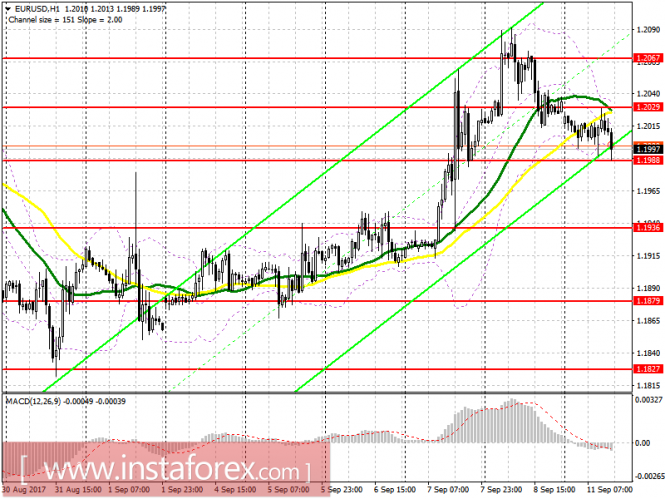

Compared to the morning forecast, nothing has radically changed. I recommend buying the European currency after upgrading support at 1.1988, down to the level of 1.1981, or immediately on the rebound from a support of 1.1936. If the euro rises in the second half of the day, only a break with a consolidation above 1.2029 will signal an increase in long positions with the expectation of a second test at 1.2067.

To open short positions for EURUSD, you need:

Sellers have fulfilled the level of 1.2029, which can still be counted, given there is a second pair of growth in that area during the second half of the day. In the event of a breakthrough in this area, selling would be best put off by a rebound from a resistance of 1.2067. I do not recommend selling at the breakdown of the level of 1.1988. Only after consolidation under it, with a test from below, upwards on the volume, you can expect it to decline towards a support of 1.1936.

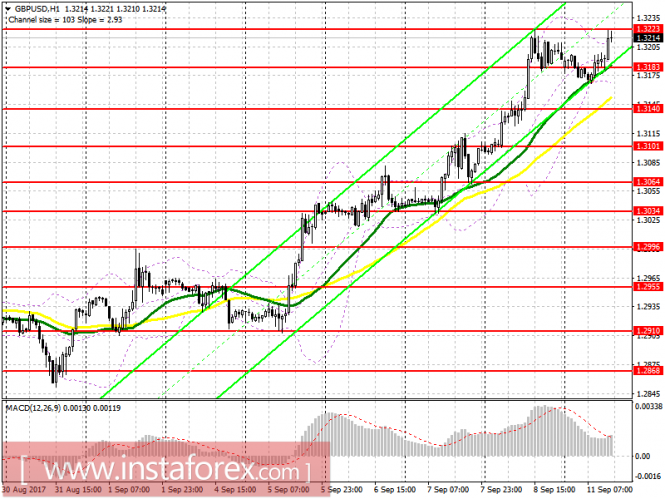

GBP/USD To open long positions for GBPUSD, you need:

GBP/USD To open long positions for GBPUSD, you need:

Buyers managed to climb the resistance at 1.3183, which I mentioned in my morning review, and reached 1.3223. Only a breakdown with the consolidation above will allow the GBP/USD pair to continue its upward movement with the expectation of reaching the new monthly highs of 1.3260 and 1.3325. In case the pound declines in the afternoon, it would be best to return to buying only to rebound from 1.3140.

To open short positions for GBPUSD, you need:

Sellers will try not to allow a break above 1.3223, and the formation of a false breakdown on it will lead to the return of the GBP/USD pair towards the support area of 1.3183 and, quite possibly, to update 1.3140, where I recommend locking in profits. In the event of the pound's continued growth above 1.3260, returning to selling would be best for a rebound from 1.3325.

Indicator description

Moving Average (average sliding) 50 days - yellow Moving Average (average sliding) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA Bollinger Bands 20

No comments:

Post a Comment