Bitcoin analysis for 30/11/2017

Financial columnist and television personality Li Cangyu, in a statement from the People's Bank of China (PBOC) in September, said p2p is trying to deceive law enforcement and violates a specific rule issued by the PBoC, which forbids any trade practice between cryptocurrencies and fiduciary currencies.

Another commentator, Wan Zhe, chief economist at China National Gold Group Corporation, the central state-owned gold mining company in the country, repeated Li's opinion and referenced Huobi Pro's website: "Not every trade in a peer-to-peer network is necessarily illegal, but by providing a "how to" guide and a trading platform of this type we undoubtedly violate the rules."

Another commentator, Wan Zhe, chief economist at China National Gold Group Corporation, the central state-owned gold mining company in the country, repeated Li's opinion and referenced Huobi Pro's website: "Not every trade in a peer-to-peer network is necessarily illegal, but by providing a "how to" guide and a trading platform of this type we undoubtedly violate the rules."

It is worth to mention here, that after the ban on ICO by the Chinese Central Bank and the suspension of transactions between cryptocurrencies and Chinese yuan, large national stock exchanges, including Huobi and OKCoin, have moved their operations to foreign peer-to-peer trading platforms such as Huobi Pro. or OKEx. CCTV is a state channel and one of the official spokespersons of the government and the Communist Party of China.

Although the program itself did not reveal the government's official position, it provided an important message and gave insights into how state media depict cryptocurrencies. The next parts of the program also discussed the high variability of Bitcoin and the benefits of Blockchain technology.

Although the program itself did not reveal the government's official position, it provided an important message and gave insights into how state media depict cryptocurrencies. The next parts of the program also discussed the high variability of Bitcoin and the benefits of Blockchain technology.

Commentator Wan also presented counterfactual statements, saying that Amazon now accepts Bitcoin as a payment method. Let's now take a look at the Bitcoin technical picture at the H4 time frame. The reversal from the Fibonacci cluster between the levels of $11,111 - $11,318 was spot on and the price dropped down to the level of the previous wave four zones at $9,243. This price action indicates a possible start of a deeper corrective movement, and wave (a) of this correction might have started already.

Ichimoku indicator analysis of USDX for November 30, 2017

The US dollar index remains inside the bearish channel. The trend remains bearish in the medium term but we have short-term bullish reversal signs. We have been calling a reversal off the 92.50 price area and so far we were correct. Our primary scenario expects a big bounce above November highs.

Black lines - bearish channel

The US dollar index remains inside the bearish channel and below the 4-hour Ichimoku cloud. Trend is bearish. However I believe that this upward bounce is a part of a bigger bounce that is expected eventually to push the price above 95. Support now is at 93 while resistance levels are found at 93.50 and 93.80. A break above the 4-hour cloud will be a bullish sign.

The US dollar index is reversing off the 61.8% Fibonacci retracement. This bounce is expected to move the price higher. Resistance on a weekly basis is at 94 and 94.50. A weekly close above these two levels will most probably push the index towards the weekly cloud at 96.50-97. As long as we do not break below this week's lows, I remain bullish.

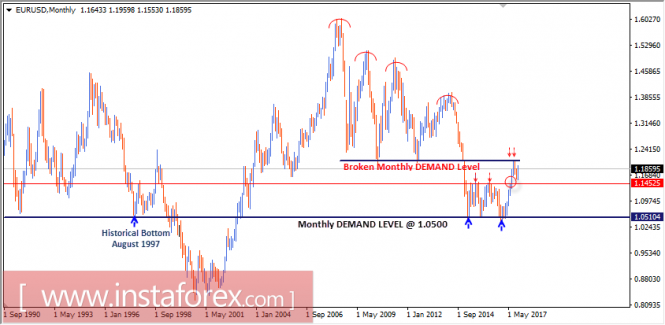

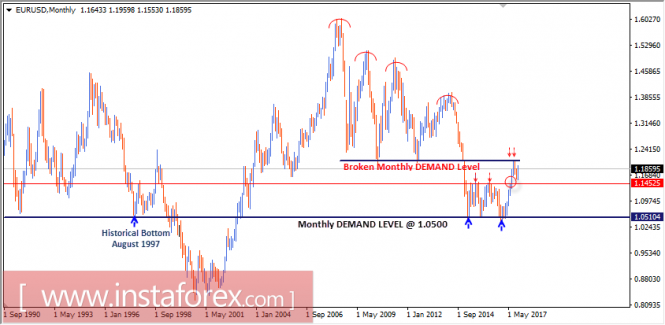

Intraday technical levels and trading recommendations for EUR/USD for November 30, 2017

Monthly Outlook

In January 2015, the EUR/USD pair moved below the major demand levels near 1.2050-1.2100 (multiple previous bottoms set in July 2012 and June 2010). Hence, a long-term bearish target was projected toward 0.9450.

In March 2015, EUR/USD bears challenged the monthly demand level around 1.0500, which had been previously reached in August 1997. In the longer term, the level of 0.9450 remains a projected target if any monthly candlestick achieves bearish closure below the depicted monthly demand level of 1.0500.

However, the EUR/USD pair has been trapped within the depicted consolidation range (1.0500-1.1450) until the current bullish breakout was executed above 1.1450.

The current bullish breakout above 1.1450 allowed a quick bullish advance towards 1.2100 where recent evidence of bearish rejection was expressed (Note the previous Monthly candlestick of September).

Daily Outlook In January 2017, the previous downtrend was reversed when the Inverted Head and Shoulders pattern was established around 1.0500. Since then, evident bullish momentum has been expressed on the chart.

As anticipated, the ongoing bullish momentum allowed the EUR/USD pair to pursue further bullish advance towards 1.1415-1.1520 (Previous Daily Supply-Zone). The daily supply zone failed to pause the ongoing bullish momentum. Instead, evident bullish breakout was expressed towards the price level of 1.2100 where the depicted Head and Shoulders reversal pattern was expressed.

If the recent bearish breakout persists below 1.1700 (Neckline of the reversal pattern), a quick bearish decline should be expected towards the price zone of 1.1415-1.1520 (Initial targets for the depicted H&S pattern).

Bearish target for the depicted Head and Shoulders pattern extends towards 1.1350. However, to pursue towards the mentioned target level, significant bearish pressure is needed to be applied against the mentioned zone (1.1415-1.1520). However, recent price action around the price zone of 1.1520-1.1415 indicated evident bullish recovery.

This hinders further bearish decline as long as the recent low around 1.1550 remains unbroken. Trade Recommendations The current price levels around 1.1900-1.1950 should be watched for a possible short-term SELL entry if the current signs of bearish rejection are maintained. S/L should be placed above 1.2030. T/P levels to be located at 1.1850, 1.1700 and 1.1590.

Ichimoku indicator analysis of gold for November 30, 2017

Ichimoku indicator analysis of USDX for November 30, 2017

The US dollar index remains inside the bearish channel. The trend remains bearish in the medium term but we have short-term bullish reversal signs. We have been calling a reversal off the 92.50 price area and so far we were correct. Our primary scenario expects a big bounce above November highs.

Black lines - bearish channel

The US dollar index remains inside the bearish channel and below the 4-hour Ichimoku cloud. Trend is bearish. However I believe that this upward bounce is a part of a bigger bounce that is expected eventually to push the price above 95. Support now is at 93 while resistance levels are found at 93.50 and 93.80. A break above the 4-hour cloud will be a bullish sign.

The US dollar index is reversing off the 61.8% Fibonacci retracement. This bounce is expected to move the price higher. Resistance on a weekly basis is at 94 and 94.50. A weekly close above these two levels will most probably push the index towards the weekly cloud at 96.50-97. As long as we do not break below this week's lows, I remain bullish.

Intraday technical levels and trading recommendations for EUR/USD for November 30, 2017

Monthly Outlook

In January 2015, the EUR/USD pair moved below the major demand levels near 1.2050-1.2100 (multiple previous bottoms set in July 2012 and June 2010). Hence, a long-term bearish target was projected toward 0.9450.

In March 2015, EUR/USD bears challenged the monthly demand level around 1.0500, which had been previously reached in August 1997. In the longer term, the level of 0.9450 remains a projected target if any monthly candlestick achieves bearish closure below the depicted monthly demand level of 1.0500.

However, the EUR/USD pair has been trapped within the depicted consolidation range (1.0500-1.1450) until the current bullish breakout was executed above 1.1450.

The current bullish breakout above 1.1450 allowed a quick bullish advance towards 1.2100 where recent evidence of bearish rejection was expressed (Note the previous Monthly candlestick of September).

Daily Outlook In January 2017, the previous downtrend was reversed when the Inverted Head and Shoulders pattern was established around 1.0500. Since then, evident bullish momentum has been expressed on the chart.

As anticipated, the ongoing bullish momentum allowed the EUR/USD pair to pursue further bullish advance towards 1.1415-1.1520 (Previous Daily Supply-Zone). The daily supply zone failed to pause the ongoing bullish momentum. Instead, evident bullish breakout was expressed towards the price level of 1.2100 where the depicted Head and Shoulders reversal pattern was expressed.

If the recent bearish breakout persists below 1.1700 (Neckline of the reversal pattern), a quick bearish decline should be expected towards the price zone of 1.1415-1.1520 (Initial targets for the depicted H&S pattern).

Bearish target for the depicted Head and Shoulders pattern extends towards 1.1350. However, to pursue towards the mentioned target level, significant bearish pressure is needed to be applied against the mentioned zone (1.1415-1.1520). However, recent price action around the price zone of 1.1520-1.1415 indicated evident bullish recovery.

This hinders further bearish decline as long as the recent low around 1.1550 remains unbroken. Trade Recommendations The current price levels around 1.1900-1.1950 should be watched for a possible short-term SELL entry if the current signs of bearish rejection are maintained. S/L should be placed above 1.2030. T/P levels to be located at 1.1850, 1.1700 and 1.1590.

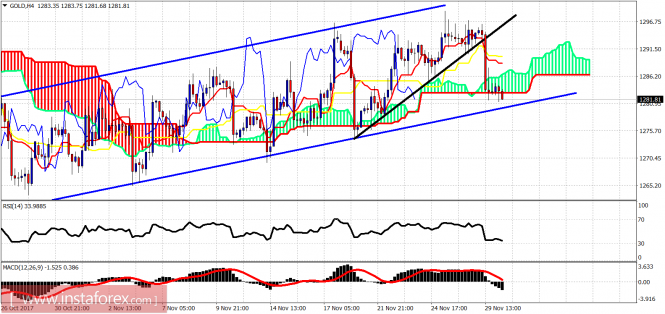

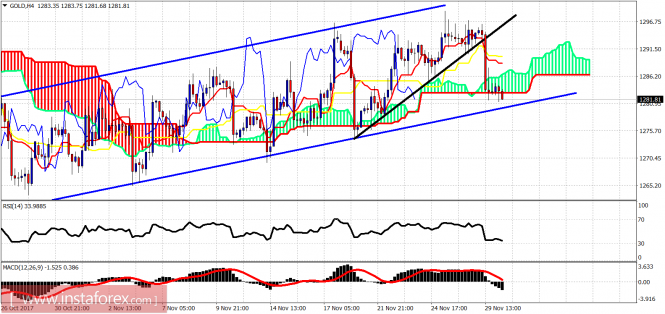

Ichimoku indicator analysis of gold for November 30, 2017

As expected, gold price got rejected at the upper channel boundary. The break below the black trend line support has given a new short-term sell signal that so far remains in profit as price has fallen towards the lower channel boundary and cloud support.

Blue lines - bullish channel

Black line - support (broken)

Blue lines - bullish channel

Black line - support (broken)

Gold price is breaking below the 4-hour Kumo support. Price is now testing the lower channel boundary. As I have been saying for the past few days, Gold price is expected to move sharply lower towards $1,250. A break below support of $1,280 will confirm that this move has started.

On a daily basis, Gold price has been rejected by the Daily Kumo (cloud). This is a bearish sign that we were expecting. Price is below the daily tenkan-sen (red line indicator) and is testing the kijun-sen (yellow line indicator). A daily close below the Kijun-sen will be a bearish sign. I expect Gold to move lower towards $1,250 over the coming days.

Trading plan for 30/11/2017

Oil in relative peace awaits the decision of the OPEC summit. The GBP, AUD and NZD exchanges received individual reasons for volatility. On the stock market mixed moods. Japanese Nikkei 225 is up 0.6%, but China's Shanghai Composite loses 0.7%.

On Thursday 30th of November, the event calendar is quite busy in important economic releases. During the London session, France, Germany, Italy, and the eurozone will post Consumer Price Index and Unemployment Rate data, Switzerland will present KOF Economic Barometer, Retail Sales and GDP data.

During the US session, Canada will present Current Account data, and the US will reveal Unemployment Claims, Personal Spending, Personal Income and Chicago Purchasing Manager Index data. Two FOMC members have a scheduled speeches later on: Randal K. Quarles and Robert Kaplan. Crude Oil analysis for 30/11/2017: The latest news from Vienna, which again pushes West Texas Intermediate oil (-1.6%) towards $57.00 per barrel, contributed to the strong reshuffle of sentiment on the global oil market.

According to the Russian Minister of Energy, Alexander Nowak, the world's miners have agreed to further reduce the production of raw materials. Salt in the eye was intended to be the publication of more detailed data on the extension of the contract, which will ultimately depend on the course of tomorrow's session. Let's now take a look at the Crude Oil technical picture in the H4 time frame.

The market dropped below the dashed blue intraday trend line and hit the technical support at the level of $56.78. The momentum is not hovering around its fifty level and the market conditions look oversold, so any positive outcome from the OPEC meeting might result in surge higher in oil. The nearest resistance is seen at the level of $58.59 and $59.04.

Market Snapshot: DAX head and shoulders pattern still in progress The price of German DAX index keeps making a right shoulder in a head and shoulders technical pattern.

This arm starts to look like a triangle now as the price is bouncing back and forth from the support and resistance levels. Any break out above 13, 200 will invalidate this pattern. The key support is seen at the level of 12,911.

Market Snapshot:

Gold still in the channel zone The price of Gold is back to the lower channel line at the level of $1,280 after a failure to rally at the upper channel line at the level of $1,298.

The next technical support is seen at the level of $1,276. The key technical resistance is still the zone between the levels of $1,298 - $1,305.

Technical analysis of USD/JPY for November 30, 2017

All our upside targets which we predicted in yesterday's analysis have been hit. USD/JPY is expected to trade with a bullish outlook. the pair is breaching the 112.00 level on the upside while being supported by the ascending 20-period moving average.

The relative strength index stays above the neutrality level of 50 showing a lack of downward momentum for the pair. The intraday outlook continues to be bullish, and the pair is expected to advance toward 112.40 before targeting 112.65.

Only a break below the key support at 111.65 would bring about a bearish reversal. Alternatively, if the price moves in the opposite direction, a short position is recommended below 111.65 with a target of 111.35.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 111.65,

Take Profit: 112.40

Resistance levels: 112.40, 112.65 and 113.00

Support Levels: 111.35, 111.10, 110.70

On a daily basis, Gold price has been rejected by the Daily Kumo (cloud). This is a bearish sign that we were expecting. Price is below the daily tenkan-sen (red line indicator) and is testing the kijun-sen (yellow line indicator). A daily close below the Kijun-sen will be a bearish sign. I expect Gold to move lower towards $1,250 over the coming days.

Trading plan for 30/11/2017

Oil in relative peace awaits the decision of the OPEC summit. The GBP, AUD and NZD exchanges received individual reasons for volatility. On the stock market mixed moods. Japanese Nikkei 225 is up 0.6%, but China's Shanghai Composite loses 0.7%.

On Thursday 30th of November, the event calendar is quite busy in important economic releases. During the London session, France, Germany, Italy, and the eurozone will post Consumer Price Index and Unemployment Rate data, Switzerland will present KOF Economic Barometer, Retail Sales and GDP data.

During the US session, Canada will present Current Account data, and the US will reveal Unemployment Claims, Personal Spending, Personal Income and Chicago Purchasing Manager Index data. Two FOMC members have a scheduled speeches later on: Randal K. Quarles and Robert Kaplan. Crude Oil analysis for 30/11/2017: The latest news from Vienna, which again pushes West Texas Intermediate oil (-1.6%) towards $57.00 per barrel, contributed to the strong reshuffle of sentiment on the global oil market.

According to the Russian Minister of Energy, Alexander Nowak, the world's miners have agreed to further reduce the production of raw materials. Salt in the eye was intended to be the publication of more detailed data on the extension of the contract, which will ultimately depend on the course of tomorrow's session. Let's now take a look at the Crude Oil technical picture in the H4 time frame.

The market dropped below the dashed blue intraday trend line and hit the technical support at the level of $56.78. The momentum is not hovering around its fifty level and the market conditions look oversold, so any positive outcome from the OPEC meeting might result in surge higher in oil. The nearest resistance is seen at the level of $58.59 and $59.04.

Market Snapshot: DAX head and shoulders pattern still in progress The price of German DAX index keeps making a right shoulder in a head and shoulders technical pattern.

This arm starts to look like a triangle now as the price is bouncing back and forth from the support and resistance levels. Any break out above 13, 200 will invalidate this pattern. The key support is seen at the level of 12,911.

Market Snapshot:

Gold still in the channel zone The price of Gold is back to the lower channel line at the level of $1,280 after a failure to rally at the upper channel line at the level of $1,298.

The next technical support is seen at the level of $1,276. The key technical resistance is still the zone between the levels of $1,298 - $1,305.

Technical analysis of USD/JPY for November 30, 2017

All our upside targets which we predicted in yesterday's analysis have been hit. USD/JPY is expected to trade with a bullish outlook. the pair is breaching the 112.00 level on the upside while being supported by the ascending 20-period moving average.

The relative strength index stays above the neutrality level of 50 showing a lack of downward momentum for the pair. The intraday outlook continues to be bullish, and the pair is expected to advance toward 112.40 before targeting 112.65.

Only a break below the key support at 111.65 would bring about a bearish reversal. Alternatively, if the price moves in the opposite direction, a short position is recommended below 111.65 with a target of 111.35.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 111.65,

Take Profit: 112.40

Resistance levels: 112.40, 112.65 and 113.00

Support Levels: 111.35, 111.10, 110.70

No comments:

Post a Comment