator, green and red lines) continue to barely narrow, while the pair itself continues to trade in a horizontal channel. Therefore, we stick to our opinion - the upward trend is completed or is about to be completed, and the high reached near the 1.2000 level may remain the peak of this trend. The US published a macroeconomic report on Tuesday, which had no impact on the pair's movement. The data was for orders for durable goods. Yesterday we drew the attention of traders to the fact that the probability of market reaction to this report is negligible. And so it happened. Volatility during the day was "unreal", by 43 points, which is extremely low even on the smallest timeframes. In principle, all four derivatives of durable goods orders exceeded their forecasts. However, the dollar failed to extract any dividends for itself. Thus, we can only state what we have said many times. The markets on the eve of the 2020 US presidential elections, which are already exactly a week away, are not going to risk in vain. The global flat has been persistent for three months now, and a local flat has also begun. Thus, we can only wait until the elections in the US are held, the results will be announced and market participants will begin to behave more actively. Until then, trading the pair is extremely inconvenient. We have two trading ideas for October 28: 1) The pair is trading in full flat, plus a descending channel has appeared. Thus, traders are advised to try to resume trading upward while aiming for the resistance area of 1.1887-1.1912 and the 1.1926 level, but not before the quotes have settled above this channel. Take Profit in this case can be up to 70 points. The 1.1887-1.1912 and 1.1900-1.1920 areas are extremely strong and the bulls are unlikely to be able to overcome them in the current environment. 2) Bears continue to remain in the shadows and, despite the descending channel, there is no downward movement. Sellers still need to wait until the Senkou Span B line (1.1784) has been overcome in order to have reasons to open sell positions with targets at the 1.1748 level and the support area at 1.1692-1.1699. The potential Take Profit in this case is from 30 to 70 points. Hot forecast and trading signals for the GBP/USD pair Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

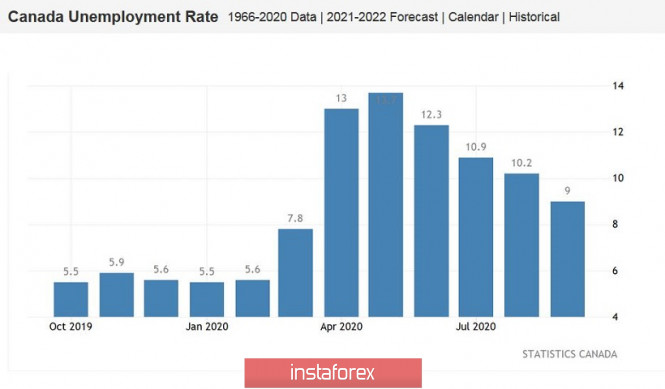

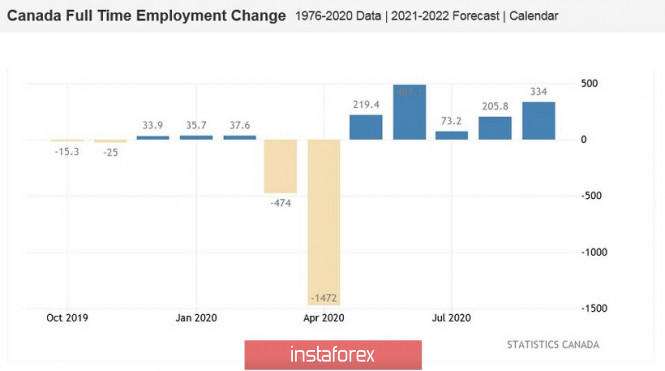

| USD/CAD. Preview of the Bank of Canada's October meeting Posted: 27 Oct 2020 05:58 PM PDT The penultimate meeting of the Bank of Canada this year will take place tomorrow. In the run-up to this event, the canadian dollar is behaving cautiously, trading within the 31st figure. On one hand, the market is not expecting any surprises from the canadian regulator: the monetary policy parameters should remain at the same values. While on the other hand, there is no consensus among experts about the general mood of the regulator's members and the tone of the accompanying statement. The current fundamental picture allows the Canadian Central Bank to take a different view of the situation. On one side of the scale is the growth of key macroeconomic indicators, while on the other side is the return of coronavirus in Canada. In the context of macroeconomic indicators, they have not really disappointed investors recently. First of all, we are talking about the canadian labor market. So, the unemployment rate in the country in September fell immediately to 9%. Although this indicator was at the level of 10.8% in August and it should have decreased by only 0.4% according to general forecasts, the indicator dived down by 1.8% at once.

In the green zone, there was also growth in the number of employment. Contrary to neutral forecasts, this indicator exceeded the forecast values more than twice, ending up at 378 thousand instead of the predicted 150 thousand. Note that this increase was mainly due to growth in the number of full-time employees (+334 thousand), while part-time employment rose only by 44 thousand. This is a positive signal, including for inflation indicators, since full-time positions imply a higher level of salaries and social security. The rate of wage growth accelerated to 4.3% from the previous value of 3.8%, signaling a strengthening of the wage scale. The data on inflation growth published last week also turned out to be quite good. Although the growth rate is quite modest, the trend itself is important. Thus, the overall consumer price index rose to 0.5% in annual terms (after the previous value of 0.1%). Core inflation showed a stronger trend, rising to 1% with growth forecast to 0.6%. Retail sales also increased, especially excluding car sales. Overall, the canadian economy is showing positive dynamics. Based on the latest data, Canada's GDP increased by 3% (on a monthly basis), while the all in all forecast was at 2.9%. At the same time, growth was recorded in all 20 industrial sectors. The "maple leaf" country's economy has been growing for the third month in a row now. Although, the pace of recovery has somewhat slowed down compared to the first "post-crisis" months.

To put it simply, the Bank of Canada has every reason to maintain the status quo at the October meeting. But the tone of the regulator's members' rhetoric may be "dovish," even despite the macroeconomic successes. It's all because of the coronavirus. In recent weeks, the spread of COVID-19 in Canada has increased significantly. Local authorities were forced to resume some of the previously lifted quarantine restrictions in some regions. Just over the past day, Canadian doctors have identified 2531 cases of infection, which is another anti-record. Prime Minister Justin Trudeau said that the country has entered the second wave of the pandemic. If current trends continue, the government will resort to stricter quarantine restrictions. This step will primarily affect the labor market indicators and consumer activity of Canadians. Thus, members of the Bank of Canada may well focus on the risks associated with the spread of coronavirus in the country. In this case, the Canadian regulator will be under significant pressure. In my subjective opinion, loonie will get support from the Canadian regulator tomorrow. Central Bank members can note the growth of the main economic indicators while maintaining a wait-and-see attitude on one hand. While on the other hand, they can express "standard concern" about the future prospects of the country's economic recovery, as they did at the September meeting when the country already noted an increase in the number of COVID-19 cases. The text of the previous accompanying statement included the phrase that the Bank of Canada predicts "a long and unstable stage of economic recovery in the face of increased uncertainty and systemic problems." If the Canadian Central Bank confines itself to this phrase tomorrow, it is possible for traders to ignore it, focusing on the other aspects of the October meeting. All this suggests that from the current positions, we can consider sales to the support level of 1.3060, which is the lower line of the Bollinger Bands indicator on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Oct 2020 02:30 PM PDT Hourly chart of the EUR/USD pair The EUR/USD pair, after overcoming the upward trend line, could not continue the downward movement it started on Tuesday, October 27. The MACD indicator generated a sell signal during the day, which, unfortunately, turned out to be false. Novice traders could have lost up to 18 points. As we have said many times in recent days, the pair's movements are now extremely complex. In fact, we now see a flat within a flat. After all, the pair continues to trade between the levels of 1.1700 and 1.1900 for the third consecutive month, that is, in a horizontal channel. And in recent days, another horizontal channel, 50 points wide, was formed, in which all trades take place. In addition to this (!!!), another downward trend channel was formed, shown in the graph, which supports those who trade for a fall, but at the same time it is directed more sideways than down. Thus, wherever we look, we can state more lateral movement than downward movement. You can formally consider short positions in the upper area of the new descending channel, expecting a downward movement to the lower border. However, we warn novice traders that almost any position now is associated with increased risks. The European Union did not publish a single macroeconomic report on Tuesday, but the United States released one on orders for durable goods. We said this morning and yesterday as well that this report is important enough, but we warned that it is unlikely that any market reaction will follow. And so it happened in practice. If there was a reaction, it was absolutely minimal, since the report turned out better than the experts' forecasts, respectively, the US dollar should have gone up in the second half of the day, which, in fact, did not happen. No important publications in the European Union or the United States on Wednesday. No major events or speeches either. Thus, a weakly volatile movement can continue, which is absolutely not in the hands of traders. Accordingly, market participants can only rely on any unexpected and unplanned news, which also simply may not exist. Recall that the number one topic in the European Union is the coronavirus, the second wave of which continues to gain momentum. In the long term, this threatens serious problems for the European economy, but so far no actual deterioration or decline in the economy has been recorded, so traders do not panic ahead of time. The number one topic in America is still the presidential elections, which have already begun, as more than 60 million Americans have already voted. Thus, the markets continue to be very worried about the outlook for the US economy and are also waiting. They are waiting for the results of the elections, which will end on November 3. Possible scenarios for October 28: 1) Buy positions on the EUR/USD pair are currently irrelevant, since the rising trend line has been overcome, and the price is currently trading within the descending channel. Thus, you can consider long positions, but first the price should settle above the descending channel, and even then, you have to be very careful, with targets of 1.1881 and 1.1902. 2) Trading for a fall at this time is more relevant, since the price is inside the descending channel. Therefore, novice traders are advised to wait for a new sell signal from the MACD and trade down with the targets of 1.1788 and 1.1767. If this signal is also quickly canceled and the downward movement does not continue, then you are advised to leave the market until the next recommendations. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD struggles to stay afloat Posted: 27 Oct 2020 08:45 AM PDT

The greenback depreciates correctively on Tuesday in relation to its main competitors after rising by 0.3% the day before. The USD index sank to 92.85 points, losing its recent gains. At the same time, the main currency pair remains at the range of 1.1800-1.1860. The absence of significant growth in EUR / USD is explained by the same reasons that pushed the pair down earlier. Hopes for an early compromise in negotiations between US Treasury Secretary Steven Mnuchin and House of Representatives Speaker Nancy Pelosi on the next package of aid to the American economy are gradually weakening. Time passes, and Donald Trump, according to polls, lags behind Joe Biden in the election race. In this situation, Pelosi seems to have no particular reason to rush into the deal. Although Biden stressed that if he wins, he will propose to Congress to increase the stimulus package to $2 trillion, judging by the dynamics of the US stock market, investors are inclined to regard this promise as nothing more than election populism. Meanwhile, the new wave of COVID-19 has caught European countries by surprise, and many national governments have been forced to tighten social distancing measures. If local restrictions do not work, the authorities of some countries will be forced to introduce a nationwide quarantine. If the government of a large country takes such a step, the rest of the region may follow its example. The euro refuses to fall so far, but the introduction of strict quarantines in the largest eurozone countries could be a turning point for the single currency. The declining demand for USD is the only reason the underlying currency pair is trading above 1.1800. However, even this driver is unlikely to be able to support the euro for a long time. There are a number of factors that will set the tone for trading on the US stock market in the coming days and will affect the dynamics of the dollar. We are waiting for the publication of data on the US GDP for the third quarter. In addition, the current week is full of quarterly reports of American corporations. Analysts believe US GDP growth has rebounded sharply in the third quarter. In this case, Trump will probably try to refer to this improvement as a reason not to introduce new restrictions, despite the record increase in the number of COVID-19 cases in the country. Biden intends to act tougher in this regard. So if he wins, one can expect the introduction of severe restrictions, which will put pressure on the financial markets. True, one must understand that even if Biden wins, he will only become president on January 20, 2021. Although the markets may start to play it back in advance. Weak quarterly reports of US corporations could also accelerate the sell-off in the local stock market, which will support the greenback. In addition, one of the important risk events this week is the ECB meeting. "The shadow of the COVID-19 pandemic continues to hang over the European economy, which should ultimately force the region's authorities to introduce more generous fiscal measures. It may even be beneficial for the euro if the bond issue is increased, "said strategists at SaxoBank. Although experts do not expect the European Central Bank to announce any major steps following the next meeting on Thursday, they expect to hear from its head of the ECB Christine Lagarde that new incentives will be adopted by the end of this year. "The market is likely to be disappointed if the ECB does not give a clear hint of the possibility of increased stimulus in December," said Gilles Mock, a specialist at AXA SA. The material has been provided by InstaForex Company - www.instaforex.com |

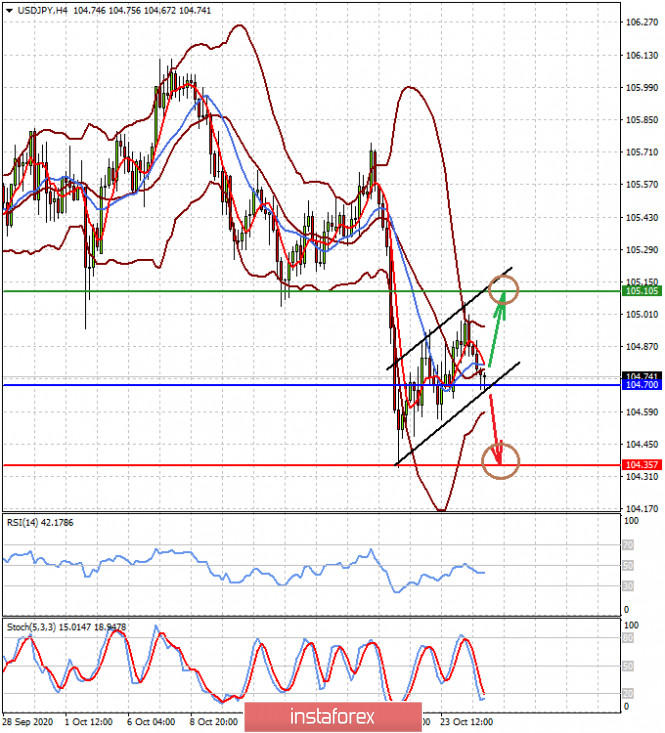

| USDJPY challenges major support Posted: 27 Oct 2020 08:43 AM PDT We have been bearish since mid October in USDJPY since it was trading around 105.50. Since then price got rejected and fell around 100 pips towards support area of 104.50-104.30. So far price has bounced twice from this support level. The next couple of sessions are very important for the short-term trend at least.

Green line - support As long as price is below the red downward sloping resistance trend line we remain bearish. If support at 104.30-104.50 fails to hold we should expect USDJPY to challenge 102.50-102 lows. The descending triangle pattern with the lower highs is a weakness sign. However for more downside to be achieved, price should not form higher lows in the RSI, as this is a sign of weak selling. Despite making lower lows USDJPY bears need to break through the support decisively. A daily close below 104.25 and staying below this level will be the key for a move towards 102. If support holds, we should expect price to bounce towards 105-105.35. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of Gold Posted: 27 Oct 2020 08:36 AM PDT Gold price continues to trade around the $1,900 price level. Price is still above $1,900 but below the Kumo (cloud). This makes Gold price vulnerable to a sell off and a move towards $1,800-$1,850. Our bearish view is triggered on a break below $1,892 as we explained in our last analysis.

|

| Short-term technical view on EURUSD Posted: 27 Oct 2020 08:31 AM PDT EURUSD is forming the last few sessions a triangle pattern after making a high at 1.1880 and a pull back low at 1.1787. Since then price is making lower highs and higher lows. Price is mostly moving sideways and that is why we will need to focus on the triangle boundaries as a break outside of the triangle could be a hint for the trend of the next days.

The upper triangle boundary is now found at 1.1850 while the lower triangle boundary support is at 1.18. Price is now at a point where traders better stay neutral. As we have seen from past analysis we posted, the 1.18 level remains a key support level. If resistance at 1.1850 is broken then we should expect EURUSD to push higher towards 1.19 and to challenge recent highs. Breaking below 1.18 would be a bearish sign but do not forget that the most important support level for the medium-term trend is at 1.17. The material has been provided by InstaForex Company - www.instaforex.com |

| October 27, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 27 Oct 2020 08:19 AM PDT

On September 25, The EURUSD pair has failed to maintain enough bearish momentum to enhance further bearish decline. Instead, recent ascending movement has been demonstrates within the depicted movement channel leading to bullish advancement towards 1.1750-1.1780 which failed to offer sufficient bearish pressure in the first attempt. Two weeks ago, temporary breakout above 1.1750 was demonstrated as an indicator for a possible bullish continuation towards 1.1880. However, temporary downside pressure pushed the EUR/USD pair towards 1.1700. This is where the previous bullish spike was initiated. Currently, the price zone around 1.1880-1.1900 constitutes a KEY Price-Zone as it corresponds to the backside of the depicted broken ascending channel. Recent Upside breakout above 1.1780 enabled further advancement towards the price levels around 1.1880-1.1900 where significant bearish pressure and a reversal Head & Shoulders pattern were demonstrated. Trade Recommendations :- Recently, Two opportunities for SELL Entries were offered upon the recent upside movement towards 1.1880-1.1900. Both positions are already running in profits. Initial Bearish target remains projected towards 1.1780 while Exit level should be placed around 1.1870 to offset the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| October 27, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 27 Oct 2020 08:15 AM PDT

In July, the EURUSD pair has failed to maintain bearish momentum strong enough to move below 1.1150 (consolidation range lower zone). Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1750 which failed to offer sufficient bearish pressure as well. Bullish persistence above 1.1700 - 1.1760 favored further bullish advancement towards 1.1975 - 1.2000 ( the upper limit of the technical channel ) which constituted a Solid SUPPLY-Zone offering bearish pressure. Moreover, Intraday traders should have noticed the recent bearish closure below 1.1700. This indicates bearish domination on the short-term. On the other hand, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1750. Instead, another bullish breakout was being demonstrated towards 1.1870 which corresponds to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stands as a solid SUPPLY Zone corresponding to the backside of the broken channel if bullish pullback occurs again soon. Intraday Trend-Traders can wait for a bearish H4 candlestick closure below 1.1770 as a valid short-term SELL Signal with a potential bearish target located around 1.1700 and 1.1630 if sufficient bearish momentum is maintained. The material has been provided by InstaForex Company - www.instaforex.com |

| October 27, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 27 Oct 2020 08:13 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. However, On September 1, the GBPUSD pair looked overbought after such quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the newly-established key-level of 1.3300. A quick bearish decline took place towards 1.2780 where considerable bullish rejection brought the pair back towards 1.3000 and 1.3100 during the past few weeks. The price zone of 1.3130-1.3150 (the depicted channel upper limit) remains an Intraday Key-Zone to determine the next destination of the GBPUSD Pair. Bullish Persistence above the mentioned price zone of 1.3100-1.3150 will probably allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested bullish pattern. However, the GBPUSD pair failed to do so, Instead, another bearish movement will probably be expressed towards the price level of 1.2840 where bullish SUPPORT will probably exist. The material has been provided by InstaForex Company - www.instaforex.com |

| European and Asian stocks continue to decline amid growing threat of COVID-19 pandemic Posted: 27 Oct 2020 07:09 AM PDT

Asian stock exchanges exhibited a sharp and significant reduction in all positions on Tuesday. The major stock indexes fell amid serious concerns about the increase in the number of cases of coronavirus infection in the world and in certain regions and countries. Market participants are also thrown out of balance by the unresolved situation with the financial stimulus program in the US. Japan's Nikkei 225 Index dropped 0.08%. China's Shanghai Composite Index rose marginally at 0.01%. The Hong Kong Hang Seng Index plunged 0.71%. South Korea's KOSPI index lost 0.65%. The state of the country's economy is gradually improving, as evidenced by statistics. In the third quarter of this year, South Korea finally turned to economic growth after the recession caused by the coronavirus pandemic. The country's GDP from July to September increased by 1.9%, which is the highest growth in the last ten years. However, there are still concerns that the second wave may undermine the entire positive that has begun. Australia's S&P/ASX 200 Index fell 1.7%. On Tuesday, a telephone conversation took place between House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin, which concerned resolving differences between the parties to speed up the final decision on the stimulus package. According to the data, the previous disagreements were removed, but the problem is that others have taken their place, and their number is increasing. In this regard, investors begin to doubt that the stimulus program will be signed before the US presidential election. Nevertheless, experts warn that any, even the most insignificant, and implicit signs of progress in the negotiation process already have a very positive effect on market participants. In general, it is worth noting the potential positive that the deal may bring in the stock market in the future. Investors' serious consideration of the epidemiological situation in the world and in the US remains the most pressing issue at the moment. The sharp increase in the number of patients in the last few days is of great concern not only for market participants but also for governments of states that are forced to introduce strict restrictive quarantine measures that do not have a very favorable impact on the state of the economy. Thus, a full-fledged way out of the crisis is not yet possible. The second wave of the pandemic delays this process indefinitely. Meanwhile, European stock markets, likewise, traded in a negative zone on Tuesday. Major stock indexes are failing to withstand pressure from the growing number of new cases of COVID-19 infection. Even the unexpectedly high profitability of some financial institutions in the region does not save the situation. The general index of the largest companies in the European region STOXX 600 decreased by 0.4%. The German DAX Index is down 0.3%. France's CAC 40 index sank 0.8%. The UK FTSE Index lost 0.1%. As of Tuesday morning, the number of new cases of coronavirus infection globally has increased by 43.4 million. Such a rapid increase was not observed in the first wave of the pandemic, which causes even greater concern. The second wave in the European region has become even more destructive than the first one. The number of cases is already breaking all records, and new restrictive measures have so far saved the situation. But the region's economy is already beginning to experience difficulties. In particular, the level of economic activity fell sharply in Spain after the government declared a state of emergency for six months. All this once again pushes the European Central Bank to more productive and thoughtful actions that will support the economy. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EURUSD on October 27, 2020 Posted: 27 Oct 2020 07:04 AM PDT

