Forex analysis review |

- Hot forecast and trading signals for the EUR/USD on October 5. COT report. Market entry points on Monday

- Overview of the GBP/USD pair. October 5. Boris Johnson blamed the EU. David Frost "began to see the outlines of a trade agreement"

- Overview of the EUR/USD pair. October 5. Donald Trump is hospitalized. The situation with the elections and the future of

- Analytics and trading signals for beginners. How to trade the EUR/USD currency pair on October 5? Analysis of Friday's deals.

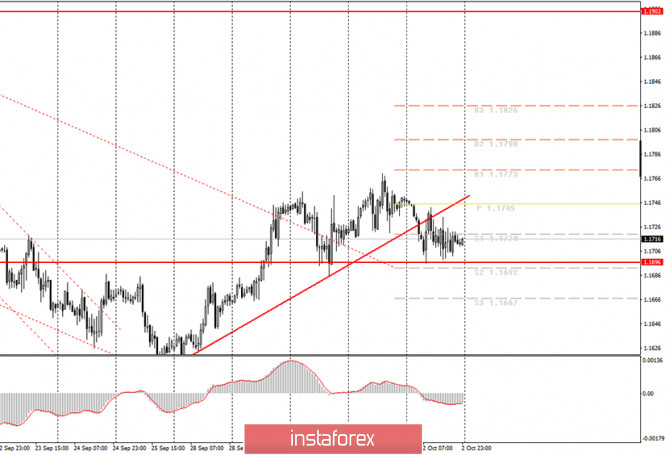

| Posted: 04 Oct 2020 06:10 PM PDT EUR/USD 1H The euro/dollar pair traded all day on the hourly timeframe on October 2 as if it were a semi-weekend or a holiday. All trades were held between the Senkou Span B and Kijun-sen lines, which are generally strong lines and signals appeared upon breaking or rebounding from them. However, we had a distinct flat on Friday. We even formed a horizontal channel capped at 1.1683 and 1.1756. And the pair has been trading between these levels for several days. What caused the new flat? Most likely a fundamental background. From a technical point of view, the dollar should continue to rise, since we have not seen a sane correction following the 1300-point rally. EUR/USD 15M Both linear regression channels are directed to the downside on the 15-minute timeframe, indicating that traders are now more inclined to overcome the lower channel line at 1.1683-1.1756. The euro/dollar rose in price by around 30 or 40 points during the last reporting week (September 23-29). We cannot even call it growth, just a normal market noise. The previous Commitment of Traders report showed that non-commercial traders opened 15,500 new Buy-contracts (longs) and almost 6,000 Sell-contracts (shorts). Thus, the net position for this group of traders increased by around 9,000. The new report clearly reflects what is currently happening in the foreign exchange market. Professional traders closed 4,500 contracts for buy positions on the euro and 3,300 contracts for sell-positions during the reporting week. That is, the net position for the "non-commercial" group has decreased by around a thousand contracts, that is, the mood of large traders has become a little more bearish. However, these are not changes that can be acknowledged as global. Therefore, we conclude that the situation has not changed dramatically. The EUR/USD pair generally stood in one place for the next three trading days (after September 29). Therefore, the next COT report can be as uninformative as possible. The European Union recently published a report on inflation for September (preliminary value). It turns out that the consumer price index fell even more and now stands at -0.3% y/y. Core inflation also fell to just 0.2% y/y. This is very, very bad news for the euro and the European Union. It is extremely difficult for an economy to show growth without inflation. News from overseas did not fare any better. We have already mentioned that US President Donald Trump has been infected with the coronavirus. The NonFarm Payrolls report turned out to be weaker than the experts' forecasts and reached 661,000 new jobs in September instead of the expected 850,000. Average hourly wages rose by only 0.1% in September. And traders were only pleased by the unemployment rate, which dropped to 7.9%. However, all these rather important reports did not have any impact on the foreign exchange market, which continued to move throughout the day in a range of no more than 50-60 points wide. We have two trading ideas for October 5: 1) Buyers did not have enough strength to sustain the upward movement so that it could go beyond the 1.1756 level. Thus, further strengthening of the euro is now in question. A horizontal channel at 1.1683-1.1756 has appeared and we recommend that you wait until the price settles above it in order to possibly open new long positions while aiming for 1.1798 and 1.1886. Take Profit in this case will be from 20 to 110 points. 2) Bears have finally released the market from their hands, but may still return to it if they manage to get the pair to settle below the 1.1683-1.1756 horizontal channel. In this case, we recommend opening new short positions while aiming for 1.1538. All support and resistance levels will be reviewed tomorrow. In this case, the potential Take Profit is up to 130 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Oct 2020 05:07 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 123.2782 On Friday, October 2, the British pound continued to be in the "storm" mode. The pair's quotes continued to be tossed from side to side. In principle, this behavior of market participants is quite justified, since recently news of such a plan has been received from the UK that it was really time to panic. However, the fundamental background on the last trading day of the week became even more unclear, and reports about the illness of Donald Trump did not add to the calmness of market participants and did not lift their spirits. As a result, the pound once again corrected to the moving average line, then bounced off it, and resumed its upward movement. However, it again failed to overcome the Murray level of "+1.8" - 1.2970, which is located very close to the psychologically important mark of 1.3000. This mark was not overcome by buyers two weeks ago, so there is reason to assume that this time the attempt to continue moving north will be unsuccessful. In the situation with the pound, it should be understood that the fundamental background is now equally bad for it and for the US dollar. Therefore, if the European currency can really continue to rise in price against the dollar, then the strengthening of the pound is a very big question. We would even say that the pound is the main contender for a fall in the last quarter of 2020, given all the events of recent weeks. After the European Union officially notified London and Boris Johnson that it was starting legal proceedings against the UK and its non-compliance with the Brexit agreement, Boris Johnson became restless and once again began to gather for an official visit to Brussels to hold talks with the head of the European Commission, Ursula von der Leyen. The meeting was scheduled for last weekend, and the results are still unknown. However, in principle, we do not understand what Johnson wants to achieve with this meeting? The European Union has been threatening for about a month that it will start legal proceedings if London does not withdraw the "Johnson bill". Instead, the UK Parliament approved the bill in the second reading. Thus, what Johnson wants to achieve with a visit to Brussels is unclear. Moreover, it is already absolutely clear to everyone that the European Union is not "led" to attempts of blackmail and bluff, which are regularly used by the British Prime Minister. Ursula von der Leyen stated: "The situation in the Brexit negotiations remains very difficult. We have already announced that the internal market bill directly contradicts the terms of the Brexit deal, in particular the protocol on the border between Ireland and Northern Ireland. We asked our British colleagues to review this act within a month, but they refused." Meanwhile, Boris Johnson himself very cleverly "threw the ball" to the side of the European Union, saying that he wants to conclude an agreement with the European Union to avoid a "hard" Brexit at the end of the year. "I hope we make a deal, but it's up to our friends," Johnson said. Also, the British Prime Minister has once again stated that he wants to get an agreement on the type of Canadian or Australian. In our humble opinion, Johnson's plans will not be implemented, because, to paraphrase the Prime Minister, it turns out "we want to get the agreement we want, and we are not ready to give in." Also last week, the ninth round of negotiations on a trade agreement between the EU and Brussels ended. At the end of this week, British negotiator David Frost said that "we are beginning to see the outlines of a future agreement, although there are still a lot of contradictions". Also, David Frost absolutely does not understand why the EU does not want to make concessions to London and give them the same agreement as with Canada. "They have signed an agreement with Canada that we would like to have. So why can't they make it with us? We are very close, because we have been members of the EU for 45 years," says Frost. But the EU's chief negotiator, Michel Barnier, does not share the optimism of his British counterpart. "The round ended with serious disagreements remaining on the main important issues," Barnier said. Both sides note that most of the differences remain in the "fishing issue". In general, from our point of view, the parties are not so much closer at the end of the next round. Recall that the parties are going to complete the negotiations before October 15. At least London is going to finish. We believe that negotiations will continue beyond this date. It's just that if an agreement can still be reached, for example, in December, then it will be ratified next year, so both sides will live without a trade agreement for several months. However, London and Brussels have already started to clash over the draft law "on the internal market", which will greatly complicate any negotiations in principle. Thus, by and large, there is no positive news for the pound. If it were not for the difficult political, economic, and epidemiological situation overseas, we would give about an 80% probability that the fall of the British currency will resume. However, it is the failed fundamental background in the US that continues to keep the pound afloat. The prospects for this currency and the currency pair are not fully defined at the moment. In the next month or even until the very end of the year, serious questions will be resolved about who will become the next US President, how Donald Trump will be treated, what will be the future negotiations and relations between London and Brussels. And any of these topics can potentially send the pair down or up 500 points or even more. Thus, for the coming weeks and months, we recommend that all traders, as they say, keep their finger on the pulse of the market. Although even taking into account the negative fundamental background in America, we still tend to believe that the fall of the British currency will resume. The GBP/USD pair is bitterly held above the moving average line, and buyers do not have enough strength to continue moving north.

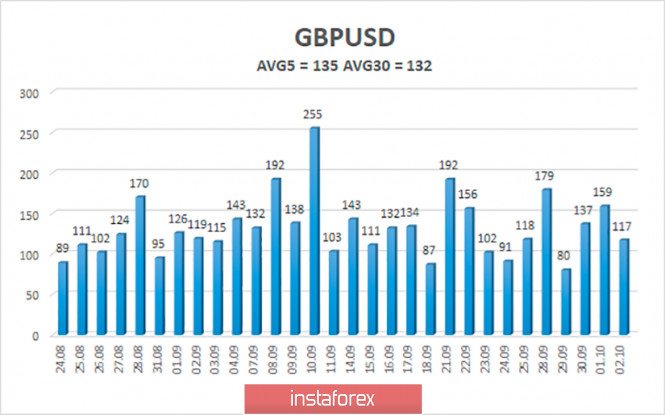

The average volatility of the GBP/USD pair is currently 135 points per day. For the pound/dollar pair, this value is "high". On Monday, October 5, therefore, we expect movement inside the channel, limited by the levels of 1.2790 and 1.3065. A new reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement. Nearest support levels: S1 – 1.2909 S2 – 1.2878 S3 – 1.2848 Nearest resistance levels: R1 – 1.2939 R2 – 1.2970 R3 – 1.3000 Trading recommendations: The GBP/USD pair on the 4-hour timeframe hardly continues its upward movement, bouncing off the moving average line once again. Thus, today it is recommended to stay in the longs with the targets of 1.2970 and 1.3000 as long as the Heiken Ashi indicator is directed upwards. It is recommended to trade the pair down with targets of 1.2817 and 1.2787 if the price returns to the area below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Oct 2020 05:07 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. CCI: 23.6373 Last week, the European currency paired with the US dollar was able to strengthen by about one cent. This is not much, given the fact that the euro has risen by 13 cents over the past few months. The price rose so much that even the European Central Bank began to "sound the alarm", and its chief economist Philippe Lane and Christine Lagarde herself said several times publicly that the current euro exchange rate is too high, which creates additional problems for the economy and also slows down inflation even more. All this week's macroeconomic reports were ignored, as usual. Or the reaction to them was so weak. These are the results of the past week. In principle, it does not even make any sense to consider macroeconomic reports. There were no performances by Jerome Powell last week. Christine Lagarde did not make loud statements, and all the top officials of the European Union are now directed at absolutely inappropriate behavior in London. There was information that the European Union had new problems with the recovery fund, which was adopted a couple of months ago in the amount of 750 billion euros. There are reports that many countries do not agree with the distribution of funds among the most affected countries, which was proposed by the European Council. However, we consider this information to be either untrue or unworthy of attention. If the 27 EU member states managed to reach a consensus on the size of the recovery fund, the budget for 2021-2027, and the sources of their funding, it is unlikely that the whole process will now stall due to the fact that countries will not be able to agree on the distribution of these funds. Moreover, immediately after the EU summit, at which everything was agreed, there was information about which country will receive how much money. Thus, again, it turned out that all the most important and interesting news came from overseas. At the beginning of the week, the first round of debates between Donald Trump and Joe Biden took place, and at the end of the week it became known that Trump and his wife Melania fell ill with "coronavirus". Many experts and participants of this show have already spoken out on the debate. According to the absolute majority of the media and publications, this was the weakest and even "shameful" debate in the history of the country. It is reported that Trump constantly interrupted Joe Biden, put pressure on both his opponent and the host, in the end, the host even lost control of this show and it became quite "chaotic". Most Americans wanted to use the debate to find out the campaign promises of both presidential candidates in order to make a conclusion for themselves who they should vote for. Instead, they saw a reality show or something similar. For several decades, it has been believed that TV debates allow both candidates to collect the remaining votes of those who have not yet decided on the choice. The debate between Trump and Biden could only worsen the position of both. "This was an absolutely terrible debate that did absolutely nothing to educate the public about the two candidates and what they would do if they were given four years to serve as President of the United States of America," CNN reporters wrote. Fox News, which is usually loyal to Donald Trump, has the following opinion: "Both candidates resorted to swearing and insults, constantly interrupting each other. Joe Biden called Trump a "clown" and a "racist," and the President taunted the former Vice President for not being able to gather a crowd, questioned him about his son's alleged misdeeds in Ukraine and China, and reminded him of the former Vice President's poor academic performance." In general, all the debates were devoted to insulting each other and trying to compromise each other. There was no civilized discussion. And now the election is just under a month away, and Donald Trump is sick. It is likely that there will not be two more scheduled rounds of debates. And in general, it is not clear how easy or difficult will Trump suffer from the disease. Recall that Boris Johnson, who is also overweight, had quite a hard time with COVID-2019 and was even in intensive care. Trump is also overweight, however, he is also aged. Recall that the US President is currently 74 years old. Thus, it is in the most serious risk group. In general, one month before the election, the situation becomes even more complicated. Meanwhile, the White House raised the question of who will lead the country and make decisions while Trump is being treated? In addition to this very important question, there is also the question of who else was infected with the "coronavirus" from Trump's entourage? So far, it is reliably known that former presidential adviser Kellyanne Conway, Trump's closest aide Hope Hicks, Republican Senators Mike Lee and Tom Tillis have fallen ill. Trump campaign chief of staff Bill Stepien was also confirmed to have "coronavirus". The most "tough" thing about this whole situation is that Trump was in contact with many Republicans and Democrats on duty. And most politicians in the United States are very old people. For example, Joe Biden is 78, speaker Nancy Pelosi is 80, and Senate Republican majority leader Mitch McConnell is 78. Almost all senators in the Upper House are over 60. Thus, they can potentially carry the virus extremely hard. So far, the reins of government have passed to Vice President Mike Pence, whose "coronavirus" has not been confirmed. Also, Steven Mnuchin, the US Treasury Secretary, has so far avoided the fate of infection. And most importantly, it is now completely unclear how the elections will be held? It's good if Trump gets better in a week. And if not? Who will be the Republican nominee then? What about Supreme Court Justice Amy Coney Barrett, who should have been appointed under the patronage of Trump himself to replace the deceased Ruth Ginsburg in the very near future? Just a week ago, we said that the times are not better for dollar investors and traders, as the level of uncertainty is too high. With Trump's illness, it has become even higher. We believe that this is a very convincing factor for the US currency to continue to weaken.

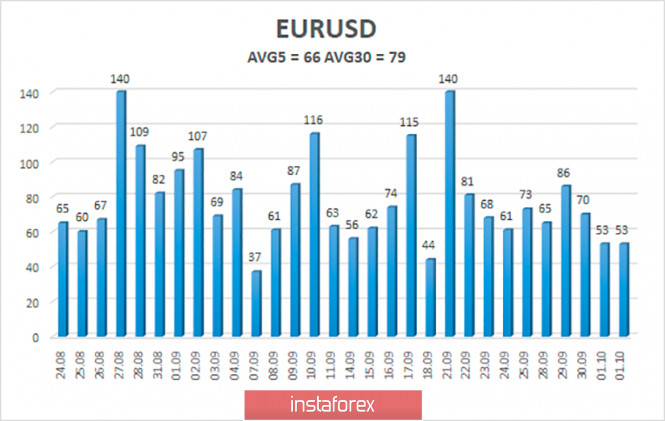

The volatility of the euro/dollar currency pair as of October 5 is 66 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1650 and 1.1781. A reversal of the Heiken Ashi indicator back upward may signal the resumption of the upward movement. Nearest support levels: S1 – 1.1719 S2 – 1.1658 S3 – 1.1597 Nearest resistance levels: R1 – 1.1780 R2 – 1.1841 R3 – 1.1902 Trading recommendations: The EUR/USD pair continues to be located just above the moving average line. Thus, today it is recommended to consider options for opening new long positions with a target of 1.1780 in the event of a price rebound from the moving average or a reversal to the top of the Heiken Ashi indicator. It is recommended to consider sell orders again if the pair is fixed back below the moving average with the first target of 1.1658. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Oct 2020 04:10 AM PDT Hourly chart of the EUR/USD pair.

On Friday, October 2, it was again quite difficult to trade the EUR/USD currency pair, especially for novice traders. If in the last few days the movements were non-standard, then there was no correction, "swing", and frequent rollbacks. Therefore, in the end, the upward trend was broken, as the price was fixed below the upward trend line. Further, on Friday, there was a frank flat (movement in a narrow price range without a certain direction). It is not recommended for anyone to trade in a flat, as it is very difficult to make a profit from the sideways movement. Thus, there are several conclusions to be drawn after Friday. First, the upward trend is broken. Secondly, traders failed to gain a foothold below the level of 1.1696, and this level again begins to support the euro/dollar pair. Third, it is now almost impossible to predict the further movement of the pair even in the coming days. Fourth, Friday's macroeconomic data did not have any impact on the course of trading. During the last trading day of this week, quite a lot of macroeconomic statistics were published. For example, the European Union released another report on inflation, which showed an even greater slowdown in the main indicator, to -0.3% y/y. This is the third consecutive month of deflation in the Eurozone. This is bad news for the euro, however, market participants did not think so. Further. In America, an extremely important report on NonFarm Payrolls (the number of new jobs created outside of agriculture) was published, however, it did not cause any reaction from the markets. The actual value of the report was lower than forecasts and the previous value, which means that the US dollar should have fallen in price. The unemployment rate in America fell to 7.9%, however, the fact that this indicator continues to decline was clear from the reports on the number of secondary applications for unemployment benefits, which we discussed on Thursday. And we have listed only the most important reports of the day. There was also a report on changes in the level of wages in the United States, the University of Michigan consumer confidence index, and others. However, macroeconomic statistics simply continue to be ignored. On Monday, October 5, the European Union, some EU countries, and the United States are scheduled to publish indices of business activity in the service sector. In the current environment, these reports are not of high significance. On Friday, the markets ignored much more significant data. Thus, we believe that only frankly bad values of these indicators can cause a reaction, that is, values below 50.0. The European Union will also publish a report on retail sales for August, however, it is unlikely to have any impact on the course of trading. Most of the market attention is now focused on Donald Trump being infected with "coronavirus", just a month before the presidential election. On October 5, the following scenarios are possible: 1) Since the upward trend line was overcome by traders, purchases of the euro/dollar pair have now ceased to be relevant. At the same time, the current technical picture looks so ambiguous that it allows for various scenarios. For example, an upward trend line can be rebuilt. However, at the moment, we do not recommend opening buy positions for novice traders. 2) Sales of the pair became relevant after the price was fixed below the trend line, however, the level of 1.1696 kept the pair from falling further. This is not the first time. Thus, we recommend opening new sales of the euro/dollar pair if traders manage to gain a foothold below this level. The nearest target is the support level of 1.1667. What's on the chart: Price support and resistance levels - the target levels when opening purchases or sales. You can place Take Profit levels near them. Red lines – channels or trend lines that display the current trend and indicate which direction is preferable to trade now. Up/down arrows - show when you reach or overcome which obstacles you should trade up or down. MACD indicator (14,22,3) is a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines (channels, trend lines). Important speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp reversal of the price against the previous movement. Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment