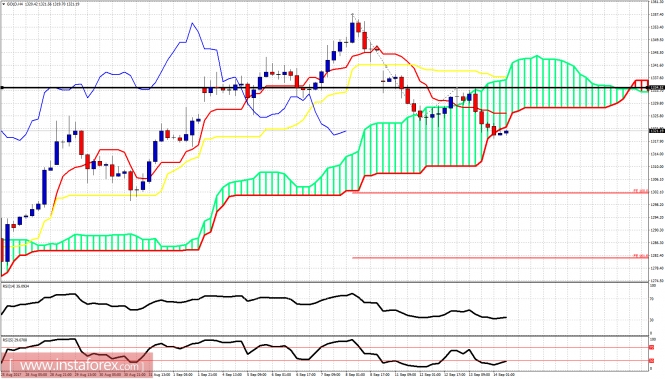

Black line - trend change level Gold price is breaking below the 4-hour Kumo support. This implies that more downside should be expected. Gold price could extend the decline lower for an equal leg down similar to the first part of the decline. The target would be at $1,302. However we should also keep an eye on the resistance and trend change level at $1,334. Breaking above it will confirm the pull back is over.

On a daily basis the close below the tenkan-sen (red line indicator) implies that the kijun-sen (yellow line indicator) will be tested. Trend remains bullish. Price should continue towards $1,380-$1,400 once the pull back is over. Kijun-sen support is at $1,308.

No comments:

Post a Comment