The euro maintains growth despite the coronavirus peak. We are expecting important news ahead. The ECB decision and the report on US GDP for the 3rd quarter will be released on Thursday. Sellers tried hard to drive the euro below 1.1800, but so far nothing has come of it. You may keep buying with a stop and a downward reversal from 1.1785. Purchases can be considered from 1.1835. Sales from 1.1785. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Oct 2020 06:21 AM PDT In the most global terms, the construction of the expected new upward section of the trend continues. Its internal wave marking does not look very convincing at the moment, but the section of the trend that begins on September 23 can hardly belong to the descending wave structure that has been formed since September 1. Thus, most likely, this is a new ascending global wave, which can take a three or five wave form. It may be part of the uptrend from March 20, or it may be an uptrend correction wave as part of a new downtrend from September 1. The wave markup on the lower chart does not look too convincing and clear. Given the very short-term increase in the instrument's quotes after the completion of wave 2 or b, we can assume that the upward wave will either take a very extended form, or it has already been completed. In the first case, the British will clearly need the help of the news background to continue the increase, in the second one, most likely, the current wave markup will become more confusing. An unsuccessful attempt to break the 38.2% Fibonacci mark still keeps the markets in an upward mood, which leaves hopes for building an upward trend section. There is still very little positive news for the British. The good thing is that there is not much news that can stir up the market. The Pound / Dollar is moving in a very calm mode and wave patterns are now more important than the news background. There is no news on the most important topic for the British. The negotiations are going on and on and on. According to reports from various sources, there is and there is no progress. Sometimes both sides say that they should prepare for Brexit without an agreement, then they call for intensifying negotiations in order to try to conclude a deal. In General, there is a lot of information and no specifics. Therefore, I would now recommend starting from the 38.2% Fibonacci level. If the quotes of the instrument remain above it, then wave 3 or C will continue its construction. It doesn't matter when or if London and Brussels come to an agreement there. A successful attempt to break through the 38.2% level will indicate that the markets are not ready for new purchases and will complicate the current wave marking. This is the least attractive option. There are no economic reports that will be published in the UK this week. If in America and in the EU there will be reports on GDP for the third quarter on inflation and an ECB meeting, there will be nothing like this planned in the UK this week. Thus, markets will have to find factors to trade in one direction or another. Either way look only in the direction of the American news background. General conclusions and recommendations: The Pound-Dollar instrument has presumably completed the construction of a downtrend section. A successful attempt to break through the level of 38.2% will indicate that the markets are not ready for new purchases of the British dollar, and the entire wave marking may be transformed to a more complex one with the transition to building a new downward wave. Thus, if the 1.3013 mark is broken, I would recommend selling the instrument with targets located near the estimated 1.2867 mark, which corresponds to 50.0% Fibonacci based on the beginning of building a new downward wave. Until this happens, you can consider buying with a target of 1.3189. The material has been provided by InstaForex Company - www.instaforex.com |

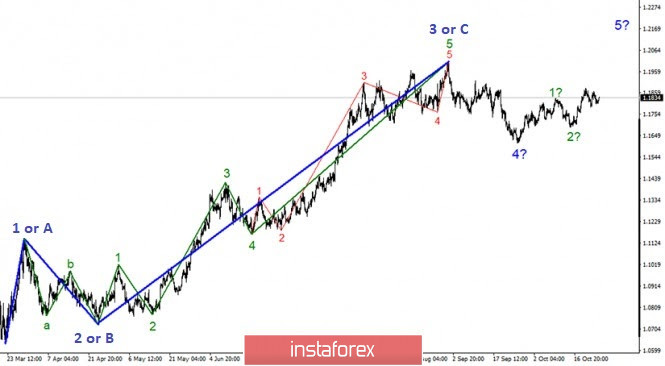

| Posted: 27 Oct 2020 06:17 AM PDT The wave marking of the EUR/USD instrument still looks quite convincing and has not changed recently. I still expect to build wave 5 of the upward section of the trend, which dates back to March. At the moment, waves 1 and 2 are viewed inside this wave. If the current wave markup is correct, then the price increase will continue from the current values with targets located near the peak of wave 3 or C. So far, there are no prerequisites for revising the current wave pattern. The smaller-scale wave marking still shows that the intended wave 4 has assumed a three-wave form and is complete. If this is true, then the price increase will continue within the 3-in-5 wave. At the same time, a slightly inactive increase in quotations suggests that the entire section of the trend that begins on September 25 may take a three-wave form and the entire section of the trend that begins on September 1 will take a corrective form. In this case, after completing the top three, you can start building the bottom three. But for now, this is a fallback. Despite the fact that the markets have been quite calm lately, things are approaching the most significant day in the second half of a completely crazy 2020. The topic of presidential elections in the United States has been the talk for several months in a row. However, now there is nothing to write or talk about this topic. Both candidates did everything they could in the fight for election ratings and most Americans have already decided on the candidate they will vote for. Moreover, more than 60 million Americans have already voted, including Donald Trump himself. All statistics now indicate that the current elections will be one of the largest not only in recent decades, but also since 1908. Forecasts suggest that more than 65% of Americans may vote this year, which are 150 million people. Experts have recently become more and more afraid that the scenario of 2016 will not be repeated, when Trump also, according to all pre-election opinion polls and ratings, was behind Hillary Clinton but won in the end. Now it's hard to even imagine what must happen for Trump to win. However, there is no doubt that he has a few tricks up his sleeve. Thus, the markets can only stock up and closely monitor events in the next week or two. Today, you can also pay attention to the report on orders for long-term goods in the United States but it seems that the markets are already fully focused on the presidential election and do not want to pay attention to other news. General conclusions and recommendations: The Euro-Dollar pair is expected to continue building a 3-in-5 wave. Thus, at this time, I still recommend buying with targets located near the estimated 1.2012 mark (which corresponds to 0.0% Fibonacci) for each MACD signal up, in the expectation of building an upward wave. The variant with a possible complication of the internal wave structure of wave 4 has not yet been confirmed. The material has been provided by InstaForex Company - www.instaforex.com |

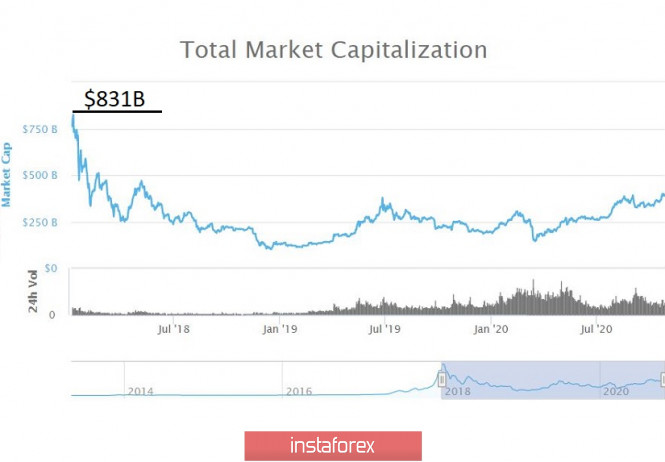

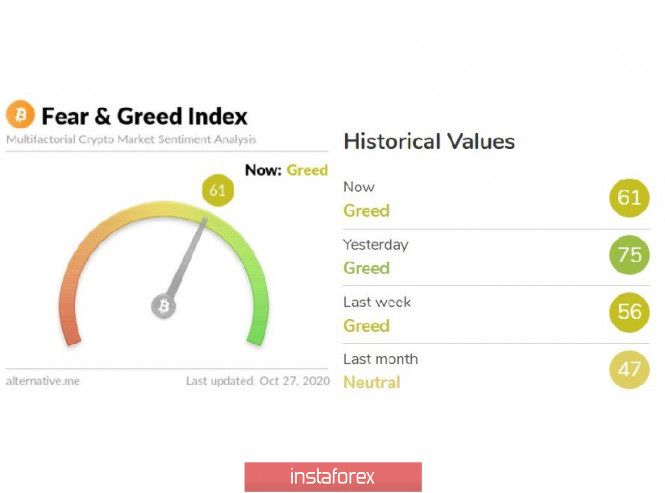

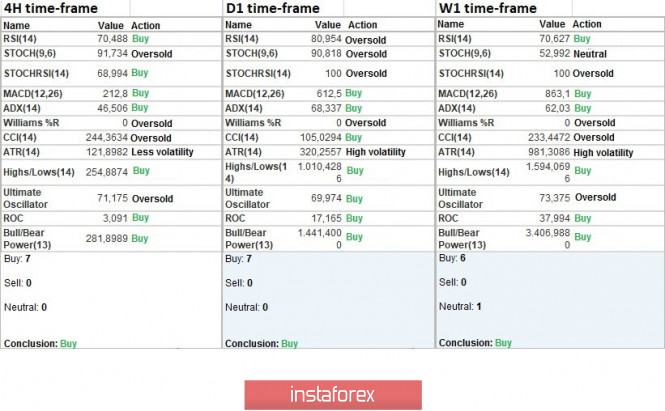

| Bitcoin continues to grow, exhibits positive trade prospects Posted: 27 Oct 2020 06:04 AM PDT The largest debit electronic payment system, PayPal, announced that its users will be able to buy, sell, and store cryptocurrencies, and starting next year, they will be able to pay it in 26 million stores. This news once again confirms the theory of Bitcoin's antifragile instrument - "That which does not kill us, only makes us stronger." Who would have thought that the first purchase in 2010 with the help of a Bitcoin surrogate would end with international use, and not just in the form of some money transfers, but widespread use, like ordinary monetary units. The famous billionaire and CEO of Galaxy Investment, Michael Novogratz, expressed his opinion on the PayPal news that market giants such as Visa, Mastercard, and American Express will also follow the path of cryptocurrency instruments very soon. "The question no longer arises whether cryptocurrencies are an object of interest, whether bitcoin is an asset, whether the blockchain will become part of the financial infrastructure. The question is not whether it will happen, the question is when it will happen. Each and every company should have its own plan, "said Novogratz. Note that last year there was more than once news that Visa and Mastercard were actively recruiting staff for crypto departments. In fact, they are in the process of opening a new segment of instruments. The next and important news is devoted to large players, even in the last article we wrote that influential funds with tens of billions of dollars in assets come to the crypto industry on a monthly basis. Now we have conducted a survey among European institutional investors, including banks, asset managers, and pension funds from Germany, Austria, Switzerland, and Liechtenstein. The total amount of assets under the management of the respondents is more than 719 billion euros. So, following from the survey, 61% of institutional investors have already invested in cryptocurrencies or are going to do so. This is a good signal that confidence in the new market is growing, and that trust is followed by asset growth and stability. The series of positive news ends with a new record for Bitcoin - addresses with volumes of 1000 BTC or more on their wallets. So, now there are 2231 such addresses, and their percentage is growing, and this is due to the fact that institutional investors come to the market with new funds. As you can see from the material provided above, the crypto environment is developing and death and collapse are no longer predicted for it, but, on the contrary, infrastructure is being worked out for more effective use. Trade prospects: The Bitcoin quote has repeatedly updated the maximum of the current year, there are literally several hundred dollars left, and under the pressure of buyers, the maximum of 2019 will fall to $13,868, and this moment will come very soon. The parallels between 2017 and 2020 continue to appear in the market, it is worth being prepared for the fact that we will see not just an update of the local maximum, but a completely new historical maximum for Bitcoin. Regarding the price outlook, the breakdown of the $13,868 coordinate will lead to even greater excitement, where the December 2017 high of $19,891 will be hit. Imagine what would happen if the $19,891 - $20,000 area fell. Google Trends will go off scale, and in every gateway, they will discuss Bitcoin and its new successes, this will lead to even more cash injections. In the latter case, everything is not so simple, since the high excitement will lead to acceleration, and this, in turn, will lead to the risk of a local collapse in the form of fixing excess profits, but we will talk about this in subsequent articles on cryptocurrencies. General background of the crypto market: Analyzing the total market capitalization of the crypto industry, you can see that the Total Market gained $73 billion in October and is currently $399 billion, where the $400 billion mark has already been passed by the market. An upward trend is visible to the naked eye, where the market volume is already at the level of 2018, and this is not a chapel. The consistent growth of the Total Market may lead not only to the renewal of the peak of $ 831 billion but to a completely new horizon in the form of $1 trillion. Market Cap: $399,077,102,663 BTC Dominance: 61.9% The index of emotions (aka fear and greed) of the crypto market in October dropped to 40 points, but then leveled off and is now on the positive side, above 60. In fact, we have a desire for further growth than the fear of a collapse. Indicator analysis: Analyzing different sectors of timeframes (TF), it can be seen that the indicators of technical instruments relative to the four-hour, daily, and weekly periods signal a buy, which is confirmed in the market by the upward movement of the Bitcoin price. |

| USD on defensive ahead of presidential election Posted: 27 Oct 2020 05:35 AM PDT EUR/USD showed a 0.1% uptick to trade at 1.1820. USD/JPY is trading mainly flat today hovering at near 104.80. Likewise, USD/CNY is trading firmly at 6.7110. The upcoming election is making its impact on Forex. The crucial event is around the corner. No wonder, investors want to play safe, so popular currency pairs are trading sideways with ranges getting narrower. On the final week before the election, Democratic nominee Joe Biden is taking the lead in the latest polls, though with a small margin. Joe Biden has less tough stance on China than Donald Trump. Analysts at Nordea reckon that traders will lock in profits on USD/CNY. GBP/USD is also trading sideways today at near 1.3023. The Turkish lira is extending weakness. Today USD/TRY rose 0.7% and settled up at 8.1309. Analysts warn that the lira is set to plumb new depths, staying above 8.0 against the US dollar for long. Meanwhile, the Turkish regulator unveiled the plans to safeguard its national currency from a nosedive. Today the US dollar could find support from a survey by the Conference Board. According to flash estimates, the consumer confidence index in the US is expected to grow to 102 points in October from 101.8 in September. The material has been provided by InstaForex Company - www.instaforex.com |

