Forex analysis review |

- Forecast for EUR/USD on November 10, 2020

- Forecast for AUD/USD on November 10, 2020

- Forecast for USD/JPY on November 10, 2020

- Hot forecast and trading signals for GBP/USD on November 10. COT report. Analysis of Monday deals. Recommendations for Tuesday

- Hot forecast and trading signals for EUR/USD on November 10. COT report. Analysis of Monday deals. Recommendations for Tuesday

- Overview of the GBP/USD pair. November 10. Donald Trump leaves, Boris Johnson continues to hope for a trade agreement.

- Overview of the EUR/USD pair. November 10. Donald Trump is the eleventh President in the history of the United States who

- USD/JPY. Pfizer's pharmacology brought down the yen

- Analytics and trading signals for beginners. How to trade EUR/USD on November 10? Getting ready for Tuesday session

- EURUSD retracing the upward move from 1.16

- Impressive rejection at cloud resistance and break of key support

- November 9, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- November 9, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- USDCAD bears remain in control as price slides below 1.30 for the first time since August 2018.

- November 9, 2020 : EUR/USD daily technical review and trade recommendations.

- EUR / USD: Euro celebrates Biden's victory while dollar face loss of 1.9%

- EUR/USD analysis for November 9

- Analysis for GBP/USD on November 9. American statistics did not support the dollar. News background from the UK did not put

- GBPUSD: Growth, fall, speculation, what else a trader needs to be happy

- BTC analysis for November 09,.2020 - Median Pitchfork line is acting like important resistance for BTC

- EUR/USD analysis on 09/11/2020: The Dollar continues to fall, Biden is the US President, markets fear Trump's possible retaliations

- EUR/USD analysis for November 09 2020 - Key povot at the price of 1.1900 is on the test

- Analysis of Gold for November 09,.2020 - Massive downside movement and both targets reached. Potential for further downside

- GBP/USD: plan for the European session on November 9. Commitment of Traders reports (analysis of yesterday's trades)

- Oil steadies amid final US election results

| Forecast for EUR/USD on November 10, 2020 Posted: 09 Nov 2020 07:06 PM PST EUR/USD The euro did not beat around the bush and decided to strengthen the correction, as it looked into the collapse of gold (-4.51%) and silver (-6.90%)n. The euro has lost 62 points since Friday's close. The price touched the upper shadow of the MACD line and decisively reversed from it on the daily chart. Now the price needs to fall below the balance indicator line, since it will be easier for the price to drop in this case. The Marlin oscillator is moving down, but is also staying in the growth trend zone, the market has not cooled down after last week's growth, a second attempt to attack the MACD line in the 1.1915 area and further, towards the price channel line in the 1.1948 area. The price has settled below the nearest level of 1.1830 on the four-hour chart, while the Marlin oscillator is attacking the border of the bears' territory. Falling below yesterday's low may extend the movement to the MACD line towards the target level of 1.1750. And being able to settle below it will become a sign of the price's intention to go down further, where the first target will be the level of 1.1620. The likelihood of rising and falling further at the moment is roughly 55% versus 45%. We are waiting for the situation to unfold. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on November 10, 2020 Posted: 09 Nov 2020 07:06 PM PST AUD/USD The Australian dollar was actively growing under the general weakening of the US dollar on Monday morning. After testing the upper border of the price channel of the higher timeframe, the price fell under the general attack of the US dollar on rival currencies. Now the price lies on the MACD line on the daily chart. The Marlin oscillator is in no hurry to move in any direction. The situation is neutral, however, it has an upside potential (0.7332). The expected divergence has formed on the four-hour chart, but due to the rapid price growth, it was not pronounced, instead it was rather weak for an optimistic reversal. Now, to confirm this signal, you need to wait for the price to settle below the nearest level of 0.7222. Then the Marlin line will also establish itself in the declining territory. So, the aussie's growth potential is not that great at the moment, and it is also too early to include a reversal in a trading strategy. We are waiting for the situation to unfold. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on November 10, 2020 Posted: 09 Nov 2020 06:44 PM PST USD/JPY The 200-point increase in the dollar-yen pair yesterday was as unexpected as it was not sustainable in the future. It was driven by the growth of stock markets due to news about the effectiveness of the American vaccine companies Pfizer and BioNTech against COVID-19 at the level of 90%. The Dow Jones stock index rose by 2.95%, the S&P 500 added 1.17%, but the growth was due to the gap from the opening of the market, the indices declined, but the gap was not closed, while the Nasdaq index closed the day with a fall of -1.53%. That is, the quality of growth in stock indexes was low, and a significant share of optimism about vaccines has long been embedded in quotes.

On the daily chart, the price overcame the resistance of the MACD line yesterday. The Marlin oscillator shot up, but this morning, the situation with the price and indicators is making an attempt to return to a downward trend. The price just needs to do a little bit to gain a foothold under the trend line below 104.78. This will be the initial condition for a reversal, and the target for further decline will be 104.05. Then 103.18, and the target 102.35 may open again. The reverse exit of the price above today's opening will open the prospect of further growth to the embedded line of the price channel at 106.06.

Meanwhile, the situation is completely upward on the four-hour chart. The price is above both indicator lines, and Marlin is in the zone of a growing trend. Thus, the first condition for restoring the downward local trend of the pair will be the fixing of the price at 104.78. The confirming factor will be a decline at 105.04, which will coincide with overcoming the MACD line on the four-hour scale. The material has been provided by InstaForex Company - www.instaforex.com |

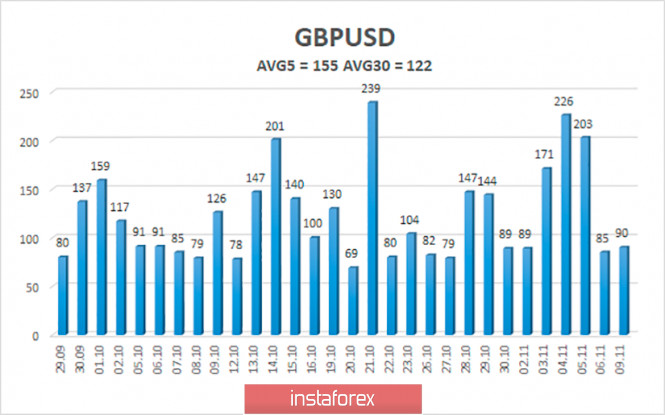

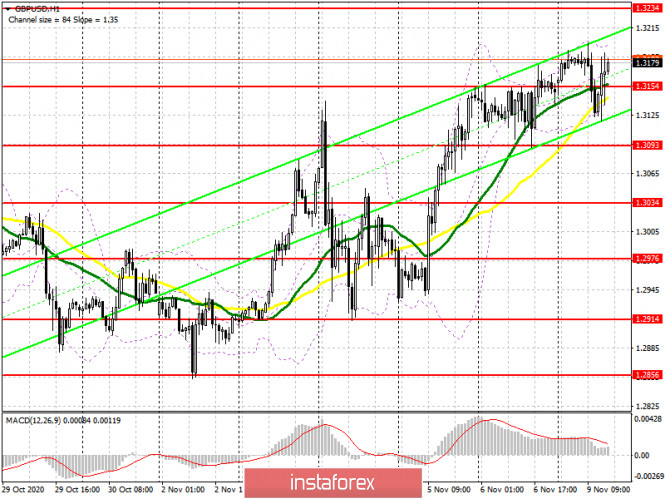

| Posted: 09 Nov 2020 06:07 PM PST GBP/USD 1H The GBP/USD pair also reached the important resistance area of 1.3160 -1.3184 on Monday, November 9 and, just like the euro, it also failed to go beyond this area during the day. Therefore, the pound could also fall. Although, unlike the euro/dollar, the pound has an ascending trend line, which supports those who are trading on the rise, and the sterling did not sharply fall as well. Oddly enough, the fundamental background is more inclined to the pound's decline. Nevertheless, buyers remain in the game and they need to go beyond the 1.3160 -1.3184. The only way they could move up is if they do so. Sellers had the opportunity to open short positions yesterday, but this did not bring them a big profit, since the price could not move far down. However, we recommended trading in small lots, as the price continues to be above the trend line, as well as above the important Kijun-sen and Senkou Span B lines. This means that the trend remains upward. GBP/USD 15M The linear regression channels are directed sideways and to the upside on the 15-minute timeframe, which indicates that there are no signs of starting a downward movement. You can even say that most of the previous day's trading took place in a horizontal channel. Therefore, the lower timeframe does not provide any reason to conclude that the upward trend is over. COT report The GBP/USD pair only lost 100 points during the last reporting week (October 27-November 2). The pound began to rise after November 2. And it wasn't so much of a rise, but more like the dollar's fall. However, let's go back to the reporting period. Non-commercial traders closed 3,281 Buy-contracts (longs) and opened 1,146 Sell-contracts (shorts). Thus, the net position for the "non-commercial" group of traders decreased by 4,500. This is much more clearly visible on the chart of the first indicator. The green and red lines, which represent the net positions of the two most important groups of traders, began to diverge in different directions. Therefore, the mood of professional traders is becoming more bearish again. However, this change did not result in the pound's decline. Because elections were already held in the United States on November 3 and the dollar was only getting cheaper then. Therefore, the new Commitment of Traders (COT) report may show that the bearish mood is weakening among professional traders. However, in any case, we believe that the markets need to calm down and only after that will it be possible to look at all the information in a new way. It is now clear that market participants are in a very agitated state due to the political chaos that is now present in the United States. Therefore, the mood of large traders can change quickly and dramatically. Fundamental background was practically absent for the pound/dollar on Monday. Bank of England Governor Andrew Bailey and the representative for monetary policy of the Bank of England Andy Haldane were scheduled to speak, but they did not mention anything interesting. In principle, they could not disclose anything important, since a BoE meeting also took place last week, during which important decisions were made, as well as worsened forecasts for the recovery of the British economy. Traders expect further easing of monetary policy and a transition to negative interest rates. Therefore, the market did not expect anything hawkish from Bailey. Several important reports from the UK are scheduled for Tuesday. Firstly, this is the unemployment rate for September, which, according to experts, will grow from 4.5% to 4.8%. Secondly, applications for unemployment benefits, the number of which may reach 36,000. Thirdly, the average salary, including bonuses and without them, which can grow by 1.1%-1.5%. However, the market is currently paying more attention to political news from America than to economic news, wherever it comes from. And so, traders can ignore all of these reports from the UK. No scheduled macroeconomic reports from America. We advise you to monitor news related to the topic of the US presidential election. They will form the fundamental background for the pair in the coming days and weeks. We have two trading ideas for November 10: 1) Buyers for the pound/dollar pair cannot overcome the 1.3160 -1.3184 area, which prevents them from continuing their upward movement. However, at the same time, they do not stray far from this area and will continue to test it for strength. Thus, we recommend buying the pair only if bulls manage to overcome the indicated area, while aiming for the resistance level of 1.3266. Take Profit in this case will be up to 60 points. 2) Sellers do not currently own the initiative in the market. However, in case the price rebounds from the 1.3160 -1.3184 area, you can try to sell the pound/dollar pair while aiming for the Kijun-sen line (1.3032) in small lots, since we currently have an upward trend. Take Profit in this case can be up to 100 points. You can confidently open sell positions after breaking the trend line and Senkou Span B line (1.2995) with the targets at the support level 1.2943 and the 1.2856-1.2874 area. Hot forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

