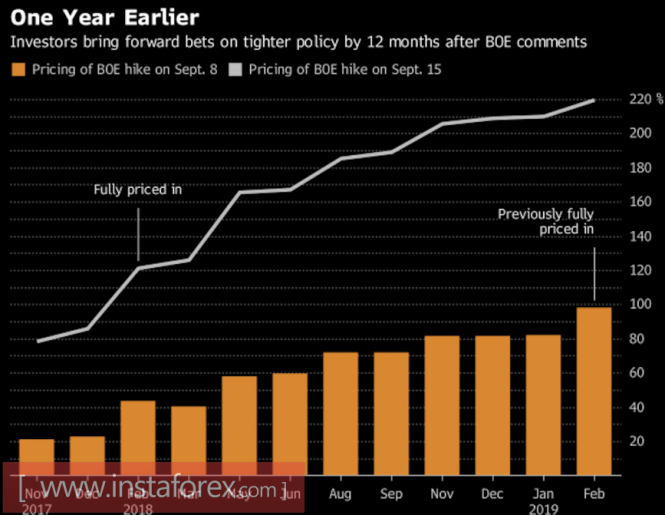

It's one thing when the market pushes the date of the rate hike and then brings it closer, as in the case of the Fed. It is quite another when the chances of tightening monetary policy grow dramatically, as in the case of the Bank of England. Guided by the need to implement its own inflation projections, the regulator made it clear that it was going to raise the repo rate in the near future. And if someone did not believe him, then the speech of Gertjan Vlieghe forced them to do it.

The most serious "dove" of the Committee on Monetary Policy said that the increase in wages, the growth of the world economy, and the household expenditures make it possible to expect the first increase in rates in the next few months. The derivatives market believes that this will happen in November.

The probability of raising the repo rate

Source: Bloomberg.

When an ardent opponent of monetary restriction speaks the language of the "hawk", it becomes the best driver for currency growth. The pound proved it, having strengthened during the day by 1.5% against the US dollar.

The minutes of the last meeting of the Bank of England and Gertjan Vlieghe proved that the "doves" remained in the minority. Meanwhile, the pound's sensitivity to upcoming releases of macroeconomic statistics should increase. It seems that the BoE is now less worried than before about the problem of reducing real wages. However, if retail sales show a decline in purchasing power, then the problem will remind it of itself. The release of the indicator is scheduled for September 20.

For the US dollar, the key event of the week will be the FOMC meeting. The open market committee can lower inflation forecasts and change the expected trajectory of the federal funds rate, which will affect the long-term outlook for the USD index. The Fed continues to be concerned about the dynamics of personal consumer spending, and the acceleration of the August CPI may eventually turn out to be the usual market noise. It is hardly to be expected that the signal from Janet Yellen and her colleagues about the act of monetary restriction in December will be the reason for buying the "dollar". The futures market thus pawns 59% of the probability that this will happen.

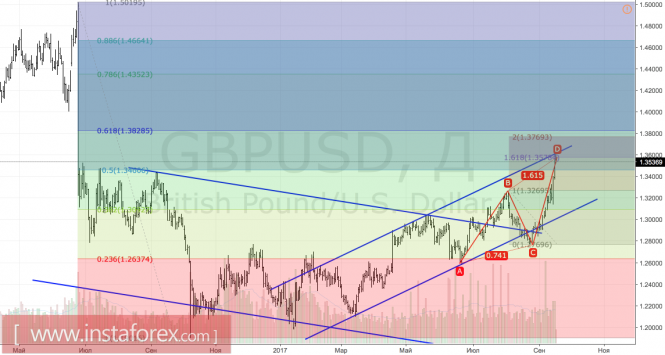

Technically, the bulls managed to achieve a target of 161.8% in the AB = CD pattern very quickly, after which the correction risks increased in the direction of 1.34-1.345. To continue the northern trend to 1.377 (targeting 200% on AB = CD), customers need to update the September maximum.

GBP / USD, daily chart

No comments:

Post a Comment