| By: Charles Sizemore, Co-Editor, Green Zone Fortunes Sometimes, you never see risk coming. It happened last year with the coronavirus pandemic, and it happened in 2008 when the housing bubble burst. Now, we have the Evergrande situation in China. In today’s Investing With Charles, research analyst Matt Clark and I discuss Evergrande and how you can protect your investments from total collapse.  Suggested Stories: Bet Big Like Soros … or Bank Wins Over and Over Again? A Low-Volatility Infrastructure Dividend for a World Gone Mad

| Industry expert points out 10x opportunity in electric vehicles virtually no one is talking about. | |

Marijuana Market Update In the latest Marijuana Market Update, I discuss a new player in the cannabis ETF market. I also answer a reader question about the profit potential of Florida-based Trulieve Cannabis Corp. (OTC: TCNNF). Click here for the latest in the cannabis sector. Suggested Stories: Simple Trading for Better Profits in 2 Days Should You Care About China's Evergrande?

| It's a controversial call. But former Wall Street VP and hedge fund manager Teeka Tiwari says he "no longer expects gold to adequately protect your wealth against the money printing happening right now." And for the first time in Palm Beach Research Group history, an editor is telling readers to sell gold … and buy Bitcoin. But this is about more than just one coin… A new class of cryptos is on the rise, Teeka says. Coins he believes could do MUCH better than Bitcoin in the coming months. Even better. | |

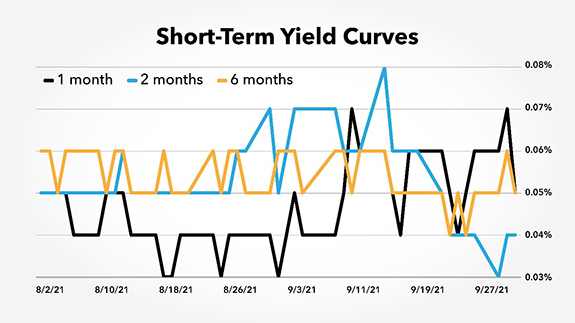

Chart of the Day Yield curves are a useful indicator. Many investors track the Treasury yield curve as a recession indicator. This curve shows interest rates or yields on Treasury debt at various maturities. In a growing economy, yields are higher for longer-term debt. As the economy slows, traders become nervous about the short term, and rates for short-term debt rise as long-term Treasury yields hold steady or fall slightly. The chart below shows the short-term yield curve. Here’s why it’s concerning.  Suggested Stories: What a Surge in Durable Goods Orders Means for Stocks Manufacturing Jobs Come Back … But Here's the Catch |

1931: New York and New Jersey were joined by the George Washington Bridge. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

No comments:

Post a Comment