This usage case describes how Blockchain would release this simple operation by releasing it from centralized databases containing client entry, rental time, security, lock, etc. However, they are currently working on something much bigger. Uber is working with NASA and several aerospace companies to launch a flying car project.

Volvo's parent company designs futuristic vehicles that can fill the sky in two years. The Uber Elevate project implements Blockchain technology for vertical takeoff and China plans to start selling 2019 flying cars. It's all about air taxis, which, thanks to the Blockchain platform, enable the entire ecosystem of vehicles, charging stations, parking and customer service to run smoothly and seamlessly. There is already a solid infrastructure needed to implement flying cars. Roofs in large metropolitan areas are equipped with functional helicopter airports, which are very rarely used at the moment.

Big cities like Tokyo, Seoul and Los Angeles boast over 70 landings. Regarding the legislation, Dubai, Singapore and other modern governments ready to accept small commercial aircraft will be an important example for regulating air traffic that will inevitably have to match the market expectations. In addition, the urban air transport market is estimated at $1.2 billion, which should suffice for rapid advances in air transport technology. Blockchain as a platform allows you to order an air taxi and pay in Bitcoin or another cryptocurrency.

Each time a transaction is made, an intelligent agreement is signed that stores service delivery information, payments and vehicle load. This is an excellent example of how future transport can absorb the best available technology. Let's now take a look at the Bitcoin technical picture at the H4 time frame.

The projected target for the wave -v- at the level of $8,365 has not been hit yet, but the recent developments might indicate the top for this wave might be in place already. Any violation of the level of $7,423 (weekly pivot point) will be treated as the first confirmation of the temporary top. The key support for the price remains at the level of $6,768.

Overnight the financial markets have gone quiet if not boring. Weakest, albeit on a limited scale, were AUD and NZD, mostly due to dovish sounding RBA minutes release. EUR/USD is hovering around 1.1740, USD/JPY around 112.55 and GBP/USD – 1.3250.

Overnight the financial markets have gone quiet if not boring. Weakest, albeit on a limited scale, were AUD and NZD, mostly due to dovish sounding RBA minutes release. EUR/USD is hovering around 1.1740, USD/JPY around 112.55 and GBP/USD – 1.3250.

The stock market is trading at a rebound after yesterday's dismal session. Gold grows, oil is standing. On Tuesday 21st of November, the event calendar is light in important economic data releases. The busiest part will be the UK Public Sector Net Borrowing data release and Inflation Report Hearings with plenty of MPC members speaking.

During the US session, Canada will post Wholesale Sales data and US will post Existing Home Sales data. GBP/USD analysis for 21/11/2017: The main event of the day will be about politics again as the BOE Deputy Governor for Financial Stability Jon Cunliffe and other MPC members (Ian McCafferty, Gertjan Vlieghe and Michael Saunders) will give speeches today.

The main theme of the speeches should be further BoE monetary policy and UK economic assessment, so it will be worth to keep an eye on British Pound related pairs as the volatility might increase. Let's now take a look at the GBP/USD technical picture at the H4 time frame.

The market is still trapped in a horizontal zone between the levels of 1.3040 - 1.3321 and as long as any of this levels is violated the sideways move will continue. The dashed black trendline indicates the bulls are now in charge of the market, at least in the short-term, but any unfavorable comments from MPC members will likely terminate these developments.

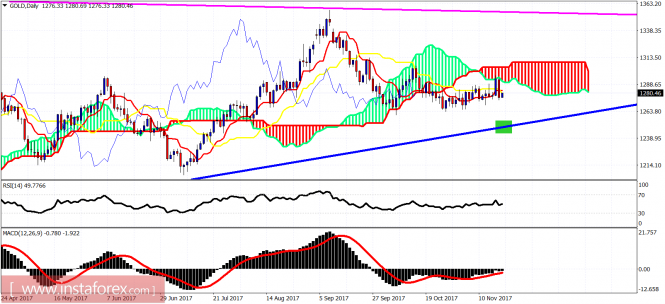

Market Snapshot: Gold falls down again After a failure to rally at the level of $1,290, the price of Gold dropped to the lower channel line support at the level of $1,274, so the sideways move inside the channel is continuing. Nevertheless, since the end of October, no new low was made yet as the market still tries to rally higher. The key to the upside remains the gray zone between the levels of $1,298-$1,305.

Market Snapshot: Head & Shoulder pattern in progress on DAX? The German DAX Index has made a local low after a drop from the high of 13,515. The bounce from the local low has returned to the previous consolidation area and now it looks like the market is making the Head & Shoulders technical price pattern. The neck line is marked in orange and the target for bears is around the level of 12, 386.

Market Snapshot: Gold falls down again After a failure to rally at the level of $1,290, the price of Gold dropped to the lower channel line support at the level of $1,274, so the sideways move inside the channel is continuing. Nevertheless, since the end of October, no new low was made yet as the market still tries to rally higher. The key to the upside remains the gray zone between the levels of $1,298-$1,305.

Market Snapshot: Head & Shoulder pattern in progress on DAX? The German DAX Index has made a local low after a drop from the high of 13,515. The bounce from the local low has returned to the previous consolidation area and now it looks like the market is making the Head & Shoulders technical price pattern. The neck line is marked in orange and the target for bears is around the level of 12, 386.

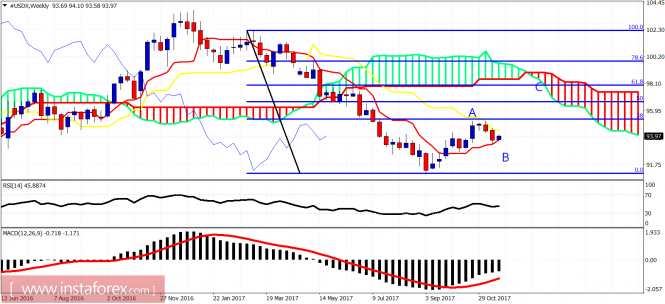

Ichimoku indicator analysis of USDX for November 21, 2017

The Dollar index is making new short-term higher highs but price remains below the cloud. Trend remains bearish in the medium-term. There are still chances that the entire decline from 95 is not over and we could see a move towards 93-92.50.

Blue line - trend line support (broken) Green rectangle - support Red rectangle - target if support fails The Dollar index stopped the decline at the 38% Fibonacci retracement. Price is below the 4-hour Kumo, so we consider short-term trend still bearish. Resistance is at 94.30-94.50. Breaking above it will open the way for a move towards 97 or higher. Support at 93.60-93.50 is also important. A break below it will open the way for a move towards the red rectangle area.

In the daily chart price holds above the daily tenkan-sen. The pull back from 95 could be over or we might need one more new low before moving towards the daily Kumo (cloud) near 97. I believe that it is more probable to see a new leg upwards than consider the entire bounce over.

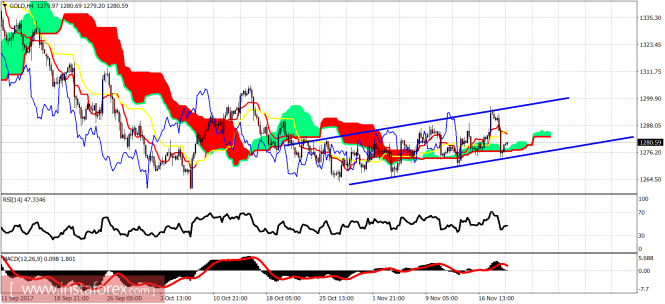

Ichimoku indicator analysis of gold for November 21, 2017

Gold price as expected got rejected at the upper trading range boundary and fell back towards cloud support. Short-term support at $1,277 was broken but not the important $1,272 one. Trend remains neutral. Gold price could continue lower towards $1,272 and as long as it closes above it, we could see $1,300.

Blue lines - trading range Gold price is moving inside a trading range with a positive slope. However the entire price formation is corrective and not impulsive, implying that eventually we should expect price break below support and make a new low towards $1,250-$1,210 area.

Blue line- long-term support Magenta line- long-term resistance Green rectangle - short-term target area for major reversal Gold price got rejected at the daily Kumo (cloud) yesterday and price fell below the tenkan-sen. This is a bearish sign. As long as price is above short-term important $1,272 support, we could even see a bounce towards $1,300 or at least a test of the daily cloud at $1,291. However if price breaks support, we should expect a sharp move towards $1,250.

No comments:

Post a Comment