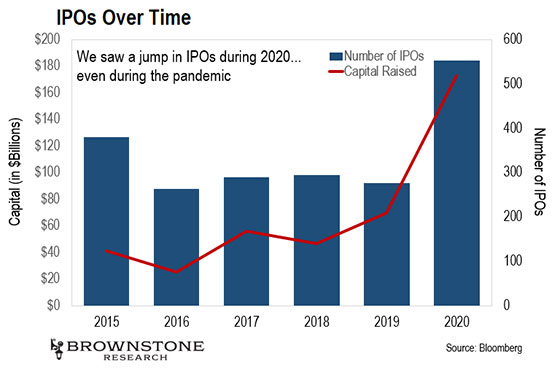

| Dear Reader, 2020 was a great year. Some might be surprised to hear that, given the pandemic lockdowns, tumultuous elections, and other curveballs thrown in the last twelve months. But readers following my research know exactly what I mean. In each of my investment services, we saw incredibly strong performance in our portfolios in 2020. In The Near Future Report, we earned realized returns like 87%, 277%, and 259%. In Exponential Tech Investor, we saw gains like 135%, 178%, and 308%. In Early Stage Trader, we had gains of 87%, 106%, and 116%. And I expect we will have another great year in 2021. But this year, I’m also introducing a new idea for finding great technology investments, all focused on a very specific area: initial public offerings (IPOs). | Recommended Link | 44 famous people shifting funds here We’ve identified 14 billionaires and dozens of wealthy, successful individuals who are shifting their funds into a special type of deal. Peter Thiel, Michael Jordan, and Wilbur Ross are just a few of the names. They’re chasing exponential gains in a new and very specific type of play with the potential to churn out some pretty extraordinary returns: (eg: 7,946%, 2,740%, 3,626%). And while gains like these can’t be promised… Our technology guru, the gentleman who found the No. 1 tech stock on the S&P four out of the last five years, Jeff Brown, is sharing where this investment capital is flowing to… and the No. 1 way for you to play this same trend. | | | | A Market on Fire The IPO market is on fire right now. In 2020, we saw 552 initial public offerings. And those IPOs raised more than $172 billion.

And I’m on record saying that the IPO market will be even bigger in 2021. Longtime readers know this, but there is an “IPO backlog” right now. There are so many exciting technology companies that have been staying private for years. And this has created a backlog of companies that are now finally going public. In essence, these companies are like a champagne bottle. All this pressure has been building for years. And now, finally, the cork has popped, and they are all lining up to go public. WARNING for Anyone with a 401(k) or IRA What’s interesting is that a lot of these IPOs were put on hold with COVID-19 and the economic lockdowns. Then this wave of IPOs came back with a vengeance around last September. But there’s just one problem with investing in these IPOs… | Recommended Link | Attend Teeka's First Event of 2021 for $0 On Wednesday, January 27… a small group of people will be exposed to a pre-IPO Tech Deal that could literally change their lives – overnight. It could be a chance to secure TOTAL financial freedom in 2021. And Teeka wants to see you there. RSVP now to join Teeka Tiwari for FREEDOM 2021, his first event of the year. | | | | The IPO Problem Here’s an example to illustrate the problem we’re seeing. On December 9, an artificial intelligence (AI) company called C3.ai held its IPO. The stock was priced at $42 a share. But when shares began trading, the stock opened at well over $100… more than double the listing price. Investors never had a chance to invest at a reasonable valuation. And sadly, that’s not the only time this has happened… Also in December, an exciting biotech company called AbCellera held its IPO. But we saw the same thing… The No. 1 Tech Stock of 2021 AbCellera, which worked alongside Eli Lilly on its COVID-19 antibody therapy over the past year, was priced at $20, but it opened at $58. That’s nearly three times higher. And even larger IPOs aren’t immune to this issue. Airbnb, the popular vacation rental company, finally held its long-awaited IPO on December 10. The stock was priced at $68 per share. But once again, when it opened for trading, it was at $146. That’s more than double the listing price. I could go on and on with similar examples. Do you see the issue? | Recommended Link | | A new type of Civil War is erupting in America

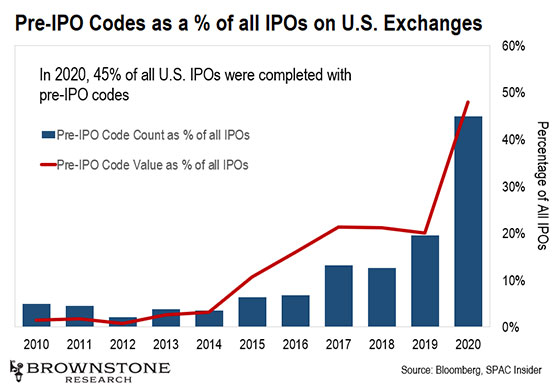

It's not between the political parties. And it's not between the states and Federal government. But this battle will DEFINITELY affect you and your money over the next few years. You have to choose which side you'll be on – and you have to decide now. | | | -- | Solving the Problem One of our strategies for success in all of my research services is to invest in great technology companies at reasonable valuations. That’s how we stack the deck in our favor. There are a number of companies with exciting technology that I would love to add to our portfolio… But many of these companies are opening for trading at valuations that are far too high. At these levels, I can’t recommend any of them. On any negative news or earnings miss, shares are likely to sell off. Investors are nearly guaranteed to lose money when investing at these levels. So how do we get into these early stage stocks before the run-up happens? Is it even possible? That’s where our new strategy comes in… In 2021, I’m going to help my readers to invest in companies before they IPO. But we’re going to do it a little differently… In a traditional IPO, pre-IPO shares are typically reserved for large hedge funds, private equity, or high-net-worth investors. Regular investors are locked out. But there is another way to get pre-IPO shares in exciting early stage companies using something I call “pre-IPO codes.” These “pre-IPO code” companies enable investors to essentially get shares in companies before their IPOs. And you don’t have to be a millionaire accredited investor to invest… And here’s the good news… Pre-IPO code companies are more common than you might think. There are hundreds of them trading right now. And in the last several years, things have really taken off. In fact, in 2020, 45% of all IPOs in the U.S. were done using these “pre-IPO codes.”

And here’s the thing. This has nothing to do with Regulation A, Regulation Crowdfunding (CF), or any other type of private deal. Investors can simply type in a pre-IPO code into their brokerage account and buy shares. This is the best way I’ve found to invest in exciting companies before IPO day. This idea is so big I knew I had to devote an entire research service to it. This might sound too good to be true… but it’s real. And I’m excited to bring this newest idea to my readers. That’s why I’ve put together a special presentation for interested investors. It’s called the Pre-IPO Code Event. And I’m letting my Bleeding Edge subscribers watch this presentation free of charge – but only for a limited time. I don’t want anyone to miss out. If you’re interested in learning more about this unique opportunity to grab pre-IPO shares in the hottest early stage companies, you can watch my presentation right here. Regards, Jeff Brown

Editor, The Bleeding Edge

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

In Case You Missed It… Not everything that shines is gold but some things might be just as good Not all stocks can be exciting blockbusters like Amazon or Google. Some stocks are more like work horses, dependable performers over a long period of time. These are the stocks master trader Jeff Clark looks for. These are the same kinds of stocks that allowed him to retire from money management at age 42. For a limited time, Jeff’s giving away the name of one of these stocks, completely FREE. Click here.

|

No comments:

Post a Comment