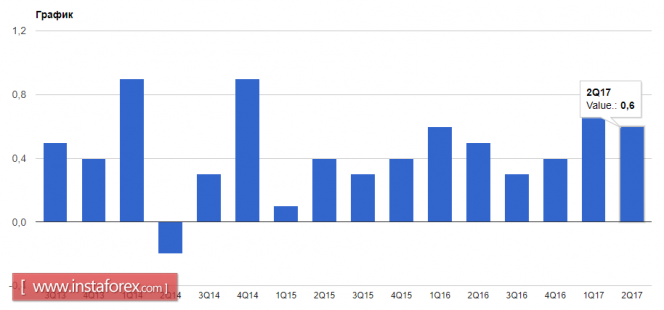

Data on the growth of the German economy did not impress traders. According to the report of the Federal Bureau of Statistics, in the second quarter of 2017, Germany's GDP grew by 2.5% year-on-year, which fully coincided with the initial estimate. Growth was due to corporate investment and increased private consumption. Investments grew by 1.2%. Show full picture Pressure on the euro due to weak data on the index of business sector sentiment in Germany, which declined in August, also showed. According to the report of the Ifo Institute, the German business sentiment index in August fell to 115.9 points from 116.0 points in July. Economists predicted the index drop to 115.5 points. As for the technical picture of the EURUSD pair, then, as noted in the morning review, everything will be tied up with statements made by the heads of the central banks of the United States and the eurozone. The movement above the monthly highs, located in the range of 1.1835-1.1850, will lead to the removal of a number of stop orders, which will allow large players to increase their long positions in the euro in order to update the levels of 1.1880 and 1.1930 as early as next week. This will also lead to the formation of a new wave of upward movement in risky assets. The weakness of the euro and, accordingly, the strengthening of the positions of the US dollar, with the return of the EUR/USD pair to the morning support level 1.1770, could lead to sharp selling, which will crash the trading instrument in the region of monthly lows located in the area of 1.1700 and 1.1655.

No comments:

Post a Comment