The commodities rally is picking up steam… You can see this in the following table…

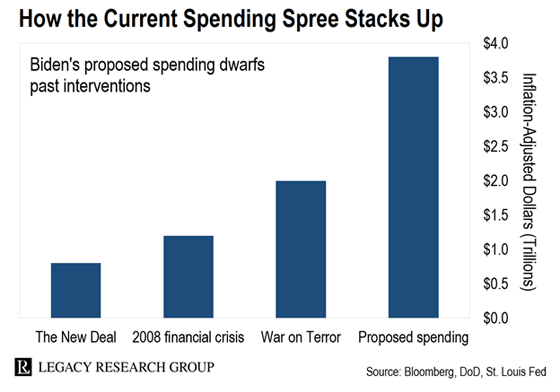

You can’t open a newspaper… or turn on CNBC… without hearing about the recent rally in stocks. Sure, U.S. stock market bellwether the S&P 500 is up 46% over the past year. But that’s nothing compared to gains on key commodities such as corn (up 135%), crude oil (up 180%), and lumber (up 378%)… which have blown the S&P gains out of the water. And as I’ll show you today, despite skyrocketing commodities prices over the past year… this rally still has a long way to go. | Recommended Link | | Major Bitcoin Supply Shock Coming? The 1973 oil embargo… The 1979 silver shock… The 2011 rare earths crisis… Anybody who got ahead of these “supply shocks” could have seen gains like: 1,272%, 2,150%, 3,988%, and even 13,025%. But according to crypto expert Teeka Tiwari, Bitcoin could be headed for the biggest supply shock ever – this year. | | | -- | Oddly, the official inflation rate remains low… You’d think spiking prices for raw materials would send official inflation figures through the roof. But the U.S. Bureau of Labor Statistics says consumer price inflation (CPI) is up just 2.6% over the past 12 months. That doesn’t mean inflation isn’t noticeable elsewhere. As our cofounder Bill Bonner recently put it to readers of his “big picture” advisory, The Bonner-Denning Letter… Yes, inflation is here. It is showing up all over the place – in commodities, food, housing, and fuel. Of course, if you don’t eat, live in a house, or go anywhere, you might not even notice. But the rest of us should prepare. Bill and his Bonner-Denning Letter coauthor, Dan Denning, have been sounding the alarm on inflation for years… Last year, they put together a special report called After Armageddon. It forecast how the pandemic would change the stock market, the economy, and American society. (If you’re a paid-up Bonner-Denning Letter subscriber, you can access it here.) They predicted more control, more politics, more centralization, more money. And, most important, more inflation. As they wrote… The government has no money. It is already running trillion-dollar deficits. All it can do is print money to pay for these bailouts, giveaways, and stimulus efforts. And when the government prints and spends money it doesn’t have, it leads to inflation. Maybe Bill and Dan have readers in high places. Because now some of the world’s wealthiest investors are starting to worry, too. Take Warren Buffett… Over the weekend, he held the annual shareholder meeting of his $640 billion investing conglomerate, Berkshire Hathaway (BRK.A). The 90-year-old superinvestor is best known for his sunny optimism about the U.S. economy. But he surprised investors by admitting inflation was becoming an issue for the businesses he controls. As he put it… We’re seeing substantial inflation. We’re raising prices, people are raising prices to us. Or take Sam Zell. He’s the billionaire behind two of the largest publicly traded real estate companies in history. Equity Residential is the largest apartment owner in the U.S. Equity Office Properties Trust is the largest office owner in the country. Up 5X More Than Bitcoin… Here’s what Zell told Bloomberg yesterday about inflation… Oh boy, we’re seeing it all over the place. You read about lumber prices, but we’re seeing it in all of our businesses. Corporate chiefs across America join Buffett and Zell in their concern. That’s going by new research out of Bank of America (BAC). It shows that the number of uses of the word “inflation” on earnings calls has more than tripled per company since this time last year. That’s the biggest jump since BofA started tracking this in 2004. These are perfect conditions for a rise in commodities… Where vaccine rollouts have been successful, economies are starting to perk up after their yearlong slumbers. This is increasing demand for raw materials. The global economy is reflating faster than experts expected… consumer confidence is back near pre-pandemic levels… and business spending on things like equipment is beating analyst estimates. Then there are COVID-related supply issues across many commodities. Raw materials including lumber, aluminum, and agricultural products are experiencing intense shortages due to supply chain bottlenecks. In addition to all that, we’ve got record levels of cash stimulus. This next chart shows the size of President Biden’s stimulus proposals, in inflation-adjusted terms, compared to past government interventions.

Biden’s plans are about three times larger than what we saw after the 2008 financial crisis. And they’re nearly five times larger than the New Deal social programs during the Great Depression in the 1930s. Commodities are a great inflation hedge. Unlike dollars, euros, or yen, governments can’t conjure them up with a few keystrokes. That makes them great ways to store value as inflation picks up. We’re still nowhere near past commodities peaks… That’s going by the Bloomberg Commodity Index. It tracks prices for 23 commonly traded raw materials.

Despite the recent rally, the commodities sector is still down from its peak by nearly two-thirds. But as I’ve shown you today, we believe commodities have a lot more room to run. Getting back to the levels we saw after the last crisis would mean a 254% rise from here. One way you can capture that gain is through the ELEMENTS Linked to the Rogers International Commodity Index ETF (RJI). Most commodity ETFs (exchange-traded funds) heavily skew towards energy. Unlike those, RJI gives you broad exposure to nearly all commodities – from silver, to hogs, to orange juice. If Bill and Dan are right… and more inflation is coming… this ETF could end up being one of the best performers in your portfolio. In the mailbag: “College taught me how to be a lackey for someone else”… In a recent edition of Casey Daily Dispatch, Legacy Research cofounder Doug Casey argued that young people should think twice before throwing money away on a college degree… It’s a gigantic mistake to sit in a classroom with other young people who know as little or less than you do, while dissipating $200,000 or $300,000 and four or more years […] College has become an extremely expensive and stultifying way to transform kids into […] no more than drones, cogs in the wheel. Many of your fellow readers wrote in to echo Doug’s view… My brothers and I graduated college in the 1970s. It did nothing for our future. Families are too impulsive about this big, expensive decision. They don’t ask what’s in it for them. They just assume there will be something in it for them. – Denise W. College is not for everyone. Young people need to develop a goal BEFORE they decide whether to go to college or not. Find a way to research occupations of interest. Then determine what education or training you need. – Mike M. Thinking may be a skill. But it certainly isn’t taught at universities. Degrees are considered essential for almost any decent job. Employers filter out applicants by demanding a degree. In most cases, these degrees are irrelevant to the job at hand. They don’t offer any greater likelihood of the person having the necessary skills, personality, capabilities, and enthusiasm. The longer this happens, the more people will unnecessarily get into debt and waste opportunities. – Roger E. Don’t get me wrong, I loved the college campus experience. I majored in business. But all the classes really taught me was how to be a lackey for someone else. Raising four children in my 20s, I felt trapped by a relatively low-paying job. After the kids were raised, I started my own business. Finally, I became financially independent. Still believing in the lie, I was determined to send my kids to college. It hasn’t paid well for them either. Three of my daughters graduated with teaching degrees. They are in their mid- to late 30s and still have college loan debt. Ironically, all three were smart enough to marry young men who were not college-educated. They are doing very well. – Jeffrey W. Rather than spending $200,000 on a degree in “Gender Bias and Identity,” you can spend far less than that for your children to… Go to a trade school and learn a skill. Electricians, plumbers, and welders are all well-paid. Go to flight school and learn to fly. Start a business. These options will put you far ahead of those who pay the Marxists for the brainwashing machines they call “institutes of higher learning.” – Bill W. Is a college education “expensive and stultifying,” as Doug claims? Join the debate at feedback@legacyresearch.com. Regards, Chris Lowe

May 5, 2021

Barcelona, Spain Like what you’re reading? Send your thoughts to feedback@legacyresearch.com. IN CASE YOU MISSED IT… Warning Sign The rich are getting nervous… According to CNBC, “The wealthy are investing like a market bubble is here” and “are making portfolio changes.” But what changes? Former Wall Street insider and hedge fund manager Teeka Tiwari uncovered a growing trend among America’s 1%… Quietly and behind the scenes, some of the smartest, wealthiest investors in the country (including Warren Buffett) are making an important shift with their money. They’re not rushing into cryptocurrencies… gold… tech stocks… or real estate. And they’re not hiding in cash either. Find out what the rich are doing with their fortunes HERE.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment