The report on the US labor market for September was significantly different from the market expectations and led to an increase in demand for the dollar. The number of new jobs declined by 33, 000, marking the first decline in seven years.

The data for the two previous months were revised downwards by 3, 000, and without taking into account other factors, such weak figures were supposed to weigh down the dollar, because they turned out to be much worse than the forecasts. However, the negative was more than offset by other indicators.

First, the Ministry of Labor issued a caveat- it said that the the decline is mainly due to the consequences of hurricanes "Harvey" and "Irma", which means it is a temporary factor. Secondly, the qualitative picture has improved - unemployment has decreased from 4.4% to 4.2% and updated the 16-month high, while the share of population participation in the labor force has increased from 62.9% to 63.1%. But most importantly - there is the growth of the average hourly wage.

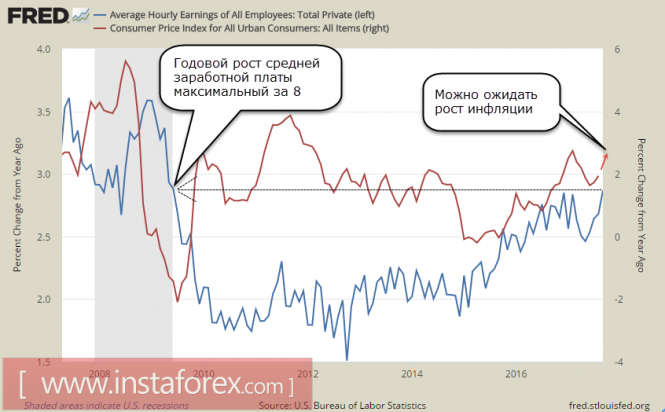

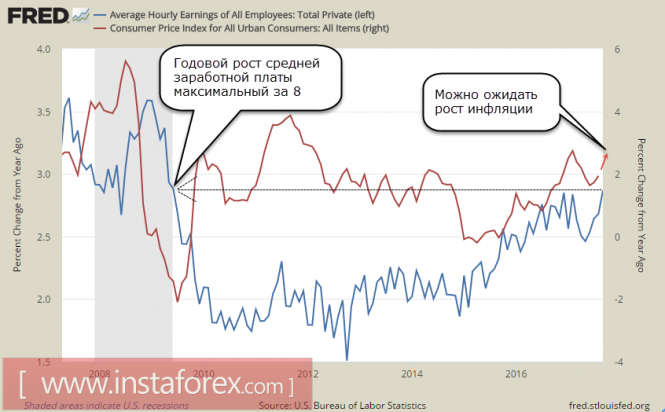

Analysts expected September increase of 0.3%, but the figures came in showing a 0.5% year-on-year increase from 2.5% to 2.9%, making it the best result since 2009.

As we know, the Fed sees a direct correlation between the growth of employment along wage growth and inflation (Philippe's curve). The leadership of the Federal Reserve constantly mentions this dependence in its public statements. Full employment leads to employers' competition for skilled workers, which is reflected in the growth of wages, which in turn provokes consumer demand growth and, at the final stage, the growth of inflation.

Inflation is one of the key factors in the change in monetary policy. Strong wage growth in September suggests that on October 13, the report on consumer inflation in September will show a result that is better than the current expectations. At the moment, the forecast is a gain of 2.0% vs. 1.9% in August, but now the markets will not be surprised if the figures show a 2.2% increase, which is a powerful bullish factor for the dollar and will allow the bulls to launch a new assault on Monday.

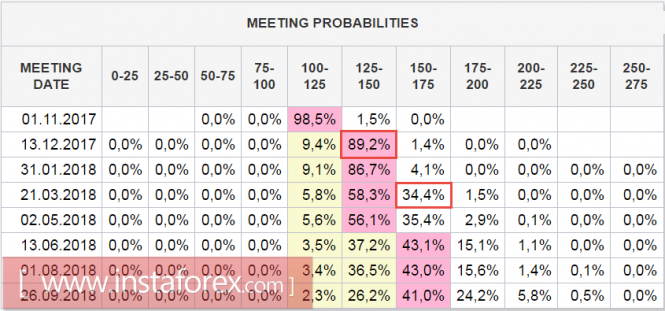

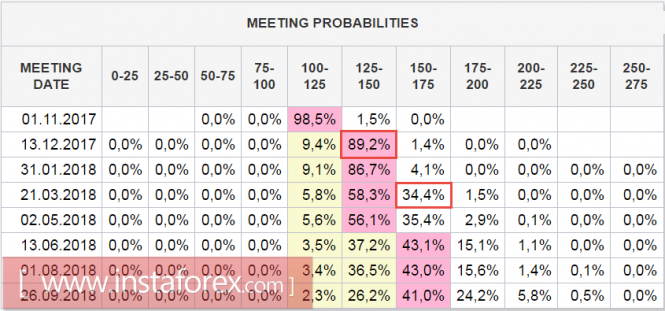

The futures market confidently forecasts a rate hike in December and a high probability of the next step already in March 2018, which is also a strong argument in favor of the dollar.

One more news should be noted, which has not yet been fully realized by the market. On Friday, the US Treasury published a report, which contains a set of recommendations for changing the regulation of financial markets. First of all, the document is important in that it contains a direct proposal to abolish part of the requirements of the Dodd-Frank law, which will cause a positive reaction of the markets and will promote the inflow of capital into the United States.

In particular, it is proposed to remove the requirement to disclose the size of the difference between the earnings of the company's management and ordinary employees, to abolish the provision on "minerals mined in the conflict zone" (which will allow American companies to actively expand into external sources of raw materials, in fact, stand in solidarity with one of the belligerents). It is also proposed to lower the margin requirements for derivatives trading. This step is able to attract, in addition to investment, hot speculative capital.

Thus, the Trump administration continues to create attractive conditions for doing business in the United States, and the expected tightening of financial conditions due to the rate increase will more than offset by the weakening of administrative regulation. Joint actions of the Federal Reserve and the administration should create a source of economic growth, that is, exactly what should, according to the plan, contribute to the inflow of capital into the American economy.

The dollar received several bullish signals at once, and the market will respond with rising demand. For the rest of the world, the news is rather negative, so the currencies of the developing countries and the commodity bloc may become the most affected next week, but the safe-haven currencies, primarily the yen, can compete with the dollar for investors' attention.

No comments:

Post a Comment