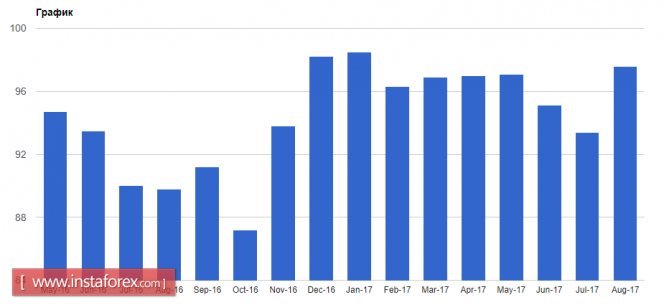

The absence of important fundamental statistics from both the US and the euro zone is forcing investors to take on a wait-and-see attitude. This is forming the side channels of the markets, especially in pairs with the euro and the British pound in it. This week, all attention of traders will be directed towards the two-day symposium of the Fed which will begin on August 24. It is expected that the main figure will be the president of the European Central Bank, Mario Draghi. It is believed that Draghi will shed light on the further actions of the bank in relation to its bond purchasing program. It should be noted that it was at the same conference in 2014 that Mario Draghi justified the need to start the quantitative easing program in the euro area. He also announced the measures to be taken in order to increase inflation. It is therefore possible that Draghi, speaking at the Fed symposium in Jackson Hole, will also announce the reduction of the mentioned program above. If the ECB president does not touch upon this topic during his speech, the attention of investors will switch to the meeting in September. Here, it is expected that the European Central Bank may announce the reduction of the quantitative easing program. As several leading world economists suggest, this can be done in two stages. In September, the ECB will announce the official reduction of the program. In October, concrete steps to carry this out will be announced. As for the fundamental data, here are the happenings. At the end of last week, it became known that the surplus of the euro zone's current account for the balance of payments for the month of June fell. This is bad news for the European Central Bank. Thus, the current account surplus of the euro area's balance of payments totaled to 21.2 billion euros following the data of 30.5 billion euros last May. The positive balance of trade in goods rose to 27.4 billion euros while the positive balance of trade in services fell to 2.2 billion euros. There was a temporary support for the US dollar at the end of last week caused by the data on the indicator of consumer sentiment in the US. The data showed an increase for the first half of August. According to the data provided, the preliminary index of consumer sentiment in August 2017 rose to 97.6 points against 93.4 points in July. Economists predicted that the preliminary index in August will be 94.5 points. Show full picture The Canadian dollar rose sharply against the US dollar, continuing its trend that was formed in the middle of the week. Demand remained after the publication of good inflation data which grew for the month of July this year in Canada. According to the report, Canada's consumer price index in July 2017 increased by 1.2% compared to the same period last year. Core inflation in July rose to 1.5% against 1.4% in June.

No comments:

Post a Comment