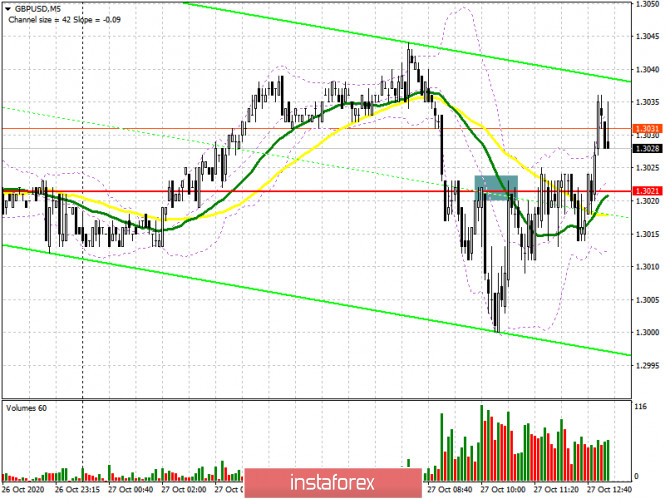

| GBP/USD: plan for the American session on October 27 (analysis of morning deals) Posted: 27 Oct 2020 04:52 AM PDT To open long positions on GBPUSD, you need: In the first half of the day, I paid attention to sales if the pair was fixed below the level of 1.3021, which happened. Let's look at the 5-minute chart and analyze the entry points. You can see how the bears go under the level of 1.3021 and then test it from the bottom up, forming a good signal to open short positions, which, unfortunately, was not implemented, since the market has no benchmarks due to the Brexit agreement hanging in the air.

The technical picture for the second half of the day has changed. Given the fact that volatility is quite low, we will not rely on intermediate levels. The main task of the bulls for the second half of the day remains to protect the support of 1.2997. The formation of a false breakout on it will be a signal to open long positions in the expectation of an upward trend towards the maximum of 1.3072. It will be possible to talk about the return of control over the pound by buyers only after fixing above this range, which will form another entry point into long positions to update the maximum of 1.3120, where I recommend fixing the profits. You can expect a larger increase to the area of the maximum of 1.3174 only after the appearance of positive news on Brexit. If there is no activity of buyers in the support area of 1.2997, I recommend that you postpone long positions until the test of the minimum of 1.2919, from which you can buy the pound for a rebound based on a correction of 20-30 points within the day. To open short positions on GBPUSD, you need: In the second half of the day, the bears will be aimed at breaking the larger support of 1.2997, and this will happen only in the event of negative news on Brexit or after a more than excellent report on the US consumer confidence indicator, which will strengthen demand for the US dollar. Fixing below 1.2997 forms a good entry point for short positions, which will push GBP/USD further down to the minimum of 1.2919, where I recommend fixing the profits. A longer-term target for sellers in the middle of the week will be the area of 1.2865. If in the second half of the day we will observe the growth of the British pound, then there is no need to hurry with sales. It is best to wait for the formation of a false breakout in the support area of 1.3072 or open short positions immediately for a rebound from the maximum of 1.3120, based on a downward correction of 20-30 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for October 20, there was a reduction in short and a sharp increase in long positions. Long non-commercial positions increased from the level of 36,195 to the level of 39,836. At the same time, non-commercial short positions dropped from the level of 45,997 to 41,836. As a result, the negative value of the non-commercial net position increased slightly to -2000 against -9,802 a week earlier, which indicates that sellers of the British pound remain in control and have a minimal advantage in the current situation. Signals of indicators: Moving averages Trading is conducted around 30 and 50 daily averages, which is more indicative of the sideways nature of the market before the release of important news. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1. Bollinger Bands Volatility has decreased, which does not give signals to enter the market. Description of indicators

|

| EUR/USD. Intrigues of American politicians and a phlegmatic dollar Posted: 27 Oct 2020 04:51 AM PDT The US currency is caught in the grip of conflicting fundamental factors. On the one hand, investors are concerned about the growing incidence of coronavirus in the United States and Europe. On the other hand, there are fading hopes for the adoption of a new stimulus package in the States before the November presidential election. And if the first factor provides background support for the greenback due to increased anti-risk sentiment, then recent events in the US are holding back the ambitions of dollar bulls. Yesterday, another "deadline" expired in negotiations between representatives of the Democratic Party and the White house over the long-suffering bill on providing additional assistance to the American economy. The result of the talks was "a little predictable": the parties again failed to find a common denominator, saying that consultations were continuing. The Chairman of the Lower House of Congress, Democrat Nancy Pelosi, said that the new $ 2 trillion stimulus package agreed with the White House could be adopted as early as this week, but at the same time it is not known whether the Senate is ready to approve it. At the same time, she assured journalists that the Democrats are making concessions to their political opponents.

However, representatives of the Trump administration, as well as Republican senators, do not share Pelosi's optimism. Moreover, White House chief of staff Mike Meadows accused Democrats of constantly "changing the rules of the game". As for the Senate, the situation is even more complicated – the Upper House of Congress is controlled by Republicans, many of whom oppose additional stimulus measures. Especially in such huge, trillionth volumes. Let me remind you that not so long ago, the Senate rejected even the Republican bill, the volume of which was (in the final version) "only" 300 billion dollars. Given this disposition, it is not difficult to predict the fate of the $ 2-trillion bill – even if it is approved by the White House. According to a number of American experts, representatives of the Democratic party are simply stalling, constantly moving deadlines, thereby prolonging the negotiation process. A week later, the presidential election will be held, according to the results of which one-party Democrat Joe Biden can lead the White House. In anticipation of such tectonic shifts, it is very short-sighted to make concessions to representatives of the Trump administration. Therefore, it is highly likely that the new package of incentives will not be adopted until November 3. At the moment, it is difficult to say in what format the negotiations will be resumed. Here it is worth recalling again the events of 20 years ago, when the counting of votes was delayed for many weeks – the results of the 2,000 elections were approved only in December, while the elections themselves traditionally ended on the first Tuesday in November. This year, this situation may be repeated if the Trump team appeals in court the results of the so-called "postal" vote. In other words, the issue of agreeing on a new stimulus package may be delayed until next year, and this fact worries investors. The general pessimism about the prospects of the long-suffering bill was reflected in the stock market yesterday. Following the results of yesterday's trading, US stock indices fell sharply. In particular, the Dow Jones Industrial Average showed the strongest one-day drop since the beginning of September and for the first time since October 6, it ended trading below the 28,000 point mark. The Standard & Poor's 500 also showed similar dynamics, which collapsed by almost 2%, having experienced the maximum one-day drop in a month. The US currency held back the blow, but could not continue its offensive in most pairs. In particular, the euro/dollar pair remained within the 18th figure, although the bears exerted pressure throughout the day yesterday. But sellers were only able to approach the lower limit of the flat range of 1.1800-1.1870 and did not even test the support level. In addition, data on the US real estate market was published last night, which disappointed traders. Thus, the volume of housing sales in the primary market in September decreased by 3.5%. This indicator is for the first time since April of this year (when the coronavirus crisis was at its peak) turned out to be in the negative area. Today, currency pairs of the so-called "major group" are traded flat, reflecting the general phlegm of traders. The euro/dollar pair is no exception: the southern momentum has faded, while buyers are not able to develop corrective growth, against the background of a negative fundamental background (primarily due to the tightening of quarantine restrictions in the EU countries). The sluggish struggle continues in anticipation of the next information drivers.

In my opinion, under the current conditions, long positions can be considered, despite the "coronavirus factor". Sellers of EUR/USD at the moment came to the lower limit of the flat range, but could not overcome it. The southern impulse has faded, and to resume it, appropriate arguments are needed, which are not available at the moment. The pair quite gently pushed off from the lower border of the price corridor and gradually went up, towards the "ceiling" of the range. Therefore, at the moment, we can consider longs with the first goal of 1.1870 – this is the upper limit of the Kumo cloud, which coincides with the upper line of the Bollinger Bands indicator on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 27 Oct 2020 04:49 AM PDT Further Development

Analyzing the current trading chart of BTC, I found that BTC is trading higher as I expected and is heading towards our upside objective at the price of $13,835. The material has been provided by InstaForex Company - www.instaforex.com |

| Currency markets remain calm while the stock markets are declining Posted: 27 Oct 2020 04:42 AM PDT The currency market practically remained calm before the US presidential election, contrary to the stock markets, which sharply declined today. As for the US stock market, it actually collapsed due to two important reasons – the absence of one (failed agreement on new stimulus package) and the growing influence of the other (coronavirus). The first reason includes the failed agreement between N. Pelosi and S. Mnuchin on new economic measures to support the country, which caused US stock indices to decline. So, the industrial index DOW fell by more than 3.0% at the moment, while two other major indices S&P 500 and NASDAQ tried to keep up with it. So why did the market collapse? Investors are hopeful that an agreement would be reached on new measures to stimulate the economy and help the American citizens before the presidential election. The Fed, represented by its leader Mr. J. Powell, also stood up for this. In addition, investors were almost 100% sure that in any case, this would be agreed on after the elections. It is clear that they believed that J. Biden will win and the Lower House of Congress will take this decision. However, the situation has changed. D. Trump, the current president, still manages to maintain good positions in the election race, and the chances of winning are still noticeably significant. This assumption especially increased after Amy Coney Barrett, which is believed to be a Trump supporter, was elected to the US Supreme Court. This is the reason why the US stock market collapsed today, which pulled other trading platforms globally. Another reason is the growing negative impact of COVID-19 in the United States and Europe. New records of cases, both infected and dead, caused a wave of fears for the standing of the world economy and the collapse of the stock market. But what's interesting is that the currency market remained calm before the US presidential results. We can explain this by two reasons – uncertainty of who will win the elections as well as whether the economically important countries will have to close their economies again to a greater extent due to the COVID-19 pandemic. Taking this into account, we believe that the general condition will remain by the end of this week and the sideways dynamics in the currency markets will dominate. Forecast of the day: The USD/CHF is consolidating in the range 0.9030-0.9080. It will allow the pair to either continue to fall or grow if this range breaks down. Thus, we expect that a slight improvement in market sentiment after yesterday's sell-off in shares may allow the pair to rise to 0.9110, but only after breaking through the level of 0.9080. Otherwise, it will decline to 0.9030. The USD/JPY pair found support at 104.70. An improvement in the market mood will lead to a local price growth to 105.10. Otherwise, it may fall to 104.35, implementing the "rising flag" trend continuation pattern.

|

| Analysis of Gold for October 27,.2020 - Contraction on the Gold and potential for the breakout Posted: 27 Oct 2020 04:39 AM PDT Eurozone September M3 money supply +10.4% vs +9.6% y/y expected Latest data released by the ECB - 27 October 2020Prior +9.5% Slight delay in the release by the source. Broad money growth continues to swell, with the annual change reflecting the biggest jump since December 2007. Meanwhile, loans to households also increased to +3.1% y/y while loans to corporates were steady at +7.1% y/y.

Further Development

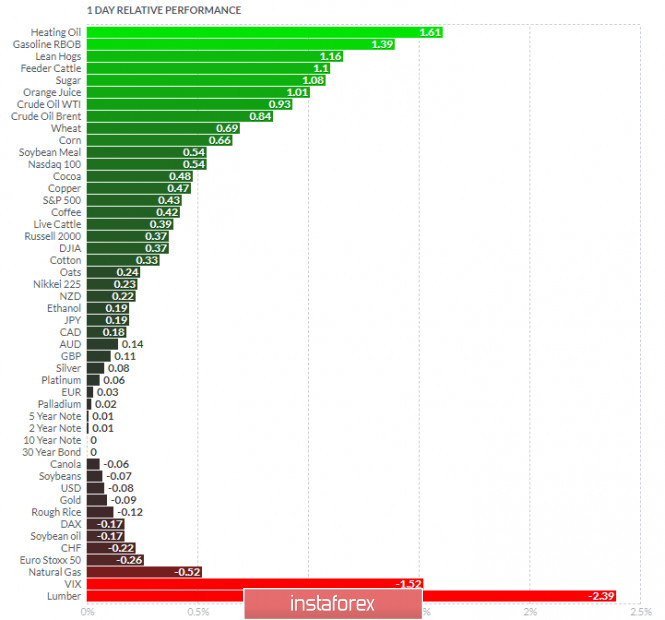

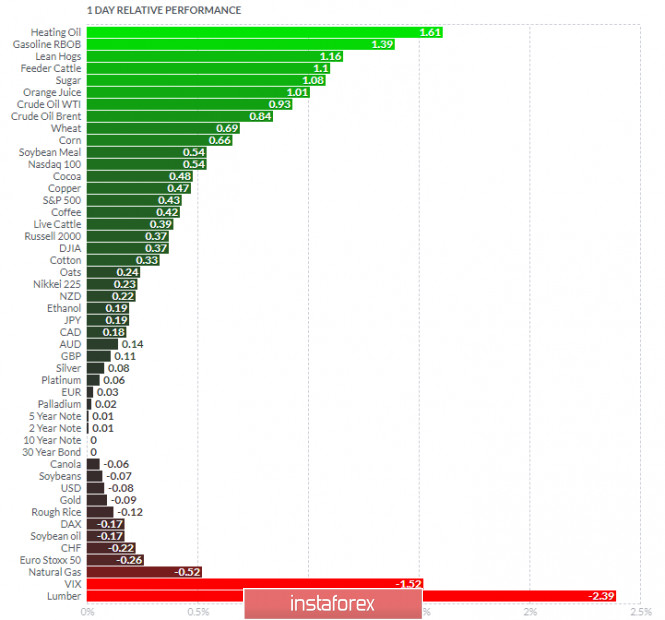

Analyzing the current trading chart of Gold, I found that the Gold is testing the support trendline at $1,900 but that price is still in consolidation and you should watch for the breakout to confirm further direction. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Heating Oil and Lean Hogs today and on the bottom Lumber and VIX. Gold looks neutral today on the relative strength list... Key Levels: Resistance: $1,913 Support levels: $1,895 The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for EURUSD pair on October 27 Posted: 27 Oct 2020 04:39 AM PDT The EUR/USD pair managed to return again to the area of the price level of 1.1810 yesterday, where there was a stop and a price rebound in the opposite direction. In fact, this is the second swing in the level of 1.1810 for two consecutive days, where the local high of 1.1880 was not updated. Therefore, we should not jump to conclusions that the four-week ascending path (1.1612 - - - > 1.1880) has come to an end. There are signals that the upward movement is completed, but at the same time, we may encounter an accumulation stage. This will be discussed later in more detail. If we go back to see the four-hour time frame last October 21 until to the current day, there is a zigzag-like pattern movement, with a compression amplitude, which is highly likely to lead to an acceleration in the market. Now, we should pay special attention to two values: the peak (1.1880) and the base (1.1787) of the zigzag-shaped pattern. If one of the above values breaks down, it will cause orders to cascade, and this will lead to an acceleration towards a breakdown. Here, we understand that there is a slowing down stage of the four-week upward course, which is confirmed by the zigzag-shaped pattern, but this same pattern can be a stage of accumulation in a big game of speculators, where it is worth working exclusively on the breakdown of a certain control level. Looking at yesterday's fifteen-minute TF, you can see that trading began with a downward gap, which set the pace in the morning. After reaching the level of 1.1810, the volume of sell positions immediately declined, which led to a slowdown and followed by a price rebound. In terms of daily dynamics, 57 points were recorded yesterday, which is 23% below the average. At the same time, speculative local activity was observed in the market during the European session. Looking at the trading chart in general terms (daily period), you can see an upward turn from September 28, but at the same time, the market takes a sideways trend from July 31, which is still relevant in the market. Yesterday's news background contained data on new home sales in the United States, where there was a forecasted growth of 3.5%, but as a result, it received a decline of -3.5%. Such a sharp divergence negatively affected the US dollar. In terms of information flow, the noise about COVID-19 is gaining impulse again, where there is a steady growth in cases of infection around the world. So in Europe, where highs are updated weekly, new restrictive measures are being discussed, in particular the tightening of quarantine and the extension of the curfew for six months. In the United States, new COVID-19 cases were recorded since last Spring. The detected infections are from 75 thousand to 85 thousand. However, they are not yet focusing attention to this due to the upcoming presidential elections, but everything may soon change. For the economic calendar, we have data on the volume of orders for durable goods in the US today, where there is a forecasted growth of 0.4%, which may have a positive effect on the USD price. Further development Analyzing the current trading chart, we can see that the quote remains at the level of 1.1810, considering it as a pivot point, where a local surge in short positions appeared at the start of the European session. We can assume that a price consolidation below 1.1800 will lead us to the base of the zigzag pattern - 1.1787/1.1880, where the breakdown of this value will be considered key in the upcoming growth. As long as the first part of the forecast does not match, the risk of a price rebound from 1.1810 will remain in the market, where it is worth considering a mirror image. That is, a price consolidation above the level of 1.1840 leads to a movement to 1.1860, while a consolidation above 1.1880, will allow the zigzag-shaped pattern to move in an upward direction. Indicator analysis Analyzing different sectors of time frames (TF), we can see that technical indicators on the minute and hourly TFs have a sell signal due to price fluctuations within the level of 1.1810. The daily TF, as before, considers the four-week move as the main one, signaling a buy. Weekly volatility / Volatility measurement: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated per Month / Quarter / Year. The current time volatility is 29 points, which is even lower than the average level by 61%. If the zigzag-shaped model is consistently broken, acceleration will occur, which will lead to an increase in volatility. Key levels Resistance zones: 1.1880; 1.1910; 1.2000 ***; 1.2100 *; 1.2450 **; 1.2550; 1.2825. Support zones: 1.1810; 1.1787 *; 1.1700; 1.1650 *; 1,1500; 1.1350; 1.1250 *; 1.1180 **; 1.1080; 1.1000 ***. * Periodic level ** Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: plan for US session on October 27 (analysis of morning deals). Bears may hit 1.1788. Posted: 27 Oct 2020 04:38 AM PDT Conditions to open long deals on the euro/dollar pair: In the early forecast, I emphasized that buy deals on the euro could be opened only after a consolidation above 1.1826. However, bulls failed to do this. Let's take a look at the five-minute chart. We can see that bulls are trying to break the resistance level of 1.1826. They may even succeed in it. However, a downward break of this level, which should have become a signal to open long deals, turned out to be unsuccessful. That is shy the euro/dollar pair returned to the area of 1.1826. After that, bears formed a good entry point for short positions. This led to a new wave of short positions. However, the euro managed to keep its positions amid a lack of important fundamental data. In the second half of the day, the main aim of buyers is to regain control over the resistance level of 1.1826. Only consolidation on the level and its break could provide a good signal to open long deals. In this case, the uptrend is likely to continue. At the same time, bulls should return to the high of 1.1864 where it is recommended to take profit. If the euro continues falling, the lower limit of the range located at 1.1788 will act as a support level. However, long deals could be opened only in case of a false break. It is possible to buy the euro/dollar pair from the low of 1.1762 with the correction of 15-20 pips within one day. Conditions to open short deals on the euro/dollar pair: Sellers regained control over the support level of 1.1826, thus forming a signal to open short positions. The euro is likely to lose in value until traders perform deals below the mentioned level. Bullish momentum is fading away. The closest target is the pair's return to the support level of 1.1788 where it is recommended to take profit. The low of 1.1761 is the next target. However, the pair reach it only amid strong data on the US consumer activity. If the euro/dollar pair climbs above 1.1826 and sellers show tepid activity at this level in the second half of the day, it is better not to open short positions. Instead, it is recommended to wait for the update of the high of 1.1864 and sell the euro there. Notably, the COT report on October 20 revealed a simultaneous rise in the number of both long and short positions. However, there were more short deals that led to an even greater drop in the positive delta. Despite this fact, buyers of risky assets expect a continuation of the bullish trend. However, they remain cautious due to the lack of good news from the eurozone. Thus, long non-profit positions rose from the level of 228,295 to t 229,878, while short non-profit positions advanced from 59,658 to 63,935. The total non-commercial net position fell to 165,943 from 168,637 a week earlier. However, bullish control over the euro remains quite high in the medium term. The deeper the euro declines against the US dollar at the end of this year, the more attractive it will be for new investors. I recommend reading my video forecast for today. Signals of the indicator: Moving Averages Trading is conducted around the 30- and 50-day moving averages, which indicates the sideways nature of the market. Note: the period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1. Bollinger Bands A break of the upper limit of the indicator in the area of 1.1835 will lead to a new wave of growth in the pair. A break of the lower limit of the indicator located at 1.1805 may increase the pressure on the euro. Description of indicators

|

| Posted: 27 Oct 2020 04:28 AM PDT Germany's Scholz: Extra measures to curb virus spread should be targeted, temporary Comments by German finance minister, Olaf Scholz

Well, we will have to wait and see what the meeting between Merkel and regional leaders on Wednesday will yield but a'lockdown light'n any form would be a blow to the German economic outlook in Q4 - even if the auto sector has been holding up. Further Development

Analyzing the current trading chart of EUR/USD, I found that there is potential for the secoind downside leg to develop. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Heating Oil and Lean Hogs today and on the bottom Lumber and VIX. Key Levels: Resistance: 1,1835 Support levels: 1,1790 and 1,1775 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment