The Bitcoin (BTC) has been trading upwards. As I expected, the price tested the level of $8,136. Hundreds of thousands of dollars worth of BCH is languishing in segwit addresses.

The funds were mistakenly sent there by users who have no easy way of differentiating segwit and non-segwit addresses. Retrieving the funds is difficult, but not entirely impossible, as p2sh.info's Antoine Le Calvez has revealed. He's discovered what's believed to be the first successful bitcoin cash recovery, aided by the miners who confirmed the transaction.

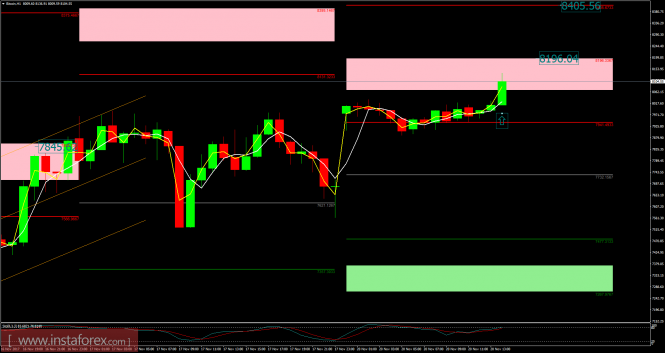

The techical picture looks bullish. Trading recommendations: According to the 1H time frame, I found the resistance at the price of $8.031 is broken. My advice is to watch for potential buying opportunties.

The upward targets are set at the price of $8.196 and at the price of $8.405.

Support/Resistance

$7.732

Pivot level

$8.126

Pivot resistance 1

$8.405

Pivot resistance 2

$7.477

The week will be shorter, so traders and investors in the US will leave for home early. This situation would mean a lack of incentives to play long-term subjects, and even short-term speculation may be rare. Especially on the USD side, there will be a shortage of data generated anchors.

The macro calendar is light in key events releases, and progress on the tax bill in the US Congress is halted, as congressmen leave Washington for the holidays as well. The only chance for the US Dollar to appreciate is a further development of political risk in Europe.

Since EUR has a dominant (58%) share in the basket forming the DXY dollar index, the EUR/USD rollover with the DXY signal could revive the strengthening of the Dollar on other crosses. Without it, there is a week without fresh impulses on financial markets that can improve the position of the Dollar.

Let's now take a look at the US Dollar Index technical picture at the H4 time frame. As indicated earlier, the market remains locked inside of the trading zone between the levels of 93.39 - 94.03 and the key level for the upside is still the technical resistance at the level of 94.47. As long as the price stays below the golden trend line the overall outlook remains bearish.

No comments:

Post a Comment