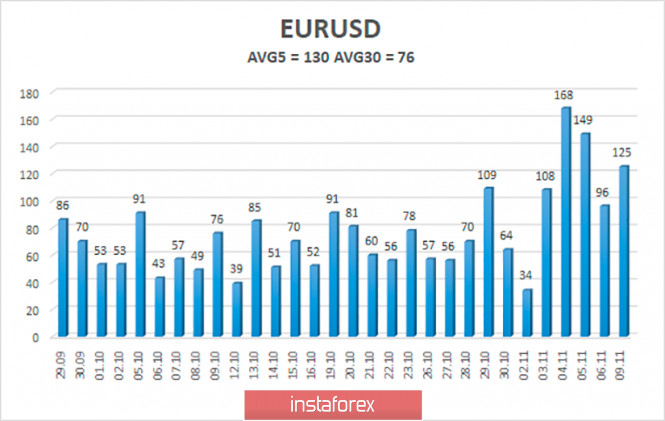

| Posted: 09 Nov 2020 06:05 PM PST EUR/USD 1H The EUR/USD pair traded near the resistance area of 1.1886-1.1912 for quite some time on the hourly timeframe on Monday, November 9, and it finally rebounded off it and fell during the US session. Therefore, yesterday's forecasts that predicted a rebound from this area were correct. And since the pair did not settle above this area, traders could open short positions during the day. The nearest target is the Kijun-sen line. In general, the upward trend is still maintained for the EUR/USD pair. Precisely because the quotes remain above the critical line. And as long as the price is above this line, the outlook for the bulls remains quite good. However, we have already repeatedly drawn attention to the fact that it will be extremely difficult to overcome the 1.1900 level. And from a fundamental point of view, there is no reason for it to rise above the 1.1900 level. Thus, we are more inclined towards the option of the euro's fall. However, sellers need to overcome the Senkou Span B and Kijun-sen lines in order for a full downward trend to form. EUR/USD 15M The lower linear regression channel has already turned to the downside on the 15-minute timeframe, and the higher one can do so in the near future. A closer look at the technical picture shows an even more eloquent rebound from the 1.1886-1.1912 area, as well as the fact that buyers failed to overcome it within 28 hours. Sellers' further prospects lie below the Kijun-sen and Senkou Span B. COT report The EUR/USD pair lost 170 points during the last reporting week (October 27-November 2). A strong upward movement began after this time range. Therefore, the fact that the pair gained 220 points simply does not fall within the timeframe of the latest Commitment of Traders (COT) report. According to it, professional traders closed 9,200 Buy-contracts (longs) and opened 7,800 Sell-contracts (shorts). Thus, the net position for non-commercial traders decreased by 17,000 at once. And any decrease in the net position indicates a strengthening of the bearish mood. Consequently, professional traders continue to look towards selling the euro. Therefore, even despite the subsequent growth, we still believe that the high near the 1.2000 level will still be the peak of the entire upward trend. At least the COT data continues to signal just that. The technical analysis may contradict the COT report, as the latter comes out with a three-day delay. We cannot now know how the big players behaved in the period from November 3 to 6, which is when the dollar was significantly falling due to the elections. Indicators are also signaling good prospects for a new downward trend, as the green and red lines continue to narrow (the first indicator). And they, we recall, reflect the net positions of non-commercial traders and commercial ones. No macroeconomic releases for America and the European Union on Monday. Therefore, traders had nothing to react to during the day. However, as we mentioned earlier, the tension in the market should have started to subside, and at the same time the US dollar should have started to rise. Last week, the dollar was under pressure solely due to political factors. However, over the weekend it became reliably known that the election was won by Joe Biden, therefore, the dollar should have received a respite at least for a while. At least for a correction after a 280-point rally. Technical factors also predicted a fall in the pair (and a rise in the dollar). No important reports or scheduled speeches for both America and the EU on Tuesday. Therefore, the fundamental and macroeconomic background will be rather scarce. The ZEW Institute Business Sentiment Index and the ZEW Institute's Current Economic Conditions Index will be released in Germany. However, this is not the kind of news that can provoke a reaction from traders. Better to continue focusing on political news from the United States. Something tells us that it won't be without surprises in the near future. Take note that Donald Trump refused to admit his defeat in the elections and is going to sue Joe Biden's team and seek a revision of the voting results. These are additional risks and a factor of additional uncertainty for the US dollar. We have two trading ideas for November 10: 1) Buyers need to wait until we have gone beyond the 1.1886-1.1912 area in order to open new buy positions on the pair with the nearest target at the resistance level of 1.1976. Or wait for the price to rebound from the Kijun-sen line (1.1759) and trade upward while aiming for the resistance area of 1.1886-1.1912. Take Profit in the first case will be up to 50 points, and up to 100 points in the second. 2) Bears kept the pair below the 1.1886-1.1912 area and began to open short positions while aiming for the Kijun-sen line (1.1759). You are advised to hold short deals for this purpose. It is recommended to open new sell orders if the pair overcomes the Senkou Span B line (1.1733), with targets in the 1.1692-1.1699 area and the 1.1612-1.1624 area. Take Profit in this case can range from 20 to 90 points. Hot forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Nov 2020 04:37 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 64.0073 The British pound sterling paired with the US dollar on Monday reached the Murray level of "8/8"-1.3184. During the day, there was a timid attempt to start a round of corrective movement to the moving average line, however, it ended unsuccessfully. Thus, the pound/dollar pair continues to trade in a similar way to the euro/dollar pair. Thus, we make an almost unambiguous conclusion: the mood of market participants now depends on the fundamental background in America. However, we made similar conclusions last week, when traders cheerfully ignored the Bank of England meeting and its "dovish" results, as well as the failure of the next round of negotiations between the groups of Michel Barnier and David Frost. Only these two events could cause the pound to fall by 100-200 points. And if you add in the macroeconomic statistics from overseas on Friday, the pound could lose even more. However, the political issue continues to be in the first place for market participants, so the US dollar remains under pressure. If the results of the US election are not reviewed, then Donald Trump will leave the office. And along with Trump, Boris Johnson's hopes of concluding a trade agreement with the United States may also collapse. Recall that Trump and Johnson have repeatedly called themselves friends and Washington has repeatedly influenced London's international politics. For example, in the case of 5G networks in Britain, which was supposed to be developed by the Chinese company Huawei, but Boris Johnson at the last moment refused to cooperate with it, as many believe due to the patronage of Trump, who conflicts with both Beijing and Huawei separately. However, during the first year and a half of Boris Johnson's Premiership, negotiations with Washington did not even begin. There were only preliminary discussions about the future agreement, nothing more. But now that Joe Biden is likely to come to power, things are getting much more interesting and fun for Britain. Recall that Biden has Irish roots and is very interested in everything that happens in his homeland. Thus, he highly honors the Belfast Agreement of 1998, which ended 30 years of bloody confrontation on the island. Even before the election, Biden said that he also highly honors any agreement with the European Union, as it applies to Ireland, too. When Boris Johnson drafted his bill "on the internal market of Great Britain", Biden was one of the first to condemn London's actions, saying that any violation of international law would greatly complicate further negotiations between London and Washington. Biden also said that any violations of the Brexit agreement and the Protocol on the Northern Ireland border will not add to the understanding between the White House and 10 Downing Street. Now Johnson finds himself in a very bad situation. The agreement with the European Union still "does not smell". The back-up agreement with America has not even begun to be discussed yet. If there is no agreement with the EU, the UK Parliament will approve the "Johnson bill", which violates previously reached agreements with the EU. The EU initiates legal proceedings, and the States can refuse to discuss any trade deal with London. Or offer much less attractive terms to Johnson. So, for some reason, the British outlook is looking worse and worse day by day. "I think there are good chances to agree. I never believed that this would be a failure, no matter what the US administration was," the British Prime Minister said. Johnson also said that he can't wait to work with Joe Biden in various areas, such as the fight against climate change, trade, and international security. But Joe Biden has repeatedly criticized Johnson, called him a "clone of Trump", and also criticized the UK's exit from the EU. Building a relationship with Biden will be much more difficult for Johnson. Meanwhile, Michel Barnier and David Frost are making a new go at the trade deal. Negotiations on a trade agreement are resuming in London. "Happy to be back in London today and renew our efforts to reach an agreement on future EU-UK cooperation," Barnier wrote on Twitter. The EU chief negotiator also said that to reach an agreement, reliable guarantees of free and fair trade, as well as mutual access to markets and fishing are needed. The most interesting thing is that none of the participants in the negotiation process, as well as the top officials of the UK and the European Union, are now talking about the deadline that Johnson set earlier. Recall that the last deadline expired on October 15, but to try to reach an agreement, Johnson allowed the negotiations to be extended for one month. This month is coming to an end. The new round of negotiations should last at least a week. Thus, it seems that Boris will again postpone his deadline, and the negotiations will continue for as long as necessary, and not as long as the British Prime Minister considers necessary. Johnson cannot fail to understand that without a deal with the EU, the British economy will be very hard in 2021. And now there is a change of power in the US, which reduces the chances of a trade agreement with Washington. In general, wherever you throw it, there is a wedge everywhere. Perhaps because of this, Johnson becomes more malleable and no longer makes unsubstantiated statements, does not try to blackmail and exert political pressure on Brussels. However, for the pound, all this does not matter yet. Because negotiations are not a deal. The very fact of negotiations will not make the British economy any better. Therefore, the British currency will have a good chance of growth when there is good news from the UK. In recent months, the pound has risen in price, solely due to the failed fundamental background from overseas. But any fairy tale comes to an end. We have repeatedly said that the pound had no reason to grow. Moreover, the UK's GDP may also shrink at the end of 2020 due to the "lockdown", and the Bank of England has already expanded its quantitative easing program, and it may introduce negative rates in early 2021.

The average volatility of the GBP/USD pair is currently 155 points per day. For the pound/dollar pair, this value is "high". On Tuesday, November 10, thus, we expect movement inside the channel, limited by the levels of 1.2973 and 1.3283. A reversal of the Heiken Ashi indicator downwards signals a round of downward correction. Nearest support levels: S1 – 1.3123 S2 – 1.3062 S3 – 1.3000 Nearest resistance levels: R1 – 1.3184 R2 – 1.3245 R3 – 1.3306 Trading recommendations: The GBP/USD pair is still in an upward movement on the 4-hour timeframe, however, it signals a desire to start correcting. Thus, today it is recommended to keep open long positions with targets of 1.3245 and 1.3283 until the Heiken Ashi indicator turns down. It is recommended to trade the pair down with targets of 1.3000 and 1.2973 if the price is fixed below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Nov 2020 04:37 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - sideways Moving average (20; smoothed) - upward. CCI: 33.6636 Trading on the first day of the week was again quite calm. However, instead of a brewing downward correction, we again saw an upward movement. Quotes only once again worked out the Murray level of "3/8"-1.1902. Recall that the 1.1900 level is the upper line of the $1.17-$1.19 side channel, where the price has been for most of the last three months. Well, then followed the long-awaited rebound from this level and a fairly strong drop in the euro quotes. The fundamental background that pushed the pair up all last week should have weakened slightly at the beginning of the new week and should have helped the bears. However, if the level of 1.1902 is confidently overcome, we can still expect a new round of upward movement to the maximum of September 1 - 1.2011. Over the past week, traders have been getting rid of the US currency for one simple reason. We've been talking about it for the last two or three months. Any election is a potential change of power. The US election is a potential change of power in the country with the largest economy in the world, which in one way or another affects the economies of all other countries. Thus, a lot depends on who will be in power in this country all over the world. A striking example is the trade war with China. It would seem that Donald Trump wants to conflict with the Middle Kingdom. This trade war has "harmed" many other countries to one degree or another, and also caused damage to global GDP. Thus, it is not for nothing that we said that the US dollar is unlikely to become more expensive until the elections are in the past. That's what happened. The maximum level of 2020 is still 1.2011, and the minimum level that bears have been able to reach over the past 3 months is 1.1620. Thus, after an increase of almost 1,300 points this year, the pair managed to correct in half by 400 points, which is less than 30%. Well, traders, even when the name of the new US President became known (at least, I want to believe it), continue to get rid of the US currency. Perhaps this is a residual effect of the previous week's trading. We continue to believe that the European currency has already grown quite strongly throughout 2020. All the advantages of the European economy over the American one (in particular, a smaller drop in GDP in the second quarter) have already been worked out. Thus, for the euro currency to continue to grow in the long term, new good reasons are needed. And they, from our point of view, are not present now. In Europe, the economy contracted less in the second quarter and recovered almost all of its losses in the third. However, with the arrival of autumn, the second "wave" of the "coronavirus" began, so many European countries introduced repeated "lockdowns". And repeated "lockdowns" are new cuts in the economy. Accordingly, at the end of the year, European GDP may again sink. In contrast to the US, since no one has re-quarantined in the States, even though America remains in first place in the world in terms of the number of cases of COVID-2019 and the number of deaths from this virus. So, the American economy will continue to recover, but the European economy will not. And this factor is already playing in favor of the US dollar. Therefore, if the United States does not start a civil war named after Donald Trump or something similar in the near future, then we consider a drop in the euro/dollar pair quotes in the coming months extremely likely. However, Donald Trump is unlikely to just give up. He lost the election and this is clear to everyone. Over the past three months, all the ratings and opinion polls have said only one thing – Joe Biden will win the election. At the same time, we can not even say that it was the figure of Joe Biden who became the key. We've already said that this was more of a "Trump or not-Trump" election than a "Trump-Biden" one. Indirectly, this assumption is confirmed by the record turnout of Americans in the elections. A total of 160 million ballots have already been counted. This is an absolute record. Americans, in the face of a severe pandemic, were not afraid to go to the polls and vote. Yes, many people voted by mail, but not all 160 million of them. Because the vast majority of Americans understood that this is almost the key election in the history of the United States. And given the fact who won them, it becomes clear what most Americans feared - Trump's re-election to a second term. Thus, Donald Trump will be only the eleventh President in the history of the United States, who failed to be re-elected. The last was George W. Bush in 1992. By and large, such statistics show the results of Trump's activities as President of the United States and how satisfied American citizens are with this activity. Joe Biden has already won a record number of votes that no President has ever won in the entire history of the country – more than 70 million. When all the votes are counted, he may even score 82 million, which is almost 7 million more than Donald Trump will score. The US dollar, in such circumstances, can now only fear one thing – Trump's further actions. The current President is a very odious and ambitious person. Even before the election, most experts were confident that there would be no peaceful transfer of power in the event of an election defeat. On the contrary, many believe that Trump will try to make the work of his successor as difficult as possible by destroying many important papers and documents or simply taking them with him from the White House. Given the words of Trump that he is ready to stay in the White House for a third and fourth term, we can assume that he expected to be re-elected. Now, like a wounded lion, he can start tearing and throwing. He has nothing to lose. Power is everything to him. Money is everything to him. He will not lose money, but he can lose power. Thus, there is no doubt that lengthy legal proceedings will now begin, although most experts believe that Trump's defeat in the election is quite convincing and even the US Supreme Court, where six of the nine judges are Republicans, will not help the President. However, this does not mean that Trump will not do anything and this is what traders and investors are afraid of. Or they may be afraid of it in the near future.

The volatility of the euro/dollar currency pair as of November 10 is 130 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1681 and 1.1941. A reversal of the Heiken Ashi indicator back to the top may signal the resumption of the upward movement. Nearest support levels: S1 – 1.1780 S2 – 1.1719 S3 – 1.1658 Nearest resistance levels: R1 – 1.1841 R2 – 1.1902 R3 – 1.1963 Trading recommendations: The EUR/USD pair started to adjust. Thus, today it is recommended to open new buy orders with targets of 1.1841 and 1.1902 if the price bounces off the moving average or the Heiken Ashi indicator turns up. It is recommended to consider sell orders if the pair is fixed below the moving average with the first target of 1.1719. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY. Pfizer's pharmacology brought down the yen Posted: 09 Nov 2020 03:48 PM PST The Japanese currency is actively getting cheaper throughout the market. In a pair with the dollar, the yen weakened by almost 250 points in just a few hours. Similar dynamics can be seen in the main cross-pairs. For example, in a pair with the European currency, the Japanese fell by almost 300 points and in a pair with the Australian dollar it is more than 200 points. In fairness, it should be noted that other defensive instruments, in particular, gold and the franc, were actively losing their positions. But the yen showed the strongest volatility reacting to news from the "coronavirus front". The USD/JPY pair in the first half of today updated the 8-month price lo, falling to 103.20 and in the second half of the day – updated the almost three-week high jumping to the middle of the 105th figure. And judging by the mood of investors, buyers of USD/JPY will soon head to the area of the 106th price level, opening up new horizons for themselves. The fact is that Pfizer pharmacologists have taken a serious step in the fight against the coronavirus pandemic. Pharmacology news today overshadowed the us election which set the tone for trading over the past week. So, the pharmaceutical companies Pfizer and BioNTech, which are working together to develop a vaccine against coronavirus reported the success of the third phase of clinical trials of the drug today: studies have shown 90 percent effectiveness. Almost 44 thousand people in six countries of the world took part in the tests. In subjects who received the drug, COVID-19 occurred 90% less often than in those who were given a placebo. Registration of the vaccine is expected in November, while the company is now collecting additional data on its safety. The performance data itself has not yet been published in a peer-reviewed journal but only in the form of a press release. Nevertheless, the news literally "blew up" the markets. It is known that Pfizer and BioNTech have signed a deal with the United States to supply at least 100 million doses of the vaccine in the amount of 1 billion 950 million dollars. At the same time, representatives of these companies have previously stated that hypothetically they will be able to produce an additional 50 million doses and this is only within the current year. And by the end of 2021, Pfizer intends to produce more than 1.5 billion doses of the drug. Why did this news cause such a stir in the markets? First, creating and distributing a vaccine is seen as the best and most reliable way to get rid of quarantine restrictions. Second, Pfizer pharmacologists were the first to "show off" such impressive results at the last stage of testing (although about a dozen vaccines are currently in the so-called "third phase"). Third, Pfizer used a completely experimental approach that involves injecting part of the virus's genetic code to "train" the immune system. And fourthly, traders finally saw a hope against the background of a record increase in the incidence of diseases not only in Europe, but also around the world (including in the United States). Representatives of Pfizer and BioNTech called their breakthrough in the development of the vaccine "a turning point in the fight against Covid-19". A major victory in the fight against the virus has revived hopes for a rapid recovery in the global economy. The market's focus has rapidly shifted from the US election to the vaccine. Against this background, such protective instruments as gold and the franc collapsed throughout the market. It is quite difficult to talk about the medium – term prospects of the dollar in a pair with the Euro or the pound - EUR/USD and GBP/USD bears showed a rather restrained reaction today. But the USD/JPY pair is likely to continue its upward trend. However, after such impulsive movements, as a rule, there is a corrective pullback, so at the moment you should not rush to buy. But in the medium term, the pair will still test the main resistance level of 106.00 (this is the upper line of the Bollinger Bands indicator on the daily chart). Therefore, a corrective decline in the price which is likely to follow during the Asian session on Tuesday can be considered as a reason to open long positions to the above target. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Nov 2020 01:21 PM PST Hourly chart of the EUR/USD pair The EUR/USD pair was trading almost "like a textbook" on Monday, November 9. The price reached the 1.1903 level, which we defined as the upper line of the horizontal channel, and so a strong downward movement began after rebounding from this line, as we expected. Thus, novice traders could work on a rebound from this level, and they could also open short positions using a Stop Loss above the 1.1903 level according to our morning recommendations. Yes, the price went slightly above the 1.1903 level, but did not even settle there for an hour. Now traders may well rely on a downward movement to the lower line of the horizontal channel at $1.17-1.19, which is where the euro/dollar pair spends most of its time. Unfortunately, there is still no trendline or trend channel. And so we can only rely on the signals of the MACD indicator in order to sell, since traders could not overcome the 1.1903 level. Therefore, an upward correction is possible now, afterwards it will be possible to catch a sell signal from the MACD. No macroeconomic reports from America and the European Union on Monday. Thus, the reason why the dollar sharply grew in the afternoon is not fundamental in nature. We have repeatedly warned traders that as soon as the tension in the market starts to subside, the US dollar may start to rise in price, and the tension could and should have started to subside on Monday. And so it happened. Joe Biden won the election. Donald Trump, of course, will try to change the situation in his favor with the help of courts, but, according to most experts, he will not be able to carry out this plan. Until Trump takes any serious action in this direction, the market can be calm. No important publications and events scheduled for America and the EU on Tuesday. Therefore, novice traders may not keep track of the news calendar. However, it is better for them to pay attention to political news from the United States. The fact is that Trump will most likely begin to actively file lawsuits in all kinds of courts in order to review the voting results, both in individual states and throughout the country. And the more he moves forward on this issue, the more the markets will be nervous again, and so the US currency will be under pressure again. All other news has frankly faded into the background. Everyone forgot about the coronavirus, lockdown in Europe and other minor problems. Separately, I would like to say that today the Pfizer and BioNTech companies have announced more than 90% effectiveness of the vaccine they are currently testing. "Our drug is capable of preventing coronavirus infections," said Pfizer CEO Albert Burla. "A potential candidate for vaccine status has shown more than 90% effectiveness in preventing COVID-19 infection," the company said in a statement. Thus, the US dollar could rise in price in part on this news. Possible scenarios for November 10: 1) Buying the EUR/USD pair ceased to be relevant after the price failed to overcome the 1.1903 level. Rebounding from this level - and the price will fall to the 1.1696 level. Therefore, you can open long deals on the euro/dollar pair, but only when the downward trend has ended, which is not expected in the near future, or even after overcoming the 1.1903 level. 2) Trading for a fall is more relevant at this time, since the price rebounded from the 1.1903 level. Thus, novice traders are advised to wait for a small upward correction and afterwards, a new sell signal from the MACD indicator, which can be traded with targets at 1.1757 and 1.1720. Unfortunately, there are still no trend lines or channels supporting this or that trend. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD retracing the upward move from 1.16 Posted: 09 Nov 2020 08:28 AM PST The bullish wave from 1.16 ended at today's high at 1.1920. Price has reversed trend and has already reached the 38% Fibonacci retracement. Bulls need to hold above 1.1720 and the 61.8% retracement otherwise bulls will be in danger of losing 1.16.

|

| Impressive rejection at cloud resistance and break of key support Posted: 09 Nov 2020 08:23 AM PST Gold bulls seemed last week that they were under control of the trend. Breaking above $1,920-30 and recapturing the $1,950 level were signs that bullish strength was on its way.....However the bulls never managed to break above the cloud resistance.

|

| November 9, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 09 Nov 2020 08:22 AM PST

Short-term bearish outlook was expected especially after bearish persistence was achieved below the lower limit of the newly-established ascending-channel around 1.3100. A quick bearish decline took place towards 1.2780 and 1.2700 where considerable bullish rejection brought the pair back towards 1.3000 and 1.3100 during the past few weeks. The price zone of 1.3100-1.3150 (the depicted channel upper limit) constituted an Intraday Key-Zone to offering considerable bearish pressure on the GBPUSD Pair. Bullish Persistence above the mentioned price zone of 1.3100-1.3150 was supposed to allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested bullish pattern. However, the GBP/USD pair failed to do so, Instead, another bearish movement was targeting the price level of 1.2840 where bullish SUPPORT existed allowing another bullish movement initially towards 1.3000. Moreover, the recent bullish breakout above 1.3000 has enabled further bullish advancement towards 1.3175-1.3200 where the upper limit of the current movement channel is located. Price action should be watched around the current price levels (1.3200) as a valid SELL Entry can be offered. Initial bearish target is located at 1.3000 The material has been provided by InstaForex Company - www.instaforex.com |

| November 9, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 09 Nov 2020 08:17 AM PST

In July, the EURUSD pair has failed to maintain bearish momentum strong enough to move below 1.1200 (consolidation range lower zone). Instead, bullish breakout was achieved above 1.1380-1.1400.This has lead to a quick bullish spike directly towards 1.1750 which failed to offer sufficient bearish pressure as well. Bullish persistence above 1.1700 - 1.1760 favored further bullish advancement towards 1.1975 - 1.2000 ( the upper limit of the technical channel ) which constituted a Solid SUPPLY-Zone offering bearish pressure. Moreover, Intraday traders should have noticed the recent bearish closure below 1.1700. This indicates bearish domination on the short-term. However, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1625 (38% Fibonacci Level). Instead, another bullish breakout was being demonstrated towards 1.1870 which corresponds to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stood as a solid SUPPLY Zone corresponding to the backside of the broken channel. Moreover, the recent bearish H4 candlestick closure below 1.1770 was mentioned in previous articles to indicate a valid short-term SELL Signal. All bearish targets were already reached at 1.1700 and 1.1630 where the current bullish recovery was initiated The current bullish pullback towards the price zone of 1.1870-1.1900 should also be considered for signs of bearish rejection and another valid SELL Entry. S/L should be placed just above 1.1950. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD bears remain in control as price slides below 1.30 for the first time since August 2018. Posted: 09 Nov 2020 08:15 AM PST As we explained in our previous post, USDCAD bears were in control of the trend as price was breaking below the triangle pattern. We also mentioned that we prefer to remain bearish for a move towards 1.28 as long as price was below 1.3150.

Green line - Support (broken) USDCAD is trading below 1.30 at 1.2978 right now. Price continues lower early this week under pressure by sellers. It is a normal follow through after the end of the week break down we saw the previous week. Trend remains bearish and we continue to expect a move towards 1.28. Short-term resistance is at the green line at 1.3130. Previous support is now resistance.Despite the new lower low in price, the RSI is still above the 30 level. This is a bullish divergence. This is not a reversal signal but a warning towards bears that they need to be cautious. With the RSI now at 33.91, bears need to move price stronger lower and the RSI break below 29.57 in order to cancel the bullish divergence. It is important to see how bulls respond this week to the selling pressures. USDCAD might be very close for a major low around 1.29 and a major reversal. USDCAD might be very close to ending the entire downward move from 1.4650. Bears need to be cautious and get overconfident. The material has been provided by InstaForex Company - www.instaforex.com |

| November 9, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 09 Nov 2020 08:07 AM PST

Until October 13, temporary breakout above 1.1750 was demonstrated within the depicted ascending channel. This indicated high probability of bullish continuation towards 1.1880. However, downside pressure pushed the EUR/USD pair towards 1.1700 where significant BUYING Pressure Existed. This was followed by another quick upside movement towards 1.1880-1.1900. The price zone around 1.1880-1.1900 constituted a KEY Price-Zone as it corresponded to the backside of the depicted broken ascending channel where significant bearish pressure and a reversal Head & Shoulders pattern were demonstrated. Recently, Two opportunities for SELL Entries were offered upon the recent upside movement towards 1.1880-1.1900. All target levels were achieved. EXIT LEVEL was reached around 1.1720. Early signs of bullish reversal were demonstrated around the current price levels of 1.1600. The EUR/USD pair has demonstrated a significant BUYING Pattern after the recent upside breakout above the depicted price zone (1.1750-1.1780) was achieved. As mentioned in the previous article, the pair has targeted the price levels around 1.1920 which exerted considerable bearish pressure bringing the pair back towards 1.1800. Trade Recommendations :- Currently, the price zone of 1.1800-1.1820 stands as a significant SUPPORT-Zone to be watched upon any upcoming downside pullback for a valid BUY Position. Exit level should be placed below 1.1740. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: Euro celebrates Biden's victory while dollar face loss of 1.9% Posted: 09 Nov 2020 07:08 AM PST

The USD index fell 1.9% last week amid expectations that Washington's trade policy under Joe Biden will be less aggressive, and the Fed's monetary policy will remain soft. At present, Biden considers himself the new President-elect of the US, which, in fact, he has already been congratulated by many world leaders. On Saturday, the democratic candidate passed the threshold of 270 electoral college votes needed to win, winning the battle in Pennsylvania. However, Republicans seem to have retained control of the Senate. Apparently, the result of the recent US election looks perfect from the market point of view, since neither trade wars nor tax increases are on the agenda. At the same time, the continued impasse over a large-scale fiscal stimulus package in the US allows investors to expect more quantitative easing from the Federal Reserve. On Monday, the greenback updated two-month lows around 92.13 points but then slowed down the decline. Sales of the USD are held back by concerns about the ongoing COVID-19 pandemic, as well as the fact that Donald Trump categorically does not want to admit defeat and is going to insist on a recount of votes in key States. Although the lawsuits of the current US President, according to experts, have no prospects, this may delay Biden's official start as the head of the White House. Traders are also wary of new lockdowns, as the number of coronavirus cases in the world is growing rapidly. On Sunday, the total number of infected cases already exceeded 50 million. The euro, on the other hand, was able to strengthen against the US dollar to the highest levels since mid-September against the background of a weakening greenback across almost the entire spectrum of the market. Although the EUR/USD bulls are aiming for a move above 1.21, they need to keep in mind the risk that European politicians will want to lower the euro again. Recall that the single currency moved away from the $1.20 mark after the activation of verbal interventions by the ECB in early September. The euro's decline slowed when investors saw that there was no real action behind the threats. The resumption of growth in EUR / USD may lead to ECB officials returning to the market and repeating that the euro is too expensive – an unacceptable luxury for the Eurozone economy in the midst of a pandemic. Among the main risks to maintaining the downward trend of the dollar are the possible introduction of new quarantine restrictions in the US and the likelihood that the expected European incentives will eventually disappoint. In this regard, investors' refusal of USD in favor of risky assets seems premature. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for November 9 Posted: 09 Nov 2020 06:05 AM PST EUR/USD has topped 1.19 after Pfizer and BioNTech announced their coronavirus vaccine is 90% efficient. Stocks are surging and the safe-haven dollar is down. The outcome of the US elections is being closely watched.

From a technical perspective, EUR/USD is retesting an ascending trendline that was tested in late October. On the daily chart, the Stochastic indicator is located at 92, indicating the overbought condition. Resistance awaits at 1.190, a psychological round figure mark, which was also a peak in September. Some support awaits at 1.1860, which was October's swing high from last week. The breakout below the October swing high (1.1860) will carve a path for the bears to test the key support (1.1620) of the 4-month trading range. On the flip side, if the bulls make a strong breakout above the August resistance level at 1.1935, a surge towards the September high level could be expected to retest the 1.200 mark. The material has been provided by InstaForex Company - www.instaforex.com |

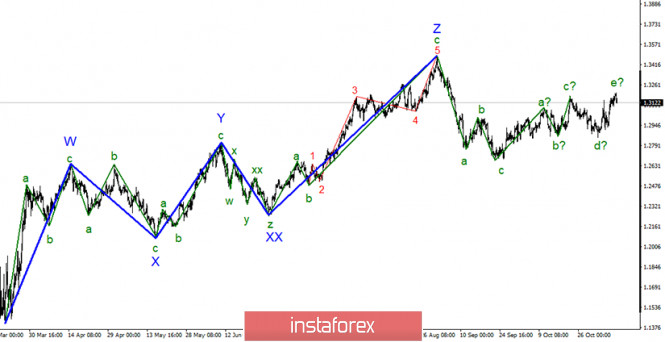

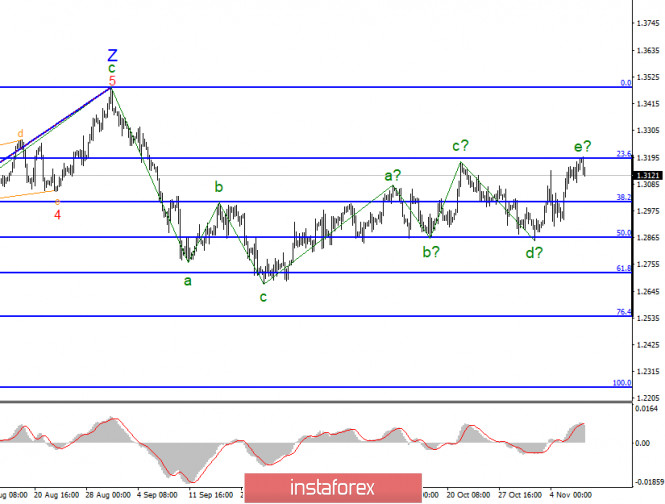

| Posted: 09 Nov 2020 06:01 AM PST

In the most global sense, the construction of an upward section of the trend can resume, however, the entire wave marking takes a complex form. The section of the trend that begins on September 23 takes a five-wave form, however, it is not impulsive. Thus, after the end of the next rising wave, the construction of a new three-wave section of the trend can begin. However, given that there is no classical wave marking now, the section of the trend from September 23 can be complicated as many times as necessary. The news background is now of great importance for the markets.

The lower chart clearly shows two failed attempts to break the 50.0% Fibonacci level, which are currently interpreted as the lows of waves b and d. Thus, the wave marking really takes on a rather non-standard appearance, and the construction of the next ascending wave can be completed already around the 23.6% Fibonacci level. An unsuccessful attempt to break the 1.3189 mark indirectly indicates the completion of the wave e. Thus, even a new downward section of the trend may begin now. On Friday, a fairly large amount of important information was released in America. The most significant information was about the number of new jobs created outside the agricultural sector, the so-called Nonfarm Payrolls. Their number increased in October by 638 thousand against market expectations of 600 thousand. The unemployment rate also dropped significantly in October – from 7.9% to 6.9%. Thus, in fact, there were quite a lot of reasons for the markets to increase demand for the US currency on Friday. And these reasons were economic, not political. However, elections in the United States outweighed all the same. The US currency continued to lose demand, and even strong statistics did not help it. But the wave marking helped. An unsuccessful attempt to break through the 23.6% Fibonacci level indicates a possible completion of the wave e. Thus, the US currency may trade with an advantage over the British in the next few weeks. The news background from the UK continues to be negative. If markets only looked at news from Britain, they would not have any questions about what to do with the pound. Everyone would sell it. And this is exactly what the markets can start doing in the near future. Wave marking supports the decline of the British. The news background supports the decline of the British dollar. There is still no agreement on trade between the EU and Britain. There are still differences between the EU and the UK on key issues of the trade agreement. And Boris Johnson, by the way, when extending the terms of negotiations, set the final date by which the deal should be agreed, November 15. November 15 is 6 days away. After that, Johnson promised to stop any negotiations with Brussels. Therefore, the British currency may soon again rush down, as once again it faces the threat of an absolutely gloomy economic future. General conclusions and recommendations: The pound/dollar instrument resumed building an uptrend section, however, its last wave may end near the 23.6% Fibonacci level. Thus, in case of a successful attempt to break the 1.3189 mark, I recommend buying the instrument again with targets located near the 1.3484 mark, which corresponds to 0.0% Fibonacci. Now we can consider cautious sales of the instrument in the expectation of building a new downward trend. The material has been provided by InstaForex Company - www.instaforex.com |

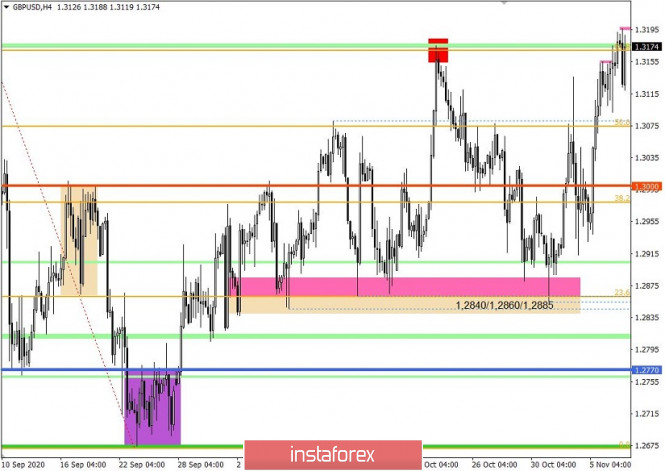

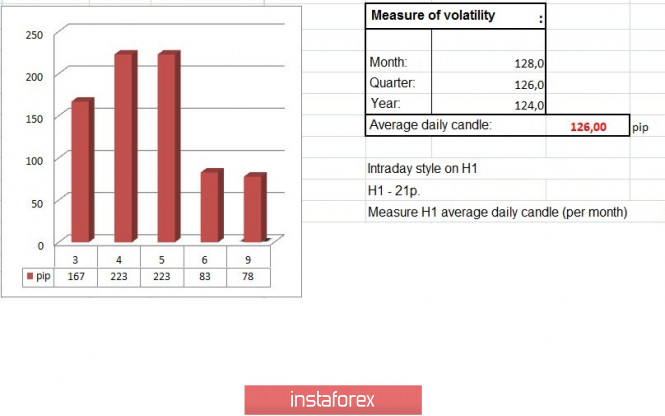

| GBPUSD: Growth, fall, speculation, what else a trader needs to be happy Posted: 09 Nov 2020 05:47 AM PST The dynamics of the market lately have fantastic opportunities for making money, just look at the numbers: - 339 points, and this is only one direction, upward; - 280/220/260 points, when calculating local fluctuations UP & DOWN; - 5 trading days combined such high speculations. The information noise associated with the presidential elections in the US, where the dollar came under strong pressure, which led to high turbulence and, as a result, its weakening by more than 300 points, is rightly considered to be the culprit of speculation. This competition between Trump and Biden is still coming to a logical end, despite the sea of emotions and lawsuits. Joseph Biden bags victory by an impressive margin, however, the current president cannot yet face defeat, so speculators are still preparing for Trump's non-standard antics. While the media talks about the presidential race, the allotted time for negotiations on a trade agreement between Britain and Europe is gradually coming to an end, but there is still no result. On Saturday, November 7, the head of the European Commission, Ursula von der Leyen, held a telephone conversation with British Prime Minister Boris Johnson, where they discussed the progress of bilateral meetings of the negotiating teams and agreed that there is a result, but differences remain. "We summed up the results of our talks with British Prime Minister Boris Johnson today. Some progress has been made, but big differences remain, especially regarding equal conditions and fishing," Von der Leyen poted on her Twitter account. In turn, Boris Johnson confirms that there are differences on a number of issues, including fishing and common rules of the game (competition). The parties agreed that negotiations will resume from November 9, but the time remains only until November 15, which may provoke speculators to another manipulation. Recall that the UK is currently under quarantine, the economy is going through the worst times in history, and in addition, there is a risk of a hard Brexit, all this can lead to a sharp weakening of the pound sterling. Thus, speculative growth, which led to a sharp increase in the value of the sterling against the background of the US presidential race, may eventually be replaced by a collapse, and the local overbooking of the pound will play as an additional lever for sellers. In terms of technical analysis, it is worth highlighting an inertial upward move based on which the local maximum of October 21, 1.3175, was broken, but the joy of buyers was short-lived and already in the area of 1.3175/1.3200 there was a slowdown with a reduction in the volume of long positions. In fact, we already have the first signals of a possible reversal, where overbought indicators are literally off the scale. The only tool for further growth can only be information noise in the US since all other instruments are already signaling a sale. As for the dynamics for November 6, a sharp slowdown of 83 points is recorded, but if we take into account an overactivity on November 4 and 5 by 223 points, then, in principle, a stop is possible. Looking at the trading chart in general terms (daily period), you can see a high risk of a break in the downward tact set in the September period, where most of the tact is played out taking into account the current growth of the pound sterling. Today, in terms of the economic calendar, we do not have particularly important statistics for Britain and the US, all attention, as before, will be reduced to monitoring the information background. Analyzing the current trading chart, you can see that during the European session there was a surge in short positions, but the echoes of bullish speculation do not let the pound go from the heights of inertia. In fact, we are faced with a dilemma: the noise of Biden's victory exerts local pressure on dollar positions, which keeps the quotes at such an impressive height. At the same time, overbought is growing hourly, where the information background of Britain's economic problems, coupled with Brexit, can very painfully hit the value of the pound sterling. Thus, we are working on the speculators but adjusted for the fact that in the near future there may be an impressive weakening of the pound. Based on the above information, we will display trading recommendations: - Buy positions are considered higher than 1.3200 with the prospect of a move to 1.3250-1.3300. - Consider sell positions lower than 1.3100 towards 1.3000. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments unanimously signal a purchase due to price fluctuations within the conditional maximum of the inertial move. Weekly volatility / Volatility measurement: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated per Month / Quarter / Year. (November 9 was built taking into account the publication time of the article) The dynamics of the current time is 78 points, which is considered an even low indicator in comparison with the general dynamics. It can be assumed that after a short stagnation, speculative fluctuations will arise again, which will lead to an acceleration of volatility in the market. Key levels Resistance zones: 1.3175 (1.3200); 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support Zones: 1.3000 ***; 1.2840 / 1.2860 / 1.2885; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411). * Periodic level ** Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Nov 2020 05:43 AM PST |

| Posted: 09 Nov 2020 05:39 AM PST The wave marking of the EUR/USD instrument suffered certain changes after the quotes fell below the minimum of wave b. In the coming days, it may suffer new changes since the trading of recent days has almost completely broken the current wave markup. At first, I assumed that a new triple down would be built. Now the entire wave marking can take an even more serious form and the construction of an upward trend section will resume. If this is true, then the increase in quotations will resume within wave 5 and wave 4 will take a very long form. In addition, another three waves may be formed which will formally be descending. A smaller-scale wave marking also indicates the possible end of the downward section of the trend that begins on October 21. With the final decrease, the instrument could form a wave from the next three so after its completion, a new three can be built up or the upward trend section within the global wave 5 will resume altogether. This might happen, as I mentioned when analyzing the 24-hour timeframe. If this is the case, then the construction of a correction wave 2 or b may soon begin. The American election is over and it is possible to draw the conclusion the the winner is Joe Biden. Thus, the US Dollar continues to lose the demand of the foreign exchange market. It seems that markets continue to be wary. They continue to fear Donald Trump because a peaceful transfer of power to Democrat Biden is clearly not planned. Republican Trump is going to challenge the election results in many disputed States where his margin over Biden was no more than 1%. Trump still believes that the Democrats rigged the election by mail-in voting. Ballots continued to arrive at election commissions much later than November 3 which was the election day in the United States. Although under US law, each voter must send a ballot with their vote by November 3 inclusive. Thus, it all depends on the US post office in what time frame it will deliver all letters with ballots to the polling stations. However, due to postal votes over the next few days (after election day), the picture changed, allowing Joe Biden to win. Thus, we can assume right now that the election will not end there. This is exactly what Trump said in one of his speeches, urging Biden not to be happy ahead of time. The markets are clearly afraid of further actions of the US President and the US Economy needs the help of the government. The government, in the coming months, will continue to fight for power in the next four years. Markets are wary of this. The Dollar continues to decline. General conclusions and recommendations: The Euro-Dollar Pair has presumably completed the construction of a three-wave downward trend section. Thus, at this time, I recommend buying a tool with targets located near the 1.2010 mark (which corresponds to 0.0% Fibonacci) for each MACD signal up, based on the construction of wave C. However, before the construction of this wave begins, quotes may depart from the reached highs within wave b. The material has been provided by InstaForex Company - www.instaforex.com |

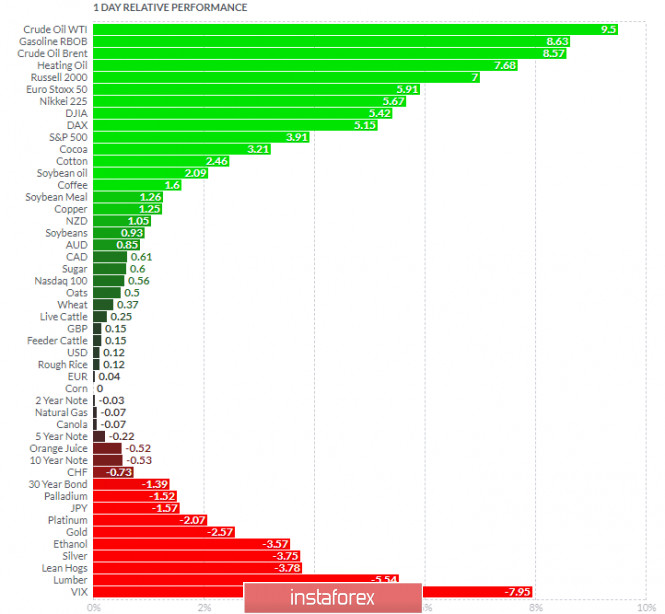

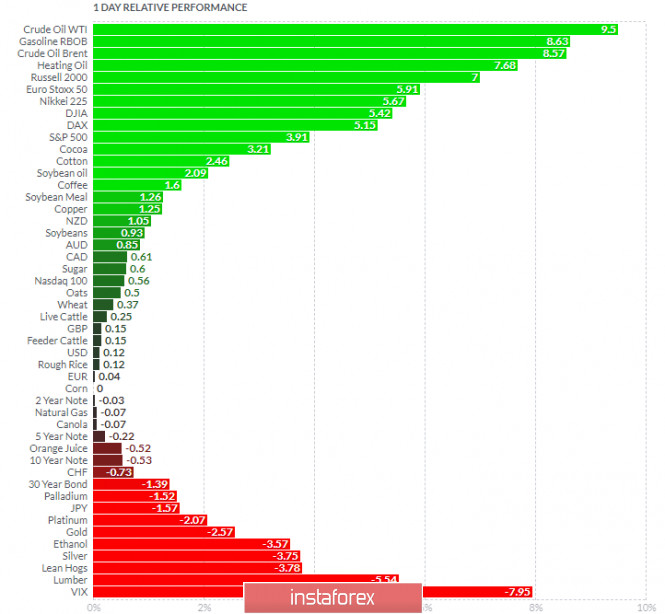

| EUR/USD analysis for November 09 2020 - Key povot at the price of 1.1900 is on the test Posted: 09 Nov 2020 05:39 AM PST  EU's Barnier outlines three keys to 'unlock' a Brexit deal EU's Barnier outlines three keys to 'unlock' a Brexit deal He tweets: Happy to be back in London today, redoubling our efforts to reach agreement on the future partnership. 3 keys to unlock a deal:No 1: Respect of EU autonomy and UK sovereignty, w/ effective governance and enforcement mechanisms between international partners;No 2: Robust guarantees of free and fair trade & competition based on shared high standards, evolving coherently over time;No 3: Stable and reciprocal access to markets and fishing opportunities in the interest of both parties. All of this continues to reaffirm that both sides are still some way from agreeing on the key outstanding issues at hand. This week's negotiations will be key as it challenges the deadline of mid-November in getting a deal agreed upon. Further Development

Analyzing the current trading chart of the EUR/USD, I found that EUR tested and rejected of the main pivot resistance at 1,1900, which is sign that there is potential for the downside rotation. 1-Day relative strength performance Finviz Based on the graph above I found that on the top of the list we got Crude Oil and Gasoline today and on the bottom VIX and Lumber, Key Levels: Resistance:1,1900 Support level: 1,1780 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Nov 2020 05:24 AM PST Pfizer vaccine study shows that it prevents 90% of coronavirus infections Experimental vaccine found to be over 90% effective in preventing COVID-19

S&P 500 futures just hit a record high and are up by over 2% now with USD/JPY rising to a session high of 103.92 and closing back in on the 104.00 handle. Notably, bonds are selling off as well with 10-year Treasury yields jumping from 0.81% to 0.85% currently as risk assets rally on the headlines above. The news is undoubtedly good in terms of the vaccine development and effectiveness, and that just bolsters sentiment that there are 'good times' to look forward to.

Further Development

Analyzing the current trading chart of the Gold, I found that both my Friday's targets at the $1,935 and $1,917 has been reached. The momentum is ultra strong to the downside after the Vaccine announcement today, which is sign that there is potential for more downside and potential test of $1,8.60 Watch for selling opportunities on the rallies with the target at the price of $1860 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Crude Oil and Gasoline today and on the bottom VIX and Lumber, Gold is very negative on the list today, which is another indication of the selling pressure. Key Levels: Resistance: $1,907 and $1,921 Support level: $1,860 The material has been provided by InstaForex Company - www.instaforex.com |

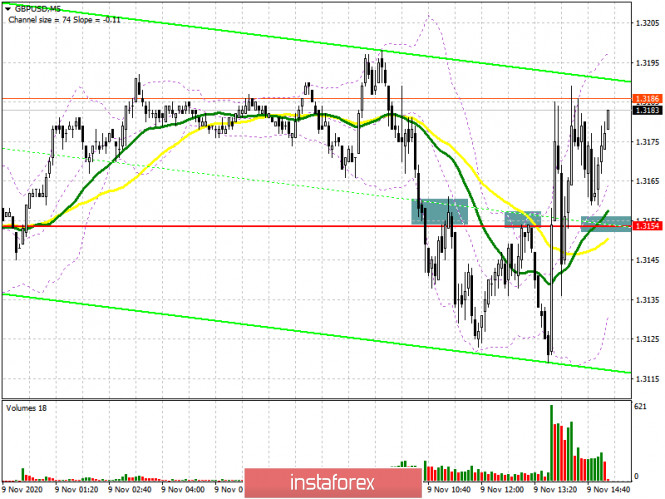

| Posted: 09 Nov 2020 05:21 AM PST To open long positions on GBPUSD, you need: In the afternoon, sellers of the pound tried to regain control of the market and it seemed that they succeeded, however, this did not lead to a larger drop in the GBP/USD. Let's look at the 5-minute chart and talk about where you can and should have sold the pound. A breakout and consolidation below the support of 1.3154, where I recommended selling the pound, occurred in the middle of the European session. It was the test of this level from the bottom up that led to a good entry point into short positions, which worked itself out twice. Each time, the downward movement was more than 30 points. But, as we can see, now the bulls have regained control of the market. This happened during a speech by Bank of England Governor Andrew Bailey.

As long as trading is conducted above the level of 1.3154, you can expect the pound to continue growing in the short term. A top-down test of the 1.3154 area and the formation of a false breakout on it will be an additional signal to open long positions to restore the GBP/USD to the area of the 1.3234 maximum, where I recommend fixing the profits. A longer-term target will be a maximum of 1.3315, however, this scenario will be implemented in the event of good news on Brexit. If the pair returns to the 1.3154 level again in the second half of the day, it is best to postpone long positions until the 1.3093 minimum is updated or buy GBP/USD immediately for a rebound from the 1.3034 support in the expectation of a correction of 20-30 points within the day. To open short positions on GBPUSD, you need to: Sellers again need to regain the level of 1.3154, as only another consolidation under it will increase pressure on the pair and lead to the resumption of the bear market. The initial goal will be to test the level of 1.3093, which we did not reach in the first half of the day. However, it will be possible to talk about resuming the downward correction only after updating the intermediate support at 1.3034. The key target for sellers at the beginning of this week will be the area of 1.2967, where I recommend fixing the profits. In the scenario of further growth of GBP/USD in the second half of the day, and the bulls have already regained control of the market after the speech of Andrew Bailey, it is best to wait for the test of the maximum of 1.3234, where the formation of a false breakout will be a signal to open short positions. I recommend selling the pound immediately for a rebound only from the resistance of 1.3315, based on a correction of 20-30 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for November 3, there was a reduction in long positions and a slight increase in short ones. Long non-commercial positions fell from 31,799 to 27,701. At the same time, short non-commercial positions rose just slightly to 38,928 from 38,459. As a result, the negative non-commercial net position was -11,227 against -6,660 a week earlier, which indicates that the sellers of the British pound retain control and their minimal advantage in the current situation. Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the equality of buyers and sellers. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1. Bollinger Bands A break of the upper limit in the area of 1.3185 will lead to a new wave of growth of the pound. A break in the lower limit of the indicator around 1.3120 will increase the pressure on the pound. Description of indicators

|

| Oil steadies amid final US election results Posted: 09 Nov 2020 05:16 AM PST

Recently, it became known that Joe Biden got enough votes to take the presidency of the United States. However, current President Donald Trump refuses to admit defeat. His lawyers believe that in some states there were violations in the counting of votes, so they filed lawsuits. According to analysts, the administration of the new US President, Joe Biden, will be more predictable and stable. Also, under the rule of Biden, the adoption of a new stimulus package for the economy seems more likely. These assumptions are driving oil prices up. However, experts believe that the oil market will remain volatile as Trump's actions delay the announcement of the official election results. Moreover, the number of people infected with COVID-19 continues to increase every day. Also, there are concerns about the demand for oil, as the quarantine was reintroduced in some European countries. In addition, there are fears that Biden will lift sanctions against Iran and Venezuela. As a result, the supply of oil may increase by more than 1.5 million barrels per day. Libya also recently reported that the country's production exceeded 1 million barrels per day, the highest level since December 2019. Brent crude futures for January rose by 2.56% to trade at $40.46 per barrel. WTI crude futures for December grew by 2.69% as well to settle at $38.14 per barrel. Experts believe that Brent crude will be trading within $39-42 per barrel this week. In general, three factors determine the situation in the oil market: the general situation in the financial markets, the spread of COVID-19, and finally, the response from the OPEC+ countries. Nevertheless, the outcome of the US election and the development of the coronavirus pandemic will strongly affect the market. The longer it takes to sum up voting results, the worse is the impact on the markets. Traders hope for the competent decisions of the OPEC+ countries, which closely monitor the situation on the oil market. It looks like the group could change the terms of the deal and postpone the planned increase in production by 1.9 million barrels per day for January 1. However, experts believe that in November and December there will be a peak of COVID-19 infections in the United States, Europe, and Russia. In other words, within a few months, the demand for oil will improve and the pressure on oil prices will decrease